UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07458

Tweedy, Browne Fund Inc.

(Exact name of registrant as specified in charter)

One Station Place, Suite 303

Stamford, CT 06902

(Address of principal executive offices) (Zip code)

Elise M. Dolan

Tweedy, Browne Company LLC

One Station Place, Suite 303

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 203-703-0600

Date of fiscal year end: March 31

Date of reporting period: September 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

Tweedy, Browne International Value Fund

Tweedy, Browne International Value Fund II – Currency Unhedged

Tweedy, Browne Value Fund

Tweedy, Browne Worldwide High Dividend Yield Value Fund

SEMI-ANNUAL REPORT

September 30, 2023

II-1

Expense Information (Unaudited)

A shareholder of the International Value Fund, International Value Fund II – Currency Unhedged, Value Fund or Worldwide High Dividend Yield Value Fund (collectively, the “Funds”) incurs ongoing costs, including management fees and other Fund expenses. The Example below is intended to help a shareholder understand the ongoing costs (in U.S. dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period of April 1, 2023 to September 30, 2023.

Actual Expenses. The first part of the table presented below, under the heading “Actual Expenses,” provides information about actual account values and actual expenses. The information in this line may be used with the amount a shareholder invested to estimate the expenses that were paid by the shareholder over the period. Simply divide the shareholder’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses paid during this period.

Hypothetical Example for Comparison Purposes. The second part of the table presented below, under the heading “Hypothetical Expenses,” provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid by the shareholder of the Funds for the period. This information may be used to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight a shareholder’s ongoing costs only. There are no transactional expenses associated with the purchase and sale of shares charged by any of the Funds, such as commissions, sales loads and/or redemption fees. Other mutual funds may have such transactional charges. Therefore, the second part of the table is useful in comparing ongoing costs only, and will not help a shareholder determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| | | | |

| | | Actual Expenses | | | | Hypothetical Expenses (5% Return before Expenses) |

| | | | | | | | |

| | | Beginning

Account

Value 4/1/23 | | Ending

Account

Value 9/30/23 | | Expenses

Paid During

Period* 4/1/23 –

9/30/23 | | | | Beginning

Account

Value 4/1/23 | | Ending

Account

Value 9/30/23 | | Expenses

Paid During

Period* 4/1/23 –

9/30/23 | | Annualized

Expense

Ratio |

International Value Fund | | $1,000.00 | | $997.80 | | $6.89 | | | | $1,000.00 | | $1,018.10 | | $6.96 | | 1.38% |

International Value Fund II –

Currency Unhedged | | $1,000.00 | | $981.70 | | $6.84 | | | | $1,000.00 | | $1,018.10 | | $6.96 | | 1.38% |

Value Fund | | $1,000.00 | | $1,022.50 | | $6.98 | | | | $1,000.00 | | $1,018.10 | | $6.96 | | 1.38% |

Worldwide High Dividend

Yield Value Fund | | $1,000.00 | | $977.20 | | $6.82 | | | | $1,000.00 | | $1,018.10 | | $6.96 | | 1.38% |

| | * | Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the period (183), divided by 366 (to reflect the one-half year period). | |

II-2

Tweedy, Browne International Value Fund

Portfolio of Investments

September 30, 2023 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | COMMON STOCKS—94.4% | | | | |

| | |

| | | | Belgium—0.9% | | | | |

| | 926,488 | | | Fagron NV | | | $15,777,581 | |

| | 552,008 | | | KBC Group NV | | | 34,414,912 | |

| | | | | | | | |

| | | | | | | 50,192,493 | |

| | | | | | | | |

| | |

| | | | Canada—2.4% | | | | |

| | 251,390 | | | Lassonde Industries, Inc., Class A(a) . | | | 23,435,795 | |

| | 1,124,700 | | | National Bank of Canada | | | 75,060,415 | |

| | 1,456,214 | | | Winpak, Ltd. | | | 41,607,653 | |

| | | | | | | | |

| | | | | | | 140,103,863 | |

| | | | | | | | |

| | |

| | | | China—4.3% | | | | |

| | 6,558,340 | | | Alibaba Group Holding, Ltd.(b) | | | 71,098,574 | |

| | 4,349,576 | | | Baidu, Inc., Class A(b) | | | 73,197,872 | |

| | 7,817,825 | | | Haitian International Holdings, Ltd. | | | 16,500,380 | |

| | 6,463,000 | | | Shanghai Mechanical and Electrical Industry Co., Ltd., Class B | | | 6,490,410 | |

| | 1,485,150 | | | Tencent Holdings, Ltd. | | | 57,563,678 | |

| | 15,974,780 | | | Uni-President China Holdings, Ltd. | | | 11,212,860 | |

| | 22,047,485 | | | WH Group, Ltd. | | | 11,538,727 | |

| | | | | | | | |

| | | | | | | 247,602,501 | |

| | | | | | | | |

| | |

| | | | Czech Republic—0.0%(c) | | | | |

| | 2,800 | | | Philip Morris CR a.s. | | | 2,087,635 | |

| | | | | | | | |

| | |

| | | | Finland—0.8% | | | | |

| | 2,919,753 | | | Kemira Oyj | | | 45,462,875 | |

| | | | | | | | |

| | |

| | | | France—13.3% | | | | |

| | 207,355 | | | Alten SA | | | 27,248,000 | |

| | 2,392,742 | | | Rubis SCA | | | 53,665,140 | |

| | 1,375,040 | | | Safran SA | | | 215,787,176 | |

| | 2,895,521 | | | SCOR SE | | | 90,024,381 | |

| | 1,527,083 | | | Tarkett SA(b) | | | 16,572,191 | |

| | 623,563 | | | Teleperformance SE | | | 78,403,390 | |

| | 3,831,330 | | | TotalEnergies SE | | | 252,264,897 | |

| | 1,030,724 | | | Ubisoft Entertainment SA(b) | | | 33,449,887 | |

| | | | | | | | |

| | | | | | | 767,415,062 | |

| | | | | | | | |

| | |

| | | | Germany—8.0% | | | | |

| | 203,190 | | | Brenntag SE | | | 15,744,481 | |

| | 2,644,654 | | | Deutsche Post AG, Registered | | | 107,460,500 | |

| | 2,540,809 | | | Fresenius SE & Co., KGaA | | | 79,030,081 | |

| | 1,219,727 | | | Henkel AG & Co., KGaA | | | 77,014,949 | |

| | 486,959 | | | Krones AG | | | 50,184,682 | |

| | 42,354 | | | KSB SE & Co., KGaA | | | 30,426,160 | |

| | 190,558 | | | Muenchener Rueckversicherungs AG, Registered | | | 74,318,642 | |

| | 537,857 | | | Norma Group SE | | | 9,952,366 | |

| | 65,633 | | | Rheinmetall AG | | | 16,908,142 | |

| | | | | | | | |

| | | | | | | 461,040,003 | |

| | | | | | | | |

| | |

| | | | Hong Kong—0.6% | | | | |

| | 25,880,073 | | | Emperor Entertainment Hotel, Ltd.(b) | | | 1,503,531 | |

| | 5,542,142 | | | Great Eagle Holdings, Ltd. | | | 9,374,372 | |

| | 12,583,508 | | | Hang Lung Group, Ltd. | | | 17,707,348 | |

| | 2,791,715 | | | Johnson Electric Holdings, Ltd. | | | 3,422,119 | |

| | 9,389,578 | | | TAI Cheung Holdings, Ltd. | | | 3,974,716 | |

| | | | | | | | |

| | | | | | | 35,982,086 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Italy—2.4% | | | | |

| | 616,566 | | | Buzzi SpA | | | $16,872,924 | |

| | 4,365,000 | | | SOL SpA | | | 123,474,283 | |

| | | | | | | | |

| | | | | | | 140,347,207 | |

| | | | | | | | |

| | |

| | | | Japan—4.4% | | | | |

| | 891,970 | | | ADEKA Corp. | | | 15,253,208 | |

| | 821,635 | | | Dentsu Group, Inc. | | | 24,200,481 | |

| | 907,464 | | | Fuji Seal International, Inc. | | | 10,822,382 | |

| | 564,220 | | | Fuso Chemical Co., Ltd. | | | 14,826,208 | |

| | 3,363,180 | | | Kuraray Co., Ltd. | | | 39,898,267 | |

| | 2,113,385 | | | Mitsubishi Gas Chemical Co., Inc. | | | 28,446,953 | |

| | 1,368,360 | | | Nabtesco Corp. | | | 24,659,518 | |

| | 221,220 | | | Nifco, Inc. | | | 5,727,533 | |

| | 470 | | | Nihon Kohden Corp. | | | 11,619 | |

| | 164,400 | | | Nippon Kanzai Holdings Co., Ltd. | | | 2,828,029 | |

| | 820,800 | | | Niterra Co., Ltd. | | | 18,604,313 | |

| | 104,825 | | | Okamoto Industries, Inc. | | | 3,558,782 | |

| | 1,284,760 | | | Sumitomo Heavy Industries, Ltd. | | | 32,581,036 | |

| | 271,950 | | | Taikisha, Ltd. | | | 8,228,350 | |

| | 588,565 | | | Transcosmos, Inc. | | | 12,587,000 | |

| | 164,305 | | | YAMABIKO Corp. | | | 1,582,415 | |

| | | | Miscellaneous Security(d) | | | 7,076,160 | |

| | | | | | | | |

| | | | | | | 250,892,254 | |

| | | | | | | | |

| | |

| | | | Mexico—1.9% | | | | |

| | 1,167,170 | | | Coca-Cola FEMSA SAB de CV, Sponsored ADR | | | 91,552,815 | |

| | 9,067,593 | | | Megacable Holdings SAB de CV | | | 20,088,174 | |

| | | | | | | | |

| | | | | | | 111,640,989 | |

| | | | | | | | |

| | |

| | | | Netherlands—3.3% | | | | |

| | 660,210 | | | Aalberts NV | | | 24,124,230 | |

| | 2,160,839 | | | Heineken Holding NV | | | 163,074,542 | |

| | | | | | | | |

| | | | | | | 187,198,772 | |

| | | | | | | | |

| | |

| | | | Philippines—0.1% | | | | |

| | 22,609,020 | | | Alliance Global Group, Inc. | | | 4,923,344 | |

| | | | | | | | |

| | |

| | | | Singapore—5.0% | | | | |

| | 5,536,500 | | | DBS Group Holdings, Ltd. | | | 136,183,727 | |

| | 7,345,990 | | | United Overseas Bank, Ltd. | | | 153,238,498 | |

| | | | | | | | |

| | | | | | | 289,422,225 | |

| | | | | | | | |

| | |

| | | | South Korea—1.9% | | | | |

| | 160,642 | | | Binggrae Co., Ltd. | | | 6,643,288 | |

| | 131,339 | | | Kangnam Jevisco Co., Ltd. | | | 2,123,356 | |

| | 998,776 | | | LG Corp. | | | 62,085,945 | |

| | 991,707 | | | LX Holdings Corp. | | | 5,514,249 | |

| | 618,300 | | | Samsung Electronics Co., Ltd. | | | 31,257,621 | |

| | | | | | | | |

| | | | | | | 107,624,459 | |

| | | | | | | | |

| | |

| | | | Sweden—5.2% | | | | |

| | 704,365 | | | Autoliv, Inc. | | | 67,957,135 | |

| | 9,470,920 | | | Husqvarna AB, Class B | | | 72,682,264 | |

| | 3,801,500 | | | SKF AB, Class B | | | 63,467,168 | |

| | 3,901,988 | | | Trelleborg AB, Class B | | | 97,495,675 | |

| | | | | | | | |

| | | | | | | 301,602,242 | |

| | | | | | | | |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-3

Tweedy, Browne International Value Fund

Portfolio of Investments

September 30, 2023 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Switzerland—13.0% | | | | |

| | 142,761 | | | Coltene Holding AG, Registered | | | $10,377,795 | |

| | 2,535,079 | | | Nestlé SA, Registered | | | 287,133,381 | |

| | 80 | | | Neue Zuercher Zeitung AG(b) | | | 525,142 | |

| | 1,284,801 | | | Novartis AG, Registered | | | 131,293,872 | |

| | 68,178 | | | Phoenix Mecano AG, Registered(a)(b) | | | 26,829,996 | |

| | 539,210 | | | Roche Holding AG | | | 147,293,435 | |

| | 429,703 | | | TX Group AG. | | | 43,449,418 | |

| | 220,831 | | | Zurich Insurance Group AG | | | 101,103,232 | |

| | | | | | | | |

| | | | | | | 748,006,271 | |

| | | | | | | | |

| | |

| | | | United Kingdom—13.4% | | | | |

| | 4,003,983 | | | Babcock International Group plc(b) | | | 20,131,287 | |

| | 16,182,566 | | | BAE Systems plc | | | 196,720,556 | |

| | 11,010,735 | | | CNH Industrial NV | | | 133,856,066 | |

| | 1,043,507 | | | Computacenter plc | | | 32,143,481 | |

| | 5,296,459 | | | Diageo plc | | | 195,342,521 | |

| | 2,704,933 | | | Grafton Group plc | | | 29,854,521 | |

| | 1,968,375 | | | Howden Joinery Group plc | | | 17,618,614 | |

| | 5,273,360 | | | Inchcape plc | | | 48,587,865 | |

| | 15,698,026 | | | Johnson Service Group plc | | | 25,931,258 | |

| | 1,156,067 | | | Unilever plc (Ordinary Shares) | | | 57,208,029 | |

| | 16,292,379 | | | Vertu Motors plc | | | 14,807,402 | |

| | | | | | | | |

| | | | | | | 772,201,600 | |

| | | | | | | | |

| | |

| | | | United States—13.5% | | | | |

| | 1,509,760 | | | Alphabet, Inc., Class A(b) | | | 197,567,194 | |

| | 454,640 | | | Alphabet, Inc., Class C(b) | | | 59,944,284 | |

| | 418 | | | Berkshire Hathaway, Inc., Class A(b) . | | | 222,157,386 | |

| | 899,710 | | | FMC Corp. | | | 60,253,579 | |

| | 2,589,316 | | | Ionis Pharmaceuticals, Inc.(b) | | | 117,451,374 | |

| | 750,927 | | | Johnson & Johnson | | | 116,956,880 | |

| | 293,905 | | | Kenvue, Inc. | | | 5,901,612 | |

| | | | | | | | |

| | | | | | | 780,232,309 | |

| | | | | | | | |

| |

| TOTAL COMMON STOCKS

(Cost $3,169,238,813) | | | 5,443,978,190 | |

| | | | | | | | |

| |

| | PREFERRED STOCKS—0.5% | | | | |

| | |

| | | | Chile—0.3% | | | | |

| | 11,044,000 | | | Embotelladora Andina SA, Class A | | | 21,013,702 | |

| | | | | | | | |

| | |

| | | | Croatia—0.2% | | | | |

| | 166,388 | | | Adris Grupa DD | | | 10,041,308 | |

| | | | | | | | |

| |

| TOTAL PREFERRED STOCKS

(Cost $35,290,988) | | | 31,055,010 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | REGISTERED INVESTMENT COMPANY—1.0% | | | | |

| | 54,563,205 | | | Dreyfus Treasury Securities Cash Management – Institutional Shares 5.24%(e)

(Cost $54,563,205) | | | $54,563,205 | |

| | | | | | | | |

| | |

Face Value | | | | | | |

|

| | U.S. TREASURY BILL—1.7% | |

| | $100,000,000 | | | 4.896%(f) due 10/12/2023

(Cost $99,855,167) | | | 99,853,542 | |

| | | | | | | | |

| | | | | | | | |

| | |

INVESTMENTS IN SECURITIES

(Cost $3,358,948,173) | | | 97.6 | % | | | 5,629,449,947 | |

| | |

UNREALIZED APPRECIATION ON FORWARD CONTRACTS (Net) | | | 1.1 | | | | 64,239,695 | |

| | |

OTHER ASSETS

AND LIABILITIES (Net) | | | 1.3 | | | | 75,606,980 | |

| | | | | | | | |

| | |

NET ASSETS | | | 100.0 | % | | | $5,769,296,622 | |

| | | | | | | | |

| | | | | | |

| * | | | | | | See Note 2 in Notes to Financial Statements. |

| (a) | | | | | | “Affiliated company” as defined by the Investment Company Act of 1940. See Note 4. |

| (b) | | | | | | Non-income producing security. |

| (c) | | | | | | Amount represents less than 0.1% of net assets. |

| (d) | | | | | | Represents one or more issuers where disclosure may be disadvantageous to the Fund’s accumulation or disposition program. The aggregate amount of $7,076,160 represents 0.1% of the net assets of the Fund. |

| (e) | | | | | | Rate disclosed is the 7-day yield at September 30, 2023. |

| (f) | | | | | | Rate represents annualized yield at date of purchase. |

| | | | | | |

|

Abbreviations: |

| ADR | | | — | | | American Depositary Receipt |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-4

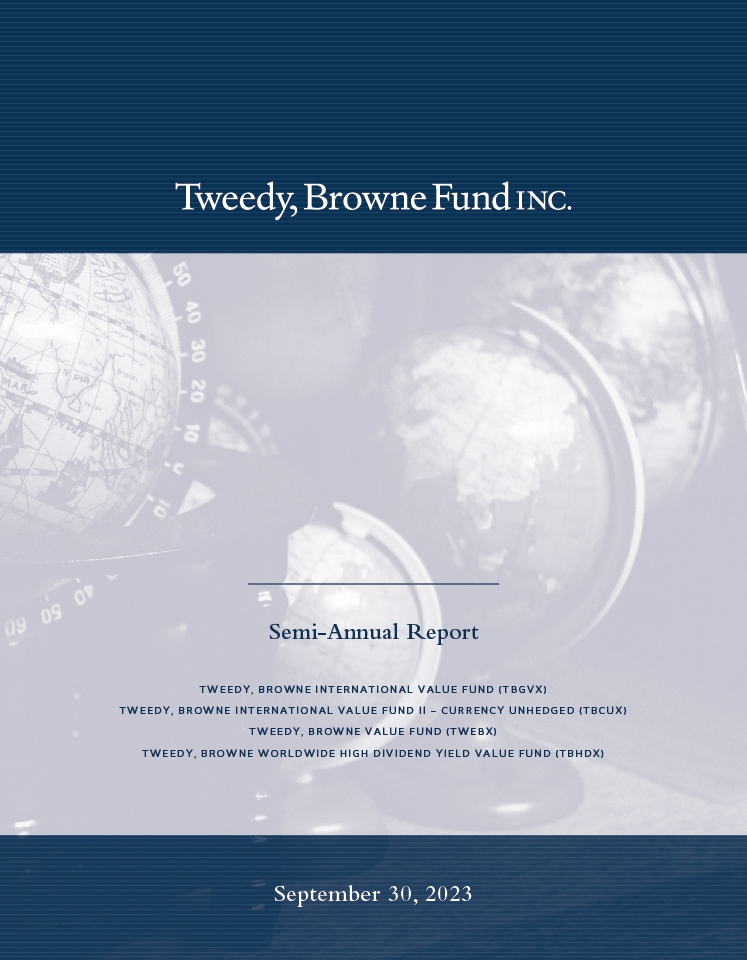

Tweedy, Browne International Value Fund

Sector Diversification

September 30, 2023 (Unaudited)

| | | | |

Sector Diversification | | Percentage of

Net Assets | |

| |

COMMON STOCKS | | | | |

| |

Capital Goods | | | 20.6 | % |

Pharmaceuticals, Biotechnology & Life Sciences | | | 8.9 | |

Insurance | | | 8.5 | |

Software & Services | | | 8.0 | |

Beverage | | | 7.8 | |

Materials | | | 7.0 | |

Banks | | | 6.9 | |

Food | | | 5.9 | |

Energy | | | 4.4 | |

Household & Personal Products | | | 2.4 | |

Consumer Discretionary Distribution & Retail | | | 2.3 | |

Commercial & Professional Services | | | 2.2 | |

Media & Entertainment | | | 2.1 | |

Transportation | | | 1.9 | |

Health Care Equipment & Services | | | 1.8 | |

Automobiles & Components | | | 1.7 | |

Utilities | | | 0.9 | |

Technology Hardware & Equipment | | | 0.6 | |

Real Estate Management & Development | | | 0.5 | |

Tobacco | | | 0.0 | * |

Consumer Services | | | 0.0 | * |

| | | | |

Total Common Stocks | | | 94.4 | |

Preferred Stocks | | | 0.5 | |

Registered Investment Company | | | 1.0 | |

U.S. Treasury Bill | | | 1.7 | |

Unrealized Appreciation on Forward Contracts | | | 1.1 | |

Other Assets and Liabilities (Net) | | | 1.3 | |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

* Amount represents less than 0.1% of net assets.

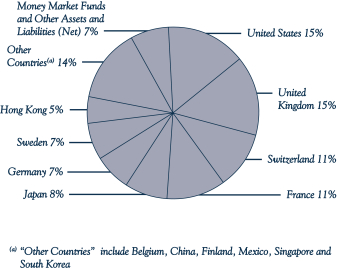

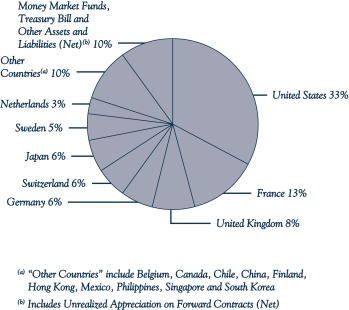

Portfolio Composition

September 30, 2023 (Unaudited)

Schedule of Forward Exchange Contracts

September 30, 2023 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

Contracts | | | | | Counter-

party | | | Settlement

Date | | | Contract Value on

Origination Date | | | Value 09/30/23* | | | Unrealized

Appreciation

(Depreciation) | |

| | FORWARD EXCHANGE CONTRACTS TO BUY(a) | |

| | 65,000,000 | | | Great Britain Pound Sterling | | | JPM | | | | 10/2/23 | | | | $79,326,000 | | | | $79,337,264 | | | | $11,264 | |

| | 180,000,000 | | | Hong Kong Dollar | | | SSB | | | | 5/3/24 | | | | 23,171,391 | | | | 23,081,514 | | | | (89,877 | ) |

| | | | | | | | | | | | | | | | |

| | TOTAL | | | | | | | | | | | $102,497,391 | | | | $102,418,778 | | | | $(78,613 | ) |

| | | | | | | | | | | | | | | | |

| | FORWARD EXCHANGE CONTRACTS TO SELL(a) | | | | | | | | | | | | | | | | | | | | |

| | 22,000,000 | | | Canadian Dollar | | | NTC | | | | 12/8/23 | | | | $(16,356,269 | ) | | | $(16,289,498 | ) | | | $66,771 | |

| | 50,000,000 | | | Canadian Dollar | | | SSB | | | | 12/28/23 | | | | (36,931,031 | ) | | | (37,040,055 | ) | | | (109,024 | ) |

| | 27,500,000 | | | Canadian Dollar | | | NTC | | | | 3/28/24 | | | | (20,163,138 | ) | | | (20,394,486 | ) | | | (231,348 | ) |

| | 37,000,000 | | | Canadian Dollar | | | NTC | | | | 9/5/24 | | | | (27,292,375 | ) | | | (27,468,284 | ) | | | (175,909 | ) |

| | 7,000,000,000 | | | Chilean Peso | | | JPM | | | | 12/28/23 | | | | (7,647,766 | ) | | | (7,781,669 | ) | | | (133,903 | ) |

| | 10,500,000,000 | | | Chilean Peso | | | SSB | | | | 3/28/24 | | | | (12,396,694 | ) | | | (11,614,074 | ) | | | 782,620 | |

| | 200,000,000 | | | Chinese Yuan | | | SSB | | | | 1/23/24 | | | | (30,293,391 | ) | | | (27,612,130 | ) | | | 2,681,261 | |

| | 220,000,000 | | | Chinese Yuan | | | JPM | | | | 1/26/24 | | | | (33,264,285 | ) | | | (30,379,462 | ) | | | 2,884,823 | |

| | 800,000,000 | | | Chinese Yuan | | | JPM | | | | 2/23/24 | | | | (119,394,075 | ) | | | (110,678,861 | ) | | | 8,715,214 | |

| | 460,000,000 | | | Chinese Yuan | | | JPM | | | | 9/5/24 | | | | (64,693,060 | ) | | | (64,541,199 | ) | | | 151,861 | |

| | 210,000,000 | | | European Union Euro | | | SSB | | | | 12/1/23 | | | | (221,397,750 | ) | | | (222,947,875 | ) | | | (1,550,125 | ) |

| | 65,000,000 | | | European Union Euro | | | SSB | | | | 12/8/23 | | | | (68,787,550 | ) | | | (69,039,213 | ) | | | (251,663 | ) |

| | 100,000,000 | | | European Union Euro | | | NTC | | | | 12/8/23 | | | | (105,792,500 | ) | | | (106,214,174 | ) | | | (421,674 | ) |

| | 80,000,000 | | | European Union Euro | | | NTC | | | | 4/9/24 | | | | (88,336,000 | ) | | | (85,488,992 | ) | | | 2,847,008 | |

| | 90,000,000 | | | European Union Euro | | | SSB | | | | 4/17/24 | | | | (99,725,850 | ) | | | (96,210,388 | ) | | | 3,515,462 | |

| | 60,000,000 | | | European Union Euro | | | BNY | | | | 5/20/24 | | | | (66,380,400 | ) | | | (64,237,438 | ) | | | 2,142,962 | |

| | 75,000,000 | | | European Union Euro | | | NTC | | | | 5/31/24 | | | | (82,043,250 | ) | | | (80,337,371 | ) | | | 1,705,879 | |

| | 75,000,000 | | | European Union Euro | | | BNY | | | | 6/4/24 | | | | (81,847,500 | ) | | | (80,352,136 | ) | | | 1,495,364 | |

| | 65,000,000 | | | Great Britain Pound Sterling | | | JPM | | | | 10/2/23 | | | | (73,561,800 | ) | | | (79,337,264 | ) | | | (5,775,464 | ) |

| | 84,000,000 | | | Great Britain Pound Sterling | | | JPM | | | | 7/22/24 | | | | (109,451,160 | ) | | | (102,674,036 | ) | | | 6,777,124 | |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-5

Tweedy, Browne International Value Fund

Schedule of Forward Exchange Contracts

September 30, 2023 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

Contracts | | | | | Counter-

party | | | Settlement

Date | | | Contract Value on

Origination Date | | | Value

09/30/23* | | | Unrealized

Appreciation

(Depreciation) | |

| | FORWARD EXCHANGE CONTRACTS TO SELL(a) (continued) | |

| | 75,000,000 | | | Great Britain Pound Sterling | | | NTC | | | | 8/8/24 | | | | $(95,380,500 | ) | | | $(91,676,739 | ) | | | $3,703,761 | |

| | 90,000,000 | | | Great Britain Pound Sterling | | | NTC | | | | 8/19/24 | | | | (114,338,520 | ) | | | (110,014,799 | ) | | | 4,323,721 | |

| | 75,000,000 | | | Great Britain Pound Sterling | | | NTC | | | | 9/20/24 | | | | (93,654,600 | ) | | | (91,685,575 | ) | | | 1,969,025 | |

| | 52,000,000 | | | Great Britain Pound Sterling | | | JPM | | | | 10/7/24 | | | | (63,515,400 | ) | | | (63,568,158 | ) | | | (52,758 | ) |

| | 240,000,000 | | | Hong Kong Dollar | | | SSB | | | | 5/3/24 | | | | (30,883,659 | ) | | | (30,775,352 | ) | | | 108,307 | |

| | 300,000,000 | | | Hong Kong Dollar | | | NTC | | | | 5/8/24 | | | | (38,578,510 | ) | | | (38,472,679 | ) | | | 105,831 | |

| | 3,200,000,000 | | | Japanese Yen | | | SSB | | | | 12/11/23 | | | | (25,332,288 | ) | | | (21,706,656 | ) | | | 3,625,632 | |

| | 3,450,000,000 | | | Japanese Yen | | | SSB | | | | 2/8/24 | | | | (27,933,458 | ) | | | (23,635,446 | ) | | | 4,298,012 | |

| | 3,500,000,000 | | | Japanese Yen | | | JPM | | | | 5/24/24 | | | | (26,861,090 | ) | | | (24,377,607 | ) | | | 2,483,483 | |

| | 3,000,000,000 | | | Japanese Yen | | | SSB | | | | 6/25/24 | | | | (22,624,400 | ) | | | (20,997,836 | ) | | | 1,626,564 | |

| | 5,800,000,000 | | | Japanese Yen | | | JPM | | | | 8/15/24 | | | | (42,912,422 | ) | | | (40,916,466 | ) | | | 1,995,956 | |

| | 6,000,000,000 | | | Japanese Yen | | | JPM | | | | 9/5/24 | | | | (43,435,769 | ) | | | (42,465,492 | ) | | | 970,277 | |

| | 3,200,000,000 | | | Japanese Yen | | | BNY | | | | 9/26/24 | | | | (22,970,354 | ) | | | (22,724,412 | ) | | | 245,942 | |

| | 360,000,000 | | | Mexican Peso | | | BNY | | | | 4/9/24 | | | | (18,595,041 | ) | | | (20,045,966 | ) | | | (1,450,925 | ) |

| | 250,000,000 | | | Mexican Peso | | | NTC | | | | 4/17/24 | | | | (12,712,942 | ) | | | (13,902,357 | ) | | | (1,189,415 | ) |

| | 250,000,000 | | | Mexican Peso | | | BNY | | | | 5/20/24 | | | | (13,147,515 | ) | | | (13,826,753 | ) | | | (679,238 | ) |

| | 100,000,000 | | | Mexican Peso | | | JPM | | | | 6/7/24 | | | | (5,283,178 | ) | | | (5,514,344 | ) | | | (231,166 | ) |

| | 130,000,000 | | | Mexican Peso | | | NTC | | | | 9/5/24 | | | | (7,235,528 | ) | | | (7,064,185 | ) | | | 171,343 | |

| | 110,000,000 | | | Philippine Peso | | | JPM | | | | 11/15/23 | | | | (1,851,228 | ) | | | (1,944,637 | ) | | | (93,409 | ) |

| | 150,000,000 | | | Philippine Peso | | | SSB | | | | 4/1/24 | | | | (2,736,228 | ) | | | (2,647,466 | ) | | | 88,762 | |

| | 75,000,000 | | | Singapore Dollar | | | JPM | | | | 12/28/23 | | | | (56,011,949 | ) | | | (55,181,182 | ) | | | 830,767 | |

| | 40,000,000 | | | Singapore Dollar | | | SSB | | | | 1/19/24 | | | | (30,323,706 | ) | | | (29,461,372 | ) | | | 862,334 | |

| | 50,000,000 | | | Singapore Dollar | | | NTC | | | | 4/17/24 | | | | (38,054,646 | ) | | | (36,991,128 | ) | | | 1,063,518 | |

| | 75,000,000 | | | Singapore Dollar | | | SSB | | | | 6/28/24 | | | | (56,726,989 | ) | | | (55,674,704 | ) | | | 1,052,285 | |

| | 50,000,000 | | | Singapore Dollar | | | JPM | | | | 7/12/24 | | | | (37,516,413 | ) | | | (37,140,940 | ) | | | 375,473 | |

| | 70,000,000 | | | Singapore Dollar | | | NTC | | | | 8/23/24 | | | | (52,426,603 | ) | | | (52,100,364 | ) | | | 326,239 | |

| | 22,000,000,000 | | | South Korean Won | | | JPM | | | | 12/8/23 | | | | (16,952,418 | ) | | | (16,368,987 | ) | | | 583,431 | |

| | 45,000,000,000 | | | South Korean Won | | | SSB | | | | 3/25/24 | | | | (35,049,459 | ) | | | (33,714,803 | ) | | | 1,334,656 | |

| | 55,000,000,000 | | | South Korean Won | | | JPM | | | | 5/20/24 | | | | (42,029,008 | ) | | | (41,351,897 | ) | | | 677,111 | |

| | 300,000,000 | | | Swedish Krona | | | NTC | | | | 2/23/24 | | | | (29,295,445 | ) | | | (27,815,556 | ) | | | 1,479,889 | |

| | 315,000,000 | | | Swedish Krona | | | NTC | | | | 4/9/24 | | | | (30,811,366 | ) | | | (29,257,883 | ) | | | 1,553,483 | |

| | 440,000,000 | | | Swedish Krona | | | SSB | | | | 5/3/24 | | | | (43,147,830 | ) | | | (40,901,911 | ) | | | 2,245,919 | |

| | 145,000,000 | | | Swedish Krona | | | SSB | | | | 9/5/24 | | | | (13,475,153 | ) | | | (13,537,278 | ) | | | (62,125 | ) |

| | 130,000,000 | | | Swedish Krona | | | BNY | | | | 9/26/24 | | | | (11,846,722 | ) | | | (12,145,879 | ) | | | (299,157 | ) |

| | 95,000,000 | | | Swiss Franc | | | BNY | | | | 12/8/23 | | | | (104,464,482 | ) | | | (104,661,156 | ) | | | (196,674 | ) |

| | 130,000,000 | | | Swiss Franc | | | SSB | | | | 12/13/23 | | | | (144,438,025 | ) | | | (143,315,079 | ) | | | 1,122,946 | |

| | 85,000,000 | | | Swiss Franc | | | JPM | | | | 12/28/23 | | | | (95,238,095 | ) | | | (93,904,390 | ) | | | 1,333,705 | |

| | 20,000,000 | | | Swiss Franc | | | JPM | | | | 1/26/24 | | | | (22,754,682 | ) | | | (22,162,697 | ) | | | 591,985 | |

| | 65,000,000 | | | Swiss Franc | | | NTC | | | | 4/17/24 | | | | (74,133,212 | ) | | | (72,668,072 | ) | | | 1,465,140 | |

| | 25,000,000 | | | Swiss Franc | | | NTC | | | | 5/21/24 | | | | (28,886,873 | ) | | | (28,046,434 | ) | | | 840,439 | |

| | | | | | | | | | | | | | | | |

| | TOTAL | | | | | | | | | | | $(3,039,321,550 | ) | | | $(2,975,003,242 | ) | | | $64,318,308 | |

| | | | | | | | | | | | | | | | |

| | Unrealized Appreciation on Forward Contracts (Net) | | | | | | | | | | | | | | | | | | | $64,239,695 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| * | | | | | | See Note 2 in Notes to Financial Statements. |

| (a) | | | | | | Primary risk exposure being hedged against is currency risk. |

Counterparty Abbreviations:

| | | | | | |

| BNY | | | — | | | The Bank of New York Mellon |

| JPM | | | — | | | JPMorgan Chase Bank NA |

| NTC | | | — | | | Northern Trust Company |

| SSB | | | — | | | State Street Bank and Trust Company |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-6

Tweedy, Browne International Value Fund II – Currency Unhedged

Portfolio of Investments

September 30, 2023 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | COMMON STOCKS—88.5% | | | | |

| | |

| | | | Belgium—1.1% | | | | |

| | 79,510 | | | Fagron NV. | | | $1,354,012 | |

| | 46,370 | | | KBC Group NV | | | 2,890,935 | |

| | | | | | | | |

| | | | | | | 4,244,947 | |

| | | | | | | | |

| | |

| | | | Canada—2.1% | | | | |

| | 3,500 | | | E-L Financial Corp., Ltd. | | | 2,306,583 | |

| | 21,490 | | | Lassonde Industries, Inc., Class A | | | 2,003,402 | |

| | 141,655 | | | Winpak, Ltd. | | | 4,047,435 | |

| | | | | | | | |

| | | | | | | 8,357,420 | |

| | | | | | | | |

| | |

| | | | China—3.6% | | | | |

| | 340,680 | | | Baidu, Inc., Class A(a) | | | 5,733,214 | |

| | 1,004,050 | | | Haitian International Holdings, Ltd. | | | 2,119,158 | |

| | 357,122 | | | Shanghai Mechanical and Electrical Industry Co., Ltd., Class B | | | 358,637 | |

| | 87,160 | | | Tencent Holdings, Ltd. | | | 3,378,278 | |

| | 2,729,475 | | | Uni-President China Holdings, Ltd. | | | 1,915,846 | |

| | 1,908,970 | | | WH Group, Ltd. | | | 999,075 | |

| | | | | | | | |

| | | | | | | 14,504,208 | |

| | | | | | | | |

| | |

| | | | Finland—1.1% | | | | |

| | 287,855 | | | Kemira Oyj | | | 4,482,131 | |

| | | | | | | | |

| | |

| | | | France—13.7% | | | | |

| | 14,845 | | | Alten SA | | | 1,950,744 | |

| | 162,140 | | | Rubis SCA | | | 3,636,525 | |

| | 77,539 | | | Safran SA | | | 12,168,316 | |

| | 382,960 | | | SCOR SE | | | 11,906,575 | |

| | 517,117 | | | Tarkett SA(a) | | | 5,611,851 | |

| | 21,095 | | | Teleperformance SE | | | 2,652,370 | |

| | 220,848 | | | TotalEnergies SE | | | 14,541,216 | |

| | 77,420 | | | Ubisoft Entertainment SA(a) | | | 2,512,496 | |

| | | | | | | | |

| | | | | | | 54,980,093 | |

| | | | | | | | |

| | |

| | | | Germany—7.0% | | | | |

| | 15,490 | | | Brenntag SE | | | 1,200,266 | |

| | 204,604 | | | Deutsche Post AG, Registered | | | 8,313,696 | |

| | 315,180 | | | Fresenius SE & Co., KGaA | | | 9,803,453 | |

| | 9,197 | | | Muenchener Rueckversicherungs AG, Registered | | | 3,586,879 | |

| | 25,285 | | | Norma Group SE | | | 467,867 | |

| | 19,138 | | | Rheinmetall AG | | | 4,930,264 | |

| | | | | | | | |

| | | | | | | 28,302,425 | |

| | | | | | | | |

| | |

| | | | Hong Kong—1.0% | | | | |

| | 1,663,100 | | | Chow Sang Sang Holdings International, Ltd. | | | 2,041,723 | |

| | 3,969,927 | | | Emperor Entertainment Hotel, Ltd.(a) | | | 230,637 | |

| | 734,000 | | | Hang Lung Group, Ltd. | | | 1,032,875 | |

| | 536,600 | | | Johnson Electric Holdings, Ltd. | | | 657,771 | |

| | 45,710 | | | Luk Fook Holdings International, Ltd. | | | 118,228 | |

| | | | | | | | |

| | | | | | | 4,081,234 | |

| | | | | | | | |

| | |

| | | | Italy—0.7% | | | | |

| | 35,576 | | | Buzzi SpA | | | 973,571 | |

| | 66,455 | | | SOL SpA | | | 1,879,836 | |

| | | | | | | | |

| | | | | | | 2,853,407 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Japan—6.9% | | | | |

| | 166,700 | | | ADEKA Corp. | | | $2,850,667 | |

| | 68,445 | | | Dentsu Group, Inc. | | | 2,015,983 | |

| | 111,200 | | | Fuji Seal International, Inc. | | | 1,326,167 | |

| | 12,000 | | | Fukuda Denshi Co., Ltd. | | | 436,353 | |

| | 42,405 | | | Fuso Chemical Co., Ltd. | | | 1,114,291 | |

| | 111,630 | | | Inaba Denki Sangyo Co., Ltd. | | | 2,417,670 | |

| | 20,600 | | | Kamigumi Co., Ltd. | | | 424,847 | |

| | 288,625 | | | Kuraray Co., Ltd. | | | 3,424,032 | |

| | 155,995 | | | Mitsubishi Gas Chemical Co., Inc. | | | 2,099,751 | |

| | 111,685 | | | Nabtesco Corp. | | | 2,012,700 | |

| | 57,855 | | | Nihon Kohden Corp. | | | 1,430,302 | |

| | 33,045 | | | Okamoto Industries, Inc. | | | 1,121,870 | |

| | 108,745 | | | Sumitomo Heavy Industries, Ltd. | | | 2,757,733 | |

| | 44,060 | | | Taikisha, Ltd. | | | 1,333,117 | |

| | 92,200 | | | Transcosmos, Inc. | | | 1,971,781 | |

| | | | Miscellaneous Security(b) | | | 1,087,602 | |

| | | | | | | | |

| | | | | | | 27,824,866 | |

| | | | | | | | |

| | |

| | | | Mexico—2.5% | | | | |

| | 51,161 | | | Coca-Cola FEMSA SAB de CV, Sponsored ADR | | | 4,013,069 | |

| | 2,625,871 | | | Megacable Holdings SAB de CV | | | 5,817,305 | |

| | | | | | | | |

| | | | | | | 9,830,374 | |

| | | | | | | | |

| | |

| | | | Netherlands—2.6% | | | | |

| | 50,405 | | | Aalberts NV | | | 1,841,811 | |

| | 37,400 | | | Heineken NV | | | 3,301,919 | |

| | 71,375 | | | Heineken Holding NV | | | 5,386,540 | |

| | | | | | | | |

| | | | | | | 10,530,270 | |

| | | | | | | | |

| | |

| | | | Philippines—0.5% | | | | |

| | 6,997,100 | | | Alliance Global Group, Inc. | | | 1,523,690 | |

| | 937,800 | | | China Banking Corp. | | | 503,115 | |

| | | | | | | | |

| | | | | | | 2,026,805 | |

| | | | | | | | |

| | |

| | | | Singapore—3.7% | | | | |

| | 297,855 | | | DBS Group Holdings, Ltd. | | | 7,326,470 | |

| | 350,605 | | | United Overseas Bank, Ltd. | | | 7,313,675 | |

| | | | | | | | |

| | | | | | | 14,640,145 | |

| | | | | | | | |

| | |

| | | | South Korea—2.8% | | | | |

| | 27,787 | | | Binggrae Co., Ltd. | | | 1,149,120 | |

| | 132,823 | | | Hankook & Co., Ltd. | | | 1,089,433 | |

| | 37,361 | | | Kangnam Jevisco Co., Ltd. | | | 604,015 | |

| | 89,851 | | | LG Corp. | | | 5,585,321 | |

| | 107,457 | | | LX Holdings Corp. | | | 597,500 | |

| | 47,060 | | | Samsung Electronics Co., Ltd. | | | 2,379,077 | |

| | | | | | | | |

| | | | | | | 11,404,466 | |

| | | | | | | | |

| | |

| | | | Sweden—5.4% | | | | |

| | 38,380 | | | Autoliv, Inc. | | | 3,702,902 | |

| | 593,318 | | | Husqvarna AB, Class B | | | 4,553,274 | |

| | 317,975 | | | SKF AB, Class B | | | 5,308,687 | |

| | 323,568 | | | Trelleborg AB, Class B | | | 8,084,720 | |

| | | | | | | | |

| | | | | | | 21,649,583 | |

| | | | | | | | |

| | |

| | | | Switzerland—8.5% | | | | |

| | 97,015 | | | Nestlé SA, Registered | | | 10,988,314 | |

| | 69,216 | | | Novartis AG, Registered | | | 7,073,186 | |

| | 5,015 | | | Phoenix Mecano AG, Registered(a) | | | 1,973,546 | |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-7

Tweedy, Browne International Value Fund II – Currency Unhedged

Portfolio of Investments

September 30, 2023 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Switzerland (continued) | | | | |

| | 27,580 | | | Roche Holding AG | | | $7,533,898 | |

| | 25,789 | | | TX Group AG | | | 2,607,655 | |

| | 8,759 | | | Zurich Insurance Group AG | | | 4,010,140 | |

| | | | | | | | |

| | | | | | | 34,186,739 | |

| | | | | | | | |

| | |

| | | | Taiwan—0.1% | | | | |

| | 148,500 | | | Lumax International Corp., Ltd. | | | 390,357 | |

| | | | | | | | |

| | |

| | | | United Kingdom—13.6% | | | | |

| | 997,937 | | | BAE Systems plc | | | 12,131,248 | |

| | 581,487 | | | CNH Industrial NV | | | 7,069,062 | |

| | 82,845 | | | Computacenter plc | | | 2,551,901 | |

| | 291,588 | | | Diageo plc | | | 10,754,267 | |

| | 229,117 | | | Grafton Group plc | | | 2,528,779 | |

| | 251,542 | | | GSK plc | | | 4,553,028 | |

| | 306,936 | | | Howden Joinery Group plc | | | 2,747,336 | |

| | 802,205 | | | Inchcape plc | | | 7,391,384 | |

| | 1,504,280 | | | Johnson Service Group plc | | | 2,484,890 | |

| | 2,741,248 | | | Vertu Motors plc | | | 2,491,396 | |

| | | | | | | | |

| | | | | | | 54,703,291 | |

| | | | | | | | |

| | |

| | | | United States—11.6% | | | | |

| | 70,070 | | | Alphabet, Inc., Class A(a) | | | 9,169,360 | |

| | 2,200 | | | AutoZone, Inc.(a) | | | 5,587,978 | |

| | 34,135 | | | Berkshire Hathaway, Inc., Class B(a) | | | 11,957,490 | |

| | 26,970 | | | FMC Corp. | | | 1,806,181 | |

| | 198,422 | | | Ionis Pharmaceuticals, Inc.(a) | | | 9,000,422 | |

| | 55,496 | | | Johnson & Johnson | | | 8,643,502 | |

| | 21,719 | | | Kenvue, Inc. | | | 436,118 | |

| | | | | | | | |

| | | | | | | 46,601,051 | |

| | | | | | | | |

| |

| TOTAL COMMON STOCKS

(Cost $293,355,394) | | | 355,593,812 | |

| | | | | | | | |

| |

| | PREFERRED STOCKS—0.5% | | | | |

| | |

| | | | Chile—0.4% | | | | |

| | 940,000 | | | Embotelladora Andina SA, Class A | | | 1,788,562 | |

| | | | | | | | |

| | |

| | | | Germany—0.1% | | | | |

| | 648 | | | KSB AG | | | 390,335 | |

| | | | | | | | |

| |

| TOTAL PREFERRED STOCKS

(Cost $3,051,153) | | | 2,178,897 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | REGISTERED INVESTMENT COMPANY—10.4% | | | | |

| 41,852,081

|

| | Dreyfus Government Securities Cash Management – Institutional Shares

5.20%(c)

(Cost $41,852,081) | | | $41,852,081 | |

| | | | | | | | |

| | | | | | | | |

| | |

INVESTMENTS IN SECURITIES (Cost $338,258,628) | | | 99.4 | % | | | 399,624,790 | |

| | |

OTHER ASSETS

AND LIABILITIES (Net) | | | 0.6 | | | | 2,261,145 | |

| | | | | | | | |

| | |

NET ASSETS | | | 100.0 | % | | | $401,885,935 | |

| | | | | | | | |

| | | | | | |

| * | | | | | | See Note 2 in Notes to Financial Statements. |

| (a) | | | | | | Non-income producing security. |

| (b) | | | | | | Represents one or more issuers where disclosure may be disadvantageous to the Fund’s accumulation or disposition program. The aggregate amount of $1,087,602 represents 0.3% of the net assets of the Fund. |

| (c) | | | | | | Rate disclosed is the 7-day yield at September 30, 2023. |

| | | | | | |

|

| Abbreviations: |

| ADR | | | — | | | American Depositary Receipt |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-8

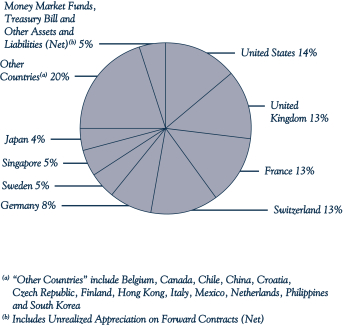

Tweedy, Browne International Value Fund II – Currency Unhedged

Sector Diversification

September 30, 2023 (Unaudited)

| | | | |

Sector Diversification | | Percentage of

Net Assets | |

| |

COMMON STOCKS | | | | |

| |

Capital Goods | | | 22.6 | % |

| |

Pharmaceuticals, Biotechnology & Life Sciences | | | 9.2 | |

| |

Insurance | | | 8.5 | |

| |

Materials | | | 6.2 | |

| |

Software & Services | | | 6.1 | |

| |

Beverage | | | 5.8 | |

| |

Banks | | | 4.5 | |

| |

Food | | | 4.3 | |

| |

Consumer Discretionary Distribution & Retail | | | 3.9 | |

| |

Energy | | | 3.6 | |

| |

Health Care Equipment & Services | | | 3.3 | |

| |

Media & Entertainment | | | 3.2 | |

| |

Transportation | | | 2.2 | |

| |

Commercial & Professional Services | | | 1.3 | |

| |

Automobiles & Components | | | 1.1 | |

| |

Utilities | | | 0.9 | |

| |

Technology Hardware & Equipment | | | 0.6 | |

| |

Consumer Durables & Apparel | | | 0.5 | |

| |

Financial Services | | | 0.3 | |

| |

Real Estate Management & Development | | | 0.2 | |

| |

Household & Personal Products | | | 0.1 | |

| |

Consumer Services | | | 0.1 | |

| | | | |

Total Common Stocks | | | 88.5 | |

Preferred Stocks | | | 0.5 | |

Registered Investment Company | | | 10.4 | |

Other Assets and Liabilities (Net) | | | 0.6 | |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

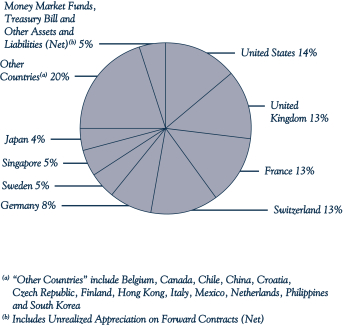

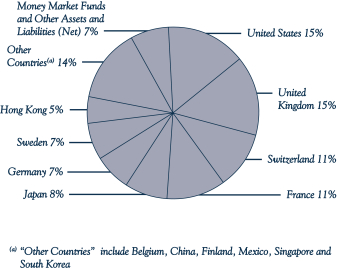

Portfolio Composition

September 30, 2023 (Unaudited)

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-9

Tweedy, Browne Value Fund

Portfolio of Investments

September 30, 2023 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | COMMON STOCKS—90.0% | | | | |

| | |

| | | | Belgium—0.8% | | | | |

| | 66,181 | | | Fagron NV | | | $1,127,026 | |

| | 38,820 | | | KBC Group NV | | | 2,420,231 | |

| | | | | | | | |

| | | | | | | 3,547,257 | |

| | | | | | | | |

| | |

| | | | Canada—1.4% | | | | |

| | 18,010 | | | Lassonde Industries, Inc., Class A | | | 1,678,979 | |

| | 147,158 | | | Winpak, Ltd. | | | 4,204,670 | |

| | | | | | | | |

| | | | | | | 5,883,649 | |

| | | | | | | | |

| | |

| | | | China—2.1% | | | | |

| | 231,680 | | | Baidu, Inc., Class A(a) | | | 3,898,882 | |

| | 1,006,590 | | | Haitian International Holdings, Ltd. | | | 2,124,519 | |

| | 345,561 | | | Shanghai Mechanical and Electrical Industry Co., Ltd., Class B | | | 347,027 | |

| | 2,349,905 | | | Uni-President China Holdings, Ltd. | | | 1,649,422 | |

| | 1,531,400 | | | WH Group, Ltd. | | | 801,470 | |

| | | | | | | | |

| | | | | | | 8,821,320 | |

| | | | | | | | |

| | |

| | | | Finland—0.8% | | | | |

| | 227,906 | | | Kemira Oyj | | | 3,548,678 | |

| | | | | | | | |

| | |

| | | | France—12.7% | | | | |

| | 15,477 | | | Alten SA | | | 2,033,794 | |

| | 299,826 | | | Rubis SCA. | | | 6,724,588 | |

| | 81,857 | | | Safran SA | | | 12,845,947 | |

| | 355,239 | | | SCOR SE | | | 11,044,703 | |

| | 150,328 | | | Tarkett SA(a) | | | 1,631,387 | |

| | 13,135 | | | Teleperformance SE | | | 1,651,523 | |

| | 236,380 | | | TotalEnergies SE | | | 15,563,884 | |

| | 72,825 | | | Ubisoft Entertainment SA(a) | | | 2,363,376 | |

| | | | | | | | |

| | | | | | | 53,859,202 | |

| | | | | | | | �� |

| | |

| | | | Germany—6.4% | | | | |

| | 14,490 | | | Brenntag SE | | | 1,122,779 | |

| | 190,881 | | | Deutsche Post AG, Registered | | | 7,756,088 | |

| | 301,060 | | | Fresenius SE & Co., KGaA | | | 9,364,260 | |

| | 17,583 | | | Krones AG | | | 1,812,057 | |

| | 150,000 | | | Norma Group SE | | | 2,775,561 | |

| | 16,413 | | | Rheinmetall AG | | | 4,228,259 | |

| | | | | | | | |

| | | | | | | 27,059,004 | |

| | | | | | | | |

| | |

| | | | Hong Kong—0.4% | | | | |

| | 1,046,000 | | | Chow Sang Sang Holdings International, Ltd. | | | 1,284,133 | |

| | 2,255 | | | Johnson Electric Holdings, Ltd. | | | 2,764 | |

| | 214,000 | | | Luk Fook Holdings International, Ltd. | | | 553,508 | |

| | | | | | | | |

| | | | | | | 1,840,405 | |

| | | | | | | | |

| | |

| | | | Japan—5.5% | | | | |

| | 63,220 | | | ADEKA Corp. | | | 1,081,099 | |

| | 72,285 | | | Dentsu Group, Inc. | | | 2,129,086 | |

| | 40,205 | | | Fuso Chemical Co., Ltd. | | | 1,056,481 | |

| | 36,595 | | | Inaba Denki Sangyo Co., Ltd. | | | 792,570 | |

| | 239,905 | | | Kuraray Co., Ltd. | | | 2,846,054 | |

| | 148,315 | | | Mitsubishi Gas Chemical Co., Inc. | | | 1,996,375 | |

| | 130,035 | | | Nabtesco Corp. | | | 2,343,390 | |

| | 48,115 | | | Nihon Kohden Corp. | | | 1,189,508 | |

| | 28,005 | | | Okamoto Industries, Inc. | | | 950,763 | |

| | 145,060 | | | Sumitomo Heavy Industries, Ltd. | | | 3,678,668 | |

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Japan (continued) | | | | |

| | 34,620 | | | Taikisha, Ltd. | | | $1,047,492 | |

| | 87,100 | | | Transcosmos, Inc. | | | 1,862,713 | |

| | 99,120 | | | YAMABIKO Corp. | | | 954,621 | |

| | | | Miscellaneous Security(b) | | | 1,107,760 | |

| | | | | | | | |

| | | | | | | 23,036,580 | |

| | | | | | | | |

| | |

| | | | Mexico—1.3% | | | | |

| | 54,420 | | | Coca-Cola FEMSA SAB de CV, Sponsored ADR | | | 4,268,705 | |

| | 615,313 | | | Megacable Holdings SAB de CV | | | 1,363,153 | |

| | | | | | | | |

| | | | | | | 5,631,858 | |

| | | | | | | | |

| | |

| | | | Netherlands—2.7% | | | | |

| | 52,805 | | | Aalberts NV | | | 1,929,507 | |

| | 128,033 | | | Heineken Holding NV | | | 9,662,415 | |

| | | | | | | | |

| | | | | | | 11,591,922 | |

| | | | | | | | |

| | |

| | | | Philippines—0.3% | | | | |

| | 6,542,900 | | | Alliance Global Group, Inc. | | | 1,424,783 | |

| | | | | | | | |

| | |

| | | | Singapore—1.9% | | | | |

| | 386,517 | | | United Overseas Bank, Ltd. | | | 8,062,805 | |

| | | | | | | | |

| | |

| | | | South Korea—1.9% | | | | |

| | 22,373 | | | Binggrae Co., Ltd. | | | 925,227 | |

| | 70,858 | | | LG Corp. | | | 4,404,677 | |

| | 61,295 | | | LX Holdings Corp. | | | 340,822 | |

| | 43,090 | | | Samsung Electronics Co., Ltd. | | | 2,178,378 | |

| | | | | | | | |

| | | | | | | 7,849,104 | |

| | | | | | | | |

| | |

| | | | Sweden—4.9% | | | | |

| | 52,604 | | | Autoliv, Inc. | | | 5,075,234 | |

| | 575,755 | | | Husqvarna AB, Class B | | | 4,418,491 | |

| | 256,145 | | | SKF AB, Class B | | | 4,276,417 | |

| | 271,905 | | | Trelleborg AB, Class B | | | 6,793,860 | |

| | | | | | | | |

| | | | | | | 20,564,002 | |

| | | | | | | | |

| | |

| | | | Switzerland—6.0% | | | | |

| | 118,780 | | | Nestlé SA, ADR | | | 13,442,333 | |

| | 50,749 | | | Novartis AG, Registered | | | 5,186,042 | |

| | 25,228 | | | Roche Holding AG | | | 6,891,413 | |

| | | | | | | | |

| | | | | | | 25,519,788 | |

| | | | | | | | |

| | |

| | | | United Kingdom—8.4% | | | | |

| | 529,590 | | | BAE Systems plc | | | 6,437,869 | |

| | 650,620 | | | CNH Industrial NV | | | 7,909,502 | |

| | 74,115 | | | Computacenter plc | | | 2,282,988 | |

| | 62,715 | | | Diageo plc, Sponsored ADR | | | 9,355,824 | |

| | 223,196 | | | Grafton Group plc | | | 2,463,429 | |

| | 252,750 | | | Howden Joinery Group plc | | | 2,262,326 | |

| | 282,425 | | | Inchcape plc | | | 2,602,217 | |

| | 1,269,763 | | | Johnson Service Group plc | | | 2,097,496 | |

| | | | | | | | |

| | | | | | | 35,411,651 | |

| | | | | | | | |

| | |

| | | | United States—32.5% | | | | |

| | 123,000 | | | Alphabet, Inc., Class A(a) | | | 16,095,780 | |

| | 16,855 | | | Alphabet, Inc., Class C(a) | | | 2,222,332 | |

| | 48,220 | | | Atmus Filtration Technologies, Inc.(a) | | | 1,005,387 | |

| | 3,595 | | | AutoZone, Inc.(a) | | | 9,131,264 | |

| | 76,760 | | | Bank of America Corp. | | | 2,101,689 | |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-10

Tweedy, Browne Value Fund

Portfolio of Investments

September 30, 2023 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | United States (continued) | | | | |

| | 56 | | | Berkshire Hathaway, Inc., Class A(a) | | | $29,762,712 | |

| | 107,535 | | | Enterprise Products Partners LP | | | 2,943,233 | |

| | 35,160 | | | FedEx Corp. | | | 9,314,587 | |

| | 34,830 | | | FMC Corp. | | | 2,332,565 | |

| | 190,425 | | | Ionis Pharmaceuticals, Inc.(a) | | | 8,637,678 | |

| | 63,514 | | | Johnson & Johnson | | | 9,892,305 | |

| | 24,852 | | | Kenvue, Inc. | | | 499,028 | |

| | 33,708 | | | National Western Life Group, Inc., Class A | | | 14,746,913 | |

| | 80,620 | | | Sealed Air Corp. | | | 2,649,173 | |

| | 24,140 | | | Thor Industries, Inc. | | | 2,296,438 | |

| | 131,295 | | | Truist Financial Corp. | | | 3,756,350 | |

| | 84,370 | | | U-Haul Holding Co. | | | 4,420,144 | |

| | 18,490 | | | Vertex Pharmaceuticals, Inc.(a) | | | 6,429,713 | |

| | 225,783 | | | Wells Fargo & Co. | | | 9,225,493 | |

| | | | | | | | |

| | | | | | | 137,462,784 | |

| | | | | | | | |

| |

| TOTAL COMMON STOCKS

(Cost $227,587,941) | | | 381,114,792 | |

| | | | | | | | |

| |

| | PREFERRED STOCK—0.2% | | | | |

| | |

| | | | Chile—0.2% | | | | |

| | 492,000 | | | Embotelladora Andina SA, Class A

(Cost $918,376) | | | 936,141 | |

| | | | | | | | |

| |

| | REGISTERED INVESTMENT COMPANY—7.1% | | | | |

| | 30,107,027 | | | Dreyfus Government Securities Cash Management – Institutional Shares 5.20%(c)

(Cost $30,107,027) | | | 30,107,027 | |

| | | | | | | | |

| | | | | | | | |

Face Value | | | | | Value* | |

| |

| | U.S. TREASURY BILL—1.2% | | | | |

| $5,070,000

|

| | 5.454%(d) due 11/30/2023

(Cost $5,025,511) | | | $5,025,754 | |

| | | | | | | | |

| | | | | | | | |

| | |

INVESTMENTS IN SECURITIES

(Cost $263,638,855) | | | 98.5 | % | | | 417,183,714 | |

| | |

UNREALIZED APPRECIATION ON FORWARD CONTRACTS (Net) | | | 1.2 | | | | 5,375,490 | |

| | |

OTHER ASSETS

AND LIABILITIES (Net) | | | 0.3 | | | | 1,062,990 | |

| | | | | | | | |

| | |

NET ASSETS | | | 100.0 | % | | | $423,622,194 | |

| | | | | | | | |

| | | | | | |

| * | | | | | | See Note 2 in Notes to Financial Statements. |

| (a) | | | | | | Non-income producing security. |

| (b) | | | | | | Represents one or more issuers where disclosure may be disadvantageous to the Fund’s accumulation or disposition program. The aggregate amount of $1,107,760 represents 0.3% of the net assets of the Fund. |

| (c) | | | | | | Rate disclosed is the 7-day yield at September 30, 2023. |

| (d) | | | | | | Rate represents annualized yield at date of purchase. |

| | | | | | |

|

| Abbreviations: |

| ADR | | | — | | | American Depositary Receipt |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-11

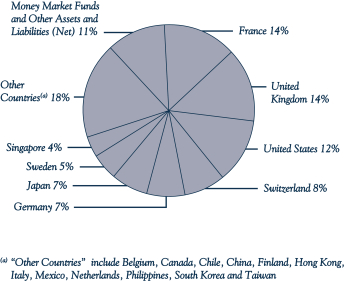

Tweedy, Browne Value Fund

Sector Diversification

September 30, 2023 (Unaudited)

| | | | |

Sector Diversification | | Percentage of

Net Assets | |

| |

COMMON STOCKS | | | | |

| |

Capital Goods | | | 18.9 | % |

Insurance | | | 13.1 | |

Pharmaceuticals, Biotechnology & Life Sciences | | | 8.6 | |

Software & Services | | | 6.7 | |

Banks | | | 6.1 | |

Beverage | | | 5.5 | |

Transportation | | | 5.1 | |

Materials | | | 4.9 | |

Energy | | | 4.4 | |

Food | | | 4.4 | |

Consumer Discretionary Distribution & Retail | | | 2.9 | |

Health Care Equipment & Services | | | 2.7 | |

Automobiles & Components | | | 2.0 | |

Utilities | | | 1.6 | |

Media & Entertainment | | | 1.3 | |

Commercial & Professional Services | | | 0.9 | |

Technology Hardware & Equipment | | | 0.5 | |

Consumer Durables & Apparel | | | 0.3 | |

Household & Personal Products | | | 0.1 | |

| | | | |

Total Common Stocks | | | 90.0 | |

Preferred Stock | | | 0.2 | |

Registered Investment Company | | | 7.1 | |

U.S. Treasury Bill | | | 1.2 | |

Unrealized Appreciation on Forward Contracts | | | 1.2 | |

Other Assets and Liabilities (Net) | | | 0.3 | |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

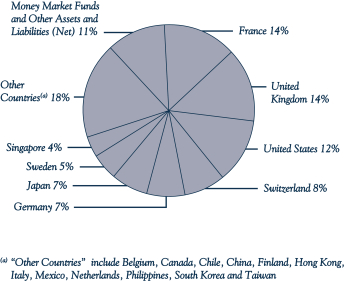

Portfolio Composition

September 30, 2023 (Unaudited)

Schedule of Forward Exchange Contracts

September 30, 2023 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

Contracts | | | | | Counter-

party | | | Settlement

Date | | | Contract Value on

Origination Date | | | Value 09/30/23* | | | Unrealized

Appreciation

(Depreciation) | |

| | FORWARD EXCHANGE CONTRACTS TO BUY(a) | | | | | | | | | | | | | | | | | |

| | 7,400,000 | | | Chinese Yuan | | | SSB | | | | 1/23/24 | | | | $1,020,141 | | | | $1,021,649 | | | | $1,508 | |

| | 27,800,000 | | | Mexican Peso | | | JPM | | | | 6/7/24 | | | | 1,535,855 | | | | 1,532,987 | | | | (2,868 | ) |

| | | | | | | | | | | | | | | | |

| | TOTAL | | | | | | | | | | | $2,555,996 | | | | $2,554,636 | | | | $(1,360 | ) |

| | | | | | | | | | | | | | | | |

| | FORWARD EXCHANGE CONTRACTS TO SELL(a) | | | | | | | | | | | | | | | | | |

| | 1,950,000 | | | Canadian Dollar | | | SSB | | | | 1/8/24 | | | | $(1,443,803 | ) | | | $(1,444,738 | ) | | | $(935 | ) |

| | 800,000,000 | | | Chilean Peso | | | SSB | | | | 8/8/24 | | | | (927,321 | ) | | | (881,702 | ) | | | 45,619 | |

| | 24,500,000 | | | Chinese Yuan | | | SSB | | | | 1/23/24 | | | | (3,710,940 | ) | | | (3,382,486 | ) | | | 328,454 | |

| | 29,000,000 | | | Chinese Yuan | | | JPM | | | | 2/23/24 | | | | (4,328,035 | ) | | | (4,012,109 | ) | | | 315,926 | |

| | 4,300,000 | | | European Union Euro | | | NTC | | | | 10/26/23 | | | | (4,339,861 | ) | | | (4,557,849 | ) | | | (217,988 | ) |

| | 8,100,000 | | | European Union Euro | | | SSB | | | | 2/8/24 | | | | (8,962,747 | ) | | | (8,631,450 | ) | | | 331,297 | |

| | 9,000,000 | | | European Union Euro | | | NTC | | | | 4/9/24 | | | | (9,937,800 | ) | | | (9,617,512 | ) | | | 320,288 | |

| | 7,000,000 | | | European Union Euro | | | BNY | | | | 5/20/24 | | | | (7,744,380 | ) | | | (7,494,368 | ) | | | 250,012 | |

| | 12,500,000 | | | European Union Euro | | | BNY | | | | 5/24/24 | | | | (13,752,500 | ) | | | (13,385,258 | ) | | | 367,242 | |

| | 3,500,000 | | | European Union Euro | | | BNY | | | | 6/28/24 | | | | (3,898,790 | ) | | | (3,753,906 | ) | | | 144,884 | |

| | 6,500,000 | | | Great Britain Pound Sterling | | | SSB | | | | 1/19/24 | | | | (7,951,450 | ) | | | (7,940,207 | ) | | | 11,243 | |

| | 4,200,000 | | | Great Britain Pound Sterling | | | JPM | | | | 7/22/24 | | | | (5,472,558 | ) | | | (5,133,702 | ) | | | 338,856 | |

| | 4,400,000 | | | Great Britain Pound Sterling | | | NTC | | | | 8/8/24 | | | | (5,595,656 | ) | | | (5,378,369 | ) | | | 217,287 | |

| | 8,500,000 | | | Hong Kong Dollar | | | SSB | | | | 2/8/24 | | | | (1,090,848 | ) | | | (1,088,171 | ) | | | 2,677 | |

| | 4,600,000 | | | Hong Kong Dollar | | | SSB | | | | 3/28/24 | | | | (592,266 | ) | | | (589,476 | ) | | | 2,790 | |

| | 11,500,000 | | | Hong Kong Dollar | | | BNY | | | | 9/5/24 | | | | (1,478,231 | ) | | | (1,478,004 | ) | | | 227 | |

| | 350,000,000 | | | Japanese Yen | | | BNY | | | | 12/8/23 | | | | (2,650,110 | ) | | | (2,372,827 | ) | | | 277,283 | |

| | 350,000,000 | | | Japanese Yen | | | SSB | | | | 12/11/23 | | | | (2,770,719 | ) | | | (2,374,165 | ) | | | 396,554 | |

| | 430,000,000 | | | Japanese Yen | | | SSB | | | | 2/8/24 | | | | (3,481,561 | ) | | | (2,945,867 | ) | | | 535,694 | |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-12

Tweedy, Browne Value Fund

Schedule of Forward Exchange Contracts

September 30, 2023 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

Contracts | | | | | Counter-

party | | | Settlement

Date | | | Contract Value on

Origination Date | | | Value 09/30/23* | | | Unrealized

Appreciation

(Depreciation) | |

| | FORWARD EXCHANGE CONTRACTS TO SELL(a) (continued) | | | | | | | | | | | | | | | | | |

| | 365,000,000 | | | Japanese Yen | | | JPM | | | | 3/18/24 | | | | $(2,842,901 | ) | | | $(2,516,204 | ) | | | $326,697 | |

| | 420,000,000 | | | Japanese Yen | | | JPM | | | | 5/24/24 | | | | (3,223,331 | ) | | | (2,925,313 | ) | | | 298,018 | |

| | 430,000,000 | | | Japanese Yen | | | SSB | | | | 6/25/24 | | | | (3,242,831 | ) | | | (3,009,690 | ) | | | 233,141 | |

| | 165,000,000 | | | Japanese Yen | | | JPM | | | | 8/15/24 | | | | (1,220,784 | ) | | | (1,164,003 | ) | | | 56,781 | |

| | 63,000,000 | | | Mexican Peso | | | JPM | | | | 6/7/24 | | | | (3,328,402 | ) | | | (3,474,037 | ) | | | (145,635 | ) |

| | 16,200,000 | | | Mexican Peso | | | BNY | | | | 7/12/24 | | | | (892,834 | ) | | | (888,216 | ) | | | 4,618 | |

| | 29,000,000 | | | Philippine Peso | | | JPM | | | | 11/15/23 | | | | (488,051 | ) | | | (512,677 | ) | | | (24,626 | ) |

| | 47,000,000 | | | Philippine Peso | | | SSB | | | | 4/1/24 | | | | (857,351 | ) | | | (829,539 | ) | | | 27,812 | |

| | 11,000,000 | | | Singapore Dollar | | | SSB | | | | 1/19/24 | | | | (8,339,019 | ) | | | (8,101,877 | ) | | | 237,142 | |

| | 6,700,000,000 | | | South Korean Won | | | JPM | | | | 3/18/24 | | | | (5,175,744 | ) | | | (5,017,620 | ) | | | 158,124 | |

| | 2,000,000,000 | | | South Korean Won | | | JPM | | | | 5/13/24 | | | | (1,532,861 | ) | | | (1,503,043 | ) | | | 29,818 | |

| | 24,000,000 | | | Swedish Krona | | | NTC | | | | 2/23/24 | | | | (2,343,636 | ) | | | (2,225,244 | ) | | | 118,392 | |

| | 44,000,000 | | | Swedish Krona | | | NTC | | | | 4/9/24 | | | | (4,303,810 | ) | | | (4,086,815 | ) | | | 216,995 | |

| | 22,000,000 | | | Swedish Krona | | | NTC | | | | 8/23/24 | | | | (2,050,613 | ) | | | (2,053,009 | ) | | | (2,396 | ) |

| | 4,700,000 | | | Swiss Franc | | | JPM | | | | 12/13/23 | | | | (5,211,596 | ) | | | (5,181,391 | ) | | | 30,205 | |

| | 9,200,000 | | | Swiss Franc | | | JPM | | | | 12/28/23 | | | | (10,308,123 | ) | | | (10,163,769 | ) | | | 144,354 | |

| | | | | | | | | | | | | | | | |

| | TOTAL | | | | | | | | | | | $(145,491,463 | ) | | | $(140,114,613 | ) | | | $5,376,850 | |

| | | | | | | | | | | | | | | | |

| | Unrealized Appreciation on Forward Contracts (Net) | | | | | | | | | | | | | | | | | | | $5,375,490 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| * | | | | | | See Note 2 in Notes to Financial Statements. |

| (a) | | | | | | Primary risk exposure being hedged against is currency risk. |

Counterparty Abbreviations:

| | | | | | |

| BNY | | | — | | | The Bank of New York Mellon |

| JPM | | | — | | | JPMorgan Chase Bank NA |

| NTC | | | — | | | Northern Trust Company |

| SSB | | | — | | | State Street Bank and Trust Company |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-13

Tweedy, Browne Worldwide High Dividend Yield Value Fund

Portfolio of Investments

September 30, 2023 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | COMMON STOCKS—92.9% | | | | |

| | |

| | | | Belgium—0.7% | | | | |

| | 7,175 | | | KBC Group NV | | | $447,325 | |

| | | | | | | | |

| | |

| | | | China—2.1% | | | | |

| | 308,710 | | | Haitian International Holdings, Ltd. | | | 651,566 | |

| | 976,845 | | | Uni-President China Holdings, Ltd. | | | 685,658 | |

| | | | | | | | |

| | | | | | | 1,337,224 | |

| | | | | | | | |

| | |

| | | | Finland—2.3% | | | | |

| | 95,220 | | | Kemira Oyj | | | 1,482,651 | |

| | | | | | | | |

| | |

| | | | France—10.7% | | | | |

| | 58,430 | | | Rubis SCA | | | 1,310,486 | |

| | 11,320 | | | Safran SA | | | 1,776,465 | |

| | 64,336 | | | SCOR SE | | | 2,000,265 | |

| | 44,294 | | | Tarkett SA(a) | | | 480,687 | |

| | 10,565 | | | Teleperformance SE | | | 1,328,385 | |

| | | | | | | | |

| | | | | | | 6,896,288 | |

| | | | | | | | |

| | |

| | | | Germany—7.5% | | | | |

| | 36,145 | | | Deutsche Post AG, Registered | | | 1,468,684 | |

| | 50,225 | | | Fresenius SE & Co., KGaA | | | 1,562,213 | |

| | 2,624 | | | Muenchener Rueckversicherungs AG, Registered | | | 1,023,374 | |

| | 41,885 | | | Norma Group SE | | | 775,029 | |

| | | | | | | | |

| | | | | | | 4,829,300 | |

| | | | | | | | |

| | |

| | | | Hong Kong—4.8% | | | | |

| | 117,150 | | | CK Hutchison Holdings, Ltd. | | | 621,889 | |

| | 407,000 | | | Hang Lung Group, Ltd. | | | 572,725 | |

| | 15,465 | | | Jardine Matheson Holdings, Ltd. | | | 716,671 | |

| | 592,340 | | | Johnson Electric Holdings, Ltd. | | | 726,098 | |

| | 172,775 | | | Luk Fook Holdings International, Ltd. | | | 446,880 | |

| | | | | | | | |

| | | | | | | 3,084,263 | |

| | | | | | | | |

| | |

| | | | Japan—7.9% | | | | |

| | 42,370 | | | ADEKA Corp. | | | 724,552 | |

| | 19,655 | | | Dentsu Group, Inc. | | | 578,919 | |

| | 45,315 | | | Inaba Denki Sangyo Co., Ltd. | | | 981,427 | |

| | 56,600 | | | Kuraray Co., Ltd. | | | 671,460 | |

| | 48,915 | | | Mitsubishi Gas Chemical Co., Inc. | | | 658,414 | |

| | 16,420 | | | Nabtesco Corp. | | | 295,909 | |

| | 17,685 | | | Sumitomo Heavy Industries, Ltd. | | | 448,485 | |

| | 35,785 | | | Takasago Thermal Engineering Co., Ltd. | | | 696,017 | |

| | | | | | | | |

| | | | | | | 5,055,183 | |

| | | | | | | | |

| | |

| | | | Mexico—3.0% | | | | |

| | 9,925 | | | Coca-Cola FEMSA SAB de CV, Sponsored ADR | | | 778,517 | |

| | 531,475 | | | Megacable Holdings SAB de CV | | | 1,177,420 | |

| | | | | | | | |

| | | | | | | 1,955,937 | |

| | | | | | | | |

| | |

| | | | Singapore—4.1% | | | | |

| | 53,795 | | | DBS Group Holdings, Ltd. | | | 1,323,219 | |

| | 63,030 | | | United Overseas Bank, Ltd. | | | 1,314,816 | |

| | | | | | | | |

| | | | | | | 2,638,035 | |

| | | | | | | | |

| | |

| | | | South Korea—1.8% | | | | |

| | 13,365 | | | LG Corp. | | | 830,796 | |

| | 53,223 | | | LX Holdings Corp. | | | 295,939 | |

| | | | | | | | |

| | | | | | | 1,126,735 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Sweden—7.5% | | | | |

| | 10,925 | | | Autoliv, Inc. | | | $1,054,044 | |

| | 101,255 | | | Husqvarna AB, Class B | | | 777,057 | |

| | 48,290 | | | SKF AB, Class B | | | 806,216 | |

| | 86,990 | | | Trelleborg AB, Class B | | | 2,173,545 | |

| | | | | | | | |

| | | | | | | 4,810,862 | |

| | | | | | | | |

| | |

| | | | Switzerland—11.0% | | | | |

| | 28,420 | | | Nestlé SA, Registered | | | 3,218,965 | |

| | 16,072 | | | Novartis AG, Registered | | | 1,642,398 | |

| | 4,550 | | | Roche Holding AG | | | 1,242,902 | |

| | 2,187 | | | Zurich Insurance Group AG | | | 1,001,276 | |

| | | | | | | | |

| | | | | | | 7,105,541 | |

| | | | | | | | |

| | |

| | | | United Kingdom—14.5% | | | | |

| | 152,600 | | | BAE Systems plc | | | 1,855,055 | |

| | 26,290 | | | Computacenter plc | | | 809,819 | |

| | 68,020 | | | Diageo plc | | | 2,508,695 | |

| | 40,695 | | | Grafton Group plc | | | 449,153 | |

| | 78,507 | | | GSK plc | | | 1,421,014 | |

| | 47,690 | | | Howden Joinery Group plc | | | 426,866 | |

| | 133,180 | | | Inchcape plc | | | 1,227,098 | |

| | 13,045 | | | Unilever plc | | | 646,740 | |

| | | | | | | | |

| | | | | | | 9,344,440 | |

| | | | | | | | |

| | |

| | | | United States—15.0% | | | | |

| | 41,145 | | | Bank of America Corp. | | | 1,126,550 | |

| | 28,760 | | | Enterprise Products Partners LP | | | 787,161 | |

| | 15,940 | | | FMC Corp. | | | 1,067,502 | |

| | 12,783 | | | Johnson & Johnson | | | 1,990,952 | |

| | 4,996 | | | Kenvue, Inc. | | | 100,320 | |

| | 13,145 | | | Paramount Global, Class B | | | 169,570 | |

| | 12,795 | | | Progressive Corp./The | | | 1,782,343 | |

| | 30,645 | | | Truist Financial Corp. | | | 876,753 | |

| | 30,030 | | | U.S. Bancorp | | | 992,792 | |

| | 23,711 | | | Verizon Communications, Inc. | | | 768,474 | |

| | | | | | | | |

| | | | | | | 9,662,417 | |

| | | | | | | | |

| |

| TOTAL COMMON STOCKS

(Cost $48,702,352) | | | 59,776,201 | |

| | | | | | | | |

|

| | REGISTERED INVESTMENT COMPANY—6.3% | |

| | 4,034,376 | | | Dreyfus Government Securities

Cash Management – Institutional Shares 5.20%(b)

(Cost $4,034,376) | | | 4,034,376 | |

| | | | | | | | |

| | | | | | | | |

| | |

INVESTMENTS IN SECURITIES

(Cost $52,736,728) | | | 99.2 | % | | | 63,810,577 | |

| | |

OTHER ASSETS

AND LIABILITIES (Net) | | | 0.8 | | | | 534,032 | |

| | | | | | | | |

| | |

NET ASSETS | | | 100.0 | % | | | $64,344,609 | |

| | | | | | | | |

| | | | | | | | |

| * | | | | | | See Note 2 in Notes to Financial Statements. |

| (a) | | | | | | Non-income producing security. |

| (b) | | | | | | Rate disclosed is the 7-day yield at September 30, 2023. |

| | | | | | | | |

|

| Abbreviations: |

| ADR | | | — | | | American Depositary Receipt |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-14

Tweedy, Browne Worldwide High Dividend Yield Value Fund

Sector Diversification

September 30, 2023 (Unaudited)

| | | | |

Sector Diversification | | Percentage of

Net Assets | |

| |

COMMON STOCKS | | | | |

| |

Capital Goods | | | 23.6 | % |

| |

Pharmaceuticals, Biotechnology & Life Sciences | | | 9.7 | |

| |

Banks | | | 9.4 | |

| |

Insurance | | | 9.1 | |

| |

Materials | | | 7.2 | |

| |

Food | | | 6.1 | |

| |

Beverage | | | 5.1 | |

| |

Media & Entertainment | | | 3.0 | |

| |

Automobiles & Components | | | 2.7 | |

| |

Consumer Discretionary Distribution & Retail | | | 2.6 | |

| |

Health Care Equipment & Services | | | 2.4 | |

| |

Transportation | | | 2.3 | |

| |

Commercial & Professional Services | | | 2.1 | |

| |

Utilities | | | 2.0 | |

| |

Software & Services | | | 1.2 | |

| |

Energy | | | 1.2 | |

| |

Telecommunication Services | | | 1.2 | |

| |

Household & Personal Products | | | 1.1 | |

| |

Real Estate Management & Development | | | 0.9 | |

| | | | |

Total Common Stocks | | | 92.9 | |

Registered Investment Company | | | 6.3 | |

Other Assets and Liabilities (Net) | | | 0.8 | |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

Portfolio Composition

September 30, 2023 (Unaudited)

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-15

Statements of Assets and Liabilities

September 30, 2023 (Unaudited)

| | | | | | | | | | | | | | | | |

| | | International Value

Fund | | | International Value

Fund II –

Currency

Unhedged | | | Value

Fund | | | Worldwide High

Dividend Yield

Value Fund | |

| | | | |

ASSETS | | | | | | | | | | | | | | | | |

Investments in securities, at cost(a) | | | $3,358,948,173 | | | | $338,258,628 | | | | $263,638,855 | | | | $52,736,728 | |

| | | | | | | | | | | | | | | | |

Investments in securities of unaffiliated issuers, at value | | | $5,579,184,156 | | | | $399,624,790 | | | | $417,183,714 | | | | $63,810,577 | |

Investments in securities of affiliated issuers, at value | | | 50,265,791 | | | | — | | | | — | | | | — | |

Dividends and interest receivable | | | 9,149,946 | | | | 683,798 | | | | 562,635 | | | | 132,249 | |

Receivable for investment securities sold | | | 48,883,490 | | | | — | | | | — | | | | — | |

Recoverable foreign withholding taxes | | | 25,745,575 | �� | | | 1,782,682 | | | | 898,996 | | | | 483,817 | |

Receivable for Fund shares sold | | | 2,417,645 | | | | 280,941 | | | | 38,552 | | | | 200 | |

Unrealized appreciation on forward exchange contracts (Note 2) | | | 77,233,549 | | | | — | | | | 5,769,938 | | | | — | |

Prepaid expense | | | 224,866 | | | | 17,317 | | | | 16,204 | | | | 4,134 | |

| | | | | | | | | | | | | | | | |

Total Assets | | | $5,793,105,018 | | | | $402,389,528 | | | | $424,470,039 | | | | $64,430,977 | |

| | | | | | | | | | | | | | | | |

| | | | |

LIABILITIES | | | | | | | | | | | | | | | | |

Unrealized depreciation of forward exchange contracts (Note 2) | | | $12,993,854 | | | | $ — | | | | $394,448 | | | $ | — | |

Payable for Fund shares redeemed | | | 4,220,492 | | | | 75,776 | | | | 5,166 | | | | 3,000 | |

Investment advisory fee payable (Note 3) | | | 3,765,883 | | | | 262,038 | | | | 276,037 | | | | 42,085 | |

Payable for investment securities purchased | | | 1,026,050 | | | | — | | | | — | | | | — | |

Shareholder servicing and administration fees payable (Note 3) | | | 241,551 | | | | 22,435 | | | | 22,121 | | | | 3,504 | |

Directors’ fees payable | | | 8,269 | | | | 1,142 | | | | 589 | | | | 120 | |

Due to custodian | | | 73,069 | | | | 5,808 | | | | 6,275 | | | | — | |

Transfer agent fees payable | | | 340,056 | | | | 15,090 | | | | 28,579 | | | | 8,782 | |

Fund administration and accounting fees payable | | | 247,332 | | | | 23,908 | | | | 25,422 | | | | 3,310 | |

Legal and audit fees payable | | | 311,226 | | | | 31,693 | | | | 34,718 | | | | 9,169 | |

Accrued expenses and other payables | | | 580,614 | | | | 65,703 | | | | 54,490 | | | | 16,398 | |

| | | | | | | | | | | | | | | | |

Total Liabilities | | | 23,808,396 | | | | 503,593 | | | | 847,845 | | | | 86,368 | |

| | | | | | | | | | | | | | | | |

NET ASSETS | | | $5,769,296,622 | | | | $401,885,935 | | | | $423,622,194 | | | | $64,344,609 | |

| | | | | | | | | | | | | | | | |

| | | | |

NET ASSETS consists of | | | | | | | | | | | | | | | | |

Paid-in capital | | | $3,257,526,017 | | | | $330,352,541 | | | | $241,468,720 | | | | $52,086,467 | |

Total distributable earnings | | | 2,511,770,605 | | | | 71,533,394 | | | | 182,153,474 | | | | 12,258,142 | |

| | | | | | | | | | | | | | | | |

Total Net Assets | | | $5,769,296,622 | | | | $401,885,935 | | | | $423,622,194 | | | | $64,344,609 | |

| | | | | | | | | | | | | | | | |

CAPITAL STOCK (common stock outstanding) | | | 212,899,078 | | | | 25,020,998 | | | | 22,698,421 | | | | 12,003,231 | |

| | | | | | | | | | | | | | | | |

NET ASSET VALUE offering price per share | | | $27.10 | | | | $16.06 | | | | $18.66 | | | | $5.36 | |

| | | | | | | | | | | | | | | | |

| (a) | Includes investments in securities of affiliated issuers, at cost for International Value Fund, International Value Fund II – Currency Unhedged, Value Fund and Worldwide High Dividend Yield Value Fund of $51,311,994, $0, $0 and $0, respectively (Note 4). |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-16

Statements of Operations

For the Six Months Ended September 30, 2023 (Unaudited)

| | | | | | | | | | | | | | | | |

| | | International Value

Fund | | | International Value

Fund II –

Currency

Unhedged | | | Value

Fund | | | Worldwide High

Dividend Yield

Value Fund | |

|

INVESTMENT INCOME | |

Dividends(a) | | | $127,073,604 | | | | $10,236,455 | | | | $7,270,066 | | | | $1,811,939 | |

Less foreign withholding taxes | | | (11,810,093 | ) | | | (951,081 | ) | | | (672,973 | ) | | | (135,823 | ) |

Interest | | | 2,372,099 | | | | 31,312 | | | | 234,571 | | | | — | |

Other | | | — | | | | 561,993 | | | | 430,771 | | | | — | |

| | | | | | | | | | | | | | | | |

Total Investment Income | | | 117,635,610 | | | | 9,878,679 | | | | 7,262,435 | | | | 1,676,116 | |

| | | | | | | | | | | | | | | | |

|

EXPENSES | |

Investment advisory fee (Note 3) | | | 37,445,080 | | | | 2,758,830 | | | | 2,696,949 | | | | 425,541 | |

Transfer agent fees (Note 3) | | | 1,115,167 | | | | 51,137 | | | | 79,123 | | | | 23,448 | |

Fund administration and accounting fees (Note 3) | | | 704,063 | | | | 51,866 | | | | 50,712 | | | | 8,001 | |

Custodian fees (Note 3) | | | 579,382 | | | | 50,996 | | | | 29,976 | | | | 8,235 | |

Directors’ fees and expenses (Note 3) | | | 436,485 | | | | 32,720 | | | | 31,303 | | | | 5,003 | |

Legal and audit fees | | | 406,404 | | | | 52,701 | | | | 38,124 | | | | 9,419 | |

Shareholder servicing and administration fees (Note 3) | | | 140,067 | | | | 15,380 | | | | 14,705 | | | | 2,350 | |

Other | | | 588,863 | | | | 75,962 | | | | 65,498 | | | | 41,014 | |

| | | | | | | | | | | | | | | | |

Total expenses before waivers. | | | 41,415,511 | | | | 3,089,592 | | | | 3,006,390 | | | | 523,011 | |

| | | | | | | | | | | | | | | | |

Investment advisory fees waived (Note 3) | | | (72,193 | ) | | | (33,029 | ) | | | (18,387 | ) | | | (51,546 | ) |

| | | | | | | | | | | | | | | | |

Net Expenses | | | 41,343,318 | | | | 3,056,563 | | | | 2,988,003 | | | | 471,465 | |

| | | | | | | | | | | | | | | | |

NET INVESTMENT INCOME | | | 76,292,292 | | | | 6,822,116 | | | | 4,274,432 | | | | 1,204,651 | |

| | | | | | | | | | | | | | | | |

|

REALIZED AND UNREALIZED GAIN (LOSS) | |

Net realized gain (loss) on: | |

Securities(a) | | | $148,966,372 | | | | 3,565,389 | | | | 15,490,857 | | | | 1,153,168 | |

Forward exchange contracts | | | 3,566,644 | | | | — | | | | (32,454 | ) | | | — | |

Foreign currencies and net other assets | | | 29,472 | | | | (63,146 | ) | | | (49,547 | ) | | | (3,507 | ) |

| | | | | | | | | | | | | | | | |

Net realized gain | | | 152,562,488 | | | | 3,502,243 | | | | 15,408,856 | | | | 1,149,661 | |

| | | | | | | | | | | | | | | | |

Net unrealized appreciation (depreciation) of: | |

Securities(b) | | | (334,347,881 | ) | | | (16,036,082 | ) | | | (15,884,360 | ) | | | (3,771,160 | ) |

Forward exchange contracts | | | 96,156,775 | | | | — | | | | 5,918,104 | | | | — | |

Foreign currencies and net other assets | | | (749,958 | ) | | | (34,546 | ) | | | (18,213 | ) | | | (13,855 | ) |

| | | | | | | | | | | | | | | | |

Net change in unrealized appreciation (depreciation) | | | (238,941,064 | ) | | | (16,070,628 | ) | | | (9,984,469 | ) | | | (3,785,015 | ) |

| | | | | | | | | | | | | | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | | | (86,378,576 | ) | | | (12,568,385 | ) | | | 5,424,387 | | | | (2,635,354 | ) |

| | | | | | | | | | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | $(10,086,284 | ) | | | $(5,746,269 | ) | | | $9,698,819 | | | | $(1,430,703 | ) |

| | | | | | | | | | | | | | | | |

| (a) | Dividends and Net realized gain (loss) on securities from affiliated issuers for International Value Fund were $1,183,432 and $0, respectively (Note 4). |

| (b) | Net change in unrealized appreciation (depreciation) of securities from affiliated issuers for International Value Fund was $2,104,841 (Note 4). |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

II-17

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | International Value Fund | | | International Value Fund II –

Currency Unhedged | |

| | | Six Months

Ended

9/30/2023

(Unaudited) | | | Year Ended

3/31/2023 | | | Six Months

Ended

9/30/2023

(Unaudited) | | | Year Ended

3/31/2023 | |

INVESTMENT ACTIVITIES: | | | | | | | | | | | | | | | | |

| | | | |

Net investment income | | | $76,292,292 | | | | $90,335,023 | | | | $6,822,116 | | | | $7,637,887 | |

| | | | |

Net realized gain | | | 152,562,488 | | | | 11,356 | | | | 3,502,243 | | | | 10,020,696 | |

| | | | |