EXHIBIT 10.1

Enbridge Pipelines Inc.

(“Enbridge”)

COMPETITIVE TOLL SETTLEMENT Dated July 1, 2011

(the “CTS”)

Table of Contents

PART I – INTRODUCTORY MATTERS

1. RECITALS

| |

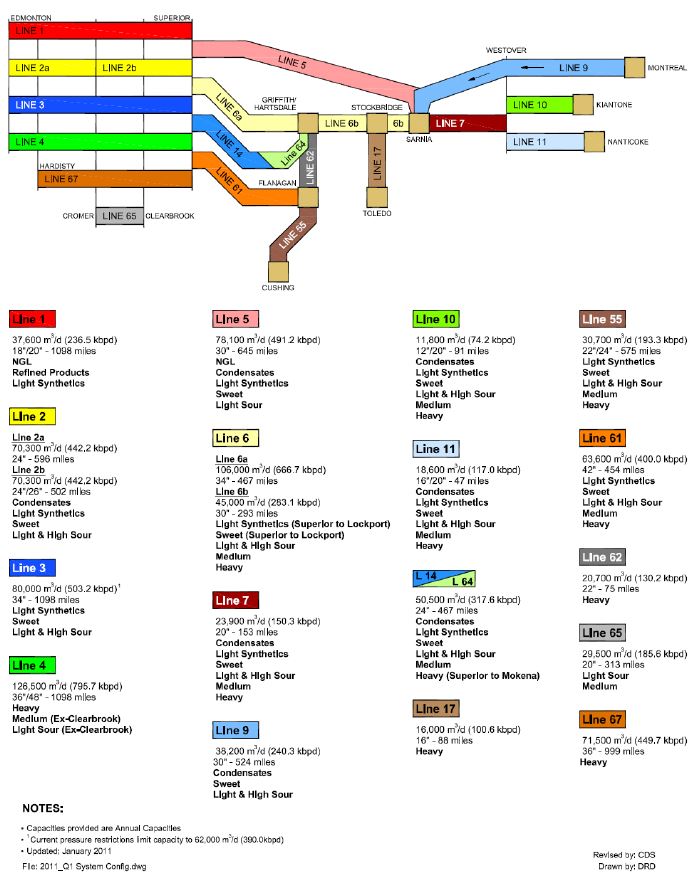

| 1.1 | Enbridge is a body corporate continued under the laws of Canada, having its registered office in the City of Calgary, in the Province of Alberta. Enbridge owns and operates those assets set forth in Schedule “A” (the “Canadian Mainline”), a common carrier pipeline system regulated under the National Energy Board Act. |

| |

| 1.2 | Enbridge Energy Limited Partnership owns and operates those assets set forth in Schedule “B” (the “Lakehead System”), a pipeline system regulated by the FERC. |

| |

| 1.3 | Together the Canadian Mainline and the Lakehead System comprise the “Enbridge Mainline”. |

| |

| 1.4 | CAPP represents companies large and small, that explore for, develop, and produce natural gas and crude oil throughout Canada. |

| |

| 1.5 | The CTS was negotiated by representatives from Enbridge, CAPP and from Shippers of Record that delivered the majority of the volumes of liquid hydrocarbons on the Enbridge Mainline in 2010 (the “2011 Negotiating Team”) and where the context requires, reference to the “2011 Negotiating Team” includes Enbridge, CAPP and such Shippers of Record. |

| |

| 1.6 | The CTS provides for an international joint toll for all hydrocarbons shipped from Western Canadian Receipt Points on the Canadian Mainline to delivery points on the Lakehead System and to delivery points on the Canadian Mainline located downstream of the Lakehead System during the Term. The CTS also establishes the local tolls for transportation services solely within Canada, from receipt points on the Canadian Mainline to delivery points on the Canadian Mainline through the Canadian Local Toll. Transportation and related services solely within the U.S., from receipt points on the Lakehead System to delivery points on the Lakehead System, will continue to be governed by the FERC Tariff Rates. |

| |

| 1.7 | The Enbridge Board of Directors and the CAPP Board of Governors have approved the principles that comprise the CTS. |

| |

| 2.1 | No one element of the CTS is to be considered as acceptable to any party in isolation from all other aspects of this settlement. The parties intend that the CTS be viewed as a whole, reflecting the allocation of risks and rewards between Enbridge and its Shippers over the Term. |

| |

| 2.2 | The 2011 Negotiating Team agrees that the CTS, including the rate principles set forth herein, are the result of good faith arm’s length negotiations, which have resulted in an agreement that is believed to be fair and equitable to Enbridge and all Shippers. Accordingly, each member of the 2011 Negotiating Team has agreed not to, directly or indirectly, commence or support any application, motion or other proceeding before an applicable regulator for the purpose of asking such regulator to set rates for the Enbridge Mainline during the Term which are inconsistent with the rate design and rates contemplated by the CTS, unless otherwise provided hereunder. For clarity, neither the foregoing, nor anything else in this CTS, is intended to, and shall not, be construed as a waiver of any parties’ right to complain, protest or otherwise dispute any agreement |

that may be reached between Enbridge and the Representative Shipper Group pursuant to any other matter as set out herein.

| |

| 2.3 | The rate design and rates contained in the CTS will be without prejudice to any positions that may be taken by any party in respect to matters governed by the CTS for periods following expiry or termination of the CTS. In particular, and without restricting the generality of the above, the 2011 Negotiating Team confirms that the selection of certain capital structures, interest rates, equity returns and operating costs, required for the purposes of implementing the backstopping principles set forth in Article 16 of the CTS, do not in any way form a precedent for the future, nor do these represent the position of either Enbridge or the Shippers as to the capital structure, interest expense, equity return and operating costs that would be appropriate absent this negotiated settlement. |

| |

| 2.4 | The 2011 Negotiating Team intends that the principles set forth in the CTS will be applicable solely to the Enbridge Mainline during the Term and will not form a precedent. |

| |

| 2.5 | There will be no priority access on the Enbridge Mainline during the Term. |

| |

| 2.6 | Subject to Section 7.2, the existing U.S. Agreements in effect as of June 30, 2011 will not be impacted by the CTS during the Term. Moreover, the tolls and tariffs on file with FERC and in effect from time to time pursuant to such U.S. Agreements shall not apply to hydrocarbons transported on the Canadian Mainline or under the IJT unless otherwise agreed between Enbridge and the Representative Shipper Group. |

| |

| 2.7 | For clarity, the CTS does not provide for an international joint tariff for hydrocarbons shipped from receipts points on the Lakehead System to delivery points on the Canadian Mainline. However, nothing in the CTS precludes Enbridge from offering additional joint tariffs. |

PART II – INTERPRETATION

3. DEFINITIONS

3.1 The following terms found in the CTS have the meanings set out below:

| |

| (a) | “2010 Depreciation Technical Update Study” means the depreciation study approved by the NEB on May 12, 2010 pursuant to file number E101-2010-04 01. |

| |

| (b) | “2011 Interim ITS Tolls” means those tolls in effect resulting from the 2011 ITS. |

| |

| (c) | “2011 ITS” means a negotiated toll settlement for the period from January 1, 2011, until December 31, 2011, approved by the NEB on March 31, 2011 pursuant to Order T0I-02-2011. |

| |

| (d) | “2011 Negotiating Team” has the meaning given to it in Section 1.5. |

| |

| (e) | “2012 Edmonton Tanks” means those four tanks described in Schedule “A”. |

| |

| (f) | “2021 Negotiating Team” has the meaning set out in Section 25.1. |

| |

| (g) | “Alberta Clipper Canada Settlement Agreement” means the Alberta Clipper Canada Settlement dated June 28, 2007 as described in Schedule “H”. |

| |

| (h) | “Allowance Oil” means the percentage of all hydrocarbons tendered to the Enbridge Mainline, which Enbridge is entitled to collect in kind as more fully described in Article 12. |

| |

| (i) | “Backstopping Agreement” means an agreement whereby a Shipper agrees to backstop Enbridge’s revenue requirement for Shipper Supported Expansion Projects. |

| |

| (j) | “Canadian Agreements” means those agreements set forth in Schedule “H” which are in effect as of June 30, 2011. |

| |

| (k) | “Canadian Mainline” has the meaning given to it in Section 1.1. |

| |

| (l) | “Canadian Sourced Hydrocarbons” means volumes of liquid hydrocarbons produced in Canada and including the diluents required to facilitate transportation of such hydrocarbons in pipelines regardless of whether the diluents were produced in Canada or not. |

| |

| (m) | “Capital Expenditures” has the meaning given to it in Section 16.1. |

| |

| (n) | “Capital Reporting Template” means the template set forth in Schedule “M”. |

| |

| (o) | “CAPP” means Canadian Association of Petroleum Producers. |

| |

| (p) | “CLT” or “Canadian Local Toll” has the meaning given to it in Section 9.1 |

| |

| (q) | “Contingent Toll Adjustment” has the meaning given to it in Section 13.1. |

| |

| (r) | “Currently Outstanding Adjustment Amounts” has the meaning given to it in Section 11.3. |

| |

| (s) | “Declining Bracket Mechanism” means the methodology approved by the NEB on March 24, 2006 in order number A-TT-FT-ENB 09 (4200-E101-9). (t) “Dispute” has the meaning given to it in Section 30.1. |

| |

| (u) | “Dispute Notice” has the meaning given to it in Section 30.2. |

| |

| (v) | “Enbridge” means Enbridge Pipelines Inc. |

| |

| (w) | “Enbridge Service Levels” means the service levels described within the Enbridge Service Levels Manual as modified from time to time, the current version of which is attached hereto as Schedule “N”. |

| |

| (x) | “Enbridge Tariff” means the tolls and tariffs, including the rules and regulations, for the Enbridge Canadian Mainline filed with the NEB. |

| |

| (y) | “Enbridge Mainline” has the meaning given to it in Section 1.3. |

| |

| (z) | “Enbridge Mainline Receipt & Delivery Points” has the meaning given to it in Section 14.2. |

| |

| (aa) | “Enbridge Specific Regulatory Change” means material change to an Existing Law or the coming into force of a New Law or regulatory action resulting in a Final Order that affects only the Enbridge Mainline, provided such action has not been initiated by Enbridge or Enbridge Energy Limited Partnership or is not the result of negligent or willful misconduct by Enbridge or Enbridge Energy Limited Partnership. |

| |

| (bb) | “Existing Law” means any law, regulation or order of a Canadian or U.S. governmental, tribunal or regulatory body enacted, promulgated, adopted or issued as of July 1, 2011, that has not been repealed, materially revised, rescinded or of spent force before July 1, 2011, even if the date of implementation or the date by which compliance is required occurs after July 1, 2011. |

| |

| (cc) | “FERC” means the Federal Energy Regulatory Commission. |

| |

| (dd) | “FERC Tariff Rates” or “FTR” means the existing tariff rates, including the rules and regulations, for the Lakehead System on file and in effect with the FERC, as amended and supplemented from time to time, including those tariff rates that FERC approves to go into effect pursuant to the U.S. Agreements. |

| |

| (ee) | “Final Order” means an order or directive, issued on or after the date the CTS is filed with the NEB, from a regulator having jurisdiction over Enbridge, including an order or directive to perform hydrostatic testing on the Enbridge Mainline, provided that such order or directive is not an interim order or a recommendation, Enbridge acts reasonably in mitigating the impact of any such order or directive, and Enbridge has given timely notice to the Representative Shipper Group of such order or directive. |

| |

| (ff) | “Force Majeure” means any act of God, war, acts of terrorism, civil disturbances, civil insurrection or disobedience, acts of public enemy, power disruptions or other disruptions of critical services, blockades, insurrections, riots, epidemics, landslides, lightning, |

earthquakes, explosions, fires or floods, or any other like event which is beyond the reasonable control of Enbridge and which Enbridge has been unable to prevent or provide against by the exercise of reasonable diligence at reasonable cost. For clarity, a pipeline leak, break, pressure restriction, repair, corrosion or other like event shall not on its own be considered a Force Majeure, unless such event is caused by one of the events set forth in the first sentence of this definition.

| |

| (gg) | “GDPP” means the annual average Canada Gross Domestic Product at Market Prices Index, published by Statistics Canada on or about February 28th, (Catalogue No. 13- 019-X “Implicit price indexes, gross domestic product”) for the prior year. |

| |

| (hh) | “GDPP Index” in any given year is calculated as the ratio of the annual change in GDPP over the GDPP for the prior year and is expressed as a percentage. For clarity, the GDPP Index applicable for 2012 would be (GDPP for 2011- GDPP for 2010) / GDPP for 2010. |

| |

| (ii) | “IJT” or “International Joint Tariff” has the meaning given to it in Section 8.1. |

| |

| (jj) | “Integrity Capital” means Capital Expenditures incurred to repair, maintain or replace portions of the Enbridge Mainline in order to manage pipeline defects, which may occur as metal loss (eg. corrosion), cracks (eg. stress corrosion cracking), and mechanical damage (eg. dents). |

| |

| (kk) | “Investment Grade” has the meaning given to it in the Enbridge Tariff. |

| |

| (ll) | “Lakehead System” has the meaning given to it in Section 1.2. |

| |

| (mm) | “Line 5 Claim” means the claim by Enbridge referenced in Ontario Case Docket No. 07-CV-338616-PD3. |

| |

| (nn) | “Line 9” means those assets set forth in Schedule “C”. |

| |

| (oo) | “LMCI” or “Land Matters Consultation Initiative” means the NEB Land Matters Consultation Initiative (RH-2-2008) and the decisions, directions and orders issued in that proceeding. |

| |

| (pp) | “Major Enbridge Mainline Expansion Capital” has the meaning given to it in Section 16.3. |

| |

| (qq) | “Material Change in Business Circumstances” has the meaning given to it in Section 20.1. |

| |

| (rr) | “Minimum Threshold Volume” has the meaning given to it in Section 19.1. |

| |

| (ss) | “Monthly Moving Average Volume” has the meaning given to it in Section 19.4. |

| |

| (tt) | “NEB” means National Energy Board. |

| |

| (uu) | “New Law” means any law, regulation, order or directive of a Canadian or U.S, governmental, tribunal or regulatory body enacted, promulgated, issued or adopted after |

July 1, 2011 and includes any material change to or amendment of Existing Law or any final and binding decision of any relevant judicial or regulatory authority interpreting Existing Law in a manner that is materially different than how such Existing Law was interpreted or applied as of July 1, 2011.

| |

| (vv) | “NGL” means natural gas liquids. |

| |

| (ww) | “Nine Month Moving Average” has the meaning given to it in Section 19.3. |

| |

| (xx) | “Non Enbridge Mainline Receipt & Delivery Points” has the meaning given to it in Section 14.3. |

| |

| (yy) | “Northern PADD II or Sarnia” means the following delivery points included in the Enbridge Mainline Delivery Points: Clearbrook, Minnesota; Superior, Wisconsin; Lockport & Mokena, Illinois; Flanagan, Illinois; Griffith, Indiana; Stockbridge, Michigan; Marysville, Michigan; Rapid River, Michigan; West Seneca, New York; Sarnia, Ontario; and Nanticoke, Ontario. |

| |

| (zz) | “Oil Pipeline Uniform Accounting Regulations” means the Oil Pipeline Uniform Accounting Regulations as issued by the NEB in Canada and 18 C.F.R. Part 352 in the United States. |

| |

| (aaa) | “Outstanding Amount Surcharge” has the meaning given to it in Section 11.1. |

| |

| (bbb) | “Over/Short Position” has the meaning given to it in Enbridge’s Practice Applicable to Automatic Balancing. |

| |

| (ccc) | “Regulatory Change(s)” means the coming into force of a New Law broadly applicable to the Enbridge Mainline and all similar liquids pipelines, excluding changes to Existing Laws with respect to (i) the FERC Index Rate and, (ii) tax rates, but including, changes to Existing Laws or a New Law that establishes a new type of tax or taxation, such as the implementation of a new carbon tax on the transportation of hydrocarbons. |

| |

| (ddd) | “Renegotiation Notice” means a written notice to renegotiate the CTS given under Article 21; |

| |

| (eee) | “Renegotiating Team” has the meaning given to it in Section 21.4. |

| |

| (fff) | “Representative Shipper Group” has the meaning given to it in Section 22.2. |

| |

| (ggg) | “Shipper” means a shipper of hydrocarbons on the Enbridge Mainline. |

| |

| (hhh) | “Shipper of Record” means the Shipper invoiced for provision of services on the Enbridge Mainline. |

| |

| (iii) | “Shipper Supported Expansion Project” has the meaning given to it in Section 16.4. |

| |

| (jjj) | “Shippers Line 5 Portion” has the meaning given to it in Section 17.1. |

| |

| (kkk) | “Supporting Shipper” means a Shipper who supports a Shipper Supported Expansion Project by executing a Backstopping Agreement pursuant to Article 16. |

| |

| (lll) | “Term” has the meaning given to it in Section 5.1. |

(mmm) “U.S.” means United States of America.

| |

| (nnn) | “U.S. Agreements” means all existing and future agreements and/or settlements for the transportation of hydrocarbons on the Lakehead System, including but not limited to, those settlements set forth in Schedule ”I”. |

| |

| (ooo) | “Western Canadian Producers” means producers of hydrocarbons originating in the Northwest Territories, British Columbia, Alberta, Saskatchewan and Manitoba. |

| |

| (ppp) | “Western Canadian Receipt Points” means receipt points on the Canadian Mainline in Alberta, Saskatchewan and Manitoba. |

4. INTERPRETATION

4.1 In the CTS, unless the context otherwise requires:

| |

| (a) | the singular includes the plural and vice versa; |

| |

| (b) | a grammatical variation of a defined term has a corresponding meaning; |

| |

| (c) | subject to the definitions of Existing Law and New Law, reference to any law means such law as amended, modified, codified, replaced or re-enacted, in whole or in part, and in effect from time to time, including rules and regulations promulgated thereunder and reference to any section or other provision of any laws means that provision of such law from time to time in effect and constituting the substantive amendment, modification, codification, replacement or re-enactment of such section or other provision; |

| |

| (d) | references to an Article, Section, Subsection, Paragraph or Schedule by number or letter or both refer to the CTS; |

| |

| (e) | “CTS”, “the CTS”, “herein”, “hereby”, “hereunder”, “hereof”, “hereto” and words of similar import are references to the whole of the CTS in which it is used and not, unless a particular Section or other part thereof is referred to, to any particular Section or other part; |

| |

| (f) | “including” means including without limiting the generality of any description preceding or succeeding such term and for purposes hereof the rule of ejusdem generis shall not be applicable to limit a general statement, followed by or referable to an enumeration of specific matters, to matters similar to those specifically mentioned; |

| |

| (g) | Schedules attached to the CTS, form part of the CTS. Where there is a conflict between the body of the CTS and any Schedule other than Schedules “J”, “K”, “L”, “M” and “O”, the language of such Schedule will prevail. Schedules “J”, “K”, “L”, “M” and “O” are included for illustrative purposes only, and where there is a conflict between the body of the CTS and a Schedule, the body of the CTS will prevail for only those Schedules; |

| |

| (h) | the phrases “the aggregate of”, “the total of”, “the sum of”, or a similar phrase means “the aggregate (or total or sum), without duplication, of”; |

| |

| (i) | all references to currency are to the lawful money of Canada, unless otherwise indicated; |

| |

| (j) | references to time of day or date means the local time or date in Calgary, Alberta; |

| |

| (k) | if any word, phrase or expression is not defined in the CTS, such word, phrase or expression will, unless the context otherwise requires, have the meaning attributed to it in the usage or custom of the hydrocarbon pipeline transportation business in North America; |

| |

| (l) | where any payment or calculation is to be made, or any other action is to be taken, on or as of a day that is not a business day, that payment or calculation is to be made, or that other action is to be taken, as applicable, on or as of the next following business day; and |

| |

| (m) | the division of the CTS and the recitals, table of contents and headings are for convenience of reference only and shall not affect the construction or interpretation hereof. |

PART III – TERM AND APPLICABILITY

| |

| 5.1 | The term of the CTS will commence July 1, 2011 and terminate on June 30, 2021 (the “Term”), unless terminated earlier hereunder or extended pursuant to Section 5.2. The CTS will replace the 2011 ITS, effective as of the start of the Term. |

| |

| 5.2 | The Term may be extended by mutual agreement of Enbridge and the 2021 Negotiating Team, provided that such extension shall be for a period of no less than 1 year. |

| |

| 6. | APPLICABILITY OF CTS vs. CANADIAN AGREEMENTS |

| |

| 6.1 | During the Term, the CTS will supersede the Canadian Agreements, provided however that any calculations that would otherwise have been made pursuant to the Canadian Agreements will be deemed to have been made during the Term. |

| |

| 6.2 | Upon the termination or expiry of the CTS, any of the Canadian Agreements that have not expired or terminated will come back into effect as of the date of termination or expiry of the CTS. Any toll and other adjustments that are permitted in the Canadian Agreements shall continue thereafter for their respective then remaining terms. For clarity, the terms under any of the Canadian Agreements shall be deemed to have been applicable during the Term and shall continue to apply thereafter. The assets under the Canadian Agreements will be included in the Canadian Mainline at their remaining undepreciated costs. An illustrative example is set forth in Schedule “J”. |

| |

| 6.3 | Notwithstanding this Article 6, CAPP preserves the audit rights pursuant to the terms of the Alberta Clipper Canada Settlement agreement. |

| |

| 7. | APPLICABILITY OF CTS vs. U.S. AGREEMENTS |

| |

| 7.1 | Subject to Section 7.2, the U.S. Agreements will remain in place, and the tariff rates on file with FERC and in effect from time to time pursuant to such U.S. Agreements shall continue to be utilized in calculating the FTR during the Term but neither such tariff rate nor the FTR will apply to hydrocarbons transported under the IJT during the term of the CTS unless otherwise agreed between Enbridge and the Representative Shipper Group pursuant to Section 13.1. |

| |

| 7.2 | Where any of the U.S. Agreements expires or terminates during the Term and is replaced by a future agreement and/or settlement for the transportation of hydrocarbons on the Lakehead System, such future agreements and/or settlements will apply in accordance with their respective terms; provided, however, that any tariff rates on file with FERC and in effect from time to time pursuant to such future agreements and/or settlements will not apply to hydrocarbons transported under the IJT unless otherwise agreed between Enbridge and the Representative Shipper Group pursuant to Section 13.1 Any toll and other adjustments that are permitted pursuant to a U.S. Agreement shall continue to be utilized in calculating the FTR during the Term. |

PART IV – TOLLS AND RELATED FINANCIAL MATTERS

| |

| 8. | INTERNATIONAL JOINT TOLLS |

| |

| 8.1 | Subject to applicable law, effective as of July 1, 2011, tolls for transportation, inclusive of receipt and delivery terminalling services, of hydrocarbons from Western Canada Receipt Points on the Enbridge Mainline to delivery points (i) on the Lakehead System, and (ii) on the Canadian Mainline that are downstream of the Lakehead System are the amounts set forth in Schedule “D” as adjusted pursuant to Section 10.1 (the “International Joint Tariff” or “IJT”). All IJT tolls are calculated on a distance adjusted basis for transmission and for commodity types, based on and with reference to an initial IJT toll of U.S. $3.85 per barrel for movement of heavy crude oil from Hardisty, Alberta to any of the delivery points in the Chicago, Illinois area (Mokena, Griffith, Lockport). In addition, the applicable Outstanding Amount Surcharge as provided in Section 11 will also be collected. |

| |

| 9.1 | Subject to applicable law, and approval by the NEB, effective as of July 1, 2011, tolls, inclusive of receipt and delivery terminalling services, for transportation of hydrocarbons solely on the Canadian Mainline are the amounts set forth in Schedule “E” (the “Canadian Local Toll”, or “CLT”). The CLTs are calculated using the 2011 Interim ITS Tolls as a starting point, adjusted for the Currently Outstanding Adjustment Amounts outlined in Section 11.3 which will be collected through the Outstanding Amount Surcharge. The CLT is intended to replace the 2011 Interim ITS Tolls as of July 1, 2011. After July 1, 2011 there will be no further true-up for prior Canadian Mainline tolls. |

| |

| 10. | ANNUAL TOLL ADJUSTMENT |

| |

| 10.1 | Commencing effective July 1, 2012, the IJT tolls and the CLT shall be adjusted annually, up or down, at a rate equal to 75% of the GDPP Index. |

| |

| 10.2 | The tankage revenue requirement used to determine receipt and delivery tankage fees in Canada in effect on July 1, 2011 will be adjusted annually, up or down, by 75% of the GDPP Index beginning July 1, 2012. An annual volume forecast will then be used to determine the average tankage fees in effect on July 1 each year and establish the actual receipt and delivery tankage fees in accordance with the Declining Bracket Mechanism. If the actual revenues collected for receipt and delivery tankage fees are greater than, or less than, what the tankage revenue requirement was for the applicable calendar year, (including differences due to the Declining Bracket Mechanism), then such difference will be used to subtract from or add to, as applicable, the next year’s tankage revenue requirement. Shippers will be required to pay the applicable receipt and delivery tankage fees for volumes transported under the IJT or the CLT. Notwithstanding the preceding, Enbridge may seek future NEB approval for a different toll design and regulatory treatment for tankage fees with the endorsement of the Representative Shipper Group. |

| |

| 10.3 | The CLT from receipt points in Canada to the International Boundary, near Gretna, Manitoba, from the International Boundary, near Sarnia, Ontario to delivery points in Canada and from receipt points in Ontario to the International Boundary, near Chippawa, Ontario will be further adjusted in the event that the sum of the CLT and FTR is not greater than or equal to the IJT tolls in effect in any given year. Enbridge will file with the NEB an application to adjust only the CLT from |

receipt points in Canada to the International Boundary near Gretna, Manitoba; from the International Boundary, near Sarnia, Ontario to delivery points in Canada; and from receipt points in Ontario to the International Boundary, near Chippawa, Ontario to ensure that the IJT is maintained in accordance with regulatory requirements.

| |

| 11. | OUTSTANDING AMOUNT SURCHARGE |

| |

| 11.1 | A per barrel toll surcharge in the amount set forth in Schedule “F” (the “Outstanding Amount Surcharge”) will be added to the IJT tolls and the CLT for the 24 month period from July 1, 2011 to June 30, 2013 in order to permit Enbridge to collect Currently Outstanding Adjustment Amounts. The Outstanding Amount Surcharge is $0.067 per barrel for movements of heavy crude oil from Hardisty, Alberta to the U.S. border near Gretna, Manitoba and is adjusted for distance and by commodity-type for all barrels transported in Canada. |

| |

| 11.2 | Any of the Currently Outstanding Adjustment Amounts that remain uncollected by Enbridge as of June 30, 2013 shall be immediately due to Enbridge. Likewise, an over collection of the Currently Outstanding Adjustment Amounts collected through the Outstanding Amount Surcharge as of June 30, 2013 will be immediately due to the Shippers. For clarity, any under or over collection of the Currently Outstanding Adjustment Amounts as of June 30, 2013 will be recovered or paid by increasing or decreasing, as applicable, the 2014 IJT and CLT tolls effective July 1, 2014 through a one-time surcharge, which adjustment will be on a per barrel basis. The Outstanding Amount Surcharge will be based on a forecast of total sum shipment volume for the IJT and CLT for the calendar year beginning July 1, 2014, which surcharge will be adjusted for distance and by commodity-type for all barrels transported in Canada. Any under or over collection remaining as of July 1, 2015 will not be collected or refunded. For clarity, the Currently Outstanding Adjustment Amounts are amounts due to Enbridge as a result of the interim tolls from January 1, 2010 to June 30, 2011. Any variance relative to the period from April 1, 2011 to June 30, 2011 shall be for Enbridge’s sole account. |

| |

| 11.3 | The “Currently Outstanding Adjustment Amounts” total $69.7 million and is comprised of the following: |

(i) a total of $130.0 million as of December 31, 2010 to recover the remaining 2010 ITS revenue shortfall;

| |

| (ii) | a total of $72.7 million as of March 31, 2011 to credit all applicable net tax loss carry forwards calculated using the applicable 2011 tax rates; and |

| |

| (iii) | a total of $12.4 million to recover amounts due to Enbridge under the 2011 ITS for the toll variance from January 1, 2011 until March 31, 2011. |

| |

| 12.1 | For transportation under the IJT, Enbridge shall collect in kind a percentage of all hydrocarbons delivered off the Enbridge Mainline in the amount of 1/10th of 1 percent of the volume of hydrocarbons physically delivered under the IJT. The IJT Allowance Oil will be collected and divided between the Canadian Mainline and the Lakehead System as 1/20th of 1 percent to each carrier. |

| |

| 12.2 | For transportation under the CLT, Enbridge shall collect in kind or deduct as Allowance Oil a percentage of all hydrocarbons delivered off the Enbridge Mainline, in the amount of 1/20th of 1 percent of the volume of hydrocarbons physically delivered under the CLT. |

| |

| 12.3 | Enbridge shall be permitted, at its discretion, to resell to Shippers the Allowance Oil hydrocarbons collected for transportation under the IJT or CLT at a price determined in accordance with the method described in the following Sections. |

| |

| 12.4 | Each month, each Shipper who either: (i) has crude or NGL delivered off the Enbridge Mainline in such month; or (ii) holds an Over/Short Position on the Enbridge Mainline at the end of such month, shall furnish to Enbridge a unit price for each crude and NGL stream delivered or held, as applicable. For each refined product stream Enbridge will utilize the prices it receives from refined product Shippers for the purpose of balancing delivery of product batches. Except as provided below, the prices for crude, NGL, and refined product streams so furnished shall be the prices at which Shippers’ Allowance Oil for each hydrocarbon stream tendered to Enbridge by each Shipper shall be resold to each Shipper by Enbridge. |

| |

| 12.5 | In the event that a Shipper does not provide a price for any crude or NGL stream, the Allowance Oil value for that Shipper will be deemed to be the simple average of the prices for that crude or NGL stream received by Enbridge from all other Shippers of that crude or NGL stream for the month that the Allowance Oil volume is being collected whose transaction prices have been accepted by Enbridge as reasonable pursuant to Section 12.6. |

| |

| 12.6 | Notwithstanding the provisions of Section 12.4, if the price furnished to Enbridge by any Shipper for any crude or NGL stream is unreasonable, in the sole opinion of Enbridge, acting reasonably, the Allowance Oil resale value for that Shipper for the crude or NGL stream in question shall be the simple average of the prices for that crude or NGL stream received by all other Shippers of that crude or NGL stream for the month whose transaction prices have been accepted by Enbridge as reasonable. Alternatively, Enbridge may choose to use the average of the monthly prices posted for light sweet crude at Edmonton by Imperial Oil Limited, Shell Canada Ltd., Flint Hills Resources and Suncor Energy Inc., or their respective successors, adjusted for quality, pursuant to industry information determined by Enbridge. The average of the monthly prices posted for light sweet crude at Edmonton must be based on all posted prices if all are posted, but if not all are posted, based on no less than three posted prices. In the event that the posted prices cannot be determined in accordance with the above, Enbridge will meet with impacted Shippers to negotiate an appropriate price. |

| |

| 13. | CONTINGENT TOLL ADJUSTMENTS |

| |

| 13.1 | In addition to those other adjustments described in this Part IV, the IJT and the CLT will be adjusted for the following, subject to NEB approval (each, a “Contingent Toll Adjustment”): |

| |

| (a) | any changes in toll methodology that may be agreed to by Enbridge and the Representative Shipper Group; |

| |

| (b) | any incremental tolls resulting from an NEB order in relation to the Land Matters Consultation Initiative; |

| |

| (c) | any Major Enbridge Mainline Expansion Capital as described in Article 16; |

| |

| (d) | any Material Change in Business Circumstances as described in Article 20; and |

| |

| (e) | any other changes that are mutually agreed to by Enbridge and the Representative Shipper Group. |

| |

| 13.2 | For clarity, if Enbridge and the Representative Shipper Group are unable to reach agreement on the amount of any Contingent Toll Adjustment identified under Section 13.1 (c) or (d), then Enbridge or the Representative Shipper Group may refer the issue of the amount of the Contingent Toll Adjustment to dispute resolution under Article 30. |

| |

| 13.3 | If the NEB does not approve any Contingent Toll Adjustment identified under Section 13.1 that has been agreed to by Enbridge and the Representative Shipper Group, then a NEB hearing to determine the amount of such Contingent Toll Adjustment may be requested. |

| |

| 14.1 | Enbridge may offer toll incentives onto the Enbridge Mainline, provided such toll incentives on the Enbridge Mainline are offered equally to all Shippers to all Enbridge Mainline Receipt & Delivery Points, as adjusted for distance and commodity types. |

| |

| 14.2 | “Enbridge Mainline Receipt & Delivery Points” means those receipt and delivery points as set forth in Schedule “A” and Schedule “B” as may be adjusted with the agreement of Enbridge and the Representative Shipper Group. For greater certainty, the IJT tolls applicable to delivery points on the Enbridge Mainline shall be the same, irrespective of the specific facilities or path used to effect such deliveries. |

| |

| 14.3 | "Non Enbridge Mainline Receipt & Delivery Points"are not Enbridge Mainline Receipt & Delivery Points. |

| |

| 14.4 | A toll incentive may also be offered for delivery of hydrocarbons to Non Enbridge Mainline Receipt & Delivery Points subject to Section 14.5. |

| |

| 14.5 | As required by regulations, tolls to Non Enbridge Mainline Receipt & Delivery Points must be greater than the toll to the nearest upstream Enbridge Mainline Receipt & Delivery Point and must be offered equally to all similarly situated Shippers, as adjusted for distance and commodity types. |

| |

| 15. | LAND MATTERS CONSULTATION INITIATIVE |

| |

| 15.1 | All Canadian pipeline assets owned by Enbridge that are regulated by the NEB, including the Canadian Mainline, are being addressed in the LMCI. The LMCI will determine the methodology by which costs for abandonment should be collected by a pipeline. Enbridge will file all required information under LMCI as per the NEB schedules for the Canadian Mainline. |

| |

| 15.2 | The CTS is unrelated to the ultimate decision regarding the responsibility for abandonment costs for the Canadian Mainline. The CTS is agreed to on a “without prejudice” basis with respect to pipeline abandonment costs for the Canadian Mainline and does not in any way limit either Enbridge or any Shipper’s right to make submissions and fully participate in the LMCI or any other proceeding related to abandonment of a pipeline. |

16. CAPITAL EXPENDITURES

| |

| 16.1 | “Capital Expenditures” means expenditures on the Enbridge Mainline made by Enbridge which, under Oil Pipeline Uniform Accounting Regulations, require capitalization as fixed assets and which would be capitalized on, or after, July 1, 2011. Capital Expenditures must be prudent, reasonable and to the benefit of the Enbridge Mainline and include, but are not limited to, maintenance, integrity, equipment additions, improvements and new facilities. Capital Expenditures would include expansion of the Enbridge Mainline such as expanded pipeline capacity, increased storage capacity, or the creation of new or expansion of existing Enbridge Mainline Receipt & Delivery Points. |

| |

| 16.2 | Enbridge is responsible for all Capital Expenditures during the Term, meaning the IJT tolls and CLT will not be adjusted for Capital Expenditures unless otherwise agreed to by Enbridge and the Representative Shipper Group. The 2012 Edmonton Tanks are deemed to be included in the Canadian Mainline as at June 30, 2011, and are therefore included in the IJT tolls and the CLT. |

| |

| 16.3 | Enbridge will negotiate with the Representative Shipper Group prior to undertaking any single project on the Enbridge Mainline with expected Capital Expenditures greater than $250 million that expands pipeline capacity, increases storage capacity, or creates or expands Enbridge Mainline Receipt & Delivery Points (“Major Enbridge Mainline Expansion Capital”). With the agreement of Enbridge and the Representative Shipper Group, the IJT tolls and respective CLT may be adjusted to allow Enbridge to recover Major Enbridge Mainline Expansion Capital as allowed for under Section 13.1(c). An illustrative example of Major Enbridge Mainline Expansion Capital is set forth as Example #1 in Schedule “K”. |

| |

| 16.4 | Projects on the Enbridge Mainline which require Capital Expenditures and which are not supported by Enbridge because the incremental revenues associated with such project would not cover the incremental costs, may proceed if there is sufficient financial support from Supporting Shipper(s) pursuant to this Article 16 (a “Shipper Supported Expansion Project”). An illustrative example of a Shipper Supported Expansion Project is set forth as Example #2 in Schedule “K”. |

| |

| 16.5 | By execution of a Backstopping Agreement and confirmation that the proposed project creates no adverse operational issues for Enbridge, as determined by Enbridge acting reasonably, Enbridge will agree to undertake such Shipper Supported Expansion Projects in accordance with the terms of such Backstopping Agreement. In the event that Enbridge is unable to secure NEB approval for construction of the Shipper Supported Expansion Project, the Supporting Shipper(s) will be required to reimburse Enbridge for all of such Shipper Supported Expansion Project’s reasonable and prudent development costs as defined in the applicable Backstopping Agreement. |

| |

| 16.6 | Subject to Section 16.10, additional revenues derived from tolls, including receipt and delivery terminalling and transmission, collected on the incremental volumes transported on the Enbridge Mainline related to such Shipper Supported Expansion Project, net of any direct incremental costs (“Net Incremental Revenue”) will be credited to the Backstopping Agreement’s revenue requirement. |

| |

| 16.7 | The Backstopping Agreement will ensure that the annual revenue requirement associated with the incremental project capital is met either through Net Incremental Revenue from associated |

incremental throughput or with annual or lump sum payments from the Supporting Shipper(s). The form and terms of a Backstopping Agreement will be developed on a project by project basis but will utilize the following parameters: a) the term will be no less than 5 years and no more than 10 years and can extend past the end of the Term; b) threshold return on equity of between 11 to 15 percent after tax; and c) capital structure of 45 percent equity. The return on equity will be negotiated between Enbridge and the Supporting Shipper(s), and the parties acting reasonably will consider such risks as volume, capital, cost, credit, financial or other relevant risks. An 11 percent return would be appropriate in a circumstance when Enbridge accepted no volume risk, did not share in any operating or capital cost risk, and credit risk was secured by either a letter of credit or a shipper with an Investment Grade credit rating. A 15 percent return would be appropriate in a circumstance when Enbridge accepts substantially more risk with respect to volumes, capital, cost, credit or financial elements of the project. Similar Shipper Supported Expansion Projects will be evaluated on a similar basis and using similar principles.

| |

| 16.8 | At the end of the Term, there will be no net rate base impact to the Enbridge Mainline as a result of Shipper Supported Expansion Projects. |

| |

| 16.9 | For example, for a Shipper Supported Expansion Project to construct new tanks, the Backstopping Agreement will require the recovery of the capital cost of the tank through accelerated depreciation. To the extent that such accelerated depreciation exceeds Enbridge’s normal depreciation rates, the excess will be credited against rate base and future depreciation expense will be reduced accordingly. |

| |

| 16.10 | Enbridge will consider the Net Incremental Revenue from incremental volumes associated with the Shipper Supported Expansion Projects compared to the incremental capital cost to determine the amount and type of Backstopping Arrangement it will require. To establish incremental volumes from existing movements, Enbridge will use an appropriate time frame, typically the 12 month period immediately preceding the month in which Enbridge anticipates the in-service date for the new facilities. |

| |

| 16.11 | The Backstopping Agreement will incorporate any terms that would allow the Supporting Shipper(s)’s commitment to be reduced by Net Incremental Revenue or capital contribution provided by one or more other Shipper(s). |

| |

| 16.12 | Backstopping Agreements are to allow the provision of services, but nothing in this Section 16 is intended to provide any priority service to Supporting Shipper(s). |

| |

| 17.1 | Following final resolution of the Line 5 Claim, the Canadian Mainline portion of any amounts (net of reasonable litigation costs incurred after June 30, 2011) actually paid to Enbridge, recovered for that period of the Line 5 Claim from January 1, 1995 to March 31, 2011, including any accrued interest, shall be determined, and such portion shall be shared between Enbridge and the Shippers, with Enbridge to receive 50% and the Shippers to receive 50% (the "Shippers Line 5 Portion”). Enbridge shall credit the Shippers Line 5 Portion against the next applicable toll filing for both the IJT and the CLT. The Shippers Line 5 Portion will be calculated on the basis of the required |

sharing under the various incentive tolling settlements that cover the period from January 1, 1995 to March 31, 2011 where the associated costs were shared between Enbridge and the Shippers.

| |

| 18.1 | Any changes in the commodity surcharge in effect on April 1, 2011, must be mutually agreed to by both Enbridge and the Representative Shipper Group. The intent of any adjustment to the commodity surcharge methodology considered during the Term is to be revenue neutral. |

PART V - RENEGOTIATION AND/OR TERMINATION OF THE CTS

| |

| 19. | MIMIMUM THRESHOLD VOLUMES |

| |

| 19.1 | “Minimum Threshold Volume” means a throughput of: |

| |

| (a) | 1,250,000 barrels per day to December 31, 2014, then |

| |

| (b) | 1,350,000 barrels per day during the remainder of the Term of Canadian Sourced Hydrocarbons on the Enbridge Mainline ex-Gretna, Manitoba, as may be adjusted pursuant to Section 19.2 and 19.5. |

| |

| 19.2 | The Minimum Threshold Volume will be reduced by the amount that the Bakken/Three Forks U.S. production receipts exceed 305,000 barrels per day into the Enbridge Mainline, less those volumes in excess of 305,000 barrels per day that are transported to delivery points other than the Enbridge Mainline Delivery Points into Northern PADD II or Sarnia (for example, incremental transportation of Bakken/Three Forks U.S. production on Mustang/Spearhead or other Non Enbridge Mainline Delivery Points). |

| |

| 19.3 | “Nine Month Moving Average” means the sum of the Monthly Moving Average Volumes for the 9 months preceding the date of calculation, divided by 9. |

| |

| 19.4 | “Monthly Moving Average Volume” means the volume of Canadian Sourced Hydrocarbons transported on the Enbridge Mainline ex-Gretna, Manitoba in a calendar month, divided by the number of days in such month. |

| |

| 19.5 | In the event that Nine Month Moving Average falls below the Minimum Threshold Volume, Enbridge and the Representative Shipper Group will determine if the cause of the shortfall was due to capacity loss on the Enbridge Mainline. If it is determined that the shortfall was due to capacity loss on the Enbridge Mainline for reasons other than Force Majeure, the Minimum Threshold Volume will be reduced by the corresponding shortfall amount. For purposes of determining the applicable capacity loss, Enbridge will use the historical Nine Month Moving Average of volumes from Canadian receipt points through Gretna as well as deliveries ex- Superior. Schedule “G” sets forth upstream and downstream capacity amounts as at December 31, 2010 as reference points for ex-Gretna capacity. |

| |

| 19.6 | Illustrative examples of the calculation of Minimum Threshold Volume are set forth in Schedule “L”. |

| |

| 20. | MATERIAL CHANGE IN BUSINESS CIRCUMSTANCES |

| |

| 20.1 | “Material Change in Business Circumstances” means: |

| |

| (i) | Regulatory Change(s) or Enbridge Specific Regulatory Change(s) which results in cumulative expenditures in a calendar year for operating costs on the Enbridge Mainline, calculated to include an amount for depreciation expense (not including depreciation expense resulting from Integrity Capital ) and subtract applicable capital cost allowance, increasing by more than $10,000,000 over what such annual operating costs would have been (based on Enbridge’s applicable operating standards immediately prior to the |

Regulatory Change(s) or Enbridge Specific Regulatory Change(s)) absent the Regulatory Change(s) or Enbridge Specific Regulatory Change(s); or

| |

| (ii) | Regulatory Change(s) which results in cumulative expenditures (commencing on the date of the first such Regulatory Change) for Integrity Capital on the Enbridge Mainline increasing by more than $100,000,000 over what such costs would have been absent the Regulatory Changes, provided however that such Regulatory Changes(s) are broadly applicable to the Enbridge Mainline and all similar liquids pipelines. |

| |

| 20.2 | The IJT and CLT include (and therefore Enbrige is responsible for) the first $10,000,000 in operating expenses in each calendar year on the Enbridge Mainline associated with any Regulatory Changes or Enbridge Specific Regulatory Changes, as applicable, and the first $100,000,000 of Integrity Capital during the Term on the Enbridge Mainline associated with any Regulatory Changes. In calculating that amounts attributable to such operating expenses or Integrity Capital, Enbridge shall deduct from such calculation any amount that Enbridge would have otherwise spent absent such Regulatory Change or Enbridge Specific Regulatory Change, as applicable. |

| |

| 21. | EVENTS TRIGGERING A RENEGOTIATION PERIOD |

| |

| 21.1 | If the Keystone XL pipeline project does not receive the required U.S. presidential permit by January 1, 2013, then the Representative Shipper Group may, on or before February 1, 2013, provide to Enbridge a Renegotiation Notice. |

| |

| 21.2 | If the Material Change in Business Circumstances referred to in Section 20.1(ii) occurs, Enbridge will, as soon as reasonably practicable following such occurrence, provide notice to the Representative Shipper Group. Following receipt of such notice, the Representative Shipper Group and Enbridge shall meet to determine whether they can agree to a Contingent Toll Adjustment under Article 13. In the event a Contingent Toll Adjustment is not agreed to within 90 days, then the Representative Shipper Group may provide to Enbridge a Renegotiation Notice. |

| |

| 21.3 | If the Nine-Month Moving Average is less than the Minimum Threshold Volume, then Enbridge may, as soon as is reasonably practicable following the occurrence of such event, provide to the Representative Shipper Group a Renegotiation Notice. |

| |

| 21.4 | Upon receipt by either Enbridge or the Representative Shipper Group of a Renegotiation Notice, Enbridge and the Representative Shipper Group (the “Renegotiating Team”) shall meet and use reasonable efforts to agree on how the CTS can be amended to accommodate the events referred to in Section 21.1, 21.2, or 21.3 above. |

| |

| 21.5 | If, within 90 days following receipt of the Renegotiation Notice, the Renegotiating Team is unable to agree on how the CTS can be amended, then the Renegotiating Team may agree to extend the renegotiation period. If the Renegotiating Team does not agree to extend the renegotiation period, then the CTS terminates and Enbridge will file a new toll application for the Canadian Mainline. |

| |

| 21.6 | The IJT and the CLT will apply during the renegotiation period and will become the interim toll after the renegotiation period until a new toll filing is approved by the NEB. |

PART VI – OTHER CTS MATTERS

| |

| 22. | REPRESENTATIVE SHIPPER GROUP |

| |

| 22.1 | Enbridge will work with its Shippers, CAPP and Western Canadian Producers to develop, by July 3, 2012, and thereafter file with the NEB, a transparent process, in compliance with current regulatory requirements, to review and administer issues related to the CTS and the formation of the Representative Shipper Group. This process is intended to be used toward reaching agreement on the resolution of issues related to the CTS during the Term and to provide a counter-party to negotiate any required changes to the CTS resulting from unanticipated events relating to the CTS, with a view to reducing adversarial aspects of NEB and FERC hearings, as well as reducing hearing time and associated costs. |

| |

| 22.2 | The Representative Shipper Group will have representation from CAPP, CAPP members and other Shippers or interested parties as applicable (the “Representative Shipper Group”). |

| |

| 23.1 | The Enbridge Service Levels, as adjusted from time to time, will continue to apply. |

| |

| 24. | GENERAL TANKAGE PRINCIPLES |

| |

| 24.1 | During the Term, Enbridge will provide sufficient receipt and breakout tankage to manage the receipt and transportation of crude petroleum in accordance with the Enbridge Service Levels under normal operating conditions. |

| |

| 24.2 | Any incremental delivery tankage requirements requested by a Shipper are the responsibility of that Shipper. |

| |

| 25.1 | Enbridge and the Representative Shipper Group will, no later than July 1, 2019, establish a group for the purposes of negotiating a new settlement following expiry of the CTS (the “2021 Negotiating Team”). The 2021 Negotiation Team will begin to negotiate a new settlement that is applicable after the expiry of the CTS. The 2021 Negotiating Team will also review and endorse discretionary capital projects proposed by Enbridge under the CTS in the last two years of the CTS, prior to Enbridge undertaking any such discretionary capital projects. Discretionary capital projects will include any projects less than $250 million excluding maintenance capital and Integrity Capital projects. If negotiations for a new settlement fail, the CTS will terminate on June 30, 2021 and Enbridge will, exercising reasonable diligence, file a new application for tolls with the NEB for the Canadian Mainline. The IJT and CLT tolls will become the interim tolls until the new toll application is approved by the NEB. |

| |

| 25.2 | At the end of the Term, Enbridge will not carry forward amounts based on toll or volume variances in a new settlement agreement or extended CTS unless otherwise agreed to by Enbridge and the 2021 Negotiation Team. |

| |

| 25.3 | Unless otherwise mutually agreed to by Enbridge and the 2021 Negotiating Team, the cumulative amount spent by Enbridge on maintenance and integrity in the last two years of the CTS must be equal to or greater than an amount equal to the average annual amount spent by Enbridge on maintenance and integrity, excluding any amounts spent as a result of Regulatory Changes or Enbridge Specific Regulatory Changes, in the first eight years of the CTS multiplied by 2. |

| |

| 25.4 | The 2010 Depreciation Technical Update Study incorporates a truncation date of 2039 which was approved by the NEB on May 8, 2010. At the end of the Term, the depreciation rates to be applied to rates subject to the NEB’s jurisdiction, exclusive of the rates covered by Section 25.5 below, will be based on the depreciation truncation date implicit in the 2010 Depreciation Technical Update Study subject to Section 25.5. |

| |

| 25.5 | Applicable depreciation rates for the assets comprising the Enbridge Mainline are set forth in Schedules “H” and “I”. |

PART VII – GENERAL PROVISIONS

| |

| 26. | REPORTING AND FILING REQUIREMENTS |

| |

| 26.1 | Each February during the Term, Enbridge will provide the Representative Shipper Group with a summary of capital additions for the prior year and forecast capital additions for the current year to the Enbridge Mainline rate base in total and will detail individual items that exceed $50 million, and the aggregate amount of capital under Shipper Supported Expansion Project(s) in accordance with the Capital Reporting Template. Enbridge will continue to meet with Shippers to annually review the Enbridge Mainline integrity plan, metrics and overall operating plan. |

| |

| 26.2 | In addition, each February of 2019, 2020 and 2021, Enbridge will provide a summary of the forecast capital additions to the Enbridge Mainline rate base for all pending projects or future projects anticipated to be initiated before the end of the Term that exceed $50 million that could result in an addition to the Enbridge Mainline rate base either before or after the end of the Term. |

| |

| 26.3 | Enbridge shall file with the applicable regulator and make available to interested parties copies of the CTS tolls and tariffs for each year. |

| |

| 26.4 | Subject to NEB approval, the intention of the CTS is that Enbridge will be exempt from the requirement for Enbridge to file financial forecasts and Financial Surveillance Reports, consistent with the relief granted pursuant to Board Order TO-3-2000, as amended. |

| |

| 27.1 | Enbridge shall file an external auditors’ report for the Enbridge consolidated financial statements with the NEB annually for each fiscal year ending December 31 by March 31 of the following year. The same such auditor’s report will be provided to all other interested parties on request. |

| |

| 27.2 | The Enbridge consolidated financial statements for each fiscal year ending December 31st will be audited by an independent auditor and reported in a manner consistent with Canadian Auditing Standards. The purpose of this audit is to confirm that the financial results as reflected on are in accordance with the provisions of the CTS, including the completeness and accuracy of the annual tolls and any relevant surcharges. |

| |

| 27.3 | Upon 60 days notice to Enbridge by the Representative Shipper Group, and subject to Enbridge’s confidentiality obligations to third parties, the Representative Shipper Group shall be able to, on two occasions, elect to engage an independent accountant or other auditor to conduct its own audit of the Enbridge financial results and of all data and information related to and necessary to establish compliance with the CTS, provided that no such audit shall occur any later than 24 months from the end of the Term. The independent accountant or other auditor will enter into a confidentiality agreement with Enbridge to ensure non-disclosure of confidential or commercial information. Enbridge agrees to undertake all reasonable commercial efforts to assist in the completion of the audit on a timely basis, during normal business hours. Shippers shall bear all third party costs associated with such audits. |

| |

| 28.1 | Enbridge will continue to use flow through tax accounting as directed by the NEB under order Order TO-1-92. |

| |

| 29.1 | Enbridge agrees to abide by the Enbridge Canadian Affiliate Relationship Code which was developed in collaboration with CAPP, as may be amended from time to time, the current version of which is posted on Enbridge’s website at: |

http://www.enbridge.com/InvestorRelations/CorporateGovernance/~/media/Site%20Documents/ Investor%20Relations/Corporate%20Governance/Key%20Documents/carc-epi-2010.ashx .

| |

| 30.1 | To facilitate the resolution of any disputes regarding the CTS in an efficient and expedited manner, disputes arising under this CTS (“Dispute”) shall be resolved in accordance with the dispute resolution mechanism set forth in this Article 30. For clarity, this Article 30 is not intended to permit a party to renegotiate terms that have been agreed to in the CTS or to resolve deadlocks between the parties over an action where the approval of any parties is required under this CTS to such action. |

| |

| 30.2 | In the event of a Dispute, either of Enbridge or a Shipper(s) (the Shipper or group of Shippers initiating the Dispute the “Disputing Shipper Group”) that wishes to initiate dispute resolution shall give written notice (the “Dispute Notice”) to any party of a Dispute and outline in reasonable detail the relevant information concerning the Dispute. The Disputing Shipper Group may self-form and is not dependent on formation pursuant to Section 22.1. Within fourteen (14) days following receipt of the Dispute Notice, Enbridge and the Disputing Shipper Group will each appoint representatives to meet to discuss and attempt to resolve the Dispute. Such representatives shall be individuals that are technically qualified to appreciate and assess the Dispute and have authority to negotiate the Dispute. If the Dispute is not settled within ninety (90) days of receipt of the Dispute Notice, the negotiation will be deemed to have failed. |

| |

| 30.3 | If the Dispute is not resolved pursuant to the process above, the Dispute may be referred to the NEB or other applicable regulator by either Enbridge or the Disputing Shipper Group, to be resolved on an expedited basis. |

| |

| 30.4 | Notwithstanding the above, any parties retain all rights for dispute resolution with the applicable regulator. |

PART VIII – LINE 9 MATTERS

| |

| 31.1 | Enbridge owns and operates Line 9, a common carrier pipeline system regulated under the NEB Act. The assets included in Line 9 are outlined in Schedule “C”. |

| |

| 31.2 | Line 9 tolls are currently set on a standalone basis and will continue to be set on a standalone basis under the CTS regardless of whether Line 9 is used for East to West or West to East service or is used for partial East to West and partial West to East service. Standalone tolling under the CTS continues to treat Line 9 assets as separate and distinct assets from the Enbridge Mainline assets. Standalone tolling under the CTS continues to base Line 9 tolls on the separate and distinct Line 9 rate base. |

| |

| 31.3 | Line 9 tolls are currently published under an NEB approved Line 9 Tariff. Subject to applicable law and approval by the NEB, tolls for transportation of hydrocarbons on Line 9 will continue to be published under a separate Line 9 tariff. In the event that Enbridge applies to reverse service on Line 9 and such reversal is approved by the NEB, such that Line 9 or a portion of Line 9 is operated in a fashion that allows volumes to flow from the Canadian Mainline into Line 9 and supports flow of hydrocarbons from West to East in Line 9, Enbridge may file, at its discretion, a negotiated International Joint Tariff for delivery on Line 9 at that time. |

| |

| 31.4 | In the event that Enbridge files an application to reverse service on Line 9 or a portion of Line 9 and such reversal is approved by the NEB, the stand alone toll for the transportation of hydrocarbons on Line 9 in a West to East service (“Line 9 Local Tolls”) shall be adjusted annually, up or down, at a rate of 75% of the GDPP Index. |

| |

| 31.5 | The CTS is unrelated to any decision regarding the possible reversal of Line 9. The CTS does not limit in any way a party’s rights to make submissions and fully participate in any Line 9 reversal facilities application and is entirely without prejudice to the position of any party in such an application. |

| |

| 31.6 | Subject to applicable law, tolls under a negotiated international joint tariff for the transportation of hydrocarbons from the Canadian Mainline to delivery points on Line 9 will be published when available. |

| |

| 31.7 | Enbridge may offer incentives in order to attract incremental volumes onto Line 9, provided such toll incentives on Line 9 are offered equally to all shippers on Line 9, as adjusted for distance and commodity types. |

| |

| 31.8 | The CTS is unrelated to any decision regarding the responsibility for the costs of abandoning Line 9. The CTS is entirely without prejudice to the position of any party on the question of responsibility for the cost of abandonment of Line 9. |

| |

| 31.9 | All Canadian pipeline assets owned by Enbridge that are regulated by the NEB, including Line 9, are being addressed in the LMCI process. The LMCI process will determine the methodology by which costs for abandonment should be collected by a pipeline. Enbridge will file all required information under LMCI as per the NEB schedules for Line 9. Through the LMCI process, whatever |

abandonment costs the NEB approves for pre-collection from shippers on Line 9 will form part of the standalone costs of Line 9. Enbridge will not apply for abandonment of Line 9 during the Term unless ordered to do so by the NEB.

| |

| 31.10 | For greater certainty, all parties may fully participate in the LMCI process or any other proceeding related to abandonment and the CTS does not limit in any way a party’s right to make submissions regarding Line 9 abandonment or abandonment costs. The CTS is unrelated to the ultimate decision regarding the responsibility for abandonment costs for Line 9. |

| |

| 31.11 | "Line 9 Capital Expenditure" means expenditures on the Line 9 made by Enbridge which, under Oil Pipeline Uniform Accounting Regulations, require capitalization as fixed assets. Line 9 Capital Expenditures must be prudent, reasonable and to the benefit of Line 9 and include, but are not limited to, maintenance, integrity, equipment additions, improvements and new facilities. Line 9 Capital Expenditures would include expansion of Line 9 such as expanded pipeline capacity, increased storage capacity, or the creation or expansion of new Line 9 receipt and delivery points. |

| |

| 31.12 | Enbridge is responsible for all Line 9 Capital Expenditures on Line 9 during the Term. |

| |

| 31.13 | Enbridge will negotiate with shippers on Line 9 prior to any single project on Line 9 with expected Line 9 Capital Expenditures greater than $25 million that expands pipeline capacity, increases storage capacity, or creates or expands new Line 9 receipt and delivery points. |

| |

| 31.14 | Projects on Line 9 which require Line 9 Capital Expenditures and which are not supported by Enbridge because the incremental revenues associated with such project would not cover the incremental costs, may proceed if there is sufficient financial support from a shipper(s) on Line 9 (a “Line 9 Shipper Supported Expansion Project”). |

| |

| 31.15 | By execution of an agreement whereby a shipper on Line 9 agrees to backstop Enbridge’s revenue requirement for Line 9 Shipper Supported Expansion Projects (a “Line 9 Backstopping Agreement”) and confirmation that the proposed project creates no adverse operational issues for Enbridge, as determined by Enbridge acting reasonably, Enbridge will agree to undertake such Line 9 Shipper Supported Expansion Projects in accordance with the terms of such Line 9 Backstopping Agreement. In the event that Enbridge is unable to secure NEB approval for construction of the project, the shipper on Line 9 who supports a Line 9 Shipper Supported Expansion Project by executing a Line 9 Backstopping Agreement (the “Line 9 Supporting Shipper(s)") will be required to reimburse Enbridge for all of the project's reasonable and prudent development costs as defined in the applicable Line 9 Backstopping Agreement. |

| |

| 31.16 | Subject to Section 31.20, additional revenues derived from tolls, including receipt and delivery terminalling and transmission, collected on the incremental volumes transported on the Enbridge Mainline and Line 9 related to such Line 9 Shipper Supported Expansion Project, net of any direct incremental costs (“Net Line 9 Incremental Revenue”) will be credited to the Line 9 Backstopping Agreement’s revenue requirement. |

| |

| 31.17 | The Line 9 Backstopping Agreement will ensure that the annual revenue requirement associated with the incremental project capital is met either through Net Line 9 Incremental Revenue from associated incremental throughput or lump sum payments from the Line 9 Supporting Shipper(s). The form and terms of a Line 9 Backstopping Agreement will be developed on a project by project |

basis but will utilize the following parameters: a) the term will be no less than 5 years and no more than 10 years and can extend past the end of the Term; b) threshold return on equity of between 11 to 15 percent after tax; and c) capital structure of 45 percent equity. The return on equity will be negotiated between, Enbridge and the Line 9 Supporting Shipper(S), and the parties acting reasonably, will consider such risks as volume, capital, cost, credit, financial or other relevant risks. An 11 percent return would be appropriate in a circumstance when Enbridge accepted no volume risk, did not share in any operating or capital cost risk, and credit risk was secured by either a letter of credit or a shipper with an Investment Grade credit rating. A 15 percent return would be appropriate in a circumstance when Enbridge accepts substantially more risk with respect to volumes, capital, cost, credit or financial elements of the project. Similar Line 9 Shipper Supported Expansion Projects will be evaluated on a similar basis and using similar principles.

| |

| 31.18 | At the end of the Term, there will be no net rate base impact to Line 9 as a result of Line 9 Shipper Supported Expansion Projects. |

| |

| 31.19 | For example, for a Line 9 Shipper Supported Expansion Project to construct new tanks, the Line 9 Backstopping Agreement will require the recovery of the capital cost of the tank through accelerated depreciation. To the extent that such accelerated depreciation exceeds Enbridge’s normal depreciation rates for Line 9, the excess will be credited against the Line 9 rate base and future depreciation expense will be reduced accordingly. |

| |

| 31.20 | Enbridge will consider the Net Line 9 Incremental Revenue from incremental volumes associated with Line 9 Shipper Supported Expansion Projects compared to the incremental capital cost to determine the amount and type of Line 9 Backstopping Arrangement it will require. To establish incremental volumes from existing movements, Enbridge will use an appropriate time frame, typically the 12 month period immediately preceding the month in which Enbridge anticipates the in-service date for the new facilities. |

| |

| 31.21 | The Line 9 Backstopping Agreement will incorporate any terms that would allow the Line 9 Supporting Shipper’s commitment to be reduced by Net Line 9 Incremental Revenue or capital contribution provided by one or more other shipper(s) on Line 9. |

| |

| 31.22 | Line 9 Backstopping Agreements are to allow the provision of services, but nothing in this Article 31 is intended to provide any priority service to Line 9 Supporting Shippers. |

| |

| 31.23 | Each February during the Term, Enbridge will provide shippers on Line 9 with a summary of capital additions for the prior year and forecast capital additions for the current year to the Line 9 rate base in total and will detail individual items that exceed $5 million, and the aggregate amount of capital under a Shipper Supported Expansion Project in accordance with the Line 9 Capital Reporting Template included in Schedule “O”. Enbridge will continue to meet with shippers on Line 9 to annually review the Line 9 integrity plan, metrics and overall operating plan. |

| |

| 31.24 | In addition, each February of 2019, 2020 and 2021, Enbridge will provide a summary of the forecast capital additions to the Line 9 rate base for all pending projects or future projects anticipated to be initiated before the end of the Term that exceed $5 million that could result in an addition to the Line 9 rate base before the end of the Term. |

| |

| 31.25 | Enbridge shall file with the NEB and make available to interested parties copies of the Line 9 tolls and tariffs for each year. |

SCHEDULE “A” - CANADIAN MAINLINE

|

|

| PIPELINES & FACILITIES |

| Line 1 |

| Line 2 |

| Line 3 |

| Line 4 |

| Line 5 |

| Line 6B |

| Line 7 |

| Line 10 |

| Line 11 |

| Line 65 |

| Line 67 |

| All related facilities associated with the above noted pipelines |

|

| |

| RECEIPT POINTS | DELIVERY POINTS |

| Edmonton, Alberta | Edmonton, Alberta |

| Hardisty, Alberta | Hardisty, Alberta |

| Kerrobert, Saskatchewan | Kerrobert, Saskatchewan |

| Regina, Saskatchewan | Stony Beach, Saskatchewan |

| Cromer, Manitoba | Regina, Saskatchewan |

| Sarnia, Ontario | Milden, Saskatchewan |

| Westover, Ontario | Gretna, Manitoba |

| | Sarnia, Ontario |

| | Nanticoke, Ontario |

2012 Edmonton Tanks

| |

| (a) | Tank #36, shell capacity of 260,000 barrels per day in service on or about September 1, 2012; |

| |

| (b) | Tank #38, shell capacity of 186,000 barrels per day in service, on or about September 1, 2012; |

| |

| (c) | Tank # 33 and Tank # 37 each with shell capacity of 372,000 barrels expected to be in service on, or about, December 1, 2012; and |

| |

| (d) | the demolition of Tank #13 and Tank #17. |

SCHEDULE “B” - LAKEHEAD SYSTEM

|

|

| PIPELINES & FACILITIES |

| Line 1 |

| Line 2 |

| Line 3 |

| Line 4 |

| Line 5 |

| Line 6A |

| Line 6B |

| Line 10 |

| Line 14/64 |

| Line 61 |

| Line 62 |

| Line 65 |

| Line 67 |

| All related facilities associated with the above noted pipelines |

|

| |

| RECEIPT POINTS | DELIVERY POINTS |

| Clearbrook, Minnesota | Clearbrook, Minnesota |

| Mokena, Illinois | Superior, Wisconsin |

| Griffith, Indiana | Lockport & Mokena, Illinois |

| Stockbridge, Michigan | Flanagan, Illinois |

| Lewiston, Michigan | Griffith, Indiana |

| | Stockbridge, Michigan |

| | Marysville, Michigan |

| | Rapid River, Michigan |

| | West Seneca, New York |

SCHEDULE “C” - LINE 9 FACILITIES EAST BOUND SERVICE

|

|

| PIPELINES & FACILITIES |

| Line 9 |

| All related facilities associated with the above noted pipeline |

|

| |

| RECEIPT POINTS | DELIVERY POINTS |

| Sarnia, Ontario | North Westover, Ontario |

| | Montreal, Quebec |

SCHEDULE “D” - TABLE OF IJT TOLLS

These tolls will escalate each July 1 by 75% of GDPP Index beginning July 1, 2012.

Schedule “ D” ( Part 1) - IJT Tolls in U.S. Dollars per Cubic Meter

|

| | | | | | |

IJT-JOINT TRANSPORTATION RATES ($USD PER CUBIC METER) |

| FROM | TO | RATE |

| NGL | CND | LIGHT | MEDIUM | HEAVY |

| Edmonton Terminal, Alberta | Clearbrook, Minnesota | — | 12.5702 | 13.3780 | 14.3201 | 15.9705 |

| Superior, Wisconsin | 14.3227 | 15.0655 | 15.8733 | 17.0053 | 18.9850 |

| Lockport, Illinois | — | 20.7469 | 21.5547 | 23.1509 | 25.9473 |

| Mokena, Illinois | — | 20.7469 | 21.5547 | 23.1509 | 25.9473 |

| Flanagan, Illinois | — | 20.7469 | 21.5547 | 23.1509 | 25.9473 |

| Griffith, Indiana | — | 20.7469 | 21.5547 | 23.1509 | 25.9473 |

| Stockbridge, Michigan | — | 22.8831 | 23.6909 | 25.4579 | 28.5542 |

| Rapid River, Michigan | 17.1569 | — | — | — | — |

| Marysville, Michigan | 21.4046 | 22.8831 | 23.6909 | 25.4579 | 28.5542 |

| Corunna or Sarnia Terminal, Ontario | 21.7335 | 23.2139 | 24.0295 | 25.8058 | 28.9124 |

| Nanticoke, Ontario | — | 25.2211 | 26.2112 | 28.1620 | 31.5741 |

| West Seneca, New York | — | 25.5215 | 26.5317 | 28.5270 | 32.0181 |

| Hardisty Terminal, Alberta | Clearbrook, Minnesota | — | — | 11.9587 | 12.7872 | 14.2390 |

| Superior, Wisconsin | — | — | 14.4540 | 15.4724 | 17.2535 |

| Lockport, Illinois | — | — | 20.1354 | 21.6180 | 24.2158 |

| Mokena, Illinois | — | — | 20.1354 | 21.6180 | 24.2158 |

| Flanagan, Illinois | — | — | 20.1354 | 21.6180 | 24.2158 |

| Griffith, Indiana | — | — | 20.1354 | 21.6180 | 24.2158 |

| Stockbridge, Michigan | — | — | 22.2716 | 23.9250 | 26.8227 |

| Rapid River, Michigan | — | — | — | — | — |

| Marysville, Michigan | — | — | 22.2716 | 23.9250 | 26.8227 |

| Corunna or Sarnia Terminal, Ontario | — | — | 22.6102 | 24.2729 | 27.1809 |

| Nanticoke, Ontario | — | — | 24.7919 | 26.6291 | 29.8425 |

| West Seneca, New York | — | — | 25.1124 | 26.9941 | 30.2865 |

Schedule “ D” ( Part 1) - IJT Tolls in U.S. Dollars per Cubic Meter - continued

|

| | | | | | |

IJT-JOINT TRANSPORTATION RATES ($USD PER CUBIC METER) |

| FROM | TO | RATE |

| NGL | CND | LIGHT | MEDIUM | HEAVY |

| Kerrobert Station, Saskatchewan | Clearbrook, Minnesota | — | — | 10.5313 | — | 12.4975 |

| Superior, Wisconsin | 11.7606 | — | 13.0266 | — | 15.5120 |

| Lockport, Illinois | — | — | 18.7080 | — | 22.4743 |

| Mokena, Illinois | — | — | 18.7080 | — | 22.4743 |

| Flanagan, Illinois | — | — | 18.7080 | — | 22.4743 |

| Griffith, Indiana | — | — | 18.7080 | — | 22.4743 |

| Stockbridge, Michigan | — | — | 20.8442 | — | 25.0812 |

| Rapid River, Michigan | 14.5948 | — | — | — | — |

| Marysville, Michigan | 18.8425 | — | 20.8442 | — | 25.0812 |

| Corunna or Sarnia Terminal, Ontario | 19.1715 | — | 21.1828 | — | 25.4394 |

| Nanticoke, Ontario | — | — | 23.3645 | — | 28.1011 |

| West Seneca, New York | — | — | 23.685 | — | 28.5450 |

| Regina Terminal, Saskatchewan | Clearbrook, Minnesota | — | — | 7.6683 | — | 9.0047 |

| Superior, Wisconsin | — | — | 10.1636 | — | 12.0192 |

| Lockport, Illinois | — | — | 15.8450 | — | 18.9815 |

| Mokena, Illinois | — | — | 15.8450 | — | 18.9815 |

| Flanagan, Illinois | — | — | 15.8450 | — | 18.9815 |

| Griffith, Indiana | — | — | 15.8450 | — | 18.9815 |

| Stockbridge, Michigan | — | — | 17.9812 | — | 21.5884 |

| Rapid River, Michigan | — | — | — | — | — |

| Marysville, Michigan | — | — | 17.9812 | — | 21.5884 |

| Corunna or Sarnia Terminal, Ontario | — | — | 18.3198 | — | 21.9466 |

| Nanticoke, Ontario | — | — | 20.5015 | — | 24.6083 |

| West Seneca, New York | — | — | 20.8221 | — | 25.0522 |

| Cromer Terminal, Manitoba | Clearbrook, Minnesota | — | — | 5.6002 | 5.9201 | 6.4816 |

| Superior, Wisconsin | 7.3226 | — | 8.0955 | 8.6053 | 9.4961 |

| Lockport, Illinois | — | — | 13.7769 | 14.7509 | 16.4584 |

| Mokena, Illinois | — | — | 13.7769 | 14.7509 | 16.4584 |

| Flanagan, Illinois | — | — | 13.7769 | 14.7509 | 16.4584 |

| Griffith, Indiana | — | — | 13.7769 | 14.7509 | 16.4584 |

| Stockbridge, Michigan | — | — | 15.9131 | 17.0579 | 19.0653 |

| Rapid River, Michigan | 10.1568 | — | — | — | — |

| Marysville, Michigan | 14.4045 | — | 15.9131 | 17.0579 | 19.0653 |

| Corunna or Sarnia Terminal, Ontario | 14.7335 | — | 16.2517 | 17.4057 | 19.4235 |

| Nanticoke, Ontario | — | — | 18.4334 | 19.7620 | 22.0852 |

| West Seneca, New York | — | — | 18.7539 | 20.1269 | 22.5291 |

Schedule “ D” ( Part 2) - IJT Tolls in U.S. Dollars per Barrel

|

| | | | | | |

IJT-JOINT TRANSPORTATION RATES ($USD PER BARREL) |

| FROM | TO | Rate |

| NGL | CND | LIGHT | MEDIUM | HEAVY |

| Edmonton Terminal, Alberta | Clearbrook, Minnesota | — | 1.9985 | 2.1269 | 2.2767 | 2.5391 |

| Superior, Wisconsin | 2.2771 | 2.3952 | 2.5237 | 2.7036 | 3.0184 |

| Lockport, Illinois | — | 3.2985 | 3.4269 | 3.6807 | 4.1253 |

| Mokena, Illinois | — | 3.2985 | 3.4269 | 3.6807 | 4.1253 |

| Flanagan, Illinois | — | 3.2985 | 3.4269 | 3.6807 | 4.1253 |

| Griffith, Indiana | — | 3.2985 | 3.4269 | 3.6807 | 4.1253 |

| Stockbridge, Michigan | — | 3.6381 | 3.7666 | 4.0475 | 4.5398 |

| Rapid River, Michigan | 2.7277 | — | — | — | — |

| Marysville, Michigan | 3.4031 | 3.6381 | 3.7666 | 4.0475 | 4.5398 |

| Corunna or Sarnia Terminal, Ontario | 3.4554 | 3.6907 | 3.8204 | 4.1028 | 4.5967 |