UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

ATA Holdings Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

April 5, 2004

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of the Shareholders of ATA Holdings Corp. at 9:00 a.m. on Monday, May 10, 2004, at the Company’s headquarters located at 7337 West Washington Street, Indianapolis, Indiana 46231. We will review the Company’s 2003 performance and answer any questions you may have. Enclosed with this Proxy Statement are your proxy card and 2003 Annual Report. Whether or not you plan to attend in person, you are requested to vote, sign, date and promptly return the enclosed proxy card in the envelope provided. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

I look forward to seeing you on May 10. Any shareholder requiring directions to the meeting should contact our Corporate Secretary, Brian T. Hunt, at 317/282-7006.

Sincerely yours,

George Mikelsons

Chairman of the Board

NOTICE OF THE

2004 ANNUAL MEETING OF SHAREHOLDERS

AND PROXY STATEMENT

The Annual Meeting of Shareholders of ATA Holdings Corp. (“ATAH” or the “Company”) will be held onMonday, May 10, 2004, at 9:00 a.m. at the Company’s headquarters located at 7337 West Washington Street, Indianapolis, Indiana 46231. At the meeting, the shareholders will consider and take action on the following:

1. Election of seven (7) Directors: J. George Mikelsons, James W. Hlavacek, Robert A. Abel, Andrejs P. Stipnieks, Dr. Claude E. Willis, David M. Wing and Gilbert F. Viets, each for a term of one year;

2. Ratification of Ernst & Young LLP as independent accountants for the fiscal year ending December 31, 2004; and

3. Transaction of any other business properly brought before the Annual Meeting or any adjournment thereof.

The ATAH Board of Directors recommends a vote“in favor of” all proposals.

Shareholders of record at the close of business on March 10, 2004, will be entitled to vote at the Annual Meeting and any adjournments thereof. A complete list of shareholders entitled to vote will be available at ATAH’s offices for a period of ten days prior to the Annual Meeting.

This Proxy Statement, proxy card and ATAH’s 2003 Annual Report to Shareholders are being distributed on April 16, 2004.

By Order of the Board of Directors,

Dated: April 5, 2004

Brian T. Hunt

Vice President and Secretary

PROXY STATEMENT

TABLE OF CONTENTS

Q U E S T I O N S A N D A N S W E R S

| | | | |

| A: | | • | | Re-election of seven (7) directors (J. George Mikelsons, James W. Hlavacek, Robert A. Abel,

Andrejs P. Stipnieks, Dr. Claude E. Willis, David M. Wing and Gilbert F. Viets); and |

| | | • | | Ratification of Ernst & Young LLP as the independent accountants for ATA Holdings Corp. (“ATAH,” also referred to herein as the “Company”). (See pages 3-9 for more details.) |

| Q: | Who is entitled to vote? |

| A: | Shareholders of record as of the close of business on March 10, 2004 (the Record Date), are entitled to vote at the Annual Meeting. Each share of ATAH common stock is entitled to one vote. |

| A: | Sign and date each proxy card you receive and return it in the prepaid envelope. You have the right to revoke your proxy at any time before the Annual Meeting by (1) notifying ATAH’s Corporate Secretary, (2) voting in person at the Annual Meeting, or (3) returning a later-dated proxy. If you return your signed proxy card but do not indicate your voting preferences, James W. Hlavacek and David M. Wing will voteFOR both proposals on your behalf. |

| Q: | Is my vote confidential? |

| A: | Yes. Proxy cards, ballots and voting tabulations that identify individual shareholders are confidential. Only the inspector of election and certain employees associated with the processing of proxy cards and counting of the votes have access to your card. Additionally, any comments directed to management (whether written on the proxy card or elsewhere) will remain confidential, unless you ask that your name be disclosed. |

| Q: | Who will count the vote? |

| A: | Representatives of National City Bank, our Stock Transfer Agent, will tabulate the votes and act as inspector of election. |

| Q: | What does it mean if I get more than one proxy card? |

| A: | It is an indication that your shares are registered differently and are in more than one account. Sign and return all proxy cards to ensure that all your shares are voted. |

| Q: | What constitutes a quorum? |

| A: | As of the Record Date, 11,824,262 shares of ATAH common stock were issued and outstanding. A majority of the outstanding shares, present or represented by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. If you submit a properly executed proxy card, then you will be considered part of the quorum. If you are present or represented by a proxy at the Annual Meeting and you abstain from voting on a proposal, your abstention will not be included in the tabulation of votes cast and, therefore, will not have the effect of votes in favor or opposition of such proposal. |

| Q: | Who can attend the Annual Meeting? |

| A: | All shareholders who hold ATAH common stock as of the Record Date can attend. |

| Q: | What percentage of stock do the ATAH directors own? |

| A: | Together, they own approximately 71% of the outstanding shares of ATAH common stock as of the Record Date. (See page 13 for more details.) |

| Q: | Who is the largest principal shareholder? |

| A: | J. George Mikelsons owned 8,210,214 shares, or 70%, as of March 10, 2004. |

| Q: | When are the 2005 shareholder proposals due? |

| A: | In order to be considered for inclusion in next year’s Proxy Statement, shareholder proposals must be submitted to the Corporate Secretary of ATAH in writing no later than December 2, 2004. |

For a shareholder proposal or nominations of persons for election to the Board of Directors that are not intended to be included in ATAH’s proxy materials but are intended to be raised by a shareholder from the floor at next year’s Annual Meeting, the shareholder must provide advance notice no later than February 15, 2005. If a proposal is received after that date, ATAH’s proxy for next year’s Annual Meeting may confer discretionary authority to vote on such matter.

Shareholder proposals and related notices should be sent to: Brian T. Hunt, Corporate Secretary, 7337 West Washington Street, Indianapolis, Indiana 46231.

| Q: | Who is soliciting proxies for the Annual Meeting? |

| A: | The Board of Directors of ATAH is soliciting proxies for the Annual Meeting. ATAH will bear all costs of soliciting proxies. Solicitation of proxies will be principally by mail, but proxies may also be solicited by directors, officers and other regular employees of ATAH who will receive no additional compensation for these activities. Brokers and others who hold shares of ATAH common stock on behalf of others will be asked to send proxy materials to the beneficial owners of those shares, and ATAH will reimburse them for their reasonable expenses in doing so. |

2

P R O P O S A L S T O B E V O T E D U P O N

| 1. | Re-election of Directors |

The Company’s Corporate Governance and Nominating Committee is responsible for the nomination of individuals for service on the Board of Directors. Nominees for re-election this year are J. George Mikelsons, James W. Hlavacek, Robert A. Abel, Andrejs P. Stipnieks, Dr. Claude E. Willis, David M. Wing and Gilbert F. Viets. All directors are elected to serve one-year terms. (See pages 5-6 for more information.)

Our bylaws provide that the nominees for director receiving a plurality of the votes cast at the Annual Meeting, up to the number of directors to be elected at the Annual Meeting, will be elected. Your Board recommends a voteFOR these nominees. Abstentions and broker non-votes are not included in the tabulation of votes cast and, therefore, do not have the effect of votes in opposition to a nominee.

| 2. | Ratification of Ernst & Young LLP as Independent Accountants |

Ernst & Young LLP has been our independent public accountants for the past 11 years. Representatives of Ernst & Young have direct access to members of the Audit Committee. Representatives of Ernst & Young will attend the Annual Meeting to answer any shareholder questions and to make a statement if they desire to do so.

Audit Fees

The aggregate fees billed by Ernst & Young for audit services rendered for the years ended December 31, 2003 and 2002 were $770,541 and $309,485, respectively. Audit fees include the audit of the Company’s annual financial statements, the reviews of the financial statements included in the Company’s quarterly reports on Form 10-Q during the year 2003, attestation services required by statute or regulation, comfort letters, consents, assistance with and review of documents filed with the SEC, and accounting and financial reporting consultations and research work necessary to comply with generally accepted auditing standards.

Audit-Related Fees

The aggregate fees billed by Ernst & Young for professional services rendered for audit-related services for the years ended December 31, 2003 and 2002 were $52,211 and $129,950, respectively. The fees consisted primarily of services for other agreed-upon procedures.

Tax Fees

The aggregate fees billed by Ernst & Young for professional services rendered for tax fees for the years ended December 31, 2003 and 2002 were $202,285 and $233,188, respectively. The fees consisted primarily of preparation and review of federal and state tax returns and tax advice.

All Other Fees

The aggregate fees billed by Ernst & Young for professional services rendered for other fees for the years ended December 31, 2003 and 2002 were $152,430 and $1,650, respectively. The fees consisted primarily of consultation related to preparation for Sarbanes-Oxley 404 requirements.

3

In 2003, the Audit Committee: (1) reviewed all services provided by Ernst & Young to ensure that they were within the scope previously approved by the Audit Committee; and (2) concluded that the non-audit services performed by Ernst & Young for ATAH and its subsidiaries did not impair its independence as ATAH’s accountants. The Report of the Audit Committee on page 10 of this Proxy Statement contains additional information on Ernst & Young’s services for ATAH.

We need a majority of the votes cast in person or by proxy and entitled to vote at the Annual Meeting in order to ratify Ernst & Young LLP as independent accountants for 2004. The Audit Committee and the Board recommend a voteFOR Ernst & Young LLP as independent accountants for 2004.

Abstentions and broker non-votes are not included in the tabulation of votes cast and, therefore, do not have the effect of votes in opposition to the ratification of Ernst & Young as independent accountants.

Other Matters

The Board of Directors does not anticipate that any other matters will be properly brought before the Annual Meeting. However, if any other matters are properly brought before the Annual Meeting, the persons named on the enclosed proxy card will have discretionary authority to vote on those matters according to their best judgment.

4

B O A R D O F D I R E C T O R S

J. GEORGE MIKELSONS | Director since 1993 |

J. George Mikelsons, age 67, is the founder, Chairman of the Board, Chief Executive Officer and, prior to the Company’s initial public offering in May 1993, was the sole shareholder of the Company. Mr. Mikelsons founded American Trans Air, Inc., presently known as ATA Airlines, Inc. (“ATA”), and Ambassadair Travel Club, Inc. in 1973. Mr. Mikelsons serves on the Board of Directors and is a member of the Executive Committee of the Air Transport Association. Mr. Mikelsons also serves on the Board of Directors of The Indianapolis Zoo, the Indianapolis Convention and Visitors Association (where he is a member of the Executive Committee), the Central Indiana Corporate Partnership and the Indianapolis Symphony Orchestra. Mr. Mikelsons has been an airline captain since 1966 and remains current on several jet aircraft. Mr. Mikelsons is a citizen of the United States.

JAMES W. HLAVACEK | Director since 1993 |

James W. Hlavacek, age 67, joined ATA in 1983 and has served as Executive Vice President since 1989. In 1995, he was appointed Chief Operating Officer for the carrier, and in May 2003, he was appointed Vice Chairman. In addition, he oversees the Company’s regional commuter airline, Chicago Express Airlines, Inc. (doing business as ATA Connection), which is based at Chicago’s Midway International Airport. From 1983 through 1989, he served ATA in various capacities, including Fleet Chief Pilot, System Chief Pilot and Vice President of Operations. He has served as a member of the National Air Carrier Association (NACA) Board of Directors since 1997. He is also a member of the Chicagoland Chamber of Commerce Board of Directions, the Chicago Convention and Tourism Bureau Board of Directors, and the Military Airlift and Security Practices Committee for the National Defense Transportation Association. Mr. Hlavacek began his aviation career as a pilot in the U.S. Air Force. He is a native of Chicago and a graduate of the University of Illinois. Mr. Hlavacek is a citizen of the United States.

ROBERT A. ABEL | Director since 1993 |

Robert A. Abel, age 51, is a director in the public accounting firm of Blue & Co., LLC. Mr. Abel is amagna cum laudegraduate of Indiana State University with a B.S. Degree in Accounting. He is a Certified Public Accountant with over 25 years of public accounting experience in the areas of auditing and corporate tax. He has been involved with aviation accounting and finance since 1976. Blue & Co., LLC provides tax and accounting services to the Company in connection with selected matters. Mr. Abel’s principal business address is 12800 N. Meridian Street, Carmel, Indiana 46032. Mr. Abel is a citizen of the United States.

ANDREJS P. STIPNIEKS | Director since 1993 |

Andrejs P. Stipnieks, age 63, is an international aviation consultant. He graduated from the University of Adelaide, South Australia, and is a Barrister and Solicitor of the Supreme Courts of South Australia, the Australian Capital Territory and of the High Court of Australia. Until 1998, Mr. Stipnieks was a Senior Government Solicitor in the Australian Attorney General’s Department, specializing in aviation and surface transport law and practice. He has represented Australia on the Legal Committee of the International Civil Aviation Organization at Montreal. Mr. Stipnieks’ principal business address is Gleznotaju Iela 5-6, Riga 1050, Latvia. Mr. Stipnieks is a citizen of Australia.

CLAUDE E. WILLIS, D.D.S. | Director since 2001 |

Claude E. Willis, age 58, has been in private dental practice in Indianapolis for 29 years. He is a member of the American Dental Association, the Indianapolis District Dental Society and was named on a list of “Top Dentists in America” by the Consumers Research Council of America. A 1968 graduate of Purdue University’s School of Science, Dr. Willis completed his graduate studies earning a Doctor of Dental Surgery Degree from Indiana University School of Dentistry in 1972. Dr. Willis’ principal business address is 5938 W. State Road 135, Trafalgar, Indiana 46181. Dr. Willis is a citizen of the United States.

5

DAVID M. WING | Director since 2003 |

David M. Wing, age 52, was appointed Chief Financial Officer of the Company in 2003. From 1994 to 2003, he was the Company’s Vice President and Controller. Before joining ATA, Mr. Wing held several leadership positions with American Airlines over a period of 15 years, including Managing Director of Canadian Accounting Services, Managing Director of Corporate Receivables and Senior Manager of Accounting and Control. Mr. Wing, a Certified Public Accountant, is a graduate of the University of Tulsa where he also holds a Masters in Business Administration. Mr. Wing is a citizen of the United States.

GILBERT F. VIETS | Director since 2003 |

Gilbert F. Viets, age 60, is a clinical professor in the Systems and Accounting Graduate Program of the Kelley School of Business at Indiana University, Bloomington, Indiana. Mr. Viets, a Certified Public Accountant, was with Arthur Andersen LLP for 35 years before retiring in 2000. He graduated from Washburn University of Topeka, Kansas. He has been active in numerous civic organizations and presently serves on the finance committees of St. Vincent Hospital and Healthcare Center, Inc. and St. Vincent Health, both located in Indianapolis, Indiana. Mr. Viets’ principal business address is 760 Wood Court, Zionsville, Indiana 46077-2025. Mr. Viets is a citizen of the United States.

Board Meetings and Committees

During 2003, the Board of Directors held four (4) meetings. All Directors attended each Board Meeting, except for Mr. Stipnieks who was unable to attend one meeting. As described below, the Board of Directors had Audit and Compensation Committees in 2003.

| | | | | | | |

| |

Name of Committee and Members | | | Functions of Committee | | | Meetings in 2003 | |

| |

Audit Gilbert F. Viets Andrejs P. Stipnieks Claude E. Willis | | | • meets with the independent accountants of the Company • reviews the audit plan for the Company • reviews the annual audit of the Company with the independent accountants • recommends whether the independent accountants should be continued as auditors for the Company | | | 8 | |

| |

Compensation Claude E. Willis Gilbert F. Viets Andrejs Stipnieks Robert A. Abel | | | • establishes compensation policies and compensation for the Company’s officers | | | 1 | |

| |

The Audit Committee and Compensation Committee are governed by written charters approved by the Board of Directors. A copy of these charters can be found on the Company’s web site (www.ata.com) under the “Investor Relations” tab. The Chairman of the Audit Committee, Gilbert Viets, meets the “independence test” of the SEC and NASDAQ Listing Standards and is a “financial expert” as defined in Item 401 of Regulation S-K. The other members of the Audit Committee and all the members of the Compensation Committee also meet the “independence test.” Beginning in 2004, the Company’s Audit Committee reviews and approves all related-party transactions. Additional information about the Audit Committee and Compensation Committee is set forth in those Committees’ reports included in this Proxy Statement.

6

Directors’ Compensation

We do not pay directors who are also officers of the Company additional compensation for their service as directors. In 2003, non-employee directors received the following:

| | • | An annual retainer of $26,000 for serving on the Board. |

| | • | An annual fee of $2,500 for serving as Chairman of a Committee. These fees were later modified as follows: $5,000 Audit Committee Chairman; $3,000 Compensation Committee Chairman; and $2,500 Corporate Governance and Nominating Committee Chairman. |

| | • | A fee of $2,000 for each Board of Directors meeting attended in person. |

| | • | A fee of $1,000 for each Committee meeting attended in person. (ATAH also pays its non-employee directors if they participate in Board and Committee meetings by telephone.) |

| | • | Lifetime flight benefits, comprised of space-available personal and family flight passes and/or positive space travel by the director and the director’s family. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers and persons who own more than ten percent of the Company’s shares to file with the Securities and Exchange Commission and NASDAQ reports on their ownership of shares of the Company (so-called 16(a) forms). Based solely on its review of copies of such reports, the Company believes that its directors have complied with all such filing requirements.

Certain Relationships and Related-Party Transactions in 2003

Mr. Mikelsons is the sole owner of Betaco, Inc., a Delaware corporation (“Betaco”). Betaco currently owns two airplanes, a Cessna Citation II and a Lear Jet, and two helicopters, a Bell 206B Jet Ranger III and a Bell 206L-3 LongRanger. The two airplanes are leased or subleased to ATA. The Jet Ranger III and LongRanger helicopters are leased to American Trans Air ExecuJet, Inc. (“ExecuJet”), a subsidiary of ATA Holdings Corp. ExecuJet uses the Jet Ranger III for third-party charter flying and subleases the LongRanger to an Indianapolis television station.

The lease for the Cessna Citation currently requires a monthly payment of $37,500 for a term beginning July 25, 1999, and ending on July 24, 2004. The lease for the Lear Jet requires a monthly payment of $33,600 for a term beginning December 24, 2001, and ending December 23, 2003. The lease for the Lear Jet is currently operating on a month-to-month basis and is being renegotiated. The lease for the JetRanger III currently requires a monthly payment of $3,500 for a term beginning November 1, 2002, and ending November 1, 2005. The lease for the LongRanger requires a monthly payment of $7,350 for a term beginning December 11, 2001, and ending October 31, 2005. The Company believes that the current terms of the leases and subleases with Betaco for this equipment are no less favorable to the Company than those that could be obtained from third parties.

Since 1996, the Company and Mr. Mikelsons have had an arrangement pursuant to which the Company provides certain domestic employees of Mr. Mikelsons with salary, health insurance and other non-cash benefits. Every quarter, the Company invoices Mr. Mikelsons for the full amount of such benefits. Prior to 2003, the timing of payments from Mr. Mikelsons to the Company had been inconsistent. Beginning in 2003, Mr. Mikelsons has reimbursed the Company prior to the date of each salary payment for these employees.

In 2004, the Company will pay approximately $296,000 in annual compensation, plus associated non-cash benefits, to six employees who serve as the crew for one boat owned by Betaco and another company owned by Mr. Mikelsons. In 2003, the Company paid approximately $258,000 for five employees. Under an agreement dated as of July 1, 2002, the Company agreed to pay for these employees in exchange for its use of the boat for business purposes (e.g., the entertainment of clients, customers and vendors of the Company). To the extent that, for any fiscal year, the crew’s compensation, plus associated non-cash benefits, exceeds 75% of the amount that would have been

7

charged by an outside third party under a fair market rental contract for the Company’s actual business use of the boat, Mr. Mikelsons is responsible for paying the difference. In 2003, the Company’s use of the boat resulted in no payments by Mr. Mikelsons to the Company.

As of December 31, 2003, Mr. Mikelsons owed $668,029 to the Company pursuant to the arrangements relating to the domestic employees and the crew for the boat. In 2002, the Company also paid Mr. Mikelsons a total of $120,000 in connection with the use of the boat by ATA prior to the July 1, 2002, agreement. While there have been other business uses of the boat by the Company, Mr. Mikelsons has determined not to seek reimbursement for them.

In 2003, Gordon Moebius, Director of ExecuJet and brother-in-law to Mr. Mikelsons, received annual compensation of approximately $87,000. In addition, Eugene Moebius and Alan Moebius, ATA airframe & powerplant aircraft mechanics and brothers-in-law to Mr. Mikelsons, received $64,567 and $60,123, respectively, in compensation from ATA in 2003.

Corporate Governance

The Company is committed to operating with the highest ethical standards. The Company believes adherence to good corporate governance practices furthers this commitment.

The Company has four (4) non-employee directors (Messrs. Abel, Stipnieks, Viets and Willis), all of whom meet the “independence” tests of the applicable SEC regulations and the NASDAQ Listing Standards. Accordingly, a majority of the Company’s Board members are independent.

In addition to the Audit and Compensation Committees, which are described on pages 6 and 7 of this Proxy Statement, the Company also has a Disclosure Committee and a Corporate Governance and Nominating Committee. The Disclosure Committee was formed to review the Company’s disclosure controls and procedures. The Corporate Governance Committee is comprised of Board members Stipnieks (Chairman), Viets and Willis, all of whom are independent. The Corporate Governance and Nominating Committee has the following responsibilities:

| | • | Publication and enforcement of the Company’s Corporate Code of Business Conduct and Ethics and Corporate Governance Guidelines, both of which are posted on the Company’s web site (www.ata.com) in the “Investor Relations” section. The Code of Business Conduct and Ethics is also attached to and was filed with our 10-K as Exhibit 14. The Code is applicable to all members of the Company’s Board of Directors, as well as the Company’s executive officers. |

| | • | Publication of the Committee’s Charter, which is also available to shareholders on the Company’s web site (www.ata.com). |

| | • | While the Company does not have a specific policy governing the consideration of shareholder-recommended director candidates, both the Nominating Committee’s Charter and the Company’s Corporate Governance Guidelines charge the Nominating Committee with the responsibility of evaluating nominated candidates for the Board against defined qualifications. The Committee would accept shareholder recommendations for director nominees just as it would accept recommendations for potential board members from other sources. See “Q: When are the 2005 shareholder proposals due?” paragraph on page 2 of this Proxy Statement for notice periods. |

| | • | Assessment of qualifications the Committee believes a nominee for the Board must have for a position on the Company’s Board. |

The Nominating Committee did not receive a nominee recommendation by any shareholder in 2003.

8

Shareholders may communicate directly with the Board and/or its members by sending a letter to: The ATA Holdings Corp. Board of Directors, c/o Corporate Secretary, ATA Holdings Corp., 7337 West Washington Street, Indianapolis, IN 46231.

9

R E P O R T O F T H E A U D I T C O M M I T T E E

The Audit Committee, comprised of independent directors, met with the independent auditors, management and internal auditors to assure that all were carrying out their respective responsibilities. The Audit Committee discussed with and received a letter from the independent auditors confirming their independence. Both the independent auditors and the internal auditors had full access to the Committee, including meetings without management present.

The Audit Committee met with the independent auditors to discuss their fees and the scope and results of their audit work, including the adequacy of internal controls and the quality of financial reporting. The Committee also discussed with the independent auditors their judgments regarding the quality and acceptability of the Company’s accounting principles, the clarity of its disclosures and the degree of aggressiveness or conservatism of its accounting principles and underlying estimates. The Audit Committee reviewed and discussed the audited financial statements with management and recommended to the Board of Directors that the financial statements be included in the Company’s Form 10-K filing with the Securities and Exchange Commission.

Audit Committee

Gilbert F. Viets, Chairman

Andrejs P. Stipnieks

Claude E. Willis, D.D.S.

10

R E P O R T O F T H E C O M P E N S A T I O N C O M M I T T E E

Our compensation philosophy

The objectives of ATAH’s executive compensation programs are to: (i) attract and retain talented and experienced executives with compensation that is competitive with other U.S. airlines within a range of sizes, both smaller and larger than ATA; (ii) reward outstanding performance and provide incentives based on individual and corporate performance; and (iii) use equity-based compensation (in the form of either restricted stock or stock options) to align the interests of management with those of the shareholders.

The Compensation Committee is responsible for administering the Company’s compensation policies and programs, including its officer incentive compensation programs. The Compensation Committee currently consists of four (4) independent non-employee directors: Claude E. Willis (Chairman), Andrejs P. Stipnieks, Gilbert F. Viets, and Robert A. Abel. Mr. Abel is a director in the accounting firm of Blue & Co., LLC. Mr. Abel’s firm provided tax and accounting services to the Company in 2003.

2003 Pay Programs

In past years, the Company has compensated its executives using a combination of base salary, annual incentive and stock option grants. As mentioned previously, base salaries are intended to be competitive with external market practice, as are incentive awards at targeted performance levels.

Like most of the domestic airline industry, in 2003, ATA’s business continued to be challenged by the ongoing economic downturn and the residual effects of the September 11, 2001, terrorist attacks. Employees across the industry, including executives, have been asked to make sacrifices in light of these conditions. Company staff and executives have been asked to make similar sacrifices.

Given the financial condition of the Company, no incentive awards were made to any Company officer during 2003. As a result, base salaries were the sole element of compensation. In addition, no base salary increases were provided to Company executives with the exception of individuals promoted to new positions in 2003.

CEO 2003 Compensation Decisions

Mr. Mikelsons’ base salary in 2003 was $687,916. Consistent with the treatment for all Company officers, Mr. Mikelsons did not receive a salary increase in 2003.

In establishing a base salary for Mr. Mikelsons, the Compensation Committee considered:

| | • | the fact that ATA is slightly above the median size (as measured by revenue) relative to a broad airline industry group of 19 companies; |

| | • | the fact that Mr. Mikelsons would not participate in any equity-based incentive compensation plan or incentive cash bonus of the Company, if such plan were offered to Company executives; |

| | • | the fact that, although Mr. Mikelsons has been eligible to receive increases in base pay, he has declined such increases every year since 1993; and |

| | • | his age, experience and responsibilities. |

11

Each of these listed factors was evaluated by the Compensation Committee on a subjective basis, and no particular weighting was given to any particular factor. After considering the above factors, the Compensation Committee approved a base salary for the Chairman and CEO for 2003 of $687,916. Based on a compensation analysis of year 2002 data performed by an independent compensation consulting firm retained directly by the Compensation Committee, such base salary was at approximately the 85th percentile of base salaries paid by other airlines to executives holding comparable positions. However, given the absence of any stock-based compensation or incentive cash bonus, Mr. Mikelsons’ total compensation was below the 25th percentile of total annual compensation, including long-term incentive compensation, paid by the other airlines included in the analysis. The compensation consulting firm determined that, based on the 2002 data, the total compensation, including long-term incentive compensation, for airline executives in comparable positions would be between $900,000 and $2.6 million. The Compensation Committee continues to support Mr. Mikelsons’ eligibility for increased compensation, which he most recently declined due to the financial conditions of the airline industry.

As in prior years, Mr. Mikelsons was not eligible for and did not receive a bonus payment or equity compensation grant in 2003.

Tax Deductibility of Executive Compensation

Under IRC Section 162(m), any compensation provided to Company officers listed in the Summary Compensation Table in excess of $1 million and not considered performance-based compensation will not be considered for a tax deduction by the Company. None of the named-executive officers in this year’s Summary Compensation Table received compensation in excess of $1 million.

The Company will continue to monitor the impact of executive compensation on Company tax deductions. As necessary, the Committee will make prudent decisions as to if and how the Company’s compensation programs should be adjusted to retain the full deductibility of executive compensation.

Compensation Committee

Claude E. Willis, D.D.S., Chairman

Robert A. Abel

Andrejs P. Stipnieks

Gilbert F. Viets

12

B E N E F I C I A L O W N E R S H I P T A B L E

This table indicates the number of shares of ATAH common stock owned by (i) the Chief Executive Officer and the next four (4) most highly compensated executive officers of the Company; (ii) the directors; (iii) any person known by management to beneficially own more than 5% of the outstanding shares of ATAH common stock; and (iv) all directors and executive officers of the Company as a group as of March 10, 2004.

| | | | | | |

Name and Address of Individual/Group

| | Number of

Shares

Owned1

| | Right to

Acquire2

| | Percent of

Outstanding

Shares3

|

J. George Mikelsons 7337 West Washington Street Indianapolis, IN 46231 | | 8,210,214 | | –0– | | 70 |

| | | |

James W. Hlavacek | | 14,263 | | 270,098 | | — |

| | | |

Robert A. Abel | | 4,000 | | 4,000 | | — |

| | | |

Gilbert F. Viets | | 4,000 | | –0– | | — |

| | | |

Andrejs P. Stipnieks | | 15,320 | | 4,000 | | — |

| | | |

Claude E. Willis | | 300 | | 2,500 | | — |

| | | |

David M. Wing4 | | 1,074 | | 59,558 | | — |

| | | |

William D. Beal5 | | 57 | | 39,333 | | — |

| | | |

Randy E. Marlar5 | | 272 | | 123,000 | | — |

| | | |

All directors and executive officers as a group6

(excluding J. George Mikelsons) | | 39,286 | | 502,489 | | — |

| 1 | Includes shares for which the named person has shared voting and investment power with a spouse. |

| 2 | Shares that can be acquired through presently exercisable stock options or stock options which will become exercisable by their terms within 60 days. |

| 4 | Mr. Wing was appointed Executive Vice President and Chief Financial Officer on March 3, 2003. |

| 5 | Messrs. Beal and Marlar were appointed Senior Vice Presidents in 2003. |

| 6 | Group consists of 8 persons (Messrs. Hlavacek, Abel, Stipnieks, Viets, Willis, Wing, Beal and Marlar). |

13

S U M M A R Y C O M P E N S A T I O N T A B L E

This table shows the compensation paid or accrued to the Chief Executive Officer and Chairman of the Board, the next four (4) most highly compensated executive officers of the Company, the former President and Chief Executive Officer, and the former Executive Vice President, Marketing and Sales for services rendered during the last three fiscal years.

| | | | | | | | | | | |

Name and Principal Position

| | Annual Compensation

| | Long-Term

Compensation

| | All Other

Compensation($)

|

| | Year

| | Salary($)

| | | Bonus($)

| | Securities

Underlying

Options (#)

| |

J. George Mikelsons | | 2003 | | 687,916 | | | None | | None | | 7,2001 |

Chief Executive Officer and | | 2002 | | 681,443 | 2 | | None | | None | | 6,6003 |

Chairman of the Board | | 2001 | | 680,403 | 4 | | None | | None | | 5,7755 |

| | | | | |

James W. Hlavacek | | 2003 | | 280,000 | | | None | | None | | 7,2001 |

Vice Chairman | | 2002 | | 346,635 | 2 | | None | | None | | 6,6003 |

| | | 2001 | | 341,923 | 4 | | 16,0006 | | None | | 5,7755 |

| | | | | |

David M. Wing7 | | 2003 | | 319,846 | | | None | | None | | 7,2001 |

Executive Vice President and | | 2002 | | 207,981 | 2 | | None | | None | | 6,6003 |

Chief Financial Officer | | 2001 | | 205,154 | 4 | | 10,0006 | | None | | 5,7755 |

| | | | | |

William D. Beal8 | | 2003 | | 248,500 | | | None | | None | | 7,2001 |

Sr. Vice President, Operations | | 2002 | | 207,981 | 2 | | None | | None | | 7,2293 |

| | | 2001 | | 205,154 | 4 | | 10,0006 | | None | | 4,2335 |

| | | | | |

Randy E. Marlar9 | | 2003 | | 230,923 | | | None | | None | | 7,2001 |

Sr. Vice President, Strategic | | 2002 | | 188,173 | 2 | | None | | None | | 7,4943 |

Sourcing and Process Improvement | | 2001 | | 185,616 | 4 | | 10,0006 | | None | | 4,2195 |

| | | | | |

John P. Tague10 | | 2003 | | 573,077 | 11 | | None | | None | | None |

Former President and | | 2002 | | 777,958 | 11 | | None | | None | | None |

Chief Executive Officer | | 2001 | | 512,885 | 4 | | None | | None | | 5,7755 |

| | | | | |

Willie G. McKnight12 | | 2003 | | 162,885 | | | None | | None | | None |

Former Executive Vice President, | | 2002 | | 461,635 | 2 | | None | | None | | None |

Marketing and Sales | | 2001 | | 456,923 | 4 | | 8,0006 | | None | | None |

| 1 | Represents the amount of the Company’s matching contribution to its 401(k) Plan in 2003. |

| 2 | Reflects a salary reduction program initiated in November 2002. Mr. McKnight’s 2002 salary includes debt forgiveness of $115,000. |

| 3 | Represents the amount of the Company’s matching contribution to its 401(k) Plan in 2002. |

| 4 | Reflects a salary reduction program due to September 11, 2001, terrorist attacks. Mr. McKnight’s 2001 salary includes debt forgiveness of $115,000. |

| 5 | Represents the amount of the Company’s matching contribution to its 401(k) Plan in 2001. |

| 6 | Bonus amounts relate to a first quarter 2001 performance plan and were paid in the first half of 2001. Such amounts do not relate to year-end 2001 performance. |

| 7 | Mr. Wing was appointed Executive Vice President and Chief Financial Officer on March 3, 2003. |

| 8 | Mr. Beal was appointed Senior Vice President, Operations on May 20, 2003. |

14

| 9 | Mr. Marlar was appointed Senior Vice President, Strategic Sourcing and Process Improvement, on May 20, 2003. |

| 10 | Mr. Tague resigned on August 5, 2002. |

| 11 | Mr. Tague’s compensation includes amounts paid to him pursuant to a Severance Agreement. |

| 12 | Mr. McKnight left the Company on March 17, 2003. His 2003 compensation includes amounts paid to him pursuant to a Severance Agreement. |

15

O P T I O N G R A N T S T A B L E

This table shows the option grants in 2003 to the individuals named in the Summary Compensation Table.

| | | | | | | | | | | | |

Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

Name

| | Number of Securities Underlying Options Granted

| | % of Total Options Granted To Employees

In Fiscal Year

| | Exercise

Price/Share($)

| | Expiration

Date

| | 5%($)

| | 10%($)

|

| | | | | | |

J. George Mikelsons | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

| | | | | | |

James W. Hlavacek | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

| | | | | | |

David M. Wing | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

| | | | | | |

William D. Beal | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

| | | | | | |

Randy E. Marlar | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

| | | | | | |

John P. Tague | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

| | | | | | |

Willie G. McKnight | | -0- | | N/A | | N/A | | N/A | | N/A | | N/A |

16

O P T I O N E X E R C I S E S AND

Y E A R-E N D O P T I O N V A L U E S T A B L E

This table shows the number and value of stock options (exercised and unexercised) for the named individuals during 2003.

| | | | | | | | | | | | |

| | | Shares Acquired On Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options At Fiscal Year-End

| | Value of Unexercised In-The-Money Options

At Fiscal Year-End Exercisable (E)/ Unexercisable (U)($)

|

Name

| | | | Exercisable

| | Unexercisable

| |

J. George Mikelsons | | -0- | | -0- | | -0- | | -0- | | -0- | | |

| | | | | | |

James W. Hlavacek | | -0- | | -0- | | 273,431 | | -0- | | 194,178 | | (E) |

| | | | | | | | | | | -0- | | (U) |

| | | | | | |

David M. Wing | | -0- | | -0- | | 59,558 | | -0- | | 34,492 | | (E) |

| | | | | | | | | | | -0- | | (U) |

| | | | | | |

William D. Beal | | -0- | | -0- | | 39,333 | | -0- | | 7,016 | | (E) |

| | | | | | | | | | | -0- | | (U) |

| | | | | | |

Randy E. Marlar | | -0- | | -0- | | 126,600 | | -0- | | 110,175 | | (E) |

| | | | | | | | | | | -0- | | (U) |

| | | | | | |

John P. Tague | | -0- | | -0- | | 266,137 | | -0- | | 438,944 | | (E) |

| | | | | | | | | | | -0- | | (U) |

| | | | | | |

Willie G. McKnight | | -0- | | -0- | | -0- | | -0- | | -0- | | (E) |

| | | | | | | | | | | -0- | | (U) |

Pension Plans

The Company has no pension plans.

401(k) Plan

Under the American Trans Air, Inc. Employees’ Retirement Savings Plan (the “401(k) Plan”), eligible employees may elect to defer up to 18% of their salary into the 401(k) Plan, not to exceed statutory limits. Generally, all employees meeting a minimum-hours requirement are eligible to participate in the 401(k) Plan. The Company has the discretion to make matching contributions to the 401(k) Plan on behalf of participants who have made salary reduction contributions under the 401(k) Plan. In 2003, the Company agreed to contribute $.60 for each dollar contributed to the 401(k) Plan by eligible participants, up to 6% of their compensation.

17

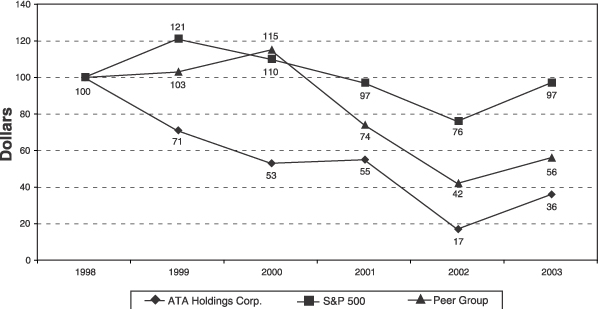

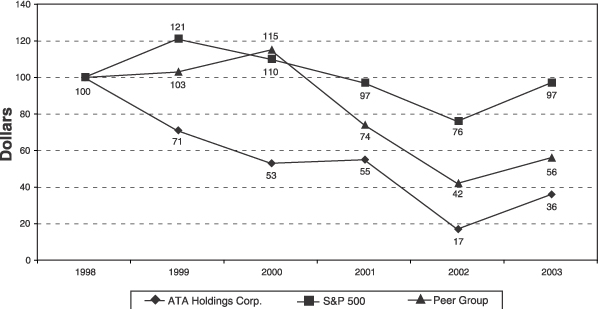

S T O C K P E R F O R M A N C E G R A P H

This performance graph compares the 2003 total shareholder return on the Company’s Common Stock with the NASDAQ Stock Market-U.S. Index and the Company’s peer group. The peer group selected by the Company consists of the following companies: AirTran Holdings, Inc., Alaska Air Group, Inc., America West Holdings Corporation, AMR Corp. (American Airlines), ATA Holdings Corp., Continental Airlines, Inc., Delta Air Lines, Inc., Frontier Airlines Inc., HAL, Inc. (Hawaiian Airlines), Northwest Airlines, Inc., Southwest Airlines Co., US Airways Group, Inc. and UAL Corp. (United Airlines).

Comparison of 5-Year Cumulative

Total Return* Among The Company,

NASDAQ Stock Market-U.S. Index And A Peer Group

*Total return based on $100 initial investment and reinvestment of dividends.

18

DETACHCARD

ATA HOLDINGS CORP.

7337WESTWASHINGTONSTREET,INDIANAPOLIS, INDIANA 46231

| | |

P R O X Y | | This proxy is solicited on behalf of the Board of Directors for the Annual Meeting, May 10, 2004. The undersigned hereby appoints James W. Hlavacek and David M. Wing and each of them, with power of substitution to each, proxies of the undersigned, to vote at the Annual Meeting of Shareholders of ATA Holdings Corp. (the “Corporation”) to be held on the 10th day of May 2004, and at any and all postponements or adjournments of said meeting, all of the shares of stock of the Corporation which the undersigned may be entitled to vote with all the powers the undersigned would possess, if then and there personally present, and especially (but without limiting the general authority and power hereby given) to vote. |

| | THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTEFOR PROPOSALS 1 and 2. |

| | 1. Election of Directors |

| | q FOR all nominees listed below q WITHHOLD AUTHORITY |

| | (except as marked to the contrary below) to vote for all nominees listed below |

| | J. George Mikelsons, James W. Hlavacek, Robert A. Abel Andrejs P. Stipnieks, Gilbert F. Viets, Claude E. Willis and David M. Wing |

| | INSTRUCTIONS: (To withhold authority to vote for any individual nominee, write that nominee’s name on the space provided below.) |

| | |

|

| | | 2. Appointment of Ernst & Young LLP as the Corporation’s Auditors for 2004. q FOR q AGAINST q ABSTAIN The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders and Proxy Statement and the Annual Report of the Corporation for 2003. (Continued, and to be signed, on the other side) |

DETACHCARD

ATA Holdings Corp.

(Continued from the other side.)

This proxy may be revoked at any time prior to said meeting, and the undersigned reserves the right to attend such meeting and vote said proxies in person.

The undersigned hereby revokes any proxy or proxies heretofore given to vote upon or act with respect to such shares and hereby ratifies and confirms all that said proxies, their substitutes or any of them may lawfully do by virtue hereof.

Unless otherwise specified, the shares represented by this proxy shall be voted FOR Proposals 1 and 2. This proxy will be voted in accordance with the instructions of the proxies named above with respect to any other matters which may properly come before the meeting and any postponements or adjournments hereof.

Dated: , 2004

Signature

Signature if held jointly

Please sign this proxy exactly as your name appears hereon. If the stock is held in the name of two or more persons, each should sign. Executors, administrators, trustees, guardians, attorneys and corporate officers should add their titles. If a corporation, sign in full corporate name by president or other authorized officer. If a partnership, sign in partnership name by authorized person

PLEASEMARK,SIGN,DATEANDMAILTHISPROXYCARDPROMPTLYUSINGTHEENCLOSEDENVELOPE.