UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-07692 |

Legg Mason Investors Trust, Inc.

|

| 100 Light Street, Baltimore, MD 21202 |

| Address of Principal Executive Offices: |

Richard M. Wachterman, Esq.

Legg Mason & Co., LLC

100 Light Street

Baltimore, MD 21202

|

| Name and address of agent for service: |

Registrant’s telephone number, including area code: (410) 539-0000

Date of fiscal year-end: March 31, 2009

Date of reporting period: September 30, 2008

| Item 1. | Report to Shareholders. |

Page 1 of 5

| | |

| Semi-Annual Report to Shareholders | | 1 |

To Our Shareholders

We are pleased to provide you with Legg Mason Investors Trust’s semi-annual report for American Leading Companies Trust and U.S. Small-Capitalization Value Trust, for the six months ended September 30, 2008.

| | | | | | |

| | | Total Returns | |

| | | 6 Months | | | 1 Year | |

American Leading Companies Trust: | | | | | | |

Primary Class | | –19.00 | % | | –36.38 | % |

Institutional Class | | –18.57 | % | | –35.72 | % |

S&P 500 Stock Composite IndexA | | –10.87 | % | | –21.98 | % |

| | |

U.S. Small-Cap Value Trust: | | | | | | |

Primary Class | | –4.54 | % | | –17.68 | % |

Institutional Class | | –4.07 | % | | –16.87 | % |

Russell 2000 IndexB | | –0.54 | % | | –14.48 | % |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information for the Primary Class please visit www.leggmason.com/individualinvestors. For the Institutional Class please visit www.lminstitutionalfunds.com. The investment return and principal value of the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

The market environment of the past six months has been among the most challenging seen by equity investors for generations. Concerns about our global financial system and the health of the global economy have negatively affected virtually all asset classes, including, of course, U.S. equities.

We understand the concerns created by market turmoil and declining prices. While no one can predict with certainty when the current crisis will end, we are heartened by the recent actions of the U.S. government to support and repair our financial system.

A | S&P 500 Stock Composite Index — A market capitalization-weighted index, composed of 500 widely held common stocks, that is generally considered representative of the U.S. stock market. |

B | Russell 2000® Index — An unmanaged index comprised of the 2,000 smallest companies of the 3,000 largest U.S. companies based on market capitalization. |

| | |

2 | | Semi-Annual Report to Shareholders |

We continue to believe in the resiliency of the U.S. economy. We believe that turmoil and downturn will eventually be followed by recovery and appreciation. And we believe in the long-term potential of our equity markets to provide rewards to patient investors. We remain committed to helping you, our shareholders, build wealth over the long term.

Information about each Fund’s performance over longer periods of time is shown in the respective Performance Information sections within this report. For more information about each Fund’s share classes included in this report, please contact your financial advisor.

Many Primary Class shareholders invest regularly in Fund shares on a dollar cost averaging basis. Most do so by authorizing automatic, monthly transfers of $50 or more from their bank checking or brokerage accounts. Dollar cost averaging is a convenient and sensible way to invest, as it encourages continued purchases over time regardless of fluctuating price levels. Of course, it does not ensure a profit nor protect against declines in the value of your investment. Your financial advisor will be happy to help you establish a dollar cost averaging account should you wish to do so.

On behalf of the Board and the entire team at Legg Mason, we appreciate your support.

| | | | |

| Sincerely, | | | | |

| | |

| | | |

|

| John F. Curley, Jr. | | | | Mark R. Fetting |

| Chairman | | | | President |

October 21, 2008

| | |

| Semi-Annual Report to Shareholders | | 3 |

Expense Example

American Leading Companies Trust

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees on Primary Class shares, and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested on April 1, 2008, and held through September 30, 2008. The ending value assumes dividends were reinvested at the time they were paid.

Actual Expenses

The first line for each class in the table below provides information about actual account values and actual expenses for each class. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account if your shares were held through the entire period.

Hypothetical Example for Comparison Purposes

The second line for each class in the table below provides information about hypothetical account values and hypothetical expenses based on the relevant class’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the class’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples for the relevant class that appear in the shareholder reports of other funds.

| | | | | | | | | |

| | | Beginning

Account

Value

4/1/08 | | Ending

Account

Value

9/30/08 | | Expenses PaidA

During the Period

4/1/08 to 9/30/08 |

Primary Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 810.00 | | $ | 8.44 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,015.74 | | | 9.40 |

Institutional Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 814.30 | | $ | 3.73 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.96 | | | 4.15 |

A | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratios of 1.86% and 0.82% for the Primary Class and Institutional Class respectively, multiplied by the average values over the period, multiplied by the number of days in the most recent fiscal half-year (183) and divided by 365. |

| | |

4 | | Semi-Annual Report to Shareholders |

Performance Information

American Leading Companies Trust

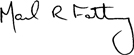

The graphs on the following pages compare the Fund’s total returns to those of a closely matched broad-based securities market index. The graphs illustrate the cumulative total return of an initial $10,000 investment in the Primary Class and an initial $1,000,000 investment in the Institutional Class, for the periods indicated. The lines for the Fund represent the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The lines representing the securities market index do not take into account any transaction costs associated with buying and selling portfolio securities in the index or other administrative expenses.

Total return measures investment performance in terms of appreciation or depreciation in a fund’s net asset value per share, plus dividends and any capital gain distributions. Both the Fund’s results and the index’s results assume reinvestment of all dividends and distributions at the time they were paid. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

| | |

| Semi-Annual Report to Shareholders | | 5 |

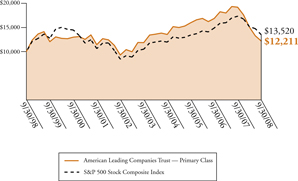

Growth of a $10,000 Investment — Primary Class

Periods Ended September 30, 2008

| | | | | | |

| | | Cumulative

Total Return | | | Average Annual

Total Return | |

One Year | | –36.38 | % | | –36.38 | % |

Five Years | | +2.93 | % | | +0.58 | % |

Ten Years | | +22.11 | % | | +2.02 | % |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.leggmason.com/individualinvestors. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

| 6 | | Semi-Annual Report to Shareholders |

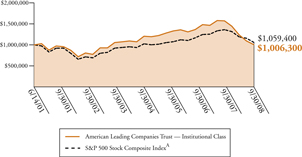

Performance Information — Continued

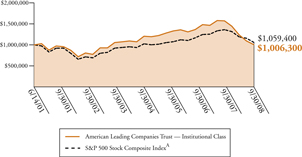

Growth of a $1,000,000 Investment — Institutional Class

Periods Ended September 30, 2008

| | | | | | |

| | | Cumulative

Total Return | | | Average Annual

Total Return | |

One Year | | –35.72 | % | | –35.72 | % |

Five Years | | +8.23 | % | | +1.59 | % |

Life of Class* | | +0.63 | % | | +0.09 | % |

| * | Inception date: June 14, 2001 |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.lminstitutionalfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

A | Index returns are for periods beginning May 31, 2001. |

| | |

| Semi-Annual Report to Shareholders | | 7 |

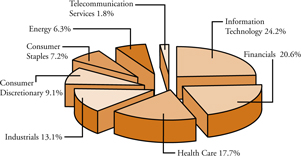

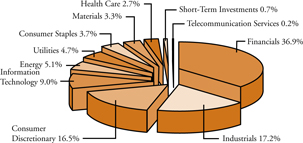

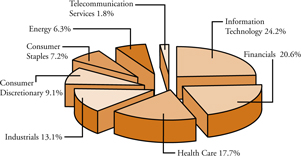

Portfolio Composition (as of September 30, 2008)B

(As a percentage of the portfolio)

Top 10 Holdings (as of September 30, 2008)

| | | |

Security | | % of

Net Assets | |

J.P. Morgan Chase and Co. | | 6.6 | % |

Bank of America Corp. | | 6.0 | % |

International Business Machines Corp. | | 4.0 | % |

Philip Morris International Inc. | | 4.0 | % |

Citigroup Inc. | | 3.9 | % |

Hewlett-Packard Co. | | 3.9 | % |

UnitedHealth Group Inc. | | 3.8 | % |

Health Net Inc. | | 3.8 | % |

General Electric Co. | | 3.7 | % |

Texas Instruments Inc. | | 3.2 | % |

B | The Fund is actively managed. As a result, the composition of its portfolio holdings and sectors is subject to change at any time. |

| | |

| 8 | | Semi-Annual Report to Shareholders |

Performance Information — Continued

American Leading Companies Trust

Selected Portfolio PerformanceC

| | | | | |

Strongest performers for the quarter ended September 30, 2008D | |

1. | | UAL Corp. | | +68.4 | % |

2. | | Bank of America Corp. | | +49.5 | % |

3. | | Pulte Homes Inc. | | +45.5 | % |

4. | | J.P. Morgan Chase and Co. | | +37.6 | % |

5. | | Capital One Financial Corp. | | +35.4 | % |

6. | | Sears Holding Corp. | | +26.9 | % |

7. | | Amgen Inc. | | +25.7 | % |

8. | | Lennar Corp. | | +24.6 | % |

9. | | Citigroup Inc. | | +24.5 | % |

10. | | Kraft Foods Inc. | | +16.1 | % |

| | | | | |

Weakest performers for the quarter ended September 30, 2008D | |

1. | | Jabil Circuit Inc. | | –41.6 | % |

2. | | Sprint Nextel Corp. | | –35.8 | % |

3. | | Anadarko Petroleum Corp. | | –35.1 | % |

4. | | Lloyds TSB Group PLC | | –32.8 | % |

5. | | Noble Corp. | | –32.4 | % |

6. | | Baker Hughes Inc. | | –30.6 | % |

7. | | Transocean Inc. | | –27.9 | % |

8. | | Apache Corp. | | –24.9 | % |

9. | | Devon Energy Corp. | | –24.0 | % |

10. | | Nokia Oyj – ADR | | –23.9 | % |

C | Individual security performance is measured by the change in the security’s price; for stocks, dividends are assumed to be reinvested at the time they were paid. |

D | Securities held for the entire quarter. |

| | |

| Semi-Annual Report to Shareholders | | 9 |

Portfolio Changes

| | |

Securities added during the quarter | | Securities sold during the quarter |

| None | | American International Group Inc. |

| | Applied Materials Inc. |

| | Centax Corp. |

| | Countrywide Financial Corp. |

| | Expedia Inc. |

| | Flextronics International Ltd. |

| | Freddie Mac |

| | General Motors Corp. |

| | Morgan Stanley |

| | The Travelers Cos. Inc. |

| | XL Capital Ltd. |

| | |

10 | | Semi-Annual Report to Shareholders |

Portfolio of Investments

American Leading Companies Trust

September 30, 2008 (Unaudited)

| | | | | | |

| | | Shares | | Value | |

Common Stocks and Equity Interests — 99.8% | | | | | | |

Consumer Discretionary — 9.1% | | | | | | |

Household Durables — 2.9% | | | | | | |

Lennar Corp. | | 317,500 | | $ | 4,822,825 | |

Pulte Homes Inc. | | 420,900 | | | 5,879,973 | |

| | | | | | |

| | | | | 10,702,798 | |

| | | | | | |

Media — 2.1% | | | | | | |

Time Warner Inc. | | 569,000 | | | 7,459,590 | |

| | | | | | |

Multiline Retail — 1.6% | | | | | | |

Sears Holdings Corp. | | 62,500 | | | 5,843,750 | A |

| | | | | | |

Specialty Retail — 2.5% | | | | | | |

The TJX Cos. Inc. | | 293,000 | | | 8,942,360 | |

| | | | | | |

Consumer Staples — 7.2% | | | | | | |

Food Products — 2.0% | | | | | | |

Kraft Foods Inc. | | 220,000 | | | 7,205,000 | |

| | | | | | |

Tobacco — 5.2% | | | | | | |

Altria Group Inc. | | 230,000 | | | 4,563,200 | |

Philip Morris International Inc. | | 299,000 | | | 14,381,900 | |

| | | | | | |

| | | | | 18,945,100 | |

| | | | | | |

Energy — 6.3% | | | | | | |

Energy Equipment and Services — 3.1% | | | | | | |

Baker Hughes Inc. | | 33,000 | | | 1,997,820 | |

Noble Corp. | | 88,000 | | | 3,863,200 | |

Transocean Inc. | | 48,000 | | | 5,272,320 | A |

| | | | | | |

| | | | | 11,133,340 | |

| | | | | | |

Oil, Gas and Consumable Fuels — 3.2% | | | | | | |

Anadarko Petroleum Corp. | | 47,000 | | | 2,279,970 | |

Apache Corp. | | 33,000 | | | 3,441,240 | |

| | |

| Semi-Annual Report to Shareholders | | 11 |

| | | | | | |

| | | Shares | | Value | |

Energy — Continued | | | | | | |

Oil, Gas and Consumable Fuels — Continued | | | | | | |

Devon Energy Corp. | | 46,000 | | $ | 4,195,200 | |

Exxon Mobil Corp. | | 23,000 | | | 1,786,180 | |

| | | | | | |

| | | | | 11,702,590 | |

| | | | | | |

Financials — 20.6% | | | | | | |

Capital Markets — 0.8% | | | | | | |

Merrill Lynch and Co. Inc. | | 115,000 | | | 2,909,500 | |

| | | | | | |

Commercial Banks — 2.5% | | | | | | |

Lloyds TSB Group PLC | | 1,810,000 | | | 7,534,478 | |

National City Corp. | | 900,000 | | | 1,575,000 | |

| | | | | | |

| | | | | 9,109,478 | |

| | | | | | |

Consumer Finance — 0.8% | | | | | | |

Capital One Financial Corp. | | 54,750 | | | 2,792,250 | |

| | | | | | |

Diversified Financial Services — 16.5% | | | | | | |

Bank of America Corp. | | 625,000 | | | 21,875,000 | |

Citigroup Inc. | | 697,500 | | | 14,305,725 | |

J.P. Morgan Chase and Co. | | 511,000 | | | 23,863,700 | |

| | | | | | |

| | | | | 60,044,425 | |

| | | | | | |

Health Care — 17.7% | | | | | | |

Biotechnology — 2.4% | | | | | | |

Amgen Inc. | | 146,000 | | | 8,653,420 | A |

| | | | | | |

Health Care Providers and Services — 10.5% | | | | | | |

Health Net Inc. | | 582,600 | | | 13,749,360 | A |

UnitedHealth Group Inc. | | 549,000 | | | 13,939,110 | |

WellPoint Inc. | | 226,600 | | | 10,598,082 | A |

| | | | | | |

| | | | | 38,286,552 | |

| | | | | | |

| | |

| 12 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

American Leading Companies Trust — Continued

| | | | | |

| | | Shares | | Value |

Health Care — Continued | | | | | |

Pharmaceuticals — 4.8% | | | | | |

Johnson and Johnson | | 163,500 | | $ | 11,327,280 |

Pfizer Inc. | | 320,000 | | | 5,900,800 |

| | | | | |

| | | | | 17,228,080 |

| | | | | |

Industrials — 13.0% | | | | | |

Aerospace and Defense — 5.3% | | | | | |

General Dynamics Corp. | | 119,000 | | | 8,760,780 |

Lockheed Martin Corp. | | 95,000 | | | 10,418,650 |

| | | | | |

| | | | | 19,179,430 |

| | | | | |

Airlines — 2.3% | | | | | |

UAL Corp. | | 940,000 | | | 8,262,600 |

| | | | | |

Industrial Conglomerates — 3.7% | | | | | |

General Electric Co. | | 530,500 | | | 13,527,750 |

| | | | | |

Machinery — 1.7% | | | | | |

Caterpillar Inc. | | 107,500 | | | 6,407,000 |

| | | | | |

Information Technology — 24.1% | | | | | |

Communications Equipment — 2.8% | | | | | |

Nokia Oyj — ADR | | 544,703 | | | 10,158,711 |

| | | | | |

Computers and Peripherals — 7.9% | | | | | |

Hewlett-Packard Co. | | 308,700 | | | 14,274,288 |

International Business Machines Corp. | | 125,000 | | | 14,620,000 |

| | | | | |

| | | | | 28,894,288 |

| | | | | |

Electronic Equipment, Instruments & Components — 2.0% | | | | | |

Jabil Circuit Inc. | | 760,000 | | | 7,250,400 |

| | | | | |

| | |

| Semi-Annual Report to Shareholders | | 13 |

| | | | | | |

| | | Shares | | Value | |

Information Technology — Continued | | | | | | |

Internet Software and Services — 3.4% | | | | | | |

eBay Inc. | | 342,000 | | $ | 7,653,960 | A |

Yahoo! Inc. | | 263,500 | | | 4,558,550 | A |

| | | | | | |

| | | | | 12,212,510 | |

| | | | | | |

IT Services — 2.3% | | | | | | |

Accenture Ltd. | | 219,000 | | | 8,322,000 | |

| | | | | | |

Semiconductors and Semiconductor Equipment — 3.2% | | | | | | |

Texas Instruments Inc. | | 544,200 | | | 11,700,300 | |

| | | | | | |

Software — 2.5% | | | | | | |

Microsoft Corp. | | 346,000 | | | 9,234,740 | |

| | | | | | |

Telecommunication Services — 1.8% | | | | | | |

Wireless Telecommunication Services — 1.8% | | | | | | |

Sprint Nextel Corp. | | 1,075,000 | | | 6,557,500 | |

| | | | | | |

Total Common Stocks and Equity Interests

(Cost — $305,002,574) | | | | | 362,665,462 | |

| | | | | | |

Total Investments — 99.8% (Cost — $305,002,574)B | | | | | 362,665,462 | |

Other Assets Less Liabilities — 0.2% | | | | | 748,170 | |

| | | | | | |

Net Assets — 100.0% | | | | $ | 363,413,632 | |

| | | | | | |

B | Aggregate cost for federal income tax purposes is substantially the same as book cost. At September 30, 2008, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were substantially as follows: |

| | | | |

Gross unrealized appreciation | | $ | 112,766,967 | |

| |

Gross unrealized depreciation | | | (55,104,079 | ) |

| | | | |

| |

Net unrealized appreciation | | $ | 57,662,888 | |

| | | | |

ADR — American Depository Receipt

See notes to financial statements.

| | |

14 | | Semi-Annual Report to Shareholders |

Statement of Assets and Liabilities

American Leading Companies Trust

September 30, 2008 (Unaudited)

| | | | | | | |

Assets: | | | | | | | |

Investment securities at market value

(Cost – $305,002,574) | | | | | $ | 362,665,462 | |

Receivable for securities sold | | | | | | 8,126,625 | |

Dividends receivable | | | | | | 891,668 | |

Receivable for fund shares sold | | | | | | 106,409 | |

Other assets | | | | | | 6,975 | |

| | | | | | | |

Total assets | | | | | | 371,797,139 | |

Liabilities: | | | | | | | |

Payable for fund shares repurchased | | $ | 7,125,254 | | | | |

Accrued distribution and service fees | | | 406,827 | | | | |

Cash overdraft | | | 394,107 | | | | |

Accrued management fee | | | 139,589 | | | | |

Accrued expenses | | | 317,730 | | | | |

| | | | | | | |

Total liabilities | | | | | | 8,383,507 | |

| | | | | | | |

Net Assets | | | | | $ | 363,413,632 | |

| | | | | | | |

Net assets consist of: | | | | | | | |

Accumulated paid-in-capital | | | | | $ | 319,254,723 | |

Undistributed net investment income | | | | | | 3,019,430 | |

Accumulated net realized loss on investments and foreign currency transactions | | | | | | (16,488,590 | ) |

Unrealized appreciation of investments | | | | | | 57,628,069 | |

| | | | | | | |

Net Assets | | | | | $ | 363,413,632 | |

| | | | | | | |

Net Asset Value Per Share: | | | | | | | |

Primary Class (21,742,294 shares outstanding) | | | | | $ | 15.77 | |

| | | | | | | |

Institutional Class (1,239,778 shares outstanding) | | | | | $ | 16.61 | |

| | | | | | | |

See notes to financial statements.

| | |

| Semi-Annual Report to Shareholders | | 15 |

Statement of Operations

American Leading Companies Trust

For the Six Months Ended September 30, 2008 (Unaudited)

| | | | | | | | |

Investment Income: | | | | | | | | |

Dividends | | $ | 6,253,751 | | | | | |

Interest | | | 8,423 | | | | | |

Less: Foreign taxes withheld | | | (74,679 | ) | | | | |

| | | | | | | | |

Total income | | | | | | $ | 6,187,495 | |

| | |

Expenses: | | | | | | | | |

Management fees | | | 1,772,332 | | | | | |

Distribution and service fees: | | | | | | | | |

Primary Class | | | 2,301,422 | | | | | |

Audit and legal fees | | | 23,650 | | | | | |

Custodian fees | | | 37,596 | | | | | |

Directors’ fees and expenses | | | 36,222 | | | | | |

Registration fees | | | 21,952 | | | | | |

Reports to shareholders | | | 97,100 | | | | | |

Transfer agent and shareholder servicing expense: | | | | | | | | |

Primary Class | | | 141,187 | | | | | |

Institutional Class | | | 7,452 | | | | | |

Other expenses | | | 20,300 | | | | | |

| | | | | | | | |

Net expenses | | | | | | | 4,459,213 | |

| | | | | | | | |

Net Investment Income | | | | | | | 1,728,282 | |

Net Realized and Unrealized Gain/(Loss) on Investments: | | | | | | | | |

Net realized loss on: | | | | | | | | |

Investments | | | (8,622,903 | ) | | | | |

Foreign currency transactions | | | (25,336 | ) | | | | |

| | | | | | | | |

| | | | | | | (8,648,239 | ) |

| | | | | | | | |

Change in unrealized depreciation of: | | | | | | | | |

Investments | | | (90,837,929 | ) | | | | |

Assets and liabilities denominated in foreign currency | | | (30,414 | ) | | | | |

| | | | | | | | |

| | | | | | | (90,868,343 | ) |

| | | | | | | | |

Net Realized and Unrealized Loss on Investments | | | | | | | (99,516,582 | ) |

| | | | | | | | |

Change in Net Assets Resulting From Operations | | | | | | $ | (97,788,300 | ) |

| | | | | | | | |

See notes to financial statements.

| | |

16 | | Semi-Annual Report to Shareholders |

Statement of Changes in Net Assets

American Leading Companies Trust

| | | | | | | | |

| | | For the Six Months Ended

September 30, 2008 | | | For the Year Ended

March 31, 2008 | |

| | | (Unaudited) | | | | |

Change in Net Assets: | | | | | | | | |

| | |

Net investment income | | $ | 1,728,282 | | | $ | 1,793,894 | |

| | |

Net realized gain/(loss) | | | (8,648,239 | ) | | | 38,783,820 | |

| | |

Change in unrealized depreciation | | | (90,868,343 | ) | | | (160,538,236 | ) |

| | | | | | | | |

Change in net assets resulting from operations | | | (97,788,300 | ) | | | (119,960,522 | ) |

Distributions to shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Institutional Class | | | (376,810 | ) | | | — | |

Net realized gain on investments: | | | | | | | | |

Primary Class | | | (1,224,154 | ) | | | (44,369,956 | ) |

Institutional Class | | | (159,648 | ) | | | (4,690,375 | ) |

Change in net assets from fund share transactions: | | | | | | | | |

Primary Class | | | (98,710,605 | ) | | | (82,074,308 | ) |

Institutional Class | | | (38,071,800 | ) | | | 13,294,031 | |

| | | | | | | | |

Change in net assets | | | (236,331,317 | ) | | | (237,801,130 | ) |

| | |

Net Assets: | | | | | | | | |

| | |

Beginning of period | | | 599,744,949 | | | | 837,546,079 | |

| | | | | | | | |

End of period | | $ | 363,413,632 | | | $ | 599,744,949 | |

| | | | | | | | |

Undistributed net investment income | | $ | 3,019,430 | | | $ | 1,667,958 | |

| | | | | | | | |

See notes to financial statements.

| | |

| Semi-Annual Report to Shareholders | | 17 |

Financial Highlights

American Leading Companies Trust

For a share of each class of capital stock outstanding:

Primary Class:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

September 30, | | | Years Ended March 31, | |

| | | 2008 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 19.52 | | | $ | 24.87 | | | $ | 24.59 | | | $ | 21.85 | | | $ | 19.85 | | | $ | 14.54 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss) | | | .05 | A | | | .03 | A | | | (.06 | )A | | | .01 | | | | — | B | | | .01 | |

Net realized and unrealized gain/(loss) | | | (3.75 | ) | | | (3.81 | ) | | | 1.64 | | | | 2.73 | | | | 2.01 | | | | 5.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (3.70 | ) | | | (3.78 | ) | | | 1.58 | | | | 2.74 | | | | 2.01 | | | | 5.31 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | (.01 | ) | | | — | | | | (.01 | ) | | | — | B |

Net realized gain on investments | | | (.05 | ) | | | (1.57 | ) | | | (1.29 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (.05 | ) | | | (1.57 | ) | | | (1.30 | ) | | | — | | | | (.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 15.77 | | | $ | 19.52 | | | $ | 24.87 | | | $ | 24.59 | | | $ | 21.85 | | | $ | 19.85 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | (19.00 | )%C | | | (16.24 | )% | | | 6.68 | % | | | 12.54 | % | | | 10.12 | % | | | 36.54 | % |

| | | | | | |

Ratios to Average Net Assets:D | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.86 | %E | | | 1.83 | % | | | 1.85 | % | | | 1.86 | % | | | 1.88 | % | | | 1.90 | % |

Expenses net of waivers, if any | | | 1.86 | %E | | | 1.83 | % | | | 1.85 | % | | | 1.86 | % | | | 1.88 | % | | | 1.90 | % |

Expenses net of all reductions | | | 1.86 | %E | | | 1.83 | % | | | 1.85 | % | | | 1.86 | % | | | 1.88 | % | | | 1.90 | % |

Net investment income (loss) | | | .59 | %E | | | .12 | % | | | (.23 | )% | | | .04 | % | | | (.01 | )% | | | .05 | % |

Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 12.2 | %C | | | 28.4 | % | | | 19.0 | % | | | 14.3 | % | | | 19.4 | % | | | 19.6 | % |

Net assets, end of period (in thousands) | | $ | 342,817 | | | $ | 531,186 | | | $ | 765,000 | | | $ | 757,630 | | | $ | 654,019 | | | $ | 585,295 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

A | Computed using average daily shares outstanding. |

B | Amount less than $.01 per share. |

D | Total expenses reflects operating expenses prior to any voluntary expense waivers and/or compensating balance credits. Expenses net of waivers reflects total expenses before compensating balance credits but net of any voluntary expense waivers. Expenses net of all reductions reflects expenses less any compensating balance credits and/or voluntary expense waivers. |

See notes to financial statements.

| | |

18 | | Semi-Annual Report to Shareholders |

Financial Highlights — Continued

Institutional Class:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

September 30, | | | Years Ended March 31, | |

| | | 2008 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 20.57 | | | $ | 25.86 | | | $ | 25.33 | | | $ | 22.34 | | | $ | 20.28 | | | $ | 14.83 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | .16 | A | | | .31 | A | | | .23 | A | | | .22 | | | | .21 | | | | .20 | |

Net realized and unrealized gain/(loss) | | | (3.96 | ) | | | (4.03 | ) | | | 1.67 | | | | 2.82 | | | | 2.06 | | | | 5.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (3.80 | ) | | | (3.72 | ) | | | 1.90 | | | | 3.04 | | | | 2.27 | | | | 5.62 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (.11 | ) | | | — | | | | (.08 | ) | | | (.05 | ) | | | (.21 | ) | | | (.17 | ) |

Net realized gain on investments | | | (.05 | ) | | | (1.57 | ) | | | (1.29 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (.16 | ) | | | (1.57 | ) | | | (1.37 | ) | | | (.05 | ) | | | (.21 | ) | | | (.17 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 16.61 | | | $ | 20.57 | | | $ | 25.86 | | | $ | 25.33 | | | $ | 22.34 | | | $ | 20.28 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | (18.57 | )%C | | | (15.37 | )% | | | 7.77 | % | | | 13.63 | % | | | 11.21 | % | | | 37.96 | % |

| | | | | | |

Ratios to Average Net Assets:D | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | .82 | %E | | | .79 | % | | | .82 | % | | | .84 | % | | | .90 | % | | | .85 | % |

Expenses net of waivers, if any | | | .82 | %E | | | .79 | % | | | .82 | % | | | .84 | % | | | .90 | % | | | .85 | % |

Expenses net of all reductions | | | .82 | %E | | | .79 | % | | | .82 | % | | | .84 | % | | | .90 | % | | | .85 | % |

Net investment income | | | 1.61 | %E | | | 1.22 | % | | | .90 | % | | | 1.09 | % | | | .99 | % | | | 1.14 | % |

Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 12.2 | %C | | | 28.4 | % | | | 19.0 | % | | | 14.3 | % | | | 19.4 | % | | | 19.6 | % |

Net assets, end of period (in thousands) | | $ | 20,597 | | | $ | 68,559 | | | $ | 72,546 | | | $ | 41,476 | | | $ | 21,386 | | | $ | 16,996 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

See notes to financial statements.

| | |

| Semi-Annual Report to Shareholders | | 19 |

Expense Example

U.S. Small-Capitalization Value Trust

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees on Primary Class shares, and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested on April 1, 2008, and held through September 30, 2008. The ending value assumes dividends were reinvested at the time they were paid.

Actual Expenses

The first line for each class in the table below provides information about actual account values and actual expenses for each class. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account if your shares were held through the entire period.

Hypothetical Example for Comparison Purposes

The second line for each class in the table below provides information about hypothetical account values and hypothetical expenses based on the relevant class’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the class’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples for the relevant class that appear in the shareholder reports of other funds.

| | | | | | | | | |

| | | Beginning

Account

Value

4/1/08 | | Ending

Account

Value

9/30/08 | | Expenses PaidA

During the

Period

4/1/08 to 9/30/08 |

Primary Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 954.60 | | $ | 9.80 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,015.04 | | | 10.10 |

Institutional Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 959.30 | | $ | 4.91 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.05 | | | 5.06 |

A | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratios of 2.00% and 1.00% for the Primary Class and Institutional Class respectively, multiplied by the average values over the period, multiplied by the number of days in the most recent fiscal half-year (183) and divided by 365. |

| | |

20 | | Semi-Annual Report to Shareholders |

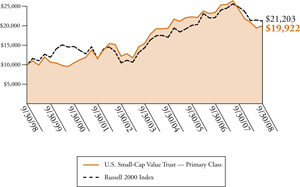

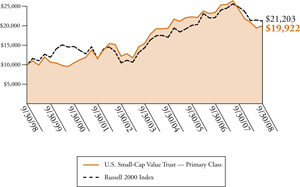

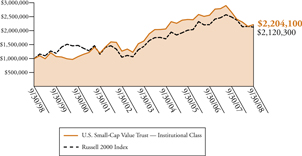

Performance Information

U.S. Small-Capitalization Value Trust

The graphs on the following pages compare the Fund’s total returns to those of a closely matched broad-based securities market index. The graphs illustrate the cumulative total return of an initial $10,000 investment in the Primary Class and an initial $1,000,000 investment in the Institutional Class, for the periods indicated. The lines for the Fund represent the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The lines representing the securities market index do not take into account any transaction costs associated with buying and selling portfolio securities in the index or other administrative expenses.

Total return measures investment performance in terms of appreciation or depreciation in a fund’s net asset value per share, plus dividends and any capital gain distributions. Both the Fund’s results and the index’s results assume reinvestment of all dividends and distributions at the time they were paid. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

| | |

| Semi-Annual Report to Shareholders | | 21 |

Growth of a $10,000 Investment — Primary Class

Periods Ended September 30, 2008

| | | | | | |

| | | Cumulative

Total Return | | | Average Annual

Total Return | |

One Year | | –17.68 | % | | –17.68 | % |

Five Years | | +28.80 | % | | +5.19 | % |

Ten Years | | +99.22 | % | | +7.14 | % |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.leggmason.com/individualinvestors. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

22 | | Semi-Annual Report to Shareholders |

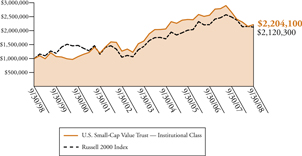

Performance Information — Continued

Growth of a $1,000,000 Investment — Institutional Class

Periods Ended September 30, 2008

| | | | | | |

| | | Cumulative

Total Return | | | Average Annual

Total Return | |

One Year | | –16.87 | % | | –16.87 | % |

Five Years | | +35.84 | % | | +6.32 | % |

Ten Years | | +120.41 | % | | +8.22 | % |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.lminstitutionalfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

| Semi-Annual Report to Shareholders | | 23 |

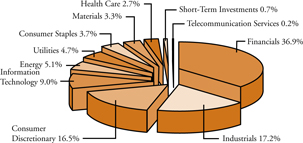

Portfolio Composition (as of September 30, 2008)A

(As a percentage of the portfolio)

Top 10 Holdings (as of September 30, 2008)

| | | |

Security | | % of

Net Assets | |

Rent-A-Center Inc. | | 1.7 | % |

Con-way Inc. | | 1.4 | % |

Del Monte Foods Co. | | 1.2 | % |

Delphi Financial Group Inc. | | 1.2 | % |

Ethan Allen Interiors Inc. | | 1.1 | % |

Lennox International Inc. | | 1.1 | % |

Stone Energy Corp. | | 1.1 | % |

WGL Holdings Inc. | | 1.1 | % |

International Bancshares Corp. | | 1.1 | % |

Trustmark Corp. | | 1.1 | % |

A | The Fund is actively managed. As a result, the composition of its portfolio holdings and sectors is subject to change at any time. |

| | |

24 | | Semi-Annual Report to Shareholders |

Performance Information — Continued

U.S. Small-Capitalization Value Trust B

Selected Portfolio Performance C

| | | | | |

Strongest performers for the quarter ended September 30, 2008D | |

1. | | TriCo Bancshares | | +98.0 | % |

2. | | Unifi Inc. | | +92.1 | % |

3. | | Univest Corporation of Pennsylvania | | +87.6 | % |

4. | | Ameris Bancorp | | +71.3 | % |

5. | | Guaranty Bancorp | | +69.4 | % |

6. | | Arrow Financial Corp. | | +63.8 | % |

7. | | Union Bankshares Corp. | | +62.4 | % |

8. | | BancorpSouth Inc. | | +62.2 | % |

9. | | Michael Baker Corp. | | +59.1 | % |

10. | | Frontier Financial Corp. | | +58.7 | % |

|

Weakest performers for the quarter ended September 30, 2008D | |

1. | | TBS International Ltd. | | –66.3 | % |

2. | | Conseco Inc. | | –64.5 | % |

3. | | Nanometrics Inc. | | –63.8 | % |

4. | | Integrated Silicon Solution Inc. | | –58.5 | % |

5. | | Plug Power Inc. | | –57.9 | % |

6. | | Trico Marine Services, Inc. | | –53.1 | % |

7. | | PC Mall, Inc. | | –49.6 | % |

8. | | National Dentex Corp. | | –49.3 | % |

9. | | Complete Production Services, Inc. | | –44.7 | % |

10. | | Bronco Drilling Co. Inc. | | –44.4 | % |

B | Portfolio changes are not reported for U.S. Small-Cap due to the Fund’s high volume of trading. |

C | Individual security performance is measured by the change in the security’s price; for stocks, dividends are assumed to be reinvested at the time they were paid. |

D | Securities held for the entire quarter. |

| | |

| Semi-Annual Report to Shareholders | | 25 |

Portfolio of Investments

U.S. Small-Capitalization Value Trust

September 30, 2008 (Unaudited)

| | | | | | |

| | | Shares/Par | | Value | |

Common Stocks and Equity Interests — 97.9% | | | | | | |

Consumer Discretionary — 16.3% | | | | | | |

Auto Components — 0.7% | | | | | | |

ATC Technology Corp. | | 4,675 | | $ | 110,985 | A |

Dorman Products Inc. | | 10,280 | | | 128,808 | A |

Modine Manufacturing Co. | | 13,360 | | | 193,453 | |

Standard Motor Products Inc. | | 5,100 | | | 31,722 | |

Superior Industries International Inc. | | 7,380 | | | 141,401 | |

TRW Automotive Holdings Corp. | | 2,280 | | | 36,275 | A |

| | | | | | |

| | | | | 642,644 | |

| | | | | | |

Distributors — 0.1% | | | | | | |

Audiovox Corp. | | 5,750 | | | 53,878 | A |

Core-Mark Holding Co. Inc. | | 2,870 | | | 71,721 | A |

| | | | | | |

| | | | | 125,599 | |

| | | | | | |

Diversified Consumer Services — 0.5% | | | | | | |

Pre-Paid Legal Services Inc. | | 11,100 | | | 457,986 | A |

| | | | | | |

Hotels, Restaurants and Leisure — 1.5% | | | | | | |

CBRL Group Inc. | | 24,910 | | | 655,133 | |

CEC Entertainment Inc. | | 2,040 | | | 67,728 | A |

Domino’s Pizza Inc. | | 6,490 | | | 78,789 | A |

Dover Downs Gaming and Entertainment Inc. | | 5,390 | | | 41,934 | |

Frisch’s Restaurants Inc. | | 5,300 | | | 120,310 | |

Interstate Hotels and Resorts Inc. | | 7,010 | | | 16,473 | A |

Landry’s Restaurants Inc. | | 1,820 | | | 28,301 | |

Lodgian Inc. | | 6,100 | | | 47,580 | A |

Red Lion Hotels Corp. | | 5,100 | | | 40,902 | A |

Speedway Motorsports Inc. | | 18,050 | | | 351,614 | |

Town Sports International Holdings Inc. | | 3,400 | | | 20,740 | A |

| | | | | | |

| | | | | 1,469,504 | |

| | | | | | |

Household Durables — 2.6% | | | | | | |

Bassett Furniture Industries Inc. | | 3,230 | | | 27,617 | |

Blyth Inc. | | 9,990 | | | 113,287 | |

CSS Industries Inc. | | 15,880 | | | 408,751 | |

| | |

| 26 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Consumer Discretionary — Continued | | | | | | |

Household Durables — Continued | | | | | | |

Ethan Allen Interiors Inc. | | 37,970 | | $ | 1,063,919 | |

Furniture Brands International Inc. | | 25,670 | | | 270,048 | |

Helen of Troy Ltd. | | 8,300 | | | 188,991 | A |

Hooker Furniture Corp. | | 12,280 | | | 217,970 | |

La-Z-Boy Inc. | | 14,330 | | | 133,556 | |

| | | | | | |

| | | | | 2,424,139 | |

| | | | | | |

Internet and Catalog Retail — N.M. | | | | | | |

NutriSystem Inc. | | 1,900 | | | 33,668 | |

| | | | | | |

Leisure Equipment and Products — 1.3% | | | | | | |

Arctic Cat Inc. | | 3,000 | | | 27,450 | |

Cybex International Inc. | | 4,500 | | | 13,545 | A |

JAKKS Pacific Inc. | | 31,140 | | | 775,698 | A |

Nautilus Inc. | | 8,100 | | | 37,017 | A |

Polaris Industries Inc. | | 7,760 | | | 353,002 | |

The Fairchild Corp. | | 5,200 | | | 13,520 | A |

| | | | | | |

| | | | | 1,220,232 | |

| | | | | | |

Media — 0.9% | | | | | | |

AH Belo Corp. | | 6,528 | | | 33,685 | |

Alloy Inc. | | 3,700 | | | 28,601 | A |

Belo Corp. | | 11,080 | | | 66,037 | |

Cox Radio Inc. | | 8,850 | | | 93,456 | A |

Lakes Entertainment Inc. | | 2,800 | | | 18,424 | A |

Saga Communications Inc. | | 13,800 | | | 78,660 | A |

Scholastic Corp. | | 10,190 | | | 261,679 | |

Valassis Communications Inc. | | 32,040 | | | 277,466 | A |

| | | | | | |

| | | | | 858,008 | |

| | | | | | |

Specialty Retail — 6.5% | | | | | | |

America’s Car-Mart Inc. | | 2,650 | | | 49,263 | A |

Asbury Automotive Group Inc. | | 43,320 | | | 499,046 | |

Cabela’s Inc. | | 12,300 | | | 148,584 | A |

Charlotte Russe Holding Inc. | | 8,480 | | | 86,920 | A |

| | |

| Semi-Annual Report to Shareholders | | 27 |

| | | | | | |

| | | Shares/Par | | Value | |

Consumer Discretionary — Continued | | | | | | |

Specialty Retail — Continued | | | | | | |

Charming Shoppes Inc. | | 26,276 | | $ | 128,490 | A |

Conn’s Inc. | | 24,590 | | | 460,079 | A |

Eddie Bauer Holdings Inc. | | 6,600 | | | 35,310 | A |

Group 1 Automotive Inc. | | 28,160 | | | 611,917 | |

Hastings Entertainment Inc. | | 17,230 | | | 99,762 | A |

Haverty Furniture Cos. Inc. | | 4,700 | | | 53,768 | |

Hot Topic Inc. | | 1,300 | | | 8,593 | A |

Jos. A Bank Clothiers Inc. | | 4,948 | | | 166,253 | A |

Mothers Work Inc. | | 1,600 | | | 22,208 | A |

Penske Automotive Group Inc. | | 56,830 | | | 651,840 | |

Rent-A-Center Inc. | | 71,620 | | | 1,595,694 | A |

REX Stores Corp. | | 15,595 | | | 180,122 | A |

Shoe Carnival Inc. | | 3,410 | | | 55,856 | A |

Sonic Automotive Inc. | | 4,940 | | | 41,792 | |

Stage Stores Inc. | | 18,385 | | | 251,139 | |

Stein Mart Inc. | | 9,700 | | | 37,927 | |

Systemax Inc. | | 10,100 | | | 142,006 | |

The Dress Barn Inc. | | 16,790 | | | 256,719 | A |

The Finish Line Inc. | | 4,350 | | | 43,456 | |

Zale Corp. | | 19,450 | | | 486,250 | A |

| | | | | | |

| | | | | 6,112,994 | |

| | | | | | |

Textiles, Apparel and Luxury Goods — 2.2% | | | | | | |

Brown Shoe Co. Inc. | | 15,430 | | | 252,743 | |

Columbia Sportswear Co. | | 9,140 | | | 383,514 | |

Culp Inc. | | 3,340 | | | 19,773 | A |

Jones Apparel Group Inc. | | 24,920 | | | 461,269 | |

K-Swiss Inc. | | 13,330 | | | 231,942 | |

Lakeland Industries Inc. | | 1,480 | | | 19,092 | A |

Maidenform Brands Inc. | | 16,540 | | | 239,995 | A |

Oxford Industries Inc. | | 4,300 | | | 111,069 | |

Perry Ellis International Inc. | | 4,150 | | | 61,877 | A |

R.G. Barry Corp. | | 3,000 | | | 20,460 | A |

| | |

| 28 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Consumer Discretionary — Continued | | | | | | |

Textiles, Apparel and Luxury Goods — Continued | | | | | | |

Skechers U.S.A. Inc. | | 11,460 | | $ | 192,872 | A |

Unifi Inc. | | 16,690 | | | 80,780 | A |

| | | | | | |

| | | | | 2,075,386 | |

| | | | | | |

Consumer Staples — 3.6% | | | | | | |

Food and Staples Retailing — 0.2% | | | | | | |

Ingles Markets Inc. | | 3,400 | | | 77,622 | |

The Andersons Inc. | | 4,710 | | | 165,886 | |

| | | | | | |

| | | | | 243,508 | |

| | | | | | |

Food Products — 2.1% | | | | | | |

Cal-Maine Foods Inc. | | 5,100 | | | 139,944 | |

Chiquita Brands International Inc. | | 12,100 | | | 191,301 | A |

Del Monte Foods Co. | | 141,180 | | | 1,101,204 | |

John B. Sanfilippo and Son Inc. | | 2,200 | | | 18,810 | A |

Monterey Gourmet Foods Inc. | | 3,740 | | | 7,293 | A |

Sanderson Farms Inc. | | 6,640 | | | 243,954 | |

TreeHouse Foods Inc. | | 8,710 | | | 258,687 | A |

| | | | | | |

| | | | | 1,961,193 | |

| | | | | | |

Personal Products — 0.8% | | | | | | |

CCA Industries Inc. | | 2,460 | | | 13,284 | |

Elizabeth Arden Inc. | | 2,740 | | | 53,786 | A |

NBTY Inc. | | 13,120 | | | 387,302 | A |

Nutraceutical International Corp. | | 9,390 | | | 103,760 | A |

Parlux Fragrances Inc. | | 5,720 | | | 29,401 | A |

Prestige Brands Holdings Inc. | | 13,100 | | | 116,328 | A |

Schiff Nutrition International Inc. | | 9,740 | | | 66,524 | A |

| | | | | | |

| | | | | 770,385 | |

| | | | | | |

Tobacco — 0.5% | | | | | | |

Universal Corp. | | 9,560 | | | 469,300 | |

| | | | | | |

| | |

| Semi-Annual Report to Shareholders | | 29 |

| | | | | | |

| | | Shares/Par | | Value | |

Energy — 5.0% | | | | | | |

Energy Equipment and Services — 3.3% | | | | | | |

Allis-Chalmers Energy Inc. | | 7,580 | | $ | 95,887 | A |

Basic Energy Services Inc. | | 3,300 | | | 70,290 | A |

Bristow Group Inc. | | 7,840 | | | 265,306 | A |

Bronco Drilling Co. Inc. | | 8,660 | | | 88,505 | A |

Cal Dive International Inc. | | 27,695 | | | 293,567 | A |

Complete Production Services Inc. | | 18,600 | | | 374,418 | A |

Grey Wolf Inc. | | 31,750 | | | 247,015 | A |

Gulf Island Fabrication Inc. | | 3,000 | | | 103,410 | |

Gulfmark Offshore Inc. | | 12,090 | | | 542,599 | A |

Hornbeck Offshore Services Inc. | | 8,300 | | | 320,546 | A |

Parker Drilling Co. | | 6,670 | | | 53,493 | A |

PHI Inc. | | 1,000 | | | 36,930 | A |

Pioneer Drilling Co. | | 8,400 | | | 111,720 | A |

SEACOR Holdings Inc. | | 5,470 | | | 431,857 | A |

Trico Marine Services Inc. | | 4,520 | | | 77,202 | A |

| | | | | | |

| | | | | 3,112,745 | |

| | | | | | |

Oil, Gas and Consumable Fuels — 1.7% | | | | | | |

Adams Resources and Energy Inc. | | 1,100 | | | 25,058 | |

GeoMet Inc. | | 8,400 | | | 45,696 | A |

Stone Energy Corp. | | 24,750 | | | 1,047,667 | A |

Swift Energy Co. | | 8,440 | | | 326,544 | A |

The Meridian Resource Corp. | | 24,700 | | | 45,448 | A |

World Fuel Services Corp. | | 6,300 | | | 145,089 | |

| | | | | | |

| | | | | 1,635,502 | |

| | | | | | |

Financials — 36.3% | | | | | | |

Capital Markets — 0.3% | | | | | | |

LaBranche Co. Inc. | | 17,300 | | | 77,850 | A |

Sanders Morris Harris Group Inc. | | 7,060 | | | 61,069 | |

TradeStation Group Inc. | | 12,180 | | | 113,883 | A |

| | | | | | |

| | | | | 252,802 | |

| | | | | | |

Commercial Banks — 15.1% | | | | | | |

1st Source Corp. | | 6,850 | | | 160,975 | |

| | |

| 30 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Financials — Continued | | | | | | |

Commercial Banks — Continued | | | | | | |

American National Bankshares Inc. | | 8,660 | | $ | 142,890 | |

Ameris Bancorp | | 3,840 | | | 57,024 | |

Arrow Financial Corp. | | 10,137 | | | 298,129 | |

BancorpSouth Inc. | | 17,400 | | | 489,462 | |

Cadence Financial Corp. | | 3,540 | | | 32,816 | |

Camden National Corp. | | 10,740 | | | 375,363 | |

Chemical Financial Corp. | | 17,561 | | | 546,850 | |

Community Trust Bancorp Inc. | | 12,569 | | | 432,374 | |

F.N.B. Corp. | | 46,490 | | | 742,910 | |

First Bancorp | | 6,468 | | | 110,603 | |

First Community Bancshares Inc. | | 10,470 | | | 392,834 | |

First M&F Corp. | | 9,766 | | | 111,625 | |

First Merchants Corp. | | 6,850 | | | 156,180 | |

First Midwest Bancorp Inc. | | 14,890 | | | 360,934 | |

First United Corp. | | 7,386 | | | 146,981 | |

Firstbank Corp. | | 1,091 | | | 11,128 | |

FirstMerit Corp. | | 700 | | | 14,700 | |

FNB Corp. | | 1,900 | | | 13,889 | |

Frontier Financial Corp. | | 3,570 | | | 47,945 | |

Fulton Financial Corp. | | 69,690 | | | 760,318 | |

German American Bancorp Inc. | | 9,020 | | | 105,083 | |

Guaranty Bancorp | | 14,740 | | | 89,914 | A |

IBERIABANK Corp. | | 3,075 | | | 162,514 | |

International Bancshares Corp. | | 37,586 | | | 1,014,822 | |

Lakeland Financial Corp. | | 10,110 | | | 222,016 | |

Macatawa Bank Corp. | | 6,145 | | | 42,954 | |

MainSource Financial Group Inc. | | 14,824 | | | 290,550 | |

MB Financial Inc. | | 4,900 | | | 162,043 | |

Merchants Bancshares Inc. | | 3,840 | | | 93,120 | |

Nara Bancorp Inc. | | 7,330 | | | 82,096 | |

National Penn Bancshares Inc. | | 20,743 | | | 302,848 | |

NBT Bancorp Inc. | | 1,200 | | | 35,904 | |

Northrim BanCorp Inc. | | 8,060 | | | 132,184 | |

Old Point Financial Corp. | | 1,801 | | | 36,025 | |

| | |

| Semi-Annual Report to Shareholders | | 31 |

| | | | | | |

| | | Shares/Par | | Value | |

Financials — Continued | | | | | | |

Commercial Banks — Continued | | | | | | |

PAB Bankshares Inc. | | 9,185 | | $ | 61,172 | |

Pacific Capital Bancorp | | 17,510 | | | 356,328 | |

Park National Corp. | | 3,230 | | | 251,940 | |

Penns Woods Bancorp Inc. | | 4,270 | | | 123,830 | |

Peoples Bancorp Inc. | | 10,568 | | | 230,065 | |

Prosperity Bancshares Inc. | | 8,840 | | | 300,472 | |

Renasant Corp. | | 8,322 | | | 180,671 | |

Republic First Bancorp Inc. | | 2,478 | | | 21,336 | A |

Sierra Bancorp | | 5,340 | | | 111,392 | |

Simmons First National Corp. | | 5,080 | | | 180,848 | |

Southwest Bancorp Inc. | | 9,560 | | | 168,925 | |

StellarOne Corp. | | 5,400 | | | 111,618 | |

Sun Bancorp Inc | | 5,176 | | | 70,135 | A |

Susquehanna Bancshares Inc. | | 21,840 | | | 426,317 | |

TriCo Bancshares | | 3,727 | | | 80,242 | |

Trustmark Corp. | | 48,120 | | | 998,009 | |

Union Bankshares Corp. | | 179 | | | 4,296 | |

United Bankshares Inc. | | 16,150 | | | 565,250 | |

Univest Corp. of Pennsylvania | | 3,410 | | | 126,170 | |

Washington Trust Bancorp Inc. | | 5,570 | | | 148,162 | |

WesBanco Inc. | | 13,170 | | | 350,585 | |

West Bancorporation | | 4,126 | | | 53,762 | |

Whitney Holding Corp. | | 33,670 | | | 816,497 | |

Wilshire Bancorp Inc. | | 7,100 | | | 86,407 | |

Wintrust Financial Corp. | | 5,390 | | | 158,197 | |

Yadkin Valley Financial Corp. | | 5,570 | | | 94,467 | |

| | | | | | |

| | | | | 14,255,096 | |

| | | | | | |

Consumer Finance — 1.3% | | | | | | |

AmeriCredit Corp. | | 40,170 | | | 406,922 | A |

Cash America International Inc. | | 5,800 | | | 209,032 | |

Credit Acceptance Corp. | | 10,560 | | | 179,520 | A |

Dollar Financial Corp. | | 6,760 | | | 104,036 | A |

| | |

| 32 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Financials — Continued | | | | | | |

Consumer Finance — Continued | | | | | | |

Nelnet Inc. | | 11,770 | | $ | 167,134 | |

World Acceptance Corp. | | 4,140 | | | 149,040 | A |

| | | | | | |

| | | | | 1,215,684 | |

| | | | | | |

Diversified Financial Services — 0.4% | | | | | | |

Asset Acceptance Capital Corp. | | 5,410 | | | 57,021 | A |

Encore Capital Group Inc. | | 5,500 | | | 75,350 | A |

Financial Federal Corp. | | 11,280 | | | 258,538 | |

Medallion Financial Corp. | | 4,820 | | | 50,465 | |

| | | | | | |

| | | | | 441,374 | |

| | | | | | |

Insurance — 15.6% | | | | | | |

American Equity Investment Life Holding Co. | | 49,380 | | | 370,350 | |

American Physicians Capital Inc. | | 2,690 | | | 113,868 | |

American Physicians Service Group Inc. | | 1,924 | | | 40,731 | |

Amerisafe Inc. | | 5,200 | | | 94,640 | A |

Amtrust Financial Services Inc. | | 16,200 | | | 220,158 | |

Argo Group International Holdings Ltd. | | 14,792 | | | 545,085 | A |

Baldwin and Lyons Inc. | | 3,430 | | | 82,217 | |

CNA Surety Corp. | | 40,170 | | | 670,839 | A |

Conseco Inc. | | 3,330 | | | 11,722 | A |

Delphi Financial Group Inc. | | 39,155 | | | 1,097,906 | |

Donegal Group Inc. — Class A | | 6,625 | | | 120,111 | |

Donegal Group Inc. — Class B | | 3,672 | | | 61,690 | |

Eastern Insurance Holdings Inc. | | 2,680 | | | 35,966 | |

EMC Insurance Group Inc. | | 5,452 | | | 160,725 | |

Employers Holdings Inc. | | 11,900 | | | 206,822 | |

FBL Financial Group Inc. | | 9,080 | | | 253,241 | |

First Mercury Financial Corp. | | 5,100 | | | 72,675 | A |

FPIC Insurance Group Inc. | | 2,410 | | | 123,850 | A |

Hallmark Financial Services Inc. | | 5,750 | | | 52,268 | A |

Harleysville Group Inc. | | 16,690 | | | 630,882 | |

Hilltop Holdings Inc. | | 13,600 | | | 140,352 | A |

Horace Mann Educators Corp. | | 40,170 | | | 516,988 | |

Infinity Property and Casualty Corp. | | 22,840 | | | 941,008 | |

| | |

| Semi-Annual Report to Shareholders | | 33 |

| | | | | | |

| | | Shares/Par | | Value | |

Financials — Continued | | | | | | |

Insurance — Continued | | | | | | |

IPC Holdings Ltd. | | 12,890 | | $ | 389,407 | |

Max Capital Group Ltd. | | 13,540 | | | 314,534 | |

Meadowbrook Insurance Group Inc. | | 43,060 | | | 304,004 | |

Mercer Insurance Group Inc. | | 1,730 | | | 27,784 | |

Montpelier Re Holdings Ltd. | | 23,420 | | | 386,664 | |

National Interstate Corp. | | 4,390 | | | 105,492 | |

National Western Life Insurance Co. | | 2,920 | | | 706,844 | |

Navigators Group Inc. | | 6,670 | | | 386,860 | A |

Nymagic Inc. | | 7,480 | | | 188,870 | |

OneBeacon Insurance Group Ltd. | | 6,500 | | | 137,475 | |

Platinum Underwriters Holdings Ltd. | | 9,780 | | | 346,994 | |

PMA Capital Corp. | | 8,810 | | | 77,704 | A |

Presidential Life Corp. | | 29,960 | | | 473,068 | |

ProAssurance Corp. | | 8,300 | | | 464,800 | A |

RLI Corp. | | 7,850 | | | 487,406 | |

Safety Insurance Group Inc. | | 20,305 | | | 770,169 | |

SeaBright Insurance Holdings | | 8,480 | | | 110,240 | A |

Selective Insurance Group Inc. | | 23,010 | | | 527,389 | |

Specialty Underwriters’ Alliance Inc. | | 5,850 | | | 28,841 | A |

State Auto Financial Corp. | | 14,430 | | | 419,480 | |

Stewart Information Services Corp. | | 4,200 | | | 124,950 | |

The Phoenix Cos. Inc. | | 46,210 | | | 426,980 | |

Tower Group Inc. | | 5,600 | | | 131,936 | |

Unico American Corp. | | 4,750 | | | 38,950 | A |

United America Indemnity Ltd. | | 5,660 | | | 80,542 | A |

United Fire and Casualty Co. | | 13,176 | | | 376,702 | |

Zenith National Insurance Corp. | | 10,380 | | | 380,323 | |

| | | | | | |

| | | | | 14,778,502 | |

| | | | | | |

Real Estate Management and Development — N.M. | | | | | | |

HouseValues Inc. | | 5,800 | | | 15,370 | A |

| | | | | | |

| | |

| 34 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Financials — Continued | | | | | | |

Thrifts and Mortgage Finance — 3.6% | | | | | | |

Abington Bancorp Inc. | | 6,770 | | $ | 68,512 | |

BankFinancial Corp. | | 5,300 | | | 77,804 | |

Berkshire Hills Bancorp Inc. | | 2,970 | | | 95,040 | |

First Defiance Financial Corp. | | 2,652 | | | 29,199 | |

First Financial Holdings Inc. | | 12,540 | | | 328,297 | |

First Niagara Financial Group Inc. | | 26,490 | | | 417,217 | |

First Place Financial Corp. | | 9,862 | | | 126,727 | |

Home Federal Bancorp Inc | | 4,830 | | | 61,583 | |

Legacy Bancorp Inc. | | 2,500 | | | 33,750 | |

NewAlliance Bancshares Inc. | | 29,320 | | | 440,680 | |

Parkvale Financial Corp. | | 7,850 | | | 123,637 | |

Provident Financial Services Inc. | | 14,400 | | | 237,744 | |

Timberland Bancorp Inc. | | 1,950 | | | 15,600 | |

United Financial Bancorp Inc. | | 4,900 | | | 72,765 | |

Washington Federal Inc. | | 33,137 | | | 611,378 | |

Webster Financial Corp. | | 13,280 | | | 335,320 | |

Westfield Financial Inc. | | 8,820 | | | 90,846 | |

WSFS Financial Corp. | | 3,650 | | | 219,000 | |

| | | | | | |

| | | | | 3,385,099 | |

| | | | | | |

Health Care — 2.7% | | | | | | |

Biotechnology — 0.2% | | | | | | |

Emergent Biosolutions Inc. | | 7,000 | | | 91,630 | A |

Repligen Corp. | | 8,150 | | | 38,386 | A |

Trimeris Inc. | | 8,200 | | | 32,144 | |

| | | | | | |

| | | | | 162,160 | |

| | | | | | |

Health Care Equipment and Supplies — 0.4% | | | | | | |

AngioDynamics Inc. | | 6,600 | | | 104,280 | A |

Cardiac Science Corp. | | 6,310 | | | 65,372 | A |

HealthTronics Inc. | | 8,210 | | | 23,973 | A |

Invacare Corp. | | 6,100 | | | 147,254 | |

| | |

| Semi-Annual Report to Shareholders | | 35 |

| | | | | | |

| | | Shares/Par | | Value | |

Health Care — Continued | | | | | | |

Health Care Equipment and Supplies — Continued | | | | | | |

National Dentex Corp. | | 1,842 | | $ | 11,236 | A |

Theragenics Corp. | | 9,380 | | | 29,266 | A |

| | | | | | |

| | | | | 381,381 | |

| | | | | | |

Health Care Providers and Services — 1.5% | | | | | | |

Advocat Inc. | | 2,460 | | | 12,251 | A |

AMERIGROUP Corp. | | 7,500 | | | 189,300 | A |

Cross Country Healthcare Inc. | | 3,200 | | | 52,128 | A |

Healthspring Inc. | | 16,400 | | | 347,024 | A |

LifePoint Hospitals Inc. | | 24,830 | | | 798,036 | A |

PDI Inc. | | 3,890 | | | 30,887 | A |

| | | | | | |

| | | | | 1,429,626 | |

| | | | | | |

Health Care Technology — N.M. | | | | | | |

AMICAS Inc. | | 7,700 | | | 18,480 | A |

| | | | | | |

Life Sciences Tools and Services — 0.1% | | | | | | |

Albany Molecular Research Inc. | | 6,320 | | | 114,329 | A |

| | | | | | |

Pharmaceuticals — 0.5% | | | | | | |

Caraco Pharmaceutical Laboratories Ltd. | | 6,500 | | | 81,315 | A |

Questcor Pharmaceuticals Inc. | | 5,400 | | | 39,690 | A |

ViroPharma Inc. | | 23,400 | | | 307,008 | A |

| | | | | | |

| | | | | 428,013 | |

| | | | | | |

Industrials — 17.0% | | | | | | |

Aerospace and Defense — 0.2% | | | | | | |

Ceradyne Inc. | | 1,300 | | | 47,658 | A |

Herley Industries Inc. | | 3,380 | | | 57,798 | A |

Kratos Defense and Security Solutions Inc. | | 11,100 | | | 21,867 | A |

SIFCO Industries Inc. | | 3,190 | | | 25,520 | A |

The Allied Defense Group Inc. | | 2,300 | | | 14,122 | A |

| | | | | | |

| | | | | 166,965 | |

| | | | | | |

| | |

| 36 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Industrials — Continued | | | | | | |

Air Freight and Logistics — 0.6% | | | | | | |

Atlas Air Worldwide Holdings Inc. | | 2,010 | | $ | 81,023 | A |

Pacer International Inc. | | 24,640 | | | 405,821 | |

Park-Ohio Holdings Corp. | | 2,970 | | | 53,133 | A |

| | | | | | |

| | | | | 539,977 | |

| | | | | | |

Airlines — 1.0% | | | | | | |

Alaska Air Group Inc. | | 10,110 | | | 206,143 | A |

Republic Airways Holdings Inc. | | 4,970 | | | 50,644 | A |

SkyWest Inc. | | 40,550 | | | 647,989 | |

| | | | | | |

| | | | | 904,776 | |

| | | | | | |

Building Products — 2.4% | | | | | | |

Apogee Enterprises Inc. | | 11,900 | | | 178,857 | |

Armstrong World Industries Inc. | | 10,400 | | | 300,560 | |

Insteel Industries Inc. | | 3,700 | | | 50,283 | |

Lennox International Inc. | | 31,650 | | | 1,052,995 | |

NCI Building Systems Inc. | | 5,350 | | | 169,863 | A |

Universal Forest Products Inc. | | 15,710 | | | 548,436 | |

| | | | | | |

| | | | | 2,300,994 | |

| | | | | | |

Commercial Services and Supplies — 2.0% | | | | | | |

American Reprographics Co. | | 12,000 | | | 207,000 | A |

Consolidated Graphics Inc. | | 2,800 | | | 84,924 | A |

Ennis Inc. | | 16,510 | | | 255,244 | |

G & K Services Inc. | | 3,711 | | | 122,648 | |

GeoEye Inc. | | 5,090 | | | 112,642 | A |

Herman Miller Inc. | | 15,710 | | | 384,424 | |

ICT Group Inc. | | 4,300 | | | 34,615 | A |

Industrial Services of America Inc. | | 1,200 | | | 12,300 | |

Kimball International Inc. | | 7,010 | | | 75,708 | |

Knoll Inc. | | 15,800 | | | 238,896 | |

Mobile Mini Inc. | | 900 | | | 17,397 | A |

North American Galvanizing and Coating Inc. | | 4,399 | | | 22,435 | A |

RSC Holdings Inc. | | 10,700 | | | 121,552 | A |

United Stationers Inc. | | 3,470 | | | 165,970 | A |

| | |

| Semi-Annual Report to Shareholders | | 37 |

| | | | | | |

| | | Shares/Par | | Value | |

Industrials — Continued | | | | | | |

Commercial Services and Supplies — Continued | | | | | | |

Virco Manufacturing | | 8,300 | | $ | 28,469 | |

WCA Waste Corp. | | 4,540 | | | 21,293 | A |

| | | | | | |

| | | | | 1,905,517 | |

| | | | | | |

Construction and Engineering — 0.4% | | | | | | |

Granite Construction Inc. | | 7,800 | | | 279,396 | |

Michael Baker Corp. | | 2,000 | | | 69,600 | A |

Perini Corp. | | 2,680 | | | 69,117 | A |

| | | | | | |

| | | | | 418,113 | |

| | | | | | |

Electrical Equipment — 2.0% | | | | | | |

A.O. Smith Corp. | | 14,800 | | | 580,012 | |

Acuity Brands Inc. | | 10,580 | | | 441,821 | |

Belden CDT Inc. | | 1,400 | | | 44,506 | |

Chase Corp. | | 2,200 | | | 27,500 | |

Plug Power Inc. | | 36,100 | | | 35,739 | A |

Regal-Beloit Corp. | | 16,880 | | | 717,738 | |

SL Industries Inc. | | 100 | | | 1,325 | A |

| | | | | | |

| | | | | 1,848,641 | |

| | | | | | |

Industrial Conglomerates — 0.2% | | | | | | |

Tredegar Corp. | | 8,800 | | | 156,552 | |

| | | | | | |

Machinery — 2.1% | | | | | | |

Alamo Group Inc. | | 2,670 | | | 45,524 | |

American Railcar Industries Inc. | | 5,280 | | | 84,691 | |

Ampco-Pittsburgh Corp. | | 4,290 | | | 111,111 | |

Astec Industries Inc. | | 5,100 | | | 157,233 | A |

Columbus McKinnon Corp. | | 5,220 | | | 123,035 | A |

Flow International Corp. | | 10,400 | | | 52,832 | A |

Greenbrier Cos. Inc. | | 4,600 | | | 89,746 | |

Hardinge Inc. | | 2,600 | | | 33,020 | |

Hurco Cos. Inc. | | 2,360 | | | 69,785 | A |

Lydall Inc. | | 6,360 | | | 61,247 | A |

Mueller Industries Inc. | | 23,920 | | | 550,399 | |

| | |

38 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Industrials — Continued | | | | | | |

Machinery — Continued | | | | | | |

NACCO Industries Inc. | | 1,600 | | $ | 151,232 | |

NN Inc. | | 4,915 | | | 63,158 | |

Tecumseh Products Co. | | 2,800 | | | 70,112 | A |

The L.S. Starrett Co. | | 1,570 | | | 28,935 | |

Twin Disc Inc. | | 300 | | | 4,128 | |

Wabash National Corp. | | 8,420 | | | 79,569 | |

Watts Water Technologies Inc. | | 7,500 | | | 205,125 | |

| | | | | | |

| | | | | 1,980,882 | |

| | | | | | |

Marine — 0.2% | | | | | | |

Genco Shipping and Trading Ltd. | | 1,000 | | | 33,240 | |

International Shipholding Corp. | | 5,020 | | | 109,938 | A |

TBS International Ltd. | | 2,920 | | | 39,303 | A |

| | | | | | |

| | | | | 182,481 | |

| | | | | | |

Professional Services — 1.7% | | | | | | |

Barrett Business Services Inc. | | 2,400 | | | 31,152 | |

COMSYS IT Partners Inc. | | 5,350 | | | 52,002 | A |

Heidrick and Struggles International Inc. | | 4,320 | | | 130,248 | |

Kelly Services Inc. | | 11,640 | | | 221,742 | |

Korn/Ferry International | | 12,400 | | | 220,968 | A |

MPS Group Inc. | | 24,210 | | | 244,037 | A |

School Specialty Inc. | | 5,360 | | | 167,178 | A |

TrueBlue Inc. | | 27,350 | | | 441,976 | A |

Volt Information Sciences Inc. | | 8,210 | | | 73,726 | A |

VSE Corp. | | 1,090 | | | 36,766 | |

| | | | | | |

| | | | | 1,619,795 | |

| | | | | | |

Road and Rail — 2.2% | | | | | | |

Arkansas Best Corp. | | 11,310 | | | 381,034 | |

Con-way Inc. | | 30,050 | | | 1,325,506 | |

Frozen Food Express Industries Inc. | | 4,620 | | | 24,994 | |

P.A.M. Transportation Services Inc. | | 6,580 | | | 72,051 | A |

Saia Inc. | | 10,330 | | | 137,182 | A |

| | |

| Semi-Annual Report to Shareholders | | 39 |

| | | | | | |

| | | Shares/Par | | Value | |

Industrials — Continued | | | | | | |

Road and Rail — Continued | | | | | | |

USA Truck Inc. | | 2,280 | | $ | 36,366 | A |

YRC Worldwide Inc. | | 12,280 | | | 146,869 | A |

| | | | | | |

| | | | | 2,124,002 | |

| | | | | | |

Trading Companies and Distributors — 2.0% | | | | | | |

Applied Industrial Technologies Inc. | | 11,820 | | | 318,313 | |

GATX Corp. | | 11,430 | | | 452,285 | |

H&E Equipment Services Inc. | | 300 | | | 2,898 | A |

Houston Wire & Cable Co. | | 2,000 | | | 34,340 | |

Interline Brands Inc. | | 3,650 | | | 59,167 | A |

Rush Enterprises Inc. | | 6,290 | | | 80,512 | A |

TAL International Group Inc. | | 5,020 | | | 104,516 | |

United Rentals Inc. | | 26,900 | | | 409,956 | A |

WESCO International Inc. | | 11,100 | | | 357,198 | A |

Willis Lease Finance Corp. | | 2,320 | | | 25,914 | A |

| | | | | | |

| | | | | 1,845,099 | |

| | | | | | |

Transportation Infrastructure — N.M. | | | | | | |

CAI International Inc. | | 3,800 | | | 42,028 | A |

| | | | | | |

Information Technology — 8.9% | | | | | | |

Communications Equipment — 0.8% | | | | | | |

Bel Fuse Inc. | | 2,500 | | | 71,175 | |

Black Box Corp. | | 4,800 | | | 165,744 | |

Communications Systems Inc. | | 2,400 | | | 25,536 | |

Endwave Corp. | | 2,300 | | | 11,546 | A |

Globecomm Systems Inc. | | 4,300 | | | 37,582 | A |

Oplink Communications Inc. | | 5,000 | | | 60,350 | A |

Performance Technologies Inc. | | 3,230 | | | 14,147 | A |

Sycamore Networks Inc. | | 79,360 | | | 256,333 | A |

Symmetricom Inc. | | 12,400 | | | 61,628 | A |

| | | | | | |

| | | | | 704,041 | |

| | | | | | |

| | |

40 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Information Technology — Continued | | | | | | |

Computers and Peripherals — 0.6% | | | | | | |

Adaptec Inc. | | 33,800 | | $ | 110,864 | A |

Hutchinson Technology Inc. | | 6,600 | | | 76,428 | A |

Imation Corp. | | 10,400 | | | 234,936 | |

Rackable Systems Inc. | | 6,760 | | | 66,316 | A |

Super Micro Computer Inc. | | 8,500 | | | 76,585 | A |

| | | | | | |

| | | | | 565,129 | |

| | | | | | |

Electronic Equipment, Instruments & Components — 3.7% | | | | | | |

Benchmark Electronics Inc. | | 49,290 | | | 694,003 | A |

Coherent Inc. | | 2,560 | | | 91,008 | A |

CPI International Inc. | | 3,480 | | | 50,391 | A |

CTS Corp. | | 9,390 | | | 120,004 | |

Data I/O Corp. | | 2,300 | | | 9,637 | A |

DDi Corp. | | 4,520 | | | 23,504 | A |

Electro Scientific Industries Inc. | | 7,710 | | | 109,636 | A |

Frequency Electronics Inc. | | 1,920 | | | 8,007 | |

Insight Enterprises Inc. | | 9,800 | | | 131,418 | A |

Methode Electronics Inc. | | 10,500 | | | 93,870 | |

Multi-Fineline Electronix Inc. | | 5,300 | | | 78,387 | A |

Newport Corp. | | 10,000 | | | 107,800 | A |

PC Mall Inc. | | 3,500 | | | 23,905 | A |

Plexus Corp. | | 4,100 | | | 84,870 | A |

RadiSys Corp. | | 5,720 | | | 49,192 | A |

Richardson Electronics Ltd. | | 3,900 | | | 24,180 | |

SYNNEX Corp. | | 34,480 | | | 770,283 | A |

Tech Data Corp. | | 14,760 | | | 440,586 | A |

TESSCO Technologies Inc. | | 800 | | | 10,240 | A |

TTM Technologies Inc. | | 9,200 | | | 91,264 | A |

Vishay Intertechnology Inc. | | 68,315 | | | 452,245 | A |

Zygo Corp. | | 4,500 | | | 56,610 | A |

| | | | | | |

| | | | | 3,521,040 | |

| | | | | | |

| | |

| Semi-Annual Report to Shareholders | | 41 |

| | | | | | |

| | | Shares/Par | | Value | |

Information Technology — Continued | | | | | | |

Internet Software and Services — 1.0% | | | | | | |

EasyLink Services International Corp. | | 6,500 | | $ | 21,385 | A |

ModusLink Global Solutions Inc. | | 13,500 | | | 129,735 | A |

RealNetworks Inc. | | 39,920 | | | 202,793 | A |

Spark Networks Inc. | | 6,300 | | | 24,570 | A |

United Online Inc. | | 61,580 | | | 579,468 | |

| | | | | | |

| | | | | 957,951 | |

| | | | | | |

IT Services — 0.6% | | | | | | |

Ciber Inc. | | 16,800 | | | 117,432 | A |

Computer Task Group Inc. | | 4,390 | | | 28,535 | A |

Convergys Corp. | | 3,800 | | | 56,164 | A |

CSG Systems International Inc. | | 9,600 | | | 168,288 | A |

Edgewater Technology Inc. | | 1,180 | | | 5,735 | A |

Ness Technologies Inc. | | 8,040 | | | 92,219 | A |

StarTek Inc. | | 4,080 | | | 26,194 | A |

TechTeam Global Inc. | | 2,900 | | | 21,518 | A |

Tier Technologies Inc. | | 5,380 | | | 39,973 | A |

| | | | | | |

| | | | | 556,058 | |

| | | | | | |

Semiconductors and Semiconductor Equipment — 2.1% | | | | | | |

Amkor Technology Inc. | | 48,300 | | | 307,671 | A |

Applied Micro Circuits Corp. | | 2,000 | | | 11,960 | A |

California Micro Devices Corp. | | 6,100 | | | 18,239 | A |

Cascade Microtech Inc. | | 3,600 | | | 15,228 | A |

Cymer Inc. | | 4,100 | | | 103,853 | A |

Entegris Inc. | | 27,600 | | | 133,584 | A |

Exar Corp. | | 9,800 | | | 75,068 | A |

Integrated Device Technology Inc. | | 36,700 | | | 285,526 | A |

Integrated Silicon Solution Inc. | | 5,680 | | | 13,121 | A |

Kulicke and Soffa Industries Inc. | | 16,960 | | | 76,490 | A |

MKS Instruments Inc. | | 38,360 | | | 763,747 | A |

Nanometrics Inc. | | 1,470 | | | 3,102 | A |

Rudolph Technologies Inc. | | 7,040 | | | 58,995 | A |

| | |

42 | | Semi-Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Information Technology — Continued | | | | | | |