QuickLinks -- Click here to rapidly navigate through this document(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

ALDILA, INC. |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

April 14, 2004

To Our Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the Annual Meeting of Stockholders of Aldila, Inc., to be held Wednesday, May 19, 2004, at 10:30 a.m. (Pacific daylight time) at the Company's executive offices and production facility, 13450 Stowe Drive, Poway, California 92064. The formal notice and proxy statement for the Annual Meeting are attached to this letter.

It is important that you vote your shares as soon as possible, either by the phone, by using the Internet, or by mail as explained on the enclosed proxy card, even if you currently plan to attend the Annual Meeting. By doing so, you will ensure that your shares are represented and voted at the meeting. If you decide to attend, you can still vote your shares in person, if you wish.

On behalf of the Board of Directors, I thank you for your cooperation and I look forward to seeing you on May 19.

Very truly yours,

/s/ PETER R. MATHEWSON

ALDILA, INC.

13450 STOWE DRIVE

POWAY, CALIFORNIA 92064

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 19, 2004

TO THE STOCKHOLDERS OF ALDILA, INC.

Notice is hereby given that the Annual Meeting of Stockholders of Aldila, Inc. (the "Company") will be held at the Company's executive offices and production facility, 13450 Stowe Drive, Poway, California 92064, on Wednesday, May 19, 2004, at 10:30 a.m., (Pacific daylight time), for the following purposes:

1. ELECTION OF DIRECTORS. To elect by vote of the holders of Common Stock a total of five persons to the Board of Directors to serve until the next Annual Meeting of Stockholders and until their successors are elected and have qualified. The Board of Directors' nominees are:

Thomas A. Brand |

|

Lloyd I. Miller, III |

Peter R. Mathewson |

|

Bryant R. Riley |

Andrew M. Leitch |

2. RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS. To ratify the Board of Directors' selection of Peterson & Co., LLP as the Company's independent accountants for the fiscal year ending December 31, 2004.

3. OTHER BUSINESS. To consider and act upon such other business as may properly come before the meeting.

Only stockholders of record at the close of business on March 31, 2004 will be entitled to notice of the Annual Meeting and to vote at the Annual Meeting and at any adjournments thereof.

Dated: April 14, 2004

Whether or not you currently plan to attend the annual meeting in person, please vote by telephone, or by using the Internet or by mail, as instructed on the enclosed proxy card, as promptly as possible. You may revoke your proxy (whether given by telephone, Internet or mail) if you decide to attend the annual meeting and wish to vote your shares in person.

TABLE OF CONTENTS

GENERAL |

|

1 |

VOTING AND REVOCATION OF PROXIES |

|

1 |

| | VOTING | | 1 |

| | REVOCATION | | 1 |

PROPOSAL NO. 1—ELECTION OF DIRECTORS |

|

2 |

| | NOMINEES FOR ELECTION BY HOLDERS OF COMMON STOCK | | 2 |

| | THE BOARD OF DIRECTORS AND COMMITTEES | | 3 |

| | ATTENDANCE AT BOARD AND COMMITTEE MEETINGS | | 3 |

| | COMMITTEES OF THE BOARD | | 3 |

| | INDEPENDENCE OF MAJORITY OF DIRECTORS | | 4 |

| | CODE OF ETHICS | | 4 |

PROPOSAL NO. 2—RATIFICATION OF THE SELECTION OF INDEPENDENT ACCOUNTANTS |

|

4 |

INDEPENDENT ACCOUNTANT FEES |

|

5 |

| | AUDIT FEES | | 5 |

| | AUDIT-RELATED FEES | | 5 |

| | TAX FEES | | 5 |

| | ALL OTHER FEES | | 5 |

| | PRE-APPROVAL POLICIES | | 5 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

6 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

|

8 |

EXECUTIVE OFFICERS OF THE COMPANY |

|

8 |

EXECUTIVE COMPENSATION |

|

9 |

| | SUMMARY COMPENSATION TABLE | | 9 |

| | STOCK OPTION GRANTS | | 9 |

| | AGGREGATED OPTION EXERCISES | | 9 |

DIRECTOR COMPENSATION |

|

10 |

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTS |

|

10 |

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION |

|

11 |

| | COMMITTEE COMPOSITION | | 11 |

| | COMPENSATION OBJECTIVES AND POLICIES | | 11 |

| | BASE SALARY | | 11 |

| | BONUS PLAN | | 12 |

| | STOCK OPTIONS | | 12 |

| | SECTION 162(m) ISSUES | | 13 |

| | COMPENSATION OF THE CHIEF EXECUTIVE OFFICER | | 13 |

AUDIT COMMITTEE |

|

14 |

| | REPORT OF AUDIT COMMITTEE | | 14 |

| | AUDIT COMMITTEE CHARTER | | 15 |

| | INDEPENDENCE OF AUDIT COMMITTEE MEMBERS | | 15 |

| | AUDIT COMMITTEE FINANCIAL EXPERT | | 16 |

PERFORMANCE GRAPH FOR ALDILA,INC. COMMON STOCK |

|

17 |

ANNUAL REPORT |

|

18 |

PROXY SOLICITATION |

|

18 |

PROPOSALS OF STOCKHOLDERS |

|

18 |

AVAILABLE INFORMATION |

|

18 |

OTHER MATTERS |

|

18 |

ALDILA, INC.

13450 STOWE DRIVE

POWAY, CALIFORNIA 92064

(858) 513-1801

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

MAY 19, 2004

GENERAL

This proxy statement is furnished to stockholders of Aldila, Inc., a Delaware corporation (the "Company"), in connection with the solicitation of proxies by the Board of Directors of the Company (the "Board" or "Board of Directors") for use at the Annual Meeting of Stockholders to be held at 10:30 a.m., (Pacific daylight time), on Wednesday, May 19, 2004, at the Company's executive offices and production facility, 13450 Stowe Drive, Poway, California 92064, and any adjournments thereof (the "Annual Meeting" or "Meeting").

Common stockholders of record as of the close of business on March 31, 2004, will be entitled to vote at the Meeting or any adjournments thereof. As of the record date, the Company had outstanding 4,834,149 shares of Common Stock, each entitled to one vote on all matters to be voted upon. This proxy statement, the accompanying form of proxy and the Company's annual report to stockholders for the fiscal year ended December 31, 2003 are being mailed on or about April 19, 2004 to each stockholder entitled to vote at the Meeting.

VOTING AND REVOCATION OF PROXIES

VOTING

If the enclosed proxy is voted by telephone, using the Internet or executed and returned by mail in time and not revoked, all shares represented thereby will be voted. Each proxy will be voted in accordance with the stockholder's instructions. If no such instructions are specified, the proxies will be voted FOR the election of each person nominated for election as a director and FOR the ratification of the Board's selection of Peterson & Co., LLP as the Company's independent accountants for the fiscal year ending December 31, 2004.

Assuming a quorum is present, the affirmative vote by the holders of a plurality of the votes cast at the Meeting will be required for the election of directors; the affirmative vote of a majority of the votes cast at the Meeting will be required for the ratification of the Board's selection of Peterson & Co., LLP as the Company's independent accountants; and the affirmative vote of a majority of the votes cast at the Meeting will be required to act on all other matters to come before the Annual Meeting. An automated system administered by the Company's transfer agent tabulates the votes. For purposes of determining the number of votes cast with respect to any voting matter, only those cast "for" or "against" are included. Abstentions and broker non-votes are counted only for purposes of determining whether a quorum is present at the Meeting. With respect to all matters (other than the election of directors), abstentions and broker non-votes will have the effect of reducing the number of affirmative votes required to achieve a majority of the votes cast.

REVOCATION

A stockholder giving a proxy may revoke it at any time before it is voted by delivery to the Company of a subsequently executed proxy or a written notice of revocation. In addition, returning your completed proxy by mail, or by telephone, or by using the Internet will not prevent you from voting in person at the Annual Meeting should you be present and wish to do so.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The Company's Restated Bylaws give the Board the power to set the number of directors at no less than one nor more than twenty-one. The size of the Company's Board is currently set at five. Directors hold office until the next annual meeting of stockholders and until their successors are elected and have qualified.

Unless otherwise directed, proxies in the accompanying form will be voted FOR the nominees listed below. If any one or more of the nominees is unable to serve for any reason or withdraws from nomination, proxies will be voted for the substitute nominee or nominees, if any, proposed by the Board of Directors. The Board has no knowledge that any nominee will or may be unable to serve or will or may withdraw from nomination. With the exception of Andrew M. Leitch, all of the following nominees are current directors of the Company whose terms end at the 2004 Annual Meeting. Information concerning the nominees for directors is set forth below.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE BOARD OF DIRECTORS' NOMINEES FOR DIRECTORS TO BE ELECTED BY THE HOLDERS OF COMMON STOCK.

NOMINEES FOR ELECTION BY HOLDERS OF COMMON STOCK

THOMAS A. BRAND has been a director of the Company since November 1997. Since January 1994, Mr. Brand has been a consultant to the composite materials industry. Since August 2000, he has been a director of Reinhold Industries, Inc., a manufacturer of advanced custom composite components, sheet molding compounds and graphic arts and industrial rollers for a variety of applications in the United States and Europe. From 1983 to 1992, he was Senior Vice President/General Manager of Fiberite Advanced Materials, a business unit of ICI-PLC. From 1964 to 1983, Mr. Brand served as Vice President/General Manager, Fiberite West Coast Corp., which is a division of Fiberite Corporation. Age: 70.

PETER R. MATHEWSON has been a director of the Company since January 1997 and has been President, Chief Executive Officer and Chairman of the Board of the Company since January 2000. From 1990 until December 31, 1999, he served as Vice President of the Company (or its predecessors). Since January 1997, Mr. Mathewson has also served as President and Chief Operating Officer of Aldila Golf Corp., the Company's operating subsidiary that conducts its core golf operations. Mr. Mathewson has been with the Company (or its predecessors) since September 1973 and has held various positions, including: plant manager, production manager, shipping and receiving supervisor, and purchasing agent. Age: 53.

LLOYD I. MILLER, III has been a director of the Company since September 4, 2001. Mr. Miller has been a registered investment advisor since 1990, and he is a director of Denny's Corporation and Stamps.com Inc. Mr. Miller also serves as a director of American Banknote Corp. Age: 49.

BRYANT R. RILEY has been the founder and Chief Executive Officer of B. Riley & Co., Inc. since January 1997. B. Riley & Co., a member of the NASD, provides research and trading ideas primarily to institutional investors. Mr. Riley has also been the General Partner of Riley Investment Management since 2001 and is a director of Celeritek, Inc. Age: 37.

ANDREW M. LEITCH is a certified public accountant, a chartered public accountant, and a private businessman. He currently serves on the Board of Directors of (i) Blackbaud, Inc., where he is also chairman of the Audit Committee, (ii) Citicorp Everbright China Fund Limited, and (iii) various private companies within the Kerry Packer Group. He served as a director of Vapotronics Inc. from June 2000 through October 2001, as its acting Chief Financial Officer from July 2000 through October 2001 and as its acting Chief Executive Officer from June 2001 through October 2001. In March 2000 he retired after 22 years as a partner of Deloitte & Touche LLP. He worked primarily in Japan, Singapore and Hong Kong, where he led the successful opening of that firm's China practice.

2

He has previously served on the Board of Directors of ING Fund—Hong Kong and NBL Communications Inc. Age: 60.

THE BOARD OF DIRECTORS AND COMMITTEES

The Board of Directors of the Company directs the management of the business and affairs of the Company, as provided by Delaware law, and conducts its business through meetings of the full Board of Directors and four standing committees: Executive, Audit, Compensation and Nominating. In addition, from time to time special committees may be established under the direction of the Board when necessary to address specific issues.

ATTENDANCE AT BOARD AND COMMITTEE MEETINGS

The Board of Directors of the Company held five meetings in fiscal 2003. Meetings of committees are discussed below. Each director attended 75% or more of the aggregate of (i) meetings of the Board held during the period for which he served as a director and (ii) meetings of all committees held during the period for which he served on those committees.

COMMITTEES OF THE BOARD

TheEXECUTIVE COMMITTEE of the Board has the authority, between meetings of the Board of Directors, to exercise all powers and authority of the Board in the management of the business and affairs of the Company that may be lawfully delegated to it under Delaware law. The Committee is chaired by Peter R. Mathewson and its other members are Lloyd I. Miller, III, and Bryant R. Riley. It is anticipated that at the meeting of the Board of Directors immediately following the Annual Meeting of Stockholders, the existing members of the Executive Committee will be re-appointed. The Executive Committee held no meetings in fiscal year 2003.

TheAUDIT COMMITTEE is currently composed of Bryant R. Riley, as chairman, Lloyd I. Miller, III and Thomas A. Brand. The Audit Committee held four meetings in fiscal 2003. See "AUDIT COMMITTEE" below for a description of the responsibilities and activities of the Audit Committee, the independence of its membership, and the proposed composition of the Audit Committee following the 2004 Annual Meeting of Shareholders.

TheCOMPENSATION COMMITTEE is currently composed of Thomas A. Brand, who is the chairman, Bryant R. Riley and Lloyd I. Miller, III. Each member of the Company's Compensation Committee has been determined, in the opinion of the Board of Directors, to be independent in accordance with NASD rules and each is a "non-employee director" within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934 (the "Exchange Act"). The Compensation Committee is charged with the responsibility of supervising and administering the Company's compensation policies, management awards, reviewing salaries, approving significant changes in salaried employee benefits, and recommending to the Board such other forms of remuneration as it deems appropriate. The Compensation Committee also determines individuals to whom stock options will be granted under the Company's 1994 Stock Incentive Plan, the terms on which such options will be granted, and to administer the 1994 Stock Incentive Plan. The Compensation Committee also retains administrative responsibility over the Company's 1992 Stock Option Plan. The Company anticipates that at the meeting of the Board of Directors immediately following the Annual Meeting of Stockholders, the existing members will be re-appointed to the Compensation Committee. The Compensation Committee held one meeting in fiscal year 2003.

TheNOMINATING COMMITTEE was established by the Board of Directors on March 3, 2004. The Nominating Committee is currently comprised of Thomas A. Brand, who is chairman, Lloyd I. Miller, III and Bryant R. Riley. Each member of the Nominating Committee has been determined, in the opinion of the Board of Directors, to be independent in accordance with NASDAQ rules. The

3

Nominating Committee has recommended to the Board of Directors, which has adopted its recommendation, that the nominees for Director named in this proxy be submitted to the stockholders for approval. The Nominating Committee will consider nominees recommended by stockholders. Any stockholder desiring to recommend such nominee may do so by contacting any member of the Nominating Committee. The Nominating Committee held no meetings in fiscal year 2003 as the committee was not established during that period.

INDEPENDENCE OF MAJORITY OF DIRECTORS

As part of the Sarbanes-Oxley Act of 2002 ("Sarbanes-Oxley") reforms, the NASD has adopted new rules regarding the independence of directors of NASDAQ listed companies. These rules become effective for the Company as of the 2004 Annual Meeting of Stockholders.

The Board of Directors has determined that Messrs. Brand, Miller and Riley, constituting a majority of the Board of Directors during 2003, are independent directors in accordance with rules of the NASD in effect during that time, and none of them are believed to have any relationships that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director.

Effective as of the 2004 Annual Meeting of Stockholders, the new, stricter NASD rules regarding the independence of directors will become effective as to the Company. The Board of Directors has determined that Messrs. Brand, Miller, Riley, and Leitch, upon his successful election as a Director, will constitute a majority of the Board of Directors, that each will be independent under the new rules of the NASD, and none of them are believed to have any relationships that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director.

Mr. Mathewson is precluded from being considered independent by NASD rules since he currently serves as an executive officer of the Company.

CODE OF ETHICS

The Company adopted a Code of Business Conduct and Ethics on December 31, 2002 governing its officers, directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the Code of Business Conduct and Ethics is available at the Company's website (www.aldila.com).

PROPOSAL NO. 2—RATIFICATION OF THE SELECTION OF INDEPENDENT ACCOUNTANTS

The Audit Committee has selected the accounting firm of Peterson & Co., LLP to audit the Company's financial statements for, and otherwise act as the Company's independent accountants with respect to, the fiscal year ending December 31, 2004. Peterson & Co., LLP has acted as independent accountants for the Company since May 20, 2003. The change to Peterson & Co., LLP was made upon the recommendation of the Audit Committee in order to reduce the Company's expenses. In accordance with the Audit Committee's resolution, its selection of Peterson & Co., LLP as the Company's independent accountants for the current fiscal year is being presented to stockholders for ratification at the Annual Meeting. The Company knows of no direct or material indirect financial interest of Peterson & Co., LLP in the Company or any connection of that firm with the Company in the capacity of promoter, underwriter, voting trustee, officer or employee.

Representatives of Peterson & Co., LLP will be present at the 2004 Annual Meeting of Stockholders, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

4

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF PETERSON & CO., LLP AS THE INDEPENDENT ACCOUNTANTS OF THE COMPANY.

INDEPENDENT ACCOUNTANT FEES

The Company paid the following fees to its principal accountant for the indicated services. During fiscal year 2002 and through May 20, 2003 the Company's principal accountant was Deloitte & Touche, LLP. From May 20, 2003 the Company's principal accountant was Peterson & Co., LLP

AUDIT FEES

The Company was billed $141,500 for 2002 and $10,250 for the first quarter of 2003 by Deloitte & Touche, LLP, and $69,827 for the remainder of 2003 by Peterson & Co, LLP for professional services rendered by its principal accountant for the audit of the Company's annual financial statements, review of financial statements included in the Company's quarterly filings, and services normally provided by the accountant in connection with statutory and regulatory filings.

AUDIT-RELATED FEES

The Company was billed $41,085 for 2002 and $0 for the first quarter of 2003 by Deloitte & Touche, LLP, and $13,399 for the remainder of 2003 by Peterson & Co., LLP for professional services rendered by its principal accountant reasonably related to the performance of the audit or review of the Company's financial statements in addition to the Audit Fees reported above. Such professional services consisted of an audit of the employee benefit plan, an audit of a foreign statutory report, and accounting consultations.

TAX FEES

The Company was billed $48,195 by Deloitte & Touche, LLP, for 2002, and $35,952 by Peterson & Co., LLP for 2003 for professional services rendered by its principal accountant for tax compliance, tax advice and tax planning. Such professional services consisted of tax planning and consultations and tax return preparation.

ALL OTHER FEES

The Company was billed $0 for 2002, and $0 for 2003 for professional services rendered by its principal accountant for other services.

PRE-APPROVAL POLICIES

Sarbanes-Oxley and applicable SEC rules strengthened the rules regarding the independence of auditors of publicly traded companies. Consistent with these requirements, the Audit Committee will consider, on a case-by-case basis, and approve in advance, if appropriate, all audit and permissible non-audit services to be provided by the Company's principal accountants. None of the services provided in 2003 fell within the exemptions to the required Audit Committee pre-approval procedures.

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

On June 4, 2002, the Company effected a one-for-three reverse stock split (the "Reverse Stock Split") of the Company's Common Stock. All historical information in this Proxy Statement relating to the Company's Common Stock, share prices, options, and similar matters prior to June 4, 2002 has been restated to give effect to the Reverse Stock Split.

The following table sets forth certain information regarding the shares of Common Stock beneficially owned as of February 1, 2004 by (a) each person or entity who, insofar as the Company has been able to ascertain, beneficially owned more than 5% of the Company's Common Stock as of such date, (b) each of the directors of the Company and nominees for directors, (c) the Company's Chief Executive Officer and the two other most highly compensated executive officers of the Company for the fiscal year ended December 31, 2003 (the "Named Executive Officers") and (d) all current and nominated directors and executive officers of the Company, as a group (seven persons). Except as otherwise indicated, the business address for each person is c/o Aldila, Inc., 13450 Stowe Drive, Poway, California 92064.

Common Stock Beneficially Owned

| |

|---|

Name

| | Beneficial Ownership

| | Percent (1)

| |

|---|

| Certain Beneficial Owners | | | | | |

| Acquisitor Holdings (Bermuda) Ltd. (2) | | 322,816 | | 6.68 | % |

| J. Carlo Cannell d/b/a Cannell Capital, LLC (3) | | 500,000 | | 10.34 | % |

| The PNC Financial Services Group, Inc. (4) | | 437,424 | | 9.05 | % |

| Directors and Officers | | | | | |

| Peter R. Mathewson (5) | | 82,442 | | 1.68 | % |

| Thomas A. Brand (6) | | 20,440 | | * | |

| Andrew M. Leitch | | 0 | | * | |

| Lloyd I. Miller, III (7) | | 921,536 | | 19.04 | % |

| Bryant R. Riley (8) | | 587,180 | | 12.14 | % |

| Robert J. Cierzan (9) | | 60,603 | | 1.24 | % |

| Michael J. Rossi (10) | | 28,263 | | * | |

| | |

| |

| |

| Total All Directors and Officers | | 1,700,464 | | 34.10 | % |

Notes:

- *

- Percentage of shares beneficially owned does not exceed one percent of the outstanding shares of Common Stock as of February 1, 2004.

- (1)

- Based on a total of 4,835,149 outstanding Common Shares as of February 1, 2004, and any options or other rights to acquire shares vesting within 60 days of that date.

- (2)

- Based on a Schedule 13D, dated October 7, 2002, as amended by Amendment No. 1 dated November 12, 2003, by Acquisitor Holdings (Bermuda) Ltd. ("Acquisitor"), a company incorporated in Bermuda. Acquisitor has sole voting and dispositive power over 322,816 shares of Common Stock of the Company. Acquisitor's principal office is located at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda.

- (3)

- Based on a joint filing of a Schedule 13G, dated January 10, 2000, as amended by Amendment No. 1, dated September 27, 2001, Amendment No. 2, dated February 14, 2002, Amendment No. 3, dated February 10, 2003 and Amendment No. 3 (sic), dated February 13, 2004 (the "Cannell 13G"), Cannell Capital, LLC ("Cannell"), which is an investment advisor and J. Carlo Cannell ("Managing Member") each have shared dispositive and shared voting power with respect to 500,000 shares of Common Stock of the Company. Based on the Cannell 13G, Cannell's beneficial ownership of the Common stock of the Company is direct as a result of its discretionary authority to buy, sell, and vote shares of such Common Stock for its investment advisory clients. Managing

6

Member's beneficial ownership of the Common Stock of the Company is indirect as a result of Managing Member's ownership and management of Cannell. The address of Cannell's and Managing Member's principal office is 150 California Street, Fifth Floor, San Francisco, California 94111.

- (4)

- Based on a Schedule 13G, dated February 12, 2001, as amended by Amendment No. 1, dated February 12, 2002, Amendment No. 2, dated February 12, 2003, and Amendment No. 3, dated February 10, 2004 (the "PNC 13G"), The PNC Financial Services Group, Inc., together with certain of its subsidiaries reported therein, collectively ("PNC Group"), the PNC Group has beneficial ownership of 437,424 shares of Common Stock of the Company, 36,518 of which the PNC Group has sole voting and dispositive power, and 400,906 of which the PNC Group has shared voting and dispositive power. Based on the PNC 13G, 400,906 of the 437,424 shares are held in Trust Accounts created by an Amended and Restated Trust Agreement, dated September 20, 1983, in which Lloyd I. Miller, Jr. was Grantor and for which PNC Bank National Association ("PNC BNA") serves as Trustee. Lloyd I. Miller, III and PNC BNA have shared voting power with respect to these shares of Common Stock held in the Trust Accounts pursuant to an Investment Advisory Agreement dated as of April 1, 1997. Based on the PNC 13G, 36,518 of the shares are held by an investment partnership of which PNC GPI, Inc. is the general partner and an unaffiliated third party investment manager has sole voting and dispositive power over those shares. PNC Group's and PNC BNA's principal office is located at One PNC Plaza, 249 Fifth Avenue, Pittsburgh, PA 15222.

- (5)

- Mr. Mathewson has shared voting and dispositive power over all Common Shares, which are held by Peter R. Mathewson and Penny E. Mathewson, Trustees of the Mathewson Family Trust dated 01/20/1998. Includes options to acquire 61,600 shares of Common Stock that will have vested within 60 days following February 1, 2004. Mr. Mathewson also has options to purchase 48,196 shares of Common Stock that will not have vested within 60 days following February 1, 2004.

- (6)

- Includes options to acquire 18,774 shares of Common Stock that will have vested within 60 days following February 1, 2004. Mr. Brand also has options to purchase 6,668 shares of Common Stock that will not have vested within 60 days following February 1, 2004.

- (7)

- Includes options to acquire 5,848 shares of Common Stock that will have vested within 60 days following February 1, 2004. Mr. Miller also has options to purchase 6,258 shares of Common Stock that will not have vested within 60 days following February 1, 2004. Mr. Miller has sole voting power over 513,782 shares of Common Stock. Mr. Miller has shared voting power over 401,906 shares of Common Stock which includes the shares of Common Stock reported under footnote (4) above. He has sole investment power over 430,862 shares of Common Stock. He has shared investment power over 484,826 shares of Common Stock which includes the shares of Common Stock reported under footnote (4) above.

- (8)

- Mr. Riley also has options to purchase 8,772 shares of Common Stock, none of which will be vested within 60 days of February 1, 2004. Mr. Riley directly or indirectly has sole voting and dispositive power over securities held by B. Riley & Co., Inc. and by Riley Management LLC, the investment advisor to and general partner of SACC Partners LP. Through these direct and indirect holdings he may be deemed to have sole voting and dispositive power over and be a beneficial owner of 472,068 shares of Common Stock held by SACC Partners, LP and 115,112 shares of Common Stock held by B. Riley & Co., Inc.

- (9)

- Includes options to acquire 37,445 shares of Common Stock that will have vested within 60 days following February 1, 2004. Mr. Cierzan also has options to purchase 29,889 shares of Common Stock that will not have vested within 60 days of February 1, 2004. Mr. Cierzan shares voting and dispositive control over 23,158 shares of Common Stock with his wife, Lynn Cierzan, as a joint tenant.

7

- (10)

- Includes options to acquire 28,197 shares of Common Stock that will have vested within 60 days following February 1, 2004. Mr. Rossi also has options to purchase 21,390 shares of Common Stock that will not have vested within 60 days of February 1, 2004.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's directors and executive officers and holders of more than 10% of the Company's Common Stock to file with the Securities and Exchange Commission (the "SEC") reports of ownership and changes in ownership of Common Stock and other equity securities of the Company on Forms 3, 4 and 5. Based on a review of such forms and written representations of reporting persons, the Company believes that during the fiscal year ended December 31, 2003, its officers and directors and holders of more than 10% of the Company's Common Stock complied with all applicable Section 16(a) filing requirements.

EXECUTIVE OFFICERS OF THE COMPANY

Set forth below is certain information regarding each of the current executive officers of the Company. Information about Mr. Mathewson is presented in "ELECTION OF DIRECTORS—Nominees for Election by Holders of Common Stock." Officers are appointed by and serve at the discretion of the Board. Except as otherwise indicated, the positions listed are with Aldila, Inc.

Name

| | Age

| | Position

|

|---|

| Peter R. Mathewson | | 53 | | Chairman of the Board of Directors, Chief Executive Officer, President and Director; President and Chief Operating Officer of Aldila Golf Corp. |

| Robert J. Cierzan | | 57 | | Vice President, Finance, Secretary and Treasurer |

| Michael J. Rossi | | 50 | | Vice President, Sales and Marketing of Aldila Golf Corp. |

The principal occupations and positions for the past five years, and in certain cases prior years, of the executive officers of the Company who are not also nominees for election as a director, are as follows:

ROBERT J. CIERZAN has been Secretary and Treasurer of Aldila (or its predecessors) since January 1991 and Vice President, Finance since March 1989. From September 1988 to February 1989, Mr. Cierzan held the position of Executive Vice President-Finance at Illinois Coil Spring Company, a diversified manufacturer of springs, automotive push-pull controls and rubber products.

MICHAEL J. ROSSI has been the Vice President, Sales and Marketing of Aldila Golf Corp. since March 24, 1997 when he joined the Company. Prior to that, from August 1994 to March 1997, Mr. Rossi was the Vice President and General Manager of Fujikura Composite America, which manufactures graphite golf shafts and is a wholly owned subsidiary of Fujikura Rubber Limited, a Japanese publicly held company. From November 1989 to August 1994, he was Vice President, Sales and Marketing for True Temper Sports, a division of the Black & Decker Corporation, which manufactures steel golf shafts.

8

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The following table sets forth the compensation (cash and non-cash, plan and non-plan) paid to each of the Named Executive Officers for services rendered in all capacities to the Company during the three fiscal years ended December 31, 2003, 2002 and 2001.

Name (1)

| | Fiscal

Year

| | Annual

Compensation (2)

Base Salary

| | Long Term Compensation

Securities Underlying

Options

| |

|---|

| Peter R. Mathewson | | 2003

2002

2001 | | $

| 262,500

262,000

250,000 | | 25,000

22,295

25,000 |

(3)

|

Robert J. Cierzan |

|

2003

2002

2001 |

|

$

|

194,481

193,000

183,000 |

|

15,000

17,334

10,000 |

(3)

|

Michael J. Rossi |

|

2003

2002

2001 |

|

$

|

182,327

180,000

172,000 |

|

15,000

5,418

8,334 |

(3)

|

- (1)

- Positions held are indicated inEXECUTIVE OFFICERS OF THE COMPANY above.

- (2)

- Excludes auto usage, imputed income on life insurance and employer's 401(k) match.

- (3)

- Includes stock options granted on December 31, 2002 pursuant to Company's tender offer to exchange certain previously outstanding stock options in connection with the re-pricing of certain stock options.

STOCK OPTION GRANTS

The following table sets forth information concerning the grant of stock options during the fiscal year ended December 31, 2003 to each of the Named Executive Officers. All options were granted under the Company's 1994 Stock Incentive Plan, on December 16, 2003, and vest one-third on each of December 16, 2004, December 16, 2005 and December 16, 2006.

| |

| | Percentage of

Total Options

Granted to

Employees in

Fiscal Year 2003

| |

| |

| | Potentially Realizable Value

at Assumed Stock Price

Appreciation for Option Term—10 yr.

|

|---|

| | Options

Granted in

Fiscal Year

2003

| |

| |

|

|---|

| | Exercise or

Base Price

(per share)

| |

|

|---|

Name

| | Expiration Date

| | 5%

| | 10%

|

|---|

| Peter R. Mathewson | | 25,000 | | 33.33 | % | $ | 3.29 | | 12/16/2013 | | $ | 133,977 | | $ | 213,335 |

Robert J. Cierzan |

|

15,000 |

|

20.00 |

% |

$ |

3.29 |

|

12/16/2013 |

|

$ |

80,386 |

|

$ |

128,001 |

Michael J. Rossi |

|

15,000 |

|

20.00 |

% |

$ |

3.29 |

|

12/16/2013 |

|

$ |

80,386 |

|

$ |

128,001 |

AGGREGATED OPTION EXERCISES

None of the Named Executive Officers exercised stock options during the fiscal year ended December 31, 2003. The following table sets forth information (on an aggregated basis) concerning the

9

fiscal year-end value of unexercised options using the closing price of $3.56 per share as of December 31, 2003. The Company has no outstanding stock appreciation rights, either freestanding or in tandem with options.

| | Number of Securities Underlying

Unexercised Options

| | Value of Unexercised In-The-Money Options

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Peter R. Mathewson | | 61,600 | | 48,196 | | $ | 14,492 | | $ | 35,733 |

Robert J. Cierzan |

|

37,445 |

|

29,889 |

|

$ |

11,267 |

|

$ |

26,584 |

Michael J. Rossi |

|

28,197 |

|

21,390 |

|

$ |

3,522 |

|

$ |

11,093 |

DIRECTOR COMPENSATION

Directors, other than management directors (Peter R. Mathewson), currently receive for their service as directors $2,000 per quarter, $1,000 per Board meeting attended and $500 per committee meeting attended. Each director, including each management director and other directors not receiving directors' fees, is reimbursed for out-of-pocket expenses arising from attendance at meetings of the Board or committees thereof.

Pursuant to the Company's 1994 Stock Incentive Plan, in May 2003, each of the non-employee directors who had more than one year of service (Thomas A. Brand and Lloyd I. Miller, III) received an annual stock option grant of 3,334 shares. Under the 1994 Stock Incentive Plan, Bryant R. Riley received a stock option grant of 8,772 shares upon his election to as a non-employee director in May 2003. Each non-employee director with more than one year of service (currently, Messrs. Brand, Miller and Riley) would receive additional options under the 1994 Stock Incentive Plan to acquire 3,334 shares annually on the last trading day in the month of May. Mr. Leitch will receive a stock option grant of 8,772 shares if he is elected as a non-employee director.

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTS

The Company entered into a Severance Protection Agreement (the "Severance Agreement") in November 2003, with each of the Named Executive Officers. All capitalized terms in the description below have the same meaning as in the Severance Agreement. Each Severance Agreement commences January 1, 2004, continues until December 31, 2004, and automatically renews for one year on each January 1 thereafter, unless either party gives ninety days advance notice of non-renewal or if the Severance Agreement is terminated, however in the event of a Change of Control the term of the Severance Agreement is twenty-four months from such event. Pursuant to the Severance Agreement, in the case of termination of employment within thirty-six months after a Change in Control as a result of death, by the Company for Cause or Disability, or by the Executive other than for Good Reason, the Executive is entitled to his Accrued Compensation. In the case of termination within thirty-six months of a Change of Control for any other reason, the Executive is entitled to the following: (i) Accrued Compensation and a Pro Rata Bonus for the year of termination (typically computed based on the average bonus paid for the prior two years), (ii) a lump sum payment equal to the sum of the Executive's then annual base salary and his average bonus for the prior two years, (iii) continued provision of insurance (including life, disability and medical) for two years, "grossed up" to cover any excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, and (iv) a lump sum equal to one years' automobile allowance (or the length of the automobile lease, if longer, in the case of automobiles leased by the Company for the Executive's use). These payments are in lieu of any other severance benefit to which the Executive would otherwise have been entitled. Upon a Change-in-Control, regardless of whether the Executive's employment has terminated, the Company is

10

required to contribute to a grantor trust an amount sufficient to fund the payments under clauses (i), (ii), and (iv) above.

"Change-in-Control" means (1) an acquisition of 40% of the Company's Common Stock, (2) the failure of the individuals who, as of November 19, 2003, are members of the Board of Directors (the "Incumbent Board") to constitute at least two-thirds of the members of the Board, unless the election of any new director is approved by a vote of at least two-thirds of the Incumbent Board, subject to certain other qualifications, (3) the completion of a merger where the existing stockholders and Board of Directors do not retain control of the surviving company, or (4) the liquidation or sale of substantially all the assets of the Company.

Except as provided above and except for the provisions of the 1994 Stock Incentive Plan and related agreements thereto, there are no compensatory plans or arrangements with respect to any of the executive officers (including each of the Named Executive Officers) which are triggered by, or result from, the resignation, retirement or any other termination of such executive officer's employment, a change-in-control of the Company or a change in such executive officer's responsibilities following a change-in-control.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee Report on Executive Compensation shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act and shall not otherwise be deemed filed under such Acts.

COMMITTEE COMPOSITION

The Compensation Committee of the Board of Directors in 2003 was comprised of Thomas A. Brand (chairman), Lloyd I. Miller, III and Bryant R. Riley.

COMPENSATION OBJECTIVES AND POLICIES

The principle objectives of the Company's executive compensation committee are to:

- •

- support the achievement of desired Company performance,

- •

- align the executive officers' interests with the success of the Company and with the interests of the Company's stockholders, and

- •

- provide compensation that will attract and retain superior talent and reward performance.

These objectives are principally achieved through compensation in the form of annual base salaries, bonuses and equity investment opportunities. In line with these objectives, the Company's executive compensation system consists generally of base salary, bonuses based on corporate performance under the Company's Executive Bonus Plan (the "Bonus Plan"), and the grant of stock options under the 1994 Stock Incentive Plan.

BASE SALARY

Executive officers generally are considered for salary increases at the time of their respective employment anniversaries as approved by the Compensation Committee, taking into consideration the recommendations of the Company's Chairman and Chief Executive Officer. Small increases in executive officer salaries were authorized in 2002. Due to the overall financial performance of the Company in 2003, executive officer salaries were not increased this year. In deciding to provide no salary increases to the executive officers, the Compensation Committee took into account the overall performance of the Company in recent years in the face of increasing market pressures, including

11

declining unit prices that have been negatively impacting the Company's gross margins, an overall drop in sales of golf equipment by many of the Company's customers, and the efforts taken by management to improve performance and control costs in light of these market factors.

BONUS PLAN

Principally as a result of the poor market conditions in 2003, the Company did not establish a Bonus Plan for 2003.

In late 2003 the Compensation Committee established a Bonus Plan for executive officers for 2004. Bonus awards in 2004 will be made under the Bonus Plan depending on the actual financial performance of the Company at the end of fiscal year 2004, compared to the target 2004 financial performance objectives based on the Company's 2004 operating plan. The bonuses to be awarded will depend upon the Company achieving a specified dollar amount of pretax profits and will be increased to the extent pretax profits exceeded that minimum level and achieve certain specified, higher levels. The bonus for each participant was set at a percentage of the participant's base salary, with the percentage depending on what level of pretax profits the Company achieved. In establishing the targets and proposed bonuses, the Committee determined that it is important the bonus structure reward executive officers for high levels of performance by the Company, weighted so superior performance (viewed against the performance expected in accordance with management's internal projections for 2004 performance approved by the Board of Directors) will result in substantially higher bonuses than will result from merely acceptable performance. While a substantial portion of the bonus will be subject solely to the Company attaining its quantitative objectives, a portion of the total bonus award will be subject to a discretionary modifier determined by the Chairman and Chief Executive Officer allowing him to reduce the bonus if the executive's individual performance so warrants.

The Compensation Committee believes that base 2003 executive compensation levels, even without any bonuses, adequately reflected (i) each executive's business results and performance in his area of responsibility, (ii) each executive's contribution to the overall management team and (iii) each executive's expected future contributions to the Company.

STOCK OPTIONS

The Board of Directors believes executive officers who are in a position to make a substantial contribution to the long-term success of the Company and to build stockholder value should have a significant stake in the Company's on-going success. To this end, the Company's compensation objectives are designed to be achieved through significant stock ownership in the Company by executive officers in addition to base salary and bonus payments.

The 1994 Stock Incentive Plan is intended to provide an additional incentive to employees maximize stockholder value and to facilitate broad and increasing stock ownership by executives and other key employees. In 2003, options to purchase an aggregate of 75,000 shares were granted to employees of the Company as a group. Of this total, options to purchase an aggregate of 55,000 shares (73.33% of all options granted in 2003) were granted to the Named Executive Officers. The Compensation Committee believes these stock option grants were appropriate in light of the policy of the Board of Directors that significant equity ownership by executive officers is an important contributor to aligning the interests of executive officers with those of the stockholders of the Company, and the number of options awarded to individual officers were set based on the Compensation Committee's perception, in part in light of recommendations by the Company's Chairman and Chief Executive Officer, as to each officer's ability to affect the Company's overall future performance. The Named Executive Officers collectively hold options to acquire 226,717 shares as of December 31, 2003. The Compensation Committee believes these options provide significant

12

incentives for executives to increase the value of the Company for the benefit of all stockholders and offer executives significant opportunities to profit personally from their efforts to increase that value.

SECTION 162(m) ISSUES

The Compensation Committee has considered the impact of Section 162(m) of the Internal Revenue Code on its executive compensation decisions. Section 162(m) generally disallows a federal income tax deduction to any publicly-held corporation for compensation paid to the chief executive officer and each of the four other most highly compensated executive officers to the extent that such compensation in a taxable year exceeds $1 million. Section 162(m), however, permits a deduction for qualified "performance-based compensation," the material terms of which are disclosed to and approved by stockholders. The Company's Bonus Plan does not qualify as performance-based compensation for the purposes of Section 162(m), although the 1994 Stock Incentive Plan so qualifies. During 2003, the Compensation Committee believed it unlikely any executive officer of the Company would receive in excess of $1 million in compensation, other than performance-based compensation. The Compensation Committee believes it is unlikely any executive officer will receive in excess of that amount in 2004. As a result, the Compensation Committee has not taken any steps to qualify the bonus plan as performance-based compensation, although it anticipates the Company would do so before any executive receives salary, bonus and other non-performance based compensation in excess of $1 million.

COMPENSATION OF THE CHIEF EXECUTIVE OFFICER

Peter R. Mathewson's compensation during 2003 as Chairman of the Board and Chief Executive Officer was reviewed in connection with the Compensation Committee's overall review of executive officer compensation. Based on current economic conditions of the market and the Company, the Compensation Committee proposed no increase to Mr. Mathewson's base salary for 2004. As described above, the Company had no bonus plan in 2003, so Mr. Mathewson did not receive any bonus in 2003. On December 16, 2003, Mr. Mathewson was granted options to purchase 25,000 shares of Common Stock. Mr. Mathewson did not receive any other grant of stock options in 2003. The Compensation Committee believes this number of options was appropriate in light of the importance of Mr. Mathewson's position to the Company and his level of stock ownership. The Compensation Committee believes Mr. Mathewson's 2004 base salary and his participation in the 2004 Bonus Plan, in conjunction with his stock ownership and employee stock options, will provide substantial incentives for him to create stockholder value.

13

AUDIT COMMITTEE

Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act or the Exchange Act that might incorporate this Proxy Statement or future filings with the Securities and Exchange Commission, in whole or in part, the following information regarding the Audit Committee and its report shall not be deemed to be incorporated by reference into any such filing.

REPORT OF AUDIT COMMITTEE

The Audit Committee currently consists of Bryant R. Riley (chairman), Lloyd I. Miller, III, and Thomas A. Brand. It held four meetings during fiscal 2003.

Under its charter, the Audit Committee's principal responsibilities are to:

- •

- retain, set the compensation of, and monitor the independence of, the Company's independent accountants, currently Peterson & Co., LLP;

- •

- oversee the performance of the Company's independent accountants and members of Company management involved with finance and accounting functions;

- •

- monitor the integrity of the Company's financial reporting process and systems of internal controls regarding finance, accounting and legal compliance;

- •

- oversee the Company's accounting policies and staff and review and approve related party transactions; and

- •

- provide an avenue of communication among the independent accountants, Company management and the Board of Directors.

The Company's management remains directly responsible for the Company's disclosure controls, internal controls, and the financial reporting process. The Company's independent accountants are responsible for performing an independent audit of the Company's financial statements in accordance with generally accepted auditing standards and to issue a report on the Company's financial statements, as well as to review the Company's quarterly financial statements. The Audit Committee has the principal responsibility to monitor and oversee these processes, although the Board of Directors retains ultimate responsibility for the performance of the Company's independent accountants and management.

The Audit Committee is charged with meeting a minimum of four times each year, including a meeting following the preparation of quarterly and annual financial statements, to review these financial statements with management and the independent accountants.

Company management has represented to the Audit Committee that the Company's financial statements for the fiscal year 2003 were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed these financial statements with management and the Company's independent accountants. The Audit Committee also discussed with the Company's independent accountants matters required to be discussed by the Statement on Auditing Standards No. 61 (communications with audit committees).

The Company's independent accountants have provided to the Audit Committee the written disclosure required by Independence Standards Board Standard No. 1 (independence discussions with audit committees), and the Audit Committee discussed with the independent accountants the accounting firm's independence. The Audit Committee also considered whether non-audit services provided by the independent accountants during the last fiscal year were compatible with maintaining the independent accountants' independence.

14

The Audit Committee is assigned the responsibility to (1) supervise the internal accounting policies and procedures in order to assess the adequacy of internal accounting and financial reporting controls, (2) review with the independent accountant the Company's financial statements and audit process and (3) review all proposed transactions between the Company and its directors and officers, and any immediate family member or affiliate of any of its directors and officers, or any other affiliate of the Company that is not a subsidiary of the Company. The Audit Committee is also responsible for recommending the independent accountants to be retained by the Company for each fiscal year and has recommended that Peterson & Co., LLP be nominated for approval by the stockholders for fiscal 2004.

Based upon the Audit Committee's discussion with management and the Company's independent accountants and the Audit Committee's review of the representations of management and the report of the independent accountants to the Audit Committee, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2003 filed with the Securities and Exchange Commission.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed under such Acts.

AUDIT COMMITTEE CHARTER

The Audit Committee Charter was approved by the Board of Directors on December 31, 2002 and attached to the proxy statement for the Company's 2003 Annual Meeting of Stockholders. There have been no amendments or changes to that Audit Committee Charter.

INDEPENDENCE OF AUDIT COMMITTEE MEMBERS

As part of the Sarbanes-Oxley reforms, the SEC and NASD have adopted new rules regarding the independence of directors who are members of the Audit Committee of a company trading on the NASDAQ, such as the Company. These rules become effective for the Company as of the 2004 Annual Meeting of Stockholders.

The rules in effect until the 2004 Annual Meeting of Stockholders generally require an Audit Committee of at least three directors, comprised solely of "independent directors," and each of whom was, or will become within a reasonable time after appointment, able to read and understand financial statements.

During fiscal year 2003 the Audit Committee consisted of Mr. Riley, Mr. Miller, and Mr. Brand. The Board of Directors has determined that each is "independent" as that term was defined in the NASD Rules applicable at the time, and able to understand the Company's financial statements.

The rules that become effective at the 2004 Annual Meeting of Stockholders are stricter. The definition of "independent director" under the NASD Rules has been tightened. In addition, the members of the Audit Committee must meet the requirements of new SEC Rule 10A-3, which includes a requirement that the Audit Committee members are not "affiliates" of the Company, although there is a 10% stock ownership safe-harbor for determining whether a director is an "affiliate" for this

15

purpose. Audit Committee members must not have participated in the preparation of the Company's financial statements during the previous three years, and they must be able to read and understand financial statements at the time they assume office. The minimum size of the Audit Committee remains at least three.

We anticipate that at the meeting of the Board of Directors immediately following the 2004 Annual Meeting of Stockholders, new members of the Audit Committee will be appointed. We anticipate the new Audit Committee will consist of Mr. Leitch, Mr. Riley and Mr. Brand. The Board of Directors has determined that (a) each will be "independent" as that term is defined in the new NASD Rules and new SEC Rule 10A-3(b)(1), although Mr. Riley is not within the "safe-harbor" of SEC Rule 10A-3(e)(1)(ii) regarding independence as a result of his ownership of more then 10% of the outstanding common stock of the Company; (b) each has not participated in the preparation of the financial statements of the Company or any of its subsidiaries at any time during the past three years; and (c) each is able to read and understand fundamental financial statements, including the Company's balance sheet, income statement, and cash flow statement.

AUDIT COMMITTEE FINANCIAL EXPERT

Prior to the 2004 Annual Meeting of Stockholders, the Audit Committee was required to have at least one member that, through past employment experience in finance and accounting or other comparable experience, resulted in that person being "financially sophisticated." The Board of Directors has determined that Mr. Miller and Mr. Riley were both "financially sophisticated."

After the 2004 Annual Meeting of Stockholders, the new, stricter SEC and NASD rules will apply. These rules require that at least one member of the Audit Committee must be an "audit committee financial expert" as that term is defined in the SEC Rules, and is "financially sophisticated" as that term is defined in the NASD Rules. The Board of Directors has determined that Mr. Leitch, following his election as a director at the 2004 Annual Meeting of Stockholders and election to the Audit Committee by the Board of Directors, will be an "audit committee financial expert" and is "financially sophisticated," as those terms are defined in the respective rules.

16

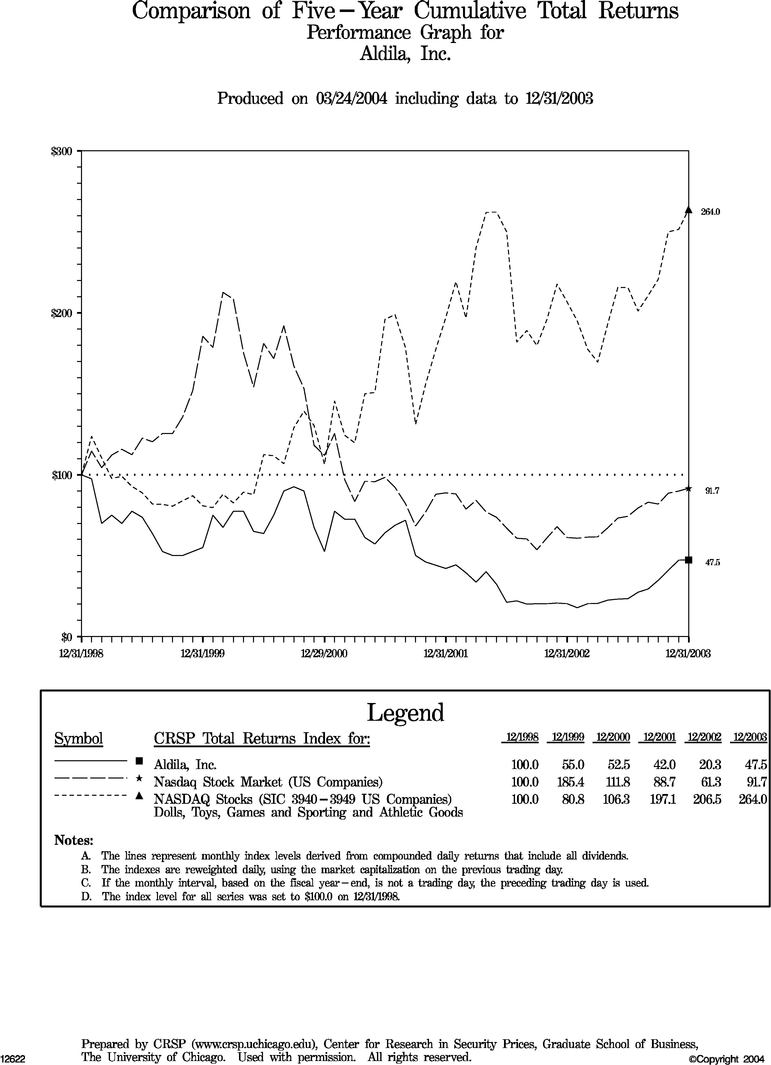

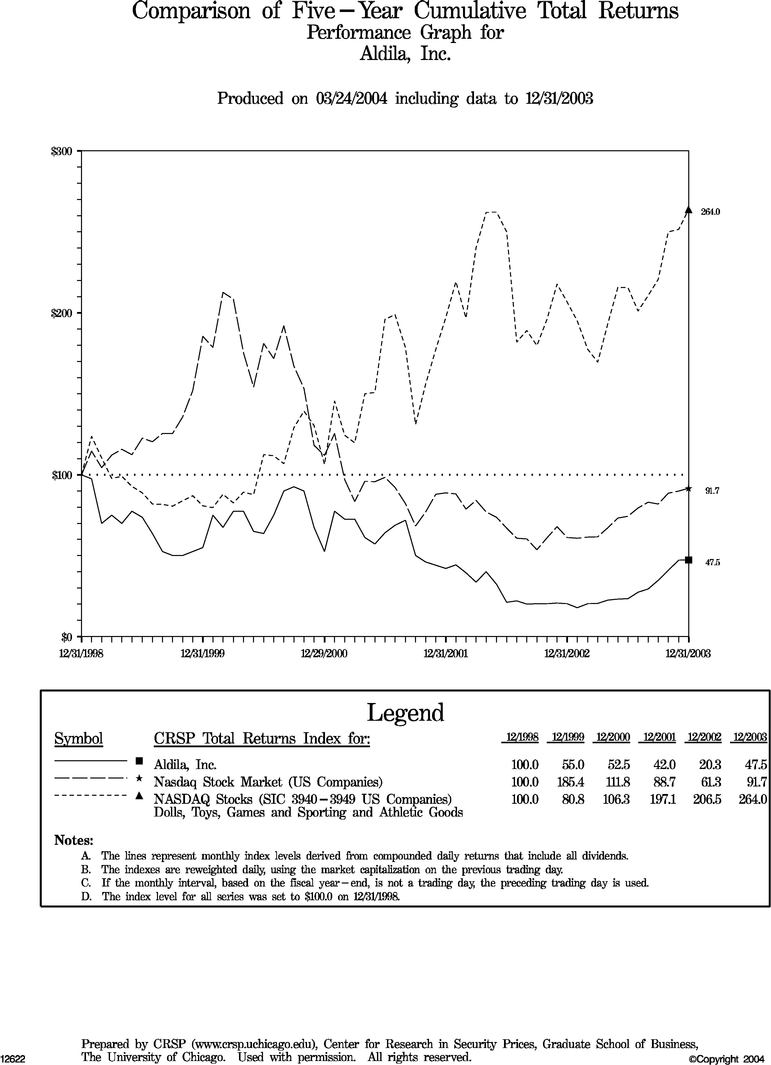

PERFORMANCE GRAPH FOR ALDILA, INC. COMMON STOCK

The performance graph for the Company's Common Stock compares the cumulative total return (assuming reinvestment of dividends) on the Company's Common Stock with (i) the Center for Research in Security Prices ("CRSP") Index for NASDAQ Stock Market (U.S. Companies) (the "Market Index") and (ii) the CRSP Index for NASDAQ Stocks (SIC 3940 - 3949)—Dolls, Toys, Games and Sporting and Athletic Goods (the "Peer Index"), assuming an investment of $100 on December 31, 1998 in each of the Common Stock, the stock comprising the Market Index and the stock comprising the Peer Index.

17

ANNUAL REPORT

The Company's Annual Report for the fiscal year ended December 31, 2003 (the "2003 Annual Report") is included with the mailing of this Proxy Statement. The 2003 Annual Report contains consolidated financial statements of the Company and its subsidiaries and the report thereon of Peterson & Co., LLP, the Company's current independent accountants.

PROXY SOLICITATION

The Company will pay the expense of this proxy solicitation. We do not anticipate that the costs and expenses incurred in connection with this proxy solicitation will exceed those normally expended for a proxy solicitation for those matters to be voted on in the annual meeting. We will, upon request, reimburse brokers, banks and similar organizations for out-of-pocket and reasonable clerical expenses incurred in forwarding proxy material to their principals. In addition to the solicitation of proxies by use of the mails, solicitation also may be made by telephone, telegraph or personal interview by our directors, officers and regular employees, none of whom will receive additional compensation for any such solicitation.

PROPOSALS OF STOCKHOLDERS

If a stockholder desires to have a proposal included in the proxy materials for the 2005 Annual Meeting of Stockholders, such proposal shall conform to the applicable proxy rules of the SEC concerning the submission and content of proposals and must be received by December 1, 2004 at the executive offices of the Company, 13450 Stowe Drive, Poway, California 92064, Attention: Secretary. The Company's receipt of notice of a stockholder's intent to submit a proposal outside of Rule 14a-8 at the 2004 Annual Meeting of Stockholders after February 25, 2005 will be considered untimely under Rule 14a-4(c)(1).

AVAILABLE INFORMATION

The Company is subject to the informational requirements of the Exchange Act and in accordance therewith files reports, proxy statements and other information with the SEC. Reports, proxy statements and other information filed by the Company may be inspected and copied at the public reference facilities maintained by the SEC at Judiciary Plaza, 450 Fifth Street, N.W., Room 1024, Washington, D.C. 20549 and at the SEC's Regional Offices located at 233 Broadway, New York, New York 10279 and 175 W. Jackson Blvd., Suite 900, Chicago, Illinois 60604. Copies of such materials can be obtained by mail from the Public Reference Section of the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates or, at no charge, may be obtained at the SEC's web site: http://www.sec.gov. In addition, such material may also be inspected and copied at the offices of the National Association of Securities Dealers, Inc., 1735 K Street, N.W., Washington, D.C. 20006-1500.

OTHER MATTERS

The Board knows of no matters other than those listed in the attached Notice of Annual Meeting which are likely to be brought before the Meeting. However, if any other matter properly comes before the Meeting, the persons named on the enclosed proxy card will vote the proxy in accordance with their best judgment on such matter.

April 14, 2004

18

ANNUAL MEETING OF STOCKHOLDERS OF

ALDILA, INC.

May 19, 2004

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

\*/ Please detach along perforated line and mail in the envelope provided. \*/

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF DIRECTORS AND "FOR" PROPOSALS 2 AND 3.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ý

- 1.

- Election of Directors:

| | | | NOMINEES: | | |

| o | FOR ALL NOMINEES | | o | Thomas A. Brand | | |

| | | | o | Peter R. Mathewson | | |

| o | WITHHOLD AUTHORITY | | o | Lloyd I. Miller, III | | |

| | FOR ALL NOMINEES | | o | Bryant R. Riley | | |

| | | | o | Andrew M. Leitch | | |

| o | FOR ALL EXCEPT

(See instructions below) | | | | | |

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark "FOR ALL EXCEPT" and fill in the circle next to each nominee you wish to withhold, as shown here: ý

| | | | | FOR | | AGAINST | | ABSTAIN |

2. |

|

Ratification of the appointment of Peterson & Co., LLP as the independent accountants of the Company. |

|

o |

|

o |

|

o |

3. |

|

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof. |

|

o |

|

o |

|

o |

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders to be held May 19, 2004 and the Proxy Statement furnished herewith.

MARK "X" HERE IF YOU PLAN TO ATTEND THE MEETING.o

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. ý

| Signature of Stockholder | | | | Date: | | | | Signature of Stockholder | | | | Date: | | |

| | |

| | | |

| | | |

| | | |

|

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

ALDILA, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned stockholder of ALDILA, INC. hereby appoints PETER R. MATHEWSON and ROBERT J. CIERZAN, or either of them, Proxies of the undersigned, each with full power to act without the other and with the power of substitution, to represent the undersigned at the Annual Meeting of Stockholders of Aldila, Inc., to be held at the Company's executive offices and production facility, 13450 Stowe Drive, Poway, California 92064 on Wednesday, May 19, 2004 at 10:30 a.m. (Pacific daylight time), and at any adjournments or postponements thereof, and to vote all shares of stock of the Company standing in the name of the undersigned with all the powers the undersigned would possess if personally present, in accordance with the instructions below and on the reverse hereof, and, in their discretion, upon such other business as may properly come before the meeting or any adjournments thereof.

THIS PROXY WILL BE VOTED ON THE REVERSE HEREOF, AND WILL BE VOTED IN FAVOR OF PROPOSALS 1 AND 2, IF NO INSTRUCTIONS ARE INDICATED.

IMPORTANT: SIGNATURE REQUIRED ON REVERSE SIDE.

(Continued and to be signed on the reverse side)

ANNUAL MEETING OF STOCKHOLDERS OF

ALDILA, INC.

May 19, 2004

PROXY VOTING INSTRUCTIONS

COMPANY NUMBER

ACCOUNT NUMBER

MAIL - Date, sign and mail your proxy card in the envelope provided as soon as possible.

- OR -

TELEPHONE - Call toll-free1-800-PROXIES (1-800-776-9437) from any touch-tone telephone and follow the instructions. Have your proxy card available when you call.

- OR -

INTERNET - Access "www.voteproxy.com" and follow the on-screen instructions. Have your proxy card available when you access the web page.

\*/ Please detach along perforated line and mail in the envelope provided IF you are not voting via telephone or the Internet. \*/

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF DIRECTORS AND "FOR" PROPOSALS 2 AND 3.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ý

- 1.

- Election of Directors:

| | | | NOMINEES: | | |

| o | FOR ALL NOMINEES | | o | Thomas A. Brand | | |

| | | | o | Peter R. Mathewson | | |

| o | WITHHOLD AUTHORITY | | o | Lloyd I. Miller, III | | |

| | FOR ALL NOMINEES | | o | Bryant R. Riley | | |

| | | | o | Andrew M. Leitch | | |

| o | FOR ALL EXCEPT

(See instructions below) | | | | | |

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark "FOR ALL EXCEPT" and fill in the circle next to each nominee you wish to withhold, as shown here: ý

| | | | | FOR | | AGAINST | | ABSTAIN |

2. |

|

Ratification of the appointment of Peterson & Co., LLP as the independent accountants of the Company. |

|

o |

|

o |

|

o |

3. |

|

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof. |

|

o |

|

o |

|

o |

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders to be held May 19, 2004 and the Proxy Statement furnished herewith.

MARK "X" HERE IF YOU PLAN TO ATTEND THE MEETING. o

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. o

| Signature of Stockholder | | | | Date: | | | | Signature of Stockholder | | | | Date: | | |

| | |

| | | |

| | | |

| | | |

|

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

QuickLinks

ALDILA, INC. 13450 STOWE DRIVE POWAY, CALIFORNIA 92064 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 19, 2004TABLE OF CONTENTSALDILA, INC. 13450 STOWE DRIVE POWAY, CALIFORNIA 92064 (858) 513-1801PROXY STATEMENT ANNUAL MEETING OF STOCKHOLDERS MAY 19, 2004GENERALVOTING AND REVOCATION OF PROXIESPROPOSAL NO. 1—ELECTION OF DIRECTORSPROPOSAL NO. 2—RATIFICATION OF THE SELECTION OF INDEPENDENT ACCOUNTANTSINDEPENDENT ACCOUNTANT FEESSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEEXECUTIVE OFFICERS OF THE COMPANYEXECUTIVE COMPENSATIONDIRECTOR COMPENSATIONEMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTSREPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATIONAUDIT COMMITTEEPERFORMANCE GRAPH FOR ALDILA, INC. COMMON STOCKANNUAL REPORTPROXY SOLICITATIONPROPOSALS OF STOCKHOLDERSAVAILABLE INFORMATIONOTHER MATTERS