Exhibit (a)(5)(xii)

UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF DELAWARE

ARTHUR NEWMAN, on behalf of himself and all others similarly situated, Plaintiff, vs. SPARK THERAPEUTICS, INC., STEVEN ALTSCHULER, M.D., LARS EKMAN, M.D., PH.D., KATHERINE HIGH, M.D., JEFFREY D. MARAZZO, ANAND MEHRA, M.D., VIN MILANO, ROBERT J. PEREZ, ELLIOT SIGAL, M.D., PH.D., and LOTA ZOTH, Defendants. | Case No.: CLASS ACTION COMPLAINT CLASS ACTION COMPLAINT FOR VIOLATIONS OF THE SECURITIES EXCHANGE ACT OF 1934 JURY DEMAND |

Plaintiff Arthur Newman (“Plaintiff”), on behalf of himself and the proposed Class defined herein, brings this class action suit for violations of Sections 14(e) and 20(a) of the Securities Exchange Act of 1934. In support of this Class Action Complaint, Plaintiff, by his attorneys, alleges upon information and belief, except for his own acts, which are alleged on knowledge, as follows:

NATURE OF THE ACTION

1. Plaintiff brings this action on behalf of himself and the public stockholders of Spark Therapeutics, Inc. (“Spark” or the “Company”) against the Company and Spark’s Board ofDirectors (collectively, the “Board” or the “Individual Defendants,” as further defined below) for violations of Sections 14(e), and 20(a) of the Securities Exchange Act of 1934 (“Exchange Act”), §§78n(e) and 78t(a) respectively, and U.S. Securities and Exchange Commission (the “SEC”) Rule

14d-9 (17 C.F.R. § 240.14d-9) and SEC Regulation G, 17 C.F.R. 244.100, in connection with the proposed acquisition of Spark by Roche Holdings, Inc. (“Roche”).

2. On February 25, 2019, the Company announced that it had entered into an agreement and plan of merger (the “Merger Agreement”) with Roche, by which Roche (through a wholly-owned subsidiary) will acquire all of the outstanding shares of Spark common stock through an all-cash tender offer at a purchase price of $114.50 per share (the “Proposed Transaction”). The February 25 Press Release disclosed that the Proposed Transaction would be accomplished through a tender offer rather than a shareholder vote (“Tender Offer”).

3. The Tender Offer commenced on March 7, 2019 when the Company filed a Recommendation Statement on Schedule 14D-9 (the “14D-9”) with the SEC, recommending that the Company’s stockholders tender their shares for the Tender Offer price. The Tender Offer is set to expire on April 3, 2019.

4. Plaintiff alleges that the 14D-9 is materially false and/or misleading because,inter alia, it fails to disclose certain material projected internal financial information about the Company, relied on by the Individual Defendants to recommend the Tender Offer and certain inputs underlying certain valuation methodologies employed by the Company’s financial advisor

Centerview Partners LLC (“Centerview”) in their financial analysis that support the fairness opinions provided by Centerview. These omissions render the projected financial disclosures and the summary of the fairness opinion in the 14D-9 incomplete and/or misleading.

5. The failure to adequately disclose such material information constitutes a violation of §§ 14(e) and 20(a) of the Exchange Act, among other reasons, because Spark stockholders are entitled to such information in order to make a fully-informed decision regarding whether to tender their shares in connection with the Tender Offer.

6. For these reasons and as set forth in detail herein, the Individual Defendants have violated federal securities laws. Accordingly, Plaintiff seeks to enjoin the Tender Offer or, in the event the Tender Offer is consummated, recover damages resulting from the Individual Defendants’ violations of these laws. Judicial intervention is warranted here to rectify existing and future irreparable harm to the Company’s stockholders.

JURISDICTION AND VENUE

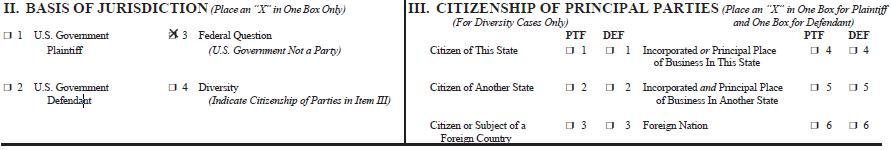

7. The claims asserted herein arise under §§ 14(e) and 20(a) of the Exchange Act, 15 U.S.C. § 78aa. The Court has subject matter jurisdiction pursuant to § 27 of the Exchange Act, 15 U.S.C. § 78aa, and 28 U.S.C. § 1331 (federal question jurisdiction).

8. The Court has personal jurisdiction over each of the Defendants because each conducts business in and maintains operations in this District or is an individual who either is present in this District for jurisdictional purposes or has sufficient minimum contacts with this District as to render the exercise of jurisdiction by this Court permissible under traditional notions of fair play and substantial justice.

9. Venue is proper in this District under § 27 of the Exchange Act, 15 U.S.C. § 78aa, as well as pursuant to 28 U.S.C. § 1391, because a substantial portion of the events or omissions occurred in this District.

PARTIES

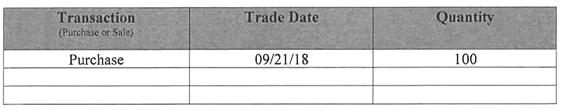

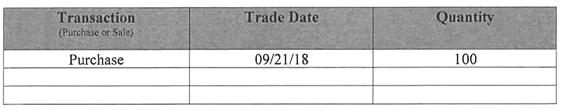

10. Plaintiff is, and has been at all relevant times, the owner of shares of Spark common stock.

11. Defendant Spark is a Delaware corporation with its principal executive offices located at 3737 Market Street, Suite 1300, Philadelphia, PA 19104. Spark’s common stock trades on the NASDAQ stock exchange under the ticker symbol “ONCE”.

12. Individual Defendant Dr. Steven Altschuler (“Altschuler”) has served as Chairman and a member of the Board since October 2013.

13. Individual Defendant Dr. Lars Ekman (“Ekman”) has served as a member of the Board since May 2014.

14. Individual Defendant Dr. Katherine High (“High”) has served as a member of the Board since September 2014.

15. Individual Defendant Jeffrey D. Marazzo (“Marazzo”) has served as a member of the Board since September 2013 and serves as the Chief Executive Officer (“CEO”) for the Company.

16. Individual Defendant Dr. Anand Mehra (“Mehra”) has served as a member of the Board since May 2014.

17. Individual Defendant Vincent Milano (“Milano”) has served as a member of the Board since June 2014.

18. Individual Defendant Robert Perez (“Perez”) has served as a member of the Board since January 2018.

19. Individual Defendant Dr. Elliot Sigal (“Sigal”) has served as a member of the Board since January 2014.

20. Individual Defendant Lota Zoth (“Zoth”) has served as a member of the Board since January 2016.

21. The Individual Defendants referred to above are collectively referred to herein as the “Individual Defendants” and/or the “Board.” The Individual Defendants and Spark may also collectively be referred to as “Defendants.”

CLASS ACTION ALLEGATIONS

22. Plaintiff brings this action individually and as a class action on behalf of all holders of Spark stock who are being, and will be, harmed by Defendants’ actions described herein (the “Class”). Excluded from the Class are Defendants herein and any person, firm, trust, corporation, or other entity related to, controlled by, or affiliated with, any Defendant, including the immediate family members of the Individual Defendants.

23. This action is properly maintainable as a class action under Federal Rule of Civil Procedure 23.

24. The Class is so numerous that joinder of all members is impracticable. As of February 15, 2019, there were 37,961,302 shares of common stock issued and outstanding. On information and belief, these shares are held by thousands of beneficial holders who are geographically dispersed across the country.

25. There are questions of law and fact which are common to the Class and which predominate over questions affecting any individual Class member. The common questions include, inter alia, the following:

| a. | whether Defendants have violated Sections 14 and 20 of the Exchange Act, and SEC regulations promulgated thereunder, in connection with the Tender Offer; and |

| b. | whether Plaintiff and the other members of the Class would be irreparably harmed and/or otherwise damaged were the transaction complained of herein consummated. |

26. Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff does not have any interests adverse to the Class.

27. Plaintiff is an adequate representative of the Class, has retained competent counsel experienced in litigation of this nature, and will fairly and adequately protect the interests of the Class.

28. The prosecution of separate actions by individual members of the Class creates a risk of inconsistent or varying adjudications with respect to individual members of the Class, which could establish incompatible standards of conduct for Defendants.

29. Plaintiff anticipates that there will be no difficulty in the management of this litigation. A class action is superior to other available methods for the fair and efficient adjudication of this controversy.

30. Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class a whole.

31. Accordingly, Plaintiff seeks injunctive and other equitable relief on behalf of himself and the Class to prevent the irreparable injury that the Company’s stockholders will suffer absent judicial intervention and, in the absence of injunctive relief, seeks to pursue a claim for damages.

SUBSTANTIVE ALLEGATIONS

| I. | Background and the Tender Offer |

32. Spark is a pharmaceutical company founded in 2013 that develops, manufactures, and markets gene therapiesincluding for blindness, hemophilia, lysosomal storage disorders and neurodegenerative diseases. The Company touts that it has successfully applied its technology in the first gene therapy approved in both the U.S. and EU for a genetic disease, and currently has

four programs in clinical trials, including product candidates that have shown promising early results in patients with hemophilia.

33. On February 25, 2019, Spark announced the Proposed Transaction, which stated the following, in relevant part:

Spark Therapeutics Enters into Definitive Merger Agreement with Roche

Roche to acquire Spark Therapeutics for $114.50 per share representing a total equity value of $4.8 billion

Spark Therapeutics will continue its operations in Philadelphia as an independent company within the Roche Group

Transaction expected to close in Q2, 2019

PHILADELPHIA, Feb. 25, 2019 (GLOBE NEWSWIRE) -- Spark Therapeutics (NASDAQ: ONCE), a fully integrated, commercial gene therapy company dedicated to challenging the inevitability of genetic disease, announced today that it has entered into a definitive merger agreement for Roche to fully acquire Spark Therapeutics at a price of $114.50 per share in an all-cash transaction. This corresponds to a total equity value of approximately $4.8 billion on a fully diluted basis, inclusive of approximately $500 million of projected net cash expected at close. The per share price represents a premium of 122 percent to Spark’s closing price on Feb. 22, 2019. The merger agreement has been unanimously approved by the boards of both Spark and Roche.

Under the terms of the merger agreement, Roche will promptly commence a tender offer to acquire all outstanding shares of Spark’s common stock, and Spark will file a recommendation statementcontaining the unanimous recommendation of the Spark board that Spark shareholders tender their shares toRoche.

“As the only biotechnology company that has successfully commercialized a gene therapy for a genetic disease in the U.S., we have built unmatched competencies in the discovery, development and delivery of genetic medicines. But the needs of patients and families living with genetic diseases are immediate and vast,” said Jeffrey D. Marrazzo, chief executive officer of Spark Therapeutics. “With its worldwide reach and extensive resources, Roche will help us accelerate the development of more gene therapies for more patients for more diseases and further expedite our vision of a world where no life is limited by genetic disease.

“Spark Therapeutics’ proven expertise in the entire gene therapy value chain may offer important new opportunities for the treatment of serious diseases,” said Severin Schwan, chief executive officer of Roche. “In particular, Spark’s hemophilia A program could become a new therapeutic option for people living with this disease. We are also excited to continue the investments in Spark’s broad product portfolio and commitment to Philadelphia as a center of excellence.”

Spark Therapeutics will continue its operations in Philadelphia as an independent company within the Roche Group.

Terms of the Agreement

Under the terms of the merger agreement,Rochewill promptly commence a tender offer to acquire all of the outstanding shares of Spark Therapeutics’ common stock at a price of$114.50per share in cash. The closing of the tender offer will be subject to a majority of Spark Therapeutics’ outstanding shares being tendered. In addition, the transaction is subject to the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and other customary conditions.

Following completion of the tender offer,Rochewill acquire all remaining shares at the same price of$114.50per share through a second step merger. The closing of the transaction is expected to take place in the second quarter of 2019.

Centerview Partnersis acting as financial advisor toSparkTherapeuticsand Goodwin Procter LLPis acting as legal counsel toSpark Therapeutics. Cowen also acted as a financial advisor in this transaction to Spark Therapeutics. Citi is acting as financial advisor to Rocheand Davis Polk & Wardwell LLPis acting as legal counsel to Roche.1

34. Spark appears well-positioned for growth and the Merger Consideration appears inadequate in view of developments prior to the announced Merger Agreement.

35. Spark reported nearly $65 million in total revenue for 2018, of which $27 million came from net sales of Luxturna. In December 2017, Luxturna became the first gene therapy approved for a genetic disease by the U.S. Food and Drug Administration. Used to treat Leber’s congenital

1 Cowen ultimately was not engaged: “The Company also engaged Cowen to render a second fairness opinion in the event of a potential transaction with one of the potentially interested parties (other than Roche Holdings) as described in Item 4 under the heading titled ‘Background of the Transactions.’ In connection with this engagement, the Company agreed to pay Cowen a fee of $500,000 upon announcement of the Transactions in the event Cowen did not render such fairness opinion. In the event that a fairness opinion was requested by the Company, $1,000,000 in the aggregate would have been payable to Cowen.The Board did not request Cowen to render a fairness opinion.The Company also agreed to reimburse Cowen for its reasonable and documented out-of-pocket expenses incurred in connection with this engagement, and to indemnify Cowen and its affiliates in a similar manner as described above with respect to Centerview.” See 14D-9, p. 36.

amaurosis, a rare inherited form of blindness that affects the retinas of about 1,000 children in the United States, a single injection of Luxturna to the retina restores sight in infants.

36. In January 2018, the Swiss drug maker Novartis agreed to pay Spark $105 million, and up to $65 million more pending European regulatory approvals and early sales, to sell Luxturna outside the U.S.

37. Last April, Spark, announced it would receive a $110 million jackpot it planned to use to fund research and development on new experimental drugs in its pipeline for hemophilia.

Roche’s pipeline also includes drugs for hemophilia, the company has reported.

38. That windfall came from Spark’s selling a “priority review voucher” to the Irish biopharmaceutical company Jazz Pharmaceuticals, which has offices in Philadelphia. The FDA uses such vouchers -- which fast-track federal review of medicines -- to encourage drug companies to develop treatments for rare illnesses in children and tropical diseases. Spark had received the voucher it sold to Jazz in December 2017 after the FDA approved Luxturna.2

39. Thus, it appears that Spark is well-positioned for financial growth, and that the Tender Offer fails to adequately compensate the Company’s shareholders. It is imperative that

Defendants disclose the material information they have omitted from the 14D-9, discussed in detail below, so that the Company’s shareholders can properly assess the fairness of the Tender Offer for themselves and make an informed decision concerning whether to tender their shares.

2 Philadelphia Inquirer,Report: Roche Holding is close to a deal to buy Philly gene-therapy start-up Spark Therapeutics Inc. (Feb. 23, 2019), available at: www.philly. com/news/roche-holding-spark-therapeutics-biotech-deal-philadelphia-20190224.html(last visited Mar. 18, 2019).

| II. | The 14D-9 Omits Material Information |

40. On March 7, 2019, Spark filed the 14D-9 with the SEC in support of the Tender Offer. As alleged below and elsewhere herein, the 14D-9 contains material misrepresentations and omissions of fact that must be cured to allow Spark’s stockholders to make an informed decision with respect to the Tender Offer. Specifically, the 14D-9 omits material information regarding: (i) certain of the Company’s financial projections; and (ii) the valuation analyses performed by the Company’s financial advisor in support of their respective fairness opinions.

The Company’s Financial Forecasts

41. The 14D-9 discloses certain financial projections based on four different scenarios on pages 34-36, which were developed by the Company’s management, relied upon the Board in recommending the Tender Offer. The 14D-9 discloses:

Case 1 Forecasts. The Case 1 Forecasts include long-term, risk-adjusted projections from fiscal years 2019 through 2035 for LUXTURNATMand the Company’s product pipeline for hemophilia A, hemophilia B, Pompe disease and Huntington’s disease. The Case 1 Forecasts include projected total revenues, including revenues from milestone and royalty payments. The Case 1 Forecasts also include senior management’s projection of operating expenses, which include research and development expenses, selling and marketing expenses, and general and administrative expenses not attributed to a specific product or product candidate. The Case 1 Forecasts are based upon certain financial, operating and commercial assumptions developed solely using the information available to the Company’s senior management at the time the Case 1 Forecasts were created. In addition, at the direction of the Company’s management, Centerview calculated, from the Case 1 Forecasts, unlevered free cash flow as set forth below for use in certain of its financial analyses.

Case 2 Forecasts. The Case 2 Forecasts assume a different mix of launch price, market share, and percentage of the total patient population eligible for the Company’s hemophilia A and Pompe programs based on a higher assessment of possible outcomes for market share for such programs. At the direction of the Company’s management, Centerview calculated, from the Case 2 Forecasts, unlevered free cash flow as set forth below for use in certain of its financial analyses.

Case 3 Forecasts. The Case 3 Forecasts assume a different mix of launch price, market share, and percentage of the total patient population eligible for the

Company’s hemophilia A and Pompe programs based on a higher assessment of possible outcomes for the launch price for such programs. At the direction of theCompany’s management, Centerview calculated, from the Case 3 Forecasts, unlevered free cash flow as set forth below for use in certain of its financial analyses.

Case 4 Forecasts. The Case 4 Forecasts assume a different mix of launch price, market share, and percentage of the total patient population eligible for the Company’s hemophilia A and Pompe programs based on potential successful development of new technology allowing access to the total patients eligible for the Company’s programs for hemophilia A and Pompe disease. At the direction of the Company’s management, Centerview calculated, from the Case 4 Forecasts, unlevered free cash flow as set forth below for use in certain of its financial analyses.

14D-9, pp. 35-36.

42. Each case discloses projected Unlevered Free Cash Flow (“UFCF”) from 2019 through 2035. UFCF is a non-GAAP (generally accepted accounting principles) financial measure. Defendants define UFCF as “. . . earnings before interest, taxes, depreciation and amortization, less capital expenditures, less changes in net working capital and less tax expense.”

Seen.1 to each “Case 1-4 Forecast” of the financial projections, 14D-9, pp. 35-36.

43. The 14D-9 does not however disclose the projected line items of (i) earnings before interest, taxes, depreciation and amortization (“EBITDA”), (ii) capital expenditures, (iii) changes in net working capital, and (iv) tax expense, that were used to project UFCF.

44. Also glaringly absent from the calculation of UFCF and the Company’s other projected financial metrics is an accounting for stock-based compensation expenses, which the Company treats in accordance with the provisions of ASC Topic 718,Compensation-Stock Compensation(“ASC 718”), which requires the recognition of expenses related to the fair value of stock-based compensation awards in the Statement of Operations.

45. Stock-based compensation (“SBC”) appears to be a significant expense. As reported in the Company’s annual report for fiscal year ending December 31, 2018, “Net cash used

in operating activities was $70.6 million for the year ended December 31, 2018, and consisted of a net loss of $78.8 million adjusted for non-cash items, including depreciation and amortization expense of $6.9 million,stock-based compensation expense of $48.6 million, non-cash rent income of $2.5 million, a loss on disposal of equipment of $0.1 million, an unrealized loss on equity investments of $5.1 million, non-cash interest income of $1.1 million and acquired in-process research and development expense of $0.3 million related to a license agreement.” Form 10-K, p. 91 (emphasis added).

46. This omitted information is material information because Defendants themselves disclose that “Unlevered free cash flow is a non-GAAP financial measure. Non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. Additionally, non-GAAP financial measures as presented in this Schedule 14D-9 may not be comparable to similarly titled measures reported by other companies.” 14D-9, p. 36.

47. Clearly, shareholders would find the aforementioned information material since the Board’s unanimous recommendation that shareholders tender their shares in connection with theTender Offer was based in part on its review of this information. 14D-9, p. 22.3

48. The use of non-GAAP compliant financial measures, as was done here, is misleading. When a company discloses non-GAAP financial measures in a 14D-9 that were relied on by a board of directors to recommend that shareholders exercise their corporate suffrage rights

3 “The Company’s Operating and Financial Condition and Prospects. The Board considered the Company’s operating and financial performance and its prospects, including certain prospective forecasts for the Company prepared by the Company’s senior management, which reflect an application of various assumptions of senior management. The Board considered the inherent uncertainty of achieving management’s prospective forecasts, as set forth under the heading titled ‘—Certain Prospective Financial Information,’ and that as a result the Company’s actual financial results in future periods could differ materially from senior management’s forecasts.”

in a particular manner, the Company must, pursuant to SEC regulatory mandates, also disclose all projections and information necessary to make the non-GAAP measures not misleading, and must provide a reconciliation (by schedule or other clearly understandable method) of the differences between the non-GAAP financial measure disclosed or released with the most comparable financial measure or measures calculated and presented in accordance with GAAP. 17 C.F.R. § 244.100.

49. Indeed, the SEC has increased its scrutiny of the use of non-GAAP financial measures in communications with shareholders. Former SEC Chairwoman Mary Jo White has stated that the frequent use by publicly traded companies of unique company-specific non-GAAP financial measures (as Spark included in the 14D-9 here), implicates the centerpiece of the SEC’s disclosures regime:

In too many cases, the non-GAAP information, which is meant to supplement the GAAP information, has become the key message to investors, crowding out and effectively supplanting the GAAP presentation. Jim Schnurr, our Chief Accountant, Mark Kronforst, our Chief Accountant in the Division of Corporation Finance and I, along with other members of the staff, have spoken out frequently about our concerns to raise the awareness of boards, management and investors. And last month, the staff issued guidance addressing a number of troublesome practiceswhich can make non-GAAP disclosures misleading: the lack of equal or greater prominence for GAAP measures; exclusion of normal, recurring cash operating expenses; individually tailored non-GAAP revenues; lack of consistency; cherry-picking; and the use of cash per share data. I strongly urge companies to carefully consider this guidance and revisit their approach to non-GAAP disclosures. I also urge again, as I did last December, that appropriate controls be considered and that audit committees carefully oversee their company’s use of non-GAAP measures and disclosures.4

50. The SEC has repeatedly emphasized that disclosure of non-GAAP projections can be inherently misleading and has therefore heightened its scrutiny of the use of such projections.5

4 Mary Jo White,Keynote Address, International Corporate Governance Network Annual Conference: Focusing the Lens of Disclosure to Set the Path Forward on Board Diversity, Non-GAAP, and Sustainability(June 27, 2016),available athttps://www.sec.gov/news/speech/chair-white-icgn-speech.html.

5See, e.g., Nicolas Grabar and Sandra Flow,Non-GAAP Financial Measures: The SEC’s Evolving Views, Harvard Law School Forum on Corporate Governance and Financial Regulation

51. Thus, in order to bring the 14D-9 into compliance with Regulation G as well as cure the materially misleading nature of the financial projections under SEC Rule 14D-9 as a result of the omitted information on pages 27-28, Defendants must provide a reconciliation table of the non-GAAP measures to the most comparable GAAP measures.

52. At the very least, the Company must disclose the line item projections for the financial metrics that were used to calculate the aforementioned non-GAAP measures. Such projections are necessary to make the non-GAAP projections included in the 14D-9 not misleading.

The Financial Advisor’s Valuation Analyses and Fairness Opinion

53. With respect to Centerview’s Discounted Cash Flow Analysis, the Solicitation Statement fails to disclose the following key components used in the analysis: (i) the inputs and assumptions underlying the selection of the discount rate range of 11.0%-13.0%, including the Company’s weighted cost of capital, the forecasted risk adjusted, after-tax unlevered free cash flows (excluding the impact of preclinical non-Luxturna / SPK-9001/ SPK-8011 / SPK-8016 / SPK-3006 / Huntington’s program pipeline R&D) of the Company over the period beginning on April 1, 2019 and ending on December 31, 2035; (ii) an implied terminal value of the Company, calculated by Centerview assuming that the Company’s after-tax unlevered free cash flows would decline in perpetuity after December 31, 2035 at a rate of free cash flow decline of 20% year-over-year, (iii) the net present value of tax savings from usage of net operating losses and future losses, and (iv) the value of preclinical non-Luxturna / SPK-9001 / SPK-8011 / SPK-8016 /SPK-3006 /

(June 24, 2016),available at https://corpgov.law.harvard.edu/2016/06/24/non-gaap-financial-measures-the-secs-evolving-views/; Gretchen Morgenson,Fantasy Math Is Helping Companies Spin Losses Into Profits, N.Y. Times (Apr. 22, 2016),available athttp://www.nytimes.com/2016/04/24/business/fantasy-math-is-helping-companies-spin-losses-into-profits.html?_r=0.

Huntington’s program pipeline based on the median pre-money valuation of a select set of preclinical / pre-proof-of-concept gene therapy and gene editing companies in initial public offerings. 14D-9, pp. 30-31.

54. These key inputs are material to Spark shareholders, and their omission renders thesummary of Centerview’s DCF valuations analyses incomplete and misleading. As a highly-respected professor explained in one of the most thorough law review articles regarding the fundamental flaws with the valuation analyses bankers perform in support of fairness opinions, in a discounted cash flow analysis a banker takes management’s forecasts, and then makes several key choices “each of which can significantly affect the final valuation.” Steven M. Davidoff,Fairness Opinions, 55 Am. U.L. Rev. 1557, 1576 (2006). Such choices include “the appropriate discount rate, and the terminal value . . . .”Id. As Professor Davidoff explains:

There is substantial leeway to determine each of these, and any change can markedly affect the discounted cash flow value . . . . The substantial discretion and lack of guidelines and standards also makes the process vulnerable to manipulation to arrive at the “right” answer for fairness. This raises a further dilemma in light of the conflicted nature of the investment banks who often provide these opinions[.]

Id.at 1577-78.

55. The above-referenced omitted information, if disclosed, would significantly alter the total mix of information available to Spark stockholders. Accordingly, based on the foregoing disclosure deficiencies in the 14D-9, Plaintiff seeks injunctive and other equitable relief to prevent the irreparable injury that Spark stockholders will suffer, absent judicial intervention, if Spark’s stockholders are required to decide whether or not to tender their shares without the above-referenced material misstatements and omissions being remedied.

CLAIMS FOR RELIEF

COUNT I

Claims Against All Defendants for Violations of § 14(e) of the

Securities Exchange Act of 1934

56. Plaintiff incorporates each and every allegation set forth above as if fully set forth

herein.

57. Section 14(e) of the Exchange Act provides that it is unlawful “for any person to make any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading . . . .” 15 U.S.C. § 78n(e).

58. As discussed above, Spark filed and delivered the 14D-9 to its stockholders, which Defendants knew contained, or recklessly disregarded, material omissions and misstatements described herein.

59. Defendants violated § 14(e) of the Exchange Act by issuing the 14D-9 in which they made untrue statements of material facts or failed to state all material facts necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading, in conjunction with the Tender Offer. Defendants knew or recklessly disregarded that the 14D-9 failed to disclose material facts necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading.

60. The 14D-9 was prepared, reviewed and/or disseminated by Defendants. It misrepresented and/or omitted material facts, including material information about the consideration offered to stockholders via the Tender Offer, the intrinsic value of the Company, the Company’s financial projections, and the financial advisor’s valuation analyses and resultant fairness opinion.

61. In so doing, Defendants made untrue statements of material fact and omitted material information necessary to make the statements that were made not misleading in violation of § 14(e) of the Exchange Act. By virtue of their positions within the Company and/or roles in the process and in the preparation of the 14D-9, Defendants were aware of this information and their obligation to disclose this information in the 14D-9.

62. The omissions and misleading statements in the 14D-9 are material in that a reasonable stockholder would consider them important in deciding whether to tender their shares or seek appraisal. In addition, a reasonable investor would view the information identified above which has been omitted from the 14D-9 as altering the “total mix” of information made available to stockholders.

63. Defendants knowingly, or with deliberate recklessness, omitted the material information identified above from the 14D-9, causing certain statements therein to be materially incomplete and therefore misleading. Indeed, while Defendants undoubtedly had access to and/or reviewed the omitted material information in connection with approving the Tender Offer, they allowed it to be omitted from the 14D-9, rendering certain portions of the 14D-9 materially incomplete and therefore misleading.

64. The misrepresentations and omissions in the 14D-9 are material to Plaintiff, and Plaintiff and Spark stockholders will be deprived of their entitlement to make a fully informed decision if such misrepresentations and omissions are not corrected prior to the expiration of the Tender Offer.

COUNT II

Against the Individual Defendants for

Violations of § 20(a) of the 1934 Act

65. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

66. The Individual Defendants acted as controlling persons of Spark within the meaning of Section 20(a) of the 1934 Act as alleged herein. By virtue of their positions as officers and/or directors of Spark and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the false statements contained in the 14D-9, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of the Company, including the content and dissemination of the various statements that Plaintiff contends are false and misleading.

67. Each of the Individual Defendants was provided with or had unlimited access to copies of the 14D-9 alleged by Plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause them to be corrected.

68. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of the Company, and, therefore, is presumed to have had the power to control and influence the particular transactions giving rise to the violations as alleged herein and exercised the same. The 14D-9 contains the unanimous recommendation of the Individual Defendants to approve the Tender Offer. They were thus directly involved in the making of the 14D-9.

69. By virtue of the foregoing, the Individual Defendants violated Section 20(a) of the 1934 Act.

70. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(e) of the 1934 Act and Rule 14d-9, by their acts and omissions as alleged herein. By virtue of their positions as controlling

persons, these Defendants are liable pursuant to Section 20(a) of the 1934 Act. As a direct and proximate result of Defendants’ conduct, Plaintiff is threatened with irreparable harm.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff prays for judgment and relief as follows:

A. Ordering that this action may be maintained as a class action and certifying Plaintiff as the Class representative and Plaintiff’s counsel as Class counsel;

B. Enjoining Defendants and all persons acting in concert with them from proceeding with the Tender Offer or consummating the Tender Offer, unless and until the Company discloses the material information discussed above, which has been omitted from the 14D-9;

C. In the event Defendants consummate the Tender Offer, awarding damages to Plaintiff and the Class;

D. Awarding Plaintiff the costs of this action, including reasonable allowance for Plaintiff’s attorneys’ and experts’ fees; and

E. Granting such other and further relief as this Court may deem just and proper.

JURY DEMAND

Plaintiff demands a trial by jury on all issues so triable.

| Dated: March 18, 2019 | |

| | |

| Respectfully submitted, |

| OF COUNSEL: | |

| | |

| FARUQI & FARUQI, LLP | FARUQI & FARUQI, LLP |

| | |

| | |

| Nadeem Faruqi | By: /s/ Michael Van Gorder |

| James M. Wilson, Jr. | Michael Van Gorder (#6214) |

| 685 Third Ave., 26th Fl. | 3828 Kennett Pike, Suite 201 |

| New York, NY 10017 | Wilmington, DE 19807 |

| Telephone: (212) 983-9330 | Tel.: (302) 482-3182 |

| Email: nfaruqi@faruqilaw.com | Email: mvangorder@faruqilaw.com |

| Email: jwilson@faruqilaw.com | |

Counsel for Plaintiff

Counsel for Plaintiff

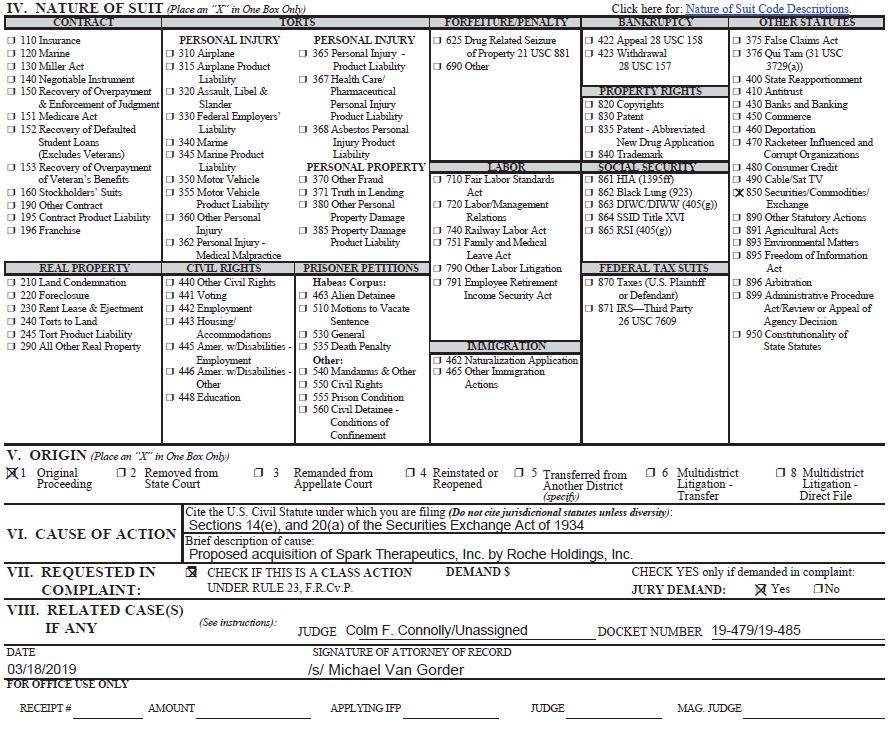

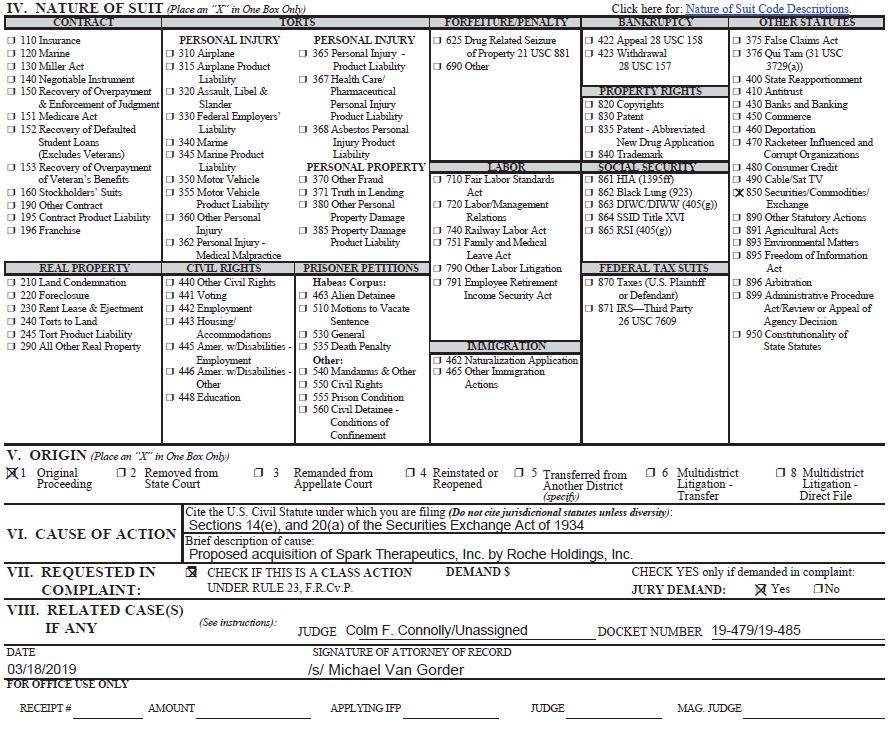

JS 44 (Rev. 06/17)

CIVIL COVER SHEET

The JS 44 civil cover sheet and the information contained herein neither replace nor supplement the filing and service of pleadings or other papers as required by law, except as provided by local rules of court. This form, approved by the Judicial Conference of the United States in September 1974, is required for the use of the Clerk of Court for the purpose of initiating the civil docket sheet.(SEE INSTRUCTIONS ON NEXT PAGE OF THIS FORM.)

I. (a) PLAINTIFFS ARTHUR NEWMAN, on behalf of himself and all others similarly situated, (b) County of Residence of First Listed Plaintiff New York City, NY (EXCEPT IN U.S. PLAINTIFF CASES) (c) Attorneys(Firm Name, Address, and Telephone Number) Faruqi & Faruqi, LLP 3828 Kennett Pike, Ste. 201, Wilmington, DE 19807 (302) 482-3182 | DEFENDANTS SPARK THERAPEUTICS, INC., STEPHEN ALTSCHULER, M.D., LARS EKMAN, M.D., PH.D., KATHERINE HIGH, M.D., JEFFERY D. MARAZZO, ANAND MEHRA, M.D., VIN MILANO, ROBERT J. PEREZ, ELLIOT SIGAL, M.D., PH.D., and LOTA ZOTH County of Residence of First Listed Defendant Philadelphia County, PA (IN U.S. PLAINTIFF CASES ONLY) NOTE: IN LAND CONDEMNATION CASES, USE THE LOCATION OF THE TRACT OF LAND INVOLVED. Attorneys(If Known) | |