6.30.2016

Guggenheim Funds Semi-Annual Report

Guggenheim Alternative Fund |

Guggenheim Multi-Hedge Strategies Fund | | |

Rydex Commodities Fund |

Rydex Commodities Strategy Fund | | |

RDXSGIALT-SEMI-0616x1216 | guggenheiminvestments.com |

DEAR SHAREHOLDER | 2 |

ECONOMIC AND MARKET OVERVIEW | 3 |

ABOUT SHAREHOLDERS’ FUND EXPENSES | 5 |

ALTERNATIVE FUND | |

MULTI-HEDGE STRATEGIES FUND | 8 |

COMMODITIES FUND | |

COMMODITIES STRATEGY FUND | 42 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | 52 |

OTHER INFORMATION | 75 |

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 79 |

GUGGENHEIM INVESTMENTS PRIVACY POLICIES | 85 |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC (the “Investment Adviser”) is pleased to present the semi-annual shareholder report for one alternative strategy fund and one commodities fund (the “Funds”) that are part of the Rydex Series Funds. This report covers performance of the Funds for the semi-annual period ended June 30, 2016.

The Investment Adviser is part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC, a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim Partners, LLC and the Investment Adviser.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Donald C. Cacciapaglia

President

July 31, 2016

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

The Funds may not be suitable for all investors. Investing involves risks, including the entire loss of principal amount invested. Certain Funds may be affected by risks that include those associated with sector concentration, international investing, investing in small and/or medium size companies, and/or the Funds’ possible use of investment techniques and strategies such as leverage, derivatives and short sales of securities. Please see each Fund’s prospectus for more information.

2 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | June 30, 2016 |

The first half of this year opened with downgrades of U.S. and global economic growth and a surge in recession fears, which triggered a bout of market volatility and negative returns. But a dovish pivot in the U.S. Federal Reserve (the “Fed”) communications in February helped spur a rally in crude oil and a reversal of dollar strength, as well as a rally in risk assets that lasted through the spring. Temporarily interrupting the rally were June’s poor non-farm payrolls report (38,000 U.S. jobs created in May) and the United Kingdom’s (“UK”) vote to leave the European Union (“EU”).

The surprising and disappointing jobs number led to a sharp fall in the 10-year U.S. Treasury yield as markets downgraded the probability of summer rate hikes. Indeed, the Federal Open Market Committee (“FOMC”) declined to raise rates in June. In late June, citizens in the UK voted to leave the European Union. This decision, nicknamed “Brexit,” prompted panic selling of risk assets in Europe, the UK, emerging markets. In the U.S., there was also a sell-off in more speculative-grade credit and equities. However, nerves settled in the last two days of the quarter, and markets appeared to bounce back, as global central banks promised to do everything in their power to maintain market stability and as it seemed that the political transition in the UK would move more quickly and smoothly than expected.

The quarter ended with the British pound at its weakest level against the U.S. dollar in over 20 years, and the 10-year Treasury note yielding 1.47 percent, 30 basis points lower than at the start of the quarter.

Brexit turmoil and the drop in Treasury yields was in spite of the rebound in U.S. economic growth over the period. The final reading of first-quarter Gross Domestic Product (“GDP”) was 0.8 percent (revised down in late July from 1.1 percent), with weakness likely due to residual seasonality effects. Consistent with previous years, growth accelerated as the year progressed, but not at the pace expected by most economists; in late July, the initial estimate of second-quarter real GDP was 1.2 percent, against an expected rate of above 2 percent, the lower figure due primarily to a fall in inventories.

While May’s payrolls report was likely an aberration, a view confirmed by a strong June number, the trend rate of job growth should slow as we near full employment. An improving labor market, low borrowing costs, and rising household formation all point to continued improvement in the housing market, as evidenced by new home sales figures recently hitting eight-year highs.

We are entering a period of seasonal weakness combined with some continuing post-Brexit uncertainty and a growing focus on the upcoming U.S. elections. Despite this, falling rates will remain supportive of credit performance. Record-low U.S. government yields are likely to be dragged down by foreign retail and institutional investors, as central banks continue to plunge rates further into negative territory. This hunt for yield will act as a “QE4” and will spill over into supporting risk assets.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3 |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) | June 30, 2016 |

With inflation expectations troublingly low, and growth in Europe likely to slow, the Fed will be hard-pressed to deliver two hikes in the balance of the year, as many FOMC members expect. We anticipate one rate hike this year, most likely in December, as the Fed remains cautious due to the asymmetry of risks near the zero lower bound. The rally in risk assets should remain intact through the third quarter of 2016, and monetary policy will ultimately create a positive backdrop for risk assets over the next two to three years.

For the six-month period ended June 30, 2016, the Standard & Poor’s 500® (“S&P 500”) Index* returned 3.84%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned -4.42%. The return of the MSCI Emerging Markets Index* was 6.41%.

In the bond market, the Barclays U.S. Aggregate Bond Index* posted a 5.31% return for the period, while the Barclays U.S. Corporate High Yield Index* returned 9.06%. The return of the Bank of America (“BofA”) Merrill Lynch 3-Month U.S. Treasury Bill Index* was 0.15% for the six-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS.

Barclays U.S. Corporate High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

S&P 500® Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of the U.S. stock market.

4 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) |

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, other distributions, and exchange fees, and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning December 31, 2015 and ending June 30, 2016.

The following tables illustrate the Funds’ costs in two ways:

Table 1. Based on actual Fund return: This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return: This section is intended to help investors compare a Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 5 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(continued) |

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about the Funds’ expenses, including annual expense ratios for periods up to five years (subject to the Fund’s inception date), can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

6 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) |

| | Expense

Ratio1 | Fund

Return | Beginning

Account Value

December 31,

2015 | Ending

Account Value

June 30,

2016 | Expenses

Paid During

Period2 |

Table 1. Based on actual Fund return3 |

Multi-Hedge Strategies Fund |

A-Class | 2.38% | (0.99%) | $ 1,000.00 | $ 990.10 | $ 11.78 |

C-Class | 3.15% | (1.34%) | 1,000.00 | 986.60 | 15.56 |

P-Class | 2.37% | (1.03%) | 1,000.00 | 989.70 | 11.72 |

Institutional Class | 2.14% | (0.85%) | 1,000.00 | 991.50 | 10.60 |

Commodities Strategy Fund |

A-Class | 1.70% | 8.98% | 1,000.00 | 1,089.80 | 8.83 |

C-Class | 2.43% | 8.57% | 1,000.00 | 1,085.70 | 12.60 |

H-Class | 1.62% | 8.81% | 1,000.00 | 1,088.10 | 8.41 |

|

Table 2. Based on hypothetical 5% return (before expenses) |

Multi-Hedge Strategies Fund |

A-Class | 2.38% | 5.00% | $ 1,000.00 | $ 1,013.03 | $ 11.91 |

C-Class | 3.15% | 5.00% | 1,000.00 | 1,009.20 | 15.74 |

P-Class | 2.37% | 5.00% | 1,000.00 | 1,013.08 | 11.86 |

Institutional Class | 2.14% | 5.00% | 1,000.00 | 1,014.22 | 10.72 |

Commodities Strategy Fund |

A-Class | 1.70% | 5.00% | 1,000.00 | 1,016.41 | 8.52 |

C-Class | 2.43% | 5.00% | 1,000.00 | 1,012.78 | 12.16 |

H-Class | 1.62% | 5.00% | 1,000.00 | 1,016.81 | 8.12 |

1 | Annualized and excludes expenses of the underlying funds in which the Funds invest. This ratio represents net expenses, which include interest and dividend expenses related to securities sold short. Excluding short interest and dividend expenses, the operating expense ratio of the Multi-Hedge Strategies Fund would be 1.44%, 2.19%, 1.43% and 1.19% for the A-Class, C-Class, P-Class and Institutional Class, respectively. |

2 | Expenses are equal to the Fund's annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

3 | Actual cumulative return at net asset value for the period December 31, 2015 to June 30, 2016. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 7 |

FUND PROFILE (Unaudited) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND

OBJECTIVE: Seeks long-term capital appreciation with less risk than traditional equity funds.

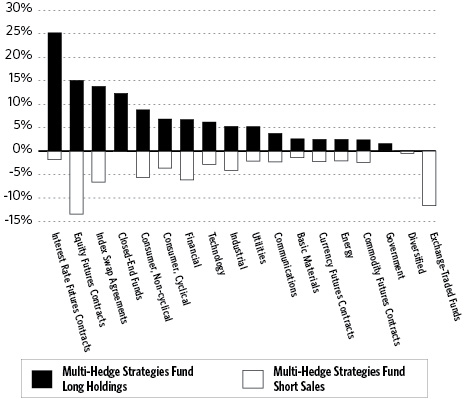

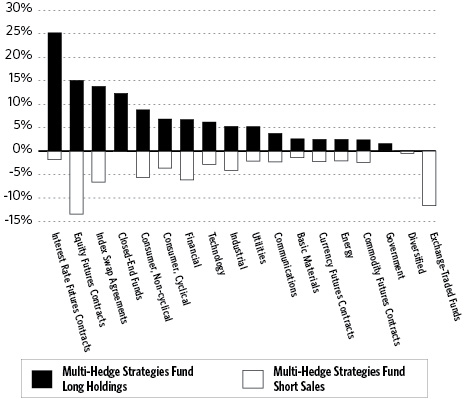

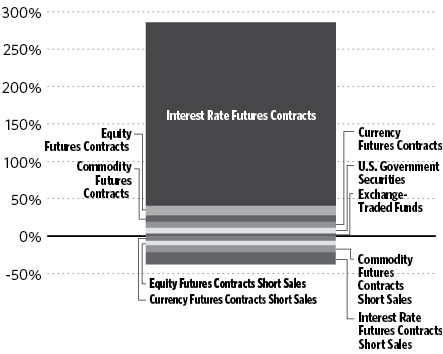

Consolidated Holdings Diversification (Market Exposure as % of Net Assets)

“Consolidated Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments or investments in Guggenheim Strategy Funds Trust mutual funds. Investments in those Funds do not provide “market exposure” to meet the Fund’s investment objective, but will significantly increase the portfolio’s exposure to certain other asset categories (and their associated risks), which may cause the Fund to deviate from its principal investment strategy, including: (i) high yield, high risk debt securities rated below the top four long-term rating categories by a nationally recognized statistical rating organization (also known as “junk bonds”); (ii) securities issued by the U.S. government or its agencies and instrumentalities; (iii) CLOs and similar investments; and (iv) other short-term fixed income securities.

8 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

FUND PROFILE (Unaudited)(concluded) | June 30, 2016 |

Inception Dates: |

A-Class | September 19, 2005 |

C-Class | September 19, 2005 |

P-Class | September 19, 2005 |

Institutional Class | May 3, 2010 |

Ten Largest Holdings (% of Total Net Assets) |

LinkedIn Corp. — Class A | 1.2% |

Piedmont Natural Gas Company, Inc. | 1.0% |

EMC Corp. | 0.9% |

Valspar Corp. | 0.9% |

Alere, Inc. | 0.8% |

St. Jude Medical, Inc. | 0.8% |

FEI Co. | 0.8% |

AGL Resources, Inc. | 0.8% |

Questar Corp. | 0.6% |

DreamWorks Animation SKG, Inc. - Class A | 0.6% |

Top Ten Total | 8.4% |

| | |

“Ten Largest Holdings” excludes any temporary cash or derivative investments. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 9 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS† - 47.8% | |

| | | | | | | |

Consumer, Non-cyclical - 8.8% | |

Alere, Inc.*,1 | | | 26,748 | | | $ | 1,114,978 | |

St. Jude Medical, Inc.1 | | | 14,168 | | | | 1,105,103 | |

ExamWorks Group, Inc.*,1 | | | 20,907 | | | | 728,609 | |

HeartWare International, Inc.* | | | 9,180 | | | | 530,145 | |

Humana, Inc.1 | | | 2,810 | | | | 505,463 | |

Allergan plc*,1 | | | 1,601 | | | | 369,976 | |

Tumi Holdings, Inc.* | | | 11,806 | | | | 315,692 | |

Apollo Education Group, Inc. — Class A*,1 | | | 28,345 | | | | 258,507 | |

SABMiller plc ADR1 | | | 3,831 | | | | 224,266 | |

Cigna Corp.1 | | | 1,719 | | | | 220,015 | |

KAR Auction Services, Inc.1 | | | 5,271 | | | | 220,012 | |

Ingredion, Inc.1 | | | 1,645 | | | | 212,879 | |

Elizabeth Arden, Inc.* | | | 15,429 | | | | 212,303 | |

Teleflex, Inc.1 | | | 1,181 | | | | 209,403 | |

Reynolds American, Inc.1 | | | 3,879 | | | | 209,194 | |

Pinnacle Foods, Inc.1 | | | 4,512 | | | | 208,860 | |

Dr Pepper Snapple Group, Inc.1 | | | 2,066 | | | | 199,638 | |

Charles River Laboratories International, Inc.*,1 | | | 2,404 | | | | 198,185 | |

Mondelez International, Inc. — Class A1 | | | 4,344 | | | | 197,695 | |

Archer-Daniels-Midland Co.1 | | | 4,596 | | | | 197,123 | |

UnitedHealth Group, Inc.1 | | | 1,391 | | | | 196,409 | |

Constellation Brands, Inc. — Class A1 | | | 1,181 | | | | 195,338 | |

Cooper Companies, Inc.1 | | | 1,138 | | | | 195,247 | |

Kroger Co.1 | | | 5,271 | | | | 193,921 | |

Hill-Rom Holdings, Inc.1 | | | 3,837 | | | | 193,577 | |

Herbalife Ltd.*,1 | | | 3,288 | | | | 192,446 | |

Tyson Foods, Inc. — Class A1 | | | 2,867 | | | | 191,487 | |

Celator Pharmaceuticals, Inc.* | | | 6,335 | | | | 191,190 | |

Bio-Rad Laboratories, Inc. — Class A*,1 | | | 1,307 | | | | 186,927 | |

Amgen, Inc.1 | | | 1,210 | | | | 184,102 | |

Western Union Co.1 | | | 9,572 | | | | 183,591 | |

United Therapeutics Corp.*,1 | | | 1,686 | | | | 178,581 | |

DaVita HealthCare Partners, Inc.*,1 | | | 2,277 | | | | 176,058 | |

Gilead Sciences, Inc.1 | | | 2,066 | | | | 172,346 | |

Coty, Inc. — Class A1 | | | 6,198 | | | | 161,086 | |

ManpowerGroup, Inc.1 | | | 2,488 | | | | 160,078 | |

Aaron’s, Inc.1 | | | 7,253 | | | | 158,768 | |

AbbVie, Inc.1 | | | 2,318 | | | | 143,507 | |

Universal Health Services, Inc. — Class B1 | | | 970 | | | | 130,077 | |

Spectrum Brands Holdings, Inc.1 | | | 970 | | | | 115,731 | |

Envision Healthcare Holdings, Inc.* | | | 4,472 | | | | 113,454 | |

Pilgrim’s Pride Corp.1 | | | 4,301 | | | | 109,589 | |

Edwards Lifesciences Corp.*,1 | | | 1,097 | | | | 109,404 | |

LDR Holding Corp.* | | | 2,858 | | | | 105,603 | |

VCA, Inc.*,1 | | | 1,391 | | | | 94,046 | |

Johnson & Johnson1 | | | 548 | | | | 66,472 | |

Laboratory Corporation of America Holdings*,1 | | | 506 | | | | 65,917 | |

Hologic, Inc.*,1 | | | 1,686 | | | | 58,336 | |

XenoPort, Inc.*,1 | | | 7,584 | | | | 53,391 | |

Eli Lilly & Co.1 | | | 591 | | | | 46,541 | |

Vantiv, Inc. — Class A*,1 | | | 716 | | | | 40,526 | |

MEDNAX, Inc.*,1 | | | 506 | | | | 36,650 | |

Quest Diagnostics, Inc.1 | | | 379 | | | | 30,854 | |

JM Smucker Co.1 | | | 168 | | | | 25,605 | |

Total System Services, Inc.1 | | | 422 | | | | 22,412 | |

Graham Holdings Co. — Class B1 | | | 43 | | | | 21,050 | |

Hormel Foods Corp.1 | | | 422 | | | | 15,445 | |

Church & Dwight Company, Inc.1 | | | 127 | | | | 13,067 | |

Quanta Services, Inc.*,1 | | | 379 | | | | 8,762 | |

Service Corporation International1 | | | 211 | | | | 5,705 | |

Acadia Healthcare Company, Inc.*,1 | | | 84 | | | | 4,654 | |

10 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

Molson Coors Brewing Co. — Class B1 | | | 43 | | | $ | 4,349 | |

Total Consumer, Non-cyclical | | | | 11,990,345 | |

| | | | | | | | | |

Consumer, Cyclical - 6.7% | |

DreamWorks Animation SKG, Inc. — Class A*,1 | | | 20,566 | | | | 840,531 | |

Virgin America, Inc.*,1 | | | 12,013 | | | | 675,250 | |

Ingram Micro, Inc. — Class A1 | | | 16,071 | | | | 558,949 | |

Krispy Kreme Doughnuts, Inc.* | | | 25,243 | | | | 529,094 | |

Starwood Hotels & Resorts Worldwide, Inc.1 | | | 7,037 | | | | 520,387 | |

Rite Aid Corp.*,1 | | | 61,927 | | | | 463,832 | |

DR Horton, Inc.1 | | | 6,283 | | | | 197,789 | |

Dolby Laboratories, Inc. — Class A1 | | | 4,090 | | | | 195,707 | |

World Fuel Services Corp.1 | | | 4,090 | | | | 194,234 | |

Lennar Corp. — Class A1 | | | 4,174 | | | | 192,421 | |

Darden Restaurants, Inc.1 | | | 2,994 | | | | 189,640 | |

Vista Outdoor, Inc.*,1 | | | 3,963 | | | | 189,154 | |

Office Depot, Inc.*,1 | | | 57,106 | | | | 189,021 | |

Walgreens Boots Alliance, Inc.1 | | | 2,193 | | | | 182,611 | |

Best Buy Company, Inc.1 | | | 5,946 | | | | 181,948 | |

CVS Health Corp.1 | | | 1,897 | | | | 181,619 | |

PVH Corp.1 | | | 1,856 | | | | 174,891 | |

Carnival Corp.1 | | | 3,879 | | | | 171,451 | |

Foot Locker, Inc.1 | | | 3,078 | | | | 168,859 | |

Target Corp.1 | | | 2,404 | | | | 167,847 | |

Royal Caribbean Cruises Ltd.1 | | | 2,445 | | | | 164,182 | |

Lear Corp.1 | | | 1,602 | | | | 163,019 | |

GameStop Corp. — Class A1 | | | 5,946 | | | | 158,045 | |

Norwegian Cruise Line Holdings Ltd.*,1 | | | 3,837 | | | | 152,866 | |

TiVo, Inc.*,1 | | | 15,209 | | | | 150,569 | |

Penske Automotive Group, Inc.1 | | | 4,722 | | | | 148,554 | |

Liberty Interactive Corporation QVC Group — Class A*,1 | | | 5,776 | | | | 146,538 | |

Alaska Air Group, Inc.1 | | | 2,488 | | | | 145,025 | |

Kohl’s Corp.1 | | | 3,584 | | | | 135,905 | |

Goodyear Tire & Rubber Co.1 | | | 5,228 | | | | 134,150 | |

CST Brands, Inc.1 | | | 2,952 | | | | 127,172 | |

Extended Stay America, Inc.1 | | | 8,012 | | | | 119,779 | |

WESCO International, Inc.*,1 | | | 2,193 | | | | 112,918 | |

International Game Technology plc1 | | | 5,946 | | | | 111,428 | |

Nu Skin Enterprises, Inc. — Class A1 | | | 2,234 | | | | 103,188 | |

Six Flags Entertainment Corp.1 | | | 1,772 | | | | 102,687 | |

Southwest Airlines Co.1 | | | 2,615 | | | | 102,534 | |

PACCAR, Inc.1 | | | 1,940 | | | | 100,628 | |

Dick’s Sporting Goods, Inc.1 | | | 2,193 | | | | 98,817 | |

Mohawk Industries, Inc.*,1 | | | 422 | | | | 80,079 | |

Whirlpool Corp.1 | | | 338 | | | | 56,324 | |

Carter’s, Inc.1 | | | 506 | | | | 53,874 | |

Carmike Cinemas, Inc.*,1 | | | 1,740 | | | | 52,409 | |

Wyndham Worldwide Corp.1 | | | 632 | | | | 45,017 | |

AutoNation, Inc.*,1 | | | 927 | | | | 43,550 | |

Ford Motor Co.1 | | | 2,909 | | | | 36,566 | |

United Continental Holdings, Inc.*,1 | | | 843 | | | | 34,597 | |

Skechers U.S.A., Inc. — Class A*,1 | | | 1,138 | | | | 33,821 | |

General Motors Co.1 | | | 1,095 | | | | 30,989 | |

Dillard’s, Inc. — Class A1 | | | 506 | | | | 30,664 | |

Skullcandy, Inc.* | | | 4,298 | | | | 26,390 | |

Hasbro, Inc.1 | | | 295 | | | | 24,777 | |

Total Consumer, Cyclical | | | | | | | 9,192,296 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 11 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

Financial - 6.7% | |

First Niagara Financial Group, Inc.1 | | | 50,653 | | | $ | 493,361 | |

FirstMerit Corp.1 | | | 15,755 | | | | 319,353 | |

PrivateBancorp, Inc. — Class A | | | 6,156 | | | | 271,049 | |

Chimera Investment Corp.1 | | | 13,696 | | | | 215,028 | |

American Capital Agency Corp.1 | | | 10,500 | | | | 208,111 | |

Mid-America Apartment Communities, Inc.1 | | | 1,940 | | | | 206,416 | |

CoreLogic, Inc.*,1 | | | 5,355 | | | | 206,060 | |

Starwood Property Trust, Inc.1 | | | 9,909 | | | | 205,314 | |

Piedmont Office Realty Trust, Inc. — Class A1 | | | 9,530 | | | | 205,275 | |

Cincinnati Financial Corp.1 | | | 2,741 | | | | 205,274 | |

American Financial Group, Inc.1 | | | 2,741 | | | | 202,642 | |

MFA Financial, Inc.1 | | | 27,871 | | | | 202,622 | |

Old Republic International Corp.1 | | | 10,247 | | | | 197,665 | |

Nasdaq, Inc.1 | | | 3,036 | | | | 196,338 | |

Reinsurance Group of America, Inc. — Class A1 | | | 2,024 | | | | 196,307 | |

Arch Capital Group Ltd.*,1 | | | 2,699 | | | | 194,327 | |

Equity Residential1 | | | 2,783 | | | | 191,693 | |

Aspen Insurance Holdings Ltd.1 | | | 4,090 | | | | 189,694 | |

Berkshire Hathaway, Inc. — Class B*,1 | | | 1,307 | | | | 189,241 | |

Popular, Inc.1 | | | 6,451 | | | | 189,015 | |

Hartford Financial Services Group, Inc.1 | | | 4,258 | | | | 188,970 | |

Assured Guaranty Ltd.1 | | | 7,380 | | | | 187,231 | |

JPMorgan Chase & Co.1 | | | 2,994 | | | | 186,047 | |

Hanover Insurance Group, Inc.1 | | | 2,193 | | | | 185,572 | |

Everest Re Group Ltd.1 | | | 1,013 | | | | 185,045 | |

Ally Financial, Inc.*,1 | | | 10,795 | | | | 184,270 | |

Bank of New York Mellon Corp.1 | | | 4,722 | | | | 183,450 | |

PNC Financial Services Group, Inc.1 | | | 2,193 | | | | 178,488 | |

Synovus Financial Corp.1 | | | 6,156 | | | | 178,462 | |

Lamar Advertising Co. — Class A1 | | | 2,656 | | | | 176,093 | |

E*TRADE Financial Corp.*,1 | | | 7,464 | | | | 175,329 | |

Interactive Brokers Group, Inc. — Class A1 | | | 4,933 | | | | 174,628 | |

Goldman Sachs Group, Inc.1 | | | 1,138 | | | | 169,084 | |

Capital One Financial Corp.1 | | | 2,615 | | | | 166,079 | |

Air Lease Corp. — Class A1 | | | 6,198 | | | | 165,982 | |

Travelers Companies, Inc.1 | | | 1,349 | | | | 160,585 | |

Voya Financial, Inc.1 | | | 5,987 | | | | 148,238 | |

Parkway Properties, Inc.1 | | | 8,220 | | | | 137,521 | |

Ameriprise Financial, Inc.1 | | | 1,475 | | | | 132,529 | |

Citigroup, Inc.1 | | | 3,120 | | | | 132,257 | |

Associated Banc-Corp.1 | | | 7,337 | | | | 125,830 | |

Synchrony Financial*,1 | | | 4,933 | | | | 124,706 | |

CBL & Associates Properties, Inc.1 | | | 12,818 | | | | 119,336 | |

Discover Financial Services1 | | | 2,193 | | | | 117,523 | |

Wilshire Bancorp, Inc.1 | | | 9,889 | | | | 103,043 | |

AmTrust Financial Services, Inc.1 | | | 4,133 | | | | 101,259 | |

American National Insurance Co.1 | | | 802 | | | | 90,746 | |

Fidelity & Guaranty Life1 | | | 3,754 | | | | 87,018 | |

Fifth Third Bancorp1 | | | 2,656 | | | | 46,719 | |

Raymond James Financial, Inc.1 | | | 843 | | | | 41,560 | |

Jones Lang LaSalle, Inc.1 | | | 422 | | | | 41,124 | |

Endurance Specialty Holdings Ltd.1 | | | 591 | | | | 39,692 | |

Bank of America Corp.1 | | | 2,615 | | | | 34,701 | |

Two Harbors Investment Corp.1 | | | 3,922 | | | | 33,572 | |

RenaissanceRe Holdings Ltd.1 | | | 253 | | | | 29,712 | |

Santander Consumer USA Holdings, Inc.*,1 | | | 2,824 | | | | 29,172 | |

12 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

CIT Group, Inc.1 | | | 800 | | | $ | 25,528 | |

Credit Acceptance Corp.*,1 | | | 84 | | | | 15,547 | |

Kimco Realty Corp.1 | | | 380 | | | | 11,924 | |

Morgan Stanley1 | | | 422 | | | | 10,964 | |

CME Group, Inc. — Class A1 | | | 43 | | | | 4,188 | |

Lincoln National Corp.1 | | | 43 | | | | 1,667 | |

People’s United Financial, Inc.1 | | | 43 | | | | 630 | |

Total Financial | | | | | | | 9,116,806 | |

| | | | | | | | | |

Technology - 6.2% | |

EMC Corp.1 | | | 46,802 | | | | 1,271,610 | |

Demandware, Inc.* | | | 9,770 | | | | 731,773 | |

Fairchild Semiconductor International, Inc. — Class A*,1 | | | 33,730 | | | | 669,540 | |

inContact, Inc.*,1 | | | 38,074 | | | | 527,325 | |

KLA-Tencor Corp.1 | | | 5,004 | | | | 366,543 | |

Lexmark International, Inc. — Class A | | | 7,038 | | | | 265,685 | |

Cvent, Inc.* | | | 7,402 | | | | 264,399 | |

Xura, Inc.*,1 | | | 10,754 | | | | 262,720 | |

NVIDIA Corp.1 | | | 5,355 | | | | 251,739 | |

Activision Blizzard, Inc.1 | | | 5,565 | | | | 220,541 | |

CA, Inc.1 | | | 6,494 | | | | 213,198 | |

Synopsys, Inc.*,1 | | | 3,922 | | | | 212,102 | |

Fidelity National Information Services, Inc.1 | | | 2,867 | | | | 211,241 | |

Intel Corp.1 | | | 6,325 | | | | 207,460 | |

Cadence Design Systems, Inc.*,1 | | | 8,180 | | | | 198,774 | |

Oracle Corp.1 | | | 4,765 | | | | 195,031 | |

Amdocs Ltd.1 | | | 3,374 | | | | 194,748 | |

SciQuest, Inc.* | | | 10,820 | | | | 191,081 | |

Electronic Arts, Inc.*,1 | | | 2,488 | | | | 188,491 | |

DST Systems, Inc.1 | | | 1,561 | | | | 181,747 | |

Allscripts Healthcare Solutions, Inc.*,1 | | | 14,253 | | | | 181,013 | |

Nuance Communications, Inc.*,1 | | | 11,259 | | | | 175,978 | |

ON Semiconductor Corp.*,1 | | | 19,902 | | | | 175,536 | |

Apple, Inc.1 | | | 1,813 | | | | 173,322 | |

Microsoft Corp.1 | | | 3,204 | | | | 163,949 | |

Leidos Holdings, Inc.1 | | | 2,531 | | | | 121,159 | |

Broadridge Financial Solutions, Inc.1 | | | 1,856 | | | | 121,011 | |

Teradyne, Inc.1 | | | 4,849 | | | | 95,477 | |

Xerox Corp.1 | | | 9,445 | | | | 89,633 | |

Western Digital Corp.1 | | | 1,580 | | | | 74,661 | |

Akamai Technologies, Inc.*,1 | | | 1,181 | | | | 66,054 | |

Citrix Systems, Inc.*,1 | | | 675 | | | | 54,061 | |

SS&C Technologies Holdings, Inc.1 | | | 1,854 | | | | 52,060 | |

Pitney Bowes, Inc.1 | | | 2,615 | | | | 46,547 | |

Genpact Ltd.*,1 | | | 1,518 | | | | 40,743 | |

HP, Inc.1 | | | 843 | | | | 10,580 | |

Dun & Bradstreet Corp.1 | | | 43 | | | | 5,239 | |

Total Technology | | | | | | | 8,472,771 | |

| | | | | | | | | |

Industrial - 5.3% | |

FEI Co. | | | 9,866 | | | | 1,054,479 | |

Rofin-Sinar Technologies, Inc.*,1 | | | 12,860 | | | | 410,748 | |

Huntington Ingalls Industries, Inc.1 | | | 1,307 | | | | 219,615 | |

Jacobs Engineering Group, Inc.*,1 | | | 4,258 | | | | 212,091 | |

Owens Corning1 | | | 4,090 | | | | 210,717 | |

L-3 Communications Holdings, Inc.1 | | | 1,434 | | | | 210,353 | |

Corning, Inc.1 | | | 10,247 | | | | 209,859 | |

Republic Services, Inc. — Class A1 | | | 4,047 | | | | 207,651 | |

Arrow Electronics, Inc.*,1 | | | 3,247 | | | | 200,989 | |

Northrop Grumman Corp.1 | | | 886 | | | | 196,939 | |

Sonoco Products Co.1 | | | 3,922 | | | | 194,766 | |

Avnet, Inc.1 | | | 4,765 | | | | 193,030 | |

AMERCO1 | | | 506 | | | | 189,522 | |

Stanley Black & Decker, Inc.1 | | | 1,686 | | | | 187,517 | |

Trinity Industries, Inc.1 | | | 10,036 | | | | 186,369 | |

Deere & Co.1 | | | 2,277 | | | | 184,528 | |

CSX Corp.1 | | | 7,042 | | | | 183,656 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 13 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

GATX Corp.1 | | | 4,174 | | | $ | 183,531 | |

Manitowoc Company, Inc.1 | | | 33,396 | | | | 182,008 | |

Eaton Corporation plc1 | | | 3,036 | | | | 181,340 | |

Crown Holdings, Inc.*,1 | | | 3,542 | | | | 179,473 | |

Spirit AeroSystems Holdings, Inc. — Class A*,1 | | | 4,047 | | | | 174,021 | |

AGCO Corp.1 | | | 3,584 | | | | 168,914 | |

Jabil Circuit, Inc.1 | | | 8,475 | | | | 156,533 | |

Carlisle Companies, Inc.1 | | | 1,475 | | | | 155,878 | |

Ryder System, Inc.1 | | | 2,445 | | | | 149,487 | |

AECOM*,1 | | | 4,428 | | | | 140,678 | |

Masco Corp.1 | | | 4,470 | | | | 138,302 | |

FedEx Corp.1 | | | 887 | | | | 134,629 | |

ITT, Inc.1 | | | 3,795 | | | | 121,364 | |

Multi-Fineline Electronix, Inc.*,1 | | | 5,136 | | | | 119,155 | |

Regal Beloit Corp.1 | | | 1,856 | | | | 102,173 | |

Oshkosh Corp.1 | | | 2,024 | | | | 96,565 | |

Waste Management, Inc.1 | | | 1,307 | | | | 86,615 | |

Bemis Company, Inc.1 | | | 1,391 | | | | 71,623 | |

Kirby Corp.*,1 | | | 1,097 | | | | 68,442 | |

Snap-on, Inc.1 | | | 338 | | | | 53,343 | |

Caterpillar, Inc.1 | | | 675 | | | | 51,172 | |

PerkinElmer, Inc.1 | | | 295 | | | | 15,464 | |

Textron, Inc.1 | | | 211 | | | | 7,714 | |

FLIR Systems, Inc.1 | | | 211 | | | | 6,530 | |

Teekay Corp.1 | | | 253 | | | | 1,804 | |

Total Industrial | | | | | | | 7,199,587 | |

| | | | | | | | | |

Utilities – 5.2% | |

Piedmont Natural Gas Company, Inc.1 | | | 22,851 | | | | 1,373,803 | |

AGL Resources, Inc.1 | | | 15,753 | | | | 1,039,225 | |

Questar Corp.1 | | | 33,692 | | | | 854,766 | |

Empire District Electric Co.1 | | | 17,310 | | | | 588,020 | |

Talen Energy Corp.* | | | 27,372 | | | | 370,891 | |

NiSource, Inc.1 | | | 8,391 | | | | 222,529 | |

Ameren Corp.1 | | | 4,006 | | | | 214,641 | |

Atmos Energy Corp.1 | | | 2,615 | | | | 212,652 | |

Pinnacle West Capital Corp.1 | | | 2,615 | | | | 211,972 | |

Xcel Energy, Inc.1 | | | 4,722 | | | | 211,451 | |

American Electric Power Company, Inc.1 | | | 2,994 | | | | 209,849 | |

SCANA Corp.1 | | | 2,741 | | | | 207,384 | |

Consolidated Edison, Inc.1 | | | 2,531 | | | | 203,594 | |

UGI Corp.1 | | | 4,344 | | | | 196,566 | |

Public Service Enterprise Group, Inc.1 | | | 4,174 | | | | 194,550 | |

Edison International1 | | | 2,488 | | | | 193,243 | |

Great Plains Energy, Inc.1 | | | 6,114 | | | | 185,866 | |

AES Corp.1 | | | 14,253 | | | | 177,877 | |

Exelon Corp.1 | | | 4,301 | | | | 156,384 | |

FirstEnergy Corp.1 | | | 169 | | | | 5,900 | |

Total Utilities | | | | | | | 7,031,163 | |

| | | | | | | | | |

Communications - 3.8% | |

LinkedIn Corp. — Class A* | | | 8,682 | | | | 1,643,070 | |

Starz — Class A* | | | 10,161 | | | | 304,017 | |

AT&T, Inc.1 | | | 4,892 | | | | 211,383 | |

Symantec Corp.1 | | | 10,120 | | | | 207,865 | |

Comcast Corp. — Class A1 | | | 3,120 | | | | 203,393 | |

Cisco Systems, Inc.1 | | | 7,042 | | | | 202,035 | |

Qihoo 360 Technology Company Ltd. ADR*,1 | | | 2,760 | | | | 201,618 | |

TEGNA, Inc.1 | | | 8,223 | | | | 190,526 | |

Thomson Reuters Corp.1 | | | 4,638 | | | | 187,468 | |

VeriSign, Inc.*,1 | | | 2,150 | | | | 185,889 | |

eBay, Inc.*,1 | | | 7,927 | | | | 185,571 | |

Juniper Networks, Inc.1 | | | 8,223 | | | | 184,935 | |

Walt Disney Co.1 | | | 1,729 | | | | 169,131 | |

Expedia, Inc.1 | | | 1,475 | | | | 156,793 | |

United States Cellular Corp.*,1 | | | 2,699 | | | | 105,990 | |

Liberty SiriusXM Group — Class A*,1 | | | 2,909 | | | | 91,226 | |

Liberty SiriusXM Group — Class C*,1 | | | 2,952 | | | | 91,128 | |

Alphabet, Inc. — Class A*,1 | | | 127 | | | | 89,348 | |

Alphabet, Inc. — Class C*,1 | | | 127 | | | | 87,897 | |

Scripps Networks Interactive, Inc. — Class A1 | | | 1,391 | | | | 86,618 | |

ARRIS International plc*,1 | | | 3,963 | | | | 83,064 | |

14 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

IAC/InterActiveCorp1 | | | 1,475 | | | $ | 83,043 | |

Telephone & Data Systems, Inc.1 | | | 2,445 | | | | 72,519 | |

CenturyLink, Inc.1 | | | 2,277 | | | | 66,056 | |

AMC Networks, Inc. — Class A*,1 | | | 506 | | | | 30,573 | |

Omnicom Group, Inc.1 | | | 253 | | | | 20,617 | |

John Wiley & Sons, Inc. — Class A1 | | | 127 | | | | 6,627 | |

Interpublic Group of Companies, Inc.1 | | | 253 | | | | 5,844 | |

GoDaddy, Inc. — Class A*,1 | | | 84 | | | | 2,620 | |

Total Communications | | | | | | | 5,156,864 | |

| | | | | | | | | |

Basic Materials - 2.6% | |

Valspar Corp.1 | | | 11,270 | | | | 1,217,499 | |

Axiall Corp. | | | 7,163 | | | | 233,585 | |

Syngenta AG ADR*,1 | | | 3,032 | | | | 232,828 | |

Albemarle Corp.1 | | | 2,825 | | | | 224,051 | |

Reliance Steel & Aluminum Co.1 | | | 2,572 | | | | 197,786 | |

Nucor Corp.1 | | | 3,795 | | | | 187,511 | |

Steel Dynamics, Inc.1 | | | 7,591 | | | | 185,980 | |

Celanese Corp. — Class A1 | | | 2,699 | | | | 176,650 | |

Domtar Corp.1 | | | 4,933 | | | | 172,704 | |

Eastman Chemical Co.1 | | | 2,488 | | | | 168,935 | |

Mosaic Co.1 | | | 6,367 | | | | 166,688 | |

LyondellBasell Industries N.V. — Class A1 | | | 2,193 | | | | 163,203 | |

Newmont Mining Corp.1 | | | 3,204 | | | | 125,340 | |

Huntsman Corp.1 | | | 5,271 | | | | 70,895 | |

Cabot Corp.1 | | | 843 | | | | 38,491 | |

Sherwin-Williams Co.1 | | | 43 | | | | 12,628 | |

Total Basic Materials | | | | | | | 3,574,774 | |

| | | | | | | | | |

Energy - 2.5% | |

Baker Hughes, Inc.1 | | | 10,636 | | | | 480,003 | |

Memorial Resource Development Corp.* | | | 17,491 | | | | 277,757 | |

Williams Partners, LP1 | | | 6,189 | | | | 214,387 | |

Exxon Mobil Corp.1 | | | 2,150 | | | | 201,542 | |

Chevron Corp.1 | | | 1,856 | | | | 194,564 | |

Rowan Companies plc — Class A1 | | | 10,373 | | | | 183,187 | |

Tesoro Corp.1 | | | 2,361 | | | | 176,885 | |

First Solar, Inc.*,1 | | | 3,458 | | | | 167,644 | |

Valero Energy Corp.1 | | | 3,204 | | | | 163,404 | |

Frank’s International N.V.1 | | | 10,289 | | | | 150,322 | |

Helmerich & Payne, Inc.1 | | | 2,193 | | | | 147,216 | |

HollyFrontier Corp.1 | | | 5,397 | | | | 128,287 | |

Noble Corporation plc1 | | | 14,758 | | | | 121,606 | |

Marathon Petroleum Corp.1 | | | 2,952 | | | | 112,058 | |

SM Energy Co.1 | | | 4,047 | | | | 109,269 | |

Rice Energy, Inc.*,1 | | | 4,512 | | | | 99,444 | |

Antero Resources Corp.*,1 | | | 3,669 | | | | 95,321 | |

PBF Energy, Inc. — Class A1 | | | 3,374 | | | | 80,234 | |

WPX Energy, Inc.*,1 | | | 7,084 | | | | 65,952 | |

Western Refining, Inc. | | | 2,683 | | | | 55,351 | |

Equities Corp.1 | | | 548 | | | | 42,432 | |

Kosmos Energy Ltd.*,1 | | | 5,776 | | | | 31,479 | |

Diamond Offshore Drilling, Inc.1 | | | 1,223 | | | | 29,756 | |

Hess Corp.1 | | | 422 | | | | 25,362 | |

EP Energy Corp. — Class A*,1 | | | 3,793 | | | | 19,648 | |

Rose Rock Midstream, LP | | | 709 | | | | 18,711 | |

Total Energy | | | | | | | 3,391,821 | |

| | | | | | | | | |

Diversified - 0.0% | |

Resource America, Inc. — Class A1 | | | 5,304 | | | | 51,555 | |

| | | | | | | | | |

Total Common Stocks | | | | | | | | |

(Cost $62,651,100) | | | | | | | 65,177,982 | |

| | | | | | | | | |

MUTUAL FUNDS†,2 - 0.0% | |

Guggenheim Strategy Fund I | | | 1,013 | | | | 25,244 | |

Guggenheim Strategy Fund II | | | 241 | | | | 5,976 | |

Total Mutual Funds | | | | | | | | |

(Cost $31,150) | | | | | | | 31,220 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 15 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

CLOSED-END FUNDS† - 12.3% | |

Nuveen Enhanced AMT-Free Municipal Credit Opportunities Fund1 | | | 33,228 | | | $ | 540,286 | |

Nuveen Maryland Premium Income Municipal Fund1 | | | 37,372 | | | | 531,055 | |

Neuberger Berman Real Estate Securities Income Fund, Inc.1 | | | 89,438 | | | | 508,007 | |

Cohen & Steers REIT and Preferred Income Fund, Inc.1 | | | 22,818 | | | | 468,681 | |

Morgan Stanley Emerging Markets Debt Fund, Inc.1 | | | 48,542 | | | | 449,499 | |

Western Asset/Claymore Inflation-Linked Opportunities & Income Fund1,2 | | | 39,617 | | | | 440,145 | |

Adams Diversified Equity Fund, Inc.1 | | | 33,345 | | | | 422,481 | |

Tri-Continental Corp.1 | | | 20,166 | | | | 414,210 | |

BlackRock Enhanced Equity Dividend Trust1 | | | 52,398 | | | | 412,896 | |

BlackRock Resources & Commodities Strategy Trust1 | | | 53,536 | | | | 412,227 | |

AllianzGI Equity & Convertible Income Fund1 | | | 22,220 | | | | 408,626 | |

Calamos Strategic Total Return Fund1 | | | 41,035 | | | | 405,425 | |

First Trust High Income Long/Short Fund1 | | | 27,308 | | | | 404,978 | |

Western Asset/Claymore Inflation-Linked Securities & Income Fund1,2 | | | 34,885 | | | | 400,480 | |

Nuveen Credit Strategies Income Fund1 | | | 49,326 | | | | 398,554 | |

BlackRock Credit Allocation Income Trust1 | | | 30,341 | | | | 395,040 | |

Alpine Total Dynamic Dividend Fund1 | | | 54,174 | | | | 393,303 | |

GDL Fund1 | | | 32,668 | | | | 324,393 | |

Boulder Growth & Income Fund, Inc.1 | | | 39,542 | | | | 321,476 | |

Zweig Total Return Fund, Inc. | | | 23,858 | | | | 287,012 | |

Gabelli Healthcare & WellnessRx Trust1 | | | 24,065 | | | | 257,014 | |

General American Investors Company, Inc.1 | | | 8,060 | | | | 248,409 | |

Clough Global Allocation Fund1 | | | 19,612 | | | | 229,460 | |

Western Asset Worldwide Income Fund, Inc.1 | | | 18,781 | | | | 206,403 | |

Swiss Helvetia Fund, Inc.1 | | | 19,886 | | | | 205,820 | |

Advent Claymore Convertible Securities and Income Fund II1,2 | | | 34,495 | | | | 190,412 | |

Madison Covered Call & Equity Strategy Fund1 | | | 22,266 | | | | 170,558 | |

Zweig Fund, Inc. | | | 12,783 | | | | 160,938 | |

Western Asset Emerging Markets Income Fund, Inc.1 | | | 12,755 | | | | 138,264 | |

Ellsworth Growth and Income Fund Ltd.1 | | | 16,871 | | | | 132,437 | |

Putnam High Income Securities Fund1 | | | 16,085 | | | | 123,372 | |

Bancroft Fund Ltd.1 | | | 6,584 | | | | 123,187 | |

Nuveen New Jersey Dividend Advantage Municipal Fund1 | | | 7,640 | | | | 117,503 | |

China Fund, Inc.1 | | | 7,561 | | | | 109,332 | |

Lazard Global Total Return and Income Fund, Inc.1 | | | 8,253 | | | | 107,949 | |

Duff & Phelps Global Utility Income Fund, Inc.1 | | | 6,160 | | | | 105,706 | |

Central Securities Corp.1 | | | 5,238 | | | | 102,874 | |

RMR Real Estate Income Fund1 | | | 4,763 | | | | 101,261 | |

16 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

Ares Dynamic Credit Allocation Fund, Inc.1 | | | 6,813 | | | $ | 93,679 | |

Wells Fargo Multi-Sector Income Fund1 | | | 7,362 | | | | 93,129 | |

Delaware Enhanced Global Dividend & Income Fund1 | | | 9,458 | | | | 91,081 | |

Nuveen Diversified Dividend & Income Fund1 | | | 7,753 | | | | 90,710 | |

Korea Equity Fund, Inc.1 | | | 11,128 | | | | 87,466 | |

First Trust Aberdeen Global Opportunity Income Fund1 | | | 7,619 | | | | 87,161 | |

Templeton Emerging Markets Income Fund1 | | | 8,302 | | | | 86,922 | |

Ivy High Income Opportunities Fund1 | | | 5,847 | | | | 79,928 | |

MFS Multimarket Income Trust1 | | | 12,912 | | | | 78,118 | |

New Ireland Fund, Inc.1 | | | 6,179 | | | | 73,159 | |

Franklin Limited Duration Income Trust1 | | | 6,102 | | | | 70,783 | |

Cohen & Steers Closed-End Opportunity Fund, Inc.1 | | | 5,908 | | | | 68,237 | |

Cohen & Steers Infrastructure Fund, Inc.1 | | | 3,154 | | | | 67,559 | |

CBRE Clarion Global Real Estate Income Fund1 | | | 7,930 | | | | 65,264 | |

First Trust Enhanced Equity Income Fund1 | | | 4,914 | | | | 64,472 | |

PIMCO Dynamic Credit Income Fund1 | | | 3,345 | | | | 63,990 | |

Gabelli Dividend & Income Trust1 | | | 3,339 | | | | 63,874 | |

Tekla Healthcare Opportunities Fund1 | | | 3,834 | | | | 63,759 | |

Eaton Vance Limited Duration Income Fund1 | | | 4,680 | | | | 62,899 | |

BlackRock Limited Duration Income Trust1 | | | 4,118 | | | | 62,800 | |

BlackRock Corporate High Yield Fund, Inc.1 | | | 5,993 | | | | 62,567 | |

Western Asset Emerging Markets Debt Fund, Inc.1 | | | 4,068 | | | | 62,566 | |

Western Asset High Yield Defined Opportunity Fund, Inc.1 | | | 4,138 | | | | 62,153 | |

Liberty All Star Equity Fund1 | | | 12,378 | | | | 62,138 | |

BlackRock Multi-Sector Income Trust1 | | | 3,750 | | | | 62,063 | |

Royce Value Trust, Inc.1 | | | 5,243 | | | | 61,710 | |

MFS Charter Income Trust1 | | | 7,316 | | | | 61,967 | |

BlackRock Debt Strategies Fund, Inc.1 | | | 17,476 | | | | 61,690 | |

AllianzGI NFJ Dividend Interest & Premium Strategy Fund1 | | | 4,866 | | | | 59,998 | |

Advent/Claymore Enhanced Growth & Income Fund1,2 | | | 7,312 | | | | 59,885 | |

ASA Gold and Precious Metals Ltd.1 | | | 3,775 | | | | 55,795 | |

Madison Strategic Sector Premium Fund1 | | | 4,590 | | | | 52,739 | |

Tortoise Energy Independence Fund, Inc.1 | | | 3,498 | | | | 52,190 | |

Tortoise Pipeline & Energy Fund, Inc.1 | | | 2,739 | | | | 50,973 | |

Brookfield Global Listed Infrastructure Income Fund, Inc.1 | | | 3,853 | | | | 50,705 | |

First Trust Energy Infrastructure Fund1 | | | 2,808 | | | | 49,000 | |

Legg Mason BW Global Income Opportunities Fund, Inc.1 | | | 3,736 | | | | 48,419 | |

Asia Tigers Fund, Inc.1 | | | 5,039 | | | | 48,223 | |

Western Asset Global High Income Fund, Inc.1 | | | 4,932 | | | | 47,890 | |

Morgan Stanley India Investment Fund, Inc.1 | | | 1,769 | | | | 47,179 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 17 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

Diversified Real Asset Income Fund1 | | | 2,845 | | | $ | 47,085 | |

Nuveen Dow 30sm Dynamic Overwrite Fund1 | | | 3,236 | | | | 47,019 | |

Voya Infrastructure Industrials and Materials Fund1 | | | 3,788 | | | | 46,820 | |

Templeton Dragon Fund, Inc.1 | | | 2,703 | | | | 46,816 | |

Nuveen Global High Income Fund | | | 3,251 | | | | 46,782 | |

Cohen & Steers MLP Income and Energy Opportunity Fund, Inc.1 | | | 4,581 | | | | 46,680 | |

Wells Fargo Global Dividend Opportunity Fund1 | | | 7,790 | | | | 46,506 | |

LMP Capital and Income Fund, Inc.1 | | | 3,535 | | | | 46,415 | |

Adams Natural Resources Fund, Inc.1 | | | 2,300 | | | | 46,253 | |

Clough Global Opportunities Fund1 | | | 4,942 | | | | 46,109 | |

Royce Micro-Capital Trust, Inc.1 | | | 6,279 | | | | 46,088 | |

Macquarie Global Infrastructure Total Return Fund, Inc.1 | | | 2,153 | | | | 46,074 | |

Putnam Premier Income Trust1 | | | 9,786 | | | | 45,994 | |

Calamos Global Dynamic Income Fund1 | | | 6,538 | | | | 45,897 | |

India Fund, Inc.1 | | | 1,869 | | | | 45,417 | |

Wells Fargo Income Opportunities Fund1 | | | 5,726 | | | | 45,236 | |

Blackstone / GSO Strategic Credit Fund1 | | | 3,108 | | | | 44,724 | |

ClearBridge American Energy MLP Fund, Inc.1 | | | 5,167 | | | | 44,695 | |

Prudential Global Short Duration High Yield Fund, Inc.1 | | | 2,948 | | | | 44,249 | |

Western Asset Managed High Income Fund, Inc.1 | | | 9,347 | | | | 44,118 | |

BlackRock Global Opportunities Equity Trust1 | | | 3,705 | | | | 43,904 | |

Voya Global Equity Dividend and Premium Opportunity Fund1 | | | 6,329 | | | | 43,860 | |

Eaton Vance Tax-Advantaged Global Dividend Income Fund1 | | | 3,035 | | | | 43,674 | |

BlackRock International Growth and Income Trust1 | | | 7,510 | | | | 43,183 | |

Avenue Income Credit Strategies Fund1 | | | 3,407 | | | | 40,816 | |

KKR Income Opportunities Fund1 | | | 2,697 | | | | 40,617 | |

Virtus Global Multi-Sector Income Fund1 | | | 2,659 | | | | 40,310 | |

Voya Natural Resources Equity Income Fund1 | | | 6,311 | | | | 39,886 | |

Nuveen Senior Income Fund1 | | | 6,551 | | | | 39,568 | |

Neuberger Berman High Yield Strategies Fund, Inc.1 | | | 3,575 | | | | 39,146 | |

John Hancock Hedged Equity & Income Fund1 | | | 2,605 | | | | 39,049 | |

Nuveen Tax-Advantaged Total Return Strategy Fund1 | | | 3,328 | | | | 37,540 | |

Nuveen Short Duration Credit Opportunities Fund1 | | | 2,385 | | | | 37,492 | |

Stone Harbor Emerging Markets Total Income Fund1 | | | 2,811 | | | | 37,105 | |

Nuveen Real Asset Income and Growth Fund1 | | | 2,179 | | | | 36,825 | |

Nuveen Tax-Advantaged Dividend Growth Fund1 | | | 2,561 | | | | 36,622 | |

Nuveen Michigan Quality Income Municipal Fund1 | | | 2,305 | | | | 35,382 | |

18 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

Templeton Emerging Markets Fund/United States1 | | | 3,004 | | | $ | 34,216 | |

Cohen & Steers Global Income Builder, Inc.1 | | | 3,806 | | | | 33,188 | |

Clough Global Equity Fund1 | | | 3,087 | | | | 33,062 | |

Nuveen Enhanced Municipal Credit Opportunities Fund1 | | | 2,054 | | | | 32,700 | |

Mexico Fund, Inc.1 | | | 1,949 | | | | 32,607 | |

Gabelli Multimedia Trust, Inc.1 | | | 4,471 | | | | 31,521 | |

Voya Emerging Markets High Income Dividend Equity Fund1 | | | 4,247 | | | | 31,215 | |

Nuveen North Carolina Premium Income Municipal Fund1 | | | 2,102 | | | | 31,089 | |

Dividend and Income Fund1 | | | 2,823 | | | | 30,799 | |

Credit Suisse Asset Management Income Fund, Inc.1 | | | 10,328 | | | | 30,261 | |

Franklin Universal Trust1 | | | 4,359 | | | | 30,077 | |

Western Asset Global Partners Income Fund, Inc.1 | | | 3,498 | | | | 29,978 | |

John Hancock Investors Trust1 | | | 1,858 | | | | 29,951 | |

Voya Asia Pacific High Dividend Equity Income Fund1 | | | 3,367 | | | | 29,798 | |

Cushing Renaissance Fund1 | | | 1,899 | | | | 29,757 | |

First Trust Strategic High Income Fund II1 | | | 2,444 | | | | 29,230 | |

Sprott Focus Trust, Inc.1 | | | 4,514 | | | | 28,980 | |

Invesco High Income Trust II1 | | | 2,083 | | | | 28,662 | |

Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund1 | | | 2,272 | | | | 28,196 | |

Alpine Global Dynamic Dividend Fund1 | | | 3,313 | | | | 28,028 | |

Nuveen Connecticut Premium Income Municipal Fund1 | | | 1,960 | | | | 27,381 | |

Aberdeen Singapore Fund, Inc.1 | | | 2,922 | | | | 26,415 | |

Calamos Global Total Return Fund1 | | | 2,358 | | | | 25,938 | |

Japan Smaller Capitalization Fund, Inc.1 | | | 2,649 | | | | 25,907 | |

Korea Fund, Inc.1 | | | 801 | | | | 25,896 | |

Lazard World Dividend & Income Fund, Inc.1 | | | 2,805 | | | | 25,329 | |

Nuveen Multi-Market Income Fund, Inc.1 | | | 2,938 | | | | 22,006 | |

Voya Global Advantage and Premium Opportunity Fund1 | | | 2,148 | | | | 21,201 | |

Special Opportunities Fund, Inc.1 | | | 1,520 | | | | 20,900 | |

Nuveen Flexible Investment Income Fund1 | | | 1,292 | | | | 20,439 | |

Morgan Stanley Emerging Markets Fund, Inc.1 | | | 1,505 | | | | 19,986 | |

Gabelli Global Utility & Income Trust1 | | | 1,068 | | | | 19,854 | |

Central Europe Russia and Turkey Fund, Inc.1 | | | 1,073 | | | | 19,657 | |

New Germany Fund, Inc.1 | | | 1,494 | | | | 19,422 | |

First Trust Aberdeen Emerging Opportunity Fund1 | | | 1,293 | | | | 19,033 | |

Delaware Investments Dividend & Income Fund, Inc.1 | | | 1,806 | | | | 17,988 | |

Aberdeen Latin America Equity Fund, Inc.1 | | | 891 | | | | 17,927 | |

Liberty All Star Growth Fund, Inc.1 | | | 4,098 | | | | 16,802 | |

Aberdeen Chile Fund, Inc.1 | | | 2,592 | | | | 16,200 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 19 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

Aberdeen Greater China Fund, Inc.1 | | | 1,936 | | | $ | 16,166 | |

Morgan Stanley Asia-Pacific Fund, Inc.1 | | | 1,146 | | | | 15,815 | |

Aberdeen Japan Equity Fund, Inc.1 | | | 2,053 | | | | 15,747 | |

JPMorgan China Region Fund, Inc.1 | | | 971 | | | | 14,759 | |

Nuveen S&P 500 Dynamic Overwrite Fund1 | | | 1,036 | | | | 14,007 | |

Taiwan Fund, Inc.*,1 | | | 911 | | | | 13,875 | |

European Equity Fund, Inc.1 | | | 1,762 | | | | 13,656 | |

Mexico Equity & Income Fund, Inc.1 | | | 1,240 | | | | 13,504 | |

Guggenheim Enhanced Equity Income Fund1,2 | | | 1,730 | | | | 12,975 | |

Guggenheim Enhanced Equity Strategy Fund1,2 | | | 827 | | | | 12,744 | |

Asia Pacific Fund, Inc.1 | | | 1,266 | | | | 12,344 | |

Aberdeen Emerging Markets Smaller Company Opportunities Fund, Inc.*,1 | | | 1,020 | | | | 12,332 | |

MFS Intermediate High Income Fund1 | | | 4,821 | | | | 11,908 | |

Deutsche Strategic Income Trust1 | | | 1,031 | | | | 11,826 | |

Advent Claymore Convertible Securities and Income Fund1,2 | | | 715 | | | | 9,974 | |

Nuveen Pennsylvania Investment Quality Municipal Fund1 | | | 594 | | | | 9,154 | |

Nuveen Select Quality Municipal Fund, Inc.1 | | | 582 | | | | 9,033 | |

Deutsche Multi-Market Income Trust1 | | | 1,105 | | | | 9,006 | |

Deutsche High Income Trust1 | | | 1,023 | | | | 8,982 | |

Nuveen Premium Income Municipal Fund, Inc.1 | | | 580 | | | | 8,949 | |

Nuveen Municipal Market Opportunity Fund, Inc.1 | | | 593 | | | | 8,942 | |

Nuveen Premier Municipal Income Fund, Inc.1 | | | 593 | | | | 8,937 | |

Nuveen New York AMT-Free Municipal Income Fund1 | | | 622 | | | | 8,864 | |

BlackRock Muni Intermediate Duration Fund, Inc.1 | | | 576 | | | | 8,778 | |

Western Asset Global Corporate Defined Opportunity Fund, Inc.1 | | | 506 | | | | 8,622 | |

Western Asset High Income Opportunity Fund, Inc.1 | | | 1,712 | | | | 8,389 | |

Guggenheim Equal Weight Enhanced Equity Income Fund1,2 | | | 500 | | | | 8,260 | |

Latin American Discovery Fund, Inc.1 | | | 889 | | | | 8,214 | |

Brookfield High Income Fund, Inc.1 | | | 1,138 | | | | 8,205 | |

Aberdeen Australia Equity Fund, Inc.1 | | | 1,438 | | | | 8,110 | |

Calamos Convertible Opportunities and Income Fund1 | | | 772 | | | | 7,589 | |

Gabelli Convertible and Income Securities Fund, Inc. | | | 1,463 | | | | 6,803 | |

BlackRock New York Municipal Income Quality Trust1 | | | 403 | | | | 6,073 | |

New America High Income Fund, Inc.1 | | | 265 | | | | 2,266 | |

Total Closed-End Funds | | | | | | | | |

(Cost $16,548,232) | | | | | | | 16,774,873 | |

20 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | Face

Amount | | | Value | |

| | | | | | |

REPURCHASE AGREEMENTS††,6 - 33.0% | |

HSBC Group

issued 06/30/16 at 0.26%

due 07/01/16 | | $ | 24,324,442 | | | $ | 24,324,442 | |

Royal Bank of Canada

issued 06/30/16 at 0.33%

due 07/01/16 | | | 20,679,908 | | | | 20,679,908 | |

Total Repurchase Agreements | | | | | |

(Cost $45,004,350) | | | | | | | 45,004,350 | |

| | | | | | | | | |

U.S. GOVERNMENT SECURITIES†† - 1.5% | |

U.S. Treasury Bill | | | | | | | | |

due 07/14/163 | | | 2,000,000 | | | | 1,999,910 | |

Total U.S. Government Securities | | | | | |

(Cost $1,999,845) | | | | | | | 1,999,910 | |

| | | | | | | | | |

Total Investments – 94.6% | | | | | |

(Cost $126,234,677) | | | | | | $ | 128,988,335 | |

| | | | | | | | | |

| | Shares | | | | | |

| | | | | | | | | |

COMMON STOCKS SOLD SHORT† - (30.0)% | |

| | | | | | | | | |

Diversified - (0.1)% | |

Leucadia National Corp. | | | 9,036 | | | $ | (156,594 | ) |

| | | | | | | | | |

Basic Materials - (1.4)% | |

Axalta Coating Systems Ltd.* | | | 967 | | | | (25,655 | ) |

Freeport-McMoRan, Inc. | | | 3,993 | | | | (44,482 | ) |

Alcoa, Inc. | | | 5,296 | | | | (49,094 | ) |

PPG Industries, Inc. | | | 673 | | | | (70,093 | ) |

Platform Specialty Products Corp.* | | | 8,110 | | | | (72,017 | ) |

Allegheny Technologies, Inc. | | | 7,439 | | | | (94,847 | ) |

NewMarket Corp. | | | 294 | | | | (121,828 | ) |

WR Grace & Co. | | | 1,681 | | | | (123,066 | ) |

Southern Copper Corp. | | | 4,917 | | | | (132,661 | ) |

RPM International, Inc. | | | 2,900 | | | | (144,855 | ) |

Praxair, Inc. | | | 1,303 | | | | (146,444 | ) |

Ecolab, Inc. | | | 1,344 | | | | (159,398 | ) |

FMC Corp. | | | 3,446 | | | | (159,584 | ) |

Tahoe Resources, Inc. | | | 10,969 | | | | (164,206 | ) |

Monsanto Co. | | | 1,597 | | | | (165,146 | ) |

Royal Gold, Inc. | | | 2,480 | | | | (178,609 | ) |

Total Basic Materials | | | | | | | (1,851,985 | ) |

| | | | | | | | | |

Energy - (2.0)% | |

Chesapeake Energy Corp.* | | | 84 | | | | (360 | ) |

Southwestern Energy Co.* | | | 43 | | | | (541 | ) |

California Resources Corp.* | | | 231 | | | | (2,818 | ) |

Whiting Petroleum Corp.* | | | 378 | | | | (3,500 | ) |

QEP Resources, Inc. | | | 588 | | | | (10,366 | ) |

Denbury Resources, Inc. | | | 3,954 | | | | (14,195 | ) |

Energen Corp. | | | 336 | | | | (16,199 | ) |

Halliburton Co. | | | 379 | | | | (17,165 | ) |

SemGroup Corp. — Class A | | | 743 | | | | (24,192 | ) |

Kinder Morgan, Inc. | | | 1,344 | | | | (25,160 | ) |

NOW, Inc.* | | | 1,512 | | | | (27,428 | ) |

CVR Energy, Inc. | | | 2,143 | | | | (33,217 | ) |

Murphy Oil Corp. | | | 1,050 | | | | (33,338 | ) |

Concho Resources, Inc.* | | | 336 | | | | (40,075 | ) |

Superior Energy Services, Inc. | | | 2,270 | | | | (41,791 | ) |

Dril-Quip, Inc.* | | | 924 | | | | (53,989 | ) |

Continental Resources, Inc.* | | | 1,219 | | | | (55,184 | ) |

Schlumberger Ltd. | | | 714 | | | | (56,463 | ) |

Western Refining, Inc. | | | 2,772 | | | | (57,186 | ) |

Cobalt International Energy, Inc.* | | | 45,641 | | | | (61,159 | ) |

ONEOK, Inc. | | | 1,344 | | | | (63,773 | ) |

RPC, Inc.* | | | 5,127 | | | | (79,622 | ) |

Noble Energy, Inc. | | | 2,270 | | | | (81,425 | ) |

Weatherford International plc* | | | 15,382 | | | | (85,370 | ) |

Targa Resources Corp. | | | 2,101 | | | | (88,536 | ) |

Apache Corp. | | | 1,639 | | | | (91,243 | ) |

Pioneer Natural Resources Co. | | | 630 | | | | (95,262 | ) |

Devon Energy Corp. | | | 2,857 | | | | (103,566 | ) |

FMC Technologies, Inc.* | | | 4,203 | | | | (112,094 | ) |

Gulfport Energy Corp.* | | | 3,656 | | | | (114,287 | ) |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 21 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

Murphy USA, Inc.* | | | 1,723 | | | $ | (127,778 | ) |

Cabot Oil & Gas Corp. — Class A | | | 5,211 | | | | (134,131 | ) |

Occidental Petroleum Corp. | | | 1,933 | | | | (146,057 | ) |

Cheniere Energy, Inc.* | | | 3,909 | | | | (146,783 | ) |

EOG Resources, Inc. | | | 1,849 | | | | (154,244 | ) |

Anadarko Petroleum Corp. | | | 2,942 | | | | (156,662 | ) |

Cimarex Energy Co. | | | 1,387 | | | | (165,497 | ) |

Range Resources Corp. | | | 6,559 | | | | (282,955 | ) |

Total Energy | | | | | | | (2,803,611 | ) |

| | | | | | | | | |

Utilities - (2.1)% | |

DTE Energy Co. | | | 84 | | | | (8,326 | ) |

American Water Works Company, Inc. | | | 336 | | | | (28,395 | ) |

Calpine Corp.* | | | 2,184 | | | | (32,214 | ) |

Westar Energy, Inc. | | | 671 | | | | (37,636 | ) |

Duke Energy Corp. | | | 546 | | | | (46,841 | ) |

NRG Energy, Inc. | | | 4,707 | | | | (70,558 | ) |

PG&E Corp. | | | 1,597 | | | | (102,080 | ) |

Hawaiian Electric Industries, Inc. | | | 4,666 | | | | (152,998 | ) |

Eversource Energy | | | 2,690 | | | | (161,131 | ) |

Southern Co. | | | 3,026 | | | | (162,284 | ) |

Sempra Energy | | | 1,429 | | | | (162,935 | ) |

Vectren Corp. | | | 3,110 | | | | (163,804 | ) |

Entergy Corp. | | | 2,017 | | | | (164,083 | ) |

NextEra Energy, Inc. | | | 1,260 | | | | (164,304 | ) |

Dominion Resources, Inc. | | | 2,130 | | | | (165,991 | ) |

OGE Energy Corp. | | | 5,127 | | | | (167,909 | ) |

Aqua America, Inc. | | | 4,738 | | | | (168,957 | ) |

CenterPoint Energy, Inc. | | | 7,060 | | | | (169,440 | ) |

Alliant Energy Corp. | | | 4,286 | | | | (170,154 | ) |

WEC Energy Group, Inc. | | | 2,606 | | | | (170,172 | ) |

National Fuel Gas Co. | | | 3,110 | | | | (176,897 | ) |

MDU Resources Group, Inc. | | | 7,593 | | | | (182,232 | ) |

Total Utilities | | | | | | | (2,829,341 | ) |

| | | | | | | | | |

Communications - (2.3)% | |

Tribune Media Co. — Class A | | | 630 | | | | (24,683 | ) |

Liberty Ventures* | | | 1,260 | | | | (46,708 | ) |

Discovery Communications, Inc. — Class A* | | | 2,186 | | | | (55,153 | ) |

Twenty-First Century Fox, Inc. — Class A | | | 2,522 | | | | (68,220 | ) |

Twenty-First Century Fox, Inc. — Class B | | | 2,522 | | | | (68,725 | ) |

Palo Alto Networks, Inc.* | | | 630 | | | | (77,263 | ) |

Frontier Communications Corp. | | | 20,215 | | | | (99,862 | ) |

Priceline Group, Inc.* | | | 84 | | | | (104,866 | ) |

Groupon, Inc. — Class A* | | | 43,371 | | | | (140,956 | ) |

Arista Networks, Inc.* | | | 2,270 | | | | (146,143 | ) |

CBS Corp. — Class B | | | 2,690 | | | | (146,444 | ) |

FireEye, Inc.* | | | 8,910 | | | | (146,748 | ) |

Twitter, Inc.* | | | 8,867 | | | | (149,941 | ) |

TripAdvisor, Inc.* | | | 2,353 | | | | (151,298 | ) |

Viavi Solutions, Inc.* | | | 23,409 | | | | (155,202 | ) |

CommScope Holding Company, Inc.* | | | 5,043 | | | | (156,484 | ) |

Splunk, Inc.* | | | 2,900 | | | | (157,122 | ) |

Yahoo!, Inc.* | | | 4,203 | | | | (157,865 | ) |

Zayo Group Holdings, Inc.* | | | 5,757 | | | | (160,793 | ) |

DISH Network Corp. — Class A* | | | 3,110 | | | | (162,964 | ) |

Yelp, Inc. — Class A* | | | 5,716 | | | | (173,538 | ) |

Clear Channel Outdoor Holdings, Inc. — Class A | | | 28,024 | | | | (174,309 | ) |

Zillow Group, Inc. — Class A* | | | 5,632 | | | | (206,414 | ) |

Pandora Media, Inc.* | | | 17,063 | | | | (212,434 | ) |

Total Communications | | | | | | | (3,144,135 | ) |

| | | | | | | | | |

Technology - (2.8)% | |

Qorvo, Inc.* | | | 84 | | | | (4,642 | ) |

Red Hat, Inc.* | | | 126 | | | | (9,148 | ) |

MSCI, Inc. — Class A | | | 126 | | | | (9,717 | ) |

Accenture plc — Class A | | | 294 | | | | (33,307 | ) |

Linear Technology Corp. | | | 1,009 | | | | (46,949 | ) |

International Business Machines Corp. | | | 378 | | | | (57,373 | ) |

22 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

VeriFone Systems, Inc.* | | | 5,380 | | | $ | (99,745 | ) |

Ultimate Software Group, Inc.* | | | 504 | | | | (105,986 | ) |

Fortinet, Inc.* | | | 3,363 | | | | (106,237 | ) |

salesforce.com, Inc.* | | | 1,344 | | | | (106,727 | ) |

Maxim Integrated Products, Inc. | | | 3,026 | | | | (107,998 | ) |

Autodesk, Inc.* | | | 2,437 | | | | (131,939 | ) |

NetSuite, Inc.* | | | 1,849 | | | | (134,607 | ) |

ServiceNow, Inc.* | | | 2,101 | | | | (139,506 | ) |

Cree, Inc.* | | | 5,800 | | | | (141,752 | ) |

Tableau Software, Inc. — Class A* | | | 2,942 | | | | (143,923 | ) |

NCR Corp.* | | | 5,253 | | | | (145,876 | ) |

Marvell Technology Group Ltd. | | | 15,760 | | | | (150,193 | ) |

Workday, Inc. — Class A* | | | 2,017 | | | | (150,609 | ) |

Teradata Corp.* | | | 6,052 | | | | (151,724 | ) |

PTC, Inc.* | | | 4,119 | | | | (154,792 | ) |

Cerner Corp.* | | | 2,690 | | | | (157,634 | ) |

QUALCOMM, Inc. | | | 2,984 | | | | (159,853 | ) |

Zynga, Inc. — Class A* | | | 64,847 | | | | (161,469 | ) |

Cypress Semiconductor Corp. | | | 16,012 | | | | (168,926 | ) |

CDK Global, Inc. | | | 3,236 | | | | (179,566 | ) |

Veeva Systems, Inc. — Class A* | | | 5,506 | | | | (187,865 | ) |

Paychex, Inc. | | | 3,363 | | | | (200,099 | ) |

Lam Research Corp. | | | 2,502 | | | | (210,318 | ) |

VMware, Inc. — Class A* | | | 5,195 | | | | (297,258 | ) |

Total Technology | | | | | | | (3,855,738 | ) |

| | | | | | | | | |

Consumer, Cyclical - (3.6)% | |

Allison Transmission Holdings, Inc. | | | 84 | | | | (2,371 | ) |

Hilton Worldwide Holdings, Inc. | | | 211 | | | | (4,754 | ) |

L Brands, Inc. | | | 84 | | | | (5,639 | ) |

Ross Stores, Inc. | | | 126 | | | | (7,143 | ) |

Toro Co. | | | 84 | | | | (7,409 | ) |

HD Supply Holdings, Inc.* | | | 715 | | | | (24,896 | ) |

lululemon athletica, Inc.* | | | 378 | | | | (27,919 | ) |

Nordstrom, Inc. | | | 757 | | | | (28,804 | ) |

Scotts Miracle-Gro Co. — Class A | | | 546 | | | | (38,171 | ) |

VF Corp. | | | 714 | | | | (43,904 | ) |

Delphi Automotive plc | | | 714 | | | | (44,696 | ) |

Wynn Resorts Ltd. | | | 504 | | | | (45,683 | ) |

Advance Auto Parts, Inc. | | | 336 | | | | (54,308 | ) |

Harman International Industries, Inc. | | | 840 | | | | (60,329 | ) |

MSC Industrial Direct Company, Inc. — Class A | | | 967 | | | | (68,232 | ) |

Under Armour, Inc. — Class A* | | | 2,060 | | | | (82,668 | ) |

TJX Companies, Inc. | | | 1,093 | | | | (84,412 | ) |

Costco Wholesale Corp. | | | 546 | | | | (85,744 | ) |

Hyatt Hotels Corp. — Class A* | | | 1,976 | | | | (97,101 | ) |

BorgWarner, Inc. | | | 3,363 | | | | (99,276 | ) |

Signet Jewelers Ltd. | | | 1,219 | | | | (100,458 | ) |

Polaris Industries, Inc. | | | 1,303 | | | | (106,533 | ) |

Tempur Sealy International, Inc.* | | | 1,933 | | | | (106,934 | ) |

Kate Spade & Co.* | | | 5,926 | | | | (122,135 | ) |

WABCO Holdings, Inc.* | | | 1,344 | | | | (123,070 | ) |

Panera Bread Co. — Class A* | | | 589 | | | | (124,833 | ) |

Tiffany & Co. | | | 2,101 | | | | (127,404 | ) |

Hanesbrands, Inc. | | | 5,211 | | | | (130,952 | ) |

Williams-Sonoma, Inc. | | | 2,563 | | | | (133,609 | ) |

Chipotle Mexican Grill, Inc. — Class A* | | | 336 | | | | (135,327 | ) |

WW Grainger, Inc. | | | 603 | | | | (137,032 | ) |

Harley-Davidson, Inc. | | | 3,067 | | | | (138,935 | ) |

Lions Gate Entertainment Corp. | | | 6,893 | | | | (139,445 | ) |

Sally Beauty Holdings, Inc.* | | | 4,791 | | | | (140,903 | ) |

Spirit Airlines, Inc.* | | | 3,152 | | | | (141,430 | ) |

Choice Hotels International, Inc. | | | 2,984 | | | | (142,098 | ) |

Dunkin’ Brands Group, Inc. | | | 3,277 | | | | (142,943 | ) |

Fastenal Co. | | | 3,236 | | | | (143,646 | ) |

CarMax, Inc.* | | | 2,942 | | | | (144,246 | ) |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 23 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

Tractor Supply Co. | | | 1,597 | | | $ | (145,614 | ) |

Tupperware Brands Corp. | | | 2,647 | | | | (148,973 | ) |

Yum! Brands, Inc. | | | 1,891 | | | | (156,802 | ) |

MGM Resorts International* | | | 7,060 | | | | (159,767 | ) |

Ulta Salon Cosmetics & Fragrance, Inc.* | | | 714 | | | | (173,959 | ) |

Copart, Inc.* | | | 3,573 | | | | (175,112 | ) |

Dollar Tree, Inc.* | | | 1,933 | | | | (182,165 | ) |

Marriott International, Inc. — Class A | | | 5,629 | | | | (374,103 | ) |

Total Consumer, Cyclical | | | | | | | (4,911,887 | ) |

| | | | | | | | | |

Industrial - (4.0)% | |

Colfax Corp.* | | | 126 | | | | (3,334 | ) |

AMETEK, Inc. | | | 168 | | | | (7,767 | ) |

Union Pacific Corp. | | | 210 | | | | (18,323 | ) |

Expeditors International of Washington, Inc. | | | 378 | | | | (18,537 | ) |

Fortune Brands Home & Security, Inc. | | | 336 | | | | (19,478 | ) |

Lockheed Martin Corp. | | | 84 | | | | (20,846 | ) |

Honeywell International, Inc. | | | 210 | | | | (24,427 | ) |

Acuity Brands, Inc. | | | 126 | | | | (31,243 | ) |

General Dynamics Corp. | | | 253 | | | | (35,228 | ) |

Hexcel Corp. | | | 1,093 | | | | (45,513 | ) |

Golar LNG Ltd. | | | 3,236 | | | | (50,158 | ) |

Pentair plc | | | 883 | | | | (51,470 | ) |

Timken Co. | | | 1,723 | | | | (52,827 | ) |

Boeing Co. | | | 420 | | | | (54,545 | ) |

Middleby Corp.* | | | 504 | | | | (58,086 | ) |

Emerson Electric Co. | | | 1,303 | | | | (67,964 | ) |

Wabtec Corp. | | | 1,219 | | | | (85,610 | ) |

Hubbell, Inc. | | | 840 | | | | (88,595 | ) |

Ball Corp. | | | 1,429 | | | | (103,302 | ) |

Kennametal, Inc. | | | 5,169 | | | | (114,287 | ) |

Graco, Inc. | | | 1,471 | | | | (116,194 | ) |

United Parcel Service, Inc. — Class B | | | 1,093 | | | | (117,738 | ) |

Triumph Group, Inc. | | | 3,320 | | | | (117,860 | ) |

Zebra Technologies Corp. — Class A* | | | 2,396 | | | | (120,040 | ) |

Kansas City Southern | | | 1,387 | | | | (124,955 | ) |

Chicago Bridge & Iron Company N.V. | | | 3,866 | | | | (133,880 | ) |

Flowserve Corp. | | | 3,067 | | | | (138,537 | ) |

SPX Corp.* | | | 9,330 | | | | (138,550 | ) |

Trimble Navigation Ltd.* | | | 5,757 | | | | (140,240 | ) |

Lincoln Electric Holdings, Inc. | | | 2,396 | | | | (141,555 | ) |

Rockwell Collins, Inc. | | | 1,681 | | | | (143,120 | ) |

B/E Aerospace, Inc. | | | 3,110 | | | | (143,604 | ) |

J.B. Hunt Transport Services, Inc. | | | 1,807 | | | | (146,241 | ) |

Armstrong World Industries, Inc.* | | | 3,740 | | | | (146,421 | ) |

Owens-Illinois, Inc.* | | | 8,196 | | | | (147,610 | ) |

United Technologies Corp. | | | 1,471 | | | | (150,851 | ) |

National Instruments Corp. | | | 5,506 | | | | (150,864 | ) |

Garmin Ltd. | | | 3,573 | | | | (151,567 | ) |

IDEX Corp. | | | 1,849 | | | | (151,803 | ) |

Stericycle, Inc.* | | | 1,471 | | | | (153,161 | ) |

SBA Communications Corp. — Class A* | | | 1,429 | | | | (154,246 | ) |

3M Co. | | | 883 | | | | (154,631 | ) |

CH Robinson Worldwide, Inc. | | | 2,101 | | | | (155,999 | ) |

Covanta Holding Corp. | | | 9,499 | | | | (156,259 | ) |

Landstar System, Inc. | | | 2,297 | | | | (157,712 | ) |

Donaldson Company, Inc. | | | 4,623 | | | | (158,846 | ) |

Eagle Materials, Inc. | | | 2,060 | | | | (158,929 | ) |

Allegion plc | | | 2,311 | | | | (160,453 | ) |

Nordson Corp. | | | 1,976 | | | | (165,213 | ) |

TransDigm Group, Inc.* | | | 673 | | | | (177,463 | ) |

Cognex Corp. | | | 4,329 | | | | (186,580 | ) |

Total Industrial | | | | | | | (5,512,662 | ) |

| | | | | | | | | |

Consumer, Non-cyclical - (5.6)% | |

Altria Group, Inc. | | | 84 | | | | (5,793 | ) |

Bunge Ltd. | | | 126 | | | | (7,453 | ) |

Community Health Systems, Inc.* | | | 715 | | | | (8,616 | ) |

Herc Holdings, Inc.* | | | 884 | | | | (9,786 | ) |

Clorox Co. | | | 84 | | | | (11,625 | ) |

24 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited)(continued) | June 30, 2016 |

MULTI-HEDGE STRATEGIES FUND | |

| | | Shares | | | Value | |

| | | | | | | |

HCA Holdings, Inc.* | | | 168 | | | $ | (12,938 | ) |

BioMarin Pharmaceutical, Inc.* | | | 210 | | | | (16,338 | ) |

Akorn, Inc.* | | | 589 | | | | (16,778 | ) |

Alexion Pharmaceuticals, Inc.* | | | 168 | | | | (19,616 | ) |

Moody’s Corp. | | | 210 | | | | (19,679 | ) |

Incyte Corp.* | | | 336 | | | | (26,873 | ) |

Robert Half International, Inc. | | | 883 | | | | (33,695 | ) |

Endo International plc* | | | 2,396 | | | | (37,354 | ) |

Avis Budget Group, Inc.* | | | 1,219 | | | | (39,288 | ) |

Bluebird Bio, Inc.* | | | 967 | | | | (41,861 | ) |

Philip Morris International, Inc. | | | 463 | | | | (47,096 | ) |

Patterson Companies, Inc. | | | 1,050 | | | | (50,285 | ) |

Bruker Corp. | | | 2,353 | | | | (53,507 | ) |

Rollins, Inc. | | | 1,849 | | | | (54,120 | ) |

CoStar Group, Inc.* | | | 253 | | | | (55,321 | ) |

Tenet Healthcare Corp.* | | | 2,017 | | | | (55,750 | ) |

Alnylam Pharmaceuticals, Inc.* | | | 1,050 | | | | (58,265 | ) |

Jazz Pharmaceuticals plc* | | | 420 | | | | (59,350 | ) |

Bristol-Myers Squibb Co. | | | 924 | | | | (67,960 | ) |

Estee Lauder Companies, Inc. — Class A | | | 757 | | | | (68,902 | ) |

Whole Foods Market, Inc. | | | 2,480 | | | | (79,410 | ) |

Ionis Pharmaceuticals, Inc.* | | | 3,783 | | | | (88,106 | ) |

PepsiCo, Inc. | | | 840 | | | | (88,990 | ) |

Nielsen Holdings plc | | | 2,060 | | | | (107,058 | ) |

Puma Biotechnology, Inc.* | | | 3,614 | | | | (107,661 | ) |

Amsurg Corp. — Class A* | | | 1,494 | | | | (115,845 | ) |

Anthem, Inc. | | | 887 | | | | (116,499 | ) |

Avon Products, Inc. | | | 32,445 | | | | (122,642 | ) |

Sprouts Farmers Market, Inc.* | | | 5,422 | | | | (124,164 | ) |

Stryker Corp. | | | 1,050 | | | | (125,822 | ) |

Alkermes plc* | | | 2,984 | | | | (128,968 | ) |

Intercept Pharmaceuticals, Inc.* | | | 924 | | | | (131,836 | ) |

Intuitive Surgical, Inc.* | | | 210 | | | | (138,897 | ) |

Illumina, Inc.* | | | 1,009 | | | | (141,643 | ) |

Premier, Inc. — Class A* | | | 4,370 | | | | (142,899 | ) |

Brookdale Senior Living, Inc. — Class A* | | | 9,330 | | | | (144,055 | ) |

Morningstar, Inc. | | | 1,766 | | | | (144,423 | ) |

CR Bard, Inc. | | | 630 | | | | (148,151 | ) |

S&P Global, Inc. | | | 1,387 | | | | (148,770 | ) |

Colgate-Palmolive Co. | | | 2,044 | | | | (149,621 | ) |

Coca-Cola Co. | | | 3,404 | | | | (154,303 | ) |

Edgewell Personal Care Co.* | | | 1,849 | | | | (156,074 | ) |

Mead Johnson Nutrition Co. — Class A | | | 1,723 | | | | (156,362 | ) |

FleetCor Technologies, Inc.* | | | 1,093 | | | | (156,441 | ) |

ConAgra Foods, Inc. | | | 3,277 | | | | (156,673 | ) |

Brown-Forman Corp. — Class B | | | 1,576 | | | | (157,222 | ) |

Macquarie Infrastructure Corp. | | | 2,143 | | | | (158,689 | ) |

Vertex Pharmaceuticals, Inc.* | | | 1,849 | | | | (159,051 | ) |

Sysco Corp. | | | 3,152 | | | | (159,932 | ) |

Verisk Analytics, Inc. — Class A* | | | 1,973 | | | | (159,971 | ) |

Kellogg Co. | | | 1,976 | | | | (161,340 | ) |

Live Nation Entertainment, Inc.* | | | 7,019 | | | | (164,946 | ) |

Hain Celestial Group, Inc.* | | | 3,363 | | | | (167,309 | ) |

Kimberly-Clark Corp. | | | 1,219 | | | | (167,588 | ) |

Gartner, Inc.* | | | 1,723 | | | | (167,837 | ) |

McCormick & Company, Inc. | | | 1,597 | | | | (170,352 | ) |

IDEXX Laboratories, Inc.* | | | 1,849 | | | | (171,698 | ) |

Align Technology, Inc.* | | | 2,143 | | | | (172,618 | ) |

WhiteWave Foods Co. — Class A* | | | 3,740 | | | | (175,556 | ) |

Automatic Data Processing, Inc. | | | 1,933 | | | | (177,585 | ) |

Hershey Co. | | | 1,639 | | | | (186,010 | ) |

Aetna, Inc. | | | 2,353 | | | | (287,372 | ) |

Abbott Laboratories | | | 12,338 | | | | (485,007 | ) |

Total Consumer, Non-cyclical | | | | (7,603,645 | ) |