UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 07584

(Exact name of registrant as specified in charter)

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Rydex Series Funds

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: December 31

Date of reporting period: June 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

June 30, 2014

Guggenheim Funds Semi-Annual Report

| Guggenheim Alternative Fund |

| Guggenheim Managed Futures Strategy Fund | | |

| RMFSF-SEMI-0614x1214 | guggenheiminvestments.com |

Go Green! Eliminate Mailbox Clutter

Go paperless with Guggenheim Investments eDelivery—a service giving you full online access to account information and documents. Save time, cut down on mailbox clutter and be a friend to the environment with eDelivery.

With Guggenheim Investments eDelivery you can:

| · | View online confirmations and statements at your convenience. |

| · | Receive email notifications when your most recent confirmations, statements and other account documents are available for review. |

| · | Access prospectuses, annual reports and semiannual reports online. |

It’s easy to enroll: 1. Visit guggenheiminvestments.com/edelivery 2. Follow the simple enrollment instructions |

If you have questions about the Guggenheim Investments eDelivery service, contact one of our Shareholder Service Representatives at 800.820.0888.

This report and the financial statements contained herein are submitted for the general information of our shareholders. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Guggenheim Funds Distributors, LLC. GI-GOGREEN-0414 x0415 #12604

| DEAR SHAREHOLDER | 2 |

| ECONOMIC AND MARKET OVERVIEW | 3 |

| ABOUT SHAREHOLDERS’ FUND EXPENSES | 4 |

| MANAGED FUTURES STRATEGY FUND | 6 |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | 16 |

| OTHER INFORMATION | 27 |

| INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 30 |

| GUGGENHEIM INVESTMENTS PRIVACY POLICIES | 33 |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC (the “Investment Adviser”) is pleased to present the semi-annual shareholder report for the Managed Futures Strategy Fund (the “Fund”) that is part of the Rydex Series Funds. This report covers performance of the Fund for the semi-annual period ended June 30, 2014.

The Investment Adviser is a part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC, (“Guggenheim”) a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Fund. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Adviser.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Donald C. Cacciapaglia

President

July 31, 2014

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

The Managed Futures Strategy Fund may not be suitable for all investors. Investing involves risks, including the entire loss of principal amount invested. The Fund may be affected by risks that include those associated with sector concentration, international investing, investing in small and/or medium size companies, and/or the Fund’s possible use of investment techniques and strategies such as leverage, derivatives and short sales of securities. Please see the Fund’s prospectus for more information.

2 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | |

Economic growth hit a winter soft patch in the first quarter of 2014, but strong underlying fundamentals helped the economy strengthen in the second quarter. The economy is adding an average of 214,000 jobs per month in 2014, while the housing market is being helped by an improving labor market, subdued mortgage rates, and tight inventory. State and local government spending is positive for growth for the first time in five years. After the period end, minutes released from the U.S. Federal Reserve’s (the “Fed”) June meeting indicated a clear end-date for its quantitative easing program–October 2014–following reductions that began in January of the Fed’s monthly purchases of U.S. Treasury securities and mortgage-backed securities.

Overseas political concerns, European monetary policy, and devaluation of the Chinese currency combined in the period to help push global investors into U.S. Treasuries, driving rates lower. As growth accelerates in the U.S., rates are expected to climb, but the upward pressure on rates from economic growth could be offset by increasing overseas demand and falling debt issuance by the U.S. government, putting a cap on how far rates can rise before the Fed begins tightening.

Recent economic data suggest that growth is improving slowly in the euro zone core and, even more so, in the peripheral countries. The European Central Bank has enacted further monetary easing, which is expected to push both yields and the euro lower, supporting the recovery. Asia is seeking an export-led rebound, although more monetary accommodation may be needed to sustain Japan’s economic expansion. Recent reforms in China are having a positive effect, but policymakers continue to depreciate the currency to help maintain export competitiveness.

Global central banks continue to flood markets with abundant liquidity. A synchronous global expansion is beginning to take hold, creating a positive environment for risk assets. We are approaching the speculative phase of the bull market in both equity and credit. Equities continue to benefit from an improving economy and continued capital flows into the U.S. Credit spreads continue to remain tight in the near term. Historically, spreads don’t begin to widen until defaults rise, which typically takes place one to two years after the Fed begins a tightening cycle.

For the six-month period ended June 30, 2014, the Standard & Poor’s 500® (“S&P 500”) Index* returned 7.14%. Foreign markets were also strong: the Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East (“EAFE”) Index* returned 4.78%. The return of the MSCI Emerging Markets Index* was 6.14%.

In the bond market, the Barclays U.S. Aggregate Bond Index* posted a 3.93% return for the period, while the Barclays U.S. Corporate High Yield Index* returned 5.46%. The return of the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index* was 0.02% for the six-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS.

Barclays U.S. Corporate High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

S&P 500® Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of the U.S. stock market.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) | |

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning December 31, 2013 and ending June 30, 2014.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

4 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) |

| | | Beginning Account Value December 31, 2013 | Ending Account Value June 30, 2014 | Expenses Paid During Period2 |

Table 1. Based on actual Fund return3 | | | |

| Managed Futures Strategy Fund | | | | | |

| A-Class | 1.67% | (2.21%) | $1,000.00 | $ 977.90 | $8.19 |

| C-Class | 2.42% | (2.57%) | 1,000.00 | 974.30 | 11.85 |

| H-Class | 1.67% | (2.17%) | 1,000.00 | 978.30 | 8.19 |

| Institutional Class | 1.34% | (2.10%) | 1,000.00 | 979.00 | 6.58 |

| Y-Class | 1.29% | (2.01%) | 1,000.00 | 979.90 | 6.33 |

|

| Table 2. Based on hypothetical 5% return (before expenses) | | | |

| Managed Futures Strategy Fund | | | | | |

| A-Class | 1.67% | 5.00% | $1,000.00 | $1,016.51 | $8.35 |

| C-Class | 2.42% | 5.00% | 1,000.00 | 1,012.79 | 12.08 |

| H-Class | 1.67% | 5.00% | 1,000.00 | 1,016.51 | 8.35 |

| Institutional Class | 1.34% | 5.00% | 1,000.00 | 1,018.15 | 6.71 |

| Y-Class | 1.29% | 5.00% | 1,000.00 | 1,018.40 | 6.46 |

| 1 | Annualized and excludes expenses of the underlying funds in which the Fund invests. |

| 2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| 3 | Actual cumulative return at net asset value for the period December 31, 2013 to June 30, 2014. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 5 |

MANAGED FUTURES STRATEGY FUND

OBJECTIVE: Seeks to achieve positive absolute returns.

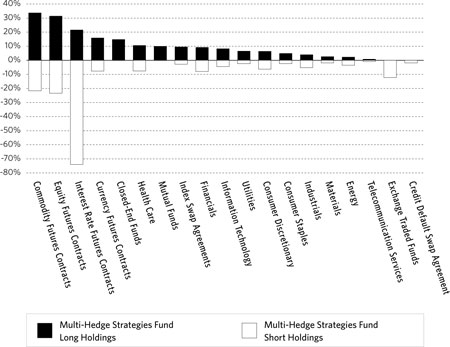

Consolidated Holdings Diversification (Market Exposure as % of Net Assets)

“Consolidated Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

|

| A-Class | March 2, 2007 |

| C-Class | March 2, 2007 |

| H-Class | March 2, 2007 |

| Institutional Class | May 3, 2010 |

| Y-Class | March 29, 2010 |

| The Fund invests principally in derivative investments such as futures contracts. |

Ten Largest Holdings (% of Total Net Assets) |

| Guggenheim Strategy Fund II | 23.9% |

| Guggenheim Strategy Fund III | 19.3% |

| Guggenheim BulletShares 2015 High Yield Corporate Bond ETF | 4.4% |

| KKR Financial CLO Ltd. 2007-AA | 4.2% |

| Guggenheim BulletShares 2016 High Yield Corporate Bond ETF | 3.0% |

| Guggenheim Enhanced Short Duration ETF | 2.2% |

| Morgan Stanley Reremic Trust 2012-I0 | 2.1% |

| Guggenheim BulletShares 2017 High Yield Corporate Bond ETF | 1.9% |

| Brentwood CLO Corp. 2006-1A | 1.8% |

Duane Street CLO IV Ltd. 2007-4A | |

| |

| “Ten Largest Holdings” exclude any temporary cash or derivative investments. |

6 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) | |

| MANAGED FUTURES STRATEGY FUND | |

| | | | | | |

| | | | | | | |

EXCHANGE TRADED FUNDS†,4 - 11.4% | |

| Guggenheim BulletShares 2015 High Yield Corporate Bond ETF | | | 393,600 | | | $ | 10,596,499 | |

| Guggenheim BulletShares 2016 High Yield Corporate Bond ETF | | | 262,400 | | | | 7,197,632 | |

| Guggenheim Enhanced Short Duration ETF | | | 108,400 | | | | 5,454,688 | |

| Guggenheim BulletShares 2017 High Yield Corporate Bond ETF | | | 165,200 | | | | 4,559,520 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $27,452,998) | | | | | | | 27,808,339 | |

| | | | | | | | | |

MUTUAL FUNDS† - 44.1% | |

Guggenheim Strategy Fund II5,6 | | | 2,331,283 | | | | 58,212,139 | |

Guggenheim Strategy Fund III5,6 | | | 1,883,621 | | | | 47,071,684 | |

Guggenheim Strategy Fund I6 | | | 92,165 | | | | 2,299,525 | |

| Total Mutual Funds | | | | | | | | |

| (Cost $107,643,033) | | | | | | | 107,583,348 | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

ASSET BACKED SECURITIES†† - 18.2% | |

| KKR Financial CLO Ltd. | | | | | | | | |

2007-AA, 0.97% due 10/15/171,2 | | $ | 10,312,966 | | | | 10,304,716 | |

| Brentwood CLO Corp. | | | | | | | | |

2006-1A, 0.50% due 02/01/221,2 | | | 4,477,614 | | | | 4,402,837 | |

| Duane Street CLO IV Ltd. | | | | | | | | |

2007-4A, 0.46% due 11/14/211,2 | | | 4,160,967 | | | | 4,095,640 | |

| N-Star REL CDO VIII Ltd. | | | | | | | | |

2006-8A, 0.44% due 02/01/411,2 | | | 3,242,162 | | | | 3,078,433 | |

| Salus CLO Ltd. | | | | | | | | |

2012-1AN, 2.48% due 03/05/211,2 | | | 2,700,000 | | | | 2,695,410 | |

| Argent Securities Incorporated Asset-Backed Pass-Through Certificates Series | | | | | | | | |

2005-W3, 0.49% due 11/25/351 | | | 2,757,892 | | | | 2,604,862 | |

| Garrison Funding Ltd. | | | | | | | | |

2013-2A, 2.03% due 09/25/231,2 | | | 2,500,000 | | | | 2,483,000 | |

| Foothill CLO Ltd. | | | | | | | | |

2007-1A, 0.47% due 02/22/211,2 | | | 2,133,292 | | | | 2,104,919 | |

| TICC CLO LLC | | | | | | | | |

2011-1A, 2.48% due 07/25/211,2 | | | 2,000,000 | | | | 2,000,000 | |

| GreenPoint Mortgage Funding Trust | | | | | | | | |

2005-HE4, 0.86% due 07/25/301 | | | 2,000,000 | | | | 1,858,866 | |

| Emporia Preferred Funding II Ltd. | | | | | | | | |

2006-2A, 0.50% due 10/18/181,2 | | | 1,300,396 | | | | 1,299,745 | |

2006-2X, 0.51% due 10/18/181 | | | 547,535 | | | | 547,206 | |

| Popular ABS Mortgage Pass-Through Trust | | | | | | | | |

2005-A, 0.58% due 06/25/351 | | | 1,646,240 | | | | 1,580,516 | |

| Black Diamond CLO Ltd. | | | | | | | | |

2005-1A, 2.13% due 06/20/171,2 | | | 1,500,000 | | | | 1,467,600 | |

| California Republic Auto Receivables Trust | | | | | | | | |

| 2013-2, 1.23% due 03/15/19 | | | 1,436,292 | | | | 1,446,391 | |

| Cornerstone CLO Ltd. | | | | | | |

2007-1A, 0.45% due 07/15/211,2 | | | 1,000,000 | | | | 984,000 | |

| Newcastle CDO IX 1 Ltd. | | | | | | | | |

2007-9A, 0.41% due 05/25/521,2 | | | 541,083 | | | | 541,083 | |

| Cerberus Onshore II CLO LLC | | | | | | | | |

2014-1A, 2.93% due 10/15/231,2 | | | 500,000 | | | | 491,600 | |

| Gleneagles CLO Ltd. | | | | | | | | |

2005-1A, 0.50% due 11/01/171,2 | | | 271,156 | | | | 270,071 | |

| Total Asset Backed Securities | | | | | | | | |

| (Cost $43,860,100) | | | | | | | 44,256,895 | |

| | | | | | | | | |

COLLATERALIZED MORTGAGE OBLIGATIONS†† - 9.8% | |

| Morgan Stanley Reremic Trust | | | | | | | | |

2012-IO, 1.00% due 03/27/512 | | | 5,135,822 | | | | 5,135,822 | |

| Credit Suisse Mortgage Capital Certificates | | | | | | | | |

2006-TF2A, 0.35% due 10/15/211,2 | | | 3,000,000 | | | | 2,979,231 | |

| Boca Hotel Portfolio Trust | | | | | | | | |

2013-BOCA, 3.20% due 08/15/261,2 | | | 2,950,000 | | | | 2,958,428 | |

| Hilton USA Trust | | | | | | | | |

2013-HLF, 2.90% due 11/05/301,2 | | | 2,750,000 | | | | 2,762,103 | |

| COMM Mortgage Trust | | | | | | | | |

2007-FL14, 0.90% due 06/15/221,2 | | | 2,512,975 | | | | 2,480,225 | |

| Banc of America Large Loan Trust | | | | | | | | |

2007-BMB1, 1.25% due 08/15/291,2 | | | 1,937,000 | | | | 1,936,541 | |

| Wachovia Bank Commercial Mortgage Trust Series | | | | | | | | |

2007-WHL8, 0.23% due 06/15/201,2 | | | 1,795,515 | | | | 1,784,101 | |

| Banc of America Merrill Lynch Commercial Mortgage, Inc. | | | | | | | | |

2005-6, 6.33% due 09/10/471,2 | | | 1,507,900 | | | | 1,544,697 | |

| Resource Capital Corporation Ltd. | | | | | | | | |

2013-CRE1, 3.00% due 12/15/281,2 | | | 1,000,000 | | | | 1,013,021 | |

| COMM Mortgage Trust | | | | | | | | |

2006-FL12, 0.28% due 12/15/201,2 | | | 959,269 | | | | 956,091 | |

| SRERS Funding Ltd. | | | | | | | | |

2011-RS, 0.40% due 05/09/461,2 | | | 355,388 | | | | 333,745 | |

| Total Collateralized Mortgage Obligations | | | | | | | | |

| (Cost $23,709,676) | | | | | | | 23,884,005 | |

| | | | | | | | | |

CORPORATE BONDS†† - 2.3% | |

| TELECOMMUNICATION SERVICES - 0.9% | | | | | | | | |

| Level 3 Financing, Inc. | | | | | | | | |

3.82% due 01/15/181,2 | | | 2,000,000 | | | | 2,034,999 | |

| | | | | | | | | |

| FINANCIALS - 0.8% | | | | | | | | |

| Icahn Enterprises Limited Partnership / Icahn Enterprises Finance Corp. | | | | | | | | |

| 3.50% due 03/15/17 | | | 2,010,000 | | | | 2,032,613 | |

| | | | | | | | | |

| INDUSTRIALS - 0.6% | | | | | | | | |

| International Lease Finance Corp. | | | | | | | | |

2.18% due 06/15/161 | | | 1,430,000 | | | | 1,438,938 | |

| | | | | | | | | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $5,457,542) | | | | | | | 5,506,550 | |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 7 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | |

| MANAGED FUTURES STRATEGY FUND | |

| | | | | | |

| | | | | | | | | |

MUNICIPAL BONDS†† - 0.3% | |

| MICHIGAN - 0.3% | | | | | | | | |

| Michigan Finance Authority Revenue Notes | | | | | | | | |

| 4.37% due 08/20/14 | | $ | 675,000 | | | $ | 678,544 | |

| Total Municipal Bonds | | | | | | | | |

| (Cost $675,000) | | | | | | | 678,544 | |

| | | | | | | | | |

SENIOR FLOATING RATE INTERESTS†† - 0.2% | |

| CONSUMER DISCRETIONARY - 0.2% | | | | | | | | |

| Sears Holdings Corp. | | | | | | | | |

| 5.50% due 06/30/18 | | | 497,500 | | | | 502,654 | |

| Total Senior Floating Rate Interests | | | | | | | | |

| (Cost $493,288) | | | | | | | 502,654 | |

| | | | | | | | | |

REPURCHASE AGREEMENTS††,3 - 2.7% | |

HSBC Group

issued 06/30/14 at 0.03%

due 07/01/14 | | | 3,494,434 | | | | 3,494,434 | |

RBC Capital Markets

issued 06/30/14 at 0.03%

due 07/01/14 | | | 1,894,464 | | | | 1,894,464 | |

Deutsche Bank

issued 06/30/14 at 0.03%

due 07/01/14 | | | 903,741 | | | | 903,741 | |

Mizuho Financial Group, Inc.

issued 06/30/14 at 0.02%

due 07/01/14 | | | 280,589 | | | | 280,589 | |

| Total Repurchase Agreements | | | | | | | | |

| (Cost $6,573,228) | | | | | | | 6,573,228 | |

| | | | | | | | | |

| Total Investments - 89.0% | | | | | | | | |

| (Cost $215,864,865) | | | | | | $ | 216,793,563 | |

| Other Assets & Liabilities, net - 11.0% | | | | | | | 26,680,021 | |

| Total Net Assets - 100.0% | | | | | | $ | 243,473,584 | |

| | | | | | |

| | | | | | | | | |

COMMODITY FUTURES CONTRACTS PURCHASED† | |

August 2014 Live Cattle

Futures Contracts

(Aggregate Value of

Contracts $28,502,979) | | | 473 | | | $ | 2,415,101 | |

September 2014 Brent Crude

Futures Contracts

(Aggregate Value of

Contracts $16,146,720) | | | 144 | | | | 336,033 | |

August 2014 Lean Hogs

Futures Contracts

(Aggregate Value of

Contracts $6,747,510) | | | 127 | | | | 194,468 | |

August 2014 WTI Crude

Futures Contracts

(Aggregate Value of

Contracts $10,120,320) | | | 96 | | | | 175,365 | |

August 2014 Gold 100 oz.

Futures Contracts

(Aggregate Value of

Contracts $9,709,730) | | | 73 | | | | 163,936 | |

August 2014 LME Zinc

Futures Contracts

(Aggregate Value of

Contracts $3,431,468) | | | 62 | | | | 143,106 | |

August 2014 LME Nickel

Futures Contracts

(Aggregate Value of

Contracts $3,764,574) | | | 33 | | | | 133,625 | |

August 2014 New York Harbor

Ultra-Low Sulfur Diesel

Futures Contracts

(Aggregate Value of

Contracts $11,623,084) | | | 93 | | | | 77,269 | |

September 2014 Copper

Futures Contracts

(Aggregate Value of

Contracts $2,243,150) | | | 28 | | | | 14,151 | |

August 2014 Gasoline RBOB

Futures Contracts

(Aggregate Value of

Contracts $5,369,087) | | | 42 | | | | 1,502 | |

August 2014 LME Lead

Futures Contracts

(Aggregate Value of

Contracts $594,248) | | | 11 | | | | 1,199 | |

September 2014 Coffee ‘C’

Futures Contracts

(Aggregate Value of

Contracts $982,688) | | | 15 | | | | (6,367 | ) |

August 2014 Natural Gas

Futures Contracts

(Aggregate Value of

Contracts $1,739,790) | | | 39 | | | | (16,141 | ) |

November 2014 Soybean

Futures Contracts

(Aggregate Value of

Contracts $9,454,600) | | | 164 | | | | (657,626 | ) |

| (Total Aggregate Value of Contracts $110,429,948) | | | | | | $ | 2,975,621 | |

8 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | |

| MANAGED FUTURES STRATEGY FUND | |

| | | | | | |

| | | | | | | | | |

INTEREST RATE FUTURES CONTRACTS PURCHASED† | |

September 2014 Euro - Bund

Futures Contracts††

(Aggregate Value of

Contracts $60,817,635) | | | 302 | | | $ | 934,780 | |

September 2014 Euro - Bobl

Futures Contracts††

(Aggregate Value of

Contracts $103,005,299) | | | 587 | | | | 694,498 | |

September 2014 Australian Government

3 Year Bond

Futures Contracts††

(Aggregate Value of

Contracts $59,791,871) | | | 579 | | | | 157,092 | |

September 2014 Euro - Schatz

Futures Contracts††

(Aggregate Value of

Contracts $145,620,414) | | | 961 | | | | 49,289 | |

September 2014 Canadian Government

10 Year Bond

Futures Contracts††

(Aggregate Value of

Contracts $7,007,404) | | | 55 | | | | 15,113 | |

September 2014 U.S. Treasury Long Bond

Futures Contracts

(Aggregate Value of

Contracts $22,341,188) | | | 163 | | | | (18,401 | ) |

| (Total Aggregate Value of Contracts $398,583,811) | | | | | | $ | 1,832,371 | |

| | | | | | | | | |

CURRENCY FUTURES CONTRACTS PURCHASED† | |

September 2014 British Pound

Futures Contracts

(Aggregate Value of

Contracts $54,842,906) | | | 513 | | | $ | 1,085,885 | |

September 2014 Euro FX

Futures Contracts

(Aggregate Value of

Contracts $15,410,250) | | | 90 | | | | 187,646 | |

September 2014 Australian Dollar

Futures Contracts

(Aggregate Value of

Contracts $19,691,700) | | | 210 | | | | 124,026 | |

September 2014 Swiss Franc

Futures Contracts

(Aggregate Value of

Contracts $8,604,813) | | | 61 | | | | 49,912 | |

| (Total Aggregate Value of Contracts $98,549,669) | | | | | | $ | 1,447,469 | |

| | | | | | | | | |

EQUITY FUTURES CONTRACTS PURCHASED† | |

July 2014 MSCI Taiwan Stock Index

Futures Contracts

(Aggregate Value of

Contracts $31,301,153) | | | 944 | | | $ | 525,612 | |

September 2014 S&P MidCap 400 Index

Mini Futures Contracts

(Aggregate Value of

Contracts $24,323,600) | | | 170 | | | | 393,113 | |

September 2014 NASDAQ-100 Index

Mini Futures Contracts

(Aggregate Value of

Contracts $27,047,680) | | | 352 | | | | 369,817 | |

July 2014 Hang Seng Index

Futures Contracts††

(Aggregate Value of

Contracts $11,319,493) | | | 76 | | | | 191,338 | |

September 2014 SPI 200 Index

Futures Contracts††

(Aggregate Value of

Contracts $24,017,634) | | | 190 | | | | 168,875 | |

September 2014 S&P 500 Index

Mini Futures Contracts

(Aggregate Value of

Contracts $20,300,800) | | | 208 | | | | 105,071 | |

September 2014 Nikkei 225 (OSE) Index

Futures Contracts††

(Aggregate Value of

Contracts $7,328,085) | | | 49 | | | | 88,195 | |

September 2014 Topix Index

Futures Contracts††

(Aggregate Value of

Contracts $5,115,105) | | | 41 | | | | 63,574 | |

September 2014 Dow Jones Industrial

Average Index

Mini Futures Contracts

(Aggregate Value of

Contracts $10,714,880) | | | 128 | | | | (47,315 | ) |

July 2014 CAC40 10 Euro Index

Futures Contracts††

(Aggregate Value of

Contracts $3,753,447) | | | 62 | | | | (90,120 | ) |

July 2014 Amsterdam Index

Futures Contracts††

(Aggregate Value of

Contracts $15,151,256) | | | 134 | | | | (107,325 | ) |

September 2014 DAX Index

Futures Contracts††

(Aggregate Value of

Contracts $13,130,828) | | | 39 | | | | (126,840 | ) |

July 2014 IBEX 35 Index

Futures Contracts††

(Aggregate Value of

Contracts $25,258,227) | | | 170 | | | | (299,048 | ) |

| (Total Aggregate Value of Contracts $218,762,188) | | | | | | $ | 1,234,947 | |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 9 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(concluded) | |

| MANAGED FUTURES STRATEGY FUND | |

| | | | | | |

| | | | | | | | | |

COMMODITY FUTURES CONTRACTS SOLD SHORT† | |

September 2014 Wheat

Futures Contracts

(Aggregate Value of

Contracts $11,443,525) | | | 397 | | | $ | 501,557 | |

September 2014 Corn

Futures Contracts

(Aggregate Value of

Contracts $6,046,500) | | | 290 | | | | 360,831 | |

September 2014 Hard Red Winter Wheat

Futures Contracts

(Aggregate Value of

Contracts $5,071,375) | | | 145 | | | | 225,452 | |

December 2014 Cotton #2

Futures Contracts

(Aggregate Value of

Contracts $3,707,710) | | | 101 | | | | 118,068 | |

August 2014 Gas Oil

Futures Contracts

(Aggregate Value of

Contracts $3,394,750) | | | 37 | | | | (74,220 | ) |

October 2014 Sugar #11

Futures Contracts

(Aggregate Value of

Contracts $6,833,008) | | | 338 | | | | (123,071 | ) |

August 2014 LME Primary Aluminum

Futures Contracts

(Aggregate Value of

Contracts $11,556,465) | | | 246 | | | | (131,949 | ) |

September 2014 Silver

Futures Contracts

(Aggregate Value of

Contracts $1,692,400) | | | 16 | | | | (155,277 | ) |

| (Total Aggregate Value of Contracts $49,745,733) | | | | | | $ | 721,391 | |

| | | | | | | | | |

EQUITY FUTURES CONTRACTS SOLD SHORT† | |

September 2014 FTSE 100 Index

Futures Contracts††

(Aggregate Value of

Contracts $15,486,008) | | | 135 | | | $ | 83,464 | |

July 2014 H-Shares Index

Futures Contracts††

(Aggregate Value of

Contracts $2,900,160) | | | 44 | | | | (32,631 | ) |

September 2014 Russell 2000 Index

Mini Futures Contracts

(Aggregate Value of

Contracts $7,839,480) | | | 66 | | | | (130,342 | ) |

| (Total Aggregate Value of Contracts $26,225,648) | | | | | | $ | (79,509 | ) |

| | | | | | | | | |

INTEREST RATE FUTURES CONTRACTS SOLD SHORT† | |

September 2014 U.S. Treasury

Ultra Long Bond

Futures Contracts

(Aggregate Value of

Contracts $598,500) | | | 4 | | | $ | 1,244 | |

September 2014 Australian Government

10 Year Bond

Futures Contracts††

(Aggregate Value of

Contracts $4,315,470) | | | 38 | | | | (51,796 | ) |

September 2014 Long Gilt

Futures Contracts††

(Aggregate Value of

Contracts $14,481,404) | | | 77 | | | | (57,789 | ) |

September 2014 U.S. Treasury 10 Year Note

Futures Contracts

(Aggregate Value of

Contracts $9,010,125) | | | 72 | | | | (59,677 | ) |

September 2014 U.S. Treasury 5 Year Note

Futures Contracts

(Aggregate Value of

Contracts $30,814,875) | | | 258 | | | | (124,847 | ) |

| (Total Aggregate Value of Contracts $59,220,374) | | | | | | $ | (292,865 | ) |

| | | | | | | | | |

CURRENCY FUTURES CONTRACTS SOLD SHORT† | |

September 2014 Canadian Dollar

Futures Contracts

(Aggregate Value of

Contracts $4,771,050) | | | 51 | | | $ | (101,588 | ) |

September 2014 Japanese Yen

Futures Contracts

(Aggregate Value of

Contracts $29,384,075) | | | 238 | | | | (298,545 | ) |

| (Total Aggregate Value of Contracts $34,155,125) | | | | | | $ | (400,133 | ) |

| † | Value determined based on Level 1 inputs, unless otherwise noted — See Note 4. |

| †† | Value determined based on Level 2 inputs — See Note 4. |

| 1 | Variable rate security. Rate indicated is rate effective at June 30, 2014. |

| 2 | Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2) securities is $62,138,058 (cost $61,728,682), or 25.5% of total net assets. |

| 3 | Repurchase Agreements — See Note 5. |

| 4 | Investment in a product that pays a management fee to a party related to the Advisor. |

| 5 | Affiliated issuer — See Note 10. |

| 6 | Investment in a product that is related to the Advisor. |

10 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| MANAGED FUTURES STRATEGY FUND | |

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

| June 30, 2014 |

| Assets: | |

| Investments in unaffiliated issuers, at value (cost $103,950,572) | | $ | 104,936,512 | |

| Investments in affiliated issuers, at value (cost $105,341,065) | | | 105,283,823 | |

| Repurchase agreements, at value (cost $6,573,228) | | | 6,573,228 | |

| Total investments (cost $215,864,865) | | | 216,793,563 | |

| Segregated cash with broker | | | 27,322,489 | |

| Receivables: | |

| Variation margin | | | 1,395,639 | |

| Securities sold | | | 325,158 | |

| Fund shares sold | | | 199,744 | |

| Interest | | | 153,206 | |

| Dividends | | | 137,194 | |

| Securities lending income | | | 2,727 | |

| Total assets | | | 246,329,720 | |

| Liabilities: | |

| Segregated cash from broker | | | 1,536,205 | |

| Due to broker | | | 328,377 | |

| Payable for: | |

| Fund shares redeemed | | | 585,552 | |

| Management fees | | | 166,145 | |

| Distribution and service fees | | | 62,154 | |

| Transfer agent and administrative fees | | | 48,418 | |

| Portfolio accounting fees | | | 19,385 | |

| Miscellaneous | | | 109,900 | |

| Total liabilities | | | 2,856,136 | |

| Net assets | | $ | 243,473,584 | |

| Net assets consist of: | |

| Paid in capital | | $ | 329,940,836 | |

| Accumulated net investment loss | | | (2,002,278 | ) |

| Accumulated net realized loss on investments | | | (92,830,890 | ) |

| Net unrealized appreciation on investments | | | 8,365,916 | |

| Net assets | | $ | 243,473,584 | |

| A-Class: | |

| Net assets | | $ | 64,487,517 | |

| Capital shares outstanding | | | 2,976,375 | |

| Net asset value per share | | $ | 21.67 | |

| Maximum offering price per share (Net asset value divided by 95.25%) | | $ | 22.75 | |

| C-Class: | |

| Net assets | | $ | 23,715,635 | |

| Capital shares outstanding | | | 1,156,777 | |

| Net asset value per share | | $ | 20.50 | |

| H-Class: | |

| Net assets | | $ | 152,621,552 | |

| Capital shares outstanding | | | 7,043,778 | |

| Net asset value per share | | $ | 21.67 | |

| Institutional Class: | |

| Net assets | | $ | 1,945,659 | |

| Capital shares outstanding | | | 88,827 | |

| Net asset value per share | | $ | 21.90 | |

| Y-Class: | |

| Net assets | | $ | 703,221 | |

| Capital shares outstanding | | | 32,039 | |

| Net asset value per share | | $ | 21.95 | |

CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited) |

| Period Ended June 30, 2014 |

| Investment Income: | |

| Interest | | $ | 1,455,689 | |

| Dividends from securities of affiliated issuers | | | 381,964 | |

| Dividends from securities of unaffiliated issuers | | | 361,237 | |

| Income from securities lending, net | | | 15,377 | |

| Total investment income | | | 2,214,267 | |

| | | | | |

| Expenses: | |

| Management fees | | | 1,239,194 | |

| Transfer agent and administrative fees: | |

| A-Class | | | 84,649 | |

| C-Class | | | 32,124 | |

| H-Class | | | 204,312 | |

| Institutional Class | | | 2,637 | |

| Y-Class | | | 1,894 | |

| Distribution and service fees: | |

| A-Class | | | 84,649 | |

| C-Class | | | 128,494 | |

| H-Class | | | 204,312 | |

| Portfolio accounting fees | | | 128,600 | |

| Registration fees | | | 192,872 | |

| Trustees’ fees* | | | 18,097 | |

| Custodian fees | | | 15,605 | |

| Line of credit interest expense | | | 59 | |

| Miscellaneous | | | 19,975 | |

| Total expenses | | | 2,357,473 | |

| Less: | |

| Expenses waived by Advisor | | | (93,123 | ) |

| Net expenses | | | 2,264,350 | |

| Net investment loss | | | (50,083 | ) |

| | | | | |

| Net Realized and Unrealized Gain (Loss): | |

| Net realized gain (loss) on: | |

| Investments in unaffiliated issuers | | | 228,982 | |

| Investments in affiliated issuers | | | (5,606 | ) |

| Futures contracts | | | 1,062,577 | |

| Foreign currency | | | 10,744 | |

| Net realized gain | | | 1,296,697 | |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments in unaffiliated issuers | | | 243,900 | |

| Investments in affiliated issuers | | | (57,242 | ) |

| Futures contracts | | | (9,471,876 | ) |

| Foreign currency | | | 1,850 | |

| Net change in unrealized appreciation (depreciation) | | | (9,283,368 | ) |

| Net realized and unrealized loss | | | (7,986,671 | ) |

| Net decrease in net assets resulting from operations | | $ | (8,036,754 | ) |

| * | Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act. |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 11 |

| MANAGED FUTURES STRATEGY FUND |

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| | Period Ended June 30, 2014 (Unaudited) | | | Year Ended December 31, 2013 | |

| Increase (Decrease) in Net Assets from Operations: | | | | | | |

| Net investment loss | | $ | (50,083 | ) | | $ | (4,739,010 | ) |

| Net realized gain on investments | | | 1,296,697 | | | | 22,680,010 | |

Net change in unrealized appreciation (depreciation) on investments | | | (9,283,368 | ) | | | (1,032,281 | ) |

Net increase (decrease) in net assets resulting from operations | | | (8,036,754 | ) | | | 16,908,719 | |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from sale of shares | | | | | | | | |

| A-Class | | | 4,113,511 | | | | 20,047,163 | |

| C-Class | | | 1,084,452 | | | | 2,300,319 | |

| H-Class | | | 15,208,289 | | | | 76,683,285 | |

| Institutional Class | | | 89,280 | | | | 6,003,352 | |

| Y-Class | | | — | | | | 574,534 | |

| Cost of shares redeemed | | | | | | | | |

| A-Class | | | (14,617,650 | ) | | | (93,084,788 | ) |

| C-Class | | | (6,123,814 | ) | | | (23,140,295 | ) |

| H-Class | | | (48,904,441 | ) | | | (396,805,134 | ) |

| Institutional Class | | | (543,780 | ) | | | (49,563,256 | ) |

| | | (2,221,841 | ) | | | (99,821,495 | ) |

Net decrease from capital share transactions | | | (51,915,994 | ) | | | (556,806,315 | ) |

| Net decrease in net assets | | | (59,952,748 | ) | | | (539,897,596 | ) |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| | | 303,426,332 | | | | 843,323,928 | |

| | $ | 243,473,584 | | | $ | 303,426,332 | |

Accumulated net investment loss at end of period | | $ | (2,002,278 | ) | | $ | (1,952,195 | ) |

| | | | | | | | | |

| Capital share activity: | | | | | | | | |

| Shares sold | | | | | | | | |

| A-Class | | | 195,379 | | | | 936,557 | |

| C-Class | | | 53,593 | | | | 112,657 | |

| H-Class | | | 719,286 | | | | 3,578,841 | |

| Institutional Class | | | 4,147 | | | | 277,573 | |

| Y-Class | | | — | | | | 26,784 | |

| Shares redeemed | | | | | | | | |

| A-Class | | | (691,144 | ) | | | (4,339,454 | ) |

| C-Class | | | (305,691 | ) | | | (1,134,434 | ) |

| H-Class | | | (2,317,019 | ) | | | (18,541,767 | ) |

| Institutional Class | | | (25,487 | ) | | | (2,304,762 | ) |

| | | (103,055 | ) | | | (4,618,693 | ) |

| | | (2,469,991 | ) | | | (26,006,698 | ) |

12 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| MANAGED FUTURES STRATEGY FUND | |

CONSOLIDATED FINANCIAL HIGHLIGHTS |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | Period Ended June 30, 2014a | | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | | | Year Ended December 31, 2011 | | | Year Ended December 31, 2010 | | | Year Ended December 31, 2009 | |

| Per Share Data | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 22.15 | | | $ | 21.23 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)b | | | — | c | | | (.19 | ) | | | (.39 | ) | | | (.44 | ) | | | (.41 | ) | | | (.39 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | (.48 | ) | | | 1.11 | | | | (2.33 | ) | | | (1.39 | ) | | | (.62 | ) | | | (.84 | ) |

Total from investment operations | | | (.48 | ) | | | .92 | | | | (2.72 | ) | | | (1.83 | ) | | | (1.03 | ) | | | (1.23 | ) |

Redemption fees collected | | | — | | | | — | | | | — | | | | — | | | | — | d | | | — | d |

| Net asset value, end of period | | $ | 21.67 | | | $ | 22.15 | | | $ | 21.23 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | |

| |

| | | (2.21 | %) | | | 4.33 | % | | | (11.32 | %) | | | (7.14 | %) | | | (3.84 | %) | | | (4.39 | %) |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 64,488 | | | $ | 76,900 | | | $ | 145,950 | | | $ | 733,469 | | | $ | 657,317 | | | $ | 636,083 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.04 | % | | | (0.89 | %) | | | (1.71 | %) | | | (1.76 | %) | | | (1.66 | %) | | | (1.42 | %) |

Total expensesf | | | 1.74 | % | | | 1.74 | % | | | 1.96 | % | | | 2.05 | % | | | 2.04 | % | | | 2.16 | % |

| | | 1.67 | % | | | 1.67 | % | | | 1.89 | % | | | 1.97 | % | | | 1.97 | % | | | 2.05 | % |

| Portfolio turnover rate | | | 48 | % | | | 102 | % | | | 172 | % | | | 72 | % | | | 148 | % | | | 125 | % |

| | Period Ended June 30, 2014a | | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | | | Year Ended December 31, 2011 | | | Year Ended December 31, 2010 | | | Year Ended December 31, 2009 | |

| Per Share Data | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 21.04 | | | $ | 20.31 | | | $ | 23.09 | | | $ | 25.04 | | | $ | 26.24 | | | $ | 27.65 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)b | | | (.07 | ) | | | (.33 | ) | | | (.53 | ) | | | (.61 | ) | | | (.59 | ) | | | (.58 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | (.47 | ) | | | 1.06 | | | | (2.25 | ) | | | (1.34 | ) | | | (.61 | ) | | | (.83 | ) |

Total from investment operations | | | (.54 | ) | | | .73 | | | | (2.78 | ) | | | (1.95 | ) | | | (1.20 | ) | | | (1.41 | ) |

Redemption fees collected | | | — | | | | — | | | | — | | | | — | | | | — | d | | | — | d |

| Net asset value, end of period | | $ | 20.50 | | | $ | 21.04 | | | $ | 20.31 | | | $ | 23.09 | | | $ | 25.04 | | | $ | 26.24 | |

| |

| | | (2.57 | %) | | | 3.59 | % | | | (12.04 | %) | | | (7.79 | %) | | | (4.57 | %) | | | (5.10 | %) |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 23,716 | | | $ | 29,637 | | | $ | 49,378 | | | $ | 96,647 | | | $ | 158,628 | | | $ | 225,416 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.72 | %) | | | (1.63 | %) | | | (2.45 | %) | | | (2.50 | %) | | | (2.41 | %) | | | (2.17 | %) |

Total expensesf | | | 2.49 | % | | | 2.48 | % | | | 2.70 | % | | | 2.80 | % | | | 2.79 | % | | | 2.92 | % |

| | | 2.42 | % | | | 2.42 | % | | | 2.64 | % | | | 2.72 | % | | | 2.72 | % | | | 2.81 | % |

| Portfolio turnover rate | | | 48 | % | | | 102 | % | | | 172 | % | | | 72 | % | | | 148 | % | | | 125 | % |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 13 |

| MANAGED FUTURES STRATEGY FUND | |

CONSOLIDATED FINANCIAL HIGHLIGHTS (continued) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | Period Ended June 30, 2014a | | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | | | Year Ended December 31, 2011 | | | Year Ended December 31, 2010 | | | Year Ended December 31, 2009 | |

| Per Share Data | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 22.15 | | | $ | 21.23 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | | | $ | 28.04 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)b | | | — | c | | | (.20 | ) | | | (.38 | ) | | | (.44 | ) | | | (.42 | ) | | | (.38 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | (.48 | ) | | | 1.12 | | | | (2.34 | ) | | | (1.39 | ) | | | (.61 | ) | | | (.85 | ) |

Total from investment operations | | | (.48 | ) | | | .92 | | | | (2.72 | ) | | | (1.83 | ) | | | (1.03 | ) | | | (1.23 | ) |

Redemption fees collected | | | — | | | | — | | | | — | | | | — | | | | — | d | | | — | d |

| Net asset value, end of period | | $ | 21.67 | | | $ | 22.15 | | | $ | 21.23 | | | $ | 23.95 | | | $ | 25.78 | | | $ | 26.81 | |

| |

| | | (2.17 | %) | | | 4.33 | % | | | (11.32 | %) | | | (7.14 | %) | | | (3.84 | %) | | | (4.39 | %) |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 152,622 | | | $ | 191,400 | | | $ | 501,109 | | | $ | 1,059,988 | | | $ | 1,199,718 | | | $ | 1,468,770 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.03 | % | | | (0.94 | %) | | | (1.70 | %) | | | (1.75 | %) | | | (1.66 | %) | | | (1.41 | %) |

Total expensesf | | | 1.74 | % | | | 1.75 | % | | | 1.95 | % | | | 2.05 | % | | | 2.04 | % | | | 2.16 | % |

| | | 1.67 | % | | | 1.68 | % | | | 1.89 | % | | | 1.97 | % | | | 1.97 | % | | | 2.05 | % |

| Portfolio turnover rate | | | 48 | % | | | 102 | % | | | 172 | % | | | 72 | % | | | 148 | % | | | 125 | % |

| | Period Ended June 30, 2014a | | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | | | Year Ended December 31, 2011 | | | Period Ended December 31, 2010h | |

| Per Share Data | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 22.36 | | | $ | 21.38 | | | $ | 24.06 | | | $ | 25.84 | | | $ | 25.58 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)b | | | .04 | | | | (.19 | ) | | | (.33 | ) | | | (.38 | ) | | | (.23 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | (.50 | ) | | | 1.17 | | | | (2.35 | ) | | | (1.40 | ) | | | .49 | |

Total from investment operations | | | (.46 | ) | | | .98 | | | | (2.68 | ) | | | (1.78 | ) | | | .26 | |

Redemption fees collected | | | — | | | | — | | | | — | | | | — | | | | — | d |

| Net asset value, end of period | | $ | 21.90 | | | $ | 22.36 | | | $ | 21.38 | | | $ | 24.06 | | | $ | 25.84 | |

| |

| | | (2.10 | %) | | | 4.63 | % | | | (11.14 | %) | | | (6.85 | %) | | | 0.98 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 1,946 | | | $ | 2,464 | | | $ | 45,700 | | | $ | 101,549 | | | $ | 134,733 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.35 | % | | | (0.86 | %) | | | (1.45 | %) | | | (1.50 | %) | | | (1.41 | %) |

Total expensesf | | | 1.41 | % | | | 1.52 | % | | | 1.70 | % | | | 1.80 | % | | | 1.78 | % |

| | | 1.34 | % | | | 1.45 | % | | | 1.64 | % | | | 1.72 | % | | | 1.72 | % |

| Portfolio turnover rate | | | 48 | % | | | 102 | % | | | 172 | % | | | 72 | % | | | 148 | % |

14 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| MANAGED FUTURES STRATEGY FUND | |

CONSOLIDATED FINANCIAL HIGHLIGHTS (concluded) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | Period Ended June 30, 2014a | | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | | | Year Ended December 31, 2011 | | | Period Ended December 31, 2010i | |

| Per Share Data | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 22.40 | | | $ | 21.41 | | | $ | 24.07 | | | $ | 25.84 | | | $ | 25.74 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)b | | | .03 | | | | (.21 | ) | | | (.32 | ) | | | (.37 | ) | | | (.26 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | (.48 | ) | | | 1.20 | | | | (2.34 | ) | | | (1.40 | ) | | | .36 | |

Total from investment operations | | | (.45 | ) | | | .99 | | | | (2.66 | ) | | | (1.77 | ) | | | .10 | |

Redemption fees collected | | | — | | | | — | | | | — | | | | — | | | | — | d |

| Net asset value, end of period | | $ | 21.95 | | | $ | 22.40 | | | $ | 21.41 | | | $ | 24.07 | | | $ | 25.84 | |

| |

| | | (2.01 | %) | | | 4.62 | % | | | (11.05 | %) | | | (6.85 | %) | | | 0.39 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 703 | | | $ | 3,026 | | | $ | 101,187 | | | $ | 404,684 | | | $ | 189,251 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.31 | % | | | (0.96 | %) | | | (1.41 | %) | | | (1.47 | %) | | | (1.36 | %) |

Total expensesf | | | 1.35 | % | | | 1.51 | % | | | 1.65 | % | | | 1.75 | % | | | 1.73 | % |

| | | 1.29 | % | | | 1.44 | % | | | 1.59 | % | | | 1.68 | % | | | 1.67 | % |

| Portfolio turnover rate | | | 48 | % | | | 102 | % | | | 172 | % | | | 72 | % | | | 148 | % |

| a | Unaudited figures for the period ended June 30, 2014. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| b | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

| c | Net investment income (loss) is less than $0.01 per share. |

| d | Redemption fees collected are less than $0.01 per share. |

| e | Total return does not reflect the impact of any applicable sales charges and has not been annualized. |

| f | Does not include expenses of the underlying funds in which the Fund invests. |

| g | Net expense information reflects the expense ratios after expense waivers. |

| h | Since commencement of operations: May 3, 2010. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| i | Since commencement of operations: March 29, 2010. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 15 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) |

1. Organization, Consolidation of Subsidiary and Significant Accounting Policies

Organization

Rydex Series Funds (the “Trust”), a Delaware business trust, is registered with the SEC under the Investment Company Act of 1940 (”1940 Act”), as a non-diversified, open-ended investment company of the series type. Each series, in effect, is representing a separate Fund. The Trust is authorized to issue an unlimited number of no par value shares. The Trust accounts for the assets of each Fund separately.

The Trust offers a combination of eight separate classes of shares: Investor Class shares, Advisor Class shares, A-Class shares, C-Class shares, H-Class shares, Y-Class shares, Institutional Class shares and Money Market Class shares. Sales of shares of each Class are made without a front-end sales charge at the net asset value per share (“NAV”), with the exception of A-Class shares. A-Class shares are sold at the NAV, plus the applicable front-end sales charge. The sales charge varies depending on the amount purchased, but will not exceed 4.75%. A-Class share purchases of $1 million or more are exempt from the front-end sales charge but have a 1% contingent deferred sales charge (“CDSC”) if shares are redeemed within 12 months of purchase. C-Class shares have a 1% CDSC if shares are redeemed within 12 months of purchase. Institutional Class shares are offered primarily for direct investment by institutions such as pension and profit sharing plans, endowments, foundations and corporations. Institutional Class shares have a minimum initial investment of $2 million and a minimum account balance of $1 million. Institutional Class shares are offered without a front-end sales charge or CDSC. At June 30, 2014, the Trust consisted of fifty-one Funds.

This report covers the Managed Futures Strategy Fund (the “Fund”).

Guggenheim Investments (“GI”) provides advisory services, and Rydex Fund Services, LLC (“RFS”) provides transfer agent, administrative and accounting services to the Trust. Guggenheim Funds Distributors, LLC (“GFD”) acts as principal underwriter for the Trust. GI, RFS and GFD are affiliated entities.

Consolidation of Subsidiary

The consolidated financial statements of the Fund include the accounts of a wholly-owned and controlled Cayman Islands subsidiary (the “Subsidiary”). Significant inter-company accounts and transactions have been eliminated in consolidation for the Fund.

The Fund may invest up to 25% of its total assets in its Subsidiary which acts as an investment vehicle in order to effect certain investments consistent with the Fund’s investment objectives and policies.

A summary of the Fund’s investment in its Subsidiary is as follows:

| Inception Date of Subsidiary | Subsidiary Net Assets at June 30, 2014 | % of Net

Assets of the

Fund at June 30, 2014 |

| Managed Futures Strategy Fund | 05/01/08 | $13,542,524 | 5.6% |

Significant Accounting Policies

The following significant accounting policies are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) and are consistently followed by the Trust. This requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. All time references are based on Eastern Time.

The NAV of a fund is calculated by dividing the market value of the fund’s securities and other assets, less all liabilities, by the number of outstanding shares of the fund.

A. Valuations of the Fund’s securities are supplied primarily by pricing services approved by the Board of Trustees. A Valuation Committee is responsible for the oversight of the valuation process of the Fund and convenes monthly, or more frequently as needed. The Valuation Committee will review the valuation of all assets which have been fair valued for reasonableness. The Trust’s officers, through the Valuation Committee under the general supervision of the Board of Trustees, regularly review procedures used by, and valuations provided by, the pricing services.

Open-end investment companies (“Mutual Funds”) are valued at their NAV as of the close of business, on the valuation date. Exchange-traded funds (“ETFs”) are valued at the last quoted sales price.

Debt securities with a maturity of greater than 60 days at acquisition are valued at prices that reflect broker/dealer supplied valuations or are obtained from

16 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)(continued) |

independent pricing services, which may consider the trade activity, treasury spreads, yields or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Short-term debt securities with a maturity of 60 days or less at acquisition are valued at amortized cost, which approximates market value.

Repurchase agreements are valued at amortized cost, which approximates market value.

Typically loans are valued using information provided by an independent third party pricing service which uses broker quotes in a non-active market. If the pricing service cannot or does not provide a valuation for a particular loan or such valuation is deemed unreliable, such loan is fair valued by the Valuation Committee.

The value of futures contracts is accounted for using the unrealized gain or loss on the contracts that is determined by marking the contracts to their current realized settlement prices. Financial futures contracts are valued at the 4:00 p.m. price on the valuation date. In the event that the exchange for a specific futures contract closes earlier than 4:00 p.m., the futures contract is valued at the Official Settlement Price of the exchange. However, the underlying securities from which the futures contract value is derived are monitored until 4:00 p.m. to determine if fair valuation would provide a more accurate valuation.

Investments for which market quotations are not readily available are fair valued as determined in good faith by GI under the direction of the Board of Trustees using methods established or ratified by the Board of Trustees. Valuations in accordance with these methods are intended to reflect each security’s (or asset’s) “fair value.” Each such determination is based on a consideration of all relevant factors, which are likely to vary from one pricing context to another. Examples of such factors may include, but are not limited to: (i) the type of security, (ii) the initial cost of the security, (iii) the existence of any contractual restrictions on the security’s disposition, (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies, (v) quotations or evaluated prices from broker-dealers and/or pricing services, (vi) information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), (vii) an analysis of the company’s financial statements, and (viii) an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold (e.g. the existence of pending merger activity, public offerings or tender offers that might affect the value of the security).

In connection with futures contracts and other derivative investments, obtaining information as to how (a) these contracts and other derivative investments trade in the futures or other derivative markets, respectively, and (b) the securities underlying these contracts and other derivative investments trade in the cash market.

B. Senior loans in which the Fund invests generally pay interest rates which are periodically adjusted by reference to a base short-term, floating rate plus a premium. These base lending rates are generally (i) the lending rate offered by one or more major European banks, such as the London Inter-Bank Offered Rate (LIBOR), (ii) the prime rate offered by one or more major United States banks, or (iii) the bank’s certificate of deposit rate. Senior floating rate interests often require prepayments from excess cash flows or permit the borrower to repay at its election. The rate at which the borrower repays cannot be predicted with accuracy. As a result, the actual remaining maturity may be substantially less than the stated maturities shown. The interest rate indicated is the rate in effect at June 30, 2014.

C. The Fund may purchase and sell interests in securities on a when-issued and delayed delivery basis, with payment and delivery scheduled for a future date. No income accrues to the Fund on such interests or securities in connection with such transactions prior to the date the Fund actually takes delivery of such interests or securities. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Although the Fund will generally purchase these securities with the intention of acquiring such securities, the Fund may sell such securities before the settlement date.

D. Upon entering into a futures contract, the Fund deposits and maintains as collateral such initial margin as required by the exchange on which the transaction is affected. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in value of the contract. Such receipts or payments are known as variation margin and are recorded by the Fund as unrealized gains or losses. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 17 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)(continued) |

E. Security transactions are recorded on the trade date for financial reporting purposes. Realized gains and losses from securities transactions are recorded using the identified cost basis. Proceeds from lawsuits related to investment holdings are recorded as realized gains in the Fund. Dividend income is recorded on the ex-dividend date, net of applicable taxes withheld by foreign countries. Taxable non-cash dividends are recorded as dividend income. Interest income, including amortization of premiums and accretion of discounts, is accrued on a daily basis. Distributions received from investments in REITs are recorded as dividend income on the ex-dividend date, subject to reclassification upon notice of the character of such distribution by the issuer.

F. Distributions of net investment income and net realized gains, if any, are declared and paid at least annually. Dividends are reinvested in additional shares unless shareholders request payment in cash. Distributions are recorded on the ex-dividend date and are determined in accordance with income tax regulations which may differ from U.S. GAAP.

G. Interest and dividend income, most expenses, all realized gains and losses, and all unrealized gains and losses are allocated to the classes based upon the value of the outstanding shares in each class. Certain costs, such as distribution and service fees are charged directly to specific classes. In addition, certain expenses have been allocated to the individual Funds in the Trust on a pro rata basis upon the respective aggregate net assets of each Fund included in the Trust.

H. The Fund may leave cash overnight in its cash account with the custodian. Periodically, the Fund may have cash due to the custodian bank as an overdraft balance. A fee is incurred on this overdraft, calculated by multiplying the overdraft by a rate based on the federal funds rate.

I. Under the Fund’s organizational documents, its Trustees and Officers are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, throughout the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

2. Financial Instruments

As part of its investment strategy, the Fund utilizes a variety of derivative instruments. These investments involve, to varying degrees, elements of market risk and risks in excess of the amounts recognized in the Statement of Assets and Liabilities.

A futures contract is an agreement to purchase (long) or sell (short) an agreed amount of securities or other instruments at a set price for delivery at a future date. There are significant risks associated with a Fund’s use of futures contracts, including (i) there may be an imperfect or no correlation between the changes in market value of the underlying asset and the prices of futures contracts; (ii) there may not be a liquid secondary market for a futures contract; (iii) trading restrictions or limitations may be imposed by an exchange; and (iv) government regulations may restrict trading in futures contracts. When investing in futures, there is minimal counterparty credit risk to the Fund because futures are exchange-traded and the exchange’s clearinghouse, as counterparty to all exchange-traded futures, guarantees against default. Cash deposits are shown as restricted cash on the Statement of Assets and Liabilities; securities held as collateral are noted on the Schedule of Investments.

The Fund uses derivative instruments to achieve leveraged exposure to its underlying index. Since the Fund’s investment strategy involves consistently applied leverage, the value of the Fund’s shares will tend to increase or decrease more than the value of any increase or decrease in the underlying index. In addition, as investment in derivative instruments generally requires a small investment relative to the amount of investment exposure assumed, this creates an opportunity for increased net income but, at the same time, additional leverage risk. The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile and riskier than if the Fund had not been leveraged.

In conjunction with the use of derivative instruments, the Fund is required to maintain collateral in various forms. The Fund uses, where appropriate, depending on the financial instrument utilized and the broker involved, margin deposits at the broker, cash and/or securities segregated at the custodian bank, discount notes or the repurchase agreements allocated to the Fund.

18 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)(continued) |

The Trust has established counterparty credit guidelines and enters into transactions only with financial institutions of investment grade or better. The Trust monitors the counterparty credit risk.

3. Fees and Other Transactions with Affiliates

Under the terms of an investment advisory contract, the Fund pays GI investment advisory fees calculated at an annualized rate of 0.90% of the average daily net assets.

RFS provides transfer agent and administrative services to the Fund calculated at an annualized rate of 0.20% of the average daily net assets of Y-Class and 0.25% of the average daily net assets of the remaining classes, respectively.

RFS also provides accounting services to the Fund for fees calculated at annualized rates below, based on the average daily net assets of the Fund.

| |

| On the first $250 million | 0.10% |

| On the next $250 million | 0.075% |

| On the next $250 million | 0.05% |

| Over $750 million | 0.03% |

RFS engages external service providers to perform other necessary services for the Trust, such as audit and accounting related services, legal services, custody, printing and mailing, etc., on a pass-through basis. Such expenses are allocated to various Funds within the complex based on relative net assets.

The Trust has adopted a Distribution Plan applicable to A-Class shares and H-Class shares for which GFD and other firms that provide distribution and/or shareholder services (“Service Providers”) may receive compensation. If a Service Provider provides distribution services, the Fund will pay distribution fees to GFD at an annual rate not to exceed 0.25% of average daily net assets, pursuant to Rule 12b-1 of the 1940 Act. GFD, in turn, will pay the Service Provider out of its fees. GFD may, at its discretion, retain a portion of such payments to compensate itself for distribution services.

The Trust has adopted a separate Distribution and Shareholder Services Plan applicable to its C-Class shares that allows the Fund to pay annual distribution and service fees of 1.00% of the Fund’s C-Class shares average daily net assets. The annual 0.25% service fee compensates the shareholder’s financial advisor for providing ongoing services to the shareholder. The annual distribution fee of 0.75% reimburses GFD for paying the shareholder’s financial advisor an ongoing sales commission. GFD advances the first year’s service and distribution fees to the financial advisor. GFD retains the service and distribution fees on accounts with no authorized dealer of record.

GI has contractually agreed to waive the management fee it receives from the Subsidiary in an amount equal to the management fee paid to GI by the Subsidiary. This undertaking will continue in effect for so long as the Fund invests in the Subsidiary, and may not be terminated by GI unless GI obtains the prior approval of the Fund’s Board of Trustees for such termination.

For the period ended June 30, 2014, GFD retained sales charges of $193,365 relating to sales of A-Class shares of the Trust.

On February 19, 2014, GI voluntarily made a capital contribution of $1,781 to the Managed Futures Strategy Fund for losses incurred during fund trading.

Certain trustees and officers of the Trust are also officers of GI, RFS and GFD.

4. Fair Value Measurement

In accordance with U.S. GAAP, fair value is defined as the price that the Fund would receive to sell an investment or pay to transfer a liability in an orderly transaction with an independent buyer in the principal market, or in the absence of a principal market, the most advantageous market for the investment or liability. U.S. GAAP establishes a three-tier fair value hierarchy based on the types of inputs used to value assets and liabilities and requires corresponding disclosure. The hierarchy and the corresponding inputs are summarized below:

| Level 1 | — | quoted prices in active markets for identical assets or liabilities. |

| Level 2 | — | significant other observable inputs (for example quoted prices for securities that are similar based on characteristics such as interest rates, prepayment speeds, credit risk, etc.). |

| Level 3 | — | significant unobservable inputs based on the best information available under the circumstances, to the extent observable inputs are not available, which may include assumptions. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 19 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)(continued) |

The types of inputs available depend on a variety of factors, such as the type of security and the characteristics of the markets in which it trades, if any. Fair valuation determinations that rely on fewer or no observable inputs require greater judgment. Accordingly, fair value determinations for Level 3 securities require the greatest amount of judgment.

The following table summarizes the inputs used to value the Fund’s net assets at June 30, 2014:

| | Level 1 Investments In Securities | | | Level 1 Other Financial Instruments* | | | Level 2 Investments In Securities | | | Level 2 Other Financial Instruments* | | | Level 3 Investments In Securities | | | | |

| Assets | | | | | | | | | | | | | | | | | | |

| Managed Futures Strategy Fund | | $ | 135,391,687 | | | $ | 7,703,989 | | | $ | 81,401,876 | | | $ | 2,446,218 | | | $ | — | | | $ | 226,943,770 | |

| |

| Liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

| Managed Futures Strategy Fund | | $ | — | | | $ | 1,945,366 | | | $ | — | | | $ | 765,549 | | | $ | — | | | $ | 2,710,915 | |

| * | Other financial instruments may include futures contracts which are reported as unrealized gain/loss at period end. |

Independent pricing services are used to value a majority of the Fund’s investments. When values are not available from a pricing service, they may be computed by the Fund’s investment adviser or an affiliate. In any event, values may be determined using a variety of sources and techniques, including: market prices; broker quotes; and models which derive prices based on inputs such as prices of securities with comparable maturities and characteristics or based on inputs such as anticipated cash flows or collateral, spread over Treasuries, and other information and analysis. A significant portion of the Fund’s assets and liabilities are categorized as Level 2 or Level 3, as indicated in this report.

Indicative quotes from broker-dealers, adjusted for fluctuations in criteria such as credit spreads and interest rates, may be also used to value the Fund’s assets and liabilities, i.e. prices provided by a broker-dealer or other market participant who has not committed to trade at that price. Although indicative quotes are typically received from established market participants, the Fund may not have the transparency to view the underlying inputs which support the market quotations. Significant changes in an indicative quote would generally result in significant changes in the fair value of the security.

Certain fixed income securities are valued by obtaining a monthly indicative quote from a broker-dealer, adjusted for fluctuations in criteria such as credit spreads and interest rates. The Fund’s fair valuation guidelines were recently revised to transition such monthly indicative quoted securities from Level 2 to Level 3.

For the period ended June 30, 2014, there were no transfers between levels.

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The suitability of the techniques and sources employed to determine fair valuation are regularly monitored and subject to change.

5. Repurchase Agreements

The Funds transfer uninvested cash balances into a single joint account, the daily aggregate balance of which is invested in one or more repurchase agreements collateralized by obligations of the U.S. Treasury and U.S. Government Agencies. The collateral is in the possession of the Funds’ custodian and is evaluated to ensure that its market value exceeds, at a minimum, 102% of the original face amount of the repurchase agreements. Each Fund holds a pro rata share of the collateral based on the dollar amount of the repurchase agreement entered into by each Fund.

20 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)(continued) |

At June 30, 2014, the repurchase agreements in the joint account were as follows: