UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (As permitted by rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

ATA HOLDINGS CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

Reg. (S) 240.14a-101.

SEC 1913 (3-99)

April 1, 2003

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of the Shareholders of ATA Holdings Corp. at 9:00 a.m. on Monday, May 12, 2003, at the Company’s headquarters located at 7337 West Washington Street, Indianapolis, Indiana 46231. We will review the Company’s 2002 performance and answer any questions you may have. Enclosed with this Proxy Statement are your proxy card and 2002 Annual Report. Whether or not you plan to attend in person, you are requested to vote, sign, date and promptly return the enclosed proxy card in the envelope provided. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

I look forward to seeing you on May 12. Any shareholder requiring directions to the meeting should contact our Secretary, Brian T. Hunt, at 317/240-7006.

Sincerely yours,

George Mikelsons

Chairman of the Board

NOTICE OF THE

2003 ANNUAL MEETING OF SHAREHOLDERS

AND PROXY STATEMENT

The Annual Meeting of Shareholders of ATA Holdings Corp. (“ATAH” or the “Company”) will be held onMonday, May 12, 2003, at 9:00 a.m. at the Company’s headquarters located at 7337 West Washington Street, Indianapolis, Indiana. At the meeting, the shareholders will consider and take action on the following:

1. Election of six (6) Directors: J. George Mikelsons, James W. Hlavacek, Robert A. Abel, Andrejs P. Stipnieks, Dr. Claude E. Willis and David M. Wing, each for a term of one year;

2. Ratification of Ernst & Young LLP as independent accountants for the fiscal year ending December 31, 2003; and

3. Transaction of any other business properly brought before the Annual Meeting or any adjournment thereof.

The ATAH Board of Directors recommends a vote“in favor of” all proposals.

Shareholders of record at the close of business on March 12, 2003, will be entitled to vote at the Annual Meeting and any adjournments thereof. A complete list of shareholders entitled to vote will be available at ATAH’s offices for a period of ten days prior to the Annual Meeting.

This Proxy Statement, proxy card and ATAH’s 2002 Annual Report to Shareholders are being distributed on April 10, 2003.

By Order of the Board of Directors,

Brian T. Hunt

Vice President and Secretary

Dated: April 1, 2003

PROXY STATEMENT

TABLE OF CONTENTS

Q U E S T I O N S A N D A N S W E R S

|

Q: | | What am I voting on? | | | | | | | | |

|

A: | | ¨ | | Re-election of six (6) directors (J. George Mikelsons, James W. Hlavacek, Robert A. Abel, Andrejs P. Stipnieks, Dr. Claude E. Willis and David M. Wing); and |

|

| | | ¨ | | Ratification of Ernst & Young LLP as ATAH’s independent accountants. (See pages 3-8 for more details.) |

|

|

|

Q: | | Who is entitled to vote? | | | | | | | | |

|

A: Shareholders of record as of the close of business on March 12, 2003 (the Record Date), are entitled to vote at the Annual Meeting. Each share of ATAH common stock is entitled to one vote.

|

|

Q: | | How do I vote? | | | | | | | | |

|

A: Sign and date each proxy card you receive and return it in the prepaid envelope. You have the right to revoke your proxy at any time before the Annual Meeting by (1) notifying ATAH’s Corporate Secretary, (2) voting in person at the Annual Meeting, or (3) returning a later-dated proxy. If you return your signed proxy card but do not indicate your voting preferences, James W. Hlavacek and David M. Wing will voteFOR both proposals on your behalf.

|

|

Q: | | Is my vote confidential? | | | | | | | | |

|

A: Yes. Proxy cards, ballots and voting tabulations that identify individual shareholders are confidential. Only the inspector of election and certain employees associated with the processing of proxy cards and counting of the votes have access to your card. Additionally, any comments directed to management (whether written on the proxy card or elsewhere) will remain confidential, unless you ask that your name be disclosed.

|

|

Q: | | Who will count the vote? | | | | | | | | |

|

A: Representatives of National City Bank, our Stock Transfer Agent, will tabulate the votes and act as inspector of election.

|

|

Q: | | What does it mean if I get more than one proxy card? | | | | | | | | |

|

A: It is an indication that your shares are registered differently and are in more than one account. Sign and return all proxy cards to insure that all your shares are voted.

|

1

|

|

|

Q: | | What constitutes a quorum? | | | | | | | | |

|

A: As of the Record Date, 11,765,101 shares of ATAH common stock were issued and outstanding. A majority of the outstanding shares, present or represented by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. If you submit a properly executed proxy card, then you will be considered part of the quorum. If you are present or represented by a proxy at the Annual Meeting and you abstain from voting on a proposal, your abstention will not be included in the tabulation of votes cast and, therefore, will not have the effect of votes in favor or opposition of such proposal.

|

|

Q: | | Who can attend the Annual Meeting? | | | | | | | | |

|

A: All shareholders who hold ATAH common stock as of the Record Date can attend.

|

|

Q: | | What percentage of stock do the ATAH directors own? | | | | | | | | |

|

A: Together, they own approximately 71% of the outstanding shares of ATAH common stock as of the Record Date. (See page 12 for more details.)

|

|

Q: | | Who are the largest principal shareholders? | | | | | | | | |

|

A: George Mikelsons owned 8,257,800 shares, or 70%, as of March 12, 2003. Dimensional Fund Advisors, Inc. owned 995,700 shares, or 9%, as of December 31, 2002.

|

|

Q: | | When are the 2004 shareholder proposals due? | | | | | | | | |

|

A: In order to be considered for inclusion in next year’s Proxy Statement, shareholder proposals must be submitted to ATAH in writing no later than December 2, 2003. For a shareholder proposal that is not intended to be included in ATAH’s proxy materials but is intended to be raised by a shareholder from the floor at next year’s Annual Meeting, the shareholder must provide advance notice no later than February 15, 2004. If a proposal is received after that date, ATAH’s proxy for next year’s Annual Meeting may confer discretionary authority to vote on such matter. Shareholder proposals and related notices should be sent to: Brian T. Hunt, Corporate Secretary, 7337 West Washington Street, Indianapolis, Indiana 46231.

|

|

Q: | | Who is soliciting proxies for the Annual Meeting? | | | | | | | | |

|

A: The Board of Directors of ATAH is soliciting proxies for the Annual Meeting. ATAH will bear all costs of soliciting proxies. Solicitation of proxies will be principally by mail, but proxies may also be solicited by directors, officers and other regular employees of ATAH who will receive no additional compensation for these activities. Brokers and others who hold shares of ATAH common stock on behalf of others will be asked to send proxy materials to the beneficial owners of those shares, and ATAH will reimburse them for their reasonable expenses in doing so.

|

2

P R O P O S A L S T O B E V O T E D U P O N

| 1. | | Re-election of Directors |

Nominees for re-election this year are J. George Mikelsons, James W. Hlavacek, Robert A. Abel, Andrejs P. Stipnieks, Dr. Claude E. Willis and David M. Wing. All directors are elected to serve one-year terms. (See pages 5-8 for more information.)

Our bylaws provide that the nominees for director receiving a plurality of the votes cast at the Annual Meeting, up to the number of directors to be elected at the Annual Meeting, will be elected. Your Board recommends a voteFOR these nominees. Abstentions and broker non-votes are not included in the tabulation of votes cast and, therefore, do not have the effect of votes in opposition to a nominee.

| 2. | | Ratification of Ernst & Young LLP as Independent Accountants |

Ernst & Young LLP has been our independent public accountants for the past ten years. The Audit Committee and the Board believe that Ernst & Young’s long-term knowledge of ATAH is invaluable. Representatives of Ernst & Young have direct access to members of the Audit Committee. Representatives of Ernst & Young will attend the Annual Meeting to answer any shareholder questions and to make a statement if they desire to do so.

Audit Fees

The aggregate fees billed by Ernst & Young for professional services rendered for the audit of the Company’s annual financial statements for the year ended December 31, 2002, and the reviews of the financial statements included in the Company’s quarterly reports on Form 10-Q during the year 2002 were $250,635.

Other Fees

The aggregate fees billed by Ernst & Young for services they rendered in the year 2002, other than services included under the heading “Audit Fees,” were $423,638. Ernst & Young performed no services for the Company in 2002 related to financial information systems design and implementation.

In 2002, the Audit Committee: (1) reviewed all services provided by Ernst & Young to insure that they were within the scope previously approved by the Audit Committee; and (2) concluded that the non-audit services performed by Ernst & Young for ATAH and its subsidiaries did not impair its independence as ATAH’s accountants. The Report of the Audit Committee on page 9 of this Proxy Statement contains additional information on Ernst & Young’s services for ATAH.

We need a majority of the votes cast in person or by proxy and entitled to vote at the Annual Meeting in order to ratify Ernst & Young LLP as independent accountants for 2003. The Audit Committee and the Board recommend a voteFOR Ernst & Young LLP as independent accountants for 2003.

Abstentions and broker non-votes are not included in the tabulation of votes cast and, therefore, do not have the effect of votes in opposition to the ratification of Ernst & Young as auditors.

3

Other Matters

The Board of Directors does not anticipate that any other matters will be properly brought before the Annual Meeting. However, if any other matters are properly brought before the Annual Meeting, the persons named on the enclosed proxy card will have discretionary authority to vote on those matters according to their best judgment.

4

B O A R D O F D I R E C T O R S

J. GEORGE MIKELSONS | Director since 1993 |

J. George Mikelsons, age 66, is the founder, Chairman of the Board, Chief Executive Officer and, prior to the Company’s initial public offering in May 1993, was the sole shareholder of the Company. Mr. Mikelsons founded American Trans Air, Inc. (“ATA”) and Ambassadair Travel Club, Inc. in 1973. Mr. Mikelsons serves on the Board of Directors and is a member of the Executive Committee of the Air Transport Association. Mr. Mikelsons also serves on the board of directors of The Indianapolis Zoo, the Indianapolis Convention and Visitors Association (where he is a member of the Executive Committee), the Central Indiana Corporate Partnership and the Indianapolis Symphony Orchestra. Mr. Mikelsons has been an airline captain since 1966 and remains current on several jet aircraft. Mr. Mikelsons is a citizen of the United States.

JAMES W. HLAVACEK | Director since 1993 |

James W. Hlavacek, age 66, joined American Trans Air in 1983 and has served as Executive Vice President since 1989. In 1995, he was appointed Chief Operating Officer for the carrier. In addition, he oversees the Company’s regional commuter airline, Chicago Express Airlines, Inc. (doing business as ATA Connection), which is based at Chicago’s Midway International Airport. Mr. Hlavacek is also President of the American Trans Air Training Corporation, which trains maintenance professionals for the commercial airline market. From 1983 through 1989, he served ATA in various capacities, including Fleet Chief Pilot, System Chief Pilot and Vice President of Operations. He has served as a member of the National Air Carrier Association (NACA) Board of Directors since 1997 and currently serves as a member of the Senior Advisory Committee of the Air Transport Association and the Military Airlift Committee of the National Defense Transportation Association (NDTA). Mr. Hlavacek began his aviation career as a pilot in the U.S. Air Force. He is a native of Chicago and a graduate of the University of Illinois. Mr. Hlavacek is a citizen of the United States.

ROBERT A. ABEL | Director since 1993 |

Robert A. Abel, age 50, is a director in the public accounting firm of Blue & Co., LLC. Mr. Abel is amagna cum laudegraduate of Indiana State University with a B.S. Degree in Accounting. He is a certified public accountant with over 25 years of public accounting experience in the areas of auditing and corporate tax. He has been involved with aviation accounting and finance since 1976. Blue & Co., LLC provides tax and accounting services to the Company in connection with selected matters. Mr. Abel’s principal business address is 11460 N. Meridian Street, Carmel, Indiana 46032. Mr. Abel is a citizen of the United States.

ANDREJS P. STIPNIEKS | Director since 1993 |

Andrejs P. Stipnieks, age 62, is an international aviation consultant. He graduated from the University of Adelaide, South Australia, and is a Barrister and Solicitor of the Supreme Courts of South Australia, the Australian Capital Territory and of the High Court of Australia. Until 1998, Mr. Stipnieks was a Senior Government Solicitor in the Australian Attorney General’s Department, specializing in aviation and surface transport law and practice. He has represented Australia on the Legal Committee of the International Civil Aviation Organization at Montreal. Mr. Stipnieks’ principal business address is 6933 Andre Drive, Indianapolis, Indiana 46278. Mr. Stipnieks is a citizen of Australia.

CLAUDE E. WILLIS, D.D.S. | Director since 1993 |

Claude E. Willis, age 57, has been in private dental practice in Indianapolis for 29 years. He is a member of the American Dental Association, the Indianapolis District Dental Society and was named on a list of “Top Dentists in America” by the Consumers Research Council of America. A 1968 graduate of Purdue University’s School of Science, Dr. Willis completed his graduate studies earning a Doctor of Dental Surgery Degree from Indiana University School of Dentistry in 1972. Dr. Willis’ principal business address is 5938 W. State Road 135, Trafalgar, Indiana 46181. Dr. Willis is a citizen of the United States.

5

DAVID M. WING | Director since 2003 |

David M. Wing, age 51, was appointed Chief Financial Officer of the Company in 2003. From 1994 to 2003, he was the Company’s Vice President and Controller. Before joining ATA, Mr. Wing held several leadership positions with American Airlines over a period of 15 years, including Managing Director of Canadian Accounting Services, Managing Director of Corporate Receivables and Senior Manager of Accounting and Control. Mr. Wing, a certified public accountant, is a graduate of the University of Tulsa where he also holds a Masters in Business Administration. Mr. Wing is a citizen of the United States of America.

Board Meetings and Committees

During 2002, the Board of Directors held four (4) meetings. As described below, the Board of Directors has Audit and Compensation Committees.

|

Name of Committee and Members | | Functions of Committee | | Meetings in 2002 |

|

|

Audit Robert A. Abel Andrejs P. Stipnieks Claude E. Willis

| | · meets with the independent accountants of the Company · reviews the audit plan for the Company · reviews the annual audit of the Company with the independent accountants · recommends whether the independent accountants should be continued as auditors for the Company | | 6 |

|

|

Compensation Claude E. Willis Robert A. Abel | | · establishes compensation policies and compensation for the Company’s officers

| | 2 |

|

The Audit Committee is governed by a written charter approved by the Board of Directors. A copy of this charter is included as Appendix A. Additional information about the Audit Committee is set forth in the “Report of the Audit Committee” included in this Proxy Statement. The Company does not have a standing nominating committee.

Directors’ Compensation

We do not pay directors who are also officers of the Company additional compensation for their service as directors. In 2002, non-employee directors received the following:

| | · | | An annual retainer of $22,000 for serving on the Board. |

| | · | | An annual fee of $2,500 for serving as Chairman of a Committee. |

| | · | | A fee of $2,000 for each Board of Directors meeting attended in person. |

| | · | | A fee of $1,000 for each Committee meeting attended in person. (ATAH also pays its non-employee directors if they participate in Board and Committee meetings by telephone.) |

| | · | | Options to purchase shares of ATAH common stock pursuant to the Amtran, Inc. Stock Option Plan for Non-Employee Directors (a one-time grant of an option to purchase 2,000 shares following his election or appointment to the Board of Directors, and for as long as he remains an Eligible Director, an annual grant of an option to purchase 500 shares on the 30th day following each annual meeting of shareholders.) |

6

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers and persons who own more than ten percent of the Company’s shares to file with the Securities and Exchange Commission and Nasdaq reports on their ownership of shares of the Company (so-called 16(a) forms). Based solely on its review of copies of such reports, the Company believes that its directors have complied with all such filing requirements.

Certain Relationships and Related-Party Transactions in 2002

Mr. Mikelsons is the sole owner of Betaco, Inc., a Delaware corporation (“Betaco”). Betaco currently owns two airplanes (a Cessna Citation II and a Lear Jet) and three helicopters (a Bell 206B Jet Ranger III, an Aerospatiale 355F2 Twin Star and a Bell 206L-3 LongRanger). The two airplanes and the Twin Star helicopter are leased or subleased to ATA. The Lear Jet has been used to fly corporate charters since September 2002.The Jet Ranger III and LongRanger helicopters are leased to American Trans Air ExecuJet, Inc. (“ExecuJet”). ExecuJet uses the Jet Ranger III for third-party charter flying and subleases the LongRanger to an Indianapolis television station.

The lease for the Cessna Citation currently requires a monthly payment of $37,500 for a term beginning July 25, 1999, and ending on July 24, 2004. The lease for the Lear Jet requires a monthly payment of $33,600 for a term beginning December 24, 2001, and ending December 23, 2003. The lease for the JetRanger III currently requires a monthly payment of $3,500 for a term beginning June 15, 1993, and ending November 1, 2005. The lease for the LongRanger requires a monthly payment of $7,350 for a term beginning December 11, 2001, and ending October 31, 2005. Betaco lowered the lease payments for the JetRanger III and LongRanger an aggregate of $7,025 per month because of the decline in values for these aircraft. The Company believes that the current terms of the leases and subleases with Betaco for this equipment are no less favorable to the Company than those that could be obtained from third parties.

The lease for the Aerospatiale 355F2 Twin Star requires a monthly payment of $9,000 for a term beginning January 1, 2002, and ending October 31, 2005. Betaco lowered the lease payment by $4,500 per month because of the decline in the value for this aircraft. Lease payments under this lease have been suspended since February 13, 2003, and will be reinstated when the Twin Star is certificated for commercial use with an operational plan that demonstrates significant operational revenue for the Company.

Since 1996, the Company and Mr. Mikelsons have had an arrangement pursuant to which the Company provides certain domestic employees of Mr. Mikelsons with salary, health insurance and other non-cash benefits. Every quarter, the Company invoices Mr. Mikelsons for the full amount of such benefits. Historically, the timing of payments from Mr. Mikelsons to the Company has been inconsistent. Beginning in 2003, Mr. Mikelsons reimburses the Company prior to the pay date for these employees.

The Company pays approximately $269,000 in annual compensation, plus associated non-cash benefits, to five employees who serve as the crew for two boats owned by Betaco and another company owned by Mr. Mikelsons. Under an agreement dated as of July 1, 2002, the Company agreed to pay for these employees in exchange for its use of the boats for business purposes (e.g., the entertainment of clients, customers and vendors of the Company). To the extent that, for any fiscal year, the crew’s compensation, plus associated non-cash benefits, exceeds 75% of the amount that would have been charged by an outside third party under a fair market rental contract for the Company’s actual use of the boats, Mr. Mikelsons shall be responsible for paying the difference.

As of March 15, 2003, Mr. Mikelsons owes $668,527 to the Company pursuant to the arrangements relating to the domestic employees and the crew for the two boats. The Company has also paid Mr. Mikelsons a total of $120,000 in connection with the use of the boats by ATA prior to the July 1, 2002, agreement. While there have been other business uses by the Company, Mr. Mikelsons has determined not to seek reimbursement for them.

7

Mr. Abel, Chairman of the Audit Committee, is a partner in the accounting firm of Blue & Co., LLC, which provided tax and accounting services to the Company in 2002.

As part of the Company’s compensation package to Willie McKnight, the Company’s former Executive Vice President, Marketing and Sales, on January 24, 2000, the Company provided Mr. McKnight with an interest-free loan of $230,000. Fifty percent (50%) of the loan was forgiven on January 24, 2001, and the remainder of the principal balance was forgiven on January 24, 2002. The loan was evidenced by a Demand Promissory Note signed by Mr. McKnight.

In addition, the Company loaned its former Chief Executive Officer, John Tague, $175,000 on February 1, 2001. The loan was evidenced by a Promissory Note, which bore interest at an annual rate of 4.75%. The loan was repaid in full by Mr. Tague on August 20, 2002.

Corporate Governance

As a result of the implementation of the Sarbanes-Oxley Act of 2002, the SEC’s related rule-making and NASDAQ Corporate Governance Proposals, ATAH has:

1. Created a Disclosure Committee to review disclosure controls and procedures.

2. Revised its Code of Business Conduct and Ethics; and

3. Filed the required certifications under the Sarbanes-Oxley Act.

8

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has reviewed and discussed the Company’s audited financial statements for the fiscal year 2002, including a discussion of accounting policies, the reasonableness of significant judgments and the clarity of disclosures in the financial statements, with management and has received the written disclosures and the letter from Ernst & Young LLP, the Company’s independent auditors, required by Independence Standards Board Standard No. 1 (Independent Discussions with Audit Committee). The Audit Committee has also discussed with Ernst & Young LLP the Company’s audited financial statements for the fiscal year 2002, including, among other things, the quality of the Company’s accounting principles, consistency of accounting policies and their application, the clarity and completeness of the Company’s financial statements, the methodologies and accounting principles applied to significant transactions, the underlying processes and estimates used by management in its financial statements, and the basis for the auditor’s conclusions regarding the reasonableness of those estimates, and the auditor’s independence, as well as the other matters required by Statement on Auditing Standards No. 61 of the Auditing Standards Board of the American Institute of Certified Public Accountants.

Based on the review and discussions referred to above, the Audit Committee recommended inclusion of the audited financial statements in the Company’s Annual Report on Form 10-K to the Board of Directors.

Audit Committee

Robert A. Abel, Chairman

Andrejs P. Stipnieks

Claude E. Willis, D.D.S.

9

REPORT OF THE COMPENSATION COMMITTEE

What is our compensation philosophy?

The objectives of ATAH’s executive compensation programs are to: (i) attract and retain talented and experienced executives with compensation that is competitive with other U.S. airlines within a range of sizes, both smaller and larger than ATA, (ii) reward outstanding performance and provide incentives based on individual and corporate performance, and (iii) use restricted stock and stock options to align the interests of management with those of the shareholders.

The Compensation Committee is responsible for administering the Company’s compensation policies and programs, including its officer incentive compensation programs. The Compensation Committee currently consists of two independent non-employee directors, Claude E. Willis and Robert A. Abel. Mr. Abel is a director in the accounting firm of Blue & Co., LLC. Mr. Abel’s firm provided tax and accounting service to the Company in 2002.

As discussed below, the elements of compensation used by the Company include salaries and short-term and long-term incentive programs, including the award of cash bonuses and stock options.

How do we determine base pay?

The base pay for Mr. Mikelsons reflects ATAH’s objective to maintain salary levels for comparable executive positions that are consistent with ATA’s size as compared with the other airlines. Accordingly, the Compensation Committee took into consideration a number of factors, as described below.

Mr. Mikelsons’ 2002 Base Pay

In establishing a base salary for Mr. Mikelsons, the Compensation Committee considered:

| | · | | the fact that ATA is the smallest major airline. |

| | · | | the fact that Mr. Mikelsons would not participate in any equity-based incentive compensation plan or incentive cash bonus of the Company. |

| | · | | the fact that, although Mr. Mikelsons has been eligible to receive increases in base pay, he has declined such increases every year since 1993. |

| | · | | his age, experience and responsibilities. |

Each of these listed factors was evaluated by the Compensation Committee on a subjective basis, and no particular weighting was given to any particular factor. After considering the above factors, the Compensation Committee approved a base salary for the Chairman for 2002 of $688,194. Based on a compensation analysis of year 2001 data performed by a compensation consulting firm in January 2003 and provided to the Compensation Committee, such base salary was at approximately the 75th percentile of base salaries paid by other airlines to executives holding comparable positions, but, given the absence of any stock-based compensation or incentive cash bonus, Mr. Mikelsons’ total compensation was below the 25th percentile of total annual compensation, including long-term incentive compensation, paid by the other airlines included in the analysis. In addition, the compensation consulting firm determined that based on the 2001 data, the total compensation, including long-term incentive compensation, for airline executives in comparable positions would be between $1.6 million and $2.4 million. The Compensation Committee continues to support Mr. Mikelsons’ eligibility for increased compensation, which he most recently declined due to the financial conditions of the airline industry.

10

Mr. Tague’s 2002 Base Pay

In establishing a base salary for Mr. Tague, the former President and Chief Executive Officer of ATA, the Compensation Committee considered:

| | · | | the fact that ATA is the smallest major airline. |

| | · | | his age, experience and responsibilities. |

Each of these listed factors was evaluated by the Compensation Committee on a subjective basis, and no particular weighting was given to any particular factor. After considering the above factors, the Compensation Committee approved an annual base salary for 2002 for Mr. Tague of $525,000. Based on a compensation analysis of year 2001 data performed in January 2003 and provided to the Compensation Committee, such base salary was above the 50th percentile of base salary paid by other airlines to executives holding comparable positions. Mr. Tague’s total compensation, including long-term incentive compensation, was below the 25th percentile of compensation paid by the other airlines included in the analysis.

How are annual bonuses determined?

Annual bonuses are paid in cash in the year following performance, based on achievement of predetermined corporate goals. As in prior years, Mr. Mikelsons was not eligible for a bonus payment in 2002. Mr. Tague did not receive a year-end bonus for 2002.

Compensation Committee

Claude E. Willis, D.D.S., Chairman

Robert A. Abel

11

BENEFICIAL OWNERSHIP

This table indicates the number of shares of ATAH common stock owned by (i) the executive officers and, in the cases of John P. Tague, Kenneth K. Wolff and Willie G. McKnight, Jr., former executive officers; (ii) the directors; (iii) any person known by management to beneficially own more than 5% of the outstanding shares of ATAH common stock; and (iv) all directors and executive officers of the Company as a group as of March 12, 2003.

Name and Address of Individual/Group

| | Number of Shares Owned1

| | Right to Acquire2

| | Percent of Outstanding Shares3

|

J. George Mikelsons | | 8,257,800 | | -0- | | 70 |

|

7337 West Washington Street | | | | | | |

|

Indianapolis, IN 46231 | | | | | | |

|

John P. Tague4 | | -0- | | 416,137 | | — |

|

James W. Hlavacek | | 44,213 | | 309,431 | | — |

|

Kenneth K. Wolff5 | | 14,831 | | 332,268 | | — |

|

Robert A. Abel | | 4,000 | | 6,000 | | — |

|

Andrejs P. Stipnieks | | 15,000 | | 6,000 | | — |

|

Claude E. Willis | | 300 | | 2,500 | | — |

|

David M. Wing6 | | 74 | | 59,558 | | — |

|

Willie G. McKnight7 | | -0- | | 100,000 | | — |

|

Dimensional Fund Advisors Inc. 1299 Ocean Avenue, 11th Floor Santa Monica, CA 90401 | | 995,7008 | | -0- | | 9 |

|

All directors and executive officers as a group9 (excluding J. George Mikelsons) | | 78,418 | | 1,231,894 | | — |

| 1 | | Includes shares for which the named person has shared voting and investment power with a spouse. |

| 2 | | Shares that can be acquired through presently exercisable stock options or stock options which will become exercisable by their terms within 60 days. |

| 4 | | Mr. Tague resigned on August 5, 2002. |

| 5 | | Mr. Wolff retired on April 1, 2003. |

| 6 | | Mr. Wing was appointed Executive Vice President and Chief Financial Officer on March 3, 2003. |

| 7 | | Mr. McKnight left the Company on March 17, 2003. |

| 8 | | Dimensional Fund Advisors Inc. (“Dimensional”), an investment adviser registered under Section 203 of the Investment Advisers Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts. (These investment companies, trusts and accounts are referred to as the “Funds.”) In its role as investment adviser and investment manager, Dimensional possesses voting and/or investment power over the shares of common stock described in this table that are owned by the Funds. Such shares of common stock are owned by the Funds, and Dimensional disclaims beneficial ownership of such securities. |

| 9 | | Group consists of eight persons (Messrs. Tague, Hlavacek, Wolff, Abel, Stipnieks, Willis, Wing and McKnight). |

12

S U M M A R Y C O M P E N S A T I O N T A B L E

This table shows the compensation paid or accrued to the Chairman of the Board, former President and Chief Executive Officer, former Chief Financial Officer, former Executive Vice President, Marketing and Sales, and two executive officers for services rendered during the last three fiscal years.

| | | Annual Compensation

| | | Long-Term Compensation

| | | |

Name and

Principal Position

| | Year

| | Salary($)

| | | Bonus($)

| | | Securities Underlying Options (#)

| | All Other

Compensation($)

| |

J. George Mikelsons Chairman of the Board | | 2002 2001 2000 | | 681,443 680,403 688,194 | 1 3 | | None None None | | | None None None | | 6,600 5,775 3,535 | 2 4 5 |

|

John P. Tague6 Former President and Chief Executive Officer | | 2002 2001 2000 | | 777,958 512,885 525,000 | 7 3 | | None None None | | | None None 75,000 | | None 5,775 5,250 | 4 5 |

|

James W. Hlavacek Executive Vice President and Chief Operating Officer | | 2002 2001 2000 | | 346,635 341,923 350,000 | 1 3 | | None 16,000 None | 8 | | None None 50,000 | | 6,600 5,775 3,506 | 2 4 5 |

|

Kenneth K. Wolff9 Former Executive Vice President and Chief Financial Officer | | 2002 2001 2000 | | 346,635 341,923 350,000 | 1 3 | | None 16,000 None | 8 | | None None 50,000 | | 6,600 5,775 3,393 | 2 4 5 |

|

David M. Wing10 Executive Vice President and Chief Financial Officer | | 2002 2001 2000 | | 207,981 205,154 200,000 | 1 3 | | None 10,000 None | 8 | | None None 18,000 | | 6,600 5,775 4,384 | 2 4 5 |

|

Willie G. McKnight11 Former Executive Vice President, Marketing and Sales | | 2002 2001 2000 | | 461,635 456,923 323,077 | 1 3 | | None 8,000 210,000 | 8 | | None None 100,000 | | None None None | |

| 1 | | Reflects a salary reduction program initiated in November 2002. Mr. McKnight’s 2002 salary includes debt forgiveness of $115,000. |

| 2 | | Represents the amount of the Company’s matching contribution to its 401(k) Plan in 2002. |

| 3 | | Reflects a salary reduction program due to September 11, 2001, terrorist attacks. Mr. McKnight’s 2001 salary includes debt forgiveness of $115,000. |

| 4 | | Represents the amount of the Company’s matching contribution to its 401(k) Plan in 2001. |

| 5 | | Represents the amount of the Company’s matching contribution to its 401(k) Plan in 2000. |

| 6 | | Mr. Tague resigned on August 5, 2002. |

| 7 | | Mr. Tague’s compensation includes amounts paid to him pursuant to a Severance Agreement. |

| 8 | | Bonus amounts relate to a first quarter 2001 performance plan and were paid in the first half of 2001. Such amounts do not relate to year-end 2001 performance. |

| 9 | | Mr. Wolff retired on April 1, 2003. |

| 10 | | Mr. Wing was appointed Executive Vice President and Chief Financial Officer on March 3, 2003. |

| 11 | | Mr. McKnight left the Company on March 17, 2003. |

13

OPTION GRANTS TABLE

This table shows the option grants in 2002 to the individuals named in the Summary Compensation Table.

Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

Name | | Number of Securities Underlying Options Granted | | % of Total Options Granted To Employees In Fiscal Year | | Exercise Price/Share($) | | Expiration Date | | 5%($) | | 10%($) |

|

|

J. George Mikelsons | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

|

John P. Tague | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

|

James W. Hlavacek | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

|

Kenneth K. Wolff | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

|

David M. Wing | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

|

Willie G. McKnight | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

14

OPTION EXERCISES AND

YEAR-END OPTION VALUES

This table shows the number and value of stock options (exercised and unexercised) for the named individuals during 2002.

Name

| | Shares Acquired On Exercise (#)

| | Value Realized ($)

| | Number of Securities

Underlying Unexercised Options At Fiscal Year-End

| | Value of Unexercised In-The-Money Options At Fiscal Year-End Exercisable (E)/ Unexercisable (U)($)

| |

| | | | Exercisable

| | Unexercisable

| |

J. George Mikelsons | | -0- | | -0- | | -0- | | -0- | | -0- | |

|

John P. Tague | | 24,621 | | 190,394 | | 416,137 | | -0- | | -0- | (E) |

| | | | | | | | | -0- | | -0- | (U) |

|

James W. Hlavacek | | -0- | | -0- | | 309,431 | | -0- | | -0- | (E) |

| | | | | | | | | -0- | | -0- | (U) |

|

Kenneth K. Wolff | | -0- | | -0- | | 332,268 | | -0- | | -0- | (E) |

| | | | | | | | | -0- | | -0- | (U) |

|

David M. Wing | | 8,442 | | 45,985 | | 59,558 | | -0- | | -0- | (E) |

| | | | | | | | | -0- | | -0- | (U) |

|

Willie G. McKnight | | -0- | | -0- | | 100,000 | | -0- | | -0- | (E) |

| | | | | | | | | | | -0- | (U) |

Pension Plans

The Company has no pension plans.

401(k) Plan

Under the American Trans Air, Inc. Employees’ Retirement Savings Plan (the “401(k) Plan”), eligible employees may elect to defer up to 18% of their salary into the 401(k) Plan, not to exceed statutory limits. Generally, all employees meeting a minimum-hours requirement are eligible to participate in the 401(k) Plan. The Company has the discretion to make matching contributions to the 401(k) Plan on behalf of participants who have made salary reduction contributions under the 401(k) Plan. In 2002, the Company agreed to contribute $.60 for each dollar contributed to the 401(k) Plan by eligible participants, up to 6% of their compensation. Moreover, an employee stock ownership feature was added to the 401(k) Plan in May 1993. The ATA Employee Stock Ownership Plan (“ESOP”) is a mechanism for the Company to award shares of Company stock for years in which profits occur. Addition of this benefit permits eligible employees to become shareholders of the Company and share in its potential future growth and profitability. Generally, the eligibility requirements for the ESOP are identical to those of the 401(k) Plan, except an employee may be eligible for an ESOP contribution of Company stock even if the employee did not elect pre-tax 401(k) Plan contributions.

In those years in which the Company experiences profits and chooses to make an ESOP contribution, the 401(k) Plan accounts of eligible employees will be credited with full and/or fractional shares of Company stock. Shares will be allocated based on compensation. In 2002, no shares of Company stock were allocated to 401(k) Plan participant accounts.

15

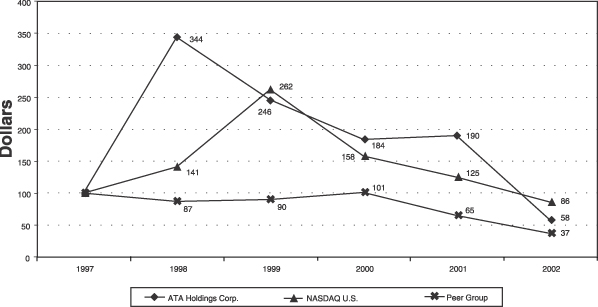

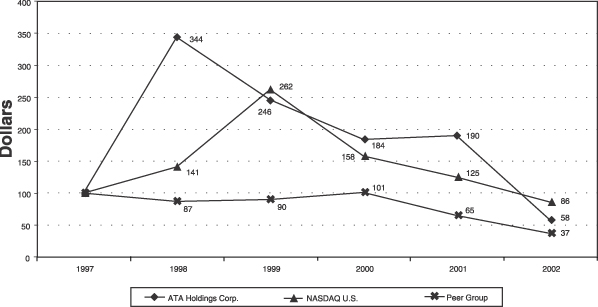

STOCK PERFORMANCE GRAPH

This performance graph compares the 2002 total shareholder return on the Company’s Common Stock with the Nasdaq Stock Market-U.S. Index and the Company’s peer group. The peer group selected by the Company consists of the following companies: AirTran Holdings, Inc., Alaska Air Group, Inc., America West Holdings Corporation, AMR Corp. (American Airlines), ATA Holdings Corp., Continental Airlines, Inc., Delta Air Lines, Inc., Frontier Airlines Inc., HAL, Inc. (Hawaiian Airlines), Northwest Airlines, Inc., Southwest Airlines Co., US Airways Group, Inc. and UAL Corp. (United Airlines).

Comparison Of 5-Year Cumulative

Total Return* Among The Company,

Nasdaq Market-U.S. Index And A Peer Group

*Total return based on $100 initial investment and reinvestment of dividends.

16

ATA Holdings Corp.

Audit Committee Charter

APPROVED – January 2002

Appendix A

ATA Holdings Corp.

Mission Statement:

The ATA Holdings Corp. Audit Committee will assist the Board of Directors in fulfilling its corporate oversight responsibilities. To fulfill this mission, the Audit Committee will review the ATA Holdings Corp. financial reporting process, the internal and external audit process, and ATA Holdings Corp.’s process for monitoring compliance with laws and regulations as well as compliance with the Company’s corporate code of ethics. In performing its duties, the Committee will maintain effective working relationships with the Board of Directors, management, the internal auditors and external auditors. In order for individual Audit Committee members to effectively perform his or her role, each Audit Committee member will obtain an understanding of responsibilities of Audit Committee membership as well as a functional understanding of ATA Holdings Corp.’s business, operations and risks.

Committee Organization:

Audit Committee members shall meet the requirements of the NASD. On and after the effective date of new rules regarding audit committees, the Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent directors as defined by the NASD. All members of the Committee shall have a basic understanding of finance and accounting, and be able to read and understand fundamental financial statements, and at least one member of the Committee shall have accounting or related financial management expertise.

Audit Committee members shall be appointed by the Board. If an Audit Committee Chairman is not designated or present, the members of the Committee may designate a Chairman by majority vote of the Committee membership.

The Committee shall meet at least two times annually, or as circumstances dictate. The Audit Committee Chairman shall prepare and/or approve an agenda in advance of each meeting. The Committee should meet privately in executive session at least annually with management, the director of the Internal Auditing Department, the independent auditors and as a committee to discuss any matters that the Committee or each of these groups believe should be discussed. In addition, the Committee, or at least its Chairman, should communicate with management and the independent auditors quarterly to review the Company’s financial statements and significant findings based upon the auditors’ limited review procedures.

Roles and Responsibilities:

Internal Control:

| · | | Evaluate whether ATA Holdings Corp. management is setting the appropriate “tone at the top” by communicating the importance of internal control and ensuring that all individuals possess an understanding of their roles and responsibilities; |

2

ATA Holdings Corp.

| · | | Focus on the extent to which the internal and external auditors review key and critical computer systems and applications, the security of such systems and applications, and the contingency plan for processing financial and operational information in the event of a systems breakdown; |

| · | | Gain an understanding of whether internal control recommendations made by the internal and external auditors have been implemented by ATA Holdings Corp. management; and |

| · | | Ensure that the internal and external auditors keep the Audit Committee informed as to any known occurrences of fraud, illegal acts, deficiencies in internal control and other matters that may impact the discharge of the Committee’s responsibilities. |

Financial Reporting:

General

| | · | | Review significant accounting and reporting issues, including recent professional and regulatory pronouncements, and understand their impact on ATA Holdings Corp.’s financial statements; |

| | · | | Ask ATA Holdings Corp. management and the internal and external auditors about significant risks and exposures effecting the financial reporting processes and the plans to minimize such risks. |

Annual Financial Statements

| | · | | Review the annual financial statements of ATA Holdings Corp. and determine whether they are complete and consistent with the information known to Committee members, and assess whether the financial statements reflect appropriate accounting principles; |

| | · | | Pay particular attention to complex and/or unusual transactions such as restructuring charges and derivative disclosures; |

| | · | | Focus on judgmental areas such as those involving valuation of assets and liabilities, including, for example, the accounting for and disclosure of obsolete or slow-moving inventory; loan losses; warranty, product and environmental liability; litigation reserves; and other commitments and contingencies; |

| | · | | Meet with ATA Holdings Corp. management and the external auditors to review the financial statements and results of the audit; |

| | · | | Consider management’s handling of proposed audit adjustments identified by the external auditors; |

3

ATA Holdings Corp.

| | · | | Review the MD&A and other sections of the ATA Holdings Corp. Annual Report before its release and consider whether the information is adequate and consistent with the Audit Committee’s knowledge about the Company and its operations; and |

Interim Financial Statements

| | · | | Be briefed on how management develops and summarizes quarterly financial information, the extent of internal audit involvement, the extent to which the external auditors review quarterly financial information and whether that review is performed on a pre- or post-issuance basis; |

| | · | | Meet with management and, if a pre-issuance review was completed, with the external auditors, either telephonically or in person, to review the interim financial statements and the results of the review. (This type of meeting may be done by the Audit Committee Chairperson or the entire committee); |

| | · | | In order to gain insights into the fairness of the interim financial statements and disclosures, obtain explanations from management and the internal and external auditors on whether: |

| | · | | Actual financial results for the quarter or interim period varied significantly from budgeted or projected results; |

| | · | | Changes in financial ratios and relationships in the interim financial statements are consistent with changes in ATA Holdings Corp.’s operations and financial practices; |

| | · | | Generally accepted accounting principles have been consistently applied; |

| | · | | There are any actual or proposed changes in accounting or financial reporting practices; |

| | · | | There are any significant or unusual events or transactions; |

| | · | | All financial and operating controls are functioning effectively; |

| | · | | The Company has complied with the terms of loan agreements or security indentures; and |

| | · | | The interim financial statements contain adequate and appropriate disclosures. |

| | · | | Ensure that the external auditors communicate certain required matters to the Committee. |

Compliance with Laws and Regulations:

| · | | Review the effectiveness of ATA Holdings Corp.’s system for monitoring compliance with laws and regulations and the results of management’s investigation and follow-up (including disciplinary actions) on any fraudulent acts or accounting irregularities; |

4

ATA Holdings Corp.

| · | | Periodically obtain updates from management, general counsel and tax director regarding compliance issues; |

| · | | Be satisfied that all regulatory compliance matters have been considered in the preparation of the financial statements; and |

| · | | Review the findings of any examinations by regulatory agencies such as the Securities and Exchange Commission. |

Compliance with ATA Holdings Corp.’s Corporate Code of Ethics:

| · | | Ensure that a code of ethics is formalized in writing and that all employees are aware of its existence; |

| · | | Evaluate whether management is setting the appropriate “tone at the top” by communicating the importance of the code of ethics and the guidelines for acceptable business practices; |

| · | | Review ATA Holdings Corp.’s program for monitoring compliance with the code of ethics; and |

| · | | Periodically obtaining updates from management and the general counsel regarding compliance matters. |

Internal Audit:

| · | | Review the internal audit plans, activities and objectives of the internal audit function; |

| · | | Review the qualifications of personnel performing internal audit work at/for ATA Holdings Corp.; and |

| · | | Review the effectiveness of the internal audit process in terms of risk monitoring, internal control review and evaluation and enhancement of organizational effectiveness. |

External Audit:

| · | | Review the external auditors’ proposed scope and approach; |

5

ATA Holdings Corp.

| · | | Review the performance of the external auditors and recommend to the ATA Holdings Corp. Board of Directors the appointment or discharge of the external auditors; and |

| · | | Review and confirm the independence of the external auditors by reviewing the non-audit services provided and the auditors’ assertion of their independence in accordance with professional standards. |

Other Responsibilities:

| · | | Meet with the internal auditors, external auditors and ATA Holdings Corp. management in separate executive sessions to discuss any matters that the Committee or these groups believe should be discussed privately; |

| · | | Ensure that significant findings and recommendations made by the internal and external auditors are received and discussed on a timely basis; |

| · | | Review with ATA Holdings Corp.’s counsel any legal matters that could have a significant impact on the Company’s financial statements; |

| · | | Review the policies and procedures in effect for considering officers’ expenses and perquisites; |

| · | | If necessary, institute special investigations and, if appropriate, hire special counsel or experts to assist; |

| · | | Perform other oversight functions as requested by the full ATA Holdings Corp. Board; and |

| · | | Review and update the Audit Committee Charter, provide oversight and update recommendations regarding the internal audit charter and receive approval of periodic changes from the full ATA Holdings Corp. Board. |

Reporting Responsibilities:

| · | | Regularly update the ATA Holdings Corp. Board of Directors regarding Audit Committee activities and make appropriate recommendations. |

| · | | Annually prepare a report to shareholders, as required by the Securities and Exchange Commission, to be included in ATA Holdings Corp.’s annual Proxy Statement. |

6

DETACH CARD

P R O X Y | | ATA Holdings Corp. 7337 WEST WASHINGTON STREET, INDIANAPOLIS, INDIANA 46231 |

| | This proxy is solicited on behalf of the Board of Directors for the Annual Meeting, May 12, 2003. The undersigned hereby appoints James W. Hlavacek and David M. Wing and each of them, with power of substitution to each, proxies of the undersigned, to vote at the Annual Meeting of Shareholders of ATA Holdings Corp. (the “Corporation”) to be held on the 12th day of May 2003, and at any and all postponements or adjournments of said meeting, all of the shares of stock of the Corporation which the undersigned may be entitled to vote with all the powers the undersigned would possess, if then and there personally present, and especially (but without limiting the general authority and power hereby given) to vote. |

| | THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTEFOR PROPOSALS 1 and 2. |

| | 1. | | Election of Directors |

| | | | ¨ FOR all nominees listed below (except as marked to the contrary below) | | ¨ WITHHOLD AUTHORITY to vote for all nominees listed below |

| | | | J. George Mikelsons, James W. Hlavacek, Robert A. Abel, Andrejs P. Stipnieks, Claude E. Willis and David M. Wing |

| | INSTRUCTION: (To withhold authority to vote for any individual nominee, write that nominee’s name on the space provided below.) |

| |

|

| | 2. | | Appointment of Ernst & Young LLP as the Corporation’s Auditors for 2003. |

| | | | ¨ FOR | | ¨ AGAINST | | ¨ ABSTAIN |

| | The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders and Proxy Statement and the Annual Report of the Corporation for 2002. |

| | | | | | (Continued, and to be signed, on the other side) |

DETACH CARD

ATA Holdings Corp.

(Continued from the other side.)

This proxy may be revoked at any time prior to said meeting, and the undersigned reserves the right to attend such meeting and vote said proxies in person.

The undersigned hereby revokes any proxy or proxies heretofore given to vote upon or act with respect to such shares and hereby ratifies and confirms all that said proxies, their substitutes or any of them may lawfully do by virtue hereof.

Unless otherwise specified, the shares represented by this proxy shall be voted FOR Proposals 1 and 2. This proxy will be voted in accordance with the instructions of the proxies named above with respect to any other matters which may properly come before the meeting and any postponements or adjournments thereof.

Dated | |

| | , 2003 |

Signature |

Signature if held jointly |

|

Please sign this proxy exactly as your name appears hereon. If the stock is held in the name of two or more persons, each should sign. Executors, administrators, trustees, guardians, attorneys and corporate officers should add their titles. If a corporation, sign in full corporate name by president or other authorized officer. If a partnership, sign in partnership name by authorized person. |

PLEASE MARK, SIGN, DATE AND MAIL THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.