Myriad Genetics Acquisition of Assurex Health 08/03/2016 Exhibit 99.2

Forward Looking Statements Some of the information presented here today may contain projections or other forward-looking statements regarding future events or the future financial performance of the Company. These statements are based on management’s current expectations and the actual events or results may differ materially and adversely from these expectations. We refer you to the documents the Company files from time to time with the Securities and Exchange Commission, specifically, the Company’s annual reports on Form 10-K, its quarterly reports on Form 10-Q, and its current reports on Form 8-K. These documents identify important risk factors that could cause the actual results to differ materially from those contained in the Company’s projections or forward-looking statements.

Myriad Genetics Acquisition of Assurex Health Strategic Rationale Allows entry into the attractive neuroscience market Synergistic product within strategy Best in class product in large market Ability to leverage psychiatry call point with future products Future opportunity for Preventive Care team to sell GeneSight. Consideration For Assurex Shareholders Acquiring Assurex for $225M upfront and up to $185M in performance-based milestones FY16 revenue of more than $60M Funding deal using cash on hand and debt Expected to close at the end of the 1Q FY17. Myriad Financial Considerations Will be dilutive to adjusted EPS in FY17 Expected to become accretive in 1H FY18 based on current reimbursement coverage Assurex will be incorporated into FY17 financial guidance provided on 4Q16 earnings call Expected to generate LT gross and operating margins consistent with our portfolio. Global leader in genetic testing for drug selection in mental health market Core product is GeneSight®, which provides individualized treatment recommendations on 55 antidepressant, antipsychotic, and other mental health medications Currently call primarily on psychiatrists in the United States Testing services provided from Assurex’s CLIA laboratory in Mason, Ohio

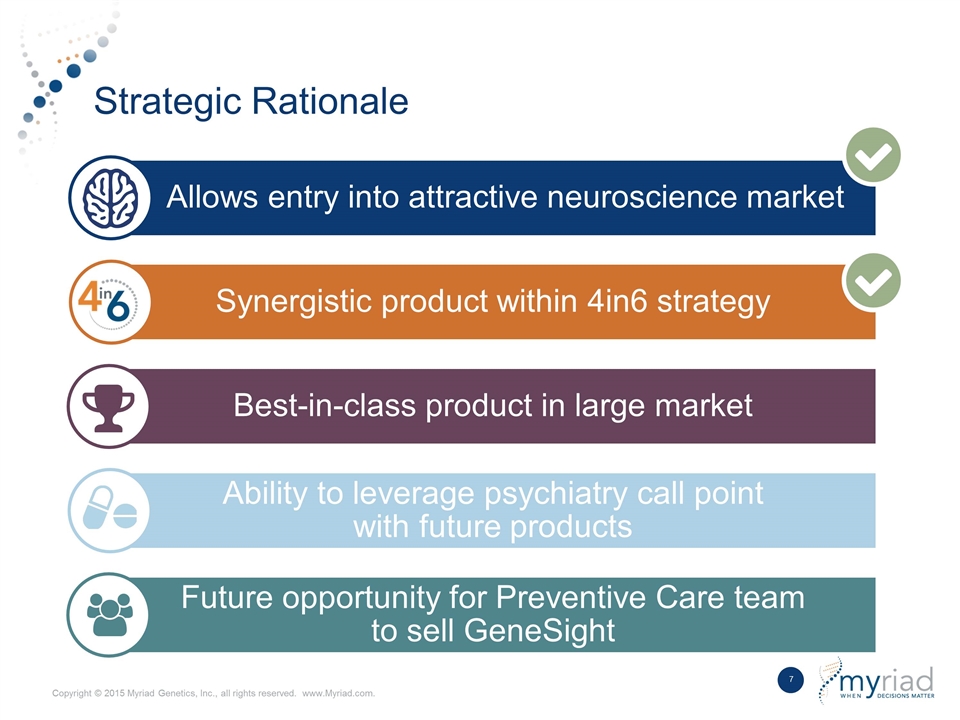

Strategic Rationale Allows entry into attractive neuroscience market Synergistic product within 4in6 strategy Best-in-class product in large market Ability to leverage psychiatry call point with future products Future opportunity for Preventive Care team to sell GeneSight

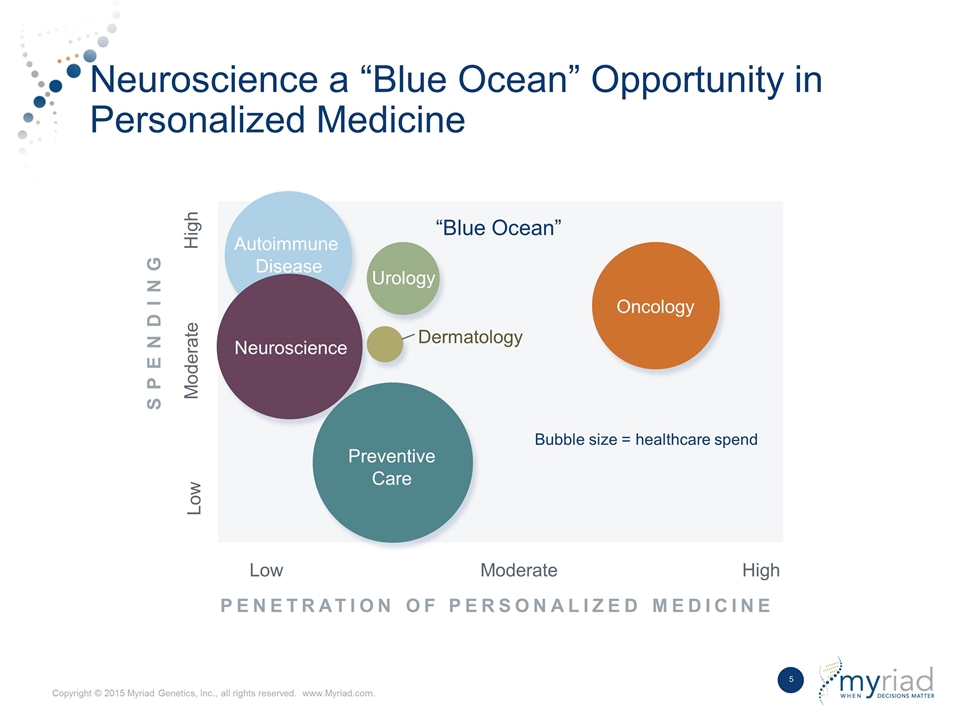

Neuroscience a “Blue Ocean” Opportunity in Personalized Medicine PENETRATION OF PERSONALIZED MEDICINE High Moderate Low “Blue Ocean” Autoimmune Disease Oncology Urology Preventive Care Neuroscience Dermatology Low Moderate High SPENDING Bubble size = healthcare spend

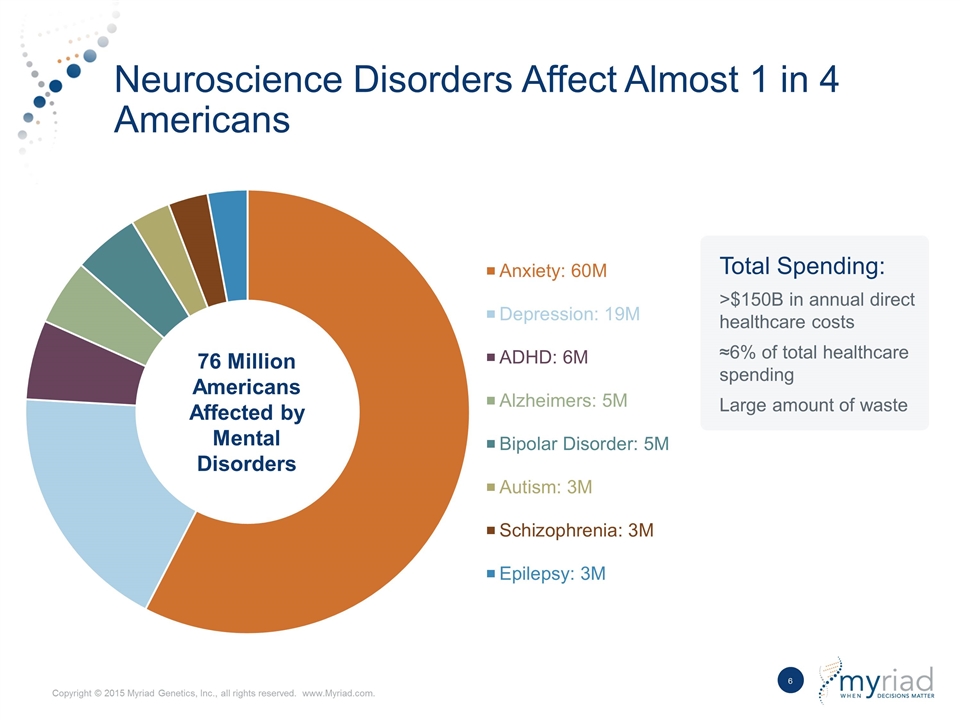

Neuroscience Disorders Affect Almost 1 in 4 Americans Total Spending: >$150B in annual direct healthcare costs ≈6% of total healthcare spending Large amount of waste 76 Million Americans Affected by Mental Disorders

Strategic Rationale Allows entry into attractive neuroscience market Synergistic product within 4in6 strategy Best-in-class product in large market Ability to leverage psychiatry call point with future products Future opportunity for Preventive Care team to sell GeneSight

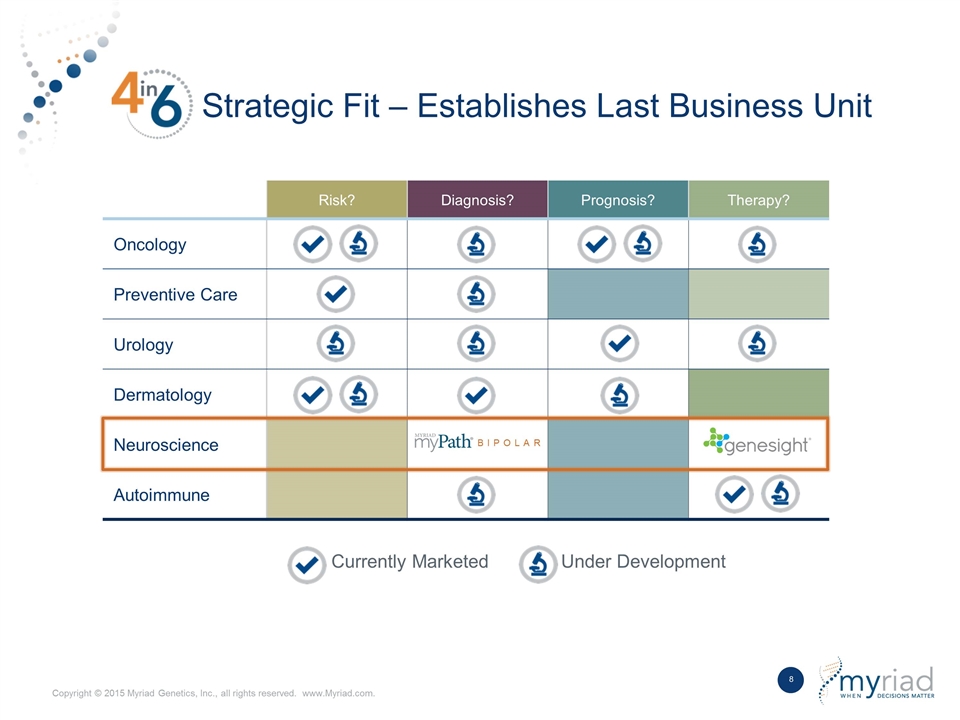

Strategic Fit – Establishes Last Business Unit Currently Marketed Under Development Risk? Diagnosis? Prognosis? Therapy? Oncology Preventive Care Urology Dermatology Neuroscience Autoimmune BIPOLAR

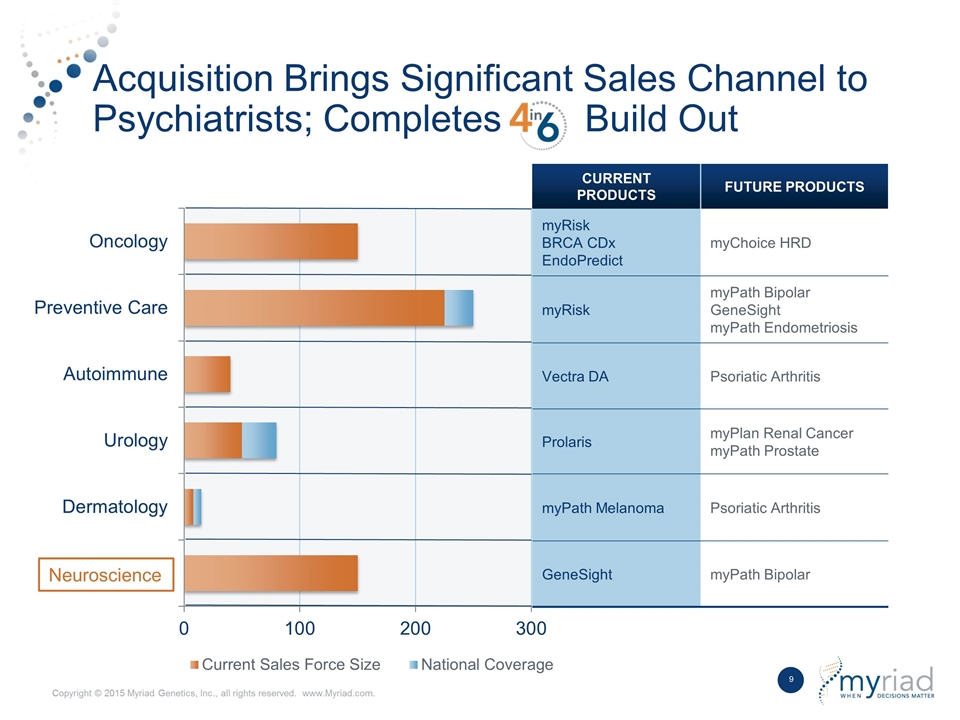

Acquisition Brings Significant Sales Channel to Psychiatrists; Completes Build Out CURRENT PRODUCTS FUTURE PRODUCTS myRisk BRCA CDx EndoPredict myChoice HRD myRisk myPath Bipolar GeneSight myPath Endometriosis Vectra DA Psoriatic Arthritis Prolaris myPlan Renal Cancer myPath Prostate myPath Melanoma Psoriatic Arthritis GeneSight myPath Bipolar Neuroscience

Strategic Rationale Allows entry into attractive neuroscience market Synergistic product within 4in6 strategy Best-in-class product in large market Ability to leverage psychiatry call point with future products Future opportunity for Preventive Care team to sell GeneSight

Why do we need ? Historically neuropsychiatric medications were prescribed by trial and error method – leads to “medication odyssey.” A delay in effective treatment can significantly complicate the treatment process, extend symptom severity, reduce patients tolerance and response to subsequent medications, or harm the patient through the misapplication of psychotropic medicines. Patients on effective therapy have improved outcomes in terms of lower healthcare utilization, lower prescription costs, and increased productivity.

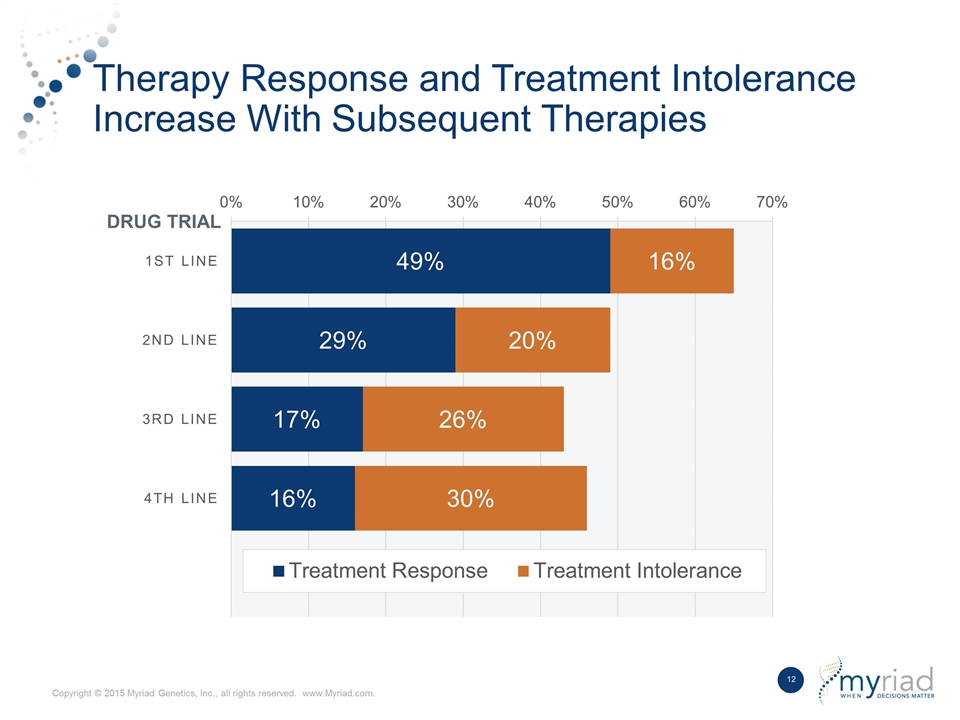

Therapy Response and Treatment Intolerance Increase With Subsequent Therapies DRUG TRIAL

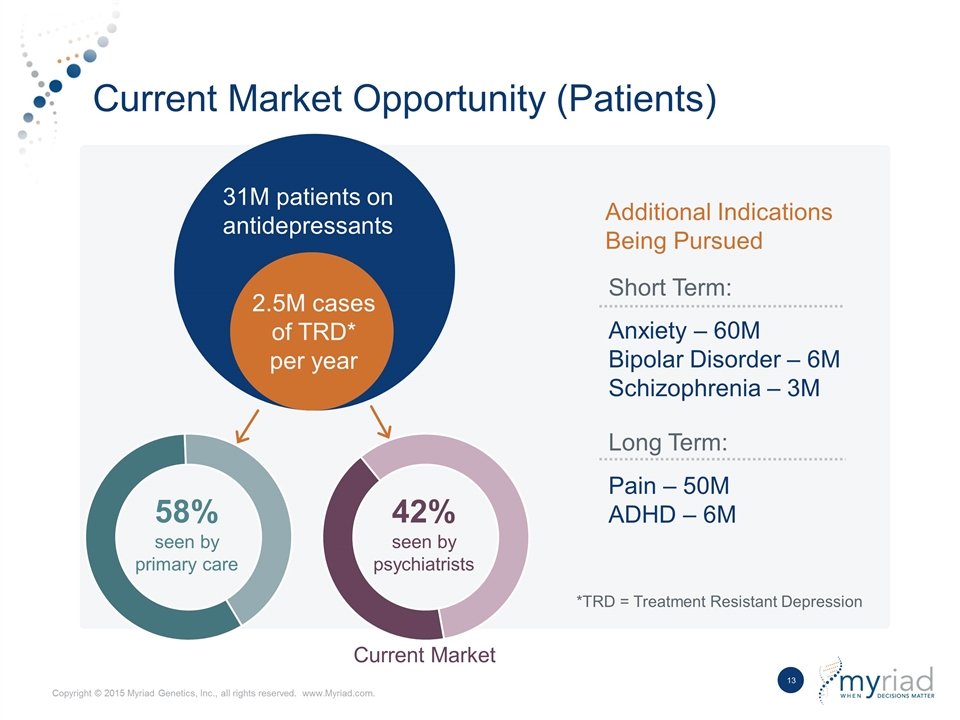

Current Market Opportunity (Patients) 31M patients on antidepressants 2.5M cases of TRD* per year *TRD = Treatment Resistant Depression 58% seen by primary care Current Market Anxiety – 60M Bipolar Disorder – 6M Schizophrenia – 3M Pain – 50M ADHD – 6M Short Term: Long Term: Additional Indications Being Pursued 42% seen by psychiatrists

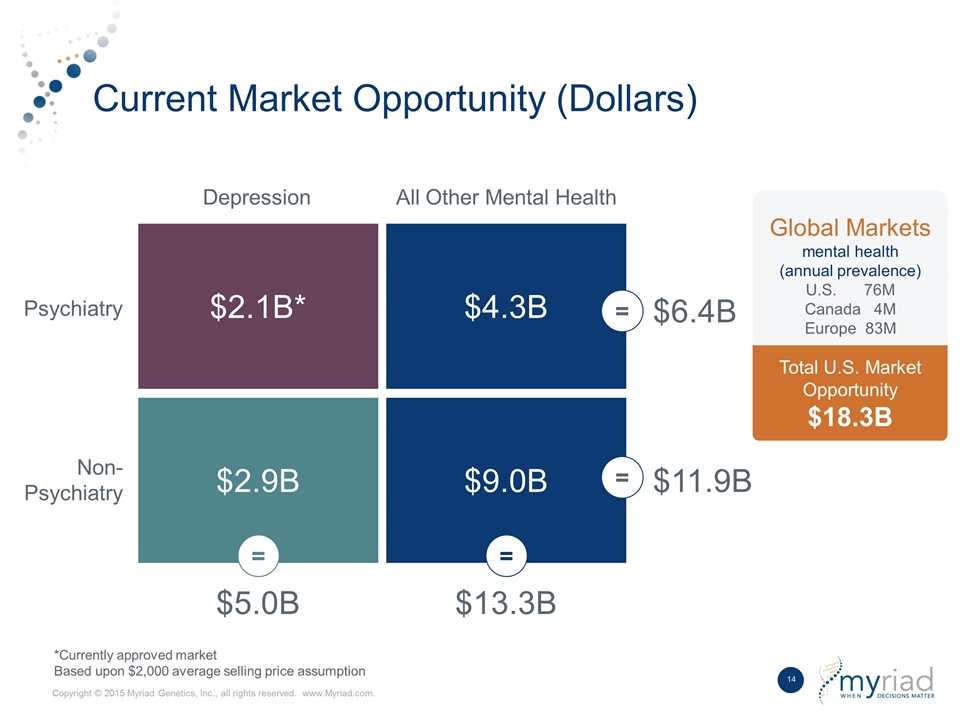

Current Market Opportunity (Dollars) *Currently approved market Based upon $2,000 average selling price assumption Global Markets mental health (annual prevalence) U.S. 76M Canada 4M Europe 83M Total U.S. Market Opportunity $18.3B Depression All Other Mental Health Psychiatry Non-Psychiatry $2.1B* $4.3B $2.9B $9.0B $5.0B $13.3B $11.9B $6.4B = = = =

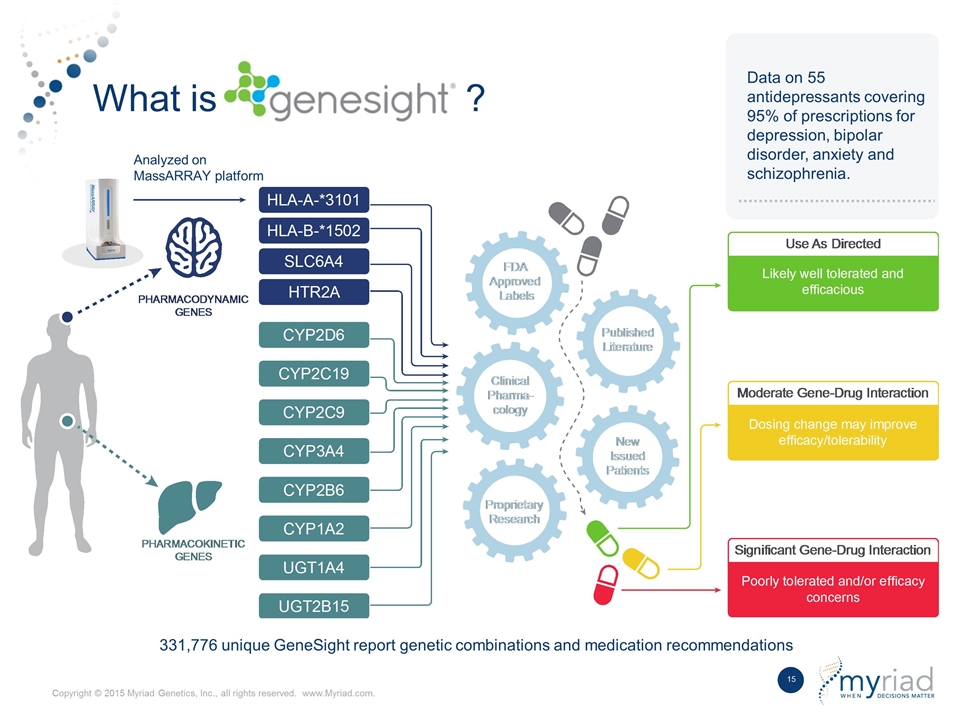

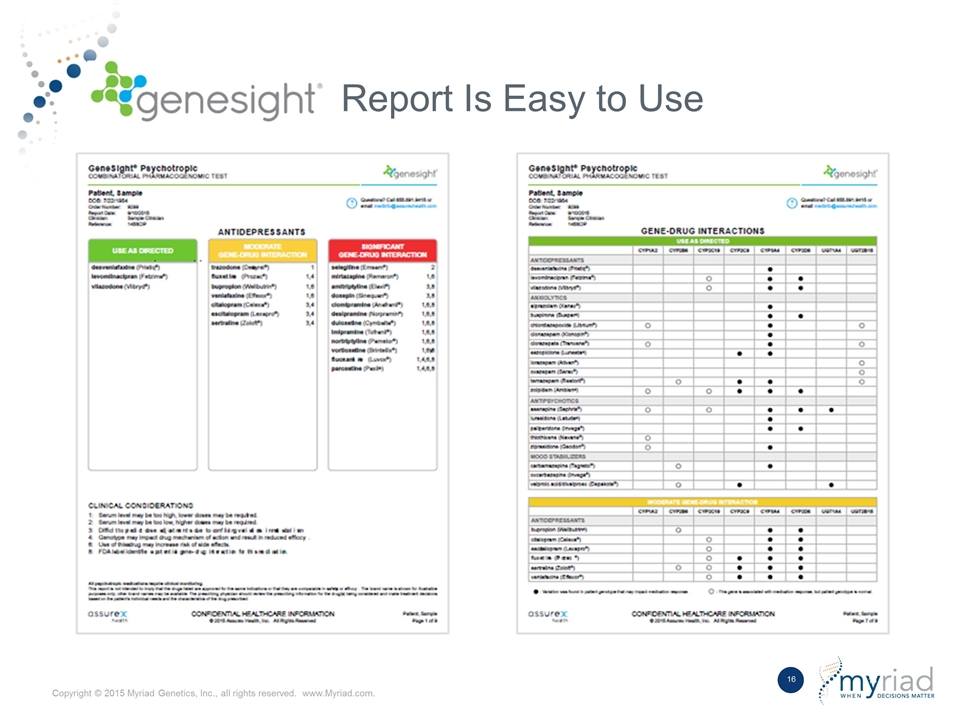

What is ? Data on 55 antidepressants covering 95% of prescriptions for depression, bipolar disorder, anxiety and schizophrenia. Analyzed on MassARRAY platform 331,776 unique GeneSight report genetic combinations and medication recommendations

Report Is Easy to Use

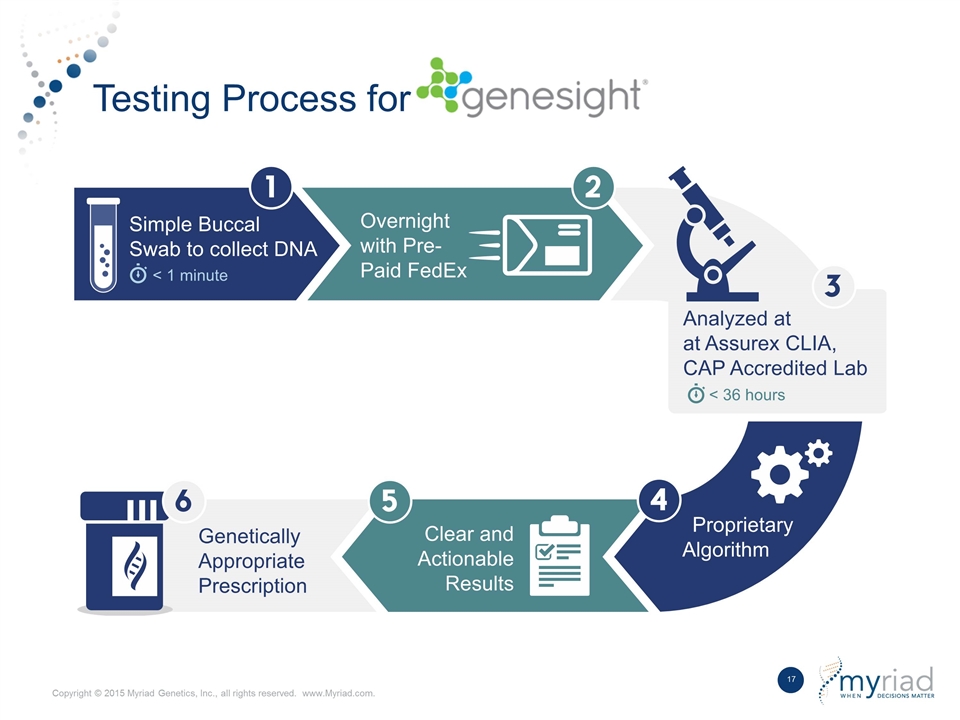

Testing Process for

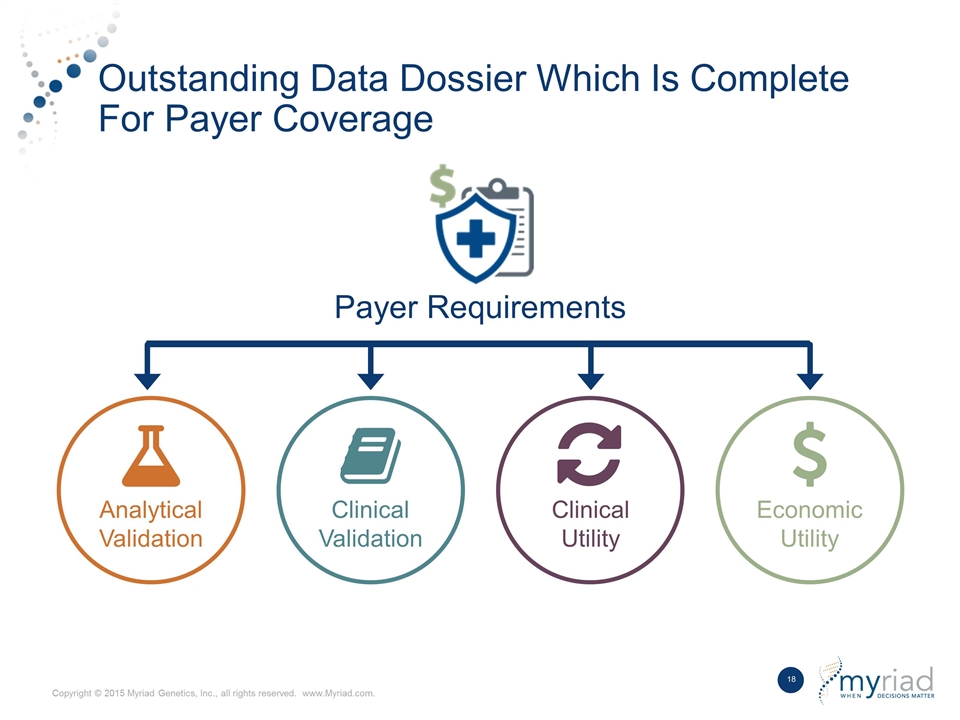

Outstanding Data Dossier Which Is Complete For Payer Coverage Analytical Validation Economic Utility Payer Requirements Clinical Utility Clinical Validation

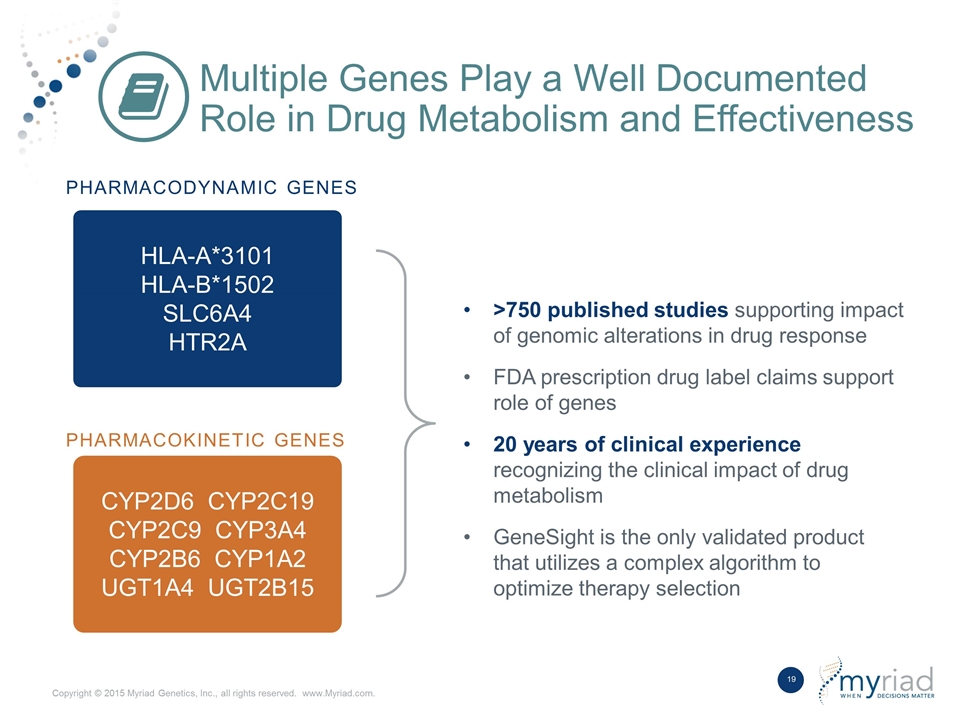

Multiple Genes Play a Well Documented Role in Drug Metabolism and Effectiveness HLA-A*3101 HLA-B*1502 SLC6A4 HTR2A CYP2D6 CYP2C19 CYP2C9 CYP3A4 CYP2B6 CYP1A2 UGT1A4 UGT2B15 Pharmacodynamic Genes Pharmacokinetic Genes >750 published studies supporting impact of genomic alterations in drug response FDA prescription drug label claims support role of genes 20 years of clinical experience recognizing the clinical impact of drug metabolism GeneSight is the only validated product that utilizes a complex algorithm to optimize therapy selection

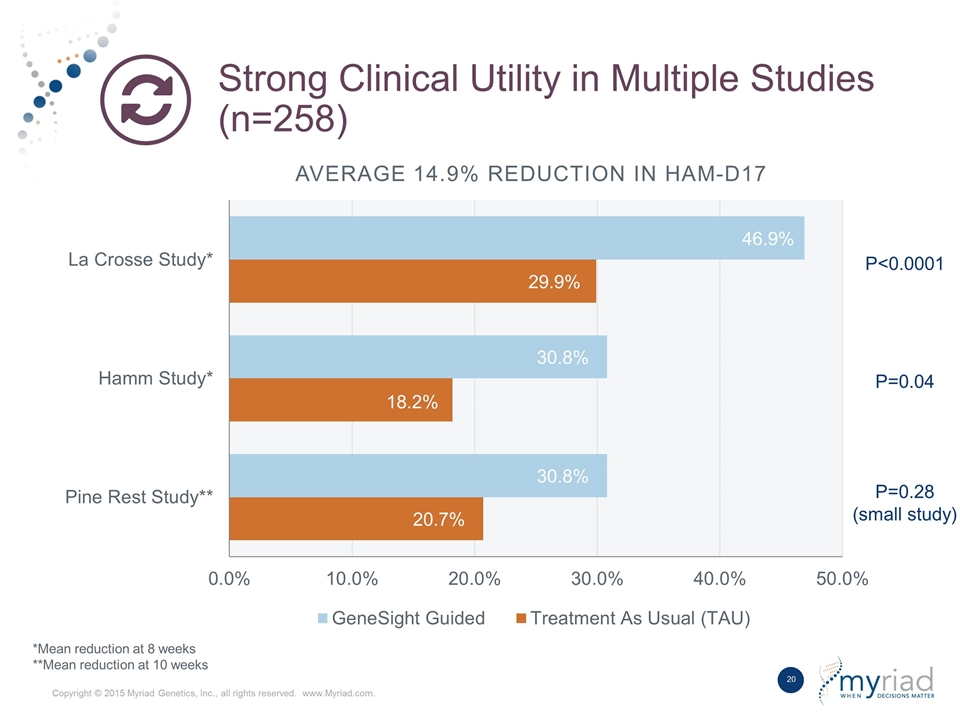

Strong Clinical Utility in Multiple Studies (n=258) P=0.28 (small study) P=0.04 P<0.0001 *Mean reduction at 8 weeks **Mean reduction at 10 weeks Average 14.9% Reduction in HAM-D17

Strong Clinical Utility Demonstrated in Multiple Studies (n=258) Mean Improvement in HAM-D17 FDA Approved Medications* “A large between-drug difference could conceivably be 7% in HamD score - Far more likely would be a difference of 5% in HamD score.” Robert Temple, MD, Deputy Center Director for Clinical Science, CDER, FDA Source: FDA summary bases of approvals

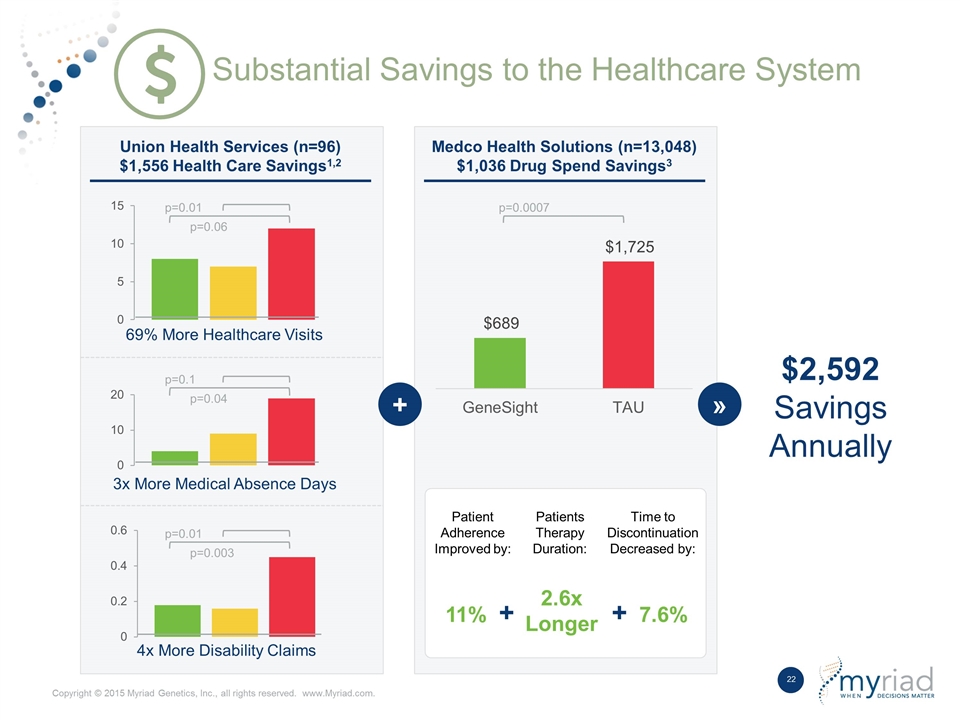

Substantial Savings to the Healthcare System p=0.01 p=0.06 p=0.1 p=0.04 p=0.01 p=0.003 4x More Disability Claims 3x More Medical Absence Days 69% More Healthcare Visits Union Health Services (n=96) $1,556 Health Care Savings1,2 Medco Health Solutions (n=13,048) $1,036 Drug Spend Savings3 p=0.0007 Patient Adherence Improved by: Patients Therapy Duration: Time to Discontinuation Decreased by: 11% + 2.6x Longer + 7.6% + » $2,592 Savings Annually

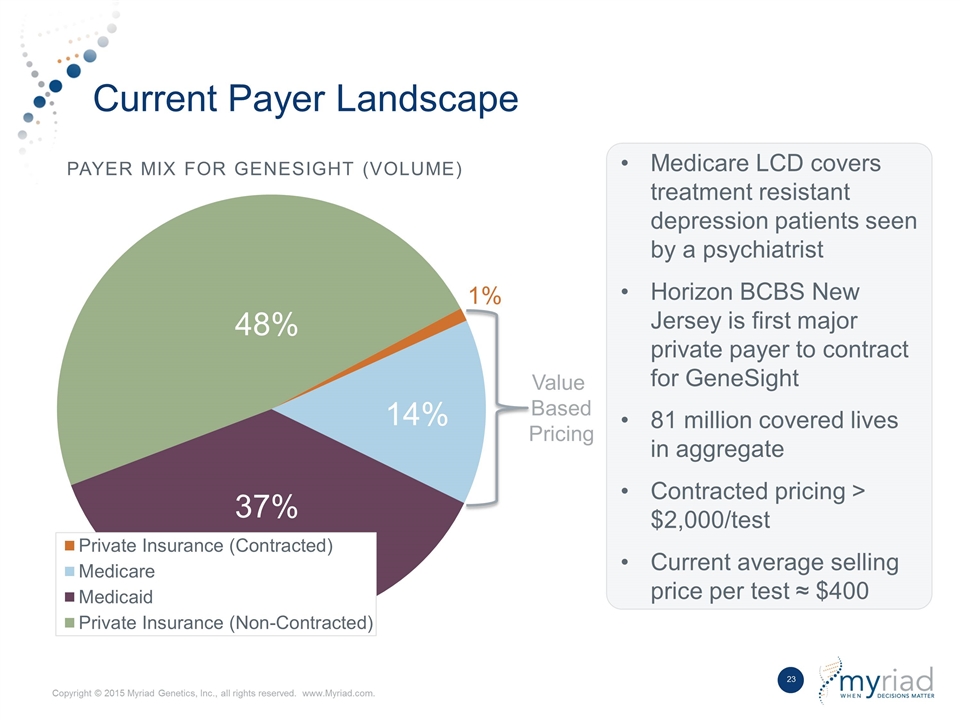

Current Payer Landscape Payer Mix for GeneSight (Volume) Value Based Pricing Medicare LCD covers treatment resistant depression patients seen by a psychiatrist Horizon BCBS New Jersey is first major private payer to contract for GeneSight 81 million covered lives in aggregate Contracted pricing > $2,000/test Current average selling price per test ≈ $400

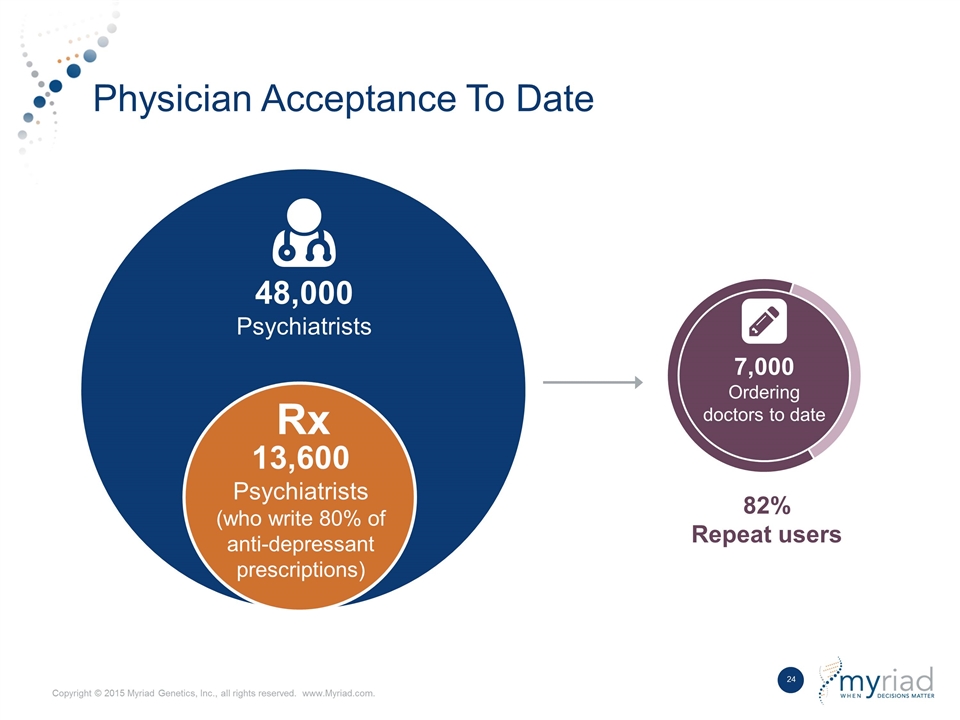

Physician Acceptance To Date 48,000 Psychiatrists 7,000 Ordering doctors to date 82% Repeat users 13,600 Psychiatrists (who write 80% of anti-depressant prescriptions) Rx

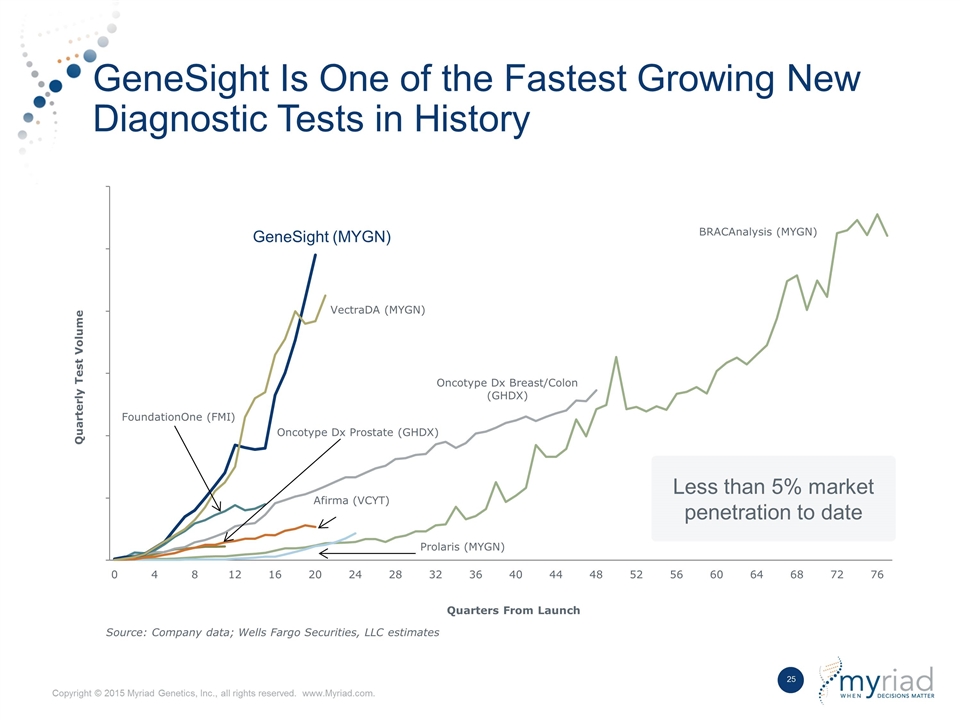

GeneSight Is One of the Fastest Growing New Diagnostic Tests in History Less than 5% market penetration to date GeneSight (MYGN)

Biorepository and database on genetic, clinical, and health record outcomes of 300,000 patients and growing First mover advantage Sales channel Trade secrets Extensive clinical development program 55 patents worldwide and 29 pending applications Substantial Barriers to Entry

Strategic Rationale Allows entry into attractive neuroscience market Synergistic product within 4in6 strategy Best-in-class product in large market Ability to leverage psychiatry call point with future products Future opportunity for Preventive Care team to sell GeneSight

Assurex Provides Sales Channel for myPath Bipolar Myriad developing differential diagnosis product for major depressive disorder (MDD) and bipolar disorder (BP) 20 million patients per year present with symptoms consistent with MDD or BP Bipolar patients do not respond to first-line or subsequent therapeutics for MDD MDD anti-depressive therapeutics can trigger manic psychosis in a subset of BP patients BP symptoms are 6th leading cause of disability in 15-44 age group Economic impact of improperly treated BP in U.S. is $72B annually

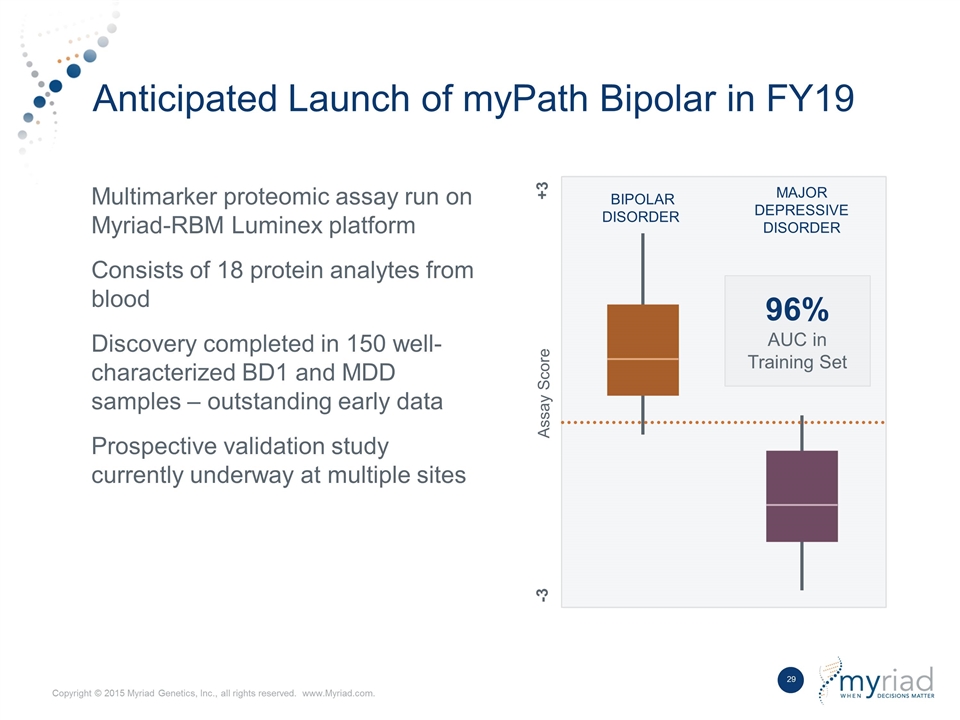

Anticipated Launch of myPath Bipolar in FY19 Multimarker proteomic assay run on Myriad-RBM Luminex platform Consists of 18 protein analytes from blood Discovery completed in 150 well- characterized BD1 and MDD samples – outstanding early data Prospective validation study currently underway at multiple sites BIPOLAR DISORDER MAJOR DEPRESSIVE DISORDER Assay Score +3 -3 96% AUC in Training Set

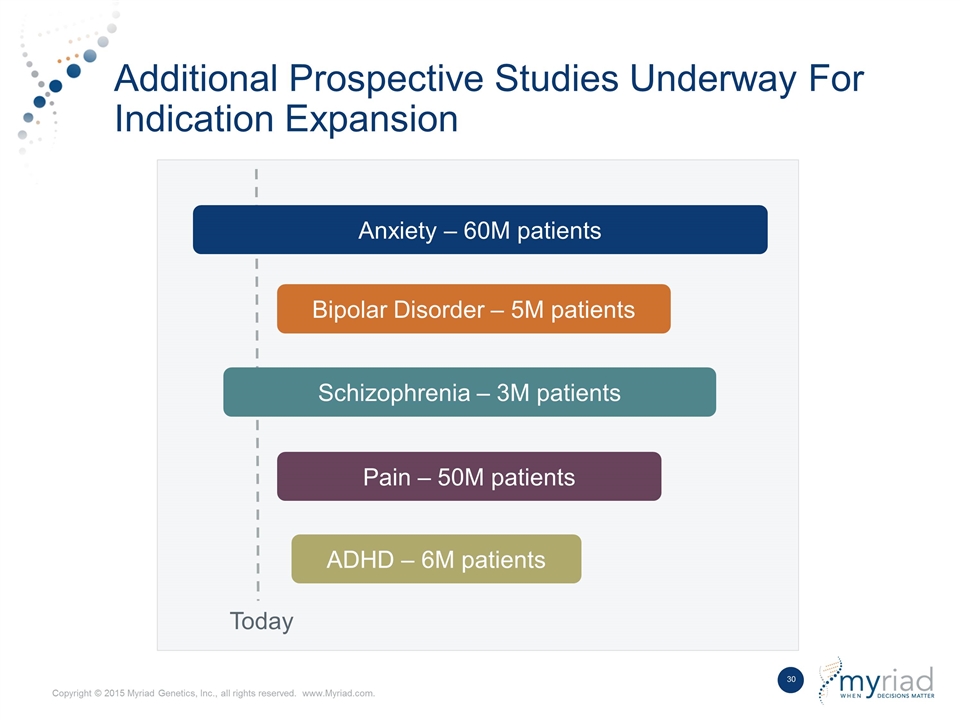

Additional Prospective Studies Underway For Indication Expansion Anxiety – 60M patients Today Bipolar Disorder – 5M patients Schizophrenia – 3M patients Pain – 50M patients ADHD – 6M patients

Strategic Rationale Allows entry into attractive neuroscience market Synergistic product within 4in6 strategy Best-in-class product in large market Ability to leverage psychiatry call point with future products Future opportunity for Preventive Care team to sell GeneSight

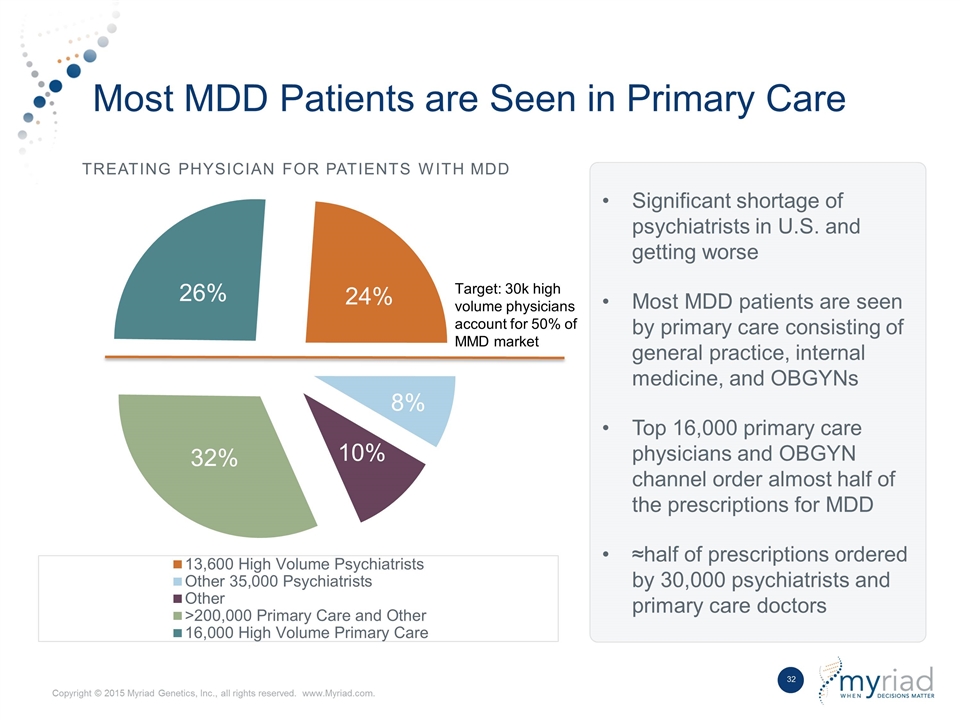

Most MDD Patients are Seen in Primary Care Treating Physician for Patients With MDD Significant shortage of psychiatrists in U.S. and getting worse Most MDD patients are seen by primary care consisting of general practice, internal medicine, and OBGYNs Top 16,000 primary care physicians and OBGYN channel order almost half of the prescriptions for MDD ≈half of prescriptions ordered by 30,000 psychiatrists and primary care doctors

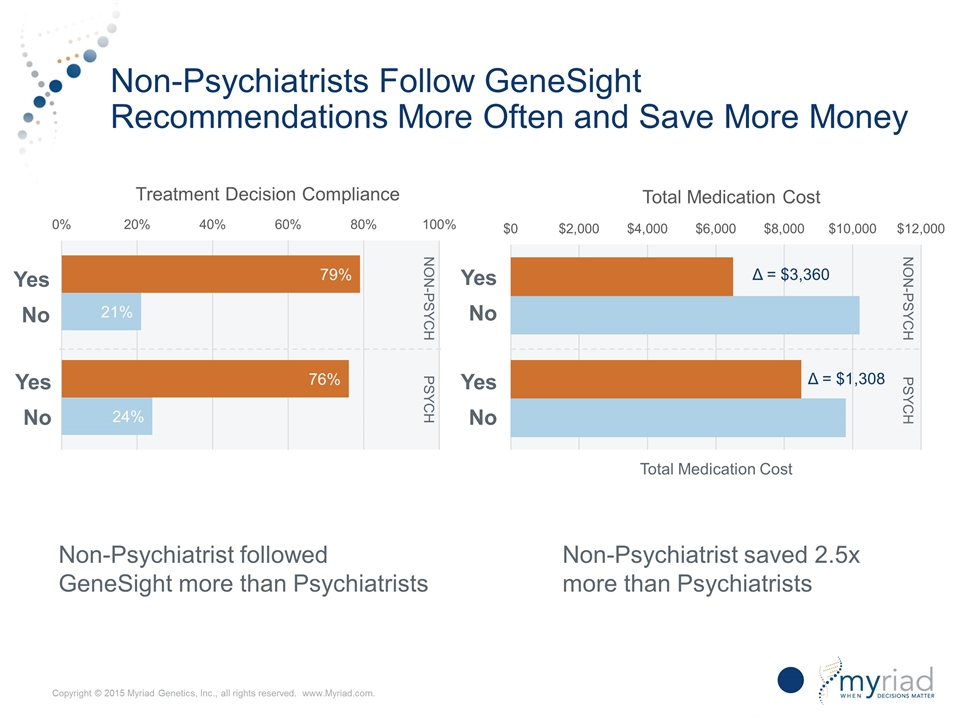

Non-Psychiatrists Follow GeneSight Recommendations More Often and Save More Money Non-Psych Psych Yes No Non-Psych Psych Non-Psychiatrist followed GeneSight more than Psychiatrists Non-Psychiatrist saved 2.5x more than Psychiatrists 33 Total Medication Cost Δ = $3,360 Δ = $1,308 Yes No Yes No Yes No

Submitting LCD to Medicare; Myriad Can Utilize Preventive Care Channel to Sell GeneSight Large GeneSight study published in July of 2015 (n≈13,000) in Current Medical Research and Opinion following current Medicare LCD that was issued in October 2014. The majority of physicians in the study were non-psychiatrists (primary care physicians). Significant number of patients in the study with anxiety and bipolar disorder; outcomes were better for these patients with higher compliance, plus 1.8x and 1.3x the cost savings respectively, compared to the significant savings for patients with depression. Request submitted to expand the LCD to cover primary care physicians and allow GeneSight tests for anxiety and bipolar disorder where the patient has failed at least one neuropsychiatric medication. Test could be sold through Myriad’s 225 person Preventive Care sales force.

Myriad Genetics Acquisition of Assurex Health Strategic Rationale Allows entry into the attractive neuroscience market Synergistic product within strategy Best in class product in large market Ability to leverage psychiatry call point with future products Future opportunity for Preventive Care team to sell GeneSight. Consideration For Assurex Shareholders Acquiring Assurex for $225M upfront and up to $185M in performance-based milestones FY16 revenue of more than $60M Funding deal using cash on hand and debt Expected to close at the end of the 1Q FY17. Myriad Financial Considerations Will be dilutive to adjusted EPS in FY17 Expected to become accretive in 1H FY18 based on current reimbursement coverage Assurex will be incorporated into FY17 financial guidance provided on 4Q16 earnings call Expected to generate LT gross and operating margins consistent with our portfolio. Global leader in genetic testing for drug selection in mental health market Core product is GeneSight®, which provides individualized treatment recommendations on 55 antidepressant, antipsychotic, and other mental health medications Currently call primarily on psychiatrists in the United States Testing services provided from Assurex’s CLIA laboratory in Mason, Ohio