| Filed by: Voya Mutual Funds |

| (SEC File Nos.: 033-56094; 811-07428) |

| pursuant to Rule 425 under the |

| Securities Act of 1933, as amended, |

| and deemed filed pursuant to Rule 14a-12 |

| under the Securities Exchange Act of 1934, as amended. |

| |

| Subject Company: The Advisors’ Inner Circle Fund, on behalf of its CBRE Clarion Global Infrastructure Value Fund. |

| (SEC File Nos.: 033-42484; 811-06400) |

March 13 2017

Client Talking Points

March 1, 2017

Voya Investment Management

Client Talking Points

Voya CBRE Global Infrastructure Fund

Voya Investment Management has announced the following changes:

Upcoming

Change | | Effective Date

(on or about) | | Merging Fund Name | | Surviving Fund Name |

Reorganization | | May 15, 2017 | | CBRE Clarion Global Infrastructure Value Fund | | Voya CBRE Global Infrastructure Fund |

The respective Board of Trustees for the CBRE Clarion Global Infrastructure Value Fund ( “CBRE Infrastructure Fund”), a series of The Advisors’ Inner Circle Fund (the “AICF Trust”), and the Voya CBRE Global Infrastructure Fund (“Voya Infrastructure Fund”), a newly created series of Voya Mutual Funds (“VMF”), have approved an Agreement and Plan of Reorganization (“Reorganization Plan”) providing for the reorganization of CBRE Infrastructure Fund with and into Voya Infrastructure Fund (the “Reorganization”). The approval of shareholders of CBRE Infrastructure Fund is required before the Reorganization may take place. CBRE Infrastructure Fund and Voya Infrastructure Fund are referred to herein collectively as the “Funds” and individually as a “Fund.”

· What is happening?

· On January 26, 2017 the AICF Trust announced that the Board of Trustees of the AICF Trust had approved the Reorganization Agreement to reorganize CBRE Infrastructure Fund into Voya Infrastructure Fund.

· Voya Infrastructure Fund was created specifically for the purpose of acquiring the assets and liabilities of CBRE Infrastructure Fund.

· Pending shareholder approval, the Reorganization is expected to close on or about May 15, 2017 (the “Closing Date”).

1

· A proxy statement/prospectus (the “Proxy Statement/Prospectus”) seeking shareholder approval of the Reorganization is expected to be mailed to shareholders on or about March 17, 2017.

· How will the Reorganization work?

· If shareholders of CBRE Infrastructure Fund approve the Reorganization, each owner of Investor Class and Institutional Class shares of CBRE Infrastructure Fund would become a shareholder of the Class A and Class I shares, respectively, of Voya Infrastructure Fund.

· The Reorganization is expected to be consummated on the Closing Date.

· Each shareholder of CBRE Infrastructure Fund will hold, immediately after the close of the Reorganization, shares of Voya Infrastructure Fund having an aggregate value equal to the aggregate value of the shares of CBRE Infrastructure Fund held by that shareholder as of the close of business on the Closing Date.

· How do the Investment Objectives compare?

| | CBRE Infrastructure Fund | | Voya Infrastructure Fund |

Investment Objective | | CBRE Infrastructure Fund seeks to provide total return, consisting of capital appreciation and current income. | | Voya Infrastructure Fund seeks total return including capital appreciation and current income. |

· What is the experience of the CBRE Investment Management Team?

· As of December 31, 2016, CBRE Clarion Securities, LLC (“CBRE Clarion”), the investment adviser of CBRE Infrastructure Fund, had approximately $17.5 billion in assets under management.

· T. Ritson Ferguson and Jeremy Anagnos are primarily responsible for the day-to-day management of CBRE Infrastructure Fund, and if the Reorganization is approved by shareholders, for the day-to-day management of Voya Infrastructure Fund.

· Mr. Ferguson is one of the three founding members of CBRE Clarion. He serves as the Chief Executive Officer and leads the firm’s Management Committee. Mr. Ferguson is Global Chief Investment Officer and Senior Portfolio Manager, as well as a member of the firm’s Global Infrastructure Allocation Committee. He has been employed with CBRE Clarion and its predecessor firms since 1992.

· Mr. Anagnos is a Co-Chief Investment Officer of CBRE Clarion. He is a Senior Portfolio Manager and a member of the firm’s Global Infrastructure Allocation Committee. Prior to joining CBRE Clarion in 2011, Mr. Anagnos served as Co-Chief Investment Officer of CBRE Global Investors’ investment team responsible for managing global real estate securities portfolios. During his career, Mr. Anagnos has worked in various management and research positions in the real estate industry with LaSalle Investment Management and Deutsche Bank.

· How do the principal investment strategies compare?

· The Funds have substantially identical principal investment strategies. Both Funds invest primarily in equity securities issued by infrastructure companies organized or located throughout the world, including the United States.

2

· CBRE Clarion will use the same multi-step investment process for constructing Voya Infrastructure Fund’s investment portfolio as is currently used to construct CBRE Infrastructure Fund’s investment portfolio. Although the principal investment strategies are substantially similar, each Fund uses different terminology to describe the investment strategies applicable to it. The following chart compares the principal investment strategies of CBRE Infrastructure Fund and Voya Infrastructure Fund.

· The differences between the principal investment strategies as described below do not reflect a material difference in the manner in which each Fund is managed, except that Voya Infrastructure Fund, as a fund in the Voya family of funds, will be permitted to participate in the Voya securities lending program.

| | CBRE Infrastructure Fund | | Voya Infrastructure Fund |

Investment Strategies | | Under normal circumstances, the Fund will invest at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities issued by infrastructure companies organized or located throughout the world, including the United States. The adviser (“Adviser”) defines an infrastructure company as a company that derives at least 50% of its revenues or profits from, or devotes at least 50% of its assets to, the ownership, management, development or operation of infrastructure assets. Examples of infrastructure assets include transportation assets (such as toll roads, bridges, railroads, airports and seaports), utility assets (such as electric transmission and distribution lines, gas distribution pipelines, water pipelines and treatment facilities and sewer facilities), energy assets (such as oil and gas pipelines, storage facilities and other facilities used for gathering, processing or transporting hydrocarbon products) and communications assets (such as communications towers and satellites). While the Fund expects to invest primarily in common stock, it may also invest in other equity securities including preferred stocks, convertible securities, rights or warrants to buy common stocks and depositary receipts with characteristics similar to common stock. The Fund may also invest up to 25% of its net assets in limited partner interests of energy infrastructure companies organized as master limited partnerships. Under normal market conditions, the Fund will invest in at least three countries, including the United States, and at least 40% of its net assets, plus any borrowings for investment purposes, will be invested in non-U.S. companies, in both developed and emerging market countries (at | | Under normal circumstances, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in securities issued by infrastructure companies. The Fund expects to invest primarily in equity securities of companies located in a number of different countries, including the United States. The sub-adviser (“Sub-Adviser”) defines an infrastructure company as a company that derives at least 50% of its revenues or profits from, or devotes at least 50% of its assets to, the ownership, management, development, construction, renovation, enhancement, or operation of infrastructure assets or the provision of services to companies engaged in such activities. Examples of infrastructure assets include transportation assets (such as toll roads, bridges, railroads, airports, and seaports), utility assets (such as electric transmission and distribution lines, gas distribution pipelines, water pipelines and treatment facilities, and sewer facilities), energy assets (such as oil and gas pipelines, storage facilities, and other facilities used for the gathering, processing, or transporting hydrocarbon products), and communications assets (such as communications towers and satellites). Under normal circumstances, the Fund invests primarily in common stock, but may also invest in other equity securities including preferred stocks, convertible securities, rights or warrants to buy common stocks, and depositary receipts with characteristics similar to common stock. The Fund may also invest up to 25% of its net assets in master limited partnerships. |

3

| | CBRE Infrastructure Fund | | Voya Infrastructure Fund |

| | least 30% of its net assets, plus any borrowings for investment purposes, will be invested in non- U.S. companies if conditions are not favorable). The Fund may invest up to 30% of its assets in emerging market companies. The Fund may invest in securities of companies of any market capitalization. The Adviser utilizes a multi-step investment process for constructing the Fund’s investment portfolio that combines top-down region and sector allocation with bottom-up individual stock selection. The Adviser first selects infrastructure sectors in certain geographic regions in which to invest, and determines the degree of representation of such sectors and regions, through a systematic evaluation of the regulatory environment and outlook, capital market trends, macroeconomic conditions, and the relative value of infrastructure sectors. The Adviser then uses an in-house valuation process to identify investments whose risk-adjusted returns it believes are compelling relative to their peers. The Adviser’s in-house valuation process examines several factors, including the company’s management and strategy, the stability and growth potential of cash flows and dividends, the location of the company’s assets, the regulatory environment in which the company operates and the company’s capital structure. Finally, portfolio construction and risk mitigation guidelines are employed to arrive at a diversified portfolio that the Adviser believes should have a lower volatility of returns relative to the broader global equity market. The Adviser may sell a security if it believes that there has been a negative change in the fundamental factors surrounding the company, region or sector weights change to reflect a revised top-down view, or more attractive alternatives exist. | | The Fund may invest up to 30% of its assets in securities of companies located or doing business in emerging markets. The Fund may, but will not necessarily, hedge its currency exposure to securities denominated in non-U.S. currencies. The Fund may invest in securities of companies of any market size. The Fund may invest in other investment companies, including exchange-traded funds, to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder (“1940 Act”). The Sub-Adviser uses a multi-step investment process for constructing the Fund’s investment portfolio that combines top-down geographic region and infrastructure sector allocation with bottom-up individual stock selection. The Sub-Adviser first selects infrastructure sectors in certain geographic regions in which to invest, and determines the degree of representation in the portfolio of such sectors and regions, through a systematic evaluation of the regulatory environment and economic outlook, capital market trends, macroeconomic conditions, and the relative value of infrastructure sectors. The Sub-Adviser then uses an in-house valuation process to identify infrastructure companies whose risk-adjusted returns it believes are compelling relative to their peers. The Sub-Adviser’s in-house valuation process examines several factors, including the company’s management and strategy, the stability and growth potential of cash flows and dividends, the location of the company’s assets, the regulatory environment in which the company operates and the company’s capital structure. The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. The Fund may lend portfolio securities on a short-term or long-term basis, up to 33 1/3% of its total assets. |

4

· How do the Total Annual Fund Expenses after reductions and waivers compare?

· These tables describe the fees and expense that you may pay if you buy and hold shares of the Funds.

· Pro Forma fees and expenses, which are the estimated fees and expenses of Voya Infrastructure Fund after giving effect to the Reorganization, assume the Reorganization occurred on October 31, 2016.

· Shareholders of CBRE Infrastructure Fund will not pay any sales charges or redemption fees in connection with the Reorganization. In addition, Voya Infrastructure Fund’s Class A shares sales charges (including front-end sales charges and contingent deferred sales charges) will not apply to investors who held Investor Class shares of CBRE Infrastructure Fund prior to the date of the Reorganization and received Class A shares of the Voya Infrastructure Fund as a result of the Reorganization, including with respect to additional purchases of Class A shares by the same account.

Shareholder Fees

Fees paid directly from your investment

| | Maximum sales

charge (load) as a %

of offering price | | Maximum deferred

sales charge as a % of

purchase or sales

price, whichever is

less | | Redemption

Fee as a % of

amount redeemed | |

CBRE Infrastructure Fund — Investor Class | | None | | None | | 2.00 | (1) |

Voya Infrastructure Fund — Class A | | 5.75 | | None | (2) | N/A | |

| | | | | | | |

CBRE Infrastructure Fund — Institutional Class | | None | | None | | 2.00 | (1) |

Voya Infrastructure Fund — Class I | | None | | None | | N/A | |

Annual Fund Operating Expenses(3)

Expenses you pay each year as a % of the value of your investment

| | | CBRE

Infrastructure

Fund | | Voya Infrastructure

Fund

Pro Forma | |

| | | Investor Class | | Class A | |

Management Fees | % | | | | 0.90 | | | | 1.00 | |

Distribution and/or Shareholder Services (12b-1) Fees | % | | | | 0.25 | | | | 0.25 | |

Other Expenses | % | | | | 1.00 | | | | 0.74 | |

Shareholder Servicing Fees | % | | 0.15 | | | | None | | | |

Other Operating Expenses | % | | 0.85 | | | | 0.74 | (5) | | |

Total Annual Fund Operating Expenses | % | | | | 2.15 | | | | 1.99 | |

Less Fee Reductions and/ or Expense Reimbursements | % | | | | (0.55 | )(4) | | | (0.64 | )(6) |

Total Annual Fund Operating Expenses after Fee Reductions and/or Expense Reimbursements | % | | 1.60 | | 1.35 | |

| | | | | | |

| | | Institutional

Class | | Class I | |

Management Fees | % | | | | 0.90 | | | | 1.00 | |

Distribution and/or Shareholder Services (12b-1) Fees | % | | | | None | | | | None | |

Other Expenses | % | | | | 0.70 | | | | 0.50 | |

Shareholder Servicing Fees | % | | 0.02 | | | | None | | | |

Other Operating Expenses | % | | 0.68 | | | | 0.50 | (5) | | |

5

Annual Fund Operating Expenses(3)

Expenses you pay each year as a % of the value of your investment

| | | CBRE

Infrastructure

Fund | | Voya Infrastructure

Fund

Pro Forma | |

Total Annual Fund Operating Expenses | % | | | | 1.60 | | | | 1.50 | |

Less Fee Reductions and/ or Expense Reimbursements | % | | | | (0.35 | )(4) | | | (0.40 | )(6) |

Total Annual Fund Operating Expenses after Fee Reductions and/or Expense Reimbursements | % | | | | 1.25 | | | | 1.10 | |

(1) A 2.00% redemption fee will be charged on the redemption of shares held less than 60 days. The redemption fee will not apply to shares purchased with reinvested dividends or distributions.

(2) A contingent deferred sales charge of 1.00% is assessed on certain redemptions of Class A shares made within 18 months after purchase where no initial sales charge was paid at the time of purchase as part of an investment of $1 million or more.

(3) Expense ratios have been adjusted to reflect current contractual rates.

(4) CBRE Clarion has contractually agreed to reduce fees and reimburse expenses to the extent necessary to keep Total Annual Fund Operating Expenses after Fee Reductions and/or Expense Reimbursements (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses (collectively, “excluded expenses”)) from exceeding 1.60% and 1.25% of CBRE Infrastructure Fund’s Investor Class shares’ average daily net assets and CBRE Infrastructure Fund’s Institutional Class shares’ average daily net assets, respectively, until February 28, 2018 (the “contractual expense limit”). In addition, if at any point Total Annual Fund Operating Expenses (not including excluded expenses) are below the contractual expense limit, CBRE Clarion may receive from CBRE Infrastructure Fund the difference between the Total Annual Fund Operating Expenses (not including excluded expenses) and the contractual expense limit to recover all or a portion of its fee reductions or expense reimbursements made during the preceding three-year period during which this agreement (or any prior agreement) was in place. This agreement may be terminated: (i) by the AICF Board, for any reason at any time, or (ii) by CBRE Clarion, upon ninety (90) days’ prior written notice to the AICF Trust, effective as of the close of business on February 28, 2018.

(5) Other Expenses are based on estimated amounts for the current fiscal year.

(6) Voya Investments, LLC (“VIL”), the investment adviser of Voya Infrastructure Fund, is contractually obligated to limit the expenses to 1.35% and 1.10% for Class A and Class I shares, respectively, through March 1, 2019. The limitations do not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. The Limitations are subject to possible recoupment by VIL within 36 months of the waiver or reimbursement. Termination or modification of these obligations requires approval by the VMF Board.

· Who will pay for the expenses of the Reorganization?

· The expenses of the Reorganization will be paid by CBRE Clarion or VIL or their affiliates.

· The expenses of the Reorganization are estimated to be approximately $340,000 and do not include the transition costs described below.

· What are the expected Portfolio Transitioning costs?

· As discussed above, the Funds have substantially identical principal investment strategies. As a result, CBRE Clarion does not anticipate that it will need to sell a significant portion of CBRE Infrastructure Fund’s holdings if the Reorganization is approved by shareholders.

6

· How does CBRE Infrastructure Fund performance compare to Voya Infrastructure Fund?

· No performance information is included here for Voya Infrastructure Fund since the Fund has not yet commenced investment operations. Voya Infrastructure Fund will assume the performance history of CBRE Infrastructure Fund at the closing of the Reorganization.

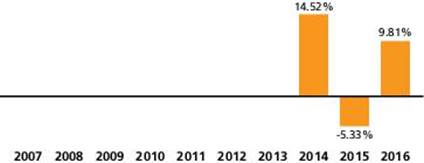

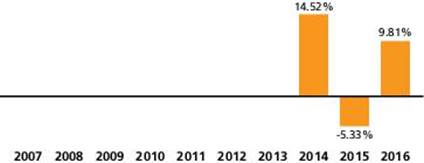

· The Annual Performance bar chart and Average Annual Total Returns table below illustrate the risks and volatility of an investment in CBRE Infrastructure Fund by showing changes in CBRE Infrastructure Fund’s Investor Class shares’ performance from year to year and by showing how CBRE Infrastructure Fund’s Investor Class shares’ and Institutional Class shares’ average annual total returns for 1 year and since inception compare with those of a broad measure of market performance.

CBRE Infrastructure Fund — Investor Class Shares

(as of December 31 of each year)

· Best quarter: 2nd 2014, 9.09% and Worst quarter: 3rd 2015, -6.49%

· The Average Annual Total Returns table below compares CBRE Infrastructure Fund’s average total returns for the periods ended December 31, 2016 to those of an appropriate broad based index. In addition, the table shows how CBRE Infrastructure Fund’s average annual total returns compare with the returns of an index designed to represent the performance of the global equity market.

Average Annual Total Returns

(for periods ended December 31, 2016)

| | | | 1 Year | | Since

Inception | | Inception

Date | |

Investor Class before taxes | | % | | 9.81 | | 6.86 | | 10/16/13 | |

After taxes on Distributions | | % | | 7.13 | | 3.56 | | | |

After Taxes on Distributions and Sale of Fund Shares | | % | | 7.03 | | 4.29 | | | |

Hybrid Benchmark Index (reflects no deduction for fees or expenses)(1) | | % | | 10.87 | | 5.23 | | | |

MSCI ACWI Index (Net) (reflects no deduction for fees, expenses, or taxes (except foreign withholding taxes))(2) | | % | | 7.86 | | 4.54 | | | |

| | | | | | | | | |

Institutional Class before taxes | | % | | 10.13 | | 8.82 | | 6/28/13 | |

7

| | | | 1 Year | | Since

Inception | | Inception

Date | |

Hybrid Benchmark Index (reflects no deduction for fees or expenses)(1) | | % | | 10.87 | | 7.37 | | | |

MSCI ACWI Index (Net) (reflects no deduction for fees, expenses, or taxes (except foreign withholding taxes))(2) | | % | | 7.86 | | 7.05 | | | |

(1) The Hybrid Benchmark Index is the UBS Global Infrastructure & Utilities 50/50 Index (Net) through March 31, 2015 and the FTSE Global Core Infrastructure 50/50 Index (Net) thereafter, due to the discontinuation of the former index.

(2) The MSCI All Country World IndexSM (“MSCI ACW IndexSM”) is a free-float adjusted market capitalization index that is designed to measure the performance of the companies in the developed markets in the MSCI World Index and companies in the emerging markets in the MSCI Emerging Markets Index.

· Of course, CBRE Infrastructure Fund’s past performance (before and after taxes) does not necessarily indicate how CBRE Infrastructure Fund or Voya Infrastructure Fund will perform in the future.

· Updated performance information is available on CBRE Infrastructure Fund’s website at www.cbreclarion.com or by calling (855) 520-4227.

· Tax Considerations

· The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, neither CBRE Infrastructure Fund nor its shareholders, nor Voya Infrastructure Fund nor its shareholders, are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement.

· As a condition to each Fund’s obligation to consummate the Reorganization, the Funds will receive an opinion from tax counsel to the effect that, on the basis of existing provisions of the Code, U.S. Treasury Regulations promulgated thereunder, current administrative rules, pronouncements and court decisions, and subject to certain qualifications, the Reorganization will qualify as a tax-free reorganization for federal income tax purposes.

The performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Voya CBRE Global Infrastructure Fund will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You may obtain performance information current to the most recent month end by visiting www.voyainvestments.com.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. In some cases the after-tax returns may

8

exceed the return before taxes due to an assumed tax benefit from any losses on the sale of Fund shares at the end of the measurement period.

The foregoing is not an offer to sell, nor a solicitation of an offer to buy, shares of any portfolio, nor is it a solicitation of any proxy. For information regarding the Voya CBRE Global Infrastructure Fund, please call Voya Investment Management toll free at 1-800-992-0180.

For information regarding any of the Funds discussed in this Talking Points, please call Voya Investment Management toll free at 1-800-992-0180. This “Client Talking Points” is qualified in its entirety by reference to the Proxy Statement/ Prospectus, and supersedes any prior Client Talking Points. The Proxy Statement/Prospectus contains important information about fund objectives, strategies, fees, expenses and risk considerations, and therefore you are advised to read it. The Proxy Statement/Prospectus and shareholder reports and other information are or will also be available for free on the SEC’s website (www.sec.gov ). Please read the Proxy Statement/Prospectus carefully before making any decision to invest or to approve the Reorganization.

This information is proprietary and cannot be reproduced or distributed. Certain information may be received from sources Voya Investment Management considers reliable; Voya Investment Management does not represent that such information is accurate or complete. Certain statements contained herein may constitute “projections,” “forecasts” and other “forward-looking statements” which do not reflect actual results and are based primarily upon applying retroactively a hypothetical set of assumptions to certain historical financial data. Actual results, performance or events may differ materially from those in such statements. Any opinions, projections, forecasts and forward looking statements presented herein are valid only as of the date of this document and are subject to change. Nothing contained herein should be construed as: (i) an offer to buy any security; or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Voya Investment Management assumes no obligation to update any forward-looking information. Past performance is no guarantee of future results.

Your clients should consider the investment objectives, risks, charges and expenses of Voya CBRE Global Infrastructure Fund carefully before investing. For a free copy of the proxy statement/prospectus, which contains this and other information, please call CBRE Infrastructure Fund’s proxy solicitor, toll free at (800) 769-7666. If you have any questions about voting procedures, please call the number listed on your proxy card. Representatives will be available Monday through Friday from 9:00 a.m. to 10:00 p.m., Eastern Time. Please instruct your clients to read the prospectus carefully before investing.

CIDxxxxxxxxxxxxxxxxx

9