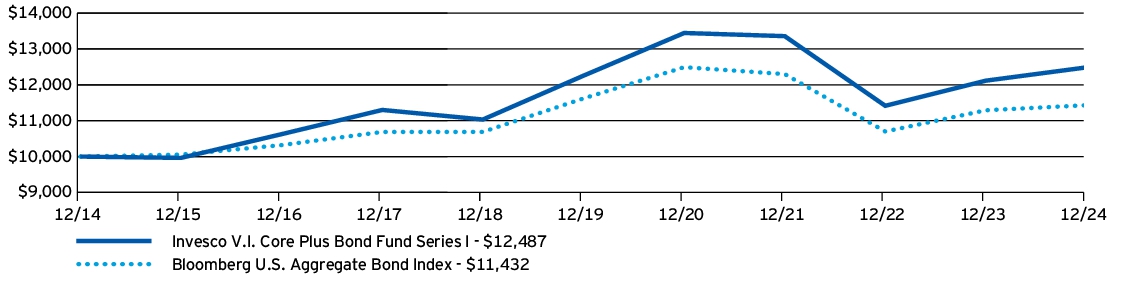

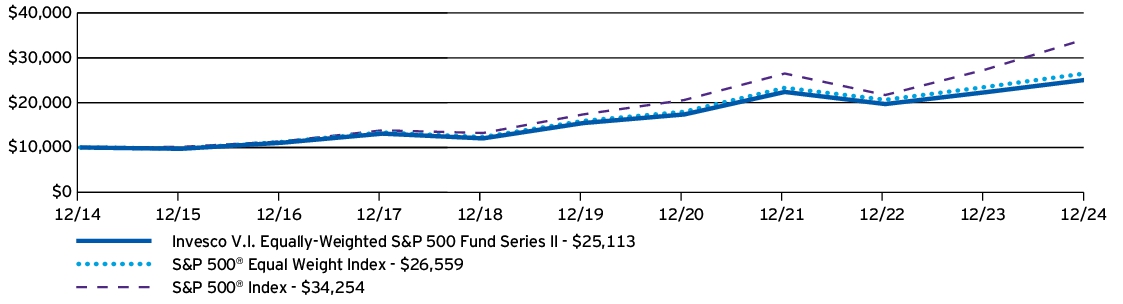

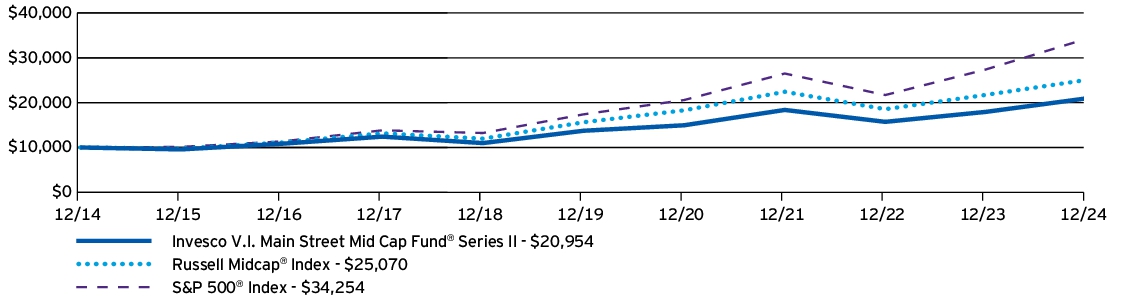

0000896435 cik0000896435:C000000457Member cik0000896435:USTreasuryNotesFourPointTwoFivePercentNovemberFifteenTwoThousandThirtyFourMember 2024-12-31 0000896435 cik0000896435:C000084644Member 2014-12-31

SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

AIM Variable Insurance Funds (Invesco Variable Insurance Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000

Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Glenn Brightman, Principal Executive Officer

11 Greenway Plaza, Suite 1000

Houston, Texas 77046

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Reports to Stockholders.

(a) The Registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Act") is as follows:

Invesco Oppenheimer V.I. International Growth Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Oppenheimer V.I. International Growth Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Oppenheimer V.I. International Growth Fund

(Series I) | $ 99 | 1.00 % † |

| Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

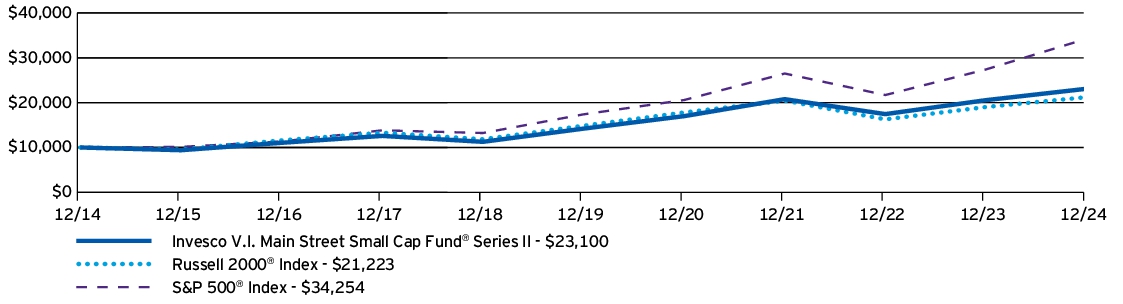

How Did The Fund Perform During The Period?

•

Global equity markets rose during the fiscal year ended December 31, 2024. In the US,

enthusiasm

around the artificial intelligence investment wave led to concentrated market leadership in the megacap technology space and to outperformance relative to non-US equities. The turn in the interest rate cycle towards the end of the period also caused high quality segments to underperform the wider market. Outside of the US, emerging markets outperformed developed markets as news of fiscal stimulus by the Chinese government drove better sentiment towards the emerging market asset class.

•

For the fiscal year ended December 31, 2024, Series I shares of the Fund returned -1.67%. For the same time period, the MSCI ACWI ex USA

®

Index returned 5.53%.

What contributed to performance?

Flutter Entertainment PLC |

The UK company that owns FanDuel, a sports betting service in the US. Legal and regulatory changes in a growing number of states increased the size and value of the addressable market, which positively impacted the company. FanDuel and its top US competitor shared roughly 80% of the US market at period end.

Dollarama, Inc. |

A Canadian discount retailer that is much like Dollar Tree and Dollar General in the US. However, unlike the US, this retail market segment in Canada is not saturated. We have owned Dollarama for several years. The company performed well during the period, which we believe was in part due to the continuing shift to online buying that benefits retailers at the very high and the very low end of pricing.

Hitachi Ltd. |

A Japanese company with a widely diversified portfolio of businesses that it has been working to streamline. Hitachi restructured itself to provide a higher return on capital invested within it over the last serveral years.

What detracted from performance?

JD Sports Fashion PLC

|

A UK company which exclusively retails certain models of several key athletic footwear brands, such as Nike and Adidas, in the US and Western Europe. The company’s share price fell on disappointing earnings results during the period.

AIXTRON SE |

A German company which makes the “metal organic chemical vapor deposition equipment” -“MOCVD equipment” – used in the manufacture of layered semiconductors made of compounds other than just silicon. During the reporting period, the company announced earnings and future guidance below expectations. We exited our position during the fiscal year.

Edenred SE |

Based in France, this company manages employee benefit programs and expenses through prepaid vouchers. It has grown steadily through geographic and service expansion, while digitization has reduced operating costs. French political uncertainty and the lack of a clear catalyst to boost earnings weighed negatively on the share price during portions of the fiscal period.

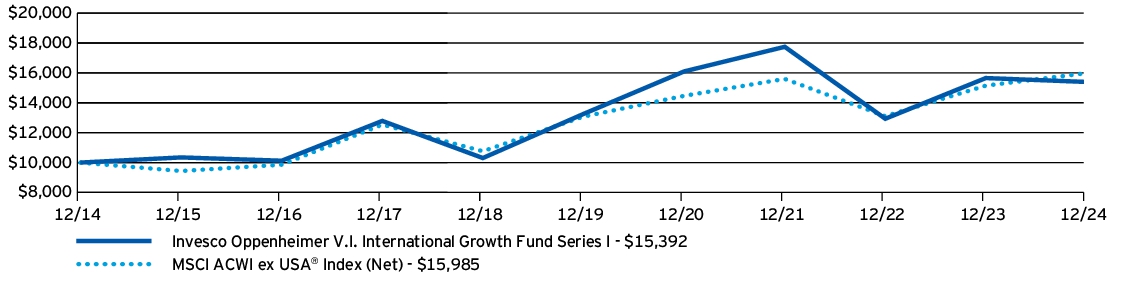

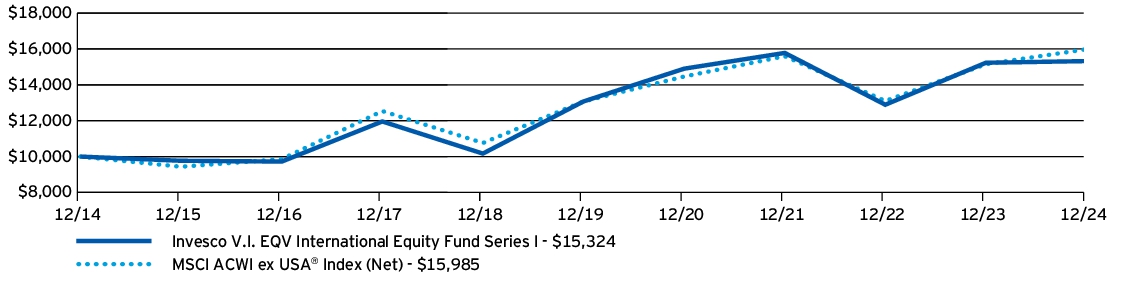

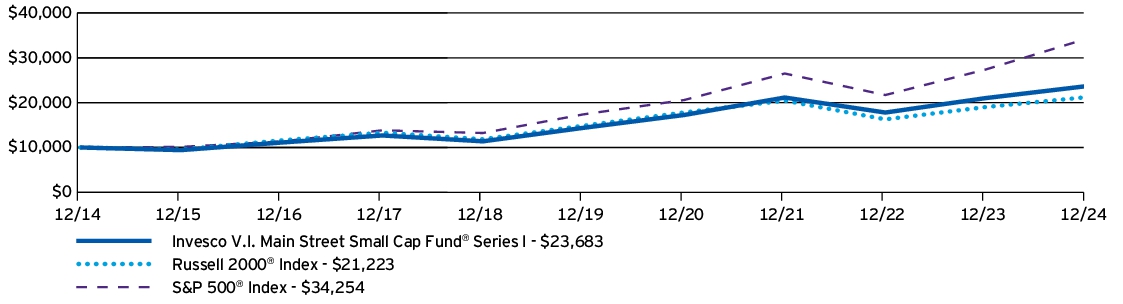

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Oppenheimer V.I. International Growth Fund (Series I) | (1.67 ) % | 3.04 % | 4.41 % |

MSCI ACWI ex USA ® Index (Net) | 5.53 % | 4.10 % | 4.80 % |

Effective after the close of business on May 24, 2019, Non-Service shares of Oppenheimer International Growth Fund/VA (the predecessor fund), were reorganized into Series I shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Non-Service shares of the predecessor fund. Share class returns will differ from those of the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 306,743,600 |

| Total number of portfolio holdings | 66 |

| Total advisory fees paid | $ 2,607,463 |

| Portfolio turnover rate | 18 % |

What Comprised The Fund's

Holdings

?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| London Stock Exchange Group PLC | 2.93 % |

| Flutter Entertainment PLC | 2.90 % |

| ResMed, Inc. | 2.87 % |

| Dollarama, Inc. | 2.63 % |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 2.63 % |

| Hermes International S.C.A. | 2.61 % |

| Reliance Industries Ltd. | 2.59 % |

| Novo Nordisk A/S, Class B | 2.48 % |

| Compass Group PLC | 2.43 % |

| ASML Holding N.V. | 2.34 % |

| * Excluding money market fund holdings, if any. | |

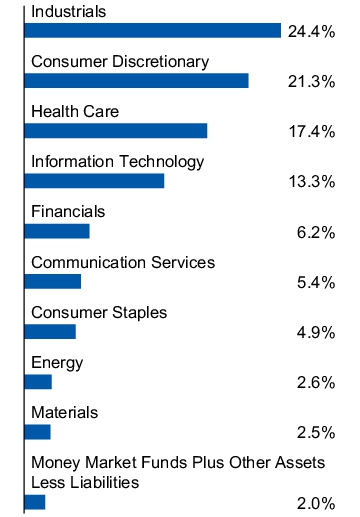

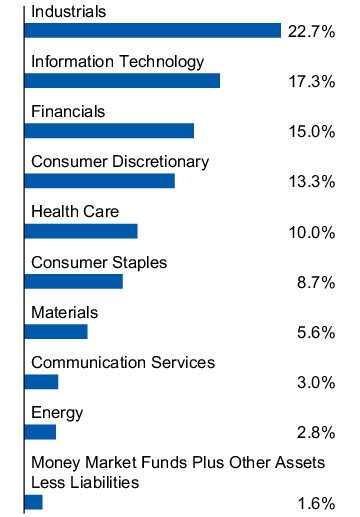

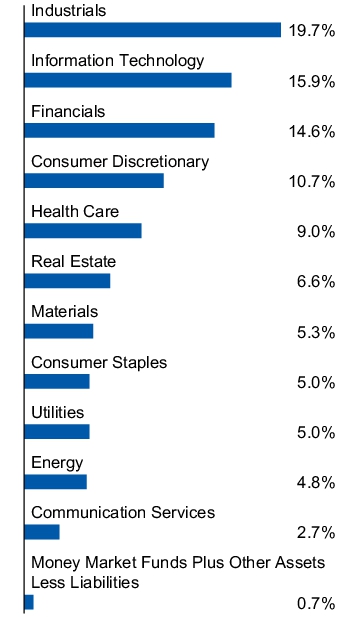

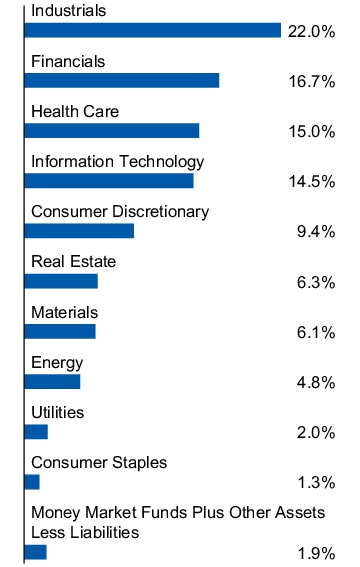

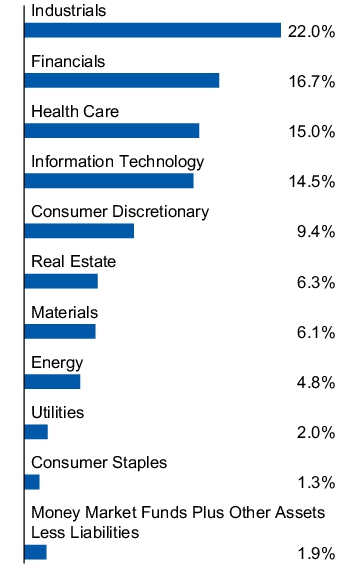

Sector allocation

(% of net assets)

Where Can I Find More Information?

You

can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco Oppenheimer V.I. International Growth Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Oppenheimer V.I. International Growth Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Oppenheimer V.I. International Growth Fund

(Series II) | $ 124 | 1.25 % † |

| Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

•

Global equity markets rose during the fiscal year ended December 31, 2024. In the US, enthusiasm around the artificial intelligence investment wave led to concentrated market leadership in the megacap technology space and to outperformance relative to non-US equities. The turn in the interest rate cycle towards the end of the period also caused high quality segments to underperform the wider market. Outside of the US, emerging markets outperformed developed markets as news of fiscal stimulus by the Chinese government drove better sentiment towards the emerging market asset class.

•

For the fiscal year ended December 31, 2024, Series II shares of the Fund returned -1.81%. For the same time period, the MSCI ACWI ex USA

®

Index returned 5.53%.

What contributed to performance?

Flutter Entertainment PLC |

The UK company that owns FanDuel, a sports betting service in the US. Legal and regulatory changes in a growing number of states increased the size and value of the addressable market, which positively impacted the company. FanDuel and its top US competitor shared roughly 80% of the US market at period end.

Dollarama, Inc. |

A Canadian discount retailer that is much like Dollar Tree and Dollar General in the US. However, unlike the US, this retail market segment in Canada is not saturated. We have owned Dollarama for several years. The company performed well during the period, which we believe was in part due to the continuing shift to online buying that benefits retailers at the very high and the very low end of pricing.

Hitachi Ltd. |

A Japanese company with a widely diversified portfolio of businesses that it has been working to streamline. Hitachi restructured itself to provide a higher return on capital invested within it over the last serveral years.

What detracted from performance?

JD Sports Fashion PLC

|

A UK company which exclusively retails certain models of several key athletic footwear brands, such as Nike and Adidas, in the US and Western Europe. The company’s share price fell on disappointing earnings results during the period.

AIXTRON SE |

A German company which makes the “metal organic chemical vapor deposition equipment” -“MOCVD equipment” – used in the manufacture of layered semiconductors made of compounds other than just silicon. During the reporting period, the company announced earnings and future guidance below expectations. We exited our position during the fiscal year.

Edenred SE |

Based in France, this company manages employee benefit programs and expenses through prepaid vouchers. It has grown steadily through geographic and service expansion, while digitization has reduced operating costs. French political uncertainty and the lack of a clear catalyst to boost earnings weighed negatively on the share price during portions of the fiscal period.

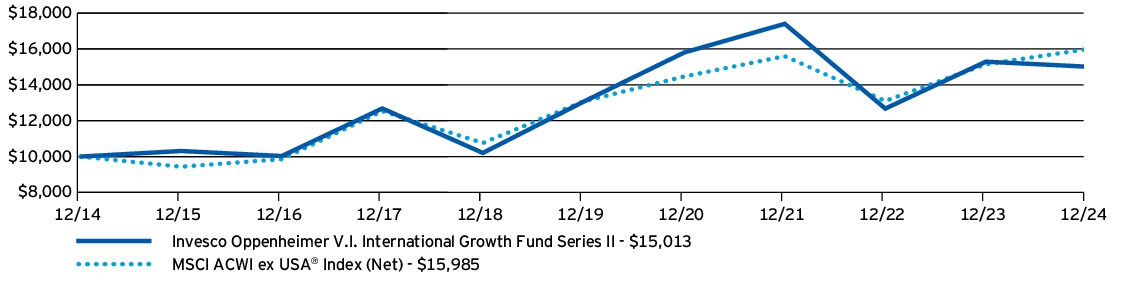

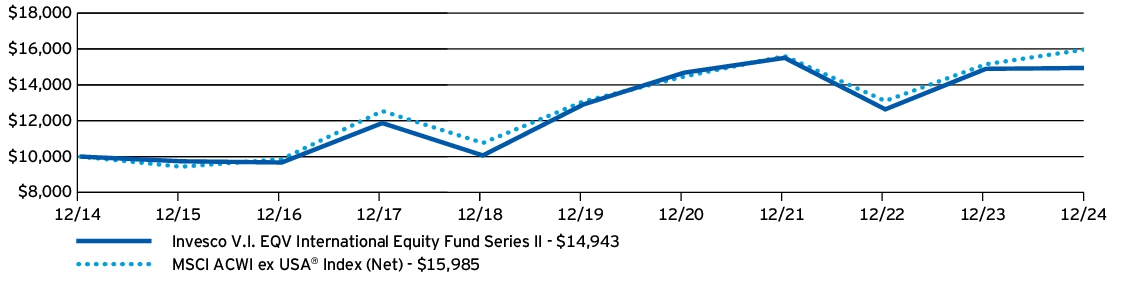

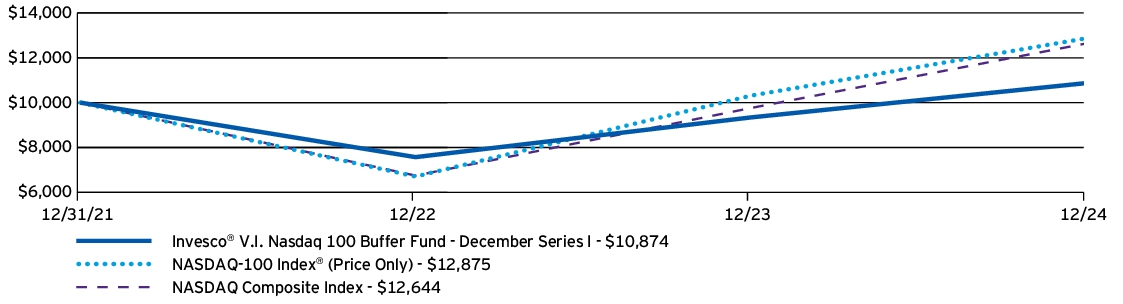

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Oppenheimer V.I. International Growth Fund (Series II) | (1.81 ) % | 2.83 % | 4.15 % |

MSCI ACWI ex USA ® Index (Net) | 5.53 % | 4.10 % | 4.80 % |

Effective after the close of business on May 24, 2019, Service shares of Oppenheimer International Growth Fund/VA (the predecessor fund), were reorganized into Series II shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Service shares of the predecessor fund. Share class returns will differ from those of the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 306,743,600 |

| Total number of portfolio holdings | 66 |

| Total advisory fees paid | $ 2,607,463 |

| Portfolio turnover rate | 18 % |

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| London Stock Exchange Group PLC | 2.93 % |

| Flutter Entertainment PLC | 2.90 % |

| ResMed, Inc. | 2.87 % |

| Dollarama, Inc. | 2.63 % |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 2.63 % |

| Hermes International S.C.A. | 2.61 % |

| Reliance Industries Ltd. | 2.59 % |

| Novo Nordisk A/S, Class B | 2.48 % |

| Compass Group PLC | 2.43 % |

| ASML Holding N.V. | 2.34 % |

| * Excluding money market fund holdings, if any. | |

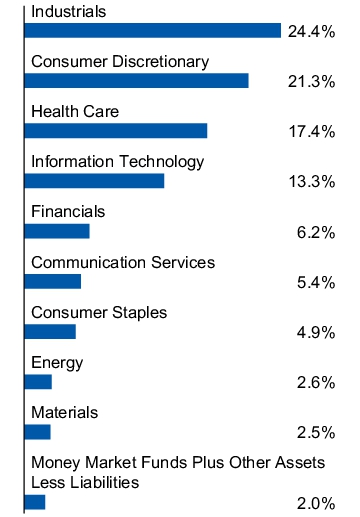

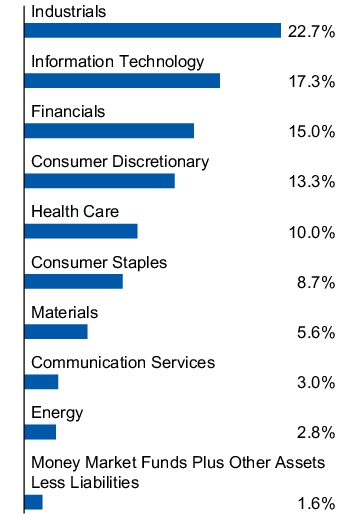

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. American Franchise Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. American Franchise Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. American Franchise Fund

(Series I) | $ 101 | 0.86 % |

How Did The Fund Perform During The Period?

•

During the fiscal year ended December 31, 2024, U.S. large-cap equities benefited from investment themes levered to artificial intelligence (AI) technology and investor anticipation that slowing inflation would cause the Federal Reserve to ease monetary policy.

•

For the fiscal year ended December 31, 2024, Series I shares of the Fund returned 34.89%. For the same time period, the Russell 1000

®

Growth Index returned 33.36%. The Fund outperformed the Russell 1000

®

Growth Index primarily due to strong stock selection in the industrials and financials sectors, though results were partially offset by a relative overweight in these sectors. An underweight exposure in the consumer staples and consumer discretionary sectors, and an overweight in the communication services sector, were also beneficial. An underweight exposure and stock selection in the information technology (IT) sector detracted from relative results.

What contributed to performance?

NVIDIA Corp. |

NVIDIA is a company at the heart of digital transformation as it produces graphics processing units (GPUs). The company completed a 10-for-1 stock split and surpassed $3 trillion in market cap over the period. There is significant excitement for the launch of its new Blackwell platform, which is marketed as being able to power generative AI faster with less cost and energy consumption. The GPUs are already sold out until the end of 2025.

Amazon.com, Inc. |

The company's strong growth in its cloud computing division, Amazon Web Services, has been a significant contributor, benefiting from increased demand for cloud solutions across various industries. Additionally, Amazon's focus on expanding its advertising business yielded positive results, with higher ad revenues boosting overall profitability. The company's strategic investments in AI and automation have also enhanced operational efficiency, further supporting its stock performance.

Meta Platforms, Inc. |

Social technology company Meta Platforms realized positive results from its AI investments through better recommendations, higher engagement, improved ad tools and more efficient ad targeting. We believe Meta is uniquely positioned to gain momentum as AI assistants become a larger part of consumer interactions and products.

What detracted from performance?

DexCom, Inc.

|

DexCom is a medical device company that specializes in continuous glucose monitors (CGM). Stocks with exposure to diabetes-related sales have experienced weakness in general following the successful launch of GLP-1 drugs. Recent US Food and Drug Administration clearance of CGMs for non-prescription sales meaningfully expands DexCom’s market to non-diabetics, as a tool that can help users maintain a healthy lifestyle. However, a sales force reorganization significantly slowed their sales forecasts.

MongoDB, Inc. |

MongoDB is a document database that stores and manages data for a variety of applications such as customer relationship management and health care systems. The company struggled with a decline in growth during 2024. Additionally, its Chief Financial Officer/Chief Operating Officer since 2015 announced he was leaving. The team sold the stock during the period.

Snowflake, Inc. |

Snowflake, a cloud-based data storage and analytics service, surprised investors with the announcement that CEO Frank Slootman retired at the end of February 2024. However, the investment team had positive views on the AI-related vision and capabilities of the new CEO, Sridhar Ramaswamy. The company also reduced revenue guidance for 2024 as software sales have generally been under pressure as corporate IT departments, and IT budgets, digest AI implications. The team sold the stock during the period.

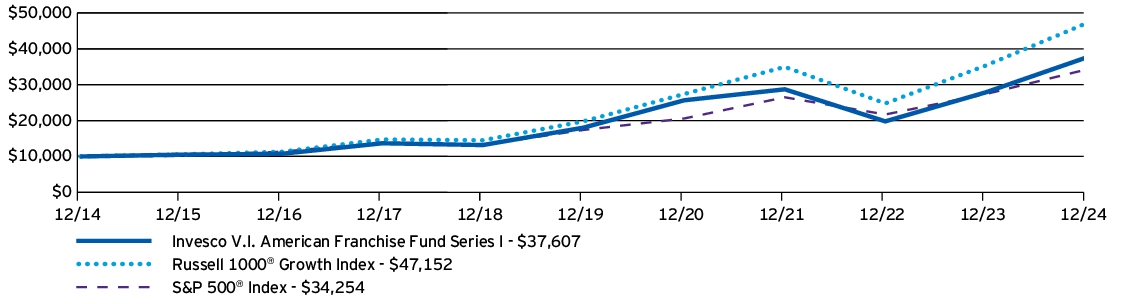

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. American Franchise Fund (Series I) | 34.89 % | 15.84 % | 14.16 % |

| Russell 1000® Growth Index | 33.36 % | 18.96 % | 16.78 % |

| S&P 500® Index | 25.02 % | 14.53 % | 13.10 % |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 889,266,825 |

| Total number of portfolio holdings | 58 |

| Total advisory fees paid | $ 5,540,046 |

| Portfolio turnover rate | 52 % |

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| NVIDIA Corp. | 10.81 % |

| Amazon.com, Inc. | 7.98 % |

| Microsoft Corp. | 7.25 % |

| Apple, Inc. | 6.47 % |

| Meta Platforms, Inc., Class A | 5.11 % |

| Broadcom, Inc. | 4.33 % |

| Alphabet, Inc., Class A | 3.58 % |

| KKR & Co., Inc., Class A | 3.20 % |

| Blackstone, Inc., Class A | 2.88 % |

| ServiceNow, Inc. | 2.81 % |

| * Excluding money market fund holdings, if any. | |

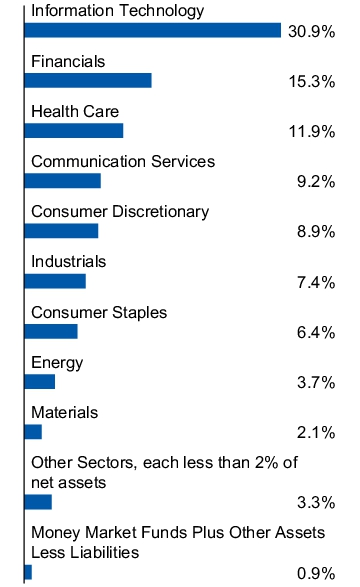

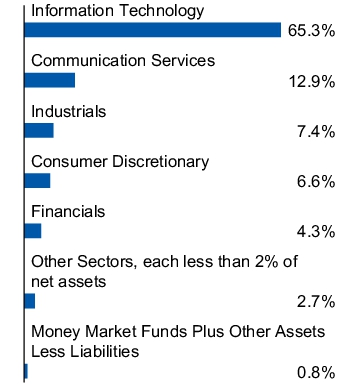

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. American Franchise Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. American Franchise Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. American Franchise Fund

(Series II) | $ 130 | 1.11 % |

How Did The Fund Perform During The Period?

•

During the fiscal year ended December 31, 2024, U.S. large-cap equities benefited from investment themes levered to artificial intelligence (AI) technology and investor anticipation that slowing inflation would cause the Federal Reserve to ease monetary policy.

•

For the fiscal year ended December 31, 2024, Series II shares of the Fund returned 34.56%. For the same time period, the Russell 1000

®

Growth Index returned 33.36%. The Fund outperformed the Russell 1000

®

Growth Index primarily due to strong stock selection in the industrials and financials sectors, though results were partially offset by a relative overweight in these sectors. An underweight exposure in the consumer staples and consumer discretionary sectors, and an overweight in the communication services sector,

were

also beneficial. An underweight exposure and stock selection in the information technology

(IT)

sector detracted from relative results.

What contributed to performance?

NVIDIA Corp. |

NVIDIA is a company at the heart of digital transformation as it produces graphics processing units (GPUs). The company completed a 10-for-1 stock split and surpassed $3 trillion in market cap over the period. There is significant excitement for the launch of its new Blackwell platform, which is marketed as being able to power generative AI faster with less cost and energy consumption. The GPUs are already sold out until the end of 2025.

Amazon.com, Inc. |

The company's strong growth in its cloud computing division, Amazon Web Services, has been a significant contributor, benefiting from increased demand for cloud solutions across various industries. Additionally, Amazon's focus on expanding its advertising business yielded positive results, with higher ad revenues boosting overall profitability. The company's strategic investments in AI and automation have also enhanced operational efficiency, further supporting its stock performance.

Meta Platforms, Inc. |

Social technology company Meta Platforms realized positive results from its AI investments through better recommendations, higher engagement, improved ad tools and more efficient ad targeting. We believe Meta is uniquely positioned to gain momentum as AI assistants become a larger part of consumer interactions and products.

What detracted from performance?

DexCom, Inc.

|

DexCom is a medical device company that specializes in continuous glucose monitors (CGM). Stocks with exposure to diabetes-related sales have experienced weakness in general following the successful launch of GLP-1 drugs. Recent US Food and Drug Administration clearance of CGMs for non-prescription sales meaningfully expands DexCom’s market to non-diabetics, as a tool that can help users maintain a healthy lifestyle. However, a sales force reorganization significantly slowed their sales forecasts.

MongoDB, Inc. |

MongoDB is a document database that stores and manages data for a variety of applications such as customer relationship management and health care systems. The company struggled with a decline in growth during 2024. Additionally, its Chief Financial Officer/Chief Operating Officer since 2015 announced he was leaving. The team sold the stock during the period.

Snowflake, Inc. |

Snowflake, a cloud-based data storage and analytics service, surprised investors with the announcement that CEO Frank Slootman retired at the end of February 2024. However, the investment team had positive views on the AI-related vision and capabilities of the new CEO, Sridhar Ramaswamy. The company also reduced revenue guidance for 2024 as software sales have generally been under pressure as corporate IT departments, and IT budgets, digest AI implications. The team sold the stock during the period.

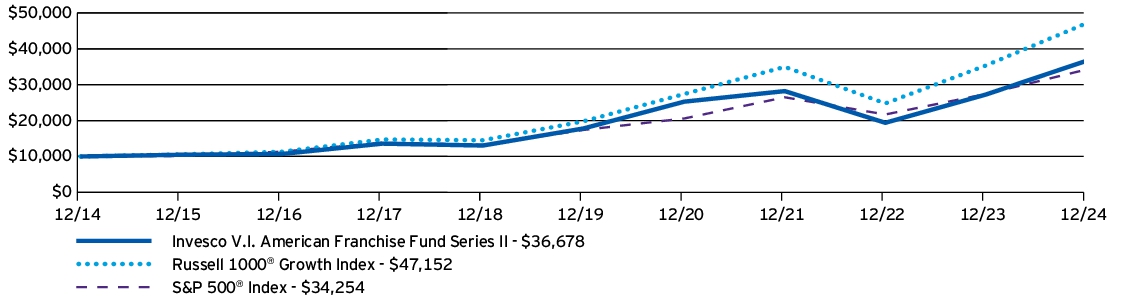

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. American Franchise Fund (Series II) | 34.56 % | 15.56 % | 13.88 % |

| Russell 1000® Growth Index | 33.36 % | 18.96 % | 16.78 % |

| S&P 500® Index | 25.02 % | 14.53 % | 13.10 % |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 889,266,825 |

| Total number of portfolio holdings | 58 |

| Total advisory fees paid | $ 5,540,046 |

| Portfolio turnover rate | 52 % |

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| NVIDIA Corp. | 10.81 % |

| Amazon.com, Inc. | 7.98 % |

| Microsoft Corp. | 7.25 % |

| Apple, Inc. | 6.47 % |

| Meta Platforms, Inc., Class A | 5.11 % |

| Broadcom, Inc. | 4.33 % |

| Alphabet, Inc., Class A | 3.58 % |

| KKR & Co., Inc., Class A | 3.20 % |

| Blackstone, Inc., Class A | 2.88 % |

| ServiceNow, Inc. | 2.81 % |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. American Value Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. American Value Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. American Value Fund

(Series I) | $ 104 | 0.90 % |

How Did The Fund Perform During The Period?

•

During the fiscal year ended December 31, 2024, US equity indices experienced strong returns. The US economy was resilient as data suggested the Federal Reserve (Fed) may have achieved its fabled soft landing, with strong consumer spending and low unemployment providing support. Enthusiasm around the artificial intelligence (AI) investment theme led to concentrated market leadership in the large cap technology space during the period.

•

For the fiscal year ended December 31, 2024, Series I shares of the Fund returned 30.41%. For the same time period, the Russell Midcap

®

Value Index returned 13.07%. The Fund outperformed the Russell Midcap

®

Value Index primarily due to strong stock selection in the information technology (IT), utilities and industrials sectors. These sectors were also the largest contributors to absolute performance. Conversely, stock selection and an overweight in energy was the largest detractor from the Fund's relative return. Stock selection and an overweight in health care detracted from both relative and absolute returns.

What contributed to performance?

Vistra Corp. |

Shares of this large US power producer and retail energy provider rose due to a better outlook for long-term demand, driven by the build out of energy-intensive AI data centers. The company’s solid financial results also supported the stock price. The Fund’s positions in Vistra Corp. were sold during the fiscal year.

Coherent Corp. |

This laser company develops and manufactures optoelectronic components and devices used in the communications, electronics and industrial markets. It benefited from the growth of AI as its optical transceivers are key enablers for networking of AI servers.

Vertiv Holdings Co. |

Vertiv is a manufacturer of electrical power, thermal management, and other equipment for data centers. Shares have risen along with the company’s strong financial performance, driven by increased spending in data centers as a result of AI investments.

What detracted from performance?

New Fortress Energy, Inc.

|

Shares of this natural gas infrastructure company fell due to declining gas prices and ongoing project delays.

APA Corp. |

Shares of the oil and gas company declined along with the broader industry due to weak energy prices. We sold this position to fund new opportunities.

Centene Corp. |

Centene is a leading provider of both Medicaid and Affordable Care Act insurance coverage. The stock underperformed because of higher medical costs that hurt the profit margins in its Medicaid segment and uncertainty around potential changes to the healthcare policies under the new Republican administration. We added to the position to take advantage of the stock price decline.

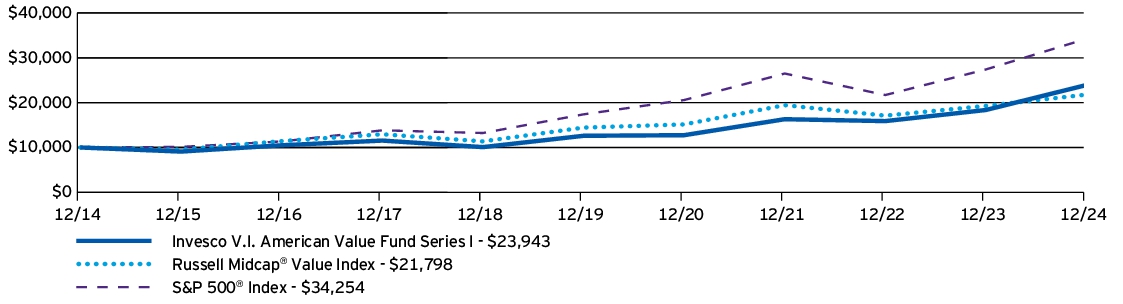

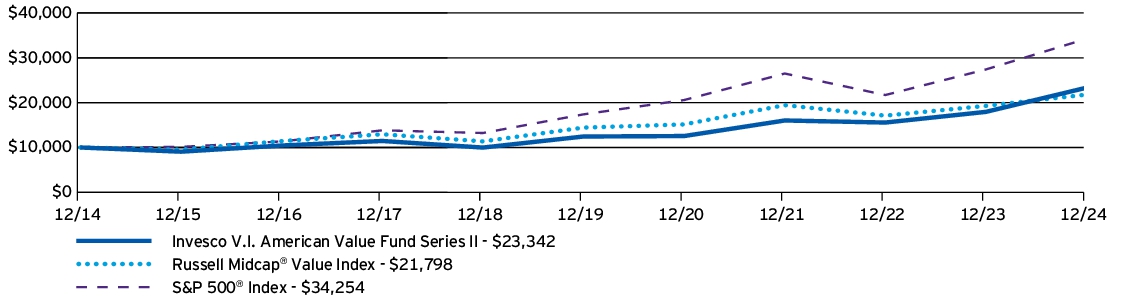

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. American Value Fund (Series I) | 30.41 % | 13.69 % | 9.12 % |

Russell Midcap ® Value Index | 13.07 % | 8.59 % | 8.10 % |

| S&P 500® Index | 25.02 % | 14.53 % | 13.10 % |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 366,273,668 |

| Total number of portfolio holdings | 75 |

| Total advisory fees paid | $ 2,419,413 |

| Portfolio turnover rate | 39 % |

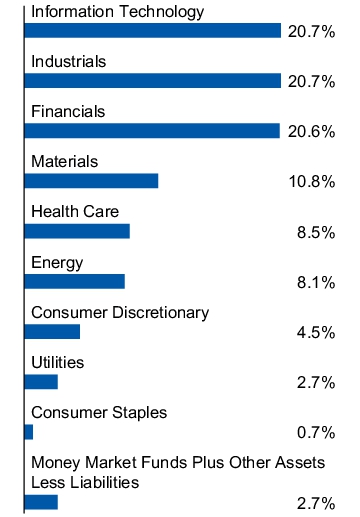

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Marvell Technology, Inc. | 3.65 % |

| Lumentum Holdings, Inc. | 3.43 % |

| Expedia Group, Inc. | 3.35 % |

| Coherent Corp. | 2.93 % |

| NRG Energy, Inc. | 2.69 % |

| Fidelity National Information Services, Inc. | 2.67 % |

| Western Alliance Bancorporation | 2.44 % |

| Huntington Bancshares, Inc. | 2.32 % |

| MasTec, Inc. | 2.31 % |

| Globe Life, Inc. | 2.23 % |

| * Excluding money market fund holdings, if any. | |

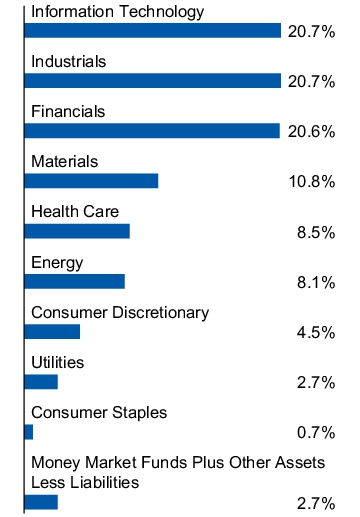

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. American Value Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. American Value Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024.

You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. American Value Fund

(Series II) | $ 132 | 1.15 % |

How Did The Fund Perform During The Period?

•

During the fiscal year ended December 31, 2024, US equity indices experienced strong returns. The US economy was resilient as data suggested the Federal Reserve (Fed) may have achieved its fabled soft landing, with strong consumer spending and low unemployment providing support. Enthusiasm around the artificial intelligence (AI) investment theme led to concentrated market leadership in the large cap technology space during the period.

•

For the fiscal year ended December 31, 2024, Series II shares of the Fund returned 30.09%. For the same time period, the Russell Midcap

®

Value Index returned 13.07%. The Fund outperformed the Russell Midcap

®

Value Index primarily due to strong stock selection in the information technology (IT), utilities and industrials sectors. These sectors were also the largest contributors to absolute performance. Conversely, stock selection and an overweight in energy was the largest detractor from the Fund's relative return. Stock selection and an overweight in health care detracted from both relative and absolute returns.

What contributed to performance?

Vistra Corp. |

Shares of this large US power producer and retail energy provider rose due to a better outlook for long-term demand, driven by the build out of energy-intensive AI data centers. The company’s solid financial results also supported the stock price. The Fund’s positions in Vistra Corp. were sold during the fiscal year.

Coherent Corp. |

This laser company develops and manufactures optoelectronic components and devices used in the communications, electronics and industrial markets. It benefited from the growth of AI as its optical transceivers are key enablers for networking of AI servers.

Vertiv Holdings Co. |

Vertiv is a manufacturer of electrical power, thermal management, and other equipment for data centers. Shares have risen along with the company’s strong financial performance, driven by increased spending in data centers as a result of AI investments.

What detracted from performance?

New Fortress Energy, Inc.

|

Shares of this natural gas infrastructure company fell due to declining gas prices and ongoing project delays.

APA Corp. |

Shares of the oil and gas company declined along with the broader industry due to weak energy prices. We sold this position to fund new opportunities.

Centene Corp. |

Centene is a leading provider of both Medicaid and Affordable Care Act insurance coverage. The stock underperformed because of higher medical costs that hurt the profit margins in its Medicaid segment and uncertainty around potential changes to the healthcare policies under the new Republican administration. We added to the position to take advantage of the stock price decline.

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. American Value Fund (Series II) | 30.09 % | 13.40 % | 8.85 % |

Russell Midcap ® Value Index | 13.07 % | 8.59 % | 8.10 % |

| 25.02 % | 14.53 % | 13.10 % |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 366,273,668 |

| Total number of portfolio holdings | 75 |

| Total advisory fees paid | $ 2,419,413 |

| Portfolio turnover rate | 39 % |

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Marvell Technology, Inc. | 3.65 % |

| Lumentum Holdings, Inc. | 3.43 % |

| Expedia Group, Inc. | 3.35 % |

| Coherent Corp. | 2.93 % |

| NRG Energy, Inc. | 2.69 % |

| Fidelity National Information Services, Inc. | 2.67 % |

| Western Alliance Bancorporation | 2.44 % |

| Huntington Bancshares, Inc. | 2.32 % |

| MasTec, Inc. | 2.31 % |

| Globe Life, Inc. | 2.23 % |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. Balanced-Risk Allocation Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. Balanced-Risk Allocation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. Balanced-Risk Allocation Fund

(Series I) | $ 73 | 0.72 % † |

| Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

•

The global monetary easing cycle finally arrived with several central banks cutting interest rates. Despite some volatility, global growth and disinflationary progress continued, leading to robust gains for global equity markets and more limited gains for fixed income markets. Commodities posted mixed performance; precious metals outperformed, while agricultural and energy commodities broadly struggled due to weaker demand. Broad markets retreated late in the year, driven by the US election and central bank caution. Resilient economic growth combined with mixed inflation data caused a spike in volatility to start the final quarter of the year. Although markets rebounded following the US election, the optimism was short-lived as uncertainty around the new administration’s policies, sticky inflation, tariffs and diverging economic outlooks set in.

•

For the fiscal year ended December 31, 2024, Series I shares of the Fund returned 3.76%. For the same time period, the Custom Invesco V.I. Balanced-Risk Allocation Index returned 11.54%.

What contributed to performance?

Growth Macro Factor |

Strategic exposure to the growth macro factor achieved through exchange-traded futures, swaps and listed options, was the top contributor to Fund performance with all six equity markets posting gains. Japanese equities outperformed their international counterparts, driven by a weakening yen in the export heavy region.

Tactical positioning

| Tactical positioning contributed to performance as gains from positioning in equities and commodities outweighed losses from positioning within global bonds.

What detracted from performance?

Defensive Macro Factor

|

Strategic exposure to the defensive macro factor achieved through exchange-traded futures, detracted from Fund results in aggregate, with losses from Australian, German, Canadian and Japanese government bonds. Central bank policy was the primary driver of performance due to inflation risks causing yields to rise on longer term bonds.

Real Return Macro Factor |

Strategic exposure to the real return macro factor achieved through exchange-traded futures, swaps and commodity linked notes, detracted from the Fund's results in aggregate as gains in energy and precious metals were outweighed by losses in agriculture and industrial metals. Agriculture exposure was the top detractor within the real return macro factor as most agricultural commodities faced pressure from oversupply concerns. Industrial metals were a slight detractor due to the threat of potential tariff policy from the Trump administration.

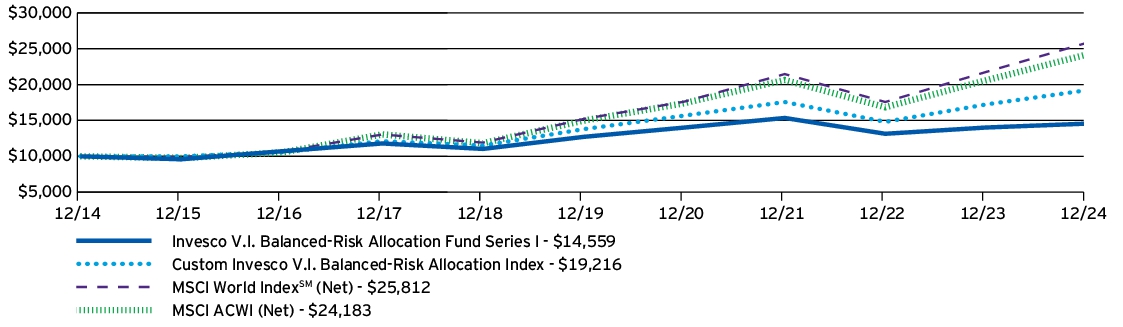

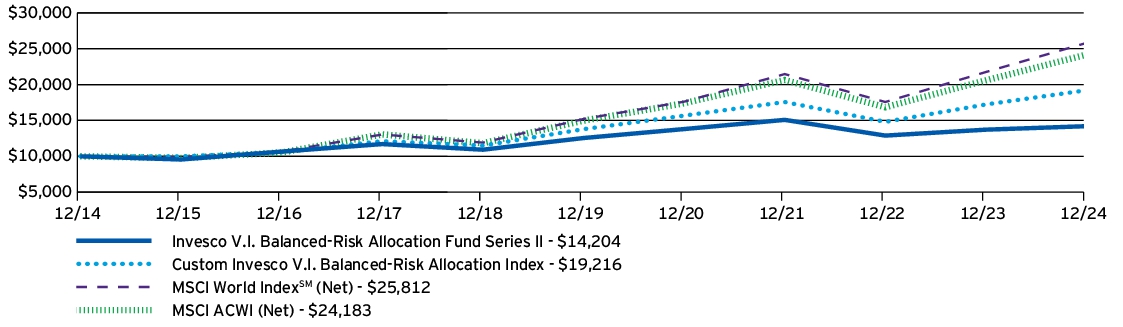

How Has The Fund Historically

Performed

?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. Balanced-Risk Allocation Fund (Series I) | 3.76 % | 2.75 % | 3.83 % |

| Custom Invesco V.I. Balanced-Risk Allocation Index | 11.54 % | 6.87 % | 6.75 % |

| MSCI World IndexSM (Net) | 18.67 % | 11.17 % | 9.95 % |

| MSCI ACWI (Net) | 17.49 % | 10.06 % | 9.23 % |

The Custom Invesco V.I. Balanced-Risk Allocation Index is composed of 60% MSCI World Index (Net) and 40% Bloomberg U.S. Aggregate Bond Index. Prior to May 2, 2011, the index comprised the MSCI World Index, JP Morgan GBI Global Index and FTSE US 3-Month Treasury Bill Index.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the

MSCI World Index

SM

(Net) to the MSCI ACWI (Net) to reflect that the MSCI ACWI (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 422,609,164 |

| Total number of portfolio holdings | 163 |

| Total advisory fees paid | $ 2,342,368 |

| Portfolio turnover rate | 10 % |

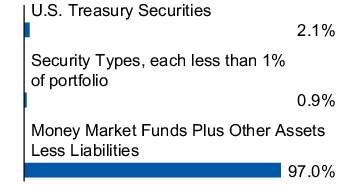

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Target risk contribution and

notional asset weights

| Asset Class | Target Risk Contribution* | Notional Asset Exposure Weights** |

| Equities and Options | 50.00 % | 80.03 % |

| Fixed Income | 23.67 | 57.86 |

| Commodities | 26.33 | 28.30 |

| Total | 100.00 % | 166.19 % |

* Reflects the risk that each asset class is expected to contribute to the overall risk of the Fund as measured by standard deviation and estimates of risk based on historical data. Standard deviation measures the annualized fluctuations (volatility) of monthly returns.

** Proprietary models determine the Notional Asset Weights necessary to achieve the Target Risk Contributions. Total Notional Asset Weight greater than 100% is achieved through derivatives and other instruments that create leverage. | | |

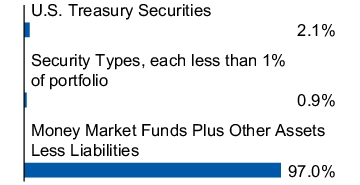

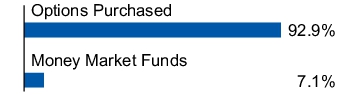

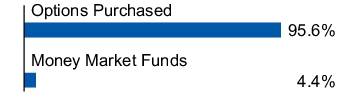

Security type allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. Balanced-Risk Allocation Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. Balanced-Risk Allocation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024.

You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. Balanced-Risk Allocation Fund

(Series II) | $ 99 | 0.97 % † |

| Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

•

The global monetary easing cycle finally arrived with several central banks cutting interest rates. Despite some volatility, global growth and disinflationary progress continued, leading to robust gains for global equity markets and more limited gains for fixed income markets. Commodities posted mixed performance; precious metals outperformed, while agricultural and energy commodities broadly struggled due to weaker demand. Broad markets retreated late in the year, driven by the US election and central bank caution. Resilient economic growth combined with mixed inflation data caused a spike in volatility to start the final quarter of the year. Although markets rebounded following the US election, the optimism was short-lived as uncertainty around the new administration’s policies, sticky inflation, tariffs and diverging economic outlooks set in.

•

For the fiscal year ended December 31, 2024, Series I shares of the Fund returned 3.56%. For the same time period, the Custom Invesco V.I. Balanced-Risk Allocation Index returned 11.54%.

What contributed to performance?

Growth Macro Factor |

Strategic exposure to the growth macro factor achieved through exchange-traded futures, swaps and listed options, was the top contributor to Fund performance with all six equity markets posting gains. Japanese equities outperformed their international counterparts, driven by a weakening yen in the export heavy region.

Tactical positioning

| Tactical positioning contributed to performance as gains from positioning in equities and commodities outweighed losses from positioning within global bonds.

What detracted from performance?

Defensive Macro Factor

|

Strategic exposure to the defensive macro factor achieved through exchange-traded futures, detracted from Fund results in aggregate, with losses from Australian, German, Canadian and Japanese government bonds. Central bank policy was the primary driver of performance due to inflation risks causing yields to rise on longer term bonds.

Real Return Macro Factor |

Strategic exposure to the real return macro factor achieved through exchange-traded futures, swaps and commodity linked notes, detracted from the Fund's results in aggregate as gains in energy and precious metals were outweighed by losses in agriculture and industrial metals. Agriculture exposure was the top detractor within the real return macro factor as most agricultural commodities faced pressure from oversupply concerns. Industrial metals were a slight detractor due to the threat of potential tariff policy from the Trump administration.

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. Balanced-Risk Allocation Fund (Series II) | 3.56 % | 2.51 % | 3.57 % |

| Custom Invesco V.I. Balanced-Risk Allocation Index | 11.54 % | 6.87 % | 6.75 % |

| MSCI World IndexSM (Net) | 18.67 % | 11.17 % | 9.95 % |

| MSCI ACWI (Net) | 17.49 % | 10.06 % | 9.23 % |

The Custom Invesco V.I. Balanced-Risk Allocation Index is composed of 60% MSCI World Index (Net) and 40% Bloomberg U.S. Aggregate Bond Index. Prior to May 2, 2011, the index comprised the MSCI World Index, JP Morgan GBI Global Index and FTSE US 3-Month Treasury Bill Index.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the

MSCI World Index

SM

(Net) to the MSCI ACWI (Net) to reflect that the MSCI ACWI (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 422,609,164 |

| Total number of portfolio holdings | 163 |

| Total advisory fees paid | $ 2,342,368 |

| Portfolio turnover rate | 10 % |

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Target risk contribution and

notional asset weights

| Asset Class | Target Risk Contribution* | Notional Asset Exposure Weights** |

| Equities and Options | 50.00 % | 80.03 % |

| Fixed Income | 23.67 | 57.86 |

| Commodities | 26.33 | 28.30 |

| Total | 100.00 % | 166.19 % |

* Reflects the risk that each asset class is expected to contribute to the overall risk of the Fund as measured by standard deviation and estimates of risk based on historical data. Standard deviation measures the annualized fluctuations (volatility) of monthly returns.

** Proprietary models determine the Notional Asset Weights necessary to achieve the Target Risk Contributions. Total Notional Asset Weight greater than 100% is achieved through derivatives and other instruments that create leverage. | | |

Security type allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. Capital Appreciation Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. Capital Appreciation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. Capital Appreciation Fund

(Series I) | $ 94 | 0.80 % † |

| Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

•

During the fiscal year ended December 31, 2024, US equity markets posted strong gains as the US economy remained resilient. Data suggested the Federal Reserve (the Fed) may have achieved its fabled soft landing, as moderating inflation, strong consumer spending, and low unemployment provided support. The Fed cut the federal funds rate several times over the period, but suggested less aggressive easing could occur in 2025 should robust economic growth and lingering inflation continue.

•

For the fiscal year ended December 31, 2024, Series I shares of the Fund returned 34.16%. For the same time period, the Russell 1000

®

Growth Index returned 33.36%. The Fund outperformed the Russell 1000

®

Growth Index mainly as a result of stock selection in the health care, industrials, and communication services sectors. Weaker stock selection in the information technology and consumer discretionary sectors partially offset these results.

What contributed to performance?

NVIDIA Corp. |

NVIDIA reported strong results and commented that AI-related demand should remain durable for the foreseeable future given the backlog of existing products and upcoming launches of new products.

Amazon.com, Inc. |

Amazon reported strong profits driven by its Amazon Web Services division, which we believe continued to be well positioned for growth at the end of the period.

What detracted from performance?

MongoDB, Inc.

|

MongoDB gained share in the large database software market but reported underwhelming results that saw slower new customer additions and growth within its installed base than expected. The Fund’s positions in MongoDB were sold during the fiscal year.

ASML Holding N.V. |

ASML detracted from the Fund’s performance due to investor concerns about the potential impact on its business from US government restrictions on chip sales to China. The Fund’s positions in ASML were sold during the fiscal year.

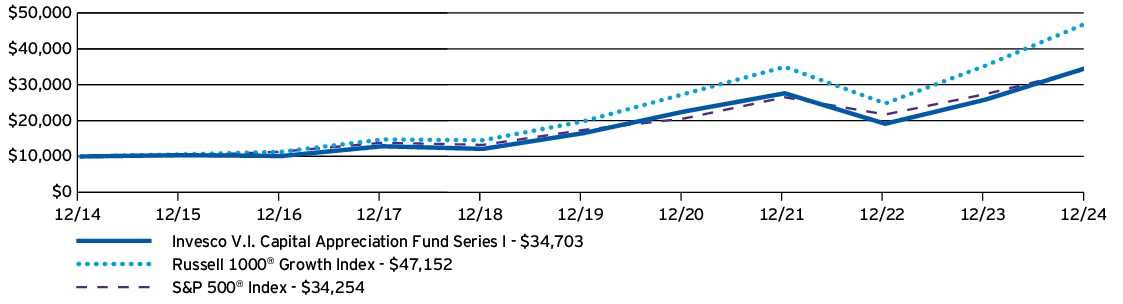

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. Capital Appreciation Fund (Series I) | 34.16 % | 16.05 % | 13.25 % |

| Russell 1000® Growth Index | 33.36 % | 18.96 % | 16.78 % |

| S&P 500® Index | 25.02 % | 14.53 % | 13.10 % |

Effective after the close of business on May 24, 2019, Non-Service shares of Oppenheimer International Growth Fund/VA (the predecessor fund), were reorganized into Series I shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Non-Service shares of the predecessor fund. Share class returns will differ from those of the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 812,676,992 |

| Total number of portfolio holdings | 57 |

| Total advisory fees paid | $ 4,809,986 |

| Portfolio turnover rate | 58 % |

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| NVIDIA Corp. | 10.50 % |

| Amazon.com, Inc. | 8.05 % |

| Microsoft Corp. | 7.09 % |

| Apple, Inc. | 6.31 % |

| Meta Platforms, Inc., Class A | 5.15 % |

| Broadcom, Inc. | 4.03 % |

| Alphabet, Inc., Class C | 3.52 % |

| Netflix, Inc. | 2.70 % |

| ServiceNow, Inc. | 2.30 % |

| KKR & Co., Inc., Class A | 2.25 % |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at

invesco.com/reports

or upon request at (800) 959-4246.

Effective on or about April 30, 2025, the name of the Fund and all references thereto will change from Invesco V.I. Capital Appreciation Fund to Invesco V.I. Discovery Large Cap Fund and the Fund will adopt a non-fundamental policy to invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of "large-cap" issuers, and in derivatives and other instruments that have economic characteristics similar to such securities. The Fund's investment objective will not change and the changes will not materially impact the way the Fund is managed.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. Capital Appreciation Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. Capital Appreciation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. Capital Appreciation Fund

(Series II) | $ 123 | 1.05 % † |

| Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

•

During the fiscal year ended December 31, 2024, US equity markets posted strong gains as the US economy remained resilient. Data suggested the Federal Reserve (the Fed) may have achieved its fabled soft landing, as moderating inflation, strong consumer spending, and low unemployment provided support. The Fed cut the federal funds rate several times over the period, but suggested less aggressive easing could occur in 2025 should robust economic growth and lingering inflation continue.

•

For the fiscal year ended December 31, 2024, Series II shares of the Fund returned 33.82%. For the same time period, the Russell 1000

®

Growth Index returned 33.36%. The Fund outperformed the Russell 1000

®

Growth Index mainly as a result of stock selection in the health care, industrials, and communication services sectors. Weaker stock selection in the information technology and consumer discretionary sectors partially offset these results.

What contributed to performance?

NVIDIA Corp. |

NVIDIA reported strong results and commented that AI-related demand should remain durable for the foreseeable future given the backlog of existing products and upcoming launches of new products.

Amazon.com, Inc. |

Amazon reported strong profits driven by its Amazon Web Services division, which we believe continued to be well positioned for growth at the end of the period.

What detracted from performance?

MongoDB, Inc.

|

MongoDB gained share in the large database software market but reported underwhelming results that saw slower new customer additions and growth within its installed base than expected. The Fund’s positions in MongoDB were sold during the fiscal year.

ASML Holding N.V. |

ASML detracted from the Fund’s performance due to investor concerns about the potential impact on its business from US government restrictions on chip sales to China. The Fund’s positions in ASML were sold during the fiscal year.

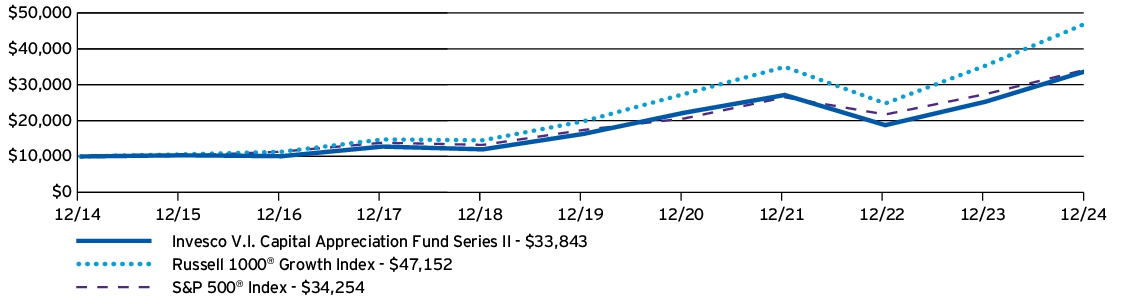

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. Capital Appreciation Fund (Series II) | 33.82 % | 15.76 % | 12.97 % |

| Russell 1000® Growth Index | 33.36 % | 18.96 % | 16.78 % |

| S&P 500® Index | 25.02 % | 14.53 % | 13.10 % |

Effective after the close of business on May 24, 2019, Service shares of Oppenheimer International Growth Fund/VA (the predecessor fund), were reorganized into Series II shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Service shares of the predecessor fund. Share class returns will differ from those of the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 812,676,992 |

| Total number of portfolio holdings | 57 |

| Total advisory fees paid | $ 4,809,986 |

| Portfolio turnover rate | 58 % |

What Comprise

d

The Fund's Holding

s

?

Top ten holdings*

(% of net assets)

| NVIDIA Corp. | 10.50 % |

| Amazon.com, Inc. | 8.05 % |

| Microsoft Corp. | 7.09 % |

| Apple, Inc. | 6.31 % |

| Meta Platforms, Inc., Class A | 5.15 % |

| Broadcom, Inc. | 4.03 % |

| Alphabet, Inc., Class C | 3.52 % |

| Netflix, Inc. | 2.70 % |

| ServiceNow, Inc. | 2.30 % |

| KKR & Co., Inc., Class A | 2.25 % |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The

Past

Yea

r

?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at

invesco.com/reports

or upon request at (800) 959-4246.

Effective on or about April 30, 2025, the name of the Fund and all references thereto will change from Invesco V.I. Capital Appreciation Fund to Invesco V.I. Discovery Large Cap Fund and the Fund will adopt a non-fundamental policy to invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of "large-cap" issuers, and in derivatives and other instruments that have economic characteristics similar to such securities. The Fund's investment objective will not change and the changes will not materially impact the way the Fund is managed.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. Comstock Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. Comstock Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. Comstock Fund

(Series I) | $ 82 | 0.76 % |

How Did The Fund Perform During The Period?

•

During the fiscal year ending December 31, 2024, US equity indices experienced strong returns. The US economy remained resilient during the period as data suggested the Federal Reserve may have achieved its fabled soft landing, as strong consumer spending and low unemployment provided support. Driven by investor demand for companies focusing on artificial intelligence (AI), communication services and information technology had strong returns, while materials and health care lagged.

•

For the fiscal year ended December 31, 2024, Series I shares of the Fund returned 15.18%. For the same time period, the Russell 1000

®

Value Index returned 14.37%. The Fund outperformed the Russell 1000

®

Value Index primarily due to strong stock selection in communication services, industrials and materials, while relative returns were partially offset by stock selection in health care, information technology and consumer staples.

What contributed to performance?

Communication Services |

Favorable performance came from Meta Platforms and Alphabet. Alphabet had substantial revenue growth in advertising and cloud services during the year. Meta Platforms stock surged significantly in 2024 due to strong revenue growth, mostly in advertisement revenue, and successful advancements in AI and augmented reality technologies.

Industrials |

Performance was mainly driven by stock selection in building products and electrical equipment. Johnson Controls International, Eaton and Emerson Electric were key contributors to relative returns. Johnson Controls International reported strong organic sales growth, robust margin expansion, and a record backlog driven by high demand in data centers. Electrical equipment stocks like Eaton and Emerson Electric performed well in 2024 due to strong order growth, robust backlog, and successful execution of strategic initiatives.

Materials |

Performance was driven by stock selection in containers/packaging and the lack of exposure to metals and mining stocks. International Paper was a key relative contributor, outperforming the sector and the Russell 1000

®

Value Index for the period. International Paper stock benefited due to strategic restructuring, cost reductions, and successful optimization of their box plant operations.

What detracted from performance?

Health Care

|

Some of the largest detractors in health care were in the managed health care and health care services segments. CVS Health underperformed due to high medical costs and high utilization in its health benefits segment. Elevance Health had higher-than-expected costs in its health benefits segment and expenses driven by its investments in growth.

Information Technology (IT) |

Stock selection in IT services company DXC Technology and within semiconductors Intel and NXP Semiconductors were key detractors. DXC Technology underperformed in 2024 due to challenges in sales execution, integration issues, and delays in achieving intended strategic results. Semiconductors not related to AI, such as Intel and NXP Semiconductors, underperformed in 2024 due to competitive disadvantages, production delays, and a weak automotive market.

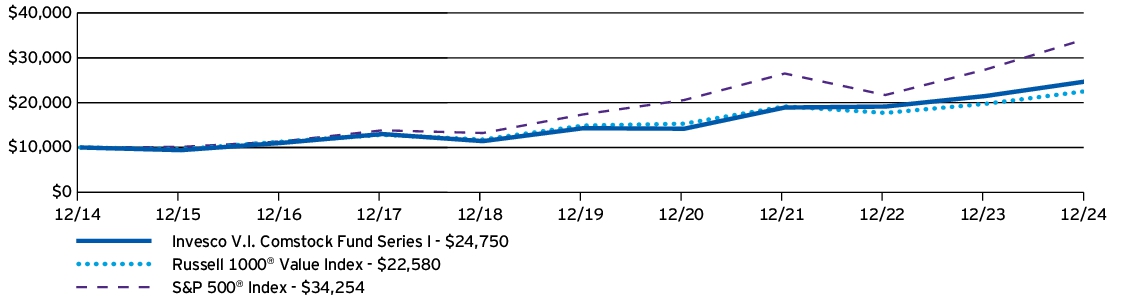

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. Comstock Fund (Series I) | 15.18 % | 11.59 % | 9.49 % |

| Russell 1000® Value Index | 14.37 % | 8.68 % | 8.49 % |

| S&P 500® Index | 25.02 % | 14.53 % | 13.10 % |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Performance figures also do not reflect sales charges, expenses and fees assessed in connection with a variable product. Such variable product charges are determined by the variable product issuers, will vary and will lower the total return. For more recent performance information, including variable product charges, please contact your variable product issuer or financial adviser.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $ 1,427,947,821 |

| Total number of portfolio holdings | 94 |

| Total advisory fees paid | $ 8,155,886 |

| Portfolio turnover rate | 19 % |

What Comprised The Fund'

s

H

olding

s

?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Wells Fargo & Co. | 3.26 % |

| Bank of America Corp. | 3.19 % |

| Microsoft Corp. | 2.66 % |

| Alphabet, Inc., Class A | 2.32 % |

| Cisco Systems, Inc. | 2.25 % |

| Meta Platforms, Inc., Class A | 2.08 % |

| Johnson Controls International PLC | 1.92 % |

| State Street Corp. | 1.91 % |

| Philip Morris International, Inc. | 1.88 % |

| Chevron Corp. | 1.88 % |

| * Excluding money market fund holdings, if any. | |

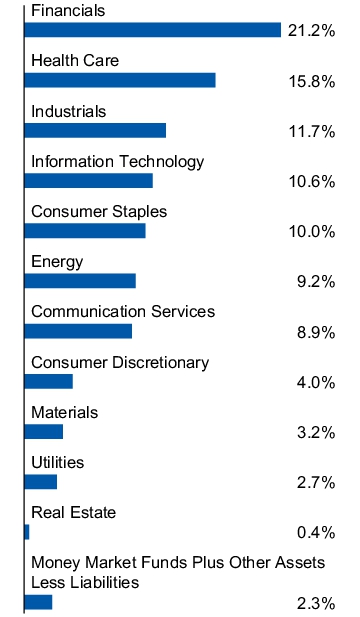

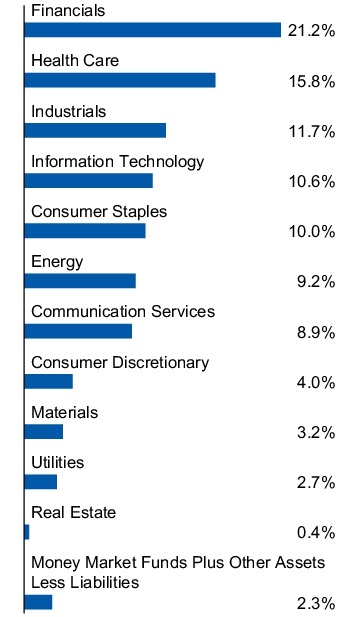

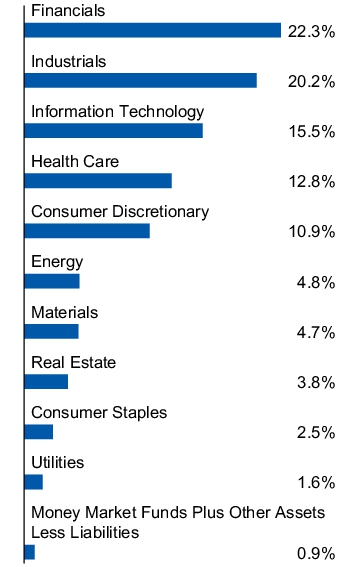

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at

invesco.com/reports

. Additionally, the Fund's proxy voting information can be found at

invesco.com/proxy-voting

.

For additional information, please scan the QR code at the left to navigate to additional material at

invesco.com/reports

.

Invesco V.I. Comstock Fund

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco V.I. Comstock Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at

invesco.com/reports

. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco V.I. Comstock Fund

(Series II) | $ 109 | 1.01 % |

How Did The Fund Perform During The Period?

•

During the fiscal year ending December 31, 2024, US equity indices experienced strong returns. The US economy remained resilient during the period as data suggested the Federal Reserve may have achieved its fabled soft landing, as strong consumer spending and low unemployment provided support. Driven by investor demand for companies focusing on artificial intelligence (AI), communication services and information technology had strong returns, while materials and health care lagged.

•

For the fiscal year ended December 31, 2024, Series II shares of the Fund returned 14.87%. For the same time period, the Russell 1000

®

Value Index returned 14.37%. The Fund outperformed the Russell 1000

®

Value Index primarily due to strong stock selection in communication services, industrials and materials, while relative returns were partially offset by stock selection in health care, information technology and consumer staples.

What contributed to performance?

Communication Services |

Favorable performance came from Meta Platforms and Alphabet. Alphabet had substantial revenue growth in advertising and cloud services during the year. Meta Platforms stock surged significantly in 2024 due to strong revenue growth, mostly in advertisement revenue, and successful advancements in AI and augmented reality technologies.

Industrials |

Performance was mainly driven by stock selection in building products and electrical equipment. Johnson Controls International, Eaton and Emerson Electric were key contributors to relative returns. Johnson Controls International reported strong organic sales growth, robust margin expansion, and a record backlog driven by high demand in data centers. Electrical equipment stocks like Eaton and Emerson Electric performed well in 2024 due to strong order growth, robust backlog, and successful execution of strategic initiatives.

Materials |

Performance was driven by stock selection in containers/packaging and the lack of exposure to metals and mining stocks. International Paper was a key relative contributor, outperforming the sector and the Russell 1000

®

Value Index for the period. International Paper stock benefited due to strategic restructuring, cost reductions, and successful optimization of their box plant operations.

What detracted from performance?

Health Care

|

Some of the largest detractors in health care were in the managed health care and health care services segments. CVS Health underperformed due to high medical costs and high utilization in its health benefits segment. Elevance Health had higher-than-expected costs in its health benefits segment and expenses driven by its investments in growth.

Information Technology (IT) |

Stock selection in IT services company DXC Technology and within semiconductors Intel and NXP Semiconductors were key detractors. DXC Technology underperformed in 2024 due to challenges in sales execution, integration issues, and delays in achieving intended strategic results. Semiconductors not related to AI, such as Intel and NXP Semiconductors, underperformed in 2024 due to competitive disadvantages, production delays, and a weak automotive market.

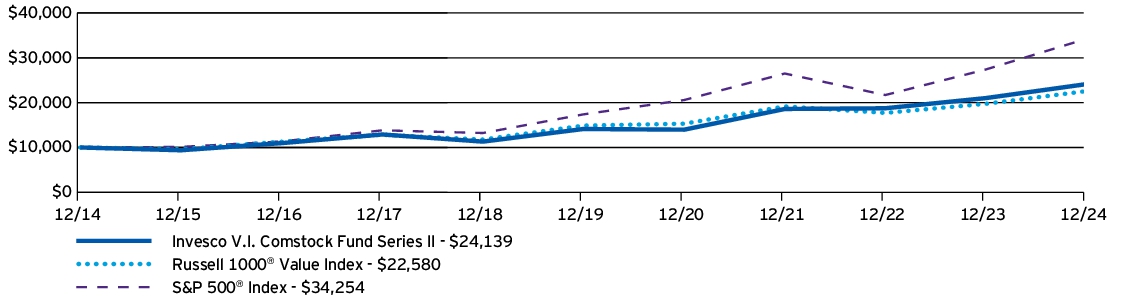

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco V.I. Comstock Fund (Series II) | 14.87 % | 11.31 % | 9.21 % |

| Russell 1000® Value Index | 14.37 % | 8.68 % | 8.49 % |

| 25.02 % | 14.53 % | 13.10 % |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

Please visit

invesco.com/viperformance

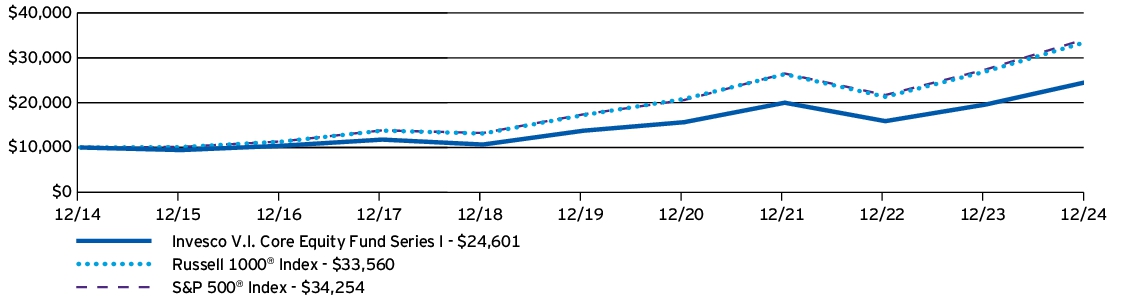

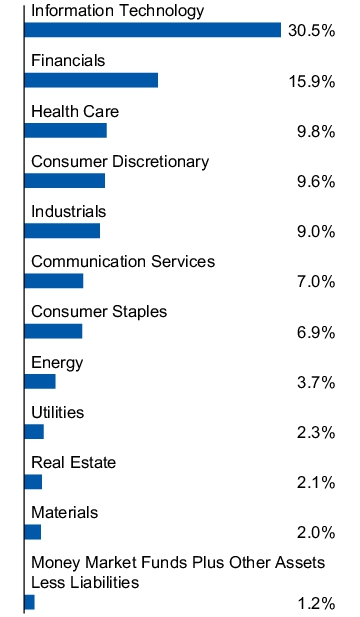

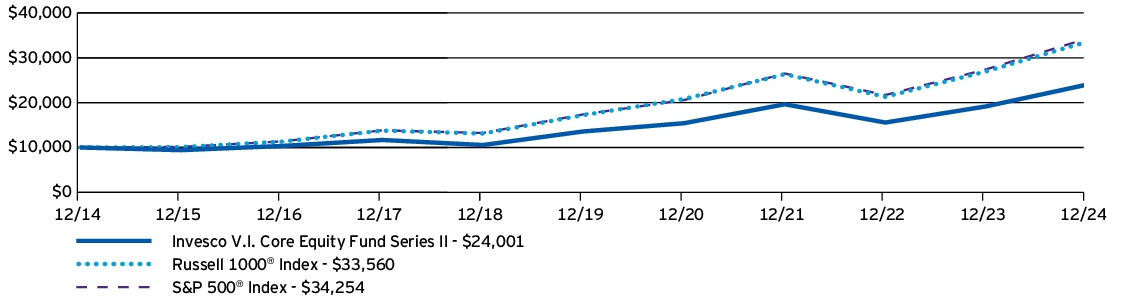

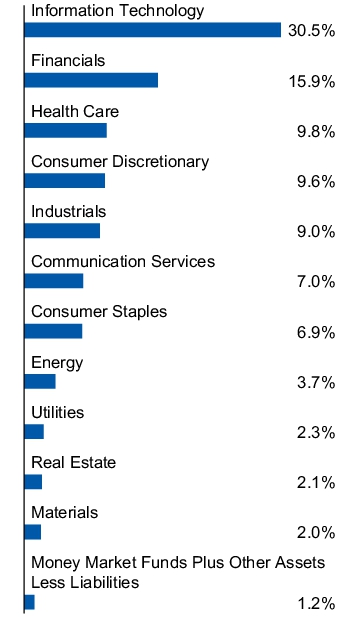

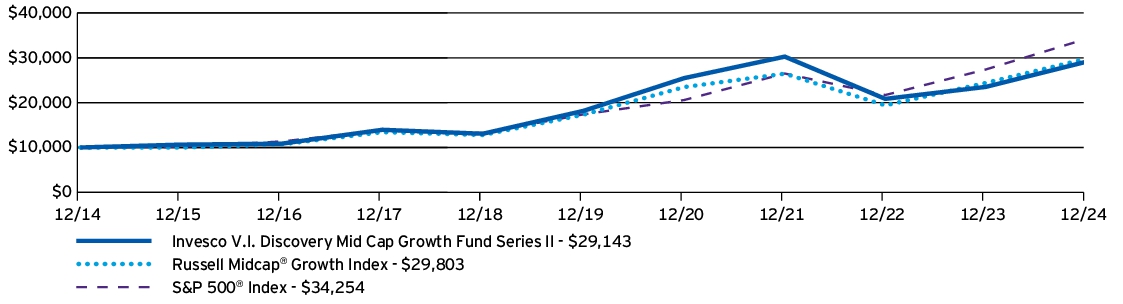

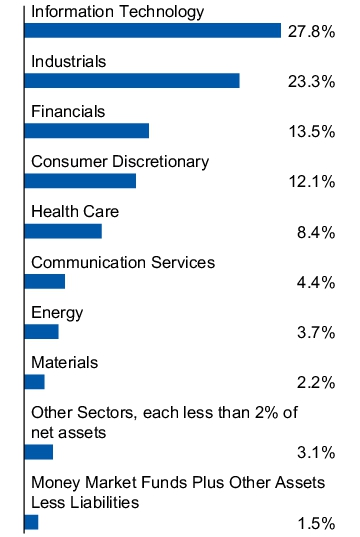

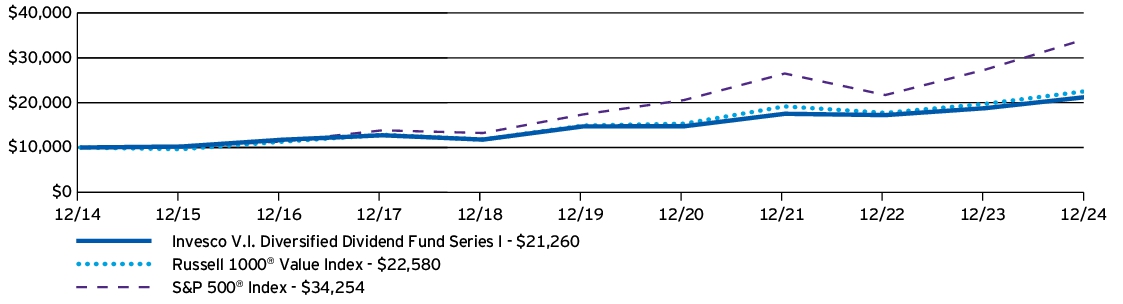

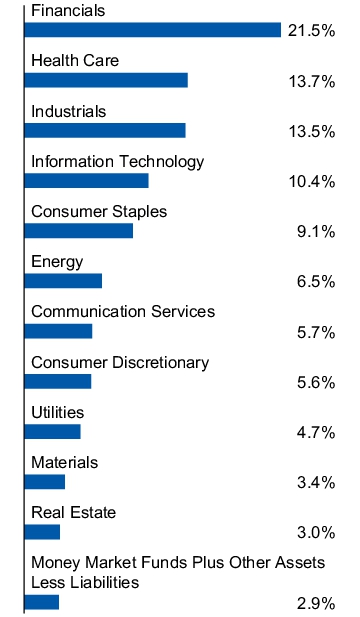

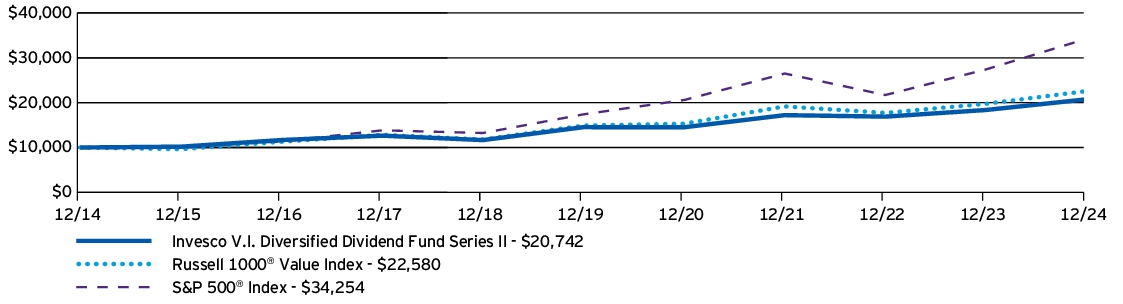

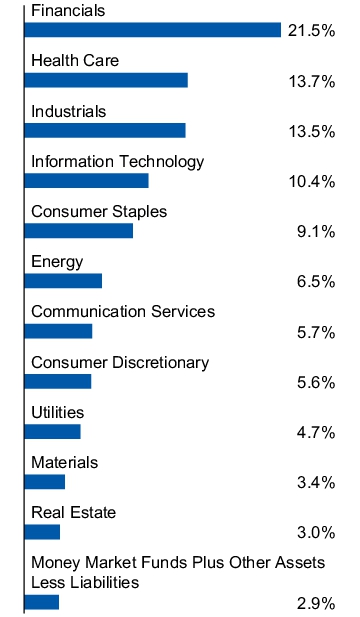

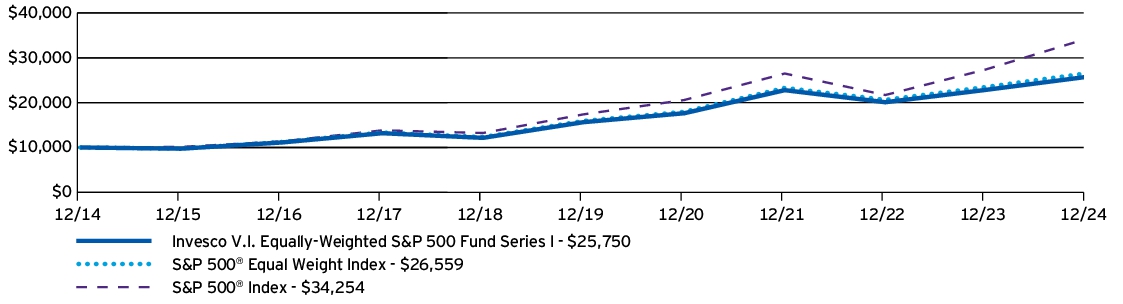

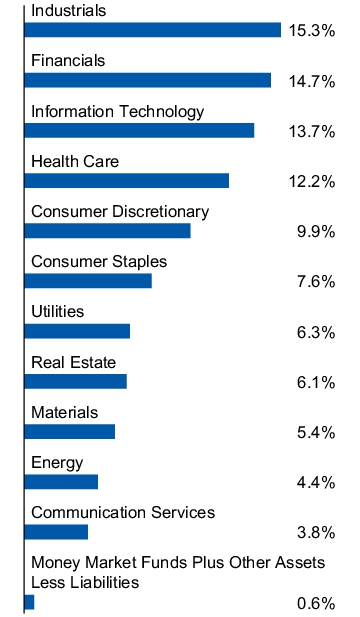

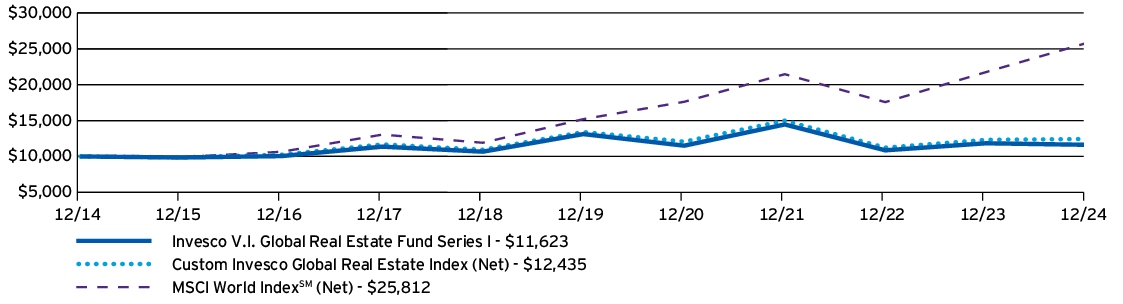

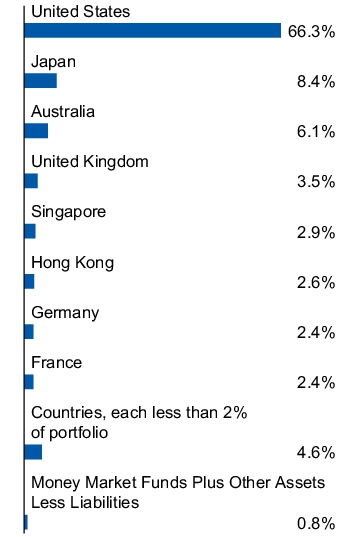

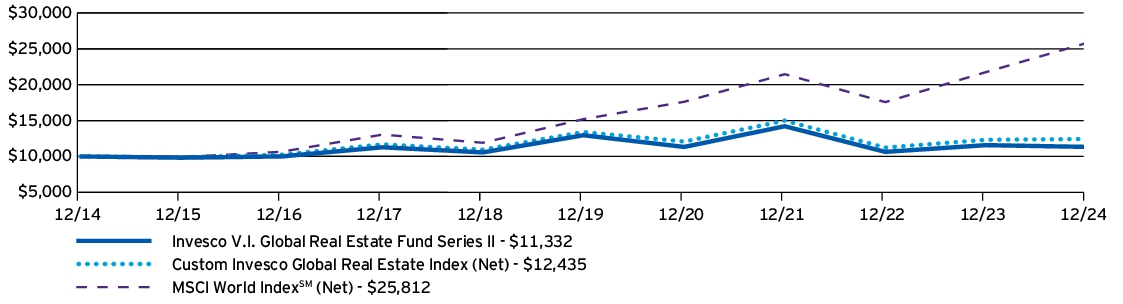

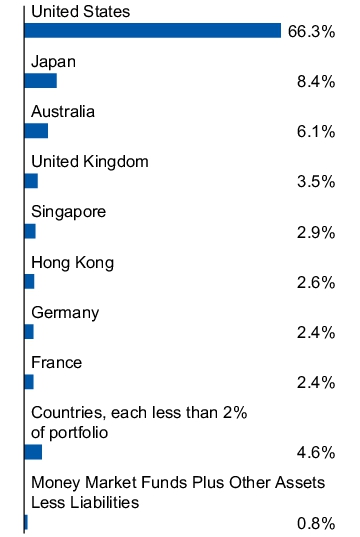

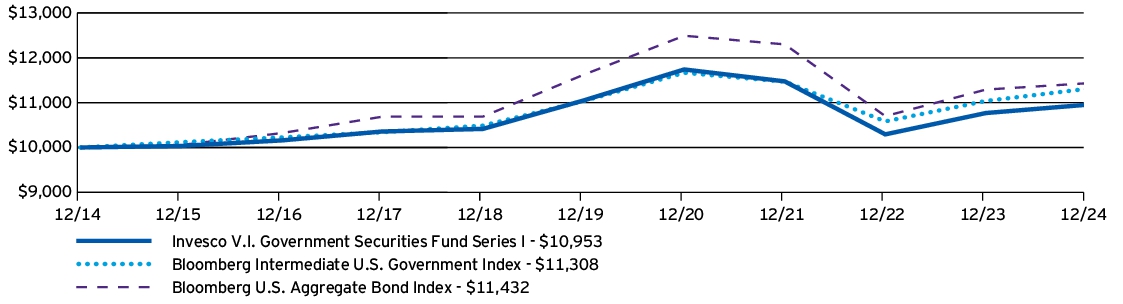

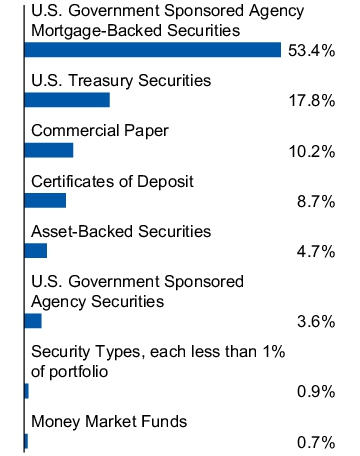

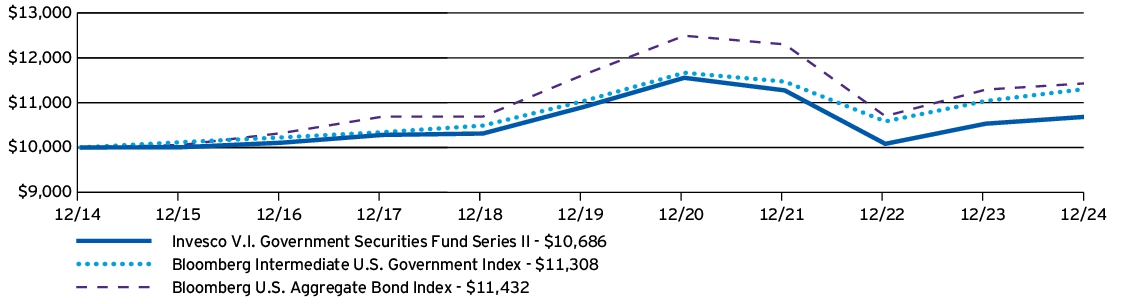

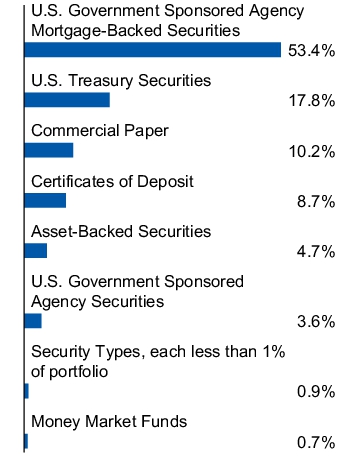

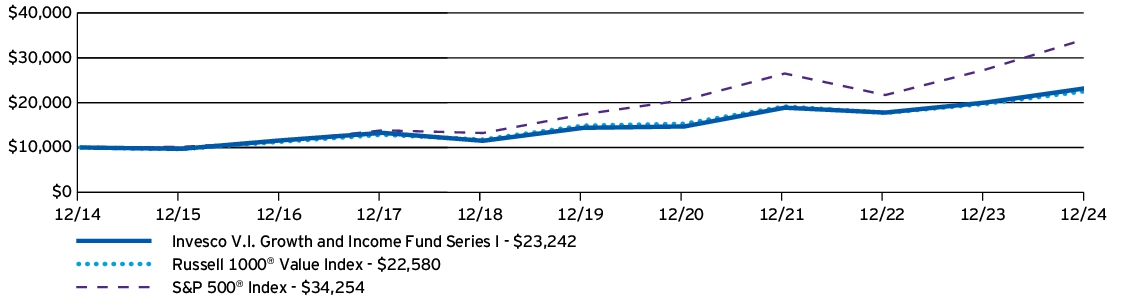

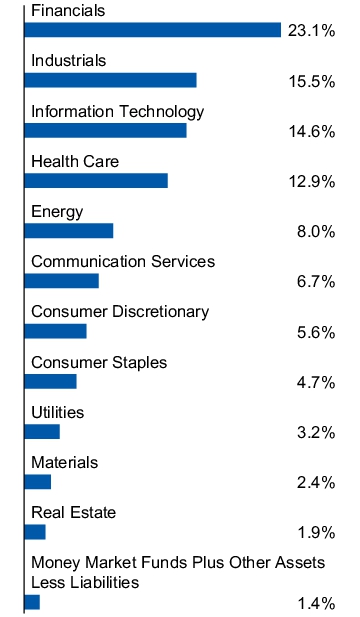

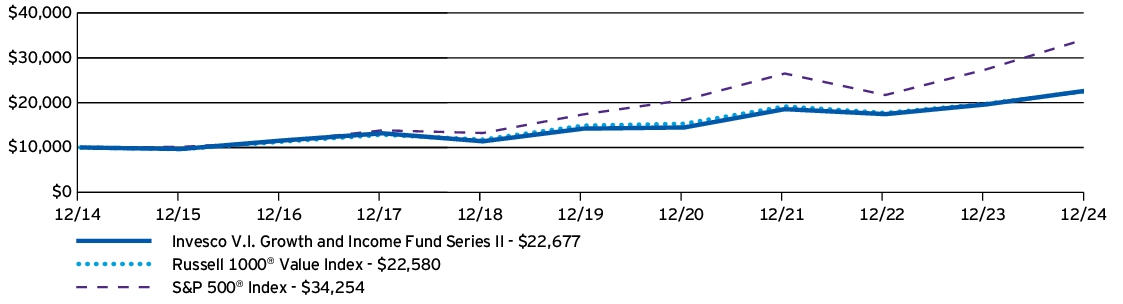

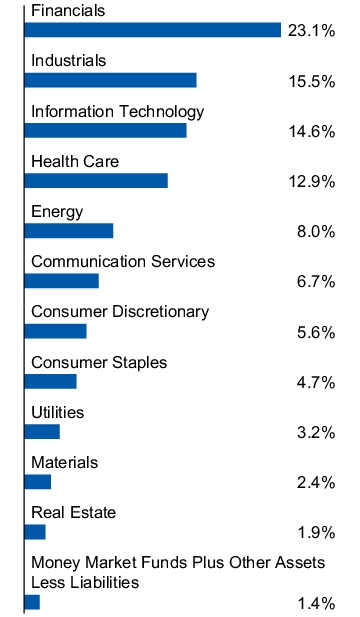

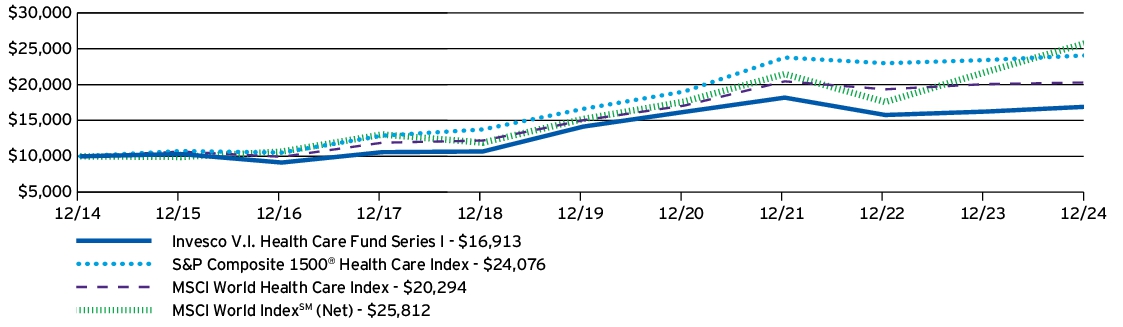

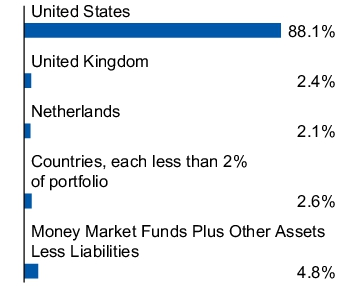

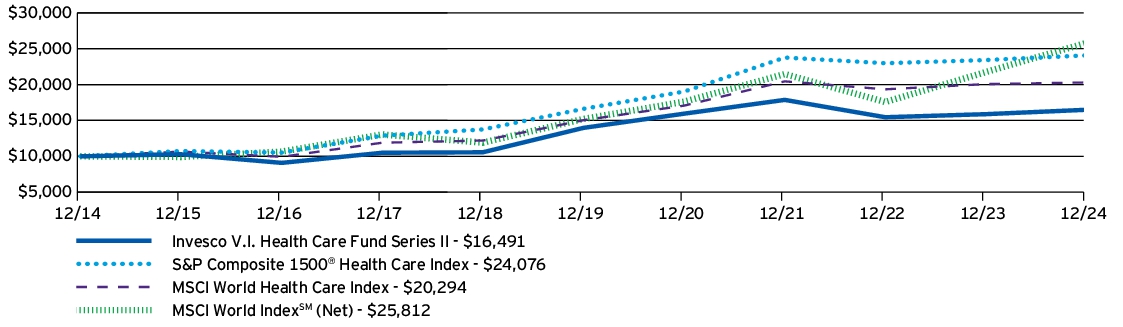

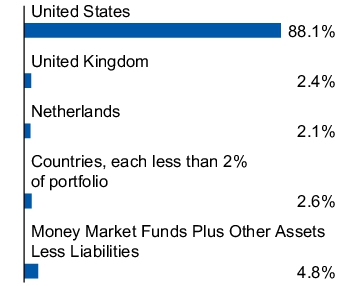

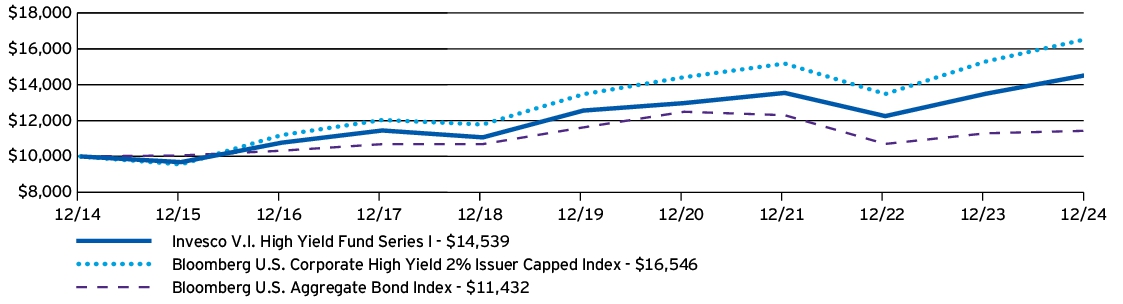

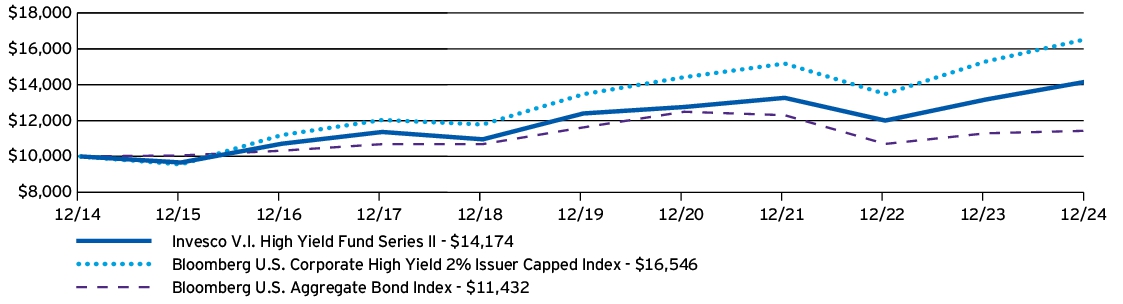

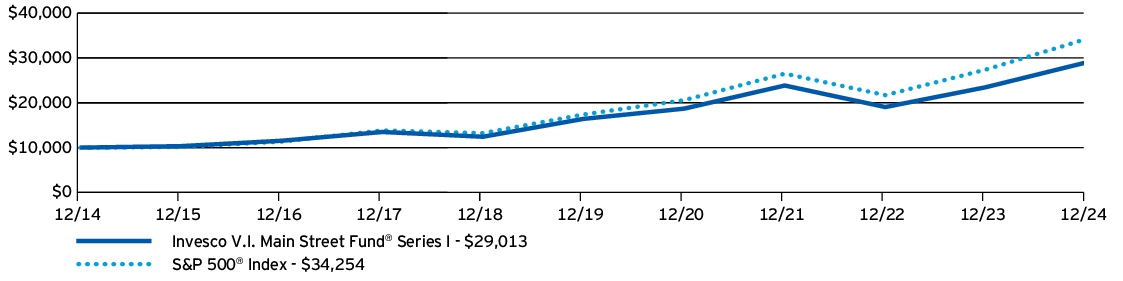

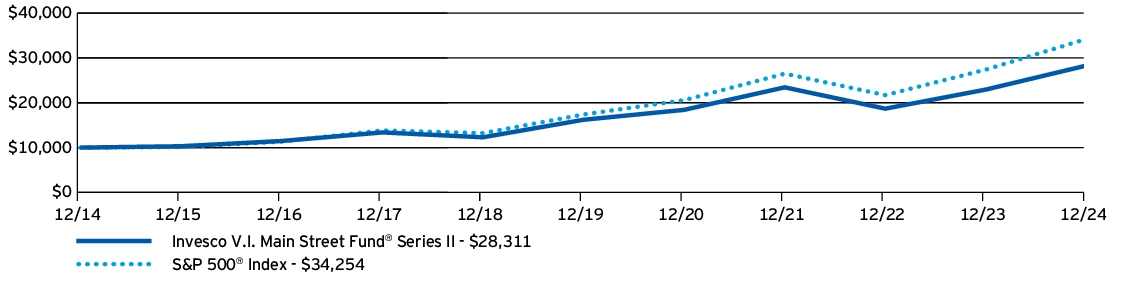

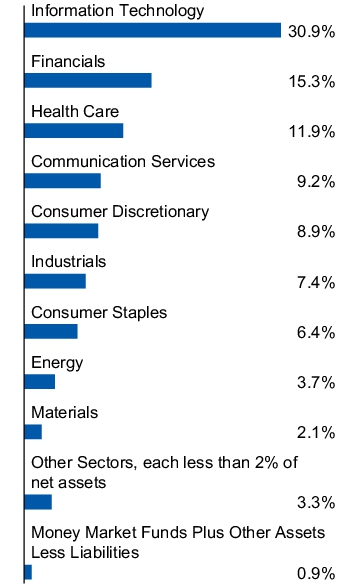

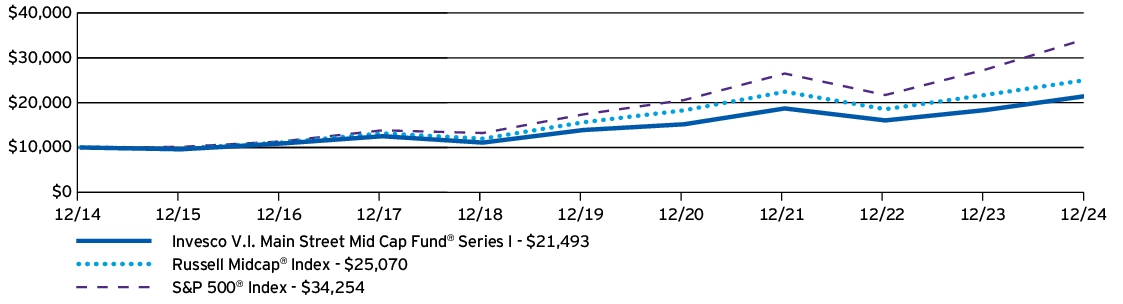

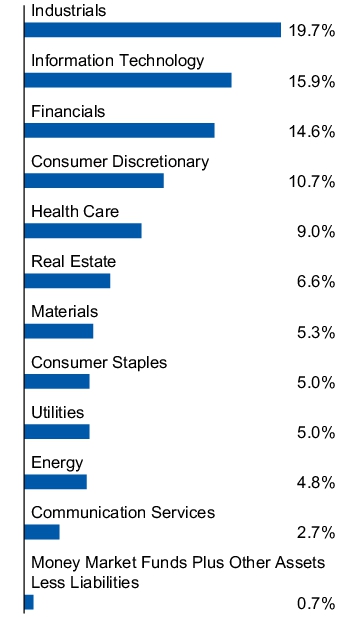

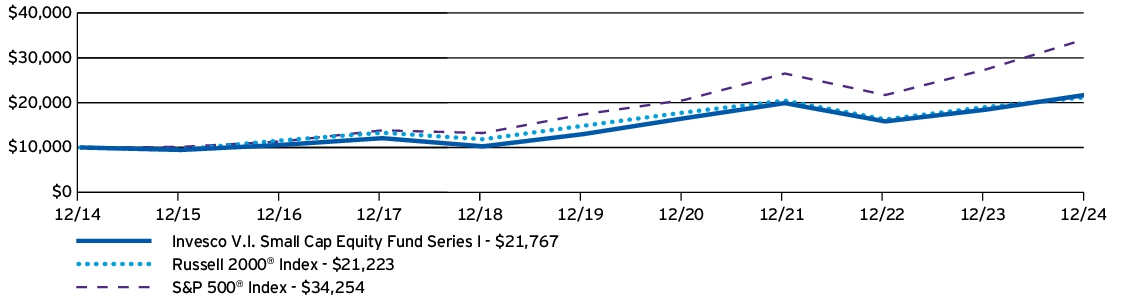

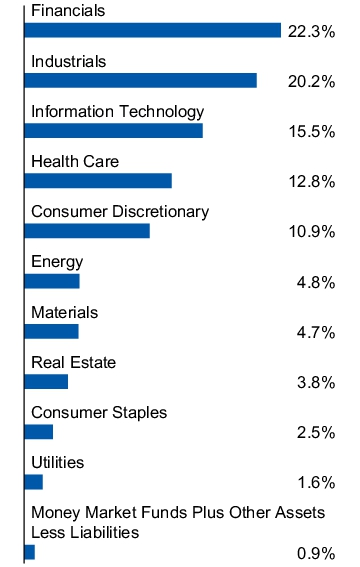

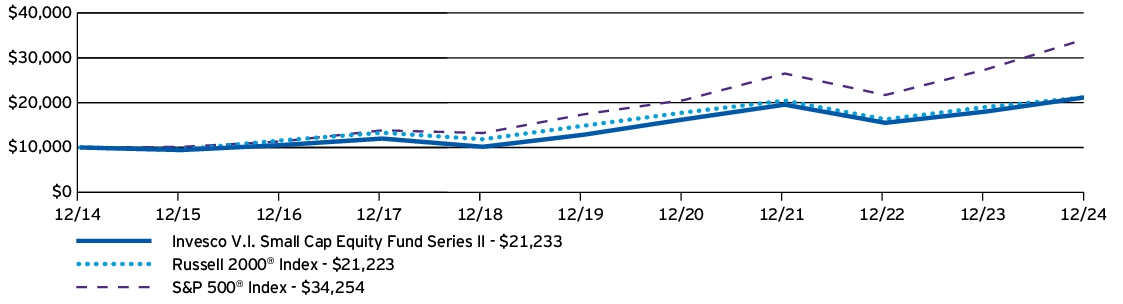

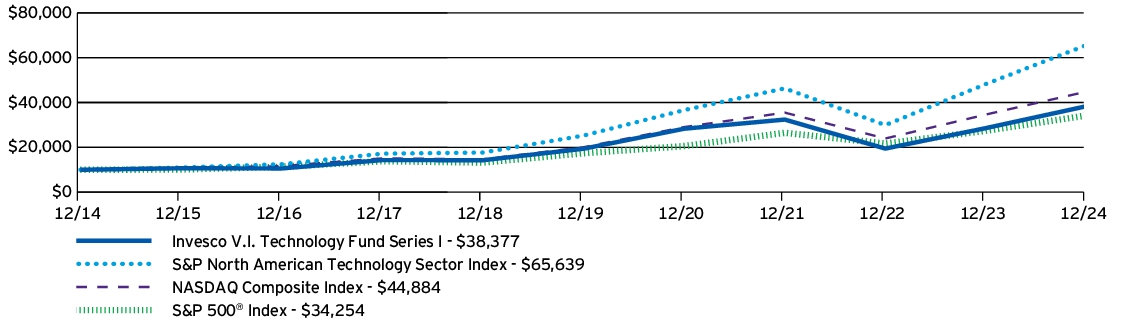

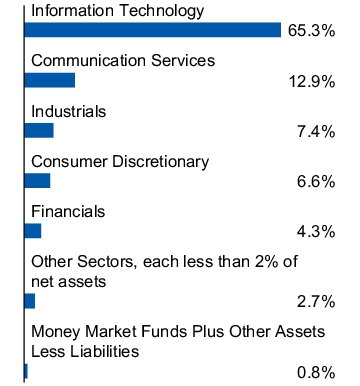

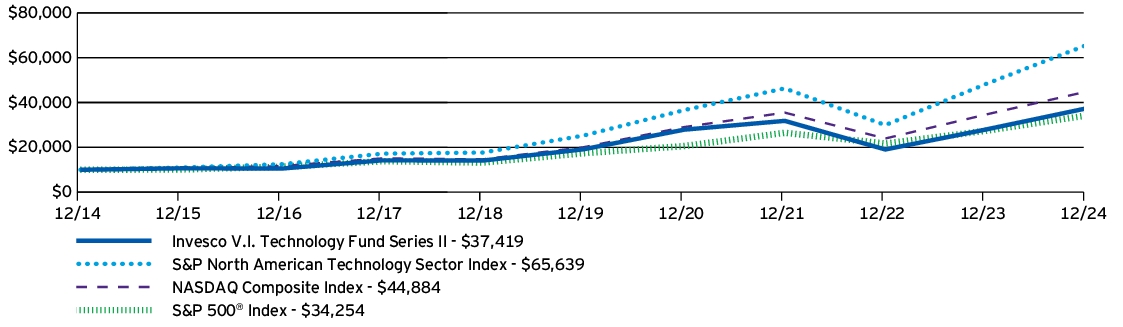

for more recent performance information.