UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07452

AIM Variable Insurance Funds

(Invesco Variable Insurance Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 12/31

Date of reporting period: 12/31/22

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

(b) Not applicable.

| | |

| | |

| Annual Report to Shareholders | | December 31, 2022 |

Invesco V.I. American Franchise Fund

The Fund provides a complete list of its portfolio holdings four times each year, at the end of each fiscal quarter. For the second and fourth quarters, the list appears, respectively, in the Fund’s semiannual and annual reports to shareholders. For the first and third quarters, the Fund files the list with the Securities and Exchange Commission (SEC) as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT filings are available on the SEC website, sec.gov. The SEC file numbers for the Fund are 811-07452 and 033-57340. The Fund’s most recent portfolio holdings, as filed on Form N-PORT, have also been made available to insurance companies issuing variable annuity contracts and variable life insurance policies (“variable products”) that invest in the Fund.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, from our Client Services department at 800 959 4246 or at invesco.com/corporate/about-us/ esg. The information is also available on the SEC website, sec.gov.

Information regarding how the Fund voted proxies related to its portfolio securities during the most recent 12-month period ended June 30 is available at invesco.com/proxysearch. The information is also available on the SEC website, sec.gov.

Invesco Advisers, Inc. is an investment adviser; it provides investment advisory services to individual and institutional clients and does not sell securities. Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s retail mutual funds, exchange-traded funds and institutional money market funds. Both are wholly owned, indirect subsidiaries of Invesco Ltd.

This report must be accompanied or preceded by a currently effective Fund prospectus and variable product prospectus, which contain more complete information, including sales charges and expenses. Investors should read each carefully before investing.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

| | |

| Invesco Distributors, Inc. | | VK-VIAMFR-AR-1 |

Management’s Discussion of Fund Performance

| | | | |

| |

Performance summary | |

For the year ended December 31, 2022, Series I shares of Invesco V.I. American Franchise Fund (the Fund) underperformed the Russell 1000 Growth Index, the Fund’s style-specific benchmark. | |

Your Fund’s long-term performance appears later in this report. | |

| |

Fund vs. Indexes | |

Total returns, 12/31/21 to 12/31/22, excluding variable product issuer charges. If variable product issuer charges were included, returns would be lower. | |

Series I Shares | | | -31.11 | % |

Series II Shares | | | -31.30 | |

S&P 500 Index▼ (Broad Market Index) | | | -18.11 | |

Russell 1000 Growth Index▼ (Style-Specific Index) | | | -29.14 | |

Lipper VUF Large-Cap Growth Funds Index∎ (Peer Group Index) | | | -34.12 | |

| |

Source(s): ▼RIMES Technologies Corp.; ∎ Lipper Inc. | | | | |

Market conditions and your Fund

Equity markets declined in the first quarter of 2022 amid volatility sparked by Russia’s invasion of Ukraine, rising commodity prices, rampant global inflation and the US Federal Reserve’s (the Fed) shift toward tighter monetary policy. Russia’s invasion exacerbated inflation pressures, disrupting already strained supply chains and increasing shortages of oil, gas and raw materials. The price of oil rose sharply, with crude prices reaching their highest price per barrel since 2008.1 Inflation continued to be a top concern for consumers, investors and the Fed. To combat inflation, the Fed raised the federal funds rate by one-quarter percentage point in March and indicated it would “taper” its asset purchase program quickly.2

As the war in Ukraine continued and corporate earnings in high-profile names like Netflix reported slowing growth and profits, the equity markets sold off for much of April 2022. The downward direction of the equity markets continued into the second quarter of 2022 amid substantial inflation, rising interest rates and an increasing likelihood of a US recession. Driven by higher food and energy prices, the consumer price index rose by yet another 40-year high to 8.6% for the twelve months ended May 2022.3 Oil prices peaked near $122 per barrel in early June, resulting in skyrocketing gasoline prices; the national average price reached a record high, above $5 per gallon in early June.1 In an effort to tame inflation, the Fed raised the benchmark federal funds rate three more times, by 0.50% in May, by 0.75% in June and another 0.75% in July, which were the largest increases in nearly 30 years.2 US equity markets rose in July and August until Fed chairman Jerome Powell’s hawkish comments at an economic policy symposium held in Jackson Hole, which sparked a sharp selloff at month-end. The Fed reiterated that it would continue taking aggressive action to curb inflation, even though such measures could “bring pain to households and businesses,” and the Fed raised the benchmark federal funds rate by another 0.75% in September.2

After experiencing a sharp drop in September 2022, US equity markets rebounded in October and November,4 despite mixed data on the economy and corporate earnings. However, the Fed’s message of continued rate hikes until data shows inflation meaningfully declining, sent markets lower in December.4 As energy prices declined,1 the rate of inflation slowed modestly in the fourth quarter.3 Corporate earnings generally met expectations, though companies provided cautious future guidance. With inflation still at multi-decade highs and little evidence of a slowing economy, the Fed raised its target rate by 0.75% in November and by 0.50% in December, marking its highest level in over a decade.2

In this environment, US stocks had negative double-digit returns for the fiscal year of -18.11%, as measured by the S&P 500 Index.4

Given headwinds on all equities and especially those equities that are more growth-oriented, the Fund produced a negative return for the fiscal year. Performance relative to its peer group benchmark, the Lipper VUF Large-Cap Growth Funds Index, was positive; however, the Fund underperformed its style-specific benchmark, the Russell 1000 Growth Index. Relative underperformance to the Russell 1000 Growth Index was driven by stock selection in the information technology (IT) sector, as well as stock selection and underweight exposure to the consumer staples sector. Stock selection in the consumer discretionary and financials sectors also detracted. Stock selection and an overweight exposure in the energy sector, as well as stock selection in the communication services and materials sectors, were beneficial to relative returns.

The top individual detractors from an absolute perspective during the fiscal year included Amazon.com and Alphabet and the top relative detractor was Farfetch.

Amazon.com is the leading global e-commerce platform, positioned to become the leading aggregator of merchandise, content and services – an “everything on demand” platform. Amazon.com is also the

leading cloud infrastructure company, through its Amazon Web Services (AWS) division, poised to capture significant technology spending and has high profit margin opportunities in advertising and numerous other investments. The stock struggled for much of the fiscal year as investors waited for the previously strong comparison periods during the height of COVID-19 lockdowns to pass and as investor interest has waned for higher-growth, longer-duration stocks. Amazon.com also wrestled with excess capacity in terms of labor and warehouses, which we believed would be transitory and lessen the need for their typical ramp before the holiday season. Towards the end of the fiscal year, Amazon.com’s third quarter earnings report showed slower than expected growth in their AWS division as well as weaker AWS margins given rising wage and energy costs. Amazon.com also lowered fourth quarter guidance that implied slowing retail into the holidays. We believed, and recent industry checks have shown, that their outlook may have been too conservative as consumption was strong during the holidays.

Search engine and video sharing platform Alphabet has largely been resilient amid increasing macro-economic headwinds delivering better than feared earnings results. Nevertheless, there have been growing concerns surrounding the company including increasing advertising inventory as over-the-top streaming names such as Netflix and Disney+ (not a fund holding) rolled out ad-supported versions of their services. This has the potential to shift a portion of advertising budgets towards other platforms at the expense of Alphabet. Additionally, as companies contend with a slowing economy, many are scaling back advertising spending, which is Alphabet’s primary source of revenue. Towards the end of the fiscal year, National Football League (NFL) and Google announced that they reached a multi-year agreement for YouTube TV to be the exclusive distributor for NFL Sunday Ticket. We believe Alphabet may have overpaid and therefore the company will need to make up the difference in ads or risk compressing margins.

Farfetch is emerging as the leading global platform for online luxury goods aggregating 1,400+ luxury brands. During the fiscal year, Farfetch reached a long-waited agreement with Italian luxury titan Richemont (not a fund holding) for 47.5% of YOOX Net-A-Porter, Richemont’s competing online business, which is expected to scale Farfetch’s operations significantly. Unfortunately, the terms for the Richemont transaction were disappointing to investors with a lower expected take rate, or percentage of sales that Farfetch will collect for the online sales. We sold the stock towards the end of the fiscal year.

Top individual contributors on an absolute basis during the fiscal year included Schlumberger, Occidental Petroleum and APA Corporation.

|

| Invesco V.I. American Franchise Fund |

Energy was the one bright spot among economic sectors for the fiscal year, returning double-digit returns overall. Schlumberger and Occidental Petroleum benefited from the tailwinds that lifted energy companies levered to oil and natural gas prices during the fiscal year. Both companies boosted their dividend during the fiscal year in an industry-wide trend of returning capital to shareholders. Occidental Petroleum also announced a $3 billion share buyback and additional plans to pay down its debt. This caught the eye of famed investor, Warren Buffett, who purchased a 15% stake in the company. Occidental Petroleum was sold from the portfolio during the fiscal year.

APA Corporation, commonly referred to as Apache, is a North American oil and gas producer and has benefited from several factors that have driven the price of oil and natural gas higher. Among them have been a resurgence in demand for oil as economies reopened following COVID-19 lockdowns, the willingness of OPEC (Organization of the Petroleum Exporting Countries) to temper its production capacity if oil prices fell too sharply, Russia cutting off supply of natural gas to Europe by shuttering its Nord Stream pipeline and China’s dovish central bank taking stimulative measures to boost economic growth. APA Corporation also announced they struck oil and gas off the coast of Suriname, which was well received by investors. We exited our position in APA Corporation during the fiscal year.

At the close of the fiscal year, the largest overweight sector exposures included communication services, primarily video game developers which offer lower relative beta and are fairly recession-resistant, and health care, given the sector’s defensive characteristics. IT is the largest underweight, primarily due to significant index exposure in Apple and to a lesser degree Microsoft, but we have also chosen to underweight higher valuation/high growth IT services stocks and semiconductors.

We believe inflation has peaked and will continue to cool, especially as consumers and enterprises scale back in the face of tighter conditions. We expect the economy will slow and growth will become scarce. In our opinion, when broad economic growth becomes scarce, companies that can grow via their own fundamental merit, such as through disruption and market share shifts, tend to have an advantage. However, we believe tighter financial conditions, increased technology regulation and significant commodity constraints will be headwinds. As a result, we are cautious on cash flows and margin stability and continue to evaluate the likelihood for earnings revisions. Looking forward, we see compelling opportunities for secular growers at attractive valuations.

Longer term, we believe that change is the fuel for growth and portfolios, thus we generally seek “share-takers”, companies that can gain market share through technology-enabled advantages in their business models and with offerings that benefit from the continued

disruptive shifts in enterprise and consumer behavior.

Thank you for your commitment to the Invesco V.I. American Franchise Fund and for sharing our long-term investment horizon.

Effective November 28, 2022, Ron Zibelli joined the Invesco V.I. American Franchise Fund as lead portfolio manager. Erik Voss and Ido Cohen will remain portfolio managers, however, Erik announced his plans to retire on June 30, 2023.

1 Source: Bloomberg LP

2 Source: US Federal Reserve

3 Source: US Bureau of Labor Statistics

4 Source: Lipper Inc.

Portfolio manager(s):

Ido Cohen

Erik Voss

Ronald Zibelli - Lead

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

|

| Invesco V.I. American Franchise Fund |

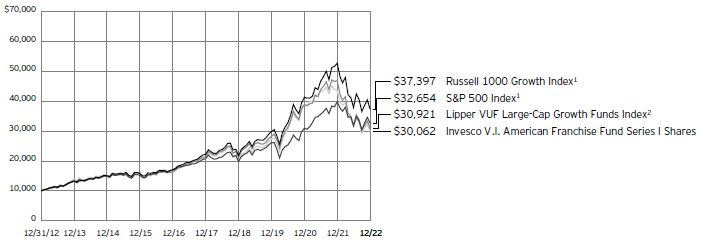

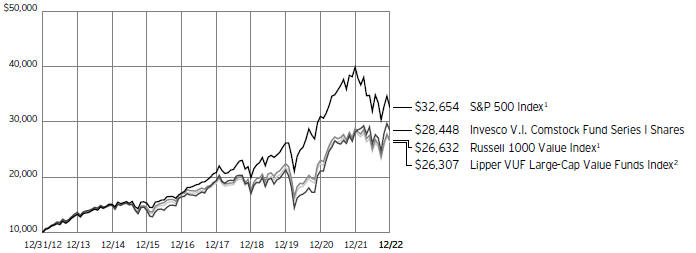

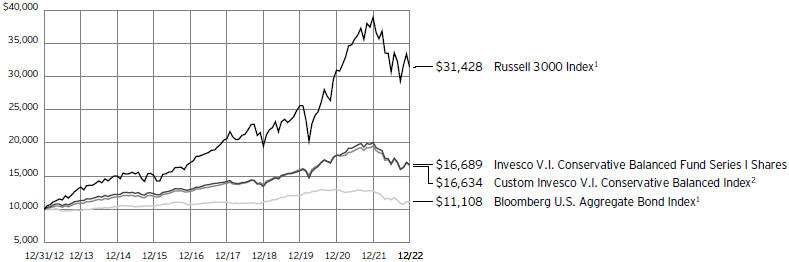

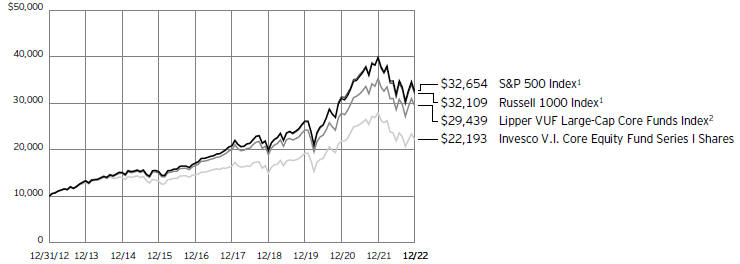

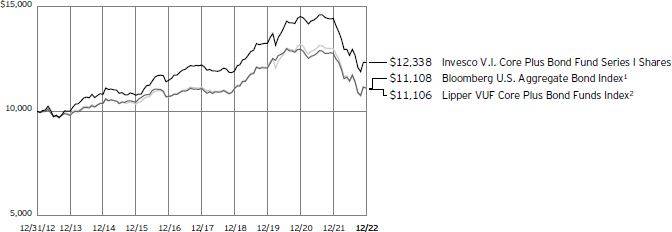

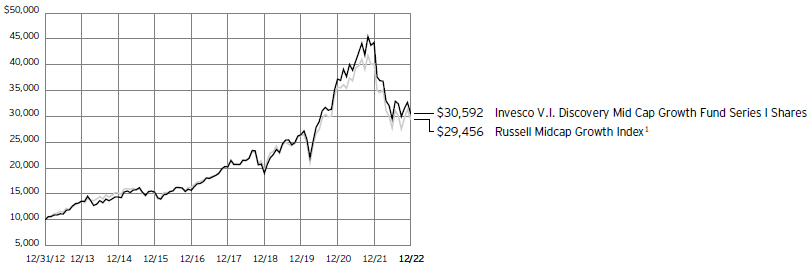

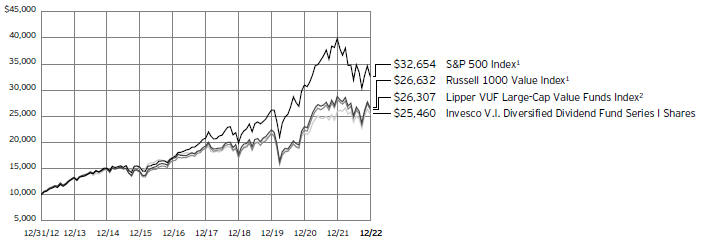

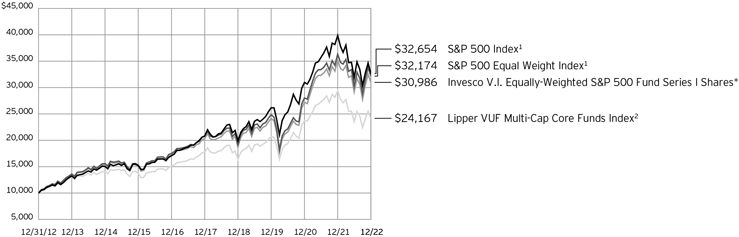

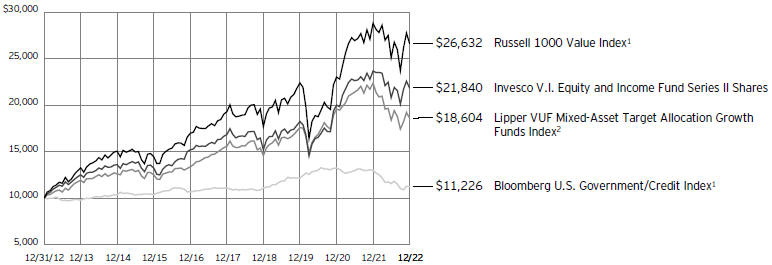

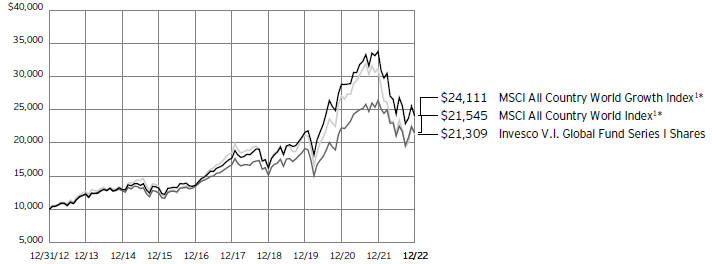

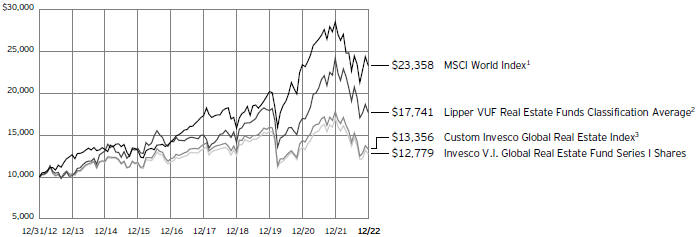

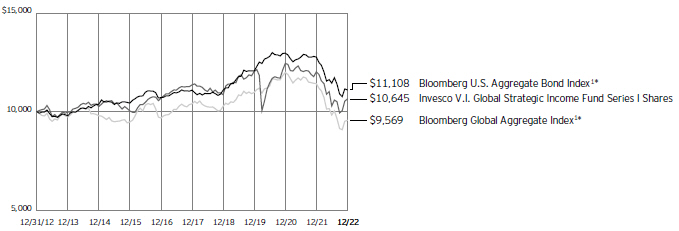

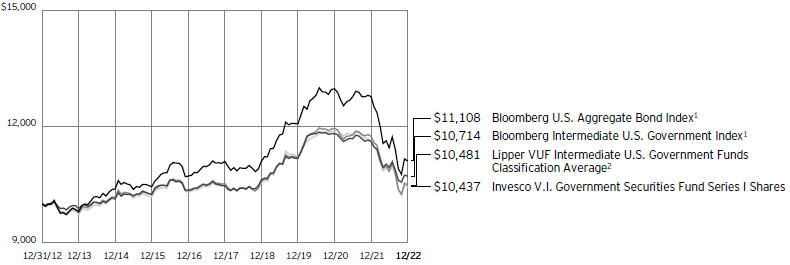

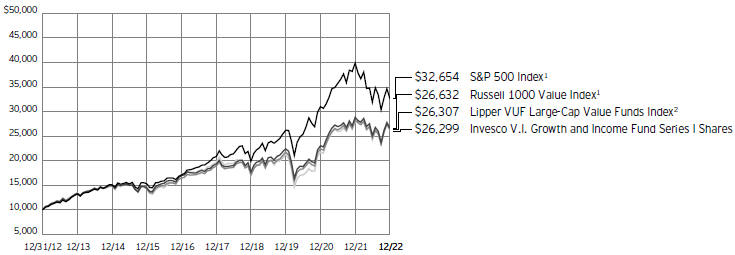

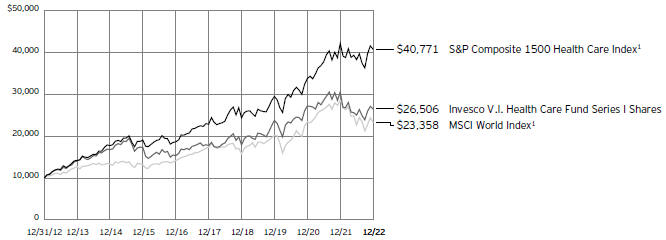

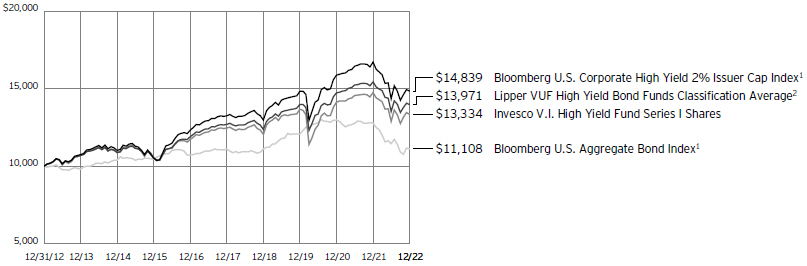

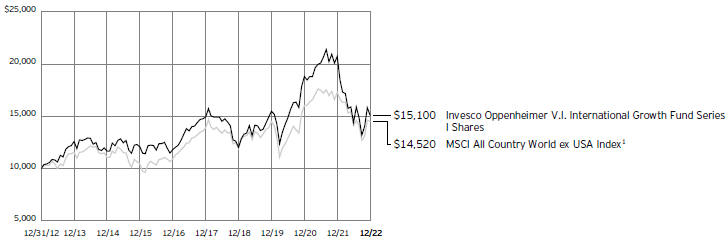

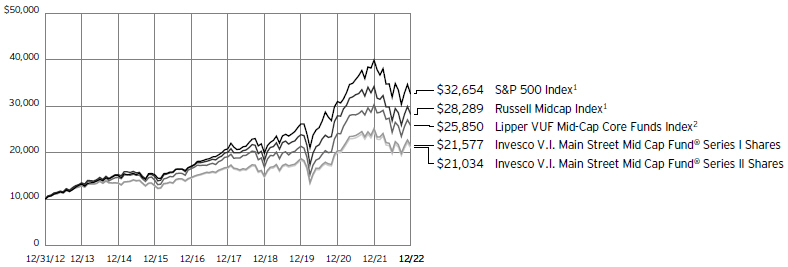

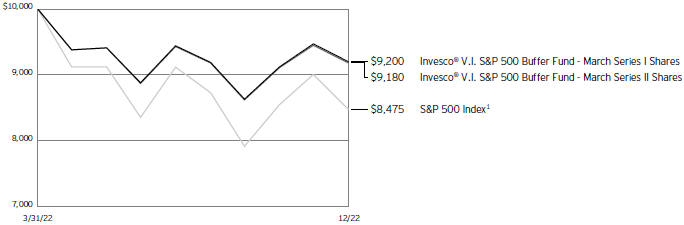

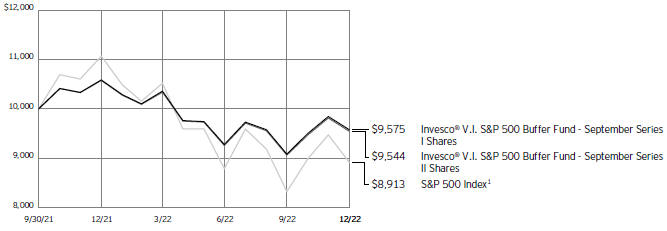

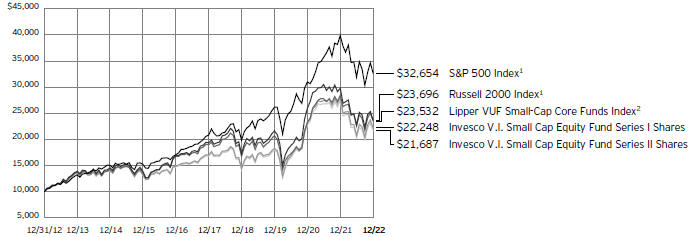

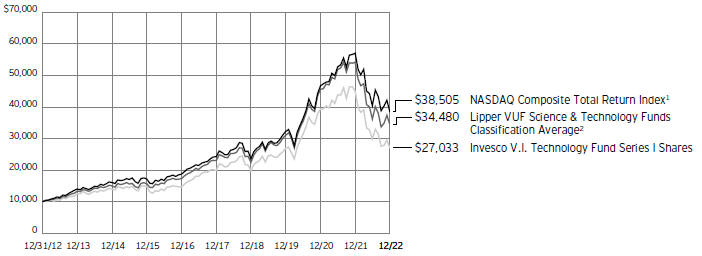

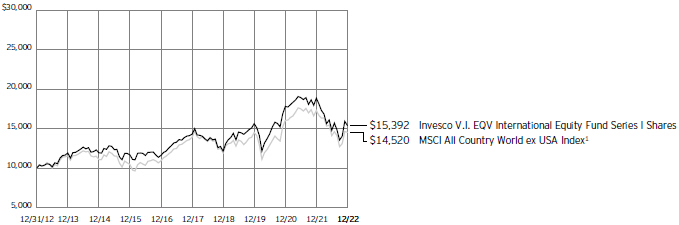

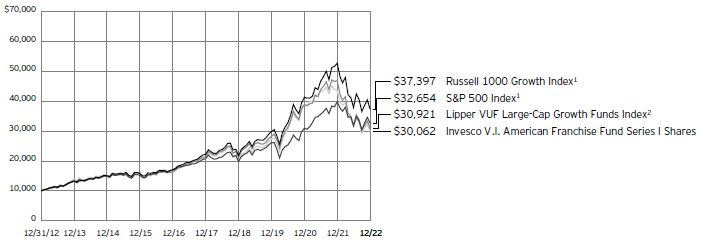

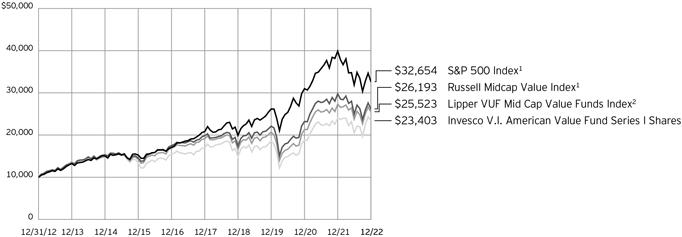

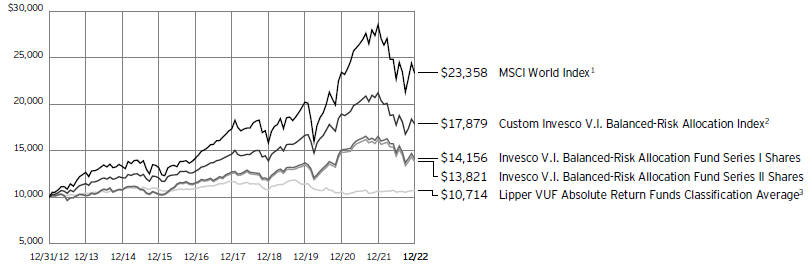

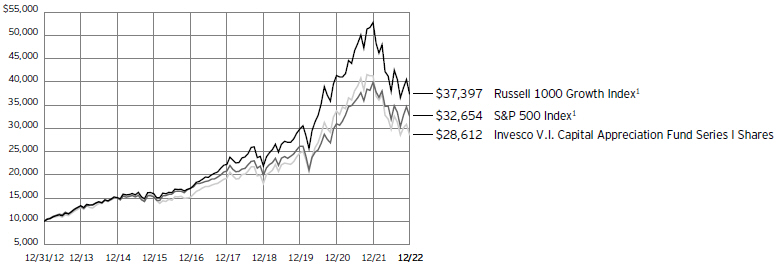

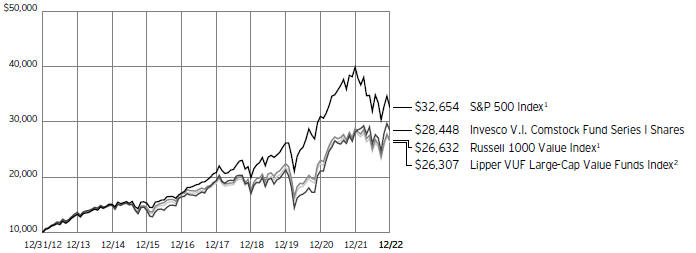

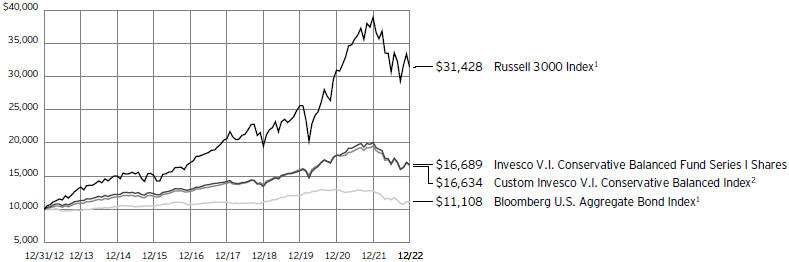

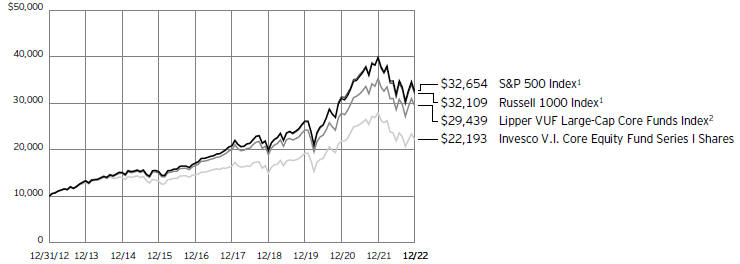

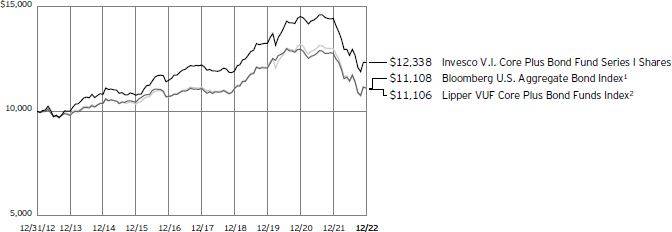

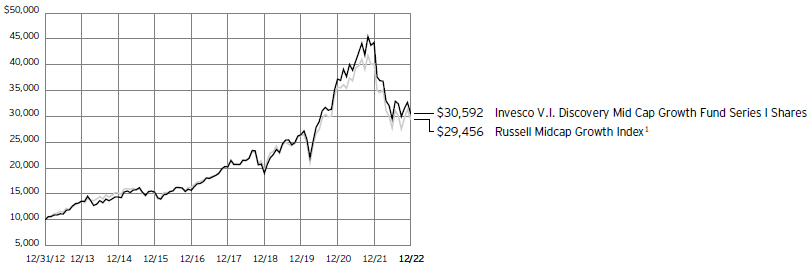

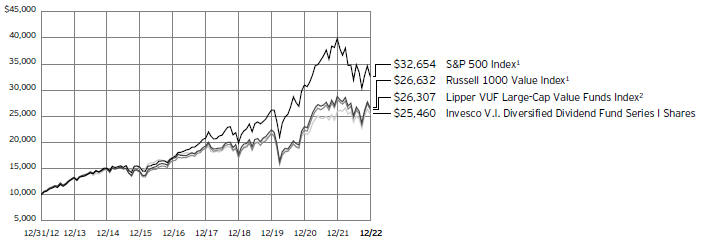

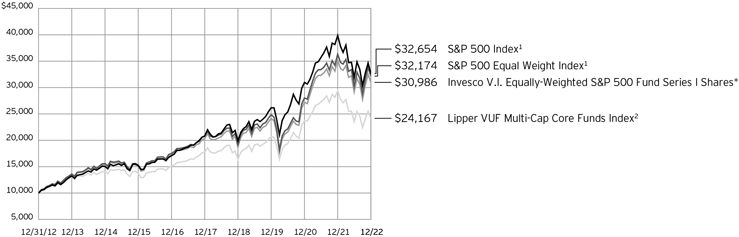

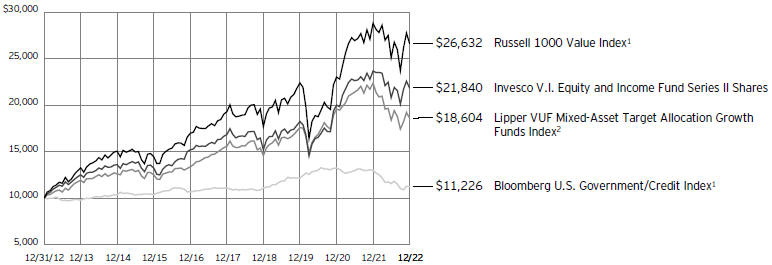

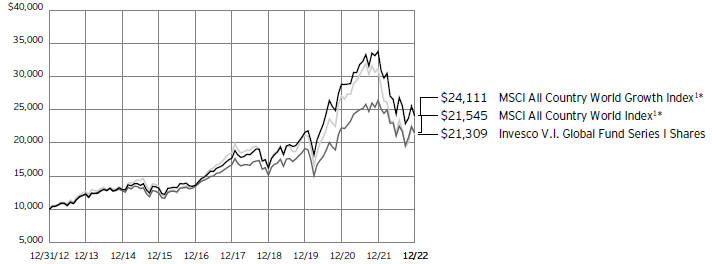

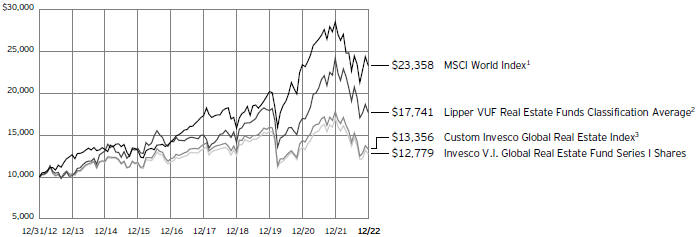

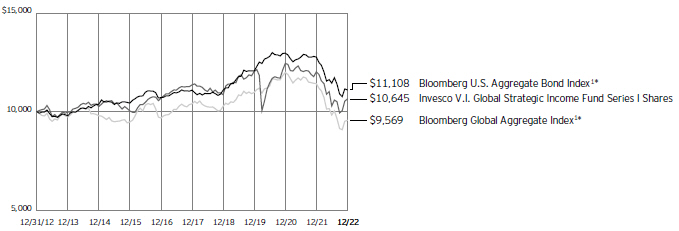

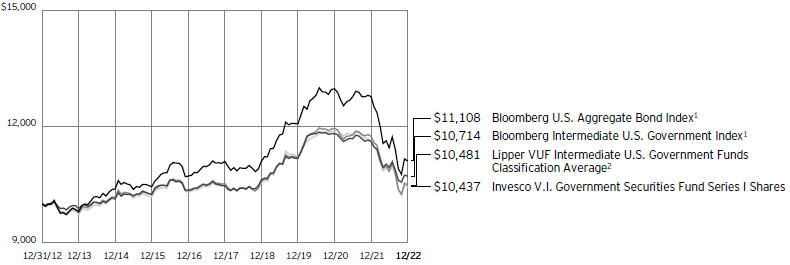

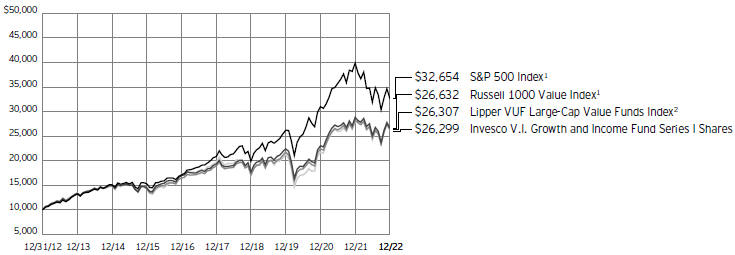

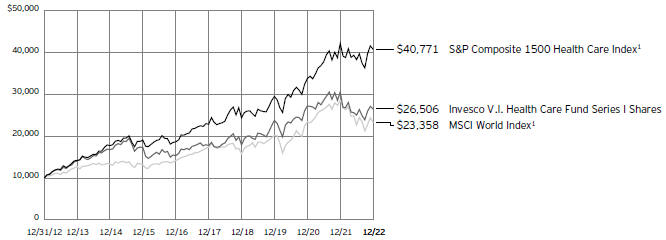

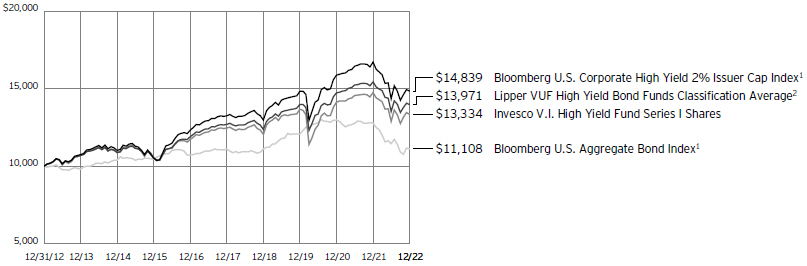

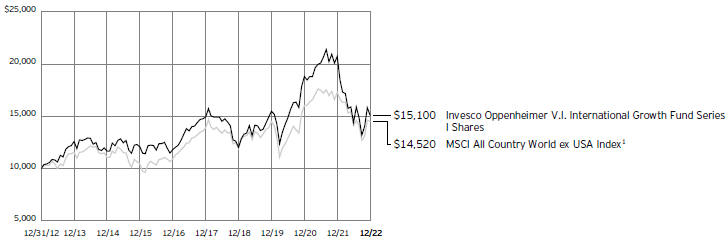

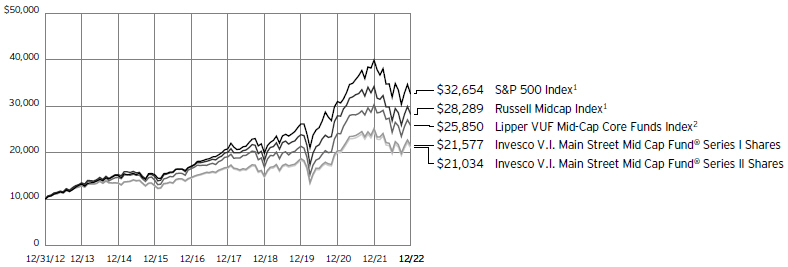

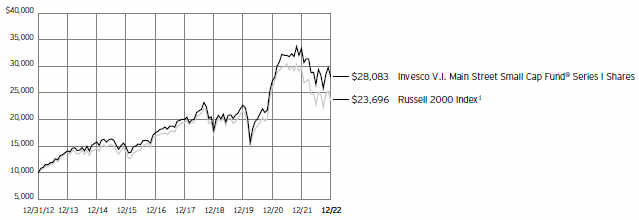

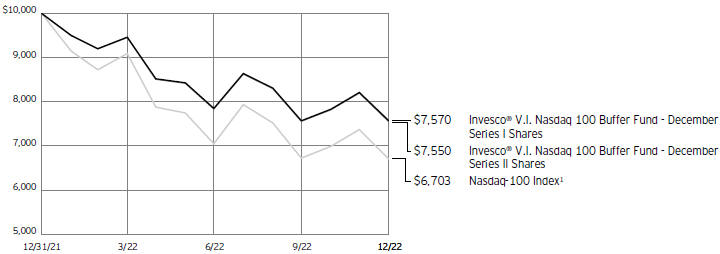

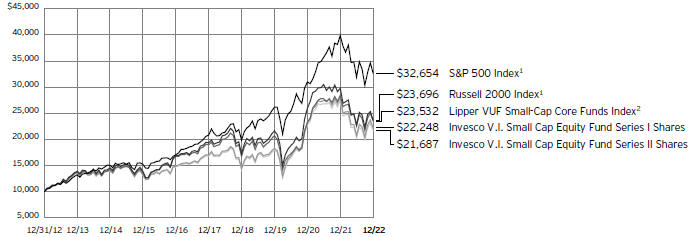

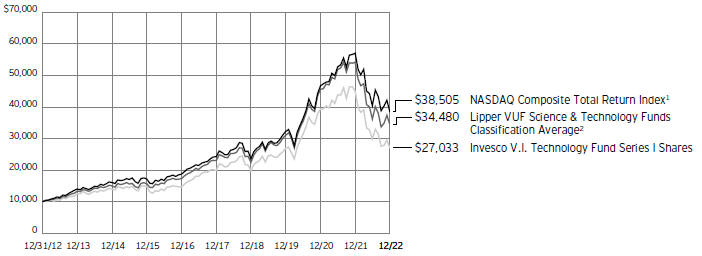

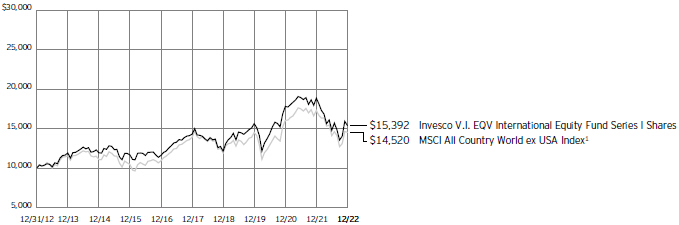

Your Fund’s Long-Term Performance

Results of a $10,000 Investment — Oldest Share Class(es)

Fund and index data from 12/31/12

1 Source: RIMES Technologies Corp.

2 Source: Lipper Inc.

Past performance cannot guarantee future results.

| | | | |

| |

Average Annual Total Returns | |

As of 12/31/22 | |

Series I Shares | | | | |

Inception (7/3/95) | | | 9.14 | % |

10 Years | | | 11.64 | |

5 Years | | | 7.66 | |

1 Year | | | -31.11 | |

| |

Series II Shares | | | | |

Inception (9/18/00) | | | 3.06 | % |

10 Years | | | 11.35 | |

5 Years | | | 7.39 | |

1 Year | | | -31.30 | |

Effective June 1, 2010, Class I and Class II shares of the predecessor fund, Van Kampen Life Investment Trust Capital Growth Portfolio, advised by Van Kampen Asset management were reorganized into Series I and Series II shares, respectively, of Invesco Van Kampen V.I. Capital Growth Fund (renamed Invesco V.I. American Franchise Fund on April 29, 2013). Returns shown above, prior to June 1, 2010, for Series I and Series II shares are those of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please contact your variable product issuer or financial adviser for the most recent month-end variable product performance. Performance figures reflect Fund expenses, reinvested distributions and changes in net asset value. Performance figures do not reflect deduction

of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Invesco V.I. American Franchise Fund, a series portfolio of AIM Variable Insurance Funds (Invesco Variable Insurance Funds), is currently offered through insurance companies issuing variable products. You cannot purchase shares of the Fund directly. Performance figures given represent the Fund and are not intended to reflect actual variable product values. They do not reflect sales charges, expenses and fees assessed in connection with a variable product. Sales charges, expenses and fees, which are determined by the variable product issuers, will vary and will lower the total return.

The most recent month-end performance at the Fund level, excluding variable product charges, is available at 800 451 4246. As mentioned above, for the most recent month-end performance including variable product charges, please contact your variable product issuer or financial adviser.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

|

| Invesco V.I. American Franchise Fund |

Supplemental Information

Invesco V.I. American Franchise Fund’s investment objective is to seek capital growth.

∎ Unless otherwise stated, information presented in this report is as of December 31, 2022, and is based on total net assets.

∎ Unless otherwise noted, all data is provided by Invesco.

∎ To access your Fund’s reports/prospectus, visit invesco.com/fundreports.

About indexes used in this report

| ∎ | The S&P 500® Index is an unmanaged index considered representative of the US stock market. |

| ∎ | The Russell 1000® Growth Index is an unmanaged index considered representative of large-cap growth stocks. The Russell 1000 Growth Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. |

| ∎ | The Lipper VUF Large-Cap Growth Funds Index is an unmanaged index considered representative of large-cap growth variable insurance underlying funds tracked by Lipper. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

|

| Invesco V.I. American Franchise Fund |

Fund Information

Portfolio Composition

| | | | | |

| By sector | | % of total net assets |

| |

Information Technology | | | | 36.56 | % |

| |

Health Care | | | | 17.54 | |

| |

Consumer Discretionary | | | | 13.73 | |

| |

Communication Services | | | | 10.12 | |

| |

Industrials | | | | 7.46 | |

| |

Consumer Staples | | | | 3.81 | |

| |

Financials | | | | 3.02 | |

| |

Energy | | | | 2.81 | |

| |

Other Sectors, Each Less than 2% of Net Assets | | | | 1.75 | |

| |

Money Market Funds Plus Other Assets Less Liabilities | | | | 3.20 | |

Top 10 Equity Holdings*

| | | | | | | |

| | | | | % of total net assets |

| | |

1. | | Microsoft Corp. | | | | 9.75 | % |

| | |

2. | | Apple, Inc. | | | | 5.39 | |

| | |

3. | | Amazon.com, Inc. | | | | 5.36 | |

| | |

4. | | Alphabet, Inc., Class A | | | | 4.52 | |

| | |

5. | | Visa, Inc., Class A | | | | 4.18 | |

| | |

6. | | NVIDIA Corp. | | | | 3.38 | |

| | |

7. | | UnitedHealth Group, Inc. | | | | 3.06 | |

| | |

8. | | Bayer AG | | | | 2.81 | |

| | |

9. | | AbbVie, Inc. | | | | 1.68 | |

| | |

10. | | Teledyne Technologies, Inc. | | | | 1.50 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

| * | Excluding money market fund holdings, if any. |

Data presented here are as of December 31, 2022.

|

| Invesco V.I. American Franchise Fund |

Schedule of Investments(a)

December 31, 2022

| | | | | | | | |

| | | Shares | | | Value | |

|

| |

Common Stocks & Other Equity Interests–96.80% | |

Advertising–0.54% | |

Trade Desk, Inc. (The), Class A(b) | | | 67,426 | | | $ | 3,022,708 | |

|

| |

|

Aerospace & Defense–2.05% | |

Airbus SE (France) | | | 30,524 | | | | 3,629,373 | |

|

| |

Lockheed Martin Corp. | | | 16,035 | | | | 7,800,867 | |

|

| |

| | | | | | | 11,430,240 | |

|

| |

|

Agricultural & Farm Machinery–1.39% | |

Deere & Co.(c) | | | 18,072 | | | | 7,748,551 | |

|

| |

|

Aluminum–0.51% | |

Alcoa Corp. | | | 62,063 | | | | 2,822,005 | |

|

| |

|

Application Software–5.35% | |

HubSpot, Inc.(b) | | | 3,173 | | | | 917,410 | |

|

| |

Intuit, Inc. | | | 21,443 | | | | 8,346,044 | |

|

| |

Paycom Software, Inc.(b) | | | 19,698 | | | | 6,112,486 | |

|

| |

Roper Technologies, Inc. | | | 9,854 | | | | 4,257,815 | |

|

| |

Synopsys, Inc.(b) | | | 18,856 | | | | 6,020,532 | |

|

| |

Workday, Inc., Class A(b)(c) | | | 25,053 | | | | 4,192,119 | |

|

| |

| | | | | | | 29,846,406 | |

|

| |

|

Asset Management & Custody Banks–0.36% | |

KKR & Co., Inc., Class A(c) | | | 42,871 | | | | 1,990,072 | |

|

| |

|

Automobile Manufacturers–0.64% | |

General Motors Co. | | | 78,106 | | | | 2,627,486 | |

|

| |

Tesla, Inc.(b) | | | 7,826 | | | | 964,007 | |

|

| |

| | | | | | | 3,591,493 | |

|

| |

|

Automotive Retail–1.01% | |

O’Reilly Automotive, Inc.(b) | | | 6,654 | | | | 5,616,176 | |

|

| |

|

Biotechnology–3.69% | |

AbbVie, Inc.(c) | | | 57,928 | | | | 9,361,744 | |

|

| |

BioMarin Pharmaceutical, Inc.(b) | | | 55,728 | | | | 5,767,291 | |

|

| |

Neurocrine Biosciences, Inc.(b) | | | 19,756 | | | | 2,359,656 | |

|

| |

Regeneron Pharmaceuticals, Inc.(b) | | | 4,351 | | | | 3,139,203 | |

|

| |

| | | | | | | 20,627,894 | |

|

| |

|

Casinos & Gaming–1.51% | |

Las Vegas Sands Corp.(b)(c) | | | 121,381 | | | | 5,834,784 | |

|

| |

Penn Entertainment, Inc.(b)(c) | | | 87,561 | | | | 2,600,562 | |

|

| |

| | | | | | | 8,435,346 | |

|

| |

|

Construction Machinery & Heavy Trucks–0.48% | |

Caterpillar, Inc.(c) | | | 11,227 | | | | 2,689,540 | |

|

| |

|

Consumer Electronics–0.74% | |

Sony Group Corp. (Japan) | | | 54,200 | | | | 4,133,070 | |

|

| |

|

Copper–0.50% | |

Freeport-McMoRan, Inc. | | | 73,699 | | | | 2,800,562 | |

|

| |

|

Data Processing & Outsourced Services–4.52% | |

Fiserv, Inc.(b) | | | 19,029 | | | | 1,923,261 | |

|

| |

Visa, Inc., Class A(c) | | | 112,219 | | | | 23,314,619 | |

|

| |

| | | | | | | 25,237,880 | |

|

| |

| | | | | | | | |

| | | Shares | | | Value | |

|

| |

Diversified Metals & Mining–0.54% | |

Glencore PLC (Australia) | | | 447,946 | | | $ | 2,995,314 | |

|

| |

|

Diversified Support Services–0.52% | |

Cintas Corp.(c) | | | 6,453 | | | | 2,914,304 | |

|

| |

|

Electrical Components & Equipment–0.45% | |

Rockwell Automation, Inc.(c) | | | 9,760 | | | | 2,513,883 | |

|

| |

|

Electronic Equipment & Instruments–1.50% | |

Teledyne Technologies, Inc.(b) | | | 20,947 | | | | 8,376,915 | |

|

| |

|

Environmental & Facilities Services–0.79% | |

Republic Services, Inc. | | | 34,376 | | | | 4,434,160 | |

|

| |

|

Financial Exchanges & Data–0.21% | |

S&P Global, Inc.(c) | | | 3,491 | | | | 1,169,276 | |

|

| |

|

Food Distributors–1.56% | |

Sysco Corp. | | | 44,440 | | | | 3,397,438 | |

|

| |

US Foods Holding Corp.(b) | | | 156,772 | | | | 5,333,383 | |

|

| |

| | | | | | | 8,730,821 | |

|

| |

|

Food Retail–0.38% | |

HelloFresh SE (Germany)(b) | | | 96,578 | | | | 2,117,321 | |

|

| |

|

General Merchandise Stores–1.28% | |

Dollar General Corp.(c) | | | 8,064 | | | | 1,985,760 | |

|

| |

Target Corp. | | | 34,607 | | | | 5,157,827 | |

|

| |

| | | | | | | 7,143,587 | |

|

| |

|

Health Care Distributors–0.96% | |

AmerisourceBergen Corp. | | | 15,378 | | | | 2,548,288 | |

|

| |

McKesson Corp. | | | 7,421 | | | | 2,783,766 | |

|

| |

| | | | | | | 5,332,054 | |

|

| |

|

Health Care Equipment–2.21% | |

DexCom, Inc.(b)(c) | | | 49,818 | | | | 5,641,390 | |

|

| |

Intuitive Surgical, Inc.(b) | | | 25,308 | | | | 6,715,478 | |

|

| |

| | | | | | | 12,356,868 | |

|

| |

|

Home Improvement Retail–1.26% | |

Lowe’s Cos., Inc.(c) | | | 35,347 | | | | 7,042,536 | |

|

| |

|

Hotels, Resorts & Cruise Lines–0.87% | |

Booking Holdings, Inc.(b) | | | 2,413 | | | | 4,862,871 | |

|

| |

|

Hypermarkets & Super Centers–0.47% | |

Walmart, Inc. | | | 18,325 | | | | 2,598,302 | |

|

| |

|

Insurance Brokers–0.78% | |

Aon PLC, Class A | | | 8,247 | | | | 2,475,255 | |

|

| |

Marsh & McLennan Cos., Inc. | | | 11,375 | | | | 1,882,335 | |

|

| |

| | | | | | | 4,357,590 | |

|

| |

|

Integrated Oil & Gas–0.74% | |

Suncor Energy, Inc. (Canada) | | | 130,688 | | | | 4,146,730 | |

|

| |

|

Interactive Home Entertainment–3.28% | |

Electronic Arts, Inc. | | | 46,276 | | | | 5,654,002 | |

|

| |

Nintendo Co. Ltd. (Japan) | | | 156,000 | | | | 6,532,594 | |

|

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

| Invesco V.I. American Franchise Fund |

| | | | | | | | |

| | | Shares | | | Value | |

|

| |

Interactive Home Entertainment–(continued) | |

Take-Two Interactive Software, Inc.(b) | | | 58,910 | | | $ | 6,134,298 | |

|

| |

| | | | | | | 18,320,894 | |

|

| |

|

Interactive Media & Services–4.86% | |

Alphabet, Inc., Class A(b) | | | 286,247 | | | | 25,255,573 | |

|

| |

Kuaishou Technology (China)(b)(d) | | | 206,700 | | | | 1,853,508 | |

|

| |

| | | | | | | 27,109,081 | |

|

| |

|

Internet & Direct Marketing Retail–6.42% | |

Amazon.com, Inc.(b) | | | 356,186 | | | | 29,919,624 | |

|

| |

JD.com, Inc., ADR (China) | | | 80,396 | | | | 4,512,627 | |

|

| |

MercadoLibre, Inc. (Brazil)(b) | | | 1,675 | | | | 1,417,452 | |

|

| |

| | | | | | | 35,849,703 | |

|

| |

|

Internet Services & Infrastructure–0.55% | |

MongoDB, Inc.(b)(c) | | | 7,369 | | | | 1,450,514 | |

|

| |

Snowflake, Inc., Class A(b)(c) | | | 11,148 | | | | 1,600,184 | |

|

| |

| | | | | | | 3,050,698 | |

|

| |

|

Life Sciences Tools & Services–2.70% | |

Danaher Corp. | | | 19,737 | | | | 5,238,595 | |

|

| |

Mettler-Toledo International, Inc.(b) | | | 3,010 | | | | 4,350,804 | |

|

| |

Thermo Fisher Scientific, Inc.(c) | | | 9,960 | | | | 5,484,872 | |

|

| |

| | | | | | | 15,074,271 | |

|

| |

|

Managed Health Care–3.90% | |

Humana, Inc.(c) | | | 9,135 | | | | 4,678,856 | |

|

| |

UnitedHealth Group, Inc. | | | 32,190 | | | | 17,066,494 | |

|

| |

| | | | | | | 21,745,350 | |

|

| |

|

Movies & Entertainment–1.44% | |

Netflix, Inc.(b)(c) | | | 27,356 | | | | 8,066,737 | |

|

| |

|

Oil & Gas Equipment & Services–1.46% | |

Schlumberger Ltd. | | | 152,900 | | | | 8,174,034 | |

|

| |

|

Oil & Gas Exploration & Production–0.61% | |

ConocoPhillips | | | 11,149 | | | | 1,315,582 | |

|

| |

Diamondback Energy, Inc. | | | 15,301 | | | | 2,092,871 | |

|

| |

| | | | | | | 3,408,453 | |

|

| |

|

Pharmaceuticals–4.08% | |

Bayer AG (Germany) | | | 303,444 | | | | 15,667,566 | |

|

| |

Eli Lilly and Co. | | | 19,381 | | | | 7,090,345 | |

|

| |

| | | | | | | 22,757,911 | |

|

| |

|

Property & Casualty Insurance–1.41% | |

Chubb Ltd. | | | 15,784 | | | | 3,481,950 | |

|

| |

Progressive Corp. (The) | | | 33,756 | | | | 4,378,491 | |

|

| |

| | | | | | | 7,860,441 | |

|

| |

|

Regional Banks–0.26% | |

SVB Financial Group(b)(c) | | | 6,324 | | | | 1,455,405 | |

|

| |

|

Semiconductor Equipment–1.15% | |

ASML Holding N.V., New York Shares (Netherlands) | | | 4,859 | | | | 2,654,957 | |

|

| |

Enphase Energy, Inc.(b)(c) | | | 14,281 | | | | 3,783,894 | |

|

| |

| | | | | | | 6,438,851 | |

|

| |

| | | | | | | | |

| | | Shares | | | Value | |

|

| |

Semiconductors–6.67% | |

Advanced Micro Devices, Inc.(b) | | | 107,054 | | | $ | 6,933,887 | |

|

| |

Marvell Technology, Inc. | | | 120,870 | | | | 4,477,025 | |

|

| |

Monolithic Power Systems, Inc.(c) | | | 19,588 | | | | 6,926,513 | |

|

| |

NVIDIA Corp.(c) | | | 129,326 | | | | 18,899,702 | |

|

| |

| | | | | | | 37,237,127 | |

|

| |

|

Soft Drinks–1.40% | |

Monster Beverage Corp.(b)(c) | | | 77,176 | | | | 7,835,679 | |

|

| |

|

Specialized REITs–0.20% | |

Crown Castle, Inc. | | | 8,404 | | | | 1,139,919 | |

|

| |

|

Systems Software–11.43% | |

Microsoft Corp. | | | 226,948 | | | | 54,426,669 | |

|

| |

Palo Alto Networks, Inc.(b)(c) | | | 9,969 | | | | 1,391,074 | |

|

| |

ServiceNow, Inc.(b) | | | 20,584 | | | | 7,992,150 | |

|

| |

| | | | | | | 63,809,893 | |

|

| |

|

Technology Hardware, Storage & Peripherals–5.39% | |

Apple, Inc. | | | 231,518 | | | | 30,081,134 | |

|

| |

|

Trading Companies & Distributors–1.06% | |

Fastenal Co. | | | 59,109 | | | | 2,797,038 | |

|

| |

United Rentals, Inc.(b)(c) | | | 8,798 | | | | 3,126,985 | |

|

| |

| | | | | | | 5,924,023 | |

|

| |

|

Trucking–0.72% | |

Knight-Swift Transportation Holdings, Inc.(c) | | | 64,881 | | | | 3,400,413 | |

|

| |

Uber Technologies, Inc.(b) | | | 25,322 | | | | 626,213 | |

|

| |

| | | | | | | 4,026,626 | |

|

| |

Total Common Stocks & Other Equity Interests

(Cost $410,332,157) | | | | 540,450,705 | |

|

| |

|

Money Market Funds–2.37% | |

Invesco Government & Agency Portfolio, Institutional Class,

4.22%(e)(f) | | | 4,623,993 | | | | 4,623,993 | |

|

| |

Invesco Liquid Assets Portfolio, Institutional Class, 4.42%(e)(f) | | | 3,296,757 | | | | 3,297,746 | |

|

| |

Invesco Treasury Portfolio, Institutional Class, 4.20%(e)(f) | | | 5,284,563 | | | | 5,284,563 | |

|

| |

Total Money Market Funds

(Cost $13,206,217) | | | | 13,206,302 | |

|

| |

TOTAL INVESTMENTS IN SECURITIES (excluding investments purchased with cash collateral from securities on loan)-99.17%

(Cost $423,538,374) | | | | 553,657,007 | |

|

| |

|

Investments Purchased with Cash Collateral from Securities on Loan | |

Money Market Funds–17.72% | |

Invesco Private Government Fund,

4.28%(e)(f)(g) | | | 27,699,594 | | | | 27,699,594 | |

|

| |

Invesco Private Prime Fund,

4.46%(e)(f)(g) | | | 71,206,166 | | | | 71,227,527 | |

|

| |

Total Investments Purchased with Cash Collateral from Securities on Loan

(Cost $98,924,218) | | | | 98,927,121 | |

|

| |

TOTAL INVESTMENTS IN SECURITIES–116.89%

(Cost $522,462,592) | | | | 652,584,128 | |

|

| |

OTHER ASSETS LESS LIABILITIES–(16.89)% | | | | (94,296,604 | ) |

|

| |

NET ASSETS–100.00% | | | | | | $ | 558,287,524 | |

|

| |

Investment Abbreviations:

ADR – American Depositary Receipt

REIT – Real Estate Investment Trust

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

| Invesco V.I. American Franchise Fund |

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | All or a portion of this security was out on loan at December 31, 2022. |

| (d) | Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The value of this security at December 31, 2022 represented less than 1% of the Fund’s Net Assets. |

| (e) | Affiliated issuer. The issuer and/or the Fund is a wholly-owned subsidiary of Invesco Ltd., or is affiliated by having an investment adviser that is under common control of Invesco Ltd. The table below shows the Fund’s transactions in, and earnings from, its investments in affiliates for the fiscal year ended December 31, 2022. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Change in | | | Realized | | | | | | |

| | | Value | | | Purchases | | | Proceeds | | | Unrealized | | | Gain | | | Value | | | |

| | | December 31, 2021 | | | at Cost | | | from Sales | | | Appreciation | | | (Loss) | | | December 31, 2022 | | | Dividend Income |

| Investments in Affiliated Money Market Funds: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class | | | $ 2,868,097 | | | $ | 69,562,425 | | | $ | (67,806,529 | ) | | | $ - | | | $ | - | | | | $ 4,623,993 | | | | $ 38,104 | |

Invesco Liquid Assets Portfolio, Institutional Class | | | 2,048,569 | | | | 49,687,446 | | | | (48,437,713 | ) | | | 85 | | | | (641) | | | | 3,297,746 | | | | 35,895 | |

Invesco Treasury Portfolio, Institutional Class | | | 3,277,826 | | | | 79,499,913 | | | | (77,493,176 | ) | | | - | | | | - | | | | 5,284,563 | | | | 53,126 | |

| Investments Purchased with Cash Collateral from Securities on Loan: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Private Government Fund | | | 6,515,520 | | | | 276,862,816 | | | | (255,678,742 | ) | | | - | | | | - | | | | 27,699,594 | | | | 295,629* | |

Invesco Private Prime Fund | | | 15,202,880 | | | | 671,498,707 | | | | (615,492,816 | ) | | | 2,903 | | | | 15,853 | | | | 71,227,527 | | | | 812,237* | |

Total | | | $29,912,892 | | | $ | 1,147,111,307 | | | $ | (1,064,908,976 | ) | | | $2,988 | | | $ | 15,212 | | | | $112,133,423 | | | | $1,234,991 | |

| | * | Represents the income earned on the investment of cash collateral, which is included in securities lending income on the Statement of Operations. Does not include rebates and fees paid to lending agent or premiums received from borrowers, if any. |

| (f) | The rate shown is the 7-day SEC standardized yield as of December 31, 2022. |

| (g) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 1I. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

| Invesco V.I. American Franchise Fund |

Statement of Assets and Liabilities

December 31, 2022

| | |

Assets: | | |

Investments in unaffiliated securities, at value (Cost $410,332,157)* | | $540,450,705 |

Investments in affiliated money market funds, at value (Cost $112,130,435) | | 112,133,423 |

Cash | | 1,834 |

Cash collateral from securities on loan | | 6,196,512 |

Foreign currencies, at value (Cost $7,928) | | 8,486 |

Receivable for: | | |

Investments sold | | 2,581,808 |

Fund shares sold | | 2,893,520 |

Dividends | | 226,045 |

Investment for trustee deferred compensation and retirement plans | | 183,406 |

Other assets | | 3,217 |

Total assets | | 664,678,956 |

| |

Liabilities: | | |

Payable for: | | |

Investments purchased | | 596,191 |

Fund shares reacquired | | 135,124 |

Collateral upon return of securities loaned | | 105,120,730 |

Accrued fees to affiliates | | 300,276 |

Accrued trustees’ and officers’ fees and benefits | | 3,565 |

Accrued other operating expenses | | 38,758 |

Trustee deferred compensation and retirement plans | | 196,788 |

Total liabilities | | 106,391,432 |

Net assets applicable to shares outstanding | | $558,287,524 |

| |

Net assets consist of: | | |

Shares of beneficial interest | | $424,388,759 |

Distributable earnings | | 133,898,765 |

| | | $558,287,524 |

| |

Net Assets: | | |

Series I | | $371,020,089 |

Series II | | $187,267,435 |

|

Shares outstanding, no par value, with an unlimited number of shares authorized: |

Series I | | 8,661,555 |

Series II | | 4,819,825 |

Series I: | | |

Net asset value per share | | $ 42.84 |

Series II: | | |

Net asset value per share | | $ 38.85 |

| * | At December 31, 2022, securities with an aggregate value of $102,963,332 were on loan to brokers. |

Statement of Operations

For the year ended December 31, 2022

| | | | |

Investment income: | | | | |

Dividends (net of foreign withholding taxes of $167,723) | | $ | 5,056,789 | |

|

| |

Dividends from affiliated money market funds (includes net securities lending income of $67,664) | | | 194,789 | |

|

| |

Total investment income | | | 5,251,578 | |

|

| |

| |

Expenses: | | | | |

Advisory fees | | | 4,387,939 | |

|

| |

Administrative services fees | | | 1,072,985 | |

|

| |

Custodian fees | | | 24,684 | |

|

| |

Distribution fees - Series II | | | 518,213 | |

|

| |

Transfer agent fees | | | 32,793 | |

|

| |

Trustees’ and officers’ fees and benefits | | | 22,255 | |

|

| |

Professional services fees | | | 43,697 | |

|

| |

Other | | | (8,879 | ) |

|

| |

Total expenses | | | 6,093,687 | |

|

| |

Less: Fees waived | | | (9,997 | ) |

|

| |

Net expenses | | | 6,083,690 | |

|

| |

Net investment income (loss) | | | (832,112 | ) |

|

| |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain (loss) from: | | | | |

Unaffiliated investment securities | | | 12,339,038 | |

|

| |

Affiliated investment securities | | | 15,212 | |

|

| |

Foreign currencies | | | (42,179 | ) |

|

| |

| | | 12,312,071 | |

|

| |

Change in net unrealized appreciation (depreciation) of: | | | | |

Unaffiliated investment securities | | | (271,056,878 | ) |

|

| |

Affiliated investment securities | | | 2,988 | |

|

| |

Foreign currencies | | | (1,385 | ) |

|

| |

| | | (271,055,275 | ) |

|

| |

Net realized and unrealized gain (loss) | | | (258,743,204 | ) |

|

| |

Net increase (decrease) in net assets resulting from operations | | $ | (259,575,316 | ) |

|

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

| Invesco V.I. American Franchise Fund |

Statement of Changes in Net Assets

For the years ended December 31, 2022 and 2021

| | | | | | | | |

| | | 2022 | | | 2021 | |

|

| |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | (832,112 | ) | | $ | (4,151,457 | ) |

|

| |

Net realized gain | | | 12,312,071 | | | | 178,910,085 | |

|

| |

Change in net unrealized appreciation (depreciation) | | | (271,055,275 | ) | | | (78,149,194 | ) |

|

| |

Net increase (decrease) in net assets resulting from operations | | | (259,575,316 | ) | | | 96,609,434 | |

|

| |

| | |

Distributions to shareholders from distributable earnings: | | | | | | | | |

Series I | | | (114,653,583 | ) | | | (69,405,765 | ) |

|

| |

Series II | | | (60,639,319 | ) | | | (32,075,893 | ) |

|

| |

Total distributions from distributable earnings | | | (175,292,902 | ) | | | (101,481,658 | ) |

|

| |

| | |

Share transactions–net: | | | | | | | | |

Series I | | | 72,092,453 | | | | (19,513,798 | ) |

|

| |

Series II | | | 74,248,097 | | | | 41,059,309 | |

|

| |

Net increase in net assets resulting from share transactions | | | 146,340,550 | | | | 21,545,511 | |

|

| |

Net increase (decrease) in net assets | | | (288,527,668 | ) | | | 16,673,287 | |

|

| |

| | |

Net assets: | | | | | | | | |

Beginning of year | | | 846,815,192 | | | | 830,141,905 | |

|

| |

End of year | | $ | 558,287,524 | | | $ | 846,815,192 | |

|

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

| Invesco V.I. American Franchise Fund |

Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset value, beginning of period | | Net investment income (loss)(a) | | Net gains (losses) on securities (both realized and unrealized) | | Total from investment operations | | Dividends from net investment income | | Distributions from net realized gains | | Total distributions | | Net asset value, end of period | | Total return(b) | | Net assets, end of period (000’s omitted) | | Ratio of expenses to average net assets with fee waivers and/or expenses absorbed | | Ratio of expenses to average net assets without fee waivers and/or expenses absorbed | | Ratio of net investment income (loss) to average net assets | | Portfolio turnover(c) |

Series I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/22 | | | $88.63 | | | | $(0.03 | ) | | | $(27.15 | ) | | | $(27.18 | ) | | | $ – | | | | $(18.61 | ) | | | $(18.61 | ) | | | $42.84 | | | | (31.11 | )% | | | $371,020 | | | | 0.86 | % | | | 0.86 | % | | | (0.05 | )% | | | 108 | % |

Year ended 12/31/21 | | | 89.10 | | | | (0.39 | ) | | | 11.37 | | | | 10.98 | | | | – | | | | (11.45 | ) | | | (11.45 | ) | | | 88.63 | | | | 11.92 | | | | 591,907 | | | | 0.86 | | | | 0.86 | | | | (0.41 | ) | | | 68 | |

Year ended 12/31/20 | | | 67.15 | | | | (0.13 | ) | | | 28.00 | | | | 27.87 | | | | (0.06 | ) | | | (5.86 | ) | | | (5.92 | ) | | | 89.10 | | | | 42.35 | | | | 611,334 | | | | 0.86 | | | | 0.86 | | | | (0.18 | ) | | | 54 | |

Year ended 12/31/19 | | | 57.15 | | | | 0.10 | | | | 19.86 | | | | 19.96 | | | | – | | | | (9.96 | ) | | | (9.96 | ) | | | 67.15 | | | | 36.76 | | | | 490,366 | | | | 0.86 | | | | 0.87 | | | | 0.15 | | | | 40 | |

Year ended 12/31/18 | | | 62.97 | | | | (0.00 | ) | | | (1.50 | ) | | | (1.50 | ) | | | – | | | | (4.32 | ) | | | (4.32 | ) | | | 57.15 | | | | (3.62 | ) | | | 405,192 | | | | 0.88 | | | | 0.88 | | | | (0.00 | ) | | | 42 | |

Series II | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/22 | | | 83.04 | | | | (0.18 | ) | | | (25.40 | ) | | | (25.58 | ) | | | – | | | | (18.61 | ) | | | (18.61 | ) | | | 38.85 | | | | (31.30 | ) | | | 187,267 | | | | 1.11 | | | | 1.11 | | | | (0.30 | ) | | | 108 | |

Year ended 12/31/21 | | | 84.31 | | | | (0.59 | ) | | | 10.77 | | | | 10.18 | | | | – | | | | (11.45 | ) | | | (11.45 | ) | | | 83.04 | | | | 11.65 | | | | 254,909 | | | | 1.11 | | | | 1.11 | | | | (0.66 | ) | | | 68 | |

Year ended 12/31/20 | | | 63.90 | | | | (0.31 | ) | | | 26.58 | | | | 26.27 | | | | – | | | | (5.86 | ) | | | (5.86 | ) | | | 84.31 | | | | 41.99 | | | | 218,808 | | | | 1.11 | | | | 1.11 | | | | (0.43 | ) | | | 54 | |

Year ended 12/31/19 | | | 54.90 | | | | (0.07 | ) | | | 19.03 | | | | 18.96 | | | | – | | | | (9.96 | ) | | | (9.96 | ) | | | 63.90 | | | | 36.43 | | | | 162,221 | | | | 1.11 | | | | 1.12 | | | | (0.10 | ) | | | 40 | |

Year ended 12/31/18 | | | 60.79 | | | | (0.16 | ) | | | (1.41 | ) | | | (1.57 | ) | | | – | | | | (4.32 | ) | | | (4.32 | ) | | | 54.90 | | | | (3.88 | ) | | | 133,216 | | | | 1.13 | | | | 1.13 | | | | (0.25 | ) | | | 42 | |

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Total returns are not annualized for periods less than one year, if applicable, and do not reflect charges assessed in connection with a variable product, which if included would reduce total returns. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

| Invesco V.I. American Franchise Fund |

Notes to Financial Statements

December 31, 2022

NOTE 1–Significant Accounting Policies

Invesco V.I. American Franchise Fund (the “Fund”) is a series portfolio of AIM Variable Insurance Funds (Invesco Variable Insurance Funds) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company. The Fund is classified as non-diversified. Information presented in these financial statements pertains only to the Fund. Matters affecting the Fund or each class will be voted on exclusively by the shareholders of the Fund or each class. Current Securities and Exchange Commission (“SEC”) guidance, however, requires participating insurance companies offering separate accounts to vote shares proportionally in accordance with the instructions of the contract owners whose investments are funded by shares of each Fund or class.

The Fund’s investment objective is to seek capital growth.

The Fund currently offers two classes of shares, Series I and Series II, both of which are offered to insurance company separate accounts funding variable annuity contracts and variable life insurance policies (“variable products”).

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations – Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange is generally valued at its trade price or official closing price that day as of the close of the exchange where the security is principally traded, or lacking any trades or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued using prices provided by an independent pricing service they may be considered fair valued. Futures contracts are valued at the daily settlement price set by an exchange on which they are principally traded. U.S. exchange-traded options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Non-U.S. exchange-traded options are valued at the final settlement price set by the exchange on which they trade. Options not listed on an exchange and swaps generally are valued using pricing provided from independent pricing services.

Securities of investment companies that are not exchange-traded (e.g., open-end mutual funds) are valued using such company’s end-of-business-day net asset value per share.

Deposits, other obligations of U.S. and non-U.S. banks and financial institutions are valued at their daily account value.

Fixed income securities (including convertible debt securities) generally are valued on the basis of prices provided by independent pricing services. Prices provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Pricing services generally value debt obligations assuming orderly transactions of institutional round lot size, but a fund may hold or transact in the same securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots, and their value may be adjusted accordingly. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the New York Stock Exchange (“NYSE”). If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Invesco Advisers, Inc. (the “Adviser” or “Invesco”) may use various pricing services to obtain market quotations as well as fair value prices. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become not representative of market value in the Adviser’s judgment (“unreliable”). If, between the time trading ends on a particular security and the close of the customary trading session on the NYSE, a significant event occurs that makes the closing price of the security unreliable, the Adviser may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith in accordance with Board- approved policies and related Adviser procedures (“Valuation Procedures”). Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Unlisted securities will be valued using prices provided by independent pricing services or by another method that the Adviser, in its judgment, believes better reflects the security’s fair value in accordance with the Valuation Procedures.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices may be used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available are fair valued by the Adviser in accordance with the Valuation Procedures. If a fair value price provided by a pricing service is unreliable, the Adviser will fair value the security using the Valuation Procedures. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general market conditions which are not specifically related to the particular issuer, such as real or perceived adverse economic conditions, changes in the general outlook for revenues or corporate earnings, changes in interest or currency rates, regional or global instability, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism, significant governmental actions or adverse investor sentiment generally and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

The price the Fund could receive upon the sale of any investment may differ from the Adviser’s valuation of the investment, particularly for securities that are valued using a fair valuation technique. When fair valuation techniques are applied, the Adviser uses available information, including both observable and unobservable inputs and assumptions, to determine a methodology that will result in a valuation that the Adviser believes approximates market value. Fund securities that are fair valued may be subject to greater fluctuation in their value from one day to the next than would be the case if market quotations were used. Because of the inherent uncertainties of valuation, and the degree of subjectivity in such decisions, the Fund could realize a greater or lesser than expected gain or loss upon the sale of the investment.

| B. | Securities Transactions and Investment Income – Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are |

|

| Invesco V.I. American Franchise Fund |

computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on an accrual basis from settlement date and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date.

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination – For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues, the country that has the primary market for the issuer’s securities and its “country of risk” as determined by a third party service provider, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions – Distributions from net investment income and net realized capital gain, if any, are generally declared and paid to separate accounts of participating insurance companies annually and recorded on the ex-dividend date. |

| E. | Federal Income Taxes – The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Expenses – Fees provided for under the Rule 12b-1 plan of a particular class of the Fund and which are directly attributable to that class are charged to the operations of such class. All other expenses are allocated among the classes based on relative net assets. |

| G. | Accounting Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications – Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Securities Lending – The Fund may lend portfolio securities having a market value up to one-third of the Fund’s total assets. Such loans are secured by collateral equal to no less than the market value of the loaned securities determined daily by the securities lending provider. Such collateral will be cash or debt securities issued or guaranteed by the U.S. Government or any of its sponsored agencies. Cash collateral received in connection with these loans is invested in short-term money market instruments or affiliated, unregistered investment companies that comply with Rule 2a-7 under the 1940 Act and money market funds (collectively, “affiliated money market funds”) and is shown as such on the Schedule of Investments. The Fund bears the risk of loss with respect to the investment of collateral. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. When loaning securities, the Fund retains certain benefits of owning the securities, including the economic equivalent of dividends or interest generated by the security. Lending securities entails a risk of loss to the Fund if, and to the extent that, the market value of the securities loaned were to increase and the borrower did not increase the collateral accordingly, and the borrower failed to return the securities. The securities loaned are subject to termination at the option of the borrower or the Fund. Upon termination, the borrower will return to the Fund the securities loaned and the Fund will return the collateral. Upon the failure of the borrower to return the securities, collateral may be liquidated and the securities may be purchased on the open market to replace the loaned securities. The Fund could experience delays and costs in gaining access to the collateral and the securities may lose value during the delay which could result in potential losses to the Fund. Some of these losses may be indemnified by the lending agent. The Fund bears the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. Dividends received on cash collateral investments for securities lending transactions, which are net of compensation to counterparties, are included in Dividends from affiliated money market funds on the Statement of Operations. The aggregate value of securities out on loan, if any, is shown as a footnote on the Statement of Assets and Liabilities. |

The Adviser serves as an affiliated securities lending agent for the Fund. The Bank of New York Mellon also serves as a lending agent. To the extent the Fund utilizes the Adviser as an affiliated securities lending agent, the Fund conducts its securities lending in accordance with, and in reliance upon, no-action letters issued by the SEC staff that provide guidance on how an affiliate may act as a direct agent lender and receive compensation for those services in a manner consistent with the federal securities laws. For the year ended December 31, 2022, the Fund paid the Adviser $4,668 in fees for securities lending agent services. Fees paid to the Adviser for securities lending agent services, if any, are included in Dividends from affiliated money market funds on the Statement of Operations.

| J. | Foreign Currency Translations – Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign |

|

| Invesco V.I. American Franchise Fund |

exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

The Fund may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests and are shown in the Statement of Operations.

| K. | Forward Foreign Currency Contracts – The Fund may engage in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis, or through forward foreign currency contracts, to manage or minimize currency or exchange rate risk. |

The Fund may also enter into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security, or the Fund may also enter into forward foreign currency contracts that do not provide for physical exchange of the two currencies on the settlement date, but instead are settled by a single cash payment calculated as the difference between the agreed upon exchange rate and the spot rate at settlement based upon an agreed upon notional amount (non-deliverable forwards).

A forward foreign currency contract is an obligation between two parties (“Counterparties”) to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts for hedging does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statement of Operations. The primary risks associated with forward foreign currency contracts include failure of the Counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statement of Assets and Liabilities.

| L. | Other Risks – The Fund is non-diversified and may invest in securities of fewer issuers than if it were diversified. Thus, the value of the Fund’s shares may vary more widely and the Fund may be subject to greater market and credit risk than if the Fund invested more broadly. |

Active trading of portfolio securities may result in added expenses, a lower return and increased tax liability.

| M. | COVID-19 Risk – The COVID-19 strain of coronavirus has resulted in instances of market closures and dislocations, extreme volatility, liquidity constraints and increased trading costs. Efforts to contain its spread have resulted in travel restrictions, disruptions of healthcare systems, business operations (including business closures) and supply chains, layoffs, lower consumer demand and employee availability, and defaults and credit downgrades, among other significant economic impacts that have disrupted global economic activity across many industries. Such economic impacts may exacerbate other pre-existing political, social and economic risks locally or globally and cause general concern and uncertainty. The full economic impact and ongoing effects of COVID-19 (or other future epidemics or pandemics) at the macro-level and on individual businesses are unpredictable and may result in significant and prolonged effects on the Fund’s performance. |

NOTE 2–Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with the Adviser. Under the terms of the investment advisory agreement, the Fund accrues daily and pays monthly an advisory fee to the Adviser based on the annual rate of the Fund’s average daily net assets as follows:

| | | | |

| Average Daily Net Assets | | Rate | |

|

| |

First $ 250 million | | | 0.695% | |

|

| |

Next $250 million | | | 0.670% | |

|

| |

Next $500 million | | | 0.645% | |

|

| |

Next $550 million | | | 0.620% | |

|

| |

Next $3.45 billion | | | 0.600% | |

|

| |

Next $250 million | | | 0.595% | |

|

| |

Next $2.25 billion | | | 0.570% | |

|

| |

Next $2.5 billion | | | 0.545% | |

|

| |

Over $10 billion | | | 0.520% | |

|

| |

For the year ended December 31, 2022, the effective advisory fee rate incurred by the Fund was 0.67%.

Under the terms of a master sub-advisory agreement between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. and separate sub-advisory agreements with Invesco Capital Management LLC and Invesco Asset Management (India) Private Limited (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, will pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Affiliated Sub-Adviser(s).

The Adviser has contractually agreed, through at least June 30, 2023, to waive advisory fees and/or reimburse expenses of all shares to the extent necessary to limit total annual fund operating expenses after fee waiver and/or expense reimbursement (excluding certain items discussed below) of Series I shares to 2.00% and Series II shares to 2.25% of the Fund’s average daily net assets (the “expense limits”). In determining the Adviser’s obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account, and could cause the total annual fund operating expenses after fee waiver and/or expense reimbursement to exceed the numbers reflected above: (1) interest; (2) taxes; (3) dividend expense on short sales; (4) extraordinary or non-routine items, including litigation expenses; and (5) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement. Unless Invesco continues the fee waiver agreement, it will terminate on June 30, 2023. During its term, the fee waiver agreement cannot be terminated or amended to increase the expense limits or reduce the advisory fee waiver without approval of the Board of Trustees. The Adviser did not waive fees and/or reimburse expenses during the period under these expense limits.

Further, the Adviser has contractually agreed, through at least June 30, 2024, to waive the advisory fee payable by the Fund in an amount equal to 100% of the net advisory fees the Adviser receives from the affiliated money market funds on investments by the Fund of uninvested cash (excluding investments of cash collateral from securities lending) in such affiliated money market funds.

For the year ended December 31, 2022, the Adviser waived advisory fees of $9,997.

The Trust has entered into a master administrative services agreement with Invesco pursuant to which the Fund has agreed to pay Invesco a fee for costs incurred in providing accounting services and fund administrative services to the Fund and to reimburse Invesco for fees paid to insurance companies that have agreed to provide certain administrative services to the Fund. These administrative services provided by the insurance companies may include, among other things: maintenance of

|

| Invesco V.I. American Franchise Fund |

master accounts with the Fund; tracking, recording and transmitting net purchase and redemption orders for Fund shares; maintaining and preserving records related to the purchase, redemption and other account activity of variable product owners; distributing copies of Fund documents such as prospectuses, proxy materials and periodic reports, to variable product owners, and responding to inquiries from variable product owners about the Fund. Pursuant to such agreement, for the year ended December 31, 2022, Invesco was paid $96,790 for accounting and fund administrative services and was reimbursed $976,195 for fees paid to insurance companies. Invesco has entered into a sub-administration agreement whereby State Street Bank and Trust Company (“SSB”) serves as fund accountant and provides certain administrative services to the Fund. Pursuant to a custody agreement with the Trust on behalf of the Fund, SSB also serves as the Fund’s custodian.