UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07618

ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II

|

| (Exact name of registrant as specified in charter) |

| | |

| 1345 Avenue of the Americas, New York, | | New York 10105 |

| (Address of principal executive offices) | | (Zip code) |

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: September 30, 2008

Date of reporting period: September 30, 2008

ITEM 1. REPORTS TO STOCKHOLDERS.

ANNUAL REPORT

AllianceBernstein

Municipal Income Fund II

Arizona Portfolio

Florida Portfolio

Massachusetts Portfolio

Michigan Portfolio

Minnesota Portfolio

New Jersey Portfolio

Ohio Portfolio

Pennsylvania Portfolio

Virginia Portfolio

Annual Report

Investment Products Offered

| | • | | Are Not Bank Guaranteed |

The investment return and principal value of an investment in the Fund will fluctuate as the prices of the individual securities in which it invests fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For a free copy of the Fund’s prospectus, which contains this and other information, visit our web site at www.alliancebernstein.com or call your financial advisor or AllianceBernstein® at (800) 227-4618. Please read the prospectus carefully before you invest.

You may obtain performance information current to the most recent month-end by visiting www.alliancebernstein.com.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AllianceBernstein’s web site at www.alliancebernstein.com, or go to the Securities and Exchange Commission’s (the “Commission”) web site at www.sec.gov, or call AllianceBernstein at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s web site at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. AllianceBernstein publishes full portfolio holdings for the Fund monthly at www.alliancebernstein.com.

AllianceBernstein Investments, Inc. is an affiliate of AllianceBernstein L.P., the manager of the AllianceBernstein funds, and is a member of FINRA.

AllianceBernstein® and the AB Logo are registered trademarks and service marks used by permission of the owner, AllianceBernstein L.P.

November 18, 2008

Annual Report

This report provides management’s discussion of fund performance for the portfolios of AllianceBernstein Municipal Income Fund II (the “Portfolios”) for the annual reporting period ended September 30, 2008.

Investment Objectives and Policies

The nine Portfolios of this open-end fund, by investing principally in high-yielding, predominantly investment-grade municipal securities, seek to provide their shareholders with the highest level of current income exempt from Federal taxation and state taxation of the respective state that is available without assuming what the Adviser considers to be undue risk. Each of the Portfolios pursues its objective by investing at least 80% of its net assets in municipal securities issued by the named state or municipal securities with interest that is otherwise exempt from the named state’s income tax. The Pennsylvania Portfolio and the Virginia Portfolio are non-diversified, meaning they can invest more of their assets in a fewer number of issuers.

Investment Results

The tables on pages 6-14 show performance for each Portfolio compared with the benchmark, the Lehman Brothers (LB) Municipal Index, for the six- and 12-month periods ended September 30, 2008. For the 12-month period ended September 30, 2008, all of the Portfolios’ Class A shares without sales charges underperformed the benchmark, the LB Municipal Index, which represents the U.S. municipal

market and returned -1.87%, except for the Massachusetts Portfolio and the Minnesota Portfolio, which outperformed. (All of the Portfolios and the benchmark posted negative returns.) For the six-month period ended September 30, 2008, all of the Portfolios’ Class A shares without sales charges underperformed the benchmark, which returned -2.60%, except for the Massachusetts Portfolio, the Minnesota Portfolio and the New Jersey Portfolio, which outperformed.

Though the Portfolios’ Municipal Bond Investment Team (the “Team”) primarily bought higher credit quality bonds, the Portfolios’ weights in lower-credit quality bonds, across various sectors, compared with the benchmark’s detracted from relative performance as credit spreads widened. The Team focused new purchases on high credit quality bonds and generally avoided the longest maturity bonds. This was beneficial to the Portfolios’ performance during the six- and 12-month periods because higher-credit quality bonds outperformed lower-credit quality bonds and shorter-maturity bonds outperformed longer-maturity bonds. Overall, the Portfolios benefited from relatively less interest-rate exposure compared with the benchmark. A more detailed description of the contribution to each Portfolio’s relative performance due to security and sector selection versus the benchmark for the annual reporting period ended September 30, 2008 follows.

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 1 |

Arizona Portfolio – The Arizona Portfolio’s underperformance compared with the benchmark was partially the result of security selection in the special tax, leasing and housing sectors. The Portfolio’s relative underweight in the general obligation sector also detracted from the Portfolio’s performance. The Portfolio’s relative underweight in the industrial revenue bond sector was beneficial to performance.

Florida Portfolio – The Florida Portfolio’s underperformance compared with the benchmark was partially the result of security selection in the general obligation, special tax and hospital sectors. The Portfolio’s relative underweight in the industrial revenue bond sector was beneficial to performance.

Massachusetts Portfolio – The Massachusetts Portfolio’s relative outperformance compared with the benchmark was largely the result of its low level of interest-rate exposure and partially the result of the Portfolio’s relative underweight in the industrial revenue bond sector and security selection within the housing sector. The Portfolio’s relative underweight in the general obligation sector, in addition to security selection in the transportation, special tax and education sectors, detracted from performance.

Michigan Portfolio – The Michigan Portfolio’s underperformance compared with the benchmark was partially the result of security selection in the pre-refunded, housing, hospital and education sectors. The Portfolio’s relative overweight in the housing sector

and underweight in the general obligation sector also detracted from performance.

Minnesota Portfolio – The Minnesota Portfolio’s relative outperformance compared with the benchmark was partially the result of the Portfolio’s relative underweight in the industrial revenue bond sector. Security selection in the housing, education, power and hospital sectors detracted from performance.

New Jersey Portfolio – The New Jersey Portfolio’s underperformance compared with the benchmark was partially the result of security selection in the education, transportation and special tax sectors. The Portfolio’s relative underweight in the general obligation sector also detracted from performance. Security selection in the industrial revenue bond sector was beneficial to performance.

Ohio Portfolio – The Ohio Portfolio’s underperformance compared with the benchmark was partially the result of security selection in the housing, special tax and education sectors. The Portfolio’s relative underweight in the general obligation sector also detracted from performance.

Pennsylvania Portfolio – The Pennsylvania Portfolio’s underperformance compared with the benchmark was partially the result of security selection in the water, transportation, education and hospital sectors. The Portfolio’s relative underweight in the general obligation sector also detracted from performance.

| | |

| 2 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Virginia Portfolio – The Virginia Portfolio’s underperformance compared with the benchmark was partially the result of security selection in the housing, transportation, water and leasing sectors. The Portfolio’s relative underweight in the general obligation sector and overweight in the housing sector also detracted from performance.

Market Review and Investment Strategy

The crisis in the financial markets continued to intensify toward the end of the annual reporting period ended September 30, 2008, and created severe dislocations in the municipal market. As investors grew increasingly more risk averse, demand for lower-rated and longer-maturity bonds diminished. As a result, municipal credit spreads—the extra yield investors demand to move down in credit quality—widened sharply, and the slope of the municipal yield curve steepened dramatically over both the six- and 12-month periods. The Team’s strategies over the last year of primarily buying high credit quality bonds and avoiding the longest maturity bonds benefited performance because credit spreads widened sharply and the slope of the yield curve steepened dramatically.

Concerns about deteriorating municipal credit quality and a weakening economy contributed to investors’ sense of unease, but it was the news that the Reserve Primary Fund, a large “prime” money market fund, had “broken the buck” that ignited a wave of fear in all the financial markets. In

the ensuing panic, investors apparently feared that similar funds would have similar problems and redeemed significant amounts of their investments in such funds. Yields of municipal cash-equivalent securities spiked from around 2.5% to around 9% as buyers flocked to the safety of Treasury bills. As a result, three-month T-bill yields dropped to a rate of virtually zero. In light of this turmoil, municipal bond portfolios generally had low to negative returns in this environment.

As the Portfolios’ fiscal year drew to a close, regulators and policymakers across the globe were working feverishly to address the financial crisis. At the same time, economic growth was beginning to slow dramatically. Historically, tax revenues have been very economically sensitive. And, there were signs that tax revenue growth was slowing quickly across the country. Fortunately, most state and local officials had successfully built up reserves to address the looming budget shortfalls. On average, state budget reserves were at 7.5% of general fund spending to start the fiscal year (July 1 for most states). States also cut spending on average this fiscal year. The average projected increase in states’ budgeted expenses was only 1%—the second lowest in 25 years. So far, municipal issuers are prudently readying themselves for difficult times ahead, which should help them weather a significant downturn.

The Portfolios may purchase municipal securities that are insured under policies issued by certain insurance companies. When issued, insured

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 3 |

municipal securities typically receive a higher credit rating which means that the issuer of the securities pays a lower interest rate. In purchasing insured securities, the Team gives consideration to both the insurer and to the credit quality of the underlying issuer. The purpose of insurance is to reduce the credit risk of a particular municipal security by supplementing the creditworthiness of the underlying issuer and providing additional security for payment of the principal and interest. Certain of the insurance companies that insure municipal securities insure other types of securities, including some involving subprime mortgages. The credit quality of many subprime mortgage securities has declined and some bond insurers’ risk of having to make payments to holders of subprime mortgage securities has increased. Because of this risk, the credit ratings of some insurance companies have been downgraded and may be further downgraded; it is possible that certain insurance companies may become insolvent. If an insurance company’s rating is downgraded or the company becomes insolvent, the prices of municipal securities insured by the insurance company may decline.

As of September 30, 2008, the Portfolios’ percentages of total investments in insured bonds and in insured bonds that have been pre-refunded are as follows:

| | | | | | |

| Portfolio | | Insured

Bonds | | | Pre-Refunded

Insured

Bonds | |

Arizona | | 47 | % | | 9 | % |

Florida | | 49 | % | | 0 | % |

Massachusetts | | 47 | % | | 8 | % |

Michigan | | 41 | % | | 15 | % |

Minnesota | | 44 | % | | 8 | % |

New Jersey | | 53 | % | | 9 | % |

Ohio | | 50 | % | | 19 | % |

Pennsylvania | | 66 | % | | 22 | % |

Virginia | | 32 | % | | 0 | % |

The Team believes that downgrades in insurance company ratings or insurance company insolvencies present limited risk to the Portfolios. The Portfolios are well diversified by bond insurer, minimizing the exposure to any single insurer. In addition, the Team believes that the generally investment-grade underlying credit quality of the insured municipal securities reduces the risk of a significant reduction in the value of the insured municipal security.

| | |

| 4 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

HISTORICAL PERFORMANCE

An Important Note About the Value of Historical Performance

The performance shown on the following pages represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.alliancebernstein.com.

The investment return and principal value of an investment in the Portfolios will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You should consider the investment objectives, risks, charges and expenses of the Portfolios carefully before investing. For a free copy of the Portfolios’ prospectus, which contains this and other information, visit our website at www.alliancebernstein.com or call your financial advisor or AllianceBernstein Investments at 800.227.4618. You should read the prospectus carefully before you invest.

All fees and expenses related to the operation of the Portfolios have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Portfolios’ quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares; the applicable contingent deferred sales charge for Class B shares (3% year 1, 2% year 2, 1% year 3, 0% year 4); a 1% 1 year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

Benchmark Disclosure

The unmanaged Lehman Brothers (LB) Municipal Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. The Index is a total return performance benchmark for the long-term investment grade, tax-exempt bond market. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Portfolios.

A Word About Risk

Price fluctuations in the Portfolios’ securities may be caused by changes in the general level of interest rates or changes in bond credit quality ratings. Changes in interest rates have a greater effect on bonds with longer maturities than on those with shorter maturities. Please note, as interest rates rise, existing bond prices fall and can cause the value of an investment in the Portfolios to decline. Municipal income securities may realize gains; therefore, shareholders will incur a tax liability from time to time. Income may be subject to state and local taxes and/or the alternative minimum tax. A municipal security could be downgraded or its issuer could default in payment of principal or interest. If applicable, for bonds that are issued at higher interest rates, the issuer may exercise its right to recall some or all of the outstanding bonds to investors prior to their maturity. Individual state municipal portfolios are non-diversified and subject to geographic risk including greater risk of adverse economic conditions and regulatory changes based on their narrow investment objectives. Additionally, the Pennsylvania and Virginia Portfolios can invest in a relatively small number of issuers, and are more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio might be. While the Portfolios invest principally in bonds and other fixed-income securities, in order to achieve their investment objectives, the Portfolios may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. These risks are fully discussed in the Portfolios’ prospectus.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 5 |

Historical Performance

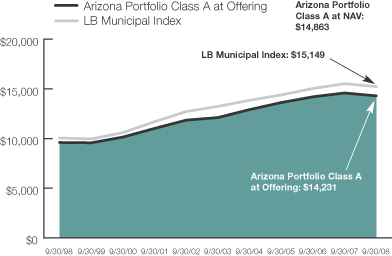

ARIZONA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE PORTFOLIO VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2008 | | Returns | | |

| | 6 Months | | 12 Months | | |

Arizona Portfolio | | | | | | |

Class A | | -2.62% | | -2.08% | | |

| |

Class B | | -2.97% | | -2.76% | | |

| |

Class C | | -2.97% | | -2.76% | | |

| |

LB Municipal Index | | -2.60% | | -1.87% | | |

| |

| | | | | | |

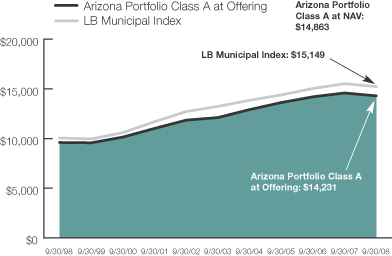

GROWTH OF A $10,000 INVESTMENT IN THE PORTFOLIO

9/30/98 TO 9/30/08

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Municipal Income Fund II Arizona Portfolio Class A shares (from 9/30/98 to 9/30/08) as compared to the performance of the Portfolio’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on the previous page.

(Historical Performance continued on next page)

| | |

| 6 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Historical Performance

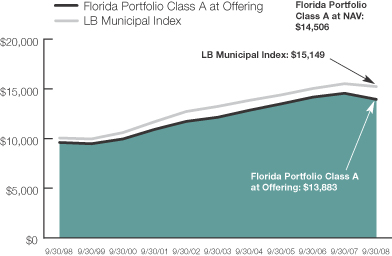

FLORIDA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE PORTFOLIO VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2008 | | Returns | | |

| | 6 Months | | 12 Months | | |

Florida Portfolio | | | | | | |

Class A | | -3.90% | | -4.16% | | |

| |

Class B | | -4.23% | | -4.82% | | |

| |

Class C | | -4.23% | | -4.82% | | |

| |

LB Municipal Index | | -2.60% | | -1.87% | | |

| |

| | | | | | |

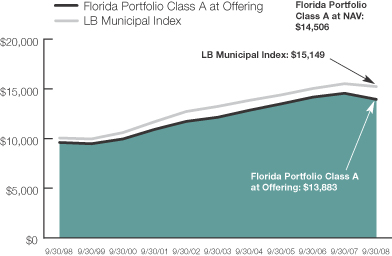

GROWTH OF A $10,000 INVESTMENT IN THE PORTFOLIO

9/30/98 TO 9/30/08

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Municipal Income Fund II Florida Portfolio Class A shares (from 9/30/98 to 9/30/08) as compared to the performance of the Portfolio’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on page 5.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 7 |

Historical Performance

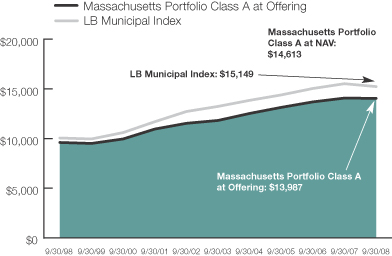

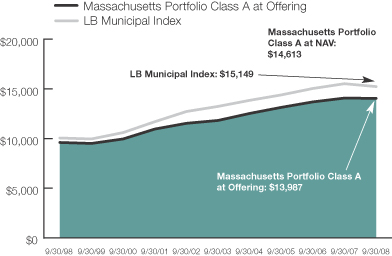

MASSACHUSETTS PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE PORTFOLIO VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2008 | | Returns | | |

| | 6 Months | | 12 Months | | |

Massachusetts Portfolio | | | | | | |

Class A | | -1.82% | | -0.22% | | |

| |

Class B | | -2.16% | | -0.91% | | |

| |

Class C | | -2.16% | | -0.91% | | |

| |

LB Municipal Index | | -2.60% | | -1.87% | | |

| |

| | | | | | |

GROWTH OF A $10,000 INVESTMENT IN THE PORTFOLIO

9/30/98 TO 9/30/08

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Municipal Income Fund II Massachusetts Portfolio Class A shares (from 9/30/98 to 9/30/08) as compared to the performance of the Portfolio’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on page 5.

(Historical Performance continued on next page)

| | |

| 8 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Historical Performance

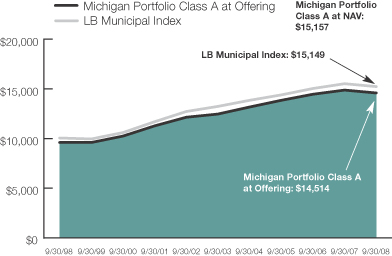

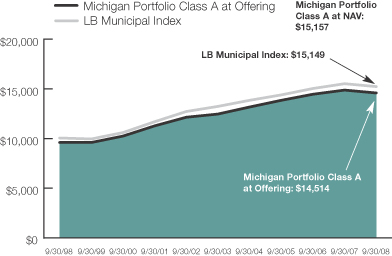

MICHIGAN PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE PORTFOLIO VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2008 | | Returns | | |

| | 6 Months | | 12 Months | | |

Michigan Portfolio | | | | | | |

Class A | | -2.97% | | -1.97% | | |

| |

Class B | | -3.32% | | -2.65% | | |

| |

Class C | | -3.32% | | -2.74% | | |

| |

LB Municipal Index | | -2.60% | | -1.87% | | |

| |

| | | | | | |

GROWTH OF A $10,000 INVESTMENT IN THE PORTFOLIO

9/30/98 TO 9/30/08

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Municipal Income Fund II Michigan Portfolio Class A shares (from 9/30/98 to 9/30/08) as compared to the performance of the Portfolio’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on page 5.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 9 |

Historical Performance

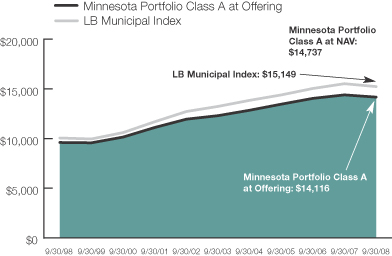

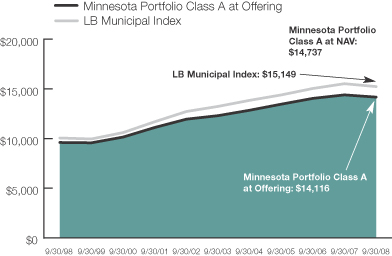

MINNESOTA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE PORTFOLIO VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2008 | | Returns | | |

| | 6 Months | | 12 Months | | |

Minnesota Portfolio | | | | | | |

Class A | | -2.49% | | -1.53% | | |

| |

Class B | | -2.83% | | -2.21% | | |

| |

Class C | | -2.83% | | -2.21% | | |

| |

LB Municipal Index | | -2.60% | | -1.87% | | |

| |

| | | | | | |

GROWTH OF A $10,000 INVESTMENT IN THE PORTFOLIO

9/30/98 TO 9/30/08

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Municipal Income Fund II Minnesota Portfolio Class A shares (from 9/30/98 to 9/30/08) as compared to the performance of the Portfolio’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on page 5.

(Historical Performance continued on next page)

| | |

| 10 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Historical Performance

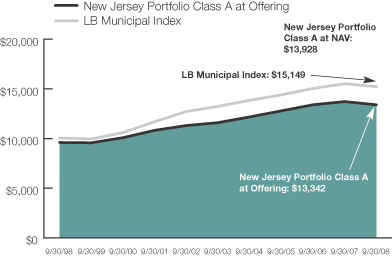

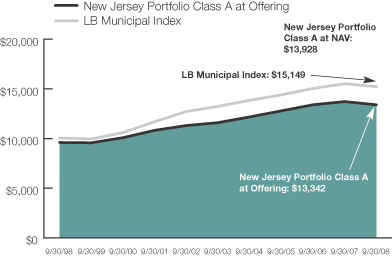

NEW JERSEY PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE PORTFOLIO VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2008 | | Returns | | |

| | 6 Months | | 12 Months | | |

New Jersey Portfolio | | | | | | |

Class A | | -2.20% | | -2.46% | | |

| |

Class B | | -2.54% | | -3.14% | | |

| |

Class C | | -2.54% | | -3.14% | | |

| |

LB Municipal Index | | -2.60% | | -1.87% | | |

| |

| | | | | | |

GROWTH OF A $10,000 INVESTMENT IN THE PORTFOLIO

9/30/98 TO 9/30/08

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Municipal Income Fund II New Jersey Portfolio Class A shares (from 9/30/98 to 9/30/08) as compared to the performance of the Portfolio’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on page 5.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 11 |

Historical Performance

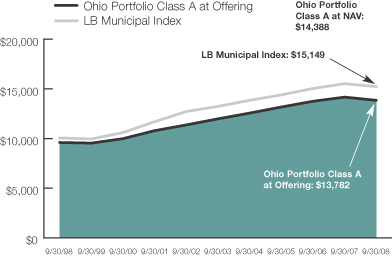

OHIO PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE PORTFOLIO VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2008 | | Returns | | |

| | 6 Months | | 12 Months | | |

Ohio Portfolio | | | | | | |

Class A | | -2.61% | | -2.33% | | |

| |

Class B | | -2.96% | | -3.02% | | |

| |

Class C | | -3.06% | | -3.11% | | |

| |

LB Municipal Index | | -2.60% | | -1.87% | | |

| |

| | | | | | |

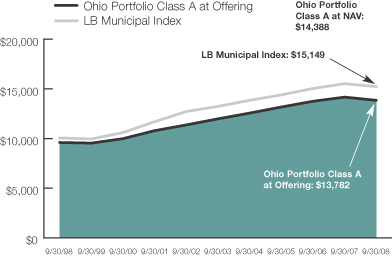

GROWTH OF A $10,000 INVESTMENT IN THE PORTFOLIO

9/30/98 TO 9/30/08

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Municipal Income Fund II Ohio Portfolio Class A shares (from 9/30/98 to 9/30/08) as compared to the performance of the Portfolio’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on page 5.

(Historical Performance continued on next page)

| | |

| 12 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Historical Performance

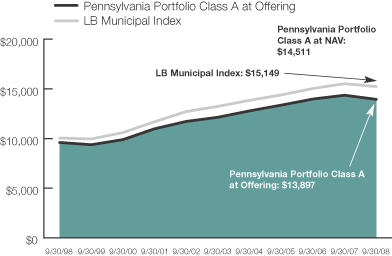

PENNSYLVANIA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE PORTFOLIO VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2008 | | Returns | | |

| | 6 Months | | 12 Months | | |

Pennsylvania Portfolio | | | | | | |

Class A | | -3.04% | | -2.80% | | |

| |

Class B | | -3.38% | | -3.48% | | |

| |

Class C | | -3.38% | | -3.48% | | |

| |

LB Municipal Index | | -2.60% | | -1.87% | | |

| |

| | | | | | |

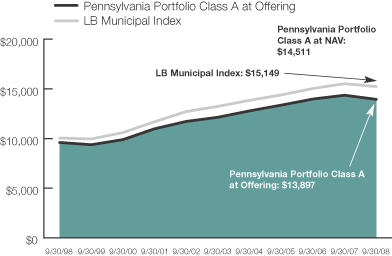

GROWTH OF A $10,000 INVESTMENT IN THE PORTFOLIO

9/30/98 TO 9/30/08

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Municipal Income Fund II Pennsylvania Portfolio Class A shares (from 9/30/98 to 9/30/08) as compared to the performance of the Portfolio’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on page 5.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 13 |

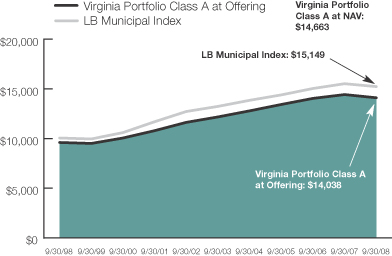

Historical Performance

VIRGINIA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE PORTFOLIO VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2008 | | Returns | | |

| | 6 Months | | 12 Months | | |

Virginia Portfolio | | | | | | |

Class A | | -2.98% | | -2.33% | | |

| |

Class B | | -3.33% | | -3.02% | | |

| |

Class C | | -3.33% | | -3.11% | | |

| |

LB Municipal Index | | -2.60% | | -1.87% | | |

| |

| | | | | | |

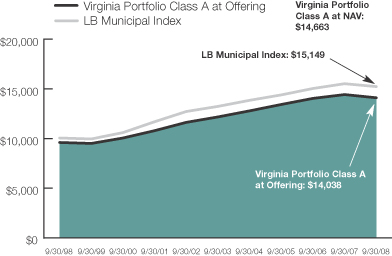

GROWTH OF A $10,000 INVESTMENT IN THE PORTFOLIO

9/30/98 TO 9/30/08

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Municipal Income Fund II Virginia Portfolio Class A shares (from 9/30/98 to 9/30/08) as compared to the performance of the Portfolio’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on page 5.

(Historical Performance continued on next page)

| | |

| 14 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Historical Performance

ARIZONA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2008 |

| | | NAV

Returns | | SEC

Returns | | SEC

Yields* | | Taxable Equivalent Yields** |

| | | | | | | | |

| Class A Shares | | | | | | 3.86% | | 6.22% |

1 Year | | -2.08% | | -6.28% | | | | |

5 Years | | 3.35% | | 2.45% | | | | |

10 Years | | 4.04% | | 3.59% | | | | |

| | | | | | | | |

| Class B Shares | | | | | | 3.31% | | 5.33% |

1 Year | | -2.76% | | -5.59% | | | | |

5 Years | | 2.64% | | 2.64% | | | | |

10 Years(a) | | 3.61% | | 3.61% | | | | |

| | | | | | | | |

| Class C Shares | | | | | | 3.32% | | 5.35% |

1 Year | | -2.76% | | -3.70% | | | | |

5 Years | | 2.64% | | 2.64% | | | | |

10 Years | | 3.32% | | 3.32% | | | | |

| | | | | | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2008) |

| | | | | | | | | SEC Returns |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | | | | | | -6.28% |

5 Years | | | | | | | | 2.45% |

10 Years | | | | | | | | 3.59% |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | | | | | | -5.59% |

5 Years | | | | | | | | 2.64% |

10 Years(a) | | | | | | | | 3.61% |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | | | | | | -3.70% |

5 Years | | | | | | | | 2.64% |

10 Years | | | | | | | | 3.32% |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.96%, 1.67% and 1.66% for Class A, Class B and Class C, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.78%, 1.48% and 1.48% for Class A, Class B and Class C, respectively. These waivers/reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | Assumes conversion of Class B shares into Class A shares after six years. |

| * | SEC Yields are calculated based on SEC guidelines for the 30-day period ended September 30, 2008. |

| ** | Taxable equivalent yields are based on SEC yields and a 35% marginal Federal income tax rate and maximum state taxes where applicable. |

See Historical Performance disclosures on page 5.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 15 |

Historical Performance

FLORIDA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2008 |

| | | NAV

Returns | | SEC

Returns | | SEC

Yields* | | Taxable Equivalent Yields** |

| | | | | | | | |

| Class A Shares | | | | | | 4.60% | | 7.08% |

1 Year | | -4.16% | | -8.23% | | | | |

5 Years | | 2.82% | | 1.93% | | | | |

10 Years | | 3.79% | | 3.34% | | | | |

| | | | | | | | |

| Class B Shares | | | | | | 4.06% | | 6.25% |

1 Year | | -4.82% | | -7.57% | | | | |

5 Years | | 2.11% | | 2.11% | | | | |

10 Years(a) | | 3.36% | | 3.36% | | | | |

| | | | | | | | |

| Class C Shares | | | | | | 4.07% | | 6.26% |

1 Year | | -4.82% | | -5.74% | | | | |

5 Years | | 2.11% | | 2.11% | | | | |

10 Years | | 3.07% | | 3.07% | | | | |

| | | | | | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2008) |

| | | | | | | | | SEC Returns |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | | | | | | -8.23% |

5 Years | | | | | | | | 1.93% |

10 Years | | | | | | | | 3.34% |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | | | | | | -7.57% |

5 Years | | | | | | | | 2.11% |

10 Years(a) | | | | | | | | 3.36% |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | | | | | | -5.74% |

5 Years | | | | | | | | 2.11% |

10 Years | | | | | | | | 3.07% |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.96%, 1.68% and 1.67% for Class A, Class B and Class C, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.78%, 1.48% and 1.48% for Class A, Class B and Class C, respectively. These waivers/reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | Assumes conversion of Class B shares into Class A shares after six years. |

| * | SEC Yields are calculated based on SEC guidelines for the 30-day period ended September 30, 2008. |

| ** | Taxable equivalent yields are based on SEC yields and a 35% marginal Federal income tax rate and maximum state taxes where applicable. |

See Historical Performance disclosures on page 5.

(Historical Performance continued on next page)

| | |

| 16 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Historical Performance

MASSACHUSETTS PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2008 |

| | | NAV

Returns | | SEC

Returns | | SEC

Yields* | | Taxable Equivalent Yields** |

| | | | | | | | |

| Class A Shares | | | | | | 3.66% | | 5.95% |

1 Year | | -0.22% | | -4.46% | | | | |

5 Years | | 3.52% | | 2.62% | | | | |

10 Years | | 3.87% | | 3.41% | | | | |

| | | | | | | | |

| Class B Shares | | | | | | 3.11% | | 5.05% |

1 Year | | -0.91% | | -3.79% | | | | |

5 Years | | 2.80% | | 2.80% | | | | |

10 Years(a) | | 3.45% | | 3.45% | | | | |

| | | | | | | | |

| Class C Shares | | | | | | 3.11% | | 5.05% |

1 Year | | -0.91% | | -1.87% | | | | |

5 Years | | 2.80% | | 2.80% | | | | |

10 Years | | 3.16% | | 3.16% | | | | |

| | | | | | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2008) |

| | | | | | | | | SEC Returns |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | | | | | | -4.46% |

5 Years | | | | | | | | 2.62% |

10 Years | | | | | | | | 3.41% |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | | | | | | -3.79% |

5 Years | | | | | | | | 2.80% |

10 Years(a) | | | | | | | | 3.45% |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | | | | | | -1.87% |

5 Years | | | | | | | | 2.80% |

10 Years | | | | | | | | 3.16% |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 1.06%, 1.77% and 1.76% for Class A, Class B and Class C, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.82%, 1.52% and 1.52% for Class A, Class B and Class C, respectively. These waivers/reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | Assumes conversion of Class B shares into Class A shares after six years. |

| * | SEC Yields are calculated based on SEC guidelines for the 30-day period ended September 30, 2008. |

| ** | Taxable equivalent yields are based on SEC yields and a 35% marginal Federal income tax rate and maximum state taxes where applicable. |

See Historical Performance disclosures on page 5.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 17 |

Historical Performance

MICHIGAN PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2008 |

| | | NAV

Returns | | SEC

Returns | | SEC

Yields* | | Taxable Equivalent Yields** |

| | | | | | | | |

| Class A Shares | | | | | | 3.40% | | 5.47% |

1 Year | | -1.97% | | -6.16% | | | | |

5 Years | | 3.15% | | 2.27% | | | | |

10 Years | | 4.25% | | 3.80% | | | | |

| | | | | | | | |

| Class B Shares | | | | | | 2.84% | | 4.57% |

1 Year | | -2.65% | | -5.47% | | | | |

5 Years | | 2.45% | | 2.45% | | | | |

10 Years(a) | | 3.81% | | 3.81% | | | | |

| | | | | | | | |

| Class C Shares | | | | | | 2.84% | | 4.57% |

1 Year | | -2.74% | | -3.68% | | | | |

5 Years | | 2.44% | | 2.44% | | | | |

10 Years | | 3.53% | | 3.53% | | | | |

| | | | | | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2008) |

| | | | | | | | | SEC Returns |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | | | | | | -6.16% |

5 Years | | | | | | | | 2.27% |

10 Years | | | | | | | | 3.80% |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | | | | | | -5.47% |

5 Years | | | | | | | | 2.45% |

10 Years(a) | | | | | | | | 3.81% |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | | | | | | -3.68% |

5 Years | | | | | | | | 2.44% |

10 Years | | | | | | | | 3.53% |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 1.10%, 1.81% and 1.81% for Class A, Class B and Class C, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 1.01%, 1.71% and 1.71% for Class A, Class B and Class C, respectively. These waivers/reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | Assumes conversion of Class B shares into Class A shares after six years. |

| * | SEC Yields are calculated based on SEC guidelines for the 30-day period ended September 30, 2008. |

| ** | Taxable equivalent yields are based on SEC yields and a 35% marginal Federal income tax rate and maximum state taxes where applicable. |

See Historical Performance disclosures on page 5.

(Historical Performance continued on next page)

| | |

| 18 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Historical Performance

MINNESOTA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2008 |

| | | NAV

Returns | | SEC

Returns | | SEC

Yields* | | Taxable Equivalent Yields** |

| | | | | | | | |

| Class A Shares | | | | | | 3.65% | | 6.09% |

1 Year | | -1.53% | | -5.75% | | | | |

5 Years | | 2.87% | | 1.98% | | | | |

10 Years | | 3.95% | | 3.51% | | | | |

| | | | | | | | |

| Class B Shares | | | | | | 3.09% | | 5.16% |

1 Year | | -2.21% | | -5.05% | | | | |

5 Years | | 2.15% | | 2.15% | | | | |

10 Years(a) | | 3.52% | | 3.52% | | | | |

| | | | | | | | |

| Class C Shares | | | | | | 3.09% | | 5.16% |

1 Year | | -2.21% | | -3.16% | | | | |

5 Years | | 2.15% | | 2.15% | | | | |

10 Years | | 3.24% | | 3.24% | | | | |

| | | | | | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2008) |

| | | | | | | | | SEC Returns |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | | | | | | -5.75% |

5 Years | | | | | | | | 1.98% |

10 Years | | | | | | | | 3.51% |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | | | | | | -5.05% |

5 Years | | | | | | | | 2.15% |

10 Years(a) | | | | | | | | 3.52% |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | | | | | | -3.16% |

5 Years | | | | | | | | 2.15% |

10 Years | | | | | | | | 3.24% |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 1.16%, 1.87% and 1.86% for Class A, Class B and Class C, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.90%, 1.60% and 1.60% for Class A, Class B and Class C, respectively. These waivers/reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | Assumes conversion of Class B shares into Class A shares after six years. |

| * | SEC Yields are calculated based on SEC guidelines for the 30-day period ended September 30, 2008. |

| ** | Taxable equivalent yields are based on SEC yields and a 35% marginal Federal income tax rate and maximum state taxes where applicable. |

See Historical Performance disclosures on page 5.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 19 |

Historical Performance

NEW JERSEY PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2008 |

| | | NAV

Returns | | SEC

Returns | | SEC

Yields* | | Taxable Equivalent Yields** |

| | | | | | | | |

| Class A Shares | | | | | | 4.10% | | 6.93% |

1 Year | | -2.46% | | -6.58% | | | | |

5 Years | | 2.94% | | 2.06% | | | | |

10 Years | | 3.37% | | 2.93% | | | | |

| | | | | | | | |

| Class B Shares | | | | | | 3.56% | | 6.02% |

1 Year | | -3.14% | | -5.95% | | | | |

5 Years | | 2.22% | | 2.22% | | | | |

10 Years(a) | | 2.93% | | 2.93% | | | | |

| | | | | | | | |

| Class C Shares | | | | | | 3.56% | | 6.02% |

1 Year | | -3.14% | | -4.08% | | | | |

5 Years | | 2.20% | | 2.20% | | | | |

10 Years | | 2.64% | | 2.64% | | | | |

| | | | | | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2008) |

| | | | | | | | | SEC Returns |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | | | | | | -6.58% |

5 Years | | | | | | | | 2.06% |

10 Years | | | | | | | | 2.93% |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | | | | | | -5.95% |

5 Years | | | | | | | | 2.22% |

10 Years(a) | | | | | | | | 2.93% |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | | | | | | -4.08% |

5 Years | | | | | | | | 2.20% |

10 Years | | | | | | | | 2.64% |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios, including interest expense, as 1.10%, 1.81% and 1.80% for Class A, Class B and Class C, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios, excluding interest expense, to 0.87%, 1.57% and 1.57% for Class A, Class B and Class C, respectively. These waivers/reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | Assumes conversion of Class B shares into Class A shares after six years. |

| * | SEC Yields are calculated based on SEC guidelines for the 30-day period ended September 30, 2008. |

| ** | Taxable equivalent yields are based on SEC yields and a 35% marginal Federal income tax rate and maximum state taxes where applicable. |

See Historical Performance disclosures on page 5.

(Historical Performance continued on next page)

| | |

| 20 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Historical Performance

OHIO PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2008 |

| | | NAV

Returns | | SEC

Returns | | SEC

Yields* | | Taxable Equivalent Yields** |

| | | | | | | | |

| Class A Shares | | | | | | 3.57% | | 5.86% |

1 Year | | -2.33% | | -6.51% | | | | |

5 Years | | 2.92% | | 2.03% | | | | |

10 Years | | 3.71% | | 3.26% | | | | |

| | | | | | | | |

| Class B Shares | | | | | | 3.00% | | 4.92% |

1 Year | | -3.02% | | -5.83% | | | | |

5 Years | | 2.21% | | 2.21% | | | | |

10 Years(a) | | 3.27% | | 3.27% | | | | |

| | | | | | | | |

| Class C Shares | | | | | | 3.00% | | 4.92% |

1 Year | | -3.11% | | -4.05% | | | | |

5 Years | | 2.19% | | 2.19% | | | | |

10 Years | | 2.98% | | 2.98% | | | | |

| | | | | | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2008) |

| | | | | | | | | SEC Returns |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | | | | | | -6.51% |

5 Years | | | | | | | | 2.03% |

10 Years | | | | | | | | 3.26% |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | | | | | | -5.83% |

5 Years | | | | | | | | 2.21% |

10 Years(a) | | | | | | | | 3.27% |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | | | | | | -4.05% |

5 Years | | | | | | | | 2.19% |

10 Years | | | | | | | | 2.98% |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 1.01%, 1.72% and 1.71% for Class A, Class B and Class C, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.85%, 1.55% and 1.55% for Class A, Class B and Class C, respectively. These waivers/reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | Assumes conversion of Class B shares into Class A shares after six years. |

| * | SEC Yields are calculated based on SEC guidelines for the 30-day period ended September 30, 2008. |

| ** | Taxable equivalent yields are based on SEC yields and a 35% marginal Federal income tax rate and maximum state taxes where applicable. |

See Historical Performance disclosures on page 5.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 21 |

Historical Performance

PENNSYLVANIA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2008 |

| | | NAV

Returns | | SEC

Returns | | SEC

Yields* | | Taxable Equivalent Yields** |

| | | | | | | | |

| Class A Shares | | | | | | 3.75% | | 5.95% |

1 Year | | -2.80% | | -6.90% | | | | |

5 Years | | 2.79% | | 1.91% | | | | |

10 Years | | 3.79% | | 3.35% | | | | |

| | | | | | | | |

| Class B Shares | | | | | | 3.18% | | 5.05% |

1 Year | | -3.48% | | -6.28% | | | | |

5 Years | | 2.07% | | 2.07% | | | | |

10 Years(a) | | 3.36% | | 3.36% | | | | |

| | | | | | | | |

| Class C Shares | | | | | | 3.19% | | 5.06% |

1 Year | | -3.48% | | -4.41% | | | | |

5 Years | | 2.08% | | 2.08% | | | | |

10 Years | | 3.07% | | 3.07% | | | | |

| | | | | | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2008) |

| | | | | | | | | SEC Returns |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | | | | | | -6.90% |

5 Years | | | | | | | | 1.91% |

10 Years | | | | | | | | 3.35% |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | | | | | | -6.28% |

5 Years | | | | | | | | 2.07% |

10 Years(a) | | | | | | | | 3.36% |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | | | | | | -4.41% |

5 Years | | | | | | | | 2.08% |

10 Years | | | | | | | | 3.07% |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 1.03%, 1.74% and 1.74% for Class A, Class B and Class C, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.95%, 1.65% and 1.65% for Class A, Class B and Class C, respectively. These waivers/reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | Assumes conversion of Class B shares into Class A shares after six years. |

| * | SEC Yields are calculated based on SEC guidelines for the 30-day period ended September 30, 2008. |

| ** | Taxable equivalent yields are based on SEC yields and a 35% marginal Federal income tax rate and maximum state taxes where applicable. |

See Historical Performance disclosures on page 5.

(Historical Performance continued on next page)

| | |

| 22 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Historical Performance

VIRGINIA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2008 |

| | | NAV

Returns | | SEC

Returns | | SEC

Yields* | | Taxable Equivalent Yields** |

| | | | | | | | |

| Class A Shares | | | | | | 4.10% | | 6.69% |

1 Year | | -2.33% | | -6.44% | | | | |

5 Years | | 2.99% | | 2.09% | | | | |

10 Years | | 3.90% | | 3.45% | | | | |

| | | | | | | | |

| Class B Shares | | | | | | 3.56% | | 5.81% |

1 Year | | -3.02% | | -5.83% | | | | |

5 Years | | 2.27% | | 2.27% | | | | |

10 Years(a) | | 3.48% | | 3.48% | | | | |

| | | | | | | | |

| Class C Shares | | | | | | 3.57% | | 5.83% |

1 Year | | -3.11% | | -4.04% | | | | |

5 Years | | 2.27% | | 2.27% | | | | |

10 Years | | 3.18% | | 3.18% | | | | |

| | | | | | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2008) |

| | | | | | | | | SEC Returns |

| | | | | | | | |

| Class A Shares | | | | | | | | |

1 Year | | | �� | | | | | -6.44% |

5 Years | | | | | | | | 2.09% |

10 Years | | | | | | | | 3.45% |

| | | | | | | | |

| Class B Shares | | | | | | | | |

1 Year | | | | | | | | -5.83% |

5 Years | | | | | | | | 2.27% |

10 Years(a) | | | | | | | | 3.48% |

| | | | | | | | |

| Class C Shares | | | | | | | | |

1 Year | | | | | | | | -4.04% |

5 Years | | | | | | | | 2.27% |

10 Years | | | | | | | | 3.18% |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.99%, 1.69% and 1.69% for Class A, Class B and Class C, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.72%, 1.42% and 1.42% for Class A, Class B and Class C, respectively. These waivers/reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | Assumes conversion of Class B shares into Class A shares after six years. |

| * | SEC Yields are calculated based on SEC guidelines for the 30-day period ended September 30, 2008. |

| ** | Taxable equivalent yields are based on SEC yields and a 35% marginal Federal income tax rate and maximum state taxes where applicable. |

See Historical Performance disclosures on page 5.

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 23 |

Historical Performance

FUND EXPENSES

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Arizona Portfolio

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 973.77 | | $ | 3.85 | | 0.78 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,021.10 | | $ | 3.94 | | 0.78 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 970.33 | | $ | 7.29 | | 1.48 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.60 | | $ | 7.47 | | 1.48 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 970.32 | | $ | 7.29 | | 1.48 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.60 | | $ | 7.47 | | 1.48 | % |

| | |

| 24 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Fund Expenses

FUND EXPENSES

(continued from previous page)

Florida Portfolio

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 960.97 | | $ | 3.82 | | 0.78 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,021.10 | | $ | 3.94 | | 0.78 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 957.67 | | $ | 7.19 | | 1.47 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.65 | | $ | 7.41 | | 1.47 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 957.68 | | $ | 7.24 | | 1.48 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.60 | | $ | 7.47 | | 1.48 | % |

Massachusetts Portfolio

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 981.81 | | $ | 4.06 | | 0.82 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,020.90 | | $ | 4.14 | | 0.82 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 978.38 | | $ | 7.52 | | 1.52 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.40 | | $ | 7.67 | | 1.52 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 978.38 | | $ | 7.52 | | 1.52 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.40 | | $ | 7.67 | | 1.52 | % |

Michigan Portfolio

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 970.28 | | $ | 4.97 | | 1.01 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,019.95 | | $ | 5.10 | | 1.01 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 966.84 | | $ | 8.41 | | 1.71 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,016.45 | | $ | 8.62 | | 1.71 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 966.84 | | $ | 8.41 | | 1.71 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,016.45 | | $ | 8.62 | | 1.71 | % |

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 25 |

Fund Expenses

FUND EXPENSES

(continued from previous page)

Minnesota Portfolio

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 975.07 | | $ | 4.44 | | 0.90 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,020.50 | | $ | 4.55 | | 0.90 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 971.68 | | $ | 7.89 | | 1.60 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.00 | | $ | 8.07 | | 1.60 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 971.68 | | $ | 7.89 | | 1.60 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.00 | | $ | 8.07 | | 1.60 | % |

New Jersey Portfolio

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 978.01 | | $ | 4.30 | | 0.87 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,020.65 | | $ | 4.39 | | 0.87 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 974.60 | | $ | 7.75 | | 1.57 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.15 | | $ | 7.92 | | 1.57 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 974.60 | | $ | 7.75 | | 1.57 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.15 | | $ | 7.92 | | 1.57 | % |

Ohio Portfolio

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 973.85 | | $ | 4.19 | | 0.85 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,020.75 | | $ | 4.29 | | 0.85 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 970.40 | | $ | 7.64 | | 1.55 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.25 | | $ | 7.82 | | 1.55 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 969.45 | | $ | 7.63 | | 1.55 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.25 | | $ | 7.82 | | 1.55 | % |

| | |

| 26 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Fund Expenses

FUND EXPENSES

(continued from previous page)

Pennsylvania Portfolio

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 969.62 | | $ | 4.68 | | 0.95 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,020.25 | | $ | 4.80 | | 0.95 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 966.22 | | $ | 8.11 | | 1.65 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,016.75 | | $ | 8.32 | | 1.65 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 966.22 | | $ | 8.11 | | 1.65 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,016.75 | | $ | 8.32 | | 1.65 | % |

Virginia Portfolio

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 1, 2008 | | Ending

Account Value

September 30, 2008 | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 970.21 | | $ | 3.55 | | 0.72 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,021.40 | | $ | 3.64 | | 0.72 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 966.75 | | $ | 6.98 | | 1.42 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.90 | | $ | 7.16 | | 1.42 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 966.72 | | $ | 6.98 | | 1.42 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,017.90 | | $ | 7.16 | | 1.42 | % |

| * | Expenses are equal to each Class’ annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

| ** | Assumes 5% return before expenses. |

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 27 |

Fund Expenses

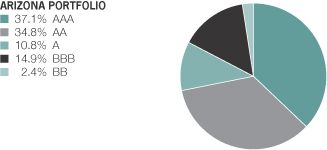

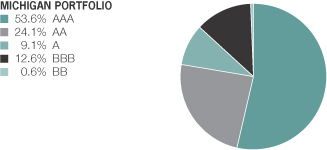

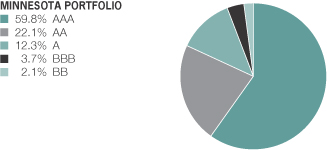

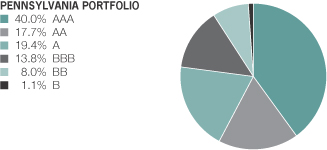

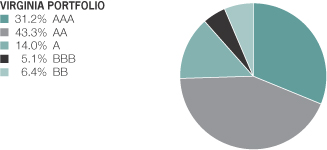

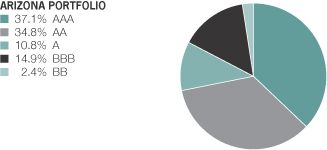

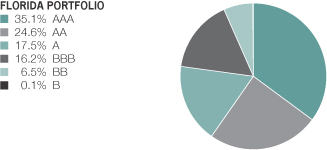

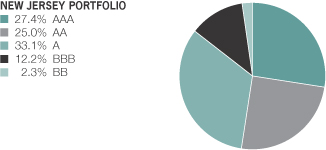

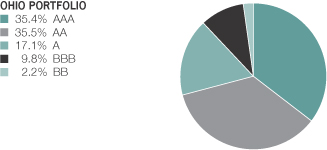

BOND RATING SUMMARY*

September 30, 2008

| * | All data are as of September 30, 2008. Each Portfolio’s quality rating distribution is expressed as a percentage of the Portfolio’s total investments rated in particular ratings categories by Standard & Poor’s Rating Services, Moody’s Investors Service, Inc. and Fitch Ratings, Ltd. The distributions may vary over time. If ratings are not available, the Fund’s Adviser will assign ratings that are considered to be of equivalent quality to such ratings. Pre-refunded bonds, which are escrowed by U.S. Government Securities, have been rated AAA by the Adviser. |

| | |

| 28 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

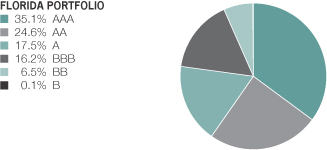

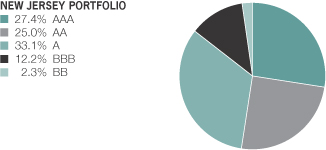

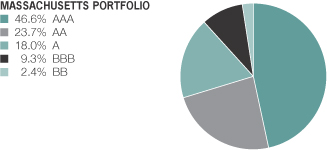

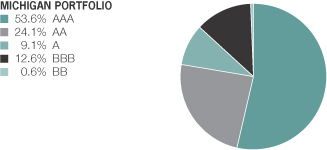

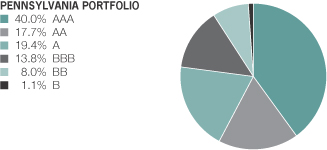

Bond Rating Summary

BOND RATING SUMMARY*

September 30, 2008

| * | All data are as of September 30, 2008. Each Portfolio’s quality rating distribution is expressed as a percentage of the Portfolio’s total investments rated in particular ratings categories by Standard & Poor’s Rating Services, Moody’s Investors Service, Inc. and Fitch Ratings, Ltd. The distributions may vary over time. If ratings are not available, the Fund’s Adviser will assign ratings that are considered to be of equivalent quality to such ratings. Pre-refunded bonds, which are escrowed by U.S. Government Securities, have been rated AAA by the Adviser. |

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 29 |

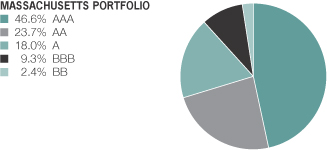

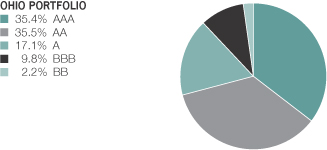

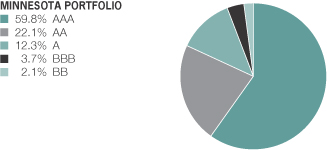

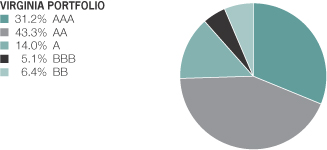

Bond Rating Summary

BOND RATING SUMMARY*

September 30, 2008

| * | All data are as of September 30, 2008. Each Portfolio’s quality rating distribution is expressed as a percentage of the Portfolio’s total investments rated in particular ratings categories by Standard & Poor’s Rating Services, Moody’s Investors Service, Inc. and Fitch Ratings, Ltd. The distributions may vary over time. If ratings are not available, the Fund’s Adviser will assign ratings that are considered to be of equivalent quality to such ratings. Pre-refunded bonds, which are escrowed by U.S. Government Securities, have been rated AAA by the Adviser. |

| | |

| 30 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Bond Rating Summary

ARIZONA PORTFOLIO

PORTFOLIO OF INVESTMENTS

September 30, 2008

| | | | | | |

| | | Principal

Amount

(000) | | U.S. $ Value |

| |

| | | | | | |

MUNICIPAL OBLIGATIONS – 98.1% | | | | | | |

Long-Term Municipal Bonds – 94.2% | | | | | | |

Arizona – 76.5% | | | | | | |

Arizona Cap Fac Fin Corp Student Hsg Rev

(Arizona St Univ Proj)

Series 00

6.25%, 9/01/32 | | $ | 2,000 | | $ | 1,868,540 |

Arizona COP

FSA Series A

5.00%, 9/01/24 | | | 6,000 | | | 5,623,560 |

Arizona Game & Fish Dept

5.00%, 7/01/26 | | | 1,000 | | | 883,340 |

Arizona HFA SFMR

(Tucson & Pima Proj) AMT

GNMA/FNMA Series 02A

5.50%, 1/01/35(a) | | | 360 | | | 359,968 |

Arizona Hlth Fac Auth

(Blood System Inc.)

Series 04

5.00%, 4/01/19 | | | 750 | | | 732,652 |

Arizona Hlth Fac Auth

(Phoenix Children’s Hosp)

8.96%, 2/01/42(b) | | | 1,150 | | | 1,039,979 |

Arizona Hlth Fac Auth

(Phoenix Children’s Hosp)

(Prerefunded)

Series 02A

6.00%, 2/15/32 | | | 5,700 | | | 6,205,020 |

Arizona Sch Fac Brd

(Prerefunded)

Series 01

5.00%, 7/01/19 | | | 6,730 | | | 7,103,582 |

Arizona St Transp Brd Hwy Rev

5.00%, 7/01/20 | | | 5,000 | | | 5,099,350 |

Series 04B

5.00%, 7/01/24 | | | 4,300 | | | 4,194,435 |

Arizona St Univ COP

(Research Infra Proj)

AMBAC Series 05A

5.00%, 9/01/23 | | | 2,000 | | | 1,906,920 |

Arizona Student Loan Auth

(Student Loan Rev) AMT

Series 99B-1

5.90%, 5/01/24 | | | 1,500 | | | 1,423,395 |

Arizona Tourism & Sports Auth

(Multipurpose Stadium Fac)

MBIA Series 03A

5.00%, 7/01/25 | | | 2,400 | | | 2,248,512 |

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 31 |

Arizona Portfolio—Portfolio of Investments

| | | | | | |

| | | Principal

Amount

(000) | | U.S. $ Value |

| |

| | | | | | |

Arizona Wtr Infra Fin Auth

(Wtr Quality)

Series 06A

5.00%, 10/01/24 | | $ | 4,000 | | $ | 3,943,720 |

Estrella Mtn Ranch CFD

(Desert Village)

7.375%, 7/01/27 | | | 1,474 | | | 1,442,324 |

Series 01A

7.875%, 7/01/25 | | | 2,983 | | | 3,009,728 |

Gilbert Wtr Res Muni Ppty Corp.

Series 04

4.90%, 4/01/19 | | | 2,500 | | | 2,311,000 |

Glendale IDA

(John C Lincoln Hlth)

Series 05B

5.25%, 12/01/22 | | | 1,000 | | | 912,100 |

Glendale IDA

(Midwestern Univ)

(Prerefunded)

Series 01A

5.875%, 5/15/31 | | | 3,770 | | | 4,097,462 |

Goodyear CFD

(Palm Valley)

Series 96C

7.25%, 7/01/16 | | | 2,108 | | | 2,095,015 |

Goodyear IDA Wtr & Swr Rev

(Litchfield Pk Svc Proj) AMT

Series 99

5.95%, 10/01/23 | | | 3,160 | | | 2,983,514 |

Greater Arizona Dev Auth Infra Rev

MBIA Series 05A

5.00%, 8/01/21 | | | 1,600 | | | 1,608,160 |

MBIA Series 05B

5.00%, 8/01/25 | | | 4,320 | | | 4,153,291 |

Hassayampa CFD #2

Series 96

7.75%, 7/01/21 | | | 2,265 | | | 2,167,696 |

Hassayampa CFD #2

(Forest Ridge Estates)

Series 00

7.50%, 7/01/24 | | | 645 | | | 654,959 |

Maricopa Cnty SFMR

(Mtg Rev) AMT

GNMA/FNMA/FHLMC Series 00-1C

6.25%, 12/01/30 | | | 5 | | | 5,020 |

GNMA/FNMA/FHLMC Series 01

5.63%, 3/01/33 | | | 485 | | | 483,637 |

| | |

| 32 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Arizona Portfolio—Portfolio of Investments

| | | | | | |

| | | Principal

Amount

(000) | | U.S. $ Value |

| |

| | | | | | |

Mesa Cnty IDA

(Discovery Hlth Sys)

(Prerefunded)

MBIA Series 99A

5.75%, 1/01/25 | | $ | 15,000 | | $ | 15,734,700 |

Nogales Muni Dev Auth

AMBAC Series 05

5.00%, 6/01/27 | | | 1,000 | | | 859,490 |

Northern Arizona Univ COP

(Northern Arizona Univ Research Proj)

AMBAC Series 04

5.125%, 9/01/21-9/01/24 | | | 7,140 | | | 7,176,920 |

Phoenix Civic Impr Corp.

(Senior Lien Arpt Rev)

5.00%, 7/01/26 | | | 4,080 | | | 3,751,111 |

Phoenix Civic Impr Corp. Excise Tax Rev

(Civic Plaza Exp Proj)

FGIC Series 05A

5.00%, 7/01/23 | | | 5,500 | | | 5,403,915 |

Phoenix IDA

(Capitol Mall LLC Proj)

AMBAC Series 05

5.00%, 9/15/25 | | | 5,935 | | | 5,769,651 |

Pima Cnty IDA

(Horizon Comnty Learning Ctr)

Series 05

5.125%, 6/01/20 | | | 1,500 | | | 1,373,235 |

Pima Cnty IDA MFHR

(La Hacienda)

(Prerefunded)

GNMA Series 99

7.00%, 12/20/31 | | | 1,290 | | | 1,461,738 |

Pima Cnty IDA SFMR

(Mtg Rev) AMT

GNMA/FNMA Series 99B-1

6.10%, 5/01/31 | | | 65 | | | 65,327 |

Pinal Cnty COP

AMBAC Series 01

5.125%, 6/01/21 | | | 1,000 | | | 987,560 |

Series 04

5.00%, 12/01/24 | | | 3,780 | | | 3,240,670 |

Pinal Cnty IDA Correctional Fac Contract

(Florence West Prison Proj)

ACA Series 06A

5.25%, 10/01/22 | | | 1,400 | | | 1,255,002 |

Queen Creek Impr Dist No 1

5.00%, 1/01/26 | | | 600 | | | 518,616 |

| | |

| ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II • | | 33 |

Arizona Portfolio—Portfolio of Investments

| | | | | | |

| | | Principal

Amount

(000) | | U.S. $ Value |

| |

| | | | | | |

Salt Verde Fin Corp.

(Prepaid Gas)

5.25%, 12/01/22-12/01/23 | | $ | 1,165 | | $ | 953,823 |

Scottsdale IDA

(Scottsdale Healthcare)

5.00%, 9/01/23 | | | 500 | | | 446,445 |

Show Low Assmt Dist #6

(Torreon)

ACA Series 00

6.00%, 1/01/18 | | | 955 | | | 933,742 |

Show Low IDA

(Navapache Regl Med Ctr)

RADIAN Series 05

5.00%, 12/01/25 | | | 1,415 | | | 1,180,053 |

Stoneridge CFD

Series 01

6.75%, 7/15/26 | | | 1,650 | | | 1,634,622 |

Sundance CFD No 1

Series 02

7.75%, 7/01/22 | | | 1,826 | | | 1,829,177 |

Tax Exempt Muni Infra Trust

Series 04B, Class A

4.05%, 12/01/08(c) | | | 3,310 | | | 3,310,199 |

Tempe Excise Tax Rev

5.00%, 7/01/24 | | | 1,035 | | | 1,009,591 |

Tolleson IDA MFHR

(Copper Cove) AMT

GNMA Series 01A

5.50%, 11/20/41 | | | 5,825 | | | 5,090,118 |

Tucson & Pima IDA SFMR

(Mtg Bkd Sec Prog) AMT

GNMA/FNMA/FHLMC Series 01A-1

6.35%, 1/01/34(a)(d) | | | 535 | | | 535,824 |

Tucson Arpt Auth Rev AMT

AMBAC Series 01

5.35%, 6/01/31 | | | 6,475 | | | 5,580,090 |

Tucson COP

MBIA Series 04A

5.00%, 7/01/23-7/01/24 | | | 6,100 | | | 6,041,187 |

Tucson Hgr Ed

(Univ Arizona)

AMBAC Series 02A

5.00%, 7/15/32 | | | 1,000 | | | 925,690 |

Univ Med Ctr Corp. Hosp Rev

5.00%, 7/01/35 | | | 3,500 | | | 2,796,885 |

Univ of Arizona COP

AMBAC

5.00%, 6/01/12 | | | 3,040 | | | 3,207,048 |

5.25%, 6/01/14-6/01/15 | | | 5,000 | | | 5,311,520 |

| | |

| 34 | | • ALLIANCEBERNSTEIN MUNICIPAL INCOME FUND II |

Arizona Portfolio—Portfolio of Investments

| | | | | | |

| | | Principal

Amount

(000) | | U.S. $ Value |

| |

| | | | | | |

West Campus Hsg LLC Student Hsg Rev

(Arizona St Univ West Campus)

AMBAC Series 05

5.00%, 7/01/30 | | $ | 1,500 | | $ | 1,388,250 |

Yavapai Cnty Hosp Rev

(Regl Med Ctr)

RADIAN Series 03A

5.25%, 8/01/21 | | | 4,000 | | | 3,573,000 |

| | | | | | |

| | | | | | 161,902,078 |

| | | | | | |

California – 1.4% | | | | | | |

California Statewide Comnty Dev Auth

(Enloe Med Ctr)

6.25%, 8/15/28 | | | 2,155 | | | 2,178,511 |

Series A

5.375%, 8/15/20 | | | 740 | | | 733,873 |

| | | | | | |

| | | | | | 2,912,384 |

| | | | | | |

Florida – 1.1% | | | | | | |

Double Branch CDD

(Oakleaf Village)

Series 02A

6.70%, 5/01/34 | | | 970 | | | 955,935 |

Fiddlers Creek CDD

(Prerefunded)

Series 99B

5.80%, 5/01/21 | | | 405 | | | 361,961 |

Highlands Cnty Hlth Fac Auth

(Adventist Hlth Sys/Sunbelt Oblig Group)

MBIA Series 2007D

8.00%, 11/15/37(a)† | | | 1,075 | | | 1,075,000 |

| | | | | | |

| | | | | | 2,392,896 |

| | | | | | |

New Jersey – 1.0% | | | | | | |

New Jersey Ed Fac Auth

(Kean Univ)

FGIC Series 2007E-2

10.00%, 7/01/37(a)† | | | 2,145 | | | 2,145,000 |

| | | | | | |

| | |

Puerto Rico – 13.4% | | | | | | |

Puerto Rico

(Pub Impr)

5.25%, 7/01/23 | | | 575 | | | 519,392 |

(Prerefunded)

FGIC Series 02A

5.00%, 7/01/32 | | | 2,500 | | | 2,662,025 |

Series 01A

5.50%, 7/01/19 | | | 500 | | | 490,820 |

Series 03A

5.25%, 7/01/23 | | | 500 | | | 451,645 |

| | |