| | |

| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | |

Investment Company Act file | | |

number | | 811-07452 | | |

| | | | |

| | AIM Variable Insurance Funds (Invesco Variable Insurance Funds) | | |

| | (Exact name of registrant as specified in charter) | | |

| | | | |

| | 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | | |

| | (Address of principal executive offices) (Zip code) | | |

| | |

Philip A. Taylor 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | | |

| (Name and address of agent for service) | | |

|

Registrant’s telephone number, including area code: (713) 626-1919 |

| | | | |

Date of fiscal year end: | | 12/31 | | |

| | |

Date of reporting period: | | 12/31/15 | | |

Item 1. Report to Stockholders.

| | | | |

| | |

| | Annual Report to Shareholders | | December 31, 2015 |

| | |

| | Invesco V.I. American Franchise Fund |

| | |

| | The Fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth quarters, the lists appear in the Fund’s semiannual and annual reports to shareholders. For the first and third quarters, the Fund files the lists with the Securities and Exchange Commission (SEC) on Form N-Q. The Fund’s Form N-Q filings are available on the SEC website, sec.gov. Copies of the Fund’s Forms N-Q may be reviewed and copied at the SEC Public Reference Room in Washington, D.C. You can obtain information on the operation of the Public Reference Room, including information about duplicating fee charges, by calling 202 551 8090 or 800 732 0330, or by electronic request at the following email address: publicinfo@sec.gov. The SEC file numbers for the Fund are 811-07452 and 033-57340. The Fund’s most recent portfolio holdings, as filed on Form N-Q, have also been made available to insurance companies issuing variable annuity contracts and variable life insurance policies (“variable products”) that invest in the Fund. A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, from our Client Services department at 800 959 4246 or at invesco.com/proxyguidelines. The information is also available on the SEC website, sec.gov. Information regarding how the Fund voted proxies related to its portfolio securities during the most recent 12-month period ended June 30 is available at invesco.com/ proxysearch. The information is also available on the SEC website, sec.gov. Invesco Advisers, Inc. is an investment adviser; it provides investment advisory services to individual and institutional clients and does not sell securities. Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s retail mutual funds, exchange-traded funds and institutional money market funds. Both are wholly owned, indirect subsidiaries of Invesco Ltd. This report must be accompanied or preceded by a currently effective Fund prospectus and variable product prospectus, which contain more complete information, including sales charges and expenses. Investors should read each carefully before investing. Invesco Distributors, Inc. VK-VIAMFR-AR-1 NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

Management’s Discussion of Fund Performance

Performance summary

For the year ended December 31, 2015, Series I shares of Invesco V.I. American Franchise Fund (the Fund) underperformed the Russell 1000 Growth Index, the Fund’s style-specific benchmark.

Your Fund’s long-term performance appears later in this report.

Fund vs. Indexes

Total returns, 12/31/14 to 12/31/15, excluding variable product issuer charges.

If variable product issuer charges were included, returns would be lower.

| | | | | |

| Series I Shares | | | | 5.01 | % |

| Series II Shares | | | | 4.75 | |

| S&P 500 Index▼ (Broad Market Index) | | | | 1.38 | |

| Russell 1000 Growth Index▼ (Style-Specific Index) | | | | 5.67 | |

| Lipper VUF Large-Cap Growth Funds Indexn (Peer Group Index) | | | | 7.52 | |

Source(s): ▼FactSet Research Systems Inc.; nLipper Inc.

Market conditions and your Fund

The US economy continued its modest, but steady growth, during the year ended December 31, 2015 – although the health of individual economic sectors varied dramatically. The headline economic story was a steady decline in already-battered energy markets, as oil prices plummeted when increased supply overwhelmed demand. This decline particularly affected companies with US-based offshore or shale-based resources – companies whose cost to recover oil is higher than many traditional producers. On the other end of the spectrum, the improved position of the US consumer was the more subtle story which drove the US economy forward during the year.

As the year began, economic growth appeared to be stronger in the US than in the rest of the world. US equity markets were recovering from the crash of oil prices initiated by OPEC’s decision to maintain high production despite low prices and slowing global growth. The view that the US Federal Reserve (the Fed) would begin raising rates while other central banks were loosening monetary policy led the US dollar to strengthen

against many currencies. This hurt commodity- and materials-based economies – and companies in related sectors. Additionally, US-based multinational companies faced foreign exchange headwinds. Low interest rates, the increasing availability of credit and an improving employment picture all contributed to higher consumer confidence and consumer spending, which drove US equity markets higher, particularly through the spring, and helped overcome fears that Greece and the eurozone would fail to reach an agreement on a financial bailout plan.

In the summer of 2015, US equity markets moved sharply lower. A significant downturn in China’s financial markets and weak global economic growth led the Fed to delay raising interest rates; this, in turn, increased investor uncertainty and market volatility. A continued decline in oil prices also contributed to market volatility. In the fall, however, US markets rallied, the Fed saw enough economic stabilization to finally raise interest rates, and most major US market indexes ended the year barely in positive territory.

During the year, the Fund produced positive returns, slightly trailing the

Fund’s style-specific benchmark. The Fund outperformed its style-specific benchmark in the industrials, information technology (IT) and materials sectors, while it underperformed in the consumer discretionary, energy and telecommunication services sectors.

The Fund outperformed its style-specific benchmark by the widest margin in the industrials sector due to both strong stock selection and underweight exposure to this weak area of the market. Within the sector, Raytheon was a strong contributor to Fund performance as it realized solid orders for missile defense systems and reported better-than-expected results for the integration of a recently acquired business. Roper Technologies continued to intelligently enter new lines of businesses, and produced significant and growing cash flows, making it a solid performer for the Fund during the year.

In the IT sector, Facebook, a high-conviction holding, significantly benefited shareholders. Throughout the year, the company reported increased usage, increased migration to mobile devices, and increased video usage, which also led to increased video advertising revenue. In addition, the company reduced guidance for its future expenses. Google and the restructured holding company it launched during the year, Alphabet, contributed to the Fund’s performance versus its style-specific benchmark. During the year, a new chief financial officer enhanced communication with investors and stressed cost discipline for the company. This responsible messaging combined with strength in its YouTube and mobile-search businesses led the company’s stock higher.

The materials sector was fairly weak during the year. The Fund outperformed its style-specific benchmark in this sector due to stock selection and modest under-

| | |

| Portfolio Composition | | |

By sector | | % of total net assets |

| | |

| |

| Information Technology | | 35.0% |

| Consumer Discretionary | | 20.9 |

| Health Care | | 20.6 |

| Industrials | | 6.8 |

| Consumer Staples | | 6.1 |

| Financials | | 5.3 |

| Telecommunication Services | | 1.5 |

| Materials | | 1.4 |

| Energy | | 1.1 |

| Money Market Funds | | |

| Plus Other Assets Less Liabilities | | 1.3 |

| | | | | | | |

| Top 10 Equity Holdings* |

| | % of total net assets |

| | | | | | | |

| | |

| 1. | | Alphabet Inc.-Class A | | | | 6.7 | % |

| 2. | | Facebook Inc.-Class A | | | | 5.6 | |

| 3. | | Amazon.com, Inc. | | | | 5.1 | |

| 4. | | Apple Inc. | | | | 4.9 | |

| 5. | | MasterCard, Inc.-Class A | | | | 3.7 | |

| 6. | | Lowe’s Cos., Inc. | | | | 3.5 | |

| 7. | | Carnival Corp. | | | | 2.7 | |

| 8. | | Gilead Sciences, Inc. | | | | 2.7 | |

| 9. | | Celgene Corp. | | | | 2.6 | |

| 10. | | Alkermes PLC | | | | 2.5 | |

| | | | | |

| Total Net Assets | | | | $655.2 million | |

| |

| Total Number of Holdings* | | | | 65 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

*Excluding money market fund holdings.

Data presented here are as of December 31, 2015.

Invesco V.I. American Franchise Fund

weight exposure. Martin Marietta Materials and Dow Chemical were two Fund holdings in this sector which significantly outperformed the Fund’s style-specific benchmark. We sold our position in Martin Marietta Materials before the end of the reporting period.

The consumer discretionary sector was a strong-performing sector during the year. Fund holdings in this sector had solid positive returns, but underperformed those of the style-specific benchmark. Dish Network was a significant holding in the Fund based on its wireless spectrum assets; however, the stock pulled back as the potential catalysts to unlock spectrum value seemed to move further into the future and the pay television business was weak. Michael Kors was another large detractor from Fund performance and was sold during the year.

The energy sector was the worst-performing sector of the market again this year. As a result, energy holdings now represent a very small slice of the large-cap growth market overall. The Fund trailed its style-specific index in this sector primarily due to modest overweight exposure to energy stocks. Whiting Petroleum was a significant detractor from Fund performance and was sold during the year as the imbalance of supply and demand evolved.

The Fund’s lone holding in the telecommunication services sector was Sprint, which underperformed the style-specific benchmark. The company generally improved its subscriber and network metrics through the year. However, investors focused on financing, considering the company’s relatively high debt levels and available cash flow within a skittish high yield financing environment, and the stock pulled back as a result.

Thank you for your commitment to Invesco V.I. American Franchise Fund and for sharing our long-term investment horizon.

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| | Erik Voss Chartered Financial Analyst, Portfolio Manager, is lead manager of Invesco V.I. American |

| Franchise Fund. He joined Invesco in 2010. Mr. Voss earned a BS in mathematics and an MS in finance from the University of Wisconsin. |

| |

| | Ido Cohen Portfolio Manager, is manager of Invesco V.I. American Franchise Fund. He joined Invesco in 2010. |

| Mr. Cohen earned a BS in economics from The Wharton School of the University of Pennsylvania. |

Invesco V.I. American Franchise Fund

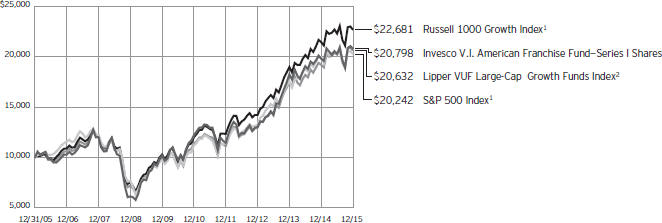

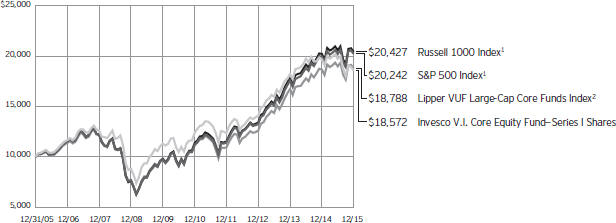

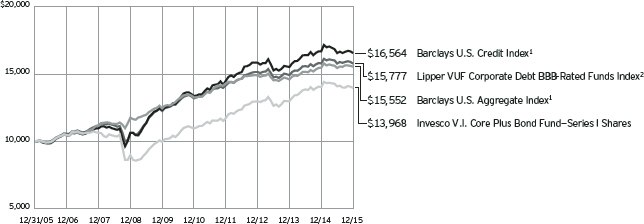

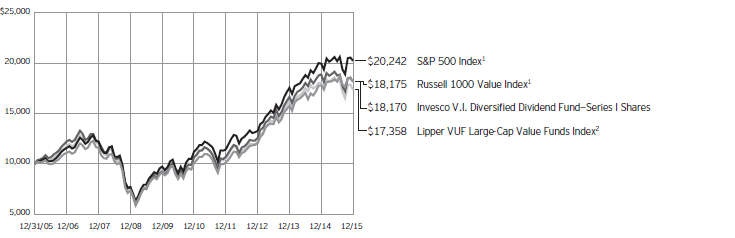

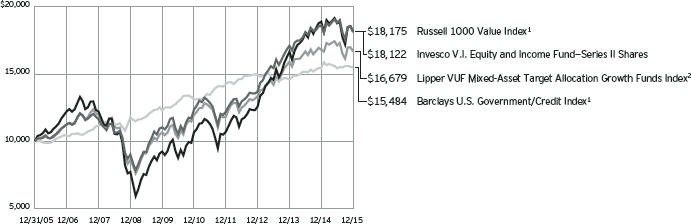

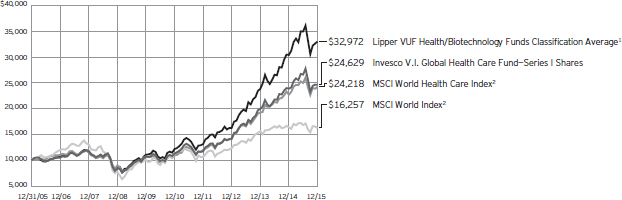

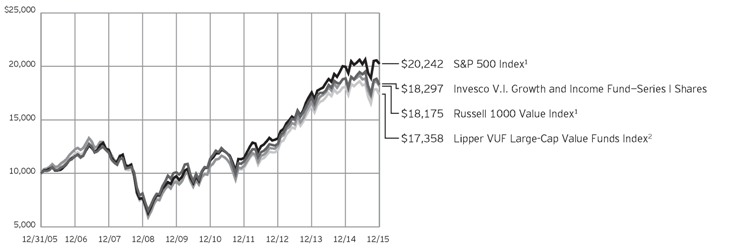

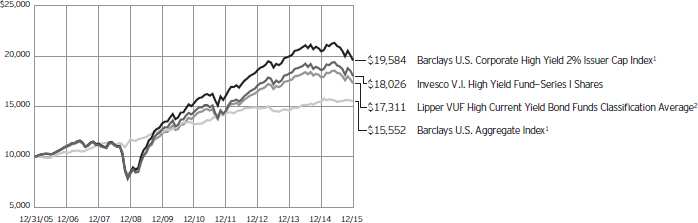

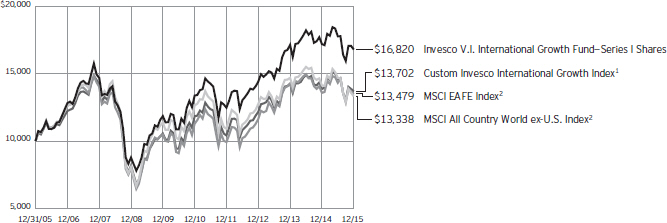

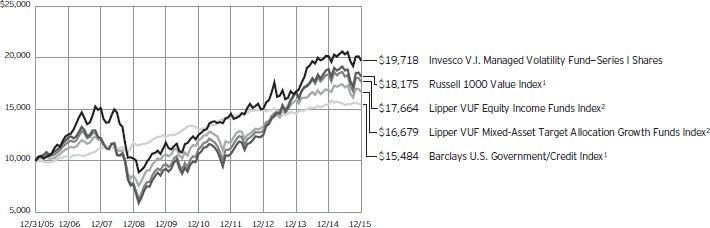

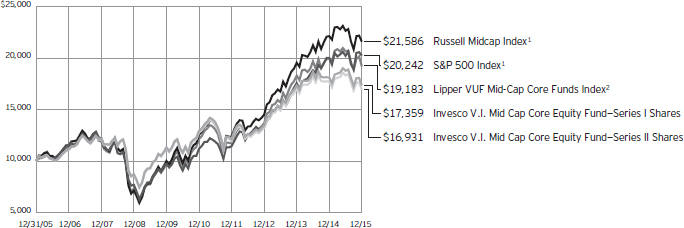

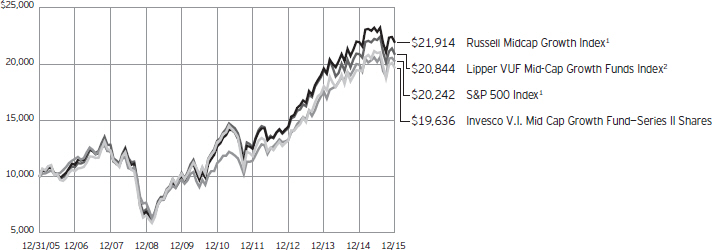

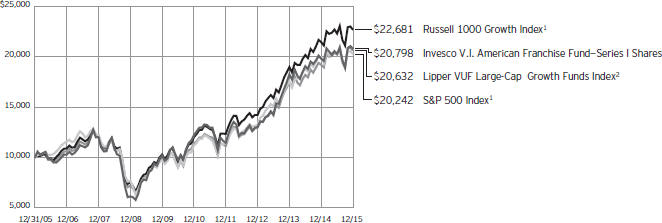

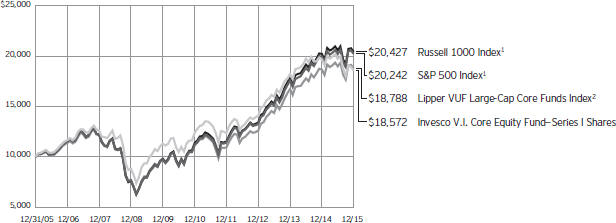

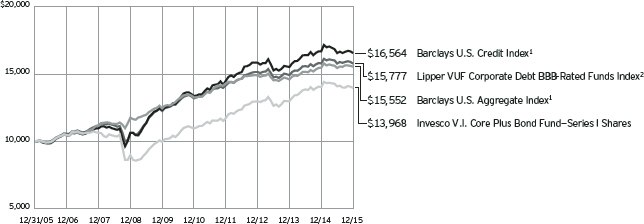

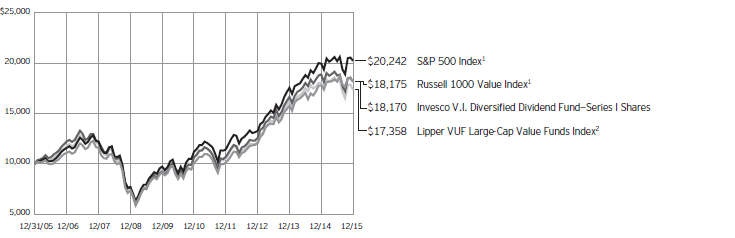

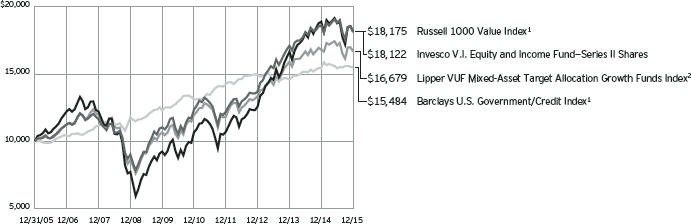

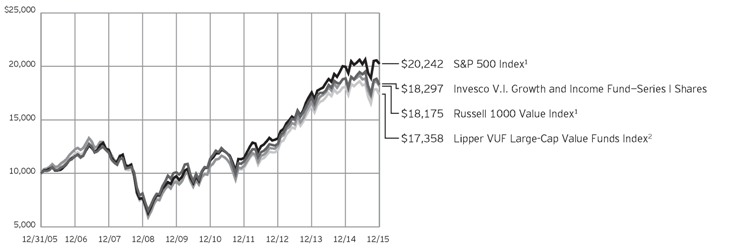

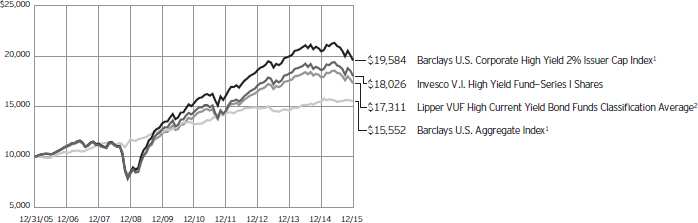

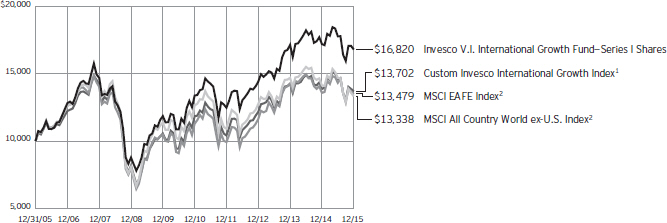

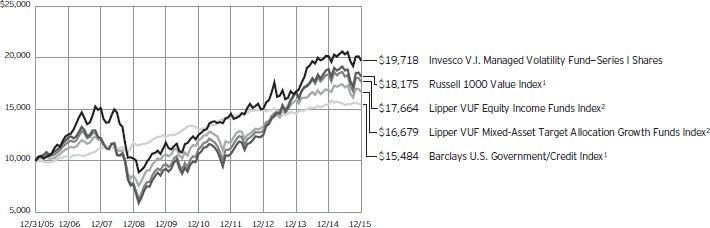

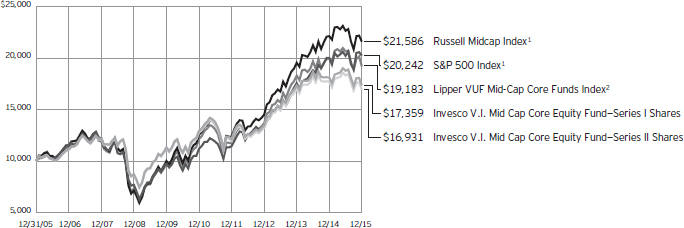

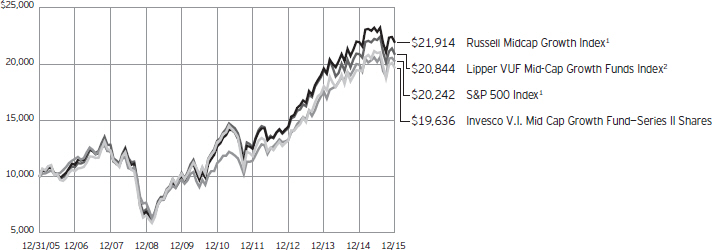

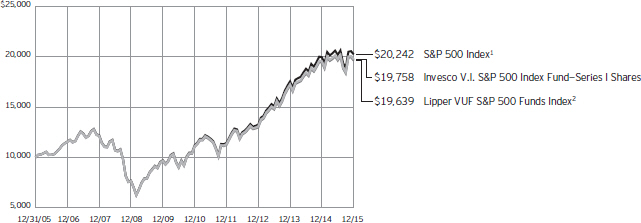

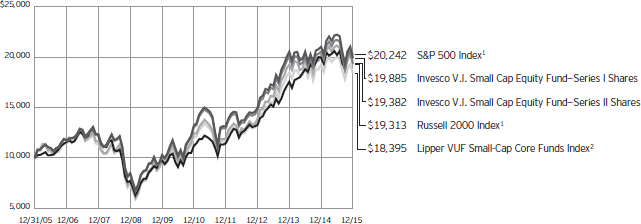

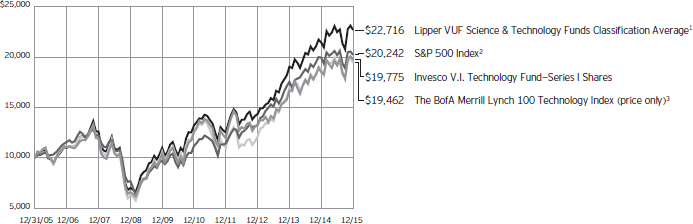

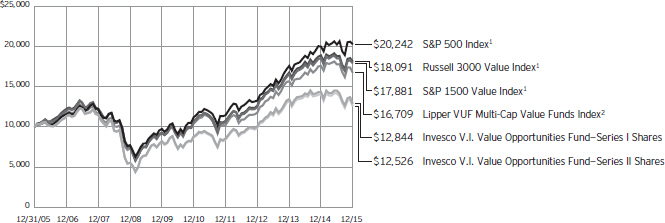

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 12/31/05

| 1 | Source: FactSet Research Systems Inc. |

Past performance cannot guarantee

comparable future results.

| | | | | |

Average Annual Total Returns | | | | | |

As of 12/31/15 | | | | | |

| |

| Series I Shares | | | | | |

Inception (7/3/95) | | | | 9.03 | % |

10 Years | | | | 7.60 | |

5 Years | | | | 11.23 | |

1 Year | | | | 5.01 | |

| |

| Series II Shares | | | | | |

Inception (9/18/00) | | | | 0.36 | % |

10 Years | | | | 7.33 | |

5 Years | | | | 10.95 | |

1 Year | | | | 4.75 | |

Effective June 1, 2010, Class I and Class II shares of the predecessor fund, Van Kampen Life Investment Trust Capital Growth Portfolio, advised by Van Kampen Asset Management were reorganized into Series I and Series II shares, respectively, of Invesco Van Kampen V.I. Capital Growth Fund (renamed Invesco V.I. American Franchise Fund on April 29, 2013). Returns shown above for Series I and Series II shares are blended returns of the predecessor fund and Invesco V.I. American Franchise Fund. Share class returns will differ from the predecessor fund because of different expenses.

The performance data quoted represent past performance and cannot guarantee comparable future results; current performance may be lower or higher. Please contact your variable product issuer or financial adviser for the most recent month-end variable product performance. Performance figures reflect Fund expenses, reinvested distributions and changes in net asset value. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Series I and Series II shares was 0.95% and 1.20%, respectively. The expense ratios presented above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report.

Invesco V.I. American Franchise Fund, a series portfolio of AIM Variable Insurance Funds (Invesco Variable Insurance Funds), is currently offered

through insurance companies issuing variable products. You cannot purchase shares of the Fund directly. Performance figures given represent the Fund and are not intended to reflect actual variable product values. They do not reflect sales charges, expenses and fees assessed in connection with a variable product. Sales charges, expenses and fees, which are determined by the variable product issuers, will vary and will lower the total return.

The most recent month-end performance at the Fund level, excluding variable product charges, is available at 800 451 4246. As mentioned above, for the most recent month-end performance including variable product charges, please contact your variable product issuer or financial adviser.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

Invesco V.I. American Franchise Fund

Invesco V.I. American Franchise Fund’s investment objective is to seek capital growth.

| n | | Unless otherwise stated, information presented in this report is as of December 31, 2015, and is based on total net assets. |

| n | | Unless otherwise noted, all data provided by Invesco. |

| n | | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

Principal risks of investing in the Fund

Foreign securities risk. The Fund’s foreign investments may be affected by changes in a foreign country’s exchange rates, political and social instability, changes in economic or taxation policies, difficulties when enforcing obligations, decreased liquidity, and increased volatility. Foreign companies may be subject to less regulation resulting in less publicly available information about the companies.

Growth investing risk. Growth stocks tend to be more expensive relative to their earnings or assets compared with other types of stock. As a result they tend to be more sensitive to changes in their earnings and can be more volatile.

Management risk. The investment techniques and risk analysis used by the Fund’s portfolio managers may not produce the desired results.

Market risk. The prices of and the income generated by the Fund’s securities may decline in response to, among other things, investor sentiment, general economic and market conditions, regional or global instability, and currency and interest rate fluctuations.

Mid-capitalization risk. Stocks of mid-sized companies tend to be more vulnerable to adverse developments and may have little or no operating history or track record of success, and limited product lines, markets, management and financial resources. The securities of mid-sized companies may be more volatile due to less market interest and less publicly available information about the issuer. They also may be illiquid or restricted as to resale, or may trade less frequently and in smaller volumes, all of which may cause difficulty when establishing or closing a position at a desirable price.

About indexes used in this report

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

The Russell 1000® Growth Index is an unmanaged index considered representative of large-cap growth stocks. The Russell 1000 Growth Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co.

The Lipper VUF Large-Cap Growth Funds Index is an unmanaged index considered representative of large-cap growth variable insurance underlying funds tracked by Lipper.

The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es).

A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not.

Other information

The returns shown in management’s discussion of Fund performance are based on net asset values calculated for shareholder transactions. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes, and as such, the net asset values for shareholder transactions and the returns based on those net asset values may differ from the net asset values and returns reported in the Financial Highlights. Additionally, the returns and net asset values shown throughout this report are at the Fund level only and do not include variable product issuer charges. If such charges were included, the total returns would be lower.

Industry classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s.

Invesco V.I. American Franchise Fund

Schedule of Investments(a)

December 31, 2015

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks & Other Equity Interests–98.67% | |

| Aerospace & Defense–2.06% | |

Honeywell International Inc. | | | 51,411 | | | $ | 5,324,637 | |

Raytheon Co. | | | 65,543 | | | | 8,162,070 | |

| | | | | | | | 13,486,707 | |

|

| Air Freight & Logistics–0.72% | |

FedEx Corp. | | | 31,810 | | | | 4,739,372 | |

|

| Airlines–1.52% | |

Southwest Airlines Co. | | | 231,256 | | | | 9,957,883 | |

|

| Application Software–2.31% | |

salesforce.com, inc.(b) | | | 193,166 | | | | 15,144,214 | |

|

| Biotechnology–12.13% | |

Alexion Pharmaceuticals, Inc.(b) | | | 21,496 | | | | 4,100,362 | |

Alkermes PLC(b) | | | 208,893 | | | | 16,581,927 | |

Amgen Inc. | | | 57,158 | | | | 9,278,458 | |

Biogen Inc.(b) | | | 23,686 | | | | 7,256,206 | |

Celgene Corp.(b) | | | 143,440 | | | | 17,178,375 | |

Gilead Sciences, Inc. | | | 172,622 | | | | 17,467,620 | |

Vertex Pharmaceuticals Inc.(b) | | | 60,351 | | | | 7,593,966 | |

| | | | | | | | 79,456,914 | |

|

| Cable & Satellite–3.43% | |

DISH Network Corp.–Class A(b) | | | 282,442 | | | | 16,150,033 | |

Time Warner Cable Inc. | | | 34,142 | | | | 6,336,414 | |

| | | | | | | | 22,486,447 | |

|

| Communications Equipment–0.94% | |

Palo Alto Networks, Inc.(b) | | | 35,017 | | | | 6,167,894 | |

|

| Consumer Electronics–2.43% | |

Harman International Industries, Inc. | | | 86,042 | | | | 8,106,017 | |

Sony Corp. (Japan) | | | 320,100 | | | | 7,841,934 | |

| | | | | | | | 15,947,951 | |

|

| Data Processing & Outsourced Services–5.64% | |

First Data Corp.–Class A(b) | | | 353,657 | | | | 5,665,585 | |

MasterCard, Inc.–Class A | | | 251,176 | | | | 24,454,495 | |

Visa Inc.–Class A | | | 87,758 | | | | 6,805,633 | |

| | | | | | | | 36,925,713 | |

|

| Distillers & Vintners–0.96% | |

Constellation Brands, Inc.–Class A | | | 43,914 | | | | 6,255,110 | |

|

| Diversified Chemicals–0.15% | |

Dow Chemical Co. (The) | | | 19,486 | | | | 1,003,139 | |

|

| Drug Retail–0.74% | |

CVS Health Corp. | | | 49,889 | | | | 4,877,648 | |

|

| Environmental & Facilities Services–1.08% | |

Republic Services, Inc. | | | 161,394 | | | | 7,099,722 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Fertilizers & Agricultural Chemicals–0.52% | | | | | |

Monsanto Co. | | | 34,352 | | | $ | 3,384,359 | |

|

| Health Care Equipment–1.08% | |

Medtronic PLC | | | 91,775 | | | | 7,059,333 | |

|

| Home Entertainment Software–1.47% | |

Activision Blizzard, Inc. | | | 91,948 | | | | 3,559,307 | |

Electronic Arts Inc.(b) | | | 88,375 | | | | 6,073,130 | |

| | | | | | | | 9,632,437 | |

|

| Home Improvement Retail–3.52% | |

Lowe’s Cos., Inc. | | | 303,341 | | | | 23,066,050 | |

|

| Hotels, Resorts & Cruise Lines–2.71% | |

Carnival Corp. | | | 326,205 | | | | 17,771,648 | |

|

| Household Appliances–1.22% | |

Whirlpool Corp. | | | 54,352 | | | | 7,982,678 | |

|

| Industrial Conglomerates–1.46% | |

Danaher Corp. | | | 63,673 | | | | 5,913,949 | |

Roper Technologies, Inc. | | | 19,261 | | | | 3,655,545 | |

| | | | | | | | 9,569,494 | |

|

| Industrial Gases–0.76% | |

Air Products and Chemicals, Inc. | | | 38,465 | | | | 5,004,681 | |

|

| Internet Retail–7.56% | |

Amazon.com, Inc.(b) | | | 49,450 | | | | 33,422,761 | |

Netflix Inc.(b) | | | 58,861 | | | | 6,732,521 | |

Priceline Group Inc. (The)(b) | | | 7,371 | | | | 9,397,656 | |

| | | | | | | | 49,552,938 | |

|

| Internet Software & Services–14.67% | |

Alibaba Group Holding Ltd.–ADR (China)(b) | | | 98,419 | | | | 7,998,512 | |

Alphabet Inc.–Class A(b) | | | 56,774 | | | | 44,170,740 | |

Facebook Inc.–Class A(b) | | | 349,794 | | | | 36,609,440 | |

LinkedIn Corp.–Class A(b) | | | 32,692 | | | | 7,358,315 | |

| | | | | | | | 96,137,007 | |

|

| Investment Banking & Brokerage–2.42% | |

Charles Schwab Corp. (The) | | | 481,426 | | | | 15,853,358 | |

|

| IT Consulting & Other Services–0.10% | |

Cognizant Technology Solutions Corp.–Class A(b) | | | 10,915 | | | | 655,118 | |

|

| Life Sciences Tools & Services–0.77% | |

Thermo Fisher Scientific, Inc. | | | 35,694 | | | | 5,063,194 | |

|

| Managed Health Care–1.73% | |

UnitedHealth Group Inc. | | | 96,321 | | | | 11,331,203 | |

|

| Oil & Gas Exploration & Production–1.11% | |

Cimarex Energy Co. | | | 14,188 | | | | 1,268,124 | |

Pioneer Natural Resources Co. | | | 48,071 | | | | 6,027,142 | |

| | | | | | | | 7,295,266 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco V.I. American Franchise Fund

| | | | | | | | |

| | | Shares | | | Value | |

| Packaged Foods & Meats–0.99% | |

JM Smucker Co. (The) | | | 20,241 | | | $ | 2,496,525 | |

Tyson Foods, Inc.–Class A | | | 74,792 | | | | 3,988,657 | |

| | | | | | | | 6,485,182 | |

|

| Pharmaceuticals–4.88% | |

Allergan PLC(b) | | | 39,875 | | | | 12,460,938 | |

Bristol-Myers Squibb Co. | | | 156,050 | | | | 10,734,680 | |

Eli Lilly and Co. | | | 103,867 | | | | 8,751,833 | |

| | | | | | | | 31,947,451 | |

|

| Semiconductors–3.43% | |

Avago Technologies Ltd. (Singapore) | | | 54,788 | | | | 7,952,478 | |

NXP Semiconductors N.V. (Netherlands)(b) | | | 172,481 | | | | 14,531,525 | |

| | | | | | | | 22,484,003 | |

|

| Soft Drinks–0.80% | |

Monster Beverage Corp.(b) | | | 35,002 | | | | 5,213,898 | |

|

| Specialized Finance–2.07% | |

CME Group Inc.–Class A | | | 66,814 | | | | 6,053,349 | |

McGraw Hill Financial, Inc. | | | 76,042 | | | | 7,496,220 | |

| | | | | | | | 13,549,569 | |

|

| Specialized REIT’s–0.79% | |

American Tower Corp. | | | 53,300 | | | | 5,167,435 | |

|

| Systems Software–1.52% | |

Check Point Software Technologies Ltd. (Israel)(b)(c) | | | 15,908 | | | | 1,294,593 | |

Microsoft Corp. | | | 35,503 | | | | 1,969,706 | |

ServiceNow, Inc.(b) | | | 77,023 | | | | 6,667,111 | |

| | | | | | | | 9,931,410 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Technology Hardware, Storage & Peripherals–4.87% | |

Apple Inc. | | | 303,104 | | | $ | 31,904,727 | |

|

| Tobacco–2.66% | |

Altria Group, Inc. | | | 87,466 | | | | 5,091,396 | |

Philip Morris International Inc. | | | 139,956 | | | | 12,303,532 | |

| | | | | | | | 17,394,928 | |

|

| Wireless Telecommunication Services–1.45% | |

Sprint Corp.(b) | | | 2,618,284 | | | | 9,478,188 | |

Total Common Stocks & Other Equity Interests

(Cost $426,950,985) | | | | 646,464,269 | |

| |

Money Market Funds–1.43% | | | | | |

Liquid Assets Portfolio–Institutional Class, 0.29%(d) | | | 4,695,981 | | | | 4,695,981 | |

Premier Portfolio–Institutional Class, 0.24%(d) | | | 4,695,981 | | | | 4,695,981 | |

Total Money Market Funds

(Cost $9,391,962) | | | | 9,391,962 | |

TOTAL INVESTMENTS (excluding investments purchased with cash collateral from securities on loan)–100.10%

(Cost $436,342,947) | | | | 655,856,231 | |

| |

Investments Purchased with Cash Collateral from Securities on Loan | | | | | |

Money Market Funds–0.15% | |

Liquid Assets Portfolio–Institutional Class, 0.29%

(Cost $1,005,187)(d)(e) | | | 1,005,187 | | | | 1,005,187 | |

TOTAL INVESTMENTS–100.25%

(Cost $437,348,134) | | | | 656,861,418 | |

OTHER ASSETS LESS LIABILITIES–(0.25)% | | | | (1,644,577 | ) |

NET ASSETS–100.00% | | | $ | 655,216,841 | |

Investment Abbreviations:

| | |

| ADR | | – American Depositary Receipt |

| REIT | | – Real Estate Investment Trust |

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | All or a portion of this security was out on loan at December 31, 2015. |

| (d) | The money market fund and the Fund are affiliated by having the same investment adviser. The rate shown is the 7-day SEC standardized yield as of December 31, 2015. |

| (e) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 1I. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco V.I. American Franchise Fund

Statement of Assets and Liabilities

December 31, 2015

Statement of Operations

For the year ended December 31, 2015

| | | | |

Assets: | |

Investments, at value (Cost $426,950,985)* | | $ | 646,464,269 | |

Investments in affiliated money market funds, at value and cost | | | 10,397,149 | |

Total investments, at value (Cost $437,348,134) | | | 656,861,418 | |

Foreign currencies, at value (Cost $6,455) | | | 6,406 | |

Receivable for: | | | | |

Investments sold | | | 335,286 | |

Fund shares sold | | | 28,610 | |

Dividends | | | 665,170 | |

Investment for trustee deferred compensation and retirement plans | | | 341,256 | |

Other assets | | | 386 | |

Total assets | | | 658,238,532 | |

| |

Liabilities: | | | | |

Payable for: | | | | |

Fund shares reacquired | | | 1,122,015 | |

Collateral upon return of securities loaned | | | 1,005,187 | |

Accrued fees to affiliates | | | 496,670 | |

Accrued trustees’ and officers’ fees and benefits | | | 246 | |

Accrued other operating expenses | | | 19,957 | |

Trustee deferred compensation and retirement plans | | | 377,616 | |

Total liabilities | | | 3,021,691 | |

Net assets applicable to shares outstanding | | $ | 655,216,841 | |

| |

Net assets consist of: | | | | |

Shares of beneficial interest | | $ | 386,466,017 | |

Undistributed net investment income (loss) | | | (393,011 | ) |

Undistributed net realized gain | | | 49,631,245 | |

Net unrealized appreciation | | | 219,512,590 | |

| | | $ | 655,216,841 | |

|

Net Assets: | |

Series I | | $ | 479,298,302 | |

Series II | | $ | 175,918,539 | |

|

Shares outstanding, $0.001 par value per share,

with an unlimited number of shares authorized: | |

Series I | | | 8,364,199 | |

Series II | | | 3,149,863 | |

Series I: | | | | |

Net asset value per share | | $ | 57.30 | |

Series II: | | | | |

Net asset value per share | | $ | 55.85 | |

| * | At December 31, 2015, securities with an aggregate value of $970,945 were on loan to brokers. |

| | | | |

Investment income: | |

Dividends (net of foreign withholding taxes of $4,591) | | $ | 6,346,572 | |

Dividends from affiliated money market funds (includes securities lending income of $9,401) | | | 15,383 | |

Interest | | | 20,823 | |

Total investment income | | | 6,382,778 | |

| |

Expenses: | | | | |

Advisory fees | | | 4,700,408 | |

Administrative services fees | | | 1,795,503 | |

Custodian fees | | | 34,175 | |

Distribution fees — Series II | | | 468,556 | |

Transfer agent fees | | | 84,249 | |

Trustees’ and officers’ fees and benefits | | | 39,502 | |

Other | | | 77,792 | |

Total expenses | | | 7,200,185 | |

Less: Fees waived | | | (7,801 | ) |

Net expenses | | | 7,192,384 | |

Net investment income (loss) | | | (809,606 | ) |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain from: | | | | |

Investment securities | | | 52,372,803 | |

Foreign currencies | | | 9,682 | |

| | | | 52,382,485 | |

Change in net unrealized appreciation (depreciation) of: | | | | |

Investment securities | | | (17,202,875 | ) |

Foreign currencies | | | (943 | ) |

| | | | (17,203,818 | ) |

Net realized and unrealized gain | | | 35,178,667 | |

Net increase in net assets resulting from operations | | $ | 34,369,061 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco V.I. American Franchise Fund

Statement of Changes in Net Assets

For the years ended December 31, 2015 and 2014

| | | | | | | | |

| | | 2015 | | | 2014 | |

Operations: | | | | | |

Net investment income (loss) | | $ | (809,606 | ) | | $ | (1,908,252 | ) |

Net realized gain | | | 52,382,485 | | | | 115,649,421 | |

Change in net unrealized appreciation (depreciation) | | | (17,203,818 | ) | | | (54,154,967 | ) |

Net increase in net assets resulting from operations | | | 34,369,061 | | | | 59,586,202 | |

| | |

Distributions to shareholders from net investment income: | | | | | | | | |

Series l | | | — | | | | (227,487 | ) |

Series ll | | | — | | | | — | |

Total distributions from net investment income | | | — | | | | (227,487 | ) |

| | |

Distributions to shareholders from net realized gains: | | | | | | | | |

Series l | | | (2,611,057 | ) | | | — | |

Series ll | | | (990,300 | ) | | | — | |

Total distributions from net realized gains | | | (3,601,357 | ) | | | — | |

| | |

Share transactions–net: | | | | | | | | |

Series l | | | (85,531,558 | ) | | | (82,553,486 | ) |

Series ll | | | (31,089,512 | ) | | | (74,143,144 | ) |

Net increase (decrease) in net assets resulting from share transactions | | | (116,621,070 | ) | | | (156,696,630 | ) |

Net increase (decrease) in net assets | | | (85,853,366 | ) | | | (97,337,915 | ) |

| | |

Net assets: | | | | | | | | |

Beginning of year | | | 741,070,207 | | | | 838,408,122 | |

End of year (includes undistributed net investment income (loss) of $(393,011) and $(425,299), respectively) | | $ | 655,216,841 | | | $ | 741,070,207 | |

Notes to Financial Statements

December 31, 2015

NOTE 1—Significant Accounting Policies

Invesco V.I. American Franchise Fund (the “Fund”) is a series portfolio of AIM Variable Insurance Funds (Invesco Variable Insurance Funds) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company consisting of twenty-four separate portfolios, (each constituting a “Fund”). The assets, liabilities and operations of each portfolio are accounted for separately. Information presented in these financial statements pertains only to the Fund. Matters affecting each Fund or class will be voted on exclusively by the shareholders of such Fund or class. Current Securities and Exchange Commission (“SEC”) guidance, however, requires participating insurance companies offering separate accounts to vote shares proportionally in accordance with the instructions of the contract owners whose investments are funded by shares of each Fund or class.

The Fund’s investment objective is to seek capital growth.

The Fund currently offers two classes of shares, Series I and Series II, both of which are offered to insurance company separate accounts funding variable annuity contracts and variable life insurance policies (“variable products”).

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations — Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect

Invesco V.I. American Franchise Fund

appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the Adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income — Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on the accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination — For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions — Distributions from net investment income and net realized capital gain, if any, are generally declared and paid to separate accounts of participating insurance companies annually and recorded on the ex-dividend date. |

| E. | Federal Income Taxes — The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

Invesco V.I. American Franchise Fund

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Expenses — Fees provided for under the Rule 12b-1 plan of a particular class of the Fund and which are directly attributable to that class are charged to the operations of such class. All other expenses are allocated among the classes based on relative net assets. |

| G. | Accounting Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications — Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Securities Lending — The Fund may lend portfolio securities having a market value up to one-third of the Fund’s total assets. Such loans are secured by collateral equal to no less than the market value of the loaned securities determined daily by the securities lending provider. Such collateral will be cash or debt securities issued or guaranteed by the U.S. Government or any of its sponsored agencies. Cash collateral received in connection with these loans is invested in short-term money market instruments or affiliated money market funds and is shown as such on the Schedule of Investments. The Fund bears the risk of loss with respect to the investment of collateral. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. When loaning securities, the Fund retains certain benefits of owning the securities, including the economic equivalent of dividends or interest generated by the security. Lending securities entails a risk of loss to the Fund if, and to the extent that, the market value of the securities loaned were to increase and the borrower did not increase the collateral accordingly, and the borrower failed to return the securities. The securities loaned are subject to termination at the option of the borrower or the Fund. Upon termination, the borrower will return to the Fund the securities loaned and the Fund will return the collateral. Upon the failure of the borrower to return the securities, collateral may be liquidated and the securities may be purchased on the open market to replace the loaned securities. The Fund could experience delays and costs in gaining access to the collateral and the securities may lose value during the delay which could result in potential losses to the Fund. Some of these losses may be indemnified by the lending agent. The Fund bears the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. Dividends received on cash collateral investments for securities lending transactions, which are net of compensation to counterparties, are included in Dividends from affiliated money market funds on the Statement of Operations. The aggregate value of securities out on loan, if any, is shown as a footnote on the Statement of Assets and Liabilities. |

| J. | Foreign Currency Translations — Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

The Fund may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests and are shown in the Statement of Operations.

| K. | Forward Foreign Currency Contracts — The Fund may engage in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis, or through forward foreign currency contracts, to manage or minimize currency or exchange rate risk. |

The Fund may also enter into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security, or the Fund may also enter into forward foreign currency contracts that do not provide for physical settlement of the two currencies, but instead are settled by a single cash payment calculated as the difference between the agreed upon exchange rate and the spot rate at settlement based upon an agreed upon notional amount (non-deliverable forwards). The Fund will set aside liquid assets in an amount equal to daily mark-to-market obligation for forward foreign currency contracts.

A forward foreign currency contract is an obligation between two parties (“Counterparties”) to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statement of Operations. The primary risks associated with forward foreign currency contracts include failure of the Counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statement of Assets and Liabilities.

Invesco V.I. American Franchise Fund

NOTE 2—Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with Invesco Advisers, Inc. (the “Adviser” or “Invesco”). Under the terms of the investment advisory agreement, the Fund pays an advisory fee to the Adviser based on the annual rate of the Fund’s average daily net assets as follows:

| | | | | | |

| Average Daily Net Assets | | Rate |

First $250 million | | | 0 | .695% | | |

Next $250 million | | | 0 | .67% | | |

Next $500 million | | | 0 | .645% | | |

Next $550 million | | | 0 | .62% | | |

Next $3.45 billion | | | 0 | .60% | | |

Next $250 million | | | 0 | .595% | | |

Next $2.25 billion | | | 0 | .57% | | |

Next $2.5 billion | | | 0 | .545% | | |

Over $10 billion | | | 0 | .52% | | |

For the year ended December 31, 2015, the effective advisory fees incurred by the Fund was 0.67%.

Under the terms of a master sub-advisory agreement between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, may pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Affiliated Sub-Adviser(s).

The Adviser has contractually agreed, through at least June 30, 2016, to waive advisory fees and/or reimburse expenses to the extent necessary to limit total annual fund operating expenses after fee waiver and/or expense reimbursement (excluding certain items discussed below) of Series I shares to 2.00% and Series II shares to 2.25% of average daily net assets. In determining the Adviser’s obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account, and could cause the total annual operating expenses after fee waiver and/or expense reimbursement to exceed the numbers reflected above: (1) interest; (2) taxes; (3) dividend expense on short sales; (4) extraordinary or non-routine items, including litigation expenses; and (5) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement. Unless Invesco continues the fee waiver agreement, it will terminate on June 30, 2016. The fee waiver agreement cannot be terminated during its term. The Adviser did not waive fees and/or reimburse expenses during the period under this expense limitation.

Further, the Adviser has contractually agreed, through at least June 30, 2017, to waive the advisory fee payable by the Fund in an amount equal to 100% of the net advisory fees the Adviser receives from the affiliated money market funds on investments by the Fund of uninvested cash (excluding investments of cash collateral from securities lending) in such affiliated money market funds.

For the year ended December 31, 2015, the Adviser waived advisory fees of $7,801.

The Trust has entered into a master administrative services agreement with Invesco pursuant to which the Fund has agreed to pay Invesco a fee for costs incurred in providing accounting services and fund administrative services to the Fund and to reimburse Invesco for administrative services fees paid to insurance companies that have agreed to provide services to the participants of separate accounts. These administrative services provided by the insurance companies may include, among other things: the printing of prospectuses, financial reports and proxy statements and the delivery of the same to existing participants; the maintenance of master accounts; the facilitation of purchases and redemptions requested by the participants; and the servicing of participants’ accounts. Pursuant to such agreement, for the year ended December 31, 2015, Invesco was paid $165,925 for accounting and fund administrative services and reimbursed $1,629,578 for services provided by insurance companies.

The Trust has entered into a transfer agency and service agreement with Invesco Investment Services, Inc. (“IIS”) pursuant to which the Fund has agreed to pay IIS a fee for providing transfer agency and shareholder services to the Fund and reimburse IIS for certain expenses incurred by IIS in the course of providing such services. For the year ended December 31, 2015, expenses incurred under the agreement are shown in the Statement of Operations as Transfer agent fees.

The Trust has entered into a master distribution agreement with Invesco Distributors, Inc. (“IDI”) to serve as the distributor for the Fund. The Trust has adopted a plan pursuant to Rule 12b-1 under the 1940 Act with respect to the Fund’s Series II shares (the “Plan”). The Fund, pursuant to the Plan, pays IDI compensation at the annual rate of 0.25% of the Fund’s average daily net assets of Series II shares. Of the Plan payments, up to 0.25% of the average daily net assets of the Series II shares may be paid to insurance companies who furnish continuing personal shareholder services to customers who purchase and own Series II shares of the Fund. For the year ended December 31, 2015, expenses incurred under the Plan are detailed in the Statement of Operations as Distribution fees.

For the year ended December 31, 2015, the Fund incurred $11,472 in brokerage commissions with Invesco Capital Markets, Inc., an affiliate of the Adviser and IDI, for portfolio transactions executed on behalf of the Fund.

Certain officers and trustees of the Trust are officers and directors of the Adviser, IIS and/or IDI.

Invesco V.I. American Franchise Fund

NOTE 3—Additional Valuation Information

GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or out of an investment’s assigned level:

| | Level 1 — | Prices are determined using quoted prices in an active market for identical assets. |

| | Level 2 — | Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. |

| | Level 3 — | Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information. |

The following is a summary of the tiered valuation input levels, as of December 31, 2015. The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Equity Securities | | $ | 649,019,484 | | | $ | 7,841,934 | | | $ | — | | | $ | 656,861,418 | |

NOTE 4—Trustees’ and Officers’ Fees and Benefits

Trustees’ and Officers’ Fees and Benefits include amounts accrued by the Fund to pay remuneration to certain Trustees and Officers of the Fund. Trustees have the option to defer compensation payable by the Fund, and Trustees’ and Officers’ Fees and Benefits also include amounts accrued by the Fund to fund such deferred compensation amounts. Those Trustees who defer compensation have the option to select various Invesco Funds in which their deferral accounts shall be deemed to be invested. Finally, certain current Trustees were eligible to participate in a retirement plan that provided for benefits to be paid upon retirement to Trustees over a period of time based on the number of years of service. The Fund may have certain former Trustees who also participate in a retirement plan and receive benefits under such plan. Trustees’ and Officers’ Fees and Benefits include amounts accrued by the Fund to fund such retirement benefits. Obligations under the deferred compensation and retirement plans represent unsecured claims against the general assets of the Fund.

NOTE 5—Cash Balances

The Fund is permitted to temporarily carry a negative or overdrawn balance in its account with State Street Bank and Trust Company, the custodian bank. Such balances, if any at period end, are shown in the Statement of Assets and Liabilities under the payable caption Amount due custodian. To compensate the custodian bank for such overdrafts, the overdrawn Fund may either (1) leave funds as a compensating balance in the account so the custodian bank can be compensated by earning the additional interest; or (2) compensate by paying the custodian bank at a rate agreed upon by the custodian bank and Invesco, not to exceed the contractually agreed upon rate.

NOTE 6—Distributions to Shareholders and Tax Components of Net Assets

Tax Character of Distributions to Shareholders Paid During the Fiscal Years Ended December 31, 2015 and 2014:

| | | | | | | | |

| | | 2015 | | | 2014 | |

Ordinary income | | $ | — | | | $ | 227,487 | |

Long-term capital gain | | | 3,601,357 | | | | — | |

Total Distributions | | $ | 3,601,357 | | | $ | 227,487 | |

Tax Components of Net Assets at Period-End:

| | | | |

| | | 2015 | |

Undistributed long-term gain | | $ | 52,641,901 | |

Net unrealized appreciation — investments | | | 216,502,628 | |

Net unrealized appreciation (depreciation) — other investments | | | (694 | ) |

Temporary book/tax differences | | | (393,011 | ) |

Shares of beneficial interest | | | 386,466,017 | |

Total net assets | | $ | 655,216,841 | |

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is due to differences in the timing of recognition of gains and losses on investments for tax and book purposes. The Fund’s net unrealized appreciation difference is attributable primarily to wash sales.

The temporary book/tax differences are a result of timing differences between book and tax recognition of income and/or expenses. The Fund’s temporary book/tax differences are the result of the trustee deferral of compensation and retirement plan benefits.

Invesco V.I. American Franchise Fund

Capital loss carryforward is calculated and reported as of a specific date. Results of transactions and other activity after that date may affect the amount of capital loss carryforward actually available for the Fund to utilize. Capital losses generated in years beginning after December 22, 2010 can be carried forward for an unlimited period, whereas previous losses expire in eight tax years. Capital losses with an expiration period may not be used to offset capital gains until all net capital losses without an expiration date have been utilized. Capital loss carryforwards with no expiration date will retain their character as either short-term or long-term capital losses instead of as short-term capital losses as under prior law. The ability to utilize capital loss carryforwards in the future may be limited under the Internal Revenue Code and related regulations based on the results of future transactions.

The Fund does not have a capital loss carryforward as of December 31, 2015.

NOTE 7—Investment Securities

The aggregate amount of investment securities (other than short-term securities, U.S. Treasury obligations and money market funds, if any) purchased and sold by the Fund during the year ended December 31, 2015 was $471,883,595 and $599,330,322, respectively. Cost of investments on a tax basis includes the adjustments for financial reporting purposes as of the most recently completed federal income tax reporting period-end.

| | | | |

| Unrealized Appreciation (Depreciation) of Investment Securities on a Tax Basis | |

Aggregate unrealized appreciation of investment securities | | $ | 225,374,790 | |

Aggregate unrealized (depreciation) of investment securities | | | (8,872,162 | ) |

Net unrealized appreciation of investment securities | | $ | 216,502,628 | |

Cost of investments for tax purposes is $440,358,790.

NOTE 8—Reclassification of Permanent Differences

Primarily as a result of differing book/tax treatment of net operating losses, on December 31, 2015, undistributed net investment income (loss) was increased by $841,894, undistributed net realized gain was increased by $11,436 and shares of beneficial interest was decreased by $853,330. This reclassification had no effect on the net assets of the Fund.

NOTE 9—Share Information

| | | | | | | | | | | | | | | | |

| | | Summary of Share Activity | |

| | | Years ended December 31, | |

| | | 2015(a) | | | 2014 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Sold: | | | | | | | | | | | | | | | | |

Series I | | | 254,518 | | | $ | 14,486,619 | | | | 497,166 | | | $ | 25,779,760 | |

Series II | | | 180,274 | | | | 9,991,611 | | | | 265,604 | | | | 13,450,608 | |

| | | | |

Issued as reinvestment of dividends: | | | | | | | | | | | | | | | | |

Series I | | | 48,878 | | | | 2,611,057 | | | | 4,272 | | | | 227,487 | |

Series II | | | 19,008 | | | | 990,300 | | | | — | | | | — | |

| | | | |

Reacquired: | | | | | | | | | | | | | | | | |

Series I | | | (1,813,621 | ) | | | (102,629,234 | ) | | | (2,094,994 | ) | | | (108,560,733 | ) |

Series II | | | (762,570 | ) | | | (42,071,423 | ) | | | (1,752,048 | ) | | | (87,593,752 | ) |

Net increase (decrease) in share activity | | | (2,073,513 | ) | | $ | (116,621,070 | ) | | | (3,080,000 | ) | | $ | (156,696,630 | ) |

| (a) | There are entities that are record owners of more than 5% of the outstanding shares of the Fund and in the aggregate own 24% of the outstanding shares of the Fund. The Fund and the Fund’s principal underwriter or adviser, are parties to participation agreements with these entities whereby these entities sell units of interest in separate accounts funding variable products that are invested in the Fund. The Fund, Invesco and/or Invesco affiliates may make payments to these entities, which are considered to be related to the Fund, for providing services to the Fund, Invesco and/or Invesco affiliates including but not limited to services such as, securities brokerage, third party record keeping and account servicing and administrative services. The Fund has no knowledge as to whether all or any portion of the shares owned of record by these entities are also owned beneficially. |

Invesco V.I. American Franchise Fund

NOTE 10—Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset

value,

beginning

of period | | Net

investment

income (loss)(a) | | Net gains

(losses) on securities (both

realized and

unrealized) | | Total from

investment operations | | Dividends

from net

investment income | | Distributions from net

realized gains | | Total

distributions | | Net asset value, end of period | | Total

return(b) | | Net assets,

end of period (000’s omitted) | | Ratio of

expenses to average net assets

with fee waivers and/or expenses absorbed | | Ratio of

expenses

to average net

assets without

fee waivers

and/or expenses

absorbed | | Ratio of net

investment

income (loss)

to average

net assets | | Portfolio

turnover(c) |

Series I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/15 | | | $ | 54.88 | | | | $ | (0.03 | ) | | | $ | 2.76 | | | | $ | 2.73 | | | | $ | — | | | | $ | (0.31 | ) | | | $ | (0.31 | ) | | | $ | 57.30 | | | | | 5.01 | % | | | $ | 479,298 | | | | | 0.96 | %(d) | | | | 0.96 | %(d) | | | | (0.05 | )%(d) | | | | 68 | % |

Year ended 12/31/14 | | | | 50.63 | | | | | (0.09 | ) | | | | 4.36 | | | | | 4.27 | | | | | (0.02 | ) | | | | — | | | | | (0.02 | ) | | | | 54.88 | | | | | 8.44 | | | | | 541,929 | | | | | 0.92 | | | | | 0.95 | | | | | (0.17 | ) | | | | 64 | |

Year ended 12/31/13 | | | | 36.28 | | | | | 0.04 | | | | | 14.50 | | | | | 14.54 | | | | | (0.19 | ) | | | | — | | | | | (0.19 | ) | | | | 50.63 | | | | | 40.13 | | | | | 580,620 | | | | | 0.90 | | | | | 0.96 | | | | | 0.08 | | | | | 75 | |

Year ended 12/31/12 | | | | 31.90 | | | | | 0.19 | | | | | 4.19 | | | | | 4.38 | | | | | — | | | | | — | | | | | — | | | | | 36.28 | | | | | 13.73 | | | | | 496,341 | | | | | 0.88 | | | | | 0.98 | | | | | 0.52 | | | | | 190 | |

Year ended 12/31/11 | | | | 34.00 | | | | | (0.05 | ) | | | | (2.05 | ) | | | | (2.10 | ) | | | | — | | | | | — | | | | | — | | | | | 31.90 | | | | | (6.18 | ) | | | | 122,986 | | | | | 0.84 | | | | | 0.99 | | | | | (0.15 | ) | | | | 126 | |

Series II | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/15 | | | | 53.63 | | | | | (0.16 | ) | | | | 2.69 | | | | | 2.53 | | | | | — | | | | | (0.31 | ) | | | | (0.31 | ) | | | | 55.85 | | | | | 4.75 | | | | | 175,919 | | | | | 1.21 | (d) | | | | 1.21 | (d) | | | | (0.30 | )(d) | | | | 68 | |

Year ended 12/31/14 | | | | 49.58 | | | | | (0.22 | ) | | | | 4.27 | | | | | 4.05 | | | | | — | | | | | — | | | | | — | | | | | 53.63 | | | | | 8.17 | | | | | 199,141 | | | | | 1.17 | | | | | 1.20 | | | | | (0.42 | ) | | | | 64 | |

Year ended 12/31/13 | | | | 35.55 | | | | | (0.07 | ) | | | | 14.20 | | | | | 14.13 | | | | | (0.10 | ) | | | | — | | | | | (0.10 | ) | | | | 49.58 | | | | | 39.79 | | | | | 257,788 | | | | | 1.15 | | | | | 1.21 | | | | | (0.17 | ) | | | | 75 | |

Year ended 12/31/12 | | | | 31.35 | | | | | 0.10 | | | | | 4.10 | | | | | 4.20 | | | | | — | | | | | — | | | | | — | | | | | 35.55 | | | | | 13.40 | | | | | 224,334 | | | | | 1.13 | | | | | 1.23 | | | | | 0.27 | | | | | 190 | |

Year ended 12/31/11 | | | | 33.49 | | | | | (0.14 | ) | | | | (2.00 | ) | | | | (2.14 | ) | | | | — | | | | | — | | | | | — | | | | | 31.35 | | | | | (6.39 | ) | | | | 85,724 | | | | | 1.09 | | | | | 1.24 | | | | | (0.40 | ) | | | | 126 | |

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Total returns are not annualized for periods less than one year, if applicable and do not reflect charges assessed in connection with a variable product, which if included would reduce total returns. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. For the year ended December 31, 2012, the portfolio turnover calculation excludes the value of securities purchased of $14,357,093 and sold of $15,173,740 in the effort to realign the Fund’s portfolio holdings after the reorganization of Invesco V.I. Capital Appreciation Fund and Invesco V.I. Leisure Fund into the Fund. For the year ended December 31, 2011, the portfolio turnover calculation excludes the value of securities purchased of $81,993,574 and sold of $49,870,241 in the effort to realign the Fund’s portfolio holdings after the reorganization of Invesco V.I. Large Cap Growth Fund into the Fund. |

| (d) | Ratios are based on average daily net assets (000’s omitted) of $512,253 and $187,422 for Series I and Series II Shares, respectively. |

Invesco V.I. American Franchise Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of AIM Variable Insurance Funds (Invesco Variable Insurance Funds)

and Shareholders of Invesco V.I. American Franchise Fund: