Item 1: Report to Shareholders

|

| Blue Chip Growth Fund | December 31, 2005 |

The views and opinions in this report were current as of December 31, 2005. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act of 2002, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Fellow Shareholders

Although several major equity market indices struggled (the widely watched Dow Jones Industrial Average eked out a modest 1.72% return for the past 12 months), stocks generally rebounded in the second half of 2005, resulting in meaningful full-year gains. Increases in energy prices, rising short-term interest rates, and a devastating set of hurricanes failed to derail U.S. economic growth. Consumer and investor confidence improved as energy costs declined in the fourth quarter, and large-cap growth stocks were among the better-performing asset classes since midyear.

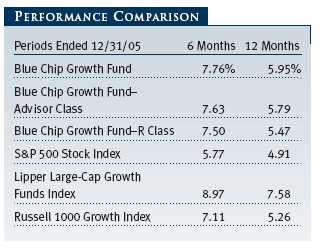

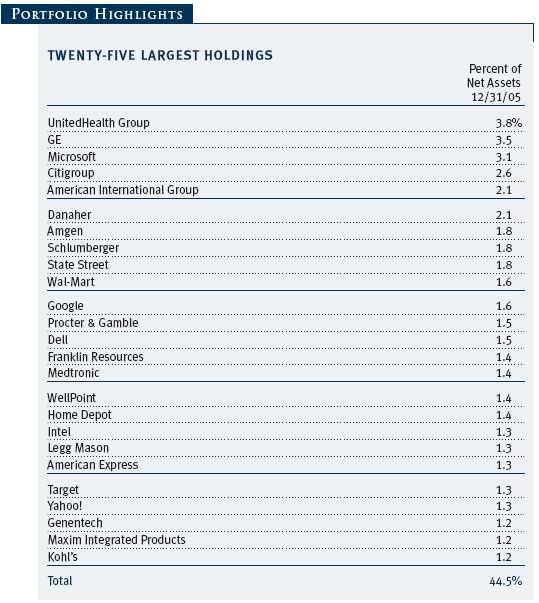

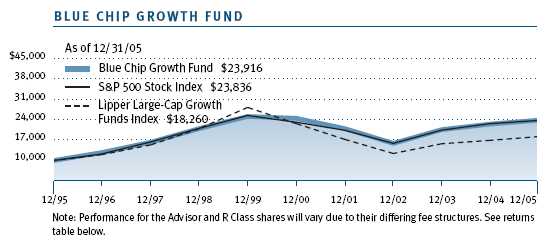

The portfolio produced solid gains for the past six months and less-inspiring returns for the full year that nonetheless surpassed the results for the benchmark S&P 500 Index and the style-specific Russell 1000 Growth Index. We trailed the Lipper peer group index in both periods, although our performance was significantly stronger on an absolute and relative basis in the second half (and particularly in the fourth quarter) as large-cap growth stocks generated improved performance. As shown in the Growth of $10,000 chart on page 11, our 10-year return is modestly ahead of the S&P 500 and significantly outperformed the Lipper peer group.

MARKET ENVIRONMENT

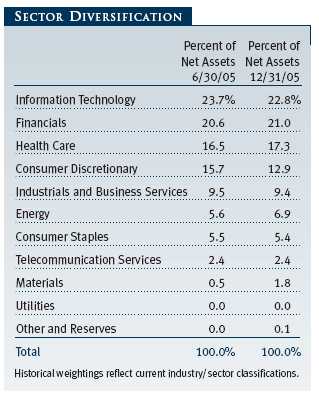

After several years of relatively mediocre performance, large growth stocks are strengthening. However, stymied by 13 Federal Reserve interest rate increases and the effects of rising energy prices, the market performed inconsistently and only grudgingly yielded gains for the largest companies. Energy stocks were strong performers in 2005. The sector’s weighting increased from 7.1% to 9.3% in the S&P 500 Index and more so among our competitors in our Lipper peer group.

The Fed’s strategy of increasing rates is designed to contain inflation but also may be directed at a perceived overheating in certain housing markets. We believe any correction in housing prices will be moderate and manageable but could affect consumer confidence and overall economic activity. The Fed’s systematic rate hikes took the fed funds rate to 4.25% from 1.00% 18 months ago. Over that period, long-term rates remained relatively stable, which led to a yield curve inversion (10-year Treasury yields were less than two-year Treasury yields at the end of the year). According to some market prognosticators, a yield curve inversion portends recession. That is not our view. We think the surprising strength of the U.S. dollar (partially due to the Fed’s tightening program) contributed to strong demand for longer-term Treasury bonds and kept their yields relatively low.

Overall, the current environment should be supportive for continued stock gains. Some moderation in economic growth is inevitable, and that should allow the Federal Reserve to stop tightening interest rates before inducing a recession. Valuations appear reasonable for many large-cap growth companies. Strong corporate profits, the related increase in free cash flow, and slowly improving capital expenditures at many companies are other major positives. Additionally, free cash flow margins and the level of cash on corporate balance sheets stand at multi-decade highs.

PORTFOLIO REVIEW

Financial stocks were the largest second-half performance contributors, which reinforced our view that it is often unwise to sell stocks based upon macroeconomic generalizations (many investors felt that financial stocks could not perform well as the Fed increased rates). Asset managers, brokers, and other capital markets stocks were particularly strong, with Franklin Resources, State Street, Merrill Lynch, Goldman Sachs, Ameritrade, and Legg Mason being the standouts. We noted in our previous letter that Ameritrade’s combination with TD Waterhouse and Legg Mason’s acquisition of Citigroup’s investment management operations should yield revenue and efficiency benefits. Insurance leaders American International Group and Hartford Financial and consumer finance giants American Express and SLM Corporation (formerly Sallie Mae) were also excellent performers. In general, we think these companies can continue to generate strong growth in earnings and free cash flow. (Please refer to the fund’s portfolio of investments for a complete listing of holdings and the amount each represents of the portfolio.)

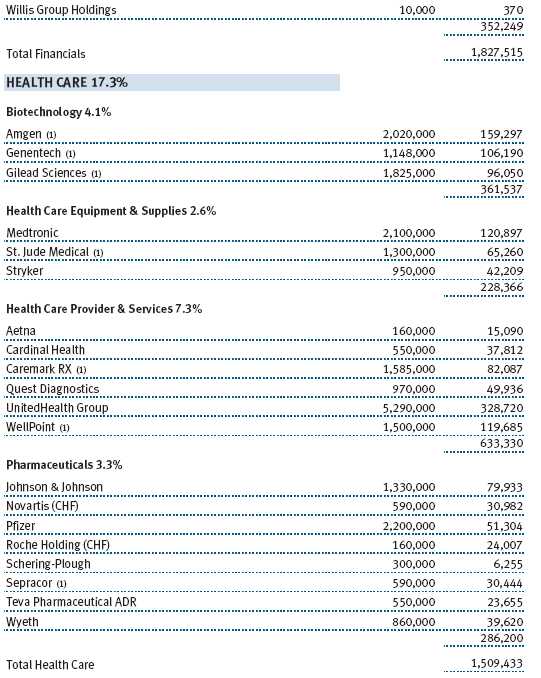

The health care sector contained some major winners as investors began to worry about the ability of more cyclical stocks to sustain performance.

UnitedHealth Group and WellPoint have been among the portfolio’s best performers for several years and they were again in the second half of 2005. The health care services industry continues to consolidate with both companies announcing major mergers. Efficiency improvements and medical costs, which are increasing more slowly than insurance pricing, should drive strong earnings growth. Amgen, Gilead Sciences, and Genentech were all strong performers in the biotech area. Medtronic and St. Jude Medical also posted solid second-half contributions.

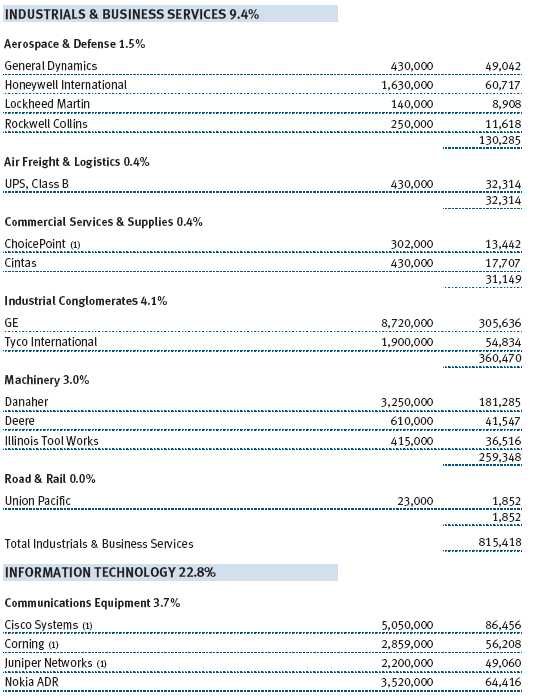

Because of our growth orientation, we have maintained an underweight in the energy sector versus the S&P 500. However, for the past six months, the energy sector was the portfolio’s third-largest contributor, thanks to decent stock selection and our overweight in the oil services industry. We believe that finding reserves will require increased spending, even if, as we expect, energy prices moderate, which is why we have been overweight in services stocks such as Schlumberger, Baker Hughes, Smith International, and Transocean for several years. They all were strong performers last year.

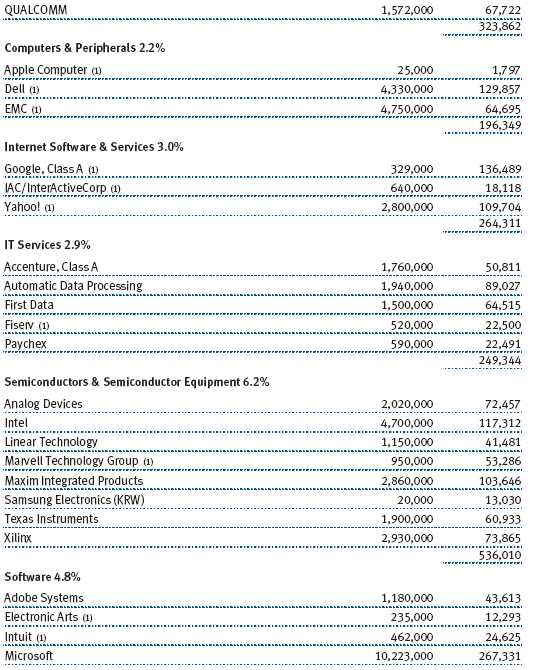

Owning the right technology stocks has been challenging but the sector produced solid second-half results. Google was the portfolio’s second-best contributor (behind UnitedHealth Group). Its share price rise has been remarkable, and we took some profits recently. However, the company possesses an outstanding business model and could continue to generate robust earnings and cash flow growth, so it remains a substantial position. Longtime holding Yahoo! has a more balanced business model that is less dependent on paid search, but it benefited from similar trends and also produced solid gains. Accenture (formerly Andersen Consulting) has a blue chip roster of clients, generates very strong cash flow, and posted good returns. Software leaders Microsoft and Adobe Systems performed well, Qualcomm and Corning were the leading contributors in communications equipment, and Marvell and Texas Instruments excelled among our semiconductor industry holdings.

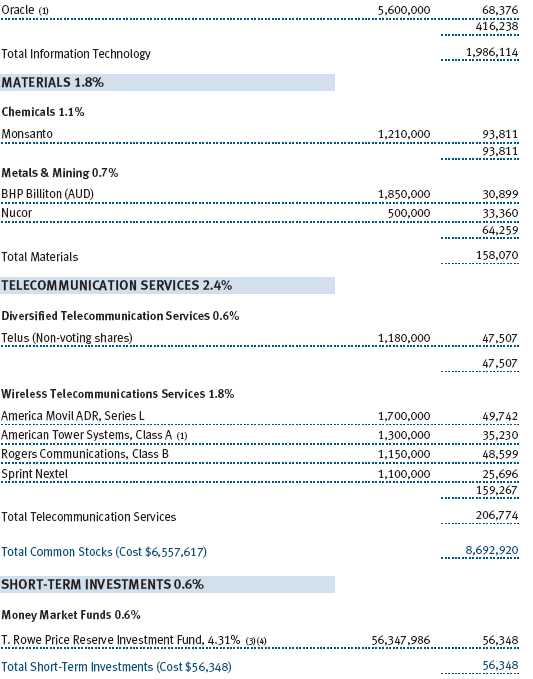

In the first half of the year, we purchased Monsanto, the leading provider of genetically engineered seeds, and it was a good second-half performer. America Movil, the dominant provider of wireless telecommunications services in Latin America, was another standout 6- and 12-month contributor.

Computer maker Dell was the fund’s largest second-half detractor by a considerable margin. The company’s average selling price and margins are under pressure as they sell increasingly to emerging markets. Competitors including Lenovo, Acer, and Hewlett-Packard are executing relatively well and chipping away at some of the cost advantage that Dell had enjoyed in these markets. The company has also had some execution problems with its pricing, sales, and service strategies. Because we thought it would take Dell several quarters (at least) to rectify these issues and our earnings estimates had to be trimmed, we sold some of our position earlier in the year at higher levels. However, we continue to believe the company possesses an outstanding business model and holds strong growth prospects.

Apollo Group, the leader in for-profit post-secondary education, was our next-largest second-half detractor. Like Dell, we think the company holds double-digit growth prospects, but enrollment growth is slowing, marketing expenses are rising, and earnings gains are likely to decline from very high growth rates. This slowdown was somewhat more significant than we initially anticipated. We have reduced our position significantly and will carefully monitor the company’s progress.

Pfizer continued to struggle in the second half, and although we significantly reduced our stake earlier in the year, the pharmaceutical giant was a significant detractor for the year. However, one of the major risks facing Pfizer, the patent litigation surrounding its largest drug, Lipitor, has been resolved favorably for the company. Following this positive news we added to our position. Although the company faces a number of near-term challenges and will probably have to set earnings estimates somewhat lower in the next few months, it has tremendous free cash flow, has increased the dividend recently by more than 20%, and will also reduce costs aggressively so that new product flow should lead to renewed growth. For the time being, we intend to keep a small position, but we think the stock has made a bottom. We will closely evaluate product and restructuring developments to determine whether we want it to become a larger position.

Kohl’s has been a frustrating holding. It recently announced that comparable-store sales and overall sales and earnings will be moderately below expectations for the fourth quarter. We are reevaluating our position, but we are likely to be patient because our retailing analyst is quite enthusiastic about the company’s prospects. It is adding improved product offerings such as the Estee Lauder cosmetic line, and is posting double-digit sales and earnings growth.

STRATEGY

We target companies with durable earnings and cash flow growth. The free cash flow we prize has become even more valuable now that tax laws are giving dividends more favorable treatment.

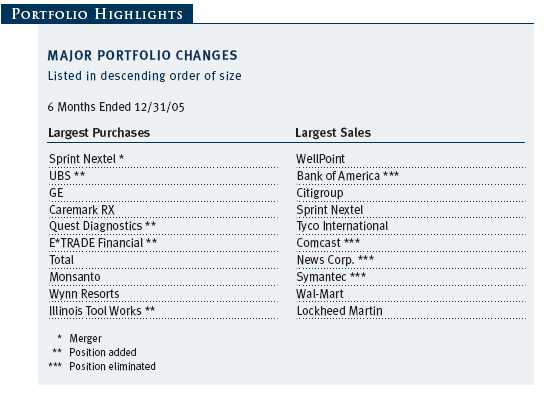

Additions to existing holdings such as General Electric, Caremark RX, French energy company Total, Monsanto, and Wynn Resorts were significant enough to be included in the 10-largest purchases for the past six months. UBS (Union Bank of Switzerland) was our largest portfolio addition for the period. UBS is a financial services leader with strong positions in personal and corporate banking. Its private banking operation is gaining market share globally and generates over half of its earnings. We think this business (and the overall company) will garner a higher valuation over time. Quest Diagnostics is a leader in the medical laboratory testing business in the U.S. It continues to experience growth in general blood testing procedures but is also growing via acquisition and the introduction of specialty and genetics-based testing. E*Trade Financial, another new holding, was strongly recommended by our analyst who had also recommended Ameritrade, which produced handsome gains. The discount brokerage business is experiencing good growth and continues to consolidate (allowing solid profitability even when trading volumes moderate). Illinois Tool Works is a high-quality industrial company with an excellent record of free cash flow generation. We made money in this company several years ago, and the stock corrected to levels where we think the risk/reward tradeoff is attractive. We also established a new position in Cardinal Health, a leading drug distributor that has revamped its contracts to establish a more stable fee-based business model. The company generates tremendous free cash flow, and it is evident that the company has become much more disciplined about expenses and capital management.

The largest sale for the past six months was our reduction of WellPoint. The company is in the middle of integrating a large acquisition (Anthem), and the stock has been an outstanding multiyear performer. We are maintaining a moderate position and are carefully monitoring the merger integration. Bank of America was our largest portfolio elimination since June. We are somewhat cautious on traditional banking stocks because we suspect credit quality will deteriorate, but Bank of America has also not been particularly disciplined in its acquisition activity, and we did not favor its recent acquisition of credit card company MBNA. We also sold significant amounts of Citigroup, Sprint Nextel, and Tyco International because the companies produced mediocre results, and we felt there were better alternatives. Citigroup continues to be a large holding, while Tyco and Sprint Nextel were reduced significantly.

Traditional media has been very disappointing, and sales made last year and earlier this year benefited performance. We eliminated Comcast because the company missed some growth targets and faces stiff competition both from regional phone companies providing DSL service and from wireless alternatives to cable. We also eliminated News Corp. as we became concerned about the company’s many acquisitions in the Internet area. Symantec was eliminated because we believe that its virus control software is facing significant competition. We sold some of our shares at significantly higher levels earlier in the year, but in retrospect we should have been even more skeptical of some of the defensive acquisitions the company made in the last year.

OUTLOOK

Stocks strengthened early in the new year (after stumbling a bit at year-end), but there are plenty of reasons for investor concern. Energy prices are edging higher again (although natural gas has dipped to pre-Katrina levels), and the Federal Reserve is likely to continue increasing short-term interest rates in the first half of the year. A sharp decline in housing prices or additional large increases in energy prices could hurt consumer confidence, economic growth, and stock prices. There is always the threat of global terrorism as the London bombings reminded us earlier in the year. Finally, stocks have rallied in the second half and are not as cheap, adding a measure of valuation risk.

However, on the positive side of the ledger, we believe that the interest rate and corporate earnings environment remains supportive of favorable investment performance for large-cap growth stocks. This is particularly true for high-quality, consistent-growth companies that have lagged the market. Overall, we believe that there is a solid case for investing in U.S. stocks:

1. Earnings growth remains strong at most high-quality U.S. companies, many of which do not need a robust economic recovery to produce strong profit growth.

2. Valuations have increased as the market has rallied. However, many consistent-growth companies’ shares have moved up only moderately and remain reasonably valued.

3. Companies have reduced expenses significantly. Consequently, a pickup in revenue growth could result in strong margin and profit growth.

4. Many of our holdings generate significant free cash flow, and free cash flow margins are at multi-decade highs. Shareholder-oriented management can use this cash to pay dividends, which now receive more favorable tax treatment, repurchase shares, or make value-added acquisitions.

As always, we will strive to enhance returns while managing risk by investing in quality companies with durable earnings and cash flow growth. We appreciate your continued confidence in this endeavor.

Respectfully submitted,

Larry J. Puglia

President and chairman of the Investment Advisory Committee

January 20, 2006

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF STOCK INVESTING

The fund’s share price can fall because of weakness in the stock markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

GLOSSARY

Dividend yield: The annual dividend of a stock divided by the stock’s price.

Free cash flow: The excess cash a company is generating from its operations that can be taken out of the business for the benefit of shareholders, such as dividends, share repurchases, investments, and acquisitions.

Lipper indexes: Fund benchmarks that consist of a small number (10 to 30) of the largest mutual funds in a particular category as tracked by Lipper Inc.

Price/book ratio: A valuation measure that compares a stock’s market price with its book value, i.e., the company’s net worth divided by the number of outstanding shares.

Price/earnings ratio (P/E): A valuation measure calculated by dividing the price of a stock by its current or projected earnings per share. This ratio gives investors an idea of how much they are paying for current or future earnings power.

Russell 1000 Growth Index: Market-capitalization weighted index of those firms in the Russell 1000 with higher price-to-book ratios and higher forecasted growth values.

S&P 500 Stock Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

| GROWTH OF $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

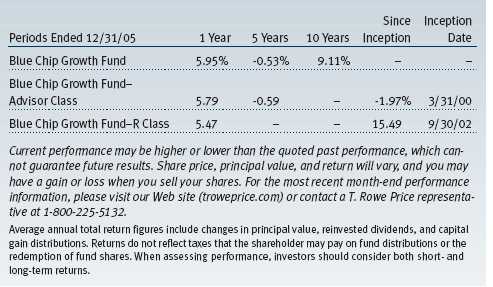

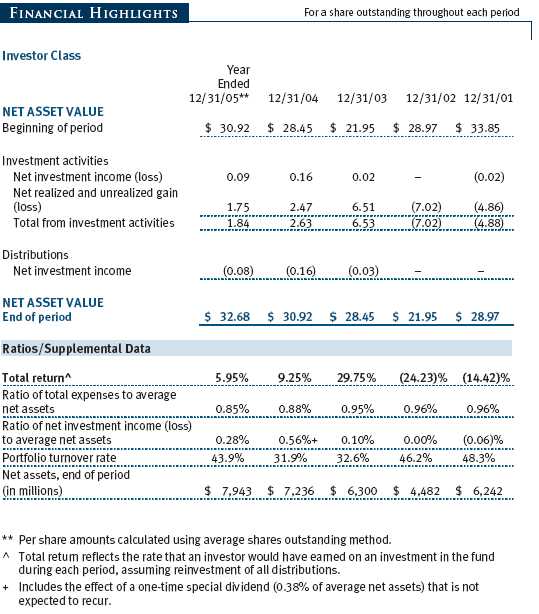

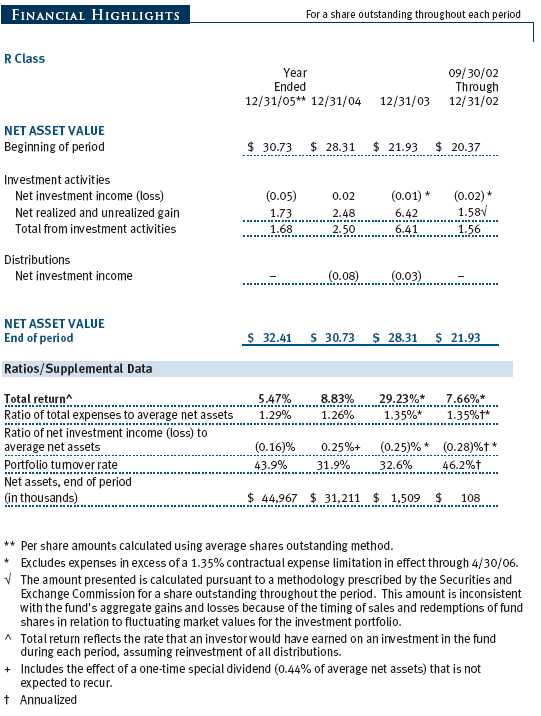

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund would have performed each year if its actual (or cumulative) returns had been earned at a constant rate.

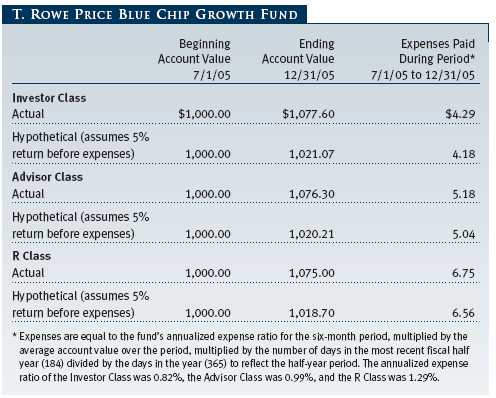

| FUND EXPENSE EXAMPLE |

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs such as redemption fees or sales loads and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has three share classes: The original share class (“investor class”) charges no distribution and service (12b-1) fee; Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee; R Class shares are available to retirement plans serviced by intermediaries and charge a 0.50% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

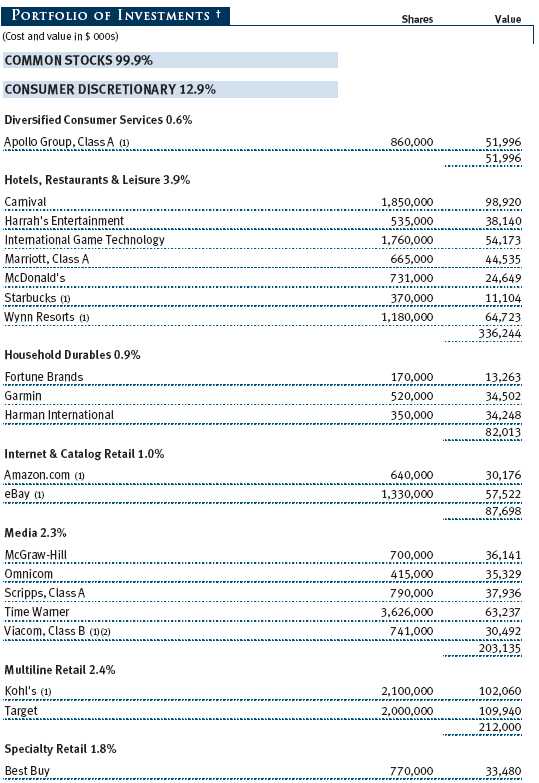

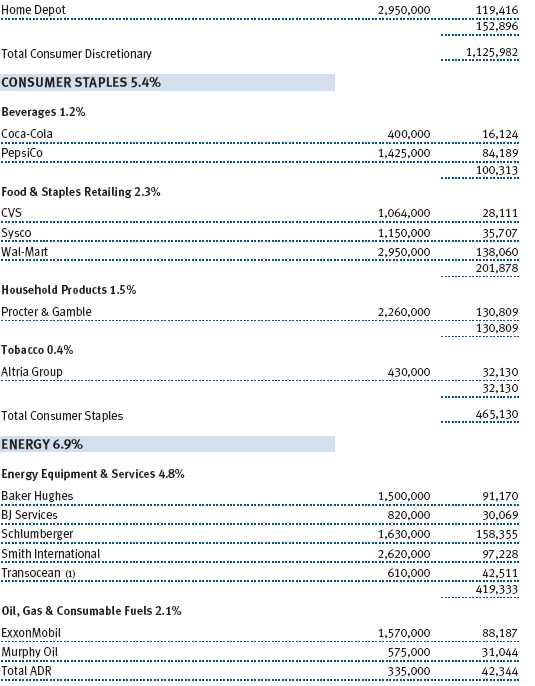

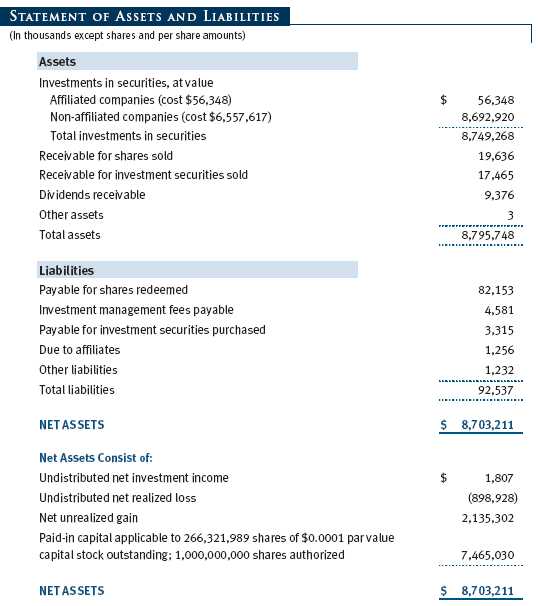

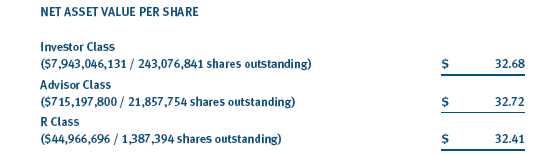

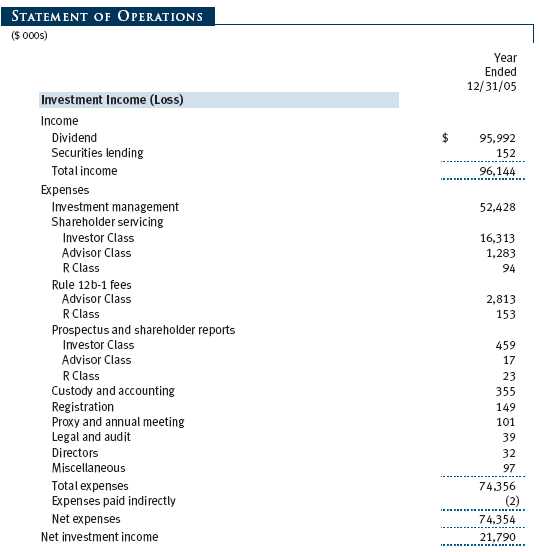

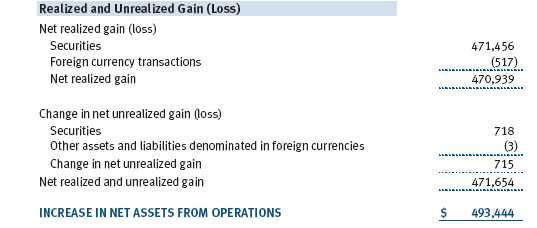

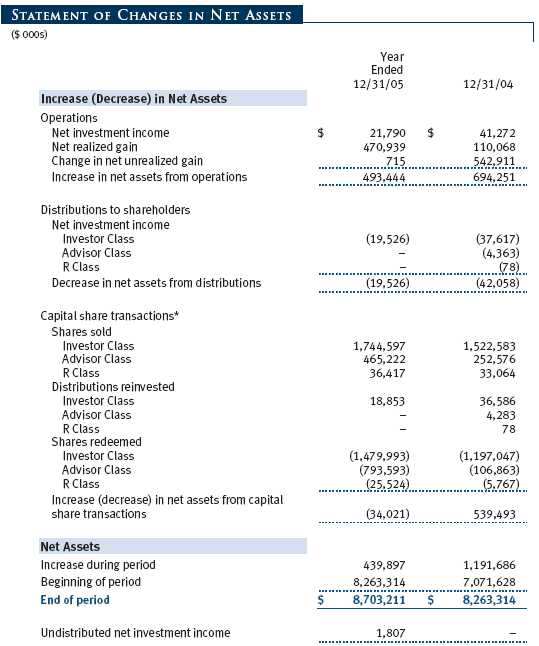

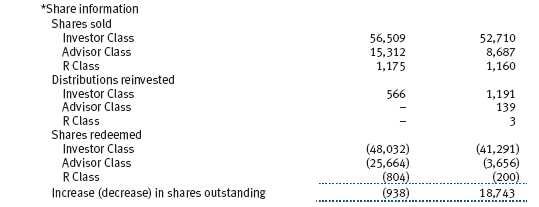

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

T. Rowe Price Blue Chip Growth Fund, Inc. (the fund) is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide long-term capital growth. Income is a secondary objective. The fund has three classes of shares: the Blue Chip Growth Fund original share class, referred to in this report as the Investor Class, offered since June 30, 1993, Blue Chip Growth Fund—Advisor Class (Advisor Class), offered since March 31, 2000, and Blue Chip Growth Fund—R Class (R Class), offered since September 30, 2002. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries, and R Class shares are available to retirement plans serviced by intermediaries. The Advisor Class and R Class each operate under separate Board-approved Rule 12b-1 plans, pursuant to which each class compensates financial intermediaries for distribution, shareholder servicing, and/or certain administrative services. Each class has exclusive voting rights on matters related solely to that class, separate voting rights on matters that relate to all classes, and, in all other respects, the same rights and obligations as the other classes.

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund ultimately realizes upon sale of the securities.

Valuation The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business. Equity securities listed or regularly traded on a securities exchange or in the over-the-counter market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Most foreign markets close before the close of trading on the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, which in turn will affect the fund’s share price, the fund will adjust the previous closing prices to reflect the fair value of the securities as of the close of the NYSE, as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. In deciding whether to make fair value adjustments, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U. S. markets that represent foreign securities and baskets of foreign securities. The fund uses outside pricing services to provide it with closing market prices and information used for adjusting those prices. The fund cannot predict when and how often it will use closing prices and when it will adjust those prices to reflect fair value. As a means of evaluating its fair value process, the fund routinely compares closing market prices, the next day’s opening prices in the same markets, and adjusted prices.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting The Advisor Class and R Class each pay distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% and 0.50%, respectively, of the class’s average daily net assets. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to all classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $400,000 for the year ended December 31, 2005. Additionally, the fund earns credits on temporarily uninvested cash balances at the custodian that reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits, which are reflected as expenses paid indirectly.

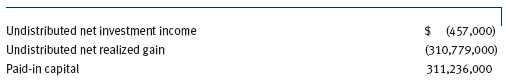

In-Kind Redemptions In accordance with guidelines described in the fund’s prospectus, the fund may distribute portfolio securities rather than cash as payment for a redemption of fund shares (in-kind redemption). For financial reporting purposes, the fund recognizes a gain on in-kind redemptions to the extent the value of the distributed securities on the date of redemption exceeds the cost of those securities. Gains and losses realized on in-kind redemptions are not recognized for tax purposes, and are reclassified from undistributed realized gain (loss) to paid-in capital. During the year ended December 31, 2005, the fund realized $311,236,000 of net gain on $656,695,000 of in-kind redemptions.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class on an annual basis. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

NOTE 2 - INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Securities Lending The fund lends its securities to approved brokers to earn additional income. It receives as collateral cash and U.S. government securities valued at 102% to 105% of the value of the securities on loan. Cash collateral is invested in a money market pooled trust managed by the fund’s lending agent in accordance with investment guidelines approved by fund management. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities, as determined at the close of fund business each day; any additional collateral required due to changes in security values is delivered to the fund the next business day. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities. Securities lending revenue recognized by the fund consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower and compensation to the lending agent. At December 31, 2005, there were no securities on loan.

Other Purchases and sales of portfolio securities, other than short-term securities, aggregated $3,732,369,000 and $3,762,261,000, respectively, for the year ended December 31, 2005.

NOTE 3 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Federal income tax regulations differ from generally accepted accounting principles; therefore, distributions determined in accordance with tax regulations may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences.

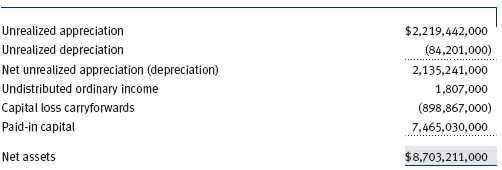

Distributions during the year ended December 31, 2005 totaled $19,526,000 and were characterized as ordinary income for tax purposes. At December 31, 2005, the tax-basis components of net assets were as follows:

The fund intends to retain realized gains to the extent of available capital loss carryforwards for federal income tax purposes. During the year ended December 31, 2005, the fund utilized $159,941,000 of capital loss carryfor-wards. As of December 31, 2005, the fund had $222,538,000 of capital loss carryforwards that expire in 2009, $433,036,000 that expire in 2010, and $243,293,000 that expire in 2011.

For the year ended December 31, 2005, the fund recorded the following permanent reclassifications to reflect tax character. Reclassifications to paid-in capital relate primarily to redemptions in kind. Results of operations and net assets were not affected by these reclassifications.

At December 31, 2005, the cost of investments for federal income tax purposes was $6,614,026,000.

NOTE 4 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee and a group fee. The individual fund fee is equal to 0.30% of the fund’s average daily net assets up to $15 billion, and 0.255% of the fund’s average daily net assets in excess of $15 billion; previously, through May 1, 2005, the individual fund fee had been a flat rate of 0.30% of the fund’s average daily net assets. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.29% for assets in excess of $160 billi on. Prior to May 1, 2005, the maximum group fee rate in the graduated fee schedule had been 0.295% for assets in excess of $120 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2005, the effective annual group fee rate was 0.31%.

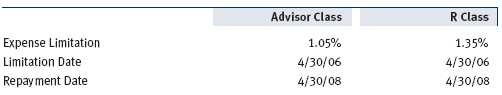

The Advisor Class and R Class are also subject to a contractual expense limitation through the limitation dates indicated in the table below. During the limitation period, the manager is required to waive its management fee and reimburse a class for any expenses, excluding interest, taxes, brokerage commissions, and extraordinary expenses, that would otherwise cause the class’s ratio of total expenses to average net assets (expense ratio) to exceed its expense limitation. Each class is required to repay the manager for expenses previously reimbursed and management fees waived to the extent the class’s net assets have grown or expenses have declined sufficiently to allow repayment without causing the class’s expense ratio to exceed its expense limitation. However, no repayment will be made more than three years after the date of any reimbursement or waiver or later than the repayment dates indicated in the table below.

For the year ended December 31, 2005, each class operated below its expense limitation.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share prices and maintains the financial records of the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and record-keeping services for certain retirement accounts invested in the Investor Class and R Class. For the year ended December 31, 2005, expenses incurred pursuant to these service agreements were $82,000 for Price Associates, $3,970,000 for T. Rowe Price Services, Inc., and $7,550,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the year ended December 31, 2005, the fund was charged $567,000 for shareholder servicing costs related to the college savings plans, of which $407,000 was for services provided by Price. The amount payable at period end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2005, approximately 4% of the outstanding shares of the Investor Class were held by college savings plans.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Spectrum Funds (Spectrum Funds) may invest. The Spectrum Funds do not invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to a special servicing agreement, expenses associated with the operation of the Spectrum Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum Funds. Expenses allocated under this agreement are reflected as shareholder servicing expense in the accompanying financial statements. For the year ended December 31, 2005, the fund was allocated $724,000 of Spectrum Funds’ expenses, of which $509,000 related to services provided by Price. The amount payable at period end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2005, approximately 6% of the outstanding shares of the Investor Class were held by the Spectrum Funds.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Funds), open-end management investment companies managed by Price Associates and affiliates of the fund. The T. Rowe Price Reserve Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates, and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Funds pay no investment management fees. During the year ended December 31, 2005, dividend income from the T. Rowe Price Reserve Funds totaled $806,000, and the value of shares of the T. Rowe Price Reserve Funds held at December 31, 2005 and December 31, 2004 was $56,348,000 and $69,489,000, respectively.

As of December 31, 2005, T. Rowe Price Group, Inc. and/or its wholly owned subsidiaries owned 115,645 shares of the Investor Class, representing less than 1% of the fund’s net assets.

NOTE 5 - INTERFUND BORROWING

Pursuant to its prospectus, the fund may borrow up to 33-1/3% of its total assets. The fund is party to an interfund borrowing agreement between itself and other T. Rowe Price-sponsored mutual funds, which permits it to borrow or lend cash at rates beneficial to both the borrowing and lending funds. Loans totaling 10% or more of a borrowing fund’s total assets are collateralized at 102% of the value of the loan; loans of less than 10% are unsecured. During the year ended December 31, 2005, the fund had outstanding borrowings on 21 days, in the average amount of $16,324,000, and at an average annual rate of 3.99%. There were no borrowings outstanding at December 31, 2005.

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Board of Directors and Shareholders of T. Rowe Price Blue Chip Growth Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Blue Chip Growth Fund, Inc. (the “Fund”) at December 31, 2005, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the fiscal periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2005 by correspondence with the custodian and by agreement to the underlying ownership records for T. Rowe Price Reserve Investment Fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 13, 2006

| TAX INFORMATION (UNAUDITED) FOR THE TAX YEAR ENDED 12/31/05 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

For taxable non-corporate shareholders, $21,333,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $21,333,000 of the fund’s income qualifies for the dividends-received deduction.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Company Info” at the top of our homepage for individual investors. Then, in the window that appears, click on the “Proxy Voting Policy” navigation button in the top left corner.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Record” at the bottom of the Proxy Voting Policy page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| ABOUT THE FUND’S DIRECTORS AND OFFICERS |

Your fund is governed by a Board of Directors that meets regularly to review investments, performance, compliance matters, advisory fees, expenses, and other business affairs, and is responsible for protecting the interests of shareholders. The majority of the fund’s directors are independent of T. Rowe Price Associates, Inc. (T. Rowe Price); “inside” directors are officers of T. Rowe Price. The Board of Directors elects the fund’s officers, who are listed in the final table. The business address of each director and officer is 100 East Pratt Street, Baltimore, MD 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-225-5132.

| Independent Directors | |

| Name | |

| (Year of Birth) | |

| Year Elected * | |

| [Number of T. Rowe Price | Principal Occupation(s) During Past 5 Years and Directorships of |

| Portfolios Overseen] | Other Public Companies |

| Jeremiah E. Casey ** | Director, National Life Insurance (2001 to 8/05); Director, The Rouse |

| (1940) | Company, real estate developers (1990 to 2004) |

| 2005 | |

| [59] | |

| Anthony W. Deering | Chairman, Exeter Capital, LLC, a private investment firm (2004 to |

| (1945) | present); Director, Chairman of the Board, and Chief Executive Officer, |

| 2001 | The Rouse Company, real estate developers (1997 to 2004); Director, |

| [113] | Mercantile Bank (4/03 to present) |

| Donald W. Dick, Jr. | Principal, EuroCapital Advisors, LLC, an acquisition and management |

| (1943) | advisory firm; Chairman, President, and Chief Executive Officer, The |

| 1993 | Haven Group, a custom manufacturer of modular homes (1/04 to |

| [113] | present) |

| David K. Fagin | Chairman and President, Nye Corporation (6/88 to present); Director, |

| (1938) | Canyon Resources Corp. and Golden Star Resources Ltd. (5/00 to |

| 1993 | present) and Pacific Rim Mining Corp. (2/02 to present) |

| [113] | |

| Karen N. Horn | Managing Director and President, Global Private Client Services, Marsh |

| (1943) | Inc. (1999 to 2003); Managing Director and Head of International Private |

| 2003 | Banking, Bankers Trust (1996 to 1999); Director, Eli Lilly and Company |

| [113] | and Georgia Pacific |

| F. Pierce Linaweaver | President, F. Pierce Linaweaver & Associates, Inc., consulting environ- |

| (1934) | mental and civil engineers |

| 2001 | |

| [113] | |

| Theo C. Rodgers *** | President, A&R Development Corporation |

| (1941) | |

| 2005 | |

| [97] | |

| John G. Schreiber | Owner/President, Centaur Capital Partners, Inc., a real estate investment |

| (1946) | company; Partner, Blackstone Real Estate Advisors, L.P.; Director, AMLI |

| 2001 | Residential Properties Trust |

| [113] | |

| * Each independent director serves until retirement, resignation, or election of a successor. | |

| ** Elected effective October 19, 2005. | |

| *** Elected effective April 1, 2005. | |

| Inside Directors | |

| Name | |

| (Year of Birth) | |

| Year Elected * | |

| [Number of T. Rowe Price | Principal Occupation(s) During Past 5 Years and Directorships of |

| Portfolios Overseen] | Other Public Companies |

| James A.C. Kennedy, CFA | Director and Vice President, T. Rowe Price and T. Rowe Price Group, Inc.; |

| (1953) | Director, T. Rowe Price Global Asset Management Limited, T. Rowe Price |

| 1997 | Global Investment Services Limited, and T. Rowe Price International, Inc. |

| [45] | |

| James S. Riepe | Director and Vice President, T. Rowe Price; Vice Chairman of the Board, |

| (1943) | Director, and Vice President, T. Rowe Price Group, Inc.; Chairman of |

| 1993 | the Board and Director, T. Rowe Price Global Asset Management |

| [113] | Limited, T. Rowe Price Global Investment Services Limited, T. Rowe Price |

| Investment Services, Inc., T. Rowe Price Retirement Plan Services, Inc., | |

| and T. Rowe Price Services, Inc.; Chairman of the Board, Director, | |

| President, and Trust Officer, T. Rowe Price Trust Company; Director, | |

| T. Rowe Price International, Inc.; Chairman of the Board, all funds | |

| * Each inside director serves until retirement, resignation, or election of a successor. | |

| Officers | |

| Name (Year of Birth) | |

| Title and Fund(s) Served | Principal Occupation(s) |

| Jeffrey W. Arricale, CPA (1971) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc.; formerly student, the Wharton School, |

| University of Pennsylvania (to 2001) | |

| P. Robert Bartolo, CPA (1972) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc.; formerly intern, T. Rowe Price |

| (to 2001) | |

| Joseph A. Carrier, CPA (1960) | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer, Blue Chip Growth Fund | Group, Inc., T. Rowe Price Investment Services, |

| Inc., and T. Rowe Price Trust Company | |

| D. Kyle Cerminara, CFA (1977) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc. |

| Donald J. Easley, CFA (1971) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc. |

| Henry M. Ellenbogen (1971) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc.; formerly Executive Vice President, |

| Business Development, HelloAsia (to 2001) | |

| Roger L. Fiery III, CPA (1959) | Vice President, T. Rowe Price, T. Rowe Price Group, |

| Vice President, Blue Chip Growth Fund | Inc., T. Rowe Price International, Inc., and T. Rowe |

| Price Trust Company | |

| Robert N. Gensler (1957) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc., and T. Rowe Price International, Inc. |

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer, Blue Chip | T. Rowe Price; Vice President, T. Rowe Group, Inc., |

| Growth Fund | and T. Rowe Price Investment Services, Inc. |

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Trust Company |

| Henry H. Hopkins (1942) | Director and Vice President, T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Investment Services, Inc., T. Rowe Price Services, |

| Inc., and T. Rowe Price Trust Company; Vice | |

| President, T. Rowe Price, T. Rowe Price Group, Inc., | |

| T. Rowe Price International, Inc., and T. Rowe Price | |

| Retirement Plan Services, Inc. | |

| Thomas J. Huber, CFA (1966) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc. |

| Kris H. Jenner, M.D., D. Phil. (1962) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc. |

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and |

| Secretary, Blue Chip Growth Fund | T. Rowe Price Investment Services, Inc. |

| Timothy E. Parker (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc.; formerly student, Darden Graduate |

| School, University of Virginia (to 2001) | |

| Larry J. Puglia, CFA, CPA (1960) | Vice President, T. Rowe Price and T. Rowe Price |

| President, Blue Chip Growth Fund | Group, Inc. |

| Karen M. Regan (1967) | Vice President, T. Rowe Price |

| Vice President, Blue Chip Growth Fund | |

| Jeffrey Rottinghaus, CPA (1970) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc.; formerly student, the Wharton School, |

| University of Pennsylvania (to 2001) | |

| Robert W. Sharps, CFA, CPA (1971) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc. |

| Robert W. Smith (1961) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc., and T. Rowe Price International, Inc. |

| Joshua K. Spencer, CFA (1973) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Blue Chip Growth Fund | Group, Inc.; formerly Research Analyst and Sector |

| Fund Portfolio Manager, Fidelity Investments | |

| (to 2004) | |

| Julie L. Waples (1970) | Vice President, T. Rowe Price |

| Vice President, Blue Chip Growth Fund | |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at | |

| least five years. | |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Donald W. Dick Jr. qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Dick is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

| 2005 | 2004 | |

| Audit Fees | $24,316 | $23,270 |

| Audit-Related Fees | 1,564 | 3,018 |

| Tax Fees | 6,907 | 6,311 |

| All Other Fees | 393 | - |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,008,000 and $903,000, respectively, and were less than the aggregate fees billed for those same periods by the registrant’s principal accountant for audit services rendered to the T. Rowe Price Funds.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the | |

| undersigned, thereunto duly authorized. | |

| T. Rowe Price Blue Chip Growth Fund, Inc. | |

| By | /s/ James S. Riepe |

| James S. Riepe | |

| Principal Executive Officer | |

| Date | February 21, 2006 |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, this report has been signed below by the following persons on behalf of | |

| the registrant and in the capacities and on the dates indicated. | |

| By | /s/ James S. Riepe |

| James S. Riepe | |

| Principal Executive Officer | |

| Date | February 21, 2006 |

| By | /s/ Joseph A. Carrier |

| Joseph A. Carrier | |

| Principal Financial Officer | |

| Date | February 21, 2006 |