UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07704

Schwab Capital Trust – Schwab Fundamental Global Real Estate Index Fund

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marie Chandoha

Schwab Capital Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: February 28

Date of reporting period: August 31, 2017

Item 1: Report(s) to Shareholders.

Semiannual Report | August 31, 2017

Schwab Fundamental Global Real Estate Index Fund

This page is intentionally left blank.

Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM).

Distributor: Charles Schwab & Co., Inc. (Schwab)

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS), which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Schwab.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabfunds.com/schwabfunds_prospectus.

| Total Returns for the 6 Months Ended August 31, 2017 |

| Schwab Fundamental Global Real Estate Index Fund (Ticker Symbol: SFREX) | 9.55% 1 |

| Russell RAFITM Global Select Real Estate Index (Net)2 | 9.02% |

| FTSE EPRA/NAREIT Global Index (Net)2 | 5.28% |

| Fund Category: Morningstar Global Real Estate3 | 6.07% |

| Performance Details | pages 8-9 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

Index ownership – Russell® is a trademark owned by Frank Russell Company (Russell). The Russell RAFI™ Index Series are calculated by Russell in conjunction with Research Affiliates® LLC (RA). Neither Russell nor RA sponsor, endorse or promote the Schwab Fundamental Global Real Estate Index Fund and are not in any way connected to it and do not accept any liability in relation to its issue, operation and trading. Any intellectual property rights in the index values and constituent list vests in Russell. “Research Affiliates®”, “Fundamental Index®” and “RAFI®” trade names are the exclusive property of RA. CSIM has obtained full license from Russell to use such intellectual property rights in the creation of this fund. For full disclaimer please see the fund’s statement of additional information. Effective December 1, 2016, the name of the index was changed by the index provider. No other changes to the index have occurred.

| 1 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 2 | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Marie Chandoha

President and CEO of

Charles Schwab Investment

Management, Inc. and the

fund covered in this report.

Dear Shareholder,

For more than 25 years, Charles Schwab Investment Management has been driven to give investors what they want and need—without confusion. One of our goals has been to reduce the complexity of investing. Our mutual funds and exchange-traded funds (ETFs) support this mission by reducing the complexity involved with building a diversified portfolio. The Schwab Fundamental Global Real Estate Index Fund has made investing more manageable by eliminating the need to select individual securities, saving shareholders time and money and leveling the playing field with large research-driven institutions.

We have taken important steps over the years to democratize the investing landscape even further on behalf of investors. For instance, this past May we eliminated the investment minimum requirement on the Schwab Fundamental Global Real Estate Index Fund, extending the fund’s benefits to every investor, regardless of how much they invest with us.

At Charles Schwab Investment Management, we also strive to take a straightforward approach in our communications. In this and in every shareholder report, we provide the fund’s financial statements and other information in a consistent format that we believe will help you to evaluate the performance of the fund. We aim to help you understand not only the fund’s return, but also how its investments are managed.

Asset Class Performance Comparison % returns during the 6 months ended August 31, 2017

These figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and you cannot invest in them directly. Remember that past performance is not a guarantee of future results.

For index definitions, please see the Glossary.

Data source: Index provider websites and CSIM.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

| * | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

From the President (continued)

“ The Schwab Fundamental Global Real Estate Index Fund has made investing more manageable by eliminating the need to select individual securities, saving shareholders time and money and leveling the playing field with large research-driven institutions.”

Our commitment to quality and transparency continues to win us both recognition and new business. During the second quarter, we were named one of Morningstar’s “9 Partners for the Next Decade,”1 based on our differentiation, low costs, repeatable investment processes, and adaptable business models. And as of July, investors have entrusted us with $20 billion of their assets held in our Fundamental Index mutual funds and ETFs.

We’re proud of these achievements, but more importantly, we’re honored to serve our investors. We’re committed to putting investors first by reducing cost and complexity—a commitment that will continue to inform how we operate and the decisions that we make.

Thank you for investing with Charles Schwab Investment Management. For more information about the Schwab Fundamental Global Real Estate Index Fund, please continue reading this report. In addition, you can find further details about this fund by visiting our website at www.schwabfunds.com. We are also happy to hear from you at 1-877-824-5615.

Sincerely,

| 1 | Morningstar, “9 Partners for the Next Decade.” Laura Pavlenko Lutton and Greggory Warren, CFA: April 27, 2017. Morningstar looked collectively across four traits (differentiation, low costs, repeatable investment processes, and adaptable business models) to identify firms that they believe are representative of these trends. |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

The Investment Environment

Over the six-month reporting period ended August 31, 2017, global real estate securities generated mixed returns. A generally strengthening global economy supported the overall real estate market, as did accommodative monetary policies and solid fundamentals such as stable office leasing activity and steady increases in rental values. In the U.S., however, Retail REITs continued to struggle, weighing on returns from the U.S. market. Despite global real estate’s overall positive performance, global real estate securities continued to lag slightly behind the broader equity market, as both U.S. and international stocks rallied after the U.S. presidential election amid expectations for tax reform, infrastructure spending, and financial deregulation. In this environment, the Dow Jones U.S. Select REIT Index returned -1.11% for the six-month reporting period, and the FTSE EPRA/NAREIT Global Index (Net), representing general trends in eligible real estate securities worldwide, returned 5.28%. The overall U.S. stock market, as measured by the S&P 500® Index, returned 5.65% over the same period. Outside the U.S., the MSCI EAFE® Index (Net), a broad measure of developed international equity performance, and the MSCI Emerging Markets Index (Net), returned 12.14% and 18.02%, respectively.

Monetary policy measures remained generally accommodative across the globe during the reporting period. Though the Federal Reserve (Fed) increased the federal funds rate by 0.25% at meetings in March and June, short-term rates in the U.S. remained low compared to historical averages. Outside the U.S., the Bank of Japan continued to utilize yield curve management as a policy tool and maintained negative interest rates throughout the reporting period. The Bank of England (BoE) left key interest rates at record lows, while the European Central Bank (ECB) announced in December that it would continue its bond purchase program until at least the end of 2017. Despite persistently low inflation across many international developed countries, the strengthening global economy prompted many central banks to reiterate that monetary policy normalization could occur sooner than some expect. In June, ECB president Mario Draghi hinted that investors should be prepared for balance sheet unwinding, and BoE governor Mark Carney in August cautioned that a rate increase may come as soon as within the next year. In emerging markets, central banks remained in different phases of monetary policy. For example, the People’s Bank of China began taking tightening steps in the first part of 2017 amid a generally stable Chinese economy, while the Central Bank of Brazil cut short-term interest rates three times over the reporting period.

Over the reporting period, the U.S. economy continued to chug along as it entered its ninth year of expansion. Stable economic growth, combined with relatively low short-term interest rates, generally supported the overall U.S. real estate market. The office market saw tenant demand solidify as new supply increased, while industrial rents maintained an upward trajectory and reached an all-time high in the second quarter of 2017 as demand for space from e-commerce companies was greater than available supply. Industrials tend to be less sensitive to rising interest rates, helped even further by the high rent growth, and so were less affected by the Fed’s federal funds rate increases. At the same time, however, the U.S. retail market fell over the reporting period with a decline in overall retail investments and headwinds from continued competition from e-commerce. Some additional signs of weakness in the overall U.S. REIT market were present during the six-month reporting period, including rising commercial mortgage defaults and softening rental growth in the U.S. family property market, though overall positive economic measurements helped offset some of these negative factors.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

The Investment Environment (continued)

Real estate markets outside the U.S. generally performed well amid rebounding global economic growth. In the Asia Pacific region, demand from owner-occupiers in Hong Kong’s housing market continued to lift prices, even with new government controls enacted to cool an overheated property market. Strength in the Chinese property market propelled the stock prices of home builders in the region, and hotel investors continued to favor the Australian market, driving solid activity over the reporting period. Japan’s real estate market remained healthy, buoyed by stable demand and rental yields, as well as an uptick in international investment attracted by the upcoming 2020 Olympics. In Europe, Spanish commercial real estate investment volumes grew, while the outcomes of elections in France and Germany supported overall property fundamentals across much of the region. Meanwhile, however, growth of house prices in the United Kingdom slowed in the second part of the reporting period amid rising inflation and a depreciating British pound.

All total returns on the prior page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

| Christopher Bliss, CFA, Vice President and Head of the Passive Equity Team, leads the portfolio management team for Schwab’s Passive Equity Funds and ETFs. He also has overall responsibility for all aspects of the management of the fund. Prior to joining CSIM in 2016, Mr. Bliss spent 12 years at BlackRock (formerly Barclays Global Investors) managing and leading institutional index teams, most recently as a Managing Director and Head of Americas Institutional Index team. Prior to BlackRock, he worked as an equity analyst and portfolio manager for Harris Bretall and before that, as a research analyst for JP Morgan. |

| Chuck Craig, CFA, Senior Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2012, Mr. Craig worked at Guggenheim Funds (formerly Claymore Group), where he spent more than five years as a managing director of portfolio management and supervision, and three years as vice president of product research and development. Prior to that, he worked as an equity research analyst at First Trust Portfolios (formerly Niké Securities), and a trader and analyst at PMA Securities, Inc. |

| Jane Qin, Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2012, Ms. Qin spent more than four years at The Bank of New York Mellon Corporation. During that time, Ms. Qin spent more than two years as an associate equity portfolio manager and nearly two years as a performance analyst. She also worked at Wells Fargo Funds Management as a mutual fund analyst and at CIGNA Reinsurance in Risk Management group as a risk analyst. |

| David Rios, Portfolio Manager, is responsible for the day-to-day co-management of the fund. He joined CSIM in 2008 and became a Portfolio Manager in September 2014. Prior to this role, Mr. Rios served as an Associate Portfolio Manager on the Schwab Equity Index Strategies team for four years. His first role with CSIM was as a trade operation specialist. He also previously worked as a senior fund accountant at Investors Bank & Trust (subsequently acquired by State Street Corporation). |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabfunds.com/schwabfunds_prospectus.

Average Annual Total Returns1

| Fund and Inception Date | 6 Months | 1 Year | Since Inception |

| Fund: Schwab Fundamental Global Real Estate Index Fund (10/22/14) | 9.55% 2 | 10.37% | 9.02% |

| Russell RAFITM Global Select Real Estate Index (Net)3 | 9.02% | 9.88% | 8.76% |

| FTSE EPRA/NAREIT Global Index (Net)3 | 5.28% | 2.43% | 5.79% |

| Fund Category: Morningstar Global Real Estate4 | 6.07% | 3.25% | 4.84% |

| Fund Expense Ratio5: 0.39% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

The fund’s performance relative to the index may be affected by fair value pricing, see financial note 2 for more information.

Small-company stocks are subject to greater volatility than many other asset classes.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

The fund is subject to risks associated with the direct ownership of real estate securities and an investment in the fund will be closely linked to the performance of the real estate markets.

Index ownership — Russell® is a trademark owned by Frank Russell Company (Russell). The Russell RAFI™ Index Series are calculated by Russell in conjunction with Research Affiliates® LLC (RA). Neither Russell nor RA sponsor, endorse or promote the Schwab Fundamental Global Real Estate Index Fund and are not in any way connected to it and do not accept any liability in relation to its issue, operation and trading. Any intellectual property rights in the index values and constituent list vests in Russell. “Research Affiliates®”, “Fundamental Index®” and “RAFI®” trade names are the exclusive property of RA. CSIM has obtained full license from Russell to use such intellectual property rights in the creation of this fund. For full disclaimer please see the fund’s statement of additional information. Effective December 1, 2016, the name of the index was changed by the index provider. No other changes to the index have occurred.

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. |

| 2 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 3 | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

| 4 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 5 | As stated in the prospectus. |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Performance and Fund Facts as of August 31, 2017

| Number of Holdings | 309 |

| Weighted Average Market Cap (millions) | $14,866 |

| Price/Earnings Ratio (P/E) | 14.1 |

| Price/Book Ratio (P/B) | 1.4 |

| Portfolio Turnover Rate2 | 6% |

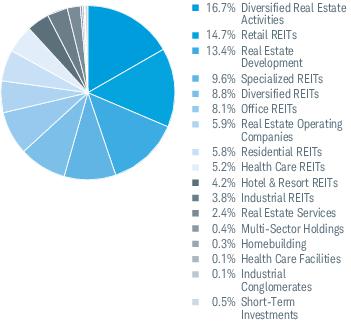

Industry Weightings % of Investments1

Top Holdings % of Net Assets3

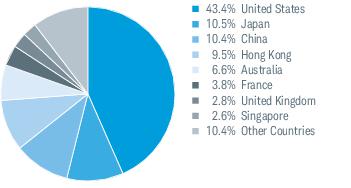

Country Weightings % of Investments4

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of trading and management costs incurred by the fund.

Source of Sector Classification: S&P and MSCI.

| 1 | Excludes derivatives. |

| 2 | Not annualized. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Fund Expenses (Unaudited)

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, transfer agent and shareholder services fees, and other fund expenses.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in the fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning March 1, 2017 and held through August 31, 2017.

The Actual Return line in the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled “Expenses Paid During Period.”

The Hypothetical Return line in the table below provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Expense Ratio

(Annualized)1 | Beginning

Account Value

at 3/1/17 | Ending

Account Value

(Net of Expenses)

at 8/31/17 | Expenses Paid

During Period

3/1/17-8/31/172 |

| Schwab Fundamental Global Real Estate Index Fund | | | | |

| Actual Return | 0.44% | $1,000.00 | $1,094.50 | $2.32 |

| Hypothetical 5% Return | 0.44% | $1,000.00 | $1,022.98 | $2.24 |

| 1 | Based on the most recent six-month expense ratio; may differ from the expense ratio provided in the Financial Highlights. Effective June 1, 2017, the fund's advisory fees changed to 0.39%. If the fund expense changes had been in place throughout the entire most recent fiscal half-year, the expenses paid during the period under the actual and hypothetical 5% return example would have been $2.06 and $1.99, respectively. (See financial note 4) |

| 2 | Expenses for the fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by the 184 days of the period, and divided by the 365 days of the fiscal year. |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Financial Statements

Financial Highlights

| | 3/1/17–

8/31/17* | 3/1/16–

2/28/17 | 3/1/15–

2/29/16 | 10/22/14 1–

2/28/15 | | |

| Per-Share Data |

| Net asset value at beginning of period | $10.73 | $9.53 | $10.74 | $10.00 | | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)2 | 0.21 | 0.29 | 0.27 | 0.10 | | |

| Net realized and unrealized gains (losses) | 0.79 | 1.42 | (1.21) | 0.75 | | |

| Total from investment operations | 1.00 | 1.71 | (0.94) | 0.85 | | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.17) | (0.43) | (0.27) | (0.11) | | |

| Distributions from net realized gains | — | (0.08) | — | (0.00) 3 | | |

| Total distributions | (0.17) | (0.51) | (0.27) | (0.11) | | |

| Net asset value at end of period | $11.56 | $10.73 | $9.53 | $10.74 | | |

| Total return | 9.45% 4 | 18.26% | (8.91%) | 8.57% 4 | | |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 0.44% 5,6 | 0.49% | 0.50% 7 | 0.13% 8,9 | | |

| Gross operating expenses | 0.48% 5,6 | 0.91% | 0.89% | 2.58% 8 | | |

| Net investment income (loss) | 3.74% 5 | 2.72% | 2.65% | 2.62% 8 | | |

| Portfolio turnover rate | 6% 4 | 23% | 26% | 4% 4 | | |

| Net assets, end of period (x 1,000,000) | $115 | $93 | $84 | $105 | | |

| |

1

Commencement of operations.

2

Calculated based on the average shares outstanding during the period.

3

Amount is less than $0.005.

4

Not annualized.

5

Annualized.

6

Effective June 1, 2017, the annual operating expense ratio was reduced. The ratio presented for the period ended 8/31/17 is a blended ratio. (See financial note 4)

7

The ratio of net operating expenses would have been 0.49%, if certain non-routine expenses had not been incurred.

8

Annualized (except for offering costs on the gross operating expenses ratio).

9

The ratio presented for period ended 2/28/15 is a blended ratio.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2017 (Unaudited)

This section shows all the securities in the fund's portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund's Form N-Q is available on the SEC's website at www.sec.gov and may be viewed and copied at the SEC's Public Reference Room in Washington, D.C. Call 1-800-SEC-0330 for information on the operation of the Public Reference Room. The fund also makes available its complete schedule of portfolio holdings 15 to 20 days after calendar quarters on the fund's website at www.schwabfunds.com/schwabfunds_prospectus.

| Security | Number

of Shares | Value ($) |

| Common Stock 99.1% of net assets |

| |

| Australia 6.5% |

| Charter Hall Retail REIT | 32,813 | 102,652 |

| Cromwell Property Group | 140,388 | 106,152 |

| Dexus | 67,444 | 515,385 |

| Goodman Group | 92,316 | 610,035 |

| Investa Office Fund | 39,650 | 142,718 |

| LendLease Group | 98,853 | 1,306,604 |

| Mirvac Group | 381,518 | 705,687 |

| Scentre Group | 409,333 | 1,258,994 |

| Stockland | 345,814 | 1,219,880 |

| The GPT Group | 120,517 | 480,168 |

| Vicinity Centres | 103,399 | 215,626 |

| Westfield Corp. | 127,541 | 754,343 |

| | | 7,418,244 |

| |

| Austria 0.6% |

| BUWOG AG * | 5,105 | 157,097 |

| CA Immobilien Anlagen AG | 5,320 | 151,712 |

| IMMOFINANZ AG * | 115,385 | 305,919 |

| S IMMO AG | 1,900 | 31,032 |

| | | 645,760 |

| |

| Belgium 0.3% |

| Befimmo S.A. | 2,101 | 132,010 |

| Cofinimmo S.A. | 2,120 | 273,546 |

| | | 405,556 |

| |

| Brazil 0.7% |

| BR Malls Participacoes S.A. | 72,522 | 313,325 |

| Cyrela Brazil Realty S.A. Empreendimentos e Participacoes | 80,989 | 339,100 |

| Multiplan Empreendimentos Imobiliarios S.A. | 5,261 | 122,155 |

| | | 774,580 |

| |

| Canada 2.2% |

| Allied Properties Real Estate Investment Trust | 1,000 | 30,999 |

| Artis Real Estate Investment Trust | 12,553 | 132,893 |

| Boardwalk Real Estate Investment Trust | 3,130 | 101,213 |

| Canadian Apartment Properties REIT | 5,491 | 150,692 |

| Canadian Real Estate Investment Trust | 3,697 | 136,156 |

| Chartwell Retirement Residences | 9,900 | 116,620 |

| Colliers International Group, Inc. | 2,169 | 112,797 |

| Cominar Real Estate Investment Trust | 15,393 | 166,904 |

| Dream Global Real Estate Investment Trust | 14,827 | 133,695 |

| Dream Office Real Estate Investment Trust | 12,669 | 216,907 |

| First Capital Realty, Inc. | 12,885 | 209,359 |

| FirstService Corp. | 600 | 41,797 |

| Security | Number

of Shares | Value ($) |

| Granite Real Estate Investment Trust | 3,948 | 160,765 |

| H&R Real Estate Investment Trust | 16,571 | 283,449 |

| RioCan Real Estate Investment Trust | 18,349 | 349,715 |

| Smart Real Estate Investment Trust | 6,489 | 158,126 |

| | | 2,502,087 |

| |

| China 10.4% |

| Agile Group Holdings Ltd. | 659,000 | 791,112 |

| BBMG Corp., Class H | 50,000 | 25,803 |

| China Evergrande Group * | 755,000 | 2,286,540 |

| China Jinmao Holdings Group Ltd. | 724,000 | 322,573 |

| China Overseas Grand Oceans Group Ltd. | 311,000 | 169,812 |

| China Overseas Land & Investment Ltd. | 374,000 | 1,311,729 |

| China Resources Land Ltd. | 270,000 | 846,457 |

| China South City Holdings Ltd. | 772,000 | 158,931 |

| China Vanke Co., Ltd., Class H | 96,500 | 289,653 |

| CIFI Holdings Group Co., Ltd. | 96,000 | 54,091 |

| Country Garden Holdings Co., Ltd. | 625,000 | 832,513 |

| Future Land Development Holdings Ltd. | 88,000 | 36,216 |

| Greentown China Holdings Ltd. | 221,000 | 268,864 |

| Guangzhou R&F Properties Co., Ltd., Class H | 247,000 | 578,012 |

| KWG Property Holding Ltd. | 266,000 | 242,424 |

| Logan Property Holdings Co., Ltd. | 38,000 | 35,645 |

| Longfor Properties Co., Ltd. | 168,500 | 405,410 |

| Poly Property Group Co., Ltd. * | 660,000 | 346,613 |

| Powerlong Real Estate Holdings Ltd. | 65,000 | 32,922 |

| Shenzhen Investment Ltd. | 350,000 | 159,946 |

| Shimao Property Holdings Ltd. | 328,000 | 678,381 |

| Sino-Ocean Group Holding Ltd. | 874,000 | 604,419 |

| SOHO China Ltd. * | 584,000 | 340,772 |

| Sunac China Holdings Ltd. | 272,000 | 818,322 |

| Yuexiu Property Co., Ltd. | 1,502,000 | 276,946 |

| Yuzhou Properties Co., Ltd. | 50,000 | 32,162 |

| | | 11,946,268 |

| |

| France 3.8% |

| Fonciere Des Regions | 3,297 | 326,147 |

| Gecina S.A. | 3,101 | 483,231 |

| ICADE | 5,270 | 468,529 |

| Klepierre S.A. | 13,998 | 564,277 |

| Mercialys S.A. | 7,765 | 156,406 |

| Nexity S.A. * | 7,319 | 405,574 |

| Unibail-Rodamco SE | 7,766 | 1,975,522 |

| | | 4,379,686 |

| |

| Germany 1.7% |

| Deutsche Wohnen SE | 10,388 | 441,473 |

| LEG Immobilien AG | 3,846 | 389,048 |

| TAG Immobilien AG | 9,928 | 165,761 |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2017 (Unaudited) (continued)

| Security | Number

of Shares | Value ($) |

| TLG Immobilien AG | 1,217 | 26,987 |

| Vonovia SE | 21,847 | 924,087 |

| | | 1,947,356 |

| |

| Hong Kong 9.4% |

| Cheung Kong Property Holdings Ltd. | 101,500 | 893,182 |

| Far East Consortium International Ltd. | 43,000 | 22,377 |

| Great Eagle Holdings Ltd. | 26,000 | 142,197 |

| Hang Lung Group Ltd. | 96,000 | 362,201 |

| Hang Lung Properties Ltd. | 201,000 | 490,073 |

| Henderson Land Development Co., Ltd. | 62,725 | 389,623 |

| Hongkong Land Holdings Ltd. | 79,900 | 592,825 |

| Hopewell Holdings Ltd. | 29,500 | 115,999 |

| Hysan Development Co., Ltd. | 32,000 | 148,169 |

| I-CABLE Communications Ltd. * | 99,364 | 3,689 |

| K Wah International Holdings Ltd. | 34,000 | 19,697 |

| Kerry Properties Ltd. | 104,000 | 412,815 |

| Link REIT | 94,000 | 776,516 |

| New World Development Co., Ltd. | 810,000 | 1,108,600 |

| Shui On Land Ltd. | 541,500 | 126,827 |

| Sino Land Co., Ltd. | 236,000 | 408,845 |

| Sun Hung Kai Properties Ltd. | 162,000 | 2,707,386 |

| Swire Properties Ltd. | 79,800 | 276,885 |

| The Wharf Holdings Ltd. | 117,000 | 1,116,126 |

| Wheelock & Co., Ltd. | 96,000 | 719,276 |

| | | 10,833,308 |

| |

| India 0.2% |

| DLF Ltd. * | 68,893 | 199,846 |

| |

| Italy 0.1% |

| Beni Stabili S.p.A | 166,991 | 143,331 |

| |

| Japan 10.4% |

| Activia Properties, Inc. | 20 | 87,870 |

| Advance Residence Investment Corp. | 70 | 179,457 |

| Aeon Mall Co., Ltd. | 15,900 | 285,657 |

| Daikyo, Inc. | 74,000 | 144,802 |

| Daito Trust Construction Co., Ltd. | 10,000 | 1,771,913 |

| Frontier Real Estate Investment Corp. | 25 | 107,450 |

| Fukuoka REIT Corp. | 15 | 22,418 |

| GLP J-REIT | 25 | 26,747 |

| Hulic Co., Ltd. | 12,400 | 122,827 |

| Japan Excellent, Inc. | 97 | 116,557 |

| Japan Prime Realty Investment Corp. | 44 | 158,093 |

| Japan Real Estate Investment Corp. | 69 | 357,757 |

| Japan Retail Fund Investment Corp. | 52 | 95,671 |

| Kenedix Office Investment Corp. | 29 | 166,135 |

| Leopalace21 Corp. | 74,300 | 544,696 |

| Mitsubishi Estate Co., Ltd. | 87,000 | 1,495,275 |

| Mitsui Fudosan Co., Ltd. | 93,000 | 2,009,493 |

| Mori Trust Sogo REIT, Inc. | 62 | 101,176 |

| Nippon Accommodations Fund, Inc. | 28 | 113,722 |

| Nippon Building Fund, Inc. | 88 | 468,277 |

| Nippon Prologis REIT, Inc. | 56 | 121,675 |

| Nomura Real Estate Holdings, Inc. | 29,600 | 611,277 |

| Nomura Real Estate Master Fund, Inc. | 18 | 23,790 |

| NTT Urban Development Corp. | 14,300 | 138,376 |

| Relo Group, Inc. | 7,500 | 170,907 |

| Starts Corp., Inc. | 1,000 | 24,974 |

| Sumitomo Realty & Development Co., Ltd. | 47,800 | 1,444,396 |

| Tokyo Tatemono Co., Ltd. | 19,800 | 243,648 |

| Security | Number

of Shares | Value ($) |

| Tokyu Fudosan Holdings Corp. | 94,100 | 561,491 |

| United Urban Investment Corp. | 154 | 232,397 |

| | | 11,948,924 |

| |

| Netherlands 0.6% |

| Eurocommercial Properties N.V. CVA | 4,459 | 191,096 |

| NSI N.V. | 3,654 | 140,937 |

| Vastned Retail N.V. | 3,026 | 140,003 |

| Wereldhave N.V. | 3,559 | 174,279 |

| | | 646,315 |

| |

| Philippines 0.3% |

| Ayala Land, Inc. | 208,400 | 171,213 |

| GT Capital Holdings, Inc. | 1,200 | 26,219 |

| SM Prime Holdings, Inc. | 257,100 | 167,844 |

| | | 365,276 |

| |

| Singapore 2.6% |

| Ascendas Real Estate Investment Trust | 155,400 | 305,081 |

| Ascott Residence Trust | 26,500 | 22,964 |

| CapitaLand Commercial Trust | 119,600 | 153,670 |

| CapitaLand Ltd. | 253,700 | 708,989 |

| CapitaLand Mall Trust | 183,400 | 293,716 |

| Fortune Real Estate Investment Trust (a) | 20,000 | 23,895 |

| Global Logistic Properties Ltd. | 145,000 | 346,770 |

| Mapletree Greater China Commercial Trust | 139,000 | 115,423 |

| Mapletree Industrial Trust | 86,700 | 118,609 |

| Mapletree Logistics Trust | 134,400 | 121,961 |

| Suntec Real Estate Investment Trust | 113,500 | 158,883 |

| UOL Group Ltd. | 55,280 | 334,002 |

| Wing Tai Holdings Ltd. | 90,100 | 141,647 |

| Yanlord Land Group Ltd. | 105,200 | 134,384 |

| | | 2,979,994 |

| |

| South Africa 0.9% |

| Emira Property Fund Ltd. | 98,445 | 104,963 |

| Growthpoint Properties Ltd. | 240,685 | 465,759 |

| Redefine Properties Ltd. | 374,677 | 307,029 |

| SA Corporate Real Estate Fund Nominees Pty Ltd. | 264,437 | 109,972 |

| Vukile Property Fund Ltd. | 76,279 | 109,944 |

| | | 1,097,667 |

| |

| Sweden 0.8% |

| Castellum AB | 17,519 | 274,351 |

| Fabege AB | 7,628 | 153,013 |

| Hemfosa Fastigheter AB | 2,393 | 29,438 |

| LE Lundbergfortagen AB, B Shares | 5,113 | 396,151 |

| Wihlborgs Fastigheter AB | 4,781 | 116,128 |

| | | 969,081 |

| |

| Switzerland 0.9% |

| Allreal Holding AG * | 1,527 | 274,216 |

| Mobimo Holding AG * | 568 | 157,111 |

| PSP Swiss Property AG | 1,281 | 117,599 |

| Swiss Prime Site AG * | 5,269 | 476,722 |

| | | 1,025,648 |

| |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2017 (Unaudited) (continued)

| Security | Number

of Shares | Value ($) |

| Taiwan 0.6% |

| Farglory Land Development Co., Ltd. | 85,000 | 103,088 |

| Highwealth Construction Corp. | 169,700 | 270,347 |

| Huaku Development Co., Ltd. | 59,000 | 121,157 |

| Ruentex Development Co., Ltd. * | 154,800 | 151,927 |

| | | 646,519 |

| |

| United Arab Emirates 0.4% |

| Emaar Properties PJSC | 199,347 | 463,475 |

| |

| United Kingdom 2.8% |

| Countrywide plc | 48,226 | 86,682 |

| Derwent London plc | 3,898 | 140,293 |

| Grainger plc | 37,655 | 124,149 |

| Hammerson plc | 56,513 | 410,417 |

| Intu Properties plc | 97,888 | 315,381 |

| Land Securities Group plc | 64,753 | 846,458 |

| McCarthy & Stone plc | 11,000 | 23,527 |

| Savills plc | 19,590 | 224,314 |

| Segro plc | 54,185 | 377,363 |

| Shaftesbury plc | 8,268 | 106,679 |

| St. Modwen Properties plc | 5,600 | 25,598 |

| The British Land Co., plc | 57,868 | 458,505 |

| The Unite Group plc | 3,000 | 26,912 |

| | | 3,166,278 |

| |

| United States 42.9% |

| Acadia Realty Trust | 3,175 | 91,091 |

| Alexandria Real Estate Equities, Inc. | 3,392 | 411,484 |

| American Campus Communities, Inc. | 6,782 | 322,755 |

| American Homes 4 Rent, Class A | 1,275 | 28,254 |

| American Tower Corp. | 11,318 | 1,675,630 |

| Apartment Investment & Management Co., Class A | 9,166 | 415,495 |

| Apple Hospitality REIT, Inc. | 17,743 | 322,568 |

| Ashford Hospitality Trust, Inc. | 21,704 | 134,782 |

| AvalonBay Communities, Inc. | 4,949 | 929,076 |

| Boston Properties, Inc. | 9,357 | 1,128,454 |

| Brandywine Realty Trust | 18,328 | 314,875 |

| Brixmor Property Group, Inc. | 18,762 | 351,225 |

| Camden Property Trust | 5,778 | 517,015 |

| CBL & Associates Properties, Inc. | 37,316 | 298,528 |

| CBRE Group, Inc., Class A * | 20,635 | 744,511 |

| Chesapeake Lodging Trust | 4,783 | 122,397 |

| Columbia Property Trust, Inc. | 17,829 | 374,409 |

| CoreCivic, Inc. | 30,461 | 816,355 |

| Corporate Office Properties Trust | 8,658 | 288,831 |

| Crown Castle International Corp. | 11,344 | 1,230,143 |

| CubeSmart | 6,259 | 154,284 |

| CyrusOne, Inc. | 500 | 31,515 |

| DCT Industrial Trust, Inc. | 3,767 | 219,804 |

| DDR Corp. | 27,528 | 266,471 |

| DiamondRock Hospitality Co. | 22,394 | 246,110 |

| Digital Realty Trust, Inc. | 8,086 | 956,897 |

| Douglas Emmett, Inc. | 7,091 | 276,265 |

| Duke Realty Corp. | 20,127 | 598,174 |

| DuPont Fabros Technology, Inc. | 3,066 | 197,328 |

| EastGroup Properties, Inc. | 1,690 | 150,173 |

| Education Realty Trust, Inc. | 834 | 32,226 |

| EPR Properties | 3,013 | 209,886 |

| Equinix, Inc. | 1,354 | 634,227 |

| Equity Commonwealth * | 11,043 | 341,670 |

| Equity LifeStyle Properties, Inc. | 3,313 | 295,354 |

| Equity Residential | 22,073 | 1,482,202 |

| Security | Number

of Shares | Value ($) |

| Essex Property Trust, Inc. | 1,893 | 503,481 |

| Extra Space Storage, Inc. | 3,794 | 294,528 |

| Federal Realty Investment Trust | 3,025 | 383,963 |

| First Industrial Realty Trust, Inc. | 4,637 | 143,654 |

| Forest City Realty Trust, Inc., Class A | 1,600 | 38,336 |

| Franklin Street Properties Corp. | 10,148 | 101,176 |

| Gaming & Leisure Properties, Inc. | 7,774 | 304,663 |

| GGP, Inc. | 38,014 | 788,791 |

| Government Properties Income Trust | 7,014 | 130,110 |

| Gramercy Property Trust | 4,820 | 146,817 |

| HCP, Inc. | 39,378 | 1,173,858 |

| Healthcare Realty Trust, Inc. | 6,574 | 218,783 |

| Healthcare Trust of America, Inc., Class A | 6,743 | 209,505 |

| Hersha Hospitality Trust | 6,421 | 119,045 |

| Highwoods Properties, Inc. | 6,517 | 340,383 |

| Hospitality Properties Trust | 23,251 | 636,147 |

| Host Hotels & Resorts, Inc. | 83,417 | 1,511,516 |

| Hudson Pacific Properties, Inc. | 800 | 26,400 |

| Investors Real Estate Trust | 20,263 | 127,252 |

| Iron Mountain, Inc. | 37,798 | 1,489,997 |

| JBG SMITH Properties * | 6,082 | 199,064 |

| Jones Lang LaSalle, Inc. | 5,637 | 687,207 |

| Kilroy Realty Corp. | 3,559 | 246,390 |

| Kimco Realty Corp. | 25,282 | 496,033 |

| Kite Realty Group Trust | 1,364 | 27,444 |

| Lamar Advertising Co., Class A | 4,927 | 327,941 |

| LaSalle Hotel Properties | 10,560 | 299,693 |

| Lexington Realty Trust | 22,833 | 225,133 |

| Liberty Property Trust | 11,523 | 490,880 |

| Life Storage, Inc. | 1,992 | 146,591 |

| Mack-Cali Realty Corp. | 12,766 | 292,214 |

| Medical Properties Trust, Inc. | 11,401 | 150,037 |

| Mid-America Apartment Communities, Inc. | 5,169 | 550,292 |

| Monogram Residential Trust, Inc. | 13,371 | 160,452 |

| National Health Investors, Inc. | 300 | 24,054 |

| National Retail Properties, Inc. | 5,988 | 250,478 |

| New Senior Investment Group, Inc. | 2,922 | 26,970 |

| Omega Healthcare Investors, Inc. | 7,974 | 254,131 |

| Outfront Media, Inc. | 20,447 | 449,834 |

| Paramount Group, Inc. | 10,840 | 171,055 |

| Park Hotels & Resorts, Inc. | 3,935 | 105,025 |

| Pebblebrook Hotel Trust | 4,321 | 145,142 |

| Pennsylvania Real Estate Investment Trust | 10,576 | 106,077 |

| Piedmont Office Realty Trust, Inc., Class A | 18,307 | 370,717 |

| Prologis, Inc. | 21,411 | 1,356,601 |

| PS Business Parks, Inc. | 1,168 | 157,809 |

| Public Storage | 5,408 | 1,110,479 |

| Quality Care Properties, Inc. * | 7,697 | 105,603 |

| Ramco-Gershenson Properties Trust | 1,892 | 24,880 |

| Realogy Holdings Corp. | 19,549 | 662,711 |

| Realty Income Corp. | 7,456 | 429,167 |

| Regency Centers Corp. | 6,399 | 411,584 |

| Retail Properties of America, Inc., Class A | 23,904 | 318,640 |

| RLJ Lodging Trust | 14,740 | 297,453 |

| Ryman Hospitality Properties, Inc. | 4,014 | 238,512 |

| Sabra Health Care REIT, Inc. | 11,277 | 246,402 |

| SBA Communications Corp. * | 3,435 | 527,444 |

| Select Income REIT | 1,000 | 23,210 |

| Senior Housing Properties Trust | 22,176 | 437,311 |

| Simon Property Group, Inc. | 15,227 | 2,388,355 |

| SL Green Realty Corp. | 5,164 | 497,706 |

| Spirit Realty Capital, Inc. | 25,719 | 223,755 |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2017 (Unaudited) (continued)

| Security | Number

of Shares | Value ($) |

| STORE Capital Corp. | 1,166 | 29,593 |

| Summit Hotel Properties, Inc. | 1,350 | 20,034 |

| Sun Communities, Inc. | 2,561 | 231,284 |

| Sunstone Hotel Investors, Inc. | 16,902 | 267,052 |

| Tanger Factory Outlet Centers, Inc. | 6,035 | 141,219 |

| Taubman Centers, Inc. | 5,632 | 294,216 |

| The GEO Group, Inc. | 14,376 | 397,353 |

| The Macerich Co. | 9,121 | 481,315 |

| Tier REIT, Inc. | 6,358 | 117,051 |

| UDR, Inc. | 13,455 | 522,323 |

| Urban Edge Properties | 910 | 22,887 |

| Ventas, Inc. | 22,160 | 1,516,630 |

| VEREIT, Inc. | 34,563 | 291,712 |

| Vornado Realty Trust | 11,997 | 893,657 |

| Washington Prime Group, Inc. | 36,075 | 301,226 |

| Washington Real Estate Investment Trust | 5,977 | 196,404 |

| Weingarten Realty Investors | 8,835 | 283,073 |

| Welltower, Inc. | 21,830 | 1,598,393 |

| WP Carey, Inc. | 5,612 | 386,386 |

| Xenia Hotels & Resorts, Inc. | 14,314 | 285,707 |

| | | 49,236,860 |

| Total Common Stock |

| (Cost $101,352,808) | | 113,742,059 |

Security

Rate, Maturity Date | Face Amount

Local Currency | Value ($) |

| Short-Term Investments 0.5% of net assets |

| |

| Time Deposits 0.5% |

| Australia & New Zealand Banking Group Ltd. |

| Australian Dollar | | |

| 0.48%, 09/01/17 (b) | 154,316 | 122,673 |

| Brown Brothers Harriman |

| Canadian Dollar | | |

| 0.15%, 09/01/17 (b) | 1,976 | 1,582 |

| Euro | | |

| (0.56%), 09/01/17 (b) | 1,488 | 1,771 |

| Hong Kong Dollar | | |

| 0.01%, 09/01/17 (b) | 84,132 | 10,751 |

| Japanese Yen | | |

| (0.23%), 09/01/17 (b) | 190,800 | 1,736 |

Security

Rate, Maturity Date | Face Amount

Local Currency | Value ($) |

| Pound Sterling | | |

| 0.05%, 09/01/17 (b) | 1,191 | 1,540 |

| Singapore Dollar | | |

| 0.01%, 09/01/17 (b) | 8,725 | 6,434 |

| South African Rand | | |

| 5.82%, 09/01/17 (b) | 6,055 | 465 |

| Swedish Krona | | |

| (0.93%), 09/01/17 (b) | 6,172 | 777 |

| Swiss Franc | | |

| (1.45%), 09/01/17 (b) | 595 | 621 |

| Sumitomo Mitsui Banking Corp. |

| U.S. Dollar | | |

| 0.59%, 09/01/17 (b) | 438,469 | 438,469 |

| Total Short-Term Investments |

| (Cost $586,819) | | 586,819 |

| | Number of

Contracts | Notional

Value

($) | Current Value/

Unrealized

Appreciation

(Depreciation)

($) |

| Futures Contracts | |

| Long | |

| MSCI EAFE Index, e-mini, expires 09/15/17 | 3 | 290,220 | 1,395 |

| MSCI Emerging Markets Index, e-mini, expires 09/15/17 | 4 | 217,240 | (256) |

| S&P 500 Index, e-mini, expires 09/15/17 | 4 | 494,020 | 5,263 |

As of 08/31/17, the values of certain foreign securities held by the fund aggregating $56,712,377 were adjusted from their closing market values in accordance with international fair valuation procedures approved by the fund's Board of Trustees.

| * | Non-income producing security. |

| (a) | Fair-valued by management in accordance with procedures approved by the Board of Trustees. |

| (b) | The rate shown is the current daily overnight rate. |

| | |

| CVA — | Dutch Certificate |

| REIT — | Real Estate Investment Trust |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2017 (Unaudited) (continued)

The following is a summary of the inputs used to value the fund's investments as of August 31, 2017 (see financial note 2(a) for additional information):

| Description | Quoted Prices in

Active Markets for

Identical Assets

(Level 1) | Other Significant

Observable Inputs

(Level 2) | Significant

Unobservable Inputs

(Level 3) | Total | |

| Assets | | | | | |

| Common Stock1 | $— | $23,590,789 | $— | $23,590,789 | |

| Austria | 339,841 | 305,919 | — | 645,760 | |

| Belgium | 132,010 | 273,546 | — | 405,556 | |

| Brazil | 774,580 | — | — | 774,580 | |

| Canada | 2,502,087 | — | — | 2,502,087 | |

| France | 156,406 | 4,223,280 | — | 4,379,686 | |

| Hong Kong | 142,197 | 10,691,111 | — | 10,833,308 | |

| Italy | 143,331 | — | — | 143,331 | |

| Japan | 1,789,507 | 10,159,417 | — | 11,948,924 | |

| Netherlands | 472,036 | 174,279 | — | 646,315 | |

| Philippines | 26,219 | 339,057 | — | 365,276 | |

| Singapore | 141,573 | 2,814,526 | 23,895 | 2,979,994 | |

| South Africa | 631,908 | 465,759 | — | 1,097,667 | |

| Switzerland | 157,111 | 868,537 | — | 1,025,648 | |

| United Kingdom | 360,121 | 2,806,157 | — | 3,166,278 | |

| United States | 49,236,860 | — | — | 49,236,860 | |

| Short-Term Investments1 | — | 586,819 | — | 586,819 | |

| Futures Contracts2 | 6,658 | — | — | 6,658 | |

| Liabilities | | | | | |

| Futures Contracts2 | (256) | — | — | (256) | |

| Total | $57,012,189 | $57,299,196 | $23,895 | $114,335,280 | |

| 1 | As categorized in Portfolio Holdings. |

| 2 | Futures contracts are valued at unrealized appreciation or depreciation. |

The fund's policy is to recognize transfers between Level 1, Level 2 and Level 3 as of the beginning of the fiscal year. There were security transfers in the amount of $191,638 and $3,105,770 from Level 1 to Level 2 and from Level 2 to Level 1, respectively, for the period ended August 31, 2017. The transfers between Level 1 and Level 2 were primarily due to the use of international fair valuation by the fund. There were no transfers in or out of Level 3 during the period.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Statement of Assets and Liabilities

As of August 31, 2017; unaudited

| Assets |

| Investments in unaffiliated issuers, at value (cost $101,939,627) | | $114,328,878 |

| Foreign currency, at value (cost $10,436) | | 10,430 |

| Deposit with broker for futures contracts | | 166,800 |

| Receivables: | | |

| Fund shares sold | | 315,103 |

| Dividends | | 112,553 |

| Foreign tax reclaims | | 21,986 |

| Variation margin on futures contracts | | 5,178 |

| Prepaid expenses | + | 16,151 |

| Total assets | | 114,977,079 |

| Liabilities |

| Payables: | | |

| Investments bought | | 3,782 |

| Investment adviser and administrator fees | | 36,624 |

| Fund shares redeemed | | 95,030 |

| Foreign capital gains tax | | 510 |

| Accrued expenses | + | 5,232 |

| Total liabilities | | 141,178 |

| Net Assets |

| Total assets | | 114,977,079 |

| Total liabilities | – | 141,178 |

| Net assets | | $114,835,901 |

| Net Assets by Source | | |

| Capital received from investors | | 103,299,079 |

| Distributions in excess of net investment income | | (472,815) |

| Net realized capital losses | | (385,609) |

| Net unrealized capital appreciation | | 12,395,246 |

| Net Asset Value (NAV) |

| Net Assets | ÷ | Shares

Outstanding | = | NAV |

| $114,835,901 | | 9,930,481 | | $11.56 |

| | | | | |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Statement of Operations

For the period March 1, 2017 through August 31, 2017; unaudited

| Investment Income |

| Dividends (net of foreign withholding tax of $97,314) | | $2,108,955 |

| Interest | + | 1,930 |

| Total investment income | | 2,110,885 |

| Expenses 1 |

| Investment adviser and administrator fees | | 199,633 |

| Shareholder service fees | | 23,427 |

| Professional fees | | 6,722 |

| Index fees | | 4,469 |

| Portfolio accounting fees | | 4,014 |

| Custodian fees | | 3,281 |

| Shareholder reports | | 778 |

| Transfer agent fees | | 384 |

| Other expenses | + | 22 |

| Total expenses | | 242,730 |

| Expense reduction by CSIM and its affiliates | – | 21,748 |

| Net expenses | – | 220,982 |

| Net investment income | | 1,889,903 |

| Realized and Unrealized Gains (Losses) |

| Net realized gains on investments | | 148,090 |

| Net realized gains on futures contracts | | 97,460 |

| Net realized gains on foreign currency transactions | + | 5,398 |

| Net realized gains | | 250,948 |

| Net change in unrealized appreciation (depreciation) on investments (net of change in foreign capital gains tax of $344) | | 7,153,149 |

| Net change in unrealized appreciation (depreciation) on futures contracts | | 5,238 |

| Net change in unrealized appreciation (depreciation) on foreign currency translations | + | 864 |

| Net change in unrealized appreciation (depreciation) | + | 7,159,251 |

| Net realized and unrealized gains | | 7,410,199 |

| Increase in net assets resulting from operations | | $9,300,102 |

| 1 | See financial note 2(e) and financial note 4. |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Statement of Changes in Net Assets

For the current and prior report periods

Figures for the current period are unaudited

| Operations | |

| | 3/1/17-8/31/17 | 3/1/16-2/28/17 |

| Net investment income | | $1,889,903 | $2,478,008 |

| Net realized gains | | 250,948 | 1,182,101 |

| Net change in unrealized appreciation (depreciation) | + | 7,159,251 | 11,158,338 |

| Increase in net assets from operations | | 9,300,102 | 14,818,447 |

| Distributions to Shareholders | |

| Distributions from net investment income | | (1,561,063) | (3,678,589) |

| Distributions from net realized gains | + | — | (702,658) |

| Total distributions | | ($1,561,063) | ($4,381,247) |

| Transactions in Fund Shares | | | |

| | | 3/1/17-8/31/17 | 3/1/16-2/28/17 |

| | | SHARES | VALUE | SHARES | VALUE |

| Shares sold | | 2,060,534 | $22,826,290 | 1,960,200 | $20,545,404 |

| Shares reinvested | | 108,574 | 1,188,706 | 329,946 | 3,374,942 |

| Shares redeemed | + | (871,412) | (9,522,876) | (2,462,207) | (25,641,783) |

| Net transactions in fund shares | | 1,297,696 | $14,492,120 | (172,061) | ($1,721,437) |

| Shares Outstanding and Net Assets | | | |

| | | 3/1/17-8/31/17 | 3/1/16-2/28/17 |

| | | SHARES | NET ASSETS | SHARES | NET ASSETS |

| Beginning of period | | 8,632,785 | $92,604,742 | 8,804,846 | $83,888,979 |

| Total increase or decrease | + | 1,297,696 | 22,231,159 | (172,061) | 8,715,763 |

| End of period | | 9,930,481 | $114,835,901 | 8,632,785 | $92,604,742 |

| Distributions in excess of net investment income | | | ($472,815) | | ($801,655) |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited

1. Business Structure of the Fund:

Schwab Fundamental Global Real Estate Index Fund is a series of Schwab Capital Trust (the trust), a no-load, open-end management investment company. The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the 1940 Act). The list below shows all the funds in the trust as of the end of the period, including the fund discussed in this report, which is highlighted:

| SCHWAB CAPITAL TRUST (ORGANIZED MAY 7, 1993) |

| Schwab Fundamental Global Real Estate Index Fund | Schwab Target 2015 Fund |

| Schwab Fundamental US Large Company Index Fund | Schwab Target 2020 Fund |

| Schwab Fundamental US Small Company Index Fund | Schwab Target 2025 Fund |

| Schwab Fundamental International Large Company Index Fund | Schwab Target 2030 Fund |

| Schwab Fundamental International Small Company Index Fund | Schwab Target 2035 Fund |

| Schwab Fundamental Emerging Markets Large Company Index Fund | Schwab Target 2040 Fund |

| Schwab S&P 500 Index Fund | Schwab Target 2045 Fund |

| Schwab Small-Cap Index Fund | Schwab Target 2050 Fund |

| Schwab Total Stock Market Index Fund | Schwab Target 2055 Fund |

| Schwab International Index Fund | Schwab Target 2060 Fund |

| Schwab MarketTrack All Equity Portfolio | Schwab Monthly Income Fund — Moderate Payout |

| Schwab MarketTrack Growth Portfolio | Schwab Monthly Income Fund — Enhanced Payout |

| Schwab MarketTrack Balanced Portfolio | Schwab Monthly Income Fund — Maximum Payout |

| Schwab MarketTrack Conservative Portfolio | Schwab Target 2010 Index Fund |

| Laudus Small-Cap MarketMasters Fund | Schwab Target 2015 Index Fund |

| Laudus International MarketMasters Fund | Schwab Target 2020 Index Fund |

| Schwab Balanced Fund | Schwab Target 2025 Index Fund |

| Schwab Core Equity Fund | Schwab Target 2030 Index Fund |

| Schwab Dividend Equity Fund | Schwab Target 2035 Index Fund |

| Schwab Large-Cap Growth Fund | Schwab Target 2040 Index Fund |

| Schwab Small-Cap Equity Fund | Schwab Target 2045 Index Fund |

| Schwab Hedged Equity Fund | Schwab Target 2050 Index Fund |

| Schwab Health Care Fund | Schwab Target 2055 Index Fund |

| Schwab International Core Equity Fund | Schwab Target 2060 Index Fund |

| Schwab Target 2010 Fund | |

Schwab Fundamental Global Real Estate Index Fund offers one share class. Shares are bought and sold at closing net asset value per share (NAV), which is the price for all outstanding shares of the fund. Each share has a par value of 1/1,000 of a cent, and the fund's Board of Trustees (the Board) may authorize the issuance of as many shares as necessary.

The fund maintains its own account for purposes of holding assets and accounting, and is considered a separate entity for tax purposes. Within its account, the fund may also keep certain assets in segregated accounts, as required by securities law.

2. Significant Accounting Policies:

The following is a summary of the significant accounting policies the fund uses in its preparation of financial statements. The fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946 Financial Services — Investment Companies. The accounting policies are in conformity with accounting principles generally accepted in the United States of America (GAAP).

The fund may invest in certain other investment companies (underlying funds). For more information about the underlying funds’ operations and policies, please refer to those funds’ semiannual and annual reports, which are filed with the U.S. Securities and Exchange Commission (SEC).

Effective August 1, 2017, the fund adopted disclosure requirement changes for SEC Regulation S-X. The adopted changes are reflected throughout this report.

(a) Security Valuation:

Under procedures approved by the Board, the investment adviser has formed a Pricing Committee to administer the pricing and valuation of portfolio securities and other assets and to ensure that prices used for internal purposes or provided by third parties reasonably reflect fair market value. Among other things, these procedures allow the fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

The fund values the securities in its portfolio every business day. The fund uses the following policies to value various types of securities:

• Securities traded on an exchange or over-the-counter: Traded securities are valued at the closing value for the day, or, on days when no closing value has been reported, at the mean of the most recent bid and ask quotes. Securities that are primarily traded on foreign exchanges are valued at the official closing price or the last sales price on the exchange where the securities are principally traded with these values then translated into U.S. dollars at the current exchange rate, unless these securities are fair valued as discussed below.

• Securities for which no quoted value is available: The Board has adopted procedures to fair value the fund’s securities when market prices are not “readily available” or are unreliable. For example, the fund may fair value a security when it is de-listed or its trading is halted or suspended; when a security’s primary pricing source is unable or unwilling to provide a price; or when a security’s primary trading market is closed during regular market hours. The fund makes fair value determinations in good faith in accordance with the fund’s valuation procedures. The Pricing Committee considers a number of factors, including unobservable market inputs when arriving at fair value. The Pricing Committee may employ techniques such as the review of related or comparable assets or liabilities, related market activities, recent transactions, market multiples, book values, transactional back-testing, disposition analysis and other relevant information. The Pricing Committee regularly reviews these inputs and assumptions to calibrate the valuations. Due to the subjective and variable nature of fair value pricing, there can be no assurance that the fund could obtain the fair value assigned to the security upon the sale of such security. The Board convenes on a regular basis to review fair value determinations made by the fund pursuant to the valuation procedures.

• Foreign equity security fair valuation: The Board has adopted procedures to fair value foreign equity securities that are traded in markets that close prior to the fund valuing its holdings. By fair valuing securities whose prices may have been affected by events occurring after the close of trading, the fund seeks to establish prices that investors might expect to realize upon the current sales of these securities. This methodology is designed to deter “arbitrage” market timers, who seek to exploit delays between the change in the value of the fund’s portfolio holdings and the NAV of the fund’s shares, and seeks to help ensure that the prices at which the fund’s shares are purchased and redeemed are fair and do not result in dilution of shareholder interest or other harm to shareholders. When fair value pricing is used at the open or close of a reporting period, it may cause a temporary divergence between the return of the fund and that of its comparative index or benchmark. The Board regularly reviews fair value determinations made by the fund pursuant to these procedures.

• Futures contracts: Futures contracts are valued at their settlement prices as of the close of their exchanges.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the fund discloses the fair value of its investments in a hierarchy that prioritizes the significant inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements). If inputs used to measure the financial instruments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the valuation. If the fund determines that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and management judgment will be required to estimate fair value.

The three levels of the fair value hierarchy are as follows:

• Level 1—quoted prices in active markets for identical securities—Investments whose values are based on quoted market prices in active markets, and whose values are therefore classified as Level 1 prices, include active listed equities, ETFs and futures contracts. Investments in mutual funds are valued daily at their NAVs, and investments in ETFs are valued daily at the last reported sale price or the official closing price, which are classified as Level 1 prices, without consideration to the classification level of the specific investments held by an underlying fund.

• Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)—Investments that trade in markets that are not considered to be active, but whose values are based on quoted market prices, dealer quotations or valuations provided by alternative pricing sources supported by observable inputs are classified as Level 2 prices. These generally include U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, less liquid listed equities, and state, municipal and

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

provincial obligations. In addition, international securities whose markets close hours before the fund values its holdings may require fair valuations due to significant movement in the U.S. markets occurring after the daily close of the foreign markets. The Board has approved a vendor that calculates fair valuations of international equity securities based on a number of factors that appear to correlate to the movements in the U.S. markets.

• Level 3—significant unobservable inputs (including the fund's own assumptions in determining the fair value of investments)—Investments whose values are classified as Level 3 prices have significant unobservable inputs, as they may trade infrequently or not at all. When observable prices are not available for these securities, the fund uses one or more valuation techniques for which sufficient and reliable data is available. The inputs used by the fund in estimating the value of Level 3 prices may include the original transaction price, quoted prices for similar securities or assets in active markets, completed or pending third-party transactions in the underlying investment or comparable issuers, and changes in financial ratios or cash flows. Level 3 prices may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the fund in the absence of market information. Assumptions used by the fund due to the lack of observable inputs may significantly impact the resulting fair value and therefore the fund's results of operations.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The levels associated with valuing the fund's investments as of August 31, 2017 are disclosed in the Portfolio Holdings.

(b) Accounting Policies for certain Portfolio Investments (if held):

Futures Contracts: Futures contracts are instruments that represent an agreement between two parties that obligates one party to buy, and the other party to sell, specific instruments at an agreed upon price on a stipulated future date. The fund must give the broker a deposit of cash and/or securities (initial margin) whenever it enters into a futures contract. The amount of the deposit may vary from one contract to another. Subsequent payments (variation margin) are made or received by the fund depending on the daily fluctuations in the value of the futures contract and are accounted for as unrealized appreciation or depreciation until the contract is closed, at which time the gains or losses are realized. Futures contracts are traded publicly on exchanges, and their market value may change daily.

Cash Management Transactions: The fund may subscribe to the Brown Brothers Harriman & Co. (BBH) Cash Management Service Sweep (CMS Sweep). The BBH CMS Sweep is an investment product that automatically sweeps the fund’s cash balances into overnight offshore time deposits with either the BBH Grand Cayman branch or a branch of a pre-approved commercial bank. This fully automated program allows the fund to earn interest on cash balances. Excess cash invested with deposit institutions domiciled outside of the U.S., as with any offshore deposit, may be subject to sovereign actions in the jurisdiction of the deposit institution including, but not limited to, freeze, seizure or diminution. The fund bears the risk associated with the repayment of principal and payment of interest on such instruments by the institution with which the deposit is ultimately placed. Balances in the CMS Sweep are accounted for on a cost basis, which approximates market value.

Passive Foreign Investment Companies: The fund may own shares in certain foreign corporations that meet the Internal Revenue Code definition of a passive foreign investment company (PFIC). The fund may elect for tax purposes to mark-to-market annually the shares of each PFIC lot held and would be required to distribute as ordinary income to shareholders any such marked-to-market gains (as well as any gains realized on sale).

(c) Security Transactions:

Security transactions are recorded as of the date the order to buy or sell the security is executed. Realized gains and losses from security transactions are based on the identified costs of the securities involved.

Assets and liabilities denominated in foreign currencies are reported in U.S. dollars. For assets and liabilities held on a given date, the dollar value is based on market exchange rates in effect on that date. Transactions involving foreign currencies, including purchases, sales, income receipts and expense payments, are calculated using exchange rates in effect on the transaction date. Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the differences between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange appreciation or depreciation arises from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period. These realized and unrealized foreign exchange gains or losses are

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

reported in foreign currency transactions or translations on the Statement of Operations. The fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Gains realized by the fund on the sale of securities in certain foreign countries may be subject to non-U.S. taxes. In those instances, the fund records a liability based on unrealized gains to provide for potential non-U.S. taxes payable upon the sale of these securities.

When the fund closes out a futures contract position, it calculates the difference between the value of the position at the beginning and at the end of the contract, and records a realized gain or loss accordingly.

The fund invests in real estate investment trusts (REITs) which report information on the source of their distributions annually. The fund's policy is to record all REIT distributions initially as dividend income on the ex-dividend date and then re-designate them as return of capital and/or capital gain distributions at the end of the reporting period based on information provided annually by each REIT, and management estimates such re-designations when actual information has not yet been reported.

(d) Investment Income:

Interest income is recorded as it accrues. Dividends and distributions from portfolio securities and underlying funds are recorded on the date they are effective (the ex-dividend date), although the fund records certain foreign security dividends on the day it learns of the ex-dividend date. Any distributions from underlying funds are recorded in accordance with the character of the distributions as designated by the underlying funds.

Income received from foreign sources may result in withholding tax. Withholding taxes are accrued at the same time as the related income if the tax rate is fixed and known, unless a tax withheld is reclaimable from the local tax authorities in which case it is recorded as receivable. If the tax rate is not known or estimable, such expense or reclaim receivable is recorded when the net proceeds are received.

(e) Expenses:

Prior to June 1, 2017, expenses that were specific to the fund were charged directly to the fund. Expenses that were common to all funds within the trust were allocated among the funds in proportion to their average daily net assets.

Effective June 1, 2017, pursuant to an Amended and Restated Investment Advisory and Administration Agreement (Advisory Agreement) between Charles Schwab Investment Management, Inc. (CSIM or the investment adviser) and the fund, CSIM pays the operating expenses of the fund, excluding acquired fund fees and expenses, taxes, any brokerage expenses, and extraordinary or non-routine expenses. Taxes, any brokerage expenses and extraordinary or non-routine expenses that are specific to the fund are charged directly to the fund.

(f) Distributions to Shareholders:

The fund generally makes distributions from net investment income, if any, quarterly and from net realized capital gains, if any, once a year.

(g) Accounting Estimates:

The accounting policies described in this report conform to GAAP. Notwithstanding this, shareholders should understand that in order to follow these principles, fund management has to make estimates and assumptions that affect the information reported in the financial statements. It’s possible that once the results are known, they may turn out to be different from these estimates and these differences may be material.

(h) Federal Income Taxes:

The fund intends to meet federal income and excise tax requirements for regulated investment companies under subchapter M of the Internal Revenue Code, as amended. Accordingly, the fund distributes substantially all of its net investment income and net realized capital gains, if any, to its respective shareholders each year. As long as the fund meets the tax requirements, it is not required to pay federal income tax.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

(i) Foreign Taxes:

The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, corporate events, foreign currency exchanges and capital gains on investments. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in foreign markets in which the fund invests. These foreign taxes, if any, are paid by the fund and are disclosed in the Statement of Operations. Foreign taxes payable as of August 31, 2017, if any, are reflected in the fund’s Statement of Assets and Liabilities.

(j) Indemnification: