UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07538 |

|

LORD ABBETT SECURITIES TRUST |

(Exact name of registrant as specified in charter) |

|

90 Hudson Street, Jersey City, NJ | | 07302 |

(Address of principal executive offices) | | (Zip code) |

|

Lawrence B. Stoller, Vice President & Assistant Secretary 90 Hudson Street, Jersey City, NJ 07302 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 201-6984 | |

|

Date of fiscal year end: | 10/31 | |

|

Date of reporting period: | 10/31/2007 | |

| | | | | | | | |

Item 1: Reports to Shareholders.

2007

LORD ABBETT

ANNUAL REPORT

Lord Abbett

All Value Fund

Alpha Strategy Fund

International Core Equity Fund

International Opportunities Fund

Large Cap Value Fund

Value Opportunities Fund

For the fiscal year ended October 31, 2007

Lord Abbett Securities Trust

Annual Report

For the fiscal year ended October 31, 2007

Dear Shareholders: We are pleased to provide you with this overview of Lord Abbett Securities Trust's performance for the fiscal year ended October 31, 2007. On this page and the following pages, we discuss the major factors that influenced performance. For detailed and more timely information about the Funds, please visit our Website at www.lordabbett.com, where you also can access the quarterly commentaries by the Funds' portfolio managers.

General information about Lord Abbett mutual funds, as well as in-depth discussions of market trends and investment strategies, is also provided in Lord Abbett Insights, a newsletter accompanying your quarterly account statements. We also encourage you to call Lord Abbett at 888-522-2388 and speak to one of our professionals if you would like more information.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Robert S. Dow

Chairman

From left to right: Robert S. Dow, Director and Chairman of the Lord Abbett Funds; E. Thayer Bigelow, Independent Lead Director of the Lord Abbett Funds; and Daria L. Foster, Director and President of the Lord Abbett Funds.

Q: What were the overall market conditions during the fiscal year ended October 31, 2007?

A: Despite a notable rise in volatility, equities (as measured by the S&P 500® Index1) generated a total return of 14.6% in the fiscal year ended October 2007. Furthermore, investors remained optimistic regarding the outlook for corporate earnings; the investor consensus estimate for calendar year 2008 earnings for the S&P 500 Index was 14.1% above the consensus for calendar year 2007 earnings. Growth (as measured by the S&P Composite Growth Index2) outperformed value (as measured by the S&P Composite Value Index2) and the performance of mid cap companies (as measured by the S&P MidCap 400® Index3) outpaced the rest of the market (as measured by the S&P 500 Index).

1

At the sector level, six of the 10 major industry groups in the S&P 500 Index posted 12-month total returns in excess of 20%, two more posted gains greater than 10%, while only two sectors declined in the fiscal year. Unfortunately, those sectors that declined – consumer discretionary and financials – account for over 28% (on a market-weight basis) of the S&P 500 Index, which cost the market approximately 50 basis points in overall performance.

On the international side, foreign equity markets posted strong returns for the year ended October 31, 2007. The MSCI EAFE® Index4 rose 25.4% (in U.S. dollar terms), and the MSCI World ex-U.S Small Cap IndexSM 5 rose 24.9% (in U.S. dollar terms), outdistancing the U.S. equity markets, as measured by the S&P 500 Index, which rose 14.6% (in U.S. dollar terms).

Emerging markets, which have generally made strong gains in recent years, delivered another year of robust gains. The MSCI Emerging Markets IndexSM 6 rose an impressive 68.3% (in U.S. dollar terms).

Lord Abbett All Value Fund

Q: How did the All Value Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 13.1%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 3000® Value Index,7 which returned 10.1% over the same period.

Q: What were the most significant factors affecting performance?

A: The financial services sector (owing to an underweight position) was the greatest contributor to the Fund's performance relative to its benchmark for the one-year period, followed by the materials and processing sector (owing to an overweight position) and the producer durables sector.

Among the individual holdings that contributed to performance were integrated oils holding ExxonMobil Corp. (the Fund's number-one contributor), a worldwide operator of petroleum and petrochemicals businesses; materials and processing holdings The Shaw Group Inc., a provider of engineering, procurement, construction, maintenance, fabrication, manufacturing, consulting, remediation, and facilities management services, and Barrick Gold Corp., an international gold company operating mines and development projects; other holding (the category reserved for diversified corporations) General Electric Co., a provider of jet engines, power plant turbines, locomotives, medical imaging equipment, and private label credit cards; and utilities holding AT&T Inc., a provider of communications services.

The utilities sector was the worst detractor from the Fund's relative performance, followed by the integrated

2

oils sector (owing to an underweight position) and the healthcare sector.

Among the individual holdings that detracted from performance were healthcare holdings IMS Health Inc. (the Fund's number-one detractor), a pharmaceutical manufacturer information partner; Mylan, Inc., a developer of generic and branded pharmaceutical products; and Novartis AG, a manufacturer of pharmaceutical and nutrition products; consumer discretionary holding Macy's, Inc., a department store operator; and utilities holding Comcast Corp., an operator of hybrid fiber-coaxial broadband cable communications networks.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett Alpha Strategy Fund

Q: How did the Alpha Strategy Fund perform during the fiscal year ended October 31, 2007?

A: The Alpha Strategy Fund is a strategic allocation fund using a fund of funds approach. Assets are currently divided among Lord Abbett International Opportunities Fund, Lord Abbett Developing Growth Fund, Lord Abbett Small Cap Value Fund, Lord Abbett Micro Cap Growth Fund, Lord Abbett Micro Cap Value Fund, Lord Abbett Small Cap Blend Fund, and Lord Abbett Value Opportunities Fund. As a result, the Alpha Strategy Fund's performance is directly related to the performance of its underlying funds.

The Alpha Strategy Fund returned 28.0%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the S&P/Citigroup Small Cap World Index,8 which returned 21.7% over the same period.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett International Opportunities Fund Component

(Approximately 25.1% of Alpha Strategy Fund portfolio)

Q: How did the International Opportunities Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 26.7%, reflecting performance at the net asset value (NAV) of Class I shares with all distributions reinvested, compared with its benchmark, the S&P/Citigroup Extended Market World ex-U.S. Index,8 which returned 28.4% over the same period.

See discussion about Lord Abbett International Opportunities Fund on page 9.

3

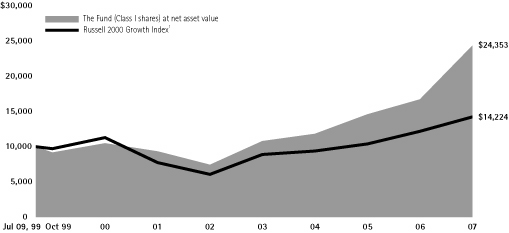

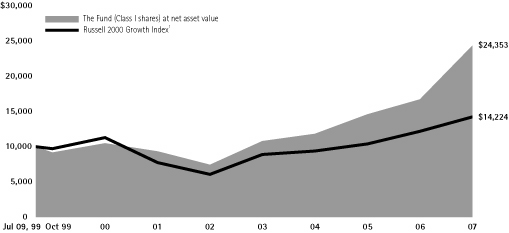

Lord Abbett Developing Growth Fund Component

(Approximately 20.2% of Alpha Strategy Fund portfolio)

Q: How did the Developing Growth Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 47.6%, reflecting performance at the net asset value (NAV) of Class I shares with all distributions reinvested, compared to its benchmark, the Russell 2000® Growth Index,9 which returned 16.7% over the same period.

Q: What were the most significant factors affecting performance?

A: The consumer discretionary sector was the greatest contributor to the Fund's performance relative to its benchmark for the one-year period, followed by the technology sector and the healthcare sector.

Among the individual holdings that contributed to performance were technology holdings SunPower Corp. (the Fund's number-one contributor) and First Solar, Inc., two companies that use semiconductor processes to generate electricity from sunlight; and consumer discretionary holdings aQuantive, Inc., an Internet marketing company (recently acquired by Microsoft); New Oriental Education & Technology Group, Inc., a provider of educational services to Chinese students, and Priceline.com Inc., an Internet-based travel company.

The utilities sector (owing to an underweight position) was the largest detractor from performance, followed by the not classified, or miscellaneous, sector.

Among the individual holdings that detracted from performance were technology holdings SiRF Technology Holdings, Inc. (the Fund's number-one detractor), a supplier of global positioning system (GPS) semiconductor solutions; Rackable Systems Inc., a provider of high-density computer servers and high-capacity storage systems based on an open architecture approach; Isilon Systems, Inc., a computer storage manufacturer; and Limelight Networks Inc., a content delivery network for Internet distribution of video, music, games, and downloads; and consumer discretionary holding Smith & Wesson Holding Corp., a producer of handguns, law enforcement products, and firearm safety and security products.

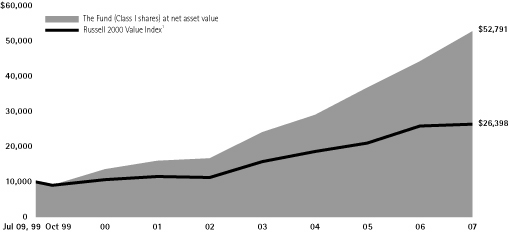

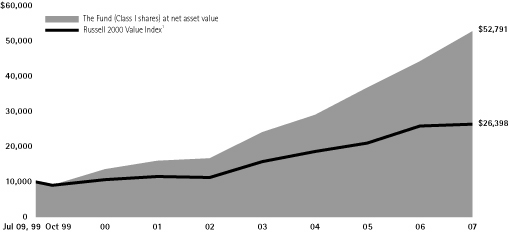

Lord Abbett Small Cap Value Fund Component

(Approximately 19.9% of Alpha Strategy Fund portfolio)

Q: How did the Small Cap Value Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 17.6%, reflecting performance at the net asset value (NAV) of Class I shares with all distributions reinvested, compared to its benchmark, the Russell 2000® Value Index,10 which returned 2.1% over the same period.

4

Q: What were the most significant factors affecting performance?

A: The financial services sector (owing to an underweight position) was the greatest contributor to the Fund's performance relative to its benchmark for the one-year period, followed by the materials and processing sector (owing to an overweight position) and the producer durables sector.

Among the individual holdings that contributed to performance were materials and processing holdings The Shaw Group Inc. (the Fund's number-one contributor), a provider of engineering, procurement, construction, maintenance, fabrication, manufacturing, consulting, remediation, and facilities management services, and Hexcel Corp., a manufacturer of reinforcement products, composite materials, and engineered products; producer durables holding Curtiss-Wright Corp., a designer of precision components and systems; and technology holdings Anixter International Inc., a distributor of communications and specialty wire and cable products, and FLIR Systems, Inc., a maker of thermal imaging and broadcast camera systems.

The consumer staples sector (owing to an underweight position) was the worst detractor from Fund relative performance for the period, followed by the auto and transportation sector and the utilities sector.

Among the individual holdings that detracted from performance were materials and processing holdings Rogers Corp. (the Fund's number-one detractor), a manufacturer of specialty materials and components for applications in the communications, computer, imaging, consumer, and transportation markets, and NCI Building Systems, Inc., a maker of metal engineered building systems and products for the building industry; consumer discretionary holdings Ruby Tuesday, an operator of a chain of specialty restaurants, and The Pantry, Inc., an operator of convenience stores; and technology holding American Reprographics Co., a provider of reprographic technology and services.

Lord Abbett Micro Cap Growth Fund Component

(Approximately 10.1% of Alpha Strategy Fund portfolio)

Q: How did the Micro Cap Growth Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 45.5%, reflecting performance at the net asset value (NAV) of Class I shares with all distributions reinvested, compared to its benchmark, the Russell 2000 Growth Index, which returned 16.7% over the same period. The Micro Cap Growth Fund was added to the portfolio on April 2, 2007.

Q: What were the most significant factors affecting performance?

A: The technology sector was the greatest contributor to Fund performance relative to its benchmark for the 12-month period,

5

followed by the healthcare sector and the materials and processing sector.

Among the individual holdings that contributed to performance were technology holdings JA Solar Holdings Co. Ltd. (the Fund's number-one contributor), a manufacturer of solar cells, and Omniture, Inc., a provider of online business optimization software; healthcare holding Hansen Medical, Inc., a developer of medical robotics used with catheter-based technologies to facilitate less-invasive surgical procedures; materials and processing holding Force Protection, Inc., a maker of vehicles that protect and save lives and property, including mine-protected vehicles used by the military; and consumer staples company Jones Soda Co., which manufactures and distributes a variety of soda and juice beverages.

The consumer discretionary was the primary detractor from the Fund's relative performance for the period, followed by the not classified or miscellaneous sector and the producer durables sector (owing to an underweight position).

Among the individual holdings that detracted from performance were consumer discretionary holdings Houston Wire & Cable Co. (the Fund's number-one detractor), a wholesaler of wire and cable to the electricity distribution market, and Smith & Wesson Holding Corp., a producer of handguns, law enforcement products, and firearm safety and security products; and technology holdings Isilon Systems, Inc., a computer storage manufacturer; STEC Inc., a designer of technology solutions that offers products based on dynamic random access memory, static random assess memory, and Flash memory technologies; and SourceFire Inc., a provider of security software to pr otect corporate networks.

Lord Abbett Micro Cap Value Fund Component

(Approximately 9.8% of Alpha Strategy Fund portfolio)

Q: How did the Micro Cap Value Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 19.2%, reflecting performance at the net asset value (NAV) of Class I shares with all distributions reinvested, compared to its benchmark, the Russell 2000 Value Index, which returned 2.1% over the same period. The Micro Cap Value Fund was added to the portfolio on April 2, 2007.

Q: What were the most significant factors affecting performance?

A: The producer durables sector was the greatest contributor to Fund performance relative to its benchmark for the one-year period, followed by the financial services sector (owing to an underweight position) and the consumer discretionary sector.

Among the individual holdings that contributed to performance were producer durables holdings Graham Corp. (the Fund's number-one contributor), a designer and builder of vacuum and heat transfer

6

equipment for process industries, and Twin Disc, Inc., a provider of heavy-duty power transmission equipment to the marine, energy, off-highway heavy equipment, and other markets; consumer discretionary holding Exponent, Inc., a provider of scientific research and analysis for failures and accidents product development, regulatory compliance, and crisis management; auto and transportation sector holding Amerigon Inc., which supplies high-technology products for automotive original manufacturers; and technology holding Applix, Inc., a financial analytics company. (Applix, Inc. was recently acquired by Cognos, a provider of business intelligence and performance management solutions.)

The most significant detractor from the Fund's relative performance was the other energy sector (which includes oil service companies, as well as smaller exploration and production companies, and independent refiners), followed by the consumer staples sector and the other sector (owing to an underweight position), made up of diversified corporations.

Among the individual holdings that detracted from performance were financial services holdings Marlin Business Services Corp. (the Fund's number-one detractor), a provider of equipment leasing solutions primarily to small businesses, and Southwest Bancorp, an independent, commercial-oriented financial services institution focusing on growth in Texas and Kansas; consumer staples holding Overhill Farms, Inc., a manufacturer of frozen food products; materials and processing holding U.S. Concrete, Inc., a provider of ready-mixed concrete and related products and services to the construction industry; and producer durables holding Flanders Corp., a manufacturer of a range of air filtration products.

Lord Abbett Small Cap Blend Fund Component

(Approximately 9.8% of Alpha Strategy Fund portfolio)

Q: How did the Small Cap Blend Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 15.8%, reflecting performance at the net asset value (NAV) of Class I shares with all distributions reinvested, compared to its benchmark, the Russell 2000® Index,11 which returned 9.3% over the same period. The Small Cap Blend Fund was added to the portfolio on June 25, 2007.

Q: What were the most significant factors affecting performance?

A: The financial services sector (owing to an underweight position) was the greatest contributor to the Fund's performance relative to its benchmark for the one-year period, followed by the healthcare sector and the producer durables sector.

Among the individual holdings that contributed to performance were financial services holding Ohio Casualty Corp. (the Fund's number-one contributor), a

7

property and casualty insurer (which was acquired by Liberty Mutual Insurance on August 24, 2007); healthcare holdings Kyphon Inc., a developer of medical devices for orthopedic applications utilizing balloon technology (which was acquired by Medtronic on November 2, 2007), and Amedisys, Inc., a multi-regional provider of alternate-site healthcare services; producer durables holding Bucyrus International, Inc., a manufacturer of large excavation machinery used for mining; and technology holding Stratasys, Inc., a developer of rapid prototyping systems.

The materials and processing sector was the worst detractor from the Fund's relative performance for the period, followed by the technology sector and the consumer staples sector.

Among the individual holdings that detracted from performance were consumer discretionary holding Select Comfort Corp. (the Fund's number-one detractor), a designer of a line of air bed mattresses with adjustable firmness, as well as foundations and accessories; materials and processing holding Beacon Roofing Supply, Inc., a distributor of roofing materials; healthcare holding LCA-Vision Inc., an operator of stand-alone laser vision correction centers; and technology holdings Websense, Inc., a provider of employee Internet management solutions, and American Reprographics Co., a provider of reprographic technology and services.

Lord Abbett Value Opportunities Fund Component

(Approximately 4.8% of Alpha Strategy Fund portfolio)

Q: How did the Value Opportunities Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 19.1%, reflecting performance at the net asset value (NAV) of Class I shares with all distributions reinvested, compared to its benchmark, the Russell 2500® Value Index,12 which returned 4.6% over the same period. The Value Opportunities Fund was added to the portfolio on June 25, 2007.

See discussion about Lord Abbett Value Opportunities Fund on page 11.

Lord Abbett International Core Equity Fund

Q: How did the International Core Equity Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 28.2%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the MSCI EAFE® Index with Net Dividends,13 which returned 24.9% over the same period.

Q: What were the most significant factors affecting performance?

A: The telecommunications services sector was the greatest contributor to the Fund's performance relative to its benchmark for

8

the one-year period, followed by the energy sector and the financials sector.

Among the individual holdings that contributed to performance were financials holdings National Bank of Greece S.A. (the Fund's number-one contributor), a provider of retail and corporate banking services, and Agile Property Holdings Ltd., a developer of properties in the Guangdong province, People's Republic of China; telecommunications services holding Vodafone Group Plc, an international provider of mobile telecommunications services, including voice and data communications; materials holding Alcan Inc., a multinational company involved in all aspects of the aluminum industry; and utilities holding CEZ, an operator of coal-fired, hydroelectric, and nuclear power plants in the Czech Republic.

The consumer discretionary sector was the worst detractor from the Fund's relative performance, followed by the industrials sector and the information technology sector.

Among the individual holdings that detracted from performance were financials holdings Sumitomo Mitsui Financial Group, Inc. (the Fund's number-one detractor), a Japanese provider of commercial banking and a variety of financial services, and ORIX Corp., a Japanese provider of comprehensive financial services throughout the world; consumer discretionary holding Sports Direct International, a British retailer of sports apparel products; energy holding Electromagnetic GeoServices AS, a Norwegian-based provider of oil and gas services using 3D electromagnetic data; and industrials holding THK Co., Ltd., a Japanese manufacturer of industrial linear motion systems, applied in such products as robots, machine tools, and semiconductor equipment.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett International Opportunities Fund

Q: How did the International Opportunities Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 26.1%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared with its benchmark, the S&P/Citigroup Extended Market World ex-U.S. Index, which returned 28.4% over the same period.

Q: What were the most significant factors affecting performance?

A: The industrials sector was the worst detractor from the Fund's performance relative to its benchmark for the 12-month period, followed by materials sector (owing to an underweight position) and the consumer staples sector.

Among the individual holdings that detracted from performance were

9

consumer staples holding C&C Group plc (the Fund's number-one detractor), an Irish manufacturer of branded beverages and snacks; consumer discretionary holdings The Japan General Estate Co., Ltd., a developer of newly constructed condominiums and houses, and Avex Group Holdings Inc., a marketer of music CDs videos and DVDs; and industrials holdings Vueling Airlines SA, an air passenger transportation services company based in Spain, and Vedior NV, a Netherland-based staffing services firm.

The financials sector was the best contributor to Fund relative performance, followed by the energy sector (owing to an overweight position) and the telecommunications services sector.

Among the individual holdings that contributed to performance were financial holdings Arques Industries AG (the Fund's number-one contributor), a company that acquires medium-sized German, Swiss, and Austrian companies in need of restructuring; RexCapital Financial Holdings Ltd., a provider of lottery services in China; Agile Property Holdings Ltd., a developer of properties in the Guangdong province, People's Republic of China; BlueBay Asset Management plc., a British manager of fixed-income credit funds and products; and materials holding Wacker Chemie AG, a German-based manufacturer of various chemical products sold worldwide.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett Large Cap Value Fund

Q: How did the Large Cap Value Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 13.0%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared with its benchmark, the Russell 1000® Value Index,14 which returned 10.8% over the same period.

Q: What were the most significant factors affecting performance?

A: The greatest contributor to the Fund's performance relative to its benchmark for the one-year period was the financial services sector (owing to an underweight position), followed by the materials and processing sector and the technology sector (owing to an overweight position).

Among the individual holdings that contributed to performance were integrated oils holding ExxonMobil Corp. (the Fund's number-one contributor), an operator of petroleum and petrochemicals businesses throughout the world; financial services holding Bank of New York Mellon Corp., a worldwide provider of financial and securities services to financial institutions, corporations, and individuals; materials and processing holdings Freeport-McMoRan Copper &

10

Gold, Inc., a miner and miller of copper, gold, and silver, and Monsanto, a provider of technology-based solutions and agricultural products for growers and downstream customers in the agricultural markets; and utilities holding AT&T Inc., a communications services provider.

The integrated oils sector (owing to an underweight position) was the largest detractor from the Fund's relative performance, followed by the consumer discretionary sector and the utilities sector (owing to an underweight position).

Among the individual holdings that detracted from performance were financial services holdings Citigroup Inc. (the Fund's number-one detractor), a diversified financial services holding company; American International Group, Inc., a provider of a variety of insurance and insurance-related services; Freddie Mac, a stockholder-owned corporation chartered by Congress to create a continuous flow of funds to mortgage lenders; consumer discretionary holding Wal-Mart Stores, Inc., an operator of discount stores and supercenters; and healthcare holding Boston Scientific Corp., a developer of minimally invasive medical devices.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett Value Opportunities Fund

Q: How did the Value Opportunities Fund perform during the fiscal year ended October 31, 2007?

A: The Fund returned 18.7%, reflecting the performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 2500 Value Index, which returned 4.6% for the same period.

Q: What were the most significant factors affecting performance?

A: The materials and processing sector was the greatest contributor to the Fund's performance relative to its benchmark for the one-year period, followed by the financial services sector (owing to an underweight position) and the consumer discretionary sector.

Among the individual holdings that contributed to performance were materials and processing holdings The Shaw Group Inc. (the Fund's number-one contributor), a provider of engineering and construction services serving the energy and environmental infrastructure market, and Harsco Corp., an industrial services and engineered products company; other holding (the category reserved for diversified corporations) Kaman Corp., with exposure to aerospace/defense through its helicopter business and industrial distribution; producer durables holding Alliant Techsystems Inc., a developer of advanced weapon and space systems; and technology

11

holding Anixter International Inc., a distributor of communications and specialty wire and cable products.

The consumer staples sector (owing to an underweight position) was the worst detractor from the Fund's relative performance for the period. The utilities sector also detracted from performance.

Among the individual holdings that detracted from performance were technology holdings Plexus Corp. (the Fund's number-one detractor), a provider of electronic manufacturing services; Micrel, Inc., a developer of analog power integrated circuits and digital circuits; and CACI International Inc., a supplier of information technology products and services; other energy holding BJ Services Co., a provider of pressure pumping and other oilfield services for the petroleum industry; and financial services holding H&E Equipment Services, Inc., an integrated equipment services company focused on heavy construction and industrial equipment.

The Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Note: Class A shares purchased subject to a front-end sales charge have no contingent deferred sales charge (CDSC). However, certain purchases of Class A shares made without a front-end sales charge may be subject to a CDSC of 1% if the shares are redeemed within 12 months of the purchase. Please see section "Your Investment – Purchases" in the prospectus for more information on redemptions that may be subject to a CDSC. The CDSC is not reflected in the average annual total returns. If the CDSC was included, performance would have been lower.

12

A prospectus contains important information about a fund, including its investment objectives, risks, charges, and ongoing expenses, which an investor should carefully consider before investing. To obtain a prospectus for any Lord Abbett mutual fund, please contact your investment professional or Lord Abbett Distributor LLC at 888-522-2388 or visit our Website at www.lordabbett.com. Read the prospectus carefully before investing.

1 The S&P 500® Index is widely regarded as the standard for measuring large cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

2 The S&P Composite 1500® Index combines the S&P 500®, S&P 400® (an index of mid-cap companies), and the S&P SmallCap 600® indexes to create a broad market portfolio representing 90% of U.S. equities. Companies in this index are split into two groups ba sed on factors including price-to-book ratio to create the Composite Growth and Composite Value indexes.

3 The S&P MidCap 400® Index measures the performance of the mid-size company segment of the U.S. market.

4 The MSCI EAFE® (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performace, excluding the United States and Canada. As of June 2006, the MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

5 The MSCI World Ex-U.S. Small Cap IndexSM is the small cap component of the MSCI World Ex-U.S. Standard Index. Securities selected represent 40% of the small cap asset class in each developed market on a capitalization-weighted basis.

6 The MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of June 2006, the MSCI Emerging Markets Index consisted of the following 24 emerging market country indexes: Argentina, Brazil, Chile, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

7 The Russell 3000® Value Index measures the performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values. The stocks in this index are also members of either the Russell 1000® Value or the Russell 2000® Value indexes.

8 S&P/Citigroup Global Equity Index SystemSM and the names of each of the indexes and subindexes that it comprises (GEIS and such indexes and subindexes, each an "Index" and collectively, the "Indexes") are service marks of Citigroup. The S&P/Citigroup Small Cap World ex-U.S. Index is a subset of the Global Citigroup Broad Market Index (BMI). The S&P/Citigroup Extended Market World ex-U.S. Index is a su bset of the Global Citigroup Extended Market Index (EMI).

9 The Russell 2000® Growth Index measures the performance of those Russell 2000® Index companies with higher price-to-book ratios and higher forecasted growth values.

10 The Russell 2000® Value Index measures the performance of those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values.

11 The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 1000 Index.

12 The Russell 2500® Value Index measures the performance of those Russell 2500® Index companies with lower price-to-book ratios and lower forecasted growth values.

13 The MSCI EAFE® Index with Net Dividends is an unmanaged index that reflects the stock markets of 22 countries, including Europe, Australasia, and the Far East, with values expressed in U.S. dollars. The MSCI EAFE Index with Net Dividends approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to nonresident individuals who do not benefit from double taxation treaties. MSCI uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates.

14 The Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted reflect past performance and are no guarantee of future results. Current performance may be higher or

13

lower than the performance quoted. The investment return and principal value of an investment in the Funds will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to our Website at www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. The Funds offer additional classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see each Fund's prospectus.

The views of the Funds' management and the portfolio holdings described in this report are as of October 31, 2007; these views and portfolio holdings may have changed subsequent to this date, and they do not guarantee the future performance of the markets or the Funds. Information provided in this report should not be considered a recommendation to purchase or sell securities.

A Note About Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with the Funds, please see each Fund's prospectus.

During certain periods shown, expense reimbursements were in place. Without such expense reimbursements, the Funds' returns would have been lower.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

14

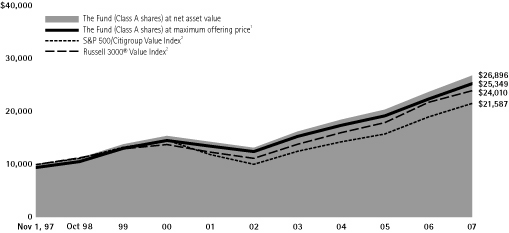

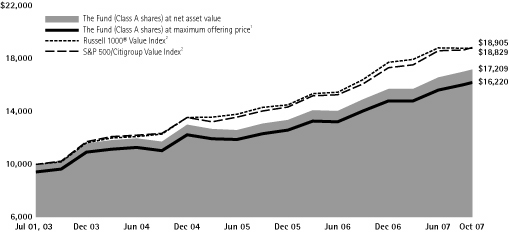

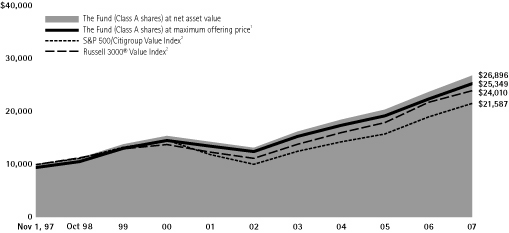

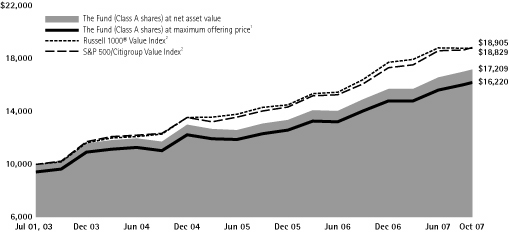

All Value Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 3000® Value Index and S&P 500/Citigroup Value Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2007

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A3 | | | 6.63 | % | | | 13.97 | % | | | 9.75 | % | | | — | | |

| Class B4 | | | 8.50 | % | | | 14.49 | % | | | 9.72 | % | | | — | | |

| Class C5 | | | 12.48 | % | | | 14.60 | % | | | 9.70 | % | | | — | | |

| Class F6 | | | — | | | | — | | | | — | | | | 0.59 | %* | |

| Class I7 | | | 13.68 | % | | | — | | | | — | | | | 17.95 | % | |

| Class P8 | | | 13.08 | % | | | 15.22 | % | | | — | | | | 8.87 | % | |

| Class R29 | | | — | | | | — | | | | — | | | | 0.51 | %* | |

| Class R310 | | | — | | | | — | | | | — | | | | 0.51 | %* | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any transaction costs, management fees or sales charges. The performance of each index is not necessarily representative of the Fund's performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A Shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2007, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years, and 0% for 10 years.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

7 Effective September 28, 2007, Class Y was renamed Class I. Class I shares commenced operations on March 31, 2003. Performance is at net asset value.

8 Class P shares commenced operations on August 15, 2001. Performance is at net asset value.

9 Class R2 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

* Because Class F, R2 and R3 shares have existed for less than one year, average annual returns are not provided.

15

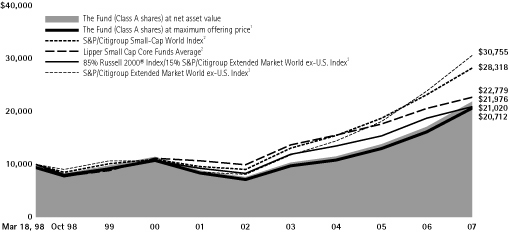

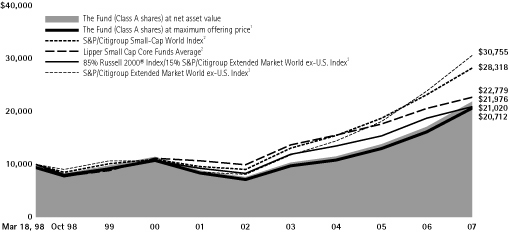

Alpha Strategy Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the S&P/Citigroup Small-Cap World Index, Lipper Small Cap Core Funds Average, 85% Russell 2000® Index/15% S&P/Citigroup Extended Market World ex-U.S. Index and S&P/Citigroup Extended Market World ex-U.S. Index, assuming reinvestment of all dividends and distributions. The Fund believes that the S&P/Citigroup Extended Market World ex-U.S. Index is a more appropriate benchmark for the Fund as a measure of the Fund's performance, and therefore will remove S&P/Citigroup Small-Cap World Index in the 2008 Annual Report. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2007

| | | 1 Year | | 5 Years | | Life of Class | |

| Class A3 | | | 20.66 | % | | | 22.24 | % | | | 7.86 | % | |

| Class B4 | | | 23.17 | % | | | 22.81 | % | | | 7.83 | % | |

| Class C5 | | | 27.20 | % | | | 22.90 | % | | | 7.83 | % | |

| Class F6 | | | — | | | | — | | | | 4.75 | %* | |

| Class I7 | | | 28.48 | % | | | — | | | | 25.12 | % | |

| Class R28 | | | — | | | | — | | | | 4.72 | %* | |

| Class R39 | | | — | | | | — | | | | 4.72 | %* | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index and average does not reflect transaction costs, management fees or sales charges. The performance of each index and average is not necessarily representative of the Fund's performance. Performance for each index and average begins on March 31, 1998.

3 Class A shares commenced operations on March 18, 1998. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A Shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2007, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on March 18, 1998. Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years, and 0% for the life of the class.

5 Class C shares commenced operations on March 18, 1998. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

7 Effective September 28, 2007, Class Y was renamed Class I. Class I shares commenced operations on October 19, 2004. Performance is at net asset value.

8 Class R2 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

9 Class R3 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

* Because Class F, R2 and R3 shares have existed for less than one year, average annual returns are not provided.

16

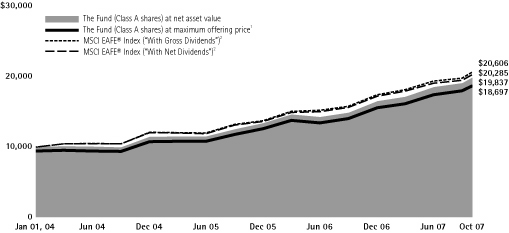

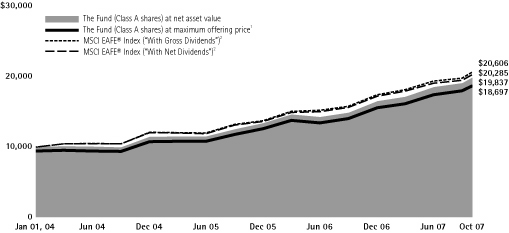

International Core Equity Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Morgan Stanley Capital International (MSCI) Europe, Australasia, Far East (EAFE®) Index ("With Gross Dividends") and the MSCI EAFE® Index ("With Net Dividends"), assuming reinvestment of all dividends and distributions. "With Net Dividends" reflects a reduction in dividends after taking into account withholding of taxes by certain foreign countries represented in the MSCI EAFE® Index. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future re sults.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2007

| | | 1 Year | | Life of Class | |

| Class A3 | | | 20.84 | % | | | 17.72 | % | |

| Class B4 | | | 23.39 | % | | | 18.30 | % | |

| Class C5 | | | 27.39 | % | | | 18.79 | % | |

| Class F6 | | | — | | | | 3.91 | %* | |

| Class I7 | | | 28.67 | % | | | 19.97 | % | |

| Class P8 | | | 28.07 | % | | | 19.43 | % | |

| Class R29 | | | — | | | | 3.85 | %* | |

| Class R310 | | | — | | | | 3.85 | %* | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of each index is not necessarily representative of the Fund's performance. Performance of each index begins on December 31, 2003.

3 Class A shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2007, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. Performance reflects the deduction of a CDSC of 4% for 1 year and 3% for the life of the class.

5 Class C shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

7 Effective September 28, 2007, Class Y was renamed Class I. Class I shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. Performance is at net asset value.

8 Class P shares commenced operations on December 15, 2003. Performance for the class begins on December 31, 2003, the SEC effective date for the Fund. Performance is at net asset value.

9 Class R2 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

* Because Class F, R2 and R3 shares have existed for less than one year, average annual returns are not provided.

17

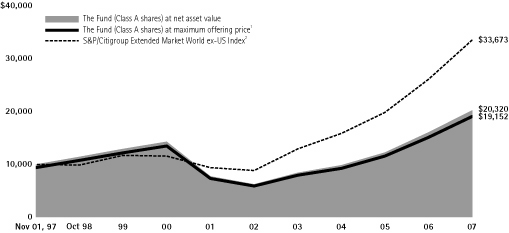

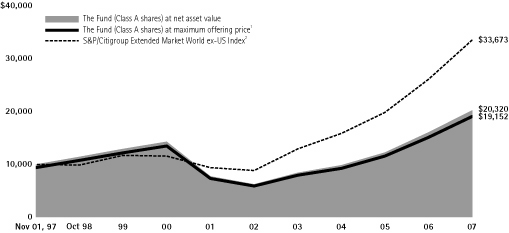

International Opportunities Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the S&P/Citigroup Extended Market World ex-U.S. Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2007

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A3 | | | 18.88 | % | | | 25.04 | % | | | 6.72 | % | | | — | | |

| Class B4 | | | 21.40 | % | | | 25.57 | % | | | 6.63 | % | | | — | | |

| Class C5 | | | 25.32 | % | | | 25.80 | % | | | 6.67 | % | | | — | | |

| Class F6 | | | — | | | | — | | | | — | | | | 5.26 | %* | |

| Class I7 | | | 26.67 | % | | | 26.92 | % | | | — | | | | 7.41 | % | |

| Class P8 | | | 26.10 | % | | | 26.55 | % | | | — | | | | 6.53 | % | |

| Class R29 | | | — | | | | — | | | | — | | | | 5.21 | %* | |

| Class R310 | | | — | | | | — | | | | — | | | | 5.26 | %* | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for the unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of the index is not necessarily representative of the Fund's performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2007 is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years, and 0% for 10 years.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

7 Effective September 28, 2007, Class Y was renamed Class I. Class I shares commenced operations on December 30, 1997. Performance is at net asset value.

8 Class P shares commenced operations on March 8, 1999. Performance is at net asset value.

9 Class R2 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

* Because Class F, R2 and R3 shares have existed for less than one year, average annual returns are not provided.

18

Large Cap Value Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 1000® Value Index and the S&P 500/Citigroup Value Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2007

| | | 1 Year | | Life of Class | |

| Class A3 | | | 6.43 | % | | | 11.81 | % | |

| Class B4 | | | 8.23 | % | | | 12.25 | % | |

| Class C5 | | | 12.29 | % | | | 12.60 | % | |

| Class F6 | | | — | | | | 0.98 | %* | |

| Class I7 | | | 13.40 | % | | | 13.75 | % | |

| Class P8 | | | 12.92 | % | | | 13.24 | % | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of each index is not necessarily representative of the Fund's performance. Performance for each index begins on June 30, 2003.

3 Class A shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2007, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. Performance reflects the deduction of a CDSC of 4% for 1 year and 2% for the life of the class.

5 Class C shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

7 Effective September 28, 2007, Class Y was renamed Class I. Class I shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. Performance is at net asset value.

8 Class P shares commenced operations on June 23, 2003. Performance for the class begins on June 30, 2003, the SEC effective date for the Fund. Performance is at net asset value.

* Because Class F shares has existed for less than one year, average annual return is not provided.

19

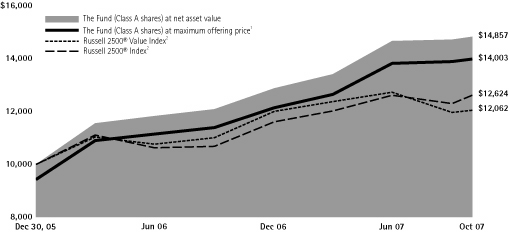

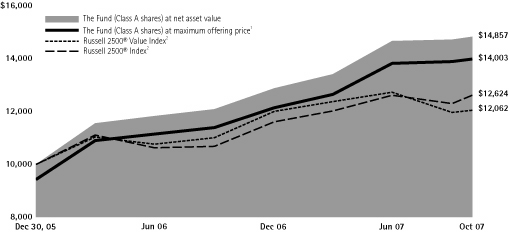

Value Opportunities Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 2500® Value Index and the Russell 2500® Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2007

| | | 1 Year | | Life of Class | |

| Class A3 | | | 11.86 | % | | | 20.11 | % | |

| Class B4 | | | 13.87 | % | | | 21.51 | % | |

| Class C5 | | | 17.87 | % | | | 23.35 | % | |

| Class F6 | | | — | | | | 0.70 | %* | |

| Class I7 | | | 19.11 | % | | | 24.52 | % | |

| Class P8 | | | 18.54 | % | | | 23.93 | % | |

| Class R29 | | | — | | | | 0.63 | %* | |

| Class R310 | | | — | | | | 0.63 | %* | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of each index is not necessarily representative of the Fund's performance. Performance for each index begins on December 30, 2005.

3 Class A shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins on December 30, 2005. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2007, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins on December 30, 2005. Performance reflects the deduction of a CDSC of 4% for 1 year and for life of Class.

5 Class C shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins on December 30, 2005. Performance reflects a 1% CDSC for Class C shares for life of Class.

6 Class F shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

7 Effective September 28, 2007, Class Y was renamed Class I. Class I shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins December 30, 2005. Performance is at net asset value.

8 Class P shares commenced operations on December 20, 2005, the SEC effective date of the Fund. Performance for the class begins December 30, 2005. Performance is at net asset value.

9 Class R2 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

* Because Class F, R2 and R3 shares have existed for less than one year, average annual returns are not provided.

20

Expense Examples

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2007 through October 31, 2007).

Actual Expenses

For each class of each Fund, the first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled "Expenses Paid During the Period 5/1/07 – 10/31/07" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

21

All Value Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/07 | | 10/31/07 | | 5/1/07 –

10/31/07 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,053.90 | | | $ | 5.85 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.52 | | | $ | 5.75 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,051.10 | | | $ | 9.20 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.24 | | | $ | 9.05 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,050.54 | | | $ | 9.20 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.24 | | | $ | 9.05 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 1,005.90 | | | $ | 0.79 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.41 | | | $ | 0.80 | | |

| Class I | |

| Actual | | $ | 1,000.00 | | | $ | 1,056.70 | | | $ | 4.10 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.22 | | | $ | 4.02 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,054.50 | | | $ | 6.37 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.01 | | | $ | 6.26 | | |

| Class R2 | |

| Actual | | $ | 1,000.00 | | | $ | 1,005.10 | | | $ | 1.20 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.01 | | | $ | 1.21 | | |

| Class R3 | |

| Actual | | $ | 1,000.00 | | | $ | 1,005.10 | | | $ | 1.10 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.11 | | | $ | 1.11 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.13% for Class A, 1.78% for Classes B and C, 0.85% for Class F, 0.79% for Class I, 1.23% for Class P, 1.28% for Class R2 and 1.18% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 for Class A, B, C, I and P (to reflect one-half year period) and mutiplied by 34/365 for Class F, R2 and R3 (to reflect the period September 28, 2007, commencement of investment operations, to October 31, 2007).

Portfolio Holdings Presented by Sector

October 31, 2007

| Sector* | | %** | |

| Auto & Transportation | | | 2.62 | % | |

| Consumer Discretionary | | | 3.89 | % | |

| Consumer Staples | | | 6.36 | % | |

| Financial Services | | | 10.08 | % | |

| Healthcare | | | 12.34 | % | |

| Integrated Oils | | | 6.22 | % | |

| Materials & Processing | | | 13.51 | % | |

| Sector* | | %** | |

| Other | | | 7.37 | % | |

| Other Energy | | | 4.97 | % | |

| Producer Durables | | | 5.69 | % | |

| Technology | | | 11.01 | % | |

| Utilities | | | 8.42 | % | |

| Short-Term Investment | | | 7.52 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

22

Alpha Strategy Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/07 | | 10/31/07 | | 5/1/07 –

10/31/07 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,127.10 | | | $ | 1.88 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.45 | | | $ | 1.79 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,123.70 | | | $ | 5.35 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.17 | | | $ | 5.09 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,123.80 | | | $ | 5.35 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.17 | | | $ | 5.09 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 1,047.50 | | | $ | 0.10 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,025.11 | | | $ | 0.09 | | |

| Class I | |

| Actual | | $ | 1,000.00 | | | $ | 1,129.40 | | | $ | 0.00 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,025.21 | | | $ | 0.00 | | |

| Class R2 | |

| Actual | | $ | 1,000.00 | | | $ | 1,047.20 | | | $ | 0.50 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.72 | | | $ | 0.49 | | |

| Class R3 | |

| Actual | | $ | 1,000.00 | | | $ | 1,047.20 | | | $ | 0.40 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.82 | | | $ | 0.40 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.35% for Class A, 1.00% for Classes B and C, 0.10% for Class F, 0.00% for Class I, 0.52% for Class R2 and 0.42% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 for Class A, B, C, and I (to reflect one-half year period) and mutiplied by 34/365 for Class F, R2 and R3 (to reflect the period September 28, 2007, commencement of investment operations, to October 31, 2007).

Portfolio Holdings Presented by Investment Objective

October 31, 2007

| Investment Objective | | %* | |

| Long Term Capital Appreciation** | | | 69.69 | % | |

| Long Term Capital Growth** | | | 29.95 | % | |

| Short-Term Investment | | | 0.36 | % | |

| Total | | | 100.00 | % | |

* Represents percent of total investments.

** Alpha Strategy Fund invests in other funds ("Underlying Funds") managed by Lord, Abbett & Co. LLC. The category shown represents the investment objective of these Underlying Funds.

23

International Core Equity Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/07 | | 10/31/07 | | 5/1/07 –

10/31/07 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,112.90 | | | $ | 7.56 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.06 | | | $ | 7.22 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,109.10 | | | $ | 11.00 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,014.79 | | | $ | 10.51 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,109.10 | | | $ | 11.00 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,014.79 | | | $ | 10.51 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 1,039.10 | | | $ | 1.21 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.02 | | | $ | 1.20 | | |

| Class I | |

| Actual | | $ | 1,000.00 | | | $ | 1,114.50 | | | $ | 5.70 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.84 | | | $ | 5.45 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,111.80 | | | $ | 8.09 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.55 | | | $ | 7.73 | | |

| Class R2 | |

| Actual | | $ | 1,000.00 | | | $ | 1,038.50 | | | $ | 1.52 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.72 | | | $ | 1.51 | | |

| Class R3 | |

| Actual | | $ | 1,000.00 | | | $ | 1,038.50 | | | $ | 1.41 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.82 | | | $ | 1.40 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.42% for Class A, 2.07% for Classes B and C, 1.27% for Class F, 1.07% for Class I, 1.52% for Class P, 1.60% for Class R2 and 1.49% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 for Class A, B, C, I and P (to reflect one-half year period) and mutiplied by 34/365 for Class F, R2 and R3 (to reflect the period September 28, 2007, commencement of investment operations, to October 31, 2007).

Portfolio Holdings Presented by Sector

October 31, 2007

| Sector* | | %** | |

| Consumer Discretionary | | | 8.02 | % | |

| Consumer Staples | | | 10.67 | % | |

| Energy | | | 6.57 | % | |

| Financials | | | 19.89 | % | |

| Health Care | | | 6.69 | % | |

| Industrials | | | 9.92 | % | |

| Sector* | | %** | |

| Information Technology | | | 6.89 | % | |

| Materials | | | 8.29 | % | |

| Telecommunication Services | | | 9.69 | % | |

| Utilities | | | 7.09 | % | |

| Short-Term Investment | | | 6.28 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

24

International Opportunities Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/07 | | 10/31/07 | | 5/1/07 –

10/31/07 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,074.90 | | | $ | 8.32 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.18 | | | $ | 8.08 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,071.20 | | | $ | 11.69 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,013.91 | | | $ | 11.37 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,071.00 | | | $ | 11.69 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,013.91 | | | $ | 11.37 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 1,052.60 | | | $ | 1.30 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.94 | | | $ | 1.28 | | |

| Class I | |

| Actual | | $ | 1,000.00 | | | $ | 1,077.00 | | | $ | 6.44 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.99 | | | $ | 6.26 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,074.70 | | | $ | 8.84 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.69 | | | $ | 8.59 | | |

| Class R2 | |

| Actual | | $ | 1,000.00 | | | $ | 1,052.10 | | | $ | 1.70 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.55 | | | $ | 1.68 | | |

| Class R3 | |

| Actual | | $ | 1,000.00 | | | $ | 1,052.60 | | | $ | 1.61 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.64 | | | $ | 1.58 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.59% for Class A, 2.24% for Classes B and C, 1.36% for Class F, 1.23% for Class I, 1.69% for Class P, 1.78% for Class R2 and 1.68% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 for Class A, B, C, I and P (to reflect one-half year period) and mutiplied by 34/365 for Class F, R2 and R3 (to reflect the period September 28, 2007, commencement of investment operations, to October 31, 2007).

Portfolio Holdings Presented by Sector

October 31, 2007

| Sector* | | %** | |

| Consumer Cyclicals | | | 17.16 | % | |

| Energy | | | 7.69 | % | |

| Healthcare | | | 5.01 | % | |

| Technology | | | 6.79 | % | |

| Telecommunications | | | 1.27 | % | |

| Transportation | | | 1.93 | % | |

| Utilities | | | 1.65 | % | |

| Basic Materials | | | 9.60 | % | |

| Sector* | | %** | |

| Consumer Non-Cyclicals | | | 6.00 | % | |

| Div. Financials | | | 7.67 | % | |

| Ind. Goods & Services | | | 20.13 | % | |

| Non-Property Financials | | | 7.88 | % | |

Property and Property

Services | | | 5.81% | | |

| Short-Term Investment | | | 1.41 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

25

Large Cap Value Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/07 | | 10/31/07 | | 5/1/07 –

10/31/07 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,054.50 | | | $ | 4.92 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.42 | | | $ | 4.84 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,051.20 | | | $ | 8.27 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.15 | | | $ | 8.13 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,051.90 | | | $ | 8.28 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.15 | | | $ | 8.13 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 1,009.80 | | | $ | 0.60 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.61 | | | $ | 0.60 | | |

| Class I | |

| Actual | | $ | 1,000.00 | | | $ | 1,057.00 | | | $ | 3.11 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,022.18 | | | $ | 3.06 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,054.50 | | | $ | 5.33 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.99 | | | $ | 5.24 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.95% for Class A, 1.60% for Classes B and C, 0.64% for Class F, 0.60% for Class I, and 1.03% for Class P) multiplied by the average account value over the period, multiplied by 184/365 for Class A, B, C, I and P (to reflect one-half year period) and mutiplied by 34/365 for Class F (to reflect the period September 28, 2007, commencement of investment operations, to October 31, 2007).

Portfolio Holdings Presented by Sector

October 31, 2007

| Sector* | | %** | |

| Auto & Transportation | | | 2.35 | % | |

| Consumer Discretionary | | | 9.13 | % | |

| Consumer Staples | | | 10.76 | % | |

| Financial Services | | | 24.31 | % | |

| Healthcare | | | 10.72 | % | |

| Integrated Oils | | | 4.56 | % | |

| Materials & Processing | | | 6.10 | % | |

| Sector* | | %** | |

| Other | | | 6.35 | % | |

| Other Energy | | | 1.27 | % | |

| Producer Durables | | | 3.10 | % | |

| Technology | | | 13.38 | % | |

| Utilities | | | 6.28 | % | |

| Short-Term Investment | | | 1.69 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

26

Value Opportunities Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 5/1/07 | | 10/31/07 | | 5/1/07 –

10/31/07 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,064.70 | | | $ | 6.77 | | |