| |

| As filed with the Securities and Exchange Commission on August 10, 2009. |

| |

| | Registration No. 333-________ |

| |

| |

| U.S. SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| |

| FORM N-14 |

| |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X] |

| |

| [ ] Pre-Effective Amendment No. |

| [ ] Post-Effective Amendment No. |

| |

| PRINCIPAL FUNDS, INC. |

| f/k/a Principal Investors Fund, Inc. |

| (Exact name of Registrant as specified in charter) |

| |

| 680 8th Street, Des Moines, Iowa 50392-2080 |

| (Address of Registrant's Principal Executive Offices) |

| |

| 515-248-3842 |

| (Registrant's Telephone Number, Including Area Code) |

| |

| Michael D. Roughton |

| Counsel, Principal Funds, Inc. |

| 711 High Street |

| Des Moines, Iowa 50392-2080 |

| (Name and Address of Agent for Service) |

| |

| | Copies of all communications to: |

| | John W. Blouch |

| | Dykema Gossett PLLC |

| 1300 I Street, N.W. |

| | Washington, D.C. 20005-3353 |

| | 202-906-8714; 202-906-8669 (Fax) |

| |

| Approximate date of proposed public offering: As soon as practicable after this Registration Statement |

| becomes effective. | |

| |

| Title of Securities Being Registered: Class A, Class B, Class C, and Institutional Class Shares common stock, |

| par value $.01 per share. | |

| |

| No filing fee is due because an indefinite number of shares have been registered in reliance on Section 24(f) |

| under the Investment Company Act of 1940, as amended. |

| |

| It is proposed that this filing will become effective on September 9, 2009, pursuant to Rule 488. |

|

| PRINCIPAL FUNDS, INC. |

| 680 8th Street |

| Des Moines, Iowa 50392-2080 |

Dear Shareholder:

A Special Meeting of Shareholders of Principal Funds, Inc. (“PFI”) will be held at 680 8th Street, Des Moines, Iowa 50392-2080, on October 19, 2009 at 10 a.m., Central Time.

At the meeting, shareholders of the MidCap Stock Fund (the “Acquired Fund”) will be asked to consider and approve a Plan of Acquisition (the “Plan”) providing for the reorganization of the MidCap Stock Fund into the MidCap Blend Fund (the “Acquiring Fund”). Each of these Funds is a separate series or fund of PFI.

Under the Plan: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund in exchange for shares of the Acquiring Fund; (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund; and (iii) the Acquired Fund will liquidate and terminate (the “Reorganization”). As a result of the Reorganization, each shareholder of the Acquired Fund will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization will equal the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange (“NYSE”) on the closing date of the Reorganization. Holders of Class A, Class B, Class C and Institutional Class shares of the Acquired Fund will receive, respectively, Class A, Class B, Class C and Institutional Class shares of the Acquiring Fund. The Reorganization is expected to occur as of the close of regularly scheduled trading on the NYSE on October 23, 2009. All share classes of the Acquired Fund will vote in the aggregate and not by class with respect to the Reorganization.

The Board of Directors of PFI believes that the Reorganization will serve the best interests of shareholders of both the Acquired and Acquiring Funds. The Funds have similar investment objectives in that the Acquiring Fund seeks to provide long-term growth of capital while the Acquired Fund seeks to provide long-term capital appreciation. The Funds also have similar principal policies and risks in that both invest in securities of mid-capitalization companies. The Acquiring Fund has lower advisory fee rates and is expected to have lower expense ratios following the Reorganization. The Acquiring Fund has outperformed the Acquired Fund over the three-year and five-year periods ended March 31, 2009. Moreover, the Reorganization may be expected to afford shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. Combining the Funds will not result in any dilution of the interests of existing shareholders of the Funds.

The value of your investment will not be affected by the Reorganization. Furthermore, in the opinion of legal counsel, no gain or loss will be recognized by any shareholder for federal income tax purposes as a result of the Reorganization.

Enclosed you will find a Notice of Special Meeting of Shareholders, a Proxy Statement/Prospectus, and a proxy card for shares of the Acquired Fund you owned as of August 21, 2009, the record date for the Meeting. The Proxy Statement/Prospectus provides background information and describes in detail the matters to be voted on at the Meeting.

The Board of Directors has unanimously voted in favor of the proposed Reorganization and recommends that you vote FOR the Proposal.

In order for shares to be voted at the Meeting, we urge you to read the Proxy Statement/Prospectus and then complete and mail your proxy card(s) in the enclosed postage-paid envelope, allowing sufficient time for receipt by us by October 18, 2009. As a convenience, we offer three options by which to vote your shares:

By Internet: Follow the instructions located on your proxy card.

By Phone: The phone number is located on your proxy card. Be sure you have your control number, as printed on your proxy card, available at the time you call.

By Mail: Sign your proxy card and enclose it in the postage-paid envelope provided in this proxy package.

We appreciate your taking the time to respond to this important matter. Your vote is important. If you have any questions regarding the Reorganization, please call our shareholder services department toll free at 1-800-222-5852.

|

| PRINCIPAL FUNDS, INC. |

| 680 8th Street |

| Des Moines, Iowa 50392-2080 |

| |

| NOTICE OF SPECIAL MEETING OF SHAREHOLDERS |

To the Shareholders of the MidCap Stock Fund:

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of the MidCap Stock Fund, a separate series of Principal Funds, Inc. (“PFI”), will be held at 680 8th Street, Des Moines, Iowa 50392-2080, on October 19, 2009 at 10 a.m., Central Time. A Proxy Statement/Prospectus providing information about the following proposal to be voted on at the Meeting is included with this notice. The Meeting is being held to consider and vote on such proposal as well as any other business that may properly come before the Meeting or any adjournment thereof:

| |

| Proposal: | Approval of a Plan of Acquisition providing for the reorganization of the MidCap Stock Fund (the “Fund”) into the |

| | MidCap Blend Fund. |

The Board of Directors of PFI recommends that shareholders of the Fund vote FOR the Proposal.

Approval of the Proposal will require the affirmative vote of the holders of at least a “Majority of the Outstanding Voting Securities” (as defined in the accompanying Proxy Statement/Prospectus) of the Fund.

Each shareholder of record at the close of business on August 21, 2009 is entitled to receive notice of and to vote at the Meeting.

Please read the attached Proxy Statement/Prospectus.

|

| By order of the Board of Directors |

| |

| Nora M. Everett |

| President |

|

| __________, 2009 |

| Des Moines, Iowa |

|

| PRINCIPAL FUNDS, INC. |

| 680 8th Street |

| Des Moines, Iowa 50392-2080 |

| |

| ————————— |

| |

| PROXY STATEMENT/PROSPECTUS |

| SPECIAL MEETING OF SHAREHOLDERS |

| TO BE HELD OCTOBER 19, 2009 |

| |

| RELATING TO THE REORGANIZATION OF: |

| THE MIDCAP STOCK FUND INTO |

| THE MIDCAP BLEND FUND |

This Proxy Statement/Prospectus is furnished in connection with the solicitation by the Board of Directors (the “Board” or “Directors”) of Principal Funds, Inc. (“PFI”) of proxies to be used at a Special Meeting of Shareholders of PFI to be held at 680 8th Street, Des Moines, Iowa 50392-2080, on October 19, 2009, at 10 a.m., Central Time (the “Meeting”).

At the Meeting, shareholders of the MidCap Stock Fund (the “Acquired Fund”) will be asked to consider and approve a proposed Plan of Acquisition (the “Plan”) providing for the reorganization of the Acquired Fund into the MidCap Blend Fund (the “Acquiring Fund”).

Under the Plan: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities of the Acquired Fund in exchange for shares of the Acquiring Fund; (ii) the Acquiring Fund shares will be distributed to the Shareholders of the Acquired Fund; and (iii) the Acquired Fund will liquidate and terminate (the “Reorganization”). As a result of the Reorganization, each shareholder of the Acquired Fund will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization will equal the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange (“NYSE”) on the closing date of the Reorganization. Holders of Class A, Class B, Class C and Institutional Class shares of the Acquired Fund will receive, respectively, Class A, Class B, Class C and Institutional Class shares of the Acquiring Fund. If approved by shareholders of the Acquired Fund, the Reorganization is expected to occur immediately after the close of regularly scheduled trading on the NYSE on October 23, 2009 (the “Effective Time”). All share classes of the Acquired Fund will vote in the aggregate and not by class. The terms and conditions of the Reorganization are more fully described below in this Proxy Statement/Prospectus and the Form of Plan of Acquisition which is attached hereto as Appendix A.

This Proxy Statement/Prospectus contains information shareholders should know before voting on the Reorganization. Please read it carefully and retain it for future reference. The Annual and Semi-Annual Reports to Shareholders of PFI contain additional information about the investments of the Acquired and Acquiring Funds, and the Annual Report contains discussions of the market conditions and investment strategies that significantly affected these Funds during the fiscal year ended October 31, 2008. Copies of these reports may be obtained at no charge by calling our shareholder services department toll free at 1-800-247-4123.

A Statement of Additional Information dated ___________, 2009 (the “Statement of Additional Information”) relating to this Proxy Statement/Prospectus has been filed with the Securities and Exchange Commission (“SEC”) and is incorporated by reference into this Proxy Statement/Prospectus. PFI’s Prospectus, dated March 1, 2009 and as supplemented (“PFI Prospectus”), and the Statement of Additional Information for PFI, dated March 1, 2009 and as supplemented (“PFI SAI”), have been filed with the SEC and, insofar as they relate to the MidCap Stock Fund, are incorporated by reference into this Proxy Statement/Prospectus. Copies of these documents may be obtained without charge by writing to PFI at the address noted above or by calling our shareholder services department toll free at 1-800-222-5852. You may also call our shareholder services department toll free at 1-800-222-5852 if you have any questions regarding the Reorganization.

PFI is subject to the informational requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940 (the “1940 Act”) and files reports, proxy materials and other information with the SEC. Such reports, proxy materials and other information may be inspected and copied at the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549 (information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-202-551-5850). Such materials are also available on the SEC’s EDGAR Database on its Internet site at www.sec.gov, and copies may be obtained, after paying a duplicating fee, by email request addressed to publicinfo@sec.gov or by writing to the SEC’s Public Reference Room.

The SEC has not approved or disapproved these securities or passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

| | The date of this Proxy Statement/Prospectus is __________, 2009. |

| | |

| | TABLE OF CONTENTS | |

| |

| | | Page |

| |

| INTRODUCTION | 4 |

| THE REORGANIZATION | 4 |

| PROPOSAL: | APPROVAL OF A PLAN OF ACQUISITION | |

| | PROVIDING FOR THE REORGANIZATION OF | |

| | THE MIDCAP STOCK FUND | |

| | INTO THE MIDCAP BLEND FUND | 6 |

| Comparison of Acquired and Acquiring Funds | 6 |

| Comparison of Investment Objectives and Strategies | 7 |

| Fees and Expenses of the Funds | 8 |

| Comparison of Principal Investment Risks | 8 |

| Performance | 13 |

| INFORMATION ABOUT THE REORGANIZATION | 16 |

| Plan of Acquisition | 16 |

| Reasons for the Reorganization | 16 |

| Board Consideration of the Reorganization | 16 |

| Description of the Securities to Be Issued | 17 |

| Federal Income Tax Consequences | 18 |

| CAPITALIZATION | 19 |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | 20 |

| Certain Investment Strategies and Related Risks of the Funds | 20 |

| Multiple Classes of Shares | 24 |

| Costs of Investing in the Funds | 24 |

| Distribution Plans and Additional Information Regarding | |

| Intermediary Compensation | 30 |

| Dividends and Distributions | 31 |

| Pricing of Fund Shares | 31 |

| Purchases, Redemptions, and Exchanges of Shares | 31 |

| Frequent Purchases and Redemptions | 32 |

| Tax Considerations | 32 |

| Portfolio Holdings Information | 44 |

| VOTING INFORMATION | 44 |

| OUTSTANDING SHARES AND SHARE OWNERSHIP | 45 |

| FINANCIAL HIGHLIGHTS | 45 |

| FINANCIAL STATEMENTS | 47 |

| LEGAL MATTERS | 47 |

| OTHER INFORMATION | 47 |

| APPENDIX A | Form of Plan of Acquisition | A-1 |

| APPENDIX B | Description of Indices | B-1 |

This Proxy Statement/Prospectus is being furnished to shareholders of the Acquired Fund to provide information regarding the Plan and the Reorganization.

Principal Funds, Inc. PFI is a Maryland corporation and an open-end management investment company registered with the SEC under the 1940 Act. PFI currently offers 66 separate series or funds (the “PFI Funds”), including the Acquired and Acquiring Funds. The sponsor of PFI is Principal Life Insurance Company (“Principal Life”), and the investment advisor to the PFI Funds is Principal Management Corporation (“PMC”). Principal Funds Distributor, Inc. (the “Distributor” or “PFD”) is the distributor for all share classes. Principal Life, an insurance company organized in 1879 under the laws of Iowa, PMC and PFD are indirect, wholly-owned subsidiaries of Principal Financial Group, Inc. (“PFG”). Their address is the Principal Financial Group, Des Moines, Iowa 50392-2080.

Investment Management. Pursuant to an investment advisory agreement with PFI with respect to the Acquired and Acquiring Funds, PMC provides investment advisory services and certain corporate administrative services to the Funds. As permitted by the investment advisory agreement, PMC has entered into sub-advisory agreements with respect to the Acquired and Acquiring Funds as follows:

| |

| Acquired Fund | Sub-Advisor |

| MidCap Stock Fund | Edge Asset Management, Inc. (“Edge”) |

| |

| |

| Acquiring Fund | Sub-Advisor |

| MidCap Blend Fund | Principal Global Investors, LLC (“PGI”) |

PMC and each sub-advisor are registered with the SEC as investment advisors under the Investment Advisers Act of 1940.

Edge is located at 601 Union Street, Suite 2200, Seattle, WA 98101. Edge is an affiliate of PFG.

PGI is located at 801 Grand Avenue, Des Moines, IA 50392. PGI is an affiliate of PFG.

At its meeting held on June 8, 2009, the Board, including all the Directors who are not “interested persons” (as defined in the 1940 Act) of PFI (the “Independent Directors”), approved the Reorganization pursuant to the Plan providing for the combination of the Acquired Fund into the Acquiring Fund. The Board concluded that the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization. The factors that the Board considered in deciding to approve the Reorganization are discussed below under “Information About the Reorganization – Board Consideration of the Reorganization.”

The Reorganization contemplates: (i) the transfer of all the assets, subject to all of the liabilities, of the Acquired Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund; (ii) the distribution to Acquired Fund shareholders of the Acquiring Fund shares; and (iii) the liquidation and termination of the Acquired Fund. As a result of the Reorganization, each shareholder of the Acquired Fund will become a shareholder of the Acquiring Fund. In the Reorganization, the Acquiring Fund will issue a number of shares with a total value equal to the total value of the net assets of the Acquired Fund, and each shareholder of the Acquired Fund will receive a number of full and fractional shares of the Acquiring Fund with a value equal to the value of that shareholder’s shares of the Acquired Fund, as of the close of regularly scheduled trading on the NYSE on the closing date of the Reorganization (the “Effective Time”). The closing date of the Reorganization is expected to be October 23, 2009. Holders of Class A, Class B, Class C and Institutional Class shares of the Acquired Fund will receive, respectively, Class A, Class B, Class C and Institutional Class shares of the Acquiring Fund. The terms and conditions of the Reorganization are more fully described below in this Proxy Statement/Prospectus and in the Form of Plan of Acquisition, which is attached hereto as Appendix A.

The Board believes that the Reorganization will serve the best interests of shareholders of both the Acquired and Acquiring Funds. The Funds have similar investment objectives in that the Acquiring Fund seeks to provide long-term growth of capital while the Acquired Fund seeks to provide long-term capital appreciation. The Funds also have similar principal policies and risks in that both invest in midcap securities. The Acquiring Fund has lower advisory fee rates and is expected to have lower expense ratios following the Reorganization. The Acquiring Fund has outperformed the Acquired Fund over the three-year and five-year periods ending March 31, 2009. Moreover, the Reorganization may be expected to afford shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. Combining the Funds will not result in any dilution of the interests of existing shareholders of the Funds.

In the opinion of legal counsel, the Reorganization will qualify as a tax-free reorganization and, for federal income tax purposes, no gain or loss will be recognized as a result of the Reorganization by the Acquired or Acquiring Fund shareholders. See “Information About the Reorganization – Federal Income Tax Consequences.”

The Reorganization will not result in any material change in the purchase and redemption procedures followed with respect to the distribution of shares. See “Additional Information About the Funds – Purchases, Redemptions and Exchanges of Shares.”

The Acquired Fund will pay all expenses and out-of-pocket fees incurred in connection with the Reorganization, including printing, mailing, and legal fees. The expenses and fees the Acquired Fund will pay are expected to total $52,000. Further, the Acquired Fund will also pay any trading costs associated with disposing of any portfolio securities of the Acquired Fund that would not be compatible with the investment objectives and strategies of the Acquiring Fund and reinvesting the proceeds in securities that would be compatible. These trading costs are estimated to be $574,000. As of April 30, 2009, the realized loss would be approximately $7,962,000 ($0.25 per share) on a US GAAP basis.

|

| PROPOSAL: |

| APPROVAL OF A PLAN OF ACQUISITION PROVIDING |

| FOR THE REORGANIZATION OF THE |

| MIDCAP STOCK FUND |

| INTO THE MIDCAP BLEND FUND |

|

| Shareholders of the MidCap Stock Fund (the “Acquired Fund”) are being asked to approve the Reorganization of the Acquired Fund into |

| the MidCap Blend Fund (the “Acquiring Fund.) |

| |

| Comparison of Acquired and Acquiring Funds |

| The following table provides comparative information with respect to the Acquired and Acquiring Funds. |

| | |

| MidCap Stock Fund | | MidCap Blend Fund |

| (Acquired Fund) | | (Acquiring Fund) |

| | |

| Approximate Net Assets as of April 30, 2009 (unaudited): | |

| $363,423,000 | | $557,940,000 |

| | |

| Investment Advisor: | PMC | |

| |

| Sub-Advisors and Portfolio Managers: | |

| |

| Edge | PGI |

| |

| Daniel R. Coleman (since 2001). Mr. Coleman, | K. William Nolin, CFA (since 2000). Mr. Nolin, |

| Managing Director, Chief Investment Officer, manages | portfolio manager, joined PGI in 1994. He serves as the |

| all investment operations at Edge. Mr. Coleman joined | portfolio manager for the firm’s international small-cap |

| Edge in October 2001. Mr. Coleman earned a Bachelor’s | equity portfolios. He earned a Bachelor’s degree in |

| degree in Finance from the University of Wisconsin and | Finance from the University of Iowa and an MBA from |

| an MBA from New York University. | the Yale School of Management. He has earned the right |

| | to use the Chartered Financial Analyst designation. |

| Investment Objective: | |

| |

| The Acquired Fund seeks to provide long-term capital | The Acquiring Fund seeks long-term growth of capital. |

| appreciation. | |

| |

| |

| Principal Investment Strategies: | |

| |

| The Fund invests primarily in common stocks of U.S. | The Fund invests primarily in common stocks and other |

| companies. Under normal market conditions, the Fund | equity securities of medium capitalization companies. |

| invests at least 80% of its net assets (plus any | Under normal circumstances, the Fund invests at least |

| borrowings for investment purposes) in common stocks | 80% of its net assets (plus any borrowings for |

| of companies with medium market capitalizations (those | investment purposes) in common stocks of companies |

| with market capitalizations between approximately $1 | with medium market capitalizations (those with market |

| billion and $10 billion at the time of purchase). Market | capitalizations similar to companies in the Russell |

| capitalization is defined as total current market value of | MidCap® Index (as of the most recent calendar year |

| a company’s outstanding common stock. | end, this range was between approximately $0.02 billion |

| | and $14.9 billion) at the time of purchase. Market |

| The Fund may invest up to 20% of its assets in REIT | capitalization is defined as total current market value of |

| securities. The Fund may invest in fixed-income | a company’s outstanding common stock. Up to 25% of |

| securities of any maturity, including investment grade | Fund assets may be invested in foreign securities. |

| corporate bonds and mortgage-backed securities, and | |

| may invest up to 20% of its assets in below-investment- | In selecting securities for investment, PGI looks at |

| grade fixed-income securities (sometimes called “junk | stocks with value and/or growth characteristics and |

| bonds”). The Fund may also invest in money market | constructs an investment portfolio that has a “blend” of |

| instruments for temporary or defensive purposes. | stocks with these characteristics. In managing the assets |

| | of the Fund, PGI does not have a policy of preferring |

| The Fund may purchase or sell U.S. government | one of these categories to the other. The value |

| securities and collateralized mortgage obligations on a | orientation emphasizes buying stocks at less than their |

| “when issued” or “delayed-delivery” basis in an | inherent value and avoiding stocks whose price has been |

| aggregate of up to 20% of the market value of its total | artificially built up. The growth orientation emphasizes |

| assets. The Fund may invest up to 25% of its assets in | buying stocks of companies whose potential for growth |

| the securities of foreign issuers. | of capital and earnings is expected to be above average. |

| |

| In selecting investments for the Fund, Edge looks for | PGI believes that superior stock selection is the key to |

| equity investments in companies that have solid | consistent out-performance. PGI seeks to achieve |

| management, a competitive advantage, and the resources | superior stock selection by systematically evaluating |

| to maintain superior cash flow and profitability over the | company fundamentals and in-depth original research. |

| long run. In determining whether securities should be | |

| sold, Edge considers factors such as high valuations | PGI focuses its stock selections on established |

| relative to other investment opportunities and | companies that it believes have a sustainable competitive |

| deteriorating short- or long-term business fundamentals | advantage. PGI constructs a portfolio that is “benchmark |

| or future growth prospects. The Fund will not | aware” in that it is sensitive to the sector (companies |

| necessarily dispose of a security merely because its | with similar characteristics) and security weightings of |

| issuer’s market capitalization is no longer in the | its benchmark. However, the Fund is actively managed |

| range represented by the S&P MidCap 400 Index. | and prepared to invest in sectors and industries |

| | differently from the benchmark. |

| |

| | The Fund may purchase securities issued as part of, or a |

| | short period after, companies’ initial public offerings and |

| | may at times dispose of those shares shortly after their |

| | acquisition. |

Hedging and Other Strategies:

Each of the Funds may invest in inverse floating rate obligations, may engage in hedging transactions through the use of financial futures and options thereon and may also purchase and sell securities on a when-issued or forward commitment basis, invest in mortgage-backed securities, enter into repurchase agreements, invest in stand-by commitments, engage in swap agreements, and lend portfolio securities. Each of the Funds may invest in floating rate and variable rate obligations, including participation interests therein.

Temporary Defensive Investing:

For temporary defensive purposes in times of unusual or adverse market, economic, or political conditions, each Fund may invest up to 100% of its assets in cash and cash equivalents. In taking such defensive measures, either Fund may fail to achieve its investment objective.

Fundamental Investment Restrictions:

Each of the Funds is subject to the same fundamental investment restrictions which may not be changed without the approval of the shareholders of the Fund. These fundamental restrictions deal with such matters as the issuance of senior securities, purchasing or selling real estate or commodities, borrowing money, making loans, underwriting securities of other issuers, diversification or concentration of investments, and short sales of securities. The fundamental investment restrictions of the Funds are described in the Statement of Additional Information.

| | Comparison of Investment Objectives and Strategies |

The Funds have similar investment objectives in that the Acquiring Fund seeks long-term growth of capital while the Acquired Fund seeks to provide long-term capital appreciation. The Funds have similar principal policies and risks in that both invest in securities of mid-capitalization companies and both may invest up to 25% of their assets in foreign securities. The Funds differ principally in that the market capitalization ranges of the Acquired Fund is fixed while that of the Acquiring Fund is tied to a market index; as a result, the Acquiring Fund may at times invest in companies that are both smaller and larger than the Acquired Fund. Further, the Acquired Fund may invest up to 20% of its assets in REIT securities, up to 20% of its assets in U.S. government securities and collateralized mortgage obligations., and up to 20% of its assets in junk bonds.

Additional information about the strategies and the types of securities in which the Funds may invest is discussed below under “Certain Investment Strategies and Related Risks of the Funds” as well as in the Statement of Additional Information.

The Statement of Additional Information provides further information about the portfolio manager for each Fund, including information about compensation, other accounts managed and ownership of Fund shares.

| | Fees and Expenses of the Funds |

The tables below compare the fees and expenses of the shares of the Acquired and Acquiring Funds. In the Reorganization, the holders of Class A, B, C and Institutional Class shares of the Acquired Fund will receive, respectively, Class A, B, C and Institutional Class shares of the Acquiring Fund.

| | Shareholder Fees (fees paid directly from your investment) |

The following table shows the fees and expenses you may pay when you buy and redeem Class A, B or C shares of the Funds. These fees and expenses are more fully described under “Additional Information About the Funds – Costs of Investing in the Funds.” Institutional Class shares are not subject to any sales or redemption charges.

| | | |

| | Class A | Class B | Class C |

| Maximum sales charge(load) imposed on | 5.50% (1) | None | None |

| purchases (as a % of offering price) | | | |

| |

| Maximum Contingent Deferred Sales | 1.00% (2) | 5.00% (3) | 1.00% (4) |

| | | |

| Charge(CDSC) (as a % of dollars subject to | | | |

| charge) | | | |

| | | |

| Redemption or Exchange Fee (as a % of amount | 1.00% (5) | 1.00% (5) | 1.00% (5) |

| redeemed/ exchanged) | | | |

| (1) | Sales charges are reduced or eliminated for purchases of $50,000 or more. |

| (2) | A CDSC may apply on certain redemptions made within 18 months following purchases of $1 million or more made without a sales charge. |

| (3) | CDSCs are reduced after two years and eliminated after five years. |

| (4) | A CDSC applies on certain redemptions made within 12 months. |

| (5) | Excessive trading fees are charged when $30,000 or more of shares are redeemed or exchanged to another fund within 30 days after they are purchased. Excessive trading fees will not be applied to shares acquired in connection with the Reorganization. |

| | Fees and Expenses as a % of average daily net assets |

The following table shows, for the Class A, B, C, and Institutional Class shares of the Funds: (a) the ratios of expenses to average net assets for the fiscal year ended October 31, 2008; and (b) the pro forma expense ratios of the Acquiring Fund for the fiscal year ending October 31, 2008 assuming that the Reorganization had taken place at the commencement of that fiscal year.

| | | | | | | | | | | | |

| | | | | | | | | | MidCap Blend Fund |

| | MidCap Stock Fund | MidCap Blend Fund | (Acquiring Fund) |

| | (Acquired Fund) | (Acquiring Fund) | (Pro Forma) (5) |

| | Class | Class | Class | | Class | Class | Class | | Class | Class | Class | |

| | A | B | C | Institutional | A | B | C(1) | Institutional(3) | A(4) | B(4) | C(1) | Institutional(3) |

| Management | 0.75% | 0.75% | 0.75% | 0.75% | 0.64% | 0.64% | 0.64% | 0.64% | 0.64% | 0.64% | 0.64% | 0.64% |

| Fees | | | | | | | | | | | | |

| |

| Distribution | 0.25% | 1.00% | 1.00% | N/A | 0.25% | 1.00% | 1.00% | N/A | 0.25% | 1.00% | 1.00% | N/A |

| and/or Service | | | | | | | | | | | | |

| (12b-1) Fees | | | | | | | | | | | | |

| |

| Other | 0.33% | 0.55% | 0.67% | 0.02 | 0.24% | 0.39% | 0.82% | 0.21% | 0.25% | 0.40% | 0.55% | 0.01% |

| Expenses(2) | | | | | | | | | | | | |

| |

| Total Fund | 1.33% | 2.30% | 2.42% | 0.77% | 1.13% | 2.03% | 2.46% | 0.85% | 1.14% | 2.04% | 2.19% | 0.65% |

| Operating | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| |

| Expense | N/A | N/A | N/A | N/A | N/A | N/A | 0.51% | N/A | 0.01% | 0.05% | 0.24% | N/A |

| Reimbursement | | | | | | | | | | | | |

| |

| Net Operating | 1.33% | 2.30% | 2.42% | 0.77% | 1.13% | 2.03% | 1.95% | 0.85% | 1.13% | 1.99% | 1.95% | 0.65% |

| Expenses | | | | | | | | | | | | |

| (1) | PMC has contractually agreed to limit the Acquiring Fund’s expense attributable to class C shares and, if necessary pay expenses normally payable by the Acquiring Fund, excluding interest expense, through the period ending February 28, 2011. The expense limit will maintain a total level of operating expense not to exceed 1.95% for Class C shares. |

| (2) | Expense information has been restated to reflect an increase in certain operating expenses of the Acquired and Acquiring Funds effective March 1, 2009. |

| (3) | PMC has voluntarily agreed to limit the Acquiring Fund’s expenses attributable to Institutional Class shares and, if necessary, pay expenses normally payable by the Acquiring Fund, excluding interest expense. The expense limit will maintain a total level of operating expense (expressed as a percent of average net assets on an annualized basis) not to exceed 0.70%. The expense limit may be terminated at anytime. |

| (4) | Effective as of the time of the Reorganization and through the period ending February 28, 2011, PMC has contractually agreed to reduce the Acquiring Fund's expenses attributable to Class A shares by 0.01% and Class B shares by 0.05% (expressed as a percent of average net assets on an annualized basis). |

| (5) | The pro forma figures do not reflect the costs associated with the Reorganization which are estimate to be $52,000 and will be paid by the Acquired Fund. Assuming the Acquiring Fund experiences the expense ratios shown above, shareholders of the Acquired Fund may expect the Acquiring Fund to recover the expense of the Reorganization in one year. |

Examples: The following examples are intended to help you compare the costs of investing in shares of the Acquired and Acquiring Funds. The examples assume that fund expenses continue at the rates shown in the table above, that you invest $10,000 in the particular Fund for the time periods indicated and that all dividends and distributions are reinvested. The examples also assume that your investment has a 5% return each year. The costs of investing for Class B shares in the 10-year examples reflect conversion of Class B shares to Class A shares after the eighth year. The examples should not be considered a representation of future expenses of the Acquired or Acquiring Fund. Actual expenses may be greater or less than those shown.

| | | | | | | | |

| | If you sell your shares: | If you do not sell your shares: |

| | Number of years you own your shares |

| | 1 | 3 | 5 | 10 | 1 | 3 | 5 | 10 |

| MidCap Stock Fund | | | | | | | | |

| (Acquired Fund) | | | | | | | | |

| Class A | $678 | $948 | $1,239 | $2,063 | $678 | $948 | $1,239 | $2,063 |

| Class B | 733 | 1,118 | 1,430 | 2,392 | 233 | 718 | 1,230 | 2,392 |

| Class C | 345 | 755 | 1,291 | 2,756 | 245 | 755 | 1,291 | 2,756 |

| Institutional | 79 | 246 | 428 | 954 | 79 | 246 | 428 | 954 |

| MidCap Blend Fund | | | | | | | | |

| (Acquiring Fund) | | | | | | | | |

| Class A | $646 | $877 | $1,126 | $1,837 | $646 | $877 | $1,126 | $1,837 |

| Class B | 706 | 1,037 | 1,293 | 2,127 | 206 | 637 | 1,093 | 2,127 |

| Class C | 298 | 710 | 1,257 | 2,751 | 198 | 710 | 1,257 | 2,751 |

| Institutional | 87 | 271 | 471 | 1,049 | 87 | 271 | 471 | 1,049 |

| MidCap Blend Fund | | | | | | | | |

| (Acquiring Fund) | | | | | | | | |

| (Pro Forma) | | | | | | | | |

| Class A | $659 | $891 | $1,142 | $1,859 | $659 | $891 | $1,142 | $1,859 |

| Class B | 702 | 1,034 | 1,293 | 2,133 | 202 | 634 | 1,093 | 2,133 |

| Class C | 298 | 658 | 1,149 | 2,502 | 198 | 658 | 1,149 | 2,502 |

| Institutional | 66 | 208 | 362 | 810 | 66 | 208 | 362 | 810 |

| |

| Investment Management Fees/Sub-Advisory Arrangements |

| The Funds each pay their investment advisor, PMC, an advisory fee which for each Fund is calculated as a percentage of the Fund’s |

| average daily net assets pursuant to the following fee schedule: |

|

| MidCap Stock Fund | MidCap Blend Fund |

| (Acquired Fund) | (Acquiring Fund) |

| |

| 0.75% of the first $1 billion; | 0.65% of the first $500 million; |

| 0.70% of the next $1 billion; | 0.63% of the next $500 million; |

| 0.65% of the next $1 billion; and | 0.61% of the next $500 million; and |

| 0.60% of the excess over $3 billion. | 0.60% of the excess over $1.5 billion. |

| |

| As sub-advisors to the Funds, Edge and PGI are paid sub-advisory fees for their services. These sub-advisory fees are paid by PMC, not |

| by the Funds. | |

| A discussion of the basis of the Board’s approval of the advisory and sub-advisory agreements with respect to the Acquired and |

| Acquiring Funds is available in PFI’s Annual Report to Shareholders for the fiscal year ended October 31, 2008. |

| | Comparison of Principal Investment Risks |

In deciding whether to approve the Reorganization, shareholders should consider the amount and character of investment risk involved in the respective investment objectives and strategies of the Acquired and Acquiring Funds. Because the Funds have similar investment objectives and principal investment policies, the Funds’ risks are substantially similar. As described below, the Funds also have some different risks, including, with respect to the Acquired Fund, those relating to its investments in fixed-income securities and REITs..

Risks Applicable to both Funds:

- Credit and Counterparty Risk. Each of the Funds is subject to the risk that the issuer or guarantor of a fixed-income security or other obligation, the counterparty to a derivatives contract or repurchase agreement, or the borrower of a portfolio’s securities will be unable or unwilling to make timely principal, interest, or settlement payments, or otherwise to honor its obligations.

- Liquidity Risk. The Funds are exposed to liquidity risk when trading volume, lack of a market maker, or legal restrictions impair the Funds’ ability to sell particular securities or close derivative positions at an advantageous price.

- Market Risk. The value of the Funds’ portfolio securities may go down in response to overall stock or bond market movements. Markets tend to move in cycles, with periods of rising prices and periods of falling prices. Stocks tend to go up and down in value more than bonds. If the Funds’ investments are concentrated in certain sectors, its performance could be worse than the overall market. It is possible to lose money when investing in the fund.

- Management Risk. The Funds are actively managed by their investment advisor or sub-advisor(s). The performance of the Funds will reflect in part the ability of the advisor or sub-advisor(s) to make investment decisions that are suited to achieving the Funds’ investment objectives. If the advisor’s or sub-advisor(s)’ strategies do not perform as expected, the Funds could underperform other mutual funds with similar investment objectives or lose money.

- Securities Lending Risk. To earn additional income, the Funds may lend portfolio securities to approved financial institutions. Risks of such a practice include the possibility that a financial institution becomes insolvent, increasing the likelihood that the Funds will be unable to recover the loaned security or its value. Further, the cash collateral received by the Funds in connection with such a loan may be invested in a security that subsequently loses value.

- Equity Securities Risk. Equity securities include common, preferred, and convertible preferred stocks and securities the values of which are tied to the price of stocks, such as rights, warrants, and convertible debt securities. Common and preferred stocks represent equity ownership in a company. Stock markets are volatile, and the price of equity securities (and their equivalents) will fluctuate. The value of equity securities purchased by the Funds could decline if the financial condition of the companies in which the fund invests decline or if overall market and economic conditions deteriorate.

- Foreign Securities Risk. Foreign securities carry risks that are not generally found in securities of U.S. companies. These risks include the loss of value as a result of political instability and financial and economic events in foreign countries. In addition, nationalization, expropriation or confiscatory taxation, and foreign exchange restrictions could adversely affect the Funds’ investments in a foreign country. Foreign securities may be subject to less stringent reporting, accounting, and disclosure standards than are required of U.S. companies, and foreign countries may also have problems associated with and causing delays in the settlement of sales.

- Market Segment Risk. The Funds are subject to the risk that their principal market segment, mid capitalization stocks, may underperform compared to other market segments or to the equity markets as a whole. The Funds’ strategy of investing in mid cap stocks carries the risk that in certain markets mid cap stocks will underperform small cap or large cap stocks.

- Growth Stock Risk. Growth stocks typically trade at higher multiples of current earnings than other securities. Growth stocks are often more sensitive to market fluctuations than other securities because their market prices are highly sensitive to future earnings expectations. Similarly, because growth securities typically do not make dividend payments to shareholders, investment returns are based on capital appreciation, making returns more dependent on market increases and decreases. Growth stocks may therefore be more volatile than non-growth stocks. The Funds’ strategy of investing in growth stocks also carries the risk that in certain markets growth stocks will underperform value stocks.

- Value Stock Risk. A fund’s investments in value stocks carry the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced. A value stock may not increase in price if other investors fail to recognize the company’s value and bid up the price or invest in markets favoring faster growing companies. A fund’s strategy of investing in value stocks also carries the risk that in certain markets value stocks will underperform growth stocks.

- Mid Cap Stock Risk. Medium capitalization companies may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, mid-size companies may pose greater risk due to narrow product lines, limited financial resources, less depth in management, or a limited trading market for their securities.

- Exchange Rate Risk. Because foreign securities are generally denominated in foreign currencies, the value of the net assets of a fund as measured in U.S. dollars will be affected by changes in exchange rates. To protect against future uncertainties in foreign currency exchange rates, the funds are authorized to enter into certain foreign currency exchange transactions. In addition, the funds’ foreign investments may be less liquid and their price more volatile than comparable investments in U.S. securities. Settlement periods may be longer for foreign securities and portfolio liquidity may be affected.

| Additional Risks Applicable to the Acquired Fund |

- Underlying Fund Risk. The Principal LifeTime Funds and the Strategic Asset Management (“SAM”) Portfolios operate as funds of funds and invest principally in other PFI Funds (“Underlying Funds”). From time to time, an Underlying Fund may experience relatively large investments or redemptions by a fund of funds due to the reallocation or rebalancing of its assets. These transactions may have

adverse effects on Underlying Fund performance to the extent an Underlying Fund is required to sell portfolio securities to meet such redemptions, or to invest cash from such investments, at times it would not otherwise do so. This may be particularly important when a fund of funds owns a significant portion of an underlying fund. These transactions may also accelerate the realization of taxable income if sales of portfolio securities result in gains, and could increase transaction costs. In addition, when a fund of funds reallocates or redeems significant assets away from an Underlying Fund, the loss of assets to the Underlying Fund could result in increased expense ratios for that fund.

PMC is the advisor to the SAM Portfolios and each of the Underlying Funds. Edge, an affiliate of PMC, is Sub-Advisor to these funds. The Acquired Fund is among the Underlying Funds owned by the SAM Portfolios. PMC and Edge are committed to minimizing the potential impact of underlying fund risk on Underlying Funds to the extent consistent with pursuing the investment objectives of the funds of funds which they manage. Each may face conflicts of interest in fulfilling its responsibilities to all such funds. The following table shows the percentage of the outstanding shares of the Acquired Fund owned by the SAM Portfolios as of October 31, 2008.

| |

| | MidCap Stock Fund |

| Strategic Asset Management Portfolios | Acquired Fund |

| Balanced Portfolio | 25.63% |

| Conservative Balanced Portfolio | 3.32% |

| Conservative Growth Portfolio | 30.94% |

| Flexible Income Portfolio | 3.64% |

| Strategic Growth Portfolio | 22.43% |

| Total | 85.96% |

| |

| • Prepayment Risk. Mortgage-backed and asset-backed securities are subject to prepayment risk. When interest rates decline, significant |

| unscheduled payments may result. These prepayments must then be reinvested at lower rates. Prepayments may also shorten the |

| effective maturities of these securities, especially during periods of declining interest rates. On the other hand, during periods of rising |

| interest rates, a reduction in prepayments may increase the effective maturities of these securities, subjecting them to the risk of decline |

| in market value in response to rising interest rates. This may increase the volatility of a fund. |

| |

| |

| • Real Estate Securities Risk. Real estate investment trusts (“REITs”) or other real estate-related securities are subject to the risks |

| associated with direct ownership of real estate, including declines in the value of real estate, risks related to general and local economic |

| conditions, increases in property taxes and operating expenses, changes in zoning laws, changes in interest rates, and liabilities resulting |

| from environmental problems. Equity and mortgage REITs are dependent on management skills and generally are not diversified. |

| Equity REITs are affected by the changes in the value of the properties owned by the trust. Mortgage REITs are affected by the quality |

| of the credit extended. Both equity and mortgage REITs: |

| • | may not be diversified with regard to the types of tenants (thus subject to business developments of the tenant(s)); |

| • | may not be diversified with regard to the geographic locations of the properties (thus subject to regional economic developments); |

| • | are subject to cash flow dependency and defaults by borrowers; and |

| • | could fail to qualify for tax-free pass-through of income under the Internal Revenue Code. |

| • | REITs typically incur fees that are separate from those of the Fund. Accordingly, the Fund's investments in REITs will result in the |

| | layering of expenses such that shareholders will indirectly bear a proportionate share of the REITs' operating expenses, in addition |

| | to paying Fund expenses. |

| |

| |

| • U.S. Government Securities Risk. Yields available from U.S. government securities are generally lower than the yields available from |

| many other fixed income securities. |

| |

| • Fixed-Income Securities Risk. Fixed-income securities are generally subject to two principal types of risks: interest rate risk and credit |

| quality risk. |

| |

| Interest Rate Risk. Fixed-income securities are affected by changes in interest rates. When interest rates decline, the |

| market value of the fixed-income securities generally can be expected to rise. Conversely, when interest rates rise, the |

| market value of fixed-income securities generally can be expected to decline. |

| |

| Credit Quality Risk. Fixed-income securities are subject to the risk that the issuer of the security will not repay all or a |

| portion of the principal borrowed and will not make all interest payments. If the credit quality of a fixed income security |

| deteriorates after a fund has purchased the security, the market value of the security may decrease and lead to a |

| decrease in the value of the fund’s investments. Lower quality and longer maturity bonds will be subject to greater |

| credit risk and price fluctuations than higher quality and shorter maturity bonds. Bonds held by a fund may be affected |

| by unfavorable political, economic, or government developments that could affect the repayment of principal or the |

| payment of interest. |

| |

| • High Yield Securities Risk. Fixed-income securities that are not investment grade are commonly referred to as high yield securities or |

| “junk bonds.” While these securities generally provide greater income potential than investments in higher rated fixed income securities, |

| there is a greater risk that principal and interest payments will not be made. Issuers of these securities may even go into default or |

become bankrupt. High yield securities generally involve greater price volatility and may be less liquid than higher rated fixed-income securities. High yield securities are considered speculative by the major credit rating agencies.

Additional Risks Applicable to the Acquiring Fund

- Initial Public Offerings (“IPOs”) Risk. There are risks associated with the purchase of shares issued in IPOs by companies that have little operating history as public companies, as well as risks inherent in those sectors of the market where these new issuers operate. The market for IPO issuers has been volatile and share prices of certain newly-public companies have fluctuated in significant amounts over short periods of time. The Funds cannot guarantee continued access to IPO offerings and may at times dispose of IPO shares shortly after their acquisition.

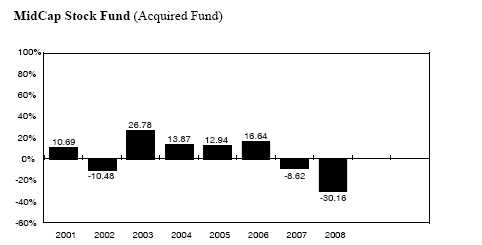

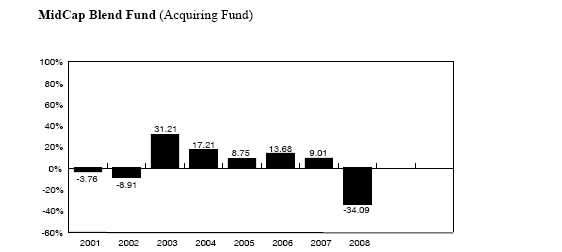

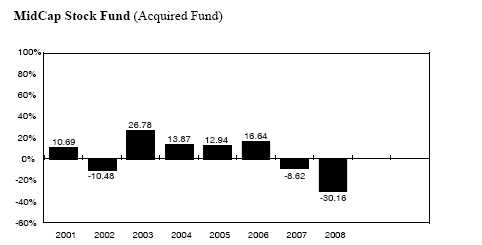

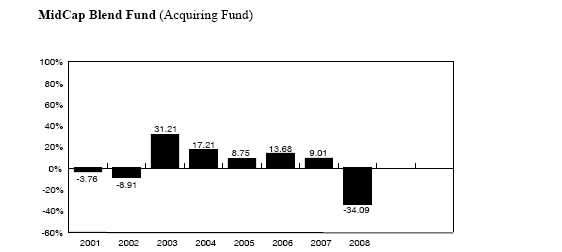

The bar charts below show how each Fund’s total return has varied year-by-year, while the tables below show each Fund’s performance over time (along with the returns of a broad-based market index and an index of funds with similar investment objectives for reference). A Fund's past performance is not necessarily an indication of how the Fund will perform in the future.

Calendar Year Total Return (%) as of 12/31 Each Year (Class A Shares)

| | |

| The year-to-date return as of June 30, 2009 is 1.70%. | | |

| |

| Highest return for a quarter during the period of the bar chart above: | Q4 ‘01 | 13.83% |

| Lowest return for a quarter during the period of the bar chart above: | Q4 ‘08 | -21.78% |

| | |

| The year-to-date return as of June 30, 2009 is 8.30%. | | |

| |

| Highest return for a quarter during the period of the bar chart above: | Q2 ‘03 | 14.10% |

| Lowest return for a quarter during the period of the bar chart above: | Q4 ‘08 | -23.89% |

| | | |

| Average Annual Total Returns (%) (with Maximum Sales Charge) | | |

| for periods ended December 31, 2008 | | | |

| | 1 Year | 5 Years | Life of Fund |

| MidCap Stock Fund (1) (Acquired Fund) | | | |

| --Class A (before taxes) | -33.98 | -1.98 | 4.93 |

| (after taxes on distributions) (2) | -33.99 | -2.92 | 4.18 |

| (after taxes on distributions and sale of shares) (2) | -22.08 | -1.36 | 4.38 |

| --Class B | -34.17 | -2.08 | 4.68 |

| --Class C | -31.51 | -1.74 | 4.65 |

| --Institutional Class | -29.58 | -0.46 | 6.06 |

| --S&P 400 MidCap Stock Index (3) | -36.23 | -0.08 | 2.99 |

| --Morningstar Mid Cap Blend Category Average | -39.18 | -1.89 | 0.27 |

| |

| MidCap Blend Fund (Acquiring Fund) | | | |

| --Class A (before taxes) (4) | -37.71 | -0.33 | 2.08 |

| (after taxes on distributions) (2)(4) | -38.27 | -1.48 | 1.30 |

| (after taxes on distributions and sale of shares) (2)(4) | -23.80 | -0.07 | 1.89 |

| --Class B (4) | -37.54 | 0.23 | 2.57 |

| --Class C (4) | -35.25 | -0.04 | 1.98 |

| --Institutional Class (before taxes) (5) | -33.75 | 1.23 | 3.33 |

| --Russell Midcap Index (3) | -41.46 | -0.71 | 0.84 |

| --Morningstar Mid Cap Blend Category Average | -39.18 | -1.89 | -0.19 |

| (1) | The Acquired Fund commenced operations after succeeding to the operations of another fund on January 12, 2007. Performance for periods prior to that date is based on the performance of the predecessor fund which commenced operations on March 1, 2000. |

| (2) | After-tax returns are shown for Class A shares only and would be different for Class B, Class C, and Institutional Class shares. They are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax- deferred arrangements such as 401(k) plans or individual retirement accounts. |

| (3) | Index performance does not reflect deductions for fees, expenses, or taxes. |

| (4) | Class A and B of the Acquiring Fund shares commenced operations on June 28, 2005, and Class C shares were first sold on January 16, 2007. The returns for Class A, B, and C shares, for the periods prior to those dates, are based on the performance of the Fund’s R-3 Class shares adjusted to reflect the fees and expenses of Class A, B, and C shares. The adjustments result in performance for such periods that is no higher than the historical performance of the R-3 Class shares. R-3 Class shares were first sold on December 6, 2000. |

| (5) | Institutional Class shares of the Acquiring Fund were first sold on March 1, 2001. The returns for the periods prior to that date are based on the performance of the Fund’s R-3 Class shares adjusted to reflect the fees and expenses of Institutional Class shares. The adjustments result in performance for such periods that is no higher than the historical performance of the R-3 Class shares. R-3 Class shares were first sold on December 6, 2000. |

| | INFORMATION ABOUT THE REORGANIZATION |

The terms of the Plan are summarized below. The summary is qualified in its entirety by reference to the Form of the Plan which is attached as Appendix A to this Proxy Statement/Prospectus.

Under the Plan, the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund. We expect that the closing date will be October 23, 2009, or such earlier or later date as PMC may determine, and that the Effective Time of the Reorganization will be as of the close of regularly scheduled trading on the NYSE (normally 3:00 p.m., Central Time) on that date. Each Fund will determine its net asset values as of the close of trading on the NYSE using the procedures described in its then current prospectus (the procedures applicable to the Acquired Fund and the Acquiring Fund are identical). The Acquiring Fund will issue to the Acquired Fund a number of shares of each share class with a total value equal to the total value of the net assets of the corresponding share class of the Acquired Fund outstanding at the Effective Time.

Immediately after the Effective Time, the Acquired Fund will distribute to its shareholders Acquiring Fund shares of the same class as the Acquired Fund shares each shareholder owns in exchange for all Acquired Fund shares of that class. Acquired Fund shareholders will receive a number of full and fractional shares of the Acquiring Fund that are equal in value to the value of the shares of the Acquired Fund that are surrendered in the exchange. In connection with the exchange, the Acquiring Fund will credit on its books an appropriate number of its shares to the account of each Acquired Fund shareholder, and the Acquired Fund will cancel on its books all its shares registered to the account of that shareholder. After the Effective Time, the Acquired Fund will be dissolved in accordance with applicable law.

The Plan may be amended, but no amendment may be made which in the opinion of the Board would materially adversely affect the interests of the shareholders of the Acquired Fund. The Board may abandon and terminate the Plan at any time before the Effective Time if it believes that consummation of the transactions contemplated by the Plan would not be in the best interests of the shareholders of either of the Funds.

Under the Plan, the Acquired Fund will pay all expenses and out-of-pocket fees incurred in connection with the Reorganization.

If the Plan is not consummated for any reason, the Board will consider other possible courses of action.

| | Reasons for the Reorganization |

The Board believes that the Reorganization will serve the best interests of shareholders of both the Acquired and Acquiring Funds. The Funds have similar investment objectives in that the Acquiring Fund seeks to provide long-term growth of capital while the Acquired Fund seeks to provide long-term capital appreciation. The Funds also have similar principal policies and risks in that both invest in midcap securities. The Acquiring Fund has lower advisory fee rates and is expected to have lower expense ratios following the Reorganization. The Acquiring Fund has outperformed the Acquired Fund over the three-year and five-year periods ended March 31, 2009. Moreover, the Reorganization may be expected to afford shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. Combining the Funds will not result in any dilution of the interests of existing shareholders of the Funds.

| | Board Consideration of the Reorganization |

The Board, including the Independent Directors, considered the Reorganization pursuant to the Plan at its meeting on June 8, 2009. The Board considered information presented by PMC, and the Independent Directors were assisted by independent legal counsel. The Board requested and evaluated such information as it deemed necessary to consider the Reorganization. At the meeting, the Board unanimously approved the Reorganization after concluding that participation in the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization.

In determining whether to approve the Reorganization, the Board made inquiry into a number of matters and considered, among others, the following factors, in no order of priority:

| (1) | similar investment objectives and similar principal investment strategies shared by the Funds; |

| (2) | the absence of any differences in the Funds’ fundamental investment restrictions; |

| (3) | estimated trading costs associated with disposing of any portfolio securities of the Acquired Fund and reinvesting the proceeds in connection with the Reorganization; |

| (4) | expense ratios and available information regarding the fees and expenses of the Funds; |

| (5) | comparative investment performance of and other information pertaining to the Funds; |

| (6) | the prospects for growth of and for achieving economies of scale by the Acquired Fund in combination with the Acquiring Fund; |

| (7) | the absence of any material differences in the rights of shareholders of the Funds; |

| (8) | the financial strength, investment experience and resources of PGI, which currently serves as sub-advisor to the Acquiring Fund; |

| (9) | any direct or indirect benefits expected to be derived by PMC and its affiliates from the Reorganization; |

| (10) | the direct or indirect federal income tax consequences of the Reorganization, including the expected tax-free nature of the Reorganization and the impact of any federal income tax loss carry forwards and the estimated capital gain or loss expected to be incurred in connection with disposing of any portfolio securities that would not be compatible with the investment objectives and strategies of the Acquiring Fund; |

| (11) | the fact that the Reorganization will not result in any dilution of Acquired or Acquiring Fund shareholder values; |

| (12) | the terms and conditions of the Plan; and |

| (13) | possible alternatives to the Reorganization. |

| |

| | The Board’s decision to recommend approval of the Reorganization was based on a number of factors, including the following: |

| |

| (1) | it should be reasonable for shareholders of the Acquired Fund to have similar investment expectations after the Reorganization because the Funds have similar investment objectives, principal investment strategies and risks; |

| (2) | PGI as sub-advisor responsible for managing the assets of the Acquiring Fund may be expected to provide high quality investment advisory services and personnel for the foreseeable future; |

| (3) | the Acquiring Fund has lower advisory fee rates and, following the Reorganization, is expected to have lower overall expense ratios than the Acquired Fund; and |

| (4) | the combination of the Acquired Fund into the Acquiring Fund may be expected to afford shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. |

| | Description of the Securities to Be Issued |

PFI is a Maryland corporation that is authorized to issue its shares of common stock in separate series and separate classes of series. Each of the Acquired and Acquiring Funds is a separate series of PFI, and the Class A, Class B, Class C and Institutional Class shares of common stock of the Acquiring Fund to be issued in connection with the Reorganization represent interests in the assets belonging to that series and have identical dividend, liquidation and other rights, except that expenses allocated to a particular series or class are borne solely by that series or class and may cause differences in rights as described herein. Expenses related to the distribution of, and other identified expenses properly allocated to, the shares of a particular series or class are charged to, and borne solely by, that series or class, and the bearing of expenses by a particular series or class may be appropriately reflected in the net asset value attributable to, and the dividend and liquidation rights of, that series or class.

All shares of PFI have equal voting rights and are voted in the aggregate and not by separate series or class of shares except that shares are voted by series or class: (i) when expressly required by Maryland law or the 1940 Act and (ii) on any matter submitted to shareholders which the Board has determined affects the interests of only a particular series or class.

The share classes of the Acquired Fund have the same rights with respect to the Acquired Fund that the share classes of the Acquiring Fund have with respect to the Acquiring Fund.

Shares of both Funds, when issued, have no cumulative voting rights, are fully paid and non-assessable, have no preemptive or conversion rights and are freely transferable. Each fractional share has proportionately the same rights as are provided for a full share.

| | Federal Income Tax Consequences |

To be considered a tax-free “reorganization” under Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), a reorganization must exhibit a continuity of business enterprise. Because the Acquiring Fund will use a portion of the Acquired Fund’s assets in its business and will continue the Acquired Fund’s historic business, the combination of the Acquired Fund into the Acquiring Fund will exhibit a continuity of business enterprise. Therefore, the combination will be considered a tax-free “reorganization” under applicable provisions of the Code. In the opinion of tax counsel to PFI, no gain or loss will be recognized by either of the Funds or their shareholders in connection with the combination, the tax cost basis of the Acquiring Fund shares received by shareholders of the Acquired Fund will equal the tax cost basis of their shares in the Acquired Fund, and their holding periods for the Acquiring Fund shares will include their holding periods for the Acquired Fund shares.

Capital Loss Carryforward. As of October 31 2008, the Acquired Fund had an accumulated capital loss carryforward of approximately $4,000. After the Reorganization, these losses will be available to the Acquiring Fund to offset its capital gains, although the amount of offsetting losses in any given year may be limited. As a result of this limitation, it is possible that the Acquiring Fund may not be able to use these losses as rapidly as the Acquired Fund might have, and part of these losses may not be useable at all. The ability of the Acquiring Fund to utilize the accumulated capital loss carryforward in the future depends upon a variety of factors that cannot be known in advance, including the existence of capital gains against which these losses may be offset. In addition, the benefits of any capital loss carryforward currently are available only to shareholders of the Acquired Fund. After the Reorganization, however, these benefits will inure to the benefit of all shareholders of the Acquiring Fund.

Distribution of Income and Gains. Prior to the Reorganization, the Acquired Fund, whose taxable year will end as a result of the Reorganization, will declare to its shareholders of record one or more distributions of all of its previously undistributed net investment income and net realized capital gain, including capital gains on any securities disposed of in connection with the Reorganization. Such distributions will be made to shareholders before the Reorganization. An Acquired Fund shareholder will be required to include any such distributions in such shareholder’s taxable income. This may result in the recognition of income that could have been deferred or might never have been realized had the Reorganization not occurred.

The foregoing is only a summary of the principal federal income tax consequences of the Reorganization and should not be considered to be tax advice. There can be no assurance that the Internal Revenue Service will concur on all or any of the issues discussed above. You may wish to consult with your own tax advisors regarding the federal, state, and local tax consequences with respect to the foregoing matters and any other considerations which may apply in your particular circumstances.

The following tables show as of April 30, 2009: (i) the capitalization of the Acquired Fund; (ii) the capitalization of the Acquiring Fund; and (iii) the pro forma combined capitalization of the Acquiring Fund, adjusted to reflect the estimated expenses of the Reorganization, as if the Reorganization had occurred as of that date. As of April 20, 2009, the Acquired Fund outstanding four classes of shares: Class A, Class B, Class C, and Institutional Class The Acquired Fund will pay all expenses and out-of-pocket fees incurred in connection with the Reorganization including printing, mailing, and legal fees. The expenses and fees the Acquired Fund will pay are expected to total $52,000.

Further, the Acquired Fund will also pay any trading costs associated with disposing of any portfolio securities of the Acquired Fund that would not be compatible with the investment objectives and strategies of the Acquiring Fund and reinvesting the proceeds in securities that would be compatible. These costs are estimated to be $574,000. As of April 30, 2009 the realized loss would be approximately $7,962,000 ($0.25 per share) on a US GAAP basis.

| | | | |

| | | | | Shares |

| | Share | Net Assets | Net Asset | Outstanding |

| Funds | Classes | (000s) | Value Per Share | (000s) |

| MidCap Stock Fund | Class A | $33,041 | $11.33 | 2,917 |

| (Acquired Fund) | Class B | 10,227 | 10.43 | 981 |

| | Class C | 3,630 | 10.42 | 349 |

| | Institutional | 316,525 | 11.45 | 27,634 |

| | Total | $363,423 | | 31,881 |

| |

| MidCap Blend Fund | Class A | $336,343 | $8.74 | 38,495 |

| (Acquiring Fund) | Class B | 29,876 | 8.61 | 3,469 |

| | Class C | 4,192 | 8.55 | 490 |

| | Class J | 120,345 | 8.48 | 14,192 |

| | Institutional | 38,451 | 8.81 | 4,363 |

| | Class R-1 | 1,383 | 8.52 | 162 |

| | Class R-2 | 2,552 | 8.55 | 298 |

| | | | |

| | | | | Shares |

| | Share | Net Assets | Net Asset | Outstanding |

| Funds | Classes | (000s) | Value Per Share | (000s) |

| | Class R-3 | 7,942 | 8.68 | 915 |

| | Class R-4 | 5,805 | 8.85 | 656 |

| | Class R-5 | 11,051 | 8.77 | 1,260 |

| | Total | $557,940 | | 64,300 |

| Reduction in net assets and | | | | |

| decrease in net asset value per | Class A | $(19) | ($0.01) | (2) |

| share of the Acquired Fund to | Class B | (8) | ($0.01) | (1) |

| reflect the estimated expenses of | Class C | (4) | ($0.01) | ** |

| the Reorganization | Institutional | (21) | * | (2) |

| |

| Increase in shares | Class A | | | 861 |

| outstanding of the Acquired | Class B | | | 206 |

| Fund to reflect the exchange for | Class C | | | 75 |

| shares of the Acquiring Fund | Institutional | | | 8,292 |

| |

| MidCap Blend Fund | Class A | $369,365 | $8.74 | 42,271 |

| (Acquiring Fund) | Class B | 40,095 | 8.61 | 4,655 |

| (Pro Forma Assuming Reorganization) | Class C | 7,818 | 8.55 | 914 |

| | Class J | 120,345 | 8.48 | 14,192 |

| | Institutional | 354,955 | 8.81 | 40,287 |

| | Class R-1 | 1,383 | 8.52 | 162 |

| | Class R-2 | 2,552 | 8.55 | 298 |

| | Class R-3 | 7,942 | 8.68 | 915 |

| | Class R-4 | 5,805 | 8.85 | 656 |

| | Class R-5 | 11,051 | 8.77 | 1,260 |

| | Total | $921,311 | | 105,610 |

| * | Less than $.005 per share. |

| ** | Less than 500 shares. |

| | ADDITIONAL INFORMATION ABOUT THE FUNDS

Certain Investment Strategies and Related Risks of the Funds |

This section provides information about certain investment strategies and related risks of the Funds. The Statement of Additional Information contains additional information about investment strategies and their related risks.

Some of the principal investment risks vary between the Funds and the variations are described above. The value of each Fund’s securities may fluctuate on a daily basis. As with all mutual funds, as the values of each Fund’s assets rise or fall, the Fund’s share price changes. If an investor sells Fund shares when their value is less than the price the investor paid, the investor will lose money. As with any security, the securities in which the Funds invest have associated risk.

Market Volatility

Equity securities include common stocks, preferred stocks, convertible securities, depositary receipts, rights, and warrants. Common stocks, the most familiar type, represent an equity (ownership) interest in a corporation. The value of a company’s stock may fall as a result of factors directly relating to that company, such as decisions made by its management or lower demand for the company’s products or services. A stock’s value may also fall because of factors affecting not just the company, but also companies in the same industry or in a number of different industries, such as increases in production costs. The value of a company’s stock may also be affected by changes in financial markets that are relatively unrelated to the company or its industry, such as changes in interest rates or currency exchange rates. In addition, a company’s stock generally pays dividends only after the company invests in its own business and makes required payments to holders of its bonds and other debt. For this reason, the value of a company’s stock will usually react more strongly than its bonds and other debt to actual or perceived changes in the company’s financial condition or prospects. Stocks of smaller companies may be more vulnerable to adverse developments than those of larger companies.

Fixed-income securities include bonds and other debt instruments that are used by issuers to borrow money from investors. The issuer generally pays the investor a fixed, variable or floating rate of interest. The amount borrowed must be repaid at maturity. Some debt securities, such as zero coupon bonds, do not pay current interest, but are sold at a discount from their face values.

Interest Rate Changes. Fixed-income securities are sensitive to changes in interest rates. In general, fixed-income security prices rise when interest rates fall and fall when interest rates rise. Longer term bonds and zero coupon bonds are generally more sensitive to interest rate changes.

Credit Risk. Fixed-income security prices are also affected by the credit quality of the issuer. Investment grade debt securities are medium and high quality securities. Some bonds, such as lower grade or “junk” bonds, may have speculative characteristics and may be particularly sensitive to economic conditions and the financial condition of the issuers.

Repurchase Agreements and Loaned Securities

The Funds may invest a portion of their assets in repurchase agreements, although this is not a principal investment strategy. Repurchase agreements typically involve the purchase of debt securities from a financial institution such as a bank, savings and loan association, or

broker-dealer. A repurchase agreement provides that the Fund sells back to the seller and that the seller repurchases the underlying securities at a specified price on a specific date. Repurchase agreements may be viewed as loans by the Fund collateralized by the underlying securities. This arrangement results in a fixed rate of return that is not subject to market fluctuation while the Fund holds the security. In the event of a default or bankruptcy by a selling financial institution, the affected Fund bears a risk of loss. To minimize such risks, the Funds enter into repurchase agreements only with large, well-capitalized and well-established financial institutions. In addition, the value of the securities collateralizing the repurchase agreement is, and during the entire term of the repurchase agreement remains, at least equal to the repurchase price, including accrued interest.

The Funds may lend their portfolio securities to unaffiliated broker-dealers and other unaffiliated qualified financial institutions. These transactions involve risk of loss to a fund if the counterparty should fail to return such securities to the fund upon demand or if the counterparty’s collateral invested by the fund declines in value as a result of investment losses.

Currency Contracts

The Funds may enter into currency contracts, currency futures contracts and options, and options on currencies for hedging and other purposes. A forward currency contract involves a privately negotiated obligation to purchase or sell a specific currency at a future date at a price set in the contract. A Fund will not hedge currency exposure to an extent greater than the aggregate market value of the securities held or to be purchased by the Fund (denominated or generally quoted or currently convertible into the currency).

Hedging is a technique used in an attempt to reduce risk. If a Fund’s Sub-Advisor hedges market conditions incorrectly or employs a strategy that does not correlate well with the Fund’s investment, these techniques could result in a loss. These techniques may increase the volatility of a Fund and may involve a small investment of cash relative to the magnitude of the risk assumed. In addition, these techniques could result in a loss if the other party to the transaction does not perform as promised. There is also a risk of government action through exchange controls that would restrict the ability of the Fund to deliver or receive currency.

Forward Commitments