Myriad Genetics Acquisition of Sividon Diagnostics 05/31/2016 Exhibit 99.2

Forward Looking Statements Some of the information presented here today may contain projections or other forward-looking statements regarding future events or the future financial performance of the Company. These statements are based on management’s current expectations and the actual events or results may differ materially and adversely from these expectations. We refer you to the documents the Company files from time to time with the Securities and Exchange Commission, specifically, the Company’s annual reports on Form 10-K, its quarterly reports on Form 10-Q, and its current reports on Form 8-K. These documents identify important risk factors that could cause the actual results to differ materially from those contained in the Company’s projections or forward-looking statements.

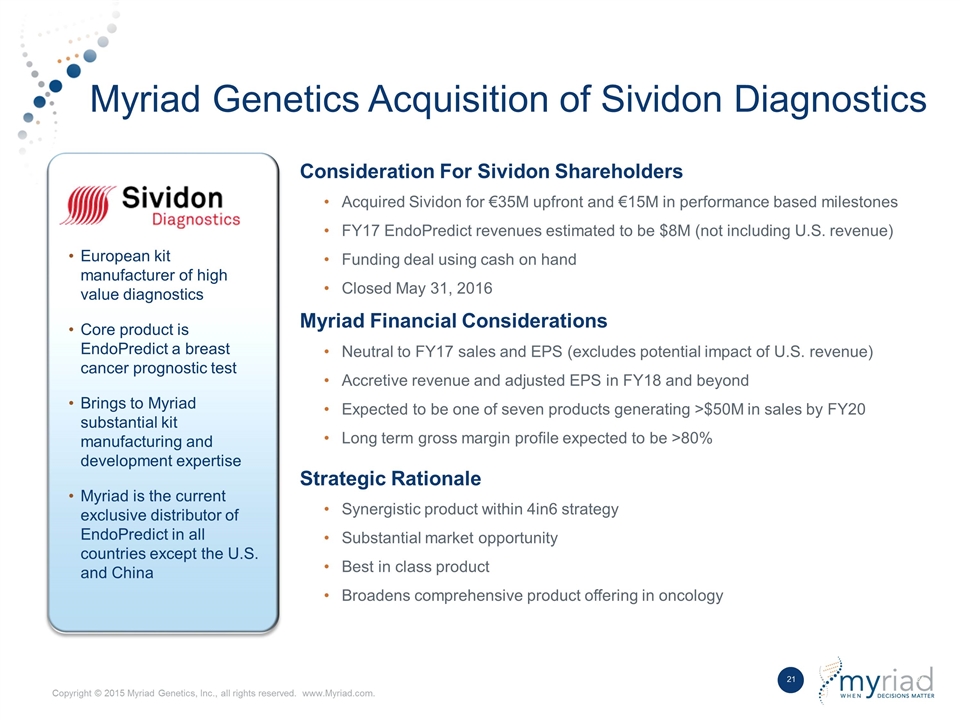

Myriad Genetics Acquisition of Sividon Diagnostics Consideration For Sividon Shareholders Acquired Sividon for €35M upfront and €15M in performance based milestones FY17 EndoPredict revenues estimated to be $8M (not including U.S. revenue) Funding deal using cash on hand Closed May 31, 2016 Myriad Financial Considerations Neutral to FY17 sales and EPS (excludes potential impact of U.S. revenue) Accretive revenue and adjusted EPS in FY18 and beyond Expected to be one of seven products generating >$50M in sales by FY20 Long term gross margin profile expected to be >80% Strategic Rationale Synergistic product within 4in6 strategy Substantial market opportunity Best in class product Broadens comprehensive product offering in oncology European kit manufacturer of high value diagnostics Core product is EndoPredict a breast cancer prognostic test Brings to Myriad substantial kit manufacturing and development expertise Myriad is the current exclusive distributor of EndoPredict in all countries except the U.S. and China

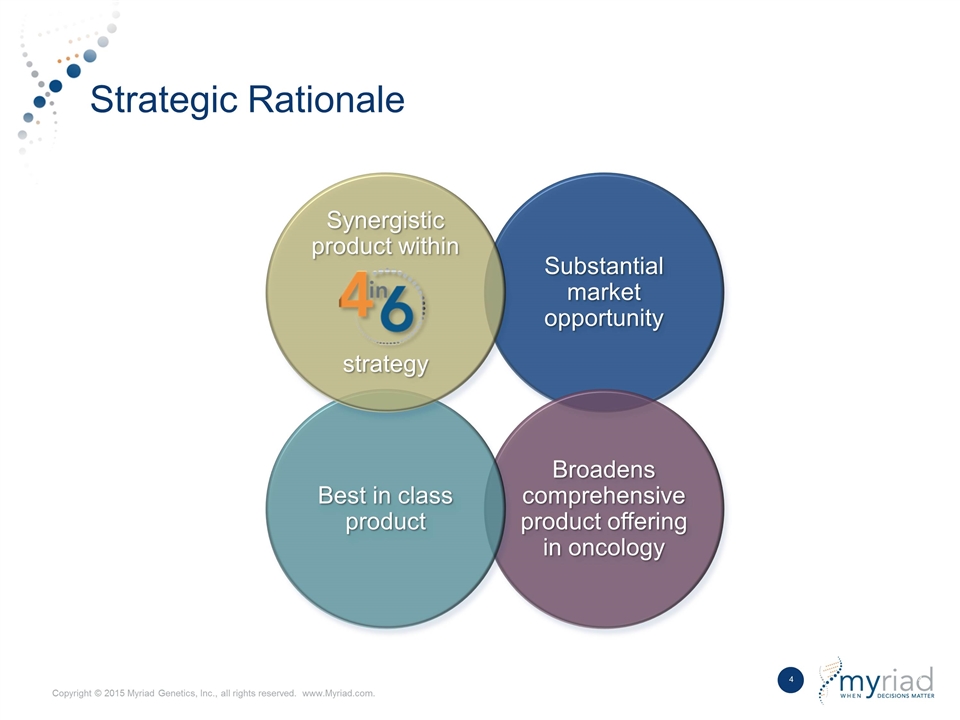

Strategic Rationale Substantial market opportunity Broadens comprehensive product offering in oncology Best in class product Synergistic product within strategy

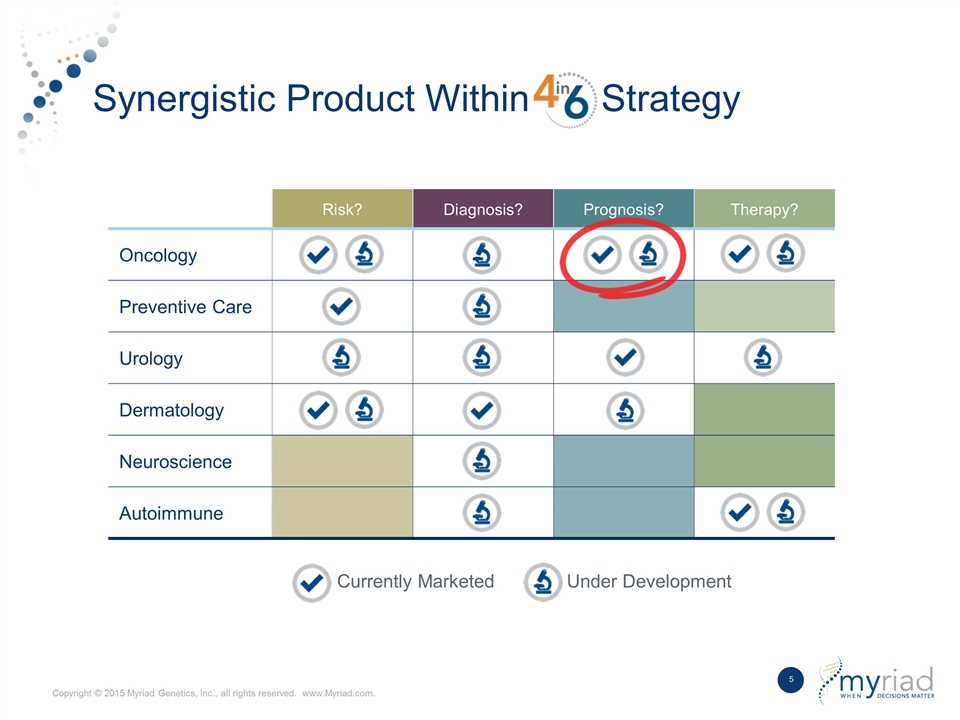

Synergistic Product Within Strategy Currently Marketed Under Development Risk? Diagnosis? Prognosis? Therapy? Oncology Preventive Care Urology Dermatology Neuroscience Autoimmune

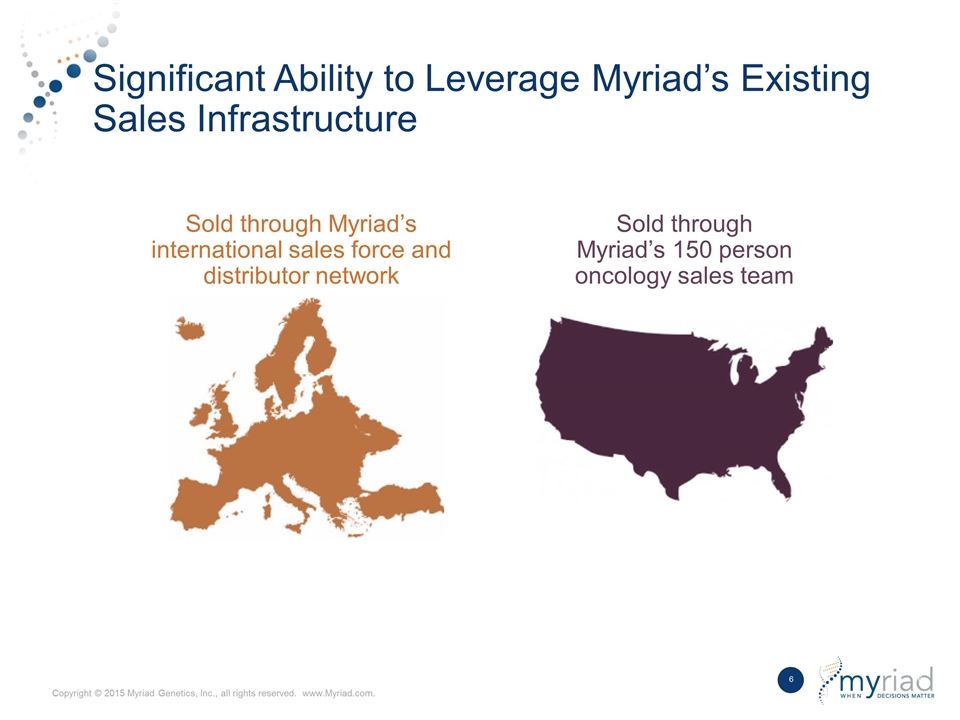

Significant Ability to Leverage Myriad’s Existing Sales Infrastructure Sold through Myriad’s 150 person oncology sales team Sold through Myriad’s international sales force and distributor network

Strategic Rationale Substantial market opportunity Broadens comprehensive product offering in oncology Best in class product Synergistic product within strategy

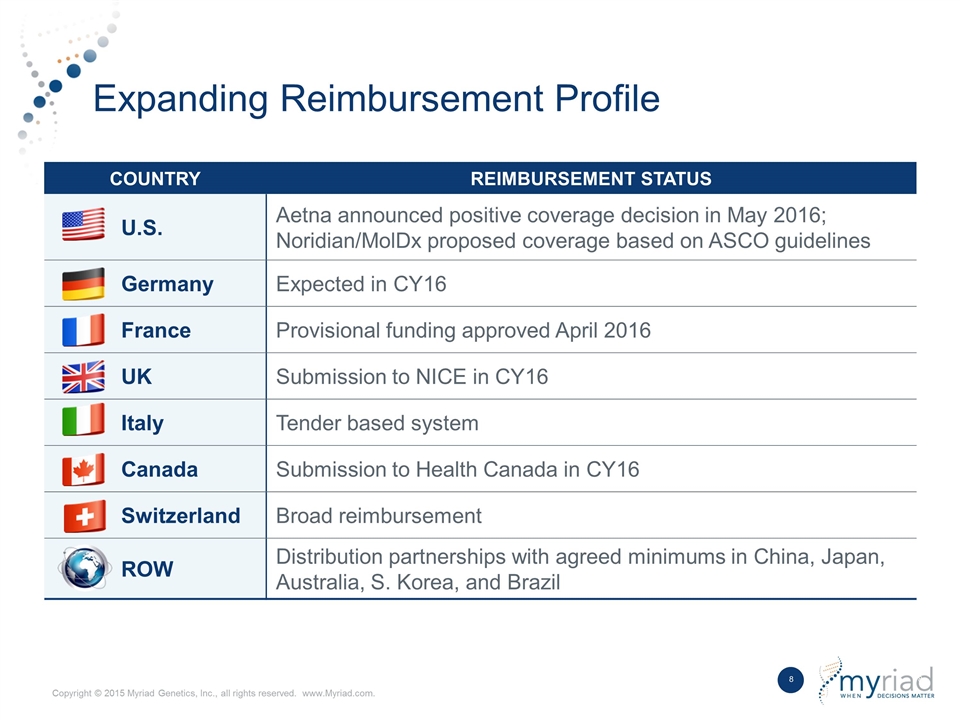

Expanding Reimbursement Profile COUNTRY REIMBURSEMENT STATUS U.S. Aetna announced positive coverage decision in May 2016; Noridian/MolDx proposed coverage based on ASCO guidelines Germany Expected in CY16 France Provisional funding approved April 2016 UK Submission to NICE in CY16 Italy Tender based system Canada Submission to Health Canada in CY16 Switzerland Broad reimbursement ROW Distribution partnerships with agreed minimums in China, Japan, Australia, S. Korea, and Brazil

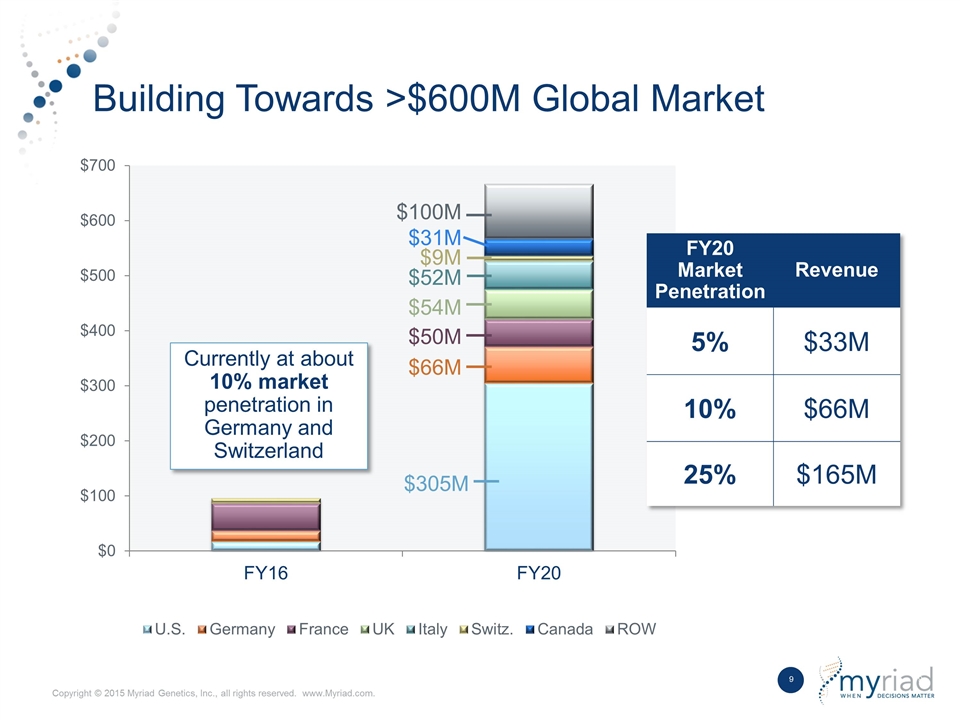

Building Towards >$600M Global Market $31M $9M $52M $54M $50M $66M $305M FY20 Market Penetration Revenue 5% $33M 10% $66M 25% $165M Currently at about 10% market penetration in Germany and Switzerland $100M

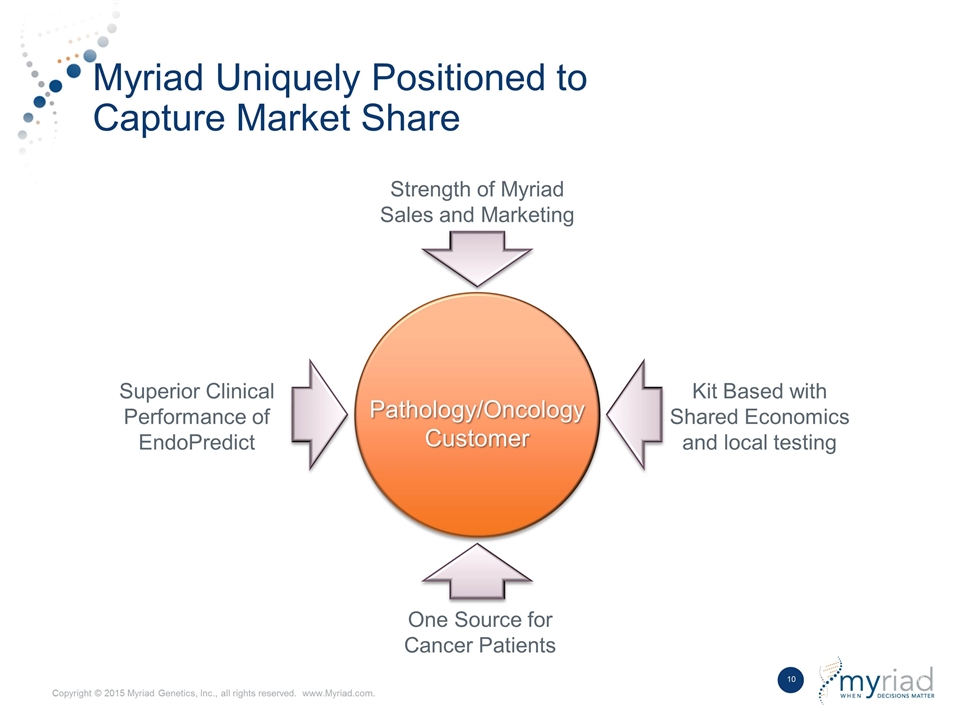

Myriad Uniquely Positioned to Capture Market Share Pathology/Oncology Customer One Source for Cancer Patients Kit Based with Shared Economics and local testing Superior Clinical Performance of EndoPredict Strength of Myriad Sales and Marketing

Strategic Rationale Substantial market opportunity Broadens comprehensive product offering in oncology Best in class product Synergistic product within strategy

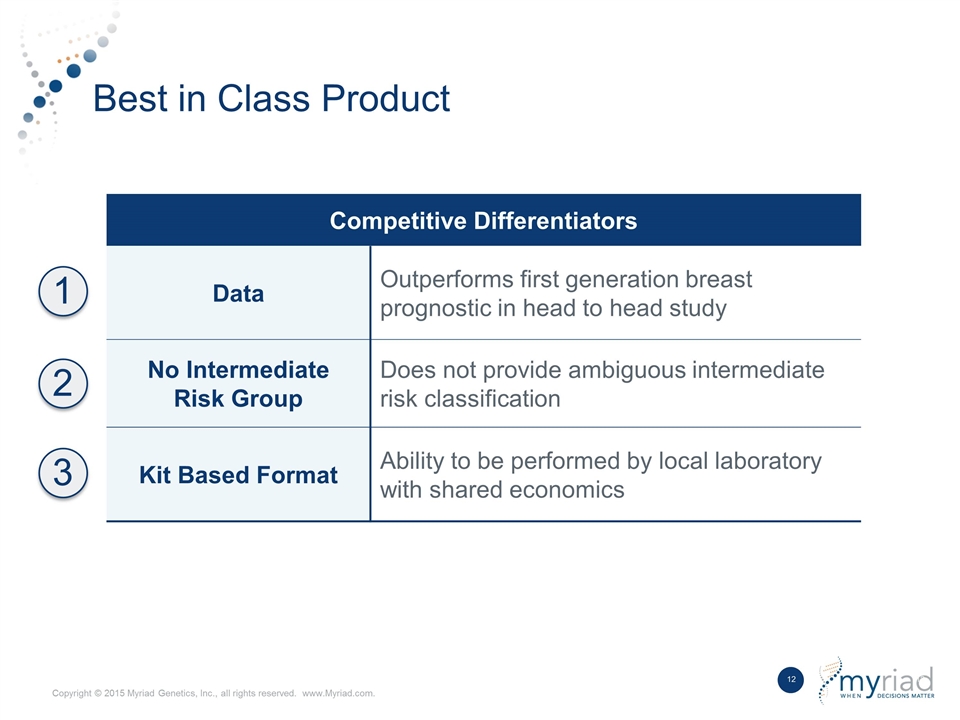

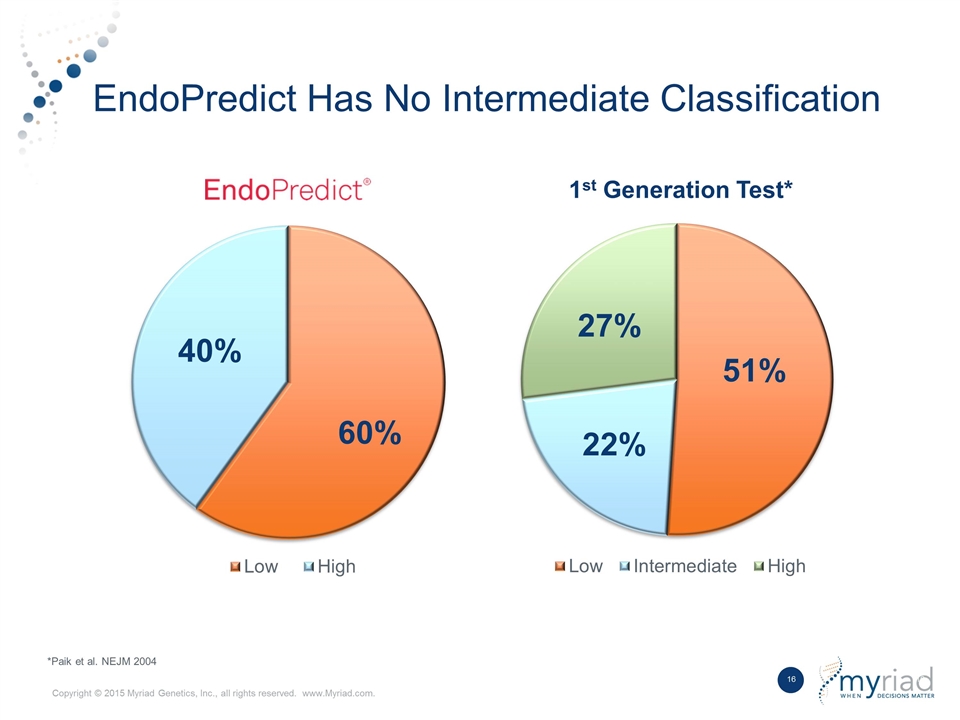

Best in Class Product Competitive Differentiators Data Outperforms first generation breast prognostic in head to head study No Intermediate Risk Group Does not provide ambiguous intermediate risk classification Kit Based Format Ability to be performed by local laboratory with shared economics 1 2 3

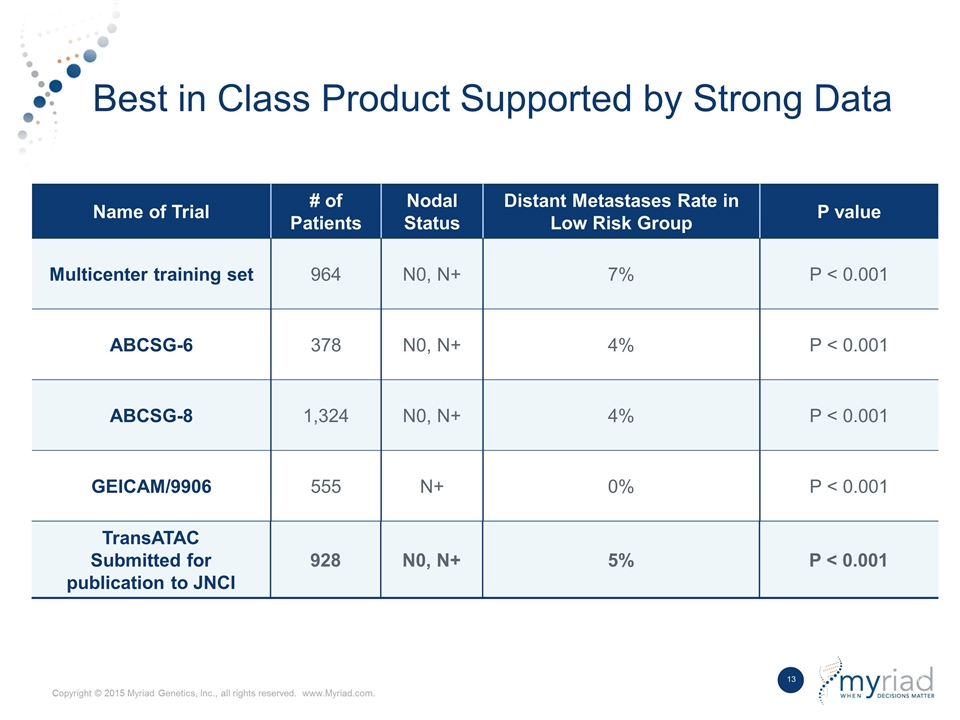

Best in Class Product Supported by Strong Data Name of Trial # of Patients Nodal Status Distant Metastases Rate in Low Risk Group P value Multicenter training set 964 N0, N+ 7% P < 0.001 ABCSG-6 378 N0, N+ 4% P < 0.001 ABCSG-8 1,324 N0, N+ 4% P < 0.001 GEICAM/9906 555 N+ 0% P < 0.001 TransATAC Submitted for publication to JNCI 928 N0, N+ 5% P < 0.001 TransATAC Submitted for publication to JNCI 928 N0, N+ 5% P < 0.001 Name of Trial # of Patients Nodal Status Distant Metastases Rate in Low Risk Group P value

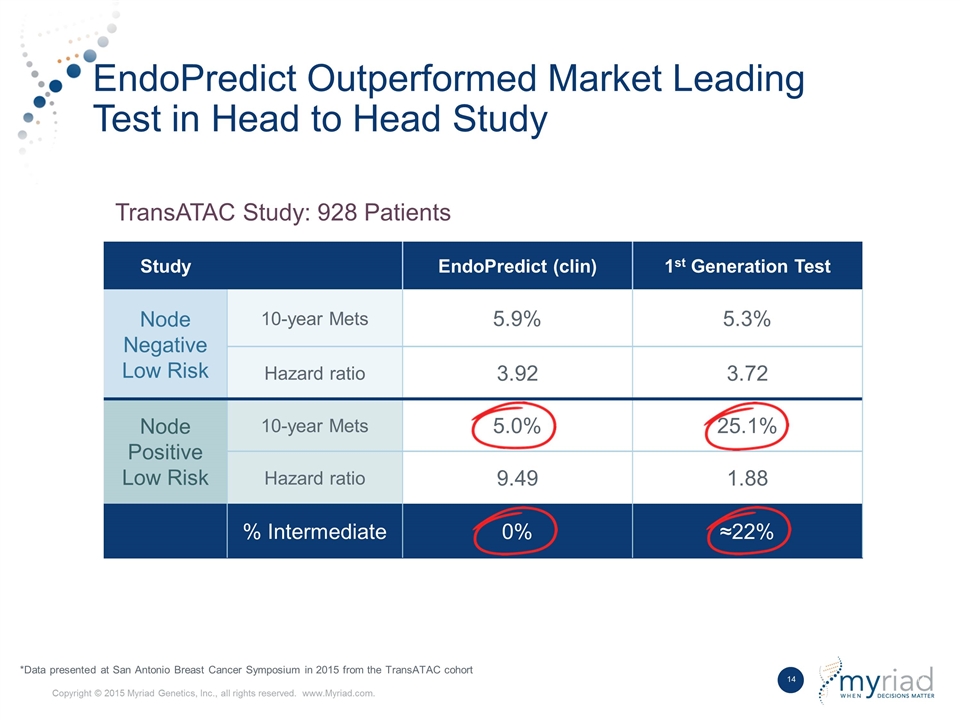

EndoPredict Outperformed Market Leading Test in Head to Head Study Study EndoPredict (clin) 1st Generation Test Node Negative Low Risk 10-year Mets 5.9% 5.3% Hazard ratio 3.92 3.72 Node Positive Low Risk 10-year Mets 5.0% 25.1% Hazard ratio 9.49 1.88 % Intermediate 0% ≈22% TransATAC Study: 928 Patients *Data presented at San Antonio Breast Cancer Symposium in 2015 from the TransATAC cohort

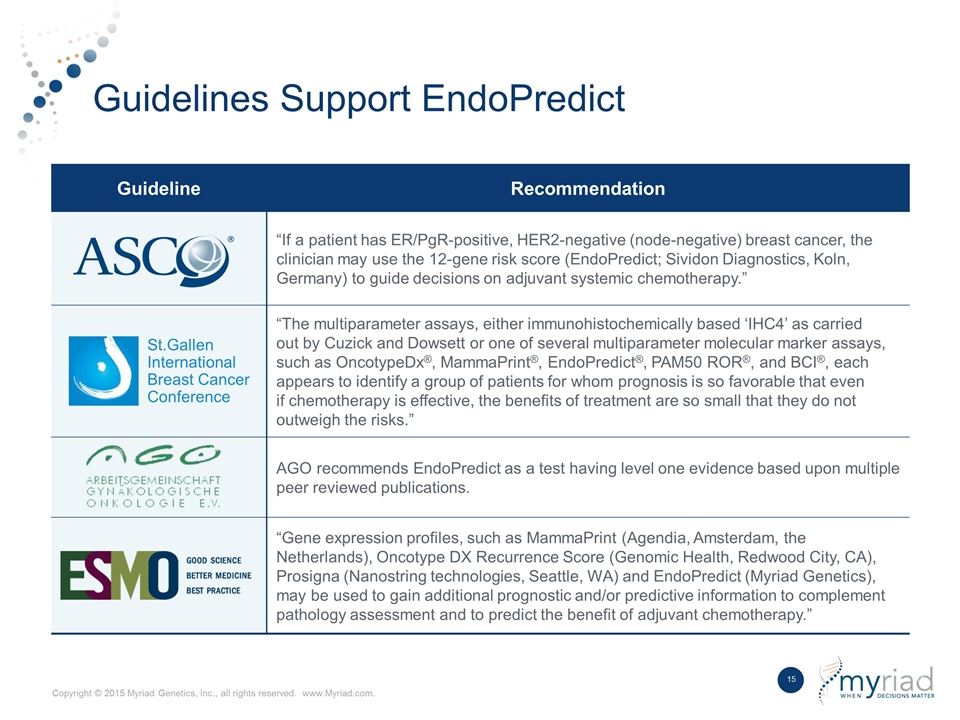

Guidelines Support EndoPredict Guideline Recommendation “If a patient has ER/PgR-positive, HER2-negative (node-negative) breast cancer, the clinician may use the 12-gene risk score (EndoPredict; Sividon Diagnostics, Koln, Germany) to guide decisions on adjuvant systemic chemotherapy.” St.Gallen International Breast Cancer Conference “The multiparameter assays, either immunohistochemically based ‘IHC4’ as carried out by Cuzick and Dowsett or one of several multiparameter molecular marker assays, such as OncotypeDx®, MammaPrint®, EndoPredict®, PAM50 ROR®, and BCI®, each appears to identify a group of patients for whom prognosis is so favorable that even if chemotherapy is effective, the benefits of treatment are so small that they do not outweigh the risks.” AGO recommends EndoPredict as a test having level one evidence based upon multiple peer reviewed publications. “Gene expression profiles, such as MammaPrint (Agendia, Amsterdam, the Netherlands), Oncotype DX Recurrence Score (Genomic Health, Redwood City, CA), Prosigna (Nanostring technologies, Seattle, WA) and EndoPredict (Myriad Genetics), may be used to gain additional prognostic and/or predictive information to complement pathology assessment and to predict the benefit of adjuvant chemotherapy.”

EndoPredict Has No Intermediate Classification *Paik et al. NEJM 2004 1st Generation Test*

Foundational Product for Global Kit Strategy RNA Expression Protein In discussions with potential partners

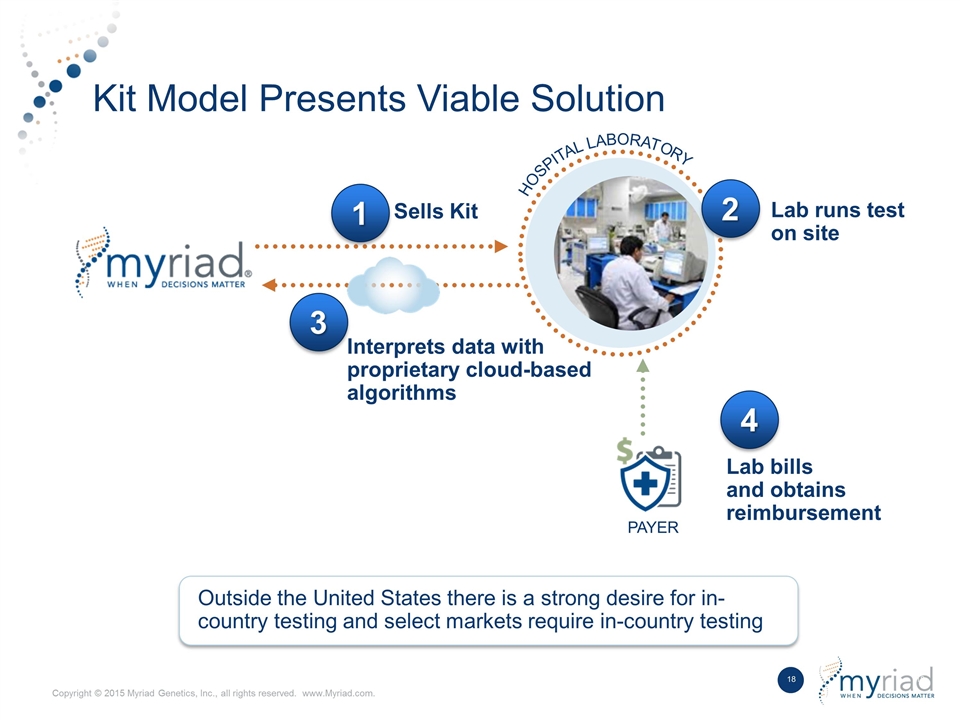

Kit Model Presents Viable Solution HOSPITAL LABORATORY Outside the United States there is a strong desire for in- country testing and select markets require in-country testing Sells Kit Lab runs test on site 3 Interprets data with proprietary cloud-based algorithms 1 2 4 Lab bills and obtains reimbursement PAYER

Strategic Rationale Substantial market opportunity Broadens comprehensive product offering in oncology Best in class product Synergistic product within strategy

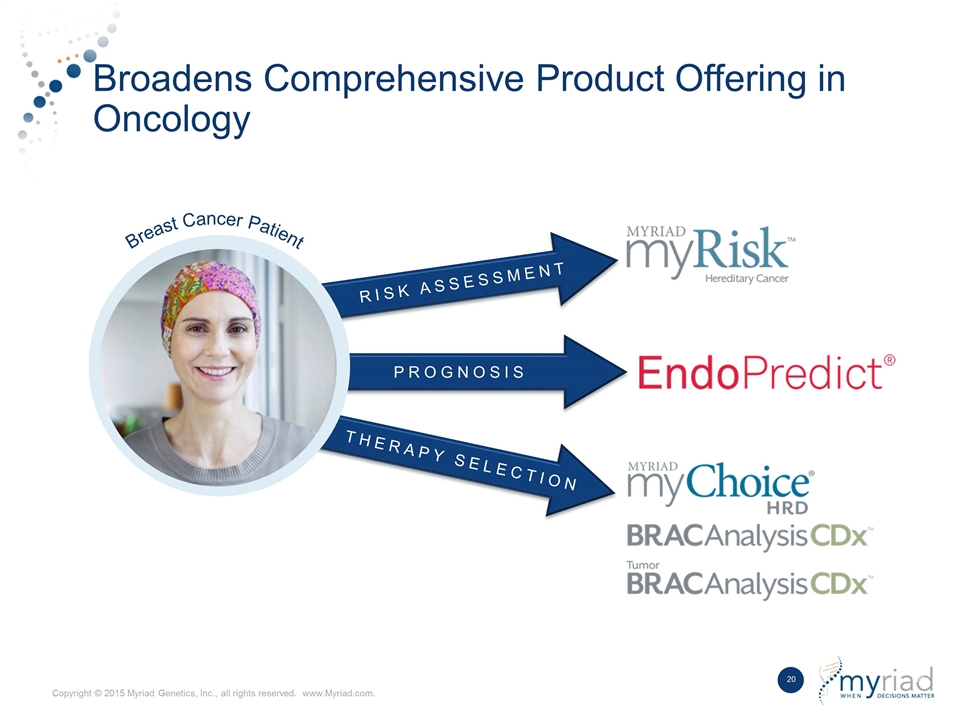

RISK ASSESSMENT Broadens Comprehensive Product Offering in Oncology PROGNOSIS THERAPY SELECTION Breast Cancer Patient

Myriad Genetics Acquisition of Sividon Diagnostics Consideration For Sividon Shareholders Acquired Sividon for €35M upfront and €15M in performance based milestones FY17 EndoPredict revenues estimated to be $8M (not including U.S. revenue) Funding deal using cash on hand Closed May 31, 2016 Myriad Financial Considerations Neutral to FY17 sales and EPS (excludes potential impact of U.S. revenue) Accretive revenue and adjusted EPS in FY18 and beyond Expected to be one of seven products generating >$50M in sales by FY20 Long term gross margin profile expected to be >80% Strategic Rationale Synergistic product within 4in6 strategy Substantial market opportunity Best in class product Broadens comprehensive product offering in oncology European kit manufacturer of high value diagnostics Core product is EndoPredict a breast cancer prognostic test Brings to Myriad substantial kit manufacturing and development expertise Myriad is the current exclusive distributor of EndoPredict in all countries except the U.S. and China