In January 2006, AstraZeneca Canada Inc. was served with a claim in the Federal Court of Canada for payment of an undetermined sum based on damages allegedly suffered by Apotex due to the delay from January 2002 to January 2004 in the issuance to Apotex of a notice of compliance (marketing approval) in Canada for its 20mg omeprazole capsule product. The claim was held in abeyance pending Apotex’s appeal to the Supreme Court of Canada, and following the November 2006 allowance of that appeal Apotex has indicated it will be advancing the damages claim. AstraZeneca believes the claim is without merit and intends to defend it and to pursue its already pending patent infringement actions against Apotex vigorously.

In January 2007, AstraZeneca Canada Inc. discontinued long pending proceedings against Reddy-Cheminor Inc. in respect of patents relating to omeprazole capsules, following Reddy-Cheminor’s withdrawal of its allegations.

The first action was brought in 2004 in the Superior Court of the State of California for the County of Los Angeles by the Afl-CIO, two unincorporated associations and an individual on behalf of themselves, the general public and a class of California consumers, third party payers, cash payers and those making a co-payment. A second action was filed in the same court on behalf of a similar putative class of consumers. Actions making substantially similar allegations were filed in 2004 and 2005 on behalf of putative classes of consumers, third party payers, purchasers and labour management trust funds in the Circuit Court of Searcy County, Arkansas; in the Superior Court of the State of Delaware in and for New Castle County; in the Superior Court of Massachusetts in Boston; in the US District Court for the District of Delaware (three consolidated cases); and in the Circuit Court of the 11th Judicial Court in and for Miami-Dade County, Florida.

In September 2005, the court in California issued a ruling on AstraZeneca’s demurrer and motion to strike in the two California actions. The court granted AstraZeneca’s motion with respect to the associational plaintiffs and denied the motion with respect to the individual plaintiffs, allowing the cases of the individuals to proceed. In October 2005, the court in Massachusetts denied AstraZeneca’s motion to dismiss. Discovery in the California and Massachusetts cases is proceeding, and plaintiffs’ motions for class certification are expected to be filed in mid-2007.

Back to Contents

| 140 | ASTRAZENECA ANNUAL REPORT AND FORM 20-F INFORMATION 2006 |

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

| 26 | COMMITMENTS AND CONTINGENT LIABILITIES CONTINUED |

| In November 2005, the US District Court for the District of Delaware granted AstraZeneca’s motion to dismiss the consolidated class action complaint. The plaintiffs appealed the dismissal to the US Court of Appeals for the Third Circuit. The Delaware state case has been stayed pending the outcome of the Delaware federal cases. |

In May 2006, the Arkansas state court granted AstraZeneca’s motion to dismiss the plaintiffs’ complaint. The plaintiffs filed additional motions and pleadings, including an amended complaint. AstraZeneca filed a motion to dismiss the amended complaint.

In October 2006, the Florida court dismissed the plaintiff’s complaint with prejudice and without leave to amend. The plaintiff has appealed the dismissal, and the opening appeal brief is due in February 2007.

In December 2006 and January 2007, several lawsuits against AstraZeneca entities, including putative class actions, were filed in US District Court for the District of Columbia alleging claims of unlawful monopolisation relating toPrilosecandNexium. Individual actions were filed on 7 December 2006 by Walgreen Co., Eckerd Corporation. Maxi Drug, Inc. d/b/a Brooks Pharmacy, The Kroger Co., New Albertson’s Inc., Safeway, Inc., Hy-Vee, Inc., and American Sales Company, Inc. and on 8 December 2006 by Rite Aid Corporation, and Rite Aid Headquarters Corp. Putative class actions brought on behalf of direct purchasers were filed on 18 December 2006 by Meijer, Inc. and Meijer Distribution, Inc., on 19 December 2006 by Louisiana Wholesale Drug Co., Inc., and on 8 January 2007 by Burlington Drug Co., Inc., Dik Drug Co., Inc, and King Drug Co. of Florence, Inc. The plaintiffs seek treble damages, injunctive relief, and attorney fees. AstraZeneca denies the allegations and intends to vigourously defend each of the actions.

In November 2003, the European Patent Office (EPO) ruled that the European substance patent covering magnesium esomeprazole, the active pharmaceutical ingredient inNexium, was valid. The patent, which expires in May 2014, was challenged by the generic manufacturer ratiopharm. The EPO ruling was appealed by ratiopharm. In December 2006, the Board of Appeals of the EPO ruled that the patent is invalid.

While disappointed with the EPO decision, AstraZeneca has confidence in the intellectual property portfolio protectingNexium. This portfolio includes process, method of use and additional substance patents with expiration dates ranging from 2009 through to 2019. The process patent is under opposition with the EPO and an Opposition Division oral hearing is scheduled for October 2007 (postponed from the original hearing date in March 2007). In addition to these patents,Nexiumhas data exclusivity valid to 2010 in major European markets.

The revocation of the AstraZeneca European substance patent relating toNexiumshould not have any substantive impact on AstraZeneca’s ability to uphold and enforce itsNexiumpatents in the United States. AstraZeneca has several US patents coveringNexium,all of which can be differentiated from the European patent found to be invalid.

In October 2004, AstraZeneca LP filed suit in the US District Court for the District of Delaware seeking declaratory judgment that its ‘Better is Better’ campaign forNexiumwas not false or misleading advertising in violation of section 43(a) of the Lanham Act, a federal statute governing false advertising claims. The action was taken in response to a letter from TAP Pharmaceuticals, Inc. demanding that AstraZeneca immediately withdraw the television commercial and other components of the direct-to-consumer advertising campaign forNexiumon the basis that they allegedly violated the statute. In November 2004, TAP requested expedited consideration of the case by filing a motion for a preliminary injunction, which the court denied in December 2004. In May and June 2006, the court dismissed all of the claims for damages asserted by TAP in its counterclaims and dismissed most of TAP’s claims for injunctive relief. In August 2006, the parties entered into a settlement agreement, and the case has been dismissed in its entirety.

In October 2005, AstraZeneca received a notice from Ranbaxy Pharmaceuticals, Inc. that Ranbaxy Laboratories Limited had submitted an Abbreviated New Drug Application (ANDA) to the US FDA for esomeprazole magnesium delayed-release capsules, 20mg and 40mg. The ANDA contained paragraph IV certifications of invalidity and/or non-infringement in respect of certain AstraZeneca US patents listed in the FDA’s Orange Book with reference toNexium. In November 2005, AstraZeneca commenced wilful infringement patent litigation in the US District Court for the District of New Jersey against Ranbaxy Pharmaceuticals, Inc. and its affiliates in response to Ranbaxy’s paragraph IV certifications regardingNexium.

In January 2006, AstraZeneca received a notice from IVAX Pharmaceuticals Inc. that IVAX Corporation had submitted an ANDA to the US FDA for esomeprazole magnesium delayed-release capsules, 20mg and 40mg. The ANDA contained paragraph IV certifications of invalidity and/or non-infringement in respect of certain AstraZeneca US patents listed in the FDA’s Orange Book with reference toNexium. IVAX also certified in respect of certain other AstraZeneca US patents listed in the Orange Book with reference toNexiumthat IVAX will not launch its product prior to the expiry of those patents, the latter of which expires in October 2007. In March 2006, AstraZeneca commenced wilful patent infringement litigation in the US District Court for the District of New Jersey against IVAX, its parent Teva Pharmaceuticals, and their affiliates. The Ranbaxy and Teva/IVAX matters have been consolidated.

In August 2006, AstraZeneca received a notice from Dr. Reddy’s Laboratories, Ltd. and Dr. Reddy’s Laboratories, Inc. (“Dr. Reddy’s”) that Dr. Reddy’s had submitted an ANDA to the US FDA for esomeprazole magnesium delayed-release capsules, 20mg and 40mg. Dr. Reddy’s was seeking FDA approval to market a generic esomeprazole magnesium product prior to the expiration of some but not all of the patents listed in the FDA Orange Book with reference toNexium.

Back to Contents

| 26 | COMMITMENTS AND CONTINGENT LIABILITIES CONTINUED |

| Dr. Reddy’s notice did not challenge three Orange Book-listed patents claiming esomeprazole magnesium (US Patent Nos. 5,714,504, 5,877,192 and 6,875,872). AstraZeneca’s exclusivity relating to these three patents expires on 3 August 2015, 27 November 2014 and 27 November 2014, respectively. Because AstraZeneca has not received notice from Dr. Reddy’s as to these three US patents, Dr. Reddy’s cannot market generic esomeprazole magnesium until the end of the exclusivity afforded by these patents. As a result, AstraZeneca did not bring a lawsuit at this time. AstraZeneca reserves the right to enforce all patents related to Nexium, including those listed in the FDA Orange Book. |

AstraZeneca continues to have full confidence in and will vigorously defend and enforce its intellectual property protectingNexium.

Nolvadex(tamoxifen)

AstraZeneca is a co-defendant with Barr Laboratories, Inc. in numerous purported class actions filed in federal and state courts throughout the US. All of the state court actions were removed to federal court and have been consolidated, along with all of the cases originally filed in the federal courts, in a federal multi-district litigation proceeding pending in the US District Court for the Eastern District of New York. Some of the cases were filed by plaintiffs representing a putative class of consumers who purchased tamoxifen. The other cases were filed on behalf of a putative class of ‘third party payers’ (including health maintenance organisations, insurers and other managed care providers and health plans) that have reimbursed or otherwise paid for prescriptions of tamoxifen. The plaintiffs allege that they paid ‘supra-competitive and monopolistic prices’ for tamoxifen as a result of the settlement of patent litigation between Zeneca and Barr in 1993. The plaintiffs seek injunctive relief, treble damages under the antitrust laws, disgorgement and restitution. In April 2002, AstraZeneca filed a motion to dismiss the cases for failure to state a cause of action. In May 2003, the US District Court for the Eastern District of New York granted AstraZeneca’s motion to dismiss. The plaintiffs appealed the decision.

In November 2005, the US Court of Appeals for the Second Circuit affirmed the District Court’s decision. The plaintiffs thereafter moved for re-hearing by the original panel of judges in the case and re-hearing by a panel of all of the judges on the US Court of Appeals for the Second Circuit. The plaintiffs’ requests for re-hearing were denied in September 2006. In December 2006, the plaintiffs filed a petition for awrit of certiorarito the US Supreme Court seeking to have the Court hear an appeal of the Second Circuit’s decision.

Pulmicort Respules(budesonide inhalation suspension)

In September 2005, AstraZeneca received a notice from IVAX Pharmaceuticals Inc. that IVAX had submitted an Abbreviated New Drug Application (ANDA) to the US FDA for a budesonide inhalation suspension containing a paragraph IV certification and alleging invalidity and non-infringement in respect of certain of AstraZeneca’s patents relating to budesonide inhalation suspension. In October 2005, AstraZeneca filed a patent infringement action against IVAX in the US District Court for the District of New Jersey. In December 2005, IVAX responded and filed counterclaims alleging non-infringement and invalidity. In January 2006, AstraZeneca filed an amended complaint, withdrawing averments as to the infringement of one of the patents-in-suit. Discovery in the litigation is ongoing.

AstraZeneca continues to have full confidence in and will vigorously defend and enforce its intellectual property protectingPulmicort Respules.

Seroquel(quetiapine fumarate)

In August 2003, Susan Zehel-Miller filed a putative class action against AstraZeneca PLC and AstraZeneca Pharmaceuticals LP on behalf of “all persons in the US who purchased and/or usedSeroquel”. Among other things, the class action alleged that AstraZeneca failed to provide adequate warnings in connection with an alleged association betweenSeroqueland the onset of diabetes. In 2004, the US District Court for the Middle District of Florida denied class certification and the case was ultimately dismissed. Two additional putative class actions raising similar allegations have likewise been dismissed. There are no other US class actions relating toSeroquel; however, four putative class actions raising substantially similar allegations have been filed in Canada.

Additionally, AstraZeneca Pharmaceuticals LP, either alone or in conjunction with one or more affiliates, has been sued in numerous individual personal injury actions involvingSeroquel. In the overwhelming majority of these cases, the nature of the plaintiffs’ alleged injuries is not clear. Although some plaintiffs contend that they developed diabetes or other related injuries as a result of takingSeroqueland/or other atypical anti-psychotic medications, in most instances, little or no factual information regarding the alleged injury has been provided. As of 24 January 2007, AstraZeneca was defending 604 served or answered lawsuits involving approximately 7,450 plaintiff groups. These include a number of recently filed cases that include close to 1,000 plaintiff groups per case. The majority of theSeroquelcases are pending in federal court with clusters of state court activity in Delaware, New Jersey, New York and Missouri. AstraZeneca is also aware of over 600 additional cases that have been filed but not yet served and has not determined how many additional cases, if any, may have been filed. Some of the cases also include claims against other pharmaceutical manufacturers such as Eli Lilly, Janssen Pharmaceutica and/or Bristol-Myers Squibb. AstraZeneca intends to vigorously defend all of the Seroquelcases.

In September 2005, AstraZeneca received a notice from Teva Pharmaceuticals USA that Teva had submitted an Abbreviated New Drug Application (ANDA) for quetiapine fumarate 25mg tablets containing a paragraph IV certification alleging invalidity, unenforceability, or non-infringement respecting AstraZeneca’s US patent listed in the FDA’s Orange Book with reference toSeroquel. In November 2005, AstraZeneca filed a lawsuit directed to Teva’s 25mg tablets ANDA in the US District Court for the District of New Jersey for wilful patent infringement. In February 2006, AstraZeneca received another notice from Teva Pharmaceuticals USA that Teva had amended its previously submitted ANDA for quetiapine fumarate 25mg tablets and added 100, 200 and 300mg tablets to its application to the US FDA. The amended ANDA submission contained a similar paragraph IV certification alleging invalidity, unenforceability, or non-infringement in respect of AstraZeneca’s US patent listed in the FDA’s Orange Book with reference toSeroquel. In March 2006, in response to Teva’s amended ANDA and Teva’s intent to market additional strengths of a generic version ofSeroquelin the US prior to the expiration of AstraZeneca’s patent, AstraZeneca filed an additional lawsuit against Teva in the US District Court for the District of New Jersey for patent infringement.

Back to Contents

| 142 | ASTRAZENECA ANNUAL REPORT AND FORM 20-F INFORMATION 2006 |

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

| 26 | COMMITMENTS AND CONTINGENT LIABILITIES CONTINUED |

| The two lawsuits were consolidated in April 2006. However in March 2006, the US District Court had granted Teva’s motion to strike AstraZeneca’s added allegation of wilfullness in its patent infringement claim in the first complaint directed to Teva’s 25mg tablets. Therefore, in the consolidated action, in response to AstraZeneca’s now-combined allegations of patent infringement directed to Teva’s 25, 100, 200 and 300mg ANDA tablets, Teva alleges non-infringement and patent invalidity. In January 2007, Teva filed a motion seeking leave to amend its pleadings in the consolidated action to add allegations, defences, and counter-claims directed to alleged inequitable conduct in the procurement of AstraZeneca’s patent. Discovery in the consolidated case is proceeding. |

AstraZeneca continues to have full confidence in and will vigorously defend and enforce its intellectual property protectingSeroquel.

Symbicort(budesonide/formoterol)

In March 2005, the European Patent Office ruled that the European patent covering the combination of formoterol and budesonide inSymbicortis valid. The patent, which expires in 2012 (Supplementary Patent Certificate expires 2015), was challenged by the generic manufacturers Yamanouchi Europe BV, Miat SpA, Liconsa, Chiesi Farmaceutici SpA, Zambon Group SpA, Generics (UK) Limited and Norton Healthcare Ltd. In May 2005, the European Patent Office ruled that the European patent forSymbicortin the treatment of chronic obstructive pulmonary disease (COPD) is valid. The patent, which expires in 2018, was challenged by the generic manufacturers Chiesi Farmaceutici SpA, Norton Healthcare Ltd and Generics (UK) Limited.

The European Patent Office rulings relating to both the combination and the COPD European patents forSymbicorthave been appealed by certain of the opponents in the proceedings. It is not anticipated that the appeals will be heard before the latter part of 2007.

In February 2004, IVAX Pharmaceuticals (UK) Limited initiated proceedings against AstraZeneca AB claiming that the UK parts of the two European patents related toSymbicortwere invalid. In May 2004, the court granted AstraZeneca’s application for a stay of the proceedings pending the determination of the parallel opposition proceedings before the European Patent Office, described above. In April 2004, IVAX initiated proceedings against AstraZeneca AB in relation to the Republic of Ireland claiming that the Irish parts of the two European patents related toSymbicortwere invalid. In October 2004, the court granted AstraZeneca’s application for a stay of proceedings pending the final decision of the European Patent Office and its Boards of Appeal in the opposition proceedings.

Toprol-XL(metoprolol succinate)

In May 2003, AstraZeneca filed a patent infringement action against KV Pharmaceutical Company in the US District Court for the Eastern District of Missouri in response to KV’s notification of its intention to market a generic version ofToprol-XLtablets in the 200mg dose prior to the expiration of AstraZeneca’s patents covering the substance and its formulation. In response to later similar notices from KV related to the 25, 50 and 100mg doses, AstraZeneca filed further actions. KV responded in each instance and filed counterclaims alleging non-infringement, invalidity and unenforceability of the listed patents.

In February 2004, AstraZeneca filed a patent infringement action against Andrx Pharmaceuticals LLC in the US District Court for the District of Delaware in response to Andrx’s notification of its intention to market a generic version ofToprol-XLtablets in the 50mg dose prior to the expiration of AstraZeneca’s patents. In response to two later similar notices from Andrx related to the 25,100 and 200mg doses, AstraZeneca filed two additional patent infringement actions in the same court. In each instance, Andrx claimed that each of the listed patents is invalid, not infringed and unenforceable.

In April 2004, AstraZeneca filed a patent infringement action against Eon Labs Manufacturing Inc. in the US District Court for the District of Delaware in response to Eon’s notification of its intention to market generic versions ofToprol-XLtablets in the 25, 50, 100 and 200mg doses prior to the expiration of AstraZeneca’s patents. In its response, Eon alleged that each of the listed patents is invalid, not infringed and unenforceable. Eon also alleged that the filing of the infringement complaints, as well as other actions by AstraZeneca, constitutes anti-competitive conduct in violation of US anti-trust laws. Pursuant to a joint motion of AstraZeneca and Eon these anti-trust counts were severed from the case and stayed, for possible consideration depending on the outcome of the trial of the patent claims.

All of the patent litigation relating toToprol-XLagainst KV, Andrx and Eon was consolidated for pre-trial discovery purposes and motion practice in the US District Court for the Eastern District of Missouri. The defendants filed a motion for summary judgment in December 2004 alleging that theToprol-XLpatents are invalid due to double patenting. A summary judgment motion of unenforceability was filed by the defendants in 2005 and AstraZeneca filed summary judgment motions on infringement and validity in 2005. In January 2006, the US District Court for the Eastern District of Missouri issued a ruling finding that the two patents-in-suit are unenforceable (based on the Company’s inequitable conduct in the prosecution of these patents in the US Patent and Trademark Office) and invalid. AstraZeneca appealed the District Court decision to the US Court of Appeals for the Federal Circuit. The appeal was fully briefed in 2006 and was argued on 8 December 2006. We await the decision of the Court of Appeals.

In August 2006, Sandoz (formerly Eon) received final approval from the US Food and Drug Administration (FDA) on the 25mg dose of metoprolol succinate and tentative approval on the 50, 100 and 200mg doses. On 21 November 2006, Sandoz launched its 25mg metoprolol succinate product, which was followed by Par Pharmaceuticals’ launch of a 25mg generic metoprolol succinate under a distribution agreement by AstraZeneca. There is no longer a stay in effect on the approval of the ANDAs filed by KV and Andrx but neither has received FDA approval.

Back to Contents

| 26 | COMMITMENTS AND CONTINGENT LIABILITIES CONTINUED |

| In the first quarter of 2006, AstraZeneca was served with 14 complaints filed in the US District Courts in Delaware, Massachusetts, and Florida against AstraZeneca Pharmaceuticals LP, AstraZeneca LP, AstraZeneca AB and Aktiebolaget Hässle. The complaints were putative class actions filed on behalf of both direct purchasers and indirect purchasers that allege that the AstraZeneca defendants attempted to illegally maintain monopoly power in the US over Toprol-XL in violation of the Sherman Act through the listing of invalid and unenforceable patents in the FDA’s Orange Book and the enforcement of such patents through litigation against generic manufacturers seeking to market metoprolol succinate. The complaints seek treble damages based on alleged overcharges to the putative classes of plaintiffs. The lawsuit is based upon the finding described above by the US District Court for the Eastern District of Missouri in the consolidated litigation against KV, Andrx and Eon that the AstraZeneca patents relating to Toprol-XL are invalid and unenforceable. As noted above, AstraZeneca is appealing the ruling in the patent litigation. These 14 complaints were consolidated into two amended complaints, one on behalf of direct purchasers, and one on behalf of indirect purchasers. AstraZeneca has filed a motion seeking to dismiss or in the alternative stay the consolidated complaint in both cases. AstraZeneca denies the allegations of the anti-trust complaints and will vigorously defend the lawsuits. |

AstraZeneca continues to maintain that its patents forToprol-XLare valid, enforceable and infringed by the actual and proposed generic products of KV, Andrx and Eon and that its enforcement of its patents did not violate anti-trust laws.

Zestril(lisinopril)

In 1996, two of AstraZeneca’s predecessor companies, Zeneca Limited and Zeneca Pharma Inc. (as licensees), Merck & Co., Inc. and Merck Frosst Canada Inc. commenced a patent infringement action in the Federal Court of Canada against Apotex Inc., alleging infringement of Merck’s lisinopril patent. Apotex sold a generic version of AstraZeneca’sZestriland Merck’s Prinivil™tablets. Apotex admitted infringement but has raised positive defences to infringement, including that it acquired certain quantities of lisinopril prior to issuance of the patent and that certain quantities were licensed under a compulsory licence. Apotex also alleged invalidity of the patent. Following a trial in early 2006, in April 2006 the Federal Court of Canada ruled in favour of AstraZeneca and Merck on the key issues and Apotex stopped selling lisinopril in May 2006. In October 2006, the Federal Court of Appeal in Canada upheld the lower court’s decision and dismissed Apotex’s appeal. In December 2006 Apotex sought leave to appeal to the Supreme Court of Canada and the application remains pending.

AstraZeneca (as licensee) also had a case pending in the Federal Court of Canada against Cobalt Pharmaceuticals Inc., pertaining to the same Merck lisinopril patent, on the basis that Cobalt was seeking a notice of compliance (marketing approval) in Canada based on a comparison with AstraZeneca’sZestril.

However, in 2006, Cobalt withdrew its notice of allegation relating to lisinopril and AstraZeneca discontinued its case against Cobalt.

Zestoretic(lisinopril/hydrochlorothiazide)

AstraZeneca (as licensee) had a case pending in the Federal Court of Canada against Apotex Inc., pertaining to Merck’s lisinopril/hydrochlorothiazide combination patent, on the basis that Apotex was seeking a notice of compliance (marketing approval) in Canada based on a comparison with AstraZeneca’sZestoretic. AstraZeneca is potentially liable for damages in the event that Apotex’s market entry is held to have been improperly delayed.

The case against Apotex was discontinued by AstraZeneca in August 2006. Apotex’s combination product will likely remain off the market until the expiry of a relevant patent in October 2007.

Average wholesale price class action litigation

In January 2002, AstraZeneca was named as a defendant along with 24 other pharmaceutical manufacturers in a class action suit, in Massachusetts, brought on behalf of a putative class of plaintiffs alleged to have overpaid for prescription drugs as a result of inflated wholesale list prices. Following the Massachusetts complaint, nearly identical class action suits were filed against AstraZeneca and various other pharmaceutical manufacturers in four other states. AstraZeneca and other manufacturers have since been sued in similar lawsuits filed by the state Attorneys General of Pennsylvania, Nevada, Montana, Wisconsin, Illinois, Alabama, Kentucky, Arizona, Mississippi, Hawaii, and Alaska, as well as by multiple individual counties in the State of New York. The Attorney General lawsuits seek to recover alleged overpayments under Medicaid and other state-funded healthcare programmes. In several cases, the states are also suing to recover alleged overpayments by state residents. Several of these suits have been consolidated with the Massachusetts action for pre-trial purposes, pursuant to federal multi-district litigation (MDL) procedures.

In January 2006, the District Court in Boston certified three classes of plaintiffs against the “Track 1” manufacturer defendants, AstraZeneca, GlaxoSmithKline, Bristol-Myers Squibb, Schering-Plough, and Johnson & Johnson. The three certified classes are: (Class1) a nationwide class of consumers who made co-payments for certain physician-administered drugs reimbursed under the Medicare Part B programme (“Part B drugs”); (Class 2) a Massachusetts-only class of third-party payers, including insurance companies, union health and welfare benefit plans, and self-insured employers, who covered consumer co-payments for Part B drugs; and (Class 3) a Massachusetts-only class of third-party payers and consumers who paid for Part B drugs outside of the Medicare programme. For all classes, the only AstraZeneca drug at issue isZoladex(goserelin acetate implant).

Back to Contents

| 144 | ASTRAZENECA ANNUAL REPORT AND FORM 20-F INFORMATION 2006 |

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

| 26 | COMMITMENTS AND CONTINGENT LIABILITIES CONTINUED |

| A bench trial against four of the Track 1 defendants, including AstraZeneca, by Classes 2 and 3 began on 6 November 2006 and concluded on 26 January 2007. The Court has yet to render its decision. A separate jury trial against AstraZeneca only, by Class 1, is scheduled for 30 April 2007. The multiple Attorney General lawsuits filed in state courts are proceeding independently of the Boston MDL proceeding. The first trials that potentially involve AstraZeneca are scheduled for November 2007 in the Alabama and Mississippi Attorney General cases. |

AstraZeneca denies the allegations made in all of the average wholesale price lawsuits and will vigorously defend the actions.

340B Class Action Litigation

In August 2004, AstraZeneca was named as a defendant along with multiple other pharmaceutical manufacturers in a class action suit filed in Alabama Federal Court on behalf of all so-called “disproportionate share” entities. These are the hospitals and clinics that treat a substantial portion of uninsured patients and thus qualify for preferential pricing under the Public Health Service Act drug discount programme (the “340B” Program). According to the complaint, the genesis of the suit was an audit report by the Department of Health and Human Services Office of Inspector General (OIG) in June 2004. The OIG later withdrew the audit report and in 2006, re-issued a revised audit report that substantially modified the previous audit findings. After the issuance of the revised OIG audit report, the named plaintiffs voluntarily dismissed their lawsuit against the defendants.

A similar class action suit was filed in August 2005 by the County of Santa Clara in California state court. The County of Santa Clara sued as a representative of a class of similarly situated counties and cities in California alleged to have overpaid for 340B-covered drugs. The case was removed to the US District Court for the Northern District of California. In 2006, the US District Court dismissed each of the allegations in the County’s complaint. The County appealed the dismissal to the US Court of Appeals for the North Circuit. AstraZeneca denies the allegations in the County’s complaint and intends to continue to defend them vigorously.

Additional government investigations into drug marketing practices

As is true for most, if not all, major prescription pharmaceutical companies operating in the US, AstraZeneca is currently involved in multiple US federal and state criminal and civil investigations into drug marketing and pricing practices. Two of the active investigations are being handled by the US Attorney’s Office in Boston. The first involves a subpoena for documents and information relating to sales and marketing interactions with a leading provider of pharmacy services to long-term care facilities. The second involves an investigation relating to the sale and marketing of products to an individual physician in Worcester, Massachusetts and certain physicians and entities affiliated with that physician. These investigations may be the subject of sealed qui tam lawsuits filed under the False Claims Act.

The US Attorney’s Office in Philadelphia is directing three additional, active investigations. The first two involve requests for documents and information relating to contracting and disease management programmes with two of the leading national Pharmacy Benefits Managers. The third involves a review of sales and marketing practices relating toSeroquel, including allegations that the Company promotedSeroquelfor non-indicated (off-label) uses. AstraZeneca understands that all of these investigations may be the subjects of sealed qui tam lawsuits filed under the False Claims Act.

There are a number of additional active investigations led by state Attorneys General. These include subpoenas received in September 2006 from the Alaska and California Attorney General’s Offices seeking information relating toSeroquelsales and marketing practices. In addition, the Nevada and Delaware Attorney General’s Offices have requested documents and information relating to the development of patient education and practice management materials for physicians.

It is not possible to predict the outcome of any of these investigations, which could include the payment of damages and the imposition of fines, penalties and administrative remedies.

Informal SEC inquiry

In October 2006, AstraZeneca received from the US Securities and Exchange Commission (“SEC”) a letter requesting documents related to its business activities in Italy, Croatia, Russia and Slovakia for the period 1 October 2003 to the present. The SEC’s request generally seeks documents concerning any payments to doctors or government officials and related internal accounting controls. The request also seeks policies, correspondence, audits and other documents concerning compliance with the Foreign Corrupt Practices Act, as well as any allegations or communications with prosecutors’ offices relating to corruption or bribery of doctors or government officials. AstraZeneca is in the process of responding to the SEC’s request. It is not currently possible to predict the outcome of this inquiry.

Drug importation anti-trust litigation

In May 2004, plaintiffs in a purported class action filed complaints in the US District Court for Minnesota and for New Jersey, alleging that AstraZeneca Pharmaceuticals LP and eight other pharmaceutical manufacturer defendants conspired to prevent American consumers from purchasing prescription drugs from Canada, “depriving consumers of the ability to purchase” drugs at competitive prices. The New Jersey case was voluntarily dismissed in July 2004. In August 2005, the Minnesota District Court dismissed with prejudice the plaintiffs’ federal anti-trust claims and declined to exercise supplemental jurisdiction in relation to the state statutory and common law claims, which claims were dismissed without prejudice. The plaintiffs appealed the District Court’s decision to the US Court of Appeals for the Eighth Circuit. In November 2006, the US Court of Appeals for the Eighth Circuit affirmed the District Court’s decision.

Back to Contents

| 26 | COMMITMENTS AND CONTINGENT LIABILITIES CONTINUED |

| In August 2004, Californian retail pharmacy plaintiffs filed an action in the Superior Court of California making similar allegations to the Minnesota action and also alleging a conspiracy by approximately 15 pharmaceutical manufacturer defendants to set the price of drugs sold in California at or above the Canadian sales price for those same drugs. In July 2005, the court overruled in part and sustained in part, without leave to amend, the defendants’ motion to dismiss the plaintiffs’ third amended complaint in these proceedings. The Court overruled the defendants’ motion in respect of conspiracy claims but sustained the motion in respect of the California Unfair Competition Law claims. On 15 December 2006, the court granted the defendants’ motion for summary judgment and the case will be dismissed. In January 2007, plaintiffs filed a Notice of Appeal with the Court of Appeal of the State of California. |

AstraZeneca denies the material allegations of both the Minnesota and California actions and is vigorously defending these matters.

Anti-trust

In July 2006, AstraZeneca Pharmaceuticals LP was named as a defendant, along with a number of other pharmaceutical manufacturers and wholesalers, in a complaint filed by RxUSA Wholesale, Inc. in the US District Court for the Eastern District of New York. The complaint alleges that the defendants violated federal and state anti-trust laws by, among other things, allegedly refusing to deal with RxUSA and other “secondary wholesalers” in the wholesale pharmaceutical industry. The plaintiff alleges a conspiracy among the manufacturers and seeks an injunction and treble damages. AstraZeneca vigorously denies the allegations and in November 2006 filed a motion to dismiss the complaint.

For a description of other anti-trust-related litigation involving AstraZeneca, see the subsections entitled “Losec/Prilosec(omeprazole)”, “Nolvadex(tamoxifen)” and “Toprol-XL(metoprolol succinate)” in this Note 26 to the Financial Statements.

StarLink

AstraZeneca Insurance Company Limited (AZIC) commenced arbitration proceedings in the UK against insurers in respect of amounts paid by Garst Seed Company of the US in settlement of claims arising in the US from Garst’s sale of StarLink, a genetically engineered corn seed. The English High Court ruled, on appeal by reinsurers from a preliminary finding in AZIC’s favour by the arbitration panel, that English law applies to recovery under the reinsurance arrangements. This is contrary to AZIC’s view, which is that recovery should be assessed under Iowa law, and AZIC sought leave to appeal this finding to the Court of Appeal. Leave to appeal was refused and in the circumstances AZIC decided not to proceed further with the case. Taking into account recoveries and a central provision, taken in 2004, this will have no impact on 2006 profits. AstraZeneca’s interest in Garst was through AstraZeneca’s 50% ownership of Advanta BV, the sale of which to Syngenta AG was announced in May 2004 and completed in September 2004.

General

With respect to each of the legal proceedings described above, other than those which have been disposed of, we are unable to make estimates of the possible loss or range of possible losses at this stage, other than where noted in the case of the European Commission fine. We also do not believe that disclosure of the amount sought by plaintiffs, if that is known, would be meaningful with respect to those legal proceedings. This is due to a number of factors including: the stage of the proceedings (in many cases trial dates have not been set) and overall length and extent of legal discovery; the entitlement of the parties to an action to appeal a decision; clarity as to theories of liability; damages and governing law; uncertainties in timing of litigation; and the possible need for further legal proceedings to establish the appropriate amount of damages, if any. However, although there can be no assurance regarding the outcome of any of the legal proceedings or investigations referred to in this Note 26 to the Financial Statements, we do not expect them to have a materially adverse effect on our financial position or profitability.

Taxation

Where tax exposures can be quantified, a provision is made based on best estimates and management’s judgement. Details of the movements in relation to material tax exposures are discussed below.

AstraZeneca faces a number of transfer pricing audits in jurisdictions around the world. The issues under audit are often complex and can require many years to resolve. Accruals for tax contingencies require management to make estimates and judgements with respect to the ultimate outcome of a tax audit, and actual results could vary from these estimates. The total net accrual included in the Financial Statements to cover the worldwide exposure to transfer pricing audits is $995m, an increase of $452m due to a number of new audits, revisions of estimates relating to existing audits, offset by a number of negotiated settlements. For certain of the audits, AstraZeneca estimates the potential for additional losses above and beyond the amount provided to be up to $445m; however, management believes that it is unlikely that these additional losses will arise. Of the remaining tax exposures, the Company does not expect material additional losses. It is not possible to estimate the timing of tax cash flows in relation to each outcome. Included in the provision is an amount of interest of $265m. Interest is accrued as a tax expense.

Back to Contents

| 146 | ASTRAZENECA ANNUAL REPORT AND FORM 20-F INFORMATION 2006 |

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

| 27 | LEASES |

| Total rentals under operating leases charged to the income statement were as follows: |

| | 2006 | | 2005 | | 2004 | |

| | $m | | $m | | $m | |

|

|

|

|

|

| |

| | 197 | | 155 | | 127 | |

|

|

|

|

|

| |

| The future minimum lease payments under operating leases that have initial or remaining terms in excess of one year at 31 December 2006 were as follows: | |

| | | Operating leases | |

| | |

|

|

|

|

| |

| | | 2006 | | 2005 | | 2004 | |

| | | $m | | $m | | $m | |

|

|

|

|

|

|

| |

| Obligations under leases comprise | | | | | | |

| Rentals due within one year | 211 | | 83 | | 112 | |

|

|

|

|

|

|

| |

| Rentals due after more than one year: | | | | | | |

| | After five years | 88 | | 90 | | 69 | |

|

|

|

|

|

|

| |

| | From four to five years | 22 | | 18 | | 28 | |

|

|

|

|

|

|

| |

| | From three to four years | 31 | | 26 | | 35 | |

|

|

|

|

|

|

| |

| | From two to three years | 43 | | 41 | | 45 | |

|

|

|

|

|

|

| |

| | From one to two years | 56 | | 52 | | 63 | |

|

|

|

|

|

|

| |

| | | 240 | | 227 | | 240 | |

|

|

|

|

|

|

| |

| | | 451 | | 310 | | 352 | |

|

|

|

|

|

|

| |

| | | |

| 28 | STATUTORY AND OTHER INFORMATION | |

| | | | | | | | |

| | | 2006 | | 2005 | | 2004 | |

| | | $m | | $m | | $m | |

|

|

|

|

|

|

| |

| Fees payable to KPMG Audit Plc and its associates: | | | | | | |

| | Group audit fee | 3.1 | | 2.5 | | 1.7 | |

|

|

|

|

|

|

| |

| Fees payable to KPMG Audit Plc and its associates for other services: | | | | | | |

| | The audit of subsidiaries pursuant to legislation | 5.4 | | 5.0 | | 4.4 | |

|

|

|

|

|

|

| |

| | Other services pursuant to legislation | 4.1 | | 0.8 | | 1.4 | |

|

|

|

|

|

|

| |

| | Taxation | 1.2 | | 1.0 | | 2.0 | |

|

|

|

|

|

|

| |

| | All other services | 1.0 | | 2.2 | | 1.8 | |

|

|

|

|

|

|

| |

| Fees payable to KPMG Audit Plc in respect of the Company’s pension schemes: | | | | | | |

| | The audit of subsidiaries pension schemes | 0.5 | | 0.5 | | 0.5 | |

|

|

|

|

|

|

| |

| | | 15.3 | | 12.0 | | 11.8 | |

|

|

|

|

|

|

| |

Other services pursuant to legislation includes fees of $3.2m (2005 $nil, 2004 $nil) in respect of Sarbanes-Oxley s404. All other services include $nil (2005 $1.8m, 2004 $1.1m) in respect of Sarbanes-Oxley s404.

Taxation services consist of tax compliance services and tax advice.

Related party transactions

The Group had no material related party transactions which might reasonably be expected to influence decisions made by the users of these Financial Statements.

| Key management personnel compensation | | | | | | | |

| | | 2006 | | 2005 | | 2004 | |

| | | $’000 | | $’000 | | $’000 | |

|

|

|

|

|

|

| |

| Short-term employee benefits | | 21,321 | | 19,334 | | 17,382 | |

|

|

|

|

|

|

| |

| Post-employment benefits | | 3,191 | | 1,731 | | 1,595 | |

|

|

|

|

|

|

| |

| Share-based payments | | 8,417 | | 5,663 | | 6,086 | |

|

|

|

|

|

|

| |

| | | 32,929 | | 26,728 | | 25,063 | |

|

|

|

|

|

|

| |

Total remuneration is included within employee costs (Note 25). The prior periods have been restated.

Subsequent events

Other than the completion of the two collaboration agreements and the acquisition agreement signed in January 2007 (as set out in Note 26) there were no material subsequent events.

Back to Contents

| 29 | SHARE CAPITAL OF PARENT COMPANY |

| | Authorised | | Allotted, called-up and fully paid | |

| |

| |

|

|

|

|

| |

| | 2006 | | 2006 | | 2005 | | 2004 | |

| | $m | | $m | | $m | | $m | |

|

|

|

|

|

|

|

| |

| Issued Ordinary Shares ($0.25 each) | 383 | | 383 | | 395 | | 411 | |

|

|

|

|

|

|

|

| |

| Unissued Ordinary Shares ($0.25 each) | 217 | | – | | – | | – | |

|

|

|

|

|

|

|

| |

| Redeemable Preference Shares (£1 each – £50,000) | – | | – | | – | | – | |

|

|

|

|

|

|

|

| |

| | 600 | | 383 | | 395 | | 411 | |

|

|

|

|

|

|

|

| |

The total authorised number of Ordinary Shares at 31 December 2006 was 2,400,000,000, of which 1,532,245,608 Ordinary Shares were in issue.

The Redeemable Preference Shares carry limited class voting rights and no dividend rights. This class of shares is capable of redemption at par at the option of the Company on the giving of seven days’ written notice to the registered holder of the shares.

The movements in share capital during the year can be summarised as follows:

| | No. of shares | | | |

| | (million) | | $m | |

|

|

|

| |

| At 1 January 2006 | 1,581 | | 395 | |

|

|

|

| |

| Issues of shares | 23 | | 6 | |

|

|

|

| |

| Re-purchase of shares | (72 | ) | (18 | ) |

|

|

|

| |

| At 31 December 2006 | 1,532 | | 383 | |

|

|

|

| |

Share re-purchase

During the year the Company re-purchased, and subsequently cancelled, 72,205,192 Ordinary Shares at an average price of 3059 pence per share. The total consideration, including expenses, was $4,147m. The excess of the consideration over the nominal value has been charged against retained earnings.

Share schemes

A total of 23,548,800 Ordinary Shares were issued during the year in respect of share schemes. Details of movements in the number of Ordinary Shares under option are shown in Note 25; details of options granted to Directors are shown in the Directors’ Remuneration Report.

Shares held by subsidiaries

No shares in the Company are held by subsidiaries in any year.

Back to Contents

| 148 | ASTRAZENECA ANNUAL REPORT AND FORM 20-F INFORMATION 2006 |

PRINCIPAL SUBSIDIARIES

| | | | Percentage of voting | | | |

| At 31 December 2006 | Country | | share capital held | | Principal activity | |

|

|

|

|

|

| |

| UK | | | | | | |

| AstraZeneca UK Limited | England | | 100 | 1 | Research and development, | |

| | | | | | manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca Reinsurance Limited | England | | 100 | | Insurance and reinsurance underwriting | |

|

|

|

|

|

| |

| AstraZeneca Treasury Limited | England | | 100 | | Treasury | |

|

|

|

|

|

| |

| Continental Europe | | | | | | |

| NV AstraZeneca SA | Belgium | | 100 | | Manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca Dunkerque Production SCS | France | | 100 | | Manufacturing | |

|

|

|

|

|

| |

| AstraZeneca SAS | France | | 100 | | Research, manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca GmbH | Germany | | 100 | | Development, manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca Holding GmbH | Germany | | 100 | | Manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca SpA | Italy | | 100 | | Manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca Farmaceutica Spain SA | Spain | | 100 | | Manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca AB | Sweden | | 100 | | Research and development, | |

| | | | | | manufacturing, marketing | |

|

| |

| |

| |

| AstraZeneca BV | The Netherlands | | 100 | | Marketing | |

|

|

|

|

|

| |

| The Americas | | | | | | |

| AstraZeneca Canada Inc. | Canada | | 100 | | Research, manufacturing, marketing | |

|

|

|

|

|

| |

| IPR Pharmaceuticals Inc. | Puerto Rico | | 100 | | Development, manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca LP | US | | 99 | | Research and development, | |

| | | | | | manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca Pharmaceuticals LP | US | | 100 | | Research and development, | |

| | | | | | manufacturing, marketing | |

|

|

|

|

|

| |

| Zeneca Holdings Inc. | US | | 100 | | Manufacturing, marketing | |

|

|

|

|

|

| |

| Asia, Africa & Australasia | | | | | | |

| AstraZeneca Pty Limited | Australia | | 100 | | Development, manufacturing, marketing | |

|

|

|

|

|

| |

| AstraZeneca KK | Japan | | 80 | | Manufacturing, marketing | |

|

|

|

|

|

| |

The companies and other entities listed above are those whose results or financial position principally affected the figures shown in the Group Financial Statements. A full list of subsidiaries, joint ventures and associates will be annexed to the Company’s next annual return filed with the Registrar of Companies. The country of registration or incorporation is stated alongside each company. The accounting year ends of subsidiaries and associates are 31 December, except for Aptium Oncology, Inc. which, owing to local conditions and to avoid undue delay in the preparation of the Financial Statements, is 30 November. AstraZeneca operates through 240 subsidiaries worldwide. The Group Financial Statements consolidate the Financial Statements of AstraZeneca PLC and its subsidiaries at 31 December 2006. Products are manufactured in 19 countries worldwide and are sold in over 100 countries.

Back to Contents

| ADDITIONAL INFORMATION FOR US INVESTORS | 149 |

ADDITIONAL INFORMATION FOR US INVESTORS

INTRODUCTION

The accompanying consolidated Financial Statements included in this Annual Report are prepared in accordance with adopted IFRSs. There are certain significant differences between adopted IFRS and US GAAP which affect AstraZeneca’s net income and shareholders’ equity and, on pages 149 to 156, additional information under US GAAP is set out as follows:

| > | Summary of differences between adoptedIFRS and US GAAP accounting principles;pages 149 to 150. |

| | |

| > | Net income; page151. |

| | |

| > | US GAAP condensed consolidatedstatement of operations; page 151. |

| | |

| > | US GAAP statement of comprehensiveincome; page 152. |

| | |

| > | Stock-based compensation; page152. |

| | |

| > | Pension and post-retirement benefits;pages152 to 154. |

| | |

| > | Taxation; page 155. |

| | |

| > | Shareholders’ equity; page155. |

| | |

| > | Acquired intangible assets and goodwill;page156. |

DIFFERENCES BETWEEN INTERNATIONAL AND US ACCOUNTING PRINCIPLES

Purchase accounting adjustments

Under adopted IFRS, the merger of Astra and Zeneca is accounted for as a ‘merger of equals’ (pooling-of-interests) as a result of the business combinations exemption permitted by IFRS 1 ‘First-time Adoption of International Financial Reporting Standards’. Under US GAAP, the merger was accounted for as the acquisition of Astra by Zeneca using ‘purchase accounting’. Under purchase accounting, the assets and liabilities of the acquired entity are recorded at fair value. As a result of the fair value exercise, increases in the values of Astra’s property, plant and equipment and inventory were recognised and values attributed to its in-process research and development and existing products, together with appropriate deferred taxation effects. The difference between the cost of investment and the fair value of the assets and liabilities of Astra was recorded as goodwill. The amount allocated to in-process research and development was, as required by US GAAP, expensed immediately in the first reporting period after the business combination. Fair value adjustments to the recorded amount of inventory were expensed in the period the inventory was utilised. Additional amortisation and depreciation have also been recorded in respect of the fair value adjustments to tangible and intangible assets.

Under adopted IFRS, up until 31 December 2002, goodwill was required to be capitalised and amortised. From 1 January 2003, goodwill is tested annually for impairment but not amortised. Under US GAAP, there is an equivalent requirement, but the effective date was 1 January 2002.

Capitalisation of interest

AstraZeneca does not capitalise interest under adopted IFRS. US GAAP requires interest incurred as part of the cost of constructing property, plant and equipment to be capitalised and amortised over the life of the asset.

Deferred taxation

Under adopted IFRS, full provision for deferred taxation is made although there are a number of different bases from US GAAP on which this calculation is made; for example, the elimination of intra-group profit on inventories and share-based payment transactions. Deferred taxation is provided on a full liability basis under US GAAP, which requires deferred tax assets to be recognised without a valuation allowance if their realisation is considered to be more likely than not.

Pension and post-retirement benefits

Adopted IFRS requires that in respect of defined benefit plans, obligations are measured at discounted fair value whilst plan assets are recorded at fair value. The operating and financing costs of such plans are recognised separately in the income statement; service costs are spread systematically over the lives of employees and financing costs are recognised in the periods in which they arise. US GAAP adopts a similar approach. Under adopted IFRS, actuarial gains and losses are permitted to be recognised immediately in the statement of recognised income and expense. Under US GAAP, such actuarial gains and losses are permitted to be amortised on a straight-line basis over the average remaining service period of employees.

The funded status of all post-retirement benefit plans, being the difference between the fair value of the plan assets and its benefit obligation, is now recognised on the Group balance sheet under US GAAP.

Intangible assets

Under adopted IFRS, certain payments to third parties for rights to compounds in development are capitalised and amortised over their economic lives from launch. Under US GAAP, these payments are generally expensed.

In-process research & development (IPR&D)

Under adopted IFRS, IPR&D compounds acquired in a business combination are capitalised as intangible assets and amortised, generally on a straight line basis, over their economic lives from launch. Such intangible assets are subject to impairment testing at each balance sheet date. Deferred tax is provided for IPR&D assets acquired in a business combination. Under US GAAP, such assets are expensed immediately in the first reporting period after the business combination. Consequently no deferred tax is provided, resulting in a reconciling adjustment to deferred tax and goodwill.

Financial instruments and hedging activities

Under adopted IFRS, certain financial assets and certain financial liabilities (including derivatives) are recognised at fair value; movements in the fair value may be recorded in equity or through income, depending upon their designation. Under US GAAP, marketable securities are recognised at fair value, with movements in fair value taken to a separate component of equity. Derivatives are also measured at fair value with movements taken through income. However, financial liabilities are recorded at amortised cost.

Back to Contents

| 150 | ASTRAZENECA ANNUAL REPORT AND FORM 20-F INFORMATION 2006 |

ADDITIONAL INFORMATION FOR US INVESTORSCONTINUED

New accounting standards adopted

In May 2005, the FASB issued SFAS No. 154 ‘Accounting Changes and Error Corrections –a replacement of APB Opinion No. 20 and FASB Statement No. 3’. SFAS No. 154 requires retrospective application of prior periods’ financial statements for changes in accounting principle. SFAS No. 154 applies to accounting periods beginning after 15 December 2005 and has been adopted in the year. There has been no impact upon the results or net assets of AstraZeneca following adoption.

AstraZeneca has adopted the provisions of SFAS No. 158 ‘Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106, and 132(R)’ in 2006. SFAS No. 158 requires a company that sponsors a post-retirement defined benefit plan to fully recognise, as an asset or liability, the overfunded or underfunded status of its benefit plans on its year end balance sheet. The funded status is measured as the difference between the fair value of the plan’s assets and its projected benefit obligation for pension plans and accumulated post-retirement obligation for other retirement benefit plans. The initial impact of the standard due to unrecognised prior service costs or credit and net actuarial gains or losses as well as subsequent changes in the funded status is recognised as a component of accumulated other comprehensive income. The statement requires application as of the end of fiscal years ending after 15 December 2006 for recognition of the asset or liability related to the funded status of plans. Adoption of SFAS No. 158 has led to the recognition of a liability of $1,890m as at 31 December 2006 in respect of pension and post-retirement plans and a decrease to our accumulated OCI of $1,624m. Statement No. 158 does not change the computation of benefit expense recognised in the income statement, consequently there has been no amendment to this computation in the current year.

New accounting standards not adopted

In September 2006, the FASB issued SFAS No. 157 ‘Fair Value Measurements’ to provide a single definition of fair value, being a market-based measurement, and set out a fair value hierarchy. SFAS No. 157 is effective for fiscal years beginning after 15 November 2007. The adoption of SFAS No. 157 is not expected to have a material effect on the results or net assets of AstraZeneca.

In March 2006, the FASB issued SFAS No. 156 ‘Accounting for Servicing of Financial Assets’ requiring an entity to separately recognise a servicing asset or liability when it undertakes an obligation to service a financial asset in certain conditions. Such assets or liabilities must be initially measured at fair value and can be subsequently measured using the amortisation or fair value measurement methods. SFAS No. 156 is effective for fiscal years beginning after 15 September 2006. The adoption of SFAS No. 156 is not expected to have a material effect on the results or net assets of AstraZeneca.

In February 2006, the FASB issued SFAS No. 155 ‘Accounting for Certain Hybrid Financial Instruments’ to allow an entity to make an irrevocable election, on an instrument-by-instrument basis, to fair value in its entirety a hybrid financial instrument containing an embedded derivative, rather than bifurcate the embedded derivative from its host contract and fair value each component separately in accordance with SFAS No. 133 ‘Accounting for Derivative Instruments and Hedging Activities’. SFAS No. 155 is effective for fiscal years beginning after 15 September 2006. The adoption of SFAS No. 155 is not expected to have a material effect on the results or net assets of AstraZeneca.

In June 2006, the FASB issued FASB Interpretation No. 48 ‘Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109’ (FIN 48). The Interpretation establishes a two-step approach for recognising and measuring tax benefits, with tax positions only to be recognised when considered to be more likely than not sustained upon examination by the taxing authority. Explicit disclosures are required at the end of each reporting period about uncertainties in the entity’s tax position. The Company is currently in the process of quantifying the effect of adoption of FIN 48 on the results and net assets of AstraZeneca.

Back to Contents

| ADDITIONAL INFORMATION FOR US INVESTORS | 151 |

NET INCOME

As a result of the significant difference between the adopted IFRS and US GAAP treatment of the combination of Astra and Zeneca in the year of acquisition, and in the results of preceding periods, condensed statements of operations under US GAAP have been prepared for the benefit of US investors.

The following is a summary of the adjustments to net income and shareholders’ equity which would have been required if US GAAP had been applied instead of adopted IFRS.

| | 2006 | | 2005 | | 2004 | |

| For the years ended 31 December | $m | | $m | | $m | |

|

|

|

|

|

| |

| Net income for the period under adopted IFRS | 6,043 | | 4,706 | | 3,664 | |

|

|

|

|

|

| |

| Adjustments to conform to US GAAP | | | | | | |

| Purchase accounting adjustments (including goodwill and intangibles) | | | | | | |

| Deemed acquisition of Astra | | | | | | |

| Amortisation and other acquisition adjustments | (1,017 | ) | (1,019 | ) | (1,014 | ) |

|

|

|

|

|

| |

| In-process research and development | (502 | ) | – | | – | |

|

|

|

|

|

| |

| Capitalisation, less disposals and amortisation of interest | (21 | ) | (13 | ) | (1 | ) |

|

|

|

|

|

| |

| Deferred taxation | | | | | | |

| On fair values of Astra | 283 | | 283 | | 283 | |

|

|

|

|

|

| |

| Others | (101 | ) | 65 | | 55 | |

|

|

|

|

|

| |

| Pension and other post-retirement benefits expense | (128 | ) | (74 | ) | (52 | ) |

|

|

|

|

|

| |

| Financial instruments | 7 | | (35 | ) | 61 | |

|

|

|

|

|

| |

| In-licensed development intangibles | (193 | ) | (29 | ) | (46 | ) |

|

|

|

|

|

| |

| Other | 21 | | – | | 1 | |

|

|

|

|

|

| |

| Net income in accordance with US GAAP | 4,392 | | 3,884 | | 2,951 | |

|

|

|

|

|

| |

US GAAP CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

| 2006 | | 2005 | | 2004 | |

| For the years ended 31 December | $m | | $m | | $m | |

|

|

|

|

|

| |

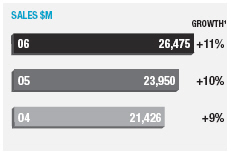

| Sales | 26,475 | | 23,950 | | 21,426 | |

|

|

|

|

|

| |

| Cost of sales | (5,562 | ) | (5,356 | ) | (5,152 | ) |

|

|

|

|

|

| |

| Distribution costs | (226 | ) | (211 | ) | (177 | ) |

|

|

|

|

|

| |

| Research and development | (4,042 | ) | (3,429 | ) | (3,900 | ) |

|

|

|

|

|

| |

| In-process research and development | (502 | ) | – | | – | |

|

|

|

|

|

| |

| Selling, general and administrative expenses | (9,238 | ) | (8,783 | ) | (8,003 | ) |

|

|

|

|

|

| |

| Amortisation of intangibles | (1,007 | ) | (1,009 | ) | (953 | ) |

|

|

|

|

|

|

|

| Other income and expense | 524 | | 193 | | 534 | |

|

|

|

|

|

| |

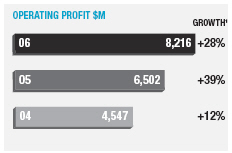

| Operating income | 6,422 | | 5,355 | | 3,775 | |

|

|

|

|

|

| |

| Net interest income/(expense) | 268 | | 123 | | (1 | ) |

|

|

|

|

|

| |

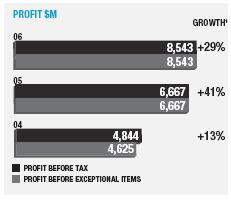

| Income from continuing operations before taxation | 6,690 | | 5,478 | | 3,774 | |

|

|

|

|

|

| |

| Taxes on income from continuing operations | (2,298 | ) | (1,594 | ) | (823 | ) |

|

|

|

|

|

| |

| Net income from continuing operations | 4,392 | | 3,884 | | 2,951 | |

|

|

|

|

|

| |

| Net income for the year | 4,392 | | 3,884 | | 2,951 | |

|

|

|

|

|

| |

| Weighted average number of $0.25 Ordinary Shares in issue (millions) | 1,564 | | 1,617 | | 1,673 | |

|

|

|

|

|

| |

| Dilutive impact of share options outstanding (millions) | 6 | | 1 | | 2 | |

|

|

|

|

|

| |

| Diluted weighted average number of $0.25 Ordinary Shares (millions) | 1,570 | | 1,618 | | 1,675 | |

|

|

|

|

|

| |

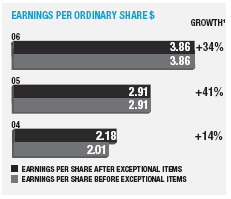

| Net income per $0.25 Ordinary Share and ADS in accordance with US GAAP – basic | $2.81 | | $2.40 | | $1.76 | |

|

|

|

|

|

| |

| Net income per $0.25 Ordinary Share and ADS in accordance with US GAAP – diluted | $2.80 | | $2.40 | | $1.76 | |

|

|

|

|

|

| |

| | | | | | | |

Back to Contents

| 152 | ASTRAZENECA ANNUAL REPORT AND FORM 20-F INFORMATION 2006 |

ADDITIONAL INFORMATION FOR US INVESTORSCONTINUED

US GAAP STATEMENT OF COMPREHENSIVE INCOME

| | 2006 | | 2005 | | 2004 | |

| For the years ended 31 December | $m | | $m | | $m | |

|

|

|

|

|

| |

| Net income for the year | 4,392 | | 3,884 | | 2,951 | |

|

|

|

|

|

| |

| Exchange gains/(losses) net of tax | 2,628 | | (3,279 | ) | 2,106 | |

|

|

|

|

|

| |

| Transitional obligation upon adoption of SFAS No. 158 | (17 | ) | – | | – | |

|

|

|

|

|

| |

| Prior service cost, upon adoption of SFAS No.158 | (89 | ) | – | | – | |

|

|

|

|

|

| |

| Net loss, upon adoption of SFAS No.158 | (1,358 | ) | – | | – | |

|

|

|

|

|

| |

| Recognition of minimum liability | (160 | ) | 181 | | – | |

|

|

|

|

|

| |

| Tax effect of adoption of SFAS No. 158 | 452 | | – | | – | |

|

|

|

|

|

| |

| Other movements, net of tax | (14 | ) | 37 | | 20 | |

|

|

|

|

|

| |

| Total comprehensive income | 5,834 | | 823 | | 5,077 | |

|

|

|

|

|

| |

Tax effects on exchange gains/(losses) were $(77)m and on other movements $44m. The cumulative exchange gains and losses (net of tax) onthe translation of foreign currency financial statements under US GAAP are set out in the following note:

| | | | | | | |

| | 2006 | | 2005 | | 2004 | |

| For the years ended 31 December | $m | | $m | | $m | |

|

|

|

|

|

| |

| Balance at 1 January | 1,063 | | 4,342 | | 2,236 | |

|

|

|

|

|

| |

| Movement in year | 2,628 | | (3,279 | ) | 2,106 | |

|

|

|

|

|

| |

| Balance at 31 December | 3,691 | | 1,063 | | 4,342 | |

|

|

|

|

|

| |

The cumulative total of other movements (net of tax) at 31 December 2006 was a charge of $1,102m (2005 credit of $84m, 2004 charge of $134m).STOCK-BASED COMPENSATION

The Group adopted SFAS No. 123(R) ‘Share-Based Payments’ in the prior year in respect of share options granted and applied its provisions retrospectively. The total compensation cost for non-vested awards not yet recognised at 31 December 2006 was approximately $166m and is expected to be recognised over a weighted average period of 21 months. $985m was received during 2006 from the exercise of share options and similar instruments granted under share-based payment arrangements and $51m tax benefit was realised from share options exercised during the year.

PENSION AND POST-RETIREMENT BENEFITS

For the purposes of US GAAP, the pension in respect of the UK retirement plans and of the retirement plans of the major non-UK subsidiaries has been restated in the following tables in accordance with the requirements of SFAS No. 158 ‘Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106 and 132(R)’. These plans comprise substantially all of the actuarial liabilities of all AstraZeneca retirement plans. The changes in projected benefit obligations, plan assets and details of the funded status of these retirement plans, together with the changes in the accumulated other post-retirement benefit obligations, under SFAS No. 158 are as follows:

| | Pension benefits | | Other post-retirement benefits | |

| |

| |

| |

| | 2006 | | 2005 | | 2004 | | 2006 | | 2005 | | 2004 | |

| Change in projected benefit obligation | $m | | $m | | $m | | $m | | $m | | $m | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Benefit obligation at beginning of year | 9,047 | | 8,707 | | 7,416 | | 257 | | 249 | | 242 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Service cost | 280 | | 256 | | 229 | | 12 | | 12 | | 11 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Interest cost | 462 | | 419 | | 385 | | 13 | | 14 | | 14 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Participant contributions | 33 | | 31 | | 30 | | – | | 1 | | 1 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Actuarial loss/(gain) | (104 | ) | 764 | | 328 | | 8 | | (1 | ) | (3 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Amendments | 20 | | – | | – | | 56 | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Settlement and curtailment | (290 | ) | – | | 10 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Benefits paid | (375 | ) | (305 | ) | (281 | ) | (18 | ) | (15 | ) | (18 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Expenses | (10 | ) | – | | – | | 1 | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Exchange | 1,063 | | (825 | ) | 590 | | 6 | | (3 | ) | 2 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Benefit obligation at end of year | 10,126 | | 9,047 | | 8,707 | | 335 | | 257 | | 249 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | |

Back to Contents

| ADDITIONAL INFORMATION FOR US INVESTORS | 153 |

PENSION AND POST-RETIREMENT BENEFITS CONTINUED

| | Pension benefits | | Other post-retirement benefits | |

|

| |

| |

| | 2006 | | 2005 | | 2004 | | 2006 | | 2005 | | 2004 | |

| Change in plan assets | $m | | $m | | $m | | $m | | $m | | $m | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Fair value at beginning of year | 7,368 | | 6,972 | | 5,905 | | 230 | | 217 | | 195 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Actual return on plan assets | 284 | | 1,134 | | 565 | | 30 | | 13 | | 22 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Group contribution | 310 | | 165 | | 280 | | 18 | | 13 | | 17 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Participant contributions | 33 | | 31 | | 30 | | – | | 1 | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Settlements | (186 | ) | – | | – | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Benefits paid | (375 | ) | (305 | ) | (281 | ) | (18 | ) | (15 | ) | (17 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Exchange | 887 | | (629 | ) | 473 | | (1 | ) | 1 | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Expenses | (10 | ) | – | | – | | 1 | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Fair value of plan assets at end of year | 8,311 | | 7,368 | | 6,972 | | 260 | | 230 | | 217 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Funded status of plans | (1,815 | ) | (1,679 | ) | (1,735 | ) | (75 | ) | (27 | ) | (32 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Unrecognised net loss | – | | 1,420 | | 1,644 | | – | | 32 | | 29 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Prior service cost not recognised | – | | 25 | | 15 | | – | | (8 | ) | (11 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Unrecognised net obligation on implementation | – | | – | | (1 | ) | – | | 19 | | 25 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | (1,815 | ) | (234 | ) | (77 | ) | (75 | ) | 16 | | 11 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Adjustments to recognise minimum liability: | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Intangible assets | – | | – | | (36 | ) | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Accumulated other comprehensive income | – | | (36 | ) | (217 | ) | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Accrued benefit (liability)/asset | (1,815 | ) | (270 | ) | (330 | ) | (75 | ) | 16 | | 11 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 2006 – before | | | |

| | adoption of | | | |

| | SFAS No. 158 | | 2005 | |

| Reconciliation of funded status | $m | | $m | |

|

|

|

| |

| Funded status | (1,890 | ) | (1,706 | ) |

|

|

|

| |

| Unrecognised net loss | 1,554 | | 1,452 | |

|

|

|

| |

| Unrecognised prior service cost | 89 | | 17 | |

|

|

|

| |

| Unrecognised transition obligation | 17 | | 19 | |

|

|

|

| |

| Adjustment to recognise minimum liability | (196 | ) | (36 | ) |

|

|

|

| |

| Net amount recognised | (426 | ) | (254 | ) |

|

|

|

| |

| | 2006 | |

| Funded status | $m | |

|

| |

| Projected benefit obligation | (10,461 | ) |

|

| |

| Fair value of plan assets | 8,571 | |

|

| |

| Funded status | (1,890 | ) |

|

| |

| Current liability | – | |

|

| |

| Non-current liabilities | (1,890 | ) |

|

| |

At 31 December 2006, the projected benefit obligation, accumulated benefit obligation and fair value of the plan assets in respect of the pension plans above with accumulated benefit obligations in excess of plan assets were $8,087m, $7,088m and $6,352m (2005 $6,984m, $5,990m and $5,566m), respectively. The total of accumulated benefit obligations for the pension plans was $9,043m (2005 $7,965m). The measurement date for the plan assets and benefit obligations set out above was 31 December 2006. Contributions to the plans in 2007 are estimated to be $266m.

Back to Contents

| 154 | ASTRAZENECA ANNUAL REPORT AND FORM 20-F INFORMATION 2006 |

ADDITIONAL INFORMATION FOR US INVESTORSCONTINUED