QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.1(c)(i) to Form 18-K

2002–2003 BUDGET PAPERS

VICTORIA

BUDGET SPEECH

Delivered on 7 May 2002

by the Honourable John Brumby, MP

Treasurer of the State of Victoria

Honourable Speaker

I move that this Bill be read a second time.

INTRODUCTION

This budget invests in our future—in the future of our people and our State.

It invests in more jobs and stronger communities.

It delivers record investment in education and innovation—driving new opportunities for all Victorians.

And it reinforces this Government's determination to make sure that all Victorians—wherever they live and whatever they do—can step into the future with confidence as part of a strong and thriving Victoria.

The first two budgets of the Bracks Labor Government began the task of undoing years of damage in education, health and community safety. We took up the challenge of rebuilding our regions. And we committed ourselves to getting the conditions right for jobs and economic growth across Victoria.

The results are there for all Victorians to see.

Strong economic growth above the national average.

Jobs growth, consumer spending, business investment—all well above the national average.

Strong economic and employment growth in regional Victoria.

And Victoria's triple-A credit rating confirmed.

Education is back in its rightful place—as the Government's top priority. Our health system is turning around. Our vital community services are being restored and repaired.

And Victorian businesses can now invest with confidence, with lower and fewer taxes, in a competitive, innovative and connected environment.

GROWING VICTORIA TOGETHER

Last year, the Government released our framework for Victoria's future, Growing Victoria Together, which balances economic, social and environmental goals in growing the whole State.

This budget puts that plan to work.

This budget continues to invest in Victoria's greatest asset: our people—in their education and health, and in the communities where they live.

We continue to invest in country Victoria—generating new jobs and investment after years of decline.

We invest in our expanding suburbs and growth corridors—places where more and more Victorian families are choosing to live.

We invest in our great city of Melbourne—in the projects and developments that will transform Melbourne into a truly 'global' waterfront city.

And we deliver services and infrastructure to link our communities together—and connect all of us to the world and to a future of high quality jobs, strong economic growth and a better standard of living.

With this budget—the third budget of the Bracks Labor Government—Victoria steps with confidence into a stronger, brighter future.

Responsible and sound financial management

Responsible financial management is crucial to Victoria's future.

This budget continues to meet the Bracks Government's commitment to maintain a substantial operating surplus of at least $100 million.

An operating surplus of $522 million is projected for 2002-03, with expected surpluses averaging around $600 million in the following three years.

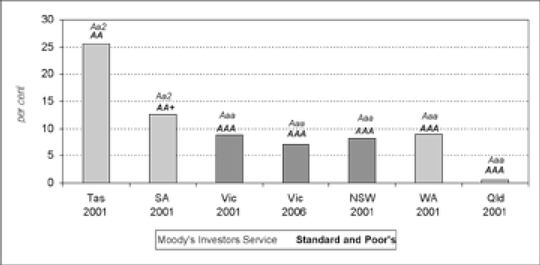

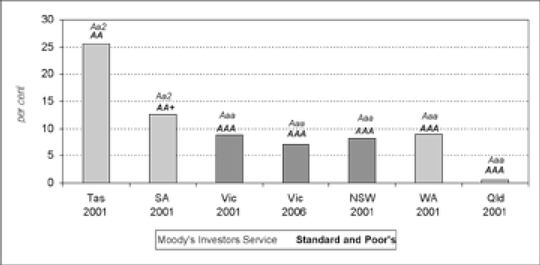

Standard and Poor's and Moody's Investors Service have again acknowledged the Government's responsible financial management, confirming Victoria's triple-A credit rating.

The Government is committed to keeping these excellent ratings by maintaining the State's net financial liabilities at prudent levels.

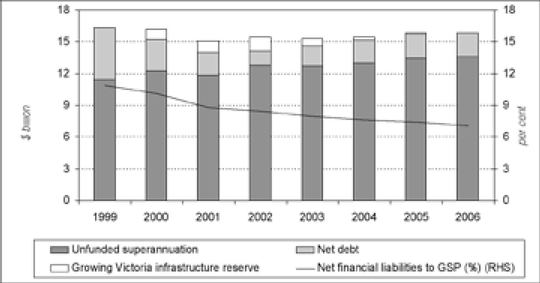

General government net financial liabilities, excluding the Growing Victoria infrastructure reserve assets, are forecast to fall from 10.8 per cent of GSP at June 1999 to 7.1 per cent by June 2006.

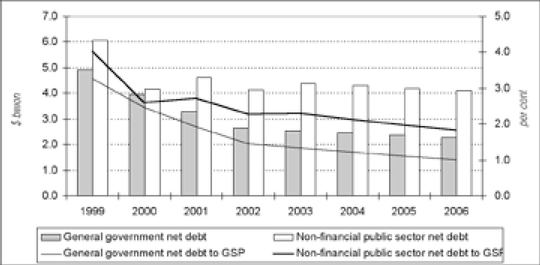

And general government net debt falls even further, from $4.9 billion in 1999 to $2.3 billion by June 2006—just 1 per cent of GSP.

Honourable Speaker, the Bracks Government has provided—and will continue to provide—responsible financial management and leadership to ensure that Victoria's financial position remains strong, sound and secure.

A growing economy—Victoria leads the way

The Victorian economy is also leading the way—proving to be robust and resilient in the face of global economic uncertainties.

This year, the Victorian economy is expected to grow by 3.75 per cent, significantly exceeding our original forecast of 2.75 per cent.

Growth in 2002-03 and beyond is forecast at 3.5 per cent—a strong performance that confirms the benefit of the Government's commitment to sound financial management.

It also reinforces the benefits of the Government's strategy to grow the whole State and invest in the drivers of growth: education, innovation and infrastructure.

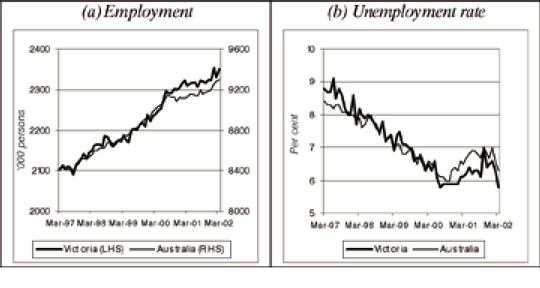

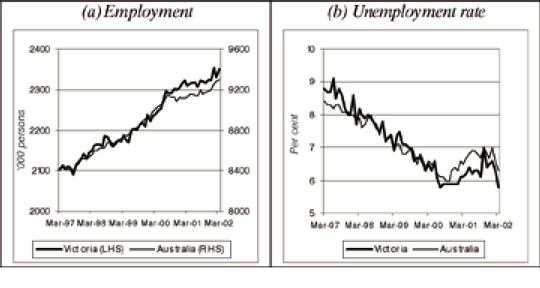

Victoria's labour market continues to out-perform the national economy, with our unemployment rate at or below the national average for the past 22 months.

Since October 1999, employment in Victoria has grown by more than 110 000 people—representing more new jobs than any other State.

There's a new climate of confidence in Victoria—a confidence that, for the first time in many years, extends beyond central Melbourne and reaches out across the State.

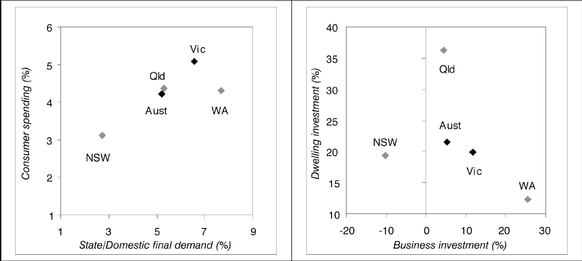

It's a confidence reflected in private business investment and consumer spending growing faster than the national average.

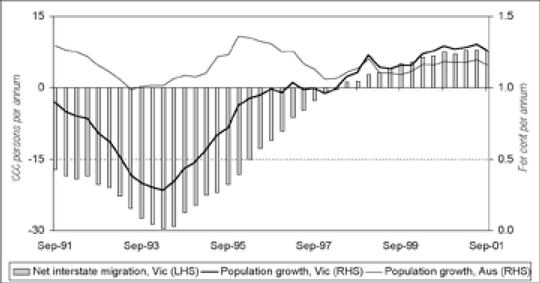

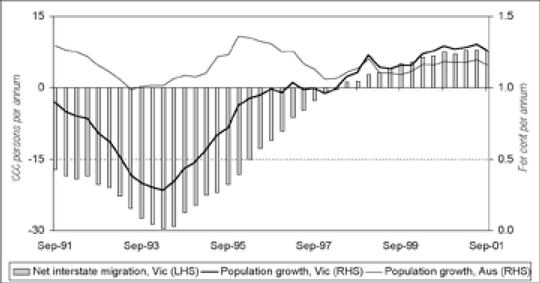

And it's reflected, too, in the record numbers of Australians choosing to call Victoria home.

We are now attracting more and more people from other States.

People who see Victoria as a place of renewed opportunity, with a commitment to building strong, caring communities—in short, a great place to live, work and raise a family.

It's just one factor in Victoria's strong economic performance over the past two years.

And in this budget, we put the proceeds of that strong performance to work—reinvesting in the assets and services that are attracting people to Victoria, and benefiting all Victorians.

Investing for our future—stronger communities

As in previous budgets, the Government is directing substantial investment towards growing and linking the whole State.

To meet that goal over the long-term, we need stronger communities.

Communities where there is trust and support—communities that can work together to create new opportunities.

High quality infrastructure is the cornerstone of such communities, and a key driver of long-term, sustainable economic growth across Victoria.

The Bracks Government has already taken investment in public infrastructure to an all-time high.

And our infrastructure program is not about monuments—it's about people.

It's about world-class schools and hospitals.

It's about modern transport and internet connections.

It's about better, safer places for people to live and work.

The 2002-03 Budget boosts asset investment by a further $3 billion for major capital works across Victoria.

It's the biggest infrastructure program in the State's history—and it's been fully funded from our budget surpluses, without adding one single dollar to debt.

This year, we focus on linking and strengthening our country and regional areas, our expanding suburbs and our growth corridors—investing in the infrastructure they need to step into the future with confidence.

Stronger suburbs

Honourable Speaker, a major focus of this budget is the expanding suburbs and growth corridors of Melbourne.

These are the places where Victorian families are increasingly choosing to live—and where much of Victoria's future population growth will be concentrated.

In this budget, the Government has committed $704 million to a major Linking the Suburbs transport strategy.

We are extending the electrified suburban rail network to Craigieburn in Melbourne's northwest, and extending tram services to Vermont South.

We are upgrading major suburban roads in Narre Warren, Langwarrin, Sunbury, Laverton and Epping.

And we are providing a massive $36 million boost for 25 suburban bus routes across Melbourne—extending routes, adding new services and introducing more low-floor, air conditioned buses.

The budget also provides $445 million for Victoria's contribution to the Scoresby Freeway.

As many people live along the Scoresby route as live in the whole of Adelaide, and the corridor is a major source of exports for Victoria and Australia.

This $1 billion, 34-kilometre project will provide a seamless link from the southeast to the city and to Victoria's ports, airports and major freight routes.

It will bring significant economic and employment benefits to Melbourne's eastern and southeastern suburbs, and the regions beyond those suburbs.

And it will cement Victoria's reputation as the transport capital of Australia.

To generate further opportunities in Melbourne's east and southeast, the budget also allocates funds for the development of Dandenong, Ringwood and Frankston as key retail and transport hubs—known as Transit Cities.

$23 million is provided in 2002-03 for five new schools in the high growth suburbs of Roxburgh Park, Melton, Narre Warren, Berwick and Carrum Downs.

Significant hospital capital works are also approved for the redevelopment of the Angliss and Dandenong Hospitals.

Stronger regions

The 2002-03 Budget continues the Government's unwavering commitment to country Victoria.

When we came to office, country Victoria had been left behind, ignored and neglected by the previous government.

The Bracks Government has worked hard to turn that around—and worked closely with country and regional communities to give them the services and infrastructure they need to compete for investment and jobs.

And, once again, the results are there for all Victorians to see.

Jobs are up, unemployment is down—with the average unemployment rate last year across country Victoria the lowest in more than a decade.

Our agricultural industries are performing exceptionally well.

And building approvals are outstripping the state average, with strong residential growth in cities like Geelong, Ballarat and Bendigo.

The Government's Regional Infrastructure Development Fund has contributed to the turnaround in many of our regions.

It is a great success story, which has changed forever the relationship between country communities and the State Government.

And that Fund now sits at the heart of this Government's ongoing commitment to country and regional Victoria.

The 2002-03 Budget builds on the Government's current major infrastructure commitments in regional areas and focuses on improving transport links, supporting regional industry and investing in schools and health services.

We are investing $102 million to create better regional transport links, including an upgrade of the Warrnambool train line, major arterial road improvements and the biggest single boost to country bus services in decades.

We are undertaking a major $101 million upgrade of the Royal Melbourne Showgrounds, securing the future of the Show to build enduring links between the suburbs of Melbourne and the regions of country Victoria.

In a major economic and environmental initiative, the Government is allocating $77 million towards the construction of the Wimmera-Mallee pipeline—one of the most significant water infrastructure projects ever undertaken in Victoria.

This new pipeline will give 40 communities across Victoria's west a more secure and higher quality water supply.

It will create jobs, open up new opportunities for regional industry, and protect the environment.

The budget also includes a major $40 million package to upgrade regional public hospitals, health centres and aged care facilities—in places such as Lorne, Stawell, Beechworth, Geelong and Omeo.

We are undertaking upgrades of more than 40 schools in country and regional Victoria, including building two new schools in Lara and Bairnsdale.

We're replacing 12 police stations in small rural communities, from towns like Pyramid Hill in Victoria's northwest and Whitfield in the northeast, to Bunyip in Gippsland.

We are investing $26 million to boost our food and fibre industries and $5 million to upgrade rail access for regional exporters to the Port of Geelong.

And we are securing the long-term future of Victoria's water and forest resources, and the regional industries and communities that rely on them.

A thriving and innovative Victorian economy

Let me now turn to innovation.

Innovation is the 21st Century's main driver of economic growth, quality jobs and high living standards—and a modern, outward looking economy must have innovation at its heart.

Innovation not only transforms existing industries, such as manufacturing and agriculture—it creates jobs in new industries, such as design and biotechnology.

Since 1999, the Government has invested heavily in science and technology, and in education, innovation and research.

We have done so because we are determined to position Victoria as a global player in fields such as biotechnology, advanced manufacturing, design, aerospace, ICT and environmental technologies.

This budget reflects and reinforces that determination.

It commits $100 million towards the construction of Australia's first synchrotron facility at Monash University in Clayton—giving Victoria the leading edge in scientific infrastructure.

We are doubling funding for medical research infrastructure in Victoria, with a $35 million boost over four years.

This will ensure we keep our best scientists and researchers here in Victoria and maintain our international leadership in medical research.

The Government is also investing $27 million over four years in biotechnology research and development, commercialisation and marketing—in line with our goal of positioning Victoria as one of the top five biotech locations in the world.

Turning good ideas into good business is critical to a successful innovation economy.

This budget builds on the Government's existing $20 million Technology Commercialisation Program by providing $7 million for a Centre for Innovation and Technology Commercialisation, cooperative research centres and a technology transfer program.

The Government is also providing funding to drive new, knowledge based industries in Victoria, including:

- •

- $9.2 million over two years to position Victoria as an international centre of design excellence;

- •

- $12 million over three years to establish a new Centre for Energy and Greenhouse Technologies in Gippsland; and

- •

- $27 million over four years for our Agenda for New Manufacturing—increasing the capacity of Victorian manufacturing to become more innovative and connect to global markets.

New initiatives in this budget will add to Victoria's growing reputation as a world leader in the modernisation of government—including a $71 million strategy to streamline government telecommunications services and $24 million for a new electronic Land Exchange.

As well as leading the way on innovation, the Government is also investing in Victoria's future as a creative State—building on our long-held reputation as Australia's arts capital.

The 2002-03 Budget delivers more than $100 million for arts projects, including:

- •

- the new Dame Elisabeth Murdoch Recital Hall and a new home for the Melbourne Theatre Company;

- •

- an additional $2 million over four years for Arts Victoria's successful Regional Arts Infrastructure Fund; and

- •

- $21 million to improve exhibition spaces and facilities at the Melbourne Museum and the State Library.

Alongside the Government's commitment to innovation, these projects deliver a strong program to drive Victoria's future as an innovative economy and a smart, creative and enterprising State.

Building Tomorrow's Businesses Today

The Government's commitment to innovation also includes the Building Tomorrow's Businesses Today package, recently announced by the Premier.

The budget gives effect to that package, allocating $364 million to create a more competitive business environment, encourage more innovative businesses and give Victorian business and industry a stronger international focus.

The package brings forward payroll tax cuts and the abolition of stamp duty on unquoted marketable securities.

It provides further cuts to payroll and land tax—bringing total business tax relief announced since October 1999 to more than $1 billion.

The Government will also provide $102 million in initiatives aimed at improving the way Victoria does business, including support for innovation and international expansion.

The Building Tomorrow's Businesses Today package is a great step forward for Victorian business—and it will help all businesses, big or small, city or country, to become more competitive, more innovative and better connected to global markets.

Valuing and investing in lifelong education

Building a successful innovative economy is simply not possible without a world-class education system.

Education is crucial to Victoria's long-term economic success, and to building strong, caring and tolerant communities.

That is why record investment in education is the cornerstone of the 2002-03 Budget.

We are making this investment to improve access and drive excellence in Victoria's education system, from preschool to post-compulsory level.

We want all Victorians to have access to world-class, lifelong education—from young children in kindergarten, to adults wanting to upgrade their qualifications, to someone wanting to learn a new language or skill later in life.

We want to make a real difference to young people's lives and give them every chance to succeed.

We want young Victorians to have the same access to education wherever they live—whether that's a country town like Birchip, a regional centre like Benalla, or suburbs like Fitzroy or Carrum Downs.

That means driving excellence and high standards across the entire State.

It means revitalising the way young people learn, and finding new, innovative ways to deliver better educational outcomes.

When we came to office, Victoria's school system was struggling.

Thousands of teachers had been taken out of the system.

Hundreds of schools had been closed down—or allowed to run down.

There were fewer apprenticeships.

We are undoing the damage of those years.

We have reduced class sizes in the critical early years of schooling.

We have set formal targets to improve literacy and numeracy, increase year 12 completion rates and improve student participation and achievement in regional Victoria.

We have put in place a Middle Years of Schooling initiative to keep students engaged in years 5 to 9.

We have invested in computers, technology, science labs and libraries.

We have upgraded TAFEs and schools across Victoria.

And we have invested in valuing, training and supporting one of this State's greatest resources—our teachers.

This year, we go even further. This year, we take the next steps to deliver a new era of opportunity and excellence in Victorian schools.

The 2002-03 Budget invests a further $550 million in education over four years—on top of the substantial commitment in our previous two budgets.

The Government is making a major new $28 million investment to improve the learning, health and wellbeing of children before they go to school.

In response to the Kirby Preschool Review, we are upgrading preschool facilities, providing extra support for children with special needs and developing a better management model for kindergartens.

In primary and secondary schools, we have allocated an extra $334 million over four years:

- •

- to improve literacy and numeracy in the early years of schooling;

- •

- for a new Access to Excellence program that will employ an additional 300 secondary teachers in schools with high absentee rates or low literacy and numeracy standards;

- •

- to deliver a new middle years program focusing on innovation and excellence; and

- •

- to roll-out, statewide, the new Victorian Certificate of Applied Learning, which offers young Victorians an alternative pathway to the VCE.

In total, more than 900 additional teachers will be employed across the State to ensure these outcomes are delivered.

The budget also focuses on improving access to education, with an injection of $31 million over four years to improve school bus services for country students, and an additional $3.6 million to support Koori students.

Across the State, the Government is building and upgrading more than 110 schools and four TAFEs—as part of a $216 million major building program.

This record investment in education will improve access and drive excellence across our schools and TAFEs.

And it confirms the Government's commitment to build a public education system that is the best in this country and among the very best in the world.

Ensuring high quality and accessible health services

The Government also continues to turn around Victoria's public health system.

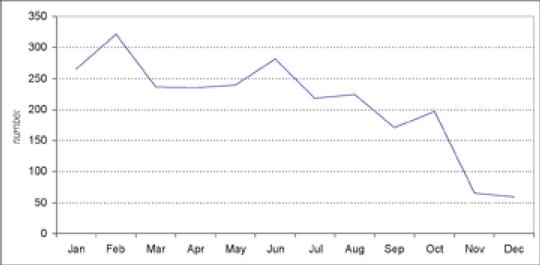

The 2002-03 Budget builds on the successful Hospital Demand Management Strategy introduced last year that has more than halved ambulance bypass and reduced waiting lists for the first time in many years.

The budget provides additional funding of $464 million over four years, enabling Victoria's public hospitals to treat 30 000 more patients and employ 700 more nurses and health workers.

The Government is providing a $100 million boost to upgrade medical equipment and hospital facilities.

We will expand and improve the delivery of ambulance services, and employ an additional 43 paramedics.

We will support older Victorians to live independently at home, through a $29 million boost to Home and Community Care services.

And we will extend a range of vital health services, including dental health, women's health and breast screening services.

In this budget, the Government makes a major $61 million commitment to improving community mental health services and opening new mental health hospital beds.

The Government will continue its program of major capital works—redeveloping the Royal Melbourne, Angliss and Dandenong Hospitals, upgrading country and regional health services, and establishing four new country ambulance stations at Kyneton, Ararat, Colac and Hopetoun.

Honourable Speaker, the Bracks Government is restoring our health services after years of chronic underfunding—and we will continue to work with our nurses, doctors and health workers to rebuild Victoria's great public health system.

Community safety

Strong communities are also safe communities, and the Bracks Government is proud of its achievement in providing additional frontline police.

Victorian police numbers are now well over the 10 000 mark and Victoria has more than 800 extra police on the frontline than we did two and a half years ago.

In addition to increasing police numbers, the Government is building 20 new police stations across Victoria, replacing a further 31 country stations and upgrading police equipment.

The 2002-03 Budget provides an additional $26 million to build two new police stations at Footscray and Coburg, and replace 12 stations in small country towns.

This year, the budget focuses on delivering major improvements to Victoria's police and emergency services communications network.

The Government has approved funding for three major projects under the Statewide Integrated Public Safety Communications Strategy.

These projects will give all Victorian emergency services state-of-the-art communications equipment—reducing response times, improving coverage and giving staff access to computer data bases from their vehicles.

The Government will not continue the previous government's flawed experiment of privatising Victoria's emergency services communications.

This budget provides the funds to take these vital services back into public hands.

Road safety is also a priority for the Bracks Government, which has set a goal of reducing death and serious injury by road accidents by 20 per cent over five years.

The 2002-03 Budget invests record funding in upgrading roads and transport infrastructure, as well as providing $21 million in specific road safety initiatives, including a new program focusing on motorcyclists.

As part of the Linking the Suburbs strategy, $48 million will also be used to target roads and intersections with high accident rates in Melbourne's outer suburbs.

Promoting sustainable development and protecting the environment for future generations

Honourable Speaker, valuing and protecting our environment is one of the most important legacies we can leave our children and grandchildren.

We have an obligation to use our natural resources wisely and responsibly.

Victorians want leadership on protecting the environment and promoting sustainable development—and the Government is showing that leadership.

We have already committed more than $300 million to tackle salinity, restore the Snowy River, and improve flows in the Murray River.

Our plan to create world-first marine parks has received international attention and acclaim.

In this budget, we take further action to protect our waterways, our forests and our land.

Some of Victoria's most important rivers are under great and growing stress.

This is not a problem we can ignore—and we must take action now to manage our waterways more responsibly.

This budget provides an additional $11 million to improve the health of our most stressed rivers, and $13 million for a Gippsland Lakes Rescue Package.

The construction of the new Wimmera-Mallee pipeline will also benefit waterways in Victoria's west, improving flows in the Glenelg and Wimmera Rivers as well as opening up new agricultural opportunities.

The 2002-03 Budget also gives effect to the Government's Our Forests, Our Future statement.

The budget allocates $80 million to promote sustainable forest practices, establish new industry arrangements and provide assistance to workers and timber communities as Victoria moves to cut logging in our native forests by one third.

The Government is also moving to protect Victoria's fragile Box-Ironbark areas, with a $21 million package to set up forests, woodlands and reserves, and provide additional support to regional communities and the users of these areas.

The budget provides an additional $6 million for the Second Generation Landcare Action Plan—and $3 million for a statewide fox control program, to protect both our native wildlife and our wool industry.

Honourable Speaker, this budget, and our actions to date, confirm that the Bracks Government will lead the way in protecting our most valuable natural resources.

We will take the tough decisions as we work towards a long-term sustainable future for all Victorians.

Building strong and caring communities

Honourable Speaker, many of the investments in this budget are directed towards the Government's goal of building strong and caring communities.

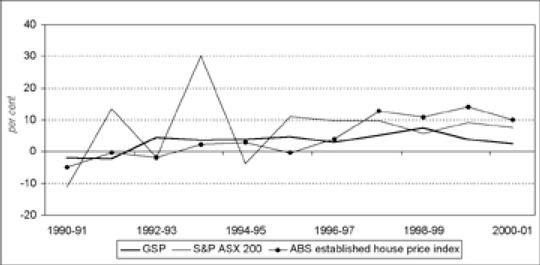

Across Victoria, most people and places are doing very well, with prosperity rising on the back of strong economic growth and a significant increase in asset values, especially housing.

But others are not doing so well, and the Government recognises that inequality and disadvantage unfairly undermine the hopes and opportunities of these Victorians and these communities.

This budget takes the proceeds of prosperity and growth, and reinvests some of those proceeds in assisting families and communities in need of support.

In response to increasing notifications of suspected child abuse and neglect, the Government is funding a $65 million new approach to child protection services.

We will improve intensive services for abused children, provide additional support for vulnerable families and assist Victoria's Koori communities protect children and young people.

This package will put 60 new child protection workers on the frontline, and it is one of the most significant improvements in community service delivery in Victoria for many years.

The budget delivers an additional $55 million over four years to improve services for people with disabilities, including the first stage of the redevelopment of Kew Residential Services.

The Government is also providing $13 million over four years to improve the safety of railway pedestrian crossings and wheelchair access to railway stations.

As part of the Government's strong commitment to reconciliation between indigenous and non-indigenous Victorians, we are providing $12 million over four years to support indigenous communities.

The Government is also undertaking a series of neighbourhood renewal projects to upgrade run-down public housing estates and assist local communities create job and education opportunities.

These projects run from Maidstone/Braybrook in Melbourne's west to communities in Seymour, Shepparton and Geelong.

$8.8 million is also provided over four years to extend services for homeless people.

To improve access to housing in our suburbs and regions, the budget allocates $13 million in 2002-03 to streamline and expand concessional arrangements to enable more Victorian families and people on low incomes to purchase a home.

The Government is also funding a $15 million redevelopment of the inadequate and outdated Turana Juvenile Justice facility, and providing $8 million to improve access to legal aid, victim support and dispute resolution services.

The Government also recognises that tolerance and diversity are important features of strong communities, as well as some of this State's greatest assets.

This budget expands the Victorian Multicultural Commission's Community Grants Program and provides funding to improve language and interpreting.

APPROPRIATION BILL

Honourable Speaker, the Appropriation (2002-03) Bill provides authority to enable government departments to meet their agreed service delivery responsibilities in 2002-03.

The Bill supports a financial management system that recognises the full cost of service delivery in Victoria and is thus based on an accrual framework.

Schedule One of the Bill contains estimates for 2002-03 and provides a comparison with the 2001-02 figures.

In line with established practices, the estimates included in Schedule One of the Bill are provided on a net appropriation basis.

These estimates do not include certain receipts that are credited to departments pursuant to Section 29 of the Financial Management Act 1994.

This budget has again been examined by the Auditor-General as required by the new standards of financial reporting and transparency established by the Government in 2000.

CONCLUSION

Honourable Speaker, Victoria in the year 2002 is a great place to live—a great place to be.

We are leading Australia in so many ways—with our strong economic and jobs growth set to continue over the years ahead.

Some of the most exciting and important projects in this State's history have already started—or are about to begin.

The redevelopment of the Austin Hospital—the largest public sector hospital project in Australia.

The new National Neuroscience Facility—kick-started by the Victorian Government and set to become a world leader in neuroscientific research.

The redevelopment of Australia's greatest sporting ground, the MCG.

New regional fast rail links to Bendigo, Ballarat, Geelong and Traralgon.

The new Holden engine plant.

The Scoresby Freeway.

The Wimmera-Mallee pipeline.

New state-of-the-art sports facilities across Victoria as we prepare for the 2006 Commonwealth Games.

Our education system is driving forward into a new era of excellence.

Literacy and numeracy standards are up. Completion rates are up. Class sizes are down. New schools are being built.

Our health system is turning around, treating more Victorians and delivering better quality care right across the State.

Our business and industry are becoming more competitive, more innovative and more connected to the world.

And new opportunities are being created in our regions and our suburbs, and in the industries of the future.

Victoria is headed in the right direction—and we have the wind in our sails.

The Government is investing well to ensure we stay on course, maintain our strong growth, and give all Victorians the chance to be part of a thriving and successful Victoria.

The 2002-03 Budget puts the proceeds of Victoria's strong economic performance over the past two years to work—renewing and rebuilding our suburbs and regions, and driving new opportunities in education and innovation.

This budget reinvests in the foundations we need for an even stronger, brighter future—for our children and for all Victorians.

Honourable Speaker, I commend the Bill to the House.

Budget Statement

2002-03

Presented by

The Honourable John Brumby, M.P.

Treasurer of the State of Victoria

for the information of Honourable Members

Budget Paper No. 2

TABLE OF CONTENTS

| 2002-03 Budget highlights | | |

Chapter 1: Financial policy objectives and strategies |

|

|

| | Financial strategies, objectives and priorities | | |

| | Seeking a better Commonwealth-State funding deal | | |

Chapter 2: Budget position and outlook |

|

|

| | 2002-03 Budget initiatives | | |

| | 2002-03 Budget estimates | | |

| | Forward estimates outlook 2002-03 to 2005-06 | | |

| | Reconciliation of forward estimates to previously published estimates | | |

| | Use of cash resources | | |

Chapter 3: Economic conditions and outlook |

|

|

| | World and Australian economic environment | | |

| | Victorian economic conditions | | |

| | Victorian economic outlook | | |

Chapter 4: Budget initiatives |

|

|

| | Growing Victoria Together | | |

| | Investing for our future—stronger communities | | |

| | Thriving and innovative industries across Victoria | | |

| | Valuing and investing in lifelong education | | |

| | High quality, accessible health and community services | | |

| | Public safety and justice | | |

| | Other Growing Victoria Together strategies | | |

Chapter 5: Balance sheet management and outlook |

|

|

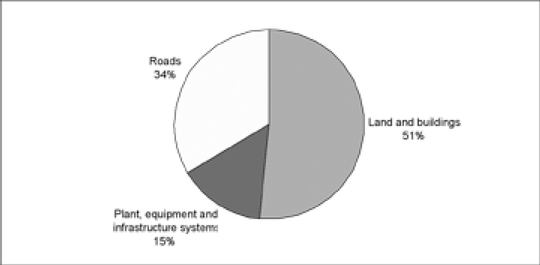

| | Asset management strategy | | |

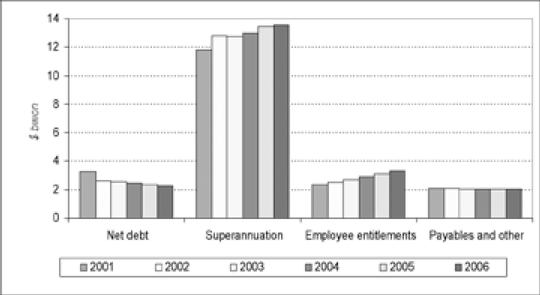

| | Liability management strategy | | |

| | Net assets | | |

Chapter 6: Statement of Risks |

|

|

| | Economic risks | | |

| | Sensitivity of the budget to economic conditions | | |

| | Expenditure and revenue risks | | |

| | Contingent liabilities | | |

Chapter 7: Estimated Financial Statements and notes |

|

|

| | Introduction | | |

| | Estimated Financial Statements for the Victorian general government (budget) sector | | |

| | Notes to the Estimated Financial Statements | | |

| | Department of Treasury and Finance Statement in relation to the Estimated Financial Statements | | |

Appendix A: Specific policy initiatives affecting the budget position |

|

|

| | Output and asset investment initiatives | | |

| | Revenue initiatives | | |

| | Savings initiatives | | |

Appendix B: Growing Victoria Infrastructure Reserve |

|

|

Appendix C: Revised 2001-02 budget outcome |

|

|

| | Revised 2001-02 Statement of Financial Performance | | |

| | Revised 2001-02 Cash Flow Statement | | |

| | Revised 2001-02 Statement of Financial Position | | |

Appendix D: Historical and forward estimates tables |

|

|

Appendix E: Uniform presentation of Government Finance Statistics |

|

|

| | The accrual GFS presentation | | |

| | Institutional sectors | | |

Appendix F: Tax expenditures |

|

|

Appendix G: Commonwealth-State financial relations |

|

|

Appendix H: Requirements of the Financial Management (Financial Responsibility) Act 2000 |

|

|

Style Conventions |

|

|

Index |

|

|

2002-03 BUDGET HIGHLIGHTS

Growing Victoria Together—priorities for the 2002-03 Budget

- •

- The Bracks Government's vision for Victoria is that by 2010 we will be a State where:

- —

- innovation leads to thriving industries generating high quality jobs;

- —

- protecting the environment for future generations is built into all government decision making;

- —

- there are caring, safe communities with equitable opportunities; and

- —

- all Victorians have access to the highest quality health and education services all through their lives.

- •

- The priority actions required to deliver these long-term commitments are identified in Growing Victoria Together and have guided budget choices and the directions of government departments in the 2002-03 Budget.

- •

- The 2002-03 Budget invests for Victoria's future. It invests in more jobs and stronger communities, with education and innovation driving new opportunities.

Sound financial management

- •

- The Bracks Government believes that a strong and secure financial base provides an essential foundation for Victoria's long-term economic, social and environmental wellbeing.

- •

- Demonstrating the Government's commitment to sound financial management, the 2002-03 Budget delivers:

- —

- a substantial general government operating surplus of $522 million in 2002-03, and surpluses averaging around $600 million for the following three years;

- —

- a reduction in general government net financial liabilities, excluding Growing Victoria infrastructure reserve, from $16.3 billion or 10.8 per cent of gross state product (GSP) at 30 June 1999 to an estimated $15.9 billion or 7.1 per cent of GSP at 30 June 2006;

- —

- over the same period general government net debt, excluding Growing Victoria infrastructure reserve, is expected fall by more than half from $4.9 billion or 3.3 per cent of GSP in June 1999 to $2.3 billion or 1.0 per cent of GSP in June 2006;

- —

- new output initiatives worth $317 million in 2002-03 and averaging $326 million per annum over the following three years;

- —

- $3 billion total estimated investment (TEI) to boost infrastructure assets, including the Scoresby Freeway; and

- —

- through Building Tomorrow's Businesses Today, tax cuts of $262 million over the next four years.

- •

- The Government's prudent financial management was acknowledged recently with the international ratings agencies Standard and Poor's and Moody's affirming Victoria's triple-A credit rating.

A growing economy—Victoria leads the way

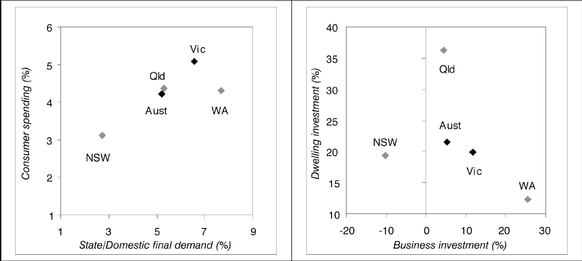

- •

- Despite the global slowdown, the Victorian economy performed strongly over the past year, exceeding the national average in key measures such as consumer spending, business investment and employment.

- •

- Domestic demand rebounded strongly during calendar 2001, particularly in the second half, underpinned by consumer spending, government capital expenditure and acceleration in housing construction.

- •

- The Victorian labour market recorded further solid gains following on from its exceptionally strong employment growth in 2000-01.

- •

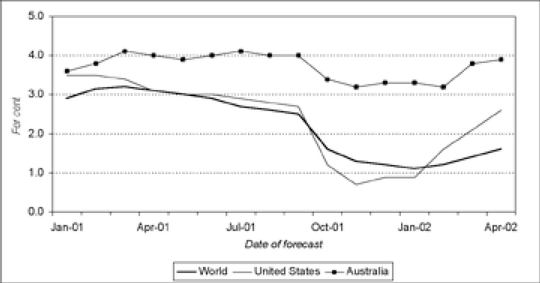

- Recent evidence of a global recovery is positive for the 2002-03 outlook.

- •

- Victorian economic growth is now estimated at 3.75 per cent in 2001-02, exceeding the original budget estimate of 2.75 per cent, and 3.5 per cent in 2002-03.

- •

- Employment is forecast to grow 1.5 per cent in 2002-03, following 1.25 per cent in 2001-02.

Investing for our future—stronger communities

- •

- The Government is committed to growing and linking the whole State. The Government recognises that the key to Victoria's future lies in strong communities, contributing to and sharing in the benefits of a thriving and innovative state economy.

- •

- The 2002-03 Budget provides a major boost to infrastructure focusing on generating more jobs, strengthening our communities and securing new opportunities across Victoria's suburbs, regions and growth corridors, including a $101 million redevelopment of the Royal Melbourne Showgrounds.

- •

- Key highlights of investment in Melbourne's growing suburbs include:

- —

- $637 million TEI (excluding Federal Government funding) in new public transport and upgrading roads, including Scoresby Freeway, electrification of rail line to Craigieburn, key arterial road upgrades and extension of Knox tram service;

- —

- $36 million over four years for 25 new and upgraded bus routes around Melbourne;

- —

- additional investment in 2002-03 in education and training facilities in Melbourne's growing suburbs; and

- —

- the redevelopment of the Royal Melbourne, Dandenong and Angliss Hospitals.

- •

- The 2002-03 Budget continues to build stronger rural and regional communities. Key highlights include:

- —

- $77 million TEI for the construction of the Wimmera-Mallee pipeline;

- —

- a $94 million investment package, including duplication of the Calder Highway between Kyneton and Faraday and other major regional road upgrades and upgrading the Warrnambool rail line, in addition to $8 million over four years to enhance bus services;

- —

- $40 million to continue the redevelopment and upgrade of rural health and public sector residential aged care facilities;

- —

- $130 million over four years for the sustainable use of Victoria's natural resources; and

- —

- improving access and excellence in regional education and training.

Thriving and innovative industries across Victoria

- •

- Innovation is the 21st Century driver of economic growth, high quality jobs, wealth and improved living standards. The 2002-03 Budget focuses on enhancing Victoria as an innovative economy by:

- —

- committing $139 million over four years to new output initiatives as well as $148 million TEI. This includes doubling of the current level of funding for medical research infrastructure and the construction of Australia's first synchrotron facility;

- —

- allocating $364 million over four years to create a more competitive business environment through Building Tomorrow's Businesses Today initiatives. This comprises $262 million in significant business taxation relief and $63 million in new output initiatives, in addition to $39 million in asset investment aimed at improving the way that Victoria does business; and

- —

- targeting agriculture and regional industries by providing $26 million over four years to promote innovation, improve skills and business management, tackle disease and boost exports in the food and fibre industries.

Valuing and investing in lifelong education

- •

- Improving access and driving innovation and excellence in education, from preschool to post-compulsory levels, is the Government's top priority. The 2002-03 Budget builds on major investments in education in the previous two budgets.

- •

- The budget provides $27 million over four years to improve the health, development, learning and wellbeing of children before they start school through reforms to preschools and the new BEST START initiative.

- •

- $334 million over four years in output initiatives, as well as asset investment of $216 million TEI, is allocated to:

- —

- support learning in the early years of schooling through reducing the average class size in prep to year 2 and the implementation of an early years numeracy program;

- —

- improve participation and achievement in education through a new Access to Excellence initiative and a Middle Years Reform and Innovations program;

- —

- address equity and access issues through funding additional Koori educators and home liaison officers to provide education services and support to Koori students;

- —

- place at least 900 additional teachers into schools across Victoria; and

- —

- the modernisation of over 110 government schools and TAFE institutes across Victoria.

Ensuring high quality, accessible health and community services

- •

- The 2002-03 Budget continues to turn around Victoria's health system with better facilities, new approaches and more health workers to give Victorians the highest quality of care.

- •

- In this budget the Government has committed $1.2 billion over four years, as well as asset investment of $217 million TEI, to:

- —

- extend the multi-year Hospital Demand Management Strategy to provide more beds to treat extra patients, including 30 000 patients in hospital emergency departments and 14 000 extra elective surgery, renal, palliative care and radiotherapy patients;

- —

- deliver enhanced community services through a new approach to the delivery of child protection and placement services;

- —

- support older people to live active lives in the community through the ongoing implementation of a program to upgrade and redevelop residential aged care and expanding the Home and Community Care program; and

- —

- respond to the growing need for community and home-based disability support services and tackle homelessness.

Creating safe streets, homes and workplaces

- •

- The Government is committed to preventing crime and maintaining community safety whether in public places, roads, homes or workplaces. The 2002-03 Budget provides $81 million TEI in asset investment, as well as $34 million over four years in new output initiatives, to:

- —

- enhance police services by providing police with upgraded equipment, and modernising and replacing metropolitan and rural police stations;

- —

- ensure seamless transition of emergency call taking and dispatch services and implementation of the Statewide Integrated Public Safety Communications Strategy; and

- —

- improve the safety of all Victorian road and transport users through substantial investment towards reducing death and serious injury from road accidents by 20 per cent over five years.

Promoting sustainable development and protecting the environment for future generations

- •

- The 2002-03 Budget provides key initiatives designed to value Victoria's natural resources. The Government is allocating $130 million over four years, as well as asset investment of $77 million TEI, specifically designed to value and protect Victoria's water, forest and land resources by:

- —

- protecting the health of Victoria's most precious rivers and providing more secure and higher quality water supply;

- —

- the construction of the Wimmera-Mallee pipeline;

- —

- ensuring the long-term future of Victorian forests and regional communities, including the Box Ironbark package; and

- —

- supporting the sustainable management of Victoria's agricultural land and ski fields.

- •

- Funding will be provided for a Centre for Energy and Greenhouse Technologies in Gippsland and the Cooperative Research Centre for Clean Power from Lignite.

Building cohesive communities and reducing inequalities

- •

- The Government has committed $192 million over four years to build strong communities to ensure that there are job opportunities,suport for families and improved access to affordable, high quality services, and making communities good places in which to live and work. This includes:

- —

- additional funding of $12 million over four years to target areas of indigenous disadvantage and to progress reconciliation between indigenous and non-indigenous Victorians;

- —

- expanding the supply of public housing and making housing more affordable. At least an extra 1500 public and community housing units will be created and $12 million provided

from the Office of Housing for neighbourhood renewal across the State. The budget also allocates $13 million in 2002-03 to reform, streamline and expand concessional arrangements to enable more Victorian families and people on low incomes to purchase their own homes; and

- —

- an injection of $84 million into Victorian sport with a focus on developing state-of-the-art facilities ahead of the 2006 Commonwealth Games, including an upgrade of the Melbourne Sports and Aquatic Centre and detailed planning and coordination of the Melbourne 2006 Commonwealth Games.

- •

- The budget also provides a $106 million boost for arts and cultural projects, including new exhibitions, maintenance of state collections and the Yarra Precinct Arts Integration project.

Promoting rights and respecting diversity

- •

- The Government recognises that the diverse cultural backgrounds, languages and abilities of Victorians are some of the State's greatest strengths.

- •

- The 2002-03 Budget builds on the Government's commitment to support and enhance the role of the Victorian Multicultural Commission through the continuation and expansion of the current community grants program.

- •

- The Government has committed $8.3 million to improve access to legal aid, victim support and alternative resolution procedures.

CHAPTER 1: FINANCIAL POLICY OBJECTIVES AND STRATEGIES

- •

- The Government's strategic priorities for Victoria are highlighted in Growing Victoria Together, the framework that balances economic, social and environmental goals and actions.

- •

- The Government is committed to maintaining a substantial operating surplus of at least $100 million in each year.

- •

- The Government is using operating surpluses to invest for the future, providing capital works to enhance social and economic infrastructure throughout Victoria, with expenditure on strategic infrastructure projects boosted by funding from the Growing Victoria infrastructure reserve.

- •

- Improved services will be delivered to all Victorians, with the key priorities being education, health and community safety.

- •

- The Government is committed to ensuring competitive and fair taxes and charges apply to Victorian businesses and households through implementation of the Government's Better Business Taxes and Building Tomorrow's Businesses Today packages.

- •

- Victoria's triple-A credit rating will be maintained by keeping net financial liabilities at prudent levels.

FINANCIAL STRATEGIES, OBJECTIVES AND PRIORITIES

This chapter set outs the Government's financial policy objectives and strategies as required by the Financial Management (Financial Responsibility) Act 2000. The Act includes a set of sound financial management principles. These are to:

- •

- manage financial risks faced by the State prudently, having regard to economic circumstances;

- •

- pursue spending and taxation policies that are consistent with a reasonable degree of stability and predictability in the level of the tax burden;

- •

- maintain the integrity of the Victorian tax system;

- •

- ensure that government policy decisions have regard to their financial effects on future generations; and

- •

- provide full, accurate and timely disclosure of financial information relating to the activities of the Government and its agencies.

The Government's financial responsibility legislation requires a statement of its short and long-term financial objectives in each budget and budget update. It is also a necessary element of the financial management principle of providing full, accurate and timely disclosure of financial information relating to the activities of the Government and its agencies.

Consistent with Growing Victoria Together the Government has a number of short and long-term financial objectives, as shown in Table 1.1.

Table 1.1: Financial objectives

Long-term

| | Short-term

|

|---|

| Maintain a substantial budget operating surplus | | Operating surplus of at least $100 million in each year |

Provide capital works to enhance social and economic infrastructure throughout Victoria |

|

Implement strategic infrastructure projects, including those funded from the Growing Victoria infrastructure reserve |

Provide improved service delivery to all Victorians |

|

Expenditure priority on education, health and community safety |

Ensure competitive and fair taxes and charges to Victorian businesses and households |

|

Implement reforms to Victoria's business taxation system |

Maintain state government net financial liabilities at prudent levels |

|

Maintain a triple-A credit rating |

The Government has met its commitment to maintain an operating surplus of at least $100 million. At the same time the Government has used the operating surplus to upgrade and modernise the State's infrastructure to address economic, social and environmental outcomes, without incurring additional borrowings. Victoria's triple-A credit rating has been maintained. Net financial liabilities are projected to fall over the forward estimates period as a proportion of gross state product (GSP).

Operating surplus

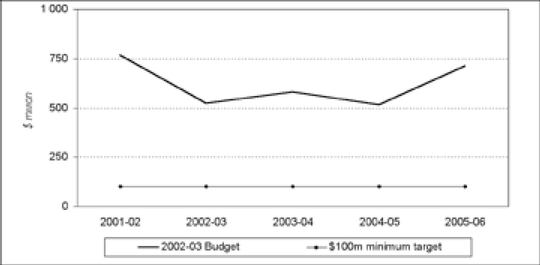

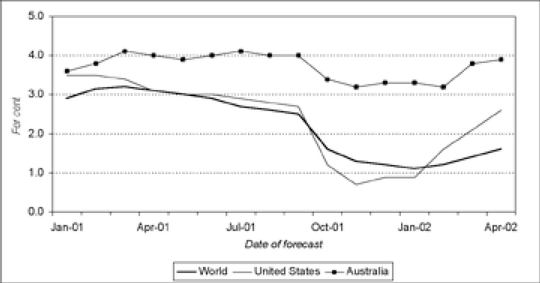

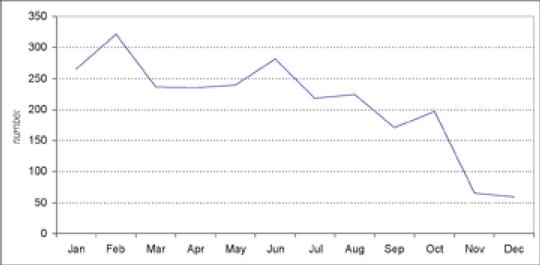

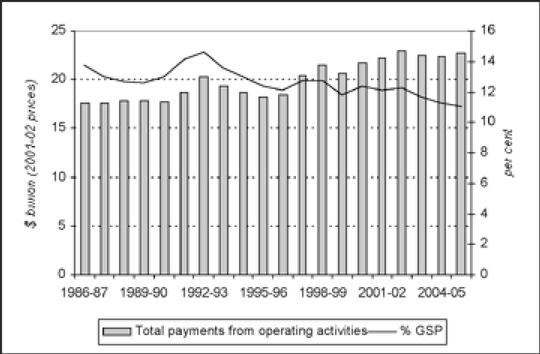

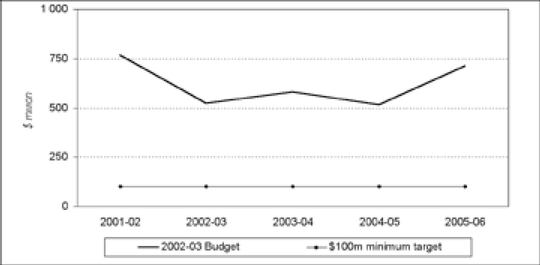

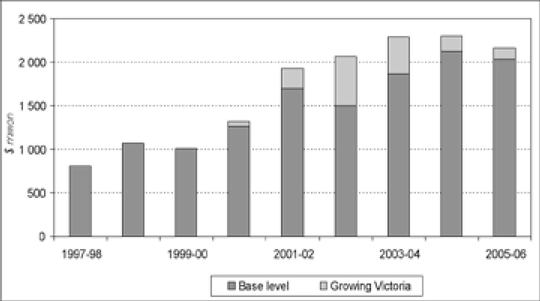

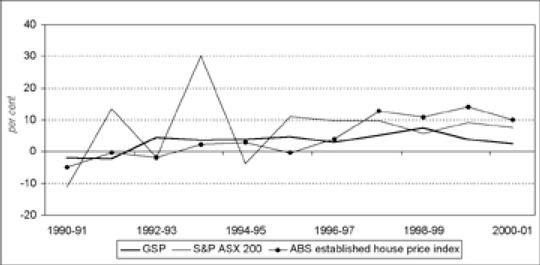

The outlook for the budget surplus remains consistent with this objective, as can be seen in Chart 1.1. Following an estimated surplus of $765 million in 2001-02, the operating surplus is now forecast to be $522 million in 2002-03 and to average around $600 million in the following three years. This substantial operating surplus is an important funding source for the Government's strong capital investment program.

The operating surplus has been achieved despite relatively low growth in taxation revenue, which is expected to grow by 0.5 per cent in 2002-03 and by an average of 1.8 per cent in the following three years. The low average annual growth over the projection period reflects a forecast moderation of property and other asset markets, the business tax cuts announced in the Government's Better Business Taxes and Building Tomorrow's Businesses Today packages, and the abolition of debits tax from 1 July 2005 (subject to review by the Ministerial Council in accordance with the Intergovernmental Agreement).

Given the continued uncertainties in the world economy (see Chapter 3, Economic Conditions and Outlook for further information), the Government is maintaining a buffer above the $100 million minimum operating surplus target. This provides protection of the operating surplus target against a moderate deterioration in the national and world economies and asset markets. For a more detailed discussion of economic and other risks, and the sensitivity of the operating surplus to changes in economic conditions, see Chapter 6, Statement of Risks.

Chart 1.1: General government sector operating surplus(a)

Source: Department of Treasury and Finance

Note:

- (a)

- The general government sector operating surplus is equivalent to the "net result" in the statement of financial performance in Chapter 7, Estimated Financial Statements and Notes.

The operating surplus objective and buffer are in accord with the financial management principle of pursuing expenditure and taxation policies that allow reasonable stability and predictability in tax burden levels. Thus, businesses and households can have confidence that tax rates and the level of service delivery will not need to be adjusted markedly and unexpectedly at some future date to retrieve the State's financial position.

Table 1.2 shows that the substantial operating surpluses and Growing Victoria infrastructure reserve are being used to fund the significant infrastructure spending program. For example, 2002-03 net infrastructure investment of $2 066 million is more than double the depreciation expense of $952 million, with the shortfall being sourced from the operating surplus ($522 million) and a drawdown in the Growing Victoria infrastructure reserve of $570 million. As a consequence, and despite the large infrastructure program, net debt falls slightly in the budget and forward estimate years.

Table 1.2: Application of cash resources

| | 2001-02

Revised

| | 2002-03

Budget

| | 2003-04

Estimate

| | 2004-05

Estimate

| | 2005-06

Estimate

|

|---|

| | ($ million)

|

|---|

| Budget operating surplus | | 765 | | 522 | | 580 | | 517 | | 712 |

| Plus: Depreciation expense | | 895 | | 952 | | 1003 | | 1067 | | 1115 |

| Plus: Other non-cash expenses (net)(a) | | 1041 | | 123 | | 388 | | 648 | | 307 |

| Plus: Net drawdown from Growing Victoria infrastructure reserve | | -174 | | 570 | | 426 | | 170 | | 130 |

| | |

| |

| |

| |

| |

|

| Cash available for asset investment | | 2528 | | 2166 | | 2397 | | 2403 | | 2264 |

| Less: Net infrastructure investment | | 1929 | | 2066 | | 2292 | | 2299 | | 2166 |

| Less: Other investment activities (net)(b) | | -56 | | 13 | | 13 | | 12 | | 10 |

| | |

| |

| |

| |

| |

|

| Reduction in net debt excluding Growing Victoria(c) | | 655 | | 87 | | 92 | | 91 | | 88 |

| | |

| |

| |

| |

| |

|

Source: Department of Treasury and Finance

Notes:

- (a)

- Includes increase in unfunded superannuation liability and increase in liability for employee entitlements.

- (b)

- Comprises increase in other financial assets and decrease in gross borrowing.

- (c)

- Growing Victoria investments are excluded as an offset to gross debt on grounds that these investments are earmarked for infrastructure projects and are therefore not available to redeem gross debt.

The Government uses the Australian Accounting Standards Board (AAS 31) operating result as its measure of the headline budget surplus. A method of presentation alternative to AAS 31 is the Government Finance Statistics (GFS) system employed by the Australian Bureau of Statistics (ABS). AAS 31 and GFS measures are shown in Table 1.3. For a detailed reconciliation between AAS 31 and the GFS measures refer to Table E.12 in Appendix E, Uniform Presentation of Government Finance Statistics.

The operating result—designed to match taxes, grants and other revenue earned in the year to expenses incurred—is similar under both generally accepted accounting principles (AAS 31) and the ABS (GFS) frameworks. The other two GFS measures incorporate a mixture of operating statement and balance sheet items. Traditionally GFS cash surplus has closely mirrored the change in net debt, although recent accounting changes have loosened this link.

GFS cash surplus measures the surplus of cash receipts over cash payments, and produces a lower surplus largely because of the inclusion of infrastructure asset expenditure as a cash payment.

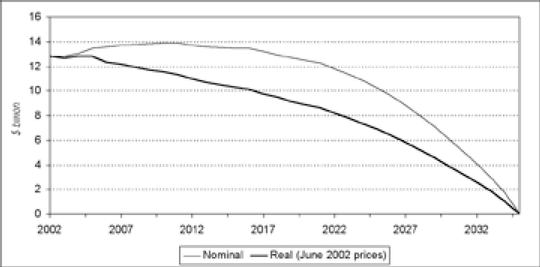

GFS net lending (or fiscal balance) is equal to the change in net debt and other financial liabilities. It moves into deficit over the forward estimates because the increasing present value of accrued members' benefit entitlements pushes up the State's unfunded superannuation liability. However, as noted below, net financial liabilities fall as a proportion of GSP over the period and the Government's commitment is to eliminate the unfunded superannuation liability by 2035.

Table 1.3: AAS 31 net result and GFS budget measures (excluding Growing Victoria)

| | 2001-02

Revised

| | 2002-03

Budget

| | 2003-04

Estimate

| | 2004-05

Estimate

| | 2005-06

Estimate

|

|---|

| | ($ million)

|

|---|

| Net operating result (AAS 31) | | 765 | | 522 | | 580 | | 517 | | 712 |

| Net operating balance (GFS) | | 1161 | | 489 | | 545 | | 483 | | 680 |

| GFS net lending(a) | | -30 | | 163 | | -145 | | -359 | | -89 |

| GFS cash surplus(a) | | 663 | | 305 | | 265 | | 315 | | 240 |

Source: Department of Treasury and Finance

Note:

- (a)

- The table shows GFS net lending (+) / borrowing (-) and GFS cash surplus (+) / deficit (-) excluding the impact of Growing Victoria. Growing Victoria investments are excluded as an offset to gross debt on grounds that these investments are earmarked for infrastructure projects and are therefore not available to redeem gross debt.

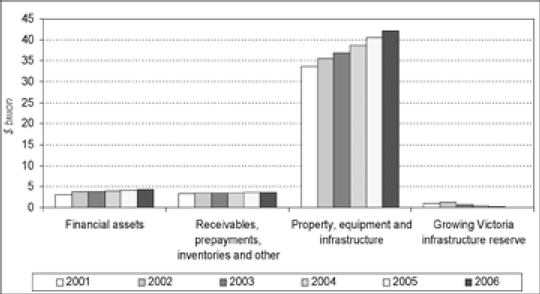

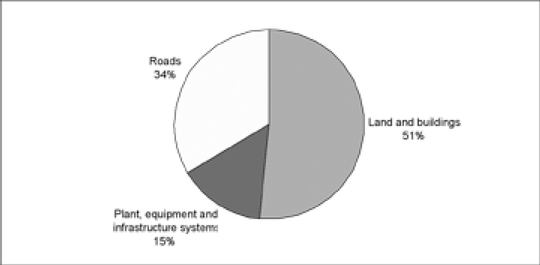

Infrastructure

The Government recognises that building effective infrastructure is essential for delivering improved services and promoting growth across the whole State. In Growing Victoria Together the Government identified the following priority infrastructure actions:

- •

- building fast, reliable and efficient transport and communication infrastructure;

- •

- better linking Melbourne and regional ports to industry and agricultural centres across Victoria; and

- •

- connecting more Victorians to the internet and other new technologies.

In addition, the Government is aiming to rebuild and modernise the State's social infrastructure including schools, hospitals, prisons, police stations, community services and recreational and culture resources—the foundations for a prosperous and equitable society.

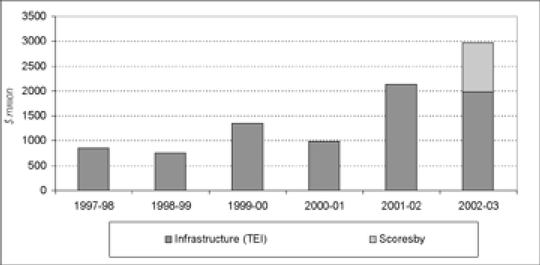

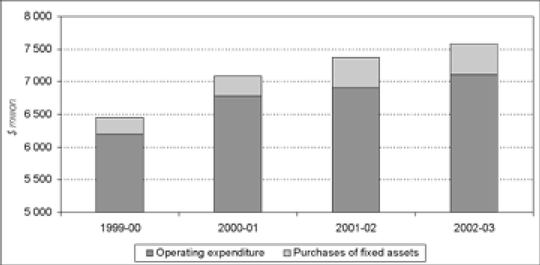

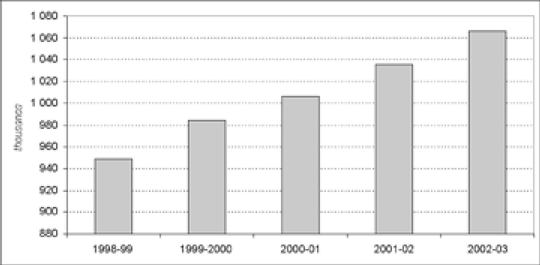

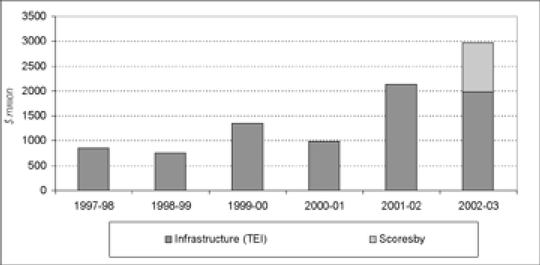

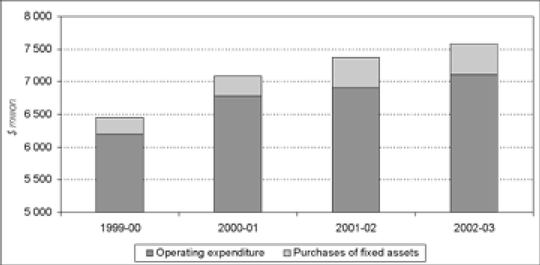

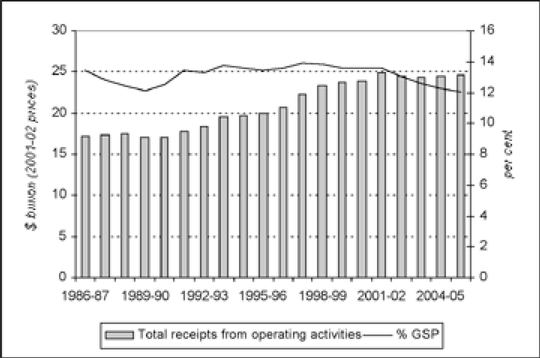

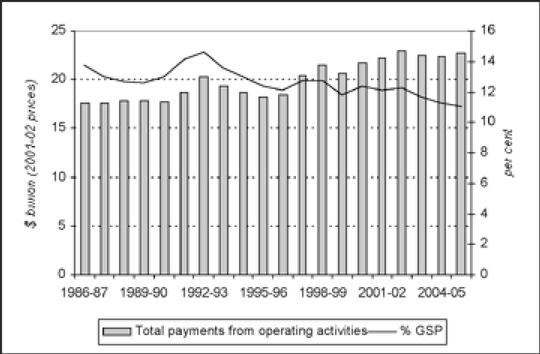

The 2002-03 Budget commits $3.0 billion (total estimated investment—TEI) to boost infrastructure assets (see Chart 1.2). A significant component of this program is the Scoresby Freeway. The Victorian Government has matched the Commonwealth Government's contribution of $445 million, in addition to the $110 million in land purchases. The Scoresby Freeway will deliver significant road and public transport improvements in one of Melbourne's most important growth corridors, creating a seamless link stretching between Ringwood and Frankston and improving east-west connections for travel to the CBD and beyond.

Chart 1.2: Infrastructure spending commitments in recent budgets (TEI)

Source: Department of Treasury and Finance

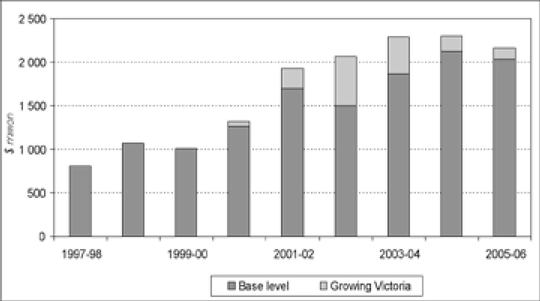

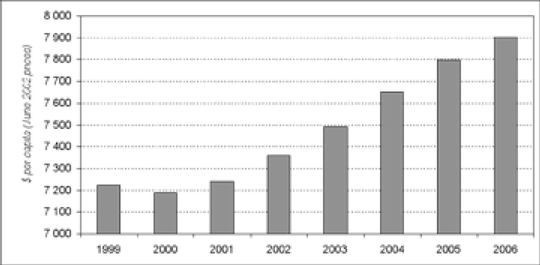

Chart 1.3 shows past actual yearly expenditure on net infrastructure investment, together with forward projections.

Chart 1.3: General government sector net infrastructure investment

Source: Department of Treasury and Finance

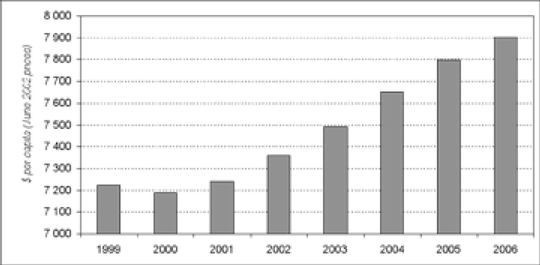

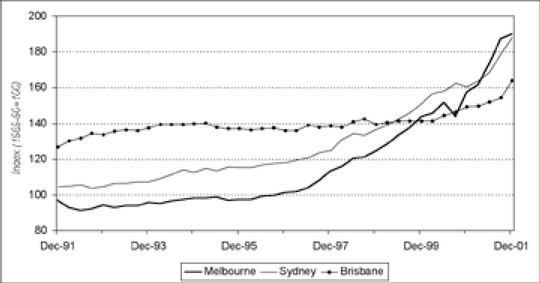

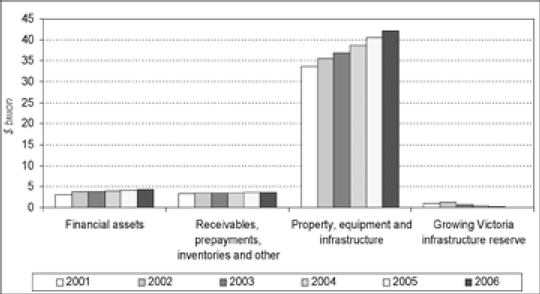

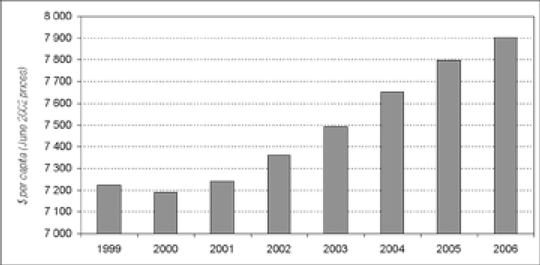

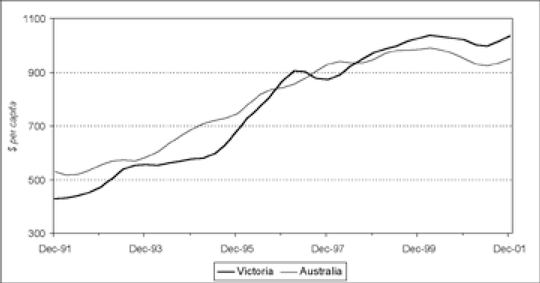

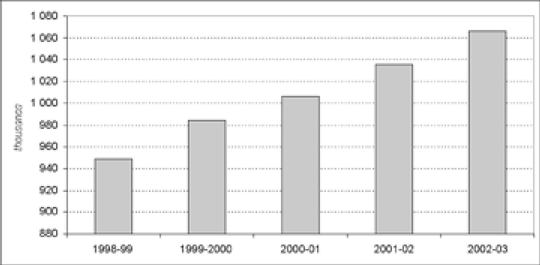

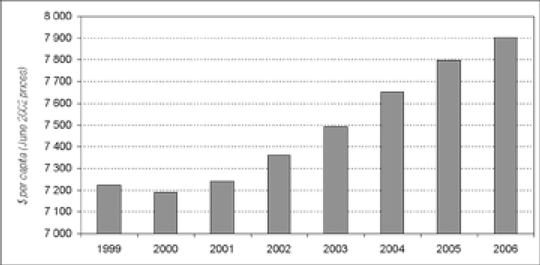

Over the period 2002-03 to 2005-06 annual expenditure on fixed assets will average $2.2 billion. This increased level of expenditure far outstrips estimated depreciation of around $1 billion per annum, and results in growth of the real capital stock over the four years to June 2006 of over 11 per cent compared to projected population growth of around 4 per cent (see Chart 1.4).

Chart 1.4: Real capital stock per capita as at 30 June

Source: Department of Treasury and Finance

Service delivery

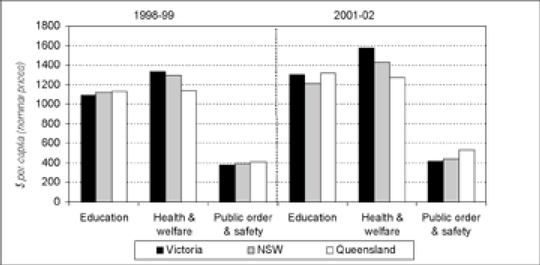

The Government is building on last year's service delivery initiatives by continuing with medium to long-term strategies to improve quality, access and equity, particularly in education, health and community safety.

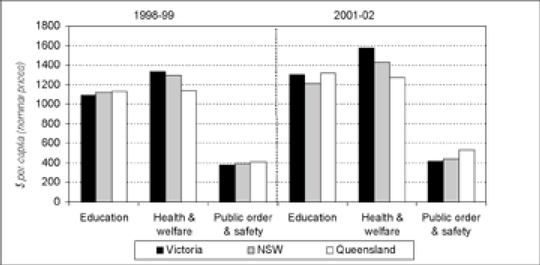

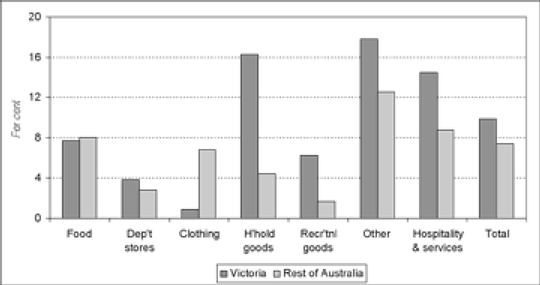

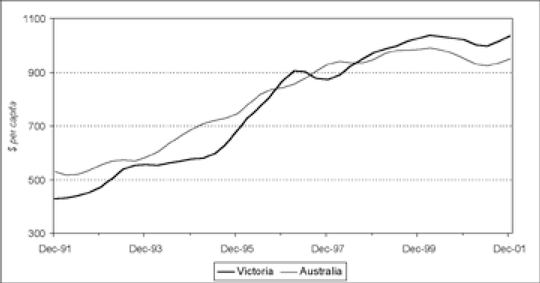

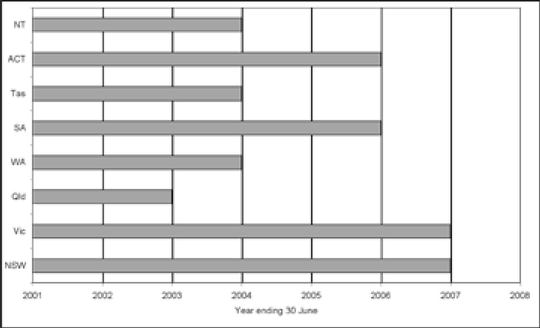

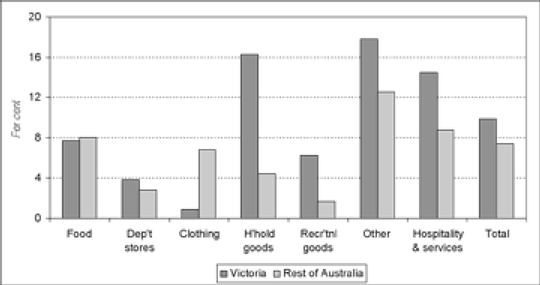

Since coming to office, the Government has lifted Victoria's spending in the areas of education, health and community safety. Chart 1.5 shows that the level of the Government's spending per capita in health has outstripped that of New South Wales and Queensland. Government expenditure per capita on education is higher than that in New South Wales and closely aligned to that in Queensland (the growth per capita in education spending has been higher in Victoria than Queensland).

This expenditure has produced better outcomes for health, education and community safety:

- •

- emergency department ambulance bypass rates have fallen significantly during 2002, while the number of patients waiting for more than 12 hours in emergency departments for admission to a ward has also decreased. Metropolitan emergency departments continue to treat more patients, and hospital capacity taken up by people waiting for residential aged care has reduced;

- •

- year 7-12 retention rates for Victorian government schools increased from 69.8 per cent in 1999 to 73.7 per cent in 2001. For the first time in many years Victorian government school retention rates were better than all other States excluding the ACT; and

- •

- in 2000, Victoria had the lowest proportion of victims of crime against both property and persons of all the States.

The 2002-03 Budget provides additional funding for new output initiatives of $317 million in 2002-03 and an average of $326 million over the following three years. This is net of $163 million of funding in 2002-03 from existing forward estimates demand contingencies (put aside for increasing service delivery required by population and demonstrated demand growth). It is also in addition to $161 million in 2002-03 of output initiatives announced since the 2001-02 Budget and reflected in the 2001-02 Budget Update.

Chart 1.5: Per capita spending in selected portfolios

Source: Australian Bureau of Statistics; Victorian Department of Treasury and Finance; NSW Department of Treasury; Queensland Department of Treasury

In 2002-03, resources are targeted towards the following key service areas identified in Growing Victoria Together:

- •

- valuing and investing in lifelong education;

- •

- high quality, accessible health and community services; and

- •

- safe streets, homes and workplaces.

The 2002-03 Budget continues the expenditure to date by focusing on initiatives which will give all schools and students the opportunity to participate in Victoria's drive towards excellence in education and training, with $334 million in new output initiatives over four years, as well as $216 million (TEI) in asset investment. The priority initiatives targeted in the 2002-03 Budget are focused on achieving the education and training goals and targets.

The 2002-03 Budget continues to turn around Victoria's health and community services system, building on new service delivery approaches implemented in the last budget, with $1.2 billion in new initiatives over four years. The budget also continues to rebuild the health and community services system with a $217 million investment in new human services infrastructure.

In the 2002-03 Budget the Government has allocated $81 million TEI and $34 million in new output initiatives over four years to preventing crime and maintaining community safety, whether in public places, homes or workplaces. The Government is committed to improving road and workplace safety and to reducing offending and re-offending.

Taxation

In Growing Victoria Together the Government reiterated its commitment to ensuring a competitive tax system in Victoria in order to foster a business environment conducive to investment and job creation.

The Government's tax reform package, Better Business Taxes announced tax cuts of $774 million on 26 April 2001, which reduced the burden of payroll tax, cut the number of state business taxes, and reduced paperwork and red tape.

The Building Tomorrow's Businesses Today statement, released on 22 April 2002, continues the Government's ongoing commitment to ensure a competitive tax regime for Victorian businesses. The Government's strong financial position enables further cuts in business taxes of $262 million to 2005-06, providing an additional boost to jobs and growth in Victoria by:

- •

- raising the payroll tax threshold from $515 000 to $550 000 from 1 July 2002, a year ahead of schedule;

- •

- reducing the payroll tax rate from 5.45 per cent to 5.35 per cent from 1 July 2002, a year ahead of schedule;

- •

- further reducing the payroll tax rate from 5.35 per cent to 5.25 per cent from 1 July 2003. The payroll tax initiatives will further stimulate business growth and employment and will represent a 9 per cent reduction in the payroll tax rate under the Bracks Government;

- •

- raising the land tax threshold from $125 000 to $150 000 from 2002-03; and

- •

- abolishing the stamp duty on unquoted marketable securities from 1 July 2002, a year ahead of schedule.

In total, across Better Business Taxes and Building Tomorrow's Businesses Today, the Government has announced tax cuts of over $1 billion in its first term of office.

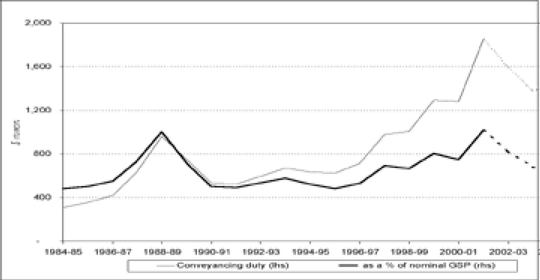

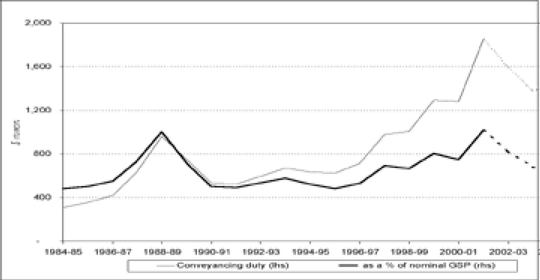

This budget allocates $13 million in 2002-03 to reform, streamline and expand existing concessions on conveyancing duty to enable more Victorian families and people on low incomes to purchase their own homes. The maximum concession available will rise to $4 660. This will double the numbers of concession card holders and families with dependent children expected to receive a concession in 2002-03.

The competitiveness of Victoria's tax regime plays an important role in underpinning economic growth and investment. Consistent with the Government's strategic priority to promote growth across the whole of Victoria, the Government is aiming to ensure Victoria's taxes remain competitive with the Australian average.

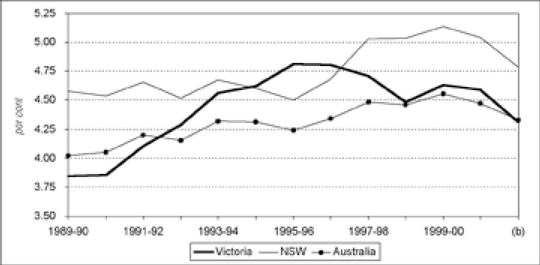

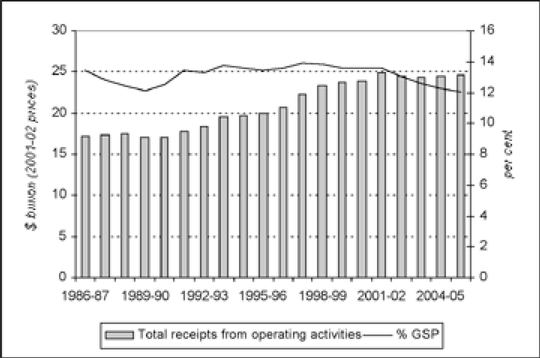

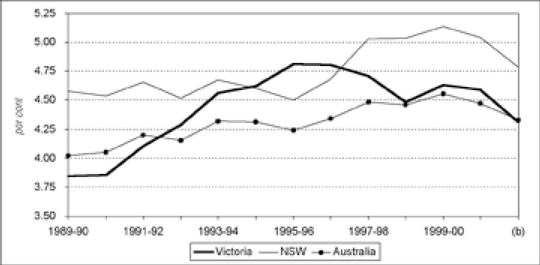

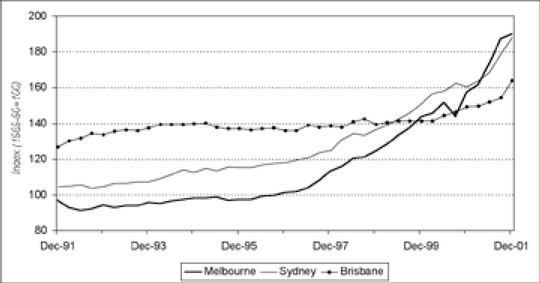

State taxation revenue expressed as a share of nominal GSP is Victoria's preferred measure of tax competitiveness as it relates the level of taxation revenue to economic capacity. Taxation revenue as a share of nominal GSP for Victoria, New South Wales and the Australian average is shown in Chart 1.6.

Chart 1.6: Taxation revenue as a share of nominal GSP(a)

Source: Australian Bureau of Statistics; Department of Treasury and Finance

Notes:

- (a)

- Historical taxation data have been recast to reflect only those taxes that remain after 1 July 2001.

- (b)

- 2000-01 data further adjusted for Victorian tax changes announced in this budget, but assuming no further tax changes in other States in their 2002-03 budgets.

Using 2000-01 actual taxation data (the latest year which is available from the ABS) and adjusting for all tax changes announced in the 2001-02 budgets of all States, as well as tax changes announced in this budget, Victoria's taxation as a share of nominal GSP is estimated to be slightly below the Australian average and a substantial 0.48 percentage points of GSP below that of New South Wales.

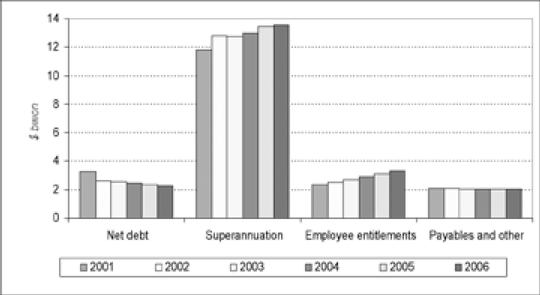

Net financial liabilities

The Government is committed to maintaining net financial liabilities (net debt and unfunded superannuation liability) at prudent levels in order to achieve its objective of maintaining Victoria's triple-A credit rating.

Victoria's triple-A long-term local currency rating was reaffirmed by Standard and Poor's on 24 January 2002 and by Moody's on 28 March 2002. Both ratings agencies cited Victoria's low debt levels, strong fiscal position and very strong financial performance in recent years as key reasons behind their decision.

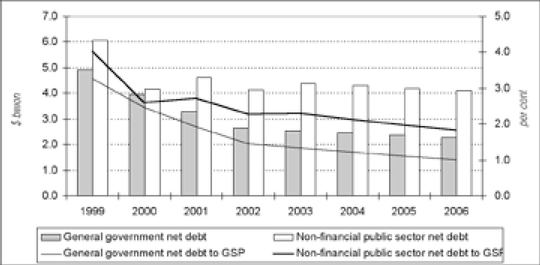

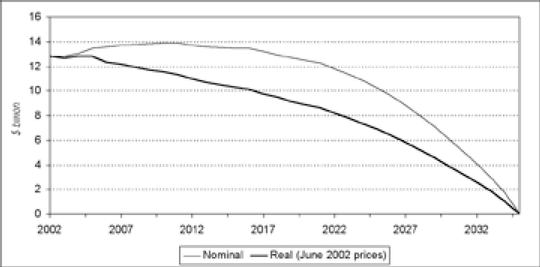

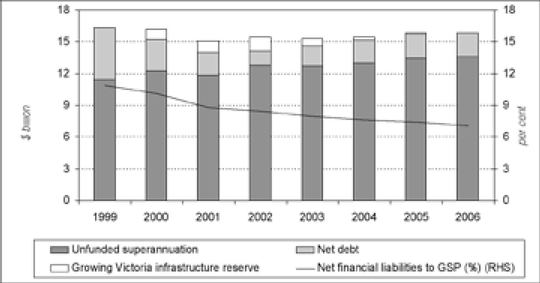

The 2002-03 budget outlook reinforces these positive factors. Substantial operating surpluses are projected for 2002-03 and the remainder of the forward estimates period. General government net financial liabilities (excluding Growing Victoria) were $16.3 billion or 10.8 per cent of GSP at June 1999. In nominal terms, they are projected to reach $15.4 billion as at June 2002 and $15.9 billion as at June 2006 (see Chart 1.7). The change during the forward estimates period reflects movement in unfunded superannuation liabilities arising from the increasing present value of accrued members' benefit entitlements. As a proportion of GSP net financial liabilities are expected to decrease to 7.1 per cent of GSP by June 2006.

Net debt as a component of net financial liabilities is forecast to fall by more than half from $4.9 billion (3.3 per cent of GSP) in 1999 to $2.3 billion (1.0 per cent of GSP) by 2006. Victoria's net financial liabilities position is expected to remain comparable with other triple-A jurisdictions.

Chart 1.7: General government net financial liabilities excluding Growing Victoria(a)(b)

Source: Department of Treasury and Finance

Notes:

- (a)

- General government net financial liabilities are calculated as the sum of net debt and net unfunded superannuation liabilities.

- (b)

- Net debt is calculated as gross debt less liquid financial assets. Growing Victoria investments are excluded as an offset to gross debt on grounds that these investments are earmarked for infrastructure projects and are therefore not available to redeem gross debt.

SEEKING A BETTER COMMONWEALTH-STATE FUNDING DEAL

The distribution of Commonwealth grants between the States and Territories is important to the achievement of the Government's financial objectives. The existing Commonwealth arrangements are in need of reform. The poor grant shares flowing to Victoria under existing arrangements reduces Victoria's capacity to deliver services, provide additional infrastructure investment and reduce taxes.

The share of Commonwealth general purpose grants redistributed away from Victoria under the Commonwealth Grants Commission (CGC) process continues to increase. Table 1.4 shows the levels and changes in cross-subsidies for each State and Territory as a result of the CGC's 2002 Update. Victoria's cross-subsidy to the other States and Territories for 2002-03, compared to the equal per capita share, is now estimated at over $1 billion, an increase of $120 million from 2001-02.

In addition, for every dollar of GST revenue raised from Victorians, it is estimated that only 83 cents is returned as revenue to Victoria. This is a result of the CGC determinations and the fact that Victorians spend more per head on goods and services than the average Australian.

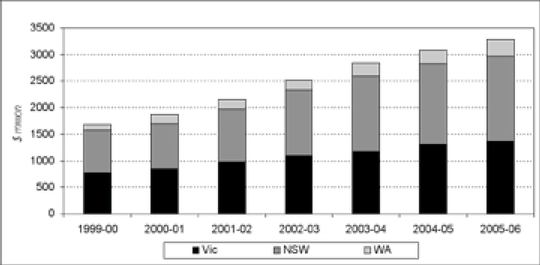

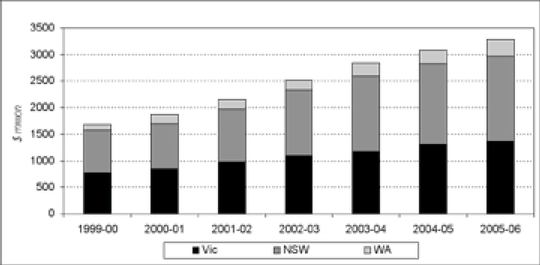

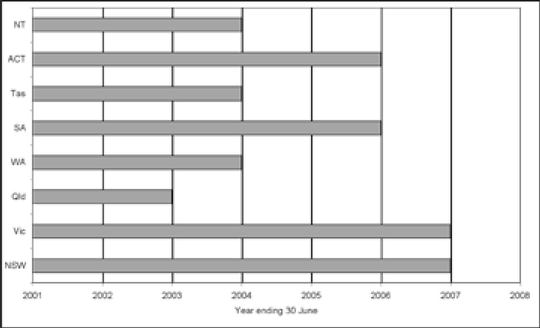

The cross-subsidy from Victoria, New South Wales and Western Australia has been growing steadily since the current CGC relativities were introduced in 1999 and is projected to double to $3.4 billion from 1999-2000 to 2005-06 (see Chart 1.8). This compares with projected Victorian nominal GSP growth of around 40 per cent over the same period. Such an increasing burden on Victoria and the other subsidising States is clearly unsustainable.

In particular, the cross-subsidy to Queensland ($207 million) and ACT ($90 million) cannot be justified on fiscal grounds when:

- •

- Queensland's tax rates are the lowest in Australia;

- •

- Queensland and the ACT are the only jurisdictions in a negative net debt position; and

- •

- ACT residents have income 40 per cent higher than the national average.

Table 1.4: Estimates of cross-subsidy paid and received for 2002-03 and changes from 2001-02

| | NSW

| | Vic

| | Qld

| | WA

| | SA

| | Tas

| | ACT

| | NT

| | Total(a)

|

|---|

| | ($ million)

| |

|

|---|

| Cross-subsidy paid | | 1 242 | | 1 096 | | | | 185 | | | | | | | | 2 522 | | |

| Change | | 245 | | 120 | | | | -2 | | | | | | | | 363 | | |

| Cross-subsidy received | | | | | | 207 | | | | 596 | | 480 | | 90 | | 1 150 | | 2 522 |

| Change | | | | | | 112 | | | | 55 | | 56 | | 12 | | 128 | | 363 |

Source: Department of Treasury and Finance

Note:

- (a)

- Totals may not add due to rounding.

Chart 1.8: Cross-subsidisation by Victoria, New South Wales and Western Australia

Source: Department of Treasury and Finance

The unsustainable grant shares are the result of the CGC's outdated method of constructing relativities. Victoria, along with New South Wales and Western Australia, representing 70 per cent of Australia's population, has been calling for an independent review of the current system for some years. The Commonwealth has continued to ignore these calls. Given this lack of support, on 30 November 2001, the three States commissioned a review into the methods for allocating Commonwealth grants to the States and Territories.

The Committee established to undertake this review is independent of the three governments and will examine the efficiency, equity, simplicity and transparency of the current system.

Key conclusions emerging from the review so far suggest that the current system:

- •

- results in an Australian economy-wide efficiency loss of between $150 million and $250 million per annum; and

- •

- delivers no improvement to overall equity.

The Committee will deliver its Final Report around the middle of 2002.

CHAPTER 2: BUDGET POSITION AND OUTLOOK

- •

- The budget incorporates the impact of significant new policy measures, including funding for new output initiatives with a net budget impact of $317 million in 2002-03.

- •

- The 2002-03 Budget provides funding for the commencement of new infrastructure investment projects with a total estimated investment of $3.0 billion (including both the Victorian and Commonwealth Government's contribution to the Scoresby Freeway).

- •

- The Government's strong financial position enables further cuts in business taxes of $262 million over the next four years, including $83 million in 2002-03, announced in Building Tomorrow's Businesses Today.

- •

- Total operating expenses are expected to increase by 2.1 per cent in 2002-03, in part reflecting the impact of 2002-03 Budget funding initiatives, with growth remaining stable at around 2.2 per cent per annum on average in the following three years.

- •

- A budget operating surplus of $522 million is forecast for 2002-03. The operating surplus is expected to average around $600 million over the remainder of the outlook period.

This chapter provides details of the projected budget position for the period 2002-03 to 2005-06. The discussion of the budget and forward estimates focuses on trends in the aggregate budget position, as well as reconciliation of major variations in key budget aggregates since the 2001-02 Budget released in May 2001 and the 2001-02 Budget Update published in January 2002.