UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

One Station Place, Suite 303

Stamford, CT 06902

(Address of principal executive offices) (Zip code)

Frederick C. Teufel, Jr.

Tweedy, Browne Company LLC

One Station Place, Suite 303

Stamford, CT 06902

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders

(a) The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

INTERNATIONAL VALUE FUND

(TBGVX)

SEMI-ANNUAL SHAREHOLDER REPORT | September 30, 2024

This Semi-Annual shareholder report contains important information about the Tweedy, Browne International Value Fund (“Fund”) for the period of April 1, 2024 to September 30, 2024 as well as certain changes to the Fund. You can find additional information about the Fund at www.tweedyfunds.com. You can also request this information by contacting us at 1-800-432-4789.

What Were the Fund Expenses for the Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT |

| INTERNATIONAL VALUE FUND (TBGVX) | $71 | 1.39% |

MANAGEMENTS’ DISCUSSION OF FUND PERFORMANCE

Market Overview

International equity markets continued to advance over the last six months, buoyed by better-than-expected economic data in many parts of the world, including declines in inflation and interest rates in Europe and China’s recent adoption of fiscal and monetary stimulus packages.

What Impacted Performance During the Period?

In this continued risk-on environment, the Tweedy, Browne International Value Fund made financial progress but underperformed its benchmark index. For the six months ending September 30, 2024, the Fund produced a return of 2.92% versus 6.81% for the MSCI EAFE Index in USD.

The Fund’s North American equity holdings contributed to returns during the period, while returns in Europe and Japan were somewhat dampened by geopolitical risks and concerns around the economic impact of a resurgent Japanese yen. The Fund’s considerable weight in European equities was a particular drag on returns.

The Fund’s materials, healthcare, financial, and communication services holdings led returns, while its consumer staples holdings, together with a number of its consumer discretionary and industrial holdings, produced disappointing results, as did its small and medium capitalization holdings. In terms of its industry segments, the Fund’s bank, chemical, interactive media, and pharmaceutical stocks were net contributors to returns, while its food and beverage, machinery, and auto-related holdings disappointed.

The Fund’s foreign currency hedging policy also detracted from returns as the US dollar weakened against most major currencies during the period, causing declines in the value of most forward hedging contracts.

Top Equity Performance Contributors

Contributors included Fresenius SE & Co, Roche Holding, United Overseas Bank, Alphabet, Berkshire Hathaway, Tencent, Kemira, Novartis, National Bank of Canada, and SOL SpA.

Top Equity Performance Detractors

Detractors included SCOR SE, Nestlé, Diageo, BAE Systems, Rubis, Samsung Electronics, Husqvarna, TotalEnergies, Heineken Holding, and Alten.

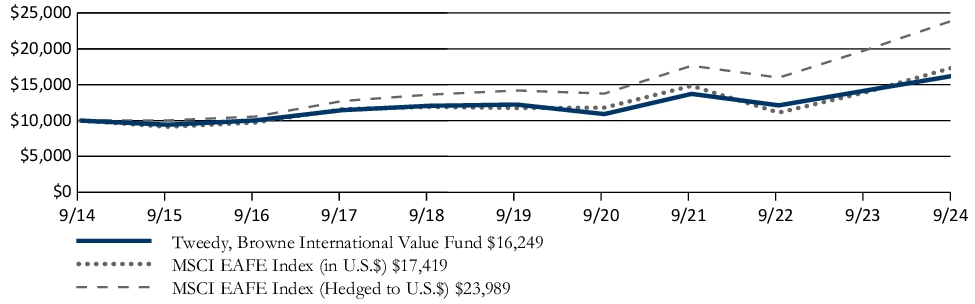

How Has the Fund Historically Performed?

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 years of the Fund. It assumes a $10,000 initial investment at the beginning of the first year in an appropriate, broad-based securities market index for the same period.

The Fund has changed its comparative broad-based securities market index from MSCI EAFE Index (Hedged to U.S.$) to the MSCI EAFE Index (in U.S.$) in order to comply with new regulatory requirements regarding the presentation of comparative index performance.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 6 MONTH | 1 YEAR | 5 YEARS | 10 YEARS |

| INTERNATIONAL VALUE FUND (TBGVX) | 2.92% | 14.48% | 5.85% | 4.97% |

| MSCI EAFE Index (in U.S.$) | 6.81% | 24.77% | 8.20% | 5.71% |

| MSCI EAFE Index (Hedged to U.S.$) | 3.20% | 20.88% | 11.06% | 9.14% |

The preceding performance data represents past performance and is not a guarantee of future results. Total return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data shown. Results are annualized for all periods greater than one year. Please visit www.tweedyfunds.com to obtain performance data that is current to the most recent month end.

| Fund net assets | $5,656,343,621 |

| Total number of portfolio holdings | 96 |

| Total advisory fee paid | $36,409,905 |

| Portfolio turnover rate as of the end of the reporting period | 10% |

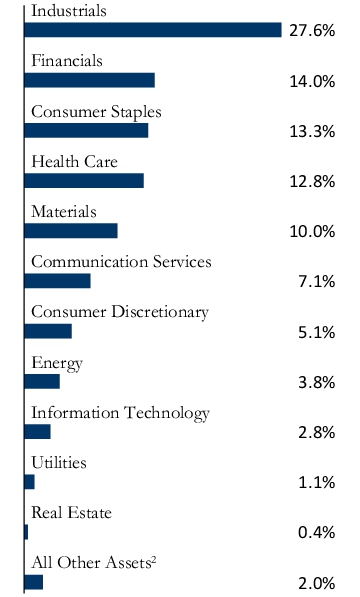

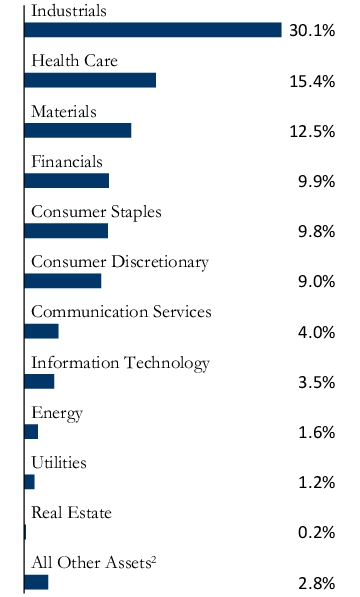

What Did the Fund Invest In?

(as of September 30, 2024)

| Berkshire Hathaway, Inc. | 4.1% |

| Safran SA | 3.9% |

| TotalEnergies SE | 3.8% |

| Alphabet, Inc. | 3.8% |

| BAE Systems plc | 3.7% |

| Nestlé SA | 3.4% |

| Roche Holding AG | 3.3% |

| United Overseas Bank, Ltd. | 3.2% |

| SOL SpA | 3.1% |

| Heineken Holding NV | 2.9% |

1 Excludes short-term investments.

2 Includes cash, Treasury Bills, and money market funds.

3 Includes Belgium, Chile, Croatia, Czech Republic, Finland, Hong Kong, Mexico and Philippines.

Material Fund Changes

There have been no material changes to the Fund since April 1, 2024.

Where Can I Find More Information?

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.tweedyfunds.com. You can also request this information by calling 1-800-432-4789.

Important Notice to Shareholders

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-432-4789 and we will begin sending you separate copies of these materials within 30 days after receiving your request. For additional information, please visit www.tweedyfunds.com.

INTERNATIONAL VALUE FUND II -

CURRENCY UNHEDGED (TBCUX)

SEMI-ANNUAL SHAREHOLDER REPORT | September 30, 2024

This Semi-Annual shareholder report contains important information about the Tweedy, Browne International Value Fund II - Currency Unhedged (“Fund”) for the period of April 1, 2024 to September 30, 2024 as well as certain changes to the Fund. You can find additional information about the Fund at www.tweedyfunds.com. You can also request this information by contacting us at 1-800-432-4789.

What Were the Fund Expenses for the Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT |

| INTERNATIONAL VALUE FUND II - CURRENCY UNHEDGED (TBCUX) | $72 | 1.40% |

MANAGEMENTS’ DISCUSSION OF FUND PERFORMANCE

Market Overview

International equity markets continued to advance over the last six months, buoyed by better-than-expected economic data in many parts of the world, including declines in inflation and interest rates in Europe and China’s recent adoption of fiscal and monetary stimulus packages.

What Impacted Performance During the Period?

In this continued risk-on environment, the Tweedy, Browne International Value Fund II — Currency Unhedged made financial progress but underperformed its benchmark index. For the six months ending September 30, 2024, the Fund produced a return of 4.48% versus 6.81% for the MSCI EAFE Index in USD.

The Fund’s North American equity holdings contributed to returns during the period, while returns in Europe and Japan were somewhat dampened by geopolitical risks and concerns around the economic impact of a resurgent Japanese yen. The Fund’s considerable weight in European equities was a particular drag on returns.

The Fund’s materials, healthcare, financial, and communication services holdings led returns, while its information technology, utility, and consumer discretionary holdings produced disappointing results, as did its smaller capitalization holdings. In terms of its industry segments, the Fund’s chemical, pharmaceutical, bank, healthcare services, and interactive media stocks were net contributors to returns, while its information technology, insurance, industrial conglomerate, and gas utility holdings disappointed.

Top Equity Performance Contributors

Contributors included Kemira, Roche Holding, Fresenius SE & Co., Kuraray, Berkshire Hathaway, Inchcape, United Overseas Bank, Alphabet, Uni-President China Holdings, and Winpak.

Top Equity Performance Detractors

Detractors included SCOR SE, Rubis SCA, Alten, Samsung Electronics, Diageo, Aalberts NV, Ionis Pharmaceuticals, Nestlé, LG Corp, and Husqvarna AB.

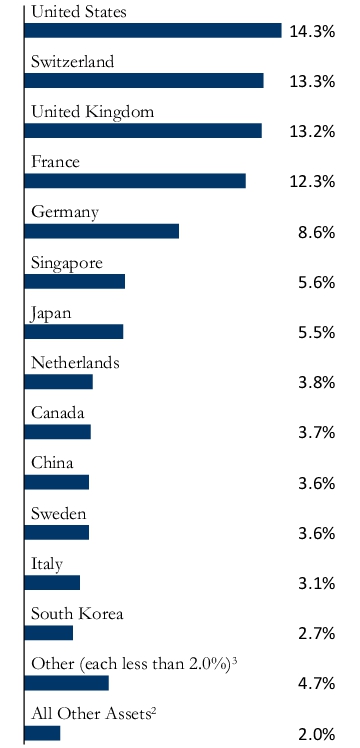

How Has the Fund Historically Performed?

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 years of the Fund. It assumes a $10,000 initial investment at the beginning of the first year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 6 MONTH | 1 YEAR | 5 YEARS | 10 YEARS |

| INTERNATIONAL VALUE FUND II - CURRENCY UNHEDGED (TBCUX) | 4.48% | 16.80% | 5.57% | 3.75% |

| MSCI EAFE Index (in U.S.$) | 6.81% | 24.77% | 8.20% | 5.71% |

The preceding performance data represents past performance and is not a guarantee of future results. Total return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data shown. Results are annualized for all periods greater than one year. Please visit www.tweedyfunds.com to obtain performance data that is current to the most recent month end.

| Fund net assets | $271,160,876 |

| Total number of portfolio holdings | 77 |

| Total advisory fee paid | $1,760,862 |

| Portfolio turnover rate as of the end of the reporting period | 6% |

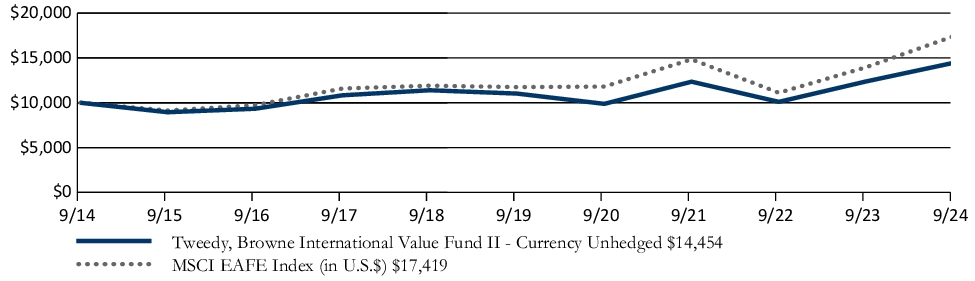

What Did the Fund Invest In?

(as of September 30, 2024)

| Berkshire Hathaway, Inc. | 3.8% |

| Roche Holding AG | 3.3% |

| Johnson & Johnson | 3.1% |

| Alphabet, Inc. | 3.1% |

| Safran SA | 3.0% |

| FMC Corp. | 2.8% |

| DHL Group | 2.8% |

| Kemira Oyj | 2.7% |

| Ionis Pharmaceuticals, Inc. | 2.6% |

| Novartis AG | 2.5% |

1 Excludes short-term investments.

2 Includes cash and money market funds.

3 Includes Belgium, Chile, Hong Kong, Italy, Mexico and Philippines.

Material Fund Changes

There have been no material changes to the Fund since April 1, 2024.

Where Can I Find More Information?

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.tweedyfunds.com. You can also request this information by calling 1-800-432-4789.

Important Notice to Shareholders

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-432-4789 and we will begin sending you separate copies of these materials within 30 days after receiving your request. For additional information, please visit www.tweedyfunds.com.

SEMI-ANNUAL SHAREHOLDER REPORT | September 30, 2024

This Semi-Annual shareholder report contains important information about the Tweedy, Browne Value Fund (“Fund”) for the period of April 1, 2024 to September 30, 2024 as well as certain changes to the Fund. You can find additional information about the Fund at www.tweedyfunds.com. You can also request this information by contacting us at 1-800-432-4789.

What Were the Fund Expenses for the Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT |

| VALUE FUND (TWEBX) | $70 | 1.38% |

MANAGEMENTS’ DISCUSSION OF FUND PERFORMANCE

Market Overview

Global equity markets continued to surge ahead over the last six months, particularly in the U.S., driven by continued enthusiasm regarding all things “AI” related and buoyed by better-than-expected economic data in many parts of the world, including declines in inflation and interest rates in Europe and China’s more recent adoption of fiscal and monetary stimulus packages.

What Impacted Performance During the Period?

In this continued risk-on environment, the Tweedy, Browne Value Fund made financial progress but underperformed its benchmark index. For the six months ending September 30, 2024, the Fund produced a return of 1.95% versus 9.16% for the MSCI World Index in USD.

The Fund’s North American equity holdings contributed to returns during the period, while returns in Europe and Japan were somewhat dampened by geopolitical risks and concerns around the economic impact of a resurgent Japanese yen. The Fund’s considerable weight in European equities, particularly its French equities, was a drag on returns, as were the Fund’s smaller capitalization holdings.

The Fund’s healthcare, materials, financials, and communication services holdings led returns, while its utilities, consumer discretionary, energy, and information technology holdings, together with a number of its industrial holdings, produced disappointing results. In terms of its industry segments, the Fund’s health care providers, diversified financial services, pharmaceutical stocks, its bank, interactive media, and chemical holdings were net contributors to returns, while its insurance, gas utility, technology hardware, industrial conglomerate, and household durables holdings disappointed.

The Fund’s foreign currency hedging policy also detracted from returns as the US dollar weakened against most major currencies during the period, causing declines in the value of most forward hedging contracts.

Top Equity Performance Contributors

Contributors included Berkshire Hathaway, Fresenius SE & Co, Roche Holding, Alphabet, Kemira, United Overseas Bank, Winpak, Vertex Pharmaceuticals, Uni-President China Holdings, and Teleperformance.

Top Equity Performance Detractors

Detractors included SCOR SE, Rubis SCA, Samsung Electronics, Alten SA, Husqvarna AB, TotalEnergies, Heineken, Ubisoft, Autoliv, and Aalberts NV.

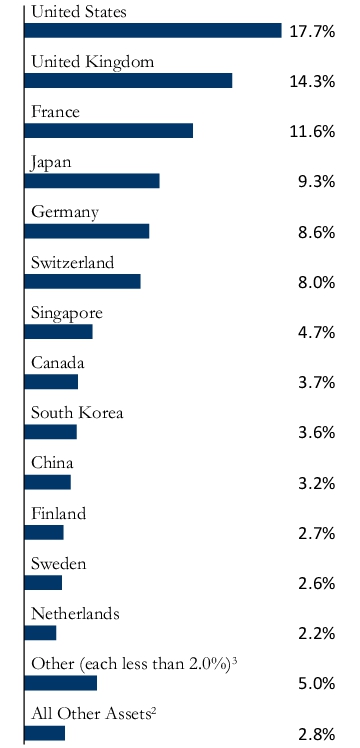

How Has the Fund Historically Performed?

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 years of the Fund. It assumes a $10,000 initial investment at the beginning of the first year in an appropriate, broad-based securities market index for the same period.

The Fund has changed its comparative broad-based securities market index from MSCI World Index (Hedged to U.S.$) to the MSCI World Index (in U.S.$) in order to comply with new regulatory requirements regarding the presentation of comparative index performance.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 6 MONTH | 1 YEAR | 5 YEARS | 10 YEARS |

| VALUE FUND (TWEBX) | 1.95% | 15.01% | 6.85% | 5.53% |

| MSCI World Index (in U.S.$) | 9.16% | 32.43% | 13.04% | 10.07% |

| MSCI World 100% Hedged to U.S.$ Index | 8.26% | 31.45% | 13.95% | 11.37% |

The preceding performance data represents past performance and is not a guarantee of future results. Total return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data shown. Results are annualized for all periods greater than one year. Please visit www.tweedyfunds.com to obtain performance data that is current to the most recent month end.

| Fund net assets | $450,429,319 |

| Total number of portfolio holdings | 88 |

| Total advisory fee paid | $2,837,166 |

| Portfolio turnover rate as of the end of the reporting period | 10% |

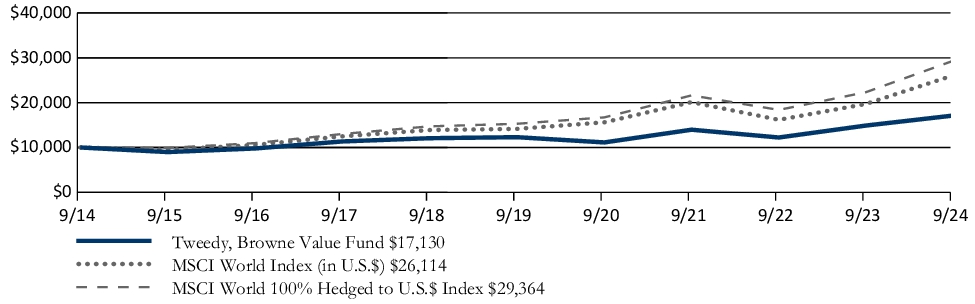

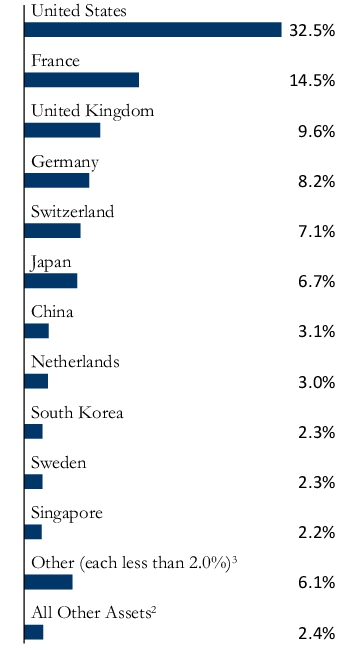

What Did the Fund Invest In?

(as of September 30, 2024)

| Berkshire Hathaway, Inc. | 6.8% |

| Safran SA | 3.8% |

| TotalEnergies SE | 3.4% |

| Alphabet, Inc. | 3.2% |

| Roche Holding AG | 3.2% |

| Wells Fargo & Co. | 2.8% |

| Nestlé SA | 2.6% |

| FMC Corp. | 2.5% |

| Johnson & Johnson | 2.3% |

| Teleperformance SE | 2.2% |

1 Excludes short-term investments.

2 Includes cash, Treasury Bills, and money market funds.

3 Includes Belgium, Canada, Chile, Finland, Hong Kong, Mexico and Philippines.

Material Fund Changes

There have been no material changes to the Fund since April 1, 2024.

Where Can I Find More Information?

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.tweedyfunds.com. You can also request this information by calling 1-800-432-4789.

Important Notice to Shareholders

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-432-4789 and we will begin sending you separate copies of these materials within 30 days after receiving your request. For additional information, please visit www.tweedyfunds.com.

WORLDWIDE HIGH DIVIDEND YIELD

VALUE FUND (TBHDX)

SEMI-ANNUAL SHAREHOLDER REPORT | September 30, 2024

This Semi-Annual shareholder report contains important information about the Tweedy, Browne Worldwide High Dividend Yield Value Fund (“Fund”) for the period of April 1, 2024 to September 30, 2024 as well as certain changes to the Fund. You can find additional information about the Fund at www.tweedyfunds.com. You can also request this information by contacting us at 1-800-432-4789.

What Were the Fund Expenses for the Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT |

| WORLDWIDE HIGH DIVIDEND YIELD VALUE FUND (TBHDX) | $72 | 1.39% |

MANAGEMENTS’ DISCUSSION OF FUND PERFORMANCE

Market Overview

Global equity markets continued to surge ahead over the last six months, particularly in the U.S., driven by continued enthusiasm regarding all things “AI” related and buoyed by better-than-expected economic data in many parts of the world, including declines in inflation and interest rates in Europe and China’s more recent adoption of fiscal and monetary stimulus packages.

What Impacted Performance During the Period?

In this continued risk-on environment, the Tweedy, Browne Worldwide High Dividend Yield Value Fund made financial progress but underperformed its benchmark index. For the six months ending September 30, 2024, the Fund produced a return of 5.38% versus 9.16% for the MSCI World Index in USD.

The Fund’s North American equity holdings contributed to returns during the period, while returns in Europe and Japan were somewhat dampened by geopolitical risks and concerns around the economic impact of a resurgent Japanese yen. The Fund’s considerable weight in European equities, particularly its French equities, was a drag on returns, as were the Fund’s smaller capitalization holdings.

The Fund’s healthcare, materials, financials, and real estate holdings led returns, while its utility, consumer staples, and consumer discretionary holdings, together with a number of its industrial holdings, produced disappointing results. In terms of its industry segments, the Fund’s chemical, bank, healthcare services, pharmaceuticals, and distributor holdings were net contributors to returns, while its gas utility, beverage, machinery, aerospace & defense, and household durables holdings disappointed.

Top Equity Performance Contributors

Contributors included Kemira, Fresenius SE & Co, Roche Holding, Uni-President China Holdings, Progressive, United Overseas Bank, Kuraray, Inchcape, Novartis, and DBS Group.

Top Equity Performance Detractors

Detractors included SCOR SE, Rubis SCA, Diageo, Nestlé, BAE Systems, GSK PLC, Aalberts, Husqvarna, Sumitomo Heavy, and Autoliv.

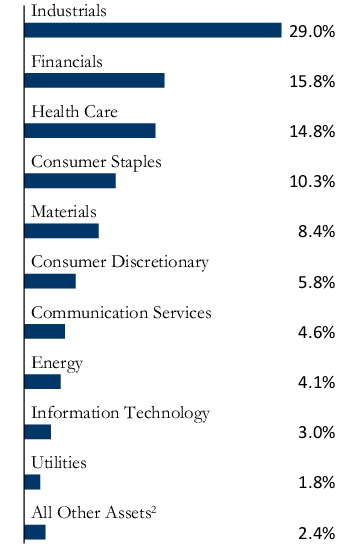

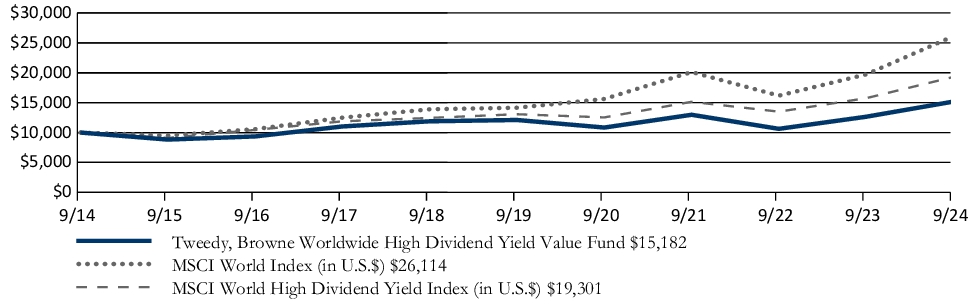

How Has the Fund Historically Performed?

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 years of the Fund. It assumes a $10,000 initial investment at the beginning of the first year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 6 MONTH | 1 YEAR | 5 YEARS | 10 YEARS |

| WORLDWIDE HIGH DIVIDEND YIELD VALUE FUND (TBHDX) | 5.38% | 20.13% | 4.64% | 4.26% |

| MSCI World Index (in U.S.$) | 9.16% | 32.43% | 13.04% | 10.07% |

| MSCI World High Dividend Yield Index (in U.S.$) | 8.59% | 22.60% | 8.12% | 6.80% |

The preceding performance data represents past performance and is not a guarantee of future results. Total return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data shown. Results are annualized for all periods greater than one year. Please visit www.tweedyfunds.com to obtain performance data that is current to the most recent month end.

| Fund net assets | $68,496,412 |

| Total number of portfolio holdings | 59 |

| Total advisory fee paid | $374,111 |

| Portfolio turnover rate as of the end of the reporting period | 3% |

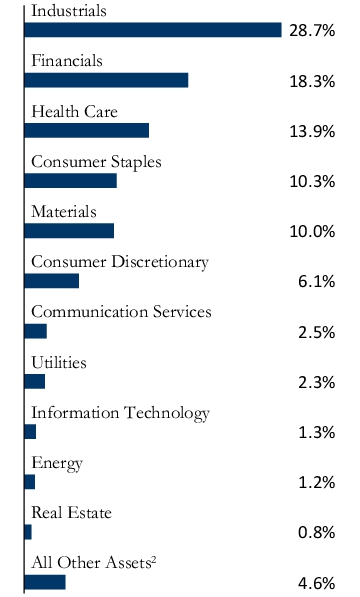

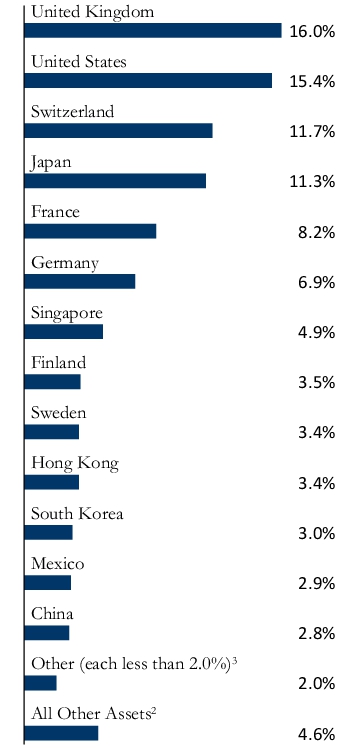

What Did the Fund Invest In?

(as of September 30, 2024)

| Nestlé SA | 4.2% |

| Kemira Oyj | 3.5% |

| BAE Systems plc | 3.5% |

| Diageo plc | 3.4% |

| Roche Holding AG | 3.1% |

| Johnson & Johnson | 3.0% |

| Safran SA | 3.0% |

| Fresenius SE & Co., KGaA | 2.8% |

| Novartis AG | 2.7% |

| FMC Corp. | 2.6% |

1 Excludes short-term investments.

2 Includes cash and money market funds.

3 Includes Belgium and Netherlands.

Material Fund Changes

There have been no material changes to the Fund since April 1, 2024.

Where Can I Find More Information?

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.tweedyfunds.com. You can also request this information by calling 1-800-432-4789.

Important Notice to Shareholders

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-432-4789 and we will begin sending you separate copies of these materials within 30 days after receiving your request. For additional information, please visit www.tweedyfunds.com.

| | (b) | The registrant has not yet relied upon Rule 30e-3 of the Act. |

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| | (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period as set forth in § 210.1212 of Regulation S-X [17 CFR 210.12-12] is included as part of the report to shareholders filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

The semi-annual Financial Statements and Financial Highlights are attached herewith.

Tweedy, Browne Fund INC.

INVESTMENT TEAM

Tweedy, Browne Fund INC.

Tweedy, Browne International Value Fund

Portfolio of Investments

September 30, 2024 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | COMMON STOCKS—95.8% | | | | |

| | |

| | | | Belgium—0.3% | | | | |

| | 926,488 | | | Fagron NV | | | $19,232,529 | |

| | | | | | | | |

| | |

| | | | Canada—3.7% | | | | |

| | 251,390 | | | Lassonde Industries, Inc., Class A(a) | | | 32,983,365 | |

| | 1,124,700 | | | National Bank of Canada | | | 106,346,777 | |

| | 1,926,024 | | | Winpak, Ltd. | | | 67,734,113 | |

| | | | | | | | |

| | | | | | | 207,064,255 | |

| | | | | | | | |

| | |

| | | | China—3.6% | | | | |

| | 815,426 | | | Baidu, Inc., Class A(b) | | | 11,085,804 | |

| | 8,383,895 | | | Haitian International Holdings, Ltd. | | | 26,983,891 | |

| | 6,463,000 | | | Shanghai Mechanical and Electrical Industry Co., Ltd., Class B | | | 6,579,334 | |

| | 1,444,150 | | | Tencent Holdings, Ltd. | | | 82,660,971 | |

| | 15,974,780 | | | Uni-President China Holdings, Ltd. | | | 14,992,745 | |

| | 2,768,830 | | | Wuliangye Yibin Co., Ltd., Class A | | | 64,132,861 | |

| | | | | | | | |

| | | | | | | 206,435,606 | |

| | | | | | | | |

| | |

| | | | Czech Republic—0.0%(c) | | | | |

| | 2,800 | | | Philip Morris CR a.s. | | | 1,896,079 | |

| | | | | | | | |

| | |

| | | | Finland—1.3% | | | | |

| | 2,919,753 | | | Kemira Oyj | | | 73,057,595 | |

| | | | | | | | |

| | |

| | | | France—12.3% | | | | |

| | 376,664 | | | Alten SA | | | 42,079,624 | |

| | 2,392,742 | | | Rubis SCA | | | 65,478,691 | |

| | 928,700 | | | Safran SA | | | 218,800,007 | |

| | 149,932 | | | Sopra Steria Group | | | 31,525,275 | |

| | 1,527,083 | | | Tarkett SA(b) | | | 16,054,515 | |

| | 1,011,618 | | | Teleperformance SE | | | 104,998,513 | |

| | 3,298,850 | | | TotalEnergies SE | | | 215,378,370 | |

| | 268,901 | | | Ubisoft Entertainment SA(b) | | | 3,031,080 | |

| | | | | | | | |

| | | | | | | 697,346,075 | |

| | | | | | | | |

| | |

| | | | Germany—6.9% | | | | |

| | 761,991 | | | Brenntag SE | | | 56,961,135 | |

| | 2,644,654 | | | DHL Group | | | 118,151,191 | |

| | 2,540,809 | | | Fresenius SE & Co., KGaA(b) | | | 97,064,980 | |

| | 369,659 | | | Krones AG | | | 53,219,973 | |

| | 42,354 | | | KSB SE & Co., KGaA | | | 31,197,660 | |

| | 65,633 | | | Rheinmetall AG | | | 35,628,659 | |

| | | | | | | | |

| | | | | | | 392,223,598 | |

| | | | | | | | |

| | |

| | | | Hong Kong—0.5% | | | | |

| | 1,550,676 | | | Great Eagle Holdings, Ltd. | | | 2,423,586 | |

| | 12,583,508 | | | Hang Lung Group, Ltd. | | | 17,010,214 | |

| | 2,791,715 | | | Johnson Electric Holdings, Ltd. | | | 4,140,400 | |

| | 7,780,578 | | | TAI Cheung Holdings, Ltd. | | | 3,125,253 | |

| | | | | | | | |

| | | | | | | 26,699,453 | |

| | | | | | | | |

| | |

| | | | Italy—3.1% | | | | |

| | 4,337,413 | | | SOL SpA | | | 172,815,481 | |

| | | | | | | | |

| | |

| | | | Japan—5.5% | | | | |

| | 891,970 | | | ADEKA Corp. | | | 18,186,735 | |

| | 750,785 | | | Fuso Chemical Co., Ltd. | | | 20,890,131 | |

| | 481,855 | | | Hosokawa Micron Corp. | | | 13,811,560 | |

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Japan (continued) | | | | |

| | 508,890 | | | Kanadevia Corp. | | | $3,525,657 | |

| | 1,958,145 | | | Koito Manufacturing Co., Ltd. | | | 27,036,748 | |

| | 3,363,180 | | | Kuraray Co., Ltd. | | | 49,834,032 | |

| | 1,567,485 | | | Mitsubishi Gas Chemical Co., Inc. | | | 30,349,201 | |

| | 221,220 | | | Nifco, Inc. | | | 5,623,294 | |

| | 940 | | | Nihon Kohden Corp. | | | 13,978 | |

| | 164,400 | | | Nippon Kanzai Holdings Co., Ltd. | | | 3,080,201 | |

| | 820,800 | | | Niterra Co., Ltd. | | | 22,924,329 | |

| | 104,825 | | | Okamoto Industries, Inc. | | | 3,832,737 | |

| | 270,565 | | | Shoei Co., Ltd. | | | 4,223,795 | |

| | 1,162,405 | | | Star Micronics Co., Ltd. | | | 15,627,131 | |

| | 1,652,755 | | | Subaru Corp. | | | 28,678,257 | |

| | 1,284,760 | | | Sumitomo Heavy Industries, Ltd. | | | 30,897,472 | |

| | 328,885 | | | Taikisha, Ltd. | | | 11,254,838 | |

| | 588,565 | | | Transcosmos, Inc. | | | 14,586,570 | |

| | 164,305 | | | YAMABIKO Corp. | | | 2,918,757 | |

| | | | Miscellaneous Security(d) | | | 3,933,630 | |

| | | | | | | | |

| | | | | | | 311,229,053 | |

| | | | | | | | |

| | |

| | | | Mexico—1.9% | | | | |

| | 1,013,053 | | | Coca-Cola FEMSA SAB de CV, Sponsored ADR | | | 89,878,062 | |

| | 9,067,593 | | | Megacable Holdings SAB de CV | | | 18,956,737 | |

| | | | | | | | |

| | | | | | | 108,834,799 | |

| | | | | | | | |

| | |

| | | | Netherlands—3.8% | | | | |

| | 1,285,260 | | | Aalberts NV | | | 52,270,062 | |

| | 2,160,839 | | | Heineken Holding NV | | | 163,506,776 | |

| | | | | | | | |

| | | | | | | 215,776,838 | |

| | | | | | | | |

| | |

| | | | Philippines—0.1% | | | | |

| | 22,609,020 | | | Alliance Global Group, Inc. | | | 3,784,477 | |

| | | | | | | | |

| | |

| | | | Singapore—5.6% | | | | |

| | 4,511,761 | | | DBS Group Holdings, Ltd. | | | 133,909,911 | |

| | 7,345,990 | | | United Overseas Bank, Ltd. | | | 184,337,362 | |

| | | | | | | | |

| | | | | | | 318,247,273 | |

| | | | | | | | |

| | |

| | | | South Korea—2.7% | | | | |

| | 132,322 | | | Binggrae Co., Ltd. | | | 6,516,431 | |

| | 219,167 | | | DB Insurance Co., Ltd. | | | 18,821,178 | |

| | 167,062 | | | Dentium Co., Ltd. | | | 10,424,607 | |

| | 998,776 | | | LG Corp. | | | 60,413,842 | |

| | 991,707 | | | LX Holdings Corp. | | | 5,414,688 | |

| | 1,086,715 | | | Samsung Electronics Co., Ltd. | | | 51,107,267 | |

| | | | | | | | |

| | | | | | | 152,698,013 | |

| | | | | | | | |

| | |

| | | | Sweden—3.6% | | | | |

| | 344,776 | | | Autoliv, Inc. | | | 32,191,735 | |

| | 4,350,000 | | | Husqvarna AB, Class B | | | 30,468,796 | |

| | 2,755,869 | | | SKF AB, Class B | | | 54,918,369 | |

| | 2,266,594 | | | Trelleborg AB, Class B | | | 87,250,654 | |

| | | | | | | | |

| | | | | | | 204,829,554 | |

| | | | | | | | |

| | |

| | | | Switzerland—13.3% | | | | |

| | 142,761 | | | Coltene Holding AG, Registered | | | 8,631,155 | |

| | 1,925,964 | | | Nestlé SA, Registered | | | 193,977,715 | |

| | 1,284,801 | | | Novartis AG, Registered | | | 147,968,013 | |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

1

Tweedy, Browne International Value Fund

Portfolio of Investments

September 30, 2024 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Switzerland (continued) | | | | |

| | 63,203 | | | Phoenix Mecano AG, Registered(a)(b) | | | $33,941,034 | |

| | 579,564 | | | Roche Holding AG | | | 185,916,683 | |

| | 400,000 | | | TX Group AG | | | 67,144,805 | |

| | 187,816 | | | Zurich Insurance Group AG | | | 113,506,724 | |

| | | | | | | | |

| | | | | | | 751,086,129 | |

| | | | | | | | |

| | |

| | | | United Kingdom—13.3% | | | | |

| | 4,003,983 | | | Babcock International Group plc | | | 25,382,129 | |

| | 12,603,785 | | | BAE Systems plc | | | 209,212,827 | |

| | 10,810,735 | | | CNH Industrial NV | | | 119,999,158 | |

| | 1,043,507 | | | Computacenter plc | | | 34,628,779 | |

| | 1,964,232 | | | CVS Group plc | | | 29,825,060 | |

| | 4,396,459 | | | Diageo plc | | | 153,503,863 | |

| | 2,704,933 | | | Grafton Group plc | | | 37,762,950 | |

| | 1,968,375 | | | Howden Joinery Group plc | | | 23,947,338 | |

| | 5,273,360 | | | Inchcape plc | | | 56,339,802 | |

| | 15,698,026 | | | Johnson Service Group plc | | | 32,806,100 | |

| | 2,567,623 | | | SThree plc | | | 12,949,745 | |

| | 16,292,379 | | | Vertu Motors plc | | | 13,155,977 | |

| | | | | | | | |

| | | | | | | 749,513,728 | |

| | | | | | | | |

| | |

| | | | United States—14.3% | | | | |

| | 1,281,722 | | | Alphabet, Inc., Class A | | | 212,573,594 | |

| | 339 | | | Berkshire Hathaway, Inc., Class A(b) | | | 234,310,020 | |

| | 1,950,303 | | | FMC Corp. | | | 128,602,980 | |

| | 2,589,316 | | | Ionis Pharmaceuticals, Inc.(b) | | | 103,727,999 | |

| | 750,927 | | | Johnson & Johnson | | | 121,695,229 | |

| | 293,905 | | | Kenvue, Inc. | | | 6,798,023 | |

| | | | | | | | |

| | | | | | | 807,707,845 | |

| | | | | | | | |

| |

| TOTAL COMMON STOCKS

(Cost $2,887,243,276) | | | 5,420,478,380 | |

| | | | | | | | |

| |

| | PREFERRED STOCKS—2.2% | | | | |

| | |

| | | | Chile—0.5% | | | | |

| | 11,044,000 | | | Embotelladora Andina SA, Class A | | | 26,567,591 | |

| | | | | | | | |

| | |

| | | | Croatia—0.1% | | | | |

| | 95,874 | | | Adris Grupa DD | | | 6,355,811 | |

| | | | | | | | |

| | |

| | | | Germany—1.6% | | | | |

| | 1,155,260 | | | Dr. Ing. h.c. F. Porsche AG | | | 92,186,946 | |

| | | | | | | | |

| |

| TOTAL PREFERRED STOCKS

(Cost $123,584,479) | | | 125,110,348 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | REGISTERED INVESTMENT COMPANY—1.2% | | | | |

| | 66,011,751 | | | Dreyfus Treasury Securities Cash Management– Institutional Shares 4.88%(e)

(Cost $66,011,751) | | | $66,011,751 | |

| | | | | | | | |

| | |

Face Value | | | | | | |

|

| | U.S. TREASURY BILLS—1.3% | |

| | $50,000,000 | | | 5.322%(f) due 10/10/2024 | | | 49,941,844 | |

| | 25,000,000 | | | 5.322%(f) due 11/14/2024 | | | 24,857,649 | |

| | | | | | | | |

| |

| TOTAL U.S. TREASURY BILLS

(Cost $74,778,633) | | | 74,799,493 | |

| | | | | | | | |

| | | | | | | | |

| | |

INVESTMENTS IN SECURITIES

(Cost $3,151,618,139) | | | 100.5 | % | | | 5,686,399,972 | |

| | |

UNREALIZED DEPRECIATION ON FORWARD CONTRACTS (Net) | | | (1.1 | ) | | | (62,214,647 | ) |

| | |

OTHER ASSETS

AND LIABILITIES (Net) | | | 0.6 | | | | 32,158,296 | |

| | | | | | | | |

| | |

NET ASSETS | | | 100.0 | % | | | $5,656,343,621 | |

| | | | | | | | |

| | | | | | | | |

* See Note 2 in Notes to Financial Statements. | | | | | | | | |

(a) “Affiliated company” as defined by the Investment Company Act of 1940. See Note 4. | | | | | | | | |

(b) Non-income producing security. | | | | | | | | |

(c) Amount represents less than 0.1% of net assets. | | | | | | | | |

(d) Represents one or more issuers where disclosure may be disadvantageous to the Fund’s accumulation or disposition program. The aggregate amount of $3,933,630 represents 0.1% of the net assets of the Fund. | | | | | | | | |

(e) Rate disclosed is the 7-day yield at September 30, 2024. | | | | | | | | |

(f) Rate represents annualized yield at date of purchase. | | | | | | | | |

| | | | | | |

|

| Abbreviations: |

| ADR | | | — | | | American Depositary Receipt |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

2

Tweedy, Browne International Value Fund

Schedule of Forward Exchange Contracts

September 30, 2024 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Contracts | | | | Counter-

party | | Settlement

Date | | Contract Value on

Origination Date | | Value 09/30/24* | | Unrealized

Appreciation

(Depreciation) |

| | | FORWARD EXCHANGE CONTRACTS TO BUY(a) | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 420,000,000 | | | Chinese Yuan | | | | JPM | | | | | 2/28/25 | | | | | $59,857,045 | | | | | $60,671,645 | | | | | $814,600 | |

| | | 75,000,000 | | | Chinese Yuan | | | | JPM | | | | | 4/23/25 | | | | | 10,735,906 | | | | | 10,865,657 | | | | | 129,751 | |

| | | 195,000,000 | | | Swedish Krona | | | | NTC | | | | | 2/28/25 | | | | | 19,317,450 | | | | | 19,377,991 | | | | | 60,541 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | TOTAL | | | | | | | | | | | | | | | | | $89,910,401 | | | | | $90,915,293 | | | | | $1,004,892 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | FORWARD EXCHANGE CONTRACTS TO SELL(a) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 22,000,000 | | | Canadian Dollar | | | | NTC | | | | | 12/12/24 | | | | | $(16,299,194 | ) | | | | $(16,314,632 | ) | | | | $(15,438) | |

| | | 50,000,000 | | | Canadian Dollar | | | | SSB | | | | | 1/2/25 | | | | | (37,830,640 | ) | | | | (37,100,588 | ) | | | | 730,052 | |

| | | 44,000,000 | | | Canadian Dollar | | | | NTC | | | | | 4/3/25 | | | | | (32,547,508 | ) | | | | (32,709,720 | ) | | | | (162,212) | |

| | | 55,000,000 | | | Canadian Dollar | | | | NTC | | | | | 9/11/25 | | | | | (40,977,530 | ) | | | | (41,019,870 | ) | | | | (42,340) | |

| | | 7,500,000,000 | | | Chilean Peso | | | | JPM | | | | | 1/2/25 | | | | | (8,369,602 | ) | | | | (8,345,464 | ) | | | | 24,138 | |

| | | 12,850,000,000 | | | Chilean Peso | | | | SSB | | | | | 4/3/25 | | | | | (13,041,713 | ) | | | | (14,282,408 | ) | | | | (1,240,695) | |

| | | 420,000,000 | | | Chinese Yuan | | | | JPM | | | | | 2/28/25 | | | | | (59,816,279 | ) | | | | (60,671,645 | ) | | | | (855,366) | |

| | | 250,000,000 | | | Chinese Yuan | | | | JPM | | | | | 4/23/25 | | | | | (35,193,918 | ) | | | | (36,218,856 | ) | | | | (1,024,938) | |

| | | 300,000,000 | | | Chinese Yuan | | | | JPM | | | | | 4/30/25 | | | | | (42,216,656 | ) | | | | (43,476,050 | ) | | | | (1,259,394) | |

| | | 250,000,000 | | | Chinese Yuan | | | | SSB | | | | | 5/9/25 | | | | | (35,270,880 | ) | | | | (36,244,433 | ) | | | | (973,553) | |

| | | 280,000,000 | | | Chinese Yuan | | | | JPM | | | | | 6/6/25 | | | | | (39,537,971 | ) | | | | (40,643,994 | ) | | | | (1,106,023) | |

| | | 210,000,000 | | | European Union Euro | | | | SSB | | | | | 12/6/24 | | | | | (233,964,150 | ) | | | | (235,000,688 | ) | | | | (1,036,538) | |

| | | 100,000,000 | | | European Union Euro | | | | NTC | | | | | 12/12/24 | | | | | (109,953,500 | ) | | | | (111,933,294 | ) | | | | (1,979,794) | |

| | | 65,000,000 | | | European Union Euro | | | | SSB | | | | | 12/12/24 | | | | | (71,458,725 | ) | | | | (72,756,641 | ) | | | | (1,297,916) | |

| | | 100,000,000 | | | European Union Euro | | | | NTC | | | | | 4/15/25 | | | | | (110,133,500 | ) | | | | (112,437,151 | ) | | | | (2,303,651) | |

| | | 100,000,000 | | | European Union Euro | | | | SSB | | | | | 4/23/25 | | | | | (108,357,000 | ) | | | | (112,470,379 | ) | | | | (4,113,379) | |

| | | 110,000,000 | | | European Union Euro | | | | BNY | | | | | 5/23/25 | | | | | (121,689,040 | ) | | | | (123,854,678 | ) | | | | (2,165,638) | |

| | | 75,000,000 | | | European Union Euro | | | | NTC | | | | | 6/6/25 | | | | | (82,540,125 | ) | | | | (84,490,116 | ) | | | | (1,949,991) | |

| | | 75,000,000 | | | European Union Euro | | | | BNY | | | | | 6/10/25 | | | | | (82,835,250 | ) | | | | (84,502,623 | ) | | | | (1,667,373) | |

| | | 52,000,000 | | | Great Britain Pound Sterling | | | | JPM | | | | | 10/7/24 | | | | | (63,515,400 | ) | | | | (69,749,848 | ) | | | | (6,234,448) | |

| | | 50,000,000 | | | Great Britain Pound Sterling | | | | JPM | | | | | 7/28/25 | | | | | (64,911,500 | ) | | | | (66,856,486 | ) | | | | (1,944,986) | |

| | | 75,000,000 | | | Great Britain Pound Sterling | | | | NTC | | | | | 8/14/25 | | | | | (95,168,250 | ) | | | | (100,260,174 | ) | | | | (5,091,924) | |

| | | 94,000,000 | | | Great Britain Pound Sterling | | | | NTC | | | | | 8/26/25 | | | | | (120,884,000 | ) | | | | (125,637,704 | ) | | | | (4,753,704) | |

| | | 75,000,000 | | | Great Britain Pound Sterling | | | | NTC | | | | | 9/26/25 | | | | | (98,813,250 | ) | | | | (100,197,008 | ) | | | | (1,383,758) | |

| | | 49,000,000 | | | Hong Kong Dollar | | | | SSB | | | | | 5/9/25 | | | | | (6,309,501 | ) | | | | (6,325,342 | ) | | | | (15,841) | |

| | | 315,000,000 | | | Hong Kong Dollar | | | | NTC | | | | | 5/14/25 | | | | | (40,582,324 | ) | | | | (40,665,079 | ) | | | | (82,755) | |

| | | 3,500,000,000 | | | Japanese Yen | | | | SSB | | | | | 12/16/24 | | | | | (25,733,402 | ) | | | | (24,726,257 | ) | | | | 1,007,145 | |

| | | 5,800,000,000 | | | Japanese Yen | | | | SSB | | | | | 2/13/25 | | | | | (41,272,708 | ) | | | | (41,252,574 | ) | | | | 20,134 | |

| | | 2,700,000,000 | | | Japanese Yen | | | | SSB | | | | | 6/30/25 | | | | | (17,918,376 | ) | | | | (19,449,719 | ) | | | | (1,531,343) | |

| | | 6,400,000,000 | | | Japanese Yen | | | | JPM | | | | | 8/21/25 | | | | | (45,435,829 | ) | | | | (46,316,027 | ) | | | | (880,198) | |

| | | 2,200,000,000 | | | Japanese Yen | | | | JPM | | | | | 8/29/25 | | | | | (15,817,462 | ) | | | | (15,932,458 | ) | | | | (114,996) | |

| | | 6,100,000,000 | | | Japanese Yen | | | | JPM | | | | | 9/11/25 | | | | | (43,650,936 | ) | | | | (44,227,479 | ) | | | | (576,543) | |

| | | 3,800,000,000 | | | Japanese Yen | | | | BNY | | | | | 10/2/25 | | | | | (27,462,600 | ) | | | | (27,602,541 | ) | | | | (139,941) | |

| | | 290,000,000 | | | Mexican Peso | | | | BNY | | | | | 4/15/25 | | | | | (16,624,151 | ) | | | | (14,353,893 | ) | | | | 2,270,258 | |

| | | 265,000,000 | | | Mexican Peso | | | | NTC | | | | | 4/23/25 | | | | | (14,975,136 | ) | | | | (13,101,072 | ) | | | | 1,874,064 | |

| | | 290,000,000 | | | Mexican Peso | | | | BNY | | | | | 5/23/25 | | | | | (16,405,499 | ) | | | | (14,274,106 | ) | | | | 2,131,393 | |

| | | 100,000,000 | | | Mexican Peso | | | | JPM | | | | | 6/9/25 | | | | | (5,373,672 | ) | | | | (4,909,896 | ) | | | | 463,776 | |

| | | 73,000,000 | | | Mexican Peso | | | | NTC | | | | | 9/11/25 | | | | | (3,479,836 | ) | | | | (3,535,728 | ) | | | | (55,892) | |

| | | 76,000,000 | | | Philippine Peso | | | | JPM | | | | | 11/20/24 | | | | | (1,361,275 | ) | | | | (1,355,977 | ) | | | | 5,298 | |

| | | 155,000,000 | | | Philippine Peso | | | | SSB | | | | | 4/3/25 | | | | | (2,743,363 | ) | | | | (2,762,859 | ) | | | | (19,496) | |

| | | 60,000,000 | | | Singapore Dollar | | | | JPM | | | | | 1/2/25 | | | | | (45,984,059 | ) | | | | (47,019,039 | ) | | | | (1,034,980) | |

| | | 40,000,000 | | | Singapore Dollar | | | | SSB | | | | | 1/24/25 | | | | | (30,130,124 | ) | | | | (31,375,554 | ) | | | | (1,245,430) | |

| | | 70,000,000 | | | Singapore Dollar | | | | NTC | | | | | 4/23/25 | | | | | (52,262,207 | ) | | | | (55,102,457 | ) | | | | (2,840,250) | |

| | | 40,000,000 | | | Singapore Dollar | | | | NTC | | | | | 5/14/25 | | | | | (30,122,750 | ) | | | | (31,507,821 | ) | | | | (1,385,071) | |

| | | 75,000,000 | | | Singapore Dollar | | | | SSB | | | | | 7/3/25 | | | | | (56,114,539 | ) | | | | (59,169,794 | ) | | | | (3,055,255) | |

| | | 67,000,000 | | | Singapore Dollar | | | | JPM | | | | | 7/18/25 | | | | | (50,429,023 | ) | | | | (52,883,225 | ) | | | | (2,454,202) | |

| | | 32,335,000,000 | | | South Korean Won | | | | JPM | | | | | 12/9/24 | | | | | (25,000,000 | ) | | | | (24,827,734 | ) | | | | 172,266 | |

| | | 57,000,000,000 | | | South Korean Won | | | | SSB | | | | | 4/1/25 | | | | | (43,219,471 | ) | | | | (43,992,963 | ) | | | | (773,492) | |

| | | 55,000,000,000 | | | South Korean Won | | | | JPM | | | | | 5/23/25 | | | | | (41,548,631 | ) | | | | (42,514,618 | ) | | | | (965,987) | |

| | | 440,000,000 | | | Swedish Krona | | | | NTC | | | | | 2/28/25 | | | | | (43,027,156 | ) | | | | (43,724,698 | ) | | | | (697,542) | |

| | | 355,000,000 | | | Swedish Krona | | | | NTC | | | | | 4/15/25 | | | | | (33,881,967 | ) | | | | (35,352,014 | ) | | | | (1,470,047) | |

| | | 500,000,000 | | | Swedish Krona | | | | SSB | | | | | 5/9/25 | | | | | (46,357,806 | ) | | | | (49,845,435 | ) | | | | (3,487,629) | |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

3

Tweedy, Browne International Value Fund

Schedule of Forward Exchange Contracts

September 30, 2024 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

Contracts | | | | | Counter-

party | | | Settlement

Date | | | Contract Value on

Origination Date | | | Value 09/30/24* | | | Unrealized

Appreciation

(Depreciation) | |

| FORWARD EXCHANGE CONTRACTS TO SELL(a) (continued) | | | | | | | | | | | | | | | | | | | | |

| | 120,000,000 | | | Swiss Franc | | | SSB | | | | 12/17/24 | | | | $(141,626,342 | ) | | | $(143,490,042 | ) | | | $(1,863,700) | |

| | 85,000,000 | | | Swiss Franc | | | JPM | | | | 1/3/25 | | | | (102,955,426 | ) | | | (101,829,863 | ) | | | 1,125,563 | |

| | 26,000,000 | | | Swiss Franc | | | JPM | | | | 1/31/25 | | | | (31,185,530 | ) | | | (31,229,785 | ) | | | (44,255) | |

| | 50,000,000 | | | Swiss Franc | | | NTC | | | | 4/23/25 | | | | (57,039,209 | ) | | | (60,507,359 | ) | | | (3,468,150) | |

| | 36,000,000 | | | Swiss Franc | | | NTC | | | | 5/23/25 | | | | (41,436,941 | ) | | | (43,674,513 | ) | | | (2,237,572) | |

| | | | | | | | | | | | | | | | |

| TOTAL | | | | | | | | | | | | | | $(2,922,792,832 | ) | | | $(2,986,012,371 | ) | | | $(63,219,539) | |

| | | | | | | | | | | | | | | | |

| | Unrealized Depreciation on Forward Contracts (Net) | | | | | | | | | | | | | | | | | | | $(62,214,647) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| * | See Note 2 in Notes to Financial Statements. |

| (a) | Primary risk exposure being hedged against is currency risk. |

Counterparty Abbreviations:

BNY — The Bank of New York Mellon

JPM — JPMorgan Chase Bank NA

NTC — Northern Trust Company

SSB — State Street Bank and Trust Company

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

4

Tweedy, Browne International Value Fund II - Currency Unhedged

Portfolio of Investments

September 30, 2024 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | COMMON STOCKS—95.0% | | | | |

| | |

| | | | Belgium—0.6% | | | | |

| | 79,510 | | | Fagron NV | | | $1,650,511 | |

| | | | | | | | |

| | |

| | | | Canada—3.7% | | | | |

| | 1,750 | | | E-L Financial Corp., Ltd. | | | 1,638,662 | |

| | 21,490 | | | Lassonde Industries, Inc., Class A | | | 2,819,573 | |

| | 154,890 | | | Winpak, Ltd. | | | 5,447,147 | |

| | | | | | | | |

| | | | | | | 9,905,382 | |

| | | | | | | | |

| | |

| | | | China—3.2% | | | | |

| | 868,680 | | | Haitian International Holdings, Ltd. | | | 2,795,880 | |

| | 357,122 | | | Shanghai Mechanical and Electrical Industry Co., Ltd., Class B | | | 363,550 | |

| | 2,729,475 | | | Uni-President China Holdings, Ltd. | | | 2,561,683 | |

| | 131,955 | | | Wuliangye Yibin Co., Ltd., Class A | | | 3,056,400 | |

| | | | | | | | |

| | | | | | | 8,777,513 | |

| | | | | | | | |

| | |

| | | | Finland—2.7% | | | | |

| | 287,855 | | | Kemira Oyj | | | 7,202,662 | |

| | | | | | | | |

| | |

| | | | France—11.5% | | | | |

| | 24,440 | | | Alten SA | | | 2,730,354 | |

| | 123,575 | | | Rubis SCA | | | 3,381,697 | |

| | 34,834 | | | Safran SA | | | 8,206,826 | |

| | 7,040 | | | Sopra Steria Group | | | 1,480,257 | |

| | 475,398 | | | Tarkett SA(a) | | | 4,997,950 | |

| | 58,650 | | | Teleperformance SE | | | 6,087,439 | |

| | 68,000 | | | TotalEnergies SE | | | 4,439,647 | |

| | | | | | | | |

| | | | | | | 31,324,170 | |

| | | | | | | | |

| | |

| | | | Germany—6.9% | | | | |

| | 37,035 | | | Brenntag SE | | | 2,768,479 | |

| | 169,154 | | | DHL Group | | | 7,557,036 | |

| | 89,400 | | | Fresenius SE & Co., KGaA(a) | | | 3,415,294 | |

| | 8,988 | | | Rheinmetall AG | | | 4,879,106 | |

| | | | | | | | |

| | | | | | | 18,619,915 | |

| | | | | | | | |

| | |

| | | | Hong Kong—0.8% | | | | |

| | 1,663,100 | | | Chow Sang Sang Holdings International, Ltd. | | | 1,535,169 | |

| | 405,955 | | | Hang Lung Group, Ltd. | | | 548,765 | |

| | 45,710 | | | Luk Fook Holdings International, Ltd. | | | 98,511 | |

| | | | | | | | |

| | | | | | | 2,182,445 | |

| | | | | | | | |

| | |

| | | | Italy—0.8% | | | | |

| | 55,200 | | | SOL SpA | | | 2,199,333 | |

| | | | | | | | |

| | |

| | | | Japan—9.3% | | | | |

| | 103,690 | | | ADEKA Corp. | | | 2,114,177 | |

| | 12,000 | | | Fukuda Denshi Co., Ltd. | | | 645,973 | |

| | 43,320 | | | Fuso Chemical Co., Ltd. | | | 1,205,352 | |

| | 111,630 | | | Inaba Denki Sangyo Co., Ltd. | | | 2,988,975 | |

| | 20,600 | | | Kamigumi Co., Ltd. | | | 469,347 | |

| | 103,740 | | | Kanadevia Corp. | | | 718,724 | |

| | 89,190 | | | Koito Manufacturing Co., Ltd. | | | 1,231,476 | |

| | 288,625 | | | Kuraray Co., Ltd. | | | 4,276,711 | |

| | 143,035 | | | Mitsubishi Gas Chemical Co., Inc. | | | 2,769,403 | |

| | 115,710 | | | Nihon Kohden Corp. | | | 1,720,604 | |

| | 24,910 | | | Okamoto Industries, Inc. | | | 910,789 | |

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Japan (continued) | | | | |

| | 86,595 | | | Star Micronics Co., Ltd. | | | $1,164,165 | |

| | 77,490 | | | Subaru Corp. | | | 1,344,590 | |

| | 44,060 | | | Taikisha, Ltd. | | | 1,507,786 | |

| | 92,200 | | | Transcosmos, Inc. | | | 2,285,018 | |

| | | | | | | | |

| | | | | | | 25,353,090 | |

| | | | | | | | |

| | |

| | | | Mexico—1.7% | | | | |

| | 23,120 | | | Coca-Cola FEMSA SAB de CV, Sponsored ADR | | | 2,051,207 | |

| | 1,244,322 | | | Megacable Holdings SAB de CV | | | 2,601,383 | |

| | | | | | | | |

| | | | | | | 4,652,590 | |

| | | | | | | | |

| | |

| | | | Netherlands—2.2% | | | | |

| | 70,260 | | | Aalberts NV | | | 2,857,394 | |

| | 41,905 | | | Heineken Holding NV | | | 3,170,876 | |

| | | | | | | | |

| | | | | | | 6,028,270 | |

| | | | | | | | |

| | |

| | | | Philippines—0.7% | | | | |

| | 6,997,100 | | | Alliance Global Group, Inc. | | | 1,171,230 | |

| | 893,400 | | | China Banking Corp. | | | 813,087 | |

| | | | | | | | |

| | | | | | | 1,984,317 | |

| | | | | | | | |

| | |

| | | | Singapore—4.7% | | | | |

| | 216,691 | | | DBS Group Holdings, Ltd. | | | 6,431,430 | |

| | 249,460 | | | United Overseas Bank, Ltd. | | | 6,259,850 | |

| | | | | | | | |

| | | | | | | 12,691,280 | |

| | | | | | | | |

| | |

| | | | South Korea—3.6% | | | | |

| | 15,005 | | | DB Insurance Co., Ltd. | | | 1,288,569 | |

| | 8,035 | | | Dentium Co., Ltd. | | | 501,381 | |

| | 89,851 | | | LG Corp. | | | 5,434,897 | |

| | 51,190 | | | Samsung Electronics Co., Ltd. | | | 2,407,421 | |

| | | | | | | | |

| | | | | | | 9,632,268 | |

| | | | | | | | |

| | |

| | | | Sweden—2.6% | | | | |

| | 16,520 | | | Autoliv, Inc. | | | 1,542,472 | |

| | 66,115 | | | SKF AB, Class B | | | 1,317,526 | |

| | 106,473 | | | Trelleborg AB, Class B | | | 4,098,590 | |

| | | | | | | | |

| | | | | | | 6,958,588 | |

| | | | | | | | |

| | |

| | | | Switzerland—8.0% | | | | |

| | 60,675 | | | Nestlé SA, Registered | | | 6,111,017 | |

| | 57,951 | | | Novartis AG, Registered | | | 6,674,103 | |

| | 27,835 | | | Roche Holding AG | | | 8,929,110 | |

| | | | | | | | |

| | | | | | | 21,714,230 | |

| | | | | | | | |

| | |

| | | | United Kingdom—14.3% | | | | |

| | 242,737 | | | BAE Systems plc | | | 4,029,242 | |

| | 499,182 | | | CNH Industrial NV | | | 5,540,920 | |

| | 82,845 | | | Computacenter plc | | | 2,749,211 | |

| | 179,539 | | | CVS Group plc | | | 2,726,135 | |

| | 161,513 | | | Diageo plc | | | 5,639,281 | |

| | 229,117 | | | Grafton Group plc | | | 3,198,650 | |

| | 243,576 | | | Howden Joinery Group plc | | | 2,963,356 | |

| | 552,500 | | | Inchcape plc | | | 5,902,829 | |

| | 1,504,280 | | | Johnson Service Group plc | | | 3,143,679 | |

| | 127,255 | | | SThree plc | | | 641,808 | |

| | 2,741,248 | | | Vertu Motors plc | | | 2,213,538 | |

| | | | | | | | |

| | | | | | | 38,748,649 | |

| | | | | | | | |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

5

Tweedy, Browne International Value Fund II - Currency Unhedged

Portfolio of Investments

September 30, 2024 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | United States—17.7% | | | | |

| | 49,976 | | | Alphabet, Inc., Class A | | | $8,288,520 | |

| | 1,945 | | | AutoZone, Inc.(a) | | | 6,126,828 | |

| | 22,551 | | | Berkshire Hathaway, Inc., Class B(a) | | | 10,379,323 | |

| | 116,052 | | | FMC Corp. | | | 7,652,469 | |

| | 175,002 | | | Ionis Pharmaceuticals, Inc.(a) | | | 7,010,580 | |

| | 52,371 | | | Johnson & Johnson | | | 8,487,244 | |

| | | | | | | | |

| | | | | | | 47,944,964 | |

| | | | | | | | |

| |

| TOTAL COMMON STOCKS

(Cost $181,409,686) | | | 257,570,177 | |

| | | | | | | | |

| |

| | PREFERRED STOCKS—2.2% | | | | |

| | | | Chile—0.4% | | | | |

| | 502,909 | | | Embotelladora Andina SA, Class A | | | 1,209,804 | |

| | | | | | | | |

| | |

| | | | Germany—1.8% | | | | |

| | 54,465 | | | Dr. Ing. h.c. F. Porsche AG | | | 4,346,175 | |

| | 648 | | | KSB AG | | | 433,920 | |

| | | | | | | | |

| | | | | | | 4,780,095 | |

| | | | | | | | |

| |

| TOTAL PREFERRED STOCKS

(Cost $6,131,673) | | | 5,989,899 | |

| | | | | | | | |

| | | | | | | | | | | | |

Shares | | | | | | | | Value* | |

|

| | REGISTERED INVESTMENT COMPANY—0.3% | |

| | 888,887 | | | Dreyfus Government Securities Cash Management– Institutional Shares 4.83%(b)

(Cost $888,887) | | | | $888,887 | |

| | | | | | | | | | | | |

| INVESTMENTS IN SECURITIES

(Cost $188,430,246) | | | 97.5 | % | | | 264,448,963 | |

| OTHER ASSETS

AND LIABILITIES (Net) | | | 2.5 | | | | 6,711,913 | |

| | | | | | | | | | | | |

| | NET ASSETS | | | 100.0 | % | | | $271,160,876 | |

| | | | | | | | | | | | |

| * | See Note 2 in Notes to Financial Statements. |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the 7-day yield at September 30, 2024. |

Abbreviations:

ADR — American Depositary Receipt

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

6

Tweedy, Browne Value Fund

Portfolio of Investments

September 30, 2024 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | COMMON STOCKS—95.8% | | | | |

| | |

| | | | Belgium—1.0% | | | | |

| | 66,181 | | | Fagron NV | | | $1,373,820 | |

| | 38,820 | | | KBC Group NV | | | 3,094,276 | |

| | | | | | | | |

| | | | | | | 4,468,096 | |

| | | | | | | | |

| | |

| | | | Canada—1.9% | | | | |

| | 18,010 | | | Lassonde Industries, Inc., Class A | | | 2,362,984 | |

| | 180,543 | | | Winpak, Ltd. | | | 6,349,308 | |

| | | | | | | | |

| | | | | | | 8,712,292 | |

| | | | | | | | |

| | |

| | | | China—3.1% | | | | |

| | 231,680 | | | Baidu, Inc., Class A(a) | | | 3,149,714 | |

| | 1,006,590 | | | Haitian International Holdings, Ltd. | | | 3,239,749 | |

| | 345,561 | | | Shanghai Mechanical and Electrical Industry Co., Ltd., Class B | | | 351,781 | |

| | 2,349,905 | | | Uni-President China Holdings, Ltd. | | | 2,205,447 | |

| | 215,487 | | | Wuliangye Yibin Co., Ltd., Class A | | | 4,991,205 | |

| | | | | | | | |

| | | | | | | 13,937,896 | |

| | | | | | | | |

| | |

| | | | Finland—1.3% | | | | |

| | 227,906 | | | Kemira Oyj | | | 5,702,628 | |

| | | | | | | | |

| | |

| | | | France—14.5% | | | | |

| | 39,502 | | | Alten SA | | | 4,413,029 | |

| | 299,826 | | | Rubis SCA | | | 8,204,902 | |

| | 72,857 | | | Safran SA | | | 17,164,975 | |

| | 233,983 | | | SCOR SE | | | 5,238,403 | |

| | 12,410 | | | Sopra Steria Group | | | 2,609,374 | |

| | 150,328 | | | Tarkett SA(a) | | | 1,580,427 | |

| | 95,170 | | | Teleperformance SE | | | 9,877,947 | |

| | 236,380 | | | Total Energies SE | | | 15,432,996 | |

| | 72,825 | | | Ubisoft Entertainment SA(a) | | | 820,891 | |

| | | | | | | | |

| | | | | | | 65,342,944 | |

| | | | | | | | |

| | |

| | | | Germany—6.6% | | | | |

| | 54,875 | | | Brenntag SE | | | 4,102,073 | |

| | 190,881 | | | DHL Group | | | 8,527,701 | |

| | 143,555 | | | Fresenius SE & Co., KGaA(a) | | | 5,484,144 | |

| | 150,000 | | | Norma Group SE | | | 2,504,416 | |

| | 16,413 | | | Rheinmetall AG | | | 8,909,743 | |

| | | | | | | | |

| | | | | | | 29,528,077 | |

| | | | | | | | |

| | |

| | | | Hong Kong—0.3% | | | | |

| | 1,046,000 | | | Chow Sang Sang Holdings International, Ltd. | | | 965,538 | |

| | 214,000 | | | Luk Fook Holdings International, Ltd. | | | 461,199 | |

| | | | | | | | |

| | | | | | | 1,426,737 | |

| | | | | | | | |

| | |

| | | | Japan—6.7% | | | | |

| | 63,220 | | | ADEKA Corp. | | | 1,289,018 | |

| | 72,285 | | | Dentsu Group, Inc. | | | 2,227,069 | |

| | 94,205 | | | Fuso Chemical Co., Ltd. | | | 2,621,196 | |

| | 37,260 | | | Hosokawa Micron Corp. | | | 1,067,995 | |

| | 36,595 | | | Inaba Denki Sangyo Co., Ltd. | | | 979,858 | |

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | Japan (continued) | | | | |

| | 352,585 | | | Kanadevia Corp. | | | $2,442,755 | |

| | 160,830 | | | Koito Manufacturing Co., Ltd. | | | 2,220,632 | |

| | 148,315 | | | Mitsubishi Gas Chemical Co., Inc. | | | 2,871,633 | |

| | 96,230 | | | Nihon Kohden Corp. | | | 1,430,937 | |

| | 28,005 | | | Okamoto Industries, Inc. | | | 1,023,952 | |

| | 80,005 | | | Shoei Co., Ltd. | | | 1,248,960 | |

| | 88,200 | | | Star Micronics Co., Ltd. | | | 1,185,742 | |

| | 127,885 | | | Subaru Corp. | | | 2,219,034 | |

| | 89,060 | | | Sumitomo Heavy Industries, Ltd. | | | 2,141,823 | |

| | 38,520 | | | Taikisha, Ltd. | | | 1,318,201 | |

| | 87,100 | | | Transcosmos, Inc. | | | 2,158,624 | |

| | 99,120 | | | YAMABIKO Corp. | | | 1,760,794 | |

| | | | | | | | |

| | | | | | | 30,208,223 | |

| | | | | | | | |

| | |

| | | | Mexico—1.1% | | | | |

| | 54,420 | | | Coca-Cola FEMSA SAB de CV, Sponsored ADR | | | 4,828,142 | |

| | | | | | | | |

| | |

| | | | Netherlands—3.0% | | | | |

| | 94,810 | | | Aalberts NV | | | 3,855,815 | |

| | 128,033 | | | Heineken Holding NV | | | 9,688,025 | |

| | | | | | | | |

| | | | | | | 13,543,840 | |

| | | | | | | | |

| | |

| | | | Philippines—0.2% | | | | |

| | 6,542,900 | | | Alliance Global Group, Inc. | | | 1,095,202 | |

| | | | | | | | |

| | |

| | | | Singapore—2.2% | | | | |

| | 386,517 | | | United Overseas Bank, Ltd. | | | 9,699,104 | |

| | | | | | | | |

| | |

| | | | South Korea—2.3% | | | | |

| | 16,075 | | | DB Insurance Co., Ltd. | | | 1,380,456 | |

| | 11,335 | | | Dentium Co., Ltd. | | | 707,300 | |

| | 70,858 | | | LG Corp. | | | 4,286,050 | |

| | 61,295 | | | LX Holdings Corp. | | | 334,669 | |

| | 81,980 | | | Samsung Electronics Co., Ltd. | | | 3,855,448 | |

| | | | | | | | |

| | | | | | | 10,563,923 | |

| | | | | | | | |

| | |

| | | | Sweden—2.3% | | | | |

| | 26,854 | | | Autoliv, Inc | | | 2,507,358 | |

| | 520,485 | | | Husqvarna AB, Class B | | | 3,645,644 | |

| | 111,490 | | | Trelleborg AB, Class B | | | 4,291,715 | |

| | | | | | | | |

| | | | | | | 10,444,717 | |

| | | | | | | | |

| | |

| | | | Switzerland—7.1% | | | | |

| | 118,780 | | | Nestlé SA, ADR | | | 11,957,583 | |

| | 50,749 | | | Novartis AG, Registered | | | 5,844,663 | |

| | 44,523 | | | Roche Holding AG | | | 14,282,406 | |

| | | | | | | | |

| | | | | | | 32,084,652 | |

| | | | | | | | |

| | |

| | | | United Kingdom—9.6% | | | | |

| | 389,775 | | | BAE Systems plc | | | 6,469,956 | |

| | 650,620 | | | CNH Industrial NV | | | 7,221,882 | |

| | 74,115 | | | Computacenter plc | | | 2,459,506 | |

| | 350,760 | | | CVS Group plc | | | 5,325,969 | |

| | 62,715 | | | Diageo plc, Sponsored ADR | | | 8,801,423 | |

| | 223,196 | | | Grafton Group plc | | | 3,115,988 | |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

7

Tweedy, Browne Value Fund

Portfolio of Investments

September 30, 2024 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| | |

| | | | United Kingdom (continued) | | | | |

| | 252,750 | | | Howden Joinery Group plc | | | $3,074,968 | |

| | 282,425 | | | Inchcape plc | | | 3,017,387 | |

| | 1,269,763 | | | Johnson Service Group plc | | | 2,653,580 | |

| | 205,013 | | | SThree plc | | | 1,033,978 | |

| | | | | | | | |

| | | | | | | 43,174,637 | |

| | | | | | | | |

| | |

| | | | United States—32.6% | | | | |

| | 86,517 | | | Alphabet, Inc., Class A | | | 14,348,844 | |

| | 48,220 | | | Atmus Filtration Technologies, Inc. | | | 1,809,697 | |

| | 1,982 | | | AutoZone, Inc.(a) | | | 6,243,379 | |

| | 76,760 | | | Bank of America Corp. | | | 3,045,837 | |

| | 44 | | | Berkshire Hathaway, Inc., Class A(a) | | | 30,411,920 | |

| | 107,535 | | | Enterprise Products Partners LP | | | 3,130,344 | |

| | 372,000 | | | Envista Holdings Corp.(a) | | | 7,350,720 | |

| | 35,160 | | | FedEx Corp. | | | 9,622,589 | |

| | 167,744 | | | FMC Corp. | | | 11,061,039 | |

| | 190,425 | | | Ionis Pharmaceuticals, Inc.(a) | | | 7,628,426 | |

| | 63,514 | | | Johnson & Johnson | | | 10,293,079 | |

| | 22,968 | | | Kenvue, Inc. | | | 531,250 | |

| | 186,300 | | | Sealed Air Corp. | | | 6,762,690 | |

| | 131,295 | | | Truist Financial Corp. | | | 5,615,487 | |

| | 122,928 | | | U-Haul Holding Co. | | | 8,850,816 | |

| | 15,355 | | | Vertex Pharmaceuticals, Inc.(a) | | | 7,141,303 | |

| | 225,783 | | | Wells Fargo & Co. | | | 12,754,482 | |

| | | | | | | | |

| | | | | | | 146,601,902 | |

| | | | | | | | |

| |

| TOTAL COMMON STOCKS

(Cost $263,198,108) | | | 431,363,012 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | PREFERRED STOCKS—1.9% | | | | |

| | |

| | | | Chile—0.3% | | | | |

| | 492,000 | | | Embotelladora Andina SA, Class A | | | $1,183,562 | |

| | | | | | | | |

| | |

| | | | Germany—1.6% | | | | |

| | 91,851 | | | Dr. Ing. h.c. F. Porsche AG | | | 7,329,487 | |

| | | | | | | | |

| |

| TOTAL PREFERRED STOCKS

(Cost $8,224,185) | | | 8,513,049 | |

| | | | | | | | |

|

| | REGISTERED INVESTMENT COMPANY—2.1% | |

| | 9,747,173 | | | Dreyfus Government Securities Cash

Management– Institutional Shares

4.83%(b)

(Cost $9,747,173) | | | 9,747,173 | |

| | | | | | | | |

| | |

Face Value | | | | | | |

| |

| | U.S. TREASURY BILL—0.9% | | | | |

| | $4,000,000 | | | 5.288%(c) due 11/29/2024

(Cost $3,966,506) | | | 3,969,325 | |

| | | | | | | | |

| | | | | | | | |

| | |

INVESTMENTS IN SECURITIES

(Cost $285,135,972) | | | 100.7 | % | | | 453,592,559 | |

| | |

UNREALIZED DEPRECIATION ON

FORWARD CONTRACTS (Net) | | | (0.8 | ) | | | (3,489,483 | ) |

| | |

OTHER ASSETS

AND LIABILITIES (Net) | | | 0.1 | | | | 326,243 | |

| | | | | | | | |

| | |

NET ASSETS | | | 100.0 | % | | | $450,429,319 | |

| | | | | | | | |

| * | See Note 2 in Notes to Financial Statements. |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the 7-day yield at September 30, 2024. |

| (c) | Rate represents annualized yield at date of purchase. |

| | | | |

| Abbreviations: |

| ADR | | — American Depositary Receipt |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

8

Tweedy, Browne Value Fund

Schedule of Forward Exchange Contracts

September 30, 2024 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

Contracts | | | | | Counter-

party | | | Settlement

Date | | | Contract Value on

Origination Date | | | Value 09/30/24* | | | Unrealized

Appreciation

(Depreciation) | |

| | FORWARD EXCHANGE CONTRACTS TO BUY(a) | | | | | | | | | | | | | | | | | | | | |

| | 13,000,000 | | | Swedish Krona | | | NTC | | | | 2/28/25 | | | | $1,237,494 | | | | $1,291,866 | | | | $54,372 | |

| | 11,300,000 | | | Swedish Krona | | | NTC | | | | 4/15/25 | | | | 1,095,193 | | | | 1,125,289 | | | | 30,096 | |

| | | | | | | | | | | | | | | | |

| | TOTAL | | | | | | | | | | | | | | $2,332,687 | | | | $2,417,155 | | | | $84,468 | |

| | | | | | | | | | | | | | | | |

| | FORWARD EXCHANGE CONTRACTS TO SELL(a) | | | | | | | | | | | | | | | | | | | | |

| | 2,300,000 | | | Canadian Dollar | | | SSB | | | | 1/13/25 | | | | $(1,735,740) | | | | $(1,707,013) | | | | $28,727 | |

| | 630,000 | | | Canadian Dollar | | | SSB | | | | 9/9/25 | | | | (471,169) | | | | (469,845) | | | | 1,324 | |

| | 1,040,000,000 | | | Chilean Peso | | | SSB | | | | 8/14/25 | | | | (1,092,437) | | | | (1,152,625) | | | | (60,188) | |

| | 31,400,000 | | | Chinese Yuan | | | JPM | | | | 2/28/25 | | | | (4,471,979) | | | | (4,535,928) | | | | (63,949) | |

| | 18,400,000 | | | Chinese Yuan | | | SSB | | | | 5/9/25 | | | | (2,595,937) | | | | (2,667,590) | | | | (71,653) | |

| | 9,800,000 | | | Chinese Yuan | | | JPM | | | | 5/23/25 | | | | (1,391,454) | | | | (1,421,660) | | | | (30,206) | |

| | 4,700,000 | | | European Union Euro | | | NTC | | | | 10/31/24 | | | | (5,063,991) | | | | (5,252,631) | | | | (188,640) | |

| | 14,200,000 | | | European Union Euro | | | SSB | | | | 2/13/25 | | | | (15,515,687) | | | | (15,931,635) | | | | (415,948) | |

| | 10,000,000 | | | European Union Euro | | | NTC | | | | 4/15/25 | | | | (11,013,350) | | | | (11,243,715) | | | | (230,365) | |

| | 9,700,000 | | | European Union Euro | | | BNY | | | | 5/23/25 | | | | (10,730,761) | | | | (10,921,731) | | | | (190,970) | |

| | 12,500,000 | | | European Union Euro | | | BNY | | | | 5/30/25 | | | | (13,789,262) | | | | (14,078,040) | | | | (288,778) | |

| | 7,700,000 | | | Great Britain Pound Sterling | | | SSB | | | | 1/24/25 | | | | (9,757,163) | | | | (10,322,313) | | | | (565,150) | |

| | 1,800,000 | | | Great Britain Pound Sterling | | | BNY | | | | 5/23/25 | | | | (2,288,934) | | | | (2,409,124) | | | | (120,190) | |

| | 2,500,000 | | | Great Britain Pound Sterling | | | JPM | | | | 7/28/25 | | | | (3,245,575) | | | | (3,342,824) | | | | (97,249) | |

| | 4,400,000 | | | Great Britain Pound Sterling | | | NTC | | | | 8/14/25 | | | | (5,583,204) | | | | (5,881,930) | | | | (298,726) | |

| | 6,500,000 | | | Hong Kong Dollar | | | SSB | | | | 12/6/24 | | | | (836,734) | | | | (837,698) | | | | (964) | |

| | 5,200,000 | | | Hong Kong Dollar | | | SSB | | | | 2/13/25 | | | | (669,013) | | | | (670,603) | | | | (1,590) | |

| | 9,700,000 | | | Hong Kong Dollar | | | SSB | | | | 4/3/25 | | | | (1,248,329) | | | | (1,251,679) | | | | (3,350) | |

| | 3,500,000 | | | Hong Kong Dollar | | | JPM | | | | 5/23/25 | | | | (451,335) | | | | (451,878) | | | | (543) | |

| | 4,500,000 | | | Hong Kong Dollar | | | BNY | | | | 9/11/25 | | | | (581,023) | | | | (581,674) | | | | (651) | |

| | 375,000,000 | | | Japanese Yen | | | SSB | | | | 12/16/24 | | | | (2,757,150) | | | | (2,649,242) | | | | 107,908 | |

| | 580,000,000 | | | Japanese Yen | | | SSB | | | | 2/13/25 | | | | (4,127,271) | | | | (4,125,257) | | | | 2,014 | |

| | 405,000,000 | | | Japanese Yen | | | JPM | | | | 3/24/25 | | | | (2,881,001) | | | | (2,892,089) | | | | (11,088) | |

| | 160,000,000 | | | Japanese Yen | | | SSB | | | | 4/25/25 | | | | (1,091,171) | | | | (1,145,888) | | | | (54,717) | |

| | 466,000,000 | | | Japanese Yen | | | JPM | | | | 5/30/25 | | | | (3,138,380) | | | | (3,347,700) | | | | (209,320) | |

| | 434,000,000 | | | Japanese Yen | | | SSB | | | | 6/30/25 | | | | (2,880,213) | | | | (3,126,362) | | | | (246,149) | |

| | 220,000,000 | | | Japanese Yen | | | JPM | | | | 8/29/25 | | | | (1,581,746) | | | | (1,593,246) | | | | (11,500) | |

| | 145,000,000 | | | Japanese Yen | | | SSB | | | | 9/9/25 | | | | (1,043,585) | | | | (1,051,122) | | | | (7,537) | |

| | 190,000,000 | | | Japanese Yen | | | BNY | | | | 10/2/25 | | | | (1,373,130) | | | | (1,380,127) | | | | (6,997) | |

| | 23,500,000 | | | Mexican Peso | | | JPM | | | | 6/9/25 | | | | (1,262,813) | | | | (1,153,826) | | | | 108,987 | |

| | 17,000,000 | | | Mexican Peso | | | BNY | | | | 7/18/25 | | | | (898,853) | | | | (829,959) | | | | 68,894 | |

| | 18,000,000 | | | Philippine Peso | | | JPM | | | | 11/20/24 | | | | (322,407) | | | | (321,152) | | | | 1,255 | |

| | 44,000,000 | | | Philippine Peso | | | SSB | | | | 4/3/25 | | | | (778,761) | | | | (784,295) | | | | (5,534) | |

| | 10,000,000 | | | Singapore Dollar | | | SSB | | | | 1/24/25 | | | | (7,532,531) | | | | (7,843,889) | | | | (311,358) | |

| | 1,100,000 | | | Singapore Dollar | | | NTC | | | | 5/14/25 | | | | (828,376) | | | | (866,465) | | | | (38,089) | |

| | 1,700,000,000 | | | South Korean Won | | | JPM | | | | 1/2/25 | | | | (1,338,056) | | | | (1,307,198) | | | | 30,858 | |

| | 7,500,000,000 | | | South Korean Won | | | JPM | | | | 3/24/25 | | | | (5,776,118) | | | | (5,786,675) | | | | (10,557) | |

| | 1,650,000,000 | | | South Korean Won | | | JPM | | | | 5/14/25 | | | | (1,231,803) | | | | (1,275,099) | | | | (43,296) | |

| | 1,760,000,000 | | | South Korean Won | | | JPM | | | | 6/10/25 | | | | (1,296,787) | | | | (1,361,192) | | | | (64,405) | |

| | 13,000,000 | | | Swedish Krona | | | NTC | | | | 2/28/25 | | | | (1,271,257) | | | | (1,291,866) | | | | (20,609) | |

| | 46,500,000 | | | Swedish Krona | | | NTC | | | | 4/15/25 | | | | (4,438,060) | | | | (4,630,616) | | | | (192,556) | |

| | 1,700,000 | | | Swiss Franc | | | SSB | | | | 12/17/24 | | | | (2,006,373) | | | | (2,032,776) | | | | (26,403) | |

| | 8,800,000 | | | Swiss Franc | | | JPM | | | | 1/3/25 | | | | (10,658,915) | | | | (10,542,386) | | | | 116,529 | |

| | 2,500,000 | | | Swiss Franc | | | BNY | | | | 6/10/25 | | | | (2,886,299) | | | | (3,037,521) | | | | (151,222) | |

| | | | | | | | | | | | | | | | |

| | TOTAL | | | | | | | | | | | | | | $(155,934,133) | | | | $(159,508,084) | | | | $(3,573,951) | |

| | | | | | | | | | | | | | | | |

| | Unrealized Depreciation on Forward Contracts (Net) | | | | | | | | | | | | | | | | | | | $(3,489,483) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| * | See Note 2 in Notes to Financial Statements. |

| (a) | Primary risk exposure being hedged against is currency risk. |

Counterparty Abbreviations:

| | | | | | |

| BNY | | | — | | | The Bank of New York Mellon |

| JPM | | | — | | | JPMorgan Chase Bank NA |

| NTC | | | — | | | Northern Trust Company |

| SSB | | | — | | | State Street Bank and Trust Company |

| | | | |

| | |

| | SEE NOTES TO FINANCIAL STATEMENTS | | |

9

Tweedy, Browne Worldwide High Dividend Yield Value Fund

Portfolio of Investments

September 30, 2024 (Unaudited)

| | | | | | | | |

Shares | | | | | Value* | |

| |

| | COMMON STOCKS—95.4% | | | | |

| | |

| | | | Belgium—0.8% | | | | |

| | 7,175 | | | KBC Group NV | | | $571,907 | |

| | | | | | | | |

| | |

| | | | China—2.8% | | | | |

| | 308,710 | | | Haitian International Holdings, Ltd. | | | 993,595 | |

| | 976,845 | | | Uni-President China Holdings, Ltd. | | | 916,794 | |

| | | | | | | | |

| | | | | | | 1,910,389 | |

| | | | | | | | |

| | |

| | | | Finland—3.5% | | | | |

| | 95,220 | | | Kemira Oyj | | | 2,382,580 | |

| | | | | | | | |

| | |

| | | | France—8.2% | | | | |

| | 58,430 | | | Rubis SCA | | | 1,598,969 | |

| | 8,630 | | | Safran SA | | | 2,033,212 | |

| | 44,294 | | | Tarkett SA(a) | | | 465,671 | |

| | 14,570 | | | Teleperformance SE | | | 1,512,259 | |

| | | | | | | | |

| | | | | | | 5,610,111 | |

| | | | | | | | |

| | |

| | | | Germany—6.9% | | | | |

| | 36,145 | | | DHL Group | | | 1,614,795 | |

| | 50,225 | | | Fresenius SE & Co., KGaA(a) | | | 1,918,715 | |

| | 1,154 | | | Muenchener Rueckversicherungs AG, Registered | | | 636,620 | |

| | 31,624 | | | Norma Group SE | | | 527,998 | |

| | | | | | | | |

| | | | | | | 4,698,128 | |

| | | | | | | | |

| | |

| | | | Hong Kong—3.4% | | | | |

| | 407,000 | | | Hang Lung Group, Ltd. | | | 550,177 | |

| | 22,115 | | | Jardine Matheson Holdings, Ltd. | | | 863,812 | |

| | 360,840 | | | Johnson Electric Holdings, Ltd. | | | 535,163 | |

| | 172,775 | | | Luk Fook Holdings International, Ltd. | | | 372,353 | |

| | | | | | | | |

| | | | | | | 2,321,505 | |

| | | | | | | | |

| | |

| | | | Japan—11.3% | | | | |

| | 42,370 | | | ADEKA Corp. | | | 863,899 | |

| | 19,655 | | | Dentsu Group, Inc. | | | 605,562 | |

| | 45,315 | | | Inaba Denki Sangyo Co., Ltd. | | | 1,213,342 | |

| | 56,600 | | | Kuraray Co., Ltd. | | | 838,673 | |

| | 48,915 | | | Mitsubishi Gas Chemical Co., Inc. | | | 947,078 | |

| | 12,325 | | | Nippon Express Holdings, Inc. | | | 649,768 | |

| | 49,970 | | | Shoei Co., Ltd. | | | 780,083 | |

| | 38,870 | | | Subaru Corp. | | | 674,464 | |

| | 17,685 | | | Sumitomo Heavy Industries, Ltd. | | | 425,310 | |

| | 30,400 | | | Transcosmos, Inc. | | | 753,412 | |

| | | | | | | | |

| | | | | | | 7,751,591 | |

| | | | | | | | |

| | |

| | | | Mexico—2.9% | | | | |

| | 9,925 | | | Coca-Cola FEMSA SAB de CV, Sponsored ADR | | | 880,546 | |

| | 531,475 | | | Megacable Holdings SAB de CV | | | 1,111,103 | |

| | | | | | | | |