0000904333 cik0000904333:Target2035CompositeIndexMember 2018-10-31 0000904333 cik0000904333:C000015023Member cik0000904333:MoneyMarketFundMember 2024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-07704

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Omar Aguilar

Schwab Capital Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Item 1: Report(s) to Shareholders.

Annual Report |

October 31, 2024

Schwab International Opportunities Fund

Ticker Symbol: SWMIX

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other

information

about the fund are available from y

our financial interm

ediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab International Opportunities Fund | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month period ended October 31, 2024, the fund returned 20.75%. The MSCI EAFE

®

Index (Net) returned

22.97

%

1

. Over

the 12-month reporting period, all four of the fund’s active subadvisers posted positive returns.

Harris Associates L.P. underperformed its comparative index. As

of October 31, 2024, Harris managed 19.6% of the fund’s net

assets.

■

Detracted from total return:

●

South Korean securities, including NAVER Corp.

●

While there were no additional markets that detracted from

total return, Canadian securities were the smallest

contributors to total return

■

Contributed to total return:

●

German securities, including Fresenius SE & Co. KGaA

●

Securities from the United Kingdom

■

From an individual security perspective:

●

Bayer AG was the largest detractor from total return

●

Lloyds Banking Group PLC was the largest contributor to

total return

Columbia Management Investment Advisers, LLC

underperformed its comparative index. As of October 31, 2024,

Columbia managed 19.9% of the fund’s net assets.

■

Detracted from total return:

●

South Korean securities, including Youngone Corp.

■

Contributed to total return:

●

Japanese securities, including Sankyo Co. Ltd.

●

Securities from the Netherlands

■

From an individual security perspective:

●

Parade Technologies Ltd. was the largest detractor from

●

Primo Water Corp. was the largest contributor to total

American Century Investment Management, Inc.

underperformed its comparative index. As of October 31, 2024,

American Century managed 22.3% of the fund’s net assets.

■

Detracted from total return:

●

South Korean securities, including JYP Entertainment Corp.

(American Century’s position was sold prior to the end of

the reporting period)

■

Contributed to total return:

●

Canadian securities, including Lundin Gold, Inc.

■

From an individual security perspective:

●

Socionext, Inc. was the largest detractor form total return

(American Century’s position was sold prior to the end of

the reporting period)

●

Asics Corp. was the largest contributor to total return

Schwab International Opportunities Fund | Annual Report

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(continued)

Baillie Gifford Overseas Limited outperformed its comparative

index. As of October 31, 2024, Baillie Gifford managed 8.6% of

the fund’s net assets.

■

Detracted from total return:

●

Securities from the United Kingdom, including Class A

holdings of Wise PLC

■

Contributed to total return:

●

Securities from the United States, including NVIDIA Corp.

●

Securities from the Netherlands

■

From an individual security perspective:

●

Kering SA was the largest detractor from total return

●

NVIDIA Corp. was the largest contributor to total return

Schwab Asset Management seeks to track the performance of the FTSE Developed ex US Quality Factor Index. The fund’s allocation

to Schwab Asset Management performed in line with this objective. As of October 31, 2024, Schwab Asset Management managed

25.9% of the fund’s net assets.

Portfolio holdings may have changed since the report date.

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment

returns

and

principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investment (October 31, 2014 - October 31, 2024)

1,2,3,4

Average Annual Total Returns

1,4

| | | |

Fund: Schwab International Opportunities Fund (04/02/2004) 2 | | | |

| | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower.

returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The fund commenced operations on October 16, 1996 which became the Schwab International Opportunities Fund Investor Shares. The Investor Shares were

consolidated

into Select Shares on February 26, 2019. The performance presented is that of the former Select Shares which commenced operations on April 2, 2004.

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations.

Schwab International Opportunities Fund | Annual Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Foreign Tax Paid and Passed Through | |

Gross Income From Foreign Sources | |

Qualified Dividend Income | |

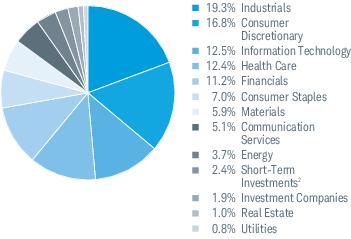

Sector Weightings % of Investments

1

Top Equity Holdings % of Net Assets

Top Country Weightings % of Investments

1

Portfolio holdings may have changed since the report date.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of

MSCI

Inc.

(

) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab International Opportunities Fund | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

www.sec.gov

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab International Opportunities Fund | Annual Report

Annual Report |

October 31, 2024

Schwab Core Equity Fund

Ticker Symbol: SWANX

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other

information

about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 36.17%. The S&P 500

®

Index returned 38.02%.

Over the reporting period, no sectors detracted from the return of the fund. However, the smallest contributors to total return were:

■

Materials sector securities, including Linde PLC

■

Energy sector securities

Top contributors to total return:

■

Information technology sector securities, including NVIDIA, Corp.

■

Financials sector securities

From an individual security perspective:

■

Celsius Holdings, Inc. was the largest detractor from total return

■

NVIDIA, Corp. was the largest contributor to total return

Portfolio holdings may have changed since the report date.

Schwab Core Equity Fund | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

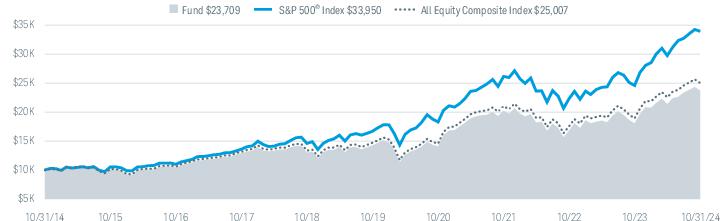

Performance of Hypothetical $10,000 Investment (October 31, 2014 - October 31, 2024)

1

Average Annual Total Returns

1

| | | |

Fund: Schwab Core Equity Fund (07/01/1996) | | | |

| | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower.

These

returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Schwab Core Equity Fund | Annual Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Dividends Received Deduction | |

Qualified Dividend Income | |

Long Term Capital Gain Distribution | |

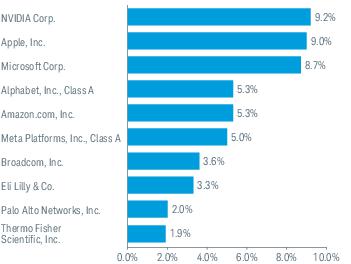

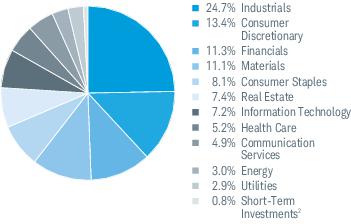

Sector Weightings % of Investments

Top Equity Holdings % of Net Assets

Portfolio holdings may have changed since the report date.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which

was

developed by and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab Core Equity Fund | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

www.sec.gov

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Core Equity Fund | Annual Report

Annual Report |

October 31, 2024

Schwab Dividend Equity Fund

Ticker Symbol: SWDSX

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

Y

ou can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HY

POTHE

TICAL $10,000 INVESTMENT)

| | |

Schwab Dividend Equity Fund | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 31.34%. The S&P 500

®

Index, which serves as the

fund’s regulatory index and provides a broad measure of market per

for

mance, returned 38.02%. The Russell 1000

®

Value Index

which returned 30.98%, is the fund’s additional index, and is more representative of the fund’s investment universe than the

regulatory index.

■

Dividend paying stocks generally performed in line with the broader market, with dividend stocks and non-dividend stocks

returning over 30%

■

Modestly declining interest rates supported stocks in general and particularly dividend paying stocks while solid US economic

growth helped boost earnings

■

As of October 31, 2024, the fund’s dividend yield was 1.93%, lower than the 2.06% dividend yield of the index. As of October 31,

2024, the fund’s 30-Day SEC yield was 1.75%.

■

Top contributors to total return:

●

Financials sector securities, including JPMorgan Chase & Co.

●

Information technology sector securities

■

Over the reporting period, no sectors detracted from the return of the fund. However, the smallest contributors to total return

were:

●

Materials sector securities, including PPG Industries, Inc.

●

Communication services sector securities

■

From an individual security perspective:

●

Broadcom, Inc. was the largest contributor to total return

●

CVS Health Corp. was the largest detractor from total return

Portfolio holdings may have cha

nged

since the report date.

Schwab Dividend Equity Fund | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

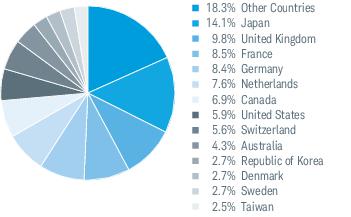

Performance of Hypothetical $10,000 Investment (Oct

obe

r 31, 2014 - October 31, 2024)

1,2

Average Annual Total

Ret

urns

1,2

| | | |

Fund: Schwab Dividend Equity Fund (09/02/2003) | | | |

| | | |

| | | |

Dividend Equity Spliced Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower.

These

returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Russell 1000

®

Value Index to the S&P 500

®

Index. The S&P 500

®

Index provides a

broad measure of market performance. The Russell 1000

®

Value Index is the fund’s additional index and is more representative of the fund’s investment universe than the

regulatory index.

Schwab Dividend Equity Fund | Annual Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

Dividends Received Deduction | |

Qualified Dividend Income | |

Long Term Capital Gain Distribution | |

Sector Weightings % of In

ves

tments

Top Equity Hold

in

gs % of Net As

se

ts

Portfolio holdings may have changed since the report

date

.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Schwab Dividend Equity Fund | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

www.sec.gov

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Dividend Equity Fund | Annual Report

Annual Report |

October 31, 2024

Schwab Large-Cap Growth Fund

Ticker Symbol: SWLSX

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Large-Cap Growth Fund* | | |

Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund.

MANAGEMENT’S DISCUSSION OF FUND PE

RFO

RMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 40.05%. The S&P 500

®

Index, which serves as the

fund’s regulatory index and provides a broad measure of market performance, returned 38.02%. The Russell 1000

®

Growth Index

which returned 43.77%, is the fund’s additional index, and is more representative of the fund’s investment universe than the

regulatory index.

■

Large-cap growth stocks outperformed the broader market primarily as a result of the performance of a few of the “Magnificent

Seven” stocks, fueled by the artificial intelligence trend as well as larger companies outperforming smaller companies in the face of

uncertain economic conditions and higher interest rates

■

Top detractors from total return:

●

Energy sector securities, including EOG Resources, Inc.

●

While there were no additional sectors that detracted from the return of the fund, securities in the materials sector were the

smallest contributors to total return

■

Top contributors to total return:

●

Information technology sector securities, including NVIDIA Corp.

●

Communication services sector securities

■

From an individual security perspective:

●

Class A holdings of Mobileye Global, Inc. was the largest detractor from total return

●

NVIDIA Corp. was the largest contributor to total return

Portfolio holdings may have ch

ang

ed since the report date.

Schwab Large-Cap Growth Fund | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investm

e

nt (October 31, 2014 - October 31, 2024)

1

Average Annual Total R

et

urns

1

| | | |

Fund: Schwab Large-Cap Growth Fund (10/03/2005) | | | |

| | | |

Russell 1000 ® Growth Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower.

These

returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Russell 1000

®

Growth Index to the S&P 500

®

Index. The S&P 500

®

Index provides a

broad measure of market performance. The Russell 1000

®

Growth Index is the fund’s additional index and is more representative of the fund’s investment universe than the

regulatory index.

Schwab Large-Cap Growth Fund | Annual Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Dividends Received Deduction | |

Qualified Dividend Income | |

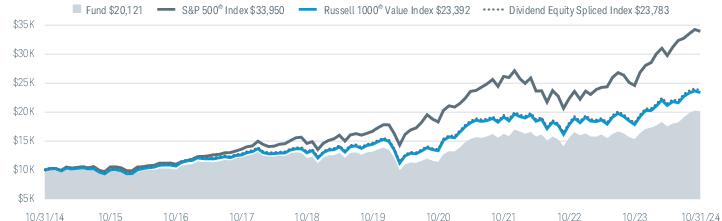

Sector Weightings % of

Inv

estments

1

Top Equity Hold

in

gs % of

Ne

t Assets

Portfolio holdings may have changed since

the

report date.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Schwab Large-Cap Growth Fund | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

www.sec.gov

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Large-Cap Growth Fund | Annual Report

Annual Report |

October 31, 2024

Schwab Small-Cap Equity Fund

This

annual shareholder report

contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Small-Cap Equity Fund | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 32.12%. The S&P 500

®

Index, which serves as the

fund’s regulatory index and provides a broad measure of market performance, returned 38.02%. The Russell 2000

®

Index which

returned 34.07%, is the fund’s additional index, and is more representative of the fund’s investment universe than the regulatory

index.

■

Small-cap stocks underperformed the broader market as broader market performance was primarily driven by the performance of

a few of the “Magnificent Seven” stocks as well as larger companies outperforming smaller companies in the face of uncertain

economic conditions and higher interest rates

■

Top detractors from total return:

●

Energy sector securities, including Weatherford International PLC

●

Communication services sector securities

■

Top contributors to total return:

●

Industrials sector securities, including EMCOR Group, Inc.

●

Health care sector securities

■

From an individual security perspective:

●

Extreme Networks, Inc. was the largest detractor from total return (which was sold prior to the end of the reporting period)

●

Super Micro Computer, Inc. was the largest contributor to total return (which was sold prior to the end of the reporting

period

)

Portfolio holdings may have changed since the report date.

Schwab Small-Cap Equity Fund | Annual Report

T

he performance data quoted represents past performance. Past performance does not guarantee future results.

Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investment (October 31, 2014 - October 31, 2024)

1

Average Annual Total Returns

1

| | | |

Fund: Schwab Small-Cap Equity Fund (07/01/2003) | | | |

| | | |

| | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and

management

costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower.

These

returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Russell 2000

®

Index to the S&P 500

®

Index. The S&P 500

®

Index provides a broad

measure of market performance.

The Russell 2000

®

Index is the fund’s additional index and is more representative of the fund’s investment universe than the regulatory

index.

Schwab Small-Cap Equity Fund | Annual

Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Dividends Received Deduction | |

Qualified Dividend Income | |

Qualified Business Income (199A) | |

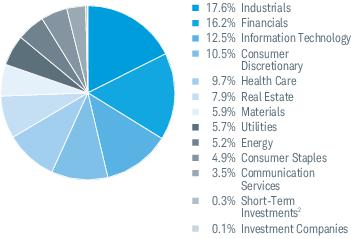

Sector Weightings % of Investments

1

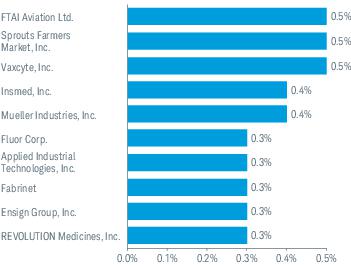

Top Equity Holdings % of Net Assets

Portfolio holdings may have changed since the report date.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was

developed

by and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab Small-Cap Equity Fund | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

www.sec.gov

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Small-Cap Equity Fund | Annual Report

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 17.63%. The S&P 500

®

Index, which serves as the

fund’s regulatory index and provides a broad measure of market performance, returned 38.02%. The Dow Jones Global Health Care

Index which returned 20.01%, is the fund’s additional index, and is more representative of the fund’s investment universe than the

regulatory index.

■

Health care stocks underperformed the broader market as the health care sector is typically more defensive and has lower volatility

than the broader market and tends to underperform in periods of strong growth

■

Top detractors from total return:

●

Electronic equipment & instruments sub-industry securities, including JEOL Ltd. (which was sold prior to the end of the

reporting period)

●

While there were no additional sub-industries that detracted from the return of the fund, securities in the managed health care

sub-industry were the smallest contributors to total return

■

Top contributors to total return:

●

Pharmaceuticals sub-industry securities, including Eli Lilly & Co.

●

Biotechnology sub-industry securities

■

From an individual security perspective:

●

Humana, Inc. was the largest detractor from total return (which was sold prior to the end of the reporting period)

●

Eli Lilly & Co. was the largest contributor to total return

Portfolio holdings may have changed

since

the report date.

Schwab Health Care Fund | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

Performance of Hypothetical $10,000 Investment (October 31, 2014 - October 31, 2024)

Average Annual Total Returns

| | | |

Fund: Schwab Health Care Fund (07/03/2000) | | | |

| | | |

Dow Jones Global Health Care Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include

trading

and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns

would

have been lower.

These

returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Dow Jones Global Health Care Index to the S&P 500

®

Index. The S&P 500

®

Index

provides a broad measure of market performance. The Dow Jones Global Health Care Index is the fund’s additional index and is more representative of the fund’s

investment universe than the regulatory index.

Schwab Health Care Fund | Annual Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Dividends Received Deduction | |

Qualified Dividend Income | |

Long Term Capital Gain Distribution | |

Industry Weightings % of Investments

Top Equity Holdings % of Net Assets

Top Country Weightings % of Investments

Portfolio holdings may have changed

since

the report date.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Schwab Health Care Fund | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Health Care Fund | Annual Report

Schwab International Core Equity Fund

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information

about

the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab International Core Equity Fund* | | |

Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund.

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 26.12%. The MSCI EAFE

®

Index (Net) returned

22.97%

1

.

Top contributors to total return:

■

Japanese securities, including Hitachi, Ltd.

■

Securities from the United Kingdom

Top detractors from total return:

■

Norwegian securities, including Equinor ASA (which was sold prior to the end of the reporting period)

From an individual security perspective:

■

Hitachi, Ltd. was the largest contributor to total return

■

Lasertec Corp. was the largest detractor from total return

Portfolio holdings may have changed since the report date.

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

Schwab International Core Equity Fund | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

Performance of Hypothetical $10,000 Investment (October 31, 2014 - October 31, 2024)

Average Annual Total Returns

| | | |

Fund: Schwab International Core Equity Fund (05/30/2008) | | | |

| | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower.

These

returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations.

Schwab International Core Equity Fund | Annual

Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Foreign Tax Paid and Passed Through | |

Gross Income From Foreign Sources | |

Qualified Dividend Income | |

Sector Weightings % of Investments

Top Equity Holdings % of Net Assets

Top Country Weightings % of

Investments

Portfolio holdings may have changed since the report date.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc.

(

MSCI

) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab International Core Equity Fund | Annual

Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab International Core Equity Fund | Annual Report

This

annual shareholder report

contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. This agreement to limit the total annual

fund operating expenses is limited to the fund’s direct operating expenses and, therefore, does not apply to acquired fund fees and expenses (AFFE), which are indirect

expenses incurred by the fund through its investments in the underlying funds.

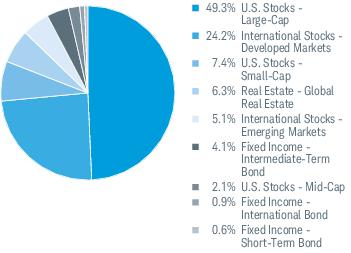

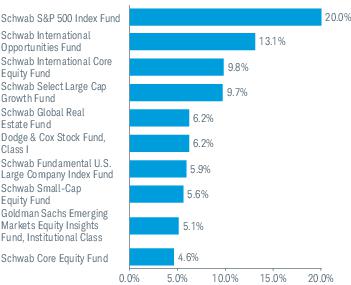

MANAGEMENT’S DISCUSSION OF FUND

PERFORMANCE

For the 12-mont

h reporti

ng period ended October 31, 2024, the fund returned 24.80%. The S&P 500

®

Index, which provides a

broad measure of equity market performance, and the Bloomberg US Aggregate Bond Index, which provides a broad measure of

bond market performance, returned 38.02% and 10.55%, respectively. The fund’s internally calculated comparative index, the

Balanced Blended Index (the composite index), returned 24.61%.

■

Asset allocations were broadly in line with those of the composite index

■

Top contributors to total return:

●

Schwab Core Equity Fund

●

Schwab Select Large Cap Growth Fund

■

Over the reporting period, there were no detractors from the return of the fund. However, the smallest contributors to total return

were:

●

Schwab International Opportunities Fund

●

Schwab Small-Cap Equity Fund

Portfolio holdings may have changed since the report date.

Sch

wab Balanc

ed Fund | Annual

Report

The performance data quoted represents past performance.

Past performance does not guarantee future results. Investmen

t return

s

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

Performance of Hypothetical $10,000 Investment (October 31, 2014 - October 31, 2024)

Average Annual Total Returns

| | | |

Fund: Schwab Balanced Fund (11/18/1996) | | | |

| | | |

Bloomberg US Aggregate Bond Index | | | |

| | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower.

These

returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Schwab

Balanced

Fund |

Annual

Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Dividends Received Deduction | |

Qualified Dividend Income | |

Long Term Capital Gain Distribution | |

Business Interest Deduction (163j) | |

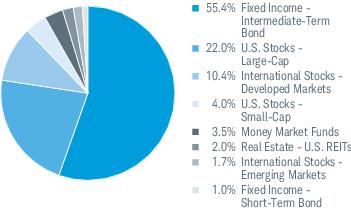

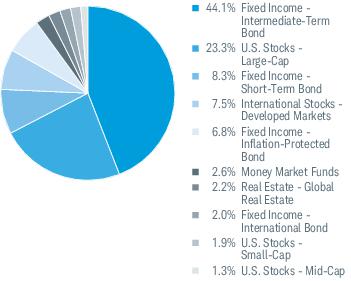

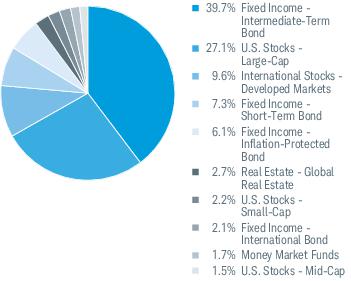

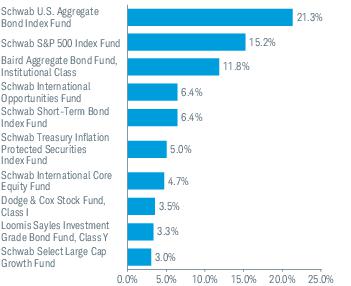

Asset Class Weightings % of Investments

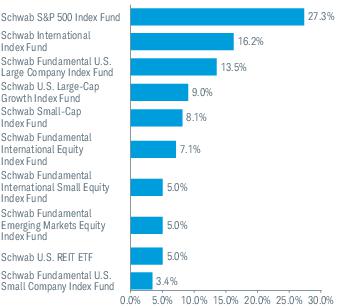

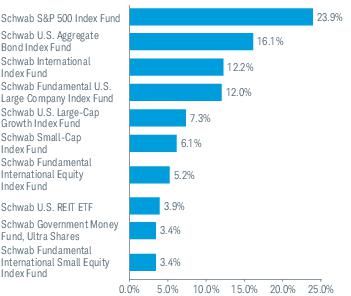

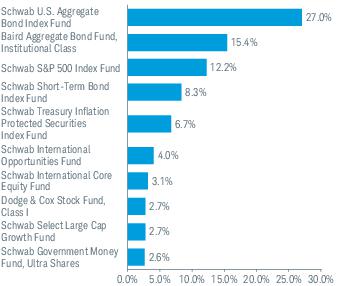

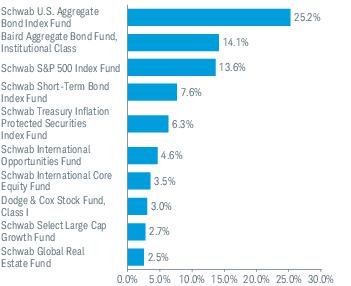

Top Holdings % of Net Assets

Portfolio holdings may

have

changed since the report date.

The holdings listed exclude any temporary liquidity investments.

Schwab Balanced Fund | Annual

Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Balanced Fund | Annual Report

Annual Report |

October 31, 2024

Schwab S&P 500 Index Fund

Ticker Symbol: SWPPX

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

.

You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

This report describes changes to the fund that occurred during the reporting period.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab S&P 500 Index Fund | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 37.95%. The S&P 500

®

Index returned 38.02%

during the same period. Differences between the return of the fund and the return of the S&P 500

®

Index may be attributable to,

among other things, the operational and transactional costs incurred by the fund and not the index.

Over the reporting period, no sectors detracted from the return of the fund. However, the smallest contributors to total return were:

■

Energy sector securities, including Schlumberger Ltd. (which detracted from the total return of the fund)

■

Materials sector securities

Top contributors to total return:

■

Information technology sector securities, including NVIDIA Corp.

■

Financials sector

securities

Portfolio holdings may have changed since the report

date

.

Schwab S&P 500 Index Fund | Annual Report

The performance data quoted represents past performance.

Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investment (October 31, 2014 - October 31, 2024)

1

Average Annual Total Returns

1

| | | |

Fund: Schwab S&P 500 Index Fund (05/19/1997) | | | |

| | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Index ownership – “Standard & Poor’s

®

,” “S&P

®

,” and “S&P 500

®

” are registered trademarks of Standard & Poor’s Financial Services LLC (S&P), and “Dow Jones

®

” is a

registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates and sublicensed for

certain purposes by Charles Schwab Investment Management, Inc. The “S&P 500

®

Index” is a product of S&P Dow Jones Indices LLC or its affiliates, and has been licensed for

use by Charles Schwab Investment Management, Inc. The Schwab S&P 500 Index Fund is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow

Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affiliates make any representation regarding the

advisability of investing in the fund.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Schwab S&P 500 Index Fund | Annual

Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Dividends Received Deduction | |

Qualified Dividend Income | |

Qualified Business Income (199A) | |

Sector Weightings % of Investments

1

Top Equity Holdings % of Net Assets

Portfolio holdings may have changed since the

report

date.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab S&P 500 Index Fund | Annual Report

This

is a summary of certain changes to the fund since November 1, 2023. For more complete information, you may review the

fund’s prospectus at

www.schwabassetmanagement.com/prospectus

or upon request by calling

1-866-414-6349

or by sending

an email request to

orders@mysummaryprospectus.com

.

■

Effective August 23, 2024, the fund revised its diversification policy under the Investment Company Act of 1940, as amended.

Under the revised policy, the fund will continue to track its benchmark index even if the fund becomes non-diversified as a result of

a change in relative market capitalization or index weighting of one or more constituents of the index. Shareholder approval will not

be sought if the fund crosses from diversified to non-diversified status under such

circumstances

.

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus,

Statement

of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

www.sec.gov

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the SEC’s

website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab S&P 500 Index Fund | Annual Report

Schwab Small-Cap Index Fund

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Small-Cap Index Fund | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 34.14%. The S&P 500

®

Index, which serves as the

fund’s regulatory index and provides a broad measure of market performance, returned 38.02%. The fund generally invests in

securities that are included in the Russell 2000

®

Index which returned 34.07% during the same period. The fund does not seek to

track the regulatory index.

Top contributors to total return:

■

Financials sector securities, including Class A holdings of Jackson Financial, Inc.

■

Industrials sector securities

Top detractors from total return:

■

Energy sector securities, including Class A holdings of PBF Energy, Inc.

■

While there were no additional sectors that detracted from the total return of the fund, utilities sector securities were the

smallest contributors to total return

Portfolio

holdings

may have changed since the report date.

Schwab Small-Cap Index Fund | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

Performance of Hypothetical $10,000 Investment (October 31, 2014 - October 31, 2024)

Average Annual Total Returns

| | | |

Fund: Schwab Small-Cap Index Fund (05/19/1997) | | | |

| | | |

| | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Index ownership – “Russell 2000

®

” is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab Small-Cap Index Fund. The

Schwab Small-Cap Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding the advisability of investing in the

fund.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Russell 2000

®

Index to the S&P 500

®

Index. The S&P 500

®

Index provides a broad

measure of market performance. The fund generally invests in securities that are included in the Russell 2000

®

Index. The fund does not seek to track the regulatory index.

Schwab Small-Cap Index Fund | Annual

Report

| |

| |

(excludes in-kind transactions) | |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Dividends Received Deduction | |

Qualified Dividend Income | |

Qualified Business Income (199A) | |

Sector Weightings % of Investments

Top Equity Holdings % of Net Assets

Portfolio holdings may have changed since the

report

date.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab Small-Cap Index Fund | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Small-Cap Index Fund | Annual Report

Schwab Total Stock Market Index Fund

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

.

You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Total Stock Market Index Fund | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 37.98%. The Dow Jones U.S. Total Stock Market

Index

SM

returned 37.99% during the same period. Differences between the return of the fund and the return of the Dow Jones

U.S. Total Stock Market Index

SM

may be attributable to, among other things, the operational and transactional costs incurred by the

fund and not the index.

Over the reporting period, no sectors detracted from the return of the fund. However, the smallest contributors to total return were:

■

Energy sector securities, including Schlumberger Ltd. (which detracted from the total return of the fund)

■

Materials sector securities

Top contributors to total return:

■

Information technology sector securities, including NVIDIA Corp.

■

Financials sector securities

Portfolio holdings may have changed since

the

report date.

Schwab Total Stock Market Index Fund | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

Performance of Hypothetical $10,000 Investment (October 31, 2014 - October 31, 2024)

Average Annual Total Returns

| | | |

Fund: Schwab Total Stock Market Index Fund (06/01/1999) | | | |

Dow Jones U.S. Total Stock Market Index SM | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Index ownership – “Standard & Poor’s

®

” and “S&P

®

” are registered trademarks of Standard & Poor’s Financial Services LLC (S&P), and “Dow Jones

®

” is a registered trademark

of Dow Jones Trademark Holdings LLC (Dow Jones) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates and sublicensed for certain purposes by

Charles Schwab Investment Management, Inc. The “Dow Jones U.S. Total Stock Market Index

SM

” is a product of S&P Dow Jones Indices LLC or its affiliates, and has been

licensed for use by Charles Schwab Investment Management, Inc. The Schwab Total Stock Market Index Fund is not sponsored, endorsed, sold or promoted by S&P Dow

Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affiliates make any

representation regarding the advisability of investing in the fund.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Schwab Total Stock Market Index Fund | Annual Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Dividends Received Deduction | |

Qualified Dividend Income | |

Qualified Business Income (199A) | |

Sector Weightings % of Investments

Top Equity Holdings % of Net Assets

Portfolio

holdings

may have

changed

since the report date.

The Sector/Industry classifications in this report use the Global

Industry

Classification

(GICS)

which

was developed

by

and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab Total Stock Market Index Fund | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Total Stock Market Index Fund | Annual Report

Schwab U.S. Large-Cap Growth Index Fund

This annual shareholder report contains important information about the fund for the period of November 1, 2023, to October 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED October 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab U.S. Large-Cap Growth Index Fund | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended October 31, 2024, the fund returned 43.77%. The S&P 500

®

Index, which serves as the

fund’s regulatory index and provides a broad measure of market performance, returned 38.02%. The fund generally invests in

securities that are included in the Russell 1000

®

Growth Index which returned 43.77% during the same period. The fund does not

seek to track the regulatory index.

Top contributors to total return:

■

Information technology sector securities, including NVIDIA Corp.

■

Communication services sector securities

Over the reporting period, no sectors detracted from the return of the fund. However, the smallest contributors to total return were:

■

Energy sector securities, including APA

Corp

. (which detracted from the total return of the fund)

■

Utilities sector securities

Portfolio holdings may have changed since the report date.

Schwab U.S. Large-Cap Growth Index Fund | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost.

Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

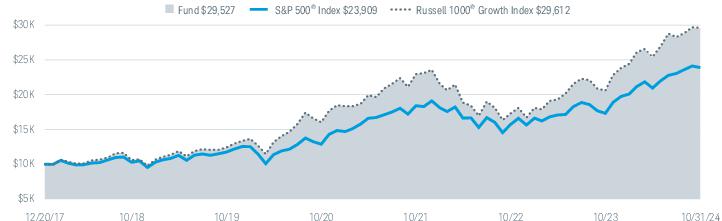

Performance of Hypothetical $10,000 Investment (December 20, 2017 - October 31, 2024)

| | | |

Fund: Schwab U.S. Large-Cap Growth Index Fund (12/20/2017) | | | |

| | | |

Russell 1000 ® Growth Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Index ownership – The Russell 1000

®

Growth Index is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab U.S. Large-Cap

Growth Index Fund. The Schwab U.S. Large-Cap Growth Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding

the advisability of investing in the fund.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Russell 1000

®

Growth Index to the S&P 500

®

Index. The S&P 500

®

Index provides a

broad measure of market performance. The fund generally invests in securities that are included in the Russell 1000

®

Growth Index. The fund does not seek to track the

regulatory index.

Schwab U.S. Large-Cap Growth Index Fund | Annual Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

Dividends Received Deduction | |

Qualified Dividend Income | |

Qualified Business Income (199A) | |

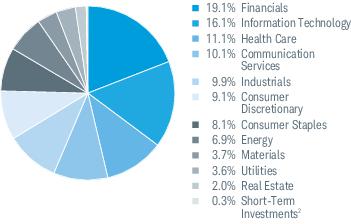

Sector Weightings % of Investments

Top Equity Holdings % of Net Assets

Portfolio holdings may have changed since the report date.

The Sector/Industry classifications in this report

use

the

Global

Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc.