UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07644

Gabelli Capital Series Funds, Inc.

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

Bruce N. Alpert

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | |

¢ Gabelli Capital Asset Fund | | Annual Report To Contractowners |

| | |

Mario J. Gabelli, CFA Portfolio Manager Objective: Growth of capital. Current income is a secondary objective Portfolio: At least 80% common stocks and securities convertible into common stocks Inception Date: May 1, 1995 Net Assets at December 31, 2015: $101,833,373 | | An Update from Fund Management For the year ended December 31, 2015, the net asset value (“NAV”) of the Gabelli Capital Asset Fund decreased 8.8% compared with an increase of 1.4% for the Standard & Poor’s (“S&P”) 500 Index. Increased volatility featured again in 2015. Markets began the year strongly, fueled by monetary easing by the European Union and Japan and a speculative bubble in China. The summer months saw the S&P 500 decline 12%, its first correction in three years. Declining commodity prices, a collapse in China, and trepidation at the onset of a rate hiking cycle by the Federal Reserve, were to blame. The market retraced its losses in October and took the December rate hike in stride, but the aforementioned concerns returned at year end, leaving December in the red. The world exited 2015 with China decelerating to sub 7% official growth, Japan sinking into its second recession in as many years and commodity driven countries such as Russia and Brazil experiencing depression conditions; the U.S. and Europe muddled along at 1% - 2%. Against a sluggish economic backdrop, the market disproportionately rewarded companies that could demonstrate robust topline growth, including the so-called “FANG” of (F)acebook, (A)mazon, (N)etflix and (G)oogle (now called Alphabet) which rose an average of 80%. Those companies alone contributed 196 basis points to the S&P 500, meaning without them the S&P 500 before dividends would have declined 2.7%. Historically we have avoided high growth companies because so much of their value is tied to a future which may encompass a high degree of variability, because they do not have a clear path to positive cash flow and/or because they are characterized by short product cycles. This is not to say we do not invest in technology or growing companies – many of our investments in aerospace, oil extraction and telecommunications feature significant amounts of technology. Growth is merely a component of value. We weigh our degree of confidence in future growth against the price for which that opportunity is on sale in the market. We are fundamentally bottom up stock pickers. We have chosen to focus on the companies in a subset of industries in which sustainable competitive advantages can be cultivated. Volatile and unpredictable crude prices, for example, are reasons we tend to avoid the energy sector and gravitate to less commoditized industries. Second, we are value investors. Our contribution to the body of work begun by Benjamin Graham and David Dodd has been the concept of Private Market Value (PMV) with a Catalyst® - we seek businesses selling in the public markets at a substantial discount to their PMVs and for which we can identity one of more events that will narrow that discount. We tend to gravitate toward hard assets and cash flow and away from visions of grandeur that may or may not occur in the future. Selected holdings that contributed positively for performance were Cablevision (CVC) (2.7% of net assets as of December 31, 2015), provides broadband, television, and phone service to approximately three million subscribers in the New York metropolitan area. An industry pioneer, CVC developed the most advanced cable plant in the country and converted over 70% of its subscribers into triple play (video, phone, and broadband) customers. After years as a potential acquisition candidate, in September 2015 CVC agreed to a sale to Altice for $34.90 per share in cash; Brown-Foreman (4.0%), a leading global distilled spirits producer. Spirits is an advantaged category that enjoys high margins, low capital requirements, strong free cash flow generation and good pricing power. The company’s global brands include Jack Daniel’s Tennessee whiskey, Southern Comfort, Finlandia vodka, Woodford Reserve bourbon, and el Jimador and Herradura tequilas; and Rollins (1.9%), which provides pest control services to nearly two million residential and commercial customers throughout North America under the Orkin and Western Pest brand names. Its services are critical to homeowners and commercial establishments alike, in both expansionary and recessionary times. Some of our weaker holdings were Viacom (2.7%), a pure-play content company that owns a global stable of cable networks, including MTV, Nickelodeon, Comedy Central, VH1, BET, and the Paramount movie studio. Viacom’s cable networks generate revenue from advertising sales, fixed monthly subscriber fees, and ancillary revenue from toy licensing. Viacom was beset with renewed concerns about changing TV viewing habits such as “cord-cutting” by cable subscribers; American Express (AXP) (2.3%), the largest closed loop credit card company in the world was another detractor to performance. AXP operates its eponymous premiere branded payment network and lends to its largely affluent customer base. The company has 114 million cards in force. American Express suffered a series of setbacks, most notably the loss of its Costco cobranding relationship beginning in 2016; and Rolls Royce (RR) (1.3%) a manufacturer of jet engines, power and propulsion systems, and services to commercial aviation, defense, marine, oil, and gas, and other industries. RR has leading engine positions as the sole supplier on the Airbus A350 and reengineered A330 (i.e. A330neo), and one of two suppliers on the Boeing 787 Dreamliner, two new wide body programs with healthy backlogs, to be delivered over the next decade. We appreciate your confidence and trust. |

The views expressed above are those of the Gabelli Capital Asset Fund’s portfolio manager as of December 31, 2015 and are subject to change without notice. They do not necessarily represent the current views of Gabelli Funds, LLC (the “Adviser”). The views expressed herein are based on current market conditions and are not intended to predict or guarantee the future performance of any Fund, any individual security, any market, or market segment. The composition of the Fund’s portfolio is subject to change. No recommendation is made with respect to any security discussed herein.

About information in this report:

| • | | It is important to consider carefully the Fund’s investment objectives, risks, fees, and expenses before investing. All funds involve some risk, including possible loss of the principal amount invested. |

| | |

| GABELLI CAPITAL ASSET FUND | | 1 |

| | |

| ¢ Gabelli Capital Asset Fund | | Annual Report To Contractowners |

Top Ten Holdings (As of 12/31/2015) (Unaudited)

| | |

| Company | | Percentage of

Total Net Assets |

Brown-Forman Corp., Cl. A | | 4.0% |

Diageo plc, ADR | | 3.6% |

Honeywell International Inc. | | 3.6% |

Viacom Inc., Cl. A | | 2.7% |

Cablevision Systems Corp. | | 2.7% |

Grupo Televisa SAB, ADR | | 2.6% |

Wells Fargo & Co. | | 2.4% |

Time Warner Inc. | | 2.3% |

American Express Co. | | 2.3% |

International Flavors & Fragrances Inc. | | 2.1% |

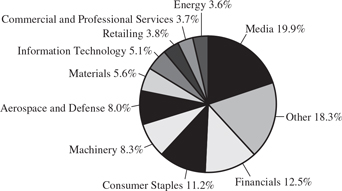

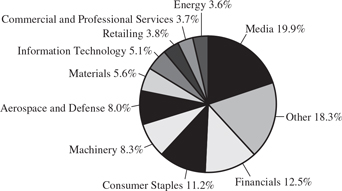

Sector Weightings (Percentage of Net Assets as of 12/31/2015) (Unaudited)

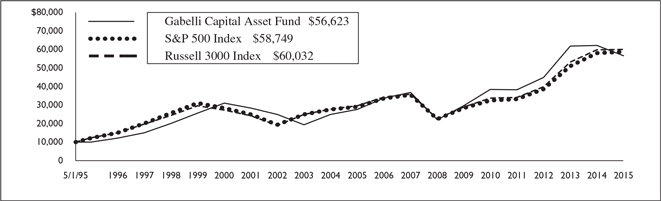

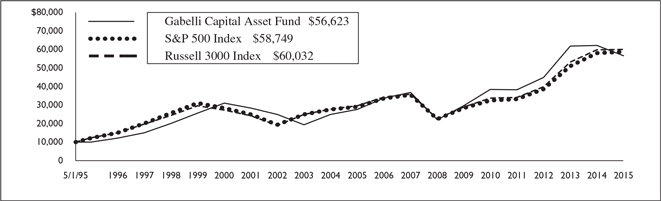

Average Annual Returns (For periods ended 12/31/2015) (Unaudited)

| | | | | | | | | | |

| | | | | | | | | | | Since Inception |

| | | 1 Year | | 5 Year | | 10 Year | | 15 Year | | (5/1/1995) |

Gabelli Capital Asset Fund | | (8.81)% | | 8.10% | | 7.43% | | 7.29% | | 9.84% |

S&P 500 Index | | 1.38 | | 12.57 | | 7.31 | | 5.00 | | 8.95(a) |

Russell 3000 Index | | 0.48 | | 12.18 | | 7.35 | | 5.39 | | 9.05(a) |

The S&P 500 Index is an index of 500 primarily large cap U.S. stocks, which is generally considered to be representative of U.S. stock market activity. The Russell 3000 Index is an unmanaged indicator which measures the performance of the 3,000 largest U.S. traded stocks, in which the underlying companies are incorporated in the U.S. Index returns are provided for comparative purposes. Please note that the indexes are unmanaged and not available for direct investment and its returns do not reflect the fees and expenses that have been deducted from the Fund.

(a) The S&P 500 Index and the Russell 3000 Index since inception performance results are as of April 30, 1995.

About information in this report:

All performance data quoted is historical and the results represent past performance and neither guarantee nor predict future investment results. To obtain performance data current to the most recent month (availability within seven business days of the most recent month end), please call us at (800) 221-3253 or visit our website at www.guardianlife.com. Current performance may be higher or lower than the performance quoted here. Investment returns and the principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

Total return figures are historical and assume the reinvestment of distributions and the deduction of all Fund expenses. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. The return figures shown do not reflect the deduction of taxes that a contract owner may pay on distributions or redemption of units.

| | |

| 2 | | GABELLI CAPITAL ASSET FUND |

| | |

| ¢ Gabelli Capital Asset Fund | | Annual Report To Contractowners |

Growth of a Hypothetical $10,000 Investment (Unaudited)

To give you a comparison, this chart shows you the performance of a hypothetical $10,000 investment made in the Fund and in the S&P 500 and Russell 3000 Indicies. Index returns do not include the fees and expenses of the Fund, but do include the reinvestment of distributions.

Past performance is not predictive of future results. The S&P 500 and Russell 3000 Indicies are unmanaged indicators of stock market performance.

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Proxy Voting

The Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Fund’s proxy voting policies, procedures, and how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

| | |

GABELLI CAPITAL ASSET FUND | | 3 |

| | |

| ¢ Gabelli Capital Asset Fund | | Annual Report To Contractowners |

Disclosure of Fund Expenses (Unaudited)

For the Six Month Period from July 1, 2015 through December 31, 2015

Expense Table

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All mutual funds have operating expenses. As a shareholder of a fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways:

Actual Fund Return: This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’s actual return during the past six months, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return: This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown. In this case – because the hypothetical return used is not the Fund’s actual return – the results do not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which would be described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The “Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the year ended December 31, 2015.

| | | | | | | | |

| | | Beginning Account Value July 1, 2015 | | Ending Account Value December 31, 2015 | | Annualized Expense Ratio | | Expenses Paid During Period* |

Gabelli Capital Asset Fund | | | | | | | | |

Actual Fund Return | | $1,000.00 | | $893.00 | | 1.25% | | $5.96 |

Hypothetical 5% Return | | $1,000.00 | | $1,018.90 | | 1.25% | | $6.36 |

| * | Expenses are equal to the Fund’s annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

| | |

| 4 | | GABELLI CAPITAL ASSET FUND |

¢ Gabelli Capital Asset Fund

| | | | | | | | | | |

December 31, 2015 | | | | | |

Shares | | | | Cost | | | Market Value | |

Common Stocks — 100.1% | |

Aerospace and Defense — 8.0% | | | | | |

89,000 | | Aerojet Rocketdyne

Holdings Inc.† | | $ | 593,466 | | | $ | 1,393,740 | |

21,000 | | Curtiss-Wright Corp. | | | 311,872 | | | | 1,438,500 | |

6,000 | | HEICO Corp. | | | 56,169 | | | | 326,160 | |

35,000 | | Honeywell International Inc. | | | 1,031,858 | | | | 3,624,950 | |

160,000 | | Rolls-Royce Holdings plc | | | 1,219,090 | | | | 1,356,272 | |

14,832,000 | | Rolls-Royce Holdings plc, Cl. C† | | | 22,869 | | | | 21,865 | |

| | | | | | | | | | |

| | | | | 3,235,324 | | | | 8,161,487 | |

| |

Automobiles and Components — 0.5% | |

2,700 | | BorgWarner Inc. | | | 29,006 | | | | 116,721 | |

10,000 | | Dana Holding Corp. | | | 192,020 | | | | 138,000 | |

12,000 | | Superior Industries

International Inc. | | | 224,209 | | | | 221,040 | |

| | | | | | | | | | |

| | | | | 445,235 | | | | 475,761 | |

| |

Building Products — 0.4% | |

25,000 | | Griffon Corp. | | | 292,772 | | | | 445,000 | |

| |

Commercial and Professional Services — 3.7% | |

74,000 | | Rollins Inc. | | | 168,365 | | | | 1,916,600 | |

34,000 | | Waste Management Inc. | | | 1,260,423 | | | | 1,814,580 | |

| | | | | | | | | | |

| | | | | 1,428,788 | | | | 3,731,180 | |

| |

Construction and Engineering — 0.6% | |

92,000 | | Furmanite Corp.† | | | 334,566 | | | | 612,720 | |

| |

Consumer Durables — 1.3% | |

4,000 | | Cavco Industries Inc.† | | | 113,920 | | | | 333,240 | |

12,500 | | Skyline Corp.† | | | 60,116 | | | | 44,750 | |

40,000 | | Sony Corp., ADR | | | 724,445 | | | | 984,400 | |

| | | | | | | | | | |

| | | | | 898,481 | | | | 1,362,390 | |

| |

Consumer Services — 2.3% | |

1,000 | | Ascent Capital Group Inc., Cl. A† | | | 27,057 | | | | 16,720 | |

30,000 | | Boyd Gaming Corp.† | | | 200,939 | | | | 596,100 | |

1,000 | | Bunge Ltd. | | | 50,230 | | | | 68,280 | |

10,000 | | Canterbury Park Holding

Corp. | | | 112,065 | | | | 103,200 | |

5,400 | | Churchill Downs Inc. | | | 220,349 | | | | 764,046 | |

59,000 | | Dover Motorsports Inc. | | | 250,840 | | | | 137,470 | |

14,000 | | Las Vegas Sands Corp. | | | 76,389 | | | | 613,760 | |

1,000 | | The Cheesecake Factory

Inc. | | | 34,814 | | | | 46,110 | |

| | | | | | | | | | |

| | | | | 972,683 | | | | 2,345,686 | |

| |

Consumer Staples — 11.2% | |

3,000 | | Archer Daniels Midland

Co. | | | 63,720 | | | | 110,040 | |

37,000 | | Brown-Forman Corp.,

Cl. A | | | 660,733 | | | | 4,074,070 | |

60,000 | | Danone SA, ADR | | | 645,034 | | | | 816,600 | |

33,500 | | Diageo plc, ADR | | | 1,380,072 | | | | 3,653,845 | |

12,000 | | Fomento Economico

Mexicano SAB de CV,

ADR | | | 395,224 | | | | 1,108,200 | |

1,000 | | Mead Johnson Nutrition

Co. | | | 43,983 | | | | 78,950 | |

| | | | | | | | | | |

| | | | | | | | | | | |

Shares | | | | Cost | | | Market Value | |

13,000 | | The Coca-Cola Co. | | $ | 320,384 | | | $ | 558,480 | |

32,000 | | Tootsie Roll Industries Inc. | | | 488,417 | | | | 1,010,880 | |

| | | | | | | | | | |

| | | | | 3,997,567 | | | | 11,411,065 | |

| |

Electrical Equipment — 2.5% | |

31,500 | | AMETEK Inc. | | | 118,066 | | | | 1,688,085 | |

750 | | Capstone Turbine Corp.† | | | 29,700 | | | | 1,050 | |

24,000 | | Franklin Electric Co. Inc. | | | 123,540 | | | | 648,720 | |

1,500 | | Rockwell Automation Inc. | | | 71,237 | | | | 153,915 | |

| | | | | | | | | | |

| | | | | 342,543 | | | | 2,491,770 | |

| |

Energy — 3.6% | |

2,000 | | Anadarko Petroleum Corp. | | | 173,251 | | | | 97,160 | |

4,500 | | Cameron International

Corp.† | | | 185,834 | | | | 284,400 | |

3,000 | | Chevron Corp. | | | 187,440 | | | | 269,880 | |

8,000 | | ConocoPhillips | | | 168,014 | | | | 373,520 | |

7,500 | | Devon Energy Corp. | | | 262,249 | | | | 240,000 | |

9,000 | | Exxon Mobil Corp. | | | 348,340 | | | | 701,550 | |

95,000 | | RPC Inc. | | | 478,690 | | | | 1,135,250 | |

70,000 | | Weatherford International

plc† | | | 956,747 | | | | 587,300 | |

| | | | | | | | | | |

| | | | | 2,760,565 | | | | 3,689,060 | |

| |

Financials — 12.5% | |

33,500 | | American Express Co. | | | 832,757 | | | | 2,329,925 | |

4,000 | | Argo Group International

Holdings Ltd. | | | 94,421 | | | | 239,360 | |

16,000 | | BKF Capital Group Inc.† | | | 65,957 | | | | 12,800 | |

55,000 | | Griffin Industrial Realty

Inc. | | | 903,145 | | | | 1,434,950 | |

14,000 | | JPMorgan Chase & Co. | | | 455,342 | | | | 924,420 | |

23,000 | | Legg Mason Inc. | | | 715,574 | | | | 902,290 | |

4,000 | | Marsh & McLennan

Companies Inc. | | | 104,159 | | | | 221,800 | |

27,500 | | Morgan Stanley | | | 779,027 | | | | 874,775 | |

3,600 | | Northern Trust Corp. | | | 176,884 | | | | 259,524 | |

17,000 | | Ryman Hospitality

Properties Inc. | | | 407,480 | | | | 877,880 | |

8,000 | | State Street Corp. | | | 402,007 | | | | 530,880 | |

41,000 | | The Bank of New York

Mellon Corp. | | | 1,133,543 | | | | 1,690,020 | |

45,500 | | Wells Fargo & Co. | | | 1,357,563 | | | | 2,473,380 | |

| | | | | | | | | | |

| | | | | 7,427,859 | | | | 12,772,004 | |

| |

Health Care — 1.9% | |

20,000 | | Boston Scientific Corp.† | | | 140,644 | | | | 368,800 | |

1,000 | | DENTSPLY International

Inc. | | | 21,925 | | | | 60,850 | |

6,200 | | Henry Schein Inc.† | | | 306,606 | | | | 980,778 | |

1,000 | | Laboratory Corp. of

America Holdings† | | | 61,439 | | | | 123,640 | |

8,000 | | Patterson Companies Inc. | | | 238,344 | | | | 361,680 | |

| | | | | | | | | | |

| | | | | 768,958 | | | | 1,895,748 | |

| |

Information Technology — 5.1% | |

5,500 | | Blackhawk Network

Holdings Inc.† | | | 137,535 | | | | 243,155 | |

30,000 | | Corning Inc. | | | 345,420 | | | | 548,400 | |

78,000 | | CTS Corp. | | | 715,364 | | | | 1,375,920 | |

| | |

See accompanying notes to financial statements. | | |

| | 5 |

¢ Gabelli Capital Asset Fund

| | | | |

Schedule of Investments (Continued) | | | | |

| | | | | | | | | | |

| Shares | | | | Cost | | | Market Value | |

Common Stocks (Continued) | |

Information Technology (Continued) | | | | | |

30,000 | | Cypress Semiconductor

Corp. | | $ | 150,198 | | | $ | 294,300 | |

25,000 | | Diebold Inc. | | | 748,906 | | | | 752,250 | |

4,000 | | EchoStar Corp., Cl. A† | | | 85,763 | | | | 156,440 | |

4,400 | | Harris Corp. | | | 348,876 | | | | 382,360 | |

12,000 | | Internap Corp.† | | | 94,224 | | | | 76,800 | |

3,000 | | NCR Corp.† | | | 35,306 | | | | 73,380 | |

18,000 | | Texas Instruments Inc. | | | 365,000 | | | | 986,580 | |

9,000 | | Yahoo! Inc.† | | | 140,928 | | | | 299,340 | |

| | | | | | | | | | |

| | | | | 3,167,520 | | | | 5,188,925 | |

| |

Machinery — 8.3% | | | | | |

15,500 | | CIRCOR International Inc. | | | 481,140 | | | | 653,325 | |

4,000 | | CLARCOR Inc. | | | 34,625 | | | | 198,720 | |

140,000 | | CNH Industrial NV, New

York | | | 914,479 | | | | 957,600 | |

12,000 | | Crane Co. | | | 349,931 | | | | 574,080 | |

3,000 | | Deere & Co. | | | 86,700 | | | | 228,810 | |

9,500 | | Flowserve Corp. | | | 163,764 | | | | 399,760 | |

14,500 | | Graco Inc. | | | 858,664 | | | | 1,045,015 | |

14,000 | | IDEX Corp. | | | 459,046 | | | | 1,072,540 | |

15,000 | | ITT Corp. | | | 281,248 | | | | 544,800 | |

51,000 | | Navistar International Corp.† | | | 1,401,550 | | | | 450,840 | |

9,000 | | The Eastern Co. | | | 96,433 | | | | 168,750 | |

43,500 | | The L.S. Starrett Co., Cl. A | | | 586,870 | | | | 422,820 | |

2,000 | | Watts Water Technologies Inc., Cl. A | | | 32,206 | | | | 99,340 | |

44,000 | | Xylem Inc. | | | 1,204,662 | | | | 1,606,000 | |

| | | | | | | | | | |

| | | | | 6,951,318 | | | | 8,422,400 | |

| |

Materials — 5.6% | | | | | |

21,000 | | Ampco-Pittsburgh Corp. | | | 323,270 | | | | 215,460 | |

11,000 | | Chemtura Corp.† | | | 247,058 | | | | 299,970 | |

62,000 | | Ferro Corp.† | | | 161,493 | | | | 689,440 | |

50,000 | | Freeport-McMoRan Inc. | | | 826,816 | | | | 338,500 | |

18,000 | | International Flavors & Fragrances Inc. | | | 884,432 | | | | 2,153,520 | |

70,000 | | Myers Industries Inc. | | | 804,903 | | | | 932,400 | |

44,000 | | Newmont Mining Corp. | | | 1,522,657 | | | | 791,560 | |

4,000 | | Sensient Technologies Corp. | | | 74,678 | | | | 251,280 | |

| | | | | | | | | | |

| | | | | 4,845,307 | | | | 5,672,130 | |

| |

Media — 19.9% | | | | | |

3,000 | | AMC Networks Inc., Cl. A† | | | 48,772 | | | | 224,040 | |

85,000 | | Cablevision Systems Corp., Cl. A | | | 744,780 | | | | 2,711,500 | |

40,000 | | CBS Corp., Cl. A, Voting | | | 657,673 | | | | 2,084,800 | |

10,000 | | Cogeco Inc. | | | 195,072 | | | | 370,384 | |

4,500 | | Discovery Communications Inc., Cl. A† | | | 57,824 | | | | 120,060 | |

10,000 | | Discovery Communications Inc., Cl. C† | | | 56,919 | | | | 252,200 | |

11,500 | | DISH Network Corp., Cl. A† | | | 177,640 | | | | 657,570 | |

98,000 | | Grupo Televisa SAB, ADR | | | 1,535,440 | | | | 2,666,580 | |

12,000 | | Journal Media Group Inc. | | | 30,652 | | | | 144,240 | |

| | | | | | | | | | |

| Shares | | | | Cost | | | Market Value | |

1,750 | | Liberty Broadband Corp., Cl. A† | | $ | 11,466 | | | $ | 90,387 | |

3,050 | | Liberty Broadband Corp., Cl. C† | | | 46,024 | | | | 158,173 | |

5,000 | | Liberty Global plc, Cl. A† | | | 35,261 | | | | 211,800 | |

12,000 | | Liberty Global plc, Cl. C† | | | 100,527 | | | | 489,240 | |

6,000 | | Liberty Media Corp., Cl. A† | | | 29,483 | | | | 235,500 | |

6,000 | | Liberty Media Corp., Cl. C† | | | 28,998 | | | | 228,480 | |

55,000 | | Media General Inc.† | | | 282,956 | | | | 888,250 | |

6,000 | | Meredith Corp. | | | 181,672 | | | | 259,500 | |

27,000 | | MSG Networks Inc., Cl. A† | | | 47,993 | | | | 561,600 | |

6,000 | | Scripps Networks Interactive Inc., Cl. A | | | 241,516 | | | | 331,260 | |

8,000 | | Sinclair Broadcast Group Inc., Cl. A | | | 55,831 | | | | 260,320 | |

10,000 | | The Interpublic Group of Companies Inc. | | | 189,378 | | | | 232,800 | |

9,000 | | The Madison Square Garden Co, Cl. A† | | | 123,410 | | | | 1,456,200 | |

36,500 | | Time Warner Inc. | | | 1,074,433 | | | | 2,360,455 | |

20,000 | | Twenty-First Century Fox Inc., Cl. A | | | 159,632 | | | | 543,200 | |

| | | | | | | | | | |

63,000 | | Viacom Inc., Cl. A | | | 2,711,287 | | | | 2,771,370 | |

| |

| | | | | 8,824,639 | | | | 20,309,909 | |

| |

Publishing — 0.9% | | | | | |

45,996 | | The E.W. Scripps Co., Cl. A | | | 469,275 | | | | 873,924 | |

| |

Retailing — 3.8% | | | | | |

37,000 | | Aaron’s Inc. | | | 203,420 | | | | 828,430 | |

21,000 | | CVS Health Corp. | | | 647,000 | | | | 2,053,170 | |

50,000 | | Hertz Global Holdings Inc.† | | | 1,057,516 | | | | 711,500 | |

3,400 | | Ingles Markets Inc., Cl. A | | | 45,936 | | | | 149,872 | |

23,000 | | J.C. Penney Co. Inc.† | | | 200,883 | | | | 153,180 | |

| | | | | | | | | | |

| | | | | 2,154,755 | | | | 3,896,152 | |

| |

Telecommunication Services — 3.6% | | | | | |

5,000 | | AT&T Inc. | | | 70,261 | | | | 172,050 | |

13,000 | | Millicom International Cellular SA, SDR | | | 1,013,116 | | | | 749,220 | |

10,000 | | Rogers Communications Inc., Cl. B | | | 136,845 | | | | 344,600 | |

20,500 | | Telephone & Data Systems Inc. | | | 576,339 | | | | 530,745 | |

45,000 | | United States Cellular Corp.† | | | 1,765,535 | | | | 1,836,450 | |

| | | | | | | | | | |

| | | | | 3,562,096 | | | | 3,633,065 | |

| |

Trading Companies and Distributors — 2.3% | | | | | |

22,000 | | GATX Corp. | | | 771,947 | | | | 936,100 | |

35,000 | | Kaman Corp. | | | 406,766 | | | | 1,428,350 | |

| | | | | | | | | | |

| | | | | 1,178,713 | | | | 2,364,450 | |

| |

Utilities — 2.1% | | | | | |

21,500 | | El Paso Electric Co. | | | 193,131 | | | | 827,750 | |

| | |

| | See accompanying notes to financial statements. |

| 6 | | |

¢ Gabelli Capital Asset Fund

| | | | |

Schedule of Investments (Continued) | | | | |

| | | | | | | | | | | | | | |

| Shares | | Cost | | | Market Value | |

Common Stocks (Continued) | |

Utilities (Continued) | |

| | | 20,000 | | | GenOn Energy Inc., Escrow† | | $ | 0 | | | $ | 0 | |

| | | 30,000 | | | National Fuel Gas Co. | | | 1,634,286 | | | | 1,282,500 | |

| | | | | | | | | | | | | | |

| | | | | | | | | 1,827,417 | | | | 2,110,250 | |

| |

| | | | | | Total Common Stocks | | | 55,886,381 | | | | 101,865,076 | |

| |

| | | | | | | | | | |

| | | | | | | | | | |

| |

Principal Amount | | Cost | | | Market Value | |

U.S. Government Obligations — 0.1% | |

$125,000 | | U.S. Treasury Bills, | | | | | | | | |

| | 0.105%††, | | | | | | | | |

| | 01/07/16 | | $ | 125,000 | | | $ | 125,000 | |

| |

| TOTAL INVESTMENTS — 100.2% | | $ | 56,011,381 | | | | 101,990,076 | |

| Other Assets and Liabilities (Net) — (0.2)% | | | | | | | (156,703 | ) |

| |

| NET ASSETS — 100.0% | | | | | | $ | 101,833,373 | |

| |

| † | Non-income producing security. |

| †† | Represents annualized yield at date of purchase. |

| ADR | American Depositary Receipt |

| SDR | Swedish Depositary Receipt |

| | |

See accompanying notes to financial statements. | | |

| | 7 |

¢ Gabelli Capital Asset Fund

| | |

Statement of Assets and Liabilities | | |

| | | | |

| December 31, 2015 | | | |

| |

| |

ASSETS: | | | | |

Investments, at value (cost $56,011,381) | | $ | 101,990,076 | |

Receivable for Fund shares sold | | | 3,993 | |

Dividends receivable | | | 115,670 | |

Prepaid expense | | | 2,704 | |

| | | | |

Total Assets | | | 102,112,443 | |

| | | | |

LIABILITIES: | | | | |

Payable to custodian | | | 3,830 | |

Payable for Fund shares redeemed | | | 136,274 | |

Payable for investment advisory fees | | | 66,247 | |

Payable for accounting fees | | | 7,500 | |

Payable for payroll expenses | | | 567 | |

Payable for administrative services | | | 22,082 | |

Payable for legal and audit fees | | | 28,991 | |

Other accrued expenses | | | 13,579 | |

| | | | |

Total Liabilities | | | 279,070 | |

| | | | |

Net Assets (applicable to 5,476,498 shares outstanding) | | $ | 101,833,373 | |

| | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 56,827,938 | |

Accumulated net realized loss on investments and foreign currency transactions | | | (973,260 | ) |

Net unrealized appreciation on investments | | | 45,978,695 | |

| | | | |

Net Assets | | $ | 101,833,373 | |

| | | | |

Shares of Capital Stock, each at $0.001 par value; 500,000,000 shares authorized: | | | | |

| | | | |

Net Asset Value, offering, and redemption

price per share ($101,833,373 ÷ 5,476,498

shares outstanding) | | | $18.59 | |

| | | | |

| | | | |

For the Year Ended December 31, 2015 | | | |

| |

| |

INVESTMENT INCOME: | | | | |

Dividends (net of foreign withholding taxes of $11,893) | | $ | 1,878,968 | |

| | | | |

Total Investment Income | | | 1,878,968 | |

| | | | |

EXPENSES: | | | | |

Management fees | | | 415,218 | |

Advisory fees | | | 574,147 | |

Administrative services fees | | | 191,360 | |

Directors’ fees | | | 56,719 | |

Legal and audit fees | | | 53,168 | |

Accounting fees | | | 45,000 | |

Shareholder communications expenses | | | 28,361 | |

Custodian fees | | | 21,418 | |

Shareholder services fees | | | 9,351 | |

Payroll expenses | | | 3,070 | |

Interest expense | | | 2,121 | |

Miscellaneous expenses | | | 20,260 | |

| | | | |

Total Expenses | | | 1,420,193 | |

| | | | |

Net Investment Income | | | 458,775 | |

| | | | |

NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

Net realized gain on investments | | | 11,726,209 | |

Net realized loss on foreign currency transactions | | | (2,978 | ) |

| | | | |

Net realized gain on investments and foreign currency transactions | | | 11,723,231 | |

| | | | |

Net change in unrealized appreciation/depreciation: | |

on investments | | | (22,321,910 | ) |

on foreign currency translations | | | 713 | |

| | | | |

Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | (22,321,197 | ) |

| | | | |

Net Realized and Unrealized Gain/(Loss) on Investments, and Foreign Currency | | | (10,597,966 | ) |

| | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (10,139,191 | ) |

| | | | |

See accompanying notes to financial statements.

8

¢ Gabelli Capital Asset Fund

| | |

Statement of Changes in Net Assets | | |

| | | | | | | | |

| | | Year Ended

December 31, 2015 | | | Year Ended

December 31, 2014 | |

OPERATIONS: | | | | | | | | |

Net investment income | | | $ 458,775 | | | | $ 568,645 | |

Net realized gain on investments, securities sold short, and foreign currency transactions | | | 11,723,231 | | | | 10,764,155 | |

Net change in unrealized depreciation on investments and foreign currency translations | | | (22,321,197 | ) | | | (10,614,121 | ) |

| | | | | | | | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | (10,139,191 | ) | | | 718,679 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Net investment income | | | (455,797 | ) | | | (571,063 | ) |

Net realized gain | | | (11,633,213 | ) | | | (10,607,875 | ) |

Return of capital | | | (67,562 | ) | | | (30,655 | ) |

| | | | | | | | |

Total Distributions to Shareholders | | | (12,156,572 | ) | | | (11,209,593 | ) |

| | | | | | | | |

Net decrease in net assets from capital share transactions | | | (6,484,860 | ) | | | (8,293,381 | ) |

| | | | | | | | |

Net Decrease in Net Assets | | | (28,780,623 | ) | | | (18,784,295 | ) |

| | | | | | | | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 130,613,996 | | | | 149,398,291 | |

| | | | | | | | |

End of year (including undistributed net investment income of $0 and $0, respectively) | | | $101,833,373 | | | | $130,613,996 | |

| | | | | | | | |

See accompanying notes to financial statements.

9

¢ Gabelli Capital Asset Fund

Selected data for a share of capital stock outstanding throughout each year:

| | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2015 |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | |

Operating Performance: | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 23.09 | | | $ | 25.08 | | | $ | 19.86 | | | $ | 18.62 | | | $ | 18.80 | | | |

Net investment income(a) | | | 0.09 | | | | 0.10 | | | | 0.16 | | | | 0.29 | | | | 0.08 | | | |

Net realized and unrealized gain/(loss)

on investments | | | (2.08 | ) | | | 0.08 | | | | 7.26 | | | | 2.93 | | | | (0.13 | ) | | |

Total from investment operations | | | (1.99 | ) | | | 0.18 | | | | 7.42 | | | | 3.22 | | | | (0.05 | ) | | |

Distributions to Shareholders: | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.10 | ) | | | (0.12 | ) | | | (0.16 | ) | | | (0.31 | ) | | | (0.09 | ) | | |

Net realized gain on investments | | | (2.40 | ) | | | (2.04 | ) | | | (2.03 | ) | | | (1.67 | ) | | | (0.04 | ) | | |

Return of capital | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | — | | | | — | | | |

Total distributions | | | (2.51 | ) | | | (2.17 | ) | | | (2.20 | ) | | | (1.98 | ) | | | (0.13 | ) | | |

Net Asset Value, End of Year | | $ | 18.59 | | | $ | 23.09 | | | $ | 25.08 | | | $ | 19.86 | | | $ | 18.62 | | | |

Total Return † | | | (8.8 | )% | | | 0.6 | % | | | 37.5 | % | | | 17.3 | % | | | (0.3 | )% | | |

Ratios to Average Net Assets and

Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year(in 000’s) | | $ | 101,833 | | | $ | 130,614 | | | $ | 149,398 | | | $ | 119,645 | | | $ | 116,479 | | | |

Ratio of net investment income

to average net assets | | | 0.39 | % | | | 0.41 | % | | | 0.67 | % | | | 1.43 | % | | | 0.44 | % | | |

Ratio of operating expenses

to average net assets | | | 1.20 | % | | | 1.15 | % | | | 1.13 | % | | | 1.21 | % | | | 1.18 | % | | |

Portfolio turnover rate | | | 1 | % | | | 3 | % | | | 10 | % | | | 2 | % | | | 2 | % | | |

| † | Total return represents aggregate total return of a hypothetical $1,000 investment at the beginning of the year and sold at the end of the year including reinvestment of distributions. |

| (a) | Per share data is calculated using the average shares outstanding method. |

See accompanying notes to financial statements.

10

¢ Gabelli Capital Asset Fund

| | | | |

Notes to Financial Statements | | | | |

December 31, 2015

The Gabelli Capital Asset Fund is a series of Gabelli Capital Series Funds, Inc. which was incorporated on April 8, 1993 in Maryland. The Fund is a diversified open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s primary objective is growth of capital. Current income is a secondary objective. The Fund commenced investment operations on May 1, 1995. Shares of the Fund are available to the public only through the purchase of certain variable annuity and variable life insurance contracts issued by The Guardian Insurance & Annuity Company, Inc. (“Guardian”) and other selected insurance companies.

| 2. | Significant Accounting Policies |

As an investment company, the Fund follows the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (“GAAP”) that may require the use of management estimates and assumptions in the preparation of its financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation

Portfolio securities listed or traded on a nationally recognized securities exchange or traded in the U.S. over-the-counter market for which market quotations are readily available are valued at the last quoted sale price or a market’s official closing price as of the close of business on the day the securities are being valued. If there were no sales that day, the security is valued at the average of the closing bid and asked prices or, if there were no asked prices quoted on that day, then the security is valued at the closing bid price on that day. If no bid or asked prices are quoted on such day, the security is valued at the most recently available price or, if the Board of Directors (the “Board”) so determines, by such other method as the Board shall determine in good faith to reflect its fair market value. Portfolio securities traded on more than one national securities exchange or market are valued according to the broadest and most representative market, as determined by Gabelli Funds, LLC (the “Adviser”).

Portfolio securities primarily traded on a foreign market are generally valued at the preceding closing values of such securities on the relevant market, but may be fair valued pursuant to procedures established by the Board if market conditions change significantly after the close of the foreign market, but prior to the close of business on the day the securities are being valued. Debt instruments with remaining maturities of sixty days or less that are not credit impaired are valued at amortized cost, unless the Board determines such amount does not reflect the securities’ fair value, in which case these securities will be fair valued as determined by the Board. Debt instruments having a maturity greater than sixty days for which market quotations are readily available are valued at the average of the latest bid and asked prices. If there were no asked prices quoted on such day, the security is valued using the closing bid price. U.S. government obligations with maturities greater than sixty days are normally valued using a model that incorporates market observable data such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued principally using dealer quotations.

Securities and assets for which market quotations are not readily available are fair valued as determined by the Board. Fair valuation methodologies and procedures may include, but are not limited to: analysis and review of available financial and non-financial information about the company; comparisons with the valuation and changes in valuation of similar securities, including a comparison of foreign securities with the equivalent U.S. dollar value American Depositary Receipt securities at the close of the U.S. exchange; and evaluation of any other information that could be indicative of the value of the security.

The inputs and valuation techniques used to measure fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

|

• Level 1 — quoted prices in active markets for identical securities; |

|

• Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

|

• Level 3 — significant unobservable inputs (including the Board’s determinations as to the fair value of investments). |

11

¢ Gabelli Capital Asset Fund

| | | | |

Notes to Financial Statements (Continued) | | | | |

December 31, 2015

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in the aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of the Fund’s investments in securities by inputs used to value the Fund’s investments as of December 31, 2015 is as follows:

| | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| | | Level 1

Quoted Prices | | | Level 2 Other Significant

Observable Inputs | | Level 3 Significant

Unobservable Inputs | | | Total Market Value

at 12/31/15 | |

INVESTMENTS IN SECURITIES: | | | | | | | | | | | | | | |

ASSETS (Market Value): | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | |

Aerospace and defense | | | $ 8,139,622 | | | $ 21,865 | | | — | | | | $ 8,161,487 | |

Utilities | | | 2,110,250 | | | — | | | $ 0 | | | | 2,110,250 | |

Other Industries (a) | | | 91,593,339 | | | — | | | — | | | | 91,593,339 | |

Total Common Stocks | | | 101,843,211 | | | 21,865 | | | 0 | | | | 101,865,076 | |

U.S. Government Obligations | | | — | | | $125,000 | | | — | | | | 125,000 | |

TOTAL INVESTMENTS IN SECURITIES – ASSETS | | | $101,843,211 | | | $146,865 | | | $ 0 | | | | $101,990,076 | |

(a) Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings.

The Fund did not have transfers among Level 1, Level 2, and Level 3 during the year ended December 31, 2015. The Fund’s policy is to recognize transfers among Levels as of the beginning of the reporting period.

Additional Information to Evaluate Qualitative Information

General. The Fund uses recognized industry pricing services – approved by the Board and unaffiliated with the Adviser –to value most of its securities, and uses broker quotes provided by market makers of securities not valued by these and other recognized pricing sources. Several different pricing feeds are received to value domestic equity securities, international equity securities, preferred equity securities, and fixed income securities. The data within these feeds is ultimately sourced from major stock exchanges and trading systems where these securities trade. The prices supplied by external sources are checked by obtaining quotations or actual transaction prices from market participants. If a price obtained from the pricing source is deemed unreliable, prices will be sought from another pricing service or from a broker/dealer that trades that security or similar securities.

Fair Valuation. Fair valued securities may be common and preferred equities, warrants, options, rights, and fixed income obligations. Where appropriate, Level 3 securities are those for which market quotations are not available, such as securities not traded for several days, or for which current bids are not available, or which are restricted as to transfer. Among the factors to be considered to fair value a security are recent prices of comparable securities that are publicly traded, reliable prices of securities not publicly traded, the use of valuation models, current analyst reports, valuing the income or cash flow of the issuer, or cost if the preceding factors do not apply. A significant change in the unobservable inputs could result in a lower or higher value in Level 3 securities. The circumstances of Level 3 securities are frequently monitored to determine if fair valuation measures continue to apply.

The Adviser reports quarterly to the Board the results of the application of fair valuation policies and procedures. These include back testing the prices realized in subsequent trades of these fair valued securities to fair values previously recognized.

Foreign Currency Translations

The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments, and other assets and liabilities are translated into U.S. dollars at current exchange rates. Purchases and sales of investment securities, income, and expenses are translated at the exchange rate prevailing on the respective dates of such transactions. Unrealized gains and losses that result from changes in foreign exchange rates and/or changes in market prices of securities have been included in unrealized appreciation/depreciation on investments and foreign currency translations. Net realized foreign currency gains and losses resulting from changes in exchange rates include foreign currency gains and losses between trade date and settlement date on investment securities transactions, foreign currency transactions, and the difference between the amounts of interest and dividends recorded

12

¢ Gabelli Capital Asset Fund

| | | | |

Notes to Financial Statements (Continued) | | | | |

December 31, 2015

on the books of the Fund and the amounts actually received. The portion of foreign currency gains and losses related to fluctuation in exchange rates between the initial purchase trade date and subsequent sale trade date is included in realized gain/(loss) on investments.

Foreign Securities

The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the inability to repatriate funds, less complete financial information about companies, and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

Foreign Taxes

The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

Securities Transactions and Investment Income

Securities transactions are accounted for on the trade date with realized gain or loss on investments determined by using the identified cost method. Interest income (including amortization of premium and accretion of discount) is recorded on the accrual basis. Premiums and discounts on debt securities are amortized using the effective yield to maturity method. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities that are recorded as soon after the ex-dividend date as the Fund becomes aware of such dividends.

Expenses

Certain administrative expenses are common to, and allocated among, various affiliated funds. Such allocations are made on the basis of each fund’s average net assets or other criteria directly affecting the expenses as determined by the Adviser pursuant to procedures established by the Board.

Distributions to Shareholders

Distributions to shareholders are recorded on the ex-dividend date. Distributions to shareholders are based on income and capital gains as determined in accordance with federal income tax regulations, which may differ from income and capital gains as determined under GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities and foreign currency transactions held by the Fund, timing differences, and differing characterizations of distributions made by the Fund. Distributions from net investment income for federal income tax purposes include net realized gains on foreign currency transactions. These book/tax differences are either temporary or permanent in nature. To the extent these differences are permanent, adjustments are made to the appropriate capital accounts in the period when the differences arise. Permanent differences were primarily due to recharacterization of distributions. These reclassifications have no impact on the net asset value (“NAV”) per share of the Fund. For the year ended December 31, 2015, reclassifications were made to decrease net investment income by $2,978 and decrease accumulated distributions in excess of net realized gains on investments and foreign currency transactions by $2,978.

The tax character of distributions paid during the years ended December 31, 2015 and 2014 was as follows:

| | | | | | | | | | |

| | | Year Ended

December 31, 2015 | | | | | Year Ended

December 31, 2014 | |

Distributions paid from: | | | | | | | | | | |

Ordinary income (inclusive of short term capital gains) | | | $ 548,705 | | | | | | $ 630,014 | |

Net long term capital gains | | | 11,540,305 | | | | | | 10,548,924 | |

Return of capital | | | 67,562 | | | | | | 30,655 | |

| | | | | | | | | | |

Total distributions paid | | | $12,156,572 | | | | | | $11,209,593 | |

| | | | | | | | | | |

13

¢ Gabelli Capital Asset Fund

| | | | |

Notes to Financial Statements (Continued) | | | | |

December 31, 2015

Provision for Income Taxes

The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

At December 31, 2015, the component of accumulated earnings/losses on a tax basis was $45,005,435 of net unrealized appreciation on investments.

Under the Regulated Investment Company Modernization Act of 2010, the Fund is permitted to carry forward for an unlimited period capital losses incurred. As a result of the rule, post-enactment capital losses that are carried forward will retain their character as either short term or long term capital losses.

At December 31, 2015, the difference between book basis and tax basis unrealized appreciation was primarily due to deferral of losses from wash sales for tax purposes.

The following summarizes the tax cost of investments and the related net unrealized appreciation at December 31, 2015:

| | | | | | | | | | | | | | | | |

| | | Cost | | | Gross

Unrealized

Appreciation | | | Gross

Unrealized

Depreciation | | | Net

Unrealized

Appreciation | |

Investments | | $ | 56,984,641 | | | $ | 50,818,307 | | | $ | (5,812,872 | ) | | $ | 45,005,435 | |

The Fund is required to evaluate tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Income tax and related interest and penalties would be recognized by the Fund as tax expense in the Statement of Operations if the tax positions were deemed not to meet the more-likely-than-not threshold. For the year ended December 31, 2015 the Fund did not incur any income tax, interest, or penalties. As of December 31, 2015, the Adviser has reviewed all open tax years and concluded that there was no impact to the Fund’s net assets or results of operations. The Fund’s federal and state tax returns for the prior three fiscal years remain open, subject to examination. On an ongoing basis, the Adviser will monitor the Fund’s tax positions to determine if adjustments to this conclusion are necessary.

| 3. | Agreements with Affiliated Parties |

Pursuant to a shareholder vote, effective May 1, 2015, the Fund entered into an investment advisory agreement (the “Advisory Agreement”) with the Adviser which provides that the Fund will pay the Adviser a fee, computed daily and paid monthly, at the annual rate of 0.75% of the value of its average daily net assets. In accordance with the Advisory Agreement, the Adviser provides a continuous investment program for the Fund’s portfolio, oversees the administration of certain aspects of the Fund’s business and affairs, and pays the compensation of all Officers and Directors of the Fund who are affiliated persons of the Adviser. Also effective May 1, 2015, the Fund entered into a shareholder services agreement with The Guardian Insurance & Annuity Company, Inc. (“Guardian”), whereby Guardian provides various administrative services, including maintenance of books and records, reconciliations with respect to Fund purchase and redemption orders, and telephone support for contract owners, as well as providing advice to the Adviser with respect to relevant insurance laws, regulations, and related matters and IRS regulations with respect to variable contracts. As compensation for its services, the Fund pays Guardian a fee, computed daily and paid monthly, at the annual rate of 0.25% of the value of its average daily net assets.

From January 1, 2015 through April 30, 2015, the Fund paid Guardian Investor Services Corporation (the “Manager”) a fee, computed daily and paid monthly, at the annual rate of 1.00% of the value of its average daily net assets. During this period, the Manager paid the Adviser a fee, computed daily and paid monthly, at the annual rate of 0.75% of the value of the Fund’s average daily net assets.

The Fund pays each Director who is not considered an affiliated person an annual retainer of $3,000 plus $1,000 for each Board meeting attended, and they are reimbursed for any out of pocket expenses incurred in attending meetings. All Board committee members receive $500 per meeting attended and the Chairman of the Audit Committee and the Lead Director each

14

¢ Gabelli Capital Asset Fund

| | | | |

Notes to Financial Statements (Continued) | | | | |

December 31, 2015

receive an annual fee of $1,000. A Director may receive a single meeting fee, allocated among the participating funds, for attending certain meetings held on behalf of multiple funds. Directors who are directors or employees of the Adviser or an affiliated company receive no compensation or expense reimbursement from the Fund.

Purchases and sales of securities during the year ended December 31, 2015, other than short term securities and U.S. Government obligations, aggregated $1,335,340 and $18,992,514, respectively.

| 5. | Transactions with Affiliates |

During the year ended December 31, 2015, the Fund paid brokerage commissions on security trades of $12,031 to G. Research, LLC, an affiliate of the adviser.

The cost of calculating the Fund’s NAV per share is a Fund expense pursuant to the Investment Advisory Agreement. During the year ended December 31, 2015, the Fund paid or accrued $45,000 to the Adviser in connection with the cost of computing the Fund’s NAV.

The Fund participates in an unsecured line of credit of up to $75,000,000 under which it may borrow up to 10% of its net assets from the custodian for temporary borrowing purposes. Borrowings under this arrangement bear interest at a variable rate per annum equal to the overnight rate plus a spread, as determined and quoted by the custodian in its sole discretion at the time of the request, which rate may be subject to change from time to time at the sole discretion of the custodian. The overnight rate is defined as of any day, the higher of (a) the federal funds rate as in effect on that day and (b) the overnight LIBOR rate as in effect on that day. This amount, if any, would be included in “interest expense” in the Statement of Operations. At December 31, 2015, there were no borrowings outstanding under the line of credit.

The average daily amount of borrowings outstanding under the line of credit during the year ended December 31, 2015 was $185,663 with a weighted average interest rate of 1.11%. The maximum amount borrowed at any time during the year ended December 31, 2015 was $987,000.

Transactions in shares of capital stock were as follows:

| | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2015 | | | Year Ended December 31, 2014 | |

| |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| |

Shares sold | | | 95,338 | | | $ | 2,174,023 | | | | 165,751 | | | $ | 4,127,619 | |

Shares issued upon reinvestment of distributions | | | 643,205 | | | | 12,156,572 | | | | 478,838 | | | | 11,209,593 | |

Shares redeemed | | | (918,966 | ) | | | (20,815,455 | ) | | | (944,539 | ) | | | (23,630,593 | ) |

| |

Net decrease | | | (180,423 | ) | | $ | (6,484,860 | ) | | | (299,950 | ) | | $ | (8,293,381 | ) |

| |

The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts. Management has reviewed the Fund’s existing contracts and expects the risk of loss to be remote.

Management has evaluated the impact on the Fund of all subsequent events occurring through the date the financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

15

¢ Gabelli Capital Asset Fund

| | | | |

Notes to Financial Statements (Continued) | | | | |

December 31, 2015

| 10. Contractowner | Special Meeting Results (Unaudited) |

A Special Meeting of Contractowners was held on April 30, 2015 at which the contractowners elected ten Directors to the Board of Directors and approved a new Advisory Agreement between the Fund and Gabelli Funds, LLC, the Adviser. The following is a report of the total votes cast by contractowners on these matters.

Proposal1 - Elect Directors to the Board of Directors

| | | | | | |

| | | Affirmative | | | | Withheld |

Mario J. Gabelli | | 5,072,584 | | | | 339,979 |

Anthony J. Colavita | | 5,070,395 | | | | 342,168 |

Clarence A. Davis | | 5,054,614 | | | | 357,949 |

Arthur V. Ferrara | | 5,072,584 | | | | 339,979 |

Mary E. Hauck | | 5,072,584 | | | | 339,979 |

Kuni Nakamura | | 5,078,891 | | | | 333,672 |

Anthony R. Pustorino | | 5,069,727 | | | | 342,835 |

Werner J. Roeder | | 5,071,916 | | | | 340,647 |

Anthonie C van Ekris | | 5,071,916 | | | | 340,647 |

Daniel E. Zucchi | | 5,072,584 | | | | 339,979 |

Proposal 2 - Approve a new Advisory Agreement between the Fund and the Adviser

| | | | | | | | | | | | |

| | | Affirmative | | Against | | | | | | Abstain | | |

| | 4,817,684 | | 294,115 | | | | | | 300,764 | | |

We thank you for your participation and appreciate your continued support.

16

Gabelli Capital Asset Fund

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Gabelli Capital Series Funds, Inc.

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Gabelli Capital Asset Fund (the “Fund”), the sole series of Gabelli Capital Series Funds, Inc., as of December 31, 2015, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2015, by correspondence with the Fund’s custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund at December 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

February 26, 2016

17

¢ Gabelli Capital Asset Fund

| | |

Additional Information (Unaudited) | | |

The business and affairs of the Fund are managed under the direction of the Company’s Board of Directors. Information pertaining to the Directors and officers of the Fund is set forth below. The Fund’s Statement of Additional Information includes additional information about the Fund’s Directors and officers and is available without charge, upon request, by writing to Gabelli Capital Series Funds, Inc. at One Corporate Center, Rye, NY 10580-1422.

| | | | | | | | |

Name, Position(s)

Address1 and Age | | Term of Office and

Length of Time

Served2 | | Number of

Funds in

Fund Complex

Overseen by

Director | | Principal Occupation(s) During Past Five Years | | Other Directorships Held by Director4 |

| | | | |

Interested Directors3 | | | | | | | | |

| | | | |

Mario J. Gabelli, CFA Director and Chief Investment Officer Age: 73 | | Since 1995 | | 29 | | Chairman, Chief Executive Officer, and Chief Investment Officer–Value Portfolios of GAMCO Investors, Inc. and Chief Investment Officer– Value Portfolios of Gabelli Funds, LLC and GAMCO Asset Management Inc.; Director/ Trustee or Chief Investment Officer of other registered investment companies within the Gabelli/GAMCO Fund Complex; Chief Executive Officer of GGCP, Inc.; Chief Executive Officer and Chairman of the Board of Associated Capital Group, Inc. | | Director of Morgan Group Holdings, Inc. (holding company); Chairman of the Board and Chief Executive Officer of LICT Corp. (multimedia and communication services company); Director of CIBL, Inc. (broadcasting and wireless communications); Director of ICTC Group Inc. (communications); Director of RLJ Acquisition Inc. (blank check company) (2011-2012) |

| | | | |

Arthur V. Ferrara Director Age: 85 | | Since 1995 | | 8 | | Former Chairman of the Board and Chief Executive Officer of The Guardian Life Insurance Company of America (1993 – 1995) | | — |

| | | | |

| Independent Directors5 | | | | | | | | |

| | | | |

Anthony J. Colavita Director Age: 80 | | Since 1995 | | 36 | | President of the law firm of Anthony J. Colavita, P.C. | | — |

| | | | |

Clarence A. Davis Director Age: 74 | | Since 2015 | | 3 | | Former Chief Executive Officer of Nestor, Inc. (2007-2009); Former Chief Operating Officer (2000-2005) and Chief Financial Officer (1999- 2000) of the American Institute of Certified Public Accountants | | Director of Telephone & Data Systems, Inc. (telephone services); Director of Pennichuck Corp. (water supply) (2009- 2012) |

| | | | |

Mary E. Hauck Director Age: 73 | | Since 2014 | | 4 | | Retired Senior Manager of the Gabelli- O’Connor Fixed Income Mutual Funds Management Company | | — |

| | | | |

William F. Heitmann Director Age: 66 | | Since 2015 | | 4 | | Managing Director and Senior Advisor of Perlmutter Investment Company (real estate); Senior Vice President of Finance, Verizon Communications, and President, Verizon Investment Management (1971-2011) | | Director and Audit Committee Chair of DRS Technologies (defense electronic systems) |

| | | | |

Kuni Nakamura Director Age: 47 | | Since 2015 | | 16 | | President of Advanced Polymer, Inc. (chemical manufacturing company); President of KEN Enterprises, Inc. (real estate) | | — |

| | | | |

Anthony R. Pustorino Director Age: 90 | | Since 1995 | | 13 | | Certified Public Accountant; Professor Emeritus, Pace University | | Director of LGL Group, Inc. (diversified manufacturing) (2004-2011) |

18

¢ Gabelli Capital Asset Fund

| | | | |

Notes to Financial Statements (Unaudited) (Continued) | | | | |

| | | | | | | | |

Name, Position(s)

Address1 and Age | | Term of Office and

Length of Time

Served2 | | Number of

Funds in

Fund Complex

Overseen by

Director | | Principal Occupation(s) During Past Five Years | | Other Directorships Held by Director4 |

| | | | |

Werner J. Roeder, MD Director Age: 75 | | Since 1995 | | 23 | | Practicing private physician; Former Medical Director of Lawrence Hospital (1999-2014) | | — |

| | | | |

Anthonie C. van Ekris Director Age: 81 | | Since 1995 | | 22 | | Chairman and Chief Executive Officer of BALMAC International, Inc. (global import/ export company) | | — |

19

¢ Gabelli Capital Asset Fund

| | | | |

Additional Information (Unaudited) (Continued) | | | | |

| | | | |

Name, Position(s)

Address1 and Age | | Term of

Office and

Length of Time

Served2 | | Principal Occupation(s) During Past Five Years |

Officers | | | | |

| | |

Bruce N. Alpert President Age: 64 | | Since 1995 | | Executive Vice President and Chief Operating Officer of Gabelli Funds, LLC since 1988; Officer of several registered investment companies within the Gabelli/GAMCO Fund Complex; Senior Vice President of GAMCO Investors, Inc. since 2008; Director of Teton Advisors, Inc., 1998-2012; Chairman of Teton Advisors, Inc., 2008-2010; President of Teton Advisors, Inc., 1998-2008 |

| | |

Andrea R. Mango Secretary Age: 43 | | Since 2013 | | Counsel of Gabelli Funds, LLC since 2013; Secretary of all registered investment companies within the Gabelli/GAMCO Fund Complex since 2013; Vice President of all closed-end funds within the Gabelli/GAMCO Fund Complex since 2014; Corporate Vice President within the Corporate Compliance Department of New York Life Insurance Company, 2011-2013; Vice President and Counsel of Deutsche Bank, 2006-2011 |

| | |

Agnes Mullady Treasurer Age: 57 | | Since 2006 | | President and Chief Operating Officer of the Fund Division of Gabelli Funds, LLC since 2015; Chief Executive Officer of G.distributors, LLC since 2010; Senior Vice President of GAMCO Investors, Inc. since 2009; Vice President of Gabelli Funds, LLC since 2007; Officer of all of the registered investment companies within the Gabelli/GAMCO Fund Complex |

| | |

Richard J. Walz Chief Compliance Officer Age: 56 | | Since 2013 | | Chief Compliance Officer of all of the registered investment companies within the Gabelli/GAMCO Fund Complex since 2013; Chief Compliance Officer of AEGON USA Investment Management, 2011-2013; Chief Compliance Officer of Cutwater Asset Management, 2004-2011 |

| 1. | Address: One Corporate Center, Rye, NY 10580-1422, unless otherwise noted. |

| 2. | Each Director will hold office for an indefinite term until the earliest of (i) the next meeting of shareholders, if any, called for the purpose of considering the election or re-election of such Director and until the election and qualification of his or her successor, if any, elected at such meeting, or (ii) the date a Director resigns or retires, or a Director is removed by the Board of Directors or shareholders, in accordance with the Fund’s By-Laws and Articles of Incorporation. Each officer will hold office for an indefinite term until the date he or she resigns or retires or until his or her successor is elected and qualified. |

| 3. | “Interested person” of the Fund as defined in the 1940 Act. Mr. Gabelli is considered an “interested person” because of his affiliation with Gabelli Funds, LLC which acts as the Fund’s investment adviser. Mr. Ferrara and Mr. Carlisle are each considered an interested person because of their affiliation with The Guardian Life Insurance Company of America, which is the parent company of the Fund’s Manager. |

| 4. | This column includes only directorships of companies required to report to the SEC under the Securities Exchange Act of 1934, as amended, i.e., public companies, or other investment companies registered under the 1940 Act. |

| 5. | Directors who are not interested persons are considered “Independent” Directors. |

20

¢ Gabelli Capital Asset Fund

| | | | |

Additional Information (Unaudited) (Continued) | | | | |

¢ Gabelli Capital Asset Fund

|

2015 Tax Notice to Shareholders (Unaudited) |

For the year ended December 31, 2015, the Fund paid to shareholders ordinary income distributions (comprised of net investment income and short term capital gains) totaling $0.113 per share, and long term capital gains totaling $11,540,305 or the maximum allowable. The distributions of long term capital gains have been designated as a capital gain dividend by the Fund’s Board of Directors. For the year ended December 31, 2015, 100% of the ordinary income distribution qualifies for the dividends received deduction available to corporations. The Fund designates 100% of the ordinary income distribution as qualified dividend income pursuant to the Jobs and Growth Tax Relief Reconciliation Act of 2003. The Fund designates 0.00% of the ordinary income distribution as qualified interest income pursuant to the Tax Relief, Unemployment Reauthorization, and Job Creation Act of 2010. The Fund designates 100% of the ordinary income distribution as qualified short term gain pursuant to the American Jobs Creation Act of 2004.

U.S. Government Income:

The percentage of the ordinary income distribution paid by the Fund during the year ended December 31, 2015 which was derived from U.S. Treasury securities was 0.00%. Due to the diversity in state and local tax law, it is recommended that you consult your personal tax adviser as to the applicability of the information provided to your specific situation.

All designations are based on financial information available as of the date of this annual report and, accordingly, are subject to change. For each item, it is the intention of the Fund to designate the maximum amount permitted under the Internal Revenue Code and the regulations thereunder.

21

Item 2. Code of Ethics.

| | (a) | The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| | (c) | There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics description. |

| | (d) | The registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions. |

Item 3. Audit Committee Financial Expert.

As of the end of the period covered by the report, the registrant’s Board of Directors has determined that Anthony R. Pustorino is qualified to serve as an audit committee financial expert serving on its audit committee and that he is “independent,” as defined by Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Audit Fees

| | (a) | The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are $32,300 for 2014 and $33,301 for 2015. |

Audit-Related Fees

| | (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item are $0 for 2014 and $0 for 2015. |

Tax Fees

| | (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning are $3,500 for 2014 and $3,600 for 2015. Tax fees represent tax compliance services provided in connection with the review of the Registrant’s tax returns. |

All Other Fees