UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 07584

Rydex Series Funds

(Exact name of registrant as specified in charter)

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Donald C. Cacciapaglia, President

Rydex Series Funds

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: December 31

Date of reporting period: June 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ALTERNATIVES FUND

MANAGED FUTURES STRATEGY FUND

RMFSF-SEMI-0613x1213

GO GREEN!

ELIMINATE MAILBOX CLUTTER

Go paperless with Guggenheim Investments eDelivery—a service giving you full online access to account information and documents. Save time, cut down on mailbox clutter and be a friend to the environment with eDelivery.

With Guggenheim Investments eDelivery you can:

| · | View online confirmations and statements at your convenience. |

| · | Receive email notifications when your most recent confirmations, statements and other account documents are available for review. |

| · | Access prospectuses, annual reports and semiannual reports online. |

If you have questions about Guggenheim Investments

eDelivery services, contact one of our Shareholder Service

Representatives at 800.820.0888.

This report and the financial statements contained herein are submitted for the general information of our shareholders. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Guggenheim Distributors, LLC.

TABLE OF CONTENTS

| THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 1 |

June 30, 2013

Dear Shareholder:

Security Investors, LLC (the “Investment Adviser”) is pleased to present the semi-annual shareholder report for one or more of our Funds (the “Funds”) for the period ended June 30, 2013.

The Investment Adviser is part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC, a global, diversified financial services firm.

Guggenheim Distributors, LLC is the distributor of the Funds. Guggenheim Distributors, LLC is affiliated with Guggenheim Partners, LLC and Security Investors, LLC.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter, and then the Fund Profile for each Fund.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Donald C. Cacciapaglia

President

July 31, 2013

Read each Fund’s prospectus and summary prospectus (if available) carefully before investing. It contains the Fund’s investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

The Funds may not be suitable for all investors. Investing involves risks, including the entire loss of principal amount invested. Certain Funds may be affected by risks that include those associated with sector concentration, international investing, investing in small and/or medium size companies, and/or the Funds’ possible use of investment techniques and strategies such as leverage, derivatives and short sales of securities. Please see each Fund’s prospectus for more information.

| 2 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

| ECONOMIC AND MARKET OVERVIEW (Unaudited) | June 30, 2013 |

Monetary accommodation from the world’s central banks and continued improvement in the U.S. housing and labor markets benefited the overall U.S. economy for the six month period ended June 30, 2013. However, speculation about the end of quantitative easing in May and June, along with growing fundamental risk in Japan and China, led to a selloff in fixed income and equity markets. For most of the period, equity markets were strong and abundant liquidity and steady quantitative easing had produced a benign credit environment with low default rates.

Housing was the primary locomotive of U.S. economic growth in the period. Housing-related activity, including private residential investment, personal expenditures on household durable goods and utilities, as well as the wealth effect on consumption from home price appreciation, has contributed positively to GDP since 1Q2011. However, housing’s contribution remains dependent on the maintenance of extremely low mortgage rates, which have recently begun moving higher.

Overshadowing solid job gains in the period was slow improvement in the unemployment rate. The participation rate has been relatively flat over the past six months, and in general, has been declining. A bright spot has been the private sector, where the U.S. economy is currently adding jobs at a rate that is over 20% higher than that of the prior expansion.

A number of global central banks implemented interest rate cuts during the period, owing to sluggish global economic growth and continuing weakness in commodity prices. The world is still in a deflationary environment, which has given policymakers a great deal of leeway to extend and expand accommodative monetary policies aimed at stimulating output.

The rise in volatility late in the period was in large part a result of shifting market sentiment, but, fundamentally, economic growth in the U.S. has not changed materially, although the impact of rising rates on housing has yet to be seen. With ongoing weakness in growth and inflation, global central banks are expected to maintain accommodative policies for the foreseeable future.

For the six-month period ended June 30, 2013, the return of the Standard & Poor’s 500® (“S&P 500”) Index* was 13.82%, and in mid-May reached an all-time high.

The Barclays U.S. Aggregate Bond Index* returned -2.44% for the period, while the Barclays U.S. High Yield Index* returned 1.42%.

The Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index* returned 0.04%.

The Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East (“EAFE”) Index* returned 4.10%. The MSCI Emerging Markets Index* return was -9.57%.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS.

Barclays U.S. High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

S&P 500® Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of the U.S. stock market.

| THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)

All mutual funds have operating expenses and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning December 31, 2012 and ending June 30, 2013.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| 4 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (concluded)

| | | | | | | | | Beginning | | | Ending | | | Expenses | |

| | | Expense | | | Fund | | | Account Value | | | Account Value | | | Paid During | |

| | | Ratio1 | | | Return | | | December 31, 2012 | | | June 30, 2013 | | | Period2 | |

| Table 1. Based on actual Fund return3 | | | | | | | | | | | | | | | | | | | | |

| Managed Futures Strategy Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.71 | % | | | 0.75 | % | | $ | 1,000.00 | | | $ | 1,007.50 | | | $ | 8.51 | |

| C-Class | | | 2.46 | % | | | 0.39 | % | | | 1,000.00 | | | | 1,003.90 | | | | 12.22 | |

| H-Class | | | 1.71 | % | | | 0.75 | % | | | 1,000.00 | | | | 1,007.50 | | | | 8.51 | |

| Institutional Class | | | 1.46 | % | | | 0.89 | % | | | 1,000.00 | | | | 1,008.90 | | | | 7.27 | |

| Y-Class | | | 1.46 | % | | | 0.89 | % | | | 1,000.00 | | | | 1,008.90 | | | | 7.27 | |

| | | | | | | | | | | | | | | | | | | | | |

| Table 2. Based on hypothetical 5% return (before expenses) | | | | | | | | | | | | | | | | | | | | |

| Managed Futures Strategy Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.71 | % | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,016.31 | | | $ | 8.55 | |

| C-Class | | | 2.46 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,012.60 | | | | 12.28 | |

| H-Class | | | 1.71 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,016.31 | | | | 8.55 | |

| Institutional Class | | | 1.46 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,017.55 | | | | 7.30 | |

| Y-Class | | | 1.46 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,017.55 | | | | 7.30 | |

| 2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| 3 | Actual cumulative return at net asset value for the period December 31, 2012 to June 30, 2013. |

| THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 5 |

| FUND PROFILE (Unaudited) | June 30, 2013 |

MANAGED FUTURES STRATEGY FUND

OBJECTIVE: Seeks to achieve positive absolute returns.

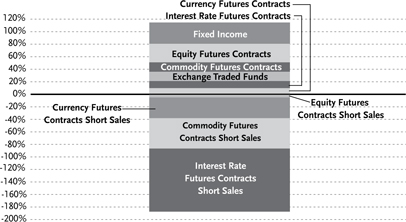

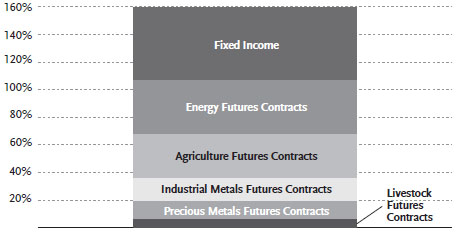

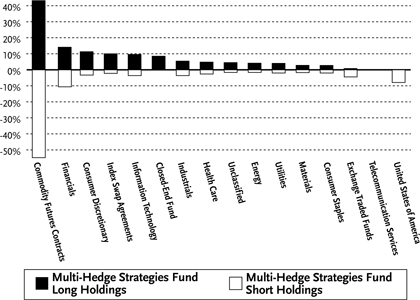

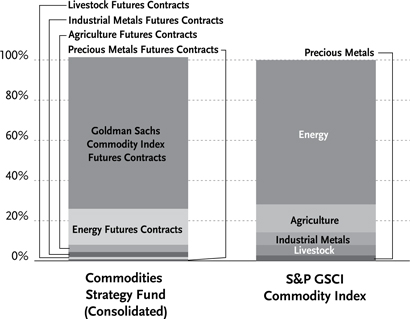

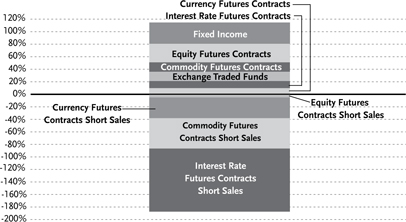

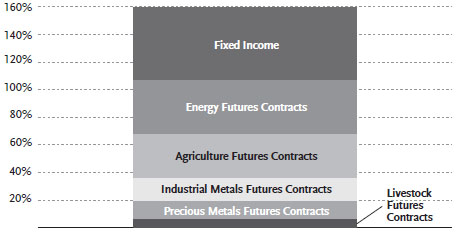

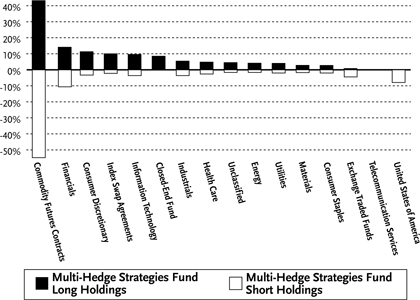

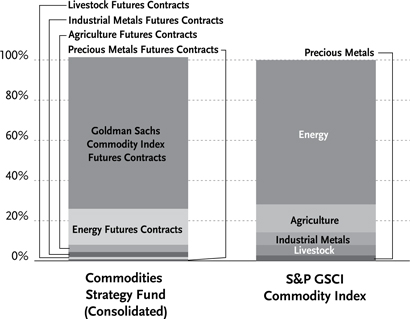

Consolidated Holdings Diversification (Market Exposure as % of Net Assets)

“Consolidated Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

| Inception Dates: | | |

| A-Class | | March 2, 2007 |

| C-Class | | March 2, 2007 |

| H-Class | | March 2, 2007 |

| Institutional Class | | May 3, 2010 |

| Y-Class | March 29, 2010 |

| Ten Largest Holdings | | | |

| (% of Total Net Assets) | | | |

| PIMCO Enhanced Short Maturity Exchange-Traded Fund | | | 13.4 | % |

| KKR Financial CLO 2007-A Corp. | | | 5.0 | % |

| Emporia Preferred Funding II Corp. | | | 2.3 | % |

| Credit Suisse Mortgage Capital Certificates 2007-TF2A | | | 2.1 | % |

| Morgan Stanley Reremic Trust | | | 2.0 | % |

| Geer Mountain Financing Ltd. | | | 2.0 | % |

| Guggenheim Enhanced Short Duration Bond ETF | | | 1.5 | % |

| COMM 2007-FL14 Mortgage Trust | | | 1.5 | % |

| Newcastle CDO Ltd. | | | 1.2 | % |

| Brentwood CLO Corp. | | | 1.0 | % |

| Top Ten Total | | | 32.0 | % |

“Ten Largest Holdings” exclude any temporary cash or derivative investments.

| 6 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) | June 30, 2013 |

| MANAGED FUTURES STRATEGY FUND |

| | | Shares | | | Value | |

| | | | | | | |

| EXCHANGE TRADED FUNDS† - 14.9% | | | | | | | | |

| PIMCO Enhanced Short Maturity | | | | | | | | |

| Exchange-Traded Fund1 | | | 600,000 | | | $ | 60,762,000 | |

| Guggenheim Enhanced Short | | | | | | | | |

| Duration Bond ETF1 | | | 140,000 | | | | 7,021,000 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $67,930,214) | | | | | | | 67,783,000 | |

| | | | | | | | | |

| | | | Face | | | | | |

| | | | Amount | | | | | |

| | | | | | | | | |

| ASSET BACKED SECURITIES†† - 17.0% | | | | | | | | |

| KKR Financial CLO 2007-A Corp. 2007-AA, | | | | | | | | |

| 1.03% due 10/15/172,3 | | $ | 22,699,150 | | | | 22,643,538 | |

| Emporia Preferred Funding II Corp. | | | | | | | | |

| 2006-2A,0.56% due 10/18/182,3 | | | 10,349,415 | | | | 10,288,146 | |

| 2006-2X,0.57% due 10/18/18 | | | 4,357,648 | | | | 4,307,664 | |

| Morgan Stanley Reremic Trust 2012-IO, | | | | | | | | |

| 1.00% due 03/27/513 | | | 9,119,794 | | | | 9,049,754 | |

| Geer Mountain Financing Ltd. 2007-1A, | | | | | | | | |

| 0.59% due 04/01/142,3 | | | 9,000,000 | | | | 8,922,600 | |

| Newcastle CDO Ltd., | | | | | | | | |

| 0.45% due 05/25/52 | | | 5,658,145 | | | | 5,495,700 | |

| Brentwood CLO Corp. 2006-1A, | | | | | | | | |

| 0.54% due 02/01/222,3 | | | 4,737,741 | | | | 4,624,225 | |

| N-Star REL CDO VIII Ltd. 2006-8A, | | | | | | | | |

| 0.48% due 02/01/412,3 | | | 3,572,797 | | | | 3,315,019 | |

| Acis CLO 2013-1 Ltd. 2013-1A, | | | | | | | | |

| 1.33% due 04/18/242,3 | | | 3,200,000 | | | | 3,199,904 | |

| FM Leveraged Capital Fund II 2006-2A, | | | | | | | | |

| 1.88% due 11/15/202,3 | | | 2,350,000 | | | | 2,345,629 | |

| NewStar Trust 2005-1 2005-1A, | | | | | | | | |

| 0.78% due 07/25/182,3 | | | 1,494,605 | | | | 1,487,924 | |

| Legg Mason Real Estate CDO I Ltd. 2006-1A, | | | | | | | | |

| 0.47% due 03/25/382,3 | | | 991,708 | | | | 967,619 | |

| Gleneagles CLO Ltd. 2005-1A, | | | | | | | | |

| 0.55% due 11/01/172,3 | | | 698,306 | | | | 689,898 | |

| Total Asset Backed Securities | | | | | | | | |

| (Cost $77,175,807) | | | | | | | 77,337,620 | |

| | | | | | | | | |

| U.S. GOVERNMENT SECURITIES† - 14.3% | | | | | | | | |

| U.S. Treasury Bill | | | | | | | | |

| 0.00% due 07/11/13 | | | 29,150,000 | | | | 29,149,825 | |

| 0.00% due 07/18/13 | | | 24,870,000 | | | | 24,869,726 | |

| 0.00% due 07/25/13 | | | 11,110,000 | | | | 11,109,867 | |

| Total U.S. Treasury Bill | | | | | | | 65,129,418 | |

| Total U.S. Government Securities | | | | | | | | |

| (Cost $65,129,742) | | | | | | | 65,129,418 | |

| | | | | | | | | |

| CORPORATE BONDS†† - 9.2% | | | | | | | | |

| Financials - 5.4% | | | | | | | | |

| Aspen Insurance Holdings Ltd. | | | | | | | | |

| 6.00% due 08/15/14 | | | 3,920,000 | | | | 4,110,857 | |

| JPMorgan Chase & Co. | | | | | | | | |

| 0.89% due 02/26/162 | | | 4,000,000 | | | | 3,991,740 | |

| Ford Motor Credit Company LLC | | | | | | | | |

| 8.00% due 06/01/14 | | | 1,384,000 | | | | 1,463,768 | |

| 8.70% due 10/01/14 | | | 1,200,000 | | | | 1,302,445 | |

| 7.00% due 04/15/15 | | | 500,000 | | | | 542,056 | |

| Nomura Holdings, Inc. | | | | | | | | |

| 1.72% due 09/13/162 | | | 3,200,000 | | | | 3,196,064 | |

| Goldman Sachs Group, Inc. | | | | | | | | |

| 1.48% due 04/30/182 | | | 3,000,000 | | | | 2,972,244 | |

| Bank of America Corp. | | | | | | | | |

| 4.50% due 04/01/15 | | | 2,400,000 | | | | 2,517,422 | |

| Morgan Stanley | | | | | | | | |

| 4.20% due 11/20/14 | | | 2,400,000 | | | | 2,482,752 | |

| Macquarie Group Ltd. | | | | | | | | |

| 7.30% due 08/01/143 | | | 1,920,000 | | | | 2,024,907 | |

| Total Financials | | | | | | | 24,604,255 | |

| | | | | | | | | |

| INDUSTRIAL - 1.9% | | | | | | | | |

| Glencore Funding LLC | | | | | | | | |

| 1.43% due 05/27/162,3 | | | 4,350,000 | | | | 4,235,699 | |

| Rio Tinto Finance USA plc | | | | | | | | |

| 1.11% due 06/17/162 | | | 3,000,000 | | | | 2,999,103 | |

| Anglo American Capital plc | | | | | | | | |

| 9.38% due 04/08/143 | | | 1,387,000 | | | | 1,470,262 | |

| Total Industrial | | | | | | | 8,705,064 | |

| | | | | | | | | |

| ENERGY - 1.0% | | | | | | | | |

| Ras Laffan Liquefied Natural | | | | | | | | |

| Gas Company Limited III | | | | | | | | |

| 5.83% due 09/30/163 | | | 4,144,613 | | | | 4,403,651 | |

| FINANCIAL INSTITUTIONS - 0.5% | | | | | | | | |

| Mack-Cali Realty, LP | | | | | | | | |

| 5.13% due 02/15/14 | | | 1,300,000 | | | | 1,330,226 | |

| WEA Finance LLC / WT | | | | | | | | |

| Finance Aust Pty Ltd. | | | | | | | | |

| 5.75% due 09/02/153 | | | 900,000 | | | | 983,299 | |

| Total Financial Institutions | | | | | | | 2,313,525 | |

| | | | | | | | | |

| INDUSTRIALS - 0.4% | | | | | | | | |

| International Lease Finance Corp. | | | | | | | | |

| 2.22% due 06/15/162 | | | 2,000,000 | | | | 1,985,000 | |

| Total Industrials | | | | | | | 1,985,000 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $42,293,513) | | | | | | | 42,011,495 | |

| | | | | | | | | |

| MORTGAGE BACKED SECURITIES†† - 7.0% | | | | | | | | |

| Credit Suisse Mortgage Capital Certificates | | | | | | | | |

| 2007-TF2A,0.37% due 04/15/222,3 | | | 9,719,696 | | | | 9,611,282 | |

| 2006-TF2A,0.39% due 10/15/212,3 | | | 3,000,000 | | | | 2,902,401 | |

| COMM 2007-FL14 Mortgage Trust | | | | | | | | |

| 2007-FL14,0.37% due 06/15/222,3 | | | 6,755,963 | | | | 6,699,828 | |

| Wachovia Bank Commercial Mortgage | | | | | | | | |

| Trust Series 2006-WHALE 7 | | | | | | | | |

| 2006-WL7A,0.36% due 09/15/212,3 | | | 4,250,000 | | | | 4,202,090 | |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 7 |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) (continued) | June 30, 2013 |

| MANAGED FUTURES STRATEGY FUND |

| | | Face | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| COMM 2006-FL12 Mortgage Trust | | | | | | | | |

| 2006-FL12,0.32% due 12/15/202,3 | | $ | 4,007,635 | | | $ | 3,917,515 | |

| Banc of America Large Loan Trust | | | | | | | | |

| 2007-BMB1,1.29% due 08/15/292,3 | | | 1,937,000 | | | | 1,919,311 | |

| GCCFC 2006-FL4A C | | | | | | | | |

| 2006-FL4A,0.42% due 11/05/21 | | | 1,900,000 | | | | 1,844,165 | |

| UBS Commercial Mortgage Trust | | | | | | | | |

| 2007-FL1,0.77% due 07/15/242,3 | | | 984,007 | | | | 982,187 | |

| Total Mortgage Backed Securities | | | | | | | | |

| (Cost $31,882,050) | | | | | | | 32,078,779 | |

| | | | | | | | | |

| MUNICIPAL BONDS†† - 0.7% | | | | | | | | |

| New York - 0.7% | | | | | | | | |

| City of New York New York | | | | | | | | |

| General Obligation Unlimited | | | | | | | | |

| 0.36% due 04/01/352 | | | 3,000,000 | | | | 3,000,000 | |

| Total Municipal Bonds | | | | | | | | |

| (Cost $3,000,000) | | | | | | | 3,000,000 | |

| | | | | | | | | |

| COMMERCIAL PAPER†† - 13.7% | | | | | | | | |

| National Grid Holdings, Inc. | | | | | | | | |

| 0.26% due 07/08/133 | | | 6,000,000 | | | | 5,999,697 | |

| Aegon N.V. | | | | | | | | |

| 0.27% due 07/08/133 | | | 6,000,000 | | | | 5,999,685 | |

| Ecolab, Inc. | | | | | | | | |

| 0.21% due 07/18/133 | | | 6,000,000 | | | | 5,999,405 | |

| Duke Energy Corp. | | | | | | | | |

| 0.27% due 07/25/133 | | | 6,000,000 | | | | 5,998,920 | |

| Tesco Treasury Services plc | | | | | | | | |

| 0.28% due 08/05/133 | | | 6,000,000 | | | | 5,998,366 | |

| Pentair Finance S.A. | | | | | | | | |

| 0.29% due 07/09/133 | | | 5,400,000 | | | | 5,399,652 | |

| AbbVie, Inc. | | | | | | | | |

| 0.19% due 07/02/133 | | | 5,000,000 | | | | 4,999,974 | |

| Kellogg Co. | | | | | | | | |

| 0.17% due 07/09/133 | | | 5,000,000 | | | | 4,999,811 | |

| Southern California Edison Co. | | | | | | | | |

| 0.22% due 07/08/133 | | | 5,000,000 | | | | 4,999,786 | |

| Noble Corporation/Cayman Islands | | | | | | | | |

| 0.31% due 07/19/133 | | | 5,000,000 | | | | 4,999,225 | |

| Kinder Morgan Energy Partners, LP | | | | | | | | |

| 0.27% due 07/24/133 | | | 5,000,000 | | | | 4,999,106 | |

| Northeast Utilities | | | | | | | | |

| 0.20% due 07/01/133 | | | 1,900,000 | | | | 1,900,000 | |

| Total Commercial Paper | | | | | | | | |

| (Cost $62,293,627) | | | | | | | 62,293,627 | |

| | | | | | | | | |

| REPURCHASE AGREEMENTS††,4 - 10.7% | | | | | | | | |

| HSBC Group | | | | | | | | |

| issued 06/28/13 at 0.07% | | | | | | | | |

| due 07/01/13 | | | 39,064,143 | | | | 39,064,143 | |

| Mizuho Financial Group, Inc. | | | | | | | | |

| issued 06/28/13 at 0.06% | | | | | | | | |

| due 07/01/13 | | | 6,713,905 | | | | 6,713,905 | |

| Deutsche Bank | | | | | | | | |

| issued 06/28/13 at 0.06% | | | | | | | | |

| due 07/01/13 | | | 2,725,405 | | | | 2,725,405 | |

| Total Repurchase Agreements | | | | | | | | |

| (Cost $48,503,453) | | | | | | | 48,503,453 | |

| | | | | | | | | |

| SECURITIES LENDING COLLATERAL††,5 - 1.1% | | | | | | | | |

| Repurchase Agreements | | | | | | | | |

| HSBC Securities, Inc. | | | | | | | | |

| issued 06/28/13 at 0.11% | | | | | | | | |

| due 07/01/13 | | | 4,338,910 | | | | 4,338,910 | |

| RBS Securities, Inc. | | | | | | | | |

| issued 06/28/13 at 0.10% | | | | | | | | |

| due 07/01/13 | | | 507,490 | | | | 507,490 | |

| Total Securities Lending Collateral | | | | | | | | |

| (Cost $4,846,400) | | | | | | | 4,846,400 | |

| | | | | | | | | |

| | | | Contracts | | | | | |

| | | | | | | | | |

| OPTIONS PURCHASED† - 0.9% | | | | | | | | |

| Put options on: | | | | | | | | |

| S&P 500 E-mini 1640 Index | | | | | | | | |

| Expiring December 2013 | | | | | | | | |

| with strike price of $640.00 | | | 625 | | | | 3,023,438 | |

| S&P 500 E-mini 1660 Index | | | | | | | | |

| Expiring December 2013 | | | | | | | | |

| with strike price of $660.00 | | | 210 | | | | 1,123,500 | |

| Total Put options | | | | | | | 4,146,938 | |

| Total Options Purchased | | | | | | | | |

| (Cost $3,210,026) | | | | | | | 4,146,938 | |

| Total Investments - 89.5% | | | | | | | | |

| (Cost $406,264,832) | | | | | | $ | 407,130,730 | |

| Other Assets & Liabilities, net - 10.5% | | | | | | | 47,521,302 | |

| Total Net Assets - 100.0% | | | | | | $ | 454,652,032 | |

| 8 | The Guggenheim Funds SEMI-annual REPORT | See Notes to Financial Statements. |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) (continued) | June 30, 2013 |

| Managed Futures Strategy Fund | |

| | | | | | Unrealized | |

| | | Contracts | | | Gain (Loss) | |

| | | | | | | |

| INTEREST RATE FUTURES CONTRACTS PURCHASED†† | | | | | | | | |

| September 2013 Euro - Bund | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $9,577,611) | | | 52 | | | $ | (65,913 | ) |

| September 2013 Euro - Bobl | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $41,556,785) | | | 255 | | | | (141,383 | ) |

| (Total Aggregate Value of Contracts | | | | | | | | |

| $51,134,396) | | | | | | $ | (207,296 | ) |

| CURRENCY FUTURES CONTRACTS PURCHASED† | | | | | | | | |

| September 2013 Euro FX Currency | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $37,760,900) | | | 232 | | | $ | (817,652 | ) |

| EQUITY FUTURES CONTRACTS PURCHASED† | | | | | | | | |

| September 2013 Topix Index | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $10,560,359) | | | 92 | | | $ | 525,588 | |

| September 2013 Nikkei 225 Index | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $12,136,423) | | | 88 | | | | 458,422 | |

| July 2013 MSCI Taiwan Stock Index | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $6,840,645) | | | 245 | | | | 354,515 | |

| September 2013 SPI 200 Index | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $5,119,908) | | | 47 | | | | (12,254 | ) |

| September 2013 Financial | | | | | | | | |

| Select Sector Mini Futures | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $6,258,113) | | | 129 | | | | (27,638 | ) |

| September 2013 FTSE 100 Index | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $3,754,506) | | | 40 | | | | (71,856 | ) |

| September 2013 Russell 2000 Index | | | | | | | | |

| Mini Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $11,534,670) | | | 119 | | | | (89,283 | ) |

| September 2013 S&P MidCap 400 Index | | | | | | | | |

| Mini Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $10,955,400) | | | 95 | | | | (94,855 | ) |

| July 2013 CAC40 10 Euro Index | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $5,827,009) | | | 120 | | | | (142,271 | ) |

| July 2013 Amsterdam Index | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $7,347,712) | | | 82 | | | | (162,461 | ) |

| September 2013 NASDAQ-100 Index | | | | | | | | |

| Mini Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $8,932,770) | | | 154 | | | | (170,681 | ) |

| September 2013 S&P 500 Index | | | | | | | | |

| Mini Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $12,602,475) | | | 158 | | | | (182,272 | ) |

| September 2013 Dow Jones | | | | | | | | |

| Industrial Average Index | | | | | | | | |

| Mini Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $14,729,980) | | | 199 | | | | (234,457 | ) |

| September 2013 DAX Index | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $9,831,403) | | | 38 | | | | (277,685 | ) |

| July 2013 FTSE China A50 Index | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $8,418,971) | | | 1,247 | | | | (700,344 | ) |

| (Total Aggregate Value of Contracts | | | | | | | | |

| $134,850,344) | | | | | | $ | (827,532 | ) |

| | | | | | | | | |

| COMMODITY FUTURES CONTRACTS PURCHASED† | | | | | | | | |

| August 2013 WTI Crude | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $1,736,460) | | | 18 | | | $ | 5,375 | |

| September 2013 Brent Crude | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $1,726,860) | | | 17 | | | | (11,398 | ) |

| August 2013 Lean Hogs | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $26,379,000) | | | 675 | | | | (121,594 | ) |

| August 2013 Gasoline RBOB | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $4,216,468) | | | 37 | | | | (129,286 | ) |

| August 2013 Natural Gas | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $6,080,900) | | | 170 | | | | (279,894 | ) |

| December 2013 Cotton #2 | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $15,357,160) | | | 364 | | | | (514,154 | ) |

| See Notes to Financial Statements. | the Guggenheim Funds SEMI - annual REPORT | 9 |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) (continued) | June 30, 2013 |

| Managed Futures Strategy Fund | |

| | | | | | Unrealized | |

| | | Contracts | | | Gain (Loss) | |

| | | | | | | |

| November 2013 Soybean | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $12,632,575) | | | 202 | | | $ | (545,971 | ) |

| (Total Aggregate Value of | | | | | | | | |

| Contracts $68,129,423) | | | | | | $ | (1,596,922 | ) |

| | | | | | | | | |

| CURRENCY FUTURES CONTRACTS SOLD SHORT† | | | | | | | | |

| September 2013 Japanese Yen | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $55,725,150) | | | 442 | | | $ | 1,632,603 | |

| September 2013 Australian Dollar | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $48,273,210) | | | 531 | | | | 1,606,117 | |

| September 2013 Canadian Dollar | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $44,982,600) | | | 474 | | | | 581,949 | |

| September 2013 British Pound | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $950,125) | | | 10 | | | | 233 | |

| September 2013 Swiss Franc | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $132,425) | | | 1 | | | | (29 | ) |

| (Total Aggregate Value of | | | | | | | | |

| Contracts $150,063,510) | | | | | | $ | 3,820,873 | |

| | | | | | | | | |

| INTEREST RATE FUTURES CONTRACTS SOLD SHORT† | | | | | | | | |

| September 2013 Long Gilt | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $33,392,593) | | | 196 | | | $ | 1,010,250 | |

| September 2013 U.S. Treasury | | | | | | | | |

| Ultra Long Bond | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $34,360,219) | | | 233 | | | | 847,634 | |

| September 2013 U.S. Treasury | | | | | | | | |

| 30 Year Bond Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $38,978,188) | | | 287 | | | | 838,363 | |

| September 2013 U.S. Treasury | | | | | | | | |

| 5 Year Note Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $82,642,999) | | | 683 | | | | 691,652 | |

| September 2013 U.S. Treasury | | | | | | | | |

| 10 Year Note Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $47,937,578) | | | 379 | | | | 632,208 | |

| September 2013 Canadian | | | | | | | | |

| Government 10 Year Bond | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $40,756,587) | | | 326 | | | | 560,335 | |

| September 2013 Japanese | | | | | | | | |

| Government 10 Year Bond | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $57,528,859) | | | 40 | | | | 77,988 | |

| September 2013 Euro - Schatz | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $19,680,208) | | | 137 | | | | 20,915 | |

| September 2013 Australian | | | | | | | | |

| Government 3 Year Bond | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $56,325,216) | | | 564 | | | | (223,387 | ) |

| September 2013 Australian | | | | | | | | |

| Government 10 Year Bond | | | | | | | | |

| Futures Contracts†† | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $47,238,599) | | | 437 | | | | (791,339 | ) |

| (Total Aggregate Value of | | | | | | | | |

| Contracts $458,841,046) | | | | | | $ | 3,664,619 | |

| | | | | | | | | |

| COMMODITY FUTURES CONTRACTS SOLD SHORT† | | | | | | | | |

| September 2013 Coffee ‘C’ | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $28,694,063) | | | 635 | | | $ | 1,055,897 | |

| September 2013 Winter Wheat | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $15,537,500) | | | 452 | | | | 814,182 | |

| August 2013 LME Primary | | | | | | | | |

| Aluminum Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $17,067,375) | | | 389 | | | | 740,237 | |

| September 2013 Wheat Futures | | | | | | | | |

| Contracts (Aggregate Value of | | | | | | | | |

| Contracts $14,908,225) | | | 454 | | | | 682,044 | |

| September 2013 Silver | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $6,858,250) | | | 70 | | | | 585,659 | |

| August 2013 LME Nickel | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $10,424,541) | | | 127 | | | | 423,615 | |

| September 2013 Corn | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $5,609,313) | | | 205 | | | | 279,186 | |

| 10 | The Guggenheim Funds SEMI - annual REPORT | See Notes to Financial Statements. |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) (concluded) | June 30, 2013 |

| Managed Futures Strategy Fund | |

| | | | | | Unrealized | |

| | | Contracts | | | Gain (Loss) | |

| | | | | | | |

| September 2013 Copper | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $6,808,500) | | | 89 | | | $ | 252,096 | |

| August 2013 Gold 100 oz. | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $4,065,270) | | | 33 | | | | 42,475 | |

| August 2013 New York Harbor | | | | | | | | |

| Ultra-Low Sulfur Diesel | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $2,522,961) | | | 21 | | | | 33,048 | |

| August 2013 Gas Oil | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $2,790,400) | | | 32 | | | | 19,053 | |

| August 2013 LME Zinc | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $15,661,250) | | | 340 | | | | 16,156 | |

| August 2013 LME Lead | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $2,969,963) | | | 58 | | | | (5,688 | ) |

| October 2013 Sugar #11 | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $30,947,280) | | | 1,635 | | | | (513,465 | ) |

| August 2013 Live Cattle | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $55,832,380) | | | 1,142 | | | | (861,604 | ) |

| (Total Aggregate Value of | | | | | | | | |

| Contracts $220,697,271) | | | | | | $ | 3,562,891 | |

| | | | | | | | | |

| EQUITY FUTURES CONTRACTS SOLD SHORT†† | | | | | | | | |

| July 2013 IBEX 35 Index | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $1,093,300) | | | 11 | | | $ | 9,446 | |

| July 2013 Hang Seng Index | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $5,713,984) | | | 43 | | | | (260,113 | ) |

| July 2013 H-Shares Index | | | | | | | | |

| Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $10,451,784) | | | 176 | | | | (464,573 | ) |

| (Total Aggregate Value of | | | | | | | | |

| Contracts $17,259,068) | | | | | | $ | (715,240 | ) |

| † | | Value determined based on Level 1 inputs, unless otherwise noted — See Note 4. |

| †† | | Value determined based on Level 2 inputs — See Note 4. |

| 1 | | All or portion of this security is on loan at June 30, 2013 — See Note 10. |

| 2 | | Variable rate security. Rate indicated is rate effective at June 30, 2013. |

| 3 | | Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2) securities is $173,180,315 (cost $173,046,997), or 38.1% of total net assets. |

| 4 | | Repurchase Agreements — See Note 5. |

| 5 | | Securities lending collateral — See Note 10. |

| | | plc — Public Limited Company |

| | | REIT — Real Estate Investment Trust |

| See Notes to Financial Statements. | the Guggenheim Funds SEMI - annual REPORT | 11 |

| Managed Futures Strategy Fund | |

| Consolidated STATEMENT OF |

| ASSETS AND LIABILITIES (Unaudited) |

June 30, 2013

| Assets: | | | | |

| Investments, at value - including $4,712,780 of securities loaned (cost $352,914,979) | | $ | 353,780,877 | |

| Repurchase agreements, at value (cost $53,349,853) | | | 53,349,853 | |

| Total investments (cost $406,264,832) | | | 407,130,730 | |

| Segregated cash with broker | | | 34,736,967 | |

| Receivables: | | | | |

| Securities sold | | | 20,303,735 | |

| Variation margin | | | 1,712,176 | |

| Interest | | | 910,390 | |

| Fund shares sold | | | 751,899 | |

| Dividends | | | 36,000 | |

| Total assets | | | 465,581,897 | |

| Liabilities: | | | | |

| Overdraft due to custodian bank | | | 1,851,931 | |

| Foreign currency, at value (cost $935,718) | | | 924,543 | |

| Payable for: | | | | |

| Upon return of securities loaned | | | 4,846,400 | |

| Fund shares redeemed | | | 2,603,335 | |

| Management fees | | | 320,564 | |

| Distribution and service fees | | | 102,560 | |

| Transfer agent and administrative fees | | | 88,515 | |

| Portfolio accounting fees | | | 31,508 | |

| Miscellaneous | | | 160,509 | |

| Total liabilities | | | 10,929,865 | |

| Net assets | | $ | 454,652,032 | |

| Net assets consist of: | | | | |

| Paid in capital | | $ | 555,360,203 | |

| Accumulated net investment loss | | | (5,770,737 | ) |

| Accumulated net realized loss on investments | | | (102,695,958 | ) |

| Net unrealized appreciation on investments | | | 7,758,524 | |

| Net assets | | $ | 454,652,032 | |

| A-Class: | | | | |

| Net assets | | $ | 95,777,899 | |

| Capital shares outstanding | | | 4,478,436 | |

| Net asset value per share | | $ | 21.39 | |

| Maximum offering price per share (Net asset value divided by 95.25%) | | $ | 22.46 | |

| C-Class: | | | | |

| Net assets | | $ | 38,183,218 | |

| Capital shares outstanding | | | 1,872,702 | |

| Net asset value per share | | $ | 20.39 | |

| H-Class: | | | | |

| Net assets | | $ | 277,431,353 | |

| Capital shares outstanding | | | 12,971,705 | |

| Net asset value per share | | $ | 21.39 | |

| Institutional Class: | | | | |

| Net assets | | $ | 30,953,958 | |

| Capital shares outstanding | | | 1,435,286 | |

| Net asset value per share | | $ | 21.57 | |

| Y-Class: | | | | |

| Net assets | | $ | 12,305,604 | |

| Capital shares outstanding | | | 569,797 | |

| Net asset value per share | | $ | 21.60 | |

| Consolidated STATEMENT |

| OF OPERATIONS (Unaudited) |

Period Ended June 30, 2013

| Investment Income: | | | | |

| Interest | | $ | 1,028,291 | |

| Dividends | | | 273,940 | |

| Income from securities lending, net | | | 18,735 | |

| Total investment income | | | 1,320,966 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 2,875,135 | |

| Transfer agent and administrative fees: | | | | |

| A-Class | | | 144,409 | |

| C-Class | | | 53,864 | |

| H-Class | | | 445,929 | |

| Institutional Class | | | 46,214 | |

| Y-Class | | | 39,199 | |

| Distribution and service fees: | | | | |

| A-Class | | | 144,410 | |

| C-Class | | | 215,456 | |

| H-Class | | | 445,928 | |

| Portfolio accounting fees | | | 239,296 | |

| Registration fees | | | 521,653 | |

| Trustees’ fees* | | | 55,581 | |

| Custodian fees | | | 37,277 | |

| Miscellaneous | | | 78,275 | |

| Total expenses | | | 5,342,626 | |

| Less: | | | | |

| Expenses waived by advisor | | | (213,240 | ) |

| Net expenses | | | 5,129,386 | |

| Net investment loss | | | (3,808,420 | ) |

| | | | | |

| Net Realized and Unrealized Gain (Loss): | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | (169,320 | ) |

| Swap agreements | | | 490,143 | |

| Futures contracts | | | 22,343,708 | |

| Foreign currency | | | (99,926 | ) |

| Options purchased | | | 74,456 | |

| Net realized gain | | | 22,639,061 | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | (214,384 | ) |

| Futures contracts | | | (11,654,626 | ) |

| Options purchased | | | 936,912 | |

| Foreign currency | | | 9,057 | |

| Net change in unrealized appreciation (depreciation) | | | (10,923,041 | ) |

| Net realized and unrealized gain | | | 11,716,020 | |

| Net increase in net assets resulting from operations | | $ | 7,907,600 | |

* Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act.

| 12 | the GUGGENHEIM FUNDS SEMI-annual report | See Notes to Financial Statements. |

| Managed Futures Strategy Fund | |

Consolidated STATEMENTS OF CHANGES IN NET ASSETS

| | | Period Ended | | | | |

| | | June 30, | | | Year Ended | |

| | | 2013 | | | December 31, | |

| | | (Unaudited) | | | 2012 | |

| Increase (Decrease) In Net Assets From Operations: | | | | | | | | |

| Net investment loss | | $ | (3,808,420 | ) | | $ | (30,926,614 | ) |

| Net realized gain (loss) on investments | | | 22,639,061 | | | | (208,209,108 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | (10,923,041 | ) | | | (4,344,238 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 7,907,600 | | | | (243,479,960 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from sale of shares | | | | | | | | |

| A-Class | | | 15,065,370 | | | | 122,900,483 | |

| C-Class | | | 1,286,836 | | | | 6,406,783 | |

| H-Class | | | 51,923,046 | | | | 809,349,983 | |

| Institutional Class | | | 4,897,757 | | | | 41,570,693 | |

| Y-Class | | | 574,073 | | | | 40,444,459 | |

| Cost of shares redeemed | | | | | | | | |

| A-Class | | | (66,637,813 | ) | | | (671,652,699 | ) |

| C-Class | | | (12,741,448 | ) | | | (43,969,338 | ) |

| H-Class | | | (280,366,435 | ) | | | (1,219,877,947 | ) |

| Institutional Class | | | (20,082,301 | ) | | | (88,606,366 | ) |

| Y-Class | | | (90,498,581 | ) | | | (306,099,003 | ) |

| Net decrease from capital share transactions | | | (396,579,496 | ) | | | (1,309,532,952 | ) |

| Net decrease in net assets | | | (388,671,896 | ) | | | (1,553,012,912 | ) |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of period | | | 843,323,928 | | | | 2,396,336,840 | |

| End of period | | $ | 454,652,032 | | | $ | 843,323,928 | |

| Accumulated net investment loss at end of period | | $ | (5,770,737 | ) | | $ | (1,962,317 | ) |

| | | | | | | | | |

| Capital share activity: | | | | | | | | |

| Shares sold | | | | | | | | |

| A-Class | | | 701,750 | | | | 5,377,085 | |

| C-Class | | | 62,654 | | | | 298,490 | |

| H-Class | | | 2,414,052 | | | | 35,175,121 | |

| Institutional Class | | | 226,376 | | | | 1,899,025 | |

| Y-Class | | | 26,784 | | | | 1,739,090 | |

| Shares redeemed | | | | | | | | |

| A-Class | | | (3,098,351 | ) | | | (29,130,895 | ) |

| C-Class | | | (620,604 | ) | | | (2,053,748 | ) |

| H-Class | | | (13,046,784 | ) | | | (55,835,873 | ) |

| Institutional Class | | | (928,446 | ) | | | (3,982,544 | ) |

| Y-Class | | | (4,183,990 | ) | | | (13,821,535 | ) |

| Net decrease in shares | | | (18,446,559 | ) | | | (60,335,784 | ) |

| See Notes to Financial Statements. | the GUGGENHEIM FUNDS SEMI - annual report | 13 |

| Managed Futures Strategy Fund | |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Period Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | June 30, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| A-Class | | 2013a,b | | | 2012b | | | 2011b | | | 2010b | | | 2009b | | | 2008b,c | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 21.23 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | | | $ | 28.26 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment lossd | | | (.13 | ) | | | (.39 | ) | | | (.44 | ) | | | (.41 | ) | | | (.39 | ) | | | (— | )e |

| Net gain (loss) on investments (realized and unrealized) | | | .29 | | | | (2.33 | ) | | | (1.39 | ) | | | (.62 | ) | | | (.84 | ) | | | .83 | |

| Total from investment operations | | | .16 | | | | (2.72 | ) | | | (1.83 | ) | | | (1.03 | ) | | | (1.23 | ) | | | .83 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | (.57 | ) |

| Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (.50 | ) |

| Total distributions | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1.07 | ) |

| Redemption fees collected | | | — | | | | — | | | | — | | | | — | f | | | — | f | | | .02 | |

| Net asset value, end of period | | $ | 21.39 | | | $ | 21.23 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returng | | | 0.75 | % | | | (11.32 | %) | | | (7.14 | %) | | | (3.84 | %) | | | (4.39 | %) | | | 2.96 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 95,778 | | | $ | 145,950 | | | $ | 733,469 | | | $ | 657,317 | | | $ | 636,083 | | | $ | 298,987 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (1.24 | %) | | | (1.71 | %) | | | (1.76 | %) | | | (1.66 | %) | | | (1.42 | %) | | | (0.02 | %) |

| Total expensesh | | | 1.78 | % | | | 1.96 | % | | | 2.05 | % | | | 2.04 | % | | | 2.16 | % | | | 1.77 | % |

| Net expensesi | | | 1.71 | % | | | 1.89 | % | | | 1.97 | % | | | 1.97 | % | | | 2.05 | % | | | 1.77 | % |

| Portfolio turnover rate | | | 27 | % | | | 172 | % | | | 72 | % | | | 148 | % | | | 125 | % | | | 74 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Period Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | June 30, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| C-Class | | 2013a,b | | | 2012b | | | 2011b | | | 2010b | | | 2009b | | | 2008b,c | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 20.31 | | | $ | 23.09 | | | $ | 25.04 | | | $ | 26.24 | | | $ | 27.65 | | | $ | 28.04 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment lossd | | | (.20 | ) | | | (.53 | ) | | | (.61 | ) | | | (.59 | ) | | | (.58 | ) | | | (.16 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | .28 | | | | (2.25 | ) | | | (1.34 | ) | | | (.61 | ) | | | (.83 | ) | | | .82 | |

| Total from investment operations | | | .08 | | | | (2.78 | ) | | | (1.95 | ) | | | (1.20 | ) | | | (1.41 | ) | | | .66 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | (.57 | ) |

| Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (.50 | ) |

| Total distributions | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1.07 | ) |

| Redemption fees collected | | | — | | | | — | | | | — | | | | — | f | | | — | f | | | .02 | |

| Net asset value, end of period | | $ | 20.39 | | | $ | 20.31 | | | $ | 23.09 | | | $ | 25.04 | | | $ | 26.24 | | | $ | 27.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returng | | | 0.39 | % | | | (12.04 | %) | | | (7.79 | %) | | | (4.57 | %) | | | (5.10 | %) | | | 2.37 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 38,183 | | | $ | 49,378 | | | $ | 96,647 | | | $ | 158,628 | | | $ | 225,416 | | | $ | 125,601 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (1.98 | %) | | | (2.45 | %) | | | (2.50 | %) | | | (2.41 | %) | | | (2.17 | %) | | | (0.78 | %) |

| Total expensesh | | | 2.53 | % | | | 2.70 | % | | | 2.80 | % | | | 2.79 | % | | | 2.92 | % | | | 2.51 | % |

| Net expensesi | | | 2.46 | % | | | 2.64 | % | | | 2.72 | % | | | 2.72 | % | | | 2.81 | % | | | 2.51 | % |

| Portfolio turnover rate | | | 27 | % | | | 172 | % | | | 72 | % | | | 148 | % | | | 125 | % | | | 74 | % |

| 14 | the GUGGENHEIM FUNDS SEMI - annual report | See Notes to Financial Statements. |

| Managed Futures Strategy Fund | |

| FINANCIAL HIGHLIGHTS (continued) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Period Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | June 30, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| H-Class | | 2013a,b | | | 2012b | | | 2011b | | | 2010b | | | 2009b | | | 2008b,c | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 21.23 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | | | $ | 28.26 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment lossd | | | (.13 | ) | | | (.38 | ) | | | (.44 | ) | | | (.42 | ) | | | (.38 | ) | | | (.01 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | .29 | | | | (2.34 | ) | | | (1.39 | ) | | | (.61 | ) | | | (.85 | ) | | | .84 | |

| Total from investment operations | | | .16 | | | | (2.72 | ) | | | (1.83 | ) | | | (1.03 | ) | | | (1.23 | ) | | | .83 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | (.57 | ) |

| Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (.50 | ) |

| Total distributions | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1.07 | ) |

| Redemption fees collected | | | — | | | | — | | | | — | | | | — | f | | | — | f | | | .02 | |

| Net asset value, end of period | | $ | 21.39 | | | $ | 21.23 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returng | | | 0.75 | % | | | (11.32 | %) | | | (7.14 | %) | | | (3.84 | %) | | | (4.39 | %) | | | 2.96 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 277,431 | | | $ | 501,109 | | | $ | 1,059,988 | | | $ | 1,199,718 | | | $ | 1,468,770 | | | $ | 838,511 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (1.27 | %) | | | (1.70 | %) | | | (1.75 | %) | | | (1.66 | %) | | | (1.41 | %) | | | (0.03 | %) |

| Total expensesh | | | 1.79 | % | | | 1.95 | % | | | 2.05 | % | | | 2.04 | % | | | 2.16 | % | | | 1.77 | % |

| Net expensesi | | | 1.71 | % | | | 1.89 | % | | | 1.97 | % | | | 1.97 | % | | | 2.05 | % | | | 1.77 | % |

| Portfolio turnover rate | | | 27 | % | | | 172 | % | | | 72 | % | | | 148 | % | | | 125 | % | | | 74 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Period Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | | | | | | | | | June 30, | | | December 31, | | | December 31, | | | December 31, | |

| Institutional Class | | | | | | | | | | 2013a,b | | | 2012b | | | 2011b | | | 2010b,j | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | | | | | | | | $ | 21.38 | | | $ | 24.06 | | | $ | 25.84 | | | $ | 25.58 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment lossd | | | | | | | | | | | (.11 | ) | | | (.33 | ) | | | (.38 | ) | | | (.23 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | | | | | | | | | .30 | | | | (2.35 | ) | | | (1.40 | ) | | | .49 | |

| Total from investment operations | | | | | | | | | | | .19 | | | | (2.68 | ) | | | (1.78 | ) | | | .26 | |

| Redemption fees collected | | | | | | | | | | | — | | | | — | | | | — | | | | — | f |

| Net asset value, end of period | | | | | | | | | | $ | 21.57 | | | $ | 21.38 | | | $ | 24.06 | | | $ | 25.84 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returng | | | | | | | | | | | 0.89 | % | | | (11.14 | %) | | | (6.85 | %) | | | 0.98 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | | | | | | | | $ | 30,954 | | | $ | 45,700 | | | $ | 101,549 | | | $ | 134,733 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | | | | | | | | | (0.99 | %) | | | (1.45 | %) | | | (1.50 | %) | | | (1.41 | %) |

| Total expensesh | | | | | | | | | | | 1.53 | % | | | 1.70 | % | | | 1.80 | % | | | 1.78 | % |

| Net expensesi | | | | | | | | | | | 1.46 | % | | | 1.64 | % | | | 1.72 | % | | | 1.72 | % |

| Portfolio turnover rate | | | | | | | | | | | 27 | % | | | 172 | % | | | 72 | % | | | 148 | % |

| See Notes to Financial Statements. | the GUGGENHEIM FUNDS SEMI - annual report | 15 |

| Managed Futures Strategy Fund | |

| FINANCIAL HIGHLIGHTS (concluded) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Period Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | June 30, | | | December 31, | | | December 31, | | | December 31, | |

| Y-Class | | 2013a,b | | | 2012b | | | 2011b | | | 2010b,k | |

| Per Share Data | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 21.41 | | | $ | 24.07 | | | $ | 25.84 | | | $ | 25.74 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment lossd | | | (.12 | ) | | | (.32 | ) | | | (.37 | ) | | | (.26 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | .31 | | | | (2.34 | ) | | | (1.40 | ) | | | .36 | |

| Total from investment operations | | | .19 | | | | (2.66 | ) | | | (1.77 | ) | | | .10 | |

| Redemption fees collected | | | — | | | | — | | | | — | | | | — | f |

| Net asset value, end of period | | $ | 21.60 | | | $ | 21.41 | | | $ | 24.07 | | | $ | 25.84 | |

| | | | | | | | | | | | | | | | | |

| Total Returng | | | 0.89 | % | | | (11.05 | %) | | | 6.85 | % | | | 0.39 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 12,306 | | | $ | 101,187 | | | $ | 404,684 | | | $ | 189,251 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | |

| Net investment loss | | | (1.12 | %) | | | (1.41 | %) | | | (1.47 | %) | | | (1.36 | %) |

| Total expensesh | | | 1.53 | % | | | 1.65 | % | | | 1.75 | % | | | 1.73 | % |

| Net expensesi | | | 1.46 | % | | | 1.59 | % | | | 1.68 | % | | | 1.67 | % |

| Portfolio turnover rate | | | 27 | % | | | 172 | % | | | 72 | % | | | 148 | % |

| a | Unaudited figures for the period ended June 30, 2013. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| c | The Fund changed its fiscal year end from March 31 to December 31 in 2008. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| d | Net investment loss per share was computed using average shares outstanding throughout the period. |

| e | Net investment income is less than $0.01 per share. |

| f | Redemption fees collected are less than $0.01 per share. |

| g | Total return does not reflect the impact of any applicable sales charges and has not been annualized. |

| h | Does not include expenses of the underlying funds in which the Fund invests. |

| i | Net expense information reflects the expense ratios after expense waivers. |

| j | Since commencement of operations: May 3, 2010. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| k | Since commencement of operations: March 29, 2010. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| 16 | the GUGGENHEIM FUNDS SEMI - annual report | See Notes to Financial Statements. |

| NOTES TO Consolidated FINANCIAL STATEMENTS (Unaudited) |

1. Organization, Consolidation of Subsidiary and Significant Accounting Policies

Organization

The Rydex Series Funds (the “Trust”) is registered with the SEC under the Investment Company Act of 1940 (“1940 Act”), as a non-diversified, open-ended investment company. Each series, in effect, is representing a separate Fund (collectively the “Funds”). The Trust is authorized to issue an unlimited number of shares. The Trust accounts for the assets of each Fund separately. The Trust offers a combination of eight separate classes of shares:

Investor Class shares, Advisor Class shares, A-Class shares, C-Class shares, H-Class shares, Y-Class shares, Institutional Class shares, and Money Market Class shares. Sales of shares of each Class are made without a front-end sales charge at the net asset value per share (“NAV”), with the exception of A-Class shares. A-Class shares are sold at the NAV, plus the applicable front-end sales charge. The sales charge varies depending on the amount purchased, but will not exceed 4.75%. A-Class share purchases of $1 million or more are exempt from the front-end sales charge but have a 1% contingent deferred sales charge (“CDSC”) if shares are redeemed within 12 months of purchase. C-Class shares have a 1% CDSC if shares are redeemed within 12 months of purchase. Institutional Class shares are offered primarily for direct investment by institutions such as pension and profit sharing plans, endowments, foundations and corporations. Institutional Class shares have a minimum initial investment of $2 million and a minimum account balance of $1 million. Institutional Class shares are offered without a front-end sales charge or CDSC.

At June 30, 2013, the Trust consisted of fifty-one separate funds. This report covers the the Managed Futures Strategy Fund (the “Fund”). Only A-Class, C-Class, H-Class, Y-Class and Institutional Class shares had been issued by the Fund.

Guggenheim Investments (“GI”) provides advisory services and Rydex Fund Services, LLC (“RFS”) provides transfer agent, administrative and accounting services to the Trust. Guggenheim Distributors, LLC (“GDL”) acts as principal underwriter for the Trust. GI, RFS and GDL are affiliated entities.

Consolidation of Subsidiary

The consolidated financial statements of the Fund includes the accounts of a wholly-owned and controlled Cayman Islands subsidiary (the “Subsidiary”). Significant inter-company accounts and transactions have been eliminated in consolidation for the Fund.

The Fund may invest up to 25% of its total assets in its Subsidiary which acts as an investment vehicle in order to effect certain investments consistent with the Fund’s investment objectives and policies.

A summary of the Fund’s investment in its respective Subsidiary is as follows:

| | | | | Subsidiary | | | % of Total Net | |

| | | | | Net Assets at | | | Assets of the Fund | |

| | | Inception Date | | June 30, | | | at June 30, | |

| | | of Subsidiary | | 2013 | | | 2013 | |

| Managed Futures Strategy Fund | | 05/10/12 | | | $47,157,000 | | | | 10.4 | % |

Significant Accounting Policies

The following significant accounting policies are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) and are consistently followed by the Fund. This requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. All time references are based on Eastern Time.

A. The value of futures contracts is accounted for using the unrealized gain or loss on the contracts that is determined by marking the contracts to their current realized settlement prices. Financial futures contracts are valued at the 4:00 p.m. price on the valuation date. In the event that the exchange for a specific futures contract closes earlier than 4:00 p.m., the futures contract is valued at the Official Settlement Price of the exchange. However, the underlying securities from which the futures contract value is derived are monitored until 4:00 p.m. to determine if fair valuation would provide a more accurate valuation.

Debt securities with a maturity of greater than 60 days at acquisition are valued at prices that reflect broker/dealer supplied valuations or are obtained from independent pricing services, which may consider the trade activity, treasury spreads, yields or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Short-term debt securities with a maturity of 60 days or less at acquisition and repurchase agreements are valued at amortized cost, which approximates market value.

Listed options are valued at the Official Settlement Price listed by the exchange, usually as of 4:00 p.m. Long options are valued using the bid price and short options are valued using the ask price. In the event that a settlement price is not available, fair valuation is enacted. Over-the-counter options are valued using the average bid price (for long options), or average ask price (for short options) obtained from one or more security dealers.

Open-end investment companies (“Mutual Funds”) are valued at their NAV as of the close of business, on the valuation date.

| the GUGGENHEIM FUNDS SEMI - annual report | 17 |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (continued) |

ETFs and closed-end investment companies are valued at the last quoted sales price.

Investments for which market quotations are not readily available are fair valued as determined in good faith by GI under the direction of the Board of Trustees using methods established or ratified by the Board of Trustees. These methods include, but are not limited to: (i) obtaining general information as to how these securities and assets trade; (ii) in connection with futures contracts and options thereupon, and other derivative investments, obtaining information as to how (a) these contracts and other derivative investments trade in the futures or other derivative markets, respectively, and (b) the securities underlying these contracts and other derivative investments trade in the cash market; and (iii) obtaining other information and considerations, including current values in related markets.

B. Security transactions are recorded on the trade date for financial reporting purposes. Realized gains and losses from securities transactions are recorded using the identified cost basis. Proceeds from lawsuits related to investment holdings are recorded as realized gains in the Fund. Dividend income is recorded on the ex-dividend date, net of applicable taxes withheld by foreign countries. Taxable non-cash dividends are recorded as dividend income. Interest income, including amortization of premiums and accretion of discount, is accrued on a daily basis.

C. Distributions of net investment income and net realized gains, if any, are declared and paid at least annually. Distributions are recorded on the ex-dividend date and are determined in accordance with income tax regulations which may differ from U.S. GAAP.

D. Upon entering into a futures contract, the Fund deposits and maintains as collateral such initial margin as required by the exchange on which the transaction is affected. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in value of the contract. Such receipts or payments are known as variation margin and are recorded by the Fund as unrealized gains or losses. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

E. Certain U.S. Government and Agency Obligations are traded on a discount basis; the interest rates shown on the Schedule of Investments reflect the effective rates paid at the time of purchase by the Fund. Other securities bear interest at the rates shown, payable at fixed dates through maturity.

F. The Fund may leave cash overnight in its cash account with the custodian, U.S. Bank. Periodically, the Fund may have cash due to the custodian bank as an overdraft balance. A fee is incurred on this overdraft, calculated by multiplying the overdraft by a rate based on the federal funds rate.

Segregated cash with the broker is held as collateral for investments in derivative instruments such as futures contracts or swap agreements.

G. Interest and dividend income, most expenses, all realized gains and losses, and all unrealized gains and losses are allocated to the Classes based upon the value of the outstanding shares in each Class. Certain costs, such as distribution fees relating to A-Class shares and H-Class shares and service and distribution fees related to C-Class shares, are charged directly to specific Classes. In addition, certain expenses have been allocated to the individual Funds in the Trust on a pro rata basis upon the respective aggregate net assets of each Fund included in the Trust.

H. Throughout the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

2. Financial Instruments

As part of its investment strategy, the Fund utilizes a variety of derivative instruments including options, futures and swap agreements. These investments involve, to varying degrees, elements of market risk and risks in excess of the amounts recognized in the Statement of Assets and Liabilities.

A futures contract is an agreement to purchase (long) or sell (short) an agreed amount of securities or other instruments at a set price for delivery at a future date. There are significant risks associated with a Fund’s use of futures contracts and related options, including (i) there may be an imperfect or no correlation between the changes in market value of the underlying asset and the prices of futures contracts; (ii) there may not be a liquid secondary market for a futures contract; (iii) trading restrictions or limitations may be imposed by an exchange; and (iv) government regulations may restrict trading in futures contracts. When investing in futures, there is minimal counterparty credit risk to the Fund because futures are exchange-traded and the exchange’s clearinghouse, as counterparty to all exchange-traded futures, guarantees against default.

| 18 | the GUGGENHEIM FUNDS SEMI - annual report |

| NOTES TO Consolidated FINANCIAL STATEMENTS (Unaudited) (continued) |

A swap is an agreement that obligates two parties to exchange a series of cash flows at specified intervals based upon or calculated by reference to changes in specified prices or rates for a specified amount of an underlying asset. A Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. Additionally, there is no guarantee that a Fund or an underlying fund could eliminate its exposure under an outstanding swap agreement by entering into an offsetting swap agreement with the same or another party.

An option on a security gives the purchaser of the option the right to sell, and the writer of the option the obligation to buy, the underlying security (put option) or the purchaser of the option the right to buy, and the writer of the option the obligation to sell, the underlying security (call option) at any time during the option period. The risk associated with purchasing options is limited to the premium originally paid. The risk in writing a call option is that a Fund may incur a loss if the market price of the underlying security increases and the option is exercised. The risk in writing a put option is that a Fund may incur a loss if the market price of the underlying security decreases and the option is exercised. In addition, there may be an imperfect correlation between the movement in prices of options and the underlying securities and a Fund may not be able to enter into a closing transaction because of an illiquid secondary market or, for over-the-counter options, because of the counterparty’s inability to perform.

In conjunction with the use of futures and swap agreements, the Fund is required to maintain collateral in various forms. The Fund uses, where appropriate, depending on the financial instrument utilized and the broker involved, margin deposits at the broker, cash and/or securities segregated at the custodian bank, discount notes, or the repurchase agreements allocated to the Fund.

The Trust has established counterparty credit guidelines and enters into transactions only with financial institutions of investment grade or better. The Trust monitors the counterparty credit risk.

3. Fees and Other Transactions with Affiliates

Under the terms of an investment advisory contract, the Fund pays GI investment advisory fees calculated at an annualized rate of 0.90% of the average daily net assets.

RFS provides transfer agent and administrative services to the Fund calculated at an annualized rate of 0.25% of the average daily net assets of A-Class, C-Class, H-Class and Institutional Class and 0.20% of the average daily net assets of Y-Class.