UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7396 |

|

Western Asset Managed High Income Fund Inc. |

(Exact name of registrant as specified in charter) |

|

55 Water Street, New York, NY | | 10041 |

(Address of principal executive offices) | | (Zip code) |

|

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (888) 777-0102 | |

|

Date of fiscal year end: | February 28 | |

|

Date of reporting period: | February 28, 2010 | |

| | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

The Annual Report to Stockholders is filed herewith.

February 28, 2010 | |

|

Annual Report

Western Asset Managed High Income Fund Inc.

(MHY)

| |

| INVESTMENT PRODUCTS: NOT FDIC INSURED · NO BANK GUARANTEE · MAY LOSE VALUE |

| |

II | | Western Asset Managed High Income Fund Inc. | | |

Fund objectives

The Fund’s primary investment objective is high current income. Capital appreciation is a secondary objective.

What’s inside

Letter from the chairman | II |

| |

Investment commentary | III |

| |

Fund overview | 1 |

| |

Fund at a glance | 5 |

| |

Schedule of investments | 6 |

| |

Statement of assets and liabilities | 19 |

| |

Statement of operations | 20 |

| |

Statements of changes in net assets | 21 |

| |

Financial highlights | 22 |

| |

Notes to financial statements | 23 |

| |

Report of independent registered public accounting firm | 30 |

| |

Board approval of management and subadvisory agreements | 31 |

| |

Additional information | 35 |

| |

Annual chief executive officer and chief financial officer certifications | 40 |

| |

Dividend reinvestment plan | 41 |

| |

Important tax information | 43 |

Letter from the Chairman |

|

Dear Shareholder,

We are pleased to provide the annual report of Western Asset Managed High Income Fund Inc. for the twelve-month reporting period ended February 28, 2010.

Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance. Important information with regard to recent regulatory developments that may affect the Fund is contained in the Notes to Financial Statements included in this report.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/cef. Here you can gain immediate access to market and investment information, including:

· Fund prices and performance,

· Market insights and commentaries from our portfolio managers, and

· A host of educational resources.

We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

March 26, 2010

| | Western Asset Managed High Income Fund Inc. | | III |

Investment commentary

Economic review

While the U.S. economy was weak during much of the first half of the twelve-month reporting period ended February 28, 2010, the lengthiest recession since the Great Depression finally appeared to have ended during the third quarter of 2009.

Looking back, the U.S. Department of Commerce reported that first quarter 2009 U.S. gross domestic product (“GDP”)i contracted 6.4%. The economic environment then started to get relatively better during the second quarter, as GDP fell 0.7%. The economy’s more modest contraction was due, in part, to smaller declines in both exports and business spending. After contracting four consecutive quarters, the Commerce Department reported that third quarter 2009 GDP growth was 2.2%. A variety of factors helped the economy to expand, including the government’s $787 billion stimulus program, its “Cash for Clunkers” car rebate program, which helped spur an increase in car sales, and tax credits for first-time home buyers. Economic growth then accelerated during the fourth quarter of 2009, as GDP growth was 5.6%. The Commerce Department cited a slower drawdown in business inventories and renewed consumer spending as contributing factors spurring the economy’s higher growth rate.

Even before GDP data started to meaningfully improve, there were signs that the economy was on the mend. The manufacturing sector, as measured by the Institute for Supply Management’s PMIii, rose to 52.8 in August 2009, the first time it surpassed 50 since January 2008 (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion). PMI data subsequently showed that manufacturing expanded from September through February 2010 as well. January’s PMI reading of 58.4 was its highest level since August 2004. Manufacturing then took a modest step backward in February as the PMI was 56.5.

While the housing market has shown signs of life, a continued large inventory of unsold homes could lead to a choppy recovery. At the end of February 2010, there was an 8.6 month supply of unsold homes, up from a 7.8 month supply the prior month. According to its most recent data, the S&P/Case-Shiller Home Price Indexiii indicated that month-over-month home prices rose for the seventh straight month in December (on a seasonally-adjusted basis). However, according to the National Association of Realtors, existing home sales fell by 16.2% in December 2009, 7.2% in January 2010 and 0.6% in February.

December’s decline was not surprising, given sales had moved higher in November as first-time home buyers rushed to complete sales before the original November deadline for the government’s $8,000 tax credit. However, with the government extending this tax credit until the end of April 2010, January’s and February’s sales declines were disappointing.

One area that remained weak — and could potentially jeopardize the economic recovery — was the labor market. While monthly job losses have moderated compared to the first quarter of 2009, the unemployment rate remained elevated during the reporting period. After reaching a twenty-six-year high of 10.1% in October 2009, the unemployment rate fell to 10.0% for November and December and subsequently declined to 9.7% in January, where it also remained at the end of February. However, according to revised U.S. Department of Labor figures, roughly 600,000 more jobs were lost in 2009 than previously reported. In addition, 8.4 million jobs have been lost since the recession officially began in December 2007.

Financial market overview

Compared to the last three months of 2008, which were characterized by upheaval in the financial markets, periods of extreme volatility, illiquidity and heightened risk aversion, the twelve-month period ended February 28, 2010 was largely a return to more normal conditions and increased investor risk appetite.

In the fixed-income market, riskier sectors, such as high-yield bonds and emerging market debt, significantly outperformed U.S. Treasuries. There were a number of factors contributing to the turnaround in the financial markets, including improving economic conditions, renewed investor confidence and the accommodative monetary policy by the Federal Reserve Board (“Fed”)iv.

While economic news often surprised on the upside during the reporting period, incoming economic data did not suggest a dramatic rebound in growth in 2010. Given this, the Fed kept the federal funds ratev in a range of 0 to 1/4 percent during each of its eight meetings during the period. At its meeting in March 2010 (subsequent to the close of the reporting period), the Fed said it “will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.”

IV | | Western Asset Managed High Income Fund Inc. | | |

Investment commentary (cont’d)

However, the Fed did take a first step in reversing its accommodative monetary stance. On February 18, 2010, the Fed raised the discount rate, the interest rate it charges banks for temporary loans, from 0.50% to 0.75%. The Fed also expects to end its $1.25 trillion mortgage securities purchase program by the end of the first quarter of 2010.

Fixed-income market review

In sharp contrast to the fourth quarter of 2008 and early 2009, when investors fled fixed-income securities that were seen as being risky and flocked to the relative safety of short-term Treasuries, investor risk aversion abated during the reporting period. Toward the beginning of the period, some encouraging economic data and a thawing of the once frozen credit markets helped bolster investor confidence. In a stunning turnaround from 2008, by the end of the first quarter of 2009, risk aversion had been replaced by robust demand for riskier, and higher-yielding, fixed-income securities. Despite some temporary setbacks, riskier assets continued to perform well during the remainder of the reporting period.

Both short- and long-term Treasury yields fluctuated during the reporting period. When the period began, Treasury yields remained relatively low, given numerous “flights to quality” that were triggered by the fallout from the financial crisis in 2008. After starting the period at 1.00% and 3.02%, respectively, two- and ten-year Treasury yields then generally moved higher (and their prices lower) until early June. Two- and ten-year yields peaked at 1.42% and 3.98%, respectively, before falling and ending the reporting period at 0.81% and 3.61%, respectively.

In contrast to their shorter-term counterparts, longer-term Treasury yields moved higher over the reporting period due to fears of future inflation given the government’s massive stimulus program. At the same time, with risk aversion being replaced with robust risk appetite, spread sector (non-Treasury) prices moved higher. For the twelve months ended February 28, 2010, the Barclays Capital U.S. Aggregate Indexvi returned 9.32%.

The high-yield bond market produced very strong results during the reporting period. The asset class posted positive returns during all twelve months of the period. This strong performance was due to a variety of factors, including improving credit conditions, generally better-than-expected economic data and strong investor demand. All told, the Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Indexvii returned 55.20% for the twelve months ended February 28, 2010.

Emerging market debt prices rallied sharply — posting positive returns each month during the reporting period. This rally was triggered by rising commodity prices, optimism that the worst of the global recession was over, solid domestic demand and increased investor risk appetite. Over the twelve months ended February 28, 2010, the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)viii returned 30.93%.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

March 26, 2010

All investments are subject to risk including the possible loss of principal. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

i Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time.

ii The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector.

iii The S&P/Case-Shiller Home Price Index measures the residential housing market, tracking changes in the value of the residential real estate market in twenty metropolitan regions across the United States.

iv The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments.

v The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day.

vi The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity.

vii The Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Barclays Capital U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market.

viii The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments.

| | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | 1 |

Fund overview

Q. What is the Fund’s investment strategy?

A. As a primary investment objective, the Fund seeks high current income. Capital appreciation is a secondary objective. The Fund invests primarily in high-yield corporate bonds, debentures and notes.

The managers employ an actively managed approach that assimilates top-down macroeconomic views with industry sector insights and bottom-up credit research to derive the general framework for the Fund’s predominantly non-investment grade credit mandate. This framework provides the foundation for how the portfolio is positioned with respect to risk (aggressive, neutral, conservative) as well as identifying sector overweights and underweights. Risk and weightings are reviewed on a regular basis. The bottom-up process provides the basis for populating the targeted industry weightings through individual credit selection. Analysts work closely with the portfolio managers to determine which securities provide the best risk/reward relationship within their respective sectors. The research team focuses on key fundamental measures such as leverage, cash flow adequacy, liquidity, amortization schedule, underlying asset value and management integrity/track record.

At Western Asset Management Company (“Western Asset”), the Fund’s subadviser, we utilize a fixed-income team approach, with decisions derived from interaction among various investment management sector specialists. The sector teams are comprised of Western Asset’s senior portfolio managers, research analysts and an in-house economist. Under this team approach, management of client fixed-income portfolios will reflect a consensus of interdisciplinary views within the Western Asset organization. S. Kenneth Leech, Stephen A. Walsh, Michael C. Buchanan and Keith J. Gardner are the co-leaders of the portfolio management team of this Fund. They are responsible for the day-to-day strategic oversight of the Fund’s investments and/or supervising the day-to-day operations of the various sector specialist teams dedicated to the specific asset classes in which the Fund invests.

Q. What were the overall market conditions during the Fund’s reporting period?

A. During the fiscal year, the fixed-income market staged a historic rally as corporate bonds recovered sharply from the financial crisis of 2008. The demand for risk re-emerged, in large part due to aggressive actions taken by the Federal Reserve Board (“Fed”)i, the U.S. Department of the Treasury and other government entities.

As the reporting period began, we were beginning to emerge from a “flight to quality” that was triggered by the seizing credit markets. At the epicenter of the turmoil were the continued repercussions from the September 2008 bankruptcy of Lehman Brothers. Weak economic data in the first quarter of 2009 triggered a flight to quality and caused high-yield prices to weaken in February 2009 (before the reporting period began) through early March. During this time, investors were drawn to the relative safety of shorter-term Treasuries, while riskier portions of the bond market performed poorly.

However, in the spring of 2009, conditions in the credit markets improved, as there were signs that the economy was stabilizing and investor risk aversion abated. Also supporting the spread sectors was strong demand from investors seeking incremental yields given the low rates available from short-term fixed-income securities. The rally really gained steam when economic data began to stabilize in the second quarter and upon the release of the U.S. Treasury sponsored bank “stress” tests in May. The stress tests were viewed as benign and provided relief to investors that the doomsday predictions by some in January and February that banks were generally insolvent were erroneous.

After a weak start when the fiscal year began in March 2009 and despite some temporary setbacks, the high-yield market continued to rally and generated exceptional returns during the reporting period. The market was supported by improving technicals, optimism regarding the government’s initiatives to stabilize the financial system, some encouraging corporate earnings news and signs that the recession was drawing to a close. Collectively, investor risk appetite

2 | | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | |

Fund overview (cont’d)

steadily returned and, despite rising default rates, demand for riskier high-yield securities increased. All told, the Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Indexii (the “Index”) returned 55.20% for the twelve months ended February 28, 2010. During this period, as measured by the Index, lower-rated CCC-rated bonds outperformed higher-rated BB-rated securities, returning 98.14% and 38.25%, respectively.

Q. How did we respond to these changing market conditions?

A. We made a number of adjustments to the portfolio during the reporting period. At the end of 2008, a number of large financial institutions’ securities were downgraded to below investment grade status. As a result, the Financials sector portion of the Index substantially increased. Given valuations that implied a high probability of default despite evidence of stabilizing fundamentals at many of these banks, we significantly increased the portfolio’s exposure to the Financials sector in an attempt to reduce its underweight versus the benchmark and to take advantage of this opportunity.

As a hedge against our lower-quality bias in the portfolio and given the uncertain economic environment, we emphasized more defensive industries, including Utilities, Health Care and Energy, that generally hold up relatively well during economic declines. When the sharp rally continued into the fourth quarter of 2009 and valuations improved dramatically, we sought to reduce the level of risk in the portfolio and increased the overall quality of the Fund by reducing its significant overweight to CCC-rated securities. We felt this adjustment was warranted given the fragile state of the economic recovery and external factors that could impact the financial markets. As a case in point, toward the end of the reporting period, the financial markets were negatively impacted by the debt crisis in Greece. While these concerns abated when the European Union stepped in and vowed to support Greece, it demonstrates the potential risks that remain in the marketplace.

Performance review

For the twelve months ended February 28, 2010, Western Asset Managed High Income Fund Inc. returned 58.43% based on its net asset value (“NAV”)iii and 64.09% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmark, the Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index, returned 55.20% for the same period. The Lipper High Current Yield Closed-End Funds Category Averageiv returned 44.40% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During the twelve-month period, the Fund made distributions to shareholders totaling $0.59 per share. The performance table shows the Fund’s twelve-month total return based on its NAV and market price as of February 28, 2010. Past performance is no guarantee of future results.

Performance Snapshot as of February 28, 2010

Price Per Share | | 12-Month Total Return* | |

$5.77 (NAV) | | 58.43% | |

$6.02 (Market Price) | | 64.09% | |

All figures represent past performance and are not a guarantee of future results.

* Total returns are based on changes in NAV or market price, respectively. Total returns assume the reinvestment of all distributions in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Q. What were the leading contributors to performance?

A. The portfolio’s quality biases were the largest contributors to the Fund’s relative performance during the reporting period. The portfolio’s overweight to CCC and below-rated securities benefited from improved demand, as investors looked to receive the historically high incremental yield given the low interest rate environment. The Fund also benefited from its underweight to BB-rated securities, which underperformed the benchmark as high-yield managers tended to favor securities further out the risk spectrum.

In terms of individual holdings, leading contributors to performance included our overweight positions in Ford Motor Co., Ford Motor Credit Co., LLC, DAE Aviation Holdings Inc., GMAC and Energy Future Holdings Corp. Ford Motor Co. has been able to outperform its peers in what has been an extremely difficult economic

| | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | 3 |

environment for the Automobiles sub-sector. Unlike its domestic peers, Ford Motor Co. made tremendous progress in its restructuring plan, which included a more focused product line of sporty fuel efficient vehicles and reductions in both its cost structure and debt. Ford Motor Credit Co. benefited from its historically high underwriting standards and a sole focus on automotive financing. DAE Aviation Holdings Inc., an aircraft maintenance, repair and overhaul company, maintained strong credit metrics throughout the year. GMAC was previously the wholly-owned financial services arm of General Motors and is now a U.S. bank holding company. The company performed well as it obtained several capital injections during the fiscal year through the government’s Troubled Asset Relief Program (“TARP”). In addition, GMAC reported better-than-expected earnings during the period. Energy Future Holdings Corp., a lower-quality holding, rallied sharply during the period. Our exposure to these subordinated debt holdings generated significant outperformance. Energy Future Holdings Corp.’s earnings results have been stable, as they have substantial hedges in place for their production. Despite being highly levered, the company has no near-term maturities and, we believe, has time to address its debt issues.

Q. What were the leading detractors from performance?

A. Sector selection, as a whole, was the largest detractor from the Fund’s relative performance over the fiscal year. As a hedge to the portfolio’s aggressive CCC ratings positioning, we maintained overweight positions in typically-defensive sectors such as Utilities, Health Care and Energy. However, these overweights were not rewarded as the defensive sectors of the market underperformed the higher-risk areas during the reporting period.

An underweight to the Information Technology (“IT”) sector also detracted from performance. Although IT came under tremendous distress in 2008 as a number of 2006 and 2007 vintage leveraged buyout technology companies weakened dramatically, the sector was one of the top performers within the benchmark during the reporting period.

The largest individual detractors for the period included Station Casinos Inc. and El Paso Corp., including its subsidiary Tennessee Gas Pipeline Co. Our overweight in gaming company Station Casinos Inc. detracted as the gaming market has suffered deep declines due to the severe economic recession. In addition, home prices in Las Vegas have fallen substantially since their peak in May 2006. Collectively, this has taken its toll on the local population of Las Vegas, a market of focus for Station Casinos Inc. Given deteriorating revenues, Station Casinos Inc. announced an exchange offer to bondholders in December 2008. However, this was rejected and negotiations between the parties have been difficult. Unable to reach agreement on a restructuring plan with its various debt holders, Station Casinos Inc. filed for bankruptcy protection in July 2009 and it continues to negotiate with lenders and creditors. BB-rated pipeline owner and operator El Paso Corp. also performed poorly. The issuer was out of favor during the reporting period given its defensive nature. In addition, El Paso Corp.’s earnings over the past twelve months fell due to low natural gas prices, and leverage metrics weakened from increased debt and lower EBITDAv. Free cash flow was negative throughout the year due to the firm’s continued spending on the Ruby pipeline project, further weakening near-term credit metrics. The company expects to be free cash flow positive by 2012. Concern has been growing as El Paso Corp. has been moving assets to its subsidiary El Paso Pipeline Partners, which could lead to weaker asset coverage for holders of senior unsecured El Paso Corp. debt should the subsidiary begin to raise debt at its level.

Looking for additional information?

The Fund is traded under the symbol “MHY” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XMHYX” on most financial websites. Barron’s and The Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites, as well as www.leggmason.com/cef.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888 777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Standard

4 | | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | |

Fund overview (cont’d)

Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Western Asset Managed High Income Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Western Asset Management Company

March 16, 2010

Portfolio holdings and breakdowns are as of February 28, 2010 and are subject to change and may not be representative of the portfolio managers’ current or future investments. Please refer to pages 6 through 18 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of February 28, 2010 were: Consumer Discretionary (19.1%), Financials (16.6%), Energy (13.9%), Industrials (11.3%) and Materials (10.0%). The Fund’s portfolio composition is subject to change at any time.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

RISKS: The Fund invests in high-yield bonds, which are subject to additional risks such as the increased risk of default and greater volatility because of the lower credit quality of the issues. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. In addition, the Fund may invest in foreign securities, which are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

i The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments.

ii The Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Barclays Capital U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market.

iii Net asset value (“NAV”) is calculated by subtracting total liabilities and outstanding preferred stock (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares.

iv Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the twelve-month period ended February 28, 2010, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 7 funds in the Fund’s Lipper category.

v EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization.

| | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | 5 |

Fund at a glance† (unaudited)

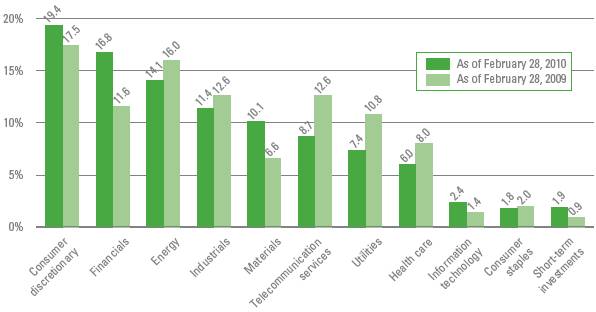

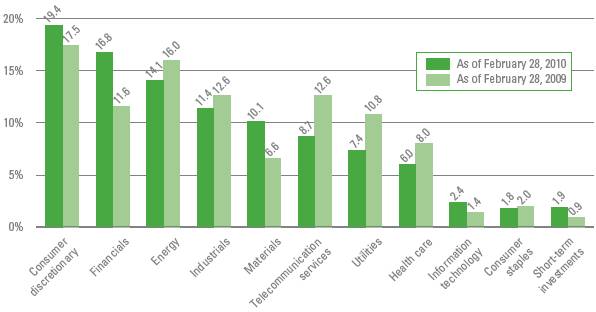

Investment breakdown (%) As a percent of total investments

† The bar graphs above represent the composition of the Fund’s investments as of February 28, 2010 and February 28, 2009 and do not include derivatives. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time.

6 | | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | |

Schedule of investments

February 28, 2010

Western Asset Managed High Income Fund Inc.

Security | | Rate | Maturity

Date | | | Face

Amount | | Value | |

Corporate Bonds & Notes — 89.9% | | | | | | | | | |

Consumer Discretionary — 17.2% | | | | | | | | | |

Auto Components — 0.4% | | | | | | | | | |

Allison Transmission Inc., Senior Notes | | 11.000 | % | 11/1/15 | | $ | 150,000 | | $ | 156,375 | (a) |

Keystone Automotive Operations Inc., Senior Subordinated Notes | | 9.750 | % | 11/1/13 | | 375,000 | | 163,125 | |

Visteon Corp., Senior Notes | | 12.250 | % | 12/31/16 | | 678,000 | | 633,930 | (a)(b) |

Total Auto Components | | | | | | | | 953,430 | |

Automobiles — 0.7% | | | | | | | | | |

Motors Liquidation Co., Senior Debentures | | 8.375 | % | 7/15/33 | | 2,860,000 | | 879,450 | (b) |

Motors Liquidation Co., Senior Notes | | 7.200 | % | 1/15/11 | | 1,860,000 | | 571,950 | (b) |

Motors Liquidation Co., Senior Notes | | 7.125 | % | 7/15/13 | | 1,325,000 | | 390,875 | (b) |

Total Automobiles | | | | | | | | 1,842,275 | |

Diversified Consumer Services — 0.5% | | | | | | | | | |

Service Corp. International, Senior Notes | | 7.500 | % | 4/1/27 | | 245,000 | | 222,338 | |

Stonemor Operating LLC/Cornerstone Family Services/Osiris Holdings, Senior Notes | | 10.250 | % | 12/1/17 | | 1,095,000 | | 1,155,225 | (a) |

Total Diversified Consumer Services | | | | | | | | 1,377,563 | |

Hotels, Restaurants & Leisure — 7.0% | | | | | | | | | |

Ameristar Casinos Inc., Senior Notes | | 9.250 | % | 6/1/14 | | 820,000 | | 842,550 | |

Boyd Gaming Corp., Senior Subordinated Notes | | 7.125 | % | 2/1/16 | | 410,000 | | 324,925 | |

Downstream Development Quapaw, Senior Notes | | 12.000 | % | 10/15/15 | | 1,030,000 | | 921,850 | (a) |

El Pollo Loco Inc., Senior Notes | | 11.750 | % | 11/15/13 | | 1,770,000 | | 1,593,000 | |

El Pollo Loco Inc., Senior Secured Notes | | 11.750 | % | 12/1/12 | | 445,000 | | 460,575 | |

Fontainebleau Las Vegas Holdings LLC/Fontainebleau Las Vegas Capital Corp. | | 10.250 | % | 6/15/15 | | 270,000 | | 4,219 | (a)(b) |

Harrah’s Operating Co. Inc., Senior Bonds | | 5.625 | % | 6/1/15 | | 490,000 | | 275,625 | |

Harrah’s Operating Co. Inc., Senior Notes | | 10.750 | % | 2/1/16 | | 2,039,000 | | 1,580,225 | |

Harrah’s Operating Co. Inc., Senior Secured Notes | | 10.000 | % | 12/15/15 | | 601,000 | | 495,825 | |

Harrah’s Operating Co. Inc., Senior Secured Notes | | 11.250 | % | 6/1/17 | | 1,985,000 | | 2,069,362 | |

Indianapolis Downs LLC & Capital Corp., Senior Secured Notes | | 11.000 | % | 11/1/12 | | 985,000 | | 645,175 | (a) |

Inn of the Mountain Gods Resort & Casino, Senior Notes | | 12.000 | % | 11/15/10 | | 2,375,000 | | 1,163,750 | (b)(c) |

Landry’s Restaurants Inc., Senior Secured Notes | | 11.625 | % | 12/1/15 | | 585,000 | | 614,250 | (a) |

MGM MIRAGE Inc., Senior Notes | | 8.500 | % | 9/15/10 | | 50,000 | | 50,125 | |

MGM MIRAGE Inc., Senior Secured Notes | | 10.375 | % | 5/15/14 | | 90,000 | | 95,850 | (a) |

MGM MIRAGE Inc., Senior Secured Notes | | 11.125 | % | 11/15/17 | | 215,000 | | 233,275 | (a) |

MGM MIRAGE Inc., Senior Subordinated Notes | | 8.375 | % | 2/1/11 | | 1,900,000 | | 1,862,000 | |

Mohegan Tribal Gaming Authority, Senior Notes | | 6.125 | % | 2/15/13 | | 250,000 | | 201,563 | |

Mohegan Tribal Gaming Authority, Senior Secured Notes | | 11.500 | % | 11/1/17 | | 1,340,000 | | 1,400,300 | (a) |

Mohegan Tribal Gaming Authority, Senior Subordinated Notes | | 8.000 | % | 4/1/12 | | 180,000 | | 160,200 | |

NCL Corp. Ltd., Senior Secured Notes | | 11.750 | % | 11/15/16 | | 1,150,000 | | 1,198,875 | (a) |

Penn National Gaming Inc., Senior Subordinated Notes | | 8.750 | % | 8/15/19 | | 260,000 | | 258,700 | (a) |

Pinnacle Entertainment Inc., Senior Notes | | 8.625 | % | 8/1/17 | | 790,000 | | 754,450 | (a) |

Sbarro Inc., Senior Notes | | 10.375 | % | 2/1/15 | | 635,000 | | 522,287 | |

Snoqualmie Entertainment Authority, Senior Secured Notes | | 4.136 | % | 2/1/14 | | 545,000 | | 373,325 | (a)(d) |

Snoqualmie Entertainment Authority, Senior Secured Notes | | 9.125 | % | 2/1/15 | | 105,000 | | 72,975 | (a) |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | 7 |

Western Asset Managed High Income Fund Inc.

Security | | Rate | Maturity

Date | | | Face

Amount | | Value | |

Hotels, Restaurants & Leisure — continued | | | | | | | | | |

Station Casinos Inc., Senior Notes | | 6.000 | % | 4/1/12 | | $ | 860,000 | | $ | 129,000 | (b)(c) |

Station Casinos Inc., Senior Notes | | 7.750 | % | 8/15/16 | | 1,430,000 | | 214,500 | (b)(c) |

Station Casinos Inc., Senior Subordinated Notes | | 6.625 | % | 3/15/18 | | 40,000 | | 408 | (b)(c) |

Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp., Secured Notes | | 7.875 | % | 11/1/17 | | 245,000 | | 243,775 | (a) |

Total Hotels, Restaurants & Leisure | | | | | | | | 18,762,939 | |

Household Durables — 0.6% | | | | | | | | | |

American Greetings Corp., Senior Notes | | 7.375 | % | 6/1/16 | | 325,000 | | 317,850 | |

Libbey Glass Inc., Senior Secured Notes | | 10.000 | % | 2/15/15 | | 640,000 | | 665,600 | (a) |

Norcraft Holdings LP/Norcraft Capital Corp., Senior Discount Notes | | 9.750 | % | 9/1/12 | | 632,000 | | 597,240 | (c) |

Total Household Durables | | | | | | | | 1,580,690 | |

Internet & Catalog Retail — 0.2% | | | | | | | | | |

Netflix Inc., Senior Notes | | 8.500 | % | 11/15/17 | | 470,000 | | 494,675 | |

Leisure Equipment & Products — 0.1% | | | | | | | | | |

Eastman Kodak Co., Senior Notes | | 7.250 | % | 11/15/13 | | 280,000 | | 265,300 | |

Media — 5.2% | | | | | | | | | |

Affinion Group Inc., Senior Subordinated Notes | | 10.125 | % | 10/15/13 | | 720,000 | | 730,800 | |

Affinion Group Inc., Senior Subordinated Notes | | 11.500 | % | 10/15/15 | | 2,525,000 | | 2,588,125 | |

CCH II LLC/CCH II Capital Corp., Senior Notes | | 13.500 | % | 11/30/16 | | 291,825 | | 343,259 | (a) |

Cengage Learning Acquisitions Inc., Senior Notes | | 10.500 | % | 1/15/15 | | 590,000 | | 540,588 | (a) |

Cengage Learning Acquisitions Inc., Senior Subordinated Notes | | 13.250 | % | 7/15/15 | | 640,000 | | 614,400 | (a) |

Charter Communications Inc., Senior Secured Notes | | 10.875 | % | 9/15/14 | | 1,980,000 | | 2,215,125 | (a) |

Clear Channel Communications Inc., Senior Notes | | 6.250 | % | 3/15/11 | | 600,000 | | 573,000 | |

DISH DBS Corp., Senior Notes | | 6.625 | % | 10/1/14 | | 270,000 | | 271,350 | |

DISH DBS Corp., Senior Notes | | 7.875 | % | 9/1/19 | | 1,620,000 | | 1,676,700 | |

Nielsen Finance LLC / Nielsen Finance Co., Senior Subordinated Notes, step bond to yield | | 10.992 | % | 8/1/16 | | 650,000 | | 591,500 | |

Sinclair Broadcast Group Inc., Senior Subordinated Notes | | 8.000 | % | 3/15/12 | | 750,000 | | 738,750 | |

Sun Media Corp., Senior Notes | | 7.625 | % | 2/15/13 | | 635,000 | | 608,013 | |

Univision Communications Inc., Senior Secured Notes | | 12.000 | % | 7/1/14 | | 1,205,000 | | 1,310,437 | (a) |

UPC Holding BV, Senior Notes | | 9.875 | % | 4/15/18 | | 410,000 | | 428,450 | (a) |

Virgin Media Finance PLC, Senior Bonds | | 9.500 | % | 8/15/16 | | 310,000 | | 330,150 | |

Virgin Media Finance PLC, Senior Notes | | 9.125 | % | 8/15/16 | | 330,000 | | 342,375 | |

Total Media | | | | | | | | 13,903,022 | |

Multiline Retail — 0.7% | | | | | | | | | |

Neiman Marcus Group Inc., Senior Notes | | 9.000 | % | 10/15/15 | | 1,412,386 | | 1,398,262 | (e) |

Neiman Marcus Group Inc., Senior Secured Notes | | 7.125 | % | 6/1/28 | | 665,000 | | 575,225 | |

Total Multiline Retail | | | | | | | | 1,973,487 | |

Specialty Retail — 1.2% | | | | | | | | | |

Blockbuster Inc., Senior Secured Notes | | 11.750 | % | 10/1/14 | | 875,000 | | 634,375 | (a) |

Michaels Stores Inc., Senior Notes | | 10.000 | % | 11/1/14 | | 1,105,000 | | 1,127,100 | |

Michaels Stores Inc., Senior Subordinated Bonds | | 11.375 | % | 11/1/16 | | 670,000 | | 676,700 | |

Michaels Stores Inc., Senior Subordinated Notes, step bond to yield | | 12.498 | % | 11/1/16 | | 1,000,000 | | 820,000 | |

Total Specialty Retail | | | | | | | | 3,258,175 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

8 | | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | |

Schedule of investments (cont’d)

February 28, 2010

Western Asset Managed High Income Fund Inc.

Security | | Rate | Maturity

Date | | | Face

Amount | | Value | |

Textiles, Apparel & Luxury Goods — 0.6% | | | | | | | | | |

Oxford Industries Inc., Senior Secured Notes | | 11.375 | % | 7/15/15 | | $ | 1,425,000 | | $ | 1,588,875 | |

Total Consumer Discretionary | | | | | | | | 46,000,431 | |

Consumer Staples — 1.8% | | | | | | | | | |

Food Products — 0.6% | | | | | | | | | |

Bumble Bee Foods LLC, Senior Secured Notes | | 7.750 | % | 12/15/15 | | 430,000 | | 432,150 | (a) |

Del Monte Corp., Senior Subordinated Notes | | 7.500 | % | 10/15/19 | | 425,000 | | 433,500 | (a) |

Dole Food Co. Inc., Senior Secured Notes | | 8.000 | % | 10/1/16 | | 430,000 | | 439,675 | (a) |

Smithfield Foods Inc., Senior Secured Notes | | 10.000 | % | 7/15/14 | | 370,000 | | 402,375 | (a) |

Total Food Products | | | | | | | | 1,707,700 | |

Household Products — 0.4% | | | | | | | | | |

American Achievement Corp., Senior Subordinated Notes | | 8.250 | % | 4/1/12 | | 355,000 | | 351,450 | (a) |

Reynolds Group DL Escrow Inc./Reynolds Group Escrow LLC, Senior Secured Notes | | 7.750 | % | 10/15/16 | | 585,000 | | 595,237 | (a) |

Total Household Products | | | | | | | | 946,687 | |

Personal Products — 0.2% | | | | | | | | | |

Revlon Consumer Products Corp., Senior Secured Notes | | 9.750 | % | 11/15/15 | | 460,000 | | 474,950 | (a) |

Tobacco — 0.6% | | | | | | | | | |

Alliance One International Inc., Senior Notes | | 10.000 | % | 7/15/16 | | 1,570,000 | | 1,640,650 | (a) |

Total Consumer Staples | | | | | | | | 4,769,987 | |

Energy — 13.4% | | | | | | | | | |

Energy Equipment & Services — 1.4% | | | | | | | | | |

Basic Energy Services Inc., Senior Secured Notes | | 11.625 | % | 8/1/14 | | 1,135,000 | | 1,222,963 | |

Complete Production Services Inc., Senior Notes | | 8.000 | % | 12/15/16 | | 690,000 | | 674,475 | |

Hercules Offshore LLC, Senior Secured Notes | | 10.500 | % | 10/15/17 | | 560,000 | | 560,000 | (a) |

Key Energy Services Inc., Senior Notes | | 8.375 | % | 12/1/14 | | 1,215,000 | | 1,208,925 | |

Parker Drilling Co., Senior Notes | | 9.625 | % | 10/1/13 | | 100,000 | | 103,000 | |

Total Energy Equipment & Services | | | | | | | | 3,769,363 | |

Oil, Gas & Consumable Fuels — 12.0% | | | | | | | | | |

Adaro Indonesia PT, Notes | | 7.625 | % | 10/22/19 | | 250,000 | | 249,375 | (a) |

Arch Coal Inc., Senior Notes | | 8.750 | % | 8/1/16 | | 745,000 | | 774,800 | (a) |

Atlas Pipeline Partners LP, Senior Notes | | 8.750 | % | 6/15/18 | | 610,000 | | 573,400 | |

Belden & Blake Corp., Secured Notes | | 8.750 | % | 7/15/12 | | 2,420,000 | | 2,238,500 | |

Berry Petroleum Co., Senior Notes | | 10.250 | % | 6/1/14 | | 700,000 | | 764,750 | |

Chesapeake Energy Corp., Senior Notes | | 6.375 | % | 6/15/15 | | 285,000 | | 277,163 | |

Chesapeake Energy Corp., Senior Notes | | 6.625 | % | 1/15/16 | | 335,000 | | 324,950 | |

Chesapeake Energy Corp., Senior Notes | | 6.500 | % | 8/15/17 | | 270,000 | | 257,850 | |

Chesapeake Energy Corp., Senior Notes | | 6.250 | % | 1/15/18 | | 950,000 | | 890,625 | |

Chesapeake Energy Corp., Senior Notes | | 7.250 | % | 12/15/18 | | 945,000 | | 935,550 | |

Compagnie Generale de Geophysique SA, Senior Notes | | 7.500 | % | 5/15/15 | | 345,000 | | 339,825 | |

Corral Petroleum Holdings AB, Senior Secured Subordinated Bonds | | 5.251 | % | 4/15/10 | | 2,133,033 | | 1,578,444 | (a)(c)(d)(e) |

Crosstex Energy/Crosstex Energy Finance Corp., Senior Notes | | 8.875 | % | 2/15/18 | | 530,000 | | 540,600 | (a) |

Denbury Resources Inc., Senior Subordinated Notes | | 8.250 | % | 2/15/20 | | 768,000 | | 798,720 | |

El Paso Corp., Senior Notes | | 8.250 | % | 2/15/16 | | 90,000 | | 95,850 | |

Encore Acquisition Co., Senior Subordinated Notes | | 9.500 | % | 5/1/16 | | 210,000 | | 224,700 | |

| | | | | | | | | | | |

See Notes to Financial Statements.

| | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | 9 |

Western Asset Managed High Income Fund Inc.

Security | | Rate | Maturity

Date | | | Face

Amount | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | |

Enterprise Products Operating LLP, Junior Subordinated Notes | | 8.375 | % | 8/1/66 | | $ | 840,000 | | $ | 850,492 | |

Enterprise Products Operating LLP, Subordinated Notes | | 7.034 | % | 1/15/68 | | 1,040,000 | | 986,855 | |

Griffin Coal Mining Co. Pty Ltd., Senior Notes | | 9.500 | % | 12/1/16 | | 40,000 | | 23,000 | (a)(b) |

International Coal Group Inc., Senior Notes | | 10.250 | % | 7/15/14 | | 1,710,000 | | 1,752,750 | |

Mariner Energy Inc., Senior Notes | | 7.500 | % | 4/15/13 | | 560,000 | | 562,800 | |

Mariner Energy Inc., Senior Notes | | 8.000 | % | 5/15/17 | | 335,000 | | 321,600 | |

MarkWest Energy Partners LP/MarkWest Energy Finance Corp., Senior Notes | | 8.750 | % | 4/15/18 | | 640,000 | | 651,200 | |

Murray Energy Corp., Senior Secured Notes | | 10.250 | % | 10/15/15 | | 1,045,000 | | 1,051,531 | (a) |

OPTI Canada Inc., Senior Secured Notes | | 9.000 | % | 12/15/12 | | 610,000 | | 623,725 | (a) |

OPTI Canada Inc., Senior Secured Notes | | 7.875 | % | 12/15/14 | | 245,000 | | 216,825 | |

OPTI Canada Inc., Senior Secured Notes | | 8.250 | % | 12/15/14 | | 520,000 | | 465,400 | |

Petrohawk Energy Corp., Senior Notes | | 9.125 | % | 7/15/13 | | 900,000 | | 940,500 | |

Petroplus Finance Ltd., Senior Notes | | 6.750 | % | 5/1/14 | | 380,000 | | 323,000 | (a) |

Petroplus Finance Ltd., Senior Notes | | 7.000 | % | 5/1/17 | | 470,000 | | 373,650 | (a) |

Plains Exploration & Production Co., Senior Notes | | 10.000 | % | 3/1/16 | | 685,000 | | 748,362 | |

Plains Exploration & Production Co., Senior Notes | | 8.625 | % | 10/15/19 | | 725,000 | | 755,812 | |

Quicksilver Resources Inc., Senior Notes | | 8.250 | % | 8/1/15 | | 720,000 | | 730,800 | |

Quicksilver Resources Inc., Senior Notes | | 11.750 | % | 1/1/16 | | 285,000 | | 324,900 | |

SandRidge Energy Inc., Senior Notes | | 8.625 | % | 4/1/15 | | 2,560,000 | | 2,521,600 | (e) |

SandRidge Energy Inc., Senior Notes | | 8.750 | % | 1/15/20 | | 30,000 | | 29,550 | (a) |

Stone Energy Corp., Senior Notes | | 8.625 | % | 2/1/17 | | 580,000 | | 569,850 | |

Teekay Corp., Senior Notes | | 8.500 | % | 1/15/20 | | 1,610,000 | | 1,642,200 | |

Tennessee Gas Pipeline Co., Senior Notes | | 8.000 | % | 2/1/16 | | 645,000 | | 744,975 | |

Tennessee Gas Pipeline Co., Senior Notes | | 8.375 | % | 6/15/32 | | 1,960,000 | | 2,326,197 | |

W&T Offshore Inc., Senior Notes | | 8.250 | % | 6/15/14 | | 795,000 | | 751,275 | (a) |

Whiting Petroleum Corp., Senior Subordinated Notes | | 7.000 | % | 2/1/14 | | 765,000 | | 776,475 | |

Total Oil, Gas & Consumable Fuels | | | | | | | | 31,930,426 | |

Total Energy | | | | | | | | 35,699,789 | |

Financials — 14.1% | | | | | | | | | |

Capital Markets — 0.1% | | | | | | | | | |

Lehman Brothers Holdings Inc., Medium-Term Notes, Senior Notes | | 5.250 | % | 2/6/12 | | 865,000 | | 198,950 | (b) |

Commercial Banks — 1.7% | | | | | | | | | |

BAC Capital Trust VI, Capital Securities, Junior Subordinated Notes | | 5.625 | % | 3/8/35 | | 650,000 | | 519,787 | |

BankAmerica Institutional Capital B, Junior Subordinated Bonds | | 7.700 | % | 12/31/26 | | 200,000 | | 191,500 | (a) |

Credit Agricole SA, Subordinated Notes | | 8.375 | % | 10/13/19 | | 400,000 | | 421,823 | (a)(d)(f) |

NB Capital Trust II, Junior Subordinated Notes | | 7.830 | % | 12/15/26 | | 200,000 | | 189,500 | |

Rabobank Nederland NV, Junior Subordinated Notes | | 11.000 | % | 6/30/19 | | 965,000 | | 1,226,214 | (a)(d)(f) |

Royal Bank of Scotland Group PLC, Subordinated Notes | | 5.000 | % | 11/12/13 | | 465,000 | | 435,353 | |

Royal Bank of Scotland Group PLC, Subordinated Notes | | 5.050 | % | 1/8/15 | | 200,000 | | 182,279 | |

Wells Fargo Capital XIII, Medium-Term Notes | | 7.700 | % | 3/26/13 | | 915,000 | | 905,850 | (d)(f) |

Wells Fargo Capital XV, Junior Subordinated Notes | | 9.750 | % | 9/26/13 | | 365,000 | | 398,105 | (d)(f) |

Total Commercial Banks | | | | | | | | 4,470,411 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

10 | | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | |

Schedule of investments (cont’d)

February 28, 2010

Western Asset Managed High Income Fund Inc.

Security | | Rate | Maturity

Date | | | Face

Amount | | Value | |

Consumer Finance — 5.1% | | | | | | | | | |

FMG Finance Pty Ltd., Senior Secured Notes | | 10.625 | % | 9/1/16 | | $ | 1,480,000 | | $ | 1,657,600 | (a) |

Ford Motor Credit Co., LLC, Senior Notes | | 9.875 | % | 8/10/11 | | 1,060,000 | | 1,112,328 | |

Ford Motor Credit Co., LLC, Senior Notes | | 7.500 | % | 8/1/12 | | 615,000 | | 617,913 | |

Ford Motor Credit Co., LLC, Senior Notes | | 12.000 | % | 5/15/15 | | 4,955,000 | | 5,665,790 | |

GMAC Inc., Senior Notes | | 7.500 | % | 12/31/13 | | 190,000 | | 188,100 | |

GMAC Inc., Senior Notes | | 8.300 | % | 2/12/15 | | 1,710,000 | | 1,729,237 | (a) |

GMAC Inc., Senior Notes | | 8.000 | % | 11/1/31 | | 373,000 | | 347,822 | |

GMAC LLC, Senior Bonds, zero coupon bond to yield | | 8.278 | % | 12/1/12 | | 1,160,000 | | 928,305 | |

SLM Corp., Medium-Term Notes, Senior Notes | | 8.450 | % | 6/15/18 | | 890,000 | | 871,850 | |

SLM Corp., Medium-Term Notes, Senior Notes | | 5.625 | % | 8/1/33 | | 550,000 | | 424,338 | |

Total Consumer Finance | | | | | | | | 13,543,283 | |

Diversified Financial Services — 4.6% | | | | | | | | | |

AES Red Oak LLC, Secured Notes | | 9.200 | % | 11/30/29 | | 870,000 | | 865,650 | |

Bank of America Corp., Notes, Preferred Securities | | 8.000 | % | 1/30/18 | | 65,000 | | 62,041 | (d)(f) |

Capital One Capital V, Junior Subordinated Notes,

Cumulative Trust Preferred Securities | | 10.250 | % | 8/15/39 | | 680,000 | | 773,248 | |

CCM Merger Inc., Notes | | 8.000 | % | 8/1/13 | | 1,450,000 | | 1,210,750 | (a) |

CIT Group Inc., Senior Secured Bonds | | 7.000 | % | 5/1/13 | | 139,495 | | 132,869 | |

CIT Group Inc., Senior Secured Bonds | | 7.000 | % | 5/1/14 | | 209,243 | | 192,242 | |

CIT Group Inc., Senior Secured Bonds | | 7.000 | % | 5/1/15 | | 209,243 | | 190,673 | |

CIT Group Inc., Senior Secured Bonds | | 7.000 | % | 5/1/16 | | 468,739 | | 416,592 | |

CIT Group Inc., Senior Secured Bonds | | 7.000 | % | 5/1/17 | | 2,758,235 | | 2,447,934 | |

Countrywide Capital III, Junior Subordinated Notes | | 8.050 | % | 6/15/27 | | 180,000 | | 173,193 | |

JPMorgan Chase & Co., Junior Subordinated Notes | | 7.900 | % | 4/30/18 | | 1,120,000 | | 1,161,664 | (d)(f) |

Leucadia National Corp., Senior Notes | | 8.125 | % | 9/15/15 | | 980,000 | | 999,600 | |

MBNA Capital A, Junior Subordinated Notes | | 8.278 | % | 12/1/26 | | 120,000 | | 117,900 | |

Smurfit Kappa Funding PLC, Senior Subordinated Notes | | 7.750 | % | 4/1/15 | | 450,000 | | 438,750 | |

TNK-BP Finance SA | | 7.875 | % | 3/13/18 | | 918,000 | | 966,195 | (a) |

TNK-BP Finance SA, Senior Notes | | 7.875 | % | 3/13/18 | | 445,000 | | 467,828 | (a) |

UPC Germany GmbH, Senior Secured Bonds | | 8.125 | % | 12/1/17 | | 700,000 | | 703,500 | (a) |

Vanguard Health Holdings Co., II LLC, Senior Notes | | 8.000 | % | 2/1/18 | | 870,000 | | 859,125 | (a) |

Total Diversified Financial Services | | | | | | | | 12,179,754 | |

Insurance — 1.4% | | | | | | | | | |

American International Group Inc., Junior Subordinated Notes | | 8.175 | % | 5/15/58 | | 525,000 | | 358,313 | (d) |

American International Group Inc., Medium-Term Notes, Senior Notes | | 5.450 | % | 5/18/17 | | 1,415,000 | | 1,151,571 | |

American International Group Inc., Medium-Term Notes, Senior Notes | | 5.850 | % | 1/16/18 | | 370,000 | | 299,206 | |

American International Group Inc., Senior Notes | | 5.050 | % | 10/1/15 | | 330,000 | | 279,152 | |

American International Group Inc., Senior Notes | | 8.250 | % | 8/15/18 | | 890,000 | | 817,899 | |

Everest Reinsurance Holdings Inc., Subordinated Notes | | 6.600 | % | 5/15/37 | | 710,000 | | 571,550 | (d) |

MetLife Capital Trust IV, Junior Subordinated Notes | | 7.875 | % | 12/15/37 | | 360,000 | | 356,400 | (a) |

Total Insurance | | | | | | | | 3,834,091 | |

Real Estate Investment Trusts (REITs) — 0.6% | | | | | | | | | |

DuPont Fabros Technology LP, Senior Notes | | 8.500 | % | 12/15/17 | | 430,000 | | 438,600 | (a) |

Host Marriott LP, Senior Notes | | 7.125 | % | 11/1/13 | | 375,000 | | 381,094 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | 11 |

Western Asset Managed High Income Fund Inc.

Security | | Rate | | Maturity

Date | | Face

Amount | | Value | |

Real Estate Investment Trusts (REITs) — continued | | | | | | | | | |

Ventas Realty LP/Ventas Capital Corp., Senior Notes | | 6.500 | % | 6/1/16 | | $ | 220,000 | | $ | 220,550 | |

Ventas Realty LP/Ventas Capital Corp., Senior Notes | | 6.750 | % | 4/1/17 | | 695,000 | | 698,475 | |

Total Real Estate Investment Trusts (REITs) | | | | | | | | 1,738,719 | |

Real Estate Management & Development — 0.6% | | | | | | | | | |

Ashton Woods USA LLC, Ashton Woods Finance Co., Senior Subordinated Notes, step bond to yield | | 24.274 | % | 6/30/15 | | 395,200 | | 130,416 | (a)(c) |

Realogy Corp., Senior Notes | | 10.500 | % | 4/15/14 | | 1,750,000 | | 1,470,000 | |

Realogy Corp., Senior Toggle Notes | | 11.000 | % | 4/15/14 | | 122,539 | | 101,095 | (e) |

Total Real Estate Management & Development | | | | | | | | 1,701,511 | |

Total Financials | | | | | | | | 37,666,719 | |

Health Care — 5.9% | | | | | | | | | |

Biotechnology — 0.2% | | | | | | | | | |

Talecris Biotherapeutics Holdings Corp., Senior Notes | | 7.750 | % | 11/15/16 | | 490,000 | | 494,900 | (a) |

Health Care Equipment & Supplies — 0.4% | | | | | | | | | |

Biomet Inc., Senior Notes | | 10.000 | % | 10/15/17 | | 560,000 | | 614,600 | |

Biomet Inc., Senior Toggle Notes | | 10.375 | % | 10/15/17 | | 565,000 | | 621,500 | (e) |

Total Health Care Equipment & Supplies | | | | | | | | 1,236,100 | |

Health Care Providers & Services — 5.3% | | | | | | | | | |

CRC Health Corp., Senior Subordinated Notes | | 10.750 | % | 2/1/16 | | 2,135,000 | | 1,932,175 | |

HCA Inc., Debentures | | 7.500 | % | 11/15/95 | | 2,345,000 | | 1,856,893 | |

HCA Inc., Notes | | 7.690 | % | 6/15/25 | | 490,000 | | 445,978 | |

HCA Inc., Senior Notes | | 6.250 | % | 2/15/13 | | 25,000 | | 24,625 | |

HCA Inc., Senior Secured Notes | | 7.875 | % | 2/15/20 | | 1,890,000 | | 1,979,775 | (a) |

Tenet Healthcare Corp., Senior Notes | | 9.000 | % | 5/1/15 | | 822,000 | | 865,155 | (a) |

Tenet Healthcare Corp., Senior Notes | | 10.000 | % | 5/1/18 | | 2,077,000 | | 2,295,085 | (a) |

Tenet Healthcare Corp., Senior Secured Notes | | 8.875 | % | 7/1/19 | | 158,000 | | 167,480 | (a) |

Universal Hospital Services Inc., Senior Secured Notes | | 3.859 | % | 6/1/15 | | 320,000 | | 272,000 | (d) |

Universal Hospital Services Inc., Senior Secured Notes | | 8.500 | % | 6/1/15 | | 1,190,000 | | 1,160,250 | (e) |

US Oncology Holdings Inc., Senior Notes | | 7.178 | % | 3/15/12 | | 2,175,000 | | 2,055,375 | (d)(e) |

US Oncology Inc., Senior Secured Notes | | 9.125 | % | 8/15/17 | | 1,055,000 | | 1,099,838 | |

Total Health Care Providers & Services | | | | | | | | 14,154,629 | |

Total Health Care | | | | | | | | 15,885,629 | |

Industrials — 10.1% | | | | | | | | | |

Aerospace & Defense — 0.7% | | | | | | | | | |

Freedom Group Inc., Senior Secured Notes | | 10.250 | % | 8/1/15 | | 110,000 | | 117,150 | (a) |

L-3 Communications Corp., Senior Subordinated Notes | | 5.875 | % | 1/15/15 | | 870,000 | | 877,612 | |

TransDigm Inc., Senior Subordinated Notes | | 7.750 | % | 7/15/15 | | 1,025,000 | | 1,030,125 | (a) |

Total Aerospace & Defense | | | | | | | | 2,024,887 | |

Airlines — 2.9% | | | | | | | | | |

American Airlines Inc., Senior Secured Notes | | 10.500 | % | 10/15/12 | | 240,000 | | 247,200 | (a) |

Continental Airlines Inc., Pass-Through Certificates | | 8.312 | % | 4/2/11 | | 124,879 | | 120,509 | |

Continental Airlines Inc., Pass-Through Certificates | | 7.339 | % | 4/19/14 | | 560,000 | | 526,400 | |

Continental Airlines Inc., Pass-Through Certificates | | 9.250 | % | 5/10/17 | | 115,000 | | 115,863 | |

DAE Aviation Holdings Inc., Senior Notes | | 11.250 | % | 8/1/15 | | 3,105,000 | | 2,848,837 | (a) |

| | | | | | | | | | | |

See Notes to Financial Statements.

12 | | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | |

Schedule of investments (cont’d)

February 28, 2010

Western Asset Managed High Income Fund Inc.

Security | | Rate | | Maturity

Date | | Face

Amount | | Value | |

Airlines — continued | | | | | | | | | |

Delta Air Lines Inc., Pass-Through Certificates | | 7.711 | % | 9/18/11 | | $1,110,000 | | $ | 1,098,900 | |

Delta Air Lines Inc., Pass-Through Certificates | | 8.954 | % | 8/10/14 | | 887,461 | | 820,902 | |

Delta Air Lines Inc., Pass-Through Certificates, Subordinated Notes | | 9.750 | % | 12/17/16 | | 380,000 | | 391,400 | |

Delta Air Lines Inc., Secured Notes | | 8.021 | % | 8/10/22 | | 778,690 | | 710,554 | |

Delta Air Lines Inc., Senior Secured Notes | | 9.500 | % | 9/15/14 | | 400,000 | | 409,000 | (a) |

United Air Lines Inc., Senior Secured Notes | | 9.875 | % | 8/1/13 | | 370,000 | | 371,850 | (a) |

Total Airlines | | | | | | | | 7,661,415 | |

Building Products — 0.4% | | | | | | | | | |

Associated Materials Inc., Senior Discount Notes | | 11.250 | % | 3/1/14 | | 185,000 | | 184,075 | |

Nortek Inc., Senior Secured Notes | | 11.000 | % | 12/1/13 | | 752,044 | | 793,407 | |

USG Corp., Senior Notes | | 9.750 | % | 8/1/14 | | 135,000 | | 142,425 | (a) |

Total Building Products | | | | | | | | 1,119,907 | |

Commercial Services & Supplies — 3.0% | | | | | | | | | |

ACCO Brands Corp., Senior Secured Notes | | 10.625 | % | 3/15/15 | | 1,020,000 | | 1,113,840 | (a) |

Altegrity Inc., Senior Subordinated Notes | | 10.500 | % | 11/1/15 | | 160,000 | | 149,800 | (a) |

Altegrity Inc., Senior Subordinated Notes | | 11.750 | % | 5/1/16 | | 1,460,000 | | 1,315,825 | (a) |

DynCorp International LLC/DIV Capital Corp., Senior Subordinated Notes | | 9.500 | % | 2/15/13 | | 165,000 | | 167,063 | |

Geo Group Inc., Senior Notes | | 7.750 | % | 10/15/17 | | 980,000 | | 997,150 | (a) |

International Lease Finance Corp., Medium-Term Notes | | 6.375 | % | 3/25/13 | | 1,290,000 | | 1,136,932 | |

International Lease Finance Corp., Medium-Term Notes, Senior Notes | | 5.750 | % | 6/15/11 | | 120,000 | | 115,211 | |

International Lease Finance Corp., Medium-Term Notes, Senior Notes | | 5.625 | % | 9/20/13 | | 1,010,000 | | 862,201 | |

International Lease Finance Corp., Senior Notes | | 5.250 | % | 1/10/13 | | 290,000 | | 251,716 | |

RSC Equipment Rental Inc., Senior Notes | | 9.500 | % | 12/1/14 | | 1,450,000 | | 1,410,125 | |

RSC Equipment Rental Inc., Senior Secured Notes | | 10.000 | % | 7/15/17 | | 520,000 | | 559,000 | (a) |

Total Commercial Services & Supplies | | | | | | | | 8,078,863 | |

Electrical Equipment — 0.1% | | | | | | | | | |

Coleman Cable Inc., Senior Notes | | 9.000 | % | 2/15/18 | | 230,000 | | 228,850 | (a) |

Machinery — 0.2% | | | | | | | | | |

American Railcar Industries Inc., Senior Notes | | 7.500 | % | 3/1/14 | | 430,000 | | 419,250 | |

Oshkosh Corp., Senior Notes | | 8.500 | % | 3/1/20 | | 100,000 | | 100,000 | (a) |

Total Machinery | | | | | | | | 519,250 | |

Marine — 0.6% | | | | | | | | | |

Marquette Transportation Co./Marquette Transportation Finance Corp., Senior Secured Notes | | 10.875 | % | 1/15/17 | | 170,000 | | 171,913 | (a) |

Trico Shipping AS, Senior Secured Notes | | 11.875 | % | 11/1/14 | | 1,440,000 | | 1,402,200 | (a) |

Total Marine | | | | | | | | 1,574,113 | |

Road & Rail — 1.4% | | | | | | | | | |

Kansas City Southern de Mexico, Senior Notes | | 9.375 | % | 5/1/12 | | 765,000 | | 791,775 | |

Kansas City Southern de Mexico, Senior Notes | | 7.375 | % | 6/1/14 | | 315,000 | | 315,000 | |

Kansas City Southern de Mexico, Senior Notes | | 12.500 | % | 4/1/16 | | 570,000 | | 654,075 | |

Kansas City Southern de Mexico, Senior Notes | | 8.000 | % | 2/1/18 | | 250,000 | | 248,125 | (a) |

Kansas City Southern Railway, Senior Notes | | 13.000 | % | 12/15/13 | | 210,000 | | 243,862 | |

RailAmerica Inc., Senior Secured Notes | | 9.250 | % | 7/1/17 | | 1,444,000 | | 1,521,615 | |

Total Road & Rail | | | | | | | | 3,774,452 | |

| | | | | | | | | | |

See Notes to Financial Statements.

| | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | 13 |

Western Asset Managed High Income Fund Inc.

Security | | Rate | | Maturity

Date | | Face

Amount | | Value | |

Trading Companies & Distributors — 0.8% | | | | | | | | | |

Ashtead Capital Inc., Notes | | 9.000 | % | 8/15/16 | | $ | 470,000 | | $ | 474,700 | (a) |

Ashtead Holdings PLC, Senior Secured Notes | | 8.625 | % | 8/1/15 | | 280,000 | | 280,000 | (a) |

H&E Equipment Services Inc., Senior Notes | | 8.375 | % | 7/15/16 | | 735,000 | | 735,000 | |

Penhall International Corp., Senior Secured Notes | | 12.000 | % | 8/1/14 | | 825,000 | | 622,875 | (a)(c) |

Total Trading Companies & Distributors | | | | | | | | 2,112,575 | |

Total Industrials | | | | | | | | 27,094,312 | |

Information Technology — 2.3% | | | | | | | | | |

Electronic Equipment, Instruments & Components — 0.3% | | | | | | | | |

Jabil Circuit Inc., Senior Notes | | 7.750 | % | 7/15/16 | | 390,000 | | 405,600 | |

Jabil Circuit Inc., Senior Notes | | 8.250 | % | 3/15/18 | | 50,000 | | 53,625 | |

NXP BV/NXP Funding LLC, Senior Secured Notes | | 7.875 | % | 10/15/14 | | 460,000 | | 427,800 | |

Total Electronic Equipment, Instruments & Components | | | | | | | 887,025 | |

Internet Software & Services — 0.1% | | | | | | | | | |

Equinix Inc., Senior Notes | | 8.125 | % | 3/1/18 | | 390,000 | | 390,000 | |

IT Services — 1.4% | | | | | | | | | |

Ceridian Corp., Senior Notes | | 12.250 | % | 11/15/15 | | 899,925 | | 863,928 | (e) |

First Data Corp., Senior Notes | | 5.625 | % | 11/1/11 | | 150,000 | | 128,250 | |

First Data Corp., Senior Notes | | 9.875 | % | 9/24/15 | | 980,000 | | 842,800 | |

First Data Corp., Senior Notes | | 10.550 | % | 9/24/15 | | 1,630,000 | | 1,422,175 | (e) |

GXS Worldwide Inc., Senior Secured Notes | | 9.750 | % | 6/15/15 | | 460,000 | | 439,300 | (a) |

Total IT Services | | | | | | | | 3,696,453 | |

Semiconductors & Semiconductor Equipment — 0.5% | | | | | | | | | |

Advanced Micro Devices Inc., Senior Notes | | 8.125 | % | 12/15/17 | | 215,000 | | 218,762 | (a) |

Freescale Semiconductor Inc., Senior Notes | | 8.875 | % | 12/15/14 | | 530,000 | | 473,025 | |

Freescale Semiconductor Inc., Senior Notes | | 9.125 | % | 12/15/14 | | 209,226 | | 181,504 | (e) |

Freescale Semiconductor Inc., Senior Subordinated Notes | | 10.125 | % | 12/15/16 | | 550,000 | | 431,750 | |

Total Semiconductors & Semiconductor Equipment | | | | | | | | 1,305,041 | |

Total Information Technology | | | | | | | | 6,278,519 | |

Materials — 9.8% | | | | | | | | | |

Chemicals — 3.1% | | | | | | | | | |

Ashland Inc., Senior Notes | | 9.125 | % | 6/1/17 | | 1,680,000 | | 1,843,800 | (a) |

FMC Finance III SA, Senior Notes | | 6.875 | % | 7/15/17 | | 1,170,000 | | 1,205,100 | |

Georgia Gulf Corp., Senior Secured Notes | | 9.000 | % | 1/15/17 | | 1,015,000 | | 1,058,138 | (a) |

Hexion Finance Escrow LLC/Hexion Escrow Corp., Senior Secured Notes | | 8.875 | % | 2/1/18 | | 420,000 | | 394,800 | (a) |

Kerling PLC, Senior Secured Notes | | 10.625 | % | 1/28/17 | | 582,000 | | 805,890 | (a) |

Solutia Inc., Senior Notes | | 8.750 | % | 11/1/17 | | 585,000 | | 614,250 | |

Terra Capital Inc., Senior Notes | | 7.750 | % | 11/1/19 | | 1,960,000 | | 2,195,200 | (a) |

Total Chemicals | | | | | | | | 8,117,178 | |

Construction Materials — 0.0% | | | | | | | | | |

Headwaters Inc., Senior Secured Notes | | 11.375 | % | 11/1/14 | | 45,000 | | 45,675 | (a) |

Containers & Packaging — 1.2% | | | | | | | | | |

Berry Plastics Holding Corp., Second Priority Senior Secured Notes | | 8.875 | % | 9/15/14 | | 485,000 | | 469,238 | |

BWAY Corp., Senior Subordinated Notes | | 10.000 | % | 4/15/14 | | 310,000 | | 320,850 | (a) |

| | | | | | | | | | | |

See Notes to Financial Statements.

14 | | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | |

Schedule of investments (cont’d)

February 28, 2010

Western Asset Managed High Income Fund Inc.

Security | | Rate | | Maturity

Date | | Face

Amount | | Value | |

Containers & Packaging — continued | | | | | | | | | |

Radnor Holdings Inc., Senior Notes | | 11.000 | % | 3/15/10 | | $ | 425,000 | | $ | 0 | (b)(c)(g) |

Rock-Tenn Co., Senior Notes | | 9.250 | % | 3/15/16 | | 390,000 | | 427,050 | |

Solo Cup Co., Senior Secured Notes | | 10.500 | % | 11/1/13 | | 955,000 | | 1,005,137 | |

Viskase Cos. Inc., Senior Secured Notes | | 9.875 | % | 1/15/18 | | 970,000 | | 986,975 | (a) |

Total Containers & Packaging | | | | | | | | 3,209,250 | |

Metals & Mining — 1.9% | | | | | | | | | |

Metals USA Inc., Senior Secured Notes | | 11.125 | % | 12/1/15 | | 2,315,000 | | 2,349,725 | |

Novelis Inc., Senior Notes | | 7.250 | % | 2/15/15 | | 1,060,000 | | 988,450 | |

Ryerson Holding Corp., Senior Discount Notes, zero coupon bond to yield | | 16.311 | % | 2/1/15 | | 1,720,000 | | 748,200 | (a) |

Ryerson Inc., Senior Secured Notes | | 12.000 | % | 11/1/15 | | 195,000 | | 201,337 | |

Teck Resources Ltd., Senior Secured Notes | | 9.750 | % | 5/15/14 | | 400,000 | | 474,000 | |

Teck Resources Ltd., Senior Secured Notes | | 10.250 | % | 5/15/16 | | 330,000 | | 395,175 | |

Total Metals & Mining | | | | | | | | 5,156,887 | |

Paper & Forest Products — 3.6% | | | | | | | | | |

Abitibi-Consolidated Co. of Canada, Senior Secured Notes | | 13.750 | % | 4/1/11 | | 1,538,720 | | 1,588,729 | (a) |

Appleton Papers Inc., Senior Secured Notes | | 10.500 | % | 6/15/15 | | 520,000 | | 483,600 | (a) |

Appleton Papers Inc., Senior Secured Notes | | 11.250 | % | 12/15/15 | | 2,462,000 | | 2,105,010 | (a) |

Georgia-Pacific LLC, Senior Notes | | 8.250 | % | 5/1/16 | | 1,050,000 | | 1,113,000 | (a) |

NewPage Corp., Senior Secured Notes | | 10.000 | % | 5/1/12 | | 10,000 | | 5,800 | |

NewPage Corp., Senior Secured Notes | | 11.375 | % | 12/31/14 | | 1,370,000 | | 1,315,200 | |

PE Paper Escrow GmbH, Senior Secured Notes | | 12.000 | % | 8/1/14 | | 340,000 | | 369,533 | (a) |

Verso Paper Holdings LLC, Senior Secured Notes | | 11.500 | % | 7/1/14 | | 1,105,000 | | 1,165,775 | (a) |

Verso Paper Holdings LLC, Senior Secured Notes | | 9.125 | % | 8/1/14 | | 1,535,000 | | 1,419,875 | |

Total Paper & Forest Products | | | | | | | | 9,566,522 | |

Total Materials | | | | | | | | 26,095,512 | |

Telecommunication Services — 8.2% | | | | | | | | | |

Diversified Telecommunication Services — 4.8% | | | | | | | | | |

CC Holdings GS V LLC, Senior Secured Notes | | 7.750 | % | 5/1/17 | | 980,000 | | 1,065,750 | (a) |

Cincinnati Bell Telephone Co., Senior Debentures | | 6.300 | % | 12/1/28 | | 175,000 | | 136,500 | |

Frontier Communications Corp., Senior Notes | | 8.125 | % | 10/1/18 | | 320,000 | | 320,000 | |

Hawaiian Telcom Communications Inc., Senior Subordinated Notes | | 12.500 | % | 5/1/15 | | 670,000 | | 67 | (b)(c) |

Intelsat Bermuda Ltd., Senior Notes | | 11.250 | % | 6/15/16 | | 910,000 | | 975,975 | |

Intelsat Corp., Senior Notes | | 9.250 | % | 8/15/14 | | 570,000 | | 589,950 | |

Intelsat Intermediate Holding Co., Ltd., Senior Discount Notes | | 9.500 | % | 2/1/15 | | 1,045,000 | | 1,084,188 | |

Intelsat Jackson Holdings Ltd., Senior Notes | | 9.500 | % | 6/15/16 | | 155,000 | | 163,525 | |

Intelsat Jackson Holdings Ltd., Senior Notes | | 11.500 | % | 6/15/16 | | 2,390,000 | | 2,557,300 | |

Level 3 Financing Inc., Senior Notes | | 10.000 | % | 2/1/18 | | 600,000 | | 553,500 | (a) |

Nordic Telephone Co. Holdings, Senior Secured Bonds | | 8.875 | % | 5/1/16 | | 1,000,000 | | 1,075,000 | (a) |

Qwest Communications International Inc., Senior Notes | | 7.500 | % | 2/15/14 | | 235,000 | | 238,525 | |

Qwest Communications International Inc., Senior Notes | | 8.000 | % | 10/1/15 | | 575,000 | | 598,000 | (a) |

Wind Acquisition Finance SA, Senior Bonds | | 12.000 | % | 12/1/15 | | 1,500,000 | | 1,612,500 | (a) |

Wind Acquisition Holdings Finance SpA, Senior Notes | | 12.250 | % | 7/15/17 | | 440,000 | | 409,200 | (a) |

Windstream Corp., Senior Notes | | 8.625 | % | 8/1/16 | | 1,365,000 | | 1,395,712 | |

Total Diversified Telecommunication Services | | | | | | | | 12,775,692 | |

| | | | | | | | | | | |

See Notes to Financial Statements.

| | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | 15 |

Western Asset Managed High Income Fund Inc.

Security | | Rate | | Maturity

Date | | Face

Amount | | Value | |

Wireless Telecommunication Services — 3.4% | | | | | | | | | |

ALLTEL Communications Inc., Senior Notes | | 10.375 | % | 12/1/17 | | $ | 800,000 | | $ | 951,094 | (a)(c)(e) |

Cricket Communications Inc., Senior Secured Notes | | 7.750 | % | 5/15/16 | | 1,500,000 | | 1,531,875 | |

Sprint Capital Corp., Senior Notes | | 7.625 | % | 1/30/11 | | 120,000 | | 123,000 | |

Sprint Capital Corp., Senior Notes | | 8.375 | % | 3/15/12 | | 350,000 | | 359,188 | |

Sprint Capital Corp., Senior Notes | | 6.875 | % | 11/15/28 | | 350,000 | | 266,875 | |

Sprint Capital Corp., Senior Notes | | 8.750 | % | 3/15/32 | | 5,225,000 | | 4,637,187 | |

True Move Co., Ltd., Notes | | 10.750 | % | 12/16/13 | | 1,370,000 | | 1,390,550 | (a) |

Total Wireless Telecommunication Services | | | | | | | | 9,259,769 | |

Total Telecommunication Services | | | | | | | | 22,035,461 | |

Utilities — 7.1% | | | | | | | | | |

Electric Utilities — 2.8% | | | | | | | | | |

Reliant Energy Mid-Atlantic Power Holdings LLC, Senior Notes | | 9.681 | % | 7/2/26 | | 1,450,000 | | 1,542,438 | |

Texas Competitive Electric Holdings Co. LLC, Senior Notes | | 10.250 | % | 11/1/15 | | 7,855,000 | | 5,910,102 | |

Total Electric Utilities | | | | | | | | 7,452,540 | |

Gas Utilities — 0.1% | | | | | | | | | |

Suburban Propane Partners LP/Suburban Energy Finance Corp., Senior Notes | | 6.875 | % | 12/15/13 | | 155,000 | | 157,325 | |

Independent Power Producers & Energy Traders — 4.2% | | | | | | | | | |

AES Corp., Secured Notes | | 8.750 | % | 5/15/13 | | 930,000 | | 950,925 | (a) |

AES Corp., Senior Notes | | 8.000 | % | 10/15/17 | | 286,000 | | 285,643 | |

AES Corp., Senior Notes | | 8.000 | % | 6/1/20 | | 960,000 | | 946,800 | |

Dynegy Holdings Inc., Senior Notes | | 7.750 | % | 6/1/19 | | 2,740,000 | | 2,164,600 | |

Dynegy Inc., Bonds | | 7.670 | % | 11/8/16 | | 160,000 | | 154,400 | |

Edison Mission Energy, Senior Notes | | 7.750 | % | 6/15/16 | | 1,000,000 | | 805,000 | |

Edison Mission Energy, Senior Notes | | 7.200 | % | 5/15/19 | | 840,000 | | 594,300 | |

Edison Mission Energy, Senior Notes | | 7.625 | % | 5/15/27 | | 1,065,000 | | 697,575 | |

Energy Future Holdings Corp., Senior Notes | | 10.875 | % | 11/1/17 | | 2,090,000 | | 1,593,625 | |

Energy Future Holdings Corp., Senior Notes | | 11.250 | % | 11/1/17 | | 445,942 | | 314,389 | (e) |

Mirant Americas Generation LLC, Senior Notes | | 9.125 | % | 5/1/31 | | 645,000 | | 582,112 | |

Mirant Mid Atlantic LLC, Pass-Through Certificates | | 9.125 | % | 6/30/17 | | 219,159 | | 231,213 | |

Mirant Mid Atlantic LLC, Pass-Through Certificates | | 10.060 | % | 12/30/28 | | 526,119 | | 565,578 | |

NRG Energy Inc., Senior Notes | | 7.250 | % | 2/1/14 | | 1,340,000 | | 1,353,400 | |

NRG Energy Inc., Senior Notes | | 7.375 | % | 1/15/17 | | 45,000 | | 44,381 | |

Total Independent Power Producers & Energy Traders | | | | | | | | 11,283,941 | |

Total Utilities | | | | | | | | 18,893,806 | |

Total Corporate Bonds & Notes (Cost — $234,405,457) | | | | | | | | 240,420,165 | |

Collateralized Senior Loans — 3.2% | | | | | | | | | |

Consumer Discretionary — 0.9% | | | | | | | | | |

Auto Components — 0.4% | | | | | | | | | |

Allison Transmission Inc., Term Loan B | 2.980 - 3.000 | % | 5/11/10 | | 1,086,377 | | 1,000,146 | (h)(i) |

Media — 0.5% | | | | | | | | | |

Idearc Inc., Term Loan | | 11.000 | % | 3/31/10 | | 392,621 | | 359,862 | (h)(i) |

Newsday LLC, Term Loan | | 10.500 | % | 7/15/10 | | 1,000,000 | | 1,073,750 | (h)(i) |

Total Media | | | | | | | | 1,433,612 | |

Total Consumer Discretionary | | | | | | | | 2,433,758 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

16 | | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | |

Schedule of investments (cont’d)

February 28, 2010

Western Asset Managed High Income Fund Inc.

Security | | Rate | | Maturity

Date | | Face

Amount | | Value | |

Energy — 0.5% | | | | | | | | | |

Energy Equipment & Services — 0.5% | | | | | | | | | |

Turbo Beta Ltd., Term Loan | | 14.500 | % | 5/13/10 | | $ | 1,577,104 | | $ | 1,387,851 | (c)(h)(i) |

Financials — 0.8% | | | | | | | | | |

Diversified Financial Services — 0.2% | | | | | | | | | |

CIT Group Inc., Term Loan | | 13.000 | % | 3/12/10 | | 450,000 | | 465,985 | (h)(i) |

Real Estate Management & Development — 0.6% | | | | | | | | | |

Realogy Corp., Term Loan | | 13.500 | % | 4/15/10 | | 1,500,000 | | 1,641,750 | (h)(i) |

Total Financials | | | | | | | | 2,107,735 | |

Industrials — 0.5% | | | | | | | | | |

Aerospace & Defense — 0.1% | | | | | | | | | |

Hawker Beechcraft, Term Loan B | 2.229 - 2.251 | % | 3/31/10 | | 385,000 | | 286,224 | (h)(i) |

Airlines — 0.3% | | | | | | | | | |

United Airlines Inc., Term Loan B | | 2.250 | % | 4/28/10 | | 985,759 | | 803,805 | (h)(i) |

Trading Companies & Distributors — 0.1% | | | | | | | | | |

Penhall International Corp., Term Loan | | 9.631 | % | 4/1/10 | | 806,108 | | 100,763 | (h)(i) |

Total Industrials | | | | | | | | 1,190,792 | |

Telecommunication Services — 0.3% | | | | | | | | | |

Diversified Telecommunication Services — 0.3% | | | | | | | | | |

Level 3 Communications Inc., Term Loan | | 11.500 | % | 4/15/10 | | 750,000 | | 813,281 | (h)(i) |

Utilities — 0.2% | | | | | | | | | |

Independent Power Producers & Energy Traders — 0.2% | | | | | | | | | |

Energy Future Holdings, Term Loan | 3.729 - 3.751 | % | 10/10/14 | | 670,000 | | 538,969 | (h)(i) |

Total Collateralized Senior Loans (Cost — $8,789,624) | | | | | | | | 8,472,386 | |

Convertible Bonds & Notes — 0.7% | | | | | | | | | |

Industrials — 0.7% | | | | | | | | | |

Marine — 0.7% | | | | | | | | | |

Horizon Lines Inc., Senior Notes (Cost — $1,794,797) | | 4.250 | % | 8/15/12 | | 2,100,000 | | 1,748,250 | |

| | | | | | | | | |

| | | | | | Shares | | | |

Common Stocks — 1.4% | | | | | | | | | |

Consumer Discretionary — 1.0% | | | | | | | | | |

Media — 1.0% | | | | | | | | | |

Charter Communications Inc. | | | | | | 57,830 | | 1,720,442 | *(g) |

Charter Communications Inc., Class A Shares | | | | | | 24,399 | | 725,870 | * |

Dex One Corp. | | | | | | 2,646 | | 78,861 | * |

SuperMedia Inc. | | | | | | 2,357 | | 98,976 | * |

Total Consumer Discretionary | | | | | | | | 2,624,149 | |

Energy — 0.0% | | | | | | | | | |

Oil, Gas & Consumable Fuels — 0.0% | | | | | | | | | |

SemGroup Corp., Class A Shares | | | | | | 5,434 | | 129,052 | * |

Financials — 0.2% | | | | | | | | | |

Diversified Financial Services — 0.2% | | | | | | | | | |

CIT Group Inc. | | | | | | 12,006 | | 437,379 | * |

| | | | | | | | | | | | | |

See Notes to Financial Statements.

| | Western Asset Managed High Income Fund Inc. 2010 Annual Report | | 17 |

Western Asset Managed High Income Fund Inc.

Security | | | | | | Shares | | Value | |

Industrials — 0.0% | | | | | | | | | |

Building Products — 0.0% | | | | | | | | | |

Nortek Inc. | | | | | | 1,738 | | $ | 65,188 | * |

Materials — 0.2% | | | | | | | | | |

Chemicals — 0.2% | | | | | | | | | |

Georgia Gulf Corp. | | | | | | 42,487 | | 606,289 | * |

Total Common Stocks (Cost — $5,463,152) | | | | | | | | 3,862,057 | |

| | | | | | | | | |

| | Rate | | Maturity

Date | | | | | |

Convertible Preferred Stocks — 1.1% | | | | | | | | | |

Financials — 1.1% | | | | | | | | | |

Diversified Financial Services — 1.1% | | | | | | | | | |

Bank of America Corp. | | 7.250 | % | | | 1,820 | | 1,651,650 | |

Citigroup Inc. | | 7.500 | % | 12/15/12 | | 11,200 | | 1,201,312 | * |

Total Convertible Preferred Stocks (Cost — $2,926,076) | | | | | | | 2,852,962 | |

Preferred Stocks — 0.4% | | | | | | | | | |

Financials — 0.4% | | | | | | | | | |