Exhibit 99.1

Annual Report and Accounts 2004

The “Shell” Transport and Trading Company, p.l.c.

About this report

Welcome to the Annual Report and Accounts 2004 for The “Shell” Transport and Trading Company, p.l.c. In this report you will find information relating to the Royal Dutch/Shell Group of Companies on pages 6 to 103, including a review of the 2004 operational and financial performance of the businesses. On pages 1 to 5 and 104 to 136, you will find information about The “Shell” Transport and Trading Company, p.l.c., one of the Parent Companies of the Royal Dutch/Shell Group.

| EXPLORATION & PRODUCTION16GAS & POWER22OIL PRODUCTS26CHEMICALS30OTHER INDUSTRY SEGMENTS32SHELL TRANSPORT104 |

Shell’s operations

The Royal Dutch/Shell Group of Companies consists of the upstream businesses of Exploration & Production and Gas & Power and the downstream businesses of Oil Products and Chemicals. We also have interests in other industry segments such as Renewables and Hydrogen. For more information on Shell’s operations, see pages 8 and 9 of this report.

1

What’s in this report

| | | |

| The “Shell” Transport and Trading Company, p.l.c. |

| 2 | | Message to shareholders |

| 3 | | Financial highlights |

| 5 | | Unification of Royal Dutch and Shell Transport |

| | | |

| Royal Dutch/Shell Group |

| 6 | | The Boards of the Parent Companies |

| 8 | | What we do |

| 9 | | Where we are |

| 10 | | Operational and Financial Review |

| 10 | | Strategy |

| 12 | | Contributing to sustainable development |

| 13 | | Market overview |

| 14 | | Summary of Group results |

| 16 | | Upstream: Exploration & Production |

| 22 | | Upstream: Gas & Power |

| 26 | | Downstream: Oil Products |

| 30 | | Downstream: Chemicals |

| 32 | | Other industry segments and Corporate |

| 34 | | Liquidity and capital resources |

| 37 | | Other matters |

| 42 | | Critical accounting estimates |

| 45 | | Controls and procedures |

| 48 | | Report of the Registered Independent Public Accounting Firms on the US GAAP Financial Statements |

| 49 | | US GAAP Financial Statements and Notes |

| 82 | | Report of the Independent Auditors (Netherlands GAAP) |

| 83 | | Netherlands GAAP Financial Statements and Notes |

| 92 | | Supplementary information — Oil and Gas (unaudited) |

| | | |

| The “Shell” Transport and Trading Company, p.l.c. |

| 105 | | Report of the Directors |

| 107 | | Corporate governance |

| 110 | | Directors’ Remuneration Report |

| 121 | | Group share plans |

| 122 | | Financial Statements |

| 124 | | Notes to the Financial Statements |

| 131 | | Report of the Independent Auditors |

| 132 | | Notes to corporate governance arrangements |

| 136 | | Shareholder information |

Report structure

The“Shell”Transport and Trading Company, p.l.c. owns 40% of the Royal Dutch/Shell Group. Throughout this report, page markers are used to identify sections that relate to these entities:

The “Shell” Transport and Trading Company, p.l.c.

The “Shell” Transport and Trading Company, p.l.c.

Royal Dutch/Shell Group

Royal Dutch/Shell Group

The companies in which Royal Dutch Petroleum Company and The “Shell” Transport and Trading Company, p.l.c. directly or indirectly own investments are separate and distinct entities. But in this report the collective expressions “Shell”, “Group” and “Royal Dutch/Shell Group of Companies” are sometimes used for convenience in contexts where reference is made to the companies of the Royal Dutch/Shell Group in general. Likewise the words “we”, “us” and “our” are used in some places to refer to companies of the Royal Dutch/Shell Group in general, and in others to those who work in those companies. Those expressions are also used where no useful purpose is served by identifying a particular company or companies.

The shell pictured on the cover of this report isConus textilefrom the Indo-Pacific region.

2 The “Shell” Transport and Trading Company, p.l.c.

2 The “Shell” Transport and Trading Company, p.l.c.

Message to shareholders

Lord Oxburgh

Message from the Chairman

2004 was one of the most challenging years in the Group’s history. However, it was also a year when we took important steps to deal with the difficulties we faced and to strengthen the foundations of the Royal Dutch/Shell Group for the future.

Addressing the issues arising from the recategorisation of the Group’s proved hydrocarbon reserves was a key priority. I believe we now have a thorough and rigorous system in place that meets the relevant regulatory and legal requirements. We have also refocused our upstream strategy, increasing capital investment to replenish our resource base.

We undertook a far reaching review of the structure and governance of the Group which has resulted in the proposals for unification that are being put to shareholders at meetings on June 28, 2005. This is a historic step that your Board believes offers the opportunity to bring greater clarity, simplicity and accountability to the governance and management of your company.

A number of Non-executive Directors will step down this year. Teymour Alireza and Sir Mark Moody-Stuart will retire at the Annual General Meeting and if the unification is approved, Dr Eileen Buttle and Luis Giusti will resign their positions in July. I would like to thank each of the Directors for their commitment and dedication to the Company during their many years of service.

I am confident that the steps we are now taking will enable us to take full advantage of the outstanding skills of our people and the value of our assets to seize the exciting opportunities ahead.

/s/ Lord Oxburgh

Lord Oxburgh

Chairman

April 27, 2005

Jeroen van der Veer

Message from the Group Chief Executive

The past year has been one of real contrasts. We faced very difficult issues arising from the recategorisation of our proved reserves but also delivered record earnings in line with our business strategy. At the same time, we made sweeping proposals to clarify and simplify the Group’s structure and to strengthen our business for the future. I would like to thank Lord Oxburgh for his leadership during this process and for his contribution to the Group over the past nine years.

Our performance in 2004 reflected the progress we made in delivering our strategy of more upstream and profitable downstream. We reported record net income of $18.2 billion, a 48% increase on 2003 and generated more than $33 billion in cash. This strong performance and cash generation is enabling us to pay more than $10 billion in dividends in 2005 and to relaunch our share buyback programme, while investing some $15 billion to build for the future.

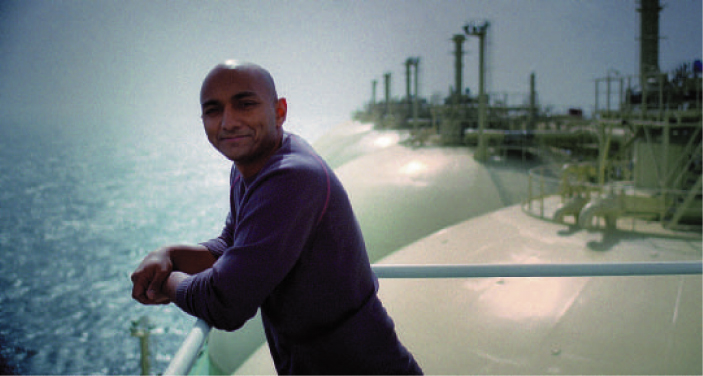

Results in the Downstream and Gas & Power in 2004 were particularly strong. Higher prices and higher margins, as well as improved operational performance, meant that earnings in the Oil Products business more than doubled. In Gas & Power, we continued to build on our industry leading position in liquefied natural gas (LNG), with 9% volume growth and new projects added to our portfolio.

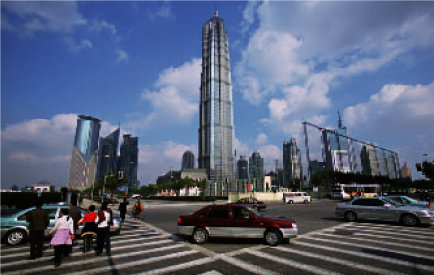

In Oil Products, the premium fuels programme continued to be popular with customers, not least in the USA where we launched Shell V-Power which quickly became the best selling premium gasoline. We took a number of important steps during the year to build our presence in the key growth markets including an

Message to shareholders 3

Financial highlights

Total Dividend

per Ordinary share

16.95p

Earnings

net income

$18,183 million

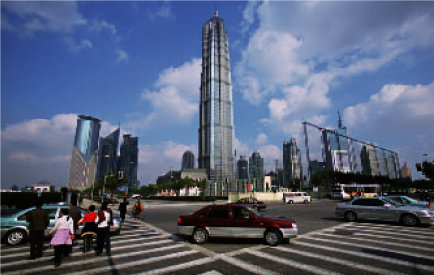

agreement with Sinopec to develop 500 retail stations in China. We continued to make good progress in reshaping the portfolio through divestments of under-performing assets.

It was encouraging that, after several difficult years, the Chemicals business showed significant success with a profit of $930 million. The main opportunities for growth in Chemicals are in Asia Pacific and we made good progress on the construction of the Nanhai plant, which is on time and on budget. The plant is scheduled to be commissioned at the end of 2005 and will serve China’s growing domestic petrochemical market.

In Exploration & Production, earnings were strong and production, considering divestments, was broadly the same as in 2003. A number of new fields started production including Jintan in Malaysia, the Goldeneye field in the North Sea and Holstein in the Gulf of Mexico. Production from the West Salym field in Siberia also began, a year earlier than planned. We continued to invest in developments that will deliver long-term value and final investment decisions were taken on the Kashagan project in Kazakhstan and the Pohokura gas development in New Zealand. We made significant additions to our overall acreage positions and participated in 31 successful exploration wells.

We completed the review of our proved reserves and I am confident that we now have the people, processes and systems in place to ensure that our reserves are recorded in a rigorous and accurate way. In the next five years we will unlock 13 billion barrels of oil equivalent in new resources through the development of identified projects in our portfolio. We also decided to increase our spend for exploration for oil and gas.

Gas & Power had another successful year with a 9% increase in LNG volumes, further reinforcing our leading position in this growing market. We made significant progress in selling LNG from the Sakhalin II facility which will start production in 2007. The majority of the plant’s LNG has now been sold to customers in Japan, Korea, and in a highly significant deal, to North America. This will be the first time that Russian gas has been sold in the North American market.

We continued to invest for the future with the final investment decision being made for a sixth train of the LNG plant in Nigeria and the agreement to build a LNG plant in Qatar. Acknowledging that a key part of the growth in global energy demand will be met by natural gas, our strategy will continue to build on our leading positions in the LNG and gas to liquids markets.

In line with our business strategy we plan to increase total investment in the upstream to some $12 billion a year. This will ensure we are positioned to seize the opportunities in a growing energy market where oil and gas prices are likely to remain relatively high.

We also made progress in embedding a culture change throughout the Group. The Executive Committee has taken the lead in rolling out “Enterprise First” based on three principles: leadership, accountability and teamwork, starting with the senior management, and through them, across the Group. The adoption of these behaviours will be critical to our future success.

I was very honoured to be appointed the Group’s first Chief Executive in October 2004. I believe that our results demonstrate that Shell retains the fundamental strengths on which to build for the future. Our employees are one of those core strengths and I would like to thank them for their hard work and dedication, especially because 2004 was a difficult year for all employees.

While I know that there will be many challenges ahead, I am fully committed to driving the actions that will transform our business, meet your expectations and help us move ahead of the competition.

/s/ Jeroen van der Veer

Jeroen van der Veer

Group Chief Executive

April 27, 2005

4 The “Shell” Transport and Trading Company, p.l.c.

4 The “Shell” Transport and Trading Company, p.l.c.

Financial highlights

Group financial highlights:

Royal Dutch/Shell Group of Companies (US GAAP)

| Net income Net assets $million $million 18,183 84,576 72,497 12,313 60,276 9,656 02 03 0402 0304 |

Information prior to 2004 for the Group has been restated where applicable to take account of the restatements as described in Note 2 to the Financial Statements of the Royal Dutch/Shell Group of Companies (see pages 52 to 55).

GAAP = generally accepted accounting principles.

Parent Company financial highlights:

The “Shell” Transport and Trading Company, p.l.c.

| Adjusted earnings a Dividends Year-end share pricepence per 25p pence per 25p pence per 25p Ordinary share Ordinary share Ordinary share41.5 16.95 44415.25 15.75 409 416 30.8 26.5 02 030402 030402 0304 Adjusted earnings a Dividends Year-end share price$ per New York Share* $ per New York Share* $ per New York Share*4.56 1.90 51.401.62 45.03 1.44 38.92 3.00 2.38 02 030402 030402 0304 |

Information in respect of adjusted earnings prior to 2004 for the Company has been restated where applicable to take account of the Reserve Restatement.

| a | | Adjusted earnings includes Shell Transport’s share of earnings retained by companies of the Royal Dutch/Shell Group and are, in the opinion of the Directors, the most meaningful since they reflect the full entitlement of the Company in the income of Group companies. A reconciliation between this Adjusted earnings per share measure and Shell Transport’s basic earnings per share, is provided on page 122. |

| |

| * | | One New York Share = six 25p Ordinary shares |

For information about the data contained in the charts relating to Shell Transport, consult the Shareholder information section on page 136.

Throughout this report, a billion = 1,000 million.

Unification of Royal Dutch and Shell Transport 5

Unification of Royal Dutch and Shell Transport

“Your Board believes that these proposals are in the best interests of shareholders and the Directors unanimously recommend that Shell Transport shareholders vote in favour of the resolutions to be proposed at the meetings on June 28, 2005.”

Lord Oxburgh

Chairman

A review of the structure and governance of the Shell Group was carried out during 2004 by a steering group drawn from the Boards of the Group’s two parent companies, Royal Dutch Petroleum Company (Royal Dutch) and The “Shell” Transport and Trading Company, p.l.c. (Shell Transport). Chaired by Lord Kerr, its remit was to consider how best to simplify the structures of the companies, the Boards and management of the Group; how to improve the decision making processes and the personal accountability of management; and how to enhance leadership of the Group. The steering group heard the views of a large number of institutional shareholders and shareholder groups and considered a wide range of solutions, in the end opting for the simplest, cleanest and clearest. The steering group’s final recommendations received the unanimous support of the Boards and were announced on October 28, 2004.

The Boards’ proposal to shareholders is for the unification of the two existing parent companies, Royal Dutch and Shell Transport, under a single new parent company, Royal Dutch Shell plc.

Royal Dutch Shell is incorporated in England and Wales and has a single corporate headquarters and its tax domicile in the Netherlands. Royal Dutch Shell will have a single tier 15-person board with a majority of independent non-executive directors, headed by a non-executive chairman. A single Chief Executive leads the Executive Committee, whose members report to him.

The Boards believe that this proposal will strengthen the Group in a number of ways. It will provide a clearer and simpler structure with a single smaller board and a simplified senior management structure. The lines of accountability will be clearer with the Executive Committee reporting to the Chief Executive, who in turn will report to the unified single board and non-executive chairman, who are accountable to shareholders. Efficiencies will be achieved by reducing duplication and centralising functions in one headquarters in The Hague.

The Executive Committee has already been established and Jeroen van der Veer has been appointed as the Group’s first Chief Executive. He has full executive authority and a remit to drive the implementation of strategy, operational delivery and cultural change.

Shell Transport is seeking shareholder approval on June 28, 2005 of the proposed unification. Further details about the proposal and instructions on how to vote, either in person or by proxy, are being sent to shareholders separately and are available on www.shell.com/unification. Voting on the proposals will take place at an Extraordinary General Meeting and at a Court convened meeting, both to be held on June 28, 2005 after the Annual General Meeting.

If the proposals are approved by shareholders of both Royal Dutch and Shell Transport, the conditions of the Royal Dutch offer are satisfied or, to the extent permitted, waived and the Shell Transport scheme of arrangement is approved by the High Court, implementation of the new structure is expected to take place in July 2005 (subject to the satisfaction or waiver of all other conditions).

6 Royal Dutch/Shell Group of Companies

6 Royal Dutch/Shell Group of Companies

The Boards of the Parent Companies

As at April 2005

Royal Dutch Supervisory Board

Aad Jacobs

Chairman

Maarten van den Bergh

Wim Kok

Jonkheer Aarnout Loudon

Professor Hubert Markl

Christine Morin-Postel

Lawrence Ricciardi

Royal Dutch Board of Management

Jeroen van der Veer

President of Royal Dutch and

Group Chief Executive

Linda Cook

Rob Routs

Shell Transport Non-executive Directors

Lord Oxburgh

Chairman

Teymour Alireza

Sir Peter Burt

Dr Eileen Buttle

Luis Giusti

Nina Henderson

Sir Peter Job

Lord Kerr of Kinlochard

Sir Mark Moody-Stuart

Shell Transport Managing Directors

Malcolm Brinded

Peter Voser

Company Secretary, Royal Dutch

Michiel Brandjes

Joined the Group in 1980 as a Legal Adviser.

General Attorney of the Company since May

2003. Appointed Company Secretary of Royal

Dutch in February 2004.

Company Secretary, Shell Transport

Jyoti Munsiff

Joined the Group in 1969 as a Legal Adviser.

Appointed Company Secretary of Shell

Transport in 1993.

Key to Committee membership

n Group Audit Committee

+ Remuneration and Succession Review Committee

# Social Responsibility Committee

ø Shell Transport Nomination Committee

The Boards of the Parent Companies are denoted as follows:

Royal Dutch

Royal Dutch

Shell Transport

Shell Transport

The Boards of the Parent Companies 7

The members of the Supervisory Board and the Board of Management of Royal Dutch Petroleum Company and the Directors and Managing Directors of The “Shell” Transport and Trading Company, p.l.c. meet regularly during the year to discuss reviews and reports on the business and plans of the Royal Dutch/Shell Group.

Aad Jacobsn

Aad Jacobsn

Chairman of the Supervisory Board of Royal Dutch

Born May 28, 1936. A Dutch national, appointed a member of the Supervisory Board in 1998 and Chairman in 2002. Due to retire in 2006. Previously Chairman of the Board of Management of ING Group. Chairman of the Supervisory Boards of Joh. Enschedé, Imtech and VNU; Vice-Chairman of the Supervisory Boards of Buhrmann and IHC Caland and a member of the Supervisory Board of ING Group.

Lord Oxburgh KBE FRSø

Lord Oxburgh KBE FRSø

Non-executive Chairman of Shell Transport

Born November 2, 1934. A British national, appointed a Director in 1996 and Non-executive Chairman in March 2004. Pursuant to the Articles of Association, he will retire in 2005 by virtue of age (70 years) and will stand for re-election at the 2005 AGM. Held a number of scientific and university appointments including Chief Scientific Advisor, Ministry of Defence and Rector, Imperial College of Science, Technology and Medicine.

Jeroen van der Veer

Jeroen van der Veer

President of Royal Dutch and Group Chief Executive

Born October 27, 1947. A Dutch national, appointed President of Royal Dutch in 2000, having been a Managing Director of Royal Dutch since 1997. Appointed Group Chief Executive in October 2004. Joined the Group in 1971 in refinery process design and held a number of senior management positions around the world. Also a member of the Supervisory Board of De Nederlandsche Bank (until September 2004) and a Non-executive Director of Unilever.

Teymour Alireza#

Teymour Alireza#

Non-executive Director of Shell Transport

Born September 7, 1939. A Saudi Arabian national, appointed a Director in 1997. Latest date for retirement by rotation 2005. President and Deputy Chairman of The Alireza Group. Also Chairman of the National Pipe Company Ltd, Saudi Arabia and a Director of Arabian Gulf Investments (Far East) Ltd and of Riyad Bank Saudi Arabia. Member of the International Board of Trustees of the World Wide Fund for Nature.

Maarten van den Bergh +#

Maarten van den Bergh +#

Member of the Supervisory Board of Royal Dutch

Born April 19, 1942. A Dutch national, appointed a member of the Supervisory Board in 2000 and 2004. Due to retire in 2008. Managing Director of Royal Dutch from 1992 to 2000 and President from 1998 to 2000. Chairman of the Board of Directors of Lloyds TSB and a member of the Boards of Directors of BT and British Airways.

Malcolm Brinded CBE FREng

Malcolm Brinded CBE FREng

Managing Director of Shell Transport and Executive Director

Born March 18, 1953. A British national, was appointed a Director and Managing Director of Shell Transport in March 2004. Latest date for retirement by rotation 2007. Previously a Managing Director of Royal Dutch since 2002. Joined the Group in 1974 and has held various positions around the world. Country Chair for Shell in the UK from 1999 to 2002 and Director of Planning, Environment and External Affairs at Shell International Ltd from 2001 to 2002.

Sir Peter Burt FRSEnø

Sir Peter Burt FRSEnø

Non-executive Director of Shell Transport

Born March 6, 1944. A British national, appointed a Director in 2002. Latest date for retirement by rotation 2006. Joined the Bank of Scotland in 1975 and rose to become Chief General Manager. Appointed Group Chief Executive and in 2001 became Executive Deputy Chairman of HBOS plc and Governor of the Bank of Scotland, retired in 2003. Chairman of Gleacher Shacklock Limited and a director of a number of charitable organisations. In February 2004 he was appointed Non-executive Chairman of ITV plc.

Dr Eileen Buttle CBE#

Dr Eileen Buttle CBE#

Non-executive Director of Shell Transport

Born October 19, 1937. A British national, appointed a Director in 1998 following retirement from a career of public scientific appointments. Latest date for retirement by rotation 2007. Member of a number of UK Government and European Union advisory committees on environmental aspects of UK and European research and of Boards of Trustees of environmental non-governmental organisations.

Linda Cook

Linda Cook

Managing Director of Royal Dutch and Executive Director

Born June 4, 1958. A US national, appointed a Managing Director of Royal Dutch in August 2004. President and Chief Executive Officer and a member of the Board of Directors of Shell Canada Ltd from August 2003 to July 2004. Joined Shell Oil Company in Houston in 1980, and worked for Shell Oil Company in Houston and California in a variety of technical and managerial positions. Member of the Society of Petroleum Engineers and member of the Board of Directors of The Boeing Company.

Luis Giustin

Luis Giustin

Non-executive Director of Shell Transport

Born November 27, 1944. A Venezuelan national, appointed a Director in 2000. Latest date for retirement by rotation 2007. Chairman and Chief Executive Officer of Petróleos de Venezuela, SA (PDVSA) from 1994 to 1999. Before joining PDVSA in 1976, worked for the Venezuelan Shell oil company. Member of the Board of Governors of the Centre for Global Energy Studies in London. Senior Advisor at the Center for Strategic and International Studies in Washington DC.

Mary R. (Nina) Hendersonn +

Mary R. (Nina) Hendersonn +

Non-executive Director of Shell Transport

Born July 6, 1950. A US national, appointed a Director in 2001. Latest date for retirement by rotation 2007. Previously President of a major division and Corporate Vice-President of Bestfoods, a major US foods company, responsible for worldwide core business development. Non-executive Director of Pactiv Corporation, AXA Financial Inc., Del Monte Foods Company and Visiting Nurse Service of New York.

Sir Peter Job KBE +ø

Sir Peter Job KBE +ø

Non-executive Director of Shell Transport

Born July 13, 1941. A British national, appointed a Director in 2001. Latest date for retirement by rotation 2005. Previously Chief Executive of Reuters plc. Non-executive Director of Schroders plc, TIBCO Software Inc., Instinet Group Inc., and a member of the Supervisory Board of Deutsche Bank AG.

Lord Kerr of Kinlochard GCMG +ø

Lord Kerr of Kinlochard GCMG +ø

Non-executive Director of Shell Transport

Born February 22, 1942. A British national, appointed a Director in 2002. Latest date for retirement by rotation 2006. A member of the UK Diplomatic Service from 1966 to 2002 (and its Head from 1997 to 2002), he was successively UK Permanent Representative to the EU, British Ambassador to the USA, Foreign Office Permanent Under Secretary of State and Secretary-General of the European Convention. Non-executive Director of Rio Tinto, Scottish American Investment Trust plc and Chairman of Court/Council of Imperial College. Trustee of the National Gallery and of the Rhodes Trust.

Wim Kok#

Wim Kok#

Member of the Supervisory Board of Royal Dutch

Born September 29, 1938. A Dutch national, appointed a member of the Supervisory Board with effect from 2003. Due to retire by rotation in 2007. Chaired the Confederation of Dutch trade unions (FNV) before becoming a member of the Lower House of Parliament and parliamentary leader of the Partij van de Arbeid (Labour Party). Appointed Minister of Finance in 1989 and Prime Minister in 1994, serving for two periods of government up to July 2002. Member of the Supervisory Boards of ING Group, KLM and TPG.

Jonkheer Aarnout Loudon +#

Jonkheer Aarnout Loudon +#

Member of the Supervisory Board of Royal Dutch

Born December 10, 1936. A Dutch national, appointed a member of the Supervisory Board in 1997. Due to retire in 2007. Member of the Board of Management of Akzo from 1977 to 1994 (Akzo Nobel as from 1994) and its Chairman from 1982 to 1994. Chairman of the Supervisory Boards of ABN AMRO Bank and Akzo Nobel and a member of the International Advisory Board of Allianz.

Professor Hubert Markl +

Professor Hubert Markl +

Member of the Supervisory Board of Royal Dutch

Born August 17, 1938. A German national, appointed a member of the Supervisory Board in 2002. Due to retire by rotation in 2006. President of the Max-Planck-Gesellschaft from 1996 to 2002. Professor of Biology at the University of Constance from 1974 to 2003. Member of the Supervisory Boards of Aventis, BMW, and Münchener Rückversicherungs-Gesellschaft.

Sir Mark Moody-Stuart KCMG#

Sir Mark Moody-Stuart KCMG#

Non-executive Director of Shell Transport

Born September 15, 1940. A British national, appointed a Non-executive Director in 2001. Latest date for retirement by rotation 2005. Appointed a Managing Director in 1991 and Chairman of Shell Transport from 1997 to 2001. Chairman of Anglo American plc and a Director of HSBC Holdings plc and Accenture. Member of the UN Secretary General’s Advisory Council for the Global Compact from 2001 to 2004.

Christine Morin-Posteln

Christine Morin-Posteln

Member of the Supervisory Board of Royal Dutch

Born October 6, 1946. A French national, appointed a member of the Supervisory Board in July, 2004. Due to retire by rotation in 2008. Formerly Chief Executive of Société Générale de Belgique and Executive Vice-President and member of the Executive Committee of Suez. Member of the Board of Alcan Inc., 3i Group plc and Pilkington plc.

Lawrence Ricciardin

Lawrence Ricciardin

Member of the Supervisory Board of Royal Dutch

Born August 14, 1940. A US national, appointed a member of the Supervisory Board in 2001. Due to retire by rotation in 2005. Previously President of RJR Nabisco, Inc. and subsequently Senior Vice-President and General Counsel of IBM. Senior Advisor to the law firm Jones Day and to Lazard Frères & Co. Member of the Board of Directors of The Reader’s Digest Association, Inc.

Rob Routs

Rob Routs

Managing Director of Royal Dutch and Executive Director

Born September 10, 1946. A Dutch national, appointed a Managing Director of Royal Dutch with effect from 2003. Joined the Group in 1971. Held various positions in the Netherlands, Canada and the USA. Previously President and Chief Executive Officer of Shell Oil Products USA and President of Shell Oil Company and Country Chair for Shell in the USA.

Peter Voser

Peter Voser

Managing Director of Shell Transport and Chief Financial Officer

Born August 29, 1958. A Swiss national, appointed a Managing Director of Shell Transport and Chief Financial Officer (CFO) in October 2004. Latest date for retirement by rotation 2008. In 2002, joined the Asea Brown Boveri (ABB) Group of Companies, based in Switzerland as CFO and Member of the Group Executive Committee. Also responsible for ABB’s Group IT and the Oil, Gas and Petrochemicals business. Originally joined the Royal Dutch/Shell Group in 1982 where he held a variety of finance and business roles in Switzerland, UK, Argentina and Chile, including CFO of Oil Products. Member of the Board of Directors of UBS AG.

8 Royal Dutch/Shell Group of Companies

8 Royal Dutch/Shell Group of Companies

What we do

Though we are probably best known to the public for our service stations and for finding and producing oil and natural gas, our activities result in many other products that play a role in people’s everyday lives.

Upstream

Shell’s upstream businesses explore for and extract oil and natural gas, and build and operate the infrastructure necessary to deliver these hydrocarbons to market. Activities also include marketing and trading of natural gas and electricity, as well as converting natural gas to liquids to provide cleaner fuels.

| | | | | |

Exploration & Production | | | | |

| Employees (thousand) | | | 17 | |

| Capital investment ($ million) | | | 9,868 | |

| |

Gas & Power | | | | |

| Employees (thousand) | | | 2 | |

| Capital investment ($ million) | | | 1,633 | |

| |

Downstream

Shell’s downstream businesses engage in refining crude oil into a range of products including fuels, lubricants and petrochemicals. The Group operates the largest single brand retail network, with over 46,000 service stations.

| | | | | |

Oil Products | | | | |

| Employees (thousand) | | | 76 | |

| Capital investment ($ million) | | | 2,466 | |

| |

Chemicals | | | | |

| Employees (thousand) | | | 8 | |

| Capital investment ($ million) | | | 705 | |

| |

Everyday products

Shell’s products play a part in people’s everyday lives:

| – | fuels and lubricants used in cars, trucks, buses and planes; |

| |

| – | natural gas, wind power and solar panels used to generate electricity for industrial and domestic use; and |

| |

| – | base chemicals and intermediates used to manufacture household products, from detergents to CDs to toys. |

Renewables and Hydrogen

The activities covered in Shell’s new energy portfolio aim to build a commercially viable business based on hydrogen and renewable sources. Part of this portfolio includes producing wind and solar energy used to generate electricity and finding solutions to develop hydrogen as a cleaner and more efficient fuel.

| | | | | |

Corporate and Other | | | | |

| Employees (thousand) | | | 9 | |

| Capital investment ($ million) | | | 243 | |

| |

Find out more

www.shell.com/aboutshell

Where we are 9

Where we are

Shell is a global group of energy and petrochemical companies, operating in more than 140 countries and territories and employing more than 112,000 people.

| Denmark SwedenThe NetherlandsNorwayBelgiumGermany Republic of Ireland Czech Republic United Kingdom Austria France Italy Spain Greece Turkey Azerbaijan Kazakhstan Russia Iran United Arab Emirates Canada Syria USA Morocco Mexico Algeria Puerto Rico Egypt Japan Dominican Republic Saudi Arabia China El Salvador Senegal Pakistan French Antilles & French Guiana Côte d’Ivoire Philippines Venezuela India Colombia Brunei Brazil Nigeria Malaysia Bolivia Cameroon Singapore Argentina Gabon Australia Oman Qatar Angola KenyaKeySouth Africa Upstream Exploration/production of oil and/or natural gas LNG production and supply, gas to liquids production, and power and gas marketing Downstream Manufacturing New Zealand Refineries Petrochemical facilities Downstream Marketing Sales of oil and/or petrochemicals Retail stations |

10Royal Dutch/Shell Group of Companies

10Royal Dutch/Shell Group of Companies

Operational and Financial Review

The Royal Dutch/Shell Group of Companies consists of the upstream businesses of Exploration & Production and Gas & Power and the downstream businesses of Oil Products and Chemicals. We also have interests in other industry segments such as Renewables and Hydrogen.

Upstream and Downstream

An energy company’s upstream activities consist of the exploration, production and transportation of oil and natural gas. Its downstream activities consist of the refining, processing, distribution and marketing of that oil and gas.

Strategy

Over time, and across the commodity price cycle, the Group has achieved higher earnings, cash flow and returns on investment in the Exploration & Production business compared with the other businesses, and sees significant growth potential in demand for natural gas. The downstream businesses continue to offer attractive returns and growth potential in certain business lines and geographies, and provide useful balance in the portfolio to reduce exposure to commodity price movements. The Group’s core competencies include the application of technology, financial and project management skills to large oil and gas projects; the ability to develop and manage a diverse and international business portfolio; and the development of customer-focused businesses built around the strength of the Shell brand.

Our strategy is clear: more upstream, profitable downstream. We intend to focus on areas with high growth potential and where we can capture value from a higher oil and gas price environment. The strategy will be achieved through the following actions:

Reshaping our portfolio

We are strengthening our portfolio through an active programme of divestments and selective focused acquisitions. We have increased our capital expenditure to about $15 billion per year for the medium term, and in the period from 2004 to 2006 will be selling non-strategic or under-performing assets with proceeds targeted at $12 to $15 billion. Most of the increased capital expenditure will be in the upstream, where we expect higher returns. We are growing our upstream business in areas of resource opportunity such as Russia, the Middle East and West Africa, and our downstream business in markets such as Asia Pacific where we see significant potential for growth. We also intend to generate new income streams from

Regaining upstream strength:

Finding new resources

Construction work for the Ormen Lange field, Norway

Ormen Lange is Europe’s second largest offshore gas field. It is situated in an area where climatic and oceanographic conditions make it one of the most challenging developments in the world.

One of our key challenges is to improve our reserves replacement ratio and build our oil and gas resources for the future. Over the next five years, we will be investing $10 billion a year to provide the infrastructure and facilities to unlock 13 billion barrels of new resources.

This activity will include investment to sustain production from our existing positions in Europe, the Americas, Brunei, Malaysia, Oman and onshore Nigeria. We are also making significant investments in new positions such as offshore Nigeria and Kashagan in Kazakhstan. We will develop our strength further in integrated gas developments in LNG, GTL and in pipeline gas from developments such as Ormen Lange. Finally, we will increase our focus on new unconventional developments such as oil sands.

Total exploration and appraisal expenditure will rise to $1.5 billion a year, most of which will be spent on acquiring new acreage and drilling new prospects, with a focus on larger exploration opportunities in fewer countries. In 2004 we have made discoveries in 14 countries and have made positive appraisals of finds in the Gulf of Mexico, Kazakhstan and Malaysia. Over recent years we have increased the drilling of exploration prospects where we expect to find more than 100 million barrels. We drilled 12 of these prospects in 2003 and 15 in 2004 and we expect to drill 15 to 20 of these each year.

Find out more

www.shell.com/ep

Operational and Financial Review11

technologies such as oil sands production and gas to liquids conversion; by providing oil and gas processing services; and from energy sources such as wind, hydrogen and solar power.

Raising our operational performance

Our strategy is underpinned by a focus on achieving the highest standards of performance and operational excellence across all of our business activities. A measure of operational performance for each business has been built into employee compensation systems, encouraging everyone in the organisation to make this a priority. Project delivery and execution has also become increasingly important as we take on larger and more complex projects. We are channelling more resources into this area and providing additional staff training. To deliver our strategy we must complete projects on time, on specification and on budget. Operational performance also means delivering competitive returns and strong cash generation.

Creating the culture and organisation to deliver

Through simplifying our structure and standardising processes across businesses and around the world, we are creating a more dynamic, responsive organisation. The three principles of leadership, accountability and teamwork form the basis of a culture change that is being embedded throughout the Group by the Executive Committee and other senior leaders. The appointment of a single Group Chief Executive to lead this process is proving to be an enabler for driving these changes.

“Improved performance will underpin all of our activities with the goal of achieving top quartile performance in all our businesses.”

Jeroen van der Veer

Group Chief Executive

More profitable downstream:

Securing the benefits of integration

A joint oil and chemicals site, Deer Park, Texas, USA

Having a facility that is fully integrated from raw materials to end products at one site means we can operate at lower cost to produce chemicals such as phenol, used to manufacture everyday goods like compact discs, computers and car headlights.

Shell’s downstream business refines some 4.4 million barrels a day of crude oil, produces some 20 million tonnes per year of chemical products and sells 145 billion litres of fuel a year at our 46,000 service stations.

This business operates in an increasingly competitive and challenging environment where our customers are becoming more discerning and where the pressures on costs are growing. If we are to meet our strategic objective of more profitable downstream we need to ensure that we manage those activities in a way that meets those challenges. That is why we have established a new global downstream organisation that integrates some activities of our Chemicals and Oil Products businesses.

There are obvious immediate practical benefits to this approach where refineries and petrochemicals plants are on the same sites and can share services. The new structure is also making it easier to adopt best practice quickly across all our operations wherever they are in the world. This helps to improve reliability and operational performance at our manufacturing sites. Equally, by standardising and simplifying business processes we can provide a more responsive and effective service to our customers.

We believe that the new downstream global strategy will reduce costs, improve the service we provide to our customers and help us to retain our position as a market leader in the downstream sector.

Find out more

www.shelldeerpark.com/ep

12Royal Dutch/Shell Group of Companies

12Royal Dutch/Shell Group of Companies

Contributing to sustainable development

The Group first made a formal commitment to contribute to sustainable development in 1997. As an energy producer we know we have a fundamental role in developing ways of meeting the world’s growing energy needs in environmentally and socially responsible ways.

Part of building the Sinopec and Shell Coal Gasification Joint Venture in Hunan Province, China involved relocating a community. We worked with our partners and the community to ensure that those affected received quality new housing with livelihood opportunities.

We have worked hard to integrate sustainable development into all of the Group’s activities from project development, to the day-to-day operation of our facilities, as well as the services and products we supply to our customers. That means we listen and respond to the views of stakeholders and work in partnership with them. In this way we are developing and implementing ways of reducing the impact of our activities and ensuring we make a positive contribution to the communities in which we work.

Our commitment to sustainable development is also reflected in the work we do to develop cleaner fuels, improve the energy efficiency of our activities and apply new technology to manage and mitigate the effect of our operations on the environment.

We believe that this approach will become increasingly important as we face the challenge of meeting the world’s rapidly increasing demand for energy. We also believe that it will provide real competitive advantages that will be a key part in the future success and profitability of our business.

We report in more detail on this work in The Shell Report which can be found at www.shell.com/shellreport.

“Sustainable development is an important enabler of our business strategy and we are working to ensure it is integrated into all of our activities.”

Jeroen van der Veer

Group Chief Executive

Using the market to help the environment:

Leading the way in EU emissions trading

Shell believes that market mechanisms, such as emissions trading, are a powerful way of delivering reductions in polluting emissions and supporting the commercial development of renewable forms of energy.

We were one of the first businesses to develop trading mechanisms as a way of reducing the impact on the environment of our activity, setting up an environmental products trading business in 2001. That business now trades in a range of products across 15 different markets worldwide. We have gained valuable experience in these markets through participation in the UK Emissions Trading System and through advance trading in the European Emissions trading system. This system caps the greenhouse gas emissions of all member states and provides them with a defined quantity of carbon dioxide (CO2) emissions to allocate to companies operating in their country. These allocations can then be sold or bought by the companies themselves. By limiting the amount of CO2 emissions but allowing trading of allowances, a market will be created in which companies will have an incentive to reduce emissions.

Currently Shell has 28 facilities under the scheme, covering about a fifth of its worldwide operational emissions. We see the trading scheme as an effective way of providing further incentives for our energy efficiency programmes and we will continue to use our long experience in energy trading to play an active part in this new market.

Find out more

www.shell.com/envandsociety

Operational and Financial Review13

Market overview

We use a variety of tools to monitor external factors and understand their implications. Factors such as oil and natural gas prices, costs of materials and services and demand for our products have a significant impact on the Group’s success.

World economy

Global economic output grew by 5% in 2004, the fastest rate of growth for two decades. This increase reflected strong growth in the USA, as well as increased activity in Europe, Japan and China. We are expecting growth to slow during 2005, reflecting more moderate expansion in the USA and European economies. China’s economy is expected to avoid the risk of overheating and see growth moderating to about 8% in 2005.

While the outlook for 2005 is positive, there are some risks that could affect the rate of global economic growth. These risks include the decline in the US dollar, a rise in protectionism, geopolitical uncertainties and financial turbulence in emerging markets such as China.

Oil and natural gas prices

Oil prices strengthened considerably in 2004 driven by significant growth in global demand, particularly from China and the USA; low US stocks of oil and natural gas; a decline in spare OPEC crude production capacity; geopolitical tensions and disruptions in supply caused by hurricanes in the Gulf of Mexico.

Oil demand growth in 2005 is expected to be lower than in 2004 but still above the average level for the past decade. Crude prices in 2005 will be influenced by the rate of global economic growth, particularly in the USA and China. Other factors affecting prices will include the pace of Iraqi oil export recovery and OPEC supply policy. Disruption to supply as a result of political and security issues would lead to price volatility and upward pressure on prices.

Henry Hub natural gas prices in the USA increased from $5.63 per million British thermal unit (Btu) in 2003 to $5.87 per million Btu in 2004. In 2005 Henry Hub prices are expected to reflect supply and demand in the USA where the development of domestic supply, demand levels from weather conditions and the rate of economic growth will be important. Prices in other markets are expected to remain largely linked to oil prices.

General industry factors

Demand for oil and natural gas is likely to continue to increase in both the short and medium-term, with particularly strong growth in emerging economies such as China and India. The International Energy Agency estimates that global energy demand could grow by almost 60% by 2030 and, within that overall total, oil demand could increase by up to 45% and natural gas demand could double. Meeting that increasing energy demand will require significant levels of new investment across all parts of the industry.

The refining and marketing environment is characterised by intensifying competition from industry consolidation and new entrants and changing and increasingly complex patterns of supply and demand. A fundamental shift in the pattern of demand is taking place as traditional markets in Western Europe and the USA see demand growth slowing while markets in Asia Pacific are experiencing significant growth. In 2004, a shortage of capacity relative to growing demand led to strong refining margins.

The business environment for chemicals has become more positive but remains cyclical. The central driver of growth in the business remains the overall pace of global economic activity.

14Royal Dutch/Shell Group of Companies

14Royal Dutch/Shell Group of Companies

Summary of Group results

2004 was a year of extremes, with the reserves recategorisation on one hand, and record net income and cash generation on the other.

“These strong results were, of course, largely the result of high oil and natural gas prices, but they also reflect our financial and operational strengths and the way we are improving our operational performance.”

Jeroen van der Veer

Group Chief Executive

| | | | | | | | | | | | | |

| Earnings | | | | | | | | | | $ million | |

| | | | | | | 2003 | | | 2002 | |

| | | 2004 | | | As restateda | | | As restateda | |

| |

| Income from continuing operations | | | 16,623 | | | | 12,033 | | | | 9,469 | |

| Income from discontinued operations | | | 1,560 | | | | 25 | | | | 187 | |

| Cumulative effect of a change in accounting principle | | | — | | | | 255 | | | | — | |

| |

Net income | | | 18,183 | | | | 12,313 | | | | 9,656 | |

| |

Change from previous year | | | +48 | % | | | +28 | % | | | –6 | % |

| |

a See Note 2 to the Group Financial Statements.

The Group’s net income in 2004 was $18.2 billion, an increase of 48% from 2003. These earnings reflect higher realised oil and gas prices in Exploration & Production and higher LNG volumes and prices in Gas & Power, as well as increases in refining margins and trading profits in Oil Products and higher volumes and margins in Chemicals.

Exploration & Production earnings were $9,315 million, 4% higher than in 2003. Production in 2004 was broadly unchanged compared to 2003, excluding the impact of divestments, price effects and hurricanes in the Gulf of Mexico. The decline in production in mature areas was largely offset by the start of production in new fields.

Hydrocarbon prices were higher in 2004 than in 2003 with Brent crude prices averaging $38.30 a barrel compared with $28.85 in 2003 and West Texas Intermediate prices averaging $41.50 a barrel in 2004 compared with $31.05 in 2003. Prices reflected the effect of strong US and Chinese demand, geopolitical uncertainty in a number of producer countries, disruptions to production as a result of the hurricanes in the Gulf of Mexico, and lower OPEC spare production capacity. The benefits of higher oil and gas prices were offset by lower hydrocarbon production, higher costs and depreciation, and an increase in the overall effective tax rate.

Earnings in Gas & Power were $2,155 million, 6% lower than in 2003. Earnings in 2003 included gains of $1,120 million mainly related to divestments (Ruhrgas), divestment gains in 2004 were $772 million. Earnings in 2004 reflected a 9% increase in LNG volumes and an 8% increase in LNG prices.

Oil Products earnings increased by 164% compared with 2003, to $7,537 million, benefiting significantly from higher refining margins and increased trading earnings. These results included divestment gains of $1,038 million and net charges of $403 million.

Earnings in Chemicals were $930 million, after a $565 million write-down in the carrying amount of Basell. This impairment followed the announcement in 2004 of a review of strategic alternatives regarding this joint venture. In 2003 a loss of $209 million for Chemicals included $478 million in asset restructuring and impairment charges. The improvement in earnings from 2003 was due to volume growth and higher margins.

The results discussed above include income from discontinued operations of $1,560 million in 2004, including gains on the disposal of such operations which are described in Note 4 to the Group Financial Statements.

Capital investment1in 2004 was $14.9 billion compared with $14.3 billion in 2003. Gross proceeds from divestments were $7.6 billion and cashflow from operating activities was $25.6 billion, an increase of 18% from 2003. At the end of 2004 the total debt ratio2was

| 1 | Capital investment is capital expenditure, exploration expense and investments in associated companies. |

| |

| 2 | The total debt ratio is defined as short-term plus long-term debt as a percentage of capital employed. Capital employed is Group net assets before deduction of minority interests, plus short-term and long-term debt. |

Operational and Financial Review15

13.8% compared with 21.0% in 2003. Cash and cash equivalents were $8.5 billion compared with $2.0 billion in 2003.

It is expected that at least $10 billion, subject to exchange rates, will be returned to shareholders in dividends in 2005. The share buyback programme was relaunched on February 3, 2005.

In view of the inappropriate overstatement of unaudited proved reserves information, it was decided to restate the Financial Statements of the Group, and each of the Parent Companies, for prior periods (the Financial Restatements) to reflect the impact of the Reserves Restatements on those Financial Statements (as announced on April 19, 2004 and February 3, 2005).

See page 45 regarding ‘‘Investigation and report to the Group Audit Committee; management changes’’ for additional detail regarding the Group Audit Committee’s investigation arising out of the Reserves Restatements.

All Group financial information contained in this section is presented in accordance with accounting principles generally accepted in the United States. The restatements described above are reflected in prior period information where applicable.

Reserves

On January 9, 2004, the Group announced the removal of approximately 3.9 billion barrels of oil equivalent (boe) originally reported as proved reserves at December 31, 2002. As a result of further field level reviews concluded in April 2004, the Group determined to restate both the Financial Statements (the First Financial Restatement) and the unaudited disclosures contained in the supplementary information accompanying the Financial Statements (the First Reserves Restatement) to reflect the removal of 4.47 billion boe originally reported as proved reserves as at December 31, 2002.

On February 3, 2005 as a result of reservoir level reviews conducted from July to December 2004 of substantially all of the Group’s proved reserves volumes, the Group announced the removal of approximately 1.37 billion boe of oil and natural gas that were originally reported as proved reserves as at December 31, 2003. The Group has restated the unaudited oil and natural gas reserves disclosures contained in the supplementary information accompanying the Group Financial Statements (the Second Reserves Restatement) to remove these volumes at the earliest date on which they did not represent “proved reserves” within the applicable rules of the United States Securities and Exchange Commission (which in many cases is the date on which the volumes were initially booked as reserves). Approximately 57% of the de-booked volumes were previously booked as proved undeveloped reserves and 43% of the de-booked volumes were previously booked as proved developed reserves.

In view of the inappropriate overstatement of unaudited proved reserves information the Financial Statements of the Group and each of the Parent Companies for the year ended December 2003 and prior periods have been restated (the Second Financial Restatement) to reflect the impact of the Second Reserves Restatement on those Financial Statements.

For further information on the Reserves Restatements and Financial Restatements see Note 2 to the Group Financial Statements on pages 52 to 55.

16Royal Dutch/Shell Group of Companies

16Royal Dutch/Shell Group of Companies

Upstream: Exploration & Production

Performance for the year was strong in terms of cash generation and the progress made on new business milestones. However, the SEC proved reserves reduction and the low 2004 reserves replacement ratio were clearly disappointing.

Our Exploration & Production business searches for and recovers oil and natural gas around the world and is active in more than 36 countries. The majority of these activities are carried out in ventures with external partners.

“The E&P business retains a sound foundation of assets, positions and people. We have some way to go, but we will regain our competitive strength.”

Malcolm Brinded

Executive Director,

Exploration & Production

Malcolm Brinded

Executive Director, Exploration & Production

| | | | | | | | | | | | | |

| | | | | | | | | | $ million | |

| | | | | | | 2003 | | | 2002 | |

| Earnings | | 2004 | | | As restateda | | | As restateda | |

| |

| Net proceeds (including inter-segment sales) | | | 39,644 | | | | 32,468 | | | | 26,320 | |

| Purchases (including change in inventories) | | | (2,658 | ) | | | (1,535 | ) | | | (1,050 | ) |

| Exploration | | | (1,823 | ) | | | (1,475 | ) | | | (1,052 | ) |

| Depreciation | | | (7,457 | ) | | | (7,316 | ) | | | (5,556 | ) |

| Operating expenses | | | (9,320 | ) | | | (7,174 | ) | | | (6,686 | ) |

| |

| Operating profit of Group companies | | | 18,386 | | | | 14,968 | | | | 11,976 | |

| Group share of operating profit of associated companies | | | 2,438 | | | | 1,857 | | | | 1,316 | |

| |

| Operating profit | | | 20,824 | | | | 16,825 | | | | 13,292 | |

| Other income/(expense) | | | 166 | | | | 72 | | | | 73 | |

| Taxation | | | (12,033 | ) | | | (8,307 | ) | | | (6,724 | ) |

| |

| Income from continuing operations | | | 8,957 | | | | 8,590 | | | | 6,641 | |

| Income from discontinued operations, net of tax | | | 358 | | | | 78 | | | | 85 | |

| Cumulative effect of a change in accounting principle | | | – | | | | 255 | | | | – | |

| |

Segment earnings | | | 9,315 | | | | 8,923 | | | | 6,726 | |

| |

a See Note 2 to the Group Financial Statements.

Earnings

Segment earnings in 2004 were $9,315 million, 4% higher than in 2003. The benefits of higher oil and gas prices were partly offset by lower hydrocarbon production, higher costs and depreciation, and an increase in the overall effective tax rate.

Earnings included divestment gains of $740 million, of which $330 million relates to divestment gains from discontinued operations and relates to divestments of operations in Angola, Bangladesh, Egypt and Thailand. The balance of the $740 million relates to divestment gains in countries where there is continued investment in operations and which do not qualify as discontinued operations under US GAAP.

Compared with 2003, costs and depreciation were higher, mainly as a result of exchange rate movements and higher activity in our growth areas. The increase in the effective tax rate was mainly driven by the impact of higher hydrocarbon prices, an increase in the tax burden in Denmark and lower tax credits than in 2003.

Write-offs of exploration properties, rights and concessions in 2004 of some $300 million due to unsuccessful drilling were in line with similar write-offs in 2003. Earnings in 2003 included a credit of $255 million resulting from a change in accounting for asset retirement obligations.

Prices

Oil prices increased significantly in 2004 with Brent crude prices averaging $38.30 a barrel

Operational and Financial Review17

in 2004 compared with $28.85 in 2003, while West Texas Intermediate averaged $41.50 a barrel compared with $31.05 in 2003. These increases reflected strong US and Chinese demand; geopolitical uncertainty in a number of producer countries; falling spare OPEC crude production capacity and the effect on oil stocks of the hurricanes in the Gulf of Mexico.

The Group’s overall realised oil prices were $35.61 a barrel up from $27.50 in 2003. In the USA realised oil prices averaged $36.15 a barrel compared with $27.24 a year earlier, and outside the USA realised prices averaged $35.53 compared with $27.54 in 2003. Realised oil prices differ from published crude oil prices because the quality, and therefore price, of actual crude oil produced differs from the quoted blends. In general, the Group produces crude oil of a lower quality than the quoted blends. The Group’s overall realised gas prices averaged $3.59 per thousand standard cubic feet compared with $3.30 in 2003.

Production

Total underlying hydrocarbon production (including oil sands) was 3% lower in 2004 than in 2003, at 3,772 thousand boe per day.1Production was affected by divestments of 76,000 boe per day, the impact of higher prices on our entitlements from production sharing contracts (PSCs) and hurricanes in the Gulf of Mexico. Excluding these effects, production was unchanged from 2003.

Oil production was 5% lower in 2004 than in 2003, mainly due to field declines in the USA, Norway and Oman, as well as lower production from fields in the UK. Production was also affected by lower entitlements from PSC operations as a result of higher oil prices.

Natural gas production was approximately the same as in 2003. Additional production from new fields, as well as high demand towards the end of the year, were offset by field declines in the USA and the UK, the effect of divestments, Gulf of Mexico hurricanes and lower entitlements from PSCs.

Various new fields started production during the year, including Jintan and Serai in Sarawak, Malaysia and Goldeneye, Scoter and Howe in the UK. In the Gulf of Mexico, production began at the Holstein, Llano and Glider fields. Oil production from the West Salym field in Russia also began, a year earlier than planned.

Building a long history:

A new discovery in Brunei

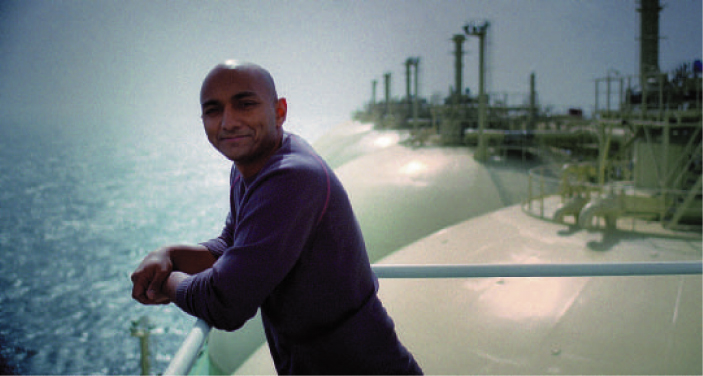

Sally Kapal, a production operator on Ampa 6.

Ampa 6 is one of Shell’s offshore production platforms in Brunei. Over 80% of the employees of Brunei Shell are Bruneian.

In 2004 Shell celebrated 75 years of production in Brunei. In a joint venture with the Brunei government, we operate 15 oil and natural gas fields, which makes Brunei the Group’s largest source of oil in the Asia Pacific region.

The mature fields in Brunei have been complemented by a potentially significant new discovery in what is known as the Seria North flank. The Seria field was first discovered in 1929 in a coastal area onshore and has been a significant producer of oil and natural gas for many years. The latest find is in an area three kilometres offshore that had not previously been drilled and, while more appraisal work needs to be done, current indications suggest that there could be up to 100 million barrels of oil in the whole of the Seria North flank.

The exploration of the area is making use of the most advanced technology including the use of what is known as a fish hook well. This type of well follows a U shape and means that the Seria North flank can be developed from a drilling rig onshore. This use of existing infrastructure and facilities is a very efficient way of extending and developing the life of the field.

Find out more

www.shell.com/ep

A number of fields increased production over the year. These included the Bijupirá-Salema field in Brazil, the Na Kika and Habanero fields in the USA, the EA field in Nigeria and the Athabasca Oil Sands Project in Canada. These increases, along with production from new fields, added 221,000 boe per day of production.

Capital investment and portfolio actions

Capital investment in 2004 of $8.8 billion (excluding the contribution of our minority partners in Sakhalin) was similar to 2003 and included exploration expense of $1.1 billion.

The final investment decision was taken for the Kashagan project in Kazakhstan (Group interest 16.7%) which is expected to start production in 2008. The development of the Pohokura gas field

| 1 | Natural gas has been converted to crude oil equivalent using a factor of 5,800 standard cubic feet per barrel. |

18Royal Dutch/Shell Group of Companies

18Royal Dutch/Shell Group of Companies

Upstream: Exploration & Production

continued

in New Zealand (Group interest 48%) was agreed and the field is expected to produce its first gas in 2006. Planning permission was granted for the terminal that will receive gas from the offshore Corrib development in Ireland (Group interest 45%).

In Oman agreements were signed with the government to extend the terms of Petroleum Development Oman’s (PDO) concession until 2044. PDO (Group interest 34%) produces from 100 fields in the concession area. A Heads of Agreement was signed with the Libyan National Oil Company to establish a long-term strategic partnership that could open up opportunities to develop Libya’s gas and LNG business.

Plans were announced to increase bitumen production at the Athabasca Oil Sands Project (Group interest 47%) from 155,000 barrels a day capacity now to between 270,000 and 290,000 barrels a day by 2010. This will involve work to expand the Muskeg River mine and to add a third hydro-conversion unit to the Scotford Upgrader.

In 2004, important progress was made on the Sakhalin project in eastern Russia. The main concrete construction work of the base substructure for the Lunskoye offshore gas production platform was completed. In March 2005, plans were announced to re-route the offshore pipelines to help protect the endangered western grey whale. This massive project still targets start-up by the end of 2007 but there are significant cost pressures in what is one of the largest single foreign investment projects in Russia.

Divestments included the sale of upstream assets in Angola, Thailand, Bangladesh, Egypt and the UK. In addition, an agreement was reached to sell the Schooner and Ketch fields in the UK.

Operational and Financial Review19

Aif K. Lillebo, Head of External Affairs, A/S Norske Shell, Ormen Lange construction, Norway

The giant Ormen Lange gas field in the Norwegian Sea could cover 20% of the UK’s gas requirements for up to 40 years.

Exploration

During 2004, we participated in 31 successful exploration wells. These included discoveries in Nigeria, Malaysia, Oman, the USA, the UK, the Netherlands, Brunei, Gabon, Egypt, Russia and Canada. All discoveries will now be appraised in order to establish the precise extent of the reserves they contain. Overall volumes found were less than in recent years, although the success rate continued to be good.

We made significant additions to our overall acreage positions with new exploration licences in the UK, Brazil, the Gulf of Mexico and Norway and additional oil sands acreage was acquired in Canada.

Reserves

As described under Note 2 to the Group Financial Statements on pages 52 to 55, this report, including the discussion below, gives effect to a restatement of proved oil and gas reserves. See “Supplementary information – Oil and Gas (unaudited)” on pages 92 to 103.

During 2004, a total of 212 million boe was added to proved developed and undeveloped reserves by Group companies (a reduction of 151 million barrels of oil and natural gas liquids and an increase of 2,108 thousand million standard cubic feet of natural gas), including 417 million boe from organic activities (which includes all activities other than purchases and sales of minerals in place). The net addition to proved developed and undeveloped reserves (calculated before production) consisted of reductions of 218 million boe from revisions and 205 million boe net from divestments and acquisitions, and additions of 15 million boe from improved recovery, and 620 million boe from extensions and discoveries. There was a net addition of 774 million boe to proved developed reserves and a net reduction of 562 million boe to proved undeveloped reserves.

During the same period, the Group share of proved developed and undeveloped reserve additions by associated companies was 39 million boe (20 million barrels of oil and natural gas liquids and 108 thousand million standard cubic feet of natural gas). The Group’s share of net additions to proved developed and undeveloped reserves by associated companies consisted of a reduction of 10 million boe from acquisitions and divestments, and additions of 2 million boe from revisions, 46 million boe from improved recovery and 1 million boe from extensions and discoveries. There was a net addition of 33 million boe to proved developed reserves and a net addition of 6 million boe to proved undeveloped reserves.

The most significant 2004 additions arose from new sales agreements covering gas volumes to

20Royal Dutch/Shell Group of Companies

20Royal Dutch/Shell Group of Companies

Upstream: Exploration & Production

continued

be produced from the Sakhalin development in Russia, a concession extension in Oman and taking the final investment decision for the Kashagan field in Kazakhstan.

The high level of year-end prices adversely affected proved reserve entitlements that are determined on the basis of production sharing arrangements, and the ability to book proved reserves associated with a heavy oil project in Canada (Peace River).

The gas volumes booked for the Sakhalin project following new sales agreements will be produced after the start of gas production from the Lunskoye field in Sakhalin, currently expected by the end of 2007. The oil volumes booked in the Kashagan field will be produced following field start-up in 2008. The volumes booked following the concession extension are expected to be produced after 2012. The rest of the reserves additions during 2004 are expected to be produced over time as development activities continue and/or production facilities are expanded or upgraded. The most significant movement from proved undeveloped to proved developed reserves is the result of installing compression facilities in the Groningen field, the Netherlands.

At December 31, 2004, after taking account of Group companies’ 2004 net additions to proved developed and undeveloped reserves of 212 million boe and production of 1,222 million boe, total proved reserves for Group companies of 10,231 million boe was 12% lower than at December 31, 2003. At the same date, after taking into account the Group’s share of associated companies’ net additions of 39 million boe and production of 126 million boe, the Group’s share of total proved developed and undeveloped reserves of associated companies of 1,652 million boe was 22% higher than December 31, 2003.

For the three years ended December 31, 2004, Group companies had net additions to proved reserves of 1,838 million boe and total production of 3,812 million boe, which resulted in a 19% decline in total proved reserves from December 31, 2001 to December 31, 2004. For the same period, the Group’s share of net additions to proved reserves by associated companies was 475 million boe and the Group’s share of production by these companies was 390 million boe, which resulted in a 40% increase in the Group’s share of proved reserves of associated companies. These changes in proved reserves include the effect of transferring a company in the Middle East from Group to associated company status as at December 31, 2004.

As at December 31, 2004, the Group’s proved developed and undeveloped reserves (excluding proved reserves of associated companies) were equivalent to 8.4 years of production (based on 2004 production).

The rate at which the Group (and associated companies) are developing proved reserves over a particular period may not necessarily be indicative of the rate at which hydrocarbon resources are being discovered for a number of reasons, including the technical nature of the definition of proved reserves and the differing time periods needed to develop proved reserves in different regions and under differing geologic, economic and regulatory conditions. However, the current level of reserves replacement by the Group and associated companies is clearly a concern and reflects the exploration strategy in the late 1990s and our relatively low investment in the post 1998 period. Exploration and appraisal has since been refocused and investment levels have increased. We consider it vital to improve reserves replacement in the coming years.

Outlook and strategy

Oil prices averaged about $10 a barrel higher in 2004 than in 2003. The high prices reflected high growth in global oil demand, most significantly from China and the USA. Upward pressure on prices also came from geopolitical tensions in the world, and the disruption to production caused by hurricanes in the Gulf of Mexico during the autumn and subsequent decline in the level of oil stocks in the USA.

We believe that crude prices in 2005 will be influenced by the pace of Iraqi oil export recovery, OPEC supply policy, the rate of global economic expansion, particularly in the USA and China, and the severity of the northern hemisphere winter. Natural gas prices in the USA will be affected by weather conditions and the rate of economic

Operational and Financial Review21

growth. Prices in other markets are expected to remain linked to oil prices (see page 37 for more on prices).

We believe that growing global energy demand and the increased upstream investment required to meet that demand means that oil prices have shifted to a higher level for the medium term.

Our strategy is focused on improving our basic underlying strengths in operational performance and project delivery, and replenishing our portfolio. The Group will work towards this by adding new acreage, pursuing an aggressive exploration programme, investing in organic growth, opening up new positions and making selective focused acquisitions.

The strategy seeks to position the Group in four strategic areas: existing oil; new material oil; integrated gas and unconventional oil. To deliver this strategy, capital investment in Exploration & Production will be increased to some $10 billion a year (excluding investment by our minority partners in Sakhalin).

The Group will seek to sustain long-term production from existing assets where we have significant positions and can benefit from higher prices (such as in the USA and the UK). Investments in new material oil projects such as Kashagan in Kazakhstan and offshore Nigeria also form a key part of our strategy.

We believe that natural gas demand will continue to grow at a faster rate than oil demand, therefore we will look for more integrated gas positions to take advantage of this growth, extending our leadership position in LNG, and securing emerging opportunities in Gas to Liquids production. Our major presence across the value chain from exploration to the production and supply of natural gas enables us to maximise the value from projects such as Sakhalin. We intend to build on our existing strength in unconventional oil technology and the success of the Athabasca Oil Sands Project, and look for more of these opportunities.

We will continue to focus on reducing costs through improving management of the supply chain, and standardising processes globally. Ensuring improved and consistent project delivery is a key priority. We will be providing additional resources in Exploration & Production through redeployment and external recruitment.

Our production forecast for 2005 to 2006 remains in the range of 3.5 to 3.8 million boe a day. After that we expect production to grow and reach between 3.8 and 4.0 million boe a day by 2009. Our longer term production aspiration is some 4.5 to 5.0 million boe a day by 2014.

Divestments will be made in areas where we see little growth potential or strategic fit. We expect to deliver around $5 billion of upstream divestments and swaps between 2004 and 2006. Following the successful divestments of 2004, more emphasis will be given to swaps. Focused acquisitions will be considered, especially those which provide price and exploration upside, which fit the strategic themes we target and where we can see clear scope for long-term value growth.

Unlocking new resources in Russia:

Salym starts production

Construction of essential field infrastructure facilities, Salym, Russia

The Salym project is an important step forward in the development of Shell’s presence in Russia, a country of high strategic importance for the Group.

The Salym project in western Siberia is a $1 billion joint venture between Shell and the Russian oil company, OAO NK Evikohn and is Shell’s second largest investment in Russia (after Sakhalin). The rapid pace of the development of these complex fields shows the value that can be gained from combining Shell’s international experience with the long established expertise of the Siberian oil industry.

The Salym group of fields is estimated to have more than 800 million barrels of producible oil and natural gas resources and to have a life of over 30 years. They cover three areas, Upper Salym, West Salym and Vadelyp. Production started from the Upper Salym field in 2003, from West Salym, the biggest field, at the end of 2004, and will be followed by Vadelyp in 2006. The development will have 213 production wells across the three fields, from which production is expected to reach 120,000 barrels of oil a day and 20 million cubic feet of natural gas. All this work is being carried out to high environmental standards and in a way that seeks to make a positive contribution to the local community.

Exploration is continuing in the area and a new prospect has been found in the Upper Salym field. While testing is continuing to establish the extent and nature of this discovery, it is an encouraging find. This underlines that the area has major potential for further development and reinforces Shell’s role in the massive and still growing Russian upstream industry.

Find out more

www.shell.com/ep

22Royal Dutch/Shell Group of Companies

22Royal Dutch/Shell Group of Companies

Upstream: Gas & Power

The drivers behind the strong performance for 2004 are LNG volume growth, record realised prices and higher dividends from joint ventures.

Our Gas & Power business liquefies and transports natural gas, and develops natural gas markets and infrastructure including gas-fired power plants. It also markets and trades natural gas and electricity and converts natural gas to liquids to provide clean fuels. The majority of activities, in particular liquefied natural gas (LNG), are carried out by associated companies.