Exhibit (a)(5)(x)

UNITED STATES DISTRICT COURT

DISTRICT OF DELAWARE

| | | | |

| ELAINE WANG, | : | | |

| | : | | |

| Plaintiff, | : | Case No. ______________ | |

| | : | JURY TRIAL DEMANDED | |

| v. | : | |

| | : | | |

| SPARK THERAPEUTICS, INC., STEVEN | : | | |

| ALTSCHULER, LARS EKMAN, | : | | |

| KATHERINE HIGH, JEFFREY D. | : | | |

| MARAZZO, ANAND MEHRA, VIN | : | | |

| MILANO, ROBERT J. PEREZ, ELLIOT | : | | |

| SIGAL, and LOTA ZOTH, | : | | |

| | : | | |

| Defendants. | : | | |

| | | | |

COMPLAINT FOR VIOLATIONS OF SECTIONS 14(e), 14(d) AND 20(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Elaine Wang (“Plaintiff”), by and through her attorneys, alleges the following upon information and belief, including investigation of counsel and review of publicly-available information, except as to those allegations pertaining to Plaintiff, which are alleged upon personal knowledge:

NATURE OF THE ACTION

1. This is an action brought by Plaintiff against Spark Therapeutics, Inc. (“Spark” or the “Company”) and the members of Spark’s board of directors (the “Board” or the “Individual Defendants” and collectively with the Company, the “Defendants”) for their violations of Section 14(e), 14(d), and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) in connection with the proposed acquisition of Spark by Roche Holdings, Inc. and its subsidiaries (“Roche”).

2. Defendants have violated the above-referenced sections of the Exchange Act by causing a materially incomplete and misleading Solicitation Statement (the “Solicitation

Statement”) to be filed on March 7, 2019 with the United States Securities and Exchange Commission (“SEC”) and disseminated to Company stockholders. The Solicitation Statement recommends that Company stockholders tender their shares in support of a proposed transaction whereby 022019 Merger Subsidiary, Inc. (“Merger Sub”), a Delaware corporation and a wholly owned subsidiary of Roche, will merge with and into Spark with Spark surviving the merger as a wholly owned subsidiary of Roche (the “Proposed Transaction”). Pursuant to the terms of the definitive agreement and plan of merger the companies entered into (the “Merger Agreement”), Merger Sub has commenced a tender offer (the “Tender Offer”) to acquire all of Spark’s outstanding common stock for $114.50 per share (the “Merger Consideration”). The Tender Offer will expire on April 3, 2019.

3. As described herein, the Merger Consideration undervalues Spark’s stock and the consideration Spark’s stockholders stand to receive in connection with the Proposed Transaction and the process by which Defendants propose to consummate the Proposed Transaction is fundamentally unfair to Plaintiff and the other common stockholders of the Company. Defendants have now asked Spark’s stockholders to support the Proposed Transaction in exchange for inadequate consideration based upon the materially incomplete and misleading representations and information contained in the Solicitation Statement. Specifically, the Solicitation Statement contains materially incomplete and misleading information concerning, among other things, (i) Spark’s financial projections relied upon by the Company’s financial advisors, Centerview Partners LLC (“Centerview”) and Cowen LLP (“Cowen”), in their financial analysis; and (ii) the data and inputs underlying the financial valuation analyses that support the fairness opinions provided by Centerview and Cowen. The failure to adequately disclose such material information

constitutes a violation of Sections 14(e), 14(d) and 20(a) of the Exchange Act as Spark stockholders need such information in order to decide whether to tender their shares.

4. It is therefore imperative that the material information that has been omitted from the Solicitation Statement is disclosed to the Company’s stockholders prior to the expiration of the Tender Offer.

5. For these reasons and as set forth in detail herein, Plaintiff seeks to enjoin Defendants from taking any steps to consummate the Proposed Transaction unless and until the material information discussed below is disclosed to Spark’s stockholders or, in the event the Proposed Transaction is consummated, to recover damages resulting from the Defendants’ violations of the Exchange Act.

JURISDICTION AND VENUE

6. This Court has subject matter jurisdiction pursuant to Section 27 of the Exchange Act (15 U.S.C. § 78aa) and 28 U.S.C. § 1331 (federal question jurisdiction) as Plaintiff alleges violations of Sections 14(e), 14(d) and 20(a) of the Exchange Act and SEC Rule 14d-9.

7. Personal jurisdiction exists over each Defendant either because the Defendant is incorporated in this District, or is an individual who is either present in this District for jurisdictional purposes or has sufficient minimum contacts with this District as to render the exercise of jurisdiction over defendant by this Court permissible under traditional notions of fair play and substantial justice.

8. Venue is proper in this District under Section 27 of the Exchange Act, 15 U.S.C. § 78aa, as well as under 28 U.S.C. § 1391, because Spark is incorporated in this District.

PARTIES

9. Plaintiff is, and has been at all relevant times, the owner of Spark common stock and has held such stock since prior to the wrongs complained of herein.

10. Individual Defendant Dr. Steven Altschuler (“Altschuler”) has served as Chairman and a member of the Board since October 2013.

11. Individual Defendant Dr. Lars Ekman (“Ekman”) has served as a member of the Board since May 2014.

12. Individual Defendant Dr. Katherine High (“High”) has served as a member of the Board since September 2014, and serves as the President and Head of Research and Development for the Company.

13. Individual Defendant Jeffrey B. Marazzo (“Marazzo”) has served as a member of the Board since September 2013, and serves as the Chief Executive Officer (“CEO”) for the Company.

14. Individual Defendant Dr. Anand Mehra (“Mehra”) has served as a member of the Board since May 2014.

15. Individual Defendant Vincent Milano (“Milano”) has served as a member of the Board since June 2014.

16. Individual Defendant Robert Perez (“Perez”) has served as a member of the Board since January 2018.

17. Individual Defendant Dr. Elliot Sigal (“Sigal”) has served as a member of the Board since January 2014.

18. Individual Defendant Lota Zoth (“Zoth”) has served as a member of the Board since January 2016.

19. Defendant Spark is incorporated in Delaware and maintains its principal offices at 3737 Market Street, Suite 1300, Philadelphia, PA 19104. The Company’s common stock trades on the NASDAQ Stock Exchange under the symbol “ONCE.”

20. Non-party Roche is a Delaware corporation and a subsidiary of Roche Holding Ltd., a Swiss joint-stock Company, and maintains its principal offices at 1 DNA WAY, MS#24, South San Francisco, CA 94080.

21. Non-party 022019 Merger Subsidiary, Inc. is a Delaware corporation and is a wholly-owned subsidiary of Roche, formed solely for the purposes of effectuating the Proposed Transaction.

22. The defendants identified in paragraphs 10-18 are collectively referred to as the “Individual Defendants” or the “Board.”

23. The defendants identified in paragraphs 10-19 are collectively referred to as the “Defendants.”

SUBSTANTIVE ALLEGATIONS

| A. | The Proposed Transaction Undervalues Spark |

| 24. | Spark develops, manufactures, and markets gene therapies. The Company’s |

products are clinical therapies and clinical candidates.

| 25. | On February 25, 2019, the Company announced the Proposed Transaction: |

PHILADELPHIA, Feb. 25, 2019 (GLOBE NEWSWIRE) -- Spark Therapeutics (NASDAQ: ONCE), a fully integrated, commercial gene therapy company dedicated to challenging the inevitability of genetic disease, announced today that it has entered into a definitive merger agreement for Roche to fully acquire Spark Therapeutics at a price of $114.50 per share in an all-cash transaction. This corresponds to a total equity value of approximately $4.8 billion on a fully diluted basis, inclusive of approximately $500 million of projected net cash expected at close. The per share price represents a premium of 122 percent to Spark’s closing price on Feb. 22, 2019. The merger agreement has been unanimously approved by the boards of both Spark and Roche.

Under the terms of the merger agreement, Roche will promptly commence a tender offer to acquire all outstanding shares of Spark’s common stock, and Spark will file a recommendation statement

containing the unanimous recommendation of the Spark board that Spark shareholders tender their shares to Roche.

“As the only biotechnology company that has successfully commercialized a gene therapy for a genetic disease in the U.S., we have built unmatched competencies in the discovery, development and delivery of genetic medicines. But the needs of patients and families living with genetic diseases are immediate and vast,” said Jeffrey D. Marrazzo, chief executive officer of Spark Therapeutics. “With its worldwide reach and extensive resources, Roche will help us accelerate the development of more gene therapies for more patients for more diseases and further expedite our vision of a world where no life is limited by genetic disease.”

“Spark Therapeutics’ proven expertise in the entire gene therapy value chain may offer important new opportunities for the treatment of serious diseases,” said Severin Schwan, chief executive officer of Roche. “In particular, Spark’s hemophilia A program could become a new therapeutic option for people living with this disease. We are also excited to continue the investments in Spark’s broad product portfolio and commitment to Philadelphia as a center of excellence.”

Spark Therapeutics will continue its operations in Philadelphia as an independent company within the Roche Group.

Terms of the Agreement

Under the terms of the merger agreement, Roche will promptly commence a tender offer to acquire all of the outstanding shares of Spark Therapeutics’ common stock at a price of $114.50 per share in cash. The closing of the tender offer will be subject to a majority of Spark Therapeutics’ outstanding shares being tendered. In addition, the transaction is subject to the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and other customary conditions.

Following completion of the tender offer, Roche will acquire all remaining shares at the same price of $114.50 per share through a second step merger. The closing of the transaction is expected to take place in the second quarter of 2019.

* * *

26. The Merger Consideration undervalues the Company’s shares in light of its prospects for future growth. On December 19, 2017, the firm gained FDA approval for voretigene

neparvovec (“Luxturna”) to manage inherited retinal disease (“IRD”) that arise from the biallelic RPE65 mutation. On November 23, 2018, Luxturna earned marketing authorization in the European Union. To commercialize Luxturna in Europe and other countries outside the United States, Spark entered into a collaborative agreement with Novartis in January 2018. Roche essentially, is purchasing the future in gene therapy for a bargain.

27. Accordingly, the Company is well-positioned for financial growth and the Merger Consideration fails to adequately compensate Company stockholders by limiting their ability to benefit from the Company’s continued growth.

28. Despite the inadequate Merger Consideration, the Board has agreed to the Proposed Transaction. It is therefore imperative that Spark’s stockholders are provided with the material information that has been omitted from the Solicitation Statement, so that they can meaningfully assess whether or not the Proposed Transaction is in their best interests to tender their shares.

B.The Materially Incomplete and Misleading Solicitation Statement

| 29. | On March 7, 2019, Spark filed the Solicitation Statement with the SEC in |

connection with the Proposed Transaction. The Solicitation Statement was furnished to the Company’s stockholders and solicits the stockholders to tender their shares in support of the Proposed Transaction. The Individual Defendants were obligated to carefully review the Solicitation Statement before it was filed with the SEC and disseminated to the Company’s stockholders to ensure that it did not contain any material misrepresentations or omissions. However, the Solicitation Statement misrepresents and/or omits material information that is necessary for the Company’s stockholders to make an informed decision concerning whether to tender their shares, in violation of Sections 14(e), 14(d), and 20(a) of the Exchange Act.

30. With respect to the financial projections disclosed in the Solicitation Statement, the Solicitation Statement fails to provide material information.

31. For Case 1 Forecasts, Case 2 Forecasts, Case 3 Forecasts, and Case 4 Forecasts, the Solicitation Statement provides values for the non-GAAP (Generally Accepted Accounting Principles) financial metric Unlevered Free Cash Flows (“UFCF”), but fails to provide: (i) the line items used to calculate the UFCF, such as EBITDA, capital expenditures, net working capital, and tax expense. Solicitation Statement at 35-36.

32. When a company discloses non-GAAP financial measures in a Solicitation Statement that were relied on by a board of directors to recommend that stockholders exercise their corporate suffrage rights in a particular manner, the company must, pursuant to SEC regulatory mandates, also disclose all projections and information necessary to make the non-GAAP measures not misleading, and must provide a reconciliation (by schedule or other clearly understandable method) of the differences between the non-GAAP financial measure disclosed or released with the most comparable financial measure or measures calculated and presented in accordance with GAAP. 17 C.F.R. § 244.100.

| 33. | The SEC has noted that: |

companies should be aware that this measure does not have a uniform definition and its title does not describe how it is calculated. Accordingly, a clear description of how this measure is calculated, as well as the necessary reconciliation, should accompany the measure where it is used. Companies should also avoid inappropriate or potentially misleading inferences about its usefulness. For example, “free cash flow” should not be used in a manner that inappropriately implies that the measure represents the residual cash flow available for discretionary expenditures, since many companies have mandatory debt service requirements or other non-discretionary expenditures that are not deducted from the measure.1

_____________________

1 U.S. Securities and Exchange Commission, Non-GAAP Financial Measures, last updated April 4, 2018, available at: https://www.sec.gov/divisions/corpfin/guidance/nongaapinterp.htm.

34. Thus, to cure the Solicitation Statement the materially misleading nature of the forecasts as a result of the omitted information in the Solicitation Statement, Defendants must provide a reconciliation table of the non-GAAP measures to the most comparable GAAP measures. At the very least, the Company must disclose the line item forecasts for the financial metrics that were used to calculate the aforementioned non-GAAP measures. Such forecasts are necessary to make the non-GAAP forecasts included in the Solicitation Statement not misleading.

35. With respect to Centerview’sDiscounted Cash Flow Analysis, the Solicitation Statement fails to disclose the following key components used in the analysis: (i) the inputs and assumptions underlying the selection of the discount rate range of 11.0%-13.0%, including the Company’s weighted cost of capital, the forecasted risk adjusted, after-tax unlevered free cash flows (excluding the impact of preclinical non-Luxturna / SPK-9001/ SPK-8011 / SPK-8016 / SPK-3006 / Huntington’s program pipeline R&D) of the Company over the period beginning on April 1, 2019 and ending on December 31, 2035; (ii) an implied terminal value of the Company, calculated by Centerview assuming that the Company’s after-tax unlevered free cash flows would decline in perpetuity after December 31, 2035 at a rate of free cash flow decline of 20% year-over-year, (iii) the net present value of tax savings from usage of net operating losses and future losses, and (iv) the value of preclinical non-Luxturna / SPK-9001 / SPK-8011 / SPK-8016 /SPK-3006 / Huntington’s program pipeline based on the median pre-money valuation of a select set of pre-clinical / pre-proof-of-concept gene therapy and gene editing companies in initial public offerings. Solicitation Statement at 30.

36. In sum, the omission of the above-referenced information renders statements in the Solicitation Statement materially incomplete and misleading in contravention of the Exchange Act. Absent disclosure of the foregoing material information prior to the expiration of the Tender Offer,

Plaintiff will be unable to make a fully-informed decision regarding whether to tender their shares, and they are thus threatened with irreparable harm, warranting the injunctive relief sought herein.

CLAIMS FOR RELIEF

COUNT I

On Behalf of Plaintiff Against All Defendants for

Violations of Section 14(e) of the Exchange Act

37. Plaintiff incorporates each and every allegation set forth above as if fully set forth

herein.

38. Section 14(e) of the Exchange Act provides that it is unlawful “for any person to make any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading . . .” 15 U.S.C. § 78n(e).

39. As set forth above, Defendants filed and delivered the Solicitation Statement to its stockholders, which Defendants knew contained, or recklessly disregarded, material omissions and misstatements described herein.

40. Defendants violated Section 14(e) of the Exchange Act by issuing the Solicitation Statement in which they made untrue statements of material facts or failed to state all material facts necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading, in conjunction with the Tender Offer. Defendants knew or recklessly disregarded that the Solicitation Statement failed to disclose material facts necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading.

41. The Solicitation Statement was prepared, reviewed and/or disseminated by Defendants. It misrepresented and/or omitted material facts, including material information about

the consideration offered to stockholders via the Tender Offer, the intrinsic value of the Company, the Company’s financial projections, and the financial advisor’s valuation analyses and resultant fairness opinion.

42. In so doing, Defendants made untrue statements of material fact and omitted material information necessary to make the statements that were made not misleading in violation of Section 14(e) of the Exchange Act. By virtue of their positions within the Company and/or roles in the process and in the preparation of the Solicitation Statement, Defendants were aware of this information and their obligation to disclose this information in the Solicitation Statement.

43. The omissions and misleading statements in the Solicitation Statement are material in that a reasonable stockholder would consider them important in deciding whether to tender their shares or seek appraisal. In addition, a reasonable investor would view the information identified above which has been omitted from the Solicitation Statement as altering the “total mix” of information made available to stockholders.

44. Defendants knowingly, or with deliberate recklessness, omitted the material information identified above from the Solicitation Statement, causing certain statements therein to be materially incomplete and therefore misleading. Indeed, while Defendants undoubtedly had access to and/or reviewed the omitted material information in connection with approving the Tender Offer, they allowed it to be omitted from the Solicitation Statement, rendering certain portions of the Solicitation Statement materially incomplete and therefore misleading.

45. The misrepresentations and omissions in the Solicitation Statement are material to Plaintiff, and Plaintiff will be deprived of her entitlement to make a fully informed decision if such misrepresentations and omissions are not corrected prior to the expiration of the Tender Offer.

COUNT II

Violations of Section 14(d)(4) of the Exchange Act and

Rule 14d-9 Promulgated Thereunder

(Against All Defendants)

46. Plaintiff repeats and re-alleges each allegation set forth above as if fully set forth

herein.

47. Defendants have caused the Solicitation Statement to be issued with the intention of soliciting stockholder support of the Tender Offer.

48. Section 14(d)(4) of the Exchange Act and SEC Rule 14d-9 promulgated thereunder require full and complete disclosure in connection with tender offers.

49. The Solicitation Statement violates Section 14(d)(4) and Rule 14d-9 because it omits material facts, including those set forth above, which render the Solicitation Statement false and/or misleading.

50. Defendants knowingly, or with deliberate recklessness, omitted the material information identified above from the Solicitation Statement, causing certain statements therein to be materially incomplete and therefore misleading. Indeed, while Defendants undoubtedly had access to and/or reviewed the omitted material information in connection with approving the Tender Offer, they allowed it to be omitted from the Solicitation Statement, rendering certain portions of the Solicitation Statement materially incomplete and therefore misleading.

51. The misrepresentations and omissions in the Solicitation Statement are material to Plaintiff and Plaintiff will be deprived of her entitlement to make a fully informed decision if such misrepresentations and omissions are not corrected prior to the expiration of the Tender Offer.

COUNT III

On Behalf of Plaintiff Against the Individual Defendants for Violations of Section 20(a) of the Exchange Act

52. Plaintiff incorporates each and every allegation set forth above as if fully set forth

herein.

53. The Individual Defendants acted as controlling persons of Spark within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their positions as directors of Spark, and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the incomplete and misleading statements contained in the Solicitation Statement filed with the SEC, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of Spark, including the content and dissemination of the various statements that Plaintiff contends are materially incomplete and misleading.

54. Each of the Individual Defendants was provided with or had unlimited access to copies of the Solicitation Statement and other statements alleged by Plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause the statements to be corrected.

55. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of Spark, and, therefore, is presumed to have had the power to control or influence the particular transactions giving rise to the Exchange Act violations alleged herein, and exercised the same. The omitted information identified above was reviewed by the Board prior to voting on the Proposed Transaction. The Solicitation Statement at issue contains the unanimous recommendation of the Board to approve the Proposed Transaction. The Individual Defendants were thus directly involved in the making of the Solicitation Statement.

56. In addition, as the Solicitation Statement sets forth at length, and as described herein, the Individual Defendants were involved in negotiating, reviewing, and approving the Merger Agreement. The Solicitation Statement purports to describe the various issues and information that the Individual Defendants reviewed and considered. The Individual Defendants participated in drafting and/or gave their input on the content of those descriptions.

57. By virtue of the foregoing, the Individual Defendants have violated Section 20(a) of the Exchange Act.

58. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(a) and Rule 14a-9, by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, these defendants are liable pursuant to Section 20(a) of the Exchange Act. As a direct and proximate result of Individual Defendants’ conduct, Plaintiff will be irreparably harmed.

59. Plaintiff has no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff be fully protected from the immediate and irreparable injury that Defendants’ actions threaten to inflict.

RELIEF REQUESTED

WHEREFORE, Plaintiff demands injunctive relief in her favor and against the Defendants

jointly and severally, as follows:

A. Preliminarily and permanently enjoining Defendants and their counsel, agents, employees and all persons acting under, in concert with, or for them, from proceeding with, consummating, or closing the Proposed Transaction, unless and until Defendants disclose the material information identified above which has been omitted from the Solicitation Statement;

A. Rescinding, to the extent already implemented, the Merger Agreement or any of the terms thereof, or granting Plaintiff rescissory damages;

B. Directing the Defendants to account to Plaintiff for all damages suffered as a result of their wrongdoing;

C. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorneys’ and expert fees and expenses; and

| D. | Granting such other and further equitable relief as this Court may deem just and |

proper.

JURY DEMAND

| Plaintiff demands a trial by jury. | | | |

| | | | |

| Dated: March 7, 2019 | | RIGRODSKY & LONG, P.A. | |

| | By: | /s/ Gina M. Serra | |

| OF COUNSEL: | | Brian D. Long (#4347) | |

| | Gina M. Serra (#5387) | |

| WOLF HALDENSTEIN ADLER | | 300 Delaware Avenue, Suite 1220 | |

| | Wilmington, DE 19801 | |

| FREEMAN & HERZ LLP | | Telephone: (302) 295-5310 | |

| Gloria Kui Melwani | | Facsimile: (302) 654-7530 | |

| 270 Madison Avenue | | Email: bdl@rl-legal.com | |

| New York, NY 10016 | | Email: gms@rl-legal.com | |

| Telephone: (212) 545-4600 | | | |

| Facsimile: (212) 686-0114 | | Attorneys for Plaintiff | |

| Email: melwani@whafh.com | | | |

| JS 44 (Rev. 06/17) | CIVIL COVER SHEET |

The JS 44 civil cover sheet and the information contained herein neither replace nor supplement the filing and service of pleadings or other papers as required by law, except as provided by local rules of court. This form, approved by the Judicial Conference of the United States in September 1974, is required for the use of the Clerk of Court for the purpose of initiating the civil docket sheet.(SEE INSTRUCTIONS ON NEXT PAGE OF THIS FORM.)

I. (a) PLAINTIFFS ELAINE WANG (b) County of Residence of First Listed Plaintiff ______________________ (EXCEPT IN U.S. PLAINTIFF CASES) (c) Attorneys(Firm Name, Address, and Telephone Number) Gina M. Serra, RIGRODSKY & LONG, P.A. 300 Delaware Avenue, Suite 1220, Wilmington, DE 19801 (302) 295-5310 | DEFENDANTS SPARK THERAPEUTICS, INC., STEVEN ALTSCHULER, LARS EKMAN, KATHERINE HIGH, JEFFREY D. MARAZZO, ANAND MEHRA, VIN MILANO, ROBERT J. PEREZ, ELLIOT SIGAL, et al. County of Residence of First Listed Defendant Philadelphia County, PA (IN U.S. PLAINTIFF CASES ONLY) NOTE: IN LAND CONDEMNATION CASES, USE THE LOCATION OF THE TRACT OF LAND INVOLVED. Attorneys(If Known) | |

JS 44 Reverse (Rev.06/17)

INSTRUCTIONS FOR ATTORNEYS COMPLETING CIVIL COVER SHEET FORM JS 44

Authority For Civil Cover Sheet

The JS 44 civil cover sheet and the information contained herein neither replaces nor supplements the filings and service of pleading or other papers as required by law, except as provided by local rules of court. This form, approved by the Judicial Conference of the United States in September 1974, is required for the use of the Clerk of Court for the purpose of initiating the civil docket sheet. Consequently, a civil cover sheet is submitted to the Clerk of Court for each civil complaint filed. The attorney filing a case should complete the form as follows:

| I.(a) | Plaintiffs-Defendants.Enter names (last, first, middle initial) of plaintiff and defendant. If the plaintiff or defendant is a government agency, use only the full name or standard abbreviations. If the plaintiff or defendant is an official within a government agency, identify first the agency and then the official, giving both name and title. |

| (b) | County of Residence.For each civil case filed, except U.S. plaintiff cases, enter the name of the county where the first listed plaintiff resides at the time of filing. In U.S. plaintiff cases, enter the name of the county in which the first listed defendant resides at the time of filing. (NOTE: In land condemnation cases, the county of residence of the "defendant" is the location of the tract of land involved.) |

| (c) | Attorneys.Enter the firm name, address, telephone number, and attorney of record. If there are several attorneys, list them on an attachment, noting in this section "(see attachment)". |

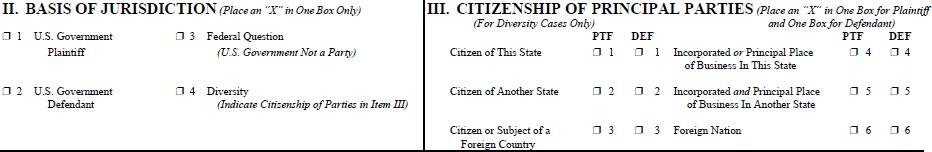

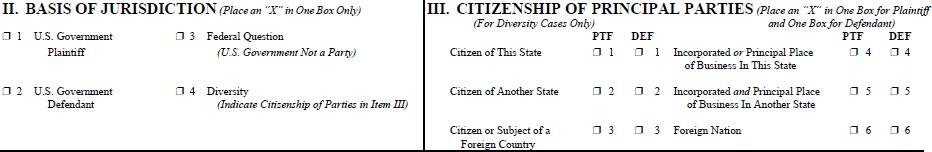

| II. | Jurisdiction.The basis of jurisdiction is set forth under Rule 8(a), F.R.Cv.P., which requires that jurisdictions be shown in pleadings. Place an "X" in one of the boxes. If there is more than one basis of jurisdiction, precedence is given in the order shown below. |

United States plaintiff. (1) Jurisdiction based on 28 U.S.C. 1345 and 1348. Suits by agencies and officers of the United States are included here. United States defendant. (2) When the plaintiff is suing the United States, its officers or agencies, place an "X" in this box.

Federal question. (3) This refers to suits under 28 U.S.C. 1331, where jurisdiction arises under the Constitution of the United States, an amendment to the Constitution, an act of Congress or a treaty of the United States. In cases where the U.S. is a party, the U.S. plaintiff or defendant code takes precedence, and box 1 or 2 should be marked.

Diversity of citizenship. (4) This refers to suits under 28 U.S.C. 1332, where parties are citizens of different states. When Box 4 is checked, the citizenship of the different parties must be checked. (See Section III below; NOTE: federal question actions take precedence over diversity cases.)

| III. | Residence (citizenship) of Principal Parties.This section of the JS 44 is to be completed if diversity of citizenship was indicated above. Mark this section for each principal party. |

| IV. | Nature of Suit.Place an "X" in the appropriate box. If there are multiple nature of suit codes associated with the case, pick the nature of suit code that is most applicable. Click here for:Nature of Suit Code Descriptions. |

| V. | Origin.Place an "X" in one of the seven boxes. |

Original Proceedings. (1) Cases which originate in the United States district courts.

Removed from State Court. (2) Proceedings initiated in state courts may be removed to the district courts under Title 28 U.S.C., Section 1441. When the petition for removal is granted, check this box.

Remanded from Appellate Court. (3) Check this box for cases remanded to the district court for further action. Use the date of remand as the filing date.

Reinstated or Reopened. (4) Check this box for cases reinstated or reopened in the district court. Use the reopening date as the filing date. Transferred from Another District. (5) For cases transferred under Title 28 U.S.C. Section 1404(a). Do not use this for within district transfers or multidistrict litigation transfers.

Multidistrict Litigation – Transfer. (6) Check this box when a multidistrict case is transferred into the district under authority of Title 28 U.S.C. Section 1407.

Multidistrict Litigation – Direct File. (8) Check this box when a multidistrict case is filed in the same district as the Master MDL docket.PLEASE NOTE THAT THERE IS NOT AN ORIGIN CODE 7.Origin Code 7 was used for historical records and is no longer relevant due to changes in statue.

| VI. | Cause of Action.Report the civil statute directly related to the cause of action and give a brief description of the cause.Do not cite jurisdictional statutes unless diversity.Example: U.S. Civil Statute: 47 USC 553 Brief Description: Unauthorized reception of cable service |

| VII. | Requested in Complaint.Class Action. Place an "X" in this box if you are filing a class action under Rule 23, F.R.Cv.P. Demand. In this space enter the actual dollar amount being demanded or indicate other demand, such as a preliminary injunction. Jury Demand. Check the appropriate box to indicate whether or not a jury is being demanded. |

| VIII. | Related Cases.This section of the JS 44 is used to reference related pending cases, if any. If there are related pending cases, insert the docket numbers and the corresponding judge names for such cases. |

Date and Attorney Signature.Date and sign the civil cover sheet.