NOTICE & PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

SIGMA-ALDRICH CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form of Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

SIGMA-ALDRICH CORPORATION

3050 Spruce Street

St. Louis, Missouri 63103

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held May 3, 2005

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Sigma-Aldrich Corporation will be held at the Sigma-Aldrich Life Science and High Technology Center, 2909 Laclede Avenue, St. Louis, Missouri 63103, on Tuesday, May 3, 2005, at 11:00 A.M., Central Daylight Time, for the following purposes:

| 1. | To elect eight directors; |

| 2. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accountant for 2005; and |

| 3. | To transact such other business as may properly come before the meeting and any adjournments thereof. |

Only shareholders of record as of the close of business on March 7, 2005 are entitled to notice of, and to vote at, the meeting.

By Order of the Board of Directors,

Michael R. Hogan, Secretary

March 29, 2005

Your vote is important. You may vote in any one of the following ways:

| • | Use the toll-free telephone number shown on the proxy card. |

| • | Use the internet web site shown on the proxy card. |

| • | Mark, sign, date and promptly return the enclosed proxy card in the postage-paid envelope. |

Shareholders who attend the meeting may revoke their proxies and vote in person if they desire.

SIGMA-ALDRICH CORPORATION

PROXY STATEMENT

Annual Meeting of Shareholders

May 3, 2005

The enclosed proxy is solicited by the Board of Directors (the “Board”) of Sigma-Aldrich Corporation (the “Company”) for use at the Annual Meeting of Shareholders (the “Meeting”) to be held at the Sigma-Aldrich Life Science and High Technology Center, 2909 Laclede Avenue, St. Louis, Missouri 63103, at 11:00 A.M. Central Daylight Time, on Tuesday, May 3, 2005, and any adjournments thereof. Any shareholder giving the proxy has the power to revoke it at any time before it is voted (i) by written notice mailed to and received by Sigma-Aldrich Corporation c/o ADP, 51 Mercedes Way, Edgewood, New York 11717, (ii) by submitting a later-dated proxy, or (iii) by attending the Meeting and casting a contrary vote. If the proxy is not so revoked or not revoked in person at the Meeting, such proxy will be voted either as designated or, if no designation is made, will be voted in favor of the nominees for directors and for the ratification of KPMG LLP as independent registered public accountant for 2005.

Shareholders of record as of the close of business on March 7, 2005 are entitled to notice and will be entitled to vote at the Meeting and at any adjournments thereof. As of the close of business on March 7, 2005, there were a total of 68,844,544 shares of common stock outstanding and entitled to vote. Shareholders of record will be entitled to one vote for each share held on all matters, including the election of directors.

The cost of solicitation of proxies will be borne by the Company. In addition to the use of the mails, proxies may be solicited personally or by telephone by employees of the Company without additional compensation. Brokers, dealers, banks and their nominees will be requested to forward proxy material to the beneficial owners of stock held by them of record, and the Company will reimburse them for their reasonable out-of-pocket and clerical expenses upon their request.

This Proxy Statement and accompanying form of proxy are first being sent to shareholders on or about March 29, 2005.

The mailing address of the Company’s principal executive office is 3050 Spruce Street, St. Louis, Missouri 63103.

-1-

ELECTION OF DIRECTORS

Eight directors of the Company are to be elected to hold office until the next annual meeting or until their successors are elected and qualified. The persons named as proxies in the accompanying proxy card intend to vote for the election of the nominees named below. If for any reason any of the nominees are unable to serve or for good cause will not serve, the persons named as proxies may exercise discretionary authority to vote for substitutes proposed by the Board of Directors.

Nominees for Board of Directors

The following are the nominees for directors of the Company, their principal occupation, background, period of service as a director of the Company, other directorships and age. All of the nominees, except for Timothy R.G. Sear, are presently directors of the Company and were elected to their present terms as directors at the 2004 Annual Meeting of Shareholders. The Board of Directors of the Company has determined that each of the Company’s directors, other than Dr. David R. Harvey, and each member of the Audit Committee, Compensation Committee and Corporate Governance Committee is an “independent director” under rules of the Nasdaq Stock Market. In addition, the Board of Directors has determined that, in its judgment, each member of the Audit Committee is independent within the meaning of Section 10A of the Securities and Exchange Act of 1934, as amended. There is no family relationship between any of the officers or directors.

| Nina V. Fedoroff | Willaman Professor of Life Sciences and Evan Pugh Professor, Pennsylvania State University, University Park, Pennsylvania, for more than five years. Member of the National Science Board. She has been a director of the Company since 1996. Age 62. | |

| David R. Harvey | Chairman and Chief Executive Officer of the Company. Dr. Harvey has been Chairman since January 1, 2001. He has served as Chief Executive Officer for more than five years. He served as President for more than five years until August 2004. He has been a director of the Company since 1981. Age 65. | |

| W. Lee McCollum | Executive Vice President and Chief Financial Officer of S.C. Johnson & Son, Inc., a manufacturer and marketer of consumer package goods, Racine, Wisconsin, for more than five years. He has been a director of the Company since 2001. He is also a director of Johnson Bank and Cofresco Frischhalteprodukte GMBH. Age 55. | |

| William C. O’Neil, Jr. | Private Investor. He was Chief Executive Officer of Tuitionfund.com, a provider of savings for higher education, Nashville, Tennessee, from January 2000 until December 2000. He has been a director of the Company since 1987. He is also a director of Advocat, Inc., American Healthways and American Home Patient. Age 70. | |

| J. Pedro Reinhard | Executive Vice President and Chief Financial Officer of The Dow Chemical Company, a manufacturer of chemicals, plastic materials, agricultural and other specialized products, Midland, Michigan, for more than five years. He is also Chairman of Dow AgroSciences LLC, a wholly owned subsidiary of The Dow Chemical Company engaged in providing pest management and biotechnology products to improve the quality and quantity of food supplies. He has been a director of the Company since 2001. He is also a director of The Dow Chemical Company, Royal Bank of Canada and The Coca-Cola Company. Age 59. | |

-2-

| D. Dean Spatz | Private Investor. He was Chairman and Chief Executive Officer of Osmonics, Inc., a manufacturer of water purification, fluid separation and fluid handling products and equipment, Minnetonka, Minnesota, for more than five years until February 2003 when Osmonics, Inc. was acquired by GE Specialty Materials, a unit of General Electric Company. He has been a director of the Company since 1994. He is also a director of S.I. Technologies, Inc. Age 61. | |

| Barrett A. Toan | Chairman and Chief Executive Officer of Express Scripts, Inc., a pharmacy benefits management company, St. Louis, Missouri, for more than five years. He also served as President of Express Scripts, Inc. for more than five years until April 2002. He has been a director of the Company since 2001. He is also a director of Express Scripts, Inc. Age 57. | |

New Nominee for Director

The following individual was recommended by the Corporate Governance Committee and approved by the Board of Directors to be a nominee as a director of the Company:

| Timothy R.G. Sear | Chairman of Alcon Laboratories, Inc., a manufacturer of ophthalmic pharmaceuticals, surgical instruments and accessories and consumer vision care products, Fort Worth, Texas, for more than five years. He also served as President and Chief Executive Officer of Alcon Laboratories, Inc. for more than five years until October 2004. He is a director of Alcon Laboratories, Inc., GTX and Prometheus. Age 68. | |

The Board of Directors recommends a vote for each of the nominees listed above.

Retiring Director

Jerome W. Sandweiss is retiring as a director of the Company and, accordingly, is not a nominee for election. He has been a director of the Company since 1975. Mr. Sandweiss was of Counsel at Blumenfeld, Kaplan & Sandweiss, P.C. for more than five years until October 2000.

Directors Meetings and Committees

The following table provides information regarding the membership of and number of meetings during 2004 of the Company’s Board of Directors and its committees:

Name | Board of Directors | Audit Committee | Compensation Committee | Corporate Governance Committee | ||||||||||||||||

Nina V. Fedoroff | x | x | ||||||||||||||||||

David R. Harvey | x | * | ||||||||||||||||||

W. Lee McCollum | x | x | * | |||||||||||||||||

William C. O’Neil, Jr. | x | x | * | x | ||||||||||||||||

J. Pedro Reinhard | x | x | x | * | ||||||||||||||||

Jerome W. Sandweiss | x | x | ||||||||||||||||||

D. Dean Spatz | x | x | ||||||||||||||||||

Barrett A. Toan | x | x | x | |||||||||||||||||

Number of 2004 Meetings | 4 | 9 | 4 | 4 | ||||||||||||||||

* indicates Chairman

-3-

Each Director attended at least 75% of the total meetings of the Board and each of the Committees on which they served during 2004. Each Director attended the Company’s 2004 Annual Meeting of Shareholders and each existing and proposed Director is expected to attend the Company’s 2005 Annual Meeting of Shareholders.

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities with regard to (1) the integrity of the Company’s financial statements, (2) the Company’s compliance with legal and regulatory requirements, (3) the independent registered public accountant’s qualifications and independence, (4) the performance of the Company’s internal audit function and independent registered public accountant, and (5) the Company’s accounting and financial reporting processes and audits of the Company’s financial statements. The Committee is directly responsible and has sole authority for the appointment, compensation, retention and oversight of the Company’s independent registered public accountant and meets with Company management, the internal auditors and the independent registered public accountant to (1) review the Company’s financial statements contained in the Company’s public earnings reports and the Company’s Annual Report on Form 10-K and quarterly reports on Form 10-Q, (2) review major issues regarding significant financial reporting matters and judgments made in connection with the preparation of the Company’s financial statements, (3) review legal matters that are reasonably likely to have a material effect on the Company’s financial statements, (4) review disclosures made by the Company’s Chief Executive Officer and Chief Financial Officer during their certification process for the Form 10-K or Form 10-Q’s, (5) discuss the adequacy and effectiveness of the Company’s internal financial controls and disclosure controls and procedures, (6) approve the annual internal audit plan and (7) receive regular reports of major findings by internal audit and of how management is addressing the conditions reported. The Board of Directors has determined that committee members meet the Nasdaq Stock Market independence requirements and that Mr. W. Lee McCollum is an “audit committee financial expert”, as defined in Item 401(h) of Regulation S-K under the Exchange Act. The Committee operates pursuant to a written charter, which was included as Appendix A to the Company’s March 29, 2004 Proxy Statement.

Compensation Committee

The Compensation Committee approves the policies and oversees the practices of the Company with respect to the compensation made available to the Company’s management so as to enable the Company to attract and retain high quality leadership in a manner consistent with the stated compensation strategy of the Company, internal equity considerations, competitive practice and the requirements of appropriate regulatory bodies. The Committee also administers the Company’s 2003 Long-Term Incentive Plan. The Board of Directors has determined that each member of the Compensation Committee is independent under rules of the Nasdaq Stock Market.

Corporate Governance Committee

The Corporate Governance Committee makes recommendations to the Board of Directors concerning the selection, qualification and compensation of members of the Board and its committees, as well as the size and composition of the Board and its committees. The Committee will consider nominees recommended by shareholders for election to the Board of Directors provided the names of such nominees, accompanied by relevant biographical information, are submitted in writing to the Secretary of the Company consistent with the timing defined in the Company’s amended By-laws as described on page 21 under SHAREHOLDER PROPOSALS. In February of each year, the Committee generally proposes to the Board nominees for directors to be elected at the Company’s Annual Meeting of Shareholders. Therefore, in order to be considered by the Committee, prospective nominee

-4-

recommendations should be received by the Secretary no later than February 4th. The Committee also periodically reviews the Corporate Governance Guidelines and the Business Conduct Policy adopted by the Board and makes recommendations to the Board concerning any changes deemed appropriate in such Guidelines and Policy and the Board’s and the Company’s operations as provided therein. The Board of Directors has determined that committee members meet the Nasdaq Stock Market independence requirements. The Committee operates pursuant to a written charter, which was included as Appendix B to the Company’s March 29, 2004 Proxy Statement.

Director Compensation and Transactions

Directors who are employed by the Company receive no compensation or fees for serving as a director or for attending board or committee meetings. Directors who are not employed by the Company receive cash and stock compensation, as described below.

Cash Compensation

Each non-employee director received cash compensation of $27,500 in 2004 for being a member of the Board and its committees. In addition, each non-employee director also receives a fee for his or her participation in Board and committee meetings. The following table provides information related to the meeting fees paid to non-employee directors:

| Board of Directors | Audit Committee (1) | Compensation Committee | Corporate Governance Committee | |||||||||

Participation in person (2) | $ | 3,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | ||||

Participation via conference call | $ | 1,500 | $ | 500 | $ | 500 | $ | 500 | ||||

| (1) | The Audit Committee Chairman received $3,000 for every meeting attended in person and $1,500 for every conference call in which he participated. |

| (2) | Non-employee directors participating in person at meetings also received reimbursement of travel expenses. |

Stock Compensation

The Company’s 2003 Long-Term Incentive Plan provides non-employee directors with stock compensation as follows:

| • | Newly elected directors will be granted options to acquire 10,000 shares of common stock upon the date of his or her initial election to the Board; and |

| • | Eligible directors serving on the Board on the day after any annual shareholder meeting, who have served on the Board for at least six months prior to the annual meeting, will be granted options to acquire 4,000 shares of common stock on such date. |

The seven non-employee directors each received options to purchase 4,000 shares of common stock in 2004. If elected at the Meeting, the six continuing non-employee directors will receive options to purchase 4,000 shares of common stock the day after the Meeting and the newly elected director will receive options to purchase 10,000 shares of common stock on the day of the Meeting.

The option price per share is equal to the fair market value of the common stock on the date the option is granted. No option will vest or may be exercised to any extent until the holder has continually served as a director of the Company for at least three months from the date of grant, provided that such options shall vest and become exercisable upon termination of service by reason of death, disability or retirement, subject to the terms and conditions of the plan. The options expire ten years from date of grant.

-5-

Shareholder Communication with the Board of Directors

Shareholders can communicate directly with the Board of Directors or any of its committees by mailing correspondence to:

Board of Directors-Sigma-Aldrich Corporation

P. O. Box 775544

St. Louis, MO 63177

USA

SECURITY OWNERSHIP OF DIRECTORS, EXECUTIVE OFFICERS

AND PRINCIPAL BENEFICIAL OWNERS

Directors and Executive Officers

The following table sets forth the amount of the Company’s common stock beneficially owned by each of the directors and executive officers of the Company shown in the summary compensation table below, and by all directors and executive officers of the Company as a group, all as of March 7, 2005, based upon information obtained from such persons:

Name | Company Position | Shares Beneficially Owned (1)(2) | ||

Nina V. Fedoroff | Director | 17,000 (4) | ||

David R. Harvey | Director, Chairman and Chief Executive Officer | 223,040 (3)(5) | ||

Michael R. Hogan | Chief Administrative Officer, Chief Financial Officer and Secretary | 156,515 (3) | ||

David W. Julien | President Biotechnology | 70,391 (3) | ||

W. Lee McCollum | Director | 19,000 (4) | ||

Jai P. Nagarkatti | President & Chief Operating Officer, President Scientific Research | 124,151 (3) | ||

William C. O’Neil, Jr. | Director | 32,000 (4) | ||

J. Pedro Reinhard | Director | 18,000 (4) | ||

Jerome W. Sandweiss | Director | 41,480 (4) | ||

Timothy R.G. Sear | Director Nominee | 3,000 | ||

D. Dean Spatz | Director | 37,200 (4) | ||

Barrett A. Toan | Director | 19,000 (4) | ||

Frank D. Wicks | President Fine Chemicals | 73,583 (3) | ||

| Directors and executive officers as a group | 1,133,371 (3) | |||

| (1) | Each nominee has both sole voting power and sole investment power with respect to the shares set forth in the table opposite his or her name, except as follows: Mr. Hogan shares voting and investment power as to 33,915 shares held in joint tenancy with his spouse; and Mr. Spatz shares voting and investment power as to 4,200 shares held in joint tenancy with his spouse. Shares owned separately by spouses are not included. |

| (2) | Represents less than one percent (1%) of the Company’s common stock outstanding as of March 7, 2005 for each of the named individuals and less than two percent (2%) for the group. |

-6-

| (3) | Includes 107,375, 122,600, 56,000, 91,000, 59,250, and 815,505 shares subject to stock options that are exercisable as of, or within 60 days of, March 7, 2005, for Dr. Harvey, Messrs. Hogan and Julien and Drs. Nagarkatti and Wicks and for the directors and executive officers as a group, respectively. |

| (4) | Includes 16,000, 18,000, 28,000, 18,000, 26,000, 28,000, and 18,000 shares subject to stock options that are exercisable as of, or within 60 days of, March 7, 2005, for Ms. Fedoroff and Messrs. McCollum, O’Neil, Reinhard, Sandweiss, Spatz and Toan, respectively. |

| (5) | Includes 25,900 restricted shares for which Dr. Harvey has dividend and voting rights. The depository rights on these shares vest in accordance with Dr. Harvey’s Employment Agreement as amended. |

Principal Beneficial Owners and Transactions

The following table sets forth information for each entity that, to the knowledge of the Company, beneficially owned more than five percent (5%) of the Company’s common stock as of March 7, 2005:

Name and Address | Shares Beneficially Owned | Percent of Shares Outstanding | ||

AMVESCAP PLC 11 Devonshire Square London, England EC2M 4YR | 6,254,668 (1) | 9.1% | ||

Barclays Global Investors, NA 45 Fremont Street San Francisco, CA 94105 | 5,948,773 (2) | 8.6% | ||

State Farm Mutual Automobile Insurance Company and related entities One State Farm Plaza Bloomington, IL 61710 | 7,091,885 (3)(4) | 10.3% | ||

| (1) | As set forth in such company’s Schedule 13G, signed February 14, 2005 and filed with the Securities and Exchange Commission on February 15, 2005. AMVESCAP PLC reports (i) sole voting power over 6,254,668 shares, (ii) shared voting power over none of the shares, (iii) sole dispositive power over 6,254,668 shares and (iv) shared dispositive power over none of the shares. |

| (2) | As set forth in such company’s Schedule 13G, signed February 14, 2005 and filed with the Securities and Exchange Commission on February 14, 2005. Barclays Global Investors, NA represents shares owned by the Company and entities affiliated with Barclays Global Investors, NA in which they hold more than a 50% indirect interest and holdings that have been aggregated for the purposes of this filing. Barclays Global Investors, NA reports (i) sole voting power over 5,354,700 shares, (ii) shared voting power over none of the shares, (iii) sole dispositive power over 5,948,773 shares and (iv) shared dispositive power over none of the shares. |

| (3) | As set forth in such company’s Schedule 13G, signed January 21, 2005 and filed with the Securities and Exchange Commission on January 21, 2005. State Farm Mutual Automobile Insurance Company represents shares owned by entities affiliated with State Farm Mutual Automobile Insurance Company. The filing indicates that such entities may constitute a group but states that each person disclaims beneficial ownership as to all shares not specifically attributed to such entity in the filing and disclaims that it is part of a group. State Farm Mutual Automobile Insurance Company reports (i) sole voting power over 7,065,380 shares, (ii) shared voting power over 26,505 shares, (iii) sole dispositive power over 7,065,380 shares and (iv) shared dispositive power over 26,505 shares. |

| (4) | As of December 31, 2004, State Farm Mutual Automobile Insurance Company held $100,000,000 of the Company’s 7.687% Senior Notes due September 12, 2010. |

-7-

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company’s executive officers, directors and persons who own beneficially more than ten percent of the Company’s outstanding stock, file reports of ownership and changes in ownership with the Securities and Exchange Commission and any national securities exchange on which the Company’s securities are listed and furnish the Company with copies of all Section 16(a) reports so filed. Based solely on a review of these reports and certain written representations furnished to the Company, the Company believes that its executive officers and directors complied with all applicable Section 16(a) filing requirements during 2004, except for Dr. Harvey who filed a late report for restricted shares and options awarded pursuant to his Employment Agreement.

Management and Directors Share Ownership Policy

The Company has a shareholding policy for the following management positions:

Position | Shareholding Requirement (salary multiple) | |

Chairman & CEO | 3X | |

President & COO, Business Unit Presidents, CAO and CFO | 2X | |

Other Corporate Officers and Key Unit Officers | 1X | |

Vice Presidents, Key Country and Unit Managers | .5X |

The policy was implemented in 2000, with three years allowed for participants in the United States and five years allowed for participants outside of the United States, to achieve the required investment level. At December 31, 2004, all members of these groups met the shareholding requirement, with total holdings for the entire group of 382,379 shares.

Non-employee directors are required to hold shares equivalent to 2X the annual retainer. This policy was implemented in 2004, with three years allowed to achieve the required investment level.

-8-

INFORMATION CONCERNING EXECUTIVE COMPENSATION

The following table presents compensation information for the Chief Executive Officer and the four other most highly compensated executive officers based on salary and bonus in 2004 for the years ended December 31, 2004, 2003 and 2002:

Summary Compensation Table

| Annual Compensation | Long-term Compensation | |||||||||||||||||||||

Name/Position | Year | Salary | Bonus (1) | Other Annual Comp. (2)(3) | Restricted Stock Award (4) | Securities Underlying Options (#) | LTIP Payouts (2) | All Other Comp. (5) | ||||||||||||||

David R. Harvey | 2004 | $ | 725,000 | $ | 449,051 | — | $ | 1,501,164 | 90,000 | $ | — | $ | 7,980 | |||||||||

Chairman & Chief | 2003 | 725,000 | 298,401 | $ | 122,841 | — | 50,000 | 195,400 | 7,800 | |||||||||||||

Executive Officer | 2002 | 725,000 | 115,928 | 188,929 | — | 50,000 | 300,525 | 7,200 | ||||||||||||||

Michael R. Hogan | 2004 | 430,000 | 199,950 | — | — | 20,000 | — | 41,280 | ||||||||||||||

Chief Administrative Officer, | 2003 | 430,000 | 132,870 | — | — | 20,000 | — | 7,800 | ||||||||||||||

Chief Financial Officer & | 2002 | 415,000 | 66,359 | — | — | 25,000 | — | 7,200 | ||||||||||||||

Secretary | ||||||||||||||||||||||

David W. Julien | 2004 | 310,000 | 144,150 | — | — | 20,000 | — | 34,680 | ||||||||||||||

President, Biotechnology | 2003 | 310,000 | 95,790 | — | — | 20,000 | — | 7,800 | ||||||||||||||

| 2002 | 290,000 | 46,371 | — | — | 25,000 | — | 7,200 | |||||||||||||||

Jai. P. Nagarkatti | 2004 | 366,875 | 262,260 | — | — | 20,000 | — | 41,280 | ||||||||||||||

President & Chief Operating | 2003 | 305,000 | 94,245 | 33,781 | — | 20,000 | 53,735 | 7,800 | ||||||||||||||

| Officer, President Scientific Research | 2002 | 290,000 | 46,371 | 32,748 | — | 25,000 | 52,091 | 7,200 | ||||||||||||||

Frank D. Wicks | 2004 | 320,000 | 148,800 | — | — | 20,000 | — | 34,680 | ||||||||||||||

President, Fine Chemicals | 2003 | 320,000 | 98,880 | 33,781 | — | 20,000 | 53,735 | 7,800 | ||||||||||||||

| 2002 | 305,000 | 48,770 | 37,786 | — | 25,000 | 60,105 | 7,200 | |||||||||||||||

| (1) | Amounts are earned and accrued during the fiscal years indicated and are paid subsequent to the end of each fiscal year pursuant to the Company’s Cash Bonus Plan, discussed on page 15. |

| (2) | The value of shares issued under the Incentive Stock Bonus Plan in 2003 and 2002 relate to performance in 1997 and 1996, respectively, and are presented as long-term incentive plan (“LTIP”) payouts. Such values represent the aggregate market value of shares of common stock issued on the payout date. Cash payouts to cover Federal income taxes related to the issuance of such shares are presented as other annual compensation. No awards are outstanding under this plan and no future awards will be issued under this plan. |

| (3) | Excludes the value of personal use of automobiles and club memberships provided by the Company, the amounts of which are immaterial for each executive officer. |

| (4) | Represents the value of 25,900 shares of restricted stock issued on February 10, 2004 pursuant to Dr. Harvey’s Employment Agreement, as amended. |

| (5) | Represents amounts contributed for each executive officer under the Company’s 401(k) Retirement Savings Plan in 2004, 2003 and 2002, respectively, and under the Supplemental Retirement Plan in 2004 discussed on page 12. |

2003 Long-Term Incentive Plan (2003 LTIP)

The Company’s Long-Term Incentive Plan is administered by the Compensation Committee of the Board. See “Compensation Committee Report on Executive Compensation—Incentive Compensation” beginning on page 16 of this Proxy Statement for information concerning the plan.

-9-

Stock Options

Stock options are awarded under the terms of the 2003 LTIP. The Compensation Committee grants options to employees as the Committee determines, taking into account the employees’ duties, their present and potential contributions to the success of the Company and such other factors, as the Committee deems relevant. The exercise price of the options is determined by the Committee; however, no option may have an exercise price less than 100% of the fair market value of the shares at the date of the grant. Full payment for stock being purchased must be made in (i) cash or (ii) at the Committee’s discretion, in Company common stock at the time an option is exercised or (iii) at the Committee’s discretion, a combination of (i) and (ii). Options are not transferable other than by will or by the laws of descent and distribution. Options expire ten years from the date of grant, although the Committee may grant non-qualified options with longer terms to participants outside of the United States. Options will generally terminate no later than twelve months after an optionee’s termination of employment without cause (as defined in the plan), retirement, death or disability.

The following table sets forth information related to stock options granted to the named executive officers during the year ended December 31, 2004:

Option Grants in 2004

Name of Executive | Number of Securities Underlying Options | % of Total Options Granted to Employees in 2004 | Exercise Price ($/ Share) (3) | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (4) | |||||||||||

| 5% | 10% | |||||||||||||||

David R. Harvey | 40,000 (1) 50,000 (2) | 4.5 5.6 | % | $ | 57.96 57.32 | 2/10/2014 5/4/2014 | $ | 1,458,029 1,802,412 | $ | 3,694,933 4,567,666 | ||||||

Michael R. Hogan | 20,000 (2) | 2.2 | 57.32 | 5/4/2014 | 720,965 | 1,827,066 | ||||||||||

David W. Julien | 20,000 (2) | 2.2 | 57.32 | 5/4/2014 | 720,965 | 1,827,066 | ||||||||||

Jai P. Nagarkatti | 20,000 (2) | 2.2 | 57.32 | 5/4/2014 | 720,965 | 1,827,066 | ||||||||||

Frank D. Wicks | 20,000 (2) | 2.2 | 57.32 | 5/4/2014 | 720,965 | 1,827,066 | ||||||||||

| (1) | Issued pursuant to Dr. Harvey’s Employment Agreement, as amended. See Employment Agreement with Dr. Harvey on page 12 for the terms of this grant. |

| (2) | Options vest at the rate of 20% per year beginning May 4, 2005, immediately upon a “Change in Control” or upon termination of employment by reason of death, disability or retirement. “Change in Control” is defined generally in the same manner as “Change in Control” in “Employment Agreements with Other Named Executive Officers” on page 14. |

| (3) | Exercise price equals the fair market value per share on the grant date. |

| (4) | Presentation is required by Securities and Exchange Commission rules and is not intended to forecast possible future price appreciation of the Company’s common stock. |

Additionally, options to acquire 70,000 shares were granted to other executive officers at exercise prices ranging from $56.10 to $57.32 and options to acquire 655,050 shares were granted to members of the management group at exercise prices ranging from $57.12 to $57.96 during the year ended December 31, 2004.

-10-

The following table presents (i) stock options exercised by the named executive officers during the year ended December 31, 2004 and (ii) the unexercised options held by each named executive officer and the value of all in-the-money options as of December 31, 2004, as if all such in-the-money options were vested and exercisable as of December 31, 2004:

Aggregated Option Exercises in 2004 and

Option Values at December 31, 2004

Name | Shares Acquired | Value Realized (1) | Number of Shares Underlying December 31, 2004 | Value of Unexercised In-the-Money Options at December 31, 2004 (2) | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

David R. Harvey | 42,800 | $ | 913,030 | 77,375 | 170,000 | $ | 1,453,339 | $ | 1,141,100 | ||||||

Michael R. Hogan | — | — | 109,600 | 57,000 | 2,942,936 | 493,850 | |||||||||

David W. Julien | 6,000 | 160,441 | 53,000 | 57,000 | 1,018,950 | 493,850 | |||||||||

Jai P. Nagarkatti | 34,500 | 1,360,853 | 78,000 | 57,000 | 1,869,200 | 493,850 | |||||||||

Frank D. Wicks | 10,315 | 412,445 | 78,000 | 57,000 | 1,869,200 | 493,850 | |||||||||

| (1) | Calculated as the aggregate market value per share of the Company’s common stock on the day prior to the exercise date net of the aggregate exercise price per share. |

| (2) | Calculated as the aggregate closing market price per share of the Company’s common stock on December 31, 2004, for the total number of in-the-money shares under option, net of the aggregate value of all option exercise proceeds. |

Equity Compensation Plan Information

The 2003 LTIP authorizes issuance of the Company’s equity securities to employees or non-employees in exchange for goods or services. This plan was approved by the Company’s shareholders.

The following table shows the number of shares of common stock issuable upon exercise of outstanding options at December 31, 2004, the weighted average exercise price of those options and the number of shares of common stock remaining available for future issuance at December 31, 2004 under the 2003 LTIP, excluding shares issuable upon exercise of outstanding options:

Equity Compensation Plan Table—December 31, 2004

Plan Category | Number of Shares of Stock to be Issued Upon Exercise of Outstanding Options (2) | Weighted- Price of | Number of Shares of Stock Remaining and Available for Future Issuance Under Equity Compensation Plans (excluding shares to be issued upon exercise) | ||||

Share Option Plans | 2,461,969 (1) | $ | 40.16 | — | |||

2003 Long-Term Incentive Plan | 1,677,800 | 54.75 | 3,810,357 | ||||

Total | 4,139,769 | 3,810,857 | |||||

| (1) | Includes 2,311,969 and 150,000 options outstanding under the Share Option Plans of 1987, 1995 and 2000, collectively, and the Directors’ Non-Qualified Share Option Plan of 1998, respectively. All plans were approved by the Company’s shareholders. |

| (2) | Shares subject to adjustment for stock splits and stock dividends. |

Retirement Security Value Plan (Pension Plan)

The Sigma-Aldrich Retirement Security Value Plan is a tax-qualified, noncontributory retirement plan that provides all eligible employees, including the named executive officers, with a retirement benefit

-11-

based upon a formula. The plan provides an annual addition to each participant’s account, ranging from 2% to 5% of salary, depending on years of service. Each account is also credited with interest annually. In no event will the benefit provided by the Retirement Security Value Plan at retirement be less than the benefit provided by the previous pension plan formula for any employee who was a participant in the plan as of January 1, 1996. Pension credits have been and will continue to be restricted by the Internal Revenue Code limitations above certain levels of compensation. Taking into account these limitations and assuming that each executive officer continues employment with the Company until the normal retirement age of 65 at his current cash compensation level and that interest rates remain at December 31, 2004 levels, Drs. Nagarkatti and Wicks and Messrs. Hogan and Julien would receive upon retirement an annual pension benefit in the form of a single life annuity of $67,913, $78,290, $21,499 and $59,752, respectively, or at his election, a lump sum distribution based on the present value of such annual benefits. Dr. Harvey, who reached age 65 in 2004, was entitled to an annual pension benefit of $72,062 as of December 31, 2004 or at his election, a lump sum distribution based on the present value of such annual benefit.

Supplemental Retirement Plan

As part of the overall review of compensation and benefits, the Compensation Committee reviewed retirement benefits for the named executives and others compared to competitors and companies comparable in size with similar growth goals and found that the Company’s benefits were not competitive. In 2004, the Compensation Committee recommended and the Board of Directors approved the implementation of a supplemental retirement plan that covers, among others, the named executive officers other than Dr. Harvey effective January 1, 2004. The Company maintains a bookkeeping account reflecting annual credits of 6%, or more at the discretion of the Chief Executive Officer with respect to some or all participants, of base salary. After five years of participation in the plan, participants will vest in 50% of the credits, including investment earnings (or losses) and, thereafter, will vest at the rate of 10% annually until fully vested after 10 years. In the event of a participant’s termination by the Company (other than for cause) or by the participant for good reason within two years after a change of control that occurs while the participant is employed with the Company, or a termination on account of death, disability or retirement, the participant will fully vest immediately in any credits and earnings (or losses) as of the date of termination. For all other terminations, the participant will forfeit any unvested credits and earnings (or losses).

Employment and Other Agreements

Employment Agreement with Dr. Harvey

The Company entered into an employment agreement, effective January 1, 2003, (the “Employment Agreement”) with Dr. Harvey for an initial term extending through January 1, 2006, with automatic one-year renewal periods thereafter unless 180 days prior notice is provided. Under the Employment Agreement, Dr. Harvey will serve as the Company’s Chief Executive Officer or in any other capacity, as determined by the Board of Directors. On February 10, 2004, the Employment Agreement was amended (the “Employment Agreement as amended”).

Pursuant to the Employment Agreement as amended, Dr. Harvey will receive a minimum annual base salary of $725,000, be eligible to participate in the Company’s annual cash bonus program and be eligible for annual performance bonuses (with an initial target bonus of 66.6% of his annual base salary). In addition, Dr. Harvey will be entitled to participate in all retirement, disability, pension, savings, medical and dental insurances and other fringe benefits or plans of the Company generally available to employees. The Compensation Committee will review Dr. Harvey’s annual base salary and bonus opportunity each year but may not reduce Dr. Harvey’s base salary below $725,000. During the two-year period commencing on a Change of Control (as defined in the Employment Agreement as amended), Dr. Harvey’s base salary and bonus opportunity may not be reduced below the level established by the Compensation Committee immediately prior to the Change of Control.

-12-

Pursuant to the Employment Agreement as amended, the Compensation Committee granted to Dr. Harvey options to purchase 40,000 shares of Common Stock at an exercise price of $57.96 equal to the fair market value of the Common Stock on February 10, 2004 and 25,900 shares of restricted Common Stock on February 10, 2004. Dr. Harvey also has a performance bonus award under which he may earn up to $1,000,000 cash as of January 1, 2006. One-half of these awards will vest on January 1, 2006 if Dr. Harvey is still employed by the Company, and all or a portion of the other half of the awards will vest on January 1, 2006 if Dr. Harvey is still employed by the Company and the Company achieves performance goals established by the Board of Directors. The performance goals will be based upon the Company’s performance equal to or better than the average performance of its peers with respect to one or more or a combination of revenue growth, earnings per share growth and growth in operating cash flow. The Board of Directors may modify the peer group annually, or may determine that the Company’s performance will be measured against a weighted market basket index of companies in the three sectors corresponding to the Company’s business – life sciences, biotechnology and chemicals. These three sectors will be appropriately weighted to reflect the percentage of the Company’s business in each such sector. In determining performance of the Company relative to its peers, the Board of Directors in its discretion will make appropriate adjustments for acquisitions or divestitures, unusual or nonrecurring items which have a material effect and the impact of currency adjustments.

If the Company achieves the targeted level of performance in calendar years 2003, 2004, and/or 2005, 16-2/3% of the package will vest for each year such performance is achieved provided Dr. Harvey is employed on January 1, 2006. Even if the Company does not achieve the targeted level of performance in each of 2003, 2004, and 2005, the other half of the package will nonetheless vest in full if Dr. Harvey is employed on January 1, 2006 and the Company achieves the targeted level of performance for the three-year period beginning January 1, 2003 and ending January 1, 2006.

The vesting of the awards will be accelerated if within 24 months after a Change of Control Dr. Harvey’s employment is involuntarily terminated by the Company or if Dr. Harvey terminates his employment for Good Reason (as defined in the Employment Agreement as amended). A pro rata portion of the awards will vest in the event of the termination of Dr. Harvey’s employment as a result of his death or disability prior to January 1, 2006. A pro rata portion of 50% of the awards shall vest in the event of Dr. Harvey’s involuntary termination with Cause (as defined in the Employment Agreement as amended) prior to January 1, 2006.

If the Company terminates Dr. Harvey’s employment for Cause or Dr. Harvey voluntarily terminates his employment without Good Reason (as defined in the Employment Agreement as amended) prior to the end of the employment period, Dr. Harvey will receive his base salary through the date of termination but will not be entitled to any severance compensation or to any further base salary, bonus or benefits, unless otherwise provided by the applicable benefit plan or program. If the Company terminates Dr. Harvey’s employment without Cause before or more than 24 months following a Change of Control (excluding any involuntary termination which is a direct result of a Change of Control and which occurs within 60 days before a Change of Control), Dr. Harvey will receive all accrued and unpaid base salary as of the date of termination and severance pay equal to one year of base salary and paid in installments over one year. If, within 24 months after a Change of Control or within 60 days before a Change of Control in the event of an involuntary termination without Cause which is a direct result of the Change of Control, the Company terminates Dr. Harvey’s employment without Cause or Dr. Harvey terminates his employment with Good Reason, Dr. Harvey will receive all accrued and unpaid base salary as of the date of termination and severance pay equal to three years of base salary paid in installments over three years. All payments will be subject to deductions for customary withholdings, including federal and state withholding taxes and social security taxes.

The Company’s obligations will not be subject to offset to the extent Dr. Harvey receives compensation from any subsequent employer.

-13-

The Company’s obligations under the Employment Agreement as amended will terminate on the last day of the month in which Dr. Harvey dies or on the date as of which he first becomes entitled to receive disability benefits under the Company’s long-term disability plan. The Company will pay to Dr. Harvey or his estate all accrued and unpaid base salary as of such date.

If any payment or distribution by the Company to Dr. Harvey would be subject to excise tax under Section 4999 of the Internal Revenue Code of 1986, as amended, then the payments will be decreased to the greatest amount that could be paid to Dr. Harvey such that receipt of the payments would not give rise to any such excise tax.

Dr. Harvey is also subject to current and post-employment confidentiality restrictions and non-competition and non-solicitation covenants during and for two years following his employment. The Employment Agreement as amended provides that Dr. Harvey will use his best efforts both during and after his employment with the Company to protect the confidential, trade secret and/or proprietary character of the Company’s confidential information. In addition, Dr. Harvey may not compete with the Company, directly or indirectly, and may not solicit the Company’s customers or employees at any time during his employment or for two years following the termination of his employment. Pursuant to the Employment Agreement as amended, Dr. Harvey will also disclose and assign his right in all of his work-related ideas, inventions and discoveries to the Company except for patents currently held by Dr. Harvey developed outside of his employment with the Company.

Employment Agreements with Other Named Executive Officers

The Company has Employment Agreements with Drs. Nagarkatti and Wicks and Messrs. Hogan and Julien that provide severance compensation (with an offset for monies earned elsewhere under certain defined situations) to each of these executives in the event of his cessation of employment with the Company or any of its subsidiaries after the occurrence of a Change in Control of the Company. “Change in Control” is defined as (a) a change in the composition of a majority of the Board of Directors, (b) an acquisition of more than 25% of the Company’s Common Stock or voting power, except certain acquisitions by specified types of affiliates, (c) a reorganization, merger, share exchange, or consolidation, unless (i) the Company’s shareholders possess more than 50% of the surviving company’s outstanding common stock and the combined voting power of the outstanding voting stock entitled to vote in the election of directors, (ii) no person or group who did not own 25% or more of the Company’s Common Stock or the outstanding voting stock entitled to vote in the election of directors before the change in control owns 25% or more of the common stock or the outstanding voting stock entitled to vote in the election of directors of the surviving company, and (iii) at least a majority of the Board of Directors of the surviving company were incumbent directors of the Company before the change in control, (d) the sale or disposition of all or substantially all of the Company’s assets, or (e) a shareholder-approved liquidation or dissolution of the Company.

These Employment Agreements may be terminated upon 60 days notice given by either the executive or the Company, provided that this 60-day termination right will no longer be available to the Company after a Change in Control of the Company. Unless notice is given to the contrary, the three-year term of the Employment Agreements is automatically extended for an additional year at the end of each agreement year. Compensation covered by the Employment Agreements is set annually by either the Compensation Committee or the Board of Directors. After a Change in Control of the Company, the executive’s total cash compensation (salary plus bonus) may not be reduced below the level in effect immediately prior to the Change in Control. After a Change in Control, if the executive’s employment terminates, the executive shall continue to receive the same compensation through the remaining term of the employment agreement as severance. The amount of severance shall be reduced by any compensation received by the executive for personal services from employment other than with the Company during the term of the employment agreement. No payments are made under the Employment Agreements if the cessation of employment is due to death. If a Change in Control of the Company had occurred as of March 7, 2005, and the employment of the named executive officers of

-14-

the Company had been terminated, Drs. Nagarkatti and Wicks and Messrs. Hogan and Julien would have collectively received $4,913,000.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Committee

The Committee is composed of the three members named below, none of whom is an employee of or is involved in any interlocking relationship with the Company.

Compensation Policy

The Committee believes that increasing share value on a long-term basis is the goal of shareholders. The Company’s compensation policy is designed to motivate employees to improve productivity and performance, resulting in increased profitability and, thus, improvement in shareholder value. Compensation for the Company’s executive officers includes three components: (1) salary, (2) an annual cash bonus and (3) long-term incentive compensation. The Company has no long-term employment contracts with any of its executive officers other than the Employment Agreements described on page 12 of this Proxy Statement. The Company’s policy is to structure compensation such that any executive compensation in excess of $1 million is tax deductible for the Company.

The Company uses an independent national consulting firm (the Firm) to review the compensation of its executive officers compared to competitors and companies comparable in size with similar growth goals. The consultant compares the compensation of the executive officers, including the Chief Executive Officer (CEO), to total compensation received by executives in similar positions at competitor and peer companies selected by the Firm. The Committee also considers the annual performance of the Company. Based on these reviews, the Committee made recommendations on the CEO’s and other executive officers’ compensation for 2004.

Components of Executive Compensation

Salary

The Committee reviews with the CEO an annual salary plan for the Company’s executive officers and then approves such plan with any modifications it deems appropriate. The Committee approves the salary plan after assessing the Company’s overall performance, including a general review of the operating results of the Company, its competitors and its peers, the executive officers’ responsibilities and performance and compensation received by executives in similar positions. The review of operating results is general in nature. In reviewing the individual executive officers’ responsibilities and performance, the Committee also considers their non-financial contributions to the Company, such as the quality and progress of research, marketing, production and process improvement activities. The Committee performs its review in a general, subjective manner with consideration given to all factors. The Committee generally believes that salaries for the Company’s executive officers should be at the 50th percentile of comparable companies if performance is similar to those peer companies.

Based upon the business knowledge and experience of the Committee members, they believe that the executive officers’ salaries are appropriate in view of the level of responsibilities and contributions by each executive officer.

Cash Bonus Plan

The Company has a Cash Bonus Plan for all management employees to further align the interests of management with its shareholders. The bonus for eligible employees is based on the Company achieving certain predetermined financial goals.

-15-

For 2004, the performance goals were based on sales and operating income growth and return on assets. The maximum cash payment for eligible employees was set at between 10% and 66.6% of their annual salary, based on their expected contribution to meeting Company objectives. Based on 2004 sales and operating income growth and return on assets, actual cash bonus payments in 2005 were between 9.3% and 61.9% of eligible employees’ annual salaries.

Incentive Compensation

The Committee considers the desirability of awards under the 2003 LTIP. The 2003 LTIP provides for the issuance of stock options, stock appreciation rights, restricted stock, performance shares and other stock-based awards.

The Committee believes that granting stock based awards is desirable because it directly correlates long-term compensation of key employees with share price appreciation. In determining grants, the Committee generally considers the same factors as those discussed under Salary above. The Committee does not consider the amounts or terms of prior stock grants in determining current grants. Stock options for 130,000 shares of the Company’s common stock were granted to the named executive officers in 2004. See “2003 Long-Term Incentive Plan” on page 9 of this Proxy Statement for additional information concerning this plan. Stock options for 40,000 shares of the Company’s common stock and 25,900 restricted shares of the Company’s common stock were awarded to Dr. Harvey pursuant to the Employment Agreement described on page 12 of this Proxy Statement.

2004 Chief Executive Officer’s Compensation

The Committee’s approach is to have a large amount of Dr. Harvey’s compensation dependent on Company performance. In measuring performance, consideration is given to the various measures described in the Components of Executive Compensation – Salary on page 15 of this Proxy Statement.

In setting Dr. Harvey’s salary for 2004, the Committee recognized Dr. Harvey’s leadership, as well as considered compensation levels for CEO’s of competitors and companies of similar size and with similar performance. Based on this review, the Committee maintained his salary at the 2003 level.

Dr. Harvey received a bonus of $449,051 for 2004 and received options for 90,000 shares of stock in 2004. The bonus is pursuant to the Company’s Cash Bonus Plan (described on page 15 of this Proxy Statement) and reflects improved growth in operating income and a higher return on assets. Of the options for 90,000 shares of stock, 40,000 options were granted pursuant to Dr. Harvey’s employment agreement (described on page 12 of this Proxy Statement) and the award of 50,000 options reflects Dr. Harvey’s level of responsibilities.

The Compensation Committee met separately without the presence of Dr. Harvey to evaluate his performance. Subsequently, the full Board met without the presence of Dr. Harvey to review his performance. The Board then met with Dr. Harvey to review his 2004 performance.

Other Executive Officer’s Compensation

For the other executive officers, the Committee determined that 2004 compensation should reflect the Company’s performance, the level of the officers’ responsibilities and any changes thereto during the year, and the officers’ contribution to strategic initiatives that will drive future growth. The Committee believes that the compensation policies and programs it has implemented have committed the executive officers of the Company to achieve long-term improvement in operating results.

COMPENSATION COMMITTEE

William C. O’Neil, Jr. (Chairman)

J. Pedro Reinhard

Barrett A. Toan

-16-

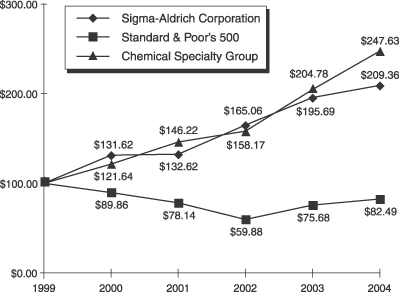

PERFORMANCE GRAPH

The following performance graph compares the Company’s cumulative shareholder return (stock price appreciation plus reinvestment of dividends) for a five year period ended December 31, 2004, with that of the Standard & Poor’s 500 Composite Stock Price Index and an index of the companies included in the Value Line Chemical Specialty Industry Group, assuming that $100 was invested in each on December 31, 1999, and that all dividends were reinvested. These indices are only included for comparative purposes as required by Securities and Exchange Commission rules and do not necessarily reflect management’s opinion that such indices are an appropriate measure of the relative performance of the Company’s common stock, and are not intended to forecast or be indicative of possible future performance of the common stock.

| 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | |||||||||||||

Sigma-Aldrich Corporation | $ | 100.00 | $ | 131.29 | $ | 132.62 | $ | 165.06 | $ | 195.69 | $ | 209.36 | ||||||

Standard & Poors 500 | 100.00 | 89.86 | 78.14 | 59.88 | 75.68 | 82.49 | ||||||||||||

Value Line: Chemical Specialty | 100.00 | 121.64 | 146.22 | 158.17 | 204.78 | 247.63 | ||||||||||||

In this Proxy Statement, the Company used as a performance graph comparison index those companies comprising the Value Line Chemical Specialty Industry Group (the “2004 Group”). The 2004 Group includes the following companies: A. Schulman Inc., ADM Tronics Unlimited Inc., Advanced Materials Group Inc., AEP Industries Inc., Agrium Inc., Airgas Inc., American Biltrite Inc., American Pacific Corp., American Vanguard Corp., Arch Chemicals, Atlantis Plastics Inc., Avery Dennison Corp., Balchem Corp., Blue Phoenix Solutions, Cabot Microelectronics Corp., CFC International Inc., CPAC Inc., Crompton Corp., Delta-Omega Technologies, Donlar Biosyntrex Corp., Dyna Group International, Inc., Ecolab Inc., Eden Bioscience Corp., Enerchem International Inc., Engelhard Corp., Epolin Inc., ESCAgenetics Corp., Ferro Corp., Flamemaster Corp., Flexible Solutions International Inc., Foamex International Inc., Glassmaster Co., Great Lakes Chemical Corp., Great West Gold, Inc., H.B. Fuller Co., Hercules Inc., Hexcel Corp., HiEnergy Technologies Inc., Human Pheromone Sciences Inc., Humatech Inc., IFT Corp., Ikonics Corp., International Flavors & Fragrances, Ionatron Inc., Isonics Corp., Jilin Chemical Industrial Co. Ltd., KMG Chemicals Inc., Kyzen Corp., Lesco Inc., Lubrizol Corp., Luna Technologies International Inc., Lydall Inc., MacDermid Inc., Mace Security International Inc., Material Sciences Corp., Millennium Cell Inc., Minerals Technologies Inc., Nanophase Technologies Corp., Nevada Chemicals Inc., NewMarket Group, NL Industries Inc.,

-17-

Octel Corp., Oil Dri Corp., OM Groups, Omnova Solutions Inc., Park Electrochemical Corp., Penford Corp., Planet Technologies Inc., PolyOne Corp., Powerball International Inc., Praxair Inc., Prolong International Corp., PW Eagle Inc., Quaker Chemical Corp., Rhodia S.A., Rohm & Haas Co., RPM International Inc., Sherwin-Williams Co., Sico Inc., Sigma-Aldrich Corp., Southwall Technologies Inc., Stepan Co., Summit Environmental Corp. Inc., SurModics Inc., Symyx Technologies Inc., Technical Ventures Inc., Terra Nitrogen Co. L.P., Tor Minerals International Inc., Tredegar Corp., UAP Holding Corp., UFP Technologies Inc., United Energy Corp., Valspar Corp., and Wellman Inc.

Compared to 2003, the 2004 Group added ESCAgenetics Corp., Great West Gold Inc., IFT Corp., Ionatron Inc., NewMarket Group, and UAP Holding Corp. The 2004 Group deleted Adven Inc., Alcide Corp., Amcol International Corp., Electrochemical Ind., Ethyl Corp., Greensmart Corp., Haber Inc., JLM Industries Inc., Krystal Digital Corp., Polymer Solutions Inc., US Home & Garden Inc., Urecoats Industries Inc., and Wannigan Capital Corp. With these exceptions, which resulted solely from the independent action of Value Line, the 2004 and 2003 Groups are identical.

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANT

The Audit Committee of the Board of Directors has appointed KPMG LLP as independent registered public accountant to conduct the annual audit of the Company’s accounts for the fiscal year ending December 31, 2005 and the Board of Directors has further directed that management submit the appointment of the Company’s independent registered public accountant for ratification by the shareholders. Although action by the shareholders in this matter is not required by the Company’s amended By-laws or otherwise, the Board of Directors believes that it is appropriate to seek shareholder ratification of this appointment in light of the important role played by the independent registered public accountant in maintaining the integrity of the Company’s financial controls and reporting. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm.

Representatives of KPMG LLP are expected to be present at the Meeting and will have the opportunity to make a statement if they wish to do so, and are expected to be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR the ratification of the appointment of KPMG LLP as independent registered public accountant for 2005.

AUDIT FIRM FEE SUMMARY

During 2004 and 2003, the Company retained its independent registered public accountant, KPMG LLP, to provide services in the following categories and amounts:

| 2004 | 2003 | |||||

Audit Fees | $ | 1,684,000 | $ | 939,000 | ||

Audit-related Fees (1) | 66,000 | 88,000 | ||||

All Other Fees (2) | 77,000 | 14,000 | ||||

| (1) | Relates to fees for audit of the Company’s employee benefit plans and audit-related services. |

| (2) | All Other Fees relate to fees for services necessary to comply with statutory audit requirements of foreign governments. |

The Audit Committee pre-approves all fees paid to KPMG LLP prior to the commencement of services. The Audit Committee has considered whether the provision of non-audit services by the Company’s independent registered public accountant is compatible with maintaining auditor independence.

-18-

REPORT OF AUDIT COMMITTEE

To the Board of Directors of Sigma-Aldrich Corporation:

We have reviewed and discussed with management the Company’s audited financial statements as of and for the year ended December 31, 2004.

Management is responsible for the Company’s financial reporting process including its system of internal control over financial reporting, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent registered public accountant is responsible for auditing those financial statements. Our responsibility is to monitor and review these processes. It is not our duty or our responsibility to conduct auditing or accounting reviews or procedures. We are not employees of the Company and some of us may not be, and do not represent ourselves to be or to serve as, registered accountants or auditors by profession or experts in the fields of accounting or auditing. Therefore, we have relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the representations of the independent registered public accountant included in their report on the Company’s financial statements. Our oversight does not provide us with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, our considerations and discussions with management and the independent registered public accountant do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that our Company’s independent registered public accountant is in fact “independent”.

Management completed the documentation, testing and evaluation of the Company’s system of internal control over financial reporting in response to the requirements set forth in Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. We received periodic reports on the progress of the evaluation and provided oversight and advice to management during the process. In connection with this oversight, we received periodic updates provided by management and KPMG LLP at each regularly scheduled Committee meeting. At the conclusion of the process, management provided the Committee with and the Committee reviewed a report on the effectiveness of the Company’s internal control over financial reporting. We will continue to oversee the Company’s efforts related to its internal control over financial reporting and management’s preparations for the evaluation in 2005.

We have discussed with the independent registered public accountant the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and the letter from the independent registered public accountant required by Independence Standard No. 1,Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and have discussed with the independent registered public accountant their independence.

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Committee referred to above and in its Charter, the Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 to be filed with the Securities and Exchange Commission.

-19-

We have also considered whether the provision of services by KPMG LLP not related to the audit of the financial statements referred to above and to the reviews of the interim financial statements included in the Company Forms 10-Q in 2004 is compatible with maintaining the independence of KPMG LLP.

AUDIT COMMITTEE

W. Lee McCollum (Chairman)

Jerome W. Sandweiss

D. Dean Spatz

-20-

VOTE REQUIRED; OTHER MATTERS

The affirmative vote of the holders of a majority of the shares that are represented in person or by proxy at the Meeting and are entitled to vote on the subject matter is required to elect directors, to ratify the appointment of KPMG as the Company’s independent registered public accountant and approve any other matters properly brought before the Meeting. Shares represented by proxies which are marked “withhold authority” with respect to the election of any one or more nominees as directors and proxies which are marked to abstain or vote against the ratification of the independent registered public accountant or to deny discretionary authority on other matters will be counted for the purpose of determining the number of shares represented by proxy at the Meeting. Such proxies will thus have the same effect as if the shares represented thereby were voted against such nominee or nominees, against ratification of the independent registered public accountant and against such other matters, respectively. Shares not voted on one or more but less than all such matters on proxies returned by brokers will be treated as not represented at the Meeting as to such matter or matters and will thus have no effect.

The Company knows of no other matters to be presented for consideration at the Meeting. If any other matters are properly brought before the Meeting, the persons named in the accompanying proxy intend to vote or act with respect to items in accordance with their best judgment. The affirmative vote of the holders of the majority of shares represented at the meeting and entitled to vote on the subject matter is required for approval of any such other matters which are properly brought before the meeting.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

The Securities and Exchange Commission permits registrants to send a mailing containing a single annual report and proxy statement to any household at which two or more shareholders reside if the registrant believes they are members of the same family. The procedure, referred to as householding, reduces the volume of duplicate information shareholders receive and reduces the expense to the Company. The Company has not implemented this householding rule with respect to its record holders; however, a number of brokerage firms have instituted householding, which may impact certain beneficial owners of Common Stock. If your family has multiple accounts by which you hold Common Stock, you may have previously received a householding information notification from your broker. Please contact your broker directly if you have any questions, require additional copies of the Proxy Statement or annual report, or wish to revoke your decision to household, and thereby receive multiple reports.

SHAREHOLDER PROPOSALS

Written proposals of shareholders to be included in the Proxy Statement and Proxy for the next Annual Meeting of Shareholders must be received at the Company’s principal executive office, 3050 Spruce Street, St. Louis, Missouri 63103, no later than November 29, 2005. Upon receipt of any such proposal, the Company will determine whether or not to include such proposal in the Proxy Statement and Proxy in accordance with regulations governing the solicitation of proxies.

Under the Company’s amended By-laws, in order for a shareholder to nominate a candidate for director, or to bring other business before a shareholders’ meeting, timely notice must be given to and received by the Company in advance of the meeting. In the case of an annual meeting, ordinarily, such notice must be given and received not less than 90 nor more than 120 days before the first anniversary of the preceding year’s annual meeting (or between January 3, 2006 and February 2, 2006 in the case of the 2006 annual meeting of shareholders); provided, however, that in the event that the date of the annual meeting is advanced by more than 30 days or delayed by more than 60 days from such

-21-

anniversary date, then such notice must be given by the shareholder and received by the Company not earlier than the opening of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of such meeting is first made. In certain cases, notice may be delivered and received later if the number of directors to be elected to the Board of Directors is increased. In the case of a nomination, the shareholder submitting the notice must describe various matters as specified in the Company’s amended By-laws, including the name and address of each proposed nominee, his or her occupation and number of shares held, and certain other information. In the case of a proposal of other business, the notice must include a description of the proposed business (which must otherwise be a proper subject for action by the shareholders), the reasons therefor and other matters specified in the Company’s amended By-laws.

In the case of special meetings of shareholders, only such business will be conducted, and only such proposals will be acted upon, as are brought pursuant to the notice of the meeting. In the event the Company calls a special meeting of shareholders to elect one or more directors, any shareholder may nominate a candidate, if such shareholder complies with the timing and notice requirements contained in the amended By-laws. Proposals of other business may be considered at a special meeting requested in accordance with the amended By-laws only if the requesting shareholders give and the Company receives a notice containing the same information as required for an annual meeting at least 30 days prior to the earlier of the time the person so designated calls the meeting pursuant to Section 2.02 of the amended By-laws or the day on which public announcement of the date of the meeting is first made.

In the case of an annual or special meeting, the shareholder proponent must be a shareholder of the Company who was a shareholder of record both at the time of giving of notice and at the time of the meeting and who is entitled to vote at the meeting. Any such notice must be given to the Secretary of the Company, whose address is 3050 Spruce Street, St. Louis, Missouri 63103. Any shareholder desiring a copy of the Company’s Certificate of Incorporation, as amended, or amended By-laws will be furnished a copy without charge upon written request to the Secretary.

The time limits described above also apply in determining whether notice is timely for purposes of Rule 14a-4(c) under the Securities Exchange Act of 1934 relating to exercise of discretionary voting authority, and are separate from and in addition to the Securities and Exchange Commission’s requirements that a shareholder must meet to have a proposal included in the Company’s proxy statement for an annual meeting.

In each case, the proposals or notices described above must be submitted in writing to Michael R. Hogan, Secretary, Sigma-Aldrich Corporation, 3050 Spruce Street, St. Louis, Missouri 63103.

By Order of the Board of Directors,

Michael R. Hogan, Secretary

March 29, 2005

-22-

3050 SPRUCE STREET ST. LOUIS, MO 63103 | FOR VOTING BY PHONE, INTERNET OR MAIL, PLEASE READ THE INSTRUCTIONS BELOW | |

VOTE BY PHONE -1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the meeting date. Have your proxy card in hand when you call and then follow the instructions. | ||

VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. | ||

VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to SIGMA-ALDRICH, c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. | ||

| March 29, 2005 | If you vote by phone or vote using the Internet, please do not mail your proxy. | |

| Dear Shareholder: | THANK YOU FOR VOTING. | |

The annual meeting of Shareholders of Sigma-Aldrich Corporation will be held at the Company’s Life Science and High Technology Center, 2909 Laclede Avenue, St. Louis, Missouri 63103 at 11:00 A.M. Central Daylight Time, on Tuesday, May 3, 2005.

It is important that these shares are represented at this meeting. Whether or not you plan to attend the meeting, please review the enclosed proxy materials. You may sign, date and return this proxy card or you may vote by telephone or Internet.

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | SGMAL1 | KEEP THIS PORTION FOR YOUR RECORDS | ||

| DETACH AND RETURN THIS PORTION ONLY | ||||

| THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. | ||||

| SIGMA-ALDRICH CORPORATION | ||||||||||||||||||||||

| This proxy will be voted FOR items 1 and 2 unless otherwise directed, and in the discretion of the proxies, on whatever other business may properly come before the meeting. | For All | Withhold All | For All Except | To withhold authority to vote, mark “For All Except” and write the nominee’s number on the line below. | ||||||||||||||||||

| The Board of Directors recommends a vote FOR the following: | ||||||||||||||||||||||

| Vote On Directors | ¨ | ¨ | ¨ | |||||||||||||||||||

1. | ELECTION OF DIRECTORS: 01) Nina V. Fedoroff, 02) David R. Harvey, 03) W. Lee McCollum, 04) William C. O’Neil, Jr., 05) J. Pedro Reinhard, 06) Timothy R.G. Sear, 07) D. Dean Spatz and 08) Barrett A. Toan. | |||||||||||||||||||||

| For | Against | Abstain | ||||||||||||||||||||

| Vote On Proposal | ||||||||||||||||||||||

2. | Ratification of the appointment of KPMG LLP as the Company’s independent registered public accountant for 2005. | ¨ | ¨ | ¨ | ||||||||||||||||||

| For address changes and/or comments, please check this box and write them on the back where indicated. | ¨ | |||||||||||||||||||||

| If stock is owned in joint names, all owners must sign. If signing for estates, trusts or corporations, please indicate title or capacity. | ||||||||||||||||||||||