UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 07584

Rydex Series Funds

(Exact name of registrant as specified in charter)

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Donald C. Cacciapaglia, President

Rydex Series Funds

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: December 31

Date of reporting period: June 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

GO GREEN!

ELIMINATE MAILBOX CLUTTER

Go paperless with Guggenheim Investments eDelivery—a service giving you full online access to account information and documents. Save time, cut down on mailbox clutter and be a friend to the environment with eDelivery.

With Guggenheim Investments eDelivery you can:

| · | View online confirmations and statements at your convenience. |

| | | |

| · | Receive email notifications when your most recent confirmations, statements and other account documents are available for review. |

| | | |

| · | Access prospectuses, annual reports and semiannual reports online. |

If you have questions about Guggenheim Investments

eDelivery services, contact one of our Shareholder Service

Representatives at 800.820.0888.

This report and the financial statements contained herein are submitted for the general information of our shareholders. The report is not authorized for

distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Rydex Distributors, LLC.

TABLE OF CONTENTS

THE GUGGENHEIM FUNDS semi-annual REPORT | 1

LETTER TO OUR SHAREHOLDERS

To Our Shareholders:

Uncertainty continued to affect securities markets over the six months ended June 30, 2012. The U.S. equity market had strong performance for the period, combining a stellar first quarter with a weak second period, when concern grew about sovereign debt in several European nations, a fledgling U.S. economic recovery and the sustainability of economic growth in Asia. Fixed-income securities, including riskier bonds, also generally provided positive returns over the six-month period, although risk aversion in late spring drove investors into dollar-denominated assets, sending rates on U.S. Treasury bonds to near historic lows.

Weak economic reports in May 2012 indicated that the world’s major economies were beginning to slip in unison, and both the Organization for Economic Cooperation and Development and the International Monetary Fund forecast lower global growth for 2012. This was in spite of recent efforts from leading central bankers to recharge the global economy, including a restructuring of Greece’s debt that enabled a new international bailout earlier in 2012, and an injection of liquidity from the European Central Bank in December that lessened financial stresses across the continent and contributed to improvement in global financial markets in early 2012. However, manufacturing gauges in late spring 2012 indicated that the eurozone was entering a period of economic contraction, meaning that policy makers may need to do more to revive growth across the region and keep the problem from infecting other countries.

Although the U.S. was in better shape than many countries, slowing growth and job creation late in the period indicated the economy is having difficulty gaining traction. U.S. gross domestic product (“GDP”) was reported to have grown at an annualized 1.9% pace in the first quarter of 2012, compared with a 3.0% rate in the fourth quarter of 2011. Companies continue to be cautious in spending and hiring, even though corporate profits have continued to rise, although at a pace lower than in recent quarters. This is translating into weak income growth for consumers, leading them to keep their spending in check and eroding sentiment.

To foster growth, the U.S. Federal Reserve (the “Fed”) has said it will leave its key interest rate close to zero at least through 2014, despite arguments by some Fed officials and investors that the Fed may have to consider raising rates much earlier than that to prevent inflation. For now, the Fed’s leadership appears to be committed to keeping rates low, thus reducing borrowing costs for businesses and consumers, and seems prepared to sustain quantitative easing if the employment and growth picture worsens. The Fed did extend until January its operation twist, a bond-exchange program designed to lower long-term interest rates.

For the six-month period ended June 30, 2012, the Standard & Poor’s 500® Index* (“S&P”), which is generally regarded as an indicator of the broad U.S. stock market, returned 9.49%. Foreign markets were weaker, but positive: the Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East Index* (“EAFE”), which is composed of approximately 1,100 companies in 20 developed countries in Europe and the Pacific Basin, returned 2.96%. The return of the MSCI Emerging Markets Index*, which measures market performance in global emerging markets, was 3.93%.

In the bond market, lower-rated bonds outperformed higher quality issues, as investors sought yield. The return of the Barclays U.S. Aggregate Bond Index*, which is a proxy for the U.S. investment grade bond market, posted a 2.37% return for the period, while the Barclays U.S. Corporate High Yield Index* returned 7.27%. Reflecting the Fed’s continuing accommodative monetary policy, interest rates on short-term securities remained at their lowest levels in many years; the return of the Barclays 1–3 Month U.S. Treasury Bill Index* was 0.04% for the six-month period.

2 | THE GUGGENHEIM FUNDS semi-annual REPORT

LETTER TO OUR SHAREHOLDERS (concluded)

We look forward to continuing our service to you. Thank you for investing in our funds.

Sincerely,

Donald C. Cacciapaglia

President

*Indices are defined as follows:

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of U.S. stock market.

The MSCI EAFE Index is a capitalization weighted measure of stock markets in Europe, Australasia and the Far East.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS.

The Barclays U.S. Corporate High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds.

The Barclays 1–3 Month U.S. Treasury Bill Index tracks the performance of U.S. Treasury bills with a remaining maturity of one to three months. U.S. Treasury bills, which are short-term loans to the U.S. government, are full-faith-and-credit obligations of the U.S. Treasury and are generally regarded as being free of any risk of default.

Performance displayed represents past performance which is no guarantee of future results. Of course, fund performance is subject to daily market volatility and may be better or worse since the end of the last quarter. For up-to-date fund performance, call us at 800.820.0888 or visit www.rydex-sgi.com.

Read the fund’s prospectus and summary prospectus (if available) carefully before investing. It contains the fund’s investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at www.rydex-sgi.com or call 800.820.0888.

The referenced fund is distributed by Rydex Distributors, LLC. Guggenheim Investments represents the investment management businesses of Guggenheim Partners, LLC (“GP”), which includes Security Investors, LLC (“SI”), the investment adviser to the referenced fund. Rydex Distributors, LLC, is affiliated with GP and SI.

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3

about shareholders’ fund expenses (Unaudited)

All mutual funds have operating expenses and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning December 31, 2011 and ending June 30, 2012.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

4 | THE GUGGENHEIM FUNDS semi-annual REPORT

about shareholders’ fund expenses (Unaudited) (concluded)

| | | | | | | | | Beginning | | | Ending | | | Expenses | |

| | | Expense | | | Fund | | | Account Value | | | Account Value | | | Paid During | |

| | | Ratio1 | | | Return | | | December 31, 2011 | | | June 30, 2012 | | | Period2 | |

| Table 1. Based on actual Fund return3 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Managed Futures Strategy Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.91 | % | | | (10.03 | %) | | $ | 1,000.00 | | | $ | 899.70 | | | $ | 9.02 | |

| C-Class | | | 2.66 | % | | | (10.39 | %) | | | 1,000.00 | | | | 896.10 | | | | 12.54 | |

| H-Class | | | 1.90 | % | | | (10.03 | %) | | | 1,000.00 | | | | 899.70 | | | | 8.97 | |

| Institutional Class | | | 1.66 | % | | | (9.93 | %) | | | 1,000.00 | | | | 900.70 | | | | 7.84 | |

| Y-Class | | | 1.61 | % | | | (9.89 | %) | | | 1,000.00 | | | | 901.10 | | | | 7.61 | |

| | | | | | | | | | | | | | | | | | | | | |

| Table 2. Based on hypothetical 5% return (before expenses) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Managed Futures Strategy Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.91 | % | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,015.37 | | | $ | 9.57 | |

| C-Class | | | 2.66 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,011.64 | | | | 13.30 | |

| H-Class | | | 1.90 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,015.42 | | | | 9.52 | |

| Institutional Class | | | 1.66 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,016.61 | | | | 8.32 | |

| Y-Class | | | 1.61 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,016.86 | | | | 8.07 | |

| 2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

| 3 | Actual cumulative return at net asset value for the period December 31, 2011 to June 30, 2012. |

THE GUGGENHEIM FUNDS semi-annual REPORT | 5

| FUND PROFILE (Unaudited) | | June 30, 2012 |

| MANAGED FUTURES STRATEGY FUND | | |

| | | |

| OBJECTIVE: Seeks to achieve positive absolute returns. | | |

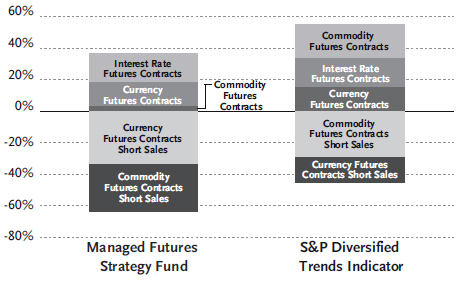

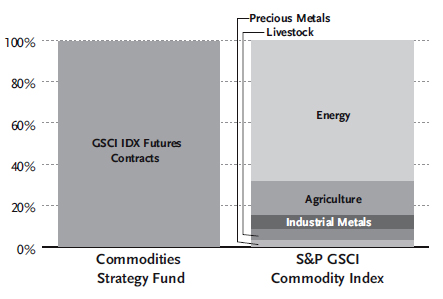

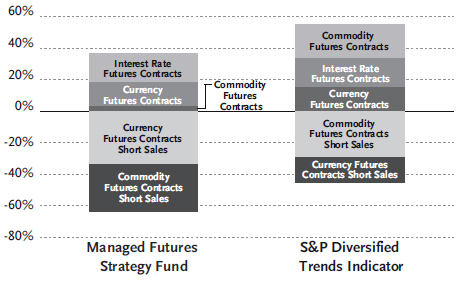

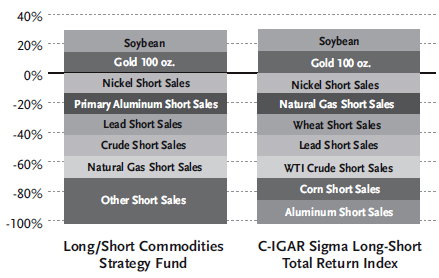

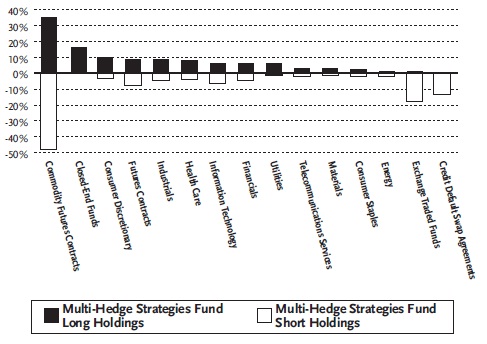

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

| Inception Dates: | | |

| A-Class | | March 2, 2007 |

| C-Class | | March 2, 2007 |

| H-Class | | March 2, 2007 |

| Institutional Class | | May 3, 2010 |

| Y-Class | | March 29, 2010 |

The Fund invests principally in derivative investments such as futures contracts.

6 | THE GUGGENHEIM FUNDS semi-annual REPORT

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) | June 30, 2012 |

| MANAGED FUTURES STRATEGY FUND |

| | | | Face | | | | | |

| | | | Amount | | | | Value | |

| | | | | | | | | |

| FEDERAL AGENCY DISCOUNT NOTES†† - 55.4% | | | | | | | | |

| Farmer Mac1 | | | | | | | | |

| 0.20% due 10/25/12 | | $ | 50,000,000 | | | $ | 49,985,650 | |

| 0.16% due 11/01/12 | | | 50,000,000 | | | | 49,981,350 | |

| 0.21% due 03/28/13 | | | 50,000,000 | | | | 49,936,550 | |

| 0.22% due 05/31/13 | | | 50,000,000 | | | | 49,912,300 | |

| 0.21% due 04/23/13 | | | 40,000,000 | | | | 39,941,080 | |

| 0.23% due 07/17/12 | | | 30,000,000 | | | | 29,999,610 | |

| 0.16% due 11/15/12 | | | 26,000,000 | | | | 25,989,210 | |

| 0.20% due 07/31/12 | | | 25,000,000 | | | | 24,999,400 | |

| 0.12% due 08/01/12 | | | 25,000,000 | | | | 24,997,417 | |

| 0.17% due 12/21/12 | | | 25,000,000 | | | | 24,984,475 | |

| 0.17% due 12/28/12 | | | 25,000,000 | | | | 24,983,850 | |

| 0.17% due 01/02/13 | | | 25,000,000 | | | | 24,982,125 | |

| 0.18% due 01/23/13 | | | 25,000,000 | | | | 24,980,075 | |

| 0.19% due 03/06/13 | | | 25,000,000 | | | | 24,970,875 | |

| 0.17% due 07/24/12 | | | 20,000,000 | | | | 19,999,640 | |

| 0.15% due 10/31/12 | | | 20,000,000 | | | | 19,993,960 | |

| 0.11% due 07/02/12 | | | 15,000,000 | | | | 14,999,954 | |

| 0.11% due 07/03/12 | | | 15,000,000 | | | | 14,999,908 | |

| 0.14% due 08/10/12 | | | 10,000,000 | | | | 9,999,460 | |

| Total Farmer Mac | | | | | | | 550,636,889 | |

| | | | | | | | | |

| Freddie Mac2 | | | | | | | | |

| 0.04% due 07/02/12 | | | 50,000,000 | | | | 49,999,944 | |

| 0.19% due 04/23/13 | | | 50,000,000 | | | | 49,926,350 | |

| 0.17% due 04/23/13 | | | 25,307,000 | | | | 25,269,723 | |

| 0.20% due 08/06/12 | | | 25,000,000 | | | | 24,998,775 | |

| 0.18% due 03/15/13 | | | 25,000,000 | | | | 24,969,826 | |

| 0.18% due 05/21/13 | | | 25,000,000 | | | | 24,957,450 | |

| 0.14% due 11/07/12 | | | 10,000,000 | | | | 9,996,090 | |

| Total Freddie Mac | | | | | | | 210,118,158 | |

| | | | | | | | | |

| Federal Farm Credit Bank1 | | | | | | | | |

| 0.06% due 07/27/12 | | | 50,000,000 | | | | 49,997,833 | |

| 0.19% due 07/02/12 | | | 30,000,000 | | | | 30,000,000 | |

| 0.20% due 07/25/12 | | | 25,000,000 | | | | 24,999,525 | |

| 0.09% due 08/03/12 | | | 25,000,000 | | | | 24,998,900 | |

| 0.13% due 09/05/12 | | | 25,000,000 | | | | 24,996,400 | |

| 0.20% due 03/28/13 | | | 25,000,000 | | | | 24,968,275 | |

| 0.19% due 01/28/13 | | | 15,000,000 | | | | 14,987,760 | |

| Total Federal Farm Credit Bank | | | | | | | 194,948,693 | |

| | | | | | | | | |

| Fannie Mae2 | | | | | | | | |

| 0.14% due 11/15/12 | | | 25,000,000 | | | | 24,989,625 | |

| 0.14% due 11/19/12 | | | 25,000,000 | | | | 24,989,300 | |

| Total Fannie Mae | | | | | | | 49,978,925 | |

| | | | | | | | | |

| Federal Home Loan Bank1 | | | | | | | | |

| 0.18% due 02/26/13 | | | 25,000,000 | | | | 24,973,475 | |

| 0.17% due 11/01/12 | | | 10,000,000 | | | | 9,996,270 | |

| Total Federal Home Loan Bank | | | | | | | 34,969,745 | |

| Total Federal Agency | | | | | | | | |

| Discount Notes | | | | | | | | |

| (Cost $1,040,509,090) | | | | | | | 1,040,652,410 | |

| | | | | | | | | |

| FEDERAL AGENCY NOTES†† - 34.5% | | | | | | | | |

| Federal Home Loan Bank1 | | | | | | | | |

| 0.19% due 02/22/13 | | | 50,000,000 | | | | 49,977,149 | |

| 0.20% due 04/30/13 | | | 50,000,000 | | | | 49,975,200 | |

| 0.12% due 03/01/13 | | | 50,000,000 | | | | 49,955,250 | |

| 0.19% due 10/26/12 | | | 40,750,000 | | | | 40,755,135 | |

| 0.25% due 07/25/12 | | | 40,620,000 | | | | 40,622,600 | |

| 0.22% due 09/07/12 | | | 25,000,000 | | | | 25,003,150 | |

| 0.18% due 11/21/12 | | | 25,000,000 | | | | 25,002,900 | |

| 0.30% due 05/28/13 | | | 25,000,000 | | | | 24,999,250 | |

| 0.18% due 12/28/12 | | | 25,000,000 | | | | 24,996,475 | |

| 0.10% due 05/21/13 | | | 25,000,000 | | | | 24,995,300 | |

| 0.22% due 04/09/13 | | | 25,000,000 | | | | 24,992,325 | |

| 0.22% due 05/02/13 | | | 25,000,000 | | | | 24,991,675 | |

| 0.30% due 06/10/13 | | | 25,000,000 | | | | 24,991,625 | |

| 0.18% due 02/28/13 | | | 25,000,000 | | | | 24,986,900 | |

| 0.16% due 02/08/13 | | | 25,000,000 | | | | 24,985,025 | |

| 0.28% due 01/11/13 | | | 23,500,000 | | | | 23,493,608 | |

| 0.17% due 01/17/13 | | | 18,625,000 | | | | 18,617,755 | |

| 0.18% due 01/10/13 | | | 15,700,000 | | | | 15,695,871 | |

| 0.24% due 09/26/12 | | | 12,600,000 | | | | 12,602,646 | |

| 0.37% due 01/29/13 | | | 10,000,000 | | | | 10,006,600 | |

| 0.20% due 12/28/12 | | | 10,000,000 | | | | 9,999,570 | |

| Total Federal Home Loan Bank | | | | | | | 571,646,009 | |

| | | | | | | | | |

| Freddie Mac2 | | | | | | | | |

| 0.51% due 11/26/12 | | | 36,922,000 | | | | 36,975,869 | |

| Federal Farm Credit Bank1 | | | | | | | | |

| 0.18% due 01/02/13 | | | 25,000,000 | | | | 24,995,175 | |

| Fannie Mae2 | | | | | | | | |

| 0.75% due 02/26/13 | | | 15,000,000 | | | | 15,047,700 | |

| Total Federal Agency Notes | | | | | | | | |

| (Cost $648,765,945) | | | | | | | 648,664,753 | |

| | | | | | | | | |

| WORLD BANK DISCOUNT NOTE†† - 0.8% | | | | | | | | |

| World Bank | | | | | | | | |

| 0.17% due 09/17/12 | | | 15,000,000 | | | | 14,997,435 | |

| Total World Bank Discount Note | | | | | | | | |

| (Cost $14,994,638) | | | | | | | 14,997,435 | |

| | | | | | | | | |

| REPURCHASE AGREEMENTS††,3 - 7.2% | | | | | | | | |

| HSBC Group | | | | | | | | |

| issued 06/29/12 at 0.12% | | | | | | | | |

| due 07/02/12 | | | 69,094,678 | | | | 69,094,678 | |

| Mizuho Financial Group, Inc. | | | | | | | | |

| issued 06/29/12 at 0.12% | | | | | | | | |

| due 07/02/12 | | | 29,466,430 | | | | 29,466,430 | |

| Deutsche Bank | | | | | | | | |

| issued 06/29/12 at 0.10% | | | | | | | | |

| due 07/02/12 | | | 19,511,127 | | | | 19,511,127 | |

| Credit Suisse Group | | | | | | | | |

| issued 06/29/12 at 0.08% | | | | | | | | |

| due 07/02/12 | | | 17,355,249 | | | | 17,355,249 | |

| Total Repurchase Agreements | | | | | | | | |

| (Cost $135,427,484) | | | | | | | 135,427,484 | |

| Total Investments - 97.9% | | | | | | | | |

| (Cost $1,839,697,157) | | | | | | $ | 1,839,742,082 | |

| Other Assets & Liabilities, net - 2.1% | | | | | | | 39,030,078 | |

| Total Net Assets - 100.0% | | | | | | $ | 1,878,772,160 | |

| See Notes to Financial Statements. | THE GUGGENHEIM FUNDS semi-annual REPORT | 7 |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) (continued) | | June 30, 2012 |

| MANAGED FUTURES STRATEGY fund | | |

| | | | | | Unrealized | |

| | | Contracts | | | Gain (Loss) | |

| | | | | | | |

| INTEREST RATE FUTURES CONTRACTS PURCHASED† | | | | | | | | |

| September 2012 U.S. Treasury | | | | | | | | |

| Long Bond Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $175,231,875) | | | 1,183 | | | $ | 4,130,225 | |

| September 2012 U.S. Treasury | | | | | | | | |

| 10 Year Note Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $178,005,625) | | | 1,334 | | | | 2,014,819 | |

| (Total Aggregate Value of | | | | | | | | |

| Contracts $353,237,500) | | | | | | $ | 6,145,044 | |

| | | | | | | | | |

| COMMODITY FUTURES CONTRACTS PURCHASED† | | | | | | | | |

| December 2012 Live Cattle | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $25,327,120) | | | 497 | | | $ | 73,146 | |

| December 2012 Lean Hogs | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $18,046,100) | | | 565 | | | | 69,301 | |

| December 2012 Cocoa | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $2,313,000) | | | 100 | | | | 30,482 | |

| March 2013 Cocoa | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $1,088,520) | | | 47 | | | | 12,382 | |

| December 2012 Silver | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $4,830,000) | | | 35 | | | | (191,855 | ) |

| (Total Aggregate Value of | | | | | | | | |

| Contracts $51,604,740) | | | | | | $ | (6,544 | ) |

| | | | | | | | | |

| CURRENCY FUTURES CONTRACTS PURCHASED† | | | | | | | | |

| September 2012 Japanese Yen | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $281,633,451) | | | 1,799 | | | $ | (6,731,105 | ) |

| | | | | | | | | |

| CURRENCY FUTURES CONTRACTS SOLD SHORT† | | | | | | | | |

| September 2012 Swiss Franc | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $48,703,388) | | | 369 | | | $ | (239,750 | ) |

| September 2012 Canadian Dollar | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $24,515,000) | | | 250 | | | | (311,503 | ) |

| September 2012 Euro | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $317,783,362) | | | 2,007 | | | | (1,703,843 | ) |

| September 2012 British Pound | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $122,335,938) | | | 1,250 | | | | (2,148,618 | ) |

| September 2012 Australian Dollar | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $50,815,000) | | | 500 | | | | (2,790,200 | ) |

| (Total Aggregate Value of | | | | | | | | |

| Contracts $564,152,688) | | | | | | $ | (7,193,914 | ) |

| | | | | | | | | |

| COMMODITY FUTURES CONTRACTS SOLD SHORT† | | | | | | | | |

| October 2012 Gold 100 oz. | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $83,091,900) | | | 519 | | | $ | 2,197,673 | |

| September 2012 Silver | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $44,493,300) | | | 324 | | | | 2,121,737 | |

| March 2013 Sugar #11 | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $12,562,368) | | | 520 | | | | 739,237 | |

| October 2012 Sugar #11 | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $13,734,269) | | | 582 | | | | 541,570 | |

| December 2012 Cotton #2 | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $17,093,825) | | | 485 | | | | 105,124 | |

| March 2013 Cotton #2 | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $8,055,000) | | | 225 | | | | 88,775 | |

| September 2012 Cocoa | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $4,136,400) | | | 180 | | | | (77,156 | ) |

| August 2012 Live Cattle | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $7,088,340) | | | 147 | | | | (96,772 | ) |

| August 2012 Lean Hogs | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $6,253,500) | | | 165 | | | | (455,517 | ) |

| March 2013 Coffee ‘C’ | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $4,390,650) | | | 66 | | | | (458,091 | ) |

| December 2012 Coffee ‘C’ | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $6,523,125) | | | 100 | | | | (711,861 | ) |

| 8 | THE GUGGENHEIM FUNDS semi-annual REPORT | See Notes to Financial Statements. |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) (concluded) | June 30, 2012 |

| MANAGED FUTURES STRATEGY fund |

| | | | | | Unrealized | |

| | | Contracts | | | Loss | |

| September 2012 Coffee ‘C’ | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $27,942,150) | | | 436 | | | $ | (2,381,667 | ) |

| March 2013 Corn | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $32,125,000) | | | 1,000 | | | | (5,956,950 | ) |

| September 2012 Copper | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $126,437,500) | | | 1,445 | | | | (5,993,322 | ) |

| September 2012 Corn | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $49,196,000) | | | 1,568 | | | | (8,652,230 | ) |

| September 2012 Wheat | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $57,949,400) | | | 1,528 | | | | (9,317,336 | ) |

| November 2012 Soybean | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $120,800,813) | | | 1,691 | | | | (14,274,913 | ) |

| (Total Aggregate Value of | | | | | | | | |

| Contracts $621,873,540) | | | | | | $ | (42,581,699 | ) |

| † | Value determined based on Level 1 inputs — See Note 4. |

| †† | Value determined based on Level 2 inputs — See Note 4. |

| 1 | The issuer operates under a Congressional charter; its securities are neither issued nor guaranteed by the U.S. Government. |

| 2 | On September 7, 2008, the issuer was placed in conservatorship by the Federal Housing Finance Agency (FHFA). As conservator, the FHFA has full powers to control the assets and operations of the firm. |

| 3 | Repurchase Agreements — See Note 5. |

| See Notes to Financial Statements. | THE GUGGENHEIM FUNDS semi-annual REPORT | 9 |

| MANAGED FUTURES STRATEGY fund |

| CONSOLIDATED STATEMENT OF | | | |

| ASSETS AND LIABILITIES (Unaudited) |

| June 30, 2012 | | | |

| Assets: | | | | |

| Investments, at value | | | | |

| (cost $1,704,269,673) | | $ | 1,704,314,598 | |

| Repurchase agreements, at value | | | | |

| (cost $135,427,484) | | | 135,427,484 | |

| Total investments | | | | |

| (cost $1,839,697,157) | | | 1,839,742,082 | |

| Segregated cash with broker | | | 75,914,078 | |

| Receivables: | | | | |

| Fund shares sold | | | 3,989,603 | |

| Interest | | | 373,580 | |

| Total assets | | | 1,920,019,343 | |

| Liabilities: | | | | |

| Payable for: | | | | |

| Variation margin | | | 31,343,614 | |

| Fund shares redeemed | | | 5,312,520 | |

| Management fees | | | 1,462,146 | |

| Transfer agent and administrative fees | | | 392,850 | |

| Distribution and service fees | | | 367,318 | |

| Portfolio accounting fees | | | 76,416 | |

| Miscellaneous | | | 2,292,319 | |

| Total liabilities | | | 41,247,183 | |

| Net assets | | $ | 1,878,772,160 | |

| net assets consist of: | | | | |

| Paid in capital | | $ | 2,158,508,395 | |

| Accumulated net investment loss | | | (20,623,411 | ) |

| Accumulated net realized loss on investments | | | (208,789,531 | ) |

| Net unrealized depreciation on investments | | | (50,323,293 | ) |

| Net assets | | $ | 1,878,772,160 | |

| A-Class: | | | | |

| Net assets | | $ | 240,228,946 | |

| Capital shares outstanding | | | 11,149,652 | |

| Net asset value per share | | $ | 21.55 | |

| Maximum offering price per share | | | | |

| (Net asset value divided by 95.25%) | | $ | 22.61 | |

| C-Class: | | | | |

| Net assets | | $ | 66,520,221 | |

| Capital shares outstanding | | | 3,214,122 | |

| Net asset value per share | | $ | 20.70 | |

| H-Class: | | | | |

| Net assets | | $ | 1,198,190,526 | |

| Capital shares outstanding | | | 55,611,701 | |

| Net asset value per share | | $ | 21.55 | |

| Institutional class: | | | | |

| Net assets | | $ | 69,958,956 | |

| Capital shares outstanding | | | 3,227,889 | |

| Net asset value per share | | $ | 21.67 | |

| Y-Class: | | | | |

| Net assets | | $ | 303,873,511 | |

| Capital shares outstanding | | | 14,007,742 | |

| Net asset value per share | | $ | 21.69 | |

| CONSOLIDATED STATEMENT | | | |

| OF OPERATIONS (Unaudited) | | | |

| Period Ended June 30, 2012 | | | |

| Investment income: | | | |

| Interest | | $ | 1,936,356 | |

| Total investment income | | | 1,936,356 | |

| Expenses: | | | | |

| Management fees | | | 10,645,218 | |

| Transfer agent and administrative fees | | | | |

| A-Class | | | 478,162 | |

| C-Class | | | 101,685 | |

| H-Class | | | 1,600,700 | |

| Institutional Class | | | 107,652 | |

| Y-Class | | | 370,412 | |

| Distribution and service fees: | | | | |

| A-Class | | | 478,162 | |

| C-Class | | | 406,741 | |

| H-Class | | | 1,600,700 | |

| Portfolio accounting fees | | | 497,985 | |

| Licensing fees | | | 3,706,658 | |

| Custodian fees | | | 265,271 | |

| Trustees’ fees* | | | 115,831 | |

| Miscellaneous | | | 973,232 | |

| Total expenses | | | 21,348,409 | |

| Less: | | | | |

| Expenses waived by Advisor | | | (740,837 | ) |

| Net expenses | | | 20,607,572 | |

| Net investment loss | | | (18,671,216 | ) |

| | | | | |

| Net Realized and Unrealized Gain (loss): | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 8,643 | |

| Futures contracts | | | (135,137,759 | ) |

| Options written | | | 391,575 | |

| Net realized loss | | | (134,737,541 | ) |

| | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| | | | |

| Investments | | | (741,489 | ) |

| Futures contracts | | | (72,607,607 | ) |

| | | | |

| Net change in unrealized appreciation (depreciation) | | | (73,349,096 | ) |

| Net realized and unrealized loss | | | (208,086,637 | ) |

| Net decrease in net assets resulting from operations | | $ | (226,757,853 | ) |

* Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act.

| 10 | THE GUGGENHEIM FUNDS semi-annual REPORT | See Notes to Financial Statements. |

| MANAGED FUTURES STRATEGY fund |

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

| | | Period Ended | | | | |

| | | June 30, | | | Year Ended | |

| | | 2012 | | | December 31, | |

| | | (Unaudited) | | | 2011 | |

| Increase (Decrease) In Net Assets From Operations: | | | | | | | | |

| Net investment loss | | $ | (18,671,216 | ) | | $ | (43,185,269 | ) |

| Net realized loss on investments | | | (134,737,541 | ) | | | (76,732,566 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | (73,349,096 | ) | | | (65,602,982 | ) |

| Net decrease in net assets resulting from operations | | | (226,757,853 | ) | | | (185,520,817 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from sale of shares | | | | | | | | |

| A-Class | | | 98,590,293 | | | | 511,923,650 | |

| C-Class | | | 3,844,909 | | | | 16,934,292 | |

| H-Class | | | 672,489,228 | | | | 795,455,515 | |

| Institutional Class | | | 13,917,454 | | | | 74,985,665 | |

| Y-Class | | | 38,598,330 | | | | 299,957,366 | |

| Cost of shares redeemed | | | | | | | | |

| A-Class | | | (555,712,234 | ) | | | (383,723,127 | ) |

| C-Class | | | (25,272,633 | ) | | | (69,518,004 | ) |

| H-Class | | | (398,538,187 | ) | | | (847,649,799 | ) |

| Institutional Class | | | (36,771,734 | ) | | | (100,701,093 | ) |

| Y-Class | | | (101,952,253 | ) | | | (55,454,346 | ) |

| Net increase (decrease) from capital share transactions | | | (290,806,827 | ) | | | 242,210,119 | |

| Net increase (decrease) in net assets | | | (517,564,680 | ) | | | 56,689,302 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 2,396,336,840 | | | | 2,339,647,538 | |

| End of period | | $ | 1,878,772,160 | | | $ | 2,396,336,840 | |

| Accumulated net investment loss at end of period | | $ | (20,623,411 | ) | | $ | (1,952,195 | ) |

| | | | | | | | | |

| Capital Share Activity: | | | | | | | | |

| Shares sold | | | | | | | | |

| A-Class | | | 4,251,708 | | | | 20,376,917 | |

| C-Class | | | 173,076 | | | | 686,909 | |

| H-Class | | | 28,804,717 | | | | 31,500,881 | |

| Institutional Class | | | 598,311 | | | | 2,971,063 | |

| Y-Class | | | 1,653,810 | | | | 11,718,228 | |

| Shares redeemed | | | | | | | | |

| A-Class | | | (23,730,903 | ) | | | (15,245,234 | ) |

| C-Class | | | (1,144,864 | ) | | | (2,835,242 | ) |

| H-Class | | | (17,458,205 | ) | | | (33,774,119 | ) |

| Institutional Class | | | (1,591,297 | ) | | | (3,965,154 | ) |

| Y-Class | | | (4,455,516 | ) | | | (2,232,779 | ) |

| Net increase (decrease) in shares | | | (12,899,163 | ) | | | 9,201,470 | |

| See Notes to Financial Statements. | THE GUGGENHEIM FUNDS semi-annual REPORT | 11 |

| MANAGED FUTURES STRATEGY fund |

FINANCIAL HIGHLIGHTS

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Period Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | | | Year Ended | |

| | | June 30, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | March 31, | |

| A-Class | | 2012a,b | | | 2011b | | | 2010b | | | 2009b | | | 2008b,c | | | 2008 | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | | | $ | 28.26 | | | $ | 25.03 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)d | | | (.20 | ) | | | (.44 | ) | | | (.41 | ) | | | (.39 | ) | | | (—) | e | | | .57 | |

| Net gain (loss) on investments (realized | | | | | | | | | | | | | | | | | | | | | | | | |

| and unrealized) | | | (2.20 | ) | | | (1.39 | ) | | | (.62 | ) | | | (.84 | ) | | | .83 | | | | 2.64 | |

| Total from investment operations | | | (2.40 | ) | | | (1.83 | ) | | | (1.03 | ) | | | (1.23 | ) | | | .83 | | | | 3.21 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | (.57 | ) | | | — | |

| Net realized gains | | | — | | | | — | | | | — | | | | — | | | | (.50 | ) | | | (—) | j |

| Total distributions | | | — | | | | — | | | | — | | | | — | | | | (1.07 | ) | | | (—) | j |

| Redemption fees collected | | | — | | | | — | | | | — | f | | | — | f | | | .02 | | | | .02 | |

| Net asset value, end of period | | $ | 21.55 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | | | $ | 28.26 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returng | | | (10.03 | %) | | | (7.14 | %) | | | (3.84 | %) | | | (4.39 | %) | | | 2.96 | % | | | 12.92 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 240,229 | | | $ | 733,469 | | | $ | 657,317 | | | $ | 636,083 | | | $ | 298,987 | | | $ | 128,744 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (1.73 | %) | | | (1.76 | %) | | | (1.66 | %) | | | (1.42 | %) | | | (0.02 | %) | | | 2.15 | % |

| Total expenses | | | 1.98 | % | | | 2.05 | % | | | 2.04 | % | | | 2.16 | % | | | 1.77 | % | | | 1.72 | % |

| Net expensesh | | | 1.91 | % | | | 1.97 | % | | | 1.97 | % | | | 2.05 | % | | | 1.77 | % | | | 1.72 | % |

| Operating expensesi | | | 1.91 | % | | | 1.97 | % | | | 1.97 | % | | | 2.05 | % | | | 1.75 | % | | | 1.69 | % |

| Portfolio turnover rate | | | 39 | % | | | 72 | % | | | 148 | % | | | 125 | % | | | 74 | % | | | 154 | % |

| | | Period Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | | | Year Ended | |

| | | June 30, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | March 31, | |

| C-Class | | 2012a,b | | | 2011b | | | 2010b | | | 2009b | | | 2008b,c | | | 2008 | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 23.09 | | | $ | 25.04 | | | $ | 26.24 | | | $ | 27.65 | | | $ | 28.04 | | | $ | 25.02 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)d | | | (.27 | ) | | | (.61 | ) | | | (.59 | ) | | | (.58 | ) | | | (.16 | ) | | | .35 | |

| Net gain (loss) on investments (realized | | | | | | | | | | | | | | | | | | | | | | | | |

| and unrealized) | | | (2.12 | ) | | | (1.34 | ) | | | (.61 | ) | | | (.83 | ) | | | .82 | | | | 2.65 | |

| Total from investment operations | | | (2.39 | ) | | | (1.95 | ) | | | (1.20 | ) | | | (1.41 | ) | | | .66 | | | | 3.00 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | (.57 | ) | | | — | |

| Net realized gains | | | — | | | | — | | | | — | | | | — | | | | (.50 | ) | | | (—) | j |

| Total distributions | | | — | | | | — | | | | — | | | | — | | | | (1.07 | ) | | | (—) | j |

| Redemption fees collected | | | — | | | | — | | | | — | f | | | — | f | | | .02 | | | | .02 | |

| Net asset value, end of period | | $ | 20.70 | | | $ | 23.09 | | | $ | 25.04 | | | $ | 26.24 | | | $ | 27.65 | | | $ | 28.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returng | | | (10.39 | %) | | | (7.79 | %) | | | (4.57 | %) | | | (5.10 | %) | | | 2.37 | % | | | 12.08 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 66,520 | | | $ | 96,647 | | | $ | 158,628 | | | $ | 225,416 | | | $ | 125,601 | | | $ | 46,005 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (2.48 | %) | | | (2.50 | %) | | | (2.41 | %) | | | (2.17 | %) | | | (0.78 | %) | | | 1.30 | % |

| Total expenses | | | 2.72 | % | | | 2.80 | % | | | 2.79 | % | | | 2.92 | % | | | 2.51 | % | | | 2.48 | % |

| Net expensesh | | | 2.66 | % | | | 2.72 | % | | | 2.72 | % | | | 2.81 | % | | | 2.51 | % | | | 2.48 | % |

| Operating expensesi | | | 2.66 | % | | | 2.72 | % | | | 2.72 | % | | | 2.81 | % | | | 2.49 | % | | | 2.45 | % |

| Portfolio turnover rate | | | 39 | % | | | 72 | % | | | 148 | % | | | 125 | % | | | 74 | % | | | 154 | % |

| 12 | THE GUGGENHEIM FUNDS semi-annual REPORT | See Notes to Financial Statements. |

| MANAGED FUTURES STRATEGY fund |

FINANCIAL HIGHLIGHTS (continued)

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Period Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | | | Year Ended | |

| | | June 30, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | March 31, | |

| H-Class | | 2012a,b | | | 2011b | | | 2010b | | | 2009b | | | 2008b,c | | | 2008 | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | | | $ | 28.26 | | | $ | 25.03 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)d | | | (.20 | ) | | | (.44 | ) | | | (.42 | ) | | | (.38 | ) | | | (.01 | ) | | | .58 | |

| Net gain (loss) on investments (realized | | | | | | | | | | | | | | | | | | | | | | | | |

| and unrealized) | | | (2.20 | ) | | | (1.39 | ) | | | (.61 | ) | | | (.85 | ) | | | .84 | | | | 2.63 | |

| Total from investment operations | | | (2.40 | ) | | | (1.83 | ) | | | (1.03 | ) | | | (1.23 | ) | | | .83 | | | | 3.21 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | (.57 | ) | | | — | |

| Net realized gains | | | — | | | | — | | | | — | | | | — | | | | (.50 | ) | | | (—) | j |

| Total distributions | | | — | | | | — | | | | — | | | | — | | | | (1.07 | ) | | | (—) | j |

| Redemption fees collected | | | — | | | | — | | | | — | f | | | — | f | | | .02 | | | | .02 | |

| Net asset value, end of period | | $ | 21.55 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | | | $ | 28.26 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returng | | | (10.03 | %) | | | (7.14 | %) | | | (3.84 | %) | | | (4.39 | %) | | | 2.96 | % | | | 12.92 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 1,198,191 | | | $ | 1,059,988 | | | $ | 1,199,718 | | | $ | 1,468,770 | | | $ | 838,511 | | | $ | 322,673 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (1.73 | %) | | | (1.75 | %) | | | (1.66 | %) | | | (1.41 | %) | | | (0.03 | %) | | | 2.17 | % |

| Total expenses | | | 1.97 | % | | | 2.05 | % | | | 2.04 | % | | | 2.16 | % | | | 1.77 | % | | | 1.73 | % |

| Net expensesh | | | 1.90 | % | | | 1.97 | % | | | 1.97 | % | | | 2.05 | % | | | 1.77 | % | | | 1.73 | % |

| Operating expensesi | | | 1.90 | % | | | 1.97 | % | | | 1.97 | % | | | 2.05 | % | | | 1.75 | % | | | 1.70 | % |

| Portfolio turnover rate | | | 39 | % | | | 72 | % | | | 148 | % | | | 125 | % | | | 74 | % | | | 154 | % |

| | | Period Ended | | | Year Ended | | | Period Ended | |

| | | June 30, | | | December 31, | | | December 31, | |

| Institutional Class | | 2012a,b | | | 2011b | | | 2010b,k | |

| Per Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 24.06 | | | $ | 25.84 | | | $ | 25.58 | |

| Income (loss) from investment operations: | | | | | | | | | | | | |

| Net investment lossd | | | (.17 | ) | | | (.38 | ) | | | (.23 | ) |

| Net gain (loss) on investments (realized | | | | | | | | | | | | |

| and unrealized) | | | (2.22 | ) | | | (1.40 | ) | | | .49 | |

| Total from investment operations | | | (2.39 | ) | | | (1.78 | ) | | | .26 | |

| Redemption fees collected | | | — | | | | — | | | | — | f |

| Net asset value, end of period | | $ | 21.67 | | | $ | 24.06 | | | $ | 25.84 | |

| | | | | | | | | | | | | |

| Total Returng | | | (9.93 | %) | | | (6.85 | %) | | | 0.98 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 69,959 | | | $ | 101,549 | | | $ | 134,733 | |

| Ratios to average net assets: | | | | | | | | | | | | |

| Net investment loss | | | (1.48 | %) | | | (1.50 | %) | | | (1.41 | %) |

| Total expenses | | | 1.72 | % | | | 1.80 | % | | | 1.78 | % |

| Net expensesh | | | 1.66 | % | | | 1.72 | % | | | 1.72 | % |

| Portfolio turnover rate | | | 39 | % | | | 72 | % | | | 148 | % |

| See Notes to Financial Statements. | THE GUGGENHEIM FUNDS semi-annual REPORT | 13 |

| MANAGED FUTURES STRATEGY fund |

FINANCIAL HIGHLIGHTS (concluded)

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Period Ended | | | Year Ended | | | Period Ended | |

| | | June 30, | | | December 31, | | | December 31, | |

| Y-Class | | 2012a,b | | | 2011b | | | 2010b,l | |

| Per Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 24.07 | | | $ | 25.84 | | | $ | 25.74 | |

| Income (loss) from investment operations: | | | | | | | | | | | | |

| Net investment lossd | | | (.16 | ) | | | (.37 | ) | | | (.26 | ) |

| Net gain (loss) on investments (realized | | | | | | | | | | | | |

| and unrealized) | | | (2.22 | ) | | | (1.40 | ) | | | .36 | |

| Total from investment operations | | | (2.38 | ) | | | (1.77 | ) | | | .10 | |

| Redemption fees collected | | | — | | | | — | | | | — | f |

| Net asset value, end of period | | $ | 21.69 | | | $ | 24.07 | | | $ | 25.84 | |

| | | | | | | | | | | | | |

| Total Returng | | | (9.89 | %) | | | (6.85 | %) | | | 0.39 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 303,874 | | | $ | 404,684 | | | $ | 189,251 | |

| Ratios to average net assets: | | | | | | | | | | | | |

| Net investment loss | | | (1.43 | %) | | | (1.47 | %) | | | (1.36 | %) |

| Total expenses | | | 1.67 | % | | | 1.75 | % | | | 1.73 | % |

| Net expensesh | | | 1.61 | % | | | 1.68 | % | | | 1.67 | % |

| Portfolio turnover rate | | | 39 | % | | | 72 | % | | | 148 | % |

| a | Unaudited figures for the period ended June 30, 2012. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| c | The Fund changed it’s fiscal year end from March 31 to December 31 in 2008. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| d | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

| e | Net investment income is less than $0.01 per share. |

| f | Redemption fees collected are less than $0.01 per share. |

| g | Total return does not reflect the impact of any applicable sales charges and has not been annualized. |

| h | Net expense information reflects the expense ratios after expense waivers. |

| i | Operating expenses exclude interest and dividend expense from securities sold short. |

| j | Distributions from realized gains are less than $0.01 per share. |

| k | Since commencement of operations: May 3, 2010. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| l | Since commencement of operations: March 29, 2010. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| 14 | THE GUGGENHEIM FUNDS semi-annual REPORT | See Notes to Financial Statements. |

NOTES TO Consolidated FINANCIAL STATEMENTS (Unaudited)

1. Organization, Consolidation of Subsidiary and Significant Accounting Policies

Organization

The Rydex Series Funds (the “Trust”) is registered with the SEC under the Investment Company Act of 1940 (“1940 Act”) as a non-diversified, open-ended investment company. The Trust offers eight separate classes of shares, Investor Class shares, Investor2 Class shares, Advisor Class shares, A-Class shares, C Class shares, H-Class shares, Y-Class shares, Institutional Class shares, and Money Market Class shares. Sales of shares of each Class are made without a sales charge at the NAV, with the exception of A-Class shares. A-Class shares are sold at the NAV, plus the applicable front-end sales charge. The sales charge varies depending on the amount purchased, but will not exceed 4.75%. A-Class share purchases of $1 million or more are exempt from the front-end sales charge but have a 1% CDSC if shares are redeemed within 18 months of purchase. C-Class shares have a 1% CDSC if shares are redeemed within 12 months of purchase.

At June 30, 2012, the Trust consisted of fifty-eight separate funds. This report covers the Managed Futures Strategy Fund (the “Fund”). Only A-Class, C-Class, H-Class, Y-Class and Institutional Class shares had been issued by the Fund.

Guggenheim Investments (“GI”) provides advisory services and Rydex Fund Services, LLC (“RFS”) provides transfer agent, administrative and accounting services to the Trust. Rydex Distributors, LLC (“RDL”) acts as principal underwriter for the Trust. GI, RFS and RDL are affiliated entities.

Consolidation of Subsidiary

Each of the consolidated financial statements of the Fund includes the accounts of a wholly-owned and controlled Cayman Islands subsidiary (the “Subsidiary”). Significant inter-company accounts and transactions have been eliminated in consolidation for the Fund.

The Fund may invest up to 25% of its total assets in its Subsidiary which acts as an investment vehicle in order to effect certain investments consistent with the Fund’s investment objectives and policies.

A summary of the Fund’s investment in its respective Subsidiary is as follows:

| | | | % of Total |

| | | Subsidiary | Net Assets of |

| | Inception | Net Assets at | the Fund at |

| | Date of | June 30, | June 30, |

| | Subsidiary | 2012 | 2012 |

| Managed Futures | | | |

| Strategy Fund | 05/01/08 | $77,476,239 | 4.12% |

Significant Accounting Policies

The following significant accounting policies are in conformity with U.S. generally accepted accounting principles (“GAAP”) and are consistently followed by the Fund. This requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. All time references are based on Eastern Time.

A. The value of futures contracts purchased and sold by the Fund is accounted for using the unrealized gain or loss on the contracts that is determined by marking the contracts to their current realized settlement prices. Financial futures contracts are valued at the 4:00 p.m. price on the valuation date. In the event that the exchange for a specific futures contract closes earlier than 4:00 p.m., the futures contract is valued at the Official Settlement Price of the exchange. However, the underlying securities from which the futures contract value is derived are monitored until 4:00 p.m. to determine if fair valuation would provide a more accurate valuation.

Debt securities with a maturity of greater than 60 days at acquisition are valued at prices that reflect broker/dealer supplied valuations or are obtained from independent pricing services, which may consider the trade activity, treasury spreads, yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Short-term debt securities with a maturity of 60 days or less at acquisition and repurchase agreements are valued at amortized cost, which approximates market value.

Investments for which market quotations are not readily available are fair valued as determined in good faith by GI under the direction of the Board of Trustees using methods established or ratified by the Board of Trustees. These methods include, but are not limited to: (i) using general information as to how these securities and assets trade; (ii) in connection with futures contracts and options thereupon, and other derivative

THE GUGGENHEIM FUNDS semi-annual REPORT | 15

NOTES TO Consolidated FINANCIAL STATEMENTS (Unaudited) (continued)

investments, information as to how (a) these contracts and other derivative investments trade in the futures or other derivative markets, respectively, and (b) the securities underlying these contracts and other derivative investments trade in the cash market; and (iii) other information and considerations, including current values in related markets.

B. Security transactions are recorded on the trade date for financial reporting purposes. Realized gains and losses from securities transactions are recorded using the identified cost basis. Proceeds from lawsuits related to investment holdings are recorded as realized gains in the Fund. Dividend income is recorded on the ex-dividend date, net of applicable taxes withheld by foreign countries. Taxable non-cash dividends are recorded as dividend income. Interest income, including amortization of premiums and accretion of discount, is accrued on a daily basis.

C. Distributions of net investment income and net realized gains, if any, are declared and paid at least annually. Distributions are recorded on the ex-dividend date and are determined in accordance with income tax regulations which may differ from U.S. GAAP.

D. Certain U.S. Government and Agency Obligations are traded on a discount basis; the interest rates shown on the Schedule of Investments reflect the effective rates paid at the time of purchase by the Fund. Other securities bear interest at the rates shown, payable at fixed dates through maturity.

E. The Fund may leave cash overnight in its cash account with the custodian, U.S. Bank. Periodically, the Fund may have cash due to the custodian bank as an overdraft balance. A fee is incurred on this overdraft, calculated by multiplying the overdraft by a rate based on the federal funds rate.

Segregated cash with the broker is held as collateral for investments in derivative instruments such as futures contracts or swap agreements.

F. Interest and dividend income, most expenses, all realized gains and losses, and all unrealized gains and losses are allocated to the Classes based upon the value of the outstanding shares in each Class. Certain costs, such as distribution fees relating to A-Class shares and H-Class shares and service and distribution fees related to C-Class shares, are charged directly to specific Classes. In addition, certain expenses have been allocated to the individual Funds in the Trust on a pro rata basis upon the respective aggregate net assets of each Fund included in the Trust.

G. When the Fund writes (sells) an option, an amount equal to the premium received is entered in the Fund’s accounting records as an asset and equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the option written. When a written option expires, or if the Fund enters into a closing purchase transaction, it realizes a gain (or loss if the cost of a closing purchase transaction exceeds the premium received when the option was sold).

H. Upon entering into a futures contract,the Fund deposits and maintains as collateral such initial margin as required by the exchange on which the transaction is affected. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in value of the contract. Such receipts or payments are known as variation margin and are recorded by the Fund as unrealized gains or losses. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

I. Throughout the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/ or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

2. Financial Instruments

As part of their investment strategy, the Fund utilizes a variety of derivative instruments including options and futures. These investments involve, to varying degrees, elements of market risk and risks in excess of the amounts recognized in the Statement of Assets and Liabilities.

An option on a security gives the purchaser of the option the right to sell, and the writer of the option the obligation to buy, the underlying security (put option) or the purchaser of the option the right to buy, and the writer of the option the obligation to sell, the underlying security (call option) at any time during the option period. The risk associated with purchasing options is limited to the premium originally paid. The risk in writing a call option is that the Fund may incur a loss if the market price of the underlying security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the underlying security decreases and the option is exercised. In addition, there may be an imperfect correlation between the movement in prices of options and the

16 | THE GUGGENHEIM FUNDS semi-annual REPORT

NOTES TO Consolidated FINANCIAL STATEMENTS (Unaudited) (continued)

underlying securities and the Fund may not be able to enter into a closing transaction because of an illiquid secondary market or, for over-the-counter options, because of the counterparty’s inability to perform.

A futures contract is an agreement to purchase (long) or sell (short) an agreed amount of securities or other instruments at a set price for delivery at a future date. There are significant risks associated with a Fund’s or an underlying fund’s use of futures contracts and related options, including (i) there may be an imperfect or no correlation between the changes in market value of the underlying asset and the prices of futures contracts; (ii) there may not be a liquid secondary market for a futures contract; (iii) trading restrictions or limitations may be imposed by an exchange; and (iv) government regulations may restrict trading in futures contracts. When investing in futures, there is minimal counterparty credit risk to the Fund because futures are exchange-traded and the exchange’s clearinghouse, as counterparty to all exchange-traded futures, guarantees against default.

In conjunction with the use of written options and futures, the Fund is required to maintain collateral in various forms. The Fund uses, where appropriate, depending on the financial instrument utilized and the broker involved, margin deposits at the broker, cash and/or securities segregated at the custodian bank, discount notes, or the repurchase agreements allocated to the Fund.

The Trust has established counterparty credit guidelines and enters into transactions only with financial institutions of investment grade or better. The Trust monitors the counterparty credit risk.

3. Fees and Other Transactions with Affiliates

Under the terms of an investment advisory contract, the Fund pays GI investment advisory fees calculated at an annualized rate of 0.90% of the average daily net assets.

RFS provides transfer agent and administrative services to the Fund for fees calculated at an annualized rate of 0.25% of the average daily net assets.

GI has contractually agreed to waive the management fee it receives from the Subsidiary in an amount equal to the management fee paid to GI by the Subsidiary. This undertaking will continue in effect for so long as the Fund invests in the Subsidiary, and may not be terminated by GI unless GI obtains the prior approval of the Fund’s Board of Trustees for such termination. In any event, this undertaking will continue through April 30, 2013.

RFS also provides accounting services to the Fund for fees calculated at annualized rates below, based on the average daily net assets of the Fund.

| Fund Accounting Fees | | (as a % of net assets) |

| On the first $250 million | | 0.10% |

| On the next $250 million | | 0.075% |

| On the next $250 million | | 0.05% |

| Over $750 million | | 0.03% |

RFS engages external service providers to perform other necessary services for the Trust, such as audit and accounting related services, legal services, custody, printing and mailing, etc., on a pass-through basis. Such expenses are allocated to various Funds within the complex based on relative net assets.

The Trust has adopted a Distribution Plan applicable to A-Class shares and H-Class shares for which RDL and other firms that provide distribution and/or shareholder services (“Service Providers”) may receive compensation. If a Service Provider provides distribution services, the Trust will pay distribution fees to RDL at an annual rate not to exceed 0.25% of average daily net assets, pursuant to Rule 12b-1 of the 1940 Act. RDL, in turn, will pay the Service Provider out of its fees. RDL may, at its discretion, retain a portion of such payments to compensate itself for distribution services.

The Trust has adopted a separate Distribution and Shareholder Services Plan applicable to its C-Class shares that allows the Funds to pay annual distribution and service fees of 1.00% of the Funds’ C-Class shares average daily net assets. The annual 0.25% service fee compensates the shareholder’s financial advisor for providing ongoing services to the shareholder. The annual distribution fee of 0.75% reimburses RDL for paying the shareholder’s financial advisor an ongoing sales commission. RDL advances the first year’s service and distribution fees to the financial advisor. RDL retains the service and distribution fees on accounts with no authorized dealer of record.

For the period ended June 30, 2012, RDL retained sales charges of $155,697 relating to sales of A-Class shares of the Trust.

Certain officers and trustees of the Trust are also officers of GI, RFS and RDL.

4. Fair Value Measurement

In accordance with U.S. GAAP, fair value is defined as the price that the Fund would receive to sell an investment or pay to transfer a liability in an orderly transaction with an independent buyer in the principal market, or in the absence of a principal

THE GUGGENHEIM FUNDS semi-annual REPORT | 17

NOTES TO Consolidated FINANCIAL STATEMENTS (Unaudited) (continued)

market the most advantageous market for the investment or liability. A three-tier hierarchy is utilized to distinguish between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Fund’s investments. The inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical securities.

Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes the inputs used to value the Fund’s net assets at June 30, 2012:

| | | Level 1 | | | Level 1 | | | Level 2 | | | Level 3 | | | | |

| | | Investments | | | Other Financial | | | Investments | | | Investments | | | | |

| Fund | | In Securities | | | Instruments* | | | In Securities | | | In Securities | | | Total | |

| Assets | | | | | | | | | | | | | | | | | | | | |

| Managed Futures Strategy Fund | | $ | — | | | $ | 12,124,471 | | | $ | 1,839,742,082 | | | $ | — | | | $ | 1,851,866,553 | |

| | | | | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | | | |

| Managed Futures Strategy Fund | | $ | — | | | $ | 62,492,689 | | | $ | — | | | $ | — | | | $ | 62,492,689 | |

* Other financial instruments include futures contracts, which are reported as unrealized gain/loss at period end.

5. Repurchase Agreements

The Funds transfer uninvested cash balances into a single joint account, the daily aggregate balance of which is invested in one or more repurchase agreements collateralized by obligations of the U.S. Treasury and U.S. Government Agencies. The collateral is in the possession of the Funds’ custodian and is evaluated to ensure that its market value exceeds, at a minimum, 102% of the original face amount of the repurchase agreements. Each Fund holds a pro rata share of the collateral based on the dollar amount of the repurchase agreement entered into by each Fund.

At June 30, 2012, the collateral for the repurchase agreements in the joint account was as follows:

| Counterparty and | | | | | | | | | | | | | | |

| Terms of Agreement | | Face Value | | | Repurchase Price | | | Collateral | | Par Value | | | Fair Value | |

| HSBC Group | | | | | | | | | | U.S. Treasury Bonds | | | | | | | | |

| 0.12% | | | | | | | | | | 3.88% - 4.50% | | | | | | | | |

| Due 07/02/12 | | $ | 696,750,000 | | | $ | 696,756,968 | | | 02/15/36 - 08/15/40 | | $ | 211,564,000 | | | $ | 281,967,002 | |

| | | | | | | | | | | U.S. Treasury STRIPS | | | | | | | | |

| | | | | | | | | | | 0.00% | | | | | | | | |

| | | | | | | | | | | 08/15/14 - 08/15/16 | | | 250,000,000 | | | | 247,095,000 | |

| | | | | | | | | | | Freddie Mac Notes | | | | | | | | |

| | | | | | | | | | | 4.38% - 5.13% | | | | | | | | |

| | | | | | | | | | | 07/15/12 - 05/15/16 | | | 95,565,000 | | | | 106,069,820 | |

| | | | | | | | | | | Federal Home Loan Bank | | | | | | | | |

| | | | | | | | | | | 0.04% | | | | | | | | |

| | | | | | | | | | | 07/02/14 | | | 75,000,000 | | | | 75,553,750 | |

| Mizuho Financial Group, Inc. | | | | | | | | | | U.S. Treasury Bill | | | | | | | | |

| 0.12% | | | | | | | | | | 0.00% | | | | | | | | |

| Due 07/02/12 | | | 297,139,164 | | | | 297,142,136 | | | 11/15/14 | | | 303,689,400 | | | | 303,082,021 | |

| Credit Suisse Group | | | | | | | | | | U.S. Treasury Notes | | | | | | | | |

| 0.08% | | | | | | | | | | 2.13% - 3.13% | | | | | | | | |

| Due 07/02/12 | | | 175,010,152 | | | | 175,011,319 | | | 05/30/13 - 08/15/21 | | | 167,346,200 | | | | 178,510,439 | |

| Deutsche Bank | | | | | | | | | | U.S. Treasury Note | | | | | | | | |

| 0.10% | | | | | | | | | | 0.38% | | | | | | | | |

| Due 07/02/12 | | | 196,750,000 | | | | 196,751,640 | | | 07/17/15 | | | 200,561,000 | | | | 200,685,027 | |

18 | THE GUGGENHEIM FUNDS semi-annual REPORT

NOTES TO Consolidated FINANCIAL STATEMENTS (Unaudited) (continued)

In the event of counterparty default, the Funds have the right to collect the collateral to offset losses incurred. There is potential loss to the Funds in the event the Funds are delayed or prevented from exercising their rights to dispose of the collateral securities, including the risk of a possible decline in the value of the underlying securities during the period while the Funds seek to assert their rights. The Funds’ investment advisor, acting under the supervision of the Board of Trustees, reviews the value of the collateral and the creditworthiness of those banks and dealers with which the Funds enter into repurchase agreements to evaluate potential risks.

6. Derivative Investment Holdings Categorized by Risk Exposure

U.S. GAAP requires disclosures to enable investors to better understand how and why the Fund uses derivative instruments, how these derivative instruments are accounted for and their effects on the Fund’s financial position and results of operations.

The Fund utilized derivatives for the following purposes:

| Fund Name | | Index Exposure | | | Liquidity | |

| Managed Futures Strategy Fund | | | x | | | | x | |

The following table represents the notional amount of derivative instruments outstanding, as an approximate percentage of the Fund’s net assets on a daily basis, while the risk to the Fund is limited to the profit earned on such derivatives.

Approximate percentage of Fund’s net assets on a daily basis

| Fund | | Long | | | Short | |

| Managed Futures Strategy Fund | | | 35% | | | | 65% | |

| The following is a summary of the location of derivative investments on the Fund’s Statement of Assets and Liabilities as of June 30, 2012: |

| |

| Location on the Statement of Assets and Liabilities |

| Derivative Investment Type | | | | | | | | | | | Liability Derivatives | |

| Interest Rate/Currency/Commodity contracts | | | | | | | | Variation margin | |

| | | | | | | | | | |

| The following table sets forth the fair value of the Fund’s derivative investments categorized by primary risk exposure at June 30, 2012: |

| |

| Asset Derivative Investments Value |

| | | | Futures | | | | Futures | | | | Futures | | | | | |

| | | | Currency | | | | Interest Rate | | | | Commodity | | | | Total Value at | |

| Fund | | | Contracts* | | | | Contracts* | | | | Contracts* | | | | June 30, 2012 | |

| Managed Futures Strategy Fund | | $ | — | | | $ | 6,145,044 | | | $ | 5,979,427 | | | $ | 12,124,471 | |

| | | | | | | | | | | | | | | | | |

| Liability Derivative Investments Value |

| | | | Futures | | | | Futures | | | | Futures | | | | | |

| | | | Currency | | | | Interest Rate | | | | Commodity | | | | Total Value at | |

| Fund | | | Contracts* | | | | Contracts* | | | | Contracts* | | | | June 30, 2012 | |

| Managed Futures Strategy Fund | | $ | 13,925,019 | | | $ | — | | | $ | 48,567,670 | | | $ | 62,492,689 | |

| * | Includes cumulative appreciation (depreciation) of futures contracts as reported on the Schedule of Investments. Only current day’s variation margin is reported within the Statement of Assets and Liabilities. |

The following is a summary of the location of derivative investments on the Fund’s Statement of Operations for the period ended June 30, 2012:

| | Location on the Statement of Operations |

| Derivative Investment Type | Location of Gain (Loss) on Derivatives |

| Equity/Interest Rate/Currency/Commodity contracts | Net realized gain (loss) on futures contracts |

| | Net realized gain (loss) on options written |

| | Net change in unrealized appreciation (depreciation) on futures contracts |

THE GUGGENHEIM FUNDS semi-annual REPORT | 19

NOTES TO Consolidated FINANCIAL STATEMENTS (Unaudited) (continued)

The following is a summary of the Fund’s realized gain (loss) and change in unrealized appreciation (depreciation) on derivative investments recognized on the Statement of Operations categorized by primary risk exposure for the period ended June 30, 2012:

Realized Gain (Loss) on Derivative Investments Recognized in the Statement of Operations

| | | Futures | | | Futures | | | Futures | | | Options | | | | |

| | | Currency | | | Interest Rate | | | Commodity | | | Written | | | | |

| | | Contracts | | | Contracts | | | Contracts | | | Contracts | | | Total | |

| Managed Futures Strategy Fund | | $ | (39,559,050 | ) | | $ | (11,301,563 | ) | | $ | (84,277,146 | ) | | $ | 391,575 | | | $ | (134,746,184 | ) |

| Change in Unrealized Appreciation(Depreciation) on Derivative Investments Recognized in the Statement of Operations | |

| | | Futures | | | Futures | | | Futures | | | Options | | | | |

| | | Currency | | | Interest Rate | | | Commodity | | | Written | | | | |

| | | Contracts | | | Contracts | | | Contracts | | | Contracts | | | Total | |

| Managed Futures Strategy Fund | | $ | (22,491,662 | ) | | $ | (314,077 | ) | | $ | (49,801,868 | ) | | $ | — | | | $ | (72,607,607 | ) |

7. Call Options Written

Transactions in options written during the period ended June 30, 2012 were as follows:.

| | | Written Call Options | |

| | | Number of | | | Premiun | |

| Managed Futures Strategy Fund | | contracts | | | amount | |

| Balance at December 31, 2011 | | | — | | | $ | — | |

| Options Written | | | 1,500 | | | | 391,575 | |

| Options terminated in closing purchase transactions | | | — | | | | — | |

| Options expired | | | (1,500 | ) | | | (391,575 | ) |

| Options exercised | | | — | | | | — | |

| Balance at June 30, 2012 | | | — | | | $ | — | |

8. Federal Income Tax Information