Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

management fees during periods of underperformance, the steps Janus Capital and Perkins had taken or were taking to improve performance, and that the performance trend was improving.

· For Janus Henderson Select Value Fund (formerly, Perkins Select Value Fund), the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Small Cap Value Fund (formerly, Perkins Small Cap Value Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Value Plus Income Fund (formerly, Perkins Value Plus Income Fund), the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2016 and the second Broadridge quartile for the 12 months ended May 31, 2016.

Mathematical Funds

· For Janus Henderson Emerging Markets Managed Volatility Fund (formerly, INTECH Emerging Markets Managed Volatility Fund), the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Global Income Managed Volatility Fund (formerly, INTECH Global Income Managed Volatility Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson International Managed Volatility Fund (formerly, INTECH International Managed Volatility Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson U.S. Managed Volatility Fund (formerly, INTECH U.S. Managed Volatility Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

Growth and Core Funds

· For Janus Henderson Balanced Fund (formerly, Janus Balanced Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the third Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Contrarian Fund (formerly, Janus Contrarian Fund), the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Henderson Enterprise Fund (formerly, Janus Enterprise Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Forty Fund (formerly, Janus Forty Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Growth and Income Fund (formerly, Janus Growth and Income Fund), the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2016 and in the second Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Research Fund (formerly, Janus Research Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the second Broadridge quartile for the 12 months ended May 31, 2016.

Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

· For Janus Henderson Triton Fund (formerly, Janus Triton Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Venture Fund (formerly, Janus Venture Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the second Broadridge quartile for the 12 months ended May 31, 2016.

Global and International Funds

· For Janus Henderson Adaptive Global Allocation Fund (formerly, Janus Adaptive Global Allocation Fund), the Trustees noted that, due to limited performance for the Fund, performance history was not a material factor.

· For Janus Henderson Asia Equity Fund (formerly, Janus Asia Equity Fund), the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Henderson Global Life Sciences Fund (formerly, Janus Global Life Sciences Fund), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Global Real Estate Fund (formerly, Janus Global Real Estate Fund), the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Henderson Global Research Fund (formerly, Janus Global Research Fund), the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Henderson Global Select Fund (formerly, Janus Global Select Fund), the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Henderson Global Technology Fund (formerly, Janus Global Technology Fund), the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance, the steps Janus Capital had taken or was taking to improve performance, and that the performance trend was improving.

· For Janus Overseas Fund (formerly, Janus Henderson Overseas Fund), the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance.

Janus Aspen Series

· For Janus Henderson Balanced Portfolio (formerly, Janus Aspen Balanced Portfolio), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the third Broadridge quartile for the 12 months ended May 31, 2016.

Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

· For Janus Henderson Enterprise Portfolio (formerly, Janus Aspen Enterprise Portfolio), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Flexible Bond Portfolio (formerly, Janus Aspen Flexible Bond Portfolio), the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Forty Portfolio (formerly, Janus Aspen Forty Portfolio), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Global Allocation Portfolio – Moderate (formerly, Janus Aspen Global Allocation Portfolio – Moderate), the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Henderson Global Research Portfolio (formerly, Janus Aspen Global Research Portfolio), the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance

· For Janus Henderson Global Technology Portfolio (formerly, Janus Aspen Global Technology Portfolio), the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2016 and the second Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Henderson Global Unconstrained Bond Portfolio (formerly, Janus Aspen Global Unconstrained Bond Portfolio), the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson U.S. Low Volatility Portfolio (formerly, Janus Aspen INTECH U.S. Low Volatility Portfolio), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Research Portfolio (formerly, Janus Aspen Janus Portfolio), the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2016 and the second Broadridge quartile for the 12 months ended May 31, 2016.

· For Janus Henderson Overseas Portfolio (formerly, Janus Aspen Overseas Portfolio), the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2016 and the bottom Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Henderson Mid Cap Value Portfolio (formerly, Janus Aspen Perkins Mid Cap Value Portfolio), the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2016 and the first Broadridge quartile for the 12 months ended May 31, 2016. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, the steps Janus Capital and Perkins had taken or were taking to improve performance, and that the performance trend was improving.

In consideration of each Fund’s performance, the Trustees concluded that, taking into account the factors relevant to performance, as well as other considerations, including steps taken to improve performance, the Fund’s performance warranted continuation of the Fund’s investment advisory and subadvisory agreement(s).

Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

Costs of Services Provided

The Trustees examined information regarding the fees and expenses of each Fund in comparison to similar information for other comparable funds as provided by Broadridge, an independent data provider. They also reviewed an analysis of that information provided by their independent fee consultant and noted that the rate of management (investment advisory and any administration, but excluding out-of-pocket costs) fees for many of the Funds, after applicable waivers, was below the average management fee rate of the respective peer group of funds selected by an independent data provider. The Trustees also examined information regarding the subadvisory fees charged for subadvisory services, as applicable, noting that all such fees were paid by Janus Capital out of its management fees collected from such Fund.

The independent fee consultant provided its belief that the management fees charged by Janus Capital to each of the Funds under the current investment advisory and administration agreements are reasonable in relation to the services provided by Janus Capital. The independent fee consultant found: (1) the total expenses and management fees of the Funds to be reasonable relative to other mutual funds; (2) total expenses, on average, were 12% below the average total expenses of their respective Broadridge Expense Group peers and 20% below the average total expenses for their Broadridge Expense Universes; (3) management fees for the Funds, on average, were 11% below the average management fees for their Expense Groups and 13% below the average for their Expense Universes; and (4) Fund expenses at the functional level for each asset and share class category were reasonable. The Trustees also considered the total expenses for each share class of each Fund compared to the average total expenses for its Broadridge Expense Group peers and to average total expenses for its Broadridge Expense Universe.

The independent fee consultant concluded that, based on its strategic review of expenses at the complex, category and individual fund level, Fund expenses were found to be reasonable relative to both Expense Group and Expense Universe benchmarks. Further, for certain Funds, the independent fee consultant also performed a systematic “focus list” analysis of expenses in the context of the performance or service delivered to each set of investors in each share class in each selected Fund. Based on this analysis, the independent fee consultant found that the combination of service quality/performance and expenses on these individual Funds and share classes were reasonable in light of performance trends, performance histories, and existence of performance fees, breakpoints, and expense waivers on such Funds.

The Trustees considered the methodology used by Janus Capital and each subadviser in determining compensation payable to portfolio managers, the competitive environment for investment management talent, and the competitive market for mutual funds in different distribution channels.

The Trustees also reviewed management fees charged by Janus Capital and each subadviser to comparable separate account clients and to comparable non-affiliated funds subadvised by Janus Capital or by a subadviser (for which Janus Capital or the subadviser provides only or primarily portfolio management services). Although in most instances subadvisory and separate account fee rates for various investment strategies were lower than management fee rates for Funds having a similar strategy, the Trustees considered that Janus Capital noted that, under the terms of the management agreements with the Funds, Janus Capital performs significant additional services for the Funds that it does not provide to those other clients, including administration services, oversight of the Funds’ other service providers, trustee support, regulatory compliance and numerous other services, and that, in serving the Funds, Janus Capital assumes many legal risks and other costs that it does not assume in servicing its other clients. Moreover, they noted that the independent fee consultant found that: (1) the management fees Janus Capital charges to the Funds are reasonable in relation to the management fees Janus Capital charges to its institutional and subadvised accounts; (2) these institutional and subadvised accounts have different service and infrastructure needs; (3) Janus mutual fund investors enjoy reasonable fees relative to the fees charged to Janus institutional and subadvised fund investors; and (4) in the majority of cases, the Funds receive proportionally better pricing than the industry in relation to Janus institutional and subadvised accounts.

The Trustees considered the fees for each Fund for its fiscal year ended in 2015, and noted the following with regard to each Fund’s total expenses, net of applicable fee waivers (the Fund’s “total expenses”):

Fixed-Income Funds and Money Market Funds

· For Janus Henderson Flexible Bond Fund (formerly, Janus Flexible Bond Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to

Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Global Bond Fund (formerly, Janus Global Bond Fund), the Trustees noted that although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Unconstrained Bond Fund (formerly, Janus Global Unconstrained Bond Fund), the Trustees noted that although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson High-Yield Fund (formerly, Janus High-Yield Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Multi-Sector Income Fund (formerly, Janus Multi-Sector Income Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Real Return Fund (formerly, Janus Real Return Fund), the Trustees noted that, although the Fund’s total expenses were equal to or exceeded the peer group average for all share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Short-Term Bond Fund (formerly, Janus Short-Term Bond Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Government Money Market Fund (formerly, Janus Government Money Market Fund), the Trustees noted that the Fund’s total expenses exceeded the peer group average for both share classes. The Trustees considered that management fees for this Fund are higher than the peer group average due to the Fund’s management fee including other costs, such as custody and transfer agent services, while many funds in the peer group pay these expenses separately from their management fee. In addition, the Trustees considered that Janus Capital voluntarily waives one-half of its advisory fee and other expenses in order to maintain a positive yield.

· For Janus Henderson Money Market Fund (formerly, Janus Money Market Fund), the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes. In addition, the Trustees considered that Janus Capital voluntarily waives one- half of its advisory fee and other expenses in order to maintain a positive yield.

Asset Allocation Funds

· For Janus Henderson Global Allocation Fund – Conservative (formerly, Janus Global Allocation Fund – Conservative), the Trustees noted that, although the Fund’s total expenses exceeded the peer group median for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Global Allocation Fund – Growth (formerly, Janus Global Allocation Fund – Growth), the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Allocation Fund – Moderate (formerly, Janus Global Allocation Fund – Moderate), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share

Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

Alternative Fund

· For Janus Henderson Diversified Alternatives Fund (formerly, Janus Diversified Alternatives Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

Value Funds

· For Janus Henderson International Value Fund (formerly, Perkins International Value Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Value Fund (formerly, Perkins Global Value Fund), the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Large Cap Value Fund (formerly, Perkins Large Cap Value Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Mid Cap Value Fund (formerly, Perkins Mid Cap Value Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Select Value Fund (formerly, Perkins Select Value Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Small Cap Value Fund (formerly, Perkins Small Cap Value Fund), the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Value Plus Income Fund (formerly, Perkins Value Plus Income Fund), the Trustees noted that although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

Mathematical Funds

· For Janus Henderson Emerging Markets Managed Volatility Fund (formerly, INTECH Emerging Markets Managed Volatility Fund), the Trustees noted that although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Income Managed Volatility Fund (formerly, INTECH Global Income Managed Volatility Fund), the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson International Managed Volatility Fund (formerly, INTECH International Managed Volatility Fund), the Trustees noted that although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson U.S. Managed Volatility Fund (formerly, INTECH U.S. Managed Volatility Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class,

Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

Growth and Core Funds

· For Janus Henderson Balanced Fund (formerly, Janus Balanced Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Contrarian Fund (formerly, Janus Contrarian Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Enterprise Fund (formerly, Janus Enterprise Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Forty Fund (formerly, Janus Forty Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Growth and Income Fund (formerly, Janus Growth and Income Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Research Fund (formerly, Janus Research Fund), the Trustees noted that although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable.

· For Janus Henderson Triton Fund (formerly, Janus Triton Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Venture Fund (formerly, Janus Venture Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

Global and International Funds

· For Janus Henderson Adaptive Global Allocation Fund (formerly, Janus Adaptive Global Allocation Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group median for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Asia Equity Fund (formerly, Janus Asia Equity Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total

Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Life Sciences Fund (formerly, Janus Global Life Sciences Fund), the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Real Estate Fund (formerly, Janus Global Real Estate Fund), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Global Research Fund (formerly, Janus Global Research Fund), the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Select Fund (formerly, Janus Global Select Fund), the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Technology Fund (formerly, Janus Global Technology Fund), the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Overseas Fund (formerly, Janus Overseas Fund), the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

Janus Aspen Series

· For Janus Henderson Balanced Portfolio (formerly, Janus Aspen Balanced Portfolio), the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes.

· For Janus Henderson Enterprise Portfolio (formerly, Janus Aspen Enterprise Portfolio), the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes.

· For Janus Henderson Flexible Bond Portfolio (formerly, Janus Aspen Flexible Bond Portfolio), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for both share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Forty Portfolio (formerly, Janus Aspen Forty Portfolio), the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes.

· For Janus Henderson Global Allocation Portfolio – Moderate (formerly, Janus Aspen Global Allocation Portfolio – Moderate), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for both share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Research Portfolio (formerly, Janus Aspen Global Research Portfolio), the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes.

· For Janus Henderson Global Technology Portfolio (formerly, Janus Aspen Global Technology Portfolio), the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes.

· For Janus Henderson Global Unconstrained Bond Portfolio (formerly, Janus Aspen Global Unconstrained Bond Portfolio), the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for both share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson U.S. Low Volatility Portfolio (formerly, Janus Aspen INTECH U.S. Low Volatility Portfolio), the Trustees noted that the Fund’s total expenses were below the peer group average for its sole share class.

· For Janus Henderson Research Portfolio (formerly, Janus Aspen Janus Portfolio), the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes.

Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

· For Janus Henderson Overseas Portfolio (formerly, Janus Aspen Overseas Portfolio), the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes.

· For Janus Henderson Mid Cap Value Portfolio (formerly, Janus Aspen Perkins Mid Cap Value Portfolio), the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes.

The Trustees reviewed information on the profitability to Janus Capital and its affiliates of their relationships with each Fund, as well as an explanation of the methodology utilized by Janus Capital when allocating various expenses of Janus Capital and its affiliates with respect to contractual relationships with the Funds and other clients. The Trustees also reviewed the financial statements and corporate structure of Janus Capital’s parent company. In their review, the Trustees considered whether Janus Capital and each subadviser receive adequate incentives and resources to manage the Funds effectively. The Trustees recognized that profitability comparisons among fund managers are difficult because very little comparative information is publicly available, and the profitability of any fund manager is affected by numerous factors, including the organizational structure of the particular fund manager, the types of funds and other accounts it manages, possible other lines of business, the methodology for allocating expenses, and the fund manager’s capital structure and cost of capital. However, taking into account those factors and the analysis provided by the Trustees’ independent fee consultant, and based on the information available, the Trustees concluded that Janus Capital’s profitability with respect to each Fund in relation to the services rendered was reasonable.

The independent fee consultant found that, while assessing the reasonableness of expenses in light of Janus Capital’s profits is dependent on comparisons with other publicly-traded mutual fund advisers, and that these comparisons are limited in accuracy by differences in complex size, business mix, institutional account orientation, and other factors, after accepting these limitations, the level of profit earned by Janus Capital from managing the Funds is reasonable.

The Trustees concluded that the management fees payable by each Fund to Janus Capital and its affiliates, as well as the fees paid by Janus Capital to the subadvisers of subadvised Funds, were reasonable in relation to the nature, extent, and quality of the services provided, taking into account the fees charged by other advisers for managing comparable mutual funds with similar strategies, the fees Janus Capital and the subadvisers charge to other clients, and, as applicable, the impact of fund performance on management fees payable by the Funds. The Trustees also concluded that each Fund’s total expenses were reasonable, taking into account the size of the Fund, the quality of services provided by Janus Capital and any subadviser, the investment performance of the Fund, and any expense limitations agreed to or provided by Janus Capital.

Economies of Scale

The Trustees considered information about the potential for Janus Capital to realize economies of scale as the assets of the Funds increase. They noted their independent fee consultant’s analysis of economies of scale in prior years. They also noted that, although many Funds pay advisory fees at a base fixed rate as a percentage of net assets, without any breakpoints, their independent fee consultant concluded that 91% of these Funds have contractual management fees (gross of waivers) below their Broadridge expense group averages and, overall, 83% of the Funds are below their respective expense group averages for contractual management fees. They also noted that for those Funds whose expenses are being reduced by the contractual expense limitations of Janus Capital, Janus Capital is subsidizing the Funds because they have not reached adequate scale. Moreover, as the assets of some of the Funds have declined in the past few years, certain Funds have benefited from having advisory fee rates that have remained constant rather than increasing as assets declined. In addition, performance fee structures have been implemented for various Funds that have caused the effective rate of advisory fees payable by such a Fund to vary depending on the investment performance of the Fund relative to its benchmark index over the measurement period; and a few Funds have fee schedules with breakpoints and reduced fee rates above certain asset levels. The Trustees also noted that the Funds share directly in economies of scale through the lower charges of third-party service providers that are based in part on the combined scale of all of the Funds. Based on all of the information they reviewed, including past research and analysis conducted by the Trustees’ independent fee consultant, the Trustees concluded that the current fee structure of each Fund was reasonable and that the current rates of fees do reflect a sharing between Janus Capital and the Fund of any economies of scale that may be present at the current asset level of the Fund.

The independent fee consultant concluded that, given the limitations of various analytical approaches to economies of scale considered in prior years, and their conflicting results, its analyses could not confirm or deny the existence of economies of scale in the Janus complex. Further, the independent fee consultant provided its belief that Fund

Janus Henderson VIT Flexible Bond Portfolio

Additional Information (unaudited)

investors are well-served by the fee levels and performance fee structures in place on the Funds in light of any economies of scale that may be present at Janus Capital.

Other Benefits to Janus Capital

The Trustees also considered benefits that accrue to Janus Capital and its affiliates and subadvisers to the Funds from their relationships with the Funds. They recognized that two affiliates of Janus Capital separately serve the Funds as transfer agent and distributor, respectively, and the transfer agent receives compensation directly from the non-money market funds for services provided. The Trustees also considered Janus Capital’s past and proposed use of commissions paid by the Funds on portfolio brokerage transactions to obtain proprietary and third-party research products and services benefiting the Fund and/or other clients of Janus Capital and/or Janus Capital, and/or a subadviser to a Fund. The Trustees concluded that Janus Capital’s and the subadvisers’ use of these types of client commission arrangements to obtain proprietary and third-party research products and services was consistent with regulatory requirements and guidelines and was likely to benefit each Fund. The Trustees also concluded that, other than the services provided by Janus Capital and its affiliates and subadvisers pursuant to the agreements and the fees to be paid by each Fund therefor, the Funds and Janus Capital and the subadvisers may potentially benefit from their relationship with each other in other ways. They concluded that Janus Capital and/or the subadvisers benefits from the receipt of research products and services acquired through commissions paid on portfolio transactions of the Funds and that the Funds benefit from Janus Capital’s and/or the subadvisers’ receipt of those products and services as well as research products and services acquired through commissions paid by other clients of Janus Capital and/or other clients of the subadvisers. They further concluded that the success of any Fund could attract other business to Janus Capital, the subadvisers or other Janus funds, and that the success of Janus Capital and the subadvisers could enhance Janus Capital’s and the subadvisers’ ability to serve the Funds.

Janus Henderson VIT Flexible Bond Portfolio

Useful Information About Your Portfolio Report (unaudited)

Management Commentary

The Management Commentary in this report includes valuable insight as well as statistical information to help you understand how your Portfolio’s performance and characteristics stack up against those of comparable indices.

If the Portfolio invests in foreign securities, this report may include information about country exposure. Country exposure is based primarily on the country of risk. A company may be allocated to a country based on other factors such as location of the company’s principal office, the location of the principal trading market for the company’s securities, or the country where a majority of the company’s revenues are derived.

Please keep in mind that the opinions expressed in the Management Commentary are just that: opinions. They are a reflection based on best judgment at the time this report was compiled, which was June 30, 2017. As the investing environment changes, so could opinions. These views are unique and are not necessarily shared by fellow employees or by Janus Henderson in general.

Performance Overviews

Performance overview graphs compare the performance of a hypothetical $10,000 investment in the Portfolio with one or more widely used market indices. When comparing the performance of the Portfolio with an index, keep in mind that market indices are not available for investment and do not reflect deduction of expenses.

Average annual total returns are quoted for a Portfolio with more than one year of performance history. Average annual total return is calculated by taking the growth or decline in value of an investment over a period of time, including reinvestment of dividends and distributions, then calculating the annual compounded percentage rate that would have produced the same result had the rate of growth been constant throughout the period. Average annual total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Cumulative total returns are quoted for a Portfolio with less than one year of performance history. Cumulative total return is the growth or decline in value of an investment over time, independent of the period of time involved. Cumulative total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Pursuant to federal securities rules, expense ratios shown in the performance chart reflect subsidized (if applicable) and unsubsidized ratios. The total annual fund operating expenses ratio is gross of any fee waivers, reflecting the Portfolio’s unsubsidized expense ratio. The net annual fund operating expenses ratio (if applicable) includes contractual waivers of Janus Capital and reflects the Portfolio’s subsidized expense ratio. Ratios may be higher or lower than those shown in the “Financial Highlights” in this report.

Schedule of Investments

Following the performance overview section is the Portfolio’s Schedule of Investments. This schedule reports the types of securities held in the Portfolio on the last day of the reporting period. Securities are usually listed by type (common stock, corporate bonds, U.S. Government obligations, etc.) and by industry classification (banking, communications, insurance, etc.). Holdings are subject to change without notice.

The value of each security is quoted as of the last day of the reporting period. The value of securities denominated in foreign currencies is converted into U.S. dollars.

If the Portfolio invests in foreign securities, it will also provide a summary of investments by country. This summary reports the Portfolio exposure to different countries by providing the percentage of securities invested in each country. The country of each security represents the country of risk. The Portfolio’s Schedule of Investments relies upon the industry group and country classifications published by Barclays and/or MSCI Inc.

Tables listing details of individual forward currency contracts, futures, written options, swaptions, and swaps follow the Portfolio’s Schedule of Investments (if applicable).

Statement of Assets and Liabilities

This statement is often referred to as the “balance sheet.” It lists the assets and liabilities of the Portfolio on the last day of the reporting period.

Janus Henderson VIT Flexible Bond Portfolio

Useful Information About Your Portfolio Report (unaudited)

The Portfolio’s assets are calculated by adding the value of the securities owned, the receivable for securities sold but not yet settled, the receivable for dividends declared but not yet received on securities owned, and the receivable for Portfolio shares sold to investors but not yet settled. The Portfolio’s liabilities include payables for securities purchased but not yet settled, Portfolio shares redeemed but not yet paid, and expenses owed but not yet paid. Additionally, there may be other assets and liabilities such as unrealized gain or loss on forward currency contracts.

The section entitled “Net Assets Consist of” breaks down the components of the Portfolio’s net assets. Because the Portfolio must distribute substantially all earnings, you will notice that a significant portion of net assets is shareholder capital.

The last section of this statement reports the net asset value (“NAV”) per share on the last day of the reporting period. The NAV is calculated by dividing the Portfolio’s net assets for each share class (assets minus liabilities) by the number of shares outstanding.

Statement of Operations

This statement details the Portfolio’s income, expenses, realized gains and losses on securities and currency transactions, and changes in unrealized appreciation or depreciation of Portfolio holdings.

The first section in this statement, entitled “Investment Income,” reports the dividends earned from securities and interest earned from interest-bearing securities in the Portfolio.

The next section reports the expenses incurred by the Portfolio, including the advisory fee paid to the investment adviser, transfer agent fees and expenses, and printing and postage for mailing statements, financial reports and prospectuses. Expense offsets and expense reimbursements, if any, are also shown.

The last section lists the amounts of realized gains or losses from investment and foreign currency transactions, and changes in unrealized appreciation or depreciation of investments and foreign currency-denominated assets and liabilities. The Portfolio will realize a gain (or loss) when it sells its position in a particular security. A change in unrealized gain (or loss) refers to the change in net appreciation or depreciation of the Portfolio during the reporting period. “Net Realized and Unrealized Gain/(Loss) on Investments” is affected both by changes in the market value of Portfolio holdings and by gains (or losses) realized during the reporting period.

Statements of Changes in Net Assets

These statements report the increase or decrease in the Portfolio’s net assets during the reporting period. Changes in the Portfolio’s net assets are attributable to investment operations, dividends and distributions to investors, and capital share transactions. This is important to investors because it shows exactly what caused the Portfolio’s net asset size to change during the period.

The first section summarizes the information from the Statement of Operations regarding changes in net assets due to the Portfolio’s investment operations. The Portfolio’s net assets may also change as a result of dividend and capital gains distributions to investors. If investors receive their dividends and/or distributions in cash, money is taken out of the Portfolio to pay the dividend and/or distribution. If investors reinvest their dividends and/or distributions, the Portfolio’s net assets will not be affected. If you compare the Portfolio’s “Net Decrease from Dividends and Distributions” to “Reinvested Dividends and Distributions,” you will notice that dividends and distributions have little effect on the Portfolio’s net assets. This is because the majority of the Portfolio’s investors reinvest their dividends and/or distributions.

The reinvestment of dividends and distributions is included under “Capital Share Transactions.” “Capital Shares” refers to the money investors contribute to the Portfolio through purchases or withdrawals via redemptions. The Portfolio’s net assets will increase and decrease in value as investors purchase and redeem shares from the Portfolio.

Financial Highlights

This schedule provides a per-share breakdown of the components that affect the Portfolio’s NAV for current and past reporting periods as well as total return, asset size, ratios, and portfolio turnover rate.

The first line in the table reflects the NAV per share at the beginning of the reporting period. The next line reports the net investment income/(loss) per share. Following is the per share total of net gains/(losses), realized and unrealized. Per share dividends and distributions to investors are then subtracted to arrive at the NAV per share at the end of the

Janus Henderson VIT Flexible Bond Portfolio

Useful Information About Your Portfolio Report (unaudited)

period. The next line reflects the total return for the period. Also included are ratios of expenses and net investment income to average net assets.

The Portfolio’s expenses may be reduced through expense offsets and expense reimbursements. The ratios shown reflect expenses before and after any such offsets and reimbursements.

The ratio of net investment income/(loss) summarizes the income earned less expenses, divided by the average net assets of the Portfolio during the reporting period. Do not confuse this ratio with the Portfolio’s yield. The net investment income ratio is not a true measure of the Portfolio’s yield because it does not take into account the dividends distributed to the Portfolio’s investors.

The next figure is the portfolio turnover rate, which measures the buying and selling activity in the Portfolio. Portfolio turnover is affected by market conditions, changes in the asset size of the Portfolio, fluctuating volume of shareholder purchase and redemption orders, the nature of the Portfolio’s investments, and the investment style and/or outlook of the portfolio manager(s) and/or investment personnel. A 100% rate implies that an amount equal to the value of the entire portfolio was replaced once during the fiscal year; a 50% rate means that an amount equal to the value of half the portfolio is traded in a year; and a 200% rate means that an amount equal to the value of the entire portfolio is traded every six months.

Janus Henderson VIT Flexible Bond Portfolio

Shareholder Meeting (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Special meetings of shareholders were held on April 6, 2017 and adjourned and reconvened on April 18, 2017 (together, the "meeting"). At the meeting, the following matters were voted on and approved by shareholders. Each vote reported represents one dollar of net asset value held on the record date for the meeting. The results of the meeting are noted below. |

| | | | | | | | | | |

Proposals | | | | | | | | | |

1. For all Portfolios, to approve a new investment advisory agreement between the Trust, on behalf of the Portfolio, and Janus Capital Management LLC. |

| | | | | | | | | | |

| Number of Votes ($) | | | | | | |

Record Date Votes ($) | Affirmative | Against | Abstain | BNV | Total | | | | |

736,301,557.196 | 567,562,568.942 | 15,243,633.532 | 31,189,299.238 | (0.002) | 613,995,501.711 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Percentage of Total Outstanding Votes (%) | | Percentage Voted (%) |

Affirmative | Against | Abstain | BNV | Total | Affirmative | Against | Abstain | BNV | Total |

77.083 | 2.070 | 4.236 | 0.000 | 83.389 | 92.438 | 2.483 | 5.080 | 0.000 | 100.000 |

| | | | | | | | | | |

| | | | | | | | | | |

4. To elect an additional Trustee to the Board of Trustees of the Trust. - Diane L. Wallace. |

| | | | | | | | | | |

| Number of Votes ($) | | | | | | |

Record Date Votes ($) | Affirmative | Against | Abstain | BNV | Total | | | | |

7,198,647,378.476 | 6,547,141,899.530 | 651,505,478.947 | 0.000 | 0.000 | 7,198,647,378.476 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Percentage of Total Outstanding Votes (%) | | Percentage Voted (%) |

Affirmative | Against | Abstain | BNV | Total | Affirmative | Against | Abstain | BNV | Total |

80.347 | 7.995 | 0.000 | 0.000 | 88.343 | 90.950 | 9.050 | 0.000 | 0.000 | 100.000 |

| | | | | | | | | | |

Alan A. Brown, William D. Cvengros, Raudline Etienne, William F. McCalpin, Gary A. Poliner, James T. Rothe, William D. Stewart and Linda S. Wolf continue to serve as Trustees following the meeting. |

| | | | | | | | | | |

| | | | | | | | | | |

5. For all Portfolios, except Global Unconstrained Bond Portfolio, to approve a proposal that would authorize the Adviser to enter into and materially amend sub-advisory agreements in the future with wholly-owned subadvisers and unaffiliated sub-advisers, with the approval of the Board of Trustees of the Trust, but without obtaining additional shareholder approval. |

| | | | | | | | | | |

| Number of Votes ($) | | | | | | |

Record Date Votes ($) | Affirmative | Against | Abstain | BNV | Total | | | | |

736,301,557.196 | 515,651,189.489 | 44,585,039.536 | 53,759,272.698 | (0.012) | 613,995,501.711 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Percentage of Total Outstanding Votes (%) | | Percentage Voted (%) |

Affirmative | Against | Abstain | BNV | Total | Affirmative | Against | Abstain | BNV | Total |

70.033 | 6.055 | 7.301 | 0.000 | 83.389 | 83.983 | 7.261 | 8.756 | 0.000 | 100.000 |

Janus Henderson VIT Flexible Bond Portfolio

Notes

NotesPage1

Knowledge. Shared

At Janus Henderson, we believe in the sharing of expert insight for better investment and business decisions. We call this ethos Knowledge. Shared.

Learn more by visiting janushenderson.com.

| | | | | | | | | |

| | | | | |

| | | | |

This report is submitted for the general information of shareholders of the Portfolio. It is not an offer or solicitation for the Portfolio and is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. |

Janus Henderson, Janus, Perkins and INTECH are trademarks or registered trademarks of Janus Henderson Investors. © Janus Henderson Investors. The name Janus Henderson Investors includes HGI Group Limited, Henderson Global Investors (Brand Management) Sarl and Janus International Holding LLC. Portfolios distributed by Janus Henderson Distributors |

| | | | | 109-24-81114 08-17 |

| | | | |

| | | |

| | | SEMIANNUAL REPORT June 30, 2017 |

| | |

| | Janus Henderson VIT Forty Portfolio (formerly named Janus Aspen Forty Portfolio) |

| | |

| | Janus Aspen Series |

| | | |

| | | HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your portfolio · Portfolio performance, characteristics

and holdings |

| | |

|

Table of Contents

Janus Henderson VIT Forty Portfolio

| | |

Management Commentary and Schedule of Investments | 1 |

Notes to Schedule of Investments and Other Information | 10 |

Statement of Assets and Liabilities | 11 |

Statement of Operations | 12 |

Statements of Changes in Net Assets | 13 |

Financial Highlights | 14 |

Notes to Financial Statements | 15 |

Additional Information | 24 |

Useful Information About Your Portfolio Report | 42 |

Shareholder Meeting | 45 |

Janus Henderson VIT Forty Portfolio (unaudited)

| | | | | | |

PORTFOLIO SNAPSHOT We believe that constructing a concentrated portfolio of quality growth companies will allow us to outperform our benchmark over time. We define quality as companies that enjoy sustainable “moats” around their businesses, potentially allowing companies to grow faster, with higher returns, than their competitors. We believe the market often underestimates these companies’ sustainable competitive advantage periods. | | | |

Doug Rao co-portfolio manager |

Nick Schommer co-portfolio manager |

| | | |

PERFORMANCE OVERVIEW

For the six-month period ended June 30, 2017, the Portfolio’s Institutional Shares and Service Shares returned 19.04% and 18.90%, respectively, versus a return of 13.99% for the Portfolio’s primary benchmark, the Russell 1000 Growth Index. The Portfolio’s secondary benchmark, the S&P 500 Index, returned 9.34% for the period.

INVESTMENT ENVIRONMENT

U.S. equities experienced strong gains during the period. Stocks rose in the first quarter, buoyed by economic data points that suggested global economic growth and hopes that the Trump administration’s proposed pro-growth initiatives would further jump-start the economy. During the second quarter, strong corporate earnings and a low global interest rate environment continued to support stocks. The technology sector was the best-performing sector within the Russell 1000 Growth Index. The energy sector lagged the broader index, due in large part to falling oil prices.

PERFORMANCE DISCUSSION

The Portfolio outperformed its primary benchmark, the Russell 1000 Growth Index, and its secondary benchmark, the S&P 500 Index, during the period. As part of our investment strategy, we seek companies that have built clear, sustainable competitive moats around their businesses, which should help them grow market share within their respective industries over time. Important competitive advantages could include a strong brand, network effects from a product or service that would be hard for a competitor to replicate, a lower cost structure than competitors in the industry, a distribution advantage or patent protection over valuable intellectual property. We think emphasizing these sustainable competitive advantages can be a meaningful driver of outperformance over longer time horizons because the market often underestimates the duration of growth for these companies and the long-term potential return to shareholders. This period we saw a number of companies in our portfolio put up impressive results, further validating our view that they are well positioned to grow in excess of the market.

Activision Blizzard was our largest contributor. Activision Blizzard’s stock has appreciated as the market has begun to recognize that the company’s digital transition enables a more durable cash flow stream and new avenues to monetize its franchises. We believe the trend toward digital gaming is a powerful tailwind for Activision. As gaming moves from physical game cartridges toward digital platforms, it reduces costs for Activision and makes it less reliant on the release of a new gaming console to drive game sales. Digital gaming also gives the company the ability to sell digital items to gamers in real-time. We also like that Activision has a number of popular game franchises, which makes the company less dependent on any single franchise and creates a loyal and receptive audience when a franchise launches a new release. We also believe Activision can improve monetization of games it acquired from King Digital by inserting advertisements into those games for the first time. Finally, we believe the company has an opportunity to monetize viewership of its games through eSports.

CSX Corp. also added to performance. The stock was up after an announcement that a new CEO with a history of improving operations at railroad companies was taking the helm at the company. We had long believed that CSX’s operating underperformance relative to other railroad companies left room for improvement, and believe better results will follow the new leadership. We believe a large rail network such as CSX’s is a valuable asset that would be hard, if not impossible, for other transportation and logistics companies to replicate. Railways also have a significant cost advantage over the trucking industry. As CSX focuses on improving its service and reliability to customers, we believe it will continue to drive more shippers to use the railway instead of trucking services.

Janus Henderson VIT Forty Portfolio (unaudited)

Adobe Systems was another large contributor to performance. The stock appreciated after the company announced better-than-expected earnings results and increased guidance in each of the last two quarters. We believe the company will continue to grow profitability as its digital media business moves from a perpetual license-based business model to a subscription-based business model. We also believe Adobe’s digital marketing business, which helps advertisers create digital content, is well positioned for the transition in advertising spending toward digital advertising platforms.

While pleased with our performance during the period, we still held stocks that detracted from our results. General Electric was our largest detractor. We have been disappointed in GE’s cash flow conversion from its industrial businesses, and sold the position during the period.

Goldman Sachs was also a negative contributor. The company had disappointing first quarter results, as its trading business underperformed relative to its investment banking competitors. This doesn’t change our long-term view. We believe the relationships Goldman has built with corporate clients and investors around the world give it a competitive advantage, and it can use that information to drive growth. We also like that Goldman has invested through the entire economic cycle, which should translate into market share gains.

Bristol Myers Squibb was another detractor. Disappointing clinical results for a trial pairing its cancer drug, Opdivo, with another treatment negatively affected the stock during the period. We sold the stock due to concerns the company’s cancer treatments would lose market share within the immuno-oncology space.

OUTLOOK

We believe stocks are fairly valued, given the context of a low interest rate environment and a resilient, albeit slow-growing, economy. We would not expect further multiple expansion, but instead, earnings and free cash flow per share growth to dictate the trajectory of individual stock prices. We feel our portfolio is well positioned for such an environment.

As we’ve highlighted in some of our commentaries, many of our holdings are enabling some of the most powerful secular growth themes in today’s economy: the shift from offline to online spending, the switch of enterprise software from on-premises data centers to the cloud and a proliferation of connected devices in the home and business, to name a few. These themes may be well known, but they remain nascent in their development. We believe our companies are still in the early innings of realizing their earnings potential as these themes push forward. We remain confident in their ability to grow earnings and welcome an environment where that growth is the key determinant of stock price appreciation.

Thank you for your investment in Janus Henderson VIT Forty Portfolio.

Janus Henderson VIT Forty Portfolio (unaudited)

Portfolio At A Glance

June 30, 2017

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | 5 Top Performers - Holdings | | | | 5 Bottom Performers - Holdings | |

| | | | Contribution | | | Contribution |

| | Activision Blizzard Inc | | 1.91% | | General Electric Co | -0.40% |

| | CSX Corp | | 1.38% | | Goldman Sachs Group Inc | -0.24% |

| | Adobe Systems Inc | | 1.11% | | Bristol-Myers Squibb Co | -0.22% |

| | Amazon.com Inc | | 1.08% | | Sealed Air Corp | -0.09% |

| | Alphabet Inc - C Class | | 1.00% | | Biogen Inc | -0.02% |

| | | | | | | |

| | 5 Top Performers - Sectors* | | | | | |

| | | | Portfolio | | Portfolio Weighting | Russell 1000 Growth Index |

| | | | Contribution | | (Average % of Equity) | Weighting |

| | Information Technology | | 3.10% | | 38.15% | 32.86% |

| | Consumer Discretionary | | 1.63% | | 15.10% | 20.72% |

| | Consumer Staples | | 0.52% | | 2.49% | 9.08% |

| | Industrials | | 0.43% | | 7.40% | 10.78% |

| | Health Care | | 0.31% | | 19.41% | 15.83% |

| | | | | | | |

| | 5 Bottom Performers - Sectors* | | | | | |

| | | | Portfolio | | Portfolio Weighting | Russell 1000 Growth Index |

| | | | Contribution | | (Average % of Equity) | Weighting |

| | Financials | | -0.50% | | 9.27% | 2.86% |

| | Materials | | -0.44% | | 2.96% | 3.56% |

| | Other** | | -0.42% | | 3.69% | 0.00% |

| | Utilities | | 0.00% | | 0.00% | 0.03% |

| | Energy | | 0.17% | | 0.00% | 0.52% |

| | | | | | | |

| | Security contribution to performance is measured by using an algorithm that multiplies the daily performance of each security with the previous day’s ending weight in the portfolio and is gross of advisory fees. Fixed income securities and certain equity securities, such as private placements and some share classes of equity securities, are excluded. |

* | Based on sector classification according to the Global Industry Classification Standard (“GICS”) codes, which are the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

** | Not a GICS classified sector. | | | | | |

Janus Henderson VIT Forty Portfolio (unaudited)

Portfolio At A Glance

June 30, 2017

| | |

5 Largest Equity Holdings - (% of Net Assets) |

Alphabet Inc - Class C | |

Internet Software & Services | 6.0% |

Microsoft Corp | |

Software | 5.0% |

Activision Blizzard Inc | |

Software | 4.6% |

Mastercard Inc | |

Information Technology Services | 4.5% |

salesforce.com Inc | |

Software | 4.3% |

| | 24.4% |

| | | | | | |

Asset Allocation - (% of Net Assets) |

Common Stocks | | 93.3% |

Investment Companies | | 6.0% |

Other | | 0.7% |

| | | 100.0% |

| | |

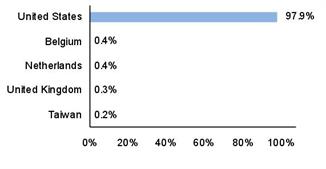

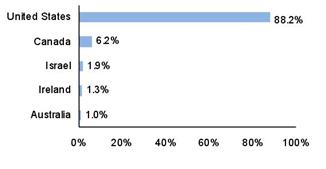

Top Country Allocations - Long Positions - (% of Investment Securities) |

As of June 30, 2017

| As of December 31, 2016

|

Janus Henderson VIT Forty Portfolio (unaudited)

Performance

| |

See important disclosures on the next page. |

| | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | Expense Ratios - |

Average Annual Total Return - for the periods ended June 30, 2017 | | | per the May 1, 2017 prospectuses |

| | Fiscal

Year-to-Date | One

Year | Five

Year | Ten

Year | Since

Inception* | | | Total Annual Fund

Operating Expenses |

Institutional Shares | | 19.04% | 23.49% | 15.89% | 9.31% | 11.24% | | | 0.74% |

Service Shares | | 18.90% | 23.22% | 15.60% | 9.04% | 10.93% | | | 0.99% |

Russell 1000 Growth Index | | 13.99% | 20.42% | 15.30% | 8.91% | 7.16% | | | |

S&P 500 Index | | 9.34% | 17.90% | 14.63% | 7.18% | 7.66% | | | |

Morningstar Quartile - Institutional Shares | | - | 1st | 1st | 1st | 1st | | | |

Morningstar Ranking - based on total returns for Large Growth Funds | | - | 279/1,490 | 170/1,409 | 127/1,175 | 17/660 | | | |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 877.335.2687 or visit janushenderson.com/VITperformance

This Portfolio has a performance-based management fee that may adjust up or down based on the Portfolio’s performance.

Performance may be affected by risks that include those associated with non-diversification, portfolio turnover, short sales, potential conflicts of interest, foreign and emerging markets, initial public offerings (IPOs), high-yield and high-risk securities, undervalued, overlooked and smaller capitalization companies, real estate related securities including Real Estate Investment Trusts (REITs), derivatives, and commodity-linked investments. Each product has different risks. Please see the prospectus for more information about risks, holdings and other details.

Returns shown do not represent actual returns since they do not include insurance charges. Returns shown would have been lower had they included insurance charges.

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

See Financial Highlights for actual expense ratios during the reporting period.

Performance for Service Shares prior to December 31, 1999 reflects the performance of Institutional Shares, adjusted to reflect the expenses of Service Shares.

Ranking is for the share class shown only; other classes may have different performance characteristics.

© 2017 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

Janus Henderson VIT Forty Portfolio (unaudited)

Performance

See Notes to Schedule of Investments and Other Information for index definitions.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

See “Useful Information About Your Portfolio Report.”

*The Portfolio’s inception date – May 1, 1997

Janus Henderson VIT Forty Portfolio (unaudited)

Expense Examples

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees (applicable to Service Shares only); transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in either share class or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as any charges at the separate account level or contract level. These fees are fully described in the Portfolio’s prospectuses. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | |

| | | | | | | | | |

| | | | Actual | | Hypothetical

(5% return before expenses) | |

| Beginning

Account

Value

(1/1/17) | Ending

Account

Value

(6/30/17) | Expenses

Paid During

Period

(1/1/17 - 6/30/17)† | | Beginning

Account

Value

(1/1/17) | Ending

Account

Value

(6/30/17) | Expenses

Paid During

Period

(1/1/17 - 6/30/17)† | Net Annualized

Expense Ratio

(1/1/17 - 6/30/17) |

Institutional Shares | $1,000.00 | $1,190.40 | $4.24 | | $1,000.00 | $1,020.93 | $3.91 | 0.78% |

Service Shares | $1,000.00 | $1,189.00 | $5.54 | | $1,000.00 | $1,019.74 | $5.11 | 1.02% |

† | Expenses Paid During Period are equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses in the examples include the effect of applicable fee waivers and/or expense reimbursements, if any. Had such waivers and/or reimbursements not been in effect, your expenses would have been higher. Please refer to the Notes to Financial Statements or the Portfolio’s prospectuses for more information regarding waivers and/or reimbursements. |

Janus Henderson VIT Forty Portfolio

Schedule of Investments (unaudited)

June 30, 2017

| | | | | | | | |

Shares

| | | Value | |

Common Stocks – 93.3% | | | |

Aerospace & Defense – 1.6% | | | |

| | General Dynamics Corp | | .59,190 | | | $11,725,539 | |

Auto Components – 2.1% | | | |

| | Delphi Automotive PLC | | 182,068 | | | 15,958,260 | |

Automobiles – 0.5% | | | |

| | Tesla Inc* | | 10,251 | | | 3,706,864 | |

Biotechnology – 4.6% | | | |

| | Celgene Corp* | | 76,939 | | | 9,992,068 | |