UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07538 |

|

LORD ABBETT SECURITIES TRUST |

(Exact name of registrant as specified in charter) |

|

90 Hudson Street, Jersey City, NJ | | 07302 |

(Address of principal executive offices) | | (Zip code) |

|

Christina T. Simmons, Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 201-6984 | |

|

Date of fiscal year end: | 10/31 | |

|

Date of reporting period: | 10/31/06 | |

| | | | | | | | | |

Item 1: Report to Shareholders.

LORD ABBETT

2006

Annual

Report

Lord Abbett

All Value Fund

Alpha Strategy Fund

International Core Equity

Fund

International Opportunities

Fund

Large Cap Value Fund

Value Opportunities Fund

For the fiscal period ended October 31, 2006

Lord Abbett Securities Trust

Annual Report

For the fiscal year ended October 31, 2006

Dear Shareholders: We are pleased to provide you with this overview of Lord Abbett Securities Trust's performance for the fiscal year ended October 31, 2006. On this page and the following pages, we discuss the major factors that influenced performance. For detailed and more timely information about the Fund, please visit our Website at www.LordAbbett.com, where you also can access the quarterly commentaries by the Fund's portfolio managers.

General information about Lord Abbett mutual funds, as well as in-depth discussions of market trends and investment strategies, is also provided in Lord Abbett Insights, a newsletter accompanying your quarterly account statements. We also encourage you to call Lord Abbett at 800-821-5129 and speak to one of our professionals if you would like more information.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

From left to right: Robert S. Dow, Director and Chairman of the Lord Abbett Funds; E. Thayer Bigelow, Independent Lead Director of the Lord Abbett Funds; and Daria L. Foster, Director and President of the Lord Abbett Funds.

Best regards,

Robert S. Dow

Chairman

Q: What were the overall market conditions during the fiscal year ended October 31, 2006?

A: The stock market gained approximately 14% (including dividends), as measured by the broad S&P Composite 1500® Index,1 in the 12 months ended October 31, 2006. After a strong close to calendar year 2005, equities continued to enjoy positive momentum into the spring of 2006, before tumbling in May. The spring sell-off persisted into July, but from mid-July through October, equities rallied to multiyear highs. Pacing the market higher between November 2005 and early May 2006 were companies with relatively small capitalizations. During May's market correction, sma ll caps, as measured by the S&P SmallCap 600® Index,2 fell nearly twice (in percentage terms) as much as

1

large caps, as measured by the S&P 100® Index.3 In late July, positive momentum returned to both capitalization ranges. For the year, the small and large cap indexes finished essentially even, up about 15% (on a total return basis). Mid-capitalized companies trailed, on average, but still managed to register a total return of 12% over the period.

Sector leadership rotated much as the preference for capitalization did. Between November 2005 and August 2006, crude oil rose nearly 40% (from about $56 per barrel to roughly $77), driving up the prices of energy stocks. With inventories of petroleum plentiful and geopolitical tensions easing, the price of crude oil began to slide in August. The $0.80 per gallon decline in the cost of gasoline fueled a late-year rally in consumer discretionary stocks. In addition, the lagging technology sector rallied in the final three months of the fiscal year. Defensive sectors, such as consumer staples and health care, lagged behind the broader market in the final months of the fiscal year.

On the international side, foreign equity markets posted strong returns for the 12-month period ended October 31, 2006. The MSCI EAFE® with Net Dividends Index4 (primarily a large company index) rose 27.5%, in U.S. dollar terms, and the S&P/Citigroup Extended Market World ex-U.S. Index5 (primarily a small company index) rose 32.0%, in U.S. dollar terms, outperforming the U.S. equity markets, as measured by the S&P 500® Index,6 which rose 16.3%, in U.S. dollar terms. Developed markets, led by Europe, which made up nearly 70% of the MSCI EAFE Index (as of October 31, 2006), had a strong 12 months, with double-digit returns posted by most developed market indexes. Emerging markets also performed well: the MSCI Emerging Market with Net Dividends Index7 returned 35.0%, in U.S. dollar terms, over the period.

Despite political instability in some regions, higher oil prices, inflation concerns, and central bank interest rate increases, global equities performed well through the end of 2005 and into 2006. Continental Europe continued to benefit from solid balance sheets, domestic investments, and merger and acquisition activity. The United Kingdom was supported by the revival of the housing market, as well as its central position within the evolving European financial industry. Although Japan saw the end of deflation, new regulation in the consumer-finance industry and shrinking liquidity created a difficult environment for Japanese equities. Emerging markets experienced a sell-off during the spring when global growth concerns heightened, but have returned to favor recently as concerns dissipated and emerging markets benefited from high commodity prices and an increased risk appetite.

Performance data quoted on the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the

2

performance quoted. The investment return and principal value of an investment in the Funds will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month-end by calling Lord Abbett at 800-821-5129 or referring to our Website at www.LordAbbett.com.

Lord Abbett All Value Fund

Q: How did the All Value Fund perform over the fiscal year ended October 31, 2006?

A: The Fund returned 16.5%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 3000® Value Index,8 which returned 21.6% over the same period. The Fund's average annual total returns, which reflect performance at the maximum 5.75% sales charge applicable to Class A share investments and include the reinvestment of all distributions, are: 1 year: 9.79%, 5 years: 9.37%, and 10 years: 11.01%.

Q: What were the most significant factors affecting performance?

A: The greatest detractor from the Fund's performance relative to its benchmark for the 12-month period was the healthcare sector, followed by the financial services sector and the technology sector.

Among the most significant individual detractors were consumer discretionary holdings Pacific Sunwear of California, Inc., a nationwide mall-based specialty retail chain of stores (and the Fund's number-one individual detractor), and The Black & Decker Corp., a manufacturer of power tools and accessories, electric cleaning and lighting products, lawn and garden tools, plumbing products, and household products. (The consumer discretionary sector includes stocks in the consumer durables, apparel, media, hotel, and leisure industries.)

Other individual detractors included materials and processing sector holding Quanex Corp., a maker of specialized metal products made from carbon and alloy steel and aluminum; other sector holding 3M Co., a large, diversified company that conducts operations in electronics, telecommunications, industrial, consumer, office, healthcare, safety, and other markets; and other energy holding Halliburton Co., a provider of energy services and engineering and construction services. (The other energy sector is a category that includes oil service companies, as well as smaller exploration and production companies, and independent refiners.)

The materials and processing sector was the greatest contributor to the Fund's performance relative to its benchmark. In addition, the integrated oils sector and the other energy sector both contributed.

The Fund's number-one individual contributor and its largest holding at

3

period end was integrated oils holding ExxonMobil Corp., an operator of petroleum and petrochemicals businesses. Agricultural commodities and products company Archer-Daniels Midland also was a strong contributor.

Three other holdings were ranked within the top five contributors: utility sector holding Comcast Corp., an operator of hybrid fiber-coaxial broadband cable communications networks; consumer discretionary holding Federated Department Stores, Inc., owner of Macy's and Bloomingdale's department stores; and other sector holding Trinity Industries, Inc., a manufacturer of transportation, construction, and industrial products. (Trinity Industries, Inc. is part of the other sector owing to its size and diversification.)

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett Alpha Strategy Fund

Q: How did the Alpha Strategy Fund perform over the fiscal year ended October 31, 2006?

A: The Alpha Strategy Fund is a strategic asset allocation fund using a fund of funds approach. Assets are currently divided among Lord Abbett Developing Growth Fund, Inc., Lord Abbett Research Fund, Inc. – Small Cap Value Fund and Lord Abbett Securities Trust – International Opportunities Fund. As a result, the Alpha Strategy Fund's performance is directly related to the performance of its underlying funds.

The Alpha Strategy Fund returned 23.9%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared with its benchmark, the S&P/Citigroup Small Cap World Index,5 which returned 23.6% over the same period. The Fund's average annual total returns, which reflect performance at the maximum 5.75% sales charge applicable to Class A share investments and include the reinvestment of all distributions, are: 1 year: 16.77%, 5 years: 12.79%, and since inception (March 18, 1998): 5.74%.

Lord Abbett Developing Growth Fund Component

(Approximately 26.8% of Alpha Strategy Fund portfolio)

Q: How did the Developing Growth Fund perform over the fiscal year ended October 31, 2006?

A: The Fund returned 15.3%, reflecting performance at the net asset value (NAV) of Class Y shares with all distributions reinvested, compared with its benchmark, the Russell 2000® Growth Index,9 which returned 17.1% over the same period. The Fund's average annual total returns, which reflect performance of Class Y share investments and include the

4

reinvestment of all distributions, are: 1 year: 15.26%, 5 years: 8.28%, and since inception (December 30, 1997): 4.85%.

Q: What were the most significant factors affecting performance?

A: The materials and processing sector was the most significant detractor from the Fund's performance relative to its benchmark for the one-year period. The producer durables sector and the healthcare sector also detracted.

Among individual holdings detracting from performance were materials and processing company Century Aluminum Co., an aluminum producer, and healthcare company Nektar Therapeutics, a developer of pharmaceutical products based on its proprietary drug delivery technologies.

Other individual stocks among the top detractors were consumer discretionary holdings Netflix, an online movie rental service, and the Fund's largest individual detractor. (The consumer discretionary sector includes stocks in the consumer durables, apparel, media, hotel, and leisure industries.) Also detracting from performance were technology holdings Monolithic Power Systems, an analog and mixed-signal semiconductor company, and LivePerson, Inc., a provider of software applications for retailers.

The greatest contributor to the Fund's relative performance was the financial services sector. Other sectors that were significant contributors were the consumer discretionary sector and the consumer staples sector.

Among individual holdings contributing to the Fund's performance were financial services holdings Intercontinental Exchange Inc. (the Fund's number-one contributor and its second largest holding at period end), which owns and operates an electronic commodities trading platform, and International Securities Exchange Holdings, Inc., which operates a fully electronic securities exchange for equity options.

Other stocks contributing to the Fund's performance were technology holding WebEx Communications Inc., a provider of real time, interactive multimedia communications services for Websites; healthcare holding Hologic, Inc., a maker of mammography and breast biopsy systems; and consumer discretionary holding Zumiez, Inc., a specialty retailer of action sports related apparel, footwear, equipment, and accessories for teenagers.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

5

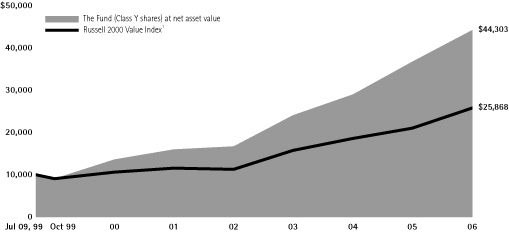

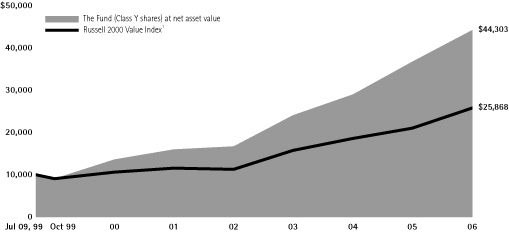

Lord Abbett Small Cap Value Fund Component

(Approximately 26.5% of Alpha Strategy Fund portfolio)

Q: How did the Small Cap Value Fund perform over the fiscal year ended October 31, 2006?

A: The Fund returned 24.4%, reflecting performance at the net asset value (NAV) of Class Y shares with all distributions reinvested, compared with its benchmark, the Russell 2000® Value Index,10 which returned 22.9% over the same period. The Fund's average annual total returns, which reflect performance of Class Y share investments and include the reinvestment of all distributions, are: 1 year: 24.41%, 5 years: 19.10%, and since inception (December 30, 1997): 14.02%.

Q: What were the most significant factors affecting performance?

A: The greatest contributor to the Fund's performance relative to its benchmark for the 12-month period was the other energy sector. (This sector includes oil service companies, as well as smaller exploration and production companies, and independent refiners.) The Fund also benefited from its overall overweight position in the other sector, which includes larger, diversified corporations.

Five other individual holdings were top contributors: technology holding Anixter International Inc. (the Fund's number-one contributor and its largest holding), a distributor of communications and specialty wire and cable products; other sector holding Trinity Industries, Inc., a manufacturer of transportation, construction, and industrial products; and materials and processing holdings Steel Dynamics, Inc., an operator of a flat-rolled steel mini-mill, as well as a cold mill; Carpenter Technology Corp., a maker of stainless steels, titanium, and specialty metal alloys; and Rogers Corp., a manufacturer of specialty materials and components for applications in the communications, computer, imaging, consumer, and transportation markets.

The biggest detractor from the Fund 's relative performance was the consumer discretionary sector. (The consumer discretionary sector includes stocks in the consumer durables, apparel, media, hotel, and leisure industries.) The integrated oils sector also was a significant detractor from the Fund's performance relative to its benchmark, as the Fund was hurt by its overall underweight position in this sector.

Among individual holdings detracting from performance were consumer discretionary company Pacific Sunwear of California, Inc. (the Fund's number-one individual detractor), which operates a nationwide mall-based specialty retail chain of stores; Eddie Bauer Holdings, Inc., a retailer of casual clothing, accessories, and home furnishings through retail stores

6

and catalogs; and DynCorp International Inc., a provider of a range of mission-critical outsourced technical services to civilian and military government agencies and commercial customers.

Other individual holdings detracting from performance were materials and processing holdings Simpson Manufacturing Co., Inc., a maker of wood-to-wood, wood-to-concrete, and wood-to-masonry connectors and shearwalls, and Quanex Corp., a manufacturer of specialized metal products made from carbon, alloy steel, and aluminum.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett International Opportunities Fund Component

(Approximately 45.3% of Alpha Strategy Fund portfolio)

Q: How did the International Opportunities Fund perform over the fiscal year ended October 31, 2006?

A: The Fund returned 31.7%, reflecting performance at the net asset value (NAV) of Class Y shares with all distributions reinvested, compared with its benchmark, the S&P/Citigroup Extended Market World ex-U.S. Index, which returned 32.0% over the same period. The Fund's average annual total returns, which reflect performance of Class Y shares and include the reinvestment of all distributions, are: 1 year: 31.70%, 5 years: 16.03%, and since inception (December 30, 1997): 5.42%.

See discussion about Lord Abbett International Opportunities Fund on page 8.

Lord Abbett International Core Equity Fund

Q: How did the International Core Equity Fund perform over the fiscal year ended October 31, 2006?

A: The Fund returned 26.9%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared with its benchmark, the MSCI EAFE® with Net Dividends Index, which returned 27.5% over the same period. The Fund's average annual total returns, which reflect performance at the maximum 5.75% sales charge applicable to Class A share investments and include the reinvestment of all distributions, are: 1 year: 19.60% and since inception (December 31, 2003): 14.22%.

Q: What were the most significant factors affecting performance?

A: The materials sector was the greatest detractor from the Fund's performance relative to its benchmark. The Fund's underweight position in the materials sector also was a negative factor. Other sectors that detracted from the Fund's

7

relative performance were the utilities sector (owing to the Fund's underweight position) and the industrials sector.

Five holdings that ranked among the Fund's largest absolute detractors included materials holding Wacker Chemie AG, a manufacturer of various chemical products worldwide; telecommunications services holdings MTN Group Ltd. (the Fund's number-one individual detractor), an investment holding company that operates a GSM cellular telephone network in South Africa and provides related services, and Mobile Telesystems, a provider of mobile telephone services in Russia and the former Soviet Union; and two financials holdings: Aiful Corp., a Japanese consumer financing firm, and Takefuki Corp., a Japanese consumer loan company.

The strongest contributor to the Fund's performance relative to its benchmark for the one-year period was the energy sector, followed by the information technology sector and the consumer staples sector.

Two of the Fund's top individual contributors were financials holdings: BNP Paribas (the Fund's number-one contributor and its largest holding at period end), which attracts deposits and offers advisory and capital markets, specialized financing, and corporate banking services, and ING Groep, a global financial services company of Dutch origin that provides a wide array of banking, insurance, and asset management services.

Among other holdings contributing to performance were telecommunications services holding Millicom International Cellular S.A., which supplies cellular telephone systems worldwide; healthcare holding Fresenius Medical Care AG & Co., which offers kidney dialysis services and manufactures and distributes equipment and products used in the treatment of dialysis patients; and industrials holding BAE Systems plc, a developer of advanced defense and aerospace systems.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett International Opportunities Fund

Q: How did the International Opportunities Fund perform over the fiscal year ended October 31, 2006?

A: The Fund returned 31.3%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared with its benchmark, the S&P/Citigroup Extended Market World ex-U.S. Index, which returned 32.0% over the same period. The Fund's average annual total returns, which reflect

8

performance at the maximum 5.75% sales charge applicable to Class A share investments and include the reinvestment of all distributions, are: 1 year: 23.78%, 5 years: 14.36%, and since inception (December 13, 1996): 5.81%.

Q: What were the most significant factors affecting performance?

A: The materials sector was the greatest detractor from the Fund's performance relative to its benchmark. Stock selection in this sector, as well as an overweight position, took away from performance. The other asset sector also significantly detracted from the Fund's relative performance, as did the financial services sector.

Among individual holdings that detracted from performance were financials sector holdings Vivacon AG, a German real estate firm that buys and sells apartment buildings; London-based Kensington Group plc, an investment holding company; and The Thai Military Bank Public Company Ltd.

Also disappointing were healthcare holding Miraca Holdings, Inc., a Japanese manufacturer, as well as importer and exporter of clinical reagents, medical drugs, and medical equipment, and Sinolink Worldwide Holdings Ltd., a China-based conglomerate with holdings in power generation, city gas distribution and real estate development (and the Fund's number-one individual detractor).

The information technology sector was the greatest contributor to the Fund's performance relative to its benchmark for the one-year period. Other areas that contributed were the industrials sector and the utilities sector.

Among the individual holdings in the information technology sector contributing to performance were CSR Plc (the Fund's number-one individual contributor), a maker of single-chip radio devices focused on solutions for the 2.4 GHz Bluetooth personal area networking standard headquartered in the United Kingdom, and AAC Acoustic Technology Holdings Inc., a Hong Kong-based manufacturer of miniature acoustic components, which are used in mobile handsets, MP3 players, and other consumer handheld devices.

In the utilities sector, AWG plc, which offers utility infrastructure maintenance services in Europe, South America, and Asia, was a solid contributor.

Two financials holdings that also aided Fund performance were Piraeus Bank, a large, aggressively expanding Greek bank with about 270 branches, including one in London, and subsidiaries in New York and the Balkans, and Unibanco–Uniao de Bancos Brasileiros S.A., a Brazilian-based bank that attracts deposits and offers retail, commercial, and investment banking services.

9

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett Large Cap Value Fund

Q: How did the Large Cap Value Fund perform over the fiscal year ended October 31, 2006?

A: The Fund returned 18.4%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared with its benchmark, the Russell 1000® Value Index,11 which returned 21.5% over the same period. The Fund's average annual total returns, which reflect performance at the maximum 5.75% sales charge applicable to Class A share investments and include the reinvestment of all distributions, are: 1 year: 11.55% and since inception (June 30, 2003): 11.47%.

Q: What were the most significant factors affecting performance?

A: The healthcare sector was the greatest detractor from the Fund's performance relative to its benchmark for the one-year period. Other sectors that detracted from the Fund's performance relative to its benchmark were the financial services sector and the consumer discretionary sector. (The consumer discretionary sector includes stocks in the consumer durables, apparel, media, hotel, and leisure industries.)

Among the individual holdings within the healthcare sector that detracted from Fund performance were Boston Scientific Corp. (the Fund's number-one individual detractor), a maker of minimally invasive medical devices used to diagnose and treat a wide range of medical problems; Medtronic, Inc., a provider of device-based therapies that restore health, extend life, and alleviate pain; Teva Pharmaceuticals, a developer of generic and branded human pharmaceuticals and active pharmaceutical ingredients; and MedImmune, Inc., a supplier of products that address medical needs in areas such as infectious diseases, transplantation medicine, autoimmune diseases, and cancer.

In addition, technology holding Microsoft Corp., which develops, manufactures, licenses, sells, and supports software products, also was a detractor.

The other energy sector was the strongest contributor to the Fund's performance relative to its benchmark. (This sector includes oil service companies, as well as smaller exploration and production companies, and independent refiners.) Other contributing sectors were utilities and producer durables.

10

Among the individual holdings that contributed to the Fund's performance were integrated oils holding ExxonMobil Corp. (the Fund's number-one contributor and its largest holding), which operates petroleum and petrochemicals businesses on a worldwide basis, and other energy sector holding Schlumberger Ltd., an oil services company. Other contributing holdings included utilities sector holdings AT&T, a communications services company; Comcast Corp., a cable communications provider; and BellSouth Corp., a supplier of telecommunications services, systems, and products.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett Value Opportunities Fund

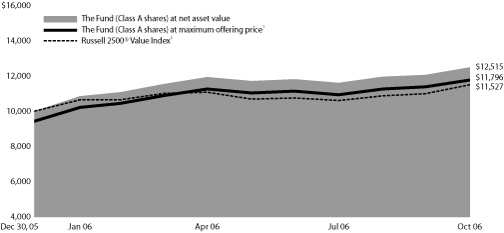

(The Lord Abbett Value Opportunities Fund began operations on December 20, 2005.)

Q: How did the Value Opportunities Fund perform over the 10-month period ended October 31, 2006?

A: The Fund returned 25.2%, reflecting the performance at the net asset value (NAV) of Class A shares with all distributions reinvested for the 10-month period ended October 31, 2006, compared with its benchmark, the Russell 2500® Value Index,12 which returned 15.3% for the same period. The Fund's average annual total return, which reflects performance at the maximum 5.75% sales charge applicable to Class A share investments and includes the reinvestment of all distributions, since December 30, 2005 is 17.93%.

Q: What were the most significant factors affecting performance?

A: The greatest contributor to the Fund's performance relative to its benchmark for the 10-month period was the technology sector. Also contributing were the materials and processing sector and the producer durables sector.

Among the individual holdings that contributed to the Fund's performance were technology holdings Anixter International Inc. (the Fund's number-one contributor and its largest holding), a distributor of communications and specialty wire and cable products, and CommScope, Inc., a manufacturer of coaxial cables and other high-performance electronic and fiberoptic cable products primarily for communication applications. Other individual holdings that contributed to performance were materials and processing holding Steel Dynamics, Inc., an operator of a flat-rolled steel mini-mill, as well as a cold mill; producer durables holding Ladish Co., Inc., a maker of forged and cast-metal components for a variety

11

of load-bearing and fatigue-resisting applications in the jet engine, aerospace, and industrial markets; and Trinity Industries, Inc., a manufacturer of transportation, construction, and industrial products. (Trinity is classified in the other sector, which includes larger, diversified corporations.)

The healthcare sector was the greatest detractor from the Fund's performance relative to its benchmark. Also detracting were the utilities sector and the integrated oils sector.

Among the individual holdings in the healthcare sector that detracted from performance were Pharmanet Development Group, Inc., a contract research organization that conducts clinical research and provides drug development services, and Omnicare, Inc., a provider of professional pharmacy, related consulting, and data management services.

Other individual holdings that detracted from performance were technology company Benchmark Electronic, Inc., a supplier of contract electronics manufacturing and design services; producer durables holding TAL International Group, Inc., an intermodal container leasing dealer; and consumer discretionary holding DynCorp International Inc., which provides a range of mission-critical outsourced technical services to civilian and military government agencies and commercial customers. (The consumer discretionary sector includes stocks in the consumer durables, apparel, media, hotel, and leisure industries.)

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Note: Class A shares purchased with a front-end sales charge have no contingent deferred sales charge (CDSC). However, certain purchases of Class A shares made without a front-end sales charge may be subject to a CDSC of 1% if the shares are redeemed within 12 months of the purchase (24 months if shares were purchased prior to November 1, 2004). Please see section "Your Investment – Purchases" in each Fund's prospectus for more information on redemptions that may be subject to a CDSC.

12

A prospectus contains important information about a fund, including its investment objectives, risks, charges, and ongoing expenses, which an investor should carefully consider before investing. To obtain a prospectus for any Lord Abbett mutual fund, please contact your investment professional or Lord Abbett Distributor LLC at 800-874-3733 or visit our Website at www.LordAbbett.com. Read the prospectus carefully before investing.

1 The S&P Composite 1500® Index combines the S&P 500®, S&P MidCap 400®, and S&P SmallCap 600® indexes, and is an efficient way to create a broad market portfolio representing 90% of U.S. equities.

2 The S&P SmallCap 600® Index is a widely accepted benchmark due to its low turnover and greater liquidity.

3 The S&P 100® Index is a market capitalization-weighted index made up of 100 major, blue-chip stocks across diverse industry groups.

4 The MSCI EAFE® with Net Dividends Index is an unmanaged index that reflects the stock markets of 22 countries, including Europe, Australasia, and the Far East, with values expressed in U.S. dollars. The MSCI EAFE with Net Dividends Index approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to nonresident individuals who do not benefit from double taxation treaties. MSCI uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates.

5 S&P/Citigroup Global Equity Index SystemSM and the names of each of the indexes and subindexes that it comprises (GEIS and such indexes and subindexes, each an "Index" and collectively, the "Indexes") are service marks of Citigroup. The S&P/Citigroup Small Cap World Index is a subset of the Global Citigroup Broad Market Index (BMI). The S&P/Citigroup Extended Market World ex-U.S. Index is a subset of the Global Citigroup Extended Market Index (EMI).

6 The S&P 500® Index is widely regarded as the standard for measuring large cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

7 The MSCI Emerging Markets with Net Dividends Index reflects approximately 60% of the market capitalization, by industry, in each of the 26 emerging market countries.

8 The Russell 3000® Value Index measures the performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values. The stocks in this index are also members of either the Russell 1000® Value or the Russell 2000® Value indexes.

9 The Russell 2000® Growth Index measures the performance of those Russell 2000® Index companies with higher price-to-book ratios and higher forecasted growth values.

10 The Russell 2000® Value Index measures the performance of those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values.

11 The Russell 1000® Value Index measures the performance of those Russell 1000® Index companies with lower price-to-book ratios and lower forecasted growth values.

12 The Russell 2500® Value Index measures the performance of those Russell 2500® Index companies with lower price-to-book ratios and lower forecasted growth values.

Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

The views of the Funds' management and the portfolio holdings described in this report are as of October 31, 2006; these views and portfolio holdings may have changed subsequent to this date, and they do not guarantee the future performance of the markets or the Funds. Information provided in this report should not be considered a recommendation to purchase or sell securities.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with the Funds, please see each Fund's prospectus.

Performance: Because of ongoing market volatility, fund performance may be subject to substantial fluctuation. Except where noted, comparative fund performance does not account for the deduction of sales charges and would be different if sales charges were included. The Funds offer additional classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see each Fund's prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

13

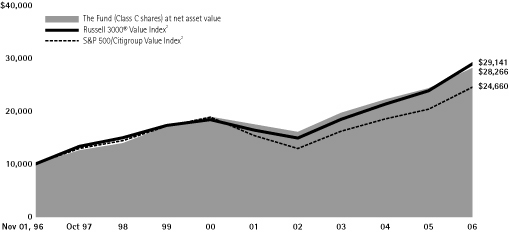

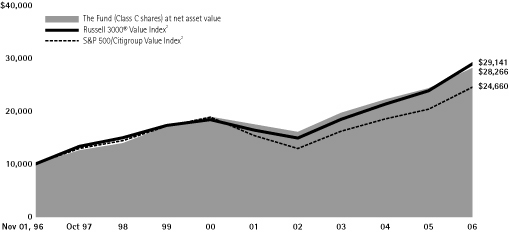

All Value Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class C shares with the same investment in the Russell 3000® Value Index, and S&P 500/Citigroup Value Index1 assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance i s no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2006

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A3 | | | 9.79 | % | | | 9.37 | % | | | 11.01 | % | | | — | | |

| Class B4 | | | 11.68 | % | | | 9.83 | % | | | — | | | | 9.76 | % | |

| Class C5 | | | 15.64 | % | | | 9.98 | % | | | 10.95 | % | | | — | | |

| Class P6 | | | 16.36 | % | | | 10.56 | % | | | — | | | | 8.08 | % | |

| Class Y7 | | | 16.87 | % | | | — | | | | — | | | | 19.17 | % | |

1 The S&P 500/Citigroup Value Index was formerly named S&P 500/Barra Value Index which recently experienced some adjustments in the methodology used for performance reporting purposes.

2 Performance for each unmanaged index does not reflect any transaction costs, management fees or sales charges. The performance of each index is not necessarily representative of the Fund's performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A Shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2006, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on June 5, 1997. Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years, and 0% for the life of the class.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class P shares commenced operations on August 15, 2001. Performance is at net asset value.

7 Class Y shares commenced operations on March 31, 2003. Performance is at net asset value.

14

Alpha Strategy Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the S&P/Citigroup Small-Cap World Index and Lipper Global Small/Mid-Cap Core Funds Average assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2006

| | | 1 Year | | 5 Years | | Life of Class | |

| Class A3 | | | 16.77 | % | | | 12.79 | % | | | 5.74 | % | |

| Class B4 | | | 19.12 | % | | | 13.29 | % | | | 5.78 | % | |

| Class C5 | | | 23.12 | % | | | 13.44 | % | | | 5.78 | % | |

| Class Y6 | | | 24.32 | % | | | — | | | | 23.50 | % | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index and average does not reflect transaction costs, management fees or sales charges. The performance of each index and average is not necessarily representative of the Fund's performance. Performance for each index and average begins on March 31, 1998.

3 Class A shares commenced operations on March 18, 1998. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A Shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2006, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on March 18, 1998. Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years, and 0% for the life of the class.

5 Class C shares commenced operations on March 18, 1998. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class Y shares commenced operations on October 19, 2004. Performance is at net asset value.

15

International Core Equity Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Morgan Stanley Capital International (MSCI) Europe, Australasia, Far East (EAFE®) Index ("With Gross Dividends") and the MSCI EAFE® Index ("With Net Dividends"), assuming reinvestment of all dividends and distributions. "With Net Dividends" reflects a reduction in dividends after taking into account withholding of taxes by certain foreign countries represented in the MSCI EAFE® Index. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future re sults.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2006

| | | 1 Year | | Life of Class | |

| Class A3 | | | 19.60 | % | | | 14.22 | % | |

| Class B4 | | | 21.98 | % | | | 15.08 | % | |

| Class C5 | | | 25.98 | % | | | 15.89 | % | |

| Class P6 | | | 26.69 | % | | | 16.52 | % | |

| Class Y7 | | | 27.26 | % | | | 17.04 | % | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of each index is not necessarily representative of the Fund's performance. Performance of each index begins on December 31, 2003.

3 Class A shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2006, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. Performance reflects the deduction of a CDSC of 4% for 1 year and 3% for the life of the class.

5 Class C shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class P shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. Performance is at net asset value.

7 Class Y shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. Performance is at net asset value.

16

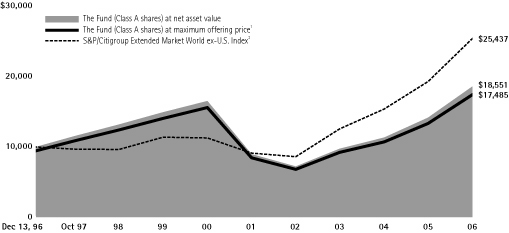

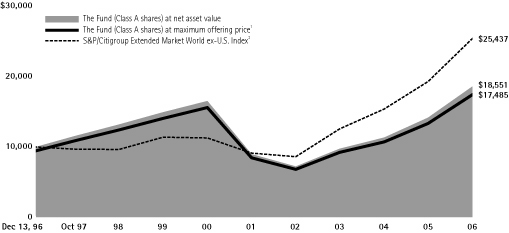

International Opportunities Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the S&P/Citigroup Extended Market World ex-U.S. Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2006

| | | 1 Year | | 5 Years | | Life of Class | |

| Class A3 | | | 23.78 | % | | | 14.36 | % | | | 5.81 | % | |

| Class B4 | | | 26.46 | % | | | 14.77 | % | | | 5.11 | % | |

| Class C5 | | | 30.42 | % | | | 15.12 | % | | | 5.17 | % | |

| Class P6 | | | 31.21 | % | | | 15.74 | % | | | 4.20 | % | |

| Class Y7 | | | 31.70 | % | | | 16.03 | % | | | 5.42 | % | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for the unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of the index is not necessarily representative of the Fund's performance. Performance for the index begins on December 31, 1996.

3 Class A shares commenced operations on December 13, 1996. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2006 is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on June 2, 1997. Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years, and 0% for the life of the class.

5 Class C shares commenced operations on June 2, 1997. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class P shares commenced operations on March 8, 1999. Performance is at net asset value.

7 Class Y shares commenced operations on December 30, 1997. Performance is at net asset value.

17

Large-Cap Value Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 1000® Value Index and the S&P 500/Citigroup Value Index1, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performan ce is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2006

| | | 1 Year | | Life of Class | |

| Class A4 | | | 11.55 | % | | | 11.47 | % | |

| Class B5 | | | 13.65 | % | | | 11.97 | % | |

| Class C6 | | | 17.58 | % | | | 12.69 | % | |

| Class P7 | | | 18.23 | % | | | 13.33 | % | |

| Class Y8 | | | 18.83 | % | | | 13.86 | % | |

1 The S&P 500/Citigroup Value Index was formerly named S&P 500/Barra Value Index which recently experienced some adjustments in the methodology used for performance reporting purposes.

2 Reflects the deduction of the maximum initial sales charge of 5.75%.

3 Performance for each unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of each index is not necessarily representative of the Fund's performance. Performance for each index begins on June 30, 2003.

4 Class A shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2006, is calculated using the SEC-required uniform method to compute such return.

5 Class B shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. Performance reflects the deduction of a CDSC of 4% for 1 year, and 3% for the life of the class.

6 Class C shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

7 Class P shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. Performance is at net asset value.

8 Class Y shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. Performance is at net asset value.

18

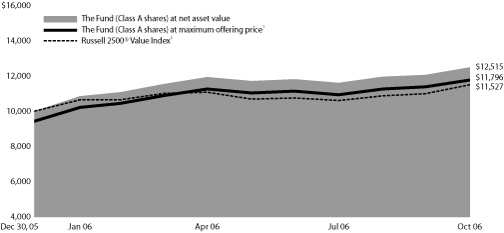

Value Opportunities Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 2500® Value Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2006

| | | Life of Class | |

| Class A3 | | | 17.93 | % | |

| Class B4 | | | 19.70 | % | |

| Class C5 | | | 23.70 | % | |

| Class P6 | | | 25.08 | % | |

| Class Y7 | | | 25.58 | % | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for the unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of the index is not necessarily representative of the Fund's performance. Performance for the index begins on December 30, 2005.

3 Class A shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins on December 30, 2005. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2006, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins on December 30, 2005. Performance reflects the deduction of a CDSC of 5% for the life of Class.

5 Class C shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins on December 30, 2005. Performance reflects a 1% CDSC for Class C shares for life of Class.

6 Class P shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins December 30, 2005. Performance is at net asset value.

7 Class Y shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins December 30, 2005. Performance is at net asset value.

19

Expense Examples

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2006 through October 31, 2006).

Actual Expenses

For each class of each Fund, the first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled "Expenses Paid During the Period 5/1/06 – 10/31/06" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

20

All Value Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/06 | | 10/31/06 | | 5/1/06 –

10/31/06 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,010.80 | | | $ | 5.83 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.40 | | | $ | 5.85 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,007.20 | | | $ | 9.11 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.12 | | | $ | 9.15 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,007.20 | | | $ | 9.11 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.12 | | | $ | 9.15 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,010.10 | | | $ | 6.33 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.89 | | | $ | 6.36 | | |

| Class Y | |

| Actual | | $ | 1,000.00 | | | $ | 1,012.30 | | | $ | 4.06 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.16 | | | $ | 4.08 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.15% for Class A, 1.80% for Classes B and C, 1.25% for Class P and 0.80% for Class Y) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period).

Portfolio Holdings Presented by Sector

October 31, 2006

| Sector* | | %** | |

| Auto & Transportation | | | 1.32 | % | |

| Consumer Discretionary | | | 8.75 | % | |

| Consumer Staples | | | 10.34 | % | |

| Financial Services | | | 14.13 | % | |

| Healthcare | | | 9.15 | % | |

| Integrated Oils | | | 6.22 | % | |

| Materials & Processing | | | 10.20 | % | |

| Sector* | | %** | |

| Other | | | 7.99 | % | |

| Other Energy | | | 1.19 | % | |

| Producer Durables | | | 5.88 | % | |

| Technology | | | 9.88 | % | |

| Utilities | | | 9.96 | % | |

| Short-Term Investment | | | 4.99 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

21

Alpha Strategy Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/06 | | 10/31/06 | | 5/1/06 –

10/31/06 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 974.50 | | | $ | 1.74 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.44 | | | $ | 1.79 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 971.40 | | | $ | 4.97 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.15 | | | $ | 5.09 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 971.00 | | | $ | 4.97 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.18 | | | $ | 5.09 | | |

| Class Y | |

| Actual | | $ | 1,000.00 | | | $ | 975.80 | | | $ | 0.00 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,025.21 | | | $ | 0.00 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.35% for Class A, 1.00% for Classes B and C, and 0.00% for Class Y) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period).

Portfolio Holdings Presented by Investment Objective

October 31, 2006

| Investment Objective | | %* | |

| Long Term Growth of Capital** | | | 26.84 | % | |

| Long Term Capital Appreciation** | | | 71.78 | % | |

| Short-Term Investment | | | 1.38 | % | |

| Total | | | 100.00 | % | |

* Represents percent of total investments.

** Alpha Strategy Fund invests in other funds ("Underlying Funds") managed by Lord, Abbett & Co. LLC. The category shown represents the investment objective of these Underlying Funds.

22

International Core Equity Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/06 | | 10/31/06 | | 5/1/06 –

10/31/06 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,018.00 | | | $ | 7.88 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.39 | | | $ | 7.88 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,014.90 | | | $ | 11.17 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,014.12 | | | $ | 11.17 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,014.90 | | | $ | 11.17 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,014.12 | | | $ | 11.17 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,018.10 | | | $ | 8.39 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.90 | | | $ | 8.39 | | |

| Class Y | |

| Actual | | $ | 1,000.00 | | | $ | 1,020.00 | | | $ | 6.11 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.14 | | | $ | 6.11 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.55% for Class A, 2.20% for Classes B and C, 1.65% for Class P and 1.20% for Class Y) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period).

Portfolio Holdings Presented by Sector

October 31, 2006

| Sector* | | %** | |

| Consumer Discretionary | | | 11.92 | % | |

| Consumer Staples | | | 10.07 | % | |

| Energy | | | 3.86 | % | |

| Financials | | | 32.60 | % | |

| Healthcare | | | 8.00 | % | |

| Industrials | | | 14.46 | % | |

| Sector* | | %** | |

| Information Technology | | | 3.87 | % | |

| Materials | | | 2.30 | % | |

| Telecommunication Services | | | 7.57 | % | |

| Utilities | | | 2.82 | % | |

| Short-Term Investment | | | 2.53 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

23

International Opportunities Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/06 | | 10/31/06 | | 5/1/06 –

10/31/06 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 990.50 | | | $ | 8.28 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.90 | | | $ | 8.39 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 986.90 | | | $ | 11.52 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,013.64 | | | $ | 11.67 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 987.50 | | | $ | 11.52 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,013.63 | | | $ | 11.67 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 990.00 | | | $ | 8.83 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.33 | | | $ | 8.94 | | |

| Class Y | |

| Actual | | $ | 1,000.00 | | | $ | 992.00 | | | $ | 6.53 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.65 | | | $ | 6.61 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.65% for Class A, 2.30% for Classes B and C, 1.76% for Class P and 1.30% for Class Y) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period).

Portfolio Holdings Presented by Sector

October 31, 2006

| Sector* | | %** | |

| Basic Materials | | | 8.86 | % | |

| Consumer Cyclicals | | | 16.92 | % | |

| Consumer Non-Cyclicals | | | 7.62 | % | |

| Div. Financials | | | 5.73 | % | |

| Energy | | | 4.92 | % | |

| Healthcare | | | 5.51 | % | |

| Ind. Goods & Services | | | 19.16 | % | |

| Non-Property Financials | | | 16.13 | % | |

| Sector* | | %** | |

| Property and Property | |

| Services | | | 3.59 | % | |

| Technology | | | 3.13 | % | |

| Telecommunications | | | 2.47 | % | |

| Transportation | | | 1.31 | % | |

| Utilities | | | 2.46 | % | |

| Short-Term Investment | | | 2.19 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

24

Large-Cap Value Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/06 | | 10/31/06 | | 5/1/06 –

10/31/06 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,055.80 | | | $ | 4.92 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.42 | | | $ | 4.84 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,052.00 | | | $ | 8.28 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.16 | | | $ | 8.13 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,052.00 | | | $ | 8.28 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.15 | | | $ | 8.13 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,055.00 | | | $ | 5.44 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.92 | | | $ | 5.35 | | |

| Class Y | |

| Actual | | $ | 1,000.00 | | | $ | 1,057.80 | | | $ | 3.11 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,022.18 | | | $ | 3.06 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.95% for Class A, 1.60% for Classes B and C, 1.05% for Class P and 0.60% for Class Y) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period).

Portfolio Holdings Presented by Sector

October 31, 2006

| Sector* | | %** | |

| Auto & Transportation | | | 1.06 | % | |

| Consumer Discretionary | | | 6.60 | % | |

| Consumer Staples | | | 14.50 | % | |

| Financial Services | | | 18.91 | % | |

| Healthcare | | | 15.25 | % | |

| Integrated Oils | | | 4.99 | % | |

| Materials & Processing | | | 6.33 | % | |

| Sector* | | %** | |

| Other | | | 2.78 | % | |

| Other Energy | | | 1.98 | % | |

| Producer Durables | | | 3.61 | % | |

| Technology | | | 4.13 | % | |

| Utilities | | | 13.06 | % | |

| Short-Term Investment | | | 6.80 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

25

Value Opportunities Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/06 | | 10/31/06 | | 5/1/06 –

10/31/06 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,045.40 | | | $ | 6.70 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.67 | | | $ | 6.61 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,043.00 | | | $ | 10.04 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,015.39 | | | $ | 9.91 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,043.00 | | | $ | 10.04 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,015.36 | | | $ | 9.91 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,045.50 | | | $ | 7.22 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.14 | | | $ | 7.12 | | |

| Class Y | |

| Actual | | $ | 1,000.00 | | | $ | 1,047.90 | | | $ | 4.90 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.44 | | | $ | 4.84 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.30% for Class A, 1.95% for Classes B and C, 1.40% for Class P and 0.95% for Class Y) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period).

Portfolio Holdings Presented by Sector

October 31, 2006

| Sector* | | %** | |

| Auto & Transportation | | | 1.17 | % | |

| Consumer Discretionary | | | 9.84 | % | |

| Consumer Staples | | | 4.20 | % | |

| Financial Services | | | 11.52 | % | |

| Healthcare | | | 4.25 | % | |

| Integrated Oils | | | 1.54 | % | |

| Materials & Processing | | | 20.57 | % | |

| Sector* | | %** | |

| Other | | | 2.82 | % | |

| Other Energy | | | 1.76 | % | |

| Producer Durables | | | 8.98 | % | |

| Technology | | | 16.38 | % | |

| Utilities | | | 5.28 | % | |

| Short-Term Investment | | | 11.69 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

26

Schedule of Investments

ALL VALUE FUND October 31, 2006

| Investments | | Shares | | Value

(000) | |

| COMMON STOCKS 95.59% | |

| Advertising Agency 0.57% | |

| R.H. Donnelley Corp.* | | | 300,000 | | | $ | 18,066 | | |

| Aerospace 0.28% | |

| Curtiss-Wright Corp. | | | 66,900 | | | | 2,264 | | |

| Moog Inc. Class A* | | | 176,000 | | | | 6,565 | | |

| Total | | | | | | | 8,829 | | |

| Banks 5.51% | |

| Bank of America Corp. | | | 485,086 | | | | 26,132 | | |

Bank of New York

Co., Inc. (The) | | | 690,000 | | | | 23,715 | | |

Cullen/Frost Bankers,

Inc. | | | 925,000 | | | | 50,098 | | |

| Marshall & Ilsley Corp. | | | 835,000 | | | | 40,030 | | |

| Popular, Inc. | | | 825,300 | | | | 15,012 | | |

| SunTrust Banks, Inc. | | | 234,600 | | | | 18,531 | | |

| Total | | | | | | | 173,518 | | |

| Beverage: Brewers 0.97% | |

Anheuser-Busch Cos.,

Inc. | | | 645,000 | | | | 30,586 | | |

| Beverage: Soft Drinks 2.19% | |

| PepsiCo, Inc. | | | 1,085,000 | | | | 68,832 | | |

| Chemicals 3.17% | |

| Cabot Corp. | | | 633,700 | | | | 25,063 | | |

| Eastman Chemical Co. | | | 209,000 | | | | 12,732 | | |

| Praxair, Inc. | | | 817,100 | | | | 49,230 | | |

| Rohm & Haas Co. | | | 244,200 | | | | 12,655 | | |

| Total | | | | | | | 99,680 | | |

| Communications & Media 0.21% | |

| Time Warner Inc. | | | 331,300 | | | | 6,629 | | |

| Communications Technology 3.34% | |

| Anixter Int'l., Inc.* | | | 547,700 | | | | 32,731 | | |

| Avaya, Inc.* | | | 186,400 | | | | 2,388 | | |

| McAfee, Inc.* | | | 1,340,000 | | | | 38,766 | | |

| Investments | | Shares | | Value

(000) | |

Symbol Technologies,

Inc. | | | 421,000 | | | $ | 6,286 | | |

| Tellabs, Inc.* | | | 2,375,054 | | | | 25,033 | | |

| Total | | | | | | | 105,204 | | |

Computer Services, Software &

Systems 1.31% | |

Cadence Design

Systems, Inc.* | | | 2,300,000 | | | | 41,078 | | |

| Computer Technology 2.35% | |

| Sun Microsystems, Inc.* | | | 5,850,000 | | | | 31,766 | | |

Zebra Technologies

Corp. Class A* | | | 1,130,000 | | | | 42,115 | | |

| Total | | | | | | | 73,881 | | |

| Consumer Electronics 0.33% | |

Harman Int'l.

Industries, Inc. | | | 100,000 | | | | 10,235 | | |

| Consumer Products 0.09% | |

Int'l. Flavors &

Fragrances Inc. | | | 66,200 | | | | 2,812 | | |

Containers & Packaging: Metal &

Glass 0.31% | |

| Crown Holdings, Inc.* | | | 495,600 | | | | 9,634 | | |

Containers & Packaging: Paper &

Plastic 0.52% | |

| Sonoco Products Co. | | | 460,000 | | | | 16,321 | | |

| Diversified Financial Services 0.99% | |

| Citigroup, Inc. | | | 619,800 | | | | 31,089 | | |

| Diversified Manufacturing 0.76% | |

| Ball Corp. | | | 442,700 | | | | 18,412 | | |

| Hexcel Corp.* | | | 345,000 | | | | 5,586 | | |

| Total | | | | | | | 23,998 | | |

| Drug & Grocery Store Chains 1.49% | |

| Kroger Co. (The) | | | 2,091,300 | | | | 47,033 | | |

See Notes to Financial Statements.

27

Schedule of Investments (continued)

ALL VALUE FUND October 31, 2006

| Investments | | Shares | | Value

(000) | |

| Drugs & Pharmaceuticals 8.65% | |

| Abbott Laboratories | | | 960,000 | | | $ | 45,610 | | |

GlaxoSmithKline

plc ADR | | | 603,371 | | | | 32,129 | | |

Mylan Laboratories,

Inc. | | | 2,000,000 | | | | 41,000 | | |

| Novartis AG ADR | | | 1,125,000 | | | | 68,321 | | |

| Pfizer, Inc. | | | 185,700 | | | | 4,949 | | |

| Schering-Plough Corp. | | | 805,000 | | | | 17,823 | | |

Teva Pharmaceutical

Industries Ltd. ADR | | | 425,000 | | | | 14,012 | | |

| Wyeth | | | 950,266 | | | | 48,492 | | |

| Total | | | | | | | 272,336 | | |

| Electrical Equipment & Components 2.76% | |

| AMETEK, Inc. | | | 182,500 | | | | 8,519 | | |

Cooper Industries

Ltd. Class A | | | 417,440 | | | | 37,340 | | |

| Emerson Electric Co. | | | 485,996 | | | | 41,018 | | |

| Total | | | | | | | 86,877 | | |

| Electronics 1.78% | |

| AVX Corp. | | | 1,895,200 | | | | 29,868 | | |

Vishay Intertechnology,

Inc.* | | | 1,927,600 | | | | 26,003 | | |

| Total | | | | | | | 55,871 | | |

| Electronics: Technology 1.16% | |

| General Dynamics Corp. | | | 515,000 | | | | 36,617 | | |

Financial Data Processing Services &

Systems 1.21% | |

Automatic Data

Processing, Inc. | | | 625,300 | | | | 30,915 | | |

| Jack Henry & Assoc. Inc. | | | 333,800 | | | | 7,274 | | |

| Total | | | | | | | 38,189 | | |

| Foods 2.01% | |

| Campbell Soup Co. | | | 977,000 | | | | 36,520 | | |

| Kraft Foods Inc. Class A | | | 780,000 | | | | 26,832 | | |

| Total | | | | | | | 63,352 | | |

| Investments | | Shares | | Value

(000) | |

| Gold 3.04% | |

Barrick Gold Corp.

(Canada)(a) | | | 1,605,000 | | | $ | 49,755 | | |

| Newmont Mining Corp. | | | 1,013,900 | | | | 45,899 | | |

| Total | | | | | | | 95,654 | | |

| Household Furnishings 0.49% | |

Ethan Allen Interiors

Inc. | | | 436,100 | | | | 15,534 | | |

Identification Control & Filter

Devices 2.53% | |

| Hubbell, Inc. Class B | | | 565,000 | | | | 27,979 | | |

| IDEX Corp. | | | 456,400 | | | | 21,405 | | |

| Parker Hannifin Corp. | | | 360,200 | | | | 30,124 | | |

| Total | | | | | | | 79,508 | | |

| Insurance: Multi-Line 3.82% | |

| Aflac Inc. | | | 210,400 | | | | 9,451 | | |

| Allstate Corp. (The) | | | 235,000 | | | | 14,420 | | |

American Int'l. Group,

Inc. | | | 735,000 | | | | 49,370 | | |

Genworth Financial,

Inc. Class A | | | 1,110,000 | | | | 37,118 | | |

| Markel Corp.* | | | 25,000 | | | | 9,988 | | |

| Total | | | | | | | 120,347 | | |

| Insurance: Property-Casualty 1.02% | |

Everest Re Group, Ltd.

(Bermuda)(a) | | | 323,800 | | | | 32,114 | | |

| Machinery: Agricultural 0.10% | |

| Deere & Co. | | | 35,900 | | | | 3,056 | | |

| Machinery: Industrial/Specialty 0.25% | |

| Kennametal Inc. | | | 125,000 | | | | 7,714 | | |

Machinery: Oil Well Equipment &

Services 0.68% | |

| Halliburton Co. | | | 202,300 | | | | 6,544 | | |

Schlumberger Ltd.

(Netherland Antilles)(a) | | | 113,200 | | | | 7,141 | | |

See Notes to Financial Statements.

28

Schedule of Investments (continued)

ALL VALUE FUND October 31, 2006

| Investments | | Shares | | Value

(000) | |

Superior Energy

Services, Inc.* | | | 247,000 | | | $ | 7,731 | | |

| Total | | | | | | | 21,416 | | |

Medical & Dental Instruments &

Supplies 0.55% | |

| Zimmer Holdings, Inc.* | | | 240,400 | | | | 17,311 | | |

| Metal Fabricating 1.67% | |

| Quanex Corp. | | | 804,962 | | | | 26,974 | | |

| Shaw Group, Inc. (The)* | | | 958,800 | | | | 25,466 | | |

| Total | | | | | | | 52,440 | | |

| Miscellaneous: Consumer Staples 1.47% | |

| Diageo plc ADR | | | 620,000 | | | | 46,171 | | |

| Miscellaneous: Materials & Processing 0.19% | |

| Rogers Corp.* | | | 85,400 | | | | 5,975 | | |

| Multi-Sector Companies 8.04% | |

Berkshire Hathaway

Financial Class B* | | | 15,050 | | | | 52,901 | | |

| Carlisle Cos., Inc. | | | 510,000 | | | | 42,682 | | |

| Eaton Corp. | | | 220,000 | | | | 15,934 | | |

| General Electric Co. | | | 3,000,000 | | | | 105,330 | | |

| Trinity Industries, Inc. | | | 1,000,050 | | | | 36,062 | | |

| Total | | | | | | | 252,909 | | |

| Oil: Integrated Domestic 0.77% | |

| EnCana Corp. (Canada)(a) | | | 509,500 | | | | 24,196 | | |

| Oil: Integrated International 5.49% | |

| Chevron Corp. | | | 435,100 | | | | 29,239 | | |

| Exxon Mobil Corp. | | | 2,010,012 | | | | 143,555 | | |

| Total | | | | | | | 172,794 | | |

| Publishing: Miscellaneous 0.92% | |

R.R. Donnelley &

Sons Co. | | | 855,000 | | | | 28,950 | | |

| Investments | | Shares | | Value

(000) | |

| Real Estate Investment Trusts 0.49% | |

Host Hotels &

Resorts Inc. | | | 664,400 | | | $ | 15,321 | | |

| Rental & Leasing Services: Commercial 0.74% | |

| GATX Financial Corp. | | | 535,000 | | | | 23,310 | | |

| Restaurants 0.98% | |

| Brinker Int'l., Inc. | | | 333,700 | | | | 15,494 | | |

Cheesecake Factory,

Inc. (The)* | | | 120,000 | | | | 3,390 | | |

OSI Restaurant