QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

ALDILA, INC. |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | |

| | | |

| | | April 18, 2005 |

To Our Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the Annual Meeting of Stockholders of Aldila, Inc., to be held Wednesday, May 18, 2005, at 10:30 a.m. (Pacific daylight time) at the Company's executive offices and production facility, 13450 Stowe Drive, Poway, California 92064. The formal notice and proxy statement for the Annual Meeting are attached to this letter.

It is important that you vote your shares as soon as possible, either by the phone, by using the Internet, or by mail as explained on the enclosed proxy card, even if you currently plan to attend the Annual Meeting. By doing so, you will ensure that your shares are represented and voted at the meeting. If you decide to attend, you can still vote your shares in person, if you wish.

On behalf of the Board of Directors, I thank you for your cooperation and I look forward to seeing you on May 18.

| | | |

| | | Very truly yours, |

| | | |

| | | /s/ PETER R. MATHEWSON

Peter R. Mathewson

Chairman of the Board |

ALDILA, INC.

13450 STOWE DRIVE

POWAY, CALIFORNIA 92064

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 18, 2005

TO THE STOCKHOLDERS OF ALDILA, INC.

Notice is hereby given that the Annual Meeting of Stockholders of Aldila, Inc. (the "Company") will be held at the Company's executive offices and production facility, 13450 Stowe Drive, Poway, California 92064, on Wednesday, May 18, 2005, at 10:30 a.m., (Pacific daylight time), for the following purposes:

1. ELECTION OF DIRECTORS. To elect by vote of the holders of Common Stock a total of five persons to the Board of Directors to serve until the next Annual Meeting of Stockholders and until their successors are elected and have qualified. The Board of Directors' nominees are:

| Thomas A. Brand | | | | Lloyd I. Miller, III |

Peter R. Mathewson |

|

|

|

Bryant R. Riley |

|

|

Andrew M. Leitch |

|

|

2. RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS. To ratify the Audit Committee's selection of Peterson & Co., LLP as the Company's independent accountants for the fiscal year ending December 31, 2005.

3. OTHER BUSINESS. To consider and act upon such other business as may properly come before the meeting.

Only stockholders of record at the close of business on April 1, 2005 will be entitled to notice of the Annual Meeting and to vote at the Annual Meeting and at any adjournments thereof.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | | |

| | | /s/ ROBERT J. CIERZAN

Robert J. Cierzan

Secretary |

Dated: April 18, 2005

Whether or not you currently plan to attend the annual meeting in person, please vote by telephone, or by using the Internet or by mail, as instructed on the enclosed proxy card, as promptly as possible. You may revoke your proxy (whether given by telephone, Internet or mail) if you decide to attend the annual meeting and wish to vote your shares in person.

TABLE OF CONTENTS

| GENERAL | | 1 |

| VOTING AND REVOCATION OF PROXIES | | 1 |

| | VOTING | | 1 |

| | REVOCATION | | 1 |

| PROPOSAL NO. 1—ELECTION OF DIRECTORS | | 2 |

| | NOMINEES FOR ELECTION BY HOLDERS OF COMMON STOCK | | 2 |

| | THE BOARD OF DIRECTORS AND COMMITTEES | | 3 |

| | ATTENDANCE AT BOARD AND COMMITTEE MEETINGS | | 3 |

| | CERTAIN COMMITTEES OF THE BOARD | | 3 |

| | INDEPENDENCE OF MAJORITY OF DIRECTORS | | 4 |

| | CODE OF ETHICS | | 4 |

| PROPOSAL NO. 2—RATIFICATION OF THE SELECTION OF INDEPENDENT ACCOUNTANTS | | 4 |

| INDEPENDENT ACCOUNTANT FEES | | 5 |

| | AUDIT FEES | | 5 |

| | AUDIT-RELATED FEES | | 5 |

| | TAX FEES | | 5 |

| | ALL OTHER FEES | | 5 |

| | PRE-APPROVAL POLICIES | | 5 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 6 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | 8 |

| EXECUTIVE OFFICERS OF THE COMPANY | | 9 |

| EXECUTIVE COMPENSATION | | 10 |

| | SUMMARY COMPENSATION TABLE | | 10 |

| | STOCK OPTION GRANTS | | 10 |

| | AGGREGATED OPTION EXERCISES | | 10 |

| DIRECTOR COMPENSATION | | 11 |

| EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTS | | 11 |

| REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION | | 13 |

| | COMMITTEE COMPOSITION | | 13 |

| | COMPENSATION OBJECTIVES AND POLICIES | | 13 |

| | BASE SALARY | | 13 |

| | BONUS PLAN | | 13 |

| | STOCK OPTIONS | | 14 |

| | SECTION 162(m) ISSUES | | 14 |

| | COMPENSATION OF THE CHIEF EXECUTIVE OFFICER | | 15 |

| AUDIT COMMITTEE | | 16 |

| | REPORT OF AUDIT COMMITTEE | | 16 |

| | AUDIT COMMITTEE CHARTER | | 17 |

| | INDEPENDENCE OF AUDIT COMMITTEE MEMBERS | | 17 |

| | AUDIT COMMITTEE FINANCIAL EXPERT | | 18 |

| PERFORMANCE GRAPH FOR ALDILA, INC. COMMON STOCK | | 19 |

| ANNUAL REPORT | | 20 |

| PROXY SOLICITATION | | 20 |

| PROPOSALS OF STOCKHOLDERS AND COMMUNICATIONS TO DIRECTORS | | 20 |

| AVAILABLE INFORMATION | | 20 |

| OTHER MATTERS | | 21 |

ALDILA, INC.

13450 STOWE DRIVE

POWAY, CALIFORNIA 92064

(858) 513-1801

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

MAY 18, 2005

GENERAL

This proxy statement is furnished to stockholders of Aldila, Inc., a Delaware corporation (the "Company"), in connection with the solicitation of proxies by the Board of Directors of the Company (the "Board" or "Board of Directors") for use at the Annual Meeting of Stockholders to be held at 10:30 a.m., (Pacific daylight time), on Wednesday, May 18, 2005, at the Company's executive offices and production facility, 13450 Stowe Drive, Poway, California 92064, and any adjournments thereof (the "Annual Meeting" or "Meeting").

Common stockholders of record as of the close of business on April 1, 2005, will be entitled to vote at the Meeting or any adjournments thereof. As of the record date, the Company had outstanding 5,188,560 shares of Common Stock, each entitled to one vote on all matters to be voted upon. This proxy statement, the accompanying form of proxy and the Company's annual report to stockholders for the fiscal year ended December 31, 2004 are being mailed on or about April 18, 2005 to each stockholder entitled to vote at the Meeting.

VOTING AND REVOCATION OF PROXIES

VOTING

If the enclosed proxy is voted by telephone, using the Internet or executed and returned by mail in time and not revoked, all shares represented thereby will be voted. Each proxy will be voted in accordance with the stockholder's instructions. If no such instructions are specified, the proxies will be voted FOR the election of each person nominated for election as a director and FOR the ratification of the Board's selection of Peterson & Co., LLP as the Company's independent accountants for the fiscal year ending December 31, 2005.

Assuming a quorum is present, the affirmative vote by the holders of a plurality of the votes cast at the Meeting will be required for the election of directors; the affirmative vote of a majority of the votes cast at the Meeting will be required for the ratification of the Board's selection of Peterson & Co., LLP as the Company's independent accountants; and the affirmative vote of a majority of the votes cast at the Meeting will be required to act on all other matters to come before the Annual Meeting. An automated system administered by the Company's transfer agent tabulates the votes. For purposes of determining the number of votes cast with respect to any voting matter, only those cast "for" or "against" are included. Abstentions and broker non-votes are counted only for purposes of determining whether a quorum is present at the Meeting. With respect to all matters (other than the election of directors), abstentions and broker non-votes will have the effect of reducing the number of affirmative votes required to achieve a majority of the votes cast.

REVOCATION

A stockholder giving a proxy may revoke it at any time before it is voted by delivery to the Company of a subsequently executed proxy or a written notice of revocation. In addition, returning

1

your completed proxy by mail, or by telephone, or by using the Internet will not prevent you from voting in person at the Annual Meeting should you be present and wish to do so.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The Company's Restated Bylaws give the Board the power to set the number of directors at no less than one nor more than twenty-one. The size of the Company's Board is currently set at five. Directors hold office until the next annual meeting of stockholders and until their successors are elected and have qualified.

Unless otherwise directed, proxies in the accompanying form will be voted FOR the nominees listed below. If any one or more of the nominees is unable to serve for any reason or withdraws from nomination, proxies will be voted for the substitute nominee or nominees, if any, proposed by the Board of Directors. The Board has no knowledge that any nominee will or may be unable to serve or will or may withdraw from nomination. All of the nominees are current directors of the Company whose terms end at the 2005 Annual Meeting. Information concerning the nominees for directors is set forth below.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE BOARD OF DIRECTORS' NOMINEES FOR DIRECTORS TO BE ELECTED BY THE HOLDERS OF COMMON STOCK.

NOMINEES FOR ELECTION BY HOLDERS OF COMMON STOCK

THOMAS A. BRAND has been a director of the Company since November 1997. Since January 1994, Mr. Brand has been a consultant to the composite materials industry. Since August 2000, he has been a director of Reinhold Industries, Inc., a manufacturer of advanced custom composite components and sheet molding compounds for a variety of applications in the United States and Europe. From 1983 to 1992, he was Senior Vice President/General Manager of Fiberite Advanced Materials, a business unit of ICI-PLC. From 1964 to 1983, Mr. Brand served as Vice President/General Manager, Fiberite West Coast Corp., which is a division of Fiberite Corporation. Age: 71.

PETER R. MATHEWSON has been a director of the Company since January 1997 and has been President, Chief Executive Officer and Chairman of the Board of the Company since January 2000. From 1990 until December 31, 1999, he served as Vice President of the Company (or its predecessors). Since January 1997, Mr. Mathewson has also served as President and Chief Operating Officer of Aldila Golf Corp., the Company's operating subsidiary that conducts its core golf operations. Mr. Mathewson has been with the Company (or its predecessors) since September 1973 and has held various positions, including: plant manager, production manager, shipping and receiving supervisor, and purchasing agent. Age: 54.

LLOYD I. MILLER, III has been a director of the Company since September 2001. Mr. Miller has been a registered investment advisor since 1990, and he is also a director of Stamps.com Inc., Synergy Brands, Inc., Dynabazaar, Inc., American Banknote Corp., and Celeritek, Inc. Age: 50.

BRYANT R. RILEY has been a director of the Company since May 2003. He is the founder and Chief Executive Officer of B. Riley & Co., Inc. since January 1997. B. Riley & Co. is an NASD member providing research and trading ideas primarily to institutional investors. Since 2001, he has also been the General Partner of Riley Investment Management. He is also a director and member of the Compensation Committee of Celeritek, Inc. Age: 38.

ANDREW M. LEITCH has been a director of the Company since May 2004. He is a certified public accountant, a chartered public accountant, and a private businessman. He currently serves on the Board of Directors of (i) Blackbaud, Inc., where he is also chairman of the Audit Committee, (ii) Citicorp Everbright China Fund Limited, and (iii) various private companies within the Kerry Packer Group. He served as a director of Vapotronics Inc. from June 2000 through October 2001, as its

2

acting Chief Financial Officer from July 2000 through October 2001 and as its acting Chief Executive Officer from June 2001 through October 2001. In March 2000 he retired after 22 years as a partner of Deloitte & Touche LLP. He worked primarily in Japan, Singapore and Hong Kong, where he led the successful opening of that firm's China practice. He has previously served on the Board of Directors of ING Fund—Hong Kong and NBL Communications Inc. Age: 61.

THE BOARD OF DIRECTORS AND COMMITTEES

The Board of Directors of the Company directs the management of the business and affairs of the Company, as provided by Delaware law, and conducts its business through meetings of the full Board of Directors and four standing committees: Executive, Audit, Compensation and Nominating. In addition, from time to time special committees may be established under the direction of the Board when necessary to address specific issues.

ATTENDANCE AT BOARD, COMMITTEE AND SHAREHOLDER MEETINGS

The Board of Directors of the Company held 6 meetings in calendar year 2004. Meetings of committees are discussed below. Each director attended 75% or more of the aggregate of (i) meetings of the Board held during the period for which he served as a director and (ii) meetings of all committees held during the period for which he served on those committees. The Company encourages all directors to attend the Annual Meeting of Shareholders. At the Annual Meeting of Shareholders held May 2004 all directors were in attendance, either in person or by telephone, except Mr. Brand who had a personal emergency which prevented his attendance.

CERTAIN COMMITTEES OF THE BOARD

TheEXECUTIVE COMMITTEE of the Board has the authority, between meetings of the Board of Directors, to exercise all powers and authority of the Board in the management of the business and affairs of the Company that may be lawfully delegated to it under Delaware law. The Committee is chaired by Peter R. Mathewson and its other members are Lloyd I. Miller, III, and Bryant R. Riley. It is anticipated that at the meeting of the Board of Directors immediately following the Annual Meeting of Stockholders, the existing members of the Executive Committee will be re-appointed. The Executive Committee held no meetings in calendar year 2004.

TheAUDIT COMMITTEE is currently composed of Andrew M. Leitch, as chairman and "financial expert," Bryant R. Riley, and Thomas A. Brand. The Audit Committee held 4 meetings in calendar year 2004. See "AUDIT COMMITTEE" below for a description of the responsibilities and activities of the Audit Committee, the independence of its membership, and the proposed composition of the Audit Committee following the 2005 Annual Meeting of Shareholders.

TheCOMPENSATION COMMITTEE is currently composed of Thomas A. Brand, who is the chairman, Bryant R. Riley and Lloyd I. Miller, III. Each member of the Company's Compensation Committee has been determined, in the opinion of the Board of Directors, to be independent in accordance with NASD rules and each is a "non-employee director" within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934 (the "Exchange Act"). The Compensation Committee is charged with the responsibility of supervising and administering the Company's compensation policies, management awards, reviewing salaries, approving significant changes in salaried employee benefits, and recommending to the Board such other forms of remuneration as it deems appropriate. The Compensation Committee also determines individuals to whom stock options will be granted under the Company's 1994 Stock Incentive Plan, the terms on which such options will be granted, and to administer the 1994 Stock Incentive Plan. The Compensation Committee also retains administrative responsibility over the Company's 1992 Stock Option Plan. The Company anticipates that at the meeting of the Board of Directors immediately following the 2005 Annual Meeting of Stockholders, the

3

existing members will be re-appointed to the Compensation Committee. The Compensation Committee held three meetings in calendar year 2004.

TheNOMINATING COMMITTEE was originally established by the Board of Directors in 2004. The Nominating Committee met on March 15, 2005 to prepare for the 2005 Annual Meeting of Shareholders. The Nominating Committee is currently comprised of Thomas A. Brand, who is chairman, Lloyd I. Miller, III and Bryant R. Riley. Each member of the Nominating Committee has been determined, in the opinion of the Board of Directors, to be independent in accordance with NASDAQ rules. The Nominating Committee has recommended to the Board of Directors, which has adopted its recommendation, that the nominees for Director named in this proxy be submitted to the stockholders for approval. The Nominating Committee will consider nominees recommended by stockholders. Any stockholder desiring to recommend such nominee may do so by contacting any member of the Nominating Committee. The Nominating Committee held one meeting in calendar year 2004.

INDEPENDENCE OF MAJORITY OF DIRECTORS

As part of the Sarbanes-Oxley Act of 2002 ("Sarbanes-Oxley") reforms, the NASD has adopted new rules regarding the independence of directors of NASDAQ listed companies. These rules become effective for the Company as of last year's Annual Meeting of Stockholders.

The Board of Directors has determined that Messrs. Brand, Miller, Riley, and Leitch constitute a majority of the Board of Directors, that each will be independent under the rules of the NASD, and none of them are believed to have any relationships that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director.

Mr. Mathewson is precluded from being considered independent by NASD rules since he currently serves as an executive officer of the Company.

CODE OF ETHICS

The Company adopted a Code of Business Conduct and Ethics on December 31, 2002 governing its officers, directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the Code of Business Conduct and Ethics is available at the Company's website (www.aldila.com).

PROPOSAL NO. 2—RATIFICATION OF THE SELECTION OF INDEPENDENT

ACCOUNTANTS

The Audit Committee has selected the accounting firm of Peterson & Co., LLP to audit the Company's financial statements for, and otherwise act as the Company's independent accountants with respect to, the fiscal year ending December 31, 2005. Peterson & Co., LLP has acted as independent accountants for the Company since May 20, 2003. The change to Peterson & Co., LLP was made upon the recommendation of the Audit Committee in order to reduce the Company's expenses. In accordance with the Audit Committee's resolution, its selection of Peterson & Co., LLP as the Company's independent accountants for the current fiscal year is being presented to stockholders for ratification at the Annual Meeting. The Company knows of no direct or material indirect financial interest of Peterson & Co., LLP in the Company or any connection of that firm with the Company in the capacity of promoter, underwriter, voting trustee, officer or employee.

Representatives of Peterson & Co., LLP will be present at the 2005 Annual Meeting of Stockholders, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF PETERSON & CO., LLP AS THE INDEPENDENT ACCOUNTANTS OF THE COMPANY.

4

INDEPENDENT ACCOUNTANT FEES

The Company paid the following fees to its principal accountant for the indicated services. Through May 20, 2003, the Company's principal accountant was Deloitte & Touche, LLP. From May 20, 2003, the Company's principal accountant was Peterson & Co., LLP. Our fiscal year is the calendar year.

AUDIT FEES

The Company was billed $10,250 for the first quarter of 2003 by Deloitte & Touche, LLP, $69,827 for the remainder of 2003 by Peterson & Co., LLP, and $100,081 for 2004 by Peterson & Co, LLP for professional services rendered by its principal accountant for the audit of the Company's annual financial statements, review of financial statements included in the Company's quarterly filings, and services normally provided by the accountant in connection with statutory and regulatory filings.

AUDIT-RELATED FEES

The Company was billed $0 for the first quarter of 2003 by Deloitte & Touche, LLP, $13,399 for the remainder of 2003 by Peterson & Co., LLP, and $8,400 for 2004 by Peterson & Co., LLP for professional services rendered by its principal accountant reasonably related to the performance of the audit or review of the Company's financial statements in addition to the Audit Fees reported above. Such professional services consisted of an audit of the employee benefit plan, an audit of a foreign statutory report, and accounting consultations.

TAX FEES

The Company was billed $35,952 for 2003, and $37,782 for 2004 by Peterson & Co., LLP for professional services rendered by its principal accountant for tax compliance, tax advice and tax planning. Such professional services consisted of tax planning and consultations and tax return preparation. The Company was not billed by Deloitte & Touche, LLP for any tax services in 2003.

ALL OTHER FEES

The Company was not billed for professional services rendered by Peterson & Co., LLP, its principal accountant, for any other services.

PRE-APPROVAL POLICIES

Sarbanes-Oxley and applicable SEC rules strengthened the rules regarding the independence of auditors of publicly traded companies. Consistent with these requirements, the Audit Committee will consider, on a case-by-case basis, and approve in advance, if appropriate, all audit and permissible non-audit services to be provided by the Company's principal accountants. None of the services provided in 2004 fell within the exemptions to the required Audit Committee pre-approval procedures.

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

On June 4, 2002, the Company effected a one-for-three reverse stock split (the "Reverse Stock Split") of the Company's Common Stock. All historical information in this Proxy Statement relating to the Company's Common Stock, share prices, options, and similar matters prior to June 4, 2002 has been restated to give effect to the Reverse Stock Split.

The following table sets forth certain information regarding the shares of Common Stock beneficially owned as of February 1, 2005 by (a) each person or entity who, insofar as the Company has been able to ascertain, beneficially owned more than 5% of the Company's Common Stock as of such date, (b) each of the directors of the Company, (c) the Company's Chief Executive Officer and the two other most highly compensated executive officers of the Company for the fiscal year ended December 31, 2004 (the "Named Executive Officers") and (d) all current directors and executive officers of the Company, as a group (seven persons). Except as otherwise indicated, the business address for each person is c/o Aldila, Inc., 13450 Stowe Drive, Poway, California 92064.

Common Stock Beneficially Owned

Name

| | Beneficial Ownership

| | Percent(1)

| |

|---|

| Certain Beneficial Owners | | | | | |

| The PNC Financial Services Group, Inc.(2) | | 418,902 | | 8.17 | % |

| Whitebox Advisors, LLC and related entities(3) | | 262,389 | | 5.12 | % |

Directors and Officers |

|

|

|

|

|

| Peter R. Mathewson(4) | | 84,040 | | 1.62 | % |

| Thomas A. Brand(5) | | 23,773 | | * | |

| Andrew M. Leitch(6) | | 0 | | * | |

| Lloyd I. Miller, III(7) | | 919,723 | | 17.90 | % |

| Bryant R. Riley(8) | | 612,887 | | 11.95 | % |

| Robert J. Cierzan(9) | | 54,714 | | 1.06 | % |

| Michael J. Rossi(10) | | 17,012 | | * | |

| | |

| |

| |

| Total All Directors and Officers | | 1,712,149 | | 32.46 | % |

Notes:

- *

- Percentage of shares beneficially owned does not exceed one percent of the outstanding shares of Common Stock as of February 1, 2005.

- (1)

- Based on a total of 5,127,310 outstanding Common Shares as of February 1, 2005, and any options or other rights to acquire shares vesting within 60 days of that date.

- (2)

- Based on a Schedule 13G, dated February 12, 2001, as amended by Amendment No. 1, dated February 12, 2002, Amendment No. 2, dated February 12, 2003, Amendment No. 3, dated February 10, 2004 and Amendment No. 4, dated February 10, 2005 (the "PNC 13G"), The PNC Financial Services Group, Inc., together with certain of its subsidiaries reported therein, collectively ("PNC Group"), the PNC Group has beneficial ownership of 418,902 shares of Common Stock of the Company, over all of which PNC Group has shared voting and dispositive power. Based on the PNC 13G, all of the shares are held in Trust Accounts created by an Amended and Restated Trust Agreement, dated September 20, 1983, in which Lloyd I. Miller, Jr. was Grantor and for which PNC Bank National Association ("PNC BNA") serves as Trustee. Lloyd I. Miller, III and PNC BNA have shared voting power pursuant to an Investment Advisory Agreement dated as of April 1, 1997. PNC Group's and PNC BNA's principal office is located at One PNC Plaza, 249 Fifth Avenue, Pittsburgh, PA 15222.

6

- (3)

- Based on a Schedule 13G, dated January 21, 2005 filed by Whitebox Advisors, LLC ("WA"), Whitebox Intermarket Advisors, LLC ("WIA"), Whitebox Intermarket Partners, L.P. ("WIP"), Whitebox Intermarket Fund, L.P.("WIFLP"), Whitebox Intermarket Fund, Ltd. ("WIFLTD"), AJR Financial, LLC ("AJR"), Pandora Select Advisors, LLC ("PSA"), Pandora Select Partners, L.P. ("PSP"), Pandora Select Fund, L.P. ("PSFLP"), and Pandora Select Fund, Ltd. ("PSFLTD") WIP beneficially owns 229,543 shares and PSP beneficially owns 32,846 shares of Common Stock of the Company. The Schedule 13G reports WA is the managing member and sole owner of WIA, with the power to direct the affairs of WIA. WIA manages accounts for the benefit of its clients WIP, WIFLP and WIFLTD. WIA has the power to direct the affairs of WIP, including decision making power with respect to the disposition of the proceeds from the sale of the Common Stock of the Company. AJR is the managing member and sole owner of PSA and has the power to direct the affairs of PSA. PSA manages accounts for the benefit of its clients PSP, PSFLP and PSFLTD. PSA has the power to direct the affairs of PSP including decision making power with respect to the disposition of the proceeds from the sale of the common stock. WA, AJR, WIA, PSA, WIP, PSP, WIFLP, PSFLP, WIFLTD and PSFLTD have shared voting and dispositive power with respect to 262,389 shares of Common Stock of the Company. WA, WIA, WIP, WIFLP, WIFLTD, AJR, PSA, PSP, PSFLP, and PSFLTD may be deemed to possess indirect beneficial ownership of 262,389 shares of Common Stock of the Company held by WIP and PSP. WA, AJR, WIA, WIFLP, WIFLTD, PSA, PSFLP, and PSFLTD each disclaim indirect beneficial ownership of such shares, except to the extent of their pecuniary interest in such shares. The principal business address of WA, WIA, WIFLP, AJR, PSA and PSFLP is 303 Excelsior Blvd, Ste. 300, Minneapolis, MN 55416. The principal business address of WIP, WIFLTD, PSP and PSFLTD is Trident Chambers, P.O. Box 146, Waterfront Drive, Wickhams Cay, Road Town, Tortola, British Virgin Islands.

- (4)

- Mr. Mathewson has shared voting and dispositive power over all Common Shares, which are held by Peter R. Mathewson and Penny E. Mathewson, Trustees of the Mathewson Family Trust dated 01/20/1998. Includes options to acquire 63,198 shares of Common Stock that will have vested within 60 days following February 1, 2005. Mr. Mathewson also has options to purchase 37,598 shares of Common Stock that will not have vested within 60 days following February 1, 2005.

- (5)

- Includes options to acquire 22,107 shares of Common Stock that will have vested within 60 days following February 1, 2005. Mr. Brand also has options to purchase 6,669 shares of Common Stock that will not have vested within 60 days following February 1, 2005.

- (6)

- Includes options to acquire 0 shares of Common Stock that will have vested within 60 days following February 1, 2005. Mr. Leitch also has options to purchase 8,772 shares of Common Stock that will not have vested within 60 days following February 1, 2005.

- (7)

- Includes options to acquire 9,883 shares of Common Stock that will have vested within 60 days following February 1, 2005. Mr. Miller also has options to purchase 5,557 shares of Common Stock that will not have vested within 60 days following February 1, 2005. Mr. Miller has sole voting and investment power over 457,476 shares of Common Stock. Mr. Miller has shared voting and investment power over 452,364 shares of Common Stock which includes the shares of Common Stock reported under footnote (2) above as well as shares held indirectly or directly, or over which he exercises control.

- (8)

- Includes options to acquire 2,924 shares of Common Stock, that will have vested within 60 days of February 1, 2005. Mr. Riley also has options to purchase 9,182 shares of Common Stock that will not have vested within 60 days following February 1, 2005. Mr. Riley directly or indirectly has sole voting and dispositive power over securities held by B. Riley & Co., Inc. and by Riley Management LLC, the investment advisor to and general partner of SACC Partners LP. Through these direct and indirect holdings he may be deemed to have sole voting and dispositive power over, and be a

7

beneficial owner of, 472,068 shares of Common Stock held by SACC Partners, LP and 137,895 shares of Common Stock held by B. Riley & Co., Inc.

- (9)

- Includes options to acquire 31,556 shares of Common Stock that will have vested within 60 days following February 1, 2005. Mr. Cierzan also has options to purchase 25,078 shares of Common Stock that will not have vested within 60 days of February 1, 2005. Mr. Cierzan shares voting and dispositive control over 23,158 shares of Common Stock with his wife, Lynn Cierzan, as a joint tenant.

- (10)

- Includes options to acquire 16,946 shares of Common Stock that will have vested within 60 days following February 1, 2005. Mr. Rossi also has options to purchase 21,106 shares of Common Stock that will not have vested within 60 days of February 1, 2005.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's directors and executive officers and holders of more than 10% of the Company's Common Stock to file with the Securities and Exchange Commission (the "SEC") reports of ownership and changes in ownership of Common Stock and other equity securities of the Company on Forms 3, 4 and 5.

Based on a review of such forms and written representations of reporting persons, the Company believes that during the calendar year ended December 31, 2004, its officers and directors and holders of more than 10% of the Company's Common Stock complied with all applicable Section 16(a) filing requirements, except Mr. Mathewson, Mr. Cierzan and Mr. Rossi each filed (i) a late Form 4 on February 6, 2004, reporting a grant of stock options made December 16, 2003; (ii) Mr. Mathewson, Mr. Cierzan and Mr. Rossi each filed a late Form 4 on September 30, 2004, reporting a grant of stock options made August 24, 2004; and (iii) Mr. Miller filed a Form 5 on February 15, 2005, reporting a grant of stock options granted on May 28, 2004.

8

EXECUTIVE OFFICERS OF THE COMPANY

Set forth below is certain information regarding each of the current executive officers of the Company. Information about Mr. Mathewson is presented in "ELECTION OF DIRECTORS—Nominees for Election by Holders of Common Stock." Officers are appointed by and serve at the discretion of the Board. Except as otherwise indicated, the positions listed are with Aldila, Inc.

Name

| | Age

| | Position

|

|---|

Peter R. Mathewson |

|

54 |

|

Chairman of the Board of Directors, Chief Executive Officer, President and Director; President and Chief Operating Officer of Aldila Golf Corp. |

Robert J. Cierzan |

|

58 |

|

Vice President, Finance, Secretary and Treasurer |

Michael J. Rossi |

|

51 |

|

Vice President, Sales and Marketing of Aldila Golf Corp. |

The principal occupations and positions for the past five years, and in certain cases prior years, of the executive officers of the Company who are not also nominees for election as a director, are as follows:

ROBERT J. CIERZAN has been Secretary and Treasurer of Aldila (or its predecessors) since January 1991 and Vice President, Finance since March 1989. From September 1988 to February 1989, Mr. Cierzan held the position of Executive Vice President-Finance at Illinois Coil Spring Company, a diversified manufacturer of springs, automotive push-pull controls and rubber products.

MICHAEL J. ROSSI has been the Vice President, Sales and Marketing of Aldila Golf Corp. since March 24, 1997 when he joined the Company. Prior to that, from August 1994 to March 1997, Mr. Rossi was the Vice President and General Manager of Fujikura Composite America, which manufactures graphite golf shafts and is a wholly owned subsidiary of Fujikura Rubber Limited, a Japanese publicly held company. From November 1989 to August 1994, he was Vice President, Sales and Marketing for True Temper Sports, a division of the Black & Decker Corporation, which manufactures steel golf shafts.

9

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The following table sets forth the compensation (cash and non-cash, plan and non-plan) paid to each of the Named Executive Officers for services rendered in all capacities to the Company during the three fiscal years ended December 31, 2004, 2003 and 2002.

| |

| | Annual Compensation(2)

| |

| |

|---|

| |

| | Long Term

Compensation

Securities Underlying

Options (#)

| |

|---|

Name(1)

| | Fiscal

Year

| | Base Salary($)

| | Bonus ($)

| |

|---|

| Peter R. Mathewson | | 2004

2003

2002 | | 262,500

262,500

262,000 | | 184,000

0

0 | | 13,500

25,000

22,295 |

(3) |

| Robert J. Cierzan | | 2004

2003

2002 | | 194,481

194,481

193,000 | | 136,000

0

0 | | 9,300

15,000

17,334 |

(3) |

| Michael J. Rossi | | 2004

2003

2002 | | 182,327

182,327

180,000 | | 128,000

0

0 | | 9,300

15,000

5,418 |

(3) |

- (1)

- Positions held are indicated inEXECUTIVE OFFICERS OF THE COMPANY above.

- (2)

- Excludes auto usage, imputed income on life insurance and employer's 401(k) match.

- (3)

- Includes stock options granted on December 31, 2002 pursuant to Company's tender offer to exchange certain previously outstanding stock options in connection with the re-pricing of certain stock options.

STOCK OPTION GRANTS

The following table sets forth information concerning the grant of stock options during the fiscal year ended December 31, 2004 to each of the Named Executive Officers.

All options were granted under the Company's 1994 Stock Incentive Plan, on August 24, 2004, and vest one-third on each of August 24, 2005, August 24, 2006 and August 24, 2007.

| |

| |

| |

| |

| | Potentially Realizable Value at Assumed Stock Price Appreciation for Option Term—10 yr.

|

|---|

| |

| | Percentage of

Total Options

Granted to

Employees in

Fiscal Year 2004

| |

| |

|

|---|

| | Options

Granted in

Fiscal Year

2004

| |

| |

|

|---|

Name

| | Exercise or

Base Price

(per share)

| | Expiration

Date

| | 5%

| | 10%

|

|---|

| Peter R. Mathewson | | 13,500 | | 13 | % | $ | 11.47 | | 8/24/2014 | | $ | 97,381 | | $ | 246,783 |

| Robert J. Cierzan | | 9,300 | | 9 | % | $ | 11.47 | | 8/24/2014 | | $ | 67,085 | | $ | 170,006 |

| Michael J. Rossi | | 9,300 | | 9 | % | $ | 11.47 | | 8/24/2014 | | $ | 67,085 | | $ | 170,006 |

AGGREGATED OPTION EXERCISES

The following table sets forth information (on an aggregated basis) concerning the exercise of stock options and the fiscal year-end value of unexercised options using the closing price of $15.25 per

10

share as of December 31, 2004. The Company has no outstanding stock appreciation rights, either freestanding or in tandem with options.

| |

| |

| | Number of Securities Underlying Unexercised Options(#)

| | Value of Unexercised In-The-Money Options($)

|

|---|

Name

| | Shares acquired on

exercise (#)

| | Value

Realized ($)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Peter R. Mathewson | | 22,500 | | 209,863 | | 61,198 | | 37,598 | | 727,563 | | 351,731 |

| Robert J. Cierzan | | 20,000 | | 214,552 | | 31,566 | | 25,078 | | 374,924 | | 233,566 |

| Michael J. Rossi | | 20,835 | | 142,533 | | 16,946 | | 21,106 | | 197,658 | | 197,388 |

DIRECTOR COMPENSATION

Directors, other than management directors (Peter R. Mathewson), currently receive for their service as directors $2,000 per quarter, $1,000 per Board meeting attended and $500 per committee meeting attended. Each director, including each management director and other directors not receiving directors' fees, is reimbursed for out-of-pocket expenses arising from attendance at meetings of the Board or committees thereof.

Pursuant to the Company's 1994 Stock Incentive Plan, in May 2004, each of the non-employee directors who had more than one year of service (Thomas A. Brand, Lloyd I. Miller, III, and Bryant R. Riley) received an annual stock option grant of 3,334 shares. Under the 1994 Stock Incentive Plan, Andrew M. Leitch received a stock option grant of 8,772 shares upon his election to as a non-employee director in May 2004. Each non-employee director with more than one year of service (currently, Messrs. Brand, Miller, Riley, and Leitch) will receive additional options under the 1994 Stock Incentive Plan to acquire 3,334 shares annually on the last trading day in the month of May 2005.

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND

CHANGE-IN-CONTROL ARRANGEMENTS

The Company entered into a Severance Protection Agreement (the "Severance Agreement") in November 2003, with each of the Named Executive Officers. All capitalized terms in the description below have the same meaning as in the Severance Agreement. Each Severance Agreement commences January 1, 2004, continues until December 31, 2004, and automatically renews for one year on each January 1 thereafter, unless either party gives ninety days advance notice of non-renewal or if the Severance Agreement is terminated, however in the event of a Change of Control the term of the Severance Agreement is twenty-four months from such event. Pursuant to the Severance Agreement, in the case of termination of employment within thirty-six months after a Change in Control as a result of death, by the Company for Cause or Disability, or by the Executive other than for Good Reason, the Executive is entitled to his Accrued Compensation. In the case of termination within thirty-six months of a Change of Control for any other reason, the Executive is entitled to the following: (i) Accrued Compensation and a Pro Rata Bonus for the year of termination (typically computed based on the average bonus paid for the prior two years), (ii) a lump sum payment equal to the sum of the Executive's then annual base salary and his average bonus for the prior two years, (iii) continued provision of insurance (including life, disability and medical) for two years, "grossed up" to cover any excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, and (iv) a lump sum equal to one years' automobile allowance (or the length of the automobile lease, if longer, in the case of automobiles leased by the Company for the Executive's use). These payments are in lieu of any other severance benefit to which the Executive would otherwise have been entitled. Upon a Change-in-Control, regardless of whether the Executive's employment has terminated, the Company is required to contribute to a grantor trust an amount sufficient to fund the payments under clauses (i), (ii), and (iv) above.

11

"Change-in-Control" means (1) an acquisition of 40% of the Company's Common Stock, (2) the failure of the individuals who, as of November 19, 2003 are members of the Board of Directors (the "Incumbent Board") to constitute at least two-thirds of the members of the Board, unless the election of any new director is approved by a vote of at least two-thirds of the Incumbent Board, subject to certain other qualifications, (3) the completion of a merger where the existing stockholders and Board of Directors do not retain control of the surviving company, or (4) the liquidation or sale of substantially all the assets of the Company.

Except as provided above and except for the provisions of the 1994 Stock Incentive Plan and related agreements thereto, there are no compensatory plans or arrangements with respect to any of the executive officers (including each of the Named Executive Officers) which are triggered by, or result from, the resignation, retirement or any other termination of such executive officer's employment, a change-in-control of the Company or a change in such executive officer's responsibilities following a change-in-control.

12

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee Report on Executive Compensation shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act and shall not otherwise be deemed filed under such Acts.

COMMITTEE COMPOSITION

The Compensation Committee of the Board of Directors in 2004 was comprised of Thomas A. Brand (chairman), Lloyd I. Miller, III and Bryant R. Riley.

COMPENSATION OBJECTIVES AND POLICIES

The principle objectives of the Company's executive compensation committee are to:

- •

- Support the achievement of desired Company performance,

- •

- Align the executive officers' interests with the success of the Company and with the interests of the Company's stockholders, and

- •

- Provide compensation that will attract and retain superior talent and reward performance.

These objectives are principally achieved through compensation in the form of annual base salaries, bonuses and equity investment opportunities. In line with these objectives, the Company's executive compensation system consists generally of base salary, bonuses based on corporate performance under the Company's Executive Bonus Plan (the "Bonus Plan"), and the grant of stock options under the 1994 Stock Incentive Plan.

BASE SALARY

Executive officers generally are considered for salary increases at the time of their respective employment anniversaries as approved by the Compensation Committee, taking into consideration the recommendations of the Company's Chairman and Chief Executive Officer. Due to the overall financial performance of the Company in 2002 and 2003, executive officer salaries were not increased during either 2003 or 2004. In deciding to provide no salary increases to the executive officers, the Compensation Committee took into account the overall performance of the Company in recent years in the face of increasing market pressures, including declining unit prices that have been negatively impacting the Company's gross margins, an overall drop in sales of golf equipment by many of the Company's customers, and the efforts taken by management to improve performance and control costs in light of these market factors. Based on the Company's improved financial performance in 2004, and other factors, including the increase in the Company's stock price during 2004, the Compensation Committee authorized a 3% increase in executive officer's salaries for fiscal year 2005.

BONUS PLAN

As a result of the poor market conditions in 2003, the Company did not establish bonus targets for 2003. In late 2003 the Compensation Committee established bonus targets for executive officers for 2004. Bonus awards for the 2004 year were paid in early 2005. The Compensation Committee established bonus targets for the 2005 year in March 2005. The Compensation Committee's recommendations have in each case been adopted by the full Board.

Awards under the Company's Bonus Plan depend on the actual financial performance of the Company in a given year, compared to the target financial performance objectives for that year. The target objectives are set annually and are based on the Company's operating plan. The bonuses awarded under the Bonus Plan depend upon the Company achieving a specified dollar amount of

13

pretax profits and increase to the extent pretax profits exceeded that minimum level and achieve certain specified, higher levels. The bonus for each participant is a percentage of the participant's base salary, with the percentage depending on the level of pretax profits the Company achieves. The maximum bonus for any employee in 2005 is 100% of that employee's 2005 base salary.

In establishing targets and proposed bonuses, the Committee has determined it is important the bonus structure reward executive officers for high levels of performance by the Company, weighted so superior performance (viewed against the performance expected in accordance with management's internal projections for performance approved by the Board of Directors) will result in substantially higher bonuses than will result from merely acceptable performance. While a substantial portion of the bonus is subject solely to the Company attaining its quantitative objectives, a portion of the total bonus award is subject to a discretionary modifier determined by the Chairman and Chief Executive Officer allowing him to reduce the bonus if the executive's individual performance so warrants.

The Compensation Committee believes that base 2004 executive compensation levels, even without any bonuses, adequately reflected (i) each executive's business results and performance in his area of responsibility, (ii) each executive's contribution to the overall management team and (iii) each executive's expected future contributions to the Company.

STOCK OPTIONS

The Board of Directors believes executive officers who are in a position to make a substantial contribution to the long-term success of the Company and to build stockholder value should have a significant stake in the Company's on-going success. To this end, the Company's compensation objectives are designed to be achieved through significant stock ownership in the Company by executive officers in addition to base salary and bonus payments.

The 1994 Stock Incentive Plan is intended to provide an additional incentive to employees maximize stockholder value and to facilitate broad and increasing stock ownership by executives and other key employees. In 2004, options to purchase an aggregate of 103,720 shares were granted to employees of the Company as a group (excluding non-employee directors). Of this total, options to purchase an aggregate of 32,100 shares (31% of all options granted in 2004) were granted to the Named Executive Officers. The Compensation Committee believes these stock option grants were appropriate in light of the policy of the Board of Directors that significant equity ownership by executive officers is an important contributor to aligning the interests of executive officers with those of the stockholders of the Company, and the number of options awarded to individual officers were set based on the Compensation Committee's perception, in part in light of recommendations by the Company's Chairman and Chief Executive Officer, as to each officer's ability to affect the Company's overall future performance. The Named Executive Officers collectively hold options to acquire 195,474 shares as of December 31, 2004. The Compensation Committee believes these options provide significant incentives for executives to increase the value of the Company for the benefit of all stockholders and offer executives significant opportunities to profit personally from their efforts to increase that value.

SECTION 162(m) ISSUES

The Compensation Committee has considered the impact of Section 162(m) of the Internal Revenue Code on its executive compensation decisions. Section 162(m) generally disallows a federal income tax deduction to any publicly-held corporation for compensation paid to the chief executive officer and each of the four other most highly compensated executive officers to the extent that such compensation in a taxable year exceeds $1 million. Section 162(m), however, permits a deduction for qualified "performance-based compensation," the material terms of which are disclosed to and approved by stockholders. The Company's Bonus Plan does not qualify as performance-based

14

compensation for the purposes of Section 162(m), although the 1994 Stock Incentive Plan does qualify. During 2004, the Compensation Committee believed it unlikely any executive officer of the Company would receive in excess of $1 million in compensation, other than performance-based compensation. The Compensation Committee believes it is unlikely any executive officer will receive in excess of that amount in 2005. As a result, the Compensation Committee has not taken any steps to qualify the bonus plan as performance-based compensation, although it anticipates the Company would do so before any executive receives salary, bonus and other non-performance based compensation in excess of $1 million.

COMPENSATION OF THE CHIEF EXECUTIVE OFFICER

Peter R. Mathewson's compensation during 2004 as Chairman of the Board and Chief Executive Officer was reviewed in connection with the Compensation Committee's overall review of executive officer compensation. Based on current economic conditions of the market and the Company, the Compensation Committee proposed and the Board adopted a 3% increase to Mr. Mathewson's base salary for 2005.

As described above, the Company had no bonus plan in 2003, so Mr. Mathewson did not receive any bonus in 2003. In 2004 the Company adopted a bonus plan, and in early 2005 paid Mr. Mathewson a bonus of $184,000 pursuant to the bonus plan. The Company has also adopted a bonus plan for 2005 (described under the subheading "BONUS PLAN" above) which will provide an incentive for Mr. Mathewson and other employees to exceed the Company's financial pretax profit performance goals established for 2005.

In late 2003, Mr. Mathewson was granted options to purchase 25,000 shares of Common Stock. On August 24, 2004, Mr. Mathewson was granted options to purchase 13,500 shares of Common Stock. Mr. Mathewson did not receive any other grant of stock options in 2004. The Compensation Committee believes this number of options was appropriate in light of the importance of Mr. Mathewson's position to the Company and his level of stock ownership.

The Compensation Committee believes Mr. Mathewson's 2005 base salary and his participation in the 2005 Bonus Plan, in conjunction with his stock ownership and employee stock options, will provide substantial incentives for him to create stockholder value.

| | | Respectfully submitted, |

| | | |

| | | Thomas A. Brand, Chairman

Bryant R. Riley

Lloyd I. Miller, III |

15

AUDIT COMMITTEE

Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act or the Exchange Act that might incorporate this Proxy Statement or future filings with the Securities and Exchange Commission, in whole or in part, the following information regarding the Audit Committee and its report shall not be deemed to be incorporated by reference into any such filing.

REPORT OF AUDIT COMMITTEE

The Audit Committee currently consists of Andrew M. Leitch (chairman and "financial expert"), Bryant R. Riley, and Thomas A. Brand. It held 4 meetings during fiscal 2004.

Under its charter, the Audit Committee's principal responsibilities are to:

- •

- Retain, set the compensation of, and monitor the independence of, the Company's independent accountants, currently Peterson & Co., LLP;

- •

- Oversee the performance of the Company's independent accountants and members of Company management involved with finance and accounting functions;

- •

- Monitor the integrity of the Company's financial reporting process and systems of internal controls regarding finance, accounting and legal compliance;

- •

- Oversee the Company's accounting policies and staff and review and approve related party transactions; and

- •

- Provide an avenue of communication among the independent accountants, Company management and the Board of Directors.

The Company's management remains directly responsible for the Company's disclosure controls, internal controls, and the financial reporting process. The Company's independent accountants are responsible for performing an independent audit of the Company's financial statements in accordance with generally accepted auditing standards and to issue a report on the Company's financial statements, as well as to review the Company's quarterly financial statements. The Audit Committee has the principal responsibility to monitor and oversee these processes, although the Board of Directors retains ultimate responsibility for the performance of the Company's independent accountants and management.

The Audit Committee is charged with meeting a minimum of four times each year, including a meeting following the preparation of quarterly and annual financial statements, to review these financial statements with management and the independent accountants.

Company management has represented to the Audit Committee that the Company's financial statements for the fiscal year 2004 were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed these financial statements with management and the Company's independent accountants. The Audit Committee also discussed with the Company's independent accountants matters required to be discussed by the Statement on Auditing Standards No. 61 (communications with audit committees).

The Company's independent accountants have provided to the Audit Committee the written disclosure required by Independence Standards Board Standard No. 1 (independence discussions with audit committees), and the Audit Committee discussed with the independent accountants the accounting firm's independence. The Audit Committee also considered whether non-audit services provided by the independent accountants during the last fiscal year were compatible with maintaining the independent accountants' independence.

16

The Audit Committee is assigned the responsibility to (1) supervise the internal accounting policies and procedures in order to assess the adequacy of internal accounting and financial reporting controls, (2) review with the independent accountant the Company's financial statements and audit process and (3) review all proposed transactions between the Company and its directors and officers, and any immediate family member or affiliate of any of its directors and officers, or any other affiliate of the Company that is not a subsidiary of the Company.

The Audit Committee is also responsible for recommending the independent accountants to be retained by the Company for each fiscal year and has recommended that Peterson & Co., LLP be nominated for approval by the stockholders for fiscal 2005.

Based upon the Audit Committee's discussion with management and the Company's independent accountants and the Audit Committee's review of the representations of management and the report of the independent accountants to the Audit Committee, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2004 filed with the Securities and Exchange Commission.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed under such Acts.

| | | Respectfully submitted, |

| | | |

| | | Andrew M. Leitch, Chairman

Bryant R. Riley

Thomas A. Brand |

AUDIT COMMITTEE CHARTER

The Audit Committee Charter was approved by the Board of Directors on December 31, 2002 and attached to the proxy statement for the Company's 2003 Annual Meeting of Stockholders. There have been no amendments or changes to that Audit Committee Charter.

INDEPENDENCE OF AUDIT COMMITTEE MEMBERS

As part of the Sarbanes-Oxley reforms, the SEC and NASD adopted new rules regarding the independence of directors who are members of the Audit Committee of a company trading on the NASDAQ, such as the Company. These rules become effective for the Company as of the 2004 Annual Meeting of Stockholders.

The rules in effect until the 2004 Annual Meeting of Stockholders generally required an Audit Committee of at least three directors, comprised solely of "independent directors," and each of whom was already, or would become within a reasonable time after appointment, able to read and understand financial statements.

Prior to the 2004 Annual Meeting of Stockholders the Audit Committee consisted of Mr. Riley, Mr. Miller, and Mr. Brand. The Board of Directors had determined that each was "independent" as that term was defined in the NASD Rules applicable at the time, and able to understand the Company's financial statements.

The rules that became effective at the 2004 Annual Meeting of Stockholders are stricter. The definition of "independent director" under the NASD Rules was tightened. In addition, the members of the Audit Committee must meet the requirements of new SEC Rule 10A-3, which includes a

17

requirement that the Audit Committee members are not "affiliates" of the Company, although there is a 10% stock ownership safe-harbor for determining whether a director is an "affiliate" for this purpose. Audit Committee members must not have participated in the preparation of the Company's financial statements during the previous three years, and they must be able to read and understand financial statements at the time they assume office. The minimum size of the Audit Committee remains at least three members.

Following the 2004 Annual Meeting of Stockholders, Mr. Leitch, Mr. Riley and Mr. Brand were elected to the Audit Committee. We anticipate that at the meeting of the Board of Directors immediately following the 2005 Annual Meeting of Stockholders, Mr. Leitch, Mr. Riley and Mr. Brand will be re-elected to the Audit Committee for 2005. The Board of Directors has determined that (a) each will be "independent" as that term is defined in the new NASD Rules and new SEC Rule 10A-3(b)(1), although Mr. Riley is not within the "safe-harbor" of SEC Rule 10A-3(e)(1)(ii) regarding independence as a result of his ownership of more then 10% of the outstanding common stock of the Company; (b) each has not participated in the preparation of the financial statements of the Company or any of its subsidiaries at any time during the past three years; and (c) each is able to read and understand fundamental financial statements, including the Company's balance sheet, income statement, and cash flow statement.

AUDIT COMMITTEE FINANCIAL EXPERT

Prior to the 2004 Annual Meeting of Stockholders, the Audit Committee was required to have at least one member that, through past employment experience in finance and accounting or other comparable experience, resulted in that person being "financially sophisticated." The Board of Directors has determined that Mr. Miller and Mr. Riley were both "financially sophisticated."

After the 2004 Annual Meeting of Stockholders, the new, stricter SEC and NASD rules apply. These rules require that at least one member of the Audit Committee must be an "audit committee financial expert" as that term is defined in the SEC Rules, and is "financially sophisticated" as that term is defined in the NASD Rules. The Board of Directors has determined that Mr. Leitch is an "audit committee financial expert" and is "financially sophisticated," as those terms are defined in the respective rules.

18

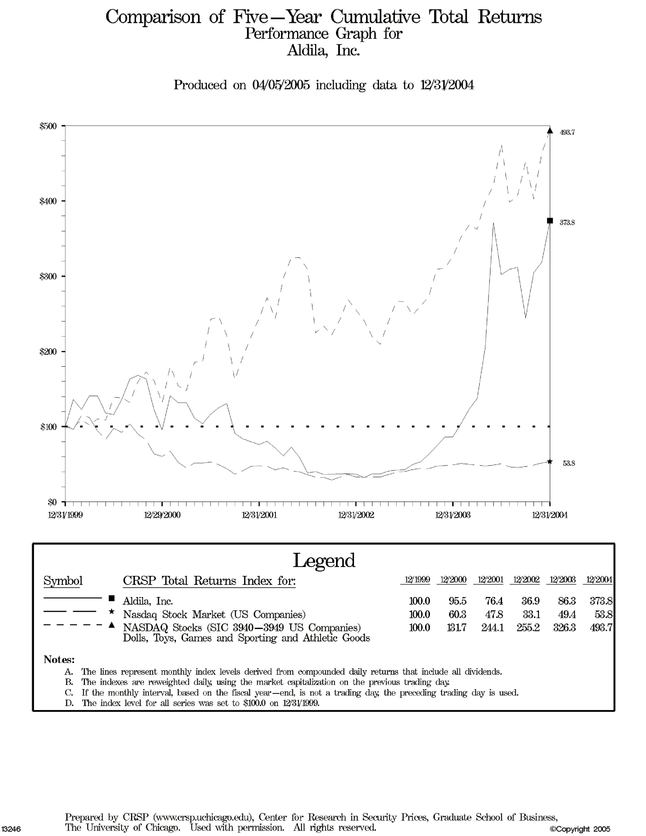

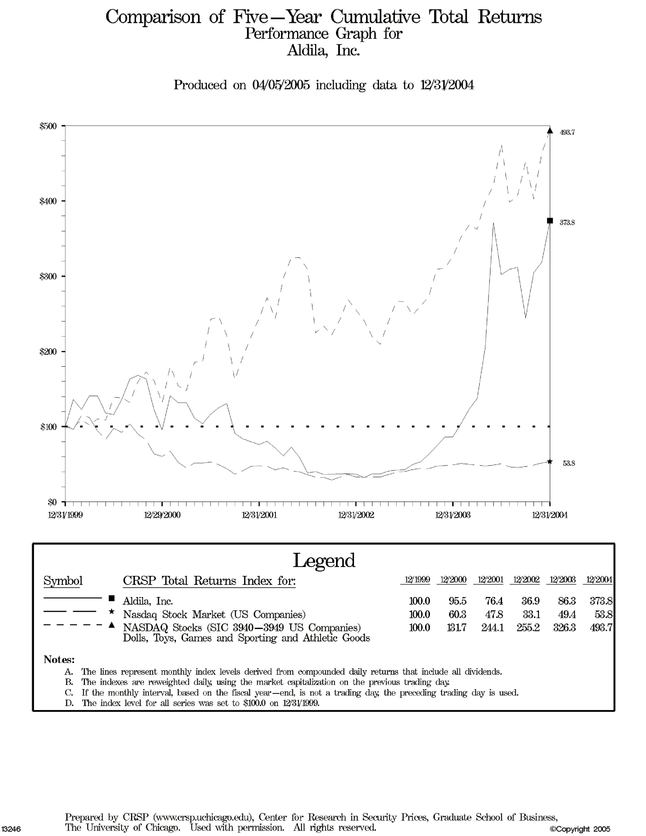

PERFORMANCE GRAPH FOR ALDILA, INC. COMMON STOCK

The performance graph for the Company's Common Stock compares the cumulative total return (assuming reinvestment of dividends) on the Company's Common Stock with (i) the Center for Research in Security Prices ("CRSP") Index for NASDAQ Stock Market (U.S. Companies) (the "Market Index") and (ii) the CRSP Index for NASDAQ Stocks (SIC 3940 - 3949)—Dolls, Toys, Games and Sporting and Athletic Goods (the "Peer Index"), assuming an investment of $100 on December 31, 1999 in each of the Company's Common Stock, the stock comprising the Market Index and the stock comprising the Peer Index.

19

ANNUAL REPORT

The Company's Annual Report for the fiscal year ended December 31, 2004 (the "2004 Annual Report") is included with the mailing of this Proxy Statement. The 2004 Annual Report contains consolidated financial statements of the Company and its subsidiaries and the report thereon of Peterson & Co., LLP, the Company's current independent accountants.

PROXY SOLICITATION

The Company will pay the expense of this proxy solicitation. We do not anticipate that the costs and expenses incurred in connection with this proxy solicitation will exceed those normally expended for a proxy solicitation for those matters to be voted on in the annual meeting. We will, upon request, reimburse brokers, banks and similar organizations for out-of-pocket and reasonable clerical expenses incurred in forwarding proxy material to their principals. In addition to the solicitation of proxies by use of the mails, solicitation also may be made by telephone, telegraph or personal interview by our directors, officers and regular employees, none of whom will receive additional compensation for any such solicitation.

PROPOSALS OF STOCKHOLDERS AND COMMUNICATIONS TO DIRECTORS

If a stockholder desires to have a proposal included in the proxy materials for the 2006 Annual Meeting of Stockholders, such proposal shall conform to the applicable proxy rules of the SEC concerning the submission and content of proposals and must be received by December 1, 2005 at the executive offices of the Company, 13450 Stowe Drive, Poway, California 92064, Attention: Secretary. The Company's receipt of notice of a stockholder's intent to submit a proposal outside of Rule 14a-8 at the 2005 Annual Meeting of Stockholders after March 4, 2006 will be considered untimely under Rule 14a-4(c)(1). Communications by stockholders to the board of directors or any single director may be sent c/o the Company, at the above address, Attn: Investor Relations Dept. All such communications are forwarded to the director(s).

AVAILABLE INFORMATION

The Company is subject to the informational requirements of the Exchange Act and in accordance therewith files reports, proxy statements and other information with the SEC. Reports, proxy statements and other information filed by the Company may be inspected and copied at the public reference facilities maintained by the SEC at Judiciary Plaza, 450 Fifth Street, N.W., Room 1024, Washington, D.C. 20549 and at the SEC's Regional Offices located at 233 Broadway, New York, New York 10279 and 175 W. Jackson Blvd., Suite 900, Chicago, Illinois 60604. Copies of such materials can be obtained by mail from the Public Reference Section of the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates or, at no charge, may be obtained at the SEC's web site: http://www.sec.gov. In addition, such material may also be inspected and copied at the offices of the National Association of Securities Dealers, Inc., 1735 K Street, N.W., Washington, D.C. 20006-1500.

20

OTHER MATTERS

The Board knows of no matters other than those listed in the attached Notice of Annual Meeting which are likely to be brought before the Meeting. However, if any other matter properly comes before the Meeting, the persons named on the enclosed proxy card will vote the proxy in accordance with their best judgment on such matter.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | | /s/ ROBERT J. CIERZAN

Robert J. Cierzan

Secretary

April 18, 2005 |

21

ALDILA, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned stockholder of ALDILA, INC. hereby appoints PETER R. MATHEWSON and ROBERT J. CIERZAN, or either of them, Proxies of the undersigned, each with full power to act without the other and with the power of substitution, to represent the undersigned at the Annual Meeting of Stockholders of Aldila, Inc., to be held at the Company's executive offices and production facility, 13450 Stowe Drive, Poway, California 92064 on Wednesday, May 18, 2005 at 10:30 a.m. (Pacific daylight time), and at any adjournments or postponements thereof, and to vote all shares of stock of the Company standing in the name of the undersigned with all the powers the undersigned would possess if personally present, in accordance with the instructions below and on the reverse hereof, and, in their discretion, upon such other business as may properly come before the meeting or any adjournments thereof.

THIS PROXY WILL BE VOTED ON THE REVERSE HEREOF, AND WILL BE VOTED IN FAVOR OF PROPOSALS 1 AND 2, IF NO INSTRUCTIONS ARE INDICATED.

IMPORTANT: SIGNATURE REQUIRED ON REVERSE SIDE.

(Continued and to be signed on the reverse side)

ANNUAL MEETING OF STOCKHOLDERS OF

ALDILA, INC.

May 18, 2005

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

\*/ Please detach along perforated line and mail in the envelope provided. \*/

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF DIRECTORS AND "FOR" PROPOSALS 2 AND 3.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ý

- 1.

- Election of Directors:

| | | | | NOMINEES: |

| o | | FOR ALL NOMINEES | | ( )

( ) | | Thomas A. Brand

Peter R. Mathewson |

| o | | WITHHOLD AUTHORITY

FOR ALL NOMINEES | | ( )

( ) | | Lloyd I. Miller, III

Bryant R. Riley |

| o | | FOR ALL EXCEPT

(See instructions below) | | ( ) | | Andrew M. Leitch |

INSTRUCTION: |

|

To withhold authority to vote for any individual nominee(s), mark "FOR ALL EXCEPT" and fill in the circle next to each nominee you wish to withhold, as shown here: |

|

• |

| | | | | FOR | | AGAINST | | ABSTAIN |

2. |

|

Ratification of the appointment of Peterson & Co., LLP as the independent accountants of the Company. |

|

o |

|

o |

|

o |

3. |

|

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof. |

|

o |

|

o |

|

o |

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders to be held May 18, 2005 and the Proxy Statement furnished herewith.

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | | o |

MARK "X" HERE IF YOU PLAN TO ATTEND THE MEETING. |

|

o |

Signature of Stockholder |

|

|

|

Date: |

|

|

|

Signature of Stockholder |

|

|

|

Date: |

|

|

| | |

| | | |

| | | |

| | | |

|

- Note:

- Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

ANNUAL MEETING OF STOCKHOLDERS OF

ALDILA, INC.

May 18, 2005

PROXY VOTING INSTRUCTIONS

MAIL — Date, sign and mail your proxy card in the envelope provided as soon as possible.

- OR -

TELEPHONE — Call toll-free1-800-PROXIES (1-800-776-9437) from any touch-tone telephone and follow the instructions. Have your proxy card available when you call.

- OR -

INTERNET — Access "www.voteproxy.com" and follow the on-screen instructions. Have your proxy card available when you access the web page.

COMPANY NUMBER

ACCOUNT NUMBER

You may enter your voting instructions at 1-800-PROXIES or www.voteproxy.com up until 11:59 PM Eastern Time the day before the cut-off or meeting date.

\*/ Please detach along perforated line and mail in the envelope provided IF you are not voting via telephone or the Internet. \*/

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF DIRECTORS AND "FOR" PROPOSALS 2 AND 3.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ý

- 1.

- Election of Directors:

| | | | | NOMINEES: |

| o | | FOR ALL NOMINEES | | ( )

( ) | | Thomas A. Brand

Peter R. Mathewson |

| o | | WITHHOLD AUTHORITY

FOR ALL NOMINEES | | ( )

( ) | | Lloyd I. Miller, III

Bryant R. Riley |

| o | | FOR ALL EXCEPT

(See instructions below) | | ( ) | | Andrew M. Leitch |

INSTRUCTION: |

|

To withhold authority to vote for any individual nominee(s), mark "FOR ALL EXCEPT" and fill in the circle next to each nominee you wish to withhold, as shown here: |

|

• |

| | | | | FOR | | AGAINST | | ABSTAIN |

2. |

|

Ratification of the appointment of Peterson & Co., LLP as the independent accountants of the Company. |

|

o |

|

o |

|

o |

3. |

|

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof. |

|

o |

|

o |

|

o |

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders to be held May 18, 2005 and the Proxy Statement furnished herewith.

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | | o |

MARK "X" HERE IF YOU PLAN TO ATTEND THE MEETING. |

|

o |

Signature of Stockholder |

|

|

|

Date: |

|

|

|

Signature of Stockholder |

|

|

|

Date: |

|

|

| | |

| | | |

| | | |

| | | |

|

- Note:

- Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 18, 2005TABLE OF CONTENTSPROXY STATEMENT ANNUAL MEETING OF STOCKHOLDERS MAY 18, 2005VOTING AND REVOCATION OF PROXIESPROPOSAL NO. 1—ELECTION OF DIRECTORSPROPOSAL NO. 2—RATIFICATION OF THE SELECTION OF INDEPENDENT ACCOUNTANTSINDEPENDENT ACCOUNTANT FEESSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTCommon Stock Beneficially OwnedSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEEXECUTIVE OFFICERS OF THE COMPANYEXECUTIVE COMPENSATIONDIRECTOR COMPENSATIONEMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTSREPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATIONAUDIT COMMITTEEPERFORMANCE GRAPH FOR ALDILA, INC. COMMON STOCKANNUAL REPORTPROXY SOLICITATIONPROPOSALS OF STOCKHOLDERS AND COMMUNICATIONS TO DIRECTORSAVAILABLE INFORMATIONOTHER MATTERS