Exhibit 15.1

What science can do

AstraZeneca Annual Report and Form 20-F Information 2016

Learn about our main therapy areas:

|

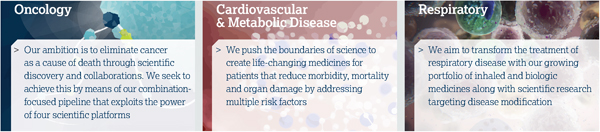

Oncology Our ambition is to eliminate cancer as a

cause of death through scientific discovery

and collaborations  See page 25 See page 25

|

|

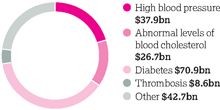

Cardiovascular & Metabolic Disease We address multiple risk factors to reduce

cardiovascular morbidity, mortality and

organ damage.  See page 30 See page 30

|

|

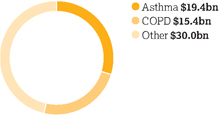

Respiratory We aim to transform the treatment of

respiratory disease with our growing

portfolio of medicines.  See page 35 See page 35

|

Front cover

Treatment for hyperkalaemia

Current treatments for hyperkalaemia, a potentially

life-threatening condition associated with chronic kidney

disease and chronic heart failure, are poorly tolerated by

patients. AstraZeneca is developing a treatment which traps

potassium in the gut and removes it from the body.

Financial highlights

| | |

| | |

| |

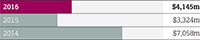

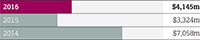

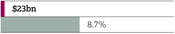

| Total Revenue* | | Net cash flow from operating activities |

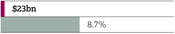

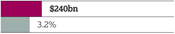

down 7% to $23,002 million at actual rate

of exchange (down 5% at CER) | | up 25% at actual rate of exchange

to $4,145 million |

| |

| |  |

| |

| $23bn | | $4.1bn |

| | |

| | |

| | |

| |

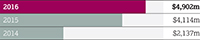

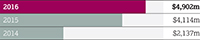

| Reported operating profit | | Core operating profit |

up 19% at actual rate of exchange

to $4,902 million (up 9% at CER) | | down 3% at actual rate of exchange

to $6,721 million (down 7% at CER) |

| |

| |  |

| |

| $4.9bn | | $6.7bn |

| | |

| | |

| |

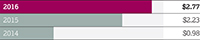

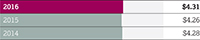

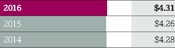

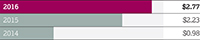

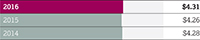

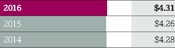

| Reported EPS | | Core EPS |

for the full year up 24% at actual rate of

exchange to $2.77 (up 9% at CER) | | for the full year up 1% at actual rate of

exchange to $4.31 (down 5% at CER) |

| |

| |  |

| |

| $2.77 | | $4.31 |

Financial Review from page 62

Financial Review from page 62

| * | As detailed on page 142, Total Revenue consists |

| | of Product Sales and Externalisation Revenue. |

| | | | | | |

| | For more information within this Annual Report | |  | | For more information see www.astrazeneca.com |

This Annual Report is also available on our website,

www.astrazeneca.com/annualreport2016

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 1 |

Strategic Report

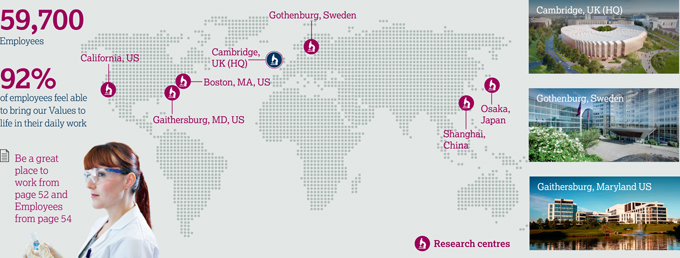

AstraZeneca at a glance

A global biopharmaceutical business delivering medicines to patients through innovative science and excellence in development and commercialisation.

Our strategic priorities reflect how we are working to achieve our Purpose of pushing the boundaries of science to deliver life-changing medicines:

| | | | | | | | | | |

| | 1 Achieve scientific leadership | |  | | 2 Return to growth | |  | | 3 Be a great place to work |

| | | | | | |

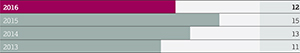

A science-led, innovation strategy Distinctive R&D capabilities: small molecule and biologic medicine, including immunotherapies and protein engineering, as well as devices, biomarkers and translational science | | 12 new molecular entities (NMEs) in Phase III/pivotal Phase II or under regulatory review | | 12 | | |

| |  | | |

Strategy and key performance indicators from page 16

Strategy and key performance indicators from page 16

Broad R&D platform in three main therapy areas

Portfolio of specialty and primary care products

| | | | | | | | | | | | |

| | | |  | | | |  | | | |  |

|

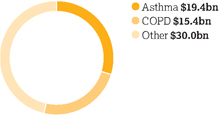

> Oncology sales represented 16% of Total Product Sales >Lynparza (sales of $218 million) available in 31 countries by end 2016 >Iressasales of $513 million, down 6% (5% at CER), as we prioritised Tagrisso | | | | > CVMD sales represented 38% of Total Product Sales > Sales ofOnglyza in US declined 10% to $376 million, as we prioritisedFarxiga > In the US,Crestor sales declined 57% to $1,223 million, reflecting entry of genericCrestor | | | | > Respiratory sales represented 22% of Total Product Sales >Pulmicort sales of $1,061 million, up 5% (8% at CER) >Bevespi Aerosphere inhalation aerosol launched in the US in January 2017 | | | | > Other sales represented 24% of Total Product Sales >Nexium sales of $2,032 million, down 19% (18% at CER) andSeroquel XR sales of $735 million, down 28% (27% at CER) following loss of exclusivity |

Therapy Area Review from page 23 and Achieve Scientific Leadership from page 45

Therapy Area Review from page 23 and Achieve Scientific Leadership from page 45

| | |

| 2 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

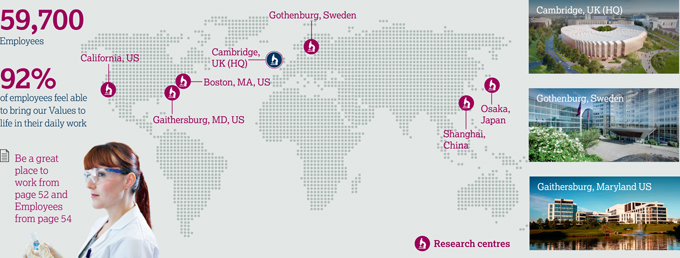

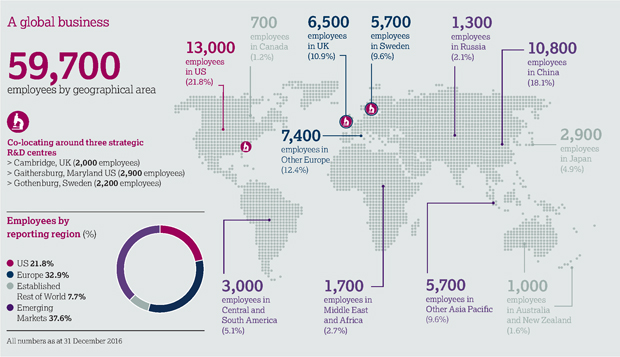

Global commercial presence, with strength in Emerging Markets

| | | | | | | | | | | | |

US | | | | Europe | | | | Established Rest of World | | | | Emerging Markets |

| | | | | | |

| | | | | | | | | | | | |

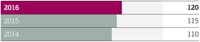

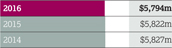

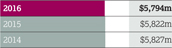

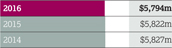

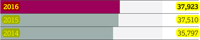

$7,365m Product Sales 2015: $9,474m 2014: $10,120m | | | | $5,064m Product Sales 2015: $5,323m 2014: $6,638m | | | | $3,096m Product Sales 2015: $3,022m 2014: $3,510m | | | | $5,794m Product Sales 2015: $5,822m 2014: $5,827m |

Commercial Highlights: Growth Platforms grew by 4% (5% at CER) in 2016

| | |

> Emerging Markets: Stable (growth of 6% at CER), supported by China, up 4% (10% at CER) to $2,636 million > Diabetes: Growth of 9% (11% at CER), asFarxiga/Forxiga became our largest-selling Diabetes medicine > Japan: Sales up 8% (decline of 3% at CER), reflecting exchange rate impact and a biennial price reduction | | >Brilinta/Brilique sales grew by 36% (39% at CER) > Respiratory: A decline of 5% (3% at CER), reflecting US pricing pressure forSymbicort > New Oncology: Strong sales with Tagrisso delivering sales of $423 million in its first full year |

Return to growth from page 48

Return to growth from page 48

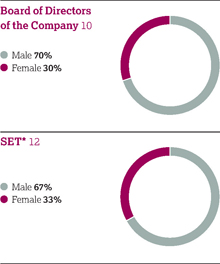

Our talented employees are committed to achieving our Purpose in a sustainable way and our Values foster a strong AstraZeneca culture

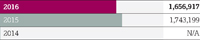

| | | | | | | | | | | | | | | | | | |

Our capital-allocation priorities

strike a balance between the

interests of the business, our

financial creditors and

shareholders, and support

our progressive dividend policy | | Distributions to shareholders $m | | | | | | | | | |

| | | |

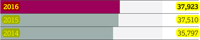

| | | | | | | 2016 | | | 2015 | | | 2014 | |

| | | |

| | Dividends | | | | | | | 3,561 | | | | 3,486 | | | | 3,521 | |

| | | |

| | Proceeds from issue of shares | | | | | | | (47) | | | | (43) | | | | (279) | |

| | | |

| | Total | | | | | | | 3,514 | | | | 3,443 | | | | 3,242 | |

| | | |

| | Dividend per Ordinary Share $ | | | | | | | | | |

| | | |

| | | | | | | 2016 | | | 2015 | | | 2014 | |

| | | |

| | Dividend per Ordinary Share | | | | | | | 2.80 | | | | 2.80 | | | | 2.80 | |

| | | |

| | Dividend per Ordinary Share for 2016 | | | | | | | | | |

| | | |

| | | | $ | | | Pence | | | SEK | | | Payment date | |

| | | |

| | First interim dividend | | | 0.90 | | | | 68.7 | | | | 7.81 | | | | 12 September 2016 | |

| | | |

Financial Review from page 62 Financial Review from page 62 | | Second interim dividend | | | 1.90 | | | | 150.2 | | | | 16.57 | | | | 20 March 2017 | |

| | | |

| | Total | | | 2.80 | | | | 218.9 | | | | 24.38 | | | | | |

| | | |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 3 |

Strategic Report

Chief Executive Officer’s Review

| | | | |

| |  2017 should be 2017 should be

a turning point in our journey as we bring new medicines to patients across the globe.” year with $423 million in Product Sales in its first full year. In diabetes,Farxiga/Forxiga is a global leader in the SGLT2 class of diabetes treatments with a 35% volume share. Product Sales ofBrilinta/Briliquereached $839 million and in many countries it is the leading medicine for patients discharged with acute coronary syndrome. While AstraZeneca benefits from realising the potential of the new medicines emerging from our pipeline, we never forget that the main beneficiaries of our life-changing medicines are patients. For instance, since its launch at the end of 2014, we have treated nearly 5,000 cancer patients withLynparza and launched it in 31 countries with seven ongoing reviews. Investing for the future As we look ahead to 2017 and beyond, continued investment in our pipeline keeps us on track to return to sustainable growth in line with our targets. Examples of how we are investing for the future for the benefit of patients appear throughout this Annual Report. However, none is more significant than our investment in Cambridge, UK, as illustrated on page 7. Cambridge, along with Gaithersburg, MD, US and Gothenburg in Sweden, is one of our three strategic R&D centres and it also became our global corporate headquarters in May 2016. Our activities there demonstrate our focus on science, collaborative way of working and commitment to sustainability. Achieve scientific leadership The panel to the right provides an overview of how we performed against each of our three strategic priorities in 2016. At the heart of our plans to achieve scientific leadership is our focus on three therapy areas. |

| | A transitional phase The first phase in our journey ended in 2015 and was focused on rebuilding our pipeline. 2016 was a crucial year in the second stage of our journey, as we manage a transitional period of patent expiries, drive our Growth Platforms and roll out our new medicines. While now largely behind us, the impact of the loss of exclusivity on some of our most important medicines has been significant and will continue in 2017. Between 2011 and 2016, Product Sales in Established Markets of brands that have lost exclusivity, includingCrestor, a statin,Nexium, a proton pump inhibitor andSeroquel, an anti-psychotic, have reduced from $20 billion to $6 billion. Unfavourable currency movements account for $2 billion of this $14 billion reduction. This decline represents a significant ‘headwind’, but we have made significant progress rebuilding our Company for the future and preparing for a new period of growth driven by our pipeline delivery. In parallel to managing our legacy brands decline, we have launched a significant number of new medicines and increased revenues from our recently launched medicines. For example,Tagrisso was only launched in November 2015 and became our biggest lung cancer medicine during the | |

| | |

| 4 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

2016 Strategic priorities overview

| | |

| | Achieve scientific leadership |

| | > | 11 approvals of NMEs or major LCM projects in major markets |

| | – | Oncology:Tagrisso– lung cancer (EU, JP) and ctDNA blood test (US, JP) |

| | – | CVMD:Brilinta/Brilique– post myocardial infarction (EU) and acute coronary syndromes and post myocardial infarction (JP);Qtern – Type 2 diabetes (EU) |

| | – | Respiratory:Bevespi Aerosphere(PT003) – COPD (US) |

| | – | Other:Zurampic – gout (EU);Zavicefta – serious infections (EU); Pandemic Live Attenuated Influenza Vaccine – pandemic influenza (EU) |

| | > | 7 Phase III NME investment decisions |

| | > | 14 NME or major LCM regulatory submissions in major markets:Faslodex – breast cancer (US, EU, JP);Tagrisso– lung cancer (CN);Tagrisso– lung cancer (AURA3 study for full approval) (US, EU); durvalumab – bladder cancer (US); DURATION-8 (exenatide+dapagliflozin) (EU); benralizumab – severe asthma (US, EU); lesinurad+allopurinol FDC – gout (US); three further submissions made await regulatory acceptance |

| | > | 10 accelerated reviews included |

| | – | Breakthrough Therapy Designation: durvalumab – bladder cancer (US) |

| | – | Orphan Drug Designation: acalabrutinib – blood cancers (EU); selumetinib – thyroid cancer (US); inebilizumab (MEDI-551) – neuromyelitis optica (US) |

| | – | Fast Track Designation:Lynparza– ovarian cancer (2nd line) (US), prostate cancer (2nd line) (US); MEDI8852 – hospitalised influenza (US); AZD3293 – Alzheimer’s disease (US) |

| | – | Priority Review Designation:Tagrisso(CN); durvalumab – bladder cancer (US) |

| | > | 22 projects discontinued |

| | |

| | Return to growth |

| | > | 7% decrease in Total Revenue to $23,002 million at actual rate of exchange; comprising Product Sales of $21,319 million (down 10%) and Externalisation Revenue of $1,683 million (up 58%) |

| | – | At CER, Total Revenue declined by 5% |

| | > | 4% increase in Growth Platforms revenue (5% at CER) contributing 63% of Total Revenue |

| | – | Emerging Markets: Stable (growth of 6% at CER) to $5,794 million, supported by China, up 4% (10% at CER) to $2,636 million |

| | – | Diabetes: Growth of 9% (11% at CER), asFarxiga/Forxigabecame our largest-selling Diabetes medicine |

| | – | Japan: Sales up 8% (down 3% at CER) to $2,184 million, reflecting exchange rate impact and a biennial price reduction |

| | – | Brilinta/Briliquesales grew by 36% (39% at CER) to $839 million |

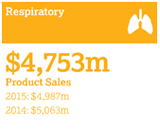

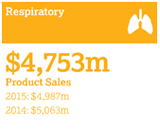

| | – | Respiratory: A decline of 5% (3% at CER) to $4,753 million, reflecting US pricing pressure forSymbicort |

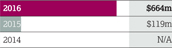

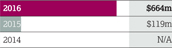

| | – | New Oncology: Strong sales of $664 million, withTagrissodelivering sales of $423 million in its first full year |

| | > | US revenue was down 22% to $7,365 million; Europe down 5% to $5,064 million; and Established ROW rose by 2% to $3,096 million (all at actual rate of exchange) |

| | |

| | Be a great place to work |

| | > | Decline in scores in our employee survey (Pulse) reflects impact of reshaping the business |

| | > | Second in Pharmaceuticals, Biotechnology and Life Sciences industry group of Dow Jones Sustainability Index |

| | > | Biggest riser in the Access to Medicine Index since the last survey, moving to 7th place in 2016 from 15th in 2014 |

Some of the most exciting science being undertaken at the moment is in Oncology as we explore the potential for novel therapies. As you can see, 2016 was a significant year for our Oncology team: we had four regional approvals, seven expedited reviews and seven regulatory submissions for our medicines. Looking ahead, we have the potential to deliver our third Oncology medicine in 2017 – halfway to our 2020 target in just four years.

Of course, pushing the boundaries of science means we sometimes encounter setbacks. Thus, in 2016, for example, we voluntarily withdrew the marketing authorisation application submitted to the EMA for cediranib in advanced ovarian cancer. However, there remain ongoing studies to investigate cediranib as a combination partner withLynparza and other compounds. In addition, three of our Oncology trials failed to meet their primary endpoints. Another development showed our Values in action. In pushing the boundaries of science with clinical trials of durvalumab for head and neck squamous cell carcinoma, we observed bleeding events. Following the precautionary principle, we put patients first and placed a voluntary hold on the enrolment of new patients. This was followed by a partial clinical hold from the FDA. However, by following the science, we provided a comprehensive analysis about the events that had been observed and the FDA’s hold was subsequently lifted.

In 2016, our Cardiovascular & Metabolic Disease team saw three approvals, four regulatory submissions and twoBrilinta trials which failed to meet their primary endpoints. We received a complete response letter from the FDA for ZS-9 for the treatment of hyperkalaemia and subsequently made a resubmission. In diabetes, positive results from our DURATION-8 trials demonstrated the efficacy ofFarxiga andBydureon in combination for the treatment of Type 2 diabetes and should help us maximise the value of our Diabetes portfolio.

During the year,Bevespi Aerosphere was approved in the US and launched in early 2017. Our Respiratory team also made three regulatory submissions, including two in respect of benralizumab for treating severe, uncontrolled asthma. We believe benralizumab, which would be our first Respiratory biologic, will become an

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 5 |

Strategic Report

Chief Executive Officer’s Reviewcontinued

important medicine for patients with severe asthma and potentially COPD, as well as an important growth driver for our Company, broadening and deepening our offering in the Respiratory market.

Business development and collaboration are at the heart of the way AstraZeneca operates. It is particularly evident in our work in Other Disease Areas. For example, we enter into collaborations to maximise the potential of key products that fall outside our main therapy areas and bring them to patients quicker. Examples in 2016 include our development and commercialisation agreements with LEO Pharma for brodalumab for psoriasis and tralokinumab for dermatitis, and with Allergan for MEDI2070 for inflammatory diseases. In Alzheimer’s disease, together with our partner Lilly, we obtained a Fast Track Designation for the BACE inhibitor and have entered a second collaboration with them to co-develop MEDI1814. We are also partnering some of our in-line products that we believe still have growth potential but which cannot receive promotional support as we focus our resources on our main therapy areas. An example is the agreement we reached with China Medical System Holdings for the promotion of Plendil in China: our partner will manage the commercialisation and both companies will share the benefits. Finally, we have been divesting smaller non-core products that will be better managed by companies that can focus on them. The value unlocked through these deals is reinvested in our pipeline, creating more long-term value through our main therapy areas.

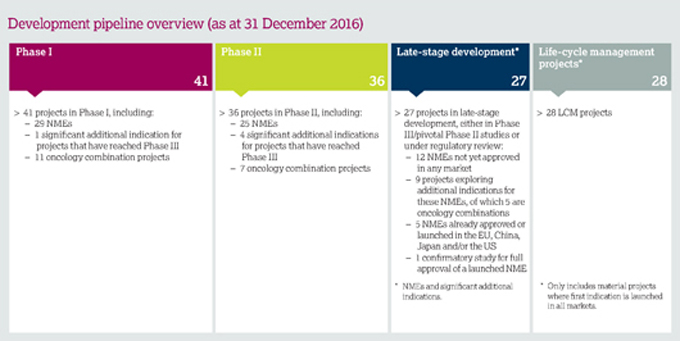

Prioritised and accelerated pipeline

Since we announced our science-led strategy in 2013, we set ourselves some ambitious pipeline targets for the end of 2016. For example, we aimed for nine to 10 new molecular entities (NMEs) in Phase III or registration: by the end of 2016, there were 12 such projects. We also set ourselves the target of eight to 10 new medicines and major line extension regulatory approvals in 2015 to 2016 and achieved a total of eight. This is a significant improvement compared to our historical pipeline performance.

We also made substantial progress in reshaping our research and early development efforts to help us to produce a steady stream of new products that will

support our long-term growth: we believed we had the potential for 12 to 16 Phase II starts in 2015 to 2016. In fact, we achieved 25. Looking ahead, we believe we have the potential for an unprecedented number of submissions in the next 24 months, with around half in our Oncology therapy area. To ensure we can deliver this potential, in April we announced plans to sharpen further the prioritisation of investments in our main therapy areas, particularly Oncology. We also want to increase partnering in relation to projects in our inflammation, infection and neuroscience disease areas. The 10 strategic transactions we undertook in 2016 bear witness to the progress we have made in that regard. We also took action to align costs to our changing business shape and streamline our operations.

Return to growth

Our Return to growth is underpinned by our Growth Platforms, shown in the panel. As our strategy has progressed, so our Growth Platforms have evolved – New Oncology (new products) was added and, from January 2017, New CVMD combined our Diabetes andBrilinta/BriliquePlatforms. As the treatment of diabetes becomes more focused on cardiovascular risk reduction based on recent data, we believe there are clear synergies managing diabetes andBrilinta/Brilique together.

The panel shows how our Growth Platforms performed in 2016. Despite increasing competition, pricing pressures and geopolitical instability, they grew by 4% at actual exchange rates (5% at CER) and now represent 63% of all revenues. Emerging Markets are particularly important in achieving our goals. This importance was recognised towards the end of the year with the appointment of Leon Wang, our Country President in China, as Executive Vice-President of Asia Pacific and a member of the Senior Executive Team.

Be a great place to work

None of the progress we are making in achieving our strategic objectives would be possible without our people; we want to ensure AstraZeneca is a great place to work and I am very grateful to each and every employee for all their efforts throughout the year.

Employee opinion surveys help us measure satisfaction and engagement and how we are doing in our aim to be a great place to work. Our most recent survey, carried out in December 2016, showed a decline compared to our very high 2015 score, although results are in line with the ‘global pharma norm’. This decline might not be unexpected given the challenges of the strategic journey on which we are embarked and the restructuring we undertook in 2016 as we continued losing sales to patent expiries. Nevertheless, we are focused on improving performance in those areas employees tell us are important drivers of employee engagement. These include people development and line manager communication.

One area in which we made significant progress during 2016, and which the Chairman reports on in more detail in his Statement on page 82, was external recognition for our commitment to sustainability – whether that be in the Dow Jones Sustainability Index or Access to Medicine Index, or in the recognition of our science-based environmental targets. During the year, the Executive team also reviewed and refreshed our sustainability strategy.

Looking ahead

Our financial results for 2016 were in line with expectations and reflected our ongoing transition. We brought a sharper strategic focus to our three main therapy areas, boosting pipeline productivity further. Our underlying business is growing as the new AstraZeneca emerges, driven by competitive franchises and Emerging Markets.

2017 should be a turning point in our journey as we bring new medicines to patients across the globe. It is an exciting time as we approach the inflection point for our anticipated return to long-term growth, built on the foundations of a science-led pipeline.

Pascal Soriot

Chief Executive Officer

| | |

| 6 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

| | | | | | | | |

| | Being committed to protecting the environment, we are: > working towards a Building Research Establishment ‘excellent’ rating for sustainability performance for our R&D centre in addition to delivering a low carbon emission facility > building the largest ground source heat pump system in Europe and a combined heat and power station to meet on-site energy needs. To inspire the next generation of scientists, we: > have three schemes to support more than 80 PhD scholarships and eight clinical lectureships > partner with the Cambridge Science Centre to ensure life science education activities reach underserved communities in the wider Cambridgeshire area > have an active community support scheme, involving more than 160 staff volunteers, focused around science-based educational events for young people. | | |

| | We announced our move to Cambridge in 2013. In doing so, we join MedImmune who have been in the city for 25 years. We begin the staged occupation of our new state-of-the-art building (illustrated above and right) in 2018 and already have some 2,000 staff actively engaged in Cambridge’s scientific, academic, clinical and business life. They are realising the value of being located at a world-leading academic and life science hub. As a global science-led business, we have: > provided new life science businesses with access to more than 60 mentors from across AstraZeneca, including support for the University of Cambridge Judge Business School’s ‘Accelerate’ programme

| | > shaped the laboratory spaces at our R&D centre collaboratively, involving our scientists in the design and commissioning process, including an on-site teaching lab for science outreach As a scientific partner, we have: > initiated over 130 collaborations with Cambridge organisations, including over 100 with the University of Cambridge > collaborated with Microsoft to develop a new cancer treatment modelling system > established the CRUK MedImmune Alliance Laboratory to provide capabilities to discover novel biologics and diagnostics > established a world-class mass spectroscopy capability with the Laboratory of Molecular Biology and the University of Cambridge > developed the AstraZeneca Medical Research Council UK Centre for Lead Discovery. | |

Key facts 130  Over 130 collaborations in Cambridge 2,000  Around 2,000 employees in Cambridge  Watch the video at Watch the video at

www.astrazeneca.com | | |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 7 |

Strategic Report | Strategy

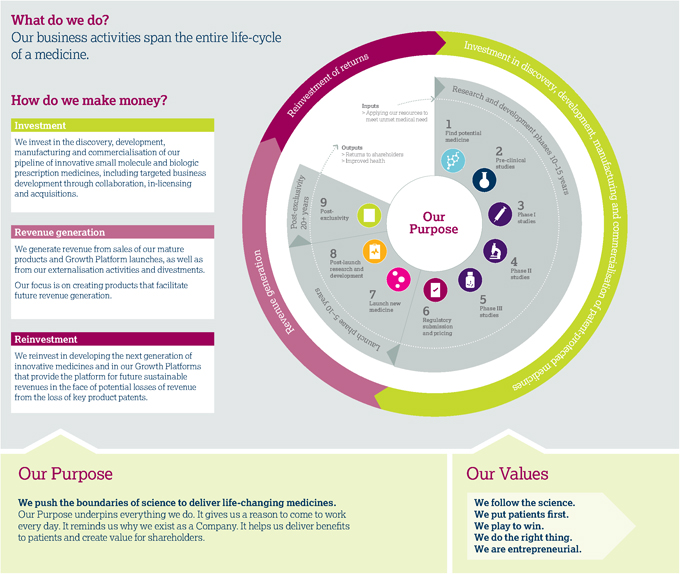

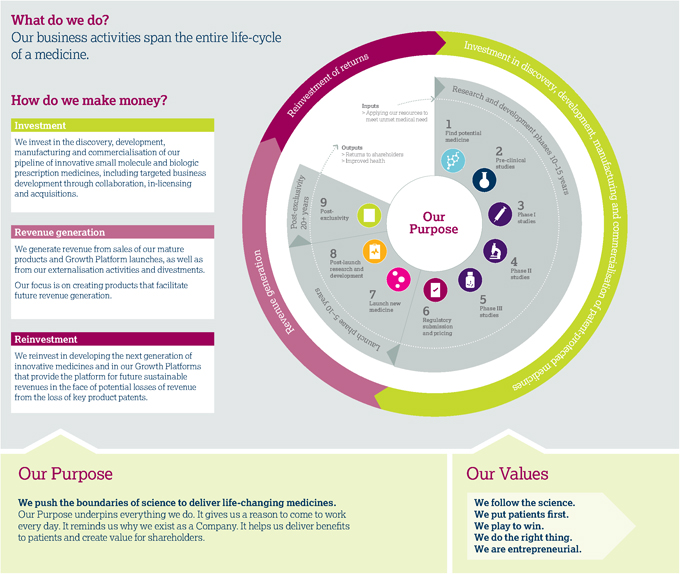

Business model and life-cycle of a medicine

AstraZeneca at a glance summarises our business. In this section, we review our business model – how we make money, the resources we need and how we add value across the entire life-cycle of a medicine.

Why AstraZeneca?

We are an integrated, science-led biopharmaceutical Company with a strategic focus on three main therapy areas built around our differentiated:

| | |

| 8 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

Life-cycle of a medicine

| | | | | | | | |

Research and development phases 10–15 years   |

| | | | | | | | | |

1 Find potential medicine > Identify unmet medical need aligned with our three therapy areas and undertake scientific research to identify potential new medicines > Initiate process of seeking patent protection 2 Pre-clinical studies > Conduct laboratory and animal studies to understand if the potential medicine is safe to introduce into humans and in what quantities > Determine likely efficacy, side effect profile and maximum dose estimates | | | | 3 Phase I studies > Begin clinical studies with small groups of healthy human volunteers (small molecules) or patients (biologics) to understand how the potential medicine is absorbed into the body, distributed around it and excreted > Determine approximate dosage and identify side effects 4 Phase II studies > Conduct studies on small- to medium-sized groups of patients to test effectiveness and tolerability of the medicine and determine optimal dose > Design Phase III studies to generate data needed for regulatory approvals and pricing/ reimbursement globally | | | | 5 Phase III studies > Engage in studies in a larger group of patients to gather information about effectiveness and safety of the medicine and evaluate the overall benefit/risk profile > Initiate branding for the new medicine in preparation for its launch 6 Regulatory submission and pricing > Seek regulatory approvals for manufacturing, marketing and selling the medicine > Submit clinical data to regulatory authorities (and, if requested, generate further data increasingly in real-world settings) to demonstrate the safety and efficacy of the medicine to enable them to decide on whether to grant regulatory approvals |

| | | | | | | | | |

Launch phase 5–10 years   | | | |  Post-exclusivity 20+ years Post-exclusivity 20+ years

|

| | | | | | | | | |

7 Launch new medicine > Raise awareness of patient benefit and appropriate use, market and sell medicine > Clinicians begin to prescribe medicines and patients begin to benefit > Continuously monitor, record and analyse reported side effects. Review need to update the side effect warnings to ensure that patients’ wellbeing is maintained > Assess real-world effectiveness, and opportunities to support patients and prescribers, to achieve maximum benefit from the medicine | | | | 8 Post-launch research and development > Conduct studies to further understand the benefit/risk profile of the medicine in larger and/ or additional patient populations > Life-cycle management activities to broaden understanding of a medicine’s full potential > Consider additional diseases or aspects of disease to be treated by or better ways of administering the medicine > Submit data packages with requests for life-cycle management to regulatory authorities for review and approval | | | | 9 Post-exclusivity > Patent expiry and generic entry > Reinvestment of returns |

| | | | | | | | | |

Note: This is a high-level overview of a medicine’s life-cycle and is illustrative only. It is neither intended to, nor does it, represent the life-cycle of any particular medicine or of every medicine discovered and/or developed by AstraZeneca, or the probability of success or approval of any AstraZeneca medicine.

| | | | | | |

Our Values determine how we work together and the behaviours that drive our success. Our Values guide our decision making, define our beliefs and foster a strong AstraZeneca culture. | | | | Sustainability We want to be valued and trusted by our stakeholders as a source of great medicines over the long term. Our sustainability commitments, which are driven by our Purpose and Values, underpin our business model and support the delivery of our business strategy.  Business Review from page 42 Business Review from page 42

| |

|

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 9 |

Strategic Report | Strategy

Business model and life-cycle of a medicinecontinued

What does our business model require to be successful?

| | |

| | |

A talented and diverse workforce |

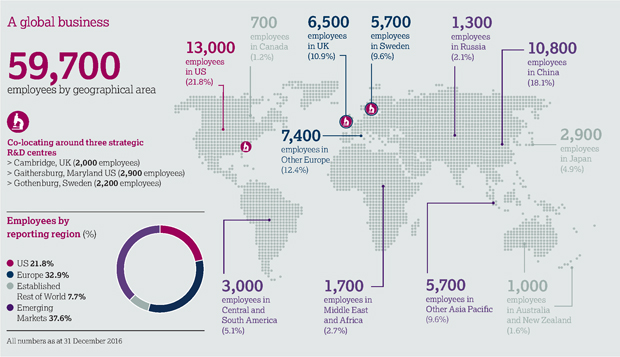

We need to acquire, retain and develop a talented and diverse workforce united in pursuit of our Purpose and Values and fostering a strong AstraZeneca culture. | | 59,700 employees  See Employees from page 54 See Employees from page 54

|

A leadership position in science |

We need to achieve scientific leadership if we are to deliver life-changing medicines. To that end, we need to focus on innovative science, prioritise and accelerate our pipeline and transform our innovation and culture model. | | $5.9bn invested in our science  See Achieve scientific leadership from page 45 and R&D resources on page 59 See Achieve scientific leadership from page 45 and R&D resources on page 59

|

Commercialisation skills |

We need a strong global commercial presence and skilled people to ensure that we can successfully launch our medicines, that they are available when needed and that patients have access to them. | | >100 countries in which we are active  See Return to growth from page 48 See Return to growth from page 48

|

Intellectual property |

We need to create and protect our IP rights. Developing a new medicine requires significant investment over many years, with no guarantee of success. For our investments to be viable, we seek to protect new medicines from being copied for a reasonable period of time through patent protection. | | >100 countries where we obtain patent protection  See Intellectual Property from page 57 See Intellectual Property from page 57

|

A robust supply chain |

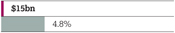

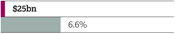

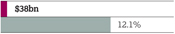

We need a supply of high-quality medicines, whether from one of the 31 Operations sites in 18 countries in which we manufacture or the $13 billion we spend on the purchase of goods, services and active pharmaceutical ingredients (API). | | $13bn spent with suppliers  See Manufacturing from page 58 and Working with suppliers from page 52 See Manufacturing from page 58 and Working with suppliers from page 52

|

Effective partnerships |

We need business development, specifically partnering, which is an important element of our business model. It supplements and strengthens our pipeline and our efforts to achieve scientific leadership. | | 600 collaborations worldwide  See Partnering from page 23 See Partnering from page 23

|

Financial strength |

We need strong financials, including access to equity and debt finance, to bear the financial risk of investing in the entire life-cycle of a medicine. | | $4.1bnnet cash flow from operating activities  See Financial Review from page 62 See Financial Review from page 62

|

| | | | |

| | How do we add value? Financial value  Revenue from the sale of our medicines generates cash flow, which helps us: > fund our investment in science and Growth Platforms to drive long-term value > meet our debt service obligations > follow our progressive dividend policy. This involves balancing the interests of our business, financial creditors and shareholders.  See Financial Review from page 62 See Financial Review from page 62

Improved health  Continuous scientific innovation is vital to achieving sustainable healthcare which as it creates value by: > improving health outcomes and transforming patients’ lives > enabling healthcare systems to reduce costs and increase efficiency > improving access to healthcare and healthcare infrastructure > helping develop the communities in which we operate through local employment and partnering. | | |

| | |

| 10 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

Marketplace

| | |

| 2bn | |  |

By 2050, the world’s population aged 60 years and older is expected to total some 2 billion.

Global investment in pharmaceutical R&D expected to reach an estimated $154 billion in 2016, an 11% increase from $139 billion in 2012.

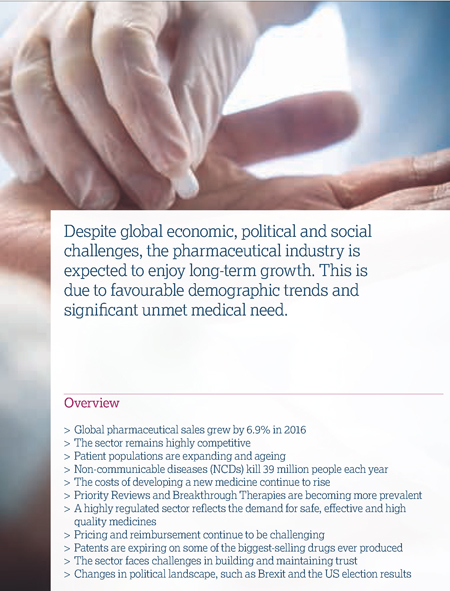

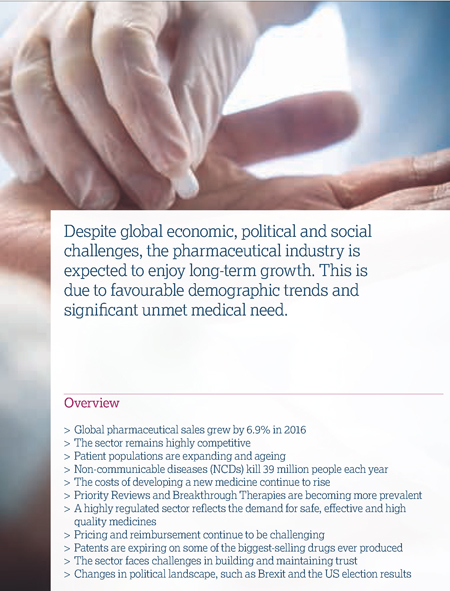

The global context

The October 2016 World Economic Outlook of the International Monetary Fund (IMF) highlighted the precarious nature of the recovery eight years after the global financial crisis. It raised the spectre that persistent stagnation, particularly in advanced economies, could further fuel populist calls for restrictions on trade and immigration. The IMF went on to observe that such restrictions would hamper productivity, growth and innovation. In China, a shift from investment and industry towards consumption and services was expected to slow growth in the short term while building the foundations for a more sustainable long-term expansion. Japan’s economy would be hampered by a shrinking population.

More generally, both political and economic uncertainty followed the Brexit vote in the UK and the election of Donald Trump to president of the US. Instability in a number of other European countries has been exacerbated by refugees fleeing civil war and unrest in the Middle East and from further afield.

Against this uncertain background, however, the demand for healthcare continues to increase. While this is a favourable trend for long-term industry growth, challenges remain. These include expiring patents, competition from and growing use of generic medicines, obtaining regulatory approval, securing reimbursement for new medicines, improving R&D productivity and attaining pricing and sales sufficient to generate revenue and sustain the cycle of innovation.

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 11 |

Strategic Report | Strategy

Marketplacecontinued

| | | | |

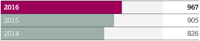

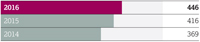

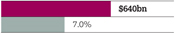

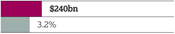

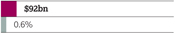

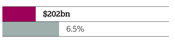

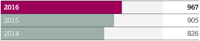

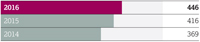

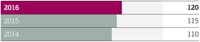

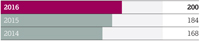

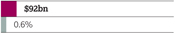

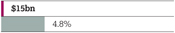

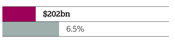

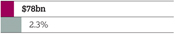

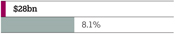

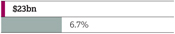

Global pharmaceutical sales | | | |

World$bn

| | | | |

$967bn(6.9%) | | | | |

US$bn

| | | | |

$446bn (7.1%) | | | | |

Europe$bn

| | | | |

$201bn (5.6%) | | | | |

Established ROW$bn

| | | | |

$120bn (5.1%) | | | | |

Emerging Markets$bn

| | | | |

| $200bn(9.1%) | | | | |

Data based on world market sales using AstraZeneca market definitions as set out in the Market definitions on page 239. Source: IMS Health, IMS Midas Quantum Q3 2016 (including US data). Reported values and growth are based at CER. Value figures are rounded to the nearest billion and growth percentages are rounded to the nearest tenth.

Expanding patient populations

The number of people accessing healthcare is increasing, as is healthcare spending, particularly by the elderly. For example, WHO estimates that, by 2050, the world’s population aged 60 years and older is expected to total some two billion, up from 900 million in 2015 and that, by then, 80% of all older people will live in low-and middle-income countries. As the diagram on page 14 shows, we expect developing markets to continue to fuel pharmaceutical growth.

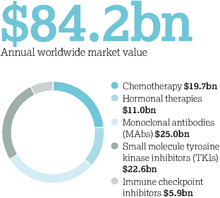

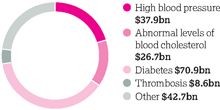

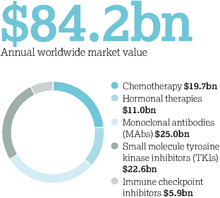

Unmet medical need

The prevalence of NCDs, such as cancer and cardiovascular, metabolic and respiratory diseases, is increasing worldwide. NCDs are often associated with ageing populations and lifestyle choices, including smoking, diet and lack of exercise. Many NCDs require long-term management. WHO estimates that NCDs kill 39 million people each year and disproportionately affect low- and middle-income countries where nearly three-quarters of these deaths occur. For example, more than 60% of the world’s total new annual cancer cases occur in Africa, Asia, and Central and South America. These regions account for 70% of the world’s cancer deaths.

The pharmaceutical sector: opportunities and challenges

As shown in the table on the left, global pharmaceutical sales grew by 6.9% in 2016. Established Markets saw average revenue growth of 6.4% and Emerging Markets revenue grew at 9.1%. The US, Japan, China, Germany and France are the world’s top five pharmaceutical markets. In 2016, the US had 44.7% of global sales (2015: 46.0%; 2014: 44.7%).

Science and technology

Innovation is critical to addressing unmet medical need. The delivery of new medicines will rely on a more advanced understanding of disease and the use of new technology and approaches, including personalised healthcare (PHC) and predictive science.

Technological breakthroughs in the design and testing of novel compounds present fresh opportunities for using small molecules as the basis for new medicines. The use of large molecules, or biologics, has also become an important source of innovation. Biologics are among the most commercially successful new products. By 2020, biologics, excluding vaccines, are expected to account for 27% of the global pharmaceutical market, having risen from 14% in 2006. As such, most pharmaceutical companies now pursue R&D in both small molecules and biologics.

Priority Reviews and Breakthrough Therapies are becoming more prevalent. Between the inception of the Breakthrough Therapy Designation programme in October 2012 and the end of 2016, the FDA granted more than 150 such requests (out of more than 450 applications), and one-third of these have already resulted in product approvals.

The cost of developing new medicines continues to rise. Global R&D investment is expected to reach $154 billion in 2016. While the growth rate of R&D spend has slowed in recent years, pharmaceutical companies continue to deliver new medicines. In 2016, the FDA approved 22 novel drugs compared with 45 in 2015 and 41 in 2014.

To ensure sustainable returns on R&D investment, the industry is working to increase its success rate in developing commercially viable new drugs while achieving a lower, more flexible cost base. Regulators and payers, however, are demanding greater evidence of comparative effectiveness of medicines. This increases development times and costs.

Fortunately, innovative technology is helping accelerate product approvals. A greater emphasis on Proof of Concept is also helping to improve productivity and reduce costs by showing the potential efficacy of drugs earlier in the development process.

| | |

| 12 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

Regulatory requirements

A highly regulated biopharmaceutical industry reflects the public’s expectation of safe, effective and high-quality medicines. Meeting this expectation requires responsible testing, manufacturing and marketing. It also relies on maintaining effective working relationships with health authorities worldwide, including the FDA in the US, the EMA in the EU, the PMDA in Japan, and the CFDA in China. Increasingly, regulation and governmental policy are being introduced to stimulate innovation in drug development. In the US, for example, the 21st Century Cures Act, signed into law on 13 December 2016, focuses on accelerating the discovery, development and delivery of promising new treatments for patients. Similarly, the Prescription Drug User Fee Act reauthorisation legislation that is required to be considered by the US Congress in 2017 is anticipated to contain proposals aimed at accelerating innovation and modernising the US regulatory environment. Additionally, the growing complexity and globalisation of clinical studies have led to an increase in public-private consortia. Such consortia, which include industry, academia and government bodies, aim to drive innovation, streamline regulatory processes, and define and clarify approval requirements for innovative drug and biologic products.

Regulatory health authorities continue to implement programmes intended to address unmet medical need and to speed up patient access to transformative medicines. This is demonstrated by the Breakthrough Therapy programme employed by the FDA and the EMA’s initiative to implement ‘adaptive pathways’ to improve timely patient access to new medicines. In Japan, the SAKIGAKE Designation System has been introduced to designate innovative medicines that hold the promise for a significant advance over currently available therapy. Once designated, the PMDA collaborates with sponsors to accelerate the development and approval of these promising unapproved medicines for serious and life-threatening diseases. The lengthy review process in China extends new medicine approval periods to as long as five years. This challenges the ability of pharmaceutical companies to deliver innovative medicines and treat unmet medical need in China. However, recent developments, including

the in-progress review of China’s Drug Administration Law and Drug Registration Regulation are likely to help address this issue over the next few years.

Greater transparency and public access to regulatory submissions that support approval of new medicines continue to be an area of interest. A recent example involves the EMA policy 0070 on publication of clinical data for medicinal products for human use, which provides guidance for the publication of clinical reports that underpin the EMA’s decision making. Paediatric development continues to present challenges to the industry as differences between study requirements and timeframes may vary significantly among health authorities. However, there have been efforts to provide incentives to stimulate paediatric research. An example is the EMA’s initiative offering free-of-charge meetings focused on paediatric studies early in drug development. In addition, the industry has appreciated the opportunity afforded by the US paediatric rare disease voucher programme to encourage paediatric drug development. International harmonisation is being advanced in this area through the revision of the ICH E11 paediatric guideline, which has facilitated discussion between regulators and the industry on topics of mutual interest.

Regulatory requirements for the registration of biosimilar products continue to develop and become better defined, as exemplified by the publication of a new pathway for China and the approvals of more biosimilar products in the US. However, significant areas of regulatory policy are still evolving. Among these are transparency of data regarding level of evidence to support approval of claims for biosimilarity in labelling, standards for interchangeability and pharmaceutical substitution, and traceability of pharmacovigilance reports through naming conventions that permit differentiation of products.

| | |

| | For more information about biosimilars, please see Patent expiries and genericisation on page 15 |

Pricing of medicines

Pricing and reimbursement remain challenging in many markets. We continue to see examples where healthcare services (including pharmaceuticals) are highly regulated by governments, insurers and other private payers through various controls on pricing and reimbursement. Implementation of cost containment reforms and shifting market dynamics are further constraining healthcare providers, while difficult economic conditions burden patients who have out-of-pocket expenses relating to their medicines. Pharmaceutical companies are now expending significant resources to demonstrate the economic as well as the therapeutic value of their medicines.

In the US, the Affordable Care Act (ACA) has directly affected the healthcare system by reshaping the market through various policies and approaches designed to expand insurance coverage, reduce costs, transform the delivery system, and improve healthcare and patient coverage. We, along with other pharmaceutical companies, have continued to work with policymakers and regulators to increase access, improve outcomes and to support an environment that fosters medical and scientific innovation and value.

The new political leadership in the US has proposed to repeal and replace the ACA and has taken initial steps to that end. While it is unclear if some or all of the ACA might be repealed or what the scope of replacement might entail if implemented, it is possible that proposals could require the healthcare industry to offset the cost of replacement. This may include changes to the pharmaceutical industry excise tax, Medicaid reform by, for example, granting the states greater flexibility in designing and funding their Medicaid programmes, including the choice of a block grant orper capita allotment of federal funds, and/or repeal the marketplace exchanges that were established under the ACA. These changes, whether directly or indirectly targeted at drugs or the pharmaceutical industry, could impact pharmaceutical coverage and patient access to healthcare under insurance plans and government programmes and could, accordingly, significantly affect the pharmaceutical industry.

| | |

| | Further details on the impact of the ACA on our business are contained in Return to growth on page 48 |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 13 |

Strategic Report | Strategy

Marketplacecontinued

We expect developing markets to continue to boost pharmaceutical growth.”

We expect developing markets to continue to boost pharmaceutical growth.”

| | |

| 84.7% | |  |

| Generics constituted 84.7% of prescriptions dispensed in the US. | |

Political leadership in the US has also continued to focus on drug pricing. Various drug pricing proposals have included measures relating to the repeal of the Medicare Part D non-interference clause that currently prohibits the government from negotiating directly with manufacturers on drug prices and US drug importation policies. In addition, lawmakers and policymakers at both the federal and state level have developed drug pricing transparency proposals that include measures relating to the submission of proprietary manufacturer data, establishment of price parameters that are indexed to certain federal programmes, and reporting of changes in pricing beyond certain thresholds. While the implementation timeline and details of such proposals are not clear, significant changes to laws and regulations regarding drug pricing could have a significant impact on the pharmaceutical industry.

In Europe, governments continue to implement and expand price control measures for medicines, including mandatory discounts, clawbacks and price referencing rules. These measures are decreasing drug prices, particularly in the challenged economies of Greece,

Romania and Italy. In France, price negotiations are particularly challenging due to budgetary pressures. In Germany, Europe’s largest pharmaceutical market, manufacturers must now prove the added benefit of their drug over existing alternatives if they are to avoid relegation to an unfavourable price reference or face non-pricing barriers to market access.

In China, pricing practices remain a priority for regulators. New national regulations and provincial and hospital tenders continue to put increasing pricing pressures on pharmaceutical companies. In Russia and selected Middle East markets, governments are encouraging local manufacturing by offering more favourable pricing legislation. In Japan, mandated biennial cuts are likely to continue as are experimental decisions by regulators based on cost effectiveness assessments. In Latin America, pricing is increasingly controlled by governments as, for example, in Colombia and Brazil with price referencing regulations.

| | |

| | For more information about price controls, reductions and US healthcare reform, and price regulation, please see the Business Review, Return to growth from page 48 and Risk from page 214 |

Estimated pharmaceutical sales and market growth – 2020

| | | | | | | | | | | | |

North America

| | | | EU

| | | | Other Europe(Non-EU countries)

| | | | Japan

|

| | | | | | |

| | | | | | | | | | | | |

Oceania

| | | | South East and East Asia

| | | | Latin America

| | | | Africa

|

| | | | | | |

| | | | | | | | | | | | |

CIS

| | | | Middle East

| | | | Indian subcontinent

| | | | · Estimated pharmaceutical sales – 2020. Ex-manufacturer prices at CER. Source: IMS Health. · Estimated pharmaceutical market growth – 2015 to 2020. Compound annual growth rate. Source: IMS Health. |

| | |

| 14 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

Patent expiries and genericisation

Patent protection for pharmaceutical products is finite. Patents are expiring on some of the biggest-selling drugs ever produced and this means that payers, physicians and patients are gaining greater access to generic alternatives (both substitutable and analogue) in many important drug classes. These generic alternatives are primarily lower priced because generic manufacturers are largely spared the costs of R&D and market development. As a result, demand for generics is high. For prescriptions dispensed in the US in 2016, generics constituted 84.7% of the market by volume (2015: 84.0%).

Generic competition can also result from patent disputes or challenges before patent expiry. Increasingly, generics companies are launching products ‘at risk’, for example, before resolution of the relevant patent litigation. This trend, which is likely to continue, creates significant market presence for the generic version while the litigation remains unresolved. Given the unpredictable nature of patent litigation, some companies have settled such challenges on terms acceptable to the innovator and generic manufacturer. While competition authorities generally accept such agreements as a legitimate way to settle these disputes, they have questioned some settlements as being anti-competitive.

Biologics typically retain exclusivity for longer than traditional small molecule pharmaceuticals, with less generic competition. With limited experience to date, the substitution of biosimilars for the original branded product has not followed the same pattern as generic substitution in small molecule products and, as a result, erosion of the original biologic’s branded market share has not been as rapid. This is due to biologics’ complex manufacturing processes and the inherent difficulties in producing a biosimilar, which could require additional clinical trials. However, with regulatory authorities in Europe and the US continuing to implement abbreviated approval pathways for biosimilar versions, innovative biologics are likely to face increased competition. Similar to biologics, some small molecule

pharmaceutical products are in complex formulations and/or require technically challenging manufacturing and thus may not follow the pattern of generic market erosion seen with traditional, tableted pharmaceuticals. For those products, the introduction of generic alternatives (both substitutable and analogue) can be slower.

Building trust

The pharmaceutical industry faces challenges in building and maintaining trust, particularly with governments and regulators. This reflects the past decade’s legal disputes between pharmaceutical companies and governmental and regulatory authorities. To address this challenge, companies are strengthening a culture of ethics and integrity, adopting higher governance standards and improving relationships with employees, shareholders and other stakeholders.

During 2016, there were also pharmaceutical industry investigations and Congressional hearings in the US related to pricing while, in the UK, the Competition and Markets Authority has been investigating allegations of excessive charging and fining companies for unfair prices.

Numerous companies, including those in the pharmaceutical industry, have been investigated by the China Public Security Bureau following allegations of bribery, and criminal and financial penalties have been imposed. Investigations by the DOJ and SEC under the Foreign Corrupt Practices Act are continuing as are investigations by the UK Serious Fraud Office under the UK Bribery Act. Information about material legal proceedings can be found in Note 28 to the Financial Statements from page 185.

Strategic responses

Our industry remains highly competitive. It includes large, research-based pharmaceutical companies (such as AstraZeneca) that discover, develop and sell innovative, patent-protected prescription medicines and vaccines, smaller biotechnology and vaccine

businesses, and companies that produce generic medicines. However, the pharmaceutical market is highly competitive. For example, our Diabetes franchise continues to see pricing pressure. In immuno-oncology, the large number of clinical trials that are being carried out highlight the competitive nature of this area and renders speed to market critical.

While many of our peers face similar challenges, they tackle them in different ways. Some companies have pursued a strategy focused on branded prescription pharmaceuticals. Others have diversified by acquiring or building branded generics businesses or consumer portfolios. A number of companies are focused on improving R&D productivity and operational efficiency. Other companies have looked to geographic expansion, especially in Emerging Markets and Japan.

Across the industry, business development deals (including licensing and collaborations), and competition for business development opportunities, while down over 2015, continued in 2016. For example, one report estimates that the value of mergers and acquisitions announced in the healthcare sector during the year amounted to more than $270 million, compared with almost $400 million in 2015.

As outlined in AstraZeneca at a glance from page 2 and our Business model from page 8, our strategic response to the pharmaceutical marketplace is to be a ‘pure-play’, global, science-led biopharmaceutical company that focuses on the discovery, development and commercialisation of prescription medicines, primarily for the treatment of diseases in three main therapy areas. The strategic priorities that follow on from this response are outlined in the next section.

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 15 |

Strategic Report | Strategy

Strategy and key performance indicators

We are focused on returning to growth through a science-led innovation strategy. Our strategic priorities, and the indicators against which we measure our success, are based on investing in three therapy areas, building a strong and balanced portfolio of primary care and specialty care medicines, and accelerating key R&D programmes. They also include targeted business development and leveraging our global commercial presence.

| | |

| Achieve scientific leadership | |

|

| | | | | | |

Strategic priorities | | Key performance indicators | | | | |

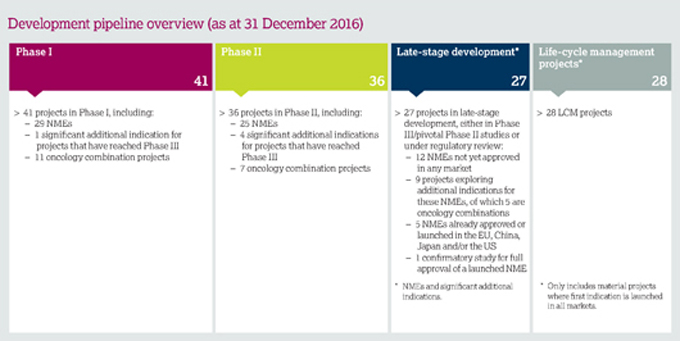

Focus on innovative science in three therapy areas Focus on Oncology, Cardiovascular & Metabolic Disease, and Respiratory. We are also selectively active in Autoimmunity, Infection and Neuroscience. Work across small molecules and biologics, including immunotherapies and protein engineering, as well as devices, biomarkers and translational science. Prioritise and accelerate our pipeline Accelerate and invest in key R&D programmes. At the end of 2016, 12 NMEs were in Phase III or under regulatory review compared with our March 2013 target of nine to 10. Against the targets we had set ourselves since 2013, by the end of 2016, we had made 25 Phase II starts (2015 to 2016 target: 12 to 16); 14 NME and major line extension regulatory submissions (2015 to 2016 target: 14 to 16); and eight NME and major line extension regulatory approvals (2015 to 2016 target: eight to 10). Strengthen our early-stage pipeline through novel science and technology. Transform our innovation and culture model Focus on novel science, such as immune-mediated therapy combinations and PHC. Co-location near bioscience clusters at three strategic centres in Cambridge, UK; Gaithersburg, Maryland US; and Gothenburg, Sweden helps to leverage our capabilities and foster collaboration with leading scientists and research organisations. Accelerate through business development Work to reinforce our therapy areas and strengthen our portfolio and pipeline through targeted business development, including collaborations, in-licensing and acquisitions. Collaborate strategically to broaden and accelerate the development of key pipeline assets (externalisation) and divest non-core assets to realise value. | | Phase III investment decisions 7

savolitinib (papillary renal cell carcinoma); durvalumab+ tremelimumab (hepatocellular carcinoma);Forxiga(heart failure);Forxiga(chronic kidney disease); AZD3293 (BACE) Alzheimer’s disease; two further decisions made through strategic partnering. | | NME or LCM project regulatory submissions in major markets 14

Faslodex– breast cancer (US, EU, JP);Tagrisso– lung cancer (CN);Tagrisso– lung cancer (AURA3 study for full approval) (US, EU); durvalumab – bladder cancer (US); DURATION-8 (exenatide+dapagliflozin) (EU); benralizumab – severe asthma (US, EU); lesinurad+allopurinol FDC – gout (US); three further submissions made await regulatory acceptance. 1 13 for determining Annual Bonus. See page 108 | | Clinical-stage strategic Transactions 10

Includes alliances, collaborations and acquisitions to enhance our portfolio and pipeline in our main therapy areas; externalisation activity to maximise the value of our assets; and divestments of non-priority medicines. |

| | NME Phase II starts/progressions 16

Vidazaand durvalumab for the treatment of acute myeloid leukaemia and CC486+durvalumab for myelodysplastic syndromes (with Celgene); MEDI0680+durvalumab for solid tumours; MEDI0562 (humanised OX40); AZD6738+Lynparzafor gastric cancer; AZD1775 (Wee1); daratumumab+durvalumab for multiple myeloma; in collaboration with Incyte, epacadostat (IDO)+ durvalumab for solid tumours; MEDI4166 (PCSK9/GLP-1); MEDI0382; AZD4076; abediterol (AZD0548) (LABA); AZD1419 (Inhaled TLR9); MEDI2070 (IL-23); MEDI3902 (pseudomonas bispecific (Psl-PcrV)); MEDI8897 (RSV). 1 15 for determining Annual Bonus. See page 108 | | NME and major LCM regional Approvals 11

Tagrisso– lung cancer (EU, JP) and ctDNA blood test (US, JP);Brilinta/Brilique– post myocardial infarction (EU) and acute coronary syndromes and post myocardial infarction (JP);Qtern– Type 2 diabetes (EU);Bevespi Aerosphere(PT003) – COPD (US);Zurampic– gout (EU);Zavicefta– serious infections (EU); Pandemic Live Attenuated Influenza Vaccine – pandemic influenza (EU). | | |

| | | | | | |

Therapy Area Review from page 23 Therapy Area Review from page 23 | |  Achieve scientific leadership from page 45 Achieve scientific leadership from page 45 | |  Development Pipeline from page 204 Development Pipeline from page 204 | | |

| | |

| 16 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

| | |

| Return to growth | |  |

| | | | | | |

Strategic priorities | | Key performance indicators | | | | |

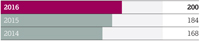

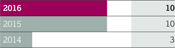

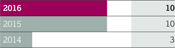

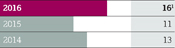

Focus on Growth Platforms Brilinta/Brilique – Work to deliverBrilinta/Brilique’s potential to reduce cardiovascular deaths through ongoing clinical studies. Diabetes – Work to maximise the potential of our broad and innovative non-insulin, anti-diabetic portfolio to transform patient care. From January 2017, New CVMD Growth Platform combines our Diabetes franchise,Brilinta/Brilique and any new launches. Respiratory – Work to maximise pipeline value, devices and medicines to fulfil unmet medical need and improve patient outcomes in asthma and COPD. New Oncology – Aim to deliver six new cancer medicines to patients by 2020. It became our sixth Growth Platform in January 2015 and includesLynparza, Iressa (US) and Tagrisso. Japan – Strengthen our Oncology franchise and work to maximise the success of our Diabetes medicines and established brands:Symbicort, Nexium andCrestor. Emerging Markets – Focus on delivering innovative medicines by investing in Emerging Markets capabilities, with a focus on China and other leading markets, such as Brazil and India. The ongoing transformation of our capabilities is supporting new products and improving access and affordability. Transform through specialty care, devices and biologics Biologics now account for about half of our NMEs in development, potentially enhancing asset longevity. A greater focus on innovative and differentiated delivery devices affords patients choice while ensuring product durability. Our new specialty care portfolio is expected to balance our strength in primary care medicines. | | Brilinta/Brilique $839m Product Sales

Actual growth CER growth 2016 +36% 2016 +39% 2015 +30% 2015 +44% 2014 +68% 2014 +70% | | Diabetes $2,427m Product Sales

Actual growth CER growth 2016 +9% 2016 +11% 2015 +19% 2015 +26% 2014 +138% 2014 +139% | | Respiratory $4,753m Product Sales

Actual growth CER growth 2016 -5% 2016 -3% 2015 -2% 2015 +7% 2014 +8% 2014 +10% |

| | Brilinta delivered Product Sales of $839 million. Continued progress was seen across the US and Europe with 45% and 12% growth (15% at CER) in the year respectively. | | Diabetes Product Sales grew by 9% (11% at CER) despite intense competition in this space with a positive contribution from all Regions. Our focus in diabetes remains on the fastest-growing SGLT2 and GLP-1 classes. | | 2016 was a challenging year. Respiratory Product Sales declined by 5% (3% at CER), the main driver of this beingSymbicort, which continued to grow volume share, however, Product Sales were down by 12% (10% at CER), reflecting developments in the US and Europe, offsetting the positive Emerging Markets and Established ROW growth. |

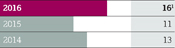

| | New Oncology $664m Product Sales

Actual growth CER growth 2016 n/m 2016 n/m 2015 N/A 2015 N/A 2014 N/A 2014 N/A | | Japan $2,184m Product Sales

Actual growth CER growth 2016 +8% 2016 -3% 2015 -9% 2015 +4% 2014 -10% 2014 -3% | | Emerging Markets $5,794m Product Sales

Actual growth CER growth 2016 0% 2016 +6% 2015 0% 2015 +12% 2014 +8% 2014 +12% |

| | New Oncology Product Sales ofLynparza, Iressa (US) andTagrisso were $664 million. Tagrisso continued to demonstrate strong uptake in the US, Europe and Japan with global Product Sales of $423 million and 46 regulatory approvals.Lynparza Product Sales were $218 million. | | In Japan, Product Sales were up by 8% (down 3% at CER), reflecting exchange rate impact and the mandated biennial price cuts. We had volume growth of about 2%. Our three biggest medicines,Crestor, Nexium andSymbicort, continued to perform well, butCrestor Product Sales were impacted by inventory reductions at our local marketing partner. | | Emerging Markets growth mainly driven byBrilinta, Forxiga and our Respiratory franchise. China represented just under half of the total Emerging Markets Product Sales in 2016. |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Return to growth from page 48 Return to growth from page 48 | |  Therapy Area Review from page 23 Therapy Area Review from page 23 | |  Geographical Review from page 226 Geographical Review from page 226 | | |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 17 |

Strategic Report | Strategy

Strategy and key performance indicatorscontinued

| | |

Be a great place to work | |  |

| | | | | | |

Strategic priorities | | Key performance indicators | | | | |

Evolve our culture Work to improve our employees’ identification with our Purpose and Values and promote greater understanding of and belief in our strategy. Invest in and implement tailored leadership development programmes. Simplify our business Develop simpler, more efficient processes and flatten our organisational structure to encourage accountability and improve decision making and communication. Attract and retain the best talent Accelerate efforts to attract diverse, top talent with new capabilities. | | Employee belief in our strategy 80%

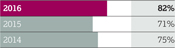

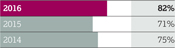

This is a key indicator of employee engagement. Decline reflects impact of reshaping the business. 1 Source: December 2016 Pulse survey across a sample of the organisation. 2 Source: January 2016 Pulse survey across a sample of the organisation. 3 Source: Global FOCUS all-employee survey. | | Organisational structure – percentage of employees within six management steps of the CEO 82%

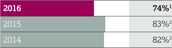

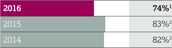

This is a key indicator of our progress in organisational efficiency, through improved decision making, driving accountability to the right level and improving communication flow. | | Employees who would recommend AstraZeneca as a great place to work 74%

This is a key indicator of whether employees believe AstraZeneca is a great place to work. Decline reflects impact of reshaping the business. 1 Source: December 2016 Pulse survey across a sample of the organisation. 2 Source: January 2016 Pulse survey across a sample of the organisation. 3 Source: Global FOCUS all-employee survey. |

| |

Be a great place to work from page 52 Be a great place to work from page 52  Employees from page 54 Employees from page 54 |

| | |

Do business sustainably | |  |

| | | | | | |

Strategic priorities | | Key performance indicators | | | | |

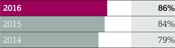

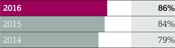

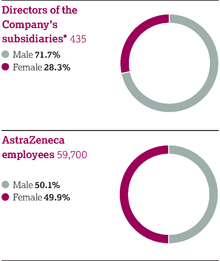

Deliver business success over the long term Deliver our business strategy in a way that delivers wider benefits to society and the planet. Focus on: > maintaining ethics and transparency in everything we do > increasing access to healthcare for more people > minimising the environmental impact of our products and processes. Align our work with the UN Sustainable Development Goals and work to integrate our commitments into day-to-day business activities. | | Dow Jones Sustainability Index ranking 86%

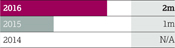

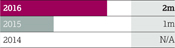

Met the target of maintaining position in the Dow Jones Sustainability World and Europe Indexes comprising the top 10% of the largest 2,500 companies with a score of 86%. | | Screening, diagnosis and treatment of hypertension as part of Healthy Heart Africa programme 2 million Patients

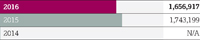

Healthy Heart Africa was launched in October 2014. By the end of 2016, we had conducted over two million hypertension screenings in the community and healthcare facilities. | | Operational carbon footprint1 1,657kt CO2e

Our 2016 operational carbon footprint met our target emission of 1,708 kt CO2e and represents a 5% reduction from our 2015 baseline. ¹ Operational carbon footprint is emissions from all Scope 1, 2, and selected Scope 3 sources. See page 231. |

| | |

Sustainability from page 43 Sustainability from page 43 | | Note: Confirmed breaches of external sales and marketing codes or regulations globally is no longer regarded as a KPI. However, this information is reported on page 52 of the Annual Report. |

| | |

| 18 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

| | |

| Achieve Group financial targets | |  |

| | | | | | |

Strategic priorities | | Key performance indicators | | | | |

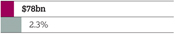

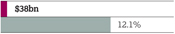

Drive on-market value Invest in R&D and on-market Growth Platforms to return to growth. Our aim is to deliver industry-leading productivity by restructuring to create scope for investment and a flexible cost base. Maintain a progressive dividend Policy is to maintain or grow dividend per share. Maintain a strong balance sheet Target a strong, investment-grade credit rating, operational cash balance and periodic share repurchases. | | Total Revenue1 $23,002m

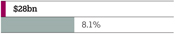

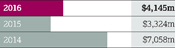

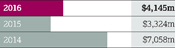

Actual growth CER growth 2016 -7% 2016 -5% 2015 -7% 2015 +1% 2014 +3% 2014 +5% | | Net cash flow from operating activities $4,145m

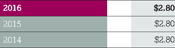

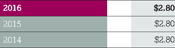

Actual growth 2016 +25% 2015 -53% 2014 -5% | | Dividend per share1 $2,80

|

| | Total Revenue comprised Product Sales of $21,319 million (down by 10% at actual rate of exchange and 8% at CER) and Externalisation Revenue of $1,683 million (up by 57% at actual rate of exchange and 59% at CER). Decline in Total Revenue at actual exchange rates reflected the particular weakness of key trading currencies against the US dollar. 1 As detailed on page 142, Total Revenue consists of Product Sales and Externalisation Revenue. | | Cash generated from operating activities improved cash management performance and one-off tax refunds. | | Dividend is consistent with the progressive dividend policy pursuant to which the Board intends to maintain or grow the dividend each year. 1 First and second interim dividend for the year. |

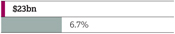

| | Reported EPS $2.77

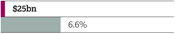

Actual growth CER growth 2016 +24% 2016 +9% 2015 +128% 2015 +137% 2014 -52% 2014 -34% | | Core EPS $4.31

Actual growth CER growth 2016 +1% 2016 -5% 2015 0% 2015 +7% 2014 -15% 2014 -8% | | |

| | | Reported EPS of $2.77 represented growth of 24% (9% at CER). This included a gain of $0.76 on the revaluation of acquisition-related liabilities. | | Core EPS increased by 1% (decreased 5% at CER), driven by the same rate of decline in Total Revenue at CER. . | | |

| | | | | | |

| | | | |

Financial Review from page 62 Financial Review from page 62 | | | | | | |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2016 | | 19 |

Strategic Report | Strategy

Risk overview

Principal Risks

We face a diverse range of risks and uncertainties and this table provides insight into the Principal Risks that could have a materially adverse effect on the business or results of operations. We outline why effective management of these risks is important and relevant to the business, how we are managing them and which risks are rising, falling or have remained static during the past 12 months.

Our approach to risk management is designed to encourage clear decision making on which risks we take and how we manage these risks. Fundamental to this process is a sound understanding of every risk’s potential strategic, commercial, financial, compliance, legal and reputational implications.

| | | | | | |

| | | | |

Risk category and Principal Risks | | | | Context/potential impact | | |

| | | |

Product pipeline and intellectual property | | | | | | |

| | | |

| Delivery of pipeline and new products | |  | | The development of any pharmaceutical product candidate is a complex, risky and lengthy process involving significant financial, R&D and other resources. A project may fail or be delayed at any stage of the process due to a number of factors, which could reduce our long-term growth, revenue and profit | | |

| | | |

Meet quality, regulatory and ethical drug approval and disclosure requirements | |  | | Delays in regulatory reviews and approvals impact patients and market access, and can materially affect our business or financial results | | |

| | | |

| Secure and protect product IP | |  | | Discovering and developing medicines requires a significant investment of resources. For this to be a viable investment, through generation of sufficient revenues, new medicines must be safeguarded from being copied with a reasonable amount of certainty for a reasonable amount of time | | |

| | | |

Commercialisation | | | | | | |

| | | |

| Externally driven demand, pricing, access and competitive pressures | |  | | Operating in over 100 countries, we are subject to political, socio-economic and financial factors both globally and in individual countries. There can be additional pressure from governments and other healthcare payers on medicine prices and sales in response to recessionary pressures, reducing our revenue, profits and cash flow | | |

| | | |

| Quality and execution of commercial strategies | |  | | If commercialisation of a product does not succeed as anticipated, or its rate of sales growth is slower than anticipated, there is a risk that we may not be able to fully recoup the costs in launching it | | |

| | | |

Supply chain and business execution | | | | | | |

| | | |

| Maintain supply of compliant, quality product | |  | | Delays or interruptions in supply can lead to recalls, product shortages, regulatory action, reputational harm and lost sales | | |

| | | |

| Information technology and data security and privacy | |  | | Significant disruption to our IT systems, cybersecurity incidents including breaches of data security, or failure to integrate new systems, could harm our reputation and materially affect our financial condition or results of operations. This could lead to regulatory penalties or non-compliance with laws and regulations | | |

| | | |

| Delivery of gains from productivity initiatives | |  | | Inappropriately managed initiatives could lead to low employee engagement and reduced productivity, increased absence and attrition levels, or even industrial action. All could adversely impact the value of the initiative | | |

| | | |

Attract, develop, engage and retain talented and capable employees at all levels | |  | | Failure to attract and retain highly skilled personnel may weaken our succession plans for critical positions in the medium term. Failure to engage our employees could impact productivity and turnover. Both could adversely affect the achievement of our strategic objectives | | |

| | | |

Legal, regulatory and compliance | | | | | | |

| | | |

| Safety and efficacy of marketed products | |  | | Patient safety is very important to us and we strive to minimise the risks and maximise the benefits of our medicines. Failure to do this could adversely impact our reputation, our business and the results of operations, and could lead to product liability claims | | |

| | | |

| Defence of product, pricing and practices litigation | |  | | Investigations or legal proceedings could be costly, divert management attention or damage our reputation and demand for our products. Unfavourable resolutions could subject us to criminal liability, fines or penalties, adversely affecting our financial results | | |

| | | |

Meet regulatory and ethical expectations on commercial practices, including bribery and corruption, and scientific exchanges | |  | | Any failure to comply with applicable laws, rules and regulations, including bribery and corruption legislation, may result in civil and/or criminal legal proceedings and/or regulatory sanctions, fines or penalties, impacting financial results | | |

| | | |

Economic and financial | | | | | | |

| | | |

| Achieve strategic plans and meet targets and expectations | |  | | Failure to successfully implement our business strategy may frustrate the achievement of our financial or other targets or expectations. This failure could, in turn, damage our reputation and materially affect our business, financial position or results of operations | | |

| | |

| 20 | | AstraZenecaAnnual Report and Form 20-F Information 2016 |

| | | | | | | | | | | | | | |

| | Strategy key | | | | | | Trend key | |  Further information on our key risk management and assurance processes can be found in Risk from pages 214 to 225 which also includes a description of circumstances under which principal and other risks and uncertainties might arise in the course of our business and their potential impact Further information on our key risk management and assurance processes can be found in Risk from pages 214 to 225 which also includes a description of circumstances under which principal and other risks and uncertainties might arise in the course of our business and their potential impact

|

| |

| | Achieve scientific leadership | |

| | Be a great place to work | |

| | Increasing risk | |

| |

| | Return to growth | |

| | Achieve Group financial targets | |

| | Decreasing risk | |

| | | | | | | | | |  | | Unchanged | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | |

| | Management actions | | Trend versus prior year |

| | | | | | |

| | | |

| | | > Prioritise and accelerate our pipeline > Strengthen pipeline through acquisitions, licensing and collaborations > Focus on innovative science in three main therapy areas | |

| | Increasing importance of pipeline contribution given loss of exclusivity on key brands |

| | | |

| | | > Quality management systems incorporating monitoring, training and assurance activities > Collaborating with regulatory bodies and advocacy groups to monitor and respond to changes in the regulatory environment, including revised process, timelines and guidance | |

| | |

| | | |

| | > Active management of IP rights | |

| | |

| | | | | | |

| | | |

| | > Focus on Growth Platforms > Demonstrating value of medicines/health economics > Global footprint > Diversified portfolio | |

| | Global economic and political conditions placing downwards pressure on healthcare pricing and spending, and therefore on revenue |

| | | | |

| | | > Focus on Growth Platforms > Accelerate and risk share through business development and strategic collaborations and alliances | |

| | Loss of exclusivity on key brands increases challenge to achieve our short- to medium-term targets |

| | | | | | |

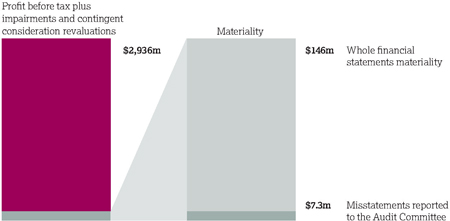

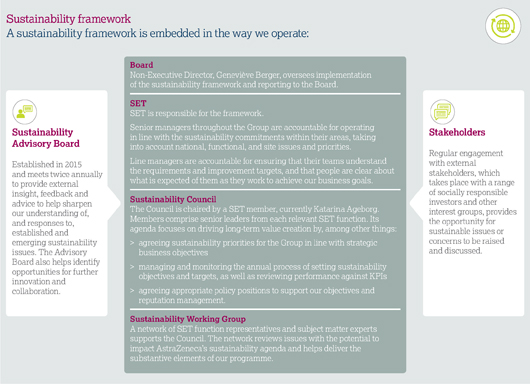

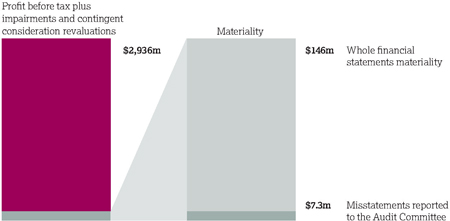

| | | |