QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrantý |

| Filed by a party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary proxy statement |

| ý | | Definitive proxy statement |

| o | | Definitive additional materials |

| o | | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12

|

QRS CORPORATION |

(Name of Registrant as Specified in Charter) |

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant) |

| | | | | |

| Payment of filing fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Rule 0-11 (Set forth the amount on which the

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials: |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | (1) | | Amount previously paid:

|

| | | (2) | | Form, schedule or registration statement no.:

|

| | | (3) | | Filing party:

|

| | | (4) | | Date filed:

|

| | | QRS Corporation | | 1400 Marina Way South

Richmond, CA

94804 USA |

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of QRS Corporation (the"Company") to be held May 14, 2002, at 9:00 a.m. local time, at the Company's headquarters, 1400 Marina Way South, Richmond, California 94804.

At the Annual Meeting, you will be asked to consider and vote upon the following proposals: (1) to elect three directors of the Company, two directors to serve for a three-year term ending in the year 2005 and another director to serve a one-year term ending in the year 2003, (2) to approve an amendment to and restatement of the QRS Corporation 1993 Stock Option/Stock Issuance Plan, and (3) to ratify the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company for the fiscal year ending December 31, 2002.

The enclosed Proxy Statement more fully describes the details of the business to be conducted at the Annual Meeting. After careful consideration, the Company's Board of Directors has unanimously approved each of the proposals and recommends that you vote FOR each such proposal.

After reading the Proxy Statement, please mark, date, sign and return the enclosed proxy card in the accompanying reply envelope. If you decide to attend the Annual Meeting and would prefer to vote in person, please notify the Secretary of the Company that you wish to vote in person and your proxy will not be voted. YOUR SHARES CANNOT BE VOTED UNLESS YOU SIGN, DATE AND RETURN THE ENCLOSED PROXY OR ATTEND THE ANNUAL MEETING IN PERSON.

A copy of the Company's 2001 Annual Report has been mailed concurrently herewith to all stockholders entitled to notice of and to vote at the Annual Meeting.

We look forward to seeing you at the Annual Meeting.

| | | Sincerely yours, |

|

|

|

|

|

Elizabeth A. Fetter

President and Chief Executive Officer |

Richmond, California

April 10, 2002 | | |

IMPORTANT

Please mark, date and sign the enclosed proxy and return it at your earliest convenience in the enclosed postage-prepaid return envelope so that if you are unable to attend the Annual Meeting, your shares may be voted.

QRS CORPORATION

1400 Marina Way South, Richmond, California 94804

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 14, 2002

TO OUR STOCKHOLDERS:

You are cordially invited to attend the Annual Meeting of Stockholders of QRS Corporation, a Delaware corporation (the"Company"), to be held on May 14, 2002, at 9:00 a.m. local time, at the Company's headquarters, 1400 Marina Way South, Richmond, California 94804, for the following purposes:

- 1.

- To elect two directors to serve for a three-year term ending in the year 2005 and to elect another director to serve a one-year term ending in the year 2003. The nominees for the three-year terms are Elizabeth A. Fetter and Patrick S. Jones, and the nominee for the one-year term is Peter R. Johnson.

- 2.

- To approve an amendment to and restatement of the QRS Corporation 1993 Stock Option/Stock Issuance Plan to increase the number of shares of Common Stock authorized for issuance thereunder by 750,000, bringing the total shares issuable thereunder to 6,200,000 shares;

- 3.

- To ratify the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company for the fiscal year ending December 31, 2002; and

- 4.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on March 22, 2002 as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be returned to assure that all your shares will be voted. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted. The prompt return of your proxy card will assist us in preparing for the Annual Meeting. We look forward to seeing you at the Annual Meeting.

| | | By Order Of The Board Of Directors |

|

|

|

|

|

Leonard R. Stein

Senior Vice President, General Counsel and Secretary |

Richmond, California

April 10, 2002 |

|

|

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. IN ANY EVENT, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

QRS CORPORATION

1400 Marina Way South

Richmond, California 94804

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

May 14, 2002

General

The enclosed proxy is solicited on behalf of the Board of Directors of QRS Corporation, a Delaware corporation (the"Company," "QRS," or"we" or"us"), for use at the Annual Meeting of Stockholders to be held on Tuesday, May 14, 2002, at 9:00 a.m. local time (the"Annual Meeting"), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Company's headquarters, 1400 Marina Way South, Richmond, California 94804. The Company mailed this proxy statement and accompanying proxy card on or about April 10, 2002 to all stockholders entitled to vote at the meeting.

Voting Rights and Outstanding Shares

Only holders of record of our common stock, par value $.001 per share ("Common Stock"), at the close of business on March 22, 2002 are entitled to notice of, and to vote at, the Annual Meeting (or at any adjournments or postponements thereof). On March 22, 2002, we had outstanding and entitled to vote 15,683,360 shares of our Common Stock.

Each holder of record of Common Stock on such date will be entitled to one vote for each share of Common Stock held on all matters to be voted on at the Annual Meeting. Stockholders may not cumulate votes in the election of directors. A majority of the outstanding shares of Common Stock will constitute a quorum for the transaction of business at the Annual Meeting.

The enclosed proxy is solicited by our Board of Directors (the"Board of Directors" or the"Board"). If any stockholder is unable to attend the Annual Meeting, such stockholder may vote by proxy. When the proxy card is returned properly completed, it will be voted as directed by the stockholder on the proxy card. Stockholders are urged to specify their choices on the enclosed proxy card.If a proxy card is signed and returned without choices specified, in the absence of contrary instructions, the shares of Common Stock represented by such proxy will be voted FOR Proposals 1, 2 and 3 and will be voted in the proxy holders' discretion as to other matters that may properly come before the Annual Meeting.

All votes will be tabulated by the inspector of election (a representative of our transfer agent) appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker "non-votes" (i.e., where the broker or nominee submits a proxy specifically indicating the lack of discretionary authority to vote on a matter).

Pursuant to Delaware law, abstentions and broker non-votes will be counted as present for purposes of determining whether a quorum of shares is present at the meeting. For Proposal 1 (election of directors), which requires a plurality of the votes cast, withheld votes and broker non-votes will have no effect. With respect to Proposals 2 and 3, (the increase in option plan shares and the appointment of independent auditors), which require the affirmative approval of a majority of the votes present or represented and entitled to vote, broker "non-votes" have no effect. Because abstentions will be included in tabulations of votes cast on proposals presented to stockholders for purposes of determining whether a proposal has been approved, abstentions have the same effect as negative votes on Proposals 2 and 3.

Revocability Of Proxies

Any person giving a proxy has the power to revoke it at any time before its exercise. A proxy may be revoked by filing with the Secretary of the Company at our principal executive offices, 1400 Marina Way South, Richmond, CA 94804, a written instrument of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Solicitation Of Proxies

We will bear the entire cost of soliciting proxies, including the preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional solicitation materials furnished to the stockholders. We have retained Mellon Investor Services LLC ("Mellon") to assist us in the distribution and solicitation of proxies. For its services, we have agreed to pay Mellon a fee of $8,000 and to reimburse it for its reasonable out-of-pocket expenses.

Copies of solicitation material will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock that are beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding the solicitation material to such beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, telegram or other means by our directors, officers, or other regular employees, or by Mellon personnel. No additional compensation will be paid to our own directors, officers or other regular employees for such services.

* * * * *

Our Annual Report for the fiscal year ended December 31, 2001 is enclosed with the mailing of the Notice of Annual Meeting and Proxy Statement to all stockholders entitled to notice of, and to vote at, the Annual Meeting. The Annual Report is not incorporated into this Proxy Statement and is not considered proxy-soliciting material.

2

PROPOSAL 1

ELECTION OF DIRECTORS

Our Certificate of Incorporation provides for a classified Board of Directors consisting of three classes of directors with staggered three-year terms, with each class consisting, as nearly as possible, of one-third of the total number of directors. Although the number of Board positions currently authorized by the Board pursuant to our Certificate of Incorporation and Bylaws is nine, the Board has reduced the number of authorized positions to seven effective simultaneously with the election of directors at the Annual Meeting. The reduction of the number of authorized directors will eliminate one (1) Class I director and one (1) Class III director. Following the Annual Meeting, if this Proposal 1 is approved, the Board will be classified as follows: Class I, which will hold office until the year 2005, will consist of Elizabeth A. Fetter and Patrick S. Jones; Class II, which will hold office until the year 2003, will consist of Peter R. Johnson, Garth Saloner and Garen K. Staglin; and Class III, which will hold office until the year 2004, will consist of John P. Dougall and Philip Schlein.

The Board has determined that it is in the best interests of the Company and its stockholders to make, commencing in 2002, an orderly transition to a Board that is composed of a majority of independent directors. "Independent" means that the Board member is not a present or former employee of the Company and is not an officer, director or employee of an entity that provides services to the Company as an adviser, consultant or otherwise. The Board considers such a structure to be desirable in order to ensure effective and responsive governance of the Company and in order for a wide variety of skills to be brought to bear in making decisions. In determining to move to this new structure, however, the Board considered it important to have an orderly transition, so that QRS continues to receive the benefit of the accumulated knowledge and experience of the majority of its current directors.

As a result of balancing these goals, the Board and certain directors have taken the following actions. Tania Amochaev, a current Class I director and former Chief Executive Officer, will not be standing for reelection at the Annual Meeting. In furtherance of the Board's plan to transition to a Board comprised of a majority of independent directors, John S. Simon, QRS' Executive Vice President of Customer and Market Development and former Chief Executive Officer, who was formerly a Class III director, and David A. Cole, a former Class II director, have resigned their Board seats. Mr. Cole, the Chairman Emeritus of Kurt Salmon Associates, Inc. ("KSA"), has resigned in light of the growing cooperation between the Company and KSA in serving the needs of the Company's customers. Peter R. Johnson, a current Class I Director and current Chairman of the Board, will be nominated to serve as a Class II director for the remainder of the term of Class II directors (until the Company's 2003 annual meeting of stockholders), at which time the Board currently intends to nominate another candidate for such seat. Immediately following the Annual Meeting, the Chairmanship of the Board will rotate from Mr. Johnson to Garth Saloner.

At the Annual Meeting, two directors (to be all of the members of Class I of the Board) are to be nominated for election to serve until the Company's 2005 annual meeting of stockholders, and one director (to be one of three members of Class II of the Board) is to be nominated for election to serve for the remainder of the term of Class II directors, until the Company's 2003 annual meeting of stockholders; or, in each case, until their respective successors are elected and qualified, or until the death, resignation or removal of such director. It is intended that the proxies will be voted for the three nominees named below for election to the Board unless authority to vote for any such nominee is withheld. The two nominees to Class I of the Board are Elizabeth A. Fetter and Patrick S. Jones. Ms. Fetter is currently a member of the Board of Directors, having been elected by the Board in October 2001. She also serves as the Company's President and Chief Executive Officer. Mr. Jones was

3

elected by the Board in March 2002 to fill the Class III vacancy resulting from the resignation of John S. Simon. Mr. Jones will resign this Class III seat simultaneously with the election of directors at the Annual Meeting. Mr. Jones has been appointed a member of the Audit Committee, and immediately following the Annual Meeting it is anticipated that he will assume the Chairmanship of the Audit Committee. The nominee to Class II of the Board is Peter R. Johnson, who currently serves as a member of Class I of the Board. In connection with the orderly transition to a seven-member Board comprised of a majority of independent directors, Mr. Johnson will be nominated to serve as a Class II director to serve for the remainder of the term of Class II directors, until the Company's 2003 annual meeting of stockholders, at which time the Board currently intends to nominate another candidate for such seat.

Each person nominated for election has agreed to serve if elected, and the Board of Directors has no reason to believe that any nominee will be unavailable or will decline to serve. In the event, however, that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the then current Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. The three candidates receiving the highest number of the affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of the Company. The proxies solicited by this Proxy Statement may not be voted for more than three nominees.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE

ELECTION OF THE FOLLOWING NOMINEES AS DIRECTORS.

NOMINEES FOR TERM ENDING UPON THE

2005 ANNUAL MEETING OF STOCKHOLDERS

Set forth below is information regarding the nominees to be elected as Class I directors, who will serve until the Company's 2005 annual meeting of stockholders or until their respective successors are duly elected and qualified.

Name

| | Position(s) with the Company

| | Age

| | Served as

Director Since:

|

|---|

| Elizabeth A. Fetter | | Director, President and Chief Executive Officer | | 43 | | October 2001 |

Patrick S. Jones(1) |

|

Director |

|

57 |

|

March 2002 |

- (1)

- Member of the Audit Committee; immediately following the Annual Meeting, it is anticipated that Mr. Jones will assume the Chairmanship of the Audit Committee.

Elizabeth A. Fetter has served as President, Chief Executive Officer and a director of QRS since October 2001. Prior to joining QRS, Ms. Fetter served as President, Chief Executive Officer and a director of NorthPoint Communications, Inc., a DSL services provider, from March 2000 to April 2001, after serving as a director since January 2000 and as the company's President and Chief Operating Officer from March 1999 to March 2000. NorthPoint Communications filed for Chapter 11 bankruptcy protection in January 2001 and subsequently sold the majority of its assets to AT&T in early 2001. From January 1998 until joining NorthPoint, Ms. Fetter was Vice President and General Manager of the Consumer Services Group at U S WEST, an integrated wireline, wireless and data services provider. From June 1997 to December 1997, Ms. Fetter served as Vice President and General Manager of Operator and Directory Services for SBC Communications Inc. From March 1991 to May 1997,

4

Ms. Fetter held various executive positions in strategy, finance, sales, marketing and general management at Pacific Bell, most recently as President of the Industry Markets Group, where she was responsible for the company's wholesale, interconnection and resale businesses. Ms. Fetter also serves on the board of directors of Berbee, a provider of electronic commerce, infrastructure, and networking solutions; Datum, Inc., a manufacturer of high-speed time and frequency products; and General Magic, Inc., a provider of voice infrastructure software and services. Ms. Fetter holds a B.A. with high honors in communication studies from Pennsylvania State University, and an M.S. with high honors in industrial administration from Carnegie Mellon University.

Patrick S. Jones has served as a director since March 2002. Mr. Jones served as a Senior Vice President and Chief Financial Officer of Gemplus International S.A., a smart card device manufacturer, from June 1998 to January 2001. From June 1992 to June 1998, Mr. Jones served as a Vice President and Corporate Controller of Intel Corporation, a semiconductor manufacturer. Mr. Jones also serves on the board of directors of Genesys S.A., a conferencing services provider; InterTrust Technologies, Inc., a digital rights management software provider; and is the chairman of the board of Dione plc, a privately held EPOS terminals manufacturer. Mr. Jones holds a B.A. in international economics from the University of Illinois and an M.B.A from St. Louis University.

NOMINEE FOR TERM ENDING UPON THE

2003 ANNUAL MEETING OF STOCKHOLDERS

Set forth below is information regarding the nominee to be elected as a Class II director, who will serve for the remainder of the term of Class II directors, until the Company's 2003 annual meeting of stockholders, or until his successor is duly elected and qualified.

Name

| | Position(s) with the Company

| | Age

| | Served as

Director Since:

|

|---|

| Peter R. Johnson(1) | | Director and Chairman of the Board | | 53 | | 1985 |

- (1)

- Member of the Nomination and Governance Committee.

Peter R. Johnson founded the Company in 1985 and has been Chairman of the Board since the Company's inception. Mr. Johnson served as Executive Chairman of the Company from September 2000 to January 2001, and served as Chief Executive Officer of the Company from October 1985 to March 1991 and again from January 1992 to May 1993. Before founding the Company, Mr. Johnson was a Corporate General Manager of Myer Emporium Limited, a large retailer in Australia. From 1995 to the present, Mr. Johnson has been a private investor in and a consultant to a number of technology companies. Mr. Johnson served as Chairman of NSB Retail Systems PLC, a publicly held company in the United Kingdom, from 1995 through October 1999. From June 1999 through September 2000, Mr. Johnson served as Chairman and Chief Executive Officer of Tradeweave, Inc., a subsidiary of the Company prior to its merger into the Company in February 2001. Mr. Johnson is Chairman of Credit Management Services, Inc., a credit card software company.

5

CONTINUING DIRECTORS FOR TERM ENDING UPON THE

2003 ANNUAL MEETING OF STOCKHOLDERS

Set forth below is information regarding the continuing directors who will serve until the Company's 2003 annual meeting of stockholders or until their respective successors are duly elected and qualified.

Name

| | Position(s) with the Company

| | Age

| | Served as

Director Since:

|

|---|

| Garth Saloner, Ph.D.(1) | | Director | | 47 | | 1993 |

| Garen K. Staglin(2) | | Director | | 57 | | 1991 |

- (1)

- Chairman of the Compensation Committee and member of the Nomination and Governance Committee; immediately following the Annual Meeting, it is anticipated that Mr. Saloner will be elected Chairman of the Board.

- (2)

- Member of the Audit Committee and the Nomination and Governance Committee; immediately following the Annual Meeting, it is anticipated that Mr. Staglin will assume the Chairmanship of the Nomination and Governance Committee.

Dr. Garth Saloner was named a director of the Company in December 1993. Dr. Saloner is the Jeffrey S. Skoll Professor of Electronic Commerce, Strategic Management and Economics at the Graduate School of Business at Stanford University (the "Stanford GSB") where he has been a member of the faculty since 1990. He also serves as a Co-Director of the Center for Electronic Business and Commerce at the Stanford GSB. He served as Associate Dean for Academic Affairs and Director of Research and Course Development at Stanford from 1993 to 1996. From 1982 to 1990, Dr. Saloner was a professor at the Massachusetts Institute of Technology. Dr. Saloner served as a director of Tradeweave, Inc., a subsidiary of the Company, from June 1999 until its merger into the Company in February 2001. Dr. Saloner is a director of Covisint, an e-commerce hub for the automotive industry, Synthean, an enterprise software company, Brilliant Digital Entertainment, a 3D animation firm, Next Stage Entertainment, a firm engaged in building a network of live entertainment theaters, and Aplia, an education software company.

Garen K. Staglin has been a director of the Company since 1991. Mr. Staglin is President and Chief Executive Officer of eONE Global LP, an electronic payments infrastructure company. From 1991 to March 2000, Mr. Staglin served as Chairman of the Board of Directors of Safelite Glass Corporation, a replacement auto glass manufacturing and retailing company, and was the Chief Executive Officer of Safelite Glass Corporation from August 1991 until April 1997. From 1980 to 1991, Mr. Staglin was a Vice President and General Manager of Automatic Data Processing, a computer networking services company. Since 1985, Mr. Staglin has been the owner and manager of Staglin Vineyards. Mr. Staglin currently serves as a director of First Data Corporation, a supplier of computer services for credit card processing and other financial services, and from 1997 to September 2000, he served as a director of CyberCash, Inc., a provider of secure transaction services for the Internet. In 1994, Mr. Staglin was named a member of the Advisory Council to the Stanford Graduate School of Business. He currently serves as Vice President—Trustee of the American Center for Wine, Food and the Arts in Napa, California.

6

CONTINUING DIRECTORS FOR TERM ENDING UPON THE

2004 ANNUAL MEETING OF STOCKHOLDERS

Set forth below is information regarding the continuing directors who will serve until the Company's 2004 annual meeting of stockholders, or until their respective successors are duly elected and qualified.

Name

| | Position(s) with the Company

| | Age

| | Served as

Director Since:

|

|---|

| John P. Dougall(1) | | Director | | 58 | | 1990 |

| Philip Schlein(2) | | Director | | 68 | | 1996 |

- (1)

- Chairman of the Audit Committee

- (2)

- Member of the Compensation Committee; immediately following the Annual Meeting, will assume the Chairmanship of the Compensation Committee.

John P. Dougall has been a director of the Company since July 1990. In February 1999, Mr. Dougall became Group Chief Executive Officer for Plessy Asia Pacific, an Australian company providing road and air navigation technology. Since October 2000, he has served as Chief Executive Officer of Commander Communications Ltd., an Australian publicly listed company specializing in integrated communications devices. From December 1997 to February 1999, Mr. Dougall was a private investor. From November 1996 to November 1997, Mr. Dougall served as Chairman and Chief Executive Officer for Aristocrat Leisure Limited, an Australian publicly listed company and a supplier to gambling and entertainment companies. From January 1992 to September 1996, Mr. Dougall served as Chief Executive Officer of AWA Limited, an Australian publicly listed company specializing in electronics and telecommunications. Mr. Dougall held various executive positions with the Company from July 1990 to January 1992, serving as President of the Company from February 1991 to June 1991 and as President and Chief Executive officer from June 1991 to January 1992. From February 1988 to June 1990, Mr. Dougall was the Executive Director of Paxus Corporation, a software services and outsourcing firm.

Philip Schlein was named a director of the Company in February 1996. Mr. Schlein has been a venture partner in U.S. Venture Partners, a venture capital firm, since April 1985, where he has advised new companies on strategy, recruiting and finance. Mr. Schlein held various executive positions with R.H. Macy & Company, Inc. from September 1957 to December 1973 and was President and Chief Executive Officer of its Macy's California division from January 1974 to January 1985. Mr. Schlein currently serves as a director of Bebe Stores, Inc., a producer of contemporary women's apparel and accessories, and various private companies. Additionally, Mr. Schlein served as a director of R.H. Macy & Company, Inc. from 1977 to 1985 and he served as a director of Apple Computer, Inc. from 1979 to 1987.

BOARD MEETINGS AND COMMITTEES

The Board of Directors held 9 meetings during fiscal year 2001. Each of the eight directors constituting the Board of Directors for the majority of fiscal year 2001 attended more than 75% of the aggregate of (i) the total number of Board meetings held during that fiscal year, and (ii) the total number of meetings held by all committees of the Board on which such director served. Elizabeth Fetter, who was appointed to the Board in October 2001, attended all the meetings held after that time. The Board of Directors has an Audit Committee, a Compensation Committee and a Nomination and Governance Committee. There are currently no other standing committees of the Board.

7

The Audit Committee of the Board of Directors held 6 meetings during fiscal 2001. The Audit Committee recommends engagement of the Company's independent auditors, reviews services performed by such auditors and reviews and evaluates the Company's accounting system and its system of internal controls. The Audit Committee operates under a written charter adopted by the Board of Directors, a copy of which was filed with the Securities and Exchange Commission as an appendix to the Company's proxy statement for its 2001 annual meeting of stockholders. The Audit Committee is currently composed of John P. Dougall, Tania Amochaev, Garen Staglin and Patrick S. Jones, each of whom satisfies the independence requirements of the National Association of Securities Dealers' listing standards.

The Compensation Committee of the Board of Directors held 6 meetings during fiscal 2001. The Compensation Committee has overall responsibility for the Company's compensation policies and determines the compensation payable to the Company's executive officers, including their participation in certain of the Company's employee benefit and stock option plans. The Compensation Committee is currently comprised of Garth Saloner and Philip Schlein.

The Nomination and Governance Committee of the Board of Directors held two meetings during fiscal 2001. The Nomination and Governance Committee reviews and recommends candidates for membership on the Board and its several committees. The Nomination and Governance Committee also considers and recommends policies relating to corporate governance. The Nomination and Governance Committee is currently comprised of Peter R. Johnson, Garth Saloner, and Philip Schlein. The Nomination and Governance Committee will consider nominees recommended from time to time by stockholders if such recommendations are delivered in a timely manner to the attention of: Secretary, QRS Corporation, 1400 Marina Way South, Richmond, CA 94804.

DIRECTOR COMPENSATION

For fiscal year 2001, each non-employee director received a quarterly fee of $3,750 for Board membership, as well as $1,000 per meeting attended. Each non-employee director who is not appointed to the Board pursuant to any contractual or other right or arrangement is eligible for reimbursement, in accordance with Company policy, for expenses incurred in connection with his attendance at meetings of the Board of Directors and the committees thereof.

Under the Automatic Option Grant Program of the QRS Corporation 1993 Stock Option/Stock Issuance Plan (the "1993 Plan"), (i) each individual who first becomes a non-employee Board member, and who has not been in the prior employ of the Company, will receive at the time of such initial election or appointment, an automatic option grant for 15,000 shares, and (ii) each individual who serves as a non-employee Board member on the first trading date in January of each year receives an option grant for 10,000 shares, provided such individual has served as a non-employee Board member for at least six months. In addition, each individual who serves as the Chairperson of any Board committee on the first trading day in January receives an additional option grant under the Automatic Option Grant Program for another 10,000 shares of Common Stock.

Each option granted under the Automatic Option Grant Program has a maximum term of ten (10) years, subject to earlier termination following the optionee's cessation of Board service. Each option will become exercisable for 25% of the option shares upon the optionee's completion of six (6) months of Board service measured from the grant date and will become exercisable for the balance of the option shares in a series of thirty-six (36) successive equal monthly installments upon the optionee's completion of continued Board service for the applicable month. Each option under the Automatic Option Grant Program will become immediately exercisable for all the option shares upon (i) certain changes in ownership or control of the Company or (ii) the death or permanent disability of the optionee while serving as a Board member. Upon the successful completion of a hostile tender offer for more than 50% of the Company's outstanding voting stock, each such option may be

8

surrendered to the Company for a cash distribution per surrendered option share in an amount equal to the excess of (a) the tender offer price paid per share of Common Stock over (b) the exercise price payable for such option share. Please see the description of the Automatic Grant Program under Proposal Two for further information concerning the remaining terms and provisions of these automatic option grants.

The Compensation Committee also issued options under the Discretionary Option Grant Program of the 1993 Plan to non-employee Board members as of July 26, 2001. Each individual who was serving as a non-employee Board member on that date was granted an option to purchase 10,000 shares of Common Stock. Accordingly, Ms. Amochaev and Messrs. Cole, Dougall, Johnson, Saloner, Schlein and Staglin received a discretionary option grant for 10,000 shares of Common Stock on July 26, 2001 in connection with their continued service as non-employee Board members. The exercise price of each of these options was $15.85 per share, the fair market value per share of Common Stock on July 26, 2001. The July 26, 2001 discretionary grant was made in view of the significant efforts made by the various Board members during the first half of 2001, as well as in view of the marked deterioration in general market conditions since the time of the Board's grant under the Automatic Option Grant Program in January 2000.

Each option granted under the Discretionary Option Grant Program has a maximum term of ten (10) years, subject to earlier termination following the optionee's cessation of Board service. Each option will become exercisable for 25% of the option shares upon the optionee's completion of six (6) months of Board service measured from the grant date and will become exercisable for the balance of the option shares in a series of thirty-six (36) successive equal monthly installments upon the optionee's completion of continued Board service for the applicable month. Each option under the Discretionary Option Grant Program will become immediately exercisable for all the option shares upon certain changes in ownership or control of the Company while the optionee is serving as a Board member. Please see the description of the Discretionary Grant Program under Proposal Two for further information concerning the remaining terms and provisions of these discretionary option grants.

9

PROPOSAL 2

APPROVAL OF AMENDMENT TO AND RESTATEMENT OF THE

1993 STOCK OPTION/STOCK ISSUANCE PLAN

The Company's stockholders are being asked to approve an amendment to and restatement of the 1993 Plan which will increase the number of shares of Common Stock authorized for issuance over the term of the 1993 Plan by an additional 750,000 shares, from 5,450,000 shares to 6,200,000 shares. The proposed amendment and restatement was adopted by the Board of Directors on March 20, 2002, subject to stockholder approval at the Annual Meeting.

The Board believes that the proposed 750,000-share increase to the 1993 Plan is necessary to assure that there is a sufficient number of shares available for issuance under the 1993 Plan in order to attract and retain the services of individuals essential to the Company's long-term success. Among other things, the Company has recently hired a number of new senior executives, and the Company desires equity incentives to play a significant role in the total compensation for each of such executives as well as other Company executives. Equity incentives play a significant role in the Company's efforts to remain competitive in the market for talented individuals generally, and the Company relies on such incentives as a means to attract and retain highly qualified individuals in the positions vital to the Company's success.

The 1993 Plan was originally adopted by the Board in June 1993 and approved by the stockholders in July 1993. The 1993 Plan became effective in connection with the initial public offering of the Common Stock and serves as the successor to the Company's 1990 Stock Option Plan (the"1990 Plan"). Each option outstanding under the 1990 Plan was incorporated into the 1993 Plan, and no further option grants have been made under the 1990 Plan since the 1993 Plan became effective.

The following is a summary of the principal features of the 1993 Plan, as most recently modified by the Board. The summary, however, does not purport to be a complete description of all the provisions of the 1993 Plan. Any stockholder who wishes to obtain a copy of the actual plan document may do so by written request to the attention of Investor Relations of the Company at the Company's corporate offices in Richmond, California.

Structure of the 1993 Plan

The 1993 Plan is divided into three separate components: (i) the Discretionary Option Grant Program, (ii) the Automatic Option Grant Program and (iii) the Stock Issuance Program. Under the Discretionary Option Grant Program, options may be issued to key employees (including officers and directors), non-employee Board members and consultants and other independent advisors in the service of the Company (or its parent or subsidiary companies) who contribute to the management, growth and financial success of the Company (or its parent or subsidiary companies). Under the Automatic Option Grant Program, option grants are automatically made at periodic intervals to non-employee members of the Board. Under the Stock Issuance Program, key employees (including officers and directors), non-employee Board members and consultants and other independent advisors in the service of the Company (or its parent or subsidiary companies) who contribute to the management, growth and financial success of the Company (or its parent or subsidiary companies) may be issued shares of Common Stock directly, either through the purchase of such shares at fair market value or as a bonus tied to their performance of services or the Company's attainment of financial objectives.

As of December 31, 2001, 558 employees (including nine executive officers) and seven non-employee Board members were eligible to participate in the Discretionary Option Grant and Stock

10

Issuance Programs, and the seven non-employee Board members were also eligible to receive grants under the Automatic Option Grant Program.

The maximum number of shares of Common Stock that can be issued under the 1993 Plan is 6,200,000 and the number available for issuance under the 1993 Plan as of March 21, 2002 is 1,218,744, including the 750,000 share increase for which stockholder approval is sought.

In no event may any one individual participating in the 1993 Plan be granted stock options, separately exercisable stock appreciation rights, and receive direct stock issuances for more than 750,000 shares of Common Stock in the aggregate under the 1993 Plan, exclusive of any grants or issuances made to such individual prior to January 1, 1994. Stockholder approval of this Proposal will also constitute re-approval of such limitation for purposes of Section 162(m) of the Internal Revenue Code.

The shares of Common Stock issuable under the 1993 Plan may be drawn from shares of authorized but unissued Common Stock or from shares of Common Stock that the Company acquires, including shares purchased on the open market. Shares subject to any outstanding options under the 1993 Plan (including options transferred from the 1990 Plan) that expire or otherwise terminate prior to exercise will also be available for subsequent issuance. In addition, unvested shares issued under the 1993 Plan that the Company subsequently purchases, at the option exercise or direct issue price paid per share, pursuant to the Company's purchase rights under the 1993 Plan will be added back to the number of shares reserved for issuance under the 1993 Plan and will accordingly be available for subsequent issuance. However, any shares subject to stock appreciation rights exercised under the 1993 Plan will not be available for re-issuance.

In the event any change is made to the Common Stock issuable under the 1993 Plan by reason of any stock split, stock dividend, combination of shares, merger, reorganization, consolidation, recapitalization, exchange of shares, or other change in capitalization of the Company affecting the outstanding shares of Common Stock as a class without the Company's receipt of consideration, appropriate adjustments will be made to (i) the maximum number and/or class of securities issuable under the 1993 Plan, (ii) the maximum number and/or class of securities for which any one individual may be granted stock options, separately exercisable stock appreciation rights and direct stock issuances under the 1993 Plan after December 31, 1993, (iii) the class and/or number of securities and option price per share in effect under each outstanding option granted under the 1993 Plan or incorporated into the 1993 Plan from the 1990 Plan, and (iv) the class and/or number of securities for which automatic option grants are to be subsequently made to new and continuing non-employee Board members under the Automatic Option Grant Program. The adjustments to the outstanding options will prevent the dilution or enlargement of benefits thereunder.

The Compensation Committee of the Board has the exclusive authority to administer the Discretionary Option Grant and Stock Issuance Programs with respect to option grants and stock issuances made to the Company's executive officers and non-employee board members and has the authority to make option grants and stock issuances under those programs to all other eligible individuals. However, the Board may at any time appoint a secondary committee of one or more Board members to have separate but concurrent authority with the Compensation Committee to make option grants and stock issuances under those two programs to individuals other than the Company's executive officers and non-employee Board members.

The term plan administrator, as used in this Proposal, will mean the Compensation Committee and any secondary committee, to the extent each such entity is acting within the scope of its administrative

11

authority under the 1993 Plan. However, neither the Compensation Committee nor any secondary committee will exercise any administrative discretion under the Automatic Option Grant Program. All grants under that program will be made in strict compliance with the express provisions of such program.

Restricted Shares and Options Granted under the 1993 Plan

The table below shows, as to each of the Named Executive Officers and the various indicated groups, the following information with respect to stock option transactions effected during the period from January 1, 2001 to March 21, 2002: (i) the number of restricted shares of Common Stock granted under the 1993 Plan, (ii) the number of shares of Common Stock subject to options granted under the 1993 Plan and (iii) the weighted average exercise price payable per share under such options. No direct stock issuances have been made to date under the 1993 Plan other than the restricted stock issuances described in "Compensation Committee Report On Restricted Share Award Program" elsewhere in this Proxy Statement.

Name and Position

| | Number of

Restricted

Shares(1)

| | Number of

Option Shares(2)

| | Weighted Average

Exercise Price of

Granted Options

|

|---|

Elizabeth A. Fetter

President and

Chief Executive Officer | | — | | 200,000

100,000

60,000 |

(3)

| $

$

$ | 10.81

10.81

12.61 |

John S. Simon

Executive Vice President of Customer and Market Development; Former Chief Executive Officer |

|

35,000 |

|

100 |

|

$ |

15.85 |

James Killough

Former Chief Administrative Officer |

|

— |

|

10,000

40,000 |

(4)

(5) |

$

$ |

11.86

9.28 |

Brian Marsden

Senior Vice President of

International Operations |

|

8,333 |

|

26,800

100 |

|

$

$ |

15.38

15.85 |

Candy Smith

Senior Vice President of

Global Services |

|

16,667 |

|

100

45,000 |

|

$

$ |

15.85

12.61 |

Mark Self

Senior Vice President of Sales |

|

30,000 |

|

100 |

|

$ |

15.85 |

Vince Morris

Former Senior Vice President

of Operations |

|

15,000 |

|

100 |

(6) |

$ |

15.85 |

Sean Salehi

Senior Vice President and

Chief Technology Officer |

|

16,667 |

|

100

45,000 |

|

$

$ |

15.85

12.61 |

All current executive officers as a group (nine persons) |

|

106,667 |

|

792,300 |

|

$ |

12.01 |

All non-employee Board members as a group (seven persons) |

|

— |

|

285,000 |

|

$ |

13.86 |

All current employees (other than executive officers) as a group |

|

128,378 |

|

582,336 |

(7) |

$ |

11.73 |

- (1)

- Each restricted share award was made at an exchange ratio of three option shares surrendered for each share of restricted common stock awarded under the restricted stock program; see "Compensation Committee Report on Restricted Share Award Program." The shares subject to

12

each restricted award are to be issued in a series of six successive equal semi-annual installments upon the individual's completion of each successive six months of continued employment with the Company, with the first such semi-annual vesting having occurred on April 30, 2001

- (2)

- Unless otherwise indicated, each option was structured so that the option would become exercisable for 25% of the option shares upon the optionee's completion of one year of service measured from the grant date and would become exercisable for the balance of the option shares in a series of thirty-six monthly installments, subject to the optionee's continued service with the Company.

- (3)

- Consists of performance-based options as follows: 25,000 options to become fully vested at such time as the Company establishes and maintains a stock price of more than $20 for 15 days; 75,000 options to become fully vested at such time as the Company establishes and maintains a stock price of more than $30 for 15 days. In any event, such options are to become fully vested upon the sixth anniversary of Ms. Fetter's employment with the Company.

- (4)

- This option, granted on January 26, 2001, was to have become exercisable in a series of twelve monthly installments, subject to the optionee's continued service with the Company. Mr. Killough's contract for consulting services to the Company expired on December 31, 2001 and was not renewed; a portion of these options are thus subject to cancellation.

- (5)

- This option, granted on May 16, 2001, was to have become exercisable in a series of 40 monthly installments, subject to the optionee's continued service with the Company. Mr. Killough's contract for consulting services to the Company expired on December 31, 2001 and was not renewed; a portion of these options are thus subject to cancellation.

- (6)

- All of such 100 options were cancelled upon the termination of Mr. Morris's employment with the Company in March 2002.

- (7)

- The total number of options granted to all current employees (other than current executive officers) as a group under all of the option plans maintained by the Company (including the Rockport Trade Systems, Inc. Option Plan and the Tradeweave, Inc. 1999 Stock Option/Stock Issuance Plan) was 704,238.

As of March 21, 2002, options for 2,754,477 shares were outstanding under the 1993 Plan, 1,939,904 shares were issued, 286,875 shares were reserved for the restricted share award program and, assuming stockholder approval of this Proposal, 1,218,744 shares remained available for future option grants and stock issuances.

In December 1997, the Company implemented the Special Non-Officer Stock Option Plan, pursuant to which 225,000 shares were initially reserved for issuance to employees of the Company who are neither officers nor Board members. The provisions of such supplemental plan are substantially the same as those in effect under the Discretionary Option Grant Program of the 1993 Plan described below. On February 15, 1999, the Board authorized an increase of 225,000 shares to this plan, and an additional 225,000 shares were added to the available reserve by the Board on May 11, 2000. As of March 21, 2002, options for 462,950 shares were outstanding, 49,557 shares had been issued, and 162,493 shares remained available for future option grants under the plan.

On December 19, 2000, the Compensation Committee approved the implementation of a restricted share award program under the Stock Issuance Program of the 1933 Plan. Each officer (from Vice President level and up) was given the opportunity under the program to surrender his or her outstanding options under the 1993 Plan that had exercise prices in excess of $15 per share in return for a restricted share award at an exchange ratio of three option shares for every one share of Common Stock subject to the restricted share award. A total of 875,126 shares were surrendered under this program and up to 286,875 shares of Common Stock may be issued pursuant to restricted share awards granted under this program.

13

Discretionary Option Grant Program and Stock Issuance Program

Options granted under the Discretionary Option Grant Program may be either incentive stock options under the federal tax laws or non-statutory options which are not intended to meet such requirements; however, only employees of the Company are eligible to receive incentive stock option grants. The principal features of the grants made under the Discretionary Option Grant Program and the direct issuances made under the Stock Issuance Program may be summarized as follows:

The exercise price per share must not be less than 100% of the fair market value per share of the Common Stock on the grant date. No option may be outstanding for more than a 10-year term. The shares subject to each option will generally vest in one or more installments over a specified period of service measured from the grant date. However, one or more options may be structured so that they will be immediately exercisable for any or all of the option shares. The shares acquired under such immediately exercisable options will be subject to repurchase by the Company, at the exercise price paid per share, if the optionee ceases service prior to vesting in those shares.

The purchase price for any shares sold under the Stock Issuance Program may not be less than 100% of the fair market value of the shares on the date of issuance. Shares may also be issued under the Stock Issuance Program for non-cash consideration, such as a bonus for past services rendered to the Company. In addition, shares may be issued under the Stock Issuance Program as an incentive tied to the individual's performance of future service or the Company's attainment of performance milestones.

The plan administrator may also assist any optionee (including an officer) in the exercise of outstanding options under the Discretionary Option Grant Program or in the purchase of shares under the Stock Issuance Program by authorizing a loan from the Company or permitting such individual to pay the exercise price or purchase price through a full-recourse, interest-bearing promissory note payable in installments over a period of years. The terms and conditions of any such loan or promissory note will be established by the plan administrator in its sole discretion, but in no event may the maximum credit extended to such individual exceed the aggregate price payable for the purchased shares, plus any Federal and state income or employment withholding taxes to which such individual may become subject in connection with the purchase. The plan administrator may also provide for the forgiveness of any outstanding loan or promissory note over the individual's period of continued service with the Company.

The plan administrator has complete discretion to establish the period of time for which any option is to remain exercisable following the optionee's cessation of service with the Company. Under no circumstances may an option be exercised after the specified expiration date of the option term. Each option under the Discretionary Option Grant Program will be exercisable only to the extent of the number of shares for which such option is exercisable at the time of the optionee's cessation of employment or service. However, the plan administrator has the discretion, exercisable at any time while the option remains outstanding, to accelerate the exercisability of such option in whole or in part. Such discretion may be exercised at any time while the options remain outstanding, whether before or after the optionee's actual cessation of service.

In the event of a Corporate Transaction (defined below), each outstanding option under the Discretionary Option Grant Program that will not be assumed by the successor corporation or otherwise replaced with a cash incentive program that preserves the existing option spread on the

14

unvested option shares will automatically accelerate in full, and all unvested shares under the Stock Issuance Program will immediately vest, except to the extent the Company's repurchase rights with respect to those shares are to be assigned to the successor corporation. The plan administrator will have the discretion to structure one or more option grants under the Discretionary Option Grant Program or one or more unvested shares issuances under the Stock Issuance Program so that those options or shares will automatically vest in the event the individual's service is subsequently terminated within a specified period following a Corporate Transaction in which those options and shares do not otherwise vest on an accelerated basis. The plan administrator may also structure one or more option grants under the Discretionary Option Grant Program and one or more unvested share issuances under the Stock Issuance Program so that those options and shares will automatically vest in full upon a Corporate Transaction. Option grants made to certain executive officers of the Company may vest on an accelerated basis in connection with an acquisition or other change in control of the Company. For further information concerning such acceleration provisions, see "Executive Compensation—Employment Contracts, Termination of Employment and Change-in-Control Agreements."

A Corporate Transaction includes one or more of the following stockholder-approved transactions: (i) a merger or acquisition in which the Company is not the surviving entity (other than a transaction the principal purpose of which is to change the state of the Company's incorporation), (ii) the sale, transfer or other disposition of all or substantially all of the Company's assets in complete liquidation or dissolution of the Company or (iii) any reverse merger in which the Company is the surviving entity but in which more than 50% of the Company's outstanding voting stock is transferred to the acquiring entity or its wholly owned subsidiary.

The plan administrator will have the discretionary authority to provide for automatic acceleration of outstanding options under the Discretionary Option Grant Program and the automatic vesting of outstanding shares under the Stock Issuance Program in connection with a Change in Control, with such acceleration or vesting to occur either at the time of the Change in Control or upon the subsequent termination of the participant's service.

A Change in Control will be deemed to occur under the 1993 Plan upon: (i) the acquisition of more than 50% of the Company's outstanding voting stock pursuant to a tender or exchange offer made directly to the Company's stockholders or (ii) a change in the composition of the Board of Directors over a period of 36 months or less such that a majority of the Board members ceases, by reason of one or more contested elections for Board membership, to be comprised of individuals who either (a) have been members of the Board continuously since the beginning of such period or (b) have been elected or nominated for election as Board members during such period by at least a majority of the Board members described in clause (a) who were still in office at the time such election or nomination was approved by the Board.

The acceleration of vesting in the event of a change in the ownership or control of the Company may be seen as an anti-takeover provision and may have the effect of discouraging a merger proposal, a takeover attempt or other efforts to gain control of the Company.

The plan administrator is authorized to issue two types of stock appreciation rights in connection with option grants made under the Discretionary Option Grant Program:

Tandem stock appreciation rights provide the holders with the right to surrender all or part of an unexercised option for an appreciation distribution from the Company equal in amount to the excess of (a) the fair market value of the shares of Common Stock subject to the surrendered option over (b) the aggregate exercise price payable for those shares. Such appreciation

15

distribution may, at the discretion of the plan administrator, be made in cash, shares of Common Stock or a combination of both.

Limited stock appreciation rights may be granted to officers of the Company as part of their option grants. Any option with such a limited stock appreciation right may be surrendered to the Company upon the successful completion of a Hostile Take-Over of the Company. In return for the surrendered option, the officer will be entitled to a cash distribution from the Company in an amount per surrendered share equal to the excess of (a) the Take-Over Price per share over (b) the exercise price payable for such share.

For purposes of such option cash-out provisions, the following definitions are in effect under the 1993 Plan:

Hostile Take-Over: the direct or indirect acquisition by any person or related group of persons (other than the Company or its affiliates) of securities possessing more than 50% of the total combined voting power of the Company's outstanding securities pursuant to a tender or exchange offer made directly to the Company's stockholders which the Board does not recommend that such stockholders accept.

Take-Over Price: the greater of (A) the fair market value of the shares of Common Stock subject to the surrendered option, measured on the surrender date in accordance with the valuation provisions of the 1993 Plan described below, or (B) the highest reported price per share paid by the tender offeror in effecting the Hostile Take-Over.

Special Tax Election

The plan administrator may provide one or more employee-holders of non-statutory options or unvested shares under the Discretionary Option Grant Program or the Stock Issuance Program with the right to have the Company withhold a portion of the shares of Common Stock otherwise issuable to such individuals upon the exercise of those options or vesting of those shares in order to satisfy the Federal and state income and employment withholding taxes to which such individuals may become subject in connection with such exercise or vesting. Alternatively, the plan administrator may allow such individuals to deliver already existing shares of the Company's Common Stock in payment of such withholding tax liability.

Automatic Option Grant Program

Under the Automatic Option Grant Program, non-employee Board members will receive option grants at specified intervals over their period of Board service. Stockholder approval of this Proposal will also constitute pre-approval of each option granted on or after the date of the Annual Meeting pursuant to the provisions of the Automatic Option Grant Program on the basis of the share increase effected pursuant to this Proposal and the subsequent exercise of that option in accordance with such provisions.

Beginning with calendar year 2001, each individual who is on the first trading day in January each year serving as a non-employee Board member will automatically be granted an option to purchase 10,000 shares of Common Stock, and each individual who is also at the time serving as a chairperson of any Board committee will automatically be granted a second option for an additional 10,000 shares, provided in each instance that the individual has served as a non-employee Board member for at least six months. During 2000 (but subsequent to the 2000 annual meeting of stockholders), each individual who had joined the Board as a non-employee Board member had automatically been granted a non-statutory option to purchase 15,000 shares of Common Stock, provided such individual had not previously been in the employ of the Company. The Board recently amended the 1993 Plan to clarify

16

that having previously served as an employee of the Company does not disqualify a director from receiving annual grants.

Each option grant under the Automatic Option Grant Program has an exercise price per share equal to 100% of the fair market value per share of Common Stock on the grant date and a maximum term of 10 years measured from such date, subject to earlier termination upon the optionee's cessation of Board service. Each option becomes exercisable for the option shares as follows: (i) the option becomes exercisable for twenty-five percent (25%) of the option shares upon the optionee's completion of six months of Board service measured from the date of the option grant and (ii) the balance of the option shares becomes exercisable in a series of thirty-six (36) successive equal monthly installments upon the optionee's completion of each additional month of Board service.

The option remains exercisable for a six-month period following the optionee's cessation of Board service for any reason other than death or permanent disability. Should the optionee die while in Board service or within six months after his or her cessation of Board service, then the option remains exercisable for a twelve-month period following such optionee's death and may be exercised by the personal representative of the optionee's estate or the person to whom the grant is transferred by the optionee's will or the laws of inheritance. Should the optionee cease Board service by reason of permanent disability, then he or she will have a twelve-month period in which to exercise the option. In no event, however, may any option be exercised after the expiration date of the option term. During the applicable exercise period, the option may not be exercised for more than the number of shares (if any) for which the option is exercisable at the time of his or her cessation of Board service.

The shares subject to each automatic option grant immediately vests should any of the following events occur during optionee's period of Board service: (i) the optionee's death or permanent disability or (ii) a Corporate Transaction or Change in Control. In addition, upon the successful completion of a Hostile Take-Over, each automatic option grant may be surrendered to the Company for a cash distribution per surrendered option share in an amount equal to the excess of (a) the Take-Over Price per share over (b) the exercise price payable for such share. Stockholder approval of this Proposal will also constitute pre-approval of each option granted with such a surrender right on or after the date of the Annual Meeting and the subsequent exercise of that right in accordance with the foregoing provisions.

General Provisions of the 1993 Plan

No optionee will have any stockholder rights with respect to the option shares until such optionee has exercised the option and paid the exercise price for the purchased shares. Options are generally not assignable or transferable other than by will or the laws of inheritance and, during the optionee's lifetime, the option may be exercised only by such optionee. However, the plan administrator may allow non-statutory options to be transferred or assigned during the optionee's lifetime to one or more members of the optionee's immediate family or to a trust established exclusively for one or more such family members.

The fair market value per share of Common Stock under the 1993 Plan on any relevant date will be the closing selling price on the date in question, as reported on the Nasdaq National Market and published inThe Wall Street Journal. On March 21, 2002, the fair market value per share of the Common Stock determined on such basis was $12.50 per share.

17

The Board may amend or modify the 1993 Plan in any or all respects whatsoever, subject to any stockholder approval required under applicable law or regulation; however, no amendment or modification will adversely affect the rights of holders of outstanding options or restricted stock unless such holder's consent is obtained. Unless sooner terminated by the Board, the 1993 Plan will terminate on the earliest of (a) December 31, 2005, (b) the date on which all shares available for issuance under the 1993 Plan have been issued or (c) the termination of all outstanding options in connection with certain changes in control or ownership of the Company.

New Plan Benefits

As of March 21, 2002, no options have been granted, and no direct stock issuances have been made, on the basis of the 750,000 share increase that is the subject of this Proposal.

Federal Tax Consequences

Options granted under the 1993 Plan may be either incentive stock options which satisfy the requirements of Section 422 of the Internal Revenue Code or non-statutory options which are not intended to satisfy such requirements. The Federal income tax treatment for the two types of options differs as follows:

The optionee recognizes no taxable income at the time of the option grant, and no taxable income is generally recognized at the time the option is exercised. The optionee will, however, recognize taxable income in the year in which the purchased shares are sold or otherwise made the subject of disposition.

For Federal income tax purposes, dispositions are divided into two categories: (i) qualifying and (ii) disqualifying. The optionee will make a qualifying disposition of the purchased shares if the sale or disposition is made more than two years after the date the option for the shares involved in such sale or other disposition is granted and more than one year after the date the option is exercised for those shares. If the sale or disposition occurs before these two requirements are satisfied, then a disqualifying disposition of the purchased shares will result.

Upon a qualifying disposition, the optionee will recognize long-term capital gain in an amount equal to the excess of (i) the amount realized upon the sale or other disposition of the purchased shares over (ii) the exercise price paid for the shares. If there is a disqualifying disposition of the shares, then the excess of (i) the fair market value of those shares on the exercise date over (ii) the exercise price paid for the shares will be taxable as ordinary income to the optionee. Any additional gain or loss recognized upon the disposition will be recognized as a capital gain or loss by the optionee.

If the optionee makes a disqualifying disposition of the purchased shares, then the Company will be entitled to an income tax deduction, for the taxable year in which such disposition occurs, equal to the excess of (i) the fair market value of such shares on the date the option was exercised over (ii) the exercise price paid for such shares. In no other instance will the Company be allowed a deduction with respect to the optionee's disposition of the purchased shares.

An optionee recognizes no taxable income upon the grant of a non-statutory option. The optionee will in general recognize ordinary income in the year in which the option is exercised equal to the excess of the fair market value of the purchased shares on the exercise date over the exercise price, and the optionee will be required to satisfy the tax withholding requirements applicable to such income.

18

If the shares acquired upon exercise of a non-statutory option are subject to a substantial risk of forfeiture (such as the Company's right to repurchase unvested shares at the original exercise price paid per share, upon the optionee's cessation of service prior to vesting in those shares), then the optionee will not recognize any taxable income at the time the option is exercised for such unvested shares but will have to report as ordinary income, as and when the shares vest, an amount equal to the excess of (a) the fair market value of the shares on the vesting date over (b) the exercise price paid for the shares. The optionee may, however, elect under Section 83(b) of the Internal Revenue Code to include as ordinary income in the year of exercise an amount equal to the difference between the fair market value of the purchased shares on the date of exercise (determined as if the unvested shares were not subject to the Company's repurchase right) and the exercise price paid for the shares. If the Section 83(b) election is made, the optionee will not recognize any additional income as and when the shares vest.

The Company will be entitled to an income tax deduction equal to the amount of ordinary income recognized by the optionee in connection with the exercise of the non-statutory option. The deduction will in general be allowed for the taxable year of the Company in which such ordinary income is recognized by the optionee.

If an option granted with a tandem stock appreciation right is surrendered for an appreciation distribution, or if an option granted with a limited stock appreciation right is cancelled for an appreciation distribution, the recipient will generally realize ordinary income on the surrender or cancellation date, equal in amount to the appreciation distribution. The Company will be entitled to a deduction equal to the amount of such ordinary income.

The tax principles applicable to direct stock issuances under the 1993 Plan will be substantially the same as those summarized above for the exercise of non-statutory option grants.

The Company anticipates that any compensation deemed paid by it (whether by the disqualifying disposition of incentive stock option shares or the exercise of non-statutory options) in connection with options with exercise prices equal to the fair market value of the option shares on the grant date will qualify as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code and will not have to be taken into account for purposes of the $1 million limitation per covered individual on the deductibility of the compensation paid to certain executive officers of the Company.

Accounting Treatment

Under the current accounting principles in effect for equity incentive programs such as the 1993 Plan, the option grants under the 1993 Plan will not result in any charge to the Company's reported earnings, but the Company must disclose, in pro-forma statements to the Company's financial statements, the impact the option grants would have upon the Company's reported earnings were the fair value of those options at the time of grant treated as compensation expense. The number of outstanding options may be a factor in determining the Company's earnings per share on a fully diluted basis.

The restricted share awards issued on January 3, 2001 in cancellation of the out-of-the-money options held by the executive officers and certain other individuals on that date cover a total of 286,875 shares of Common Stock. These awards have and will result in a non-cash compensation expense to the Company based on the $13.6875 per share fair market value of the Common Stock on that date. Such

19

compensation expense (approximately a $4 million maximum expense) is being amortized, for financial reporting purposes, over the three-year vesting period in effect for those awards.

Option grants made to independent consultants (but not non-employee Board members) after December 15, 1998 will result in a direct charge to the Company's reported earnings based upon the fair value of the option measured initially as of the grant date of that option and then subsequently on the vesting date of each installment of the underlying option shares. No charge will, however, be required for periods before July 1, 2000. A charge of $302,000 was taken by the Company in connection with option grants made to James Killough, a former officer of the Company.

Should one or more optionees be granted stock appreciation rights under the 1993 Plan that have no conditions upon exercisability other than a service or employment requirement, then such rights would result in a compensation expense to be charged against the Company's reported earnings. At the end of each fiscal quarter, the amount (if any) by which the fair market value of the shares of Common Stock subject to such outstanding stock appreciation rights has increased from the prior quarter-end would be accrued as compensation expense, to the extent such fair market value is in excess of the aggregate exercise price in effect for those rights.

Stockholder Approval

The affirmative vote of a majority of the shares represented and entitled to vote at the Annual Meeting is required for approval of the proposed share increase to the 1993 Plan. If stockholder approval of the proposed share increase is not obtained, then any options granted on the basis of that share increase will terminate without becoming exercisable for any of the shares of Common Stock subject to those options, and no further options will be granted on the basis of such share increase. However, the 1993 Plan will continue to remain in effect, and option grants and direct stock issuances may continue to be made pursuant to the provisions of the 1993 Plan, until the available reserve of Common Stock as last approved by the stockholders has been issued pursuant to such option grants and direct stock issuances made under the 1993 Plan or (if earlier) until the December 31, 2005 termination date of the 1993 Plan.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR

APPROVING THE AMENDED AND RESTATED 1993 PLAN AND

THE SHARE INCREASE THEREUNDER.

PROPOSAL 3

RATIFICATION OF INDEPENDENT AUDITORS

The Company is asking the stockholders to ratify the selection of PricewaterhouseCoopers LLP as the Company's independent accountants to provide auditing services to the Company during the fiscal year ending December 31, 2002. The affirmative vote of the holders of a majority of the shares represented and entitled to vote at the Annual Meeting will be required to ratify the selection of PricewaterhouseCoopers LLP. PricewaterhouseCoopers LLP's representatives are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

20

In the event the stockholders fail to ratify the appointment, the Audit Committee of the Board of Directors will consider it as a direction to select other auditors for the subsequent year. Even if the selection is ratified, the Board in its discretion may direct the appointment of a different independent accounting firm at any time during the year if the Board determines that such a change would be in the best interest of the Company and its stockholders.

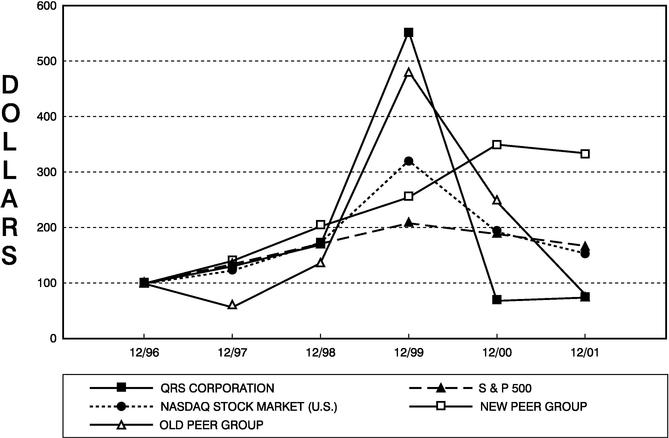

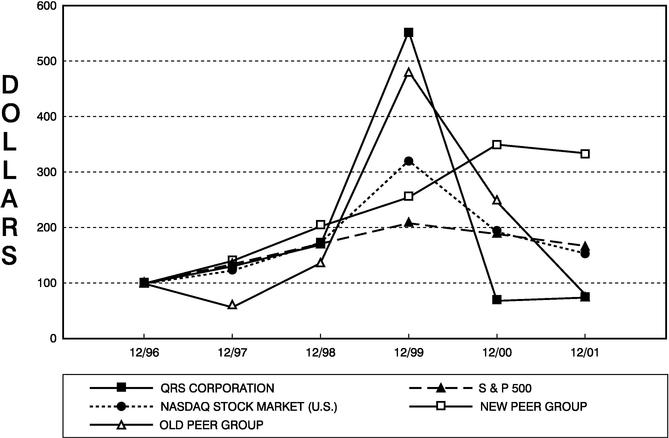

Change In Independent Accountants