UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07454

Pacific Capital Funds

(Exact name of registrant as specified in charter)

| 111 South King Street Honolulu, HI | 96813 | |

| (Address of principal executive offices) | (Zip code) |

BISYS Fund Services, 3435 Stelzer Road Columbus, Ohio 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 614-470-8000

Date of fiscal year end: 7/31/04

Date of reporting period: 7/31/04

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

PACIFIC CAPITAL FUNDS

Annual Report

As of July 31, 2004

MUTUAL FUNDS: ARE NOT FDIC INSURED • HAVE NO BANK GUARANTEE • MAY LOSE VALUE

Table of Contents

Letter to Shareholders

Page 1

Fund Performance Review

Page 3

Statements of Assets and Liabilities

Page 29

Statements of Operations

Page 32

Statements of Changes in Net Assets

Page 35

Schedules of Portfolio Investments

Page 39

Notes to Financial Statements

Page 67

Financial Highlights

Page 81

Report of Independent Registered Public Accounting Firm

Page 93

Letter to Shareholders

Dear Shareholders:

The U.S. economy began the 12-month period between August 1, 2003 and July 31, 2004 with strong growth. Growth decelerated but remained solid during the period. Performance produced by the stock market rose during the six months through January. The Dow Jones Industrial Average1 gained 9.81% during the period, while the Standard & Poor’s 500 Index2 gained 13.16%.

Accommodative monetary policy helped spur the economy. The Federal Reserve Board (“the Fed”) kept short-term interest rates at historically low levels through June, in an effort to stimulate growth and hold off the possibility of deflation. Low interest rates and low inflation resulted in inexpensive borrowing costs for consumers, many of whom refinanced mortgages to free up cash for large items such as home improvements and automobiles. That trend buttressed consumer spending throughout the early part of the period, helping buoy the economic expansion. Business spending, which had been very low during prior years, picked up during this period. Generally, corporate profits increased in that environment.

Meanwhile, rising energy costs and weak job creation restrained economic growth during the latter half of the period. Increases in oil prices, combined with demand for basic materials from China and elsewhere, increased the likelihood of inflation during early 2004. The Fed held off on raising short-term interest rates until job growth strengthened in the spring. The Fed announced in April that it was likely to increase rates to prevent the economy from overheating, and it did so on June 30. The economy slowed between April and July, due in part to softer consumer spending. Gross Domestic Product3 grew at annualized rates of 7.4% in the third calendar quarter of 2004, 4.1% during the fourth quarter, 4.5% in the first quarter of 2004 and 2.8% during the second quarter.

Generally, stocks rose during the first six months of the period and then entered a choppy correction phase from January through July. The economic rebound initially lifted stocks in technology and other high-growth sectors. Market leadership quickly shifted to value stocks, however, and value out-gained growth by a considerable margin for the period as a whole. Investor unease, fueled by problems in Iraq, the prospect for terrorism and the uncertainty associated with a tight presidential contest, weighed on stocks during the second half of the period.

Energy stocks led the market, supported by historically high oil prices. Financial-services shares also performed well. Finance companies were able to avoid the difficulties often associated with rising interest rates, and benefited from the rising stock market, despite weak demand for loans. Technology stocks fell dramatically toward the end of the period, as cautious earnings projections caused investors to reevaluate the shares’ valuations.

Stocks of low-quality firms with high debt and weak earnings, which had floundered during the bear market, outperformed their higher-quality counterparts during the first half of the period. Investors prized the relatively low valuations on small- and mid-cap stocks, which dramatically outperformed large caps. Smaller stocks became more expensive relative to their larger counterparts during the period, and shares of large firms appeared to assume market leadership near the end of the fiscal year.

Yields on Treasury securities were stable during the first half of the period. The six months from January through July saw rates on short-term Treasuries increase significantly in anticipation of Fed action, while yields on long-term Treasuries increased only slightly. Low-quality bonds produced very strong returns early in the period, as investors sought higher yields based on their lower prices.

At the Pacific Capital Funds

We launched the Pacific Capital Mid Cap Fund on December 30, 2003, in order to give shareholders access to that attractive sector of the market. The Fund has produced strong returns since its inception, gaining 3.50% (Class A Shares at NAV)*, compared to 0.52% for its benchmark, the Standard & Poor’s Mid Cap 400 Index4. The Pacific Capital Small Cap Fund also generated strong performance, with a return of 27.53% (Class A Shares at NAV)* for the 12 months through July, compared to a 22.83% for its benchmark, the Russell 2000 Value Index.5

Small and Mid Cap Funds Investment Concerns:

Small- and mid-capitalization stocks typically carry additional risk, since smaller companies generally have higher risk of failure and, historically, their stocks have experienced a greater degree of volatility.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232.

| 1 | Dow Jones Industrial Average is a price-weighted average based on the price-only performance of 30 blue chip stocks (The average is computed by adding the prices of the 30 stocks and dividing by a denominator, which has been adjusted over the years for stocks splits, stock dividends and substitutions of stocks). |

| 2 | Standard & Poor’s 500 Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange, and is a measure of the U.S. stock market as a whole. It is not possible to invest directly in any index. |

| 3 | Gross Domestic Product is the measure of the market value of the goods and services produced by labor and property in the United States. |

| 4 | The Standard & Poor’s Midcap 400 Index is an unmanaged index generally representative of 400 stocks in the mid-range sector of the domestic stock market, representing all major industries. It is not possible to invest directly in any index. |

| 5 | The Russell 2000 Value Index is an unmanaged index which measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. It is not possible to invest directly in any index. |

| * | For additional information, please refer to the Fund’s commentary section. |

1

Letter to Shareholders (cont.)

In general, the Pacific Capital Equity Funds focus on shares of high-quality firms with strong balance sheets and attractive growth prospects trading at favorable valuations and exhibiting positive momentum. That approach did not help relative returns during this 12-month period, when low-quality and value stocks led the market, but we are confident that over time our focus on quality and earnings growth will offer shareholders the best balance of risk and reward. We enhanced the Pacific Capital equity team during this period by providing our managers with increased analytics and risk-evaluation support.

The Pacific Capital Fixed-Income Funds continued their strategy of controlled, active duration management with a bias toward high-quality securities. Our focus on quality did not help returns during the 12 months through July 2004, but we believe over longer periods that focus will increase value while decreasing volatility.

Going Forward

We believe the economy’s fundamentals are sound. In particular, the growing workforce and productivity increases should allow the economy to continue to grow without generating significant increases in inflation. The Fed is likely to increase interest rates, but in a measured fashion that should not have an adverse impact on the economy or the stock market.

We expect to see the stock market gain ground once the uncertainty of the election has passed. Selling pressure recently has reached a cyclical low point, whereas buying pressure has reached a high. We believe those trends, coupled with solid economic growth, strong corporate earnings and reasonable valuations, stand to benefit the stock market. We believe that the overall market will show a gain for 2004, and that the market downturn in July will prove to be nothing more than a correction in an ongoing bull market.

Yields on fixed-income securities should trade in a relatively narrow range going forward. We expect the yield on the 10-year Treasury bond to vacillate between roughly 4.20% and 4.80%; our objective is to sell securities when yields are near the low point of that range, and buy when rates are at the high end. We will maintain the Funds’ focus on high-quality securities.

We would like to take this opportunity to remind investors of the importance of focusing on long-term investment goals and constructing diversified portfolios that provide the proper balance of risk and reward to reach them. The Pacific Capital Funds are designed to offer shareholders all the elements necessary to construct such portfolios, regardless of short-term market developments.

Thank you for your confidence in the Pacific Capital Funds. If you have any questions or would like a fund prospectus, please contact your registered investment consultant or call BISYS Fund Services at (800) 258-9232.

Sincerely,

Howard Hodel

Executive Vice President & Manager

Bank of Hawaii Asset Management Group

William Barton

Senior Vice President, Manager

Investment Management Group

The Asset Management Group of the Bank of Hawaii

NOTICE ABOUT DUPLICATE MAILINGS

In order to reduce expenses of the Pacific Capital Funds incurred in connection with the mailing of prospectuses, prospectus supplements, semi-annual reports and annual reports to multiple shareholders at the same address, Pacific Capital Funds may in the future deliver one copy of a prospectus, prospectus supplement, semi-annual report or annual report to a single investor sharing a street address or post office box with other investors, provided that all such investors have the same last name or are believed to be members of the same family. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you share an address with another investor and wish to receive your own prospectus, prospectus supplements, semi-annual reports and annual reports, please call the Trust toll-free at (800) 258-9232.

2

Pacific Capital New Asia Growth Fund

Investment Style

Regional, multi-cap, growth.

Investment Considerations

An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. The Fund’s share price is expected to be more volatile than that of a U.S.-only fund. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Objective

Long-term capital appreciation by investing in a broadly diversified portfolio of companies located in Asia’s developing regions, excluding Japan. Investments are not limited to any size or sector.

Investment Process

| • | Follow active bottom-up investment approach |

| • | Invest for absolute versus relative return |

| • | Look outside benchmark representation for fresh opportunities |

| • | Identify sensibly priced, high-quality companies that exhibit long-term growth potential |

Investment Management

Advised by The Asset Management Group of Bank of Hawaii

Sub-Advised by First State (Hong Kong) LLC

| • | Founded in 1988, with offices in Sydney, London, Edinburgh, Hong Kong, Singapore and Indonesia |

| • | Specializes in single country, regional and sector specific investments |

| • | Oversees more than $73.3 billion in assets |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2004, the fund gained 17.94% (Class A Shares without sales charge), compared to its benchmark, the MSCI AC Far East Free Index (excluding Japan), which returned 16.79%.

For the same period, the Fund ranked in the 43rd percentile among 55 funds in the Lipper Pacific Ex Japan Funds universe.1

What were the major factors in the market that influenced the Fund’s performance?

During the first half of the review period, stock markets rose due to a weaker U.S. dollar (thus boosting domestic liquidity in Asia), stronger global growth and buoyant domestic demand.

However, in the second half of the review period, stock markets fell due to a combination of weak technology stocks, fears of a ‘hard landing’ in China, political uncertainty, higher oil prices and U.S. interest rates.

The year saw elections in India, Indonesia, Malaysia, the Philippines and Taiwan. India was the biggest surprise with the election of the Congress Party, to which the market reacted negatively. The Philippines and Malaysia saw market-friendly results. The election contest in Indonesia is likely to advance to a second round and for Taiwan, there is still an amount of uncertainty surrounding the results.

Strong economic growth in Mainland China has driven demand for materials to exceptionally high levels. Companies in the materials sector have been major beneficiaries, for example, Anhui Conch Cement. In addition, the dramatic rise in oil prices lead to strong performance from CNOOC.†

Sentiment in Hong Kong continued to improve. Retail sales, residential property prices and office rents have rebounded sharply from their lows last year. In addition, the closer economic partnership with Mainland China has seen a huge influx of Mainland tourists to Hong Kong. This is likely to continue for the foreseeable future and bodes well for companies leveraged to the domestic economy. Esprit, Giordano, Hong Kong Land and Swire Pacific are some of the holdings that contributed to Fund performance.†

Domestic consumption also continues to rise in China, India, Singapore, Malaysia and Thailand. In stark contrast to the West, the current consumption boom is not credit driven. This means consumption should be more sustainable in Asia than elsewhere. The notable exception is South Korea, where consumer indebtedness is worrying and unemployment amongst the younger population is currently at extremely high levels.†

The biggest drag on performance was stock selection in South Korea. This was in part due to strong performance from Samsung Electronics, which despite being the largest holding in the Fund at about 5%, is a significantly higher component in the Index. Also, the stock price of Kook Soon Dang fell substantially as the company struggled to achieve projected sales of their new “soju” (Korean whisky) product.†

Past performance does not guarantee future results.

| 1 | The Lipper Pacific Ex Japan Funds Average is comprised of mutual funds that concentrates their investments in equity securities with primary trading markets or operations concentrated in the Pacific region (including Asian countries) and that specifically does not invest in Japan. For the one- and five-year periods ended July 31, 2004 the Pacific Capital New Asia Fund ranked 24 and 17 out of 55 and 41 funds in the Lipper Pacific Ex Japan Funds category, respectively. The Lipper Rankings are based on total returns and do not reflect a sales charge. Funds with multiple share classes have a common portfolio. |

| † | The composition of the Fund’s portfolio is subject to change. |

3

Pacific Capital New Asia Growth Fund (cont.)

What major changes have occurred in the portfolio during the period covered by the report?

Following the integration of the Singapore and Hong Kong investment teams with the Edinburgh investment team, a number of significant changes to the Fund were made.

First, the beta2 of the Fund was reduced by selling a significant amount of the technology exposure. Generally, these companies struggle to deliver sustainable earnings growth over a 3-5 year time horizon and were trading on unsustainably high valuations.

Second, the absolute risk in the Fund was reduced through the halving of the Samsung Electronics weighting that had been at about 10% of the total portfolio. As conviction-based investors, we feel that at this juncture, a 5% position in Samsung Electronics is appropriate and as mentioned above, it is still the largest holding in the Fund.†

Third, exposure to domestic consumer companies was increased through acquisitions in Hong Kong of Swire Pacific, Hong Kong Land and Wing Hang Bank and elsewhere in the region, Amorepacific, Tanjong, and Shinsegae Department stores.†

What is your outlook for the Fund?

We remain optimistic about the outlook for the Asian region. The developed world continues to outsource its manufacturing to Asia, most notably to China, which continues to see strong domestic inflows. We believe valuations are still comparatively inexpensive, though somewhat less attractive than early last year. The key to absolute returns in the short term may depend more on trends in the global economy than on local influences.

The weak U.S. dollar has so far proved to be a blessing for the asset class, boosting exports of both commodities and finished goods as well as increasing domestic liquidity. Confidence in the U.S. dollar as the world’s principal store of value should not be taken for granted. An uncontrollable shift out of U.S. dollars by either Central Banks in Asia or the private sector could yet have serious ramifications for the global economic and stockmarket outlook.

Domestic consumption remains the area where we believe we can find the most attractive companies that we anticipate could deliver sustainable earnings growth on a 3-5 year horizon.

If Asian interest rates were to decouple from those in the U.S., as we believe they well might, both absolute and relative stockmarket performance could surprise on the upside. At the same time, our focus on quality in terms of management, franchise and financials will stand us in good stead if markets prove to be less robust than was the case in 2003.

| † | The composition of the Fund’s portfolio is subject to change. |

| 2 | Beta is the measure of volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. |

4

Pacific Capital New Asia Growth Fund (cont.)

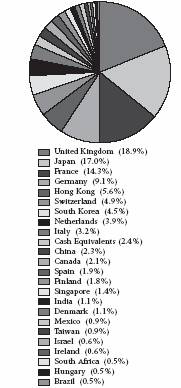

Country Weightings as of July 31, 2004

(as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

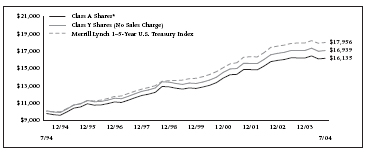

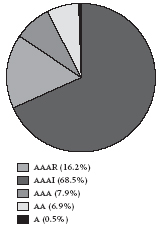

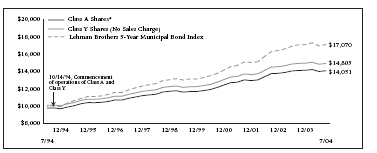

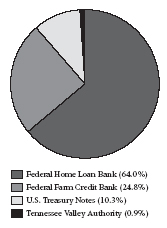

Growth of a $10,000 Investment

For performance purposes, the above graph has not been adjusted for CDSC charges. The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark. The chart above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns as of July 31, 2004

| 1 Year | 5 Year | Since Inception (2/15/95) | |||||||

Class A Shares* | 11.76 | % | 0.67 | % | 2.58 | % | |||

Class B Shares** | 13.18 | % | 0.94 | % | 2.71 | % | |||

Class C Shares** | 16.18 | % | 1.13 | % | 2.71 | % | |||

Class Y Shares (No Sales Charge) | 18.21 | % | 2.04 | % | 3.41 | % |

| * | Reflects 5.25% Maximum Front-End Sales Charge. |

| ** | Reflects Maximum Contingent Deferred Sales Charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares. The CDSC does not apply to performance over 6 years. |

The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232.

The Pacific Capital Funds are distributed by BISYS Fund Services. The Asset Management Group of Bank of Hawaii provides investment advisory and other services to the Fund and receives fees for those services. First State (Hong Kong) LLC is sub-advisor to the Fund and is paid a fee for its services.

Class B and Class C shares of the Fund commenced operations on March 2, 1998 and April 30, 2004, respectively. Performance information for Class C shares is based upon the performance of Class B shares from inception. Performance calculated for any period up to and through March 2, 1998 is based upon the performance of Class A shares, which does not reflect the higher 12b-1 fees. Had the higher 12b-1 fees been incorporated, total return figures may have been adversely affected. Performance figures reflect no deduction for taxes.

The performance of the Pacific Capital New Asia Growth Fund is measured against the Morgan Stanley Capital International (MSCI) All Country (AC) Far East Free Index (excluding Japan), which is unmanaged and is generally representative of the 48 developed and emerging markets around the world that collectively comprise virtually all of the foreign equity stock markets. The index does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

5

Pacific Capital International Stock Fund

Investment Style

International, multi-cap, blend

Investment Objective

Long-term capital appreciation by investing in a broadly diversified portfolio of companies domiciled outside the United States. Investments are not limited to any particular country or market capitalization.

Investment Considerations

An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. The Fund’s share price is expected to be more volatile than that of a U.S.-only fund. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Style neutral growth and value discipline |

| • | 50% managed by growth team—50% managed by value team |

| • | Disciplined bottom-up stock selection |

| • | Disciplined risk management framework to control industry and regional weightings |

Investment Management

Advised by The Asset Management Group of Bank of Hawaii

Sub-Advised by Hansberger Global Investors, Inc.

| • | Founded in 1994 by Thomas L. Hansberger, former President and CEO of Templeton Worldwide |

| • | Headquartered in Ft. Lauderdale, Florida, with satellite offices in Hong Kong, Moscow and Toronto |

| • | 17 investment professionals, 15 nationalities |

| • | $5.2 billion in assets under management |

How did the Fund perform compared to its benchmark?

During the period the Fund changed its standardized benchmark from the MSCI EAFE Index to the MSCI ACWI ex U.S. Index1. The new index provides a more appropriate market comparison of the Fund’s performance. During the partial period after this change was made from June 7 to July 31, the Fund underperformed the new benchmark The Fund was down –5.15% while the benchmark MSCI ACWI ex U.S. Index was down –2.69%. For the period ended July 31, 2004, the Fund produced a return of 14.71% (Class A Shares without sales charge) compared to a 25.50% return for the MSCI EAFE Index and a 30.75% return for the MSCI ACWI ex. U.S. Index.

What were the major factors in the market that influenced the Fund’s performance?

On June 7, 2004, after a special shareholder meeting to approve a sub-advisor change, Hansberger Global Investors, Inc. (HGI), assumed the role of sub-advisor for the International Stock Fund. Selected by Pacific Capital Funds for their strong track record and global investment concentration, HGI was founded in 1994 by Thomas L. Hansberger, former President and Chief Executive Officer of Templeton Worldwide. Headquartered in Fort Lauderdale, Florida, HGI manages more than $5 billion in assets and follows global investment markets through satellite offices in Hong Kong, Toronto and Moscow.

HGI pursues a style neutral investment strategy in which 50 percent of the portfolio is managed by the growth team and the other 50 percent by the value team. Both teams follow a rigorous, bottom-up stock selection process and adhere to a disciplined risk management framework to control industry and regional weightings. With the absence of style bias, this core investment style seeks to offer a more consistent risk/return profile.

What major changes have occurred in the portfolio during the period covered by the report?

Hansberger Global Investors, Inc. assumed the role of sub-advisor of the Fund on June 7.

What is your outlook for the Fund?

Recent market weakness presents the Fund with some possible opportunities as our analysts factor in the effect of changing conditions on stock valuations. We believe our analysts will asses potential interest rate increases. The Japanese market, while still expensive on a valuation basis, appears more attractive but may be weighted down by weakening demand from China.

HGI anticipates that equity investors will find many challenges in 2004 as election results and fiscal actions shift the economic landscape in which we invest. HGI will continue to deploy its long-term fundamental stock picking strategy in its mission to add value.

Past performance does not guarantee future results.

| 1 | The MSCI ACWI ex U.S. is a market capitalization index that is designed to measure equity market performance in the global developed and emerging markets. As of December 2003 the MSCI ACWI consisted of 49 developed and emerging market country indices. |

| † | The composition of the Fund’s portfolio is subject to change. |

6

Pacific Capital International Stock Fund (cont.)

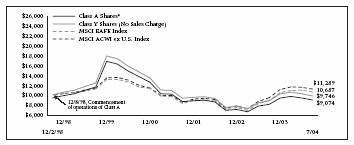

Country Weightings as of July 31, 2004

(as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

Growth of a $10,000 Investment

For performance purposes, the above graph has not been adjusted for CDSC charges. The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark. The chart above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns as of July 31, 2004

| 1 Year | 5 Year | Since Inception (12/2/98) | |||||||

Class A Shares* | 8.65 | % | -5.38 | % | -1.70 | % | |||

Class B Shares** | 9.78 | % | -5.13 | % | -1.55 | % | |||

Class C Shares** | 12.78 | % | -4.99 | % | -1.42 | % | |||

Class Y Shares (No Sales Charge) | 14.92 | % | -4.06 | % | -0.45 | % |

| * | Reflects 5.25% Maximum Front-End Sales Charge. |

| ** | Reflects Maximum Contingent Deferred Sales Charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares. |

The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232.

The Pacific Capital Funds are distributed by BISYS Fund Services. The Asset Management Group of Bank of Hawaii provides investment advisory and other services to the Fund and receives fees for those services. Hansberger Global Investors, Inc. is sub-advisor to the Fund and is paid a fee for its services.

The Pacific Capital International Stock Fund’s inception date was December 2, 1998. Class A Shares were not in existence prior to December 8, 1998. Performance calculated for any period up to and through December 8, 1998, is based upon the performance of Class Y Shares, which does not reflect the higher 12b-1 fees. Had the higher 12b-1 fees been incorporated, total return figures may have been inversely affected. Total return calculations for the Fund include changes in share price and reinvestment of dividends and capital gains.

Class A, Class B and Class C shares were not in existence prior to December 8, 1998, December 20, 1998 and April 30, 2004, respectively. Performance information for Class C shares is based upon the performance of Class B shares from inception. Performance calculated for any period up to and through such inception dates is based upon the performance of Class Y shares, which does not reflect the higher 12b-1 fees. Had the higher 12b-1 fees been incorporated, before and after-tax total return figures may have been adversely affected.

The performance of the Pacific Capital International Stock Fund is measured against the Morgan Stanley Capital International (MSCI) Europe, Australasia and Far East (EAFE®) Index, and the Morgan Stanley Capital International (MSCI) All Country World Free (ACWI) ex U.S. The MSCI EAFE® is generally a sample of companies representative of the market structure of 20 European and Pacific Basin countries. The MSCI ACWI ex U.S. is a market capitalization index that is designed to measure equity market performance in the global developed and emerging markets. As of December 2003 the MSCI ACWI consisted of 49 developed and emerging market country indices. The indices are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. The Fund has changed its standardized benchmark from the MSCI EAFE® Index to the MSCI ACWI ex U.S. Index to provide a more appropriate market comparison for the Fund’s performance. Investors cannot invest directly in an index, although they can invest in its underlying securities.

7

Pacific Capital Small Cap Fund

Investment Style

Domestic, small-cap, value

Investment Objective

Long-term capital appreciation by investing in a diversified portfolio of small-capitalization companies—average market cap of $16 million to $2.7 billion—believed to be undervalued, fundamentally strong and undergoing positive change.

Investment Considerations

Small-capitalization stocks typically carry additional risk, since smaller companies generally have a higher risk of failure and have experienced a greater degree of volatility. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Follow active bottom-up investment approach |

| • | Assess attractive valuations through price-to-book, price-to-earnings and dividend yield ratios |

| • | Identify improvement based on free cash flow, balance sheet liquidity, inventory sales ratio, insider buying and management change |

Investment Management

Advised by The Asset Management Group of Bank of Hawaii

Sub-Advised by Nicholas Applegate Capital Management

| • | Founded in 1984, NACM employs more than 57 investment professionals |

| • | Specializes in global and international equity, domestic equity and special strategy management |

| • | $17.8 billion in assets under management |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2004, the Fund returned 27.53% (Class A Shares at NAV), outperforming the Russell 2000® Value Index’s return of 22.83%.

For the same period, the Fund ranked in the 11th percentile amoung 515 funds in the Lipper Small-Cap Core Funds universe.1

The portfolio’s outperformance was largely a result of strong stock selection in industrials, materials and telecommunications services. Within industrials, Middleby, a manufacturer of foodservice equipment, continues to be a top performer with upgrades by several analysts and stronger-than-expected revenue. Brinks also exceeded earnings expectations benefiting from improvements in its BAX Global air freight business. Joy Global, a leading manufacturer of mining equipment, gained as a result of stronger copper and coal prices, which leads to increased capital investment by mining companies.†

In materials, stock selection was strong relative to the benchmark. Cleveland Cliffs, OM Group and Commonwealth Industries positively impacted performance during the period. Cleveland Cliffs, a processor of iron ore, benefited from a stronger pricing environment. OM Group, a processor of cobalt, benefited from higher cobalt prices. Commonwealth Industries, a producer of sheet aluminum, regained profitability following a positive turnaround in revenues and margins.†

Telecommunication services, one of the smaller sectors in the portfolio, added value compared to the benchmark. Wireless services provider NII Holdings gained after posting strong second quarter results and guiding net subscriber additions in Mexico much higher for the year.†

Stock selection lagged in the underweighted energy and consumer staples sectors. In consumer staples, Duane Reade, a regional drug store operator, missed analysts’ estimates as a result of higher operating costs. Delta & Pine, a leading commercial breeder, producer and marketer of cotton planting seed, announced lower cotton planting in the second half of the year, as a result of higher soybean plantings and higher soybean commodity prices.†

What were the major factors in the market that influenced the fund’s performance?

The U.S. equity markets delivered strong returns for the 12 months ending July 31, 2004 with small cap stocks outpacing large cap stocks during the period. The Dow Jones Industrial Average2 gained 12.2% and the NASDAQ Composite2 was up 8.8% for the one-year period while the cyclically-heavy Russell 2000 Value index gained 22.8%3.

Past performance does not guarantee future results.

| 1 | The Lipper Small-Cap Core Funds Average is comprised mutual of funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Small-cap core funds have more latitude in the companies in which they invest. These funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P SmallCap 600 Index. For the one-, three- and five-year periods ended July 31, 2004 the Pacific Capital Small Cap Fund ranked 54, 14 and 10 out of 515, 418 and 293 funds in the Lipper Small-Cap Core Funds category, respectively. The Lipper Rankings are based on total returns and do not reflect a sales charge. Funds with multiple share classes have a common portfolio. |

| 2 | Dow Jones Industrial Average is a price-weighted average based on the price-only performance of 30 blue chip stocks (The average is computed by adding the prices of the 30 stocks and dividing by a denominator, which has been adjusted over the years for stocks splits, stock dividends and substitutions of stocks). |

NASDAQ Composite Index is a market price only index that tracks the performance of domestic common stocks traded on the regular Nasdaq market as well as National Market System traded foreign common stocks and American Depository Receipts.

| † | The composition of the Fund’s portfolio is subject to change. |

8

Pacific Capital Small Cap Fund (cont.)

The broad-based economic recovery in the second half of 2003 resulted in double-digit earning growth through the first quarter of 2004 with cyclical stocks posting particularly strong profits.

Commodity prices rose sharply in the second half of 2003 driven by increased demand from China and a weaker U.S. dollar. As a result, metals and chemical stocks posted some of the strongest gains. Energy prices also rose sharply with oil topping $42 per barrel by June.

Bond yields rose sharply in April in anticipation of the first interest rate increase by the Fed in four years, causing interest-rate sensitive stocks to sell off sharply with REITs among the hardest hit.

Increased tensions in Iraq, and concerns about the strength of the U.S. economic recovery led to selling pressure more recently. In addition, high raw material and energy costs have put pressure on margins for manufacturing companies. These trends have been confirmed by cautious earnings guidance from companies for the second half of 2004.

What major changes have occurred in the portfolio during the period covered by the report?

The Fund’s holdings remain diversified across sectors and industries. As a result of the Russell reconstitution on June 30th, our relative overweight positions in Industrials and Consumer Discretionary stocks and our underweight positions in Utilities and Financials have increased.

What is your outlook for the Fund?

We believe the economy is recovering and earnings have generally been coming in ahead of expectations. However, fears of rapidly rising interest rates have recently given way to concerns about the strength of the economic recovery. Additionally, the Chinese government may be taking steps to slow economic growth, which could weaken commodity prices and impact our basic materials companies.

Overall, valuations continue to be a concern. However, the recent sharp sell off in many stocks may have presented some new opportunities.

We believe our diversified approach to managing small cap value, focusing on attractive valuation, financial strength and positive change should help the Fund perform relative to its benchmark in the coming market environment.

9

Pacific Capital Small Cap Fund (cont.)

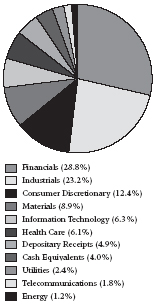

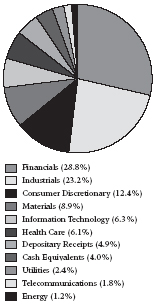

Sector Weightings as of July 31, 2004

(as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

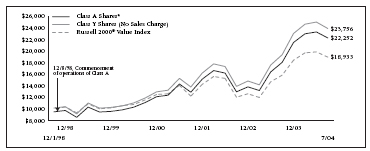

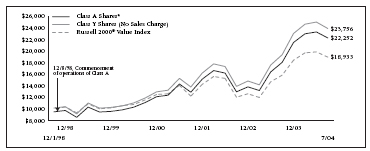

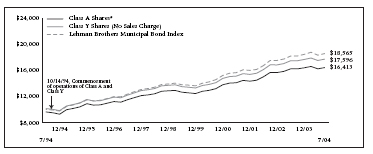

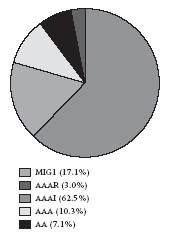

Growth of a $10,000 Investment

For performance purposes, the above graph has not been adjusted for CDSC charges. The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark. The chart above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns as of July 31, 2004

| 1 Year | 5 Year | Since Inception (12/3/98) | |||||||

Class A Shares* | 20.86 | % | 15.84 | % | 15.17 | % | |||

Class B Shares** | 22.48 | % | 16.09 | % | 15.29 | % | |||

Class C Shares** | 25.56 | % | 16.21 | % | 15.39 | % | |||

Class Y Shares (No Sales Charge) | 27.78 | % | 17.35 | % | 16.51 | % |

| * | Reflects 5.25% Maximum Front-End Sales Charge. |

| ** | Reflects Maximum Contingent Deferred Sales Charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares. |

The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232.

The Pacific Capital Funds are distributed by BISYS Fund Services. The Asset Management Group of Bank of Hawaii provides investment advisory and other services to the Fund and receives fees for those services. Nicholas-Applegate Capital Management is sub-advisor to the Fund and is paid a fee for its services.

The Pacific Capital Small Cap Fund’s inception date was December 3, 1998. Class A, Class B and Class C shares were not in existence prior to December 8, 1998, December 20, 1998 and April 30, 2004, respectively. Performance information for Class C shares is based upon the performance of Class B shares from inception. Performance calculated for any period up to and through such inception dates is based upon the performance of Class Y shares, which does not reflect the higher 12b-1 fees. Had the higher 12b-1 fees been incorporated, before and after-tax total return figures may have been adversely affected.

The performance of the Pacific Capital Small Cap Fund is measured against the Russell 2000® Value Index, an unmanaged index comprised of securities in the Russell 2000® Index with a less-than-average growth orientation. The index does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

10

Pacific Capital Mid-Cap Fund

Investment Style

Domestic, mid-cap, blend

Investment Objective

Long-term capital appreciation by investing in a diversified portfolio of mid-capitalization companies– average market cap of $410 million to $11.3 billion – that are reasonably priced, fundamentally strong and exhibit better growth expectations relative to peers.

Investment Considerations

Mid-capitalization stocks typically carry additional risk, since smaller companies generally have a higher risk of failure and have experienced a greater degree of volatility. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Quantitative research analysis with fundamental research overlay |

| • | Quantitative analysts use proprietary screen to evaluate expectations, valuation and quality of 3,000 stocks |

| • | Fundamental analysts identify factors not included in the screen to determine most attractive stocks |

| • | Portfolio construction emphasizes stock selection and seeks to neutralize risk elements that are not consistently rewarded |

Investment Management

Advised by The Asset Management Group of Bank of Hawaii

Sub-Advised by Bankoh Investment Partners, LLC, (BIP), a joint venture between Bank of Hawaii and Chicago Equity Partners (CEP)

| • | Jim Miller, Chairman, and Doug Coughenour, CEO, of CEP lead the core domestic equity team responsible for day-to-day investment decisions |

| • | CEP specializes in core domestic equity markets |

| • | Founded in 1989, CEP investment management team averages 17 years experience |

| • | CEP currently oversees more than $5 billion in assets |

How did the Fund perform compared to its benchmark?

From the Fund’s inception on 12/30/03 through 7/31/04, the Fund outperformed the S&P 400 MidCap Index with a return of 3.50% (Class A Shares at NAV). In comparison, the benchmark produced a 0.53% return. Excess return for this time period was due to security selection, as would be expected with our investment process. Our process virtually eliminates cash exposure, while neutralizing style tilts, industry weightings, and market capitalization. As a result, portfolio excess performance is attained through superior security selection utilizing our proprietary investment process and integrated research. The Fund had strong performance from most market sectors, with the strongest security performance from the Healthcare and Industrial sectors.†

What were the major factors in the market that influenced the Fund’s performance?

Equity markets started the year strong, but ended July in negative territory for most benchmarks. The core mid cap indexes are the few benchmarks that ended July in positive territory. Earnings for the first and second quarter have come in strong, 24% for the first quarter and between 20-25% for the second quarter. The major factors affecting the market this year have been oil prices, rising inflation and interest rates, and geopolitics/war on terror. The fundamentals of the market, including corporate revenues and earnings, consumer spending, and capital expenditures began the year strong, but have recently hit a soft spot. Of course, fears of inflation, prospects of further Fed tightening, crude oil in the $40 range, and challenges of returning sovereignty to Iraq are all factors that impact market valuations. But these headwinds may have been discounted at a greater rate than the positive outlook of corporate profit expectations.

What major changes have occurred in the portfolio during the period covered by the report?

Other than the normal re-balancing that occurs throughout this time period, no major changes have occurred in the portfolio. Bankoh Investment Partners began managing the Pacific Capital Mid Cap Fund as of 12/30/03. At that time, the portfolio was constructed using proprietary quantitative research and fundamental input. The quantitative research is designed to refine large amounts of data into usable information for the fundamental portfolio managers. The portfolio managers use this information to assist them in determining the most attractive stocks within each industry. Cash exposure is virtually eliminated while neutralizing style tilts, industry weightings, and capitalization. The result is a portfolio with benchmark-like risk characteristics. We strive for predictable returns at a comfortable risk level.

What is your outlook for the Fund?

In the near-term, continued strength in corporate profits should gain recognition over various macro risk factors. Over the long-term, the combination of higher interest rates and strong profit margins will make multiple expansions difficult to achieve. With inflation likely to move higher, we believe it will be tough for stocks to escape the gravitational pull of the long-term average P/E ratios.1

With our sights firmly fixed on our quantitative and fundamental investing process, we will stay focused on our long-term investment responsibilities. Our discipline and process allows us to virtually eliminate emotional stock decisions and focus on the long term fundamental prospects of the companies. We are careful at measuring the risk we are taking in the portfolio, and continue to believe we can achieve positive returns through precise portfolio construction and prudent security selection.

Overall, our philosophy will not change based on short-term trends or conditions in the market. Our goal is to add value through security selection, while attempting to manage other risk factors, such as market timing and sector rotation, for which there is not adequate compensation by the market.

Past performance does not guarantee future results.

| 1 | Price to Earnings Ratio is the valuation ratio of a company’s current share price compared to its per share earnings. |

| † | The composition of the Fund’s portfolio is subject to change. |

11

Pacific Capital Mid-Cap Fund (cont.)

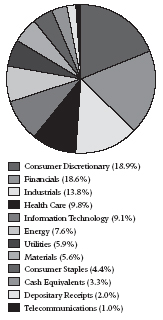

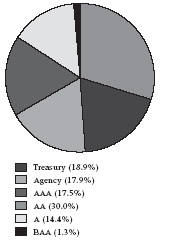

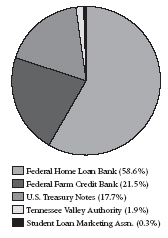

Sector Weightings as of July 31, 2004

(as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

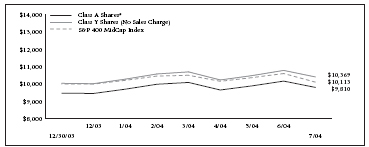

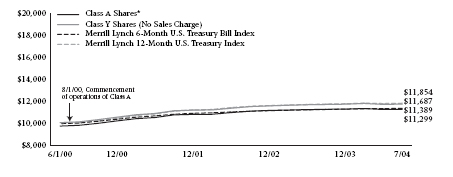

Growth of a $10,000 Investment

For performance purposes, the above graph has not been adjusted for CDSC charges. The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark. The chart above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Aggregate Total Returns as of July 31, 2004

| Since Inception (12/30/03) | |||

Class A Shares* | -1.90 | % | |

Class C Shares** | 2.31 | % | |

Class Y Shares (No Sales Charge) | 3.69 | % |

| * | Reflects 5.25% Maximum Front-End Sales Charge. |

| ** | Reflects Maximum Contingent Deferred Sales Charge (CDSC) of up to 1.00%. |

The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232.

The Pacific Capital Funds are distributed by BISYS Fund Services. The Asset Management Group of Bank of Hawaii provides investment advisory and other services to the Fund and receives fees for those services. Bankoh Investment Partners, LLC, is sub-advisor to the Fund and is paid a fee for its services.

Class C shares were not in existence April 30, 2004. Performance calculated for any period up to and through April 30, 2004, is based upon the performance of Class A shares, which does not reflect the higher 12b-1 fees and contingent deferred sales charge (“CDSC”). Had the higher 12b-1 fees been incorporated, total return figures may have been adversely affected.

The performance of the Pacific Capital Mid-Cap Fund is measured against the S&P 400 MidCap Index, an unmanaged market capitalization-weighted index of 400 medium capitalization stocks. The index does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

12

Pacific Capital Growth Stock Fund

Investment Style

Domestic, large-cap, growth

Investment Considerations

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Objective

Long-term capital appreciation with a secondary emphasis on dividend income, by investing in a diversified portfolio of large-capitalization companies – greater than $1 billion – whose earnings are expected to grow faster than the average for the U.S. market.

Investment Process

| • | Top-down macroeconomic analysis of sector trends |

| • | Bottom-up fundamental research to identify attractive stocks |

| • | Rigorous quantitative risk analysis |

Investment Management

Advised by The Asset Management Group of Bank of Hawaii (AMG)

| • | Founded in 1898, AMG is Hawaii’s largest money manager with more than 40 investment professionals |

| • | Provides wealth management services to foundations, corporations, institutions and individual investors |

| • | $7.5 billion in assets under management |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2004, the Fund gained 3.55% (Class A Shares without sales charge), compared to its benchmark, the Russell 1000® Growth Index, which returned 8.51%.

For the same period, the Fund ranked in the 79th percentile among 604 funds in the Lipper Large-Cap Growth Funds universe.1

What were the major factors in the market that influenced the Fund’s performance?

Both the stock market and the Fund appreciated as the economy and corporate earnings advanced sharply over the last year. While the first half of the fiscal year was marked by strong stock price gains, the second half witnessed lower prices. The weakness in the second half reflected concerns associated with sharply higher oil prices, rising interest rates, election year uncertainties and terrorism.

Large capitalization growth stocks, the focus of the Fund, lagged the performance of smaller growth stocks. We believe weak stock selection and a large cap focus caused the Fund to trail its benchmark and contributed negatively to its low percentile ranking within its Lipper peer group.

What major changes have occurred in the portfolio during the period covered by the report?

Toward the end of the fiscal year, a number of measures were instituted to help improve stock selection. Specifically, a greater emphasis has been placed on holding securities in the Fund that possess favorable momentum, value and quality characteristics. In addition, a new security sell discipline was implemented in mid-June designed to help manage losses on unsuccessful selections. Finally, a heavier emphasis is being placed on companies exhibiting above average levels of earnings stability.

What is your outlook for the Fund?

We believe the stock market is not likely to resume an upward trajectory until uncertainties associated with the upcoming presidential election are resolved and fears of an election tied terrorist attack subside. Furthermore, the combined impact of high oil prices and rising short-term interest rates may tend to moderate near term market advances. Despite these difficulties, we believe the economy’s underpinnings appear sufficiently strong enough to produce respectable gains in corporate earnings through next year.

Past performance does not guarantee future results.

| 1 | The Lipper Large-Cap Growth Funds Average is comprised of mutual funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Large-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index. For the one-, five and ten-year periods ended July 31, 2004 the Pacific Capital Growth Stock Fund ranked 476, 139 and 56 out of 604, 350 and 109 funds in the Lipper Large-Cap Growth Funds category, respectively. The Lipper Rankings are based on total returns and do not reflect a sales charge. Funds with multiple share classes have a common portfolio. |

13

Pacific Capital Growth Stock Fund (cont.)

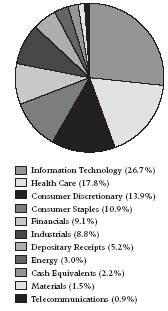

Sector Weightings as of July 31, 2004

(as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

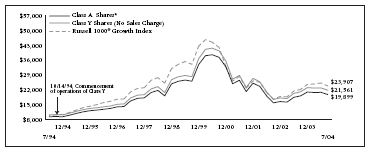

Growth of a $10,000 Investment

For performance purposes, the above graph has not been adjusted for CDSC charges. The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark. The chart above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns as of July 31, 2004

| 1 Year | 5 Year | 10 Year | |||||||

Class A Shares* | -1.87 | % | -5.87 | % | 7.12 | % | |||

Class B Shares** | -1.23 | % | -5.64 | % | 7.21 | % | |||

Class C Shares** | 1.77 | % | -5.53 | % | 7.21 | % | |||

Class Y Shares (No Sales Charge) | 3.85 | % | -4.57 | % | 7.99 | % |

| * | Reflects 5.25% Maximum Front-End Sales Charge. |

| ** | Reflects Maximum Contingent Deferred Sales Charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares. The B Share CDSC does not apply to performance over 6 years; therefore, the 10-year return does not reflect the CDSC. |

The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232.

The Pacific Capital Funds are distributed by BISYS Fund Services. The Asset Management Group of Bank of Hawaii provides investment advisory and other services to the Fund and receives fees for those services.

The quoted performance of the Pacific Capital Growth Stock Fund includes the performance of certain common trust fund (“Commingled”) accounts advised by The Asset Management Group of Bank of Hawaii and managed the same as the Fund in all material respects, for periods dating back to July 31, 1994, and prior to the Fund’s commencement of operations on November 1, 1993, for the A Class, and on October 14, 1994, for the Y Class, as adjusted to reflect the expenses associated with the Fund. The Commingled accounts were not registered with the Securities and Exchange Commission under the Investment Company Act of 1940 and, therefore, were not subject to the investment restrictions imposed by law on registered mutual funds. If the Commingled accounts had been registered, the Commingled accounts’ performance may have been adversely affected.

Class B and Class C shares of the Fund commenced operations on March 2, 1998 and April 30, 2004, respectively. Performance information for Class C shares is based upon the performance of Class B shares from inception. Performance calculated for any period up to and through March 2, 1998 is based upon the performance of Class A shares, which does not reflect the higher 12b-1 fees. Had the higher 12b-1 fees been incorporated, total return figures may have been adversely affected. Performance figures reflect no deduction for taxes.

The performance of the Pacific Capital Growth Stock Fund is measured against the Russell 1000® Growth Index which measures the performance of 1,000 securities found in the Russell universe with higher price-to-book ratios and higher forecasted growth values. The index does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in the underlying securities.

14

Pacific Capital Growth and Income Fund

Investment Style

Domestic, large-cap, blend

Investment Considerations

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Objective

Long-term capital appreciation with a secondary emphasis on dividend income, by investing in a diversified portfolio of large-capitalization dividend-paying companies – greater than $1 billion – whose earnings are expected to grow at above-average rates in relation to industry peers.

Investment Process

| • | Top-down macroeconomic analysis of sector trends |

| • | Bottom-up fundamental research to identify attractive stocks |

| • | Rigorous quantitative risk analysis |

Investment Management

Advised by The Asset Management Group of Bank of Hawaii (AMG)

| • | Founded in 1898, AMG is Hawaii’s largest money manager with more than 40 investment professionals |

| • | Provides wealth management services to foundations, corporations, institutions and individual investors |

| • | $7.5 billion in assets under management |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2004, the Fund gained 9.11% (Class A Shares without sales charge), compared to its benchmark, the Standard and Poor’s 500 Index, which returned 13.16%.

For the same period, the Fund ranked in the 58th percentile among 958 funds in the Lipper Large-Cap Core Funds universe.1

What were the major factors in the market that influenced the Fund’s performance?

Overall, the stock market was strong for the past fiscal year. The period began with a continuation of the rally that started in March 2003, after the start of the second Iraqi war. Economic growth as measured by real GDP2 (Gross Domestic Product) accelerated to 7.4% in the third quarter before dropping to the 4-4.5% range. Corporate profits also began to pick up, helping to fuel the rally until early March of this year, when geopolitical concerns, higher oil prices and renewed weak job creation precipitated a market correction, which still persists. The FOMC (Federal Open Market Committee) also began to raise the Federal Funds rate, although it reassured investors that the pace of monetary tightening will be gradual. The Fund was impacted by its overweight in the technology, and to a lesser extent, the financial and consumer discretionary sectors. It was helped late in the fiscal year by its overweight in the energy and industrial sectors and its underweight in health care.†

What major changes have occurred in the portfolio during the period covered by the report?

A new stock selection strategy was initiated during the period that emphasizes equities exhibiting favorable momentum, quality and value characteristics. A new security sell discipline was implemented in mid-June designed to help manage losses on unsuccessful selections.

What is your outlook for the Fund?

We believe current market concerns may subside within the next several months, supporting a rally in the equity markets. We also anticipate that the FOMC will not be overly restrictive with monetary policy, should the economy continue to grow and produce respectable earnings growth.

Past performance does not guarantee future results.

| 1 | The Lipper Large-Cap Core Funds Average is comprised of mutual funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Large-cap core funds have more latitude in the companies in which they invest. These funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index. For the one- and five-year periods ended July 31, 2004 the Pacific Capital Growth and Income Fund ranked 548 and 357 out of 958 and 601 funds in the Lipper Large-Cap Core Funds category, respectively. The Lipper Rankings are based on total returns and do not reflect a sales charge. Funds with multiple share classes have a common portfolio. |

| 2 | Gross Domestic Product is the measure of the market value of the goods and services produced by labor and property in the United States. |

| † | The composition of the Fund’s portfolio is subject to change. |

15

Pacific Capital Growth and Income Fund (cont.)

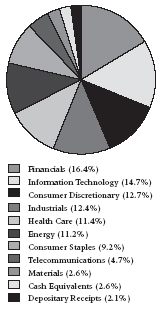

Sector Weightings as of July 31, 2004

(as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

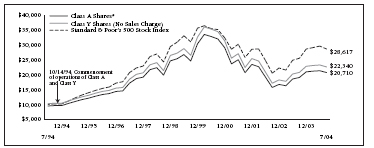

Growth of a $10,000 Investment

For performance purposes, the above graph has not been adjusted for CDSC charges. The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark. The chart above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns as of July 31, 2004

| 1 Year | 5 Year | 10 Year | |||||||

Class A Shares* | 3.40 | % | -4.93 | % | 7.55 | % | |||

Class B Shares** | 4.33 | % | -4.75 | % | 7.60 | % | |||

Class C Shares** | 7.33 | % | -4.60 | % | 7.60 | % | |||

Class Y Shares (No Sales Charge) | 9.39 | % | -3.65 | % | 8.37 | % |

| * | Reflects 5.25% Maximum Front-End Sales Charge. |

| ** | Reflects Maximum Contingent Deferred Sales Charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares. The B Share CDSC does not apply to performance over 6 years; therefore, the 10-year return does not reflect the CDSC. |

The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232.

The Pacific Capital Funds are distributed by BISYS Fund Services. The Asset Management Group of Bank of Hawaii provides investment advisory and other services to the Fund and receives fees for those services.

The quoted performance of the Pacific Capital Growth and Income Fund (“Fund”) includes the performance of certain common trust fund (“Commingled”) accounts advised by The Asset Management Group of Bank of Hawaii and managed the same as the Fund in all material respects, for periods dating back to July 31, 1994, and prior to the Fund’s commencement of operations on October 14, 1994, as adjusted to reflect the expenses associated with the Fund. The Commingled accounts were not registered with the Securities and Exchange Commission under the Investment Company Act of 1940 and, therefore, were not subject to the investment restrictions imposed by law on registered mutual funds. If the Commingled accounts had been registered, the Commingled accounts’ performance may have been adversely affected.

Class B and Class C shares of the Fund commenced operations on March 2, 1998 and April 30, 2004, respectively. Performance information for Class C shares is based upon the performance of Class B shares from inception. Performance calculated for any period up to and through March 2, 1998 is based upon the performance of Class A shares, which does not reflect the higher 12b-1 fees. Had the higher 12b-1 fees been incorporated, total return figures may have been adversely affected. Performance figures reflect no deduction for taxes.

The performance of the Pacific Capital Growth and Income Fund is measured against the Standard & Poor’s 500 Stock Index, an unmanaged index generally representative of the broad domestic stock universe. The index does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

16

Pacific Capital Value Fund

Investment Style

Domestic, large-cap, value

Investment Objective

Long-term capital appreciation with a secondary emphasis on dividend income, by investing in a diversified portfolio of large-capitalization companies – greater than $1 billion – believed to be undervalued, fundamentally strong and undergoing positive change.

Investment Considerations

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Top-down macroeconomic analysis of sector trends |

| • | Bottom-up fundamental research to identify attractive stocks |

| • | Rigorous quantitative risk analysis |

Investment Management

Advised by The Asset Management Group of Bank of Hawaii (AMG)

| • | Founded in 1898, AMG is Hawaii’s largest money manager with more than 40 investment professionals |

| • | Provides wealth management services to foundations, corporations, institutions and individual investors |

| • | $7.5 billion in assets under management |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2004, the Fund gained 14.52% (Class A Shares without sales charge), compared to its benchmark, the Russell 1000® Value Index, which returned 17.68%.

For the same period, the Fund ranked in the 50th percentile among 409 funds in the Lipper Large-Cap Value Funds universe.1

What were the major factors in the market that influenced the Fund’s performance?

Over the past 12 months, the market was marked by a myriad of events that brought solid gains in the first half of the period and eroding momentum in the back half. In the end, the market managed to finish in positive territory with the Dow Jones Industrial Average2, NASDAQ2, and Standard & Poor’s 500 Index2 returning 12.2%, 8.8%, and 13.2%, respectively. Improvements in the economy and increases in manufacturing activity were offset by anemic job growth and lingering fears over terrorism. In addition, exorbitant energy prices served to dampen investors’ enthusiasm for stocks in the latter half due to concerns over slowing corporate earnings growth and consumer spending. Investors also witnessed the first interest rate hike in four years as the Federal Open Market Committee increased the federal funds rate by an expected 25 basis points (0.25%) to 1.25%.

The Pacific Capital Value Fund underperformed the benchmark for the period primarily due to stock selection in financials, materials, and consumer discretionary; however this was mitigated by positive contributions from an overweight in energy and industrials sectors. The Fund’s focus on large capitalization stocks also contributed negatively to performance as investors continued to prize small cap stocks versus large cap stocks for the period.†

What major changes have occurred in the portfolio during the period covered by the report?

During the last half of the period, the financial sector in the Fund was brought from an overweight to an underweight relative to the index given the backdrop of a rising interest rate environment. An annual rebalancing event for the Russell Indexes at the end of June resulted in the Fund adding positions in the industrial and information technology sectors. The Fund added to General Electric and initiated Microsoft as they entered the Russell 1000® Value Index with significant weightings. In addition, a greater emphasis was placed on securities that exhibited favorable momentum, value and quality characteristics.†

What is your outlook for the Fund?

A mixture of economic and earnings news coupled with terrorism concerns and soaring energy prices may have contributed to the volatility of the markets over the past 12 months. The markets winning streak from last year came to a halt earlier in the period as macro and geopolitical factors coupled with election uncertainty created an overhang that limited upside movement in the midst of strong corporate earnings. However, with sustained increases in manufacturing activity in conjunction with an improving economic and employment picture, we believe the outlook is positive for equity markets.

Past performance does not guarantee future results.

| 1 | The Lipper Large-Cap Value Funds Average is comprised of mutual funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Large-cap value funds typically have a below-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index. For the one- and five-year periods ended July 31, 2004 the Pacific Capital Value Fund ranked 204 and 154 out of 409 and 218 funds in the Lipper Large-Cap Value Funds category, respectively. The Lipper Rankings are based on total returns and do not reflect a sales charge. Funds with multiple share classes have a common portfolio. |

| 2 | Dow Jones Industrial Average is a price-weighted average based on the price-only performance of 30 blue chip stocks (The average is computed by adding the prices of the 30 stocks and dividing by a denominator, which has been adjusted over the years for stocks splits, stock dividends and substitutions of stocks). |

NASDAQ Composite Index is a market price only index that tracks the performance of domestic common stocks traded on the regular Nasdaq market as well as National Market System traded foreign common stocks and American Depository Receipts.

S&P 500 Stock Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange, and is a measure of the U.S. stock market as a whole.

| † | The composition of the Fund’s portfolio is subject to change. |

17

Pacific Capital Value Fund (cont.)

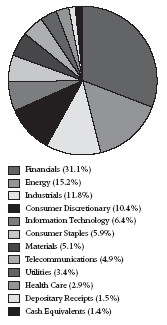

Sector Weightings as of July 31, 2004

(as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

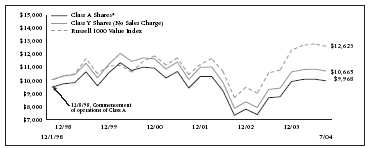

Growth of a $10,000 Investment

For performance purposes, the above graph has not been adjusted for CDSC charges. The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark. The chart above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns as of July 31, 2004

| 1 Year | 5 Year | Since Inception (12/3/98) | |||||||

Class A Shares* | 8.48 | % | -1.65 | % | -0.06 | % | |||

Class B Shares** | 9.55 | % | -1.53 | % | -0.02 | % | |||

Class C Shares** | 12.69 | % | -1.34 | % | 0.15 | % | |||

Class Y Shares (No Sales Charge) | 14.76 | % | -0.35 | % | 1.14 | % |

| * | Reflects 5.25% Maximum Front-End Sales Charge. |

| ** | Reflects Maximum Contingent Deferred Sales Charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares. |

The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232.