SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ | | Preliminary Proxy Statement |

| |

x | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or 14a-12 |

QRS CORPORATION

(Name of Registrant as Specified In Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1). |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials: |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

QRS CORPORATION

1400 Marina Way South

Richmond, CA

94804 USA

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of QRS Corporation to be held June 8, 2004, at 9:00 a.m. local time, at our Company’s headquarters, 1400 Marina Way South, Richmond, California 94804.

Details of the business to be conducted at the Annual Meeting are given in the attached Notice of Annual Meeting of Stockholders and Proxy Statement.

Whether or not you plan to attend the Annual Meeting, please mark, date, sign and return the enclosed proxy card in the accompanying reply envelope as soon as possible.

Sincerely yours,

Elizabeth A. Fetter

President and Chief Executive Officer

Richmond, California

April 29, 2004

|

|

|

| IMPORTANT |

|

| Please mark, date and sign the enclosed proxy and return it at your earliest convenience in the enclosed postage-prepaid return envelope (to which no postage need be affixed if mailed in the United States). |

|

QRS CORPORATION

1400 Marina Way South

Richmond, California 94804

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 8, 2004

The Annual Meeting of Stockholders of QRS Corporation (the “Company”) will be held on June 8, 2004, at 9:00 a.m. local time, at the Company’s headquarters, 1400 Marina Way South, Richmond, California 94804, for the following purposes:

| | 1. | | To elect two directors to serve as Class I directors until the Company’s 2007 annual meeting of stockholders. The nominees are Charles K. Crovitz and John P. Dougall; |

| | 2. | | To ratify the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company for the fiscal year ending December 31, 2004; |

| | 3. | | To approve the adoption of the QRS Corporation 2004 Employee Stock Purchase Plan; and |

| | 4. | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. The Board of Directors has fixed the close of business on April 16, 2004 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof.

Your vote is important regardless of the number of shares you own. Whether or not you plan to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy card as soon as possible. You may revoke your proxy at any time prior to the Annual Meeting. Your prompt response is necessary to assure that your shares are represented at the Annual Meeting. If you attend the Annual Meeting and vote by ballot at the Annual Meeting, your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted.

By Order Of The Board Of Directors

Stacey A. Giamalis

Vice President, General Counsel and Corporate Secretary

Richmond, California

April 29, 2004

QRS CORPORATION

1400 Marina Way South

Richmond, California 94804

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

June 8, 2004

General

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board of Directors” or “Board”) of QRS Corporation (the “Company,” “QRS,” “we” or “us”) for use at the Annual Meeting of Stockholders to be held on Tuesday, June 8, 2004, at 9:00 a.m. local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Company’s headquarters, 1400 Marina Way South, Richmond, California 94804. The Company mailed this Proxy Statement and accompanying proxy card on or about April 29, 2004 to all stockholders entitled to vote at the meeting.

Voting Rights and Outstanding Shares

Only holders of record of our common stock (“Common Stock”) at the close of business on April 16, 2004 are entitled to notice of and to vote at the Annual Meeting (or at any adjournments or postponements thereof). On April 16, 2004, we had outstanding and entitled to vote 15,928,263 shares of our Common Stock.

Each holder of record of Common Stock on such date will be entitled to one vote for each share of Common Stock held on all matters to be voted on at the Annual Meeting. Stockholders may not cumulate votes in the election of directors. A majority of the outstanding shares of Common Stock present or represented by proxy will constitute a quorum for the transaction of business at the Annual Meeting.

If any stockholder is unable to attend the Annual Meeting, such stockholder may vote by proxy. When the proxy card is returned properly completed, the proxy holder will vote the shares as directed by the stockholder on the proxy card. Stockholders are urged to specify their choices on the enclosed proxy card.If a proxy card is signed and returned without choices specified, in the absence of contrary instructions, the shares of Common Stock represented by such proxy will be voted FOR Proposals 1, 2 and 3 and will be voted in the proxy holder’s discretion as to other matters that may properly come before the Annual Meeting.

All votes will be tabulated by the inspector of elections (a representative of our transfer agent) appointed for the meeting, who will separately tabulate affirmative, negative and withheld votes, abstentions and broker “non-votes” (i.e., where the broker or nominee submits a proxy specifically indicating the lack of discretionary authority to vote on a matter).

Pursuant to Delaware law, abstentions and broker non-votes will be counted as present for purposes of determining whether a quorum of shares is present at the meeting. For Proposal 1 (election of directors), which requires a plurality of the votes cast, withheld votes and broker non-votes will have no effect. With respect to Proposals 2 and 3 (the appointment of independent auditors and the adoption of the 2004 Employee Stock Purchase Plan), which require the affirmative approval of a majority of the votes present or represented and entitled to vote, broker “non-votes” have no effect. Because abstentions will be included in tabulations of votes cast on proposals presented to stockholders for purposes of determining whether a proposal has been approved, abstentions have the same effect as negative votes on Proposals 2 and 3.

1

Revocability of Proxies

Any person giving a proxy has the power to revoke it at any time before its exercise. A proxy may be revoked by filing with the Secretary of the Company at our headquarters a written instrument of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person by ballot. Attendance at the meeting will not, by itself, revoke a proxy.

Solicitation of Proxies

We will bear the entire cost of soliciting proxies, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any additional solicitation materials furnished to our stockholders. We have retained Mellon Investor Services LLC (“Mellon”) to assist us in the distribution and solicitation of proxies. For its services, we have agreed to pay Mellon a fee of $5,500 and to reimburse it for its reasonable out-of-pocket expenses.

Copies of solicitation material will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock that are beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding the solicitation material to such beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, telegram or other means by our directors, officers, or other regular employees, or by Mellon personnel. No additional compensation will be paid to our own directors, officers or other regular employees for such services.

* * * * *

Our Annual Report for the fiscal year ended December 31, 2003 is enclosed with the mailing of the Notice of Annual Meeting and Proxy Statement to all stockholders entitled to notice of and to vote at the Annual Meeting. The Annual Report is not incorporated into this Proxy Statement and is not considered proxy-soliciting material.

2

PROPOSAL 1

ELECTION OF DIRECTORS

Our Certificate of Incorporation provides for a classified Board of Directors consisting of three classes of directors with staggered three-year terms, with each class consisting, as nearly as possible, of one-third of the total number of directors. The Company currently has seven authorized directors on the Board of Directors. Nominations for election of directors at the Annual Meeting were made by the Board of Directors. Charles K. Crovitz and John P. Dougall have been nominated for election as a Class I director at the Annual Meeting, to serve until the Company’s 2007 annual meeting of stockholders and their respective successors are duly elected and qualified, or until the earlier resignation or removal of such director.

Each person nominated for election has agreed to serve if elected, and the Board of Directors has no reason to believe that any nominee will be unavailable or will decline to serve. In the event, however, that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the then current Board of Directors to fill the vacancy. The proxy holders intend to vote the proxies received by them for the nominees named below, unless the proxy card indicates that authority to vote for any or all nominees is withheld. The two candidates receiving the highest number of the affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of the Company. The proxies solicited by this Proxy Statement may not be voted for more than two nominees.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors Recommends that Stockholders Vote FOR the Election of the Following Nominees as Directors.

NOMINEES FOR TERM ENDING AT THE

2007 ANNUAL MEETING OF STOCKHOLDERS

Set forth below is information regarding the nominees to be elected as Class I directors, who will serve until the Company’s 2007 annual meeting of stockholders and until their respective successors are duly elected and qualified, or until the earlier resignation or removal of such director.

| | | | | | |

Name

| | Position with the Company

| | Age

| | Served as

Director Since

|

Charles K. Crovitz(1) | | Director | | 50 | | 2003 |

John P. Dougall(2) | | Director | | 60 | | 1990 |

| (1) | | Chairman of the Compensation Committee and member of the Nominations and Governance Committee. |

| (2) | | Member of the Compensation Committee. |

Charles K. Crovitz was named a director of QRS in September 2003. From June 2000 to July 2003, he served as Executive Vice President and Chief Supply Chain Officer for Gap Inc., one of the world’s largest specialty retailers. From 1998 to 2000, Mr. Crovitz was Executive Vice President, Supply Chain and Technology for Gap. Mr. Crovitz joined the Gap in 1993. During his 10 years at Gap, Mr. Crovitz had responsibility for global supply chain management, information technology and sourcing, and oversaw the distribution of over 1 billion units worldwide. Before joining Gap, Mr. Crovitz spent almost a decade at Safeway Inc., one of the largest food and drug retailers in North America. Mr. Crovitz held executive positions in strategy, marketing and technology at Safeway. Prior to Safeway, Mr. Crovitz was with McKinsey & Company, a leading global strategic management consulting firm, where he led client service teams in retailing and personal computing industries. He serves on the board of directors for Under One Roof and on the board of trustees for the Saddlehorn Fund Equestrian Foundation.

3

John P. Dougall has been a director of the Company since July 1990. From February 1999 until June 2002, Mr. Dougall served as Chief Executive Officer of Commander Communications Ltd., an Australian publicly listed company specializing in integrated communications devices. From February 1999 until October 2000, Mr. Dougall also served as Group Chief Executive Officer for Plessey Asia Pacific, an Australian company providing road and air navigation technology. From November 1997 to February 1999, Mr. Dougall was a private investor. From November 1996 to November 1997, Mr. Dougall served as Chairman and Chief Executive Officer for Aristocrat Leisure Limited, an Australian publicly listed company and a supplier to gambling and entertainment companies. From January 1992 to September 1996, Mr. Dougall served as Chief Executive Officer of AWA Limited, an Australian publicly listed company specializing in electronics and telecommunications. Mr. Dougall held various executive positions with the Company from July 1990 to January 1992, including Chief Executive Officer from June 1991 to January 1992. Mr. Dougall serves on the board of directors of Plessey Asia Pacific.

CONTINUING DIRECTORS FOR TERM ENDING AT

THE 2005 ANNUAL MEETING OF STOCKHOLDERS

Set forth below is information regarding the continuing Class III directors who will serve until the Company’s 2005 annual meeting of stockholders and their respective successors are duly elected and qualified, or until the earlier resignation or removal of such director.

| | | | | | |

Name

| | Position(s) with the Company

| | Age

| | Served as

Director Since

|

Elizabeth A. Fetter | | Director, President and Chief Executive Officer | | 45 | | 2001 |

Patrick S. Jones(1) | | Director | | 59 | | 2002 |

| (1) | | Chairman of the Audit Committee. |

Elizabeth A. Fetterhas served as President, Chief Executive Officer and a director of the Company since October 2001. Prior to joining the Company, Ms. Fetter served as President, Chief Executive Officer and a director of NorthPoint Communications, Inc., a DSL services provider, from March 2000 to April 2001, after serving as a director since January 2000 and as the company’s President and Chief Operating Officer from March 1999 to March 2000. NorthPoint Communications filed for Chapter 11 bankruptcy protection in January 2001 and subsequently sold the majority of its assets to AT&T in early 2001. From January 1998 until joining NorthPoint, Ms. Fetter was Vice President and General Manager of the Consumer Services Group at US WEST, an integrated wireline, wireless and data services provider. From March 1991 to December 1997, Ms. Fetter served in various general management capacities at SBC/Pacific Bell, including as President, Industry Markets Group. Ms. Fetter also serves on the board of directors of Berbee, a privately held provider of electronic commerce, infrastructure, and networking solutions, and Symmetricom, Inc., a publicly held manufacturer of high-speed data, timing and frequency products.

Patrick S. Jones has been a director of the Company since March 2002. Mr. Jones served as a Senior Vice President and Chief Financial Officer of Gemplus International S.A., a smart card device manufacturer, from June 1998 to March 2001. From June 1992 to June 1998, Mr. Jones served as a Vice President and Corporate Controller of Intel Corporation, a semiconductor manufacturer. Mr. Jones also serves on the board of directors of Genesys S.A., a publicly held conferencing services provider; Liberate Technologies, Inc., a publicly held provider of interactive TV software; and SMARTTRUST A.B., a privately held developer of software applications for mobile devices. Mr. Jones is also the chairman of the board of Dione plc, a privately held manufacturer of Electronic Point Of Sale terminals.

4

CONTINUING DIRECTORS FOR TERM ENDING AT

THE 2006 ANNUAL MEETING OF STOCKHOLDERS

Set forth below is information regarding the continuing Class II directors who will serve until the Company’s 2006 annual meeting of stockholders and their respective successors are duly elected and qualified, or until the earlier resignation or removal of such director.

| | | | | | |

Name

| | Position with the Company

| | Age

| | Served as

Director Since

|

Garth Saloner, Ph.D.(1) | | Director | | 49 | | 1993 |

Jeremiah J. Sullivan(2) | | Director | | 65 | | 2003 |

Terry R. Peets(2) | | Director | | 59 | | 2003 |

| (1) | | Chairman of the Board of Directors, Chairman of the Nominations and Governance Committee and member of the Compensation Committee. |

| (2) | | Member of the Audit Committee. |

Dr. Garth Saloner has been a director of the Company since 1993. Dr. Saloner is the Jeffrey S. Skoll Professor of Electronic Commerce, Strategic Management and Economics at the Graduate School of Business at Stanford University (the “Stanford GSB”) where he has been a member of the faculty since 1990. He also serves as a Co-Director of the Center for Electronic Business and Commerce at the Stanford GSB. He served as Associate Dean for Academic Affairs and Director of Research and Course Development at Stanford from 1993 to 1996. From 1982 to 1990, Dr. Saloner was a professor at the Massachusetts Institute of Technology. Dr. Saloner served as a director of Tradeweave, Inc., a subsidiary of the Company, from June 1999 until its merger into the Company in February 2001. Dr. Saloner is a director of Synthean, a privately held enterprise software company, and Aplia, a privately held education software company.

Jeremiah J. Sullivan was named a director of QRS in January 2003. Mr. Sullivan was Chairman and CEO of Macy’s West, a division of Federated Department Stores, Inc., from December 1999 until his retirement in June 2002. He was promoted from President of Macy’s West, a position he held since April 1995. Mr. Sullivan was President of Federated’s Lazarus division from 1989 to 1995. Before joining Federated, Mr. Sullivan was President of Filene’s from 1987 to 1989 and Chairman of Filene’s from 1988 to 1989. Prior to that, Mr. Sullivan had been Executive Vice President at I. Magnin from 1984 to 1987. Mr. Sullivan serves on the board of governors and the executive committee of the San Francisco Symphony.

Terry R. Peets has been a director of QRS since May 2003. Mr. Peets is currently and has been since 2000 an advisor to J.P. Morgan Partners in its consideration of investment opportunities in the consumer segment. From December 2000 to January 2003, Mr. Peets served as Director and Chairman of the Board of Bruno’s Supermarkets, Inc. He served as President, CEO and Director of PIA Merchandising Co., Inc., a provider of nationwide retail merchandising services, from 1997 until the sale of the company in 1999. From 1995 to 1997, Mr. Peets was Executive Vice President of The Vons Companies, Inc. where he was responsible for distribution/logistics, manufacturing, retail and non-retail procurement, and sales and marketing functions. Between 1977 and 1995, Mr. Peets held various executive positions at Ralphs Grocery Co., the last three years of which he served as Executive Vice President with responsibility for distribution/logistics, manufacturing, retail and non-retail procurement, and sales and marketing functions. Mr. Peets serves as chairman of the board of World Kitchens, Inc., a manufacturer and marketer of cookware, dishes and utensils; and as a member of the board of directors of Doane Petcare, Inc., a manufacturer of pet food; PSC, Inc., a manufacturer of Spectraphysics point of sale scanners for the retail industry; Pinnacle Foods Group, Inc., a producer of well-known grocery staples; Ruiz Foods, Inc., a manufacturer of Mexican food; City of Hope National Medical Center, a non-profit entity; and the Children’s Museum of Orange County, a non-profit entity.

5

BOARD MEETINGS AND COMMITTEES

The Board of Directors held ten (10) meetings during fiscal year 2003. Each of the seven directors constituting the Board of Directors attended more than 75% of the aggregate of (i) the total number of Board meetings held during that fiscal year, and (ii) the total number of meetings held by all committees of the Board on which such director served. The Board of Directors has an Audit Committee, a Compensation Committee and a Nominations and Governance Committee. There are currently no other standing committees of the Board.

The Audit Committee of the Board of Directors held five (5) meetings during fiscal year 2003. The Audit Committee oversees the quality and integrity of the Company’s financial statements and its independent auditors, approves and reviews services performed by such auditors, reviews compliance with applicable legal and regulatory requirements, and evaluates the Company’s system of internal controls. The Audit Committee operates under a written charter, a copy of which was attached as an appendix to the Proxy Statement for the 2003 annual stockholders meeting and is available at www.qrs.com/governance. The Audit Committee is currently composed of Messrs. Jones, Peets and Sullivan, each of whom is an “independent director” as defined under the applicable rules of the Nasdaq Stock Market and the Securities and Exchange Commission (“SEC”). The Board of Directors has determined that Mr. Jones is an audit committee financial expert, as defined under SEC rules.

The Compensation Committee of the Board of Directors held six (6) meetings during fiscal year 2003. The Compensation Committee has overall responsibility for the Company’s compensation policies for executive officers and directors, evaluates the performance of the executive officers of the Company, administers the stock and incentive plans of the Company, determines the compensation payable to the Company’s executive officers (other than the Chief Executive Officer), assists the full Board in determining the compensation payable to the Company’s Chief Executive Officer and assists the Board of Directors in developing succession plans for executive officers. The Compensation Committee operates under a written charter, a copy of which is available at www.qrs.com/governance. The Compensation Committee is currently comprised of Messrs. Crovitz, Dougall and Dr. Saloner, each of whom is an “independent director” as defined under the applicable rules of the Nasdaq Stock Market.

The Nominations and Governance Committee of the Board of Directors held two (2) meetings during fiscal year 2003. The Nominations and Governance Committee identifies and recommends candidates for membership on the Board and its committees and considers and recommends policies relating to corporate governance. The Nominations and Governance Committee operates under a written charter, a copy of which is available at www.qrs.com/governance. The Nominations and Governance Committee is currently comprised of Dr. Saloner and Mr. Crovitz, both of whom are “independent directors” as defined under the applicable rules of the Nasdaq Stock Market. The Nominations and Governance Committee will consider recommendations for director nominees from stockholders. Such recommendations, together with appropriate biographical information, should be submitted to the Nominations and Governance Committee, c/o Corporate Secretary, QRS Corporation, 1400 Marina Way South, Richmond, California 94804. Stockholder nominees will receive the same consideration that nominees of the Board receive. The Company has retained a third party executive recruitment firm to assist the Nominations and Governance Committee in identifying and evaluating potential nominees for the Board.

Stockholders may communicate with any of the Company’s directors by writing to them c/o Chairman of the Board, QRS Corporation, 1400 Marina Way South, Richmond, California 94804. The Chairman of the Board will distribute the communications to the Board, or to any individual director or directors as appropriate, depending upon the facts and circumstances outlined in the communications. Actions or responses to communications, if any, will be determined on a case by case basis.

At our 2003 annual meeting of stockholders two directors, Garth Saloner and Elizabeth Fetter, were in attendance. The Board of Directors has adopted a policy of strongly encouraging members of the Board to attend our annual meetings of stockholders.

6

The Board of Directors has adopted a Financial Officer Code of Ethics that is applicable to the Chief Executive Officer, Chief Financial Officer and Controller. The text of the Financial Officer Code of Ethics is posted on our website at www.qrs.com/governance/docs/QRS_Financial_Officer_Code_of_Ethics.pdf. The Company will disclose any amendment to the Financial Officer Code of Ethics or waiver of a provision of the Financial Officer Code of Ethics, including the name of the officer to whom the waiver was granted, on our website at www.qrs.com on the Investor Relations page.

DIRECTOR COMPENSATION

Cash Fees. Each non-employee director receives an annual retainer fee of $15,000 payable in quarterly installments plus a $1,000 fee per Board or Board committee meeting attended. In addition, the Chairman of the Board, the chairman of the Audit Committee and the chairman of each Board committee other than the Audit Committee receives an annual fee of $15,000, $10,000 and $5,000, respectively, payable in quarterly installments. Each of the other members of the Audit Committee receives an additional annual fee of $2,500, payable in quarterly installments. The annual fee to the Chairman of the Board was increased to the current $15,000 level effective October 1, 2003. For the first three quarters of 2003, the annual fee to the Chairman of the Board was $10,000. Accordingly, Dr. Saloner in his capacity as Chairman of the Board for the 2003 year received a total annual fee of $11,250.

Equity Compensation. Under the automatic grant program in effect for the non-employee Board members under the Company’s 1993 Stock Option/Stock Issuance Plan (the “Plan”), each new non-employee Board member will receive at the time of his or her initial election or appointment to the Board an automatic option grant for 15,000 shares, and each continuing non-employee Board member who has served as a non-employee Board member for at least six months will receive on the first trading day following the annual stockholder meeting an option grant for 10,000 shares.

Each automatic option grant will have an exercise price per share equal to the fair market value per share of the Common Stock on the grant date and will have a term of 10 years, subject to earlier termination upon the optionee’s cessation of Board service. Each initial 15,000-share option grant will become exercisable for fifty percent (50%) of the option shares upon the optionee’s completion of one year of Board service measured from the grant date and will become exercisable for the balance of the option shares upon the optionee’s completion of an additional year of Board service thereafter. Each annual 10,000-share option grant will become exercisable for all the option shares upon the optionee’s completion of one year of Board service measured from the grant date. Each automatic option grant will vest in full and become exercisable for all the option shares upon the occurrence of certain changes in ownership or control of the company or upon the death or disability of the optionee while serving as a Board member.

In 2003, the following option grants were made to our non-employee Board members under the automatic option grant program. Messrs. Peets and Sullivan each received an option to purchase 15,000 shares of Common Stock upon their appointment to the Board at an exercise price per share of $4.64 and $5.32, respectively. Upon his appointment to the Board, Mr. Crovitz received an option to purchase 15,000 shares at an exercise price per share of $10.11. On the first trading day after the 2003 annual stockholders meeting, Messrs. Schlein, Saloner, Dougall and Jones each received an option to purchase 10,000 shares at an exercise price per share of $4.64.

Under the discretionary option grant and stock issuance programs in effect under the Plan, the Compensation Committee may issue additional option grants and other stock-based awards to non-employee Board members who are not members of that committee, and a disinterested majority of the Board may issue additional option grants and other stock-based awards to members of the Compensation Committee. Any such option grants will have an exercise price per share equal to the fair market value of the Common Stock on the grant date and a maximum term of ten (10) years.

7

In August 2003, the Compensation Committee approved an increase to the equity compensation provided to new non-employee Board members by supplementing their initial automatic option grant for 15,000 shares with a concurrent stock option grant for an additional 10,000 shares that would be made under the discretionary option grant program under the Plan with the same terms as the automatic option grant. The Compensation Committee at the same time decided to make supplemental option grants for 10,000 shares to each non-employee director initially appointed or elected to the Board during the 2002 fiscal year or the portion of the 2003 fiscal year preceding the August 2003 increase to the equity compensation provided to new non-employee Board members.

In 2003, the following option grants were made to our non-employee Board members under the discretionary option grant program in connection with the increase to the initial grant of stock options to non-employee Board members. Upon his appointment to the Board in September 2003, Mr. Crovitz received, in addition to his 15,000-share automatic option grant, an option to purchase 10,000 shares of Common Stock at an exercise price per share of $10.11. That option will become exercisable in accordance with the same vesting schedule in effect for his automatic option grant. In addition to their 15,000-share automatic option grants, Messrs. Peets and Sullivan each received an additional option to purchase 10,000 shares of Common Stock at an exercise price per share of $8.28. Each of those options will become exercisable in accordance with the same vesting schedule described above for their automatic option grants. In addition to his 10,000-share automatic grant as a continuing non-employee Board member, Mr. Jones received an option to purchase 10,000 shares of Common Stock at an exercise price per share of $8.28 per share. The option will become exercisable for fifty percent (50%) of the option shares upon his completion of one year of Board service measured from the grant date and will become exercisable for the balance of the option shares upon the completion of an additional year of Board service thereafter.

The Board of Directors also granted Mr. Dougall an option to purchase 20,000 shares of Common Stock at an exercise price of $10.11 as a reward for his dedicated and extended service to the Company as a director. The option will vest and become exercisable for all the shares upon his continuation in Board service through the day immediately preceding the date of the 2004 annual stockholders meeting.

On October 23, 2003, Dr. Saloner was awarded share rights as to 20,000 shares of Common Stock. Fifty percent (50%) of the shares subject to those rights will vest and be issued on October 1, 2004, provided he continues to serve on the Board through such date, and the remainder will vest and be issued on the date of the 2005 annual stockholders meeting if he remains on the Board through such date. In the event of certain changes in ownership or control prior to October 1, 2004, fifty percent (50%) of the shares subject to the award plus a prorated amount of the balance of the 20,000 shares for each month elapsed since October 1, 2003 will immediately vest and be issued. Upon certain changes in ownership or control occurring on or after October 1, 2004, all the shares subject to the award will vest and be issued.

In January 2003, in connection with the resignation of Peter Johnson as a non-employee Board member, the Compensation Committee partially accelerated the vesting schedule in effect for the options granted to Mr. Johnson on January 2, 2001, July 26, 2001 and January 2, 2002 so that those options became exercisable on an accelerated basis for an aggregate of 39,582 shares and also extended his right to exercise the vested portions of these options until June 30, 2004. The accelerated vesting provided Mr. Johnson with vested option shares as if he had continued to serve on the Board until March 31, 2004. Mr. Johnson did not receive any cash Board fees for the first calendar quarter of 2003.

In May 2003, Garen Staglin retired as a director of the Company. In connection with his retirement the Compensation Committee partially accelerated the vesting of the options granted to him on January 2, 2001, July 26, 2001 and January 2, 2002 so that those options became exercisable on an accelerated basis for an aggregate of 37,708 shares and extended his right to exercise the vested portions of those options until November 30, 2004. The accelerated vesting provided Mr. Staglin with vested option shares as if he had continued to serve on the Board until August 31, 2004.

8

In September 2003, in connection with the resignation of Phil Schlein as a non-employee Board member, the Compensation Committee partially accelerated the vesting of the options granted to him on January 2, 2001, July 26, 2001, January 2, 2002 and May 15, 2003 so that those options became exercisable on an accelerated basis for an aggregate of 36,666 shares and extended his right to exercise the vested portions of those options until November 30, 2004. The accelerated vesting provided Mr. Schlein with vested option shares as if he had continued to serve on the Board until August 31, 2004.

9

PROPOSAL 2

RATIFICATION OF INDEPENDENT AUDITORS

The Company is asking the stockholders to ratify the selection by the Audit Committee of PricewaterhouseCoopers LLP as the Company’s independent auditors to provide auditing services to the Company during the fiscal year ending December 31, 2004. PricewaterhouseCoopers LLP’s representatives are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

The affirmative vote of holders of a majority of our outstanding shares present or represented and entitled to vote at the Annual Meeting is required for approval of the ratification of the selection of PricewaterhouseCoopers LLP. In the event the stockholders fail to ratify the appointment, the Audit Committee will consider it as a direction to select other auditors for the subsequent year. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interest of the Company and its stockholders.

Principal Accounting Fees and Services

The following table sets forth the approximate aggregate fees billed for fiscal years 2003 and 2002 by PricewaterhouseCoopers LLP.

| | | | | | |

| | | 2003

| | 2002

|

Audit Fees(1) | | $ | 535,000 | | $ | 592,500 |

Audit-Related Fees(2) | | | 41,867 | | | 227,735 |

Tax Fees(3) | | | 276,789 | | | 648,635 |

All Other Fees(4) | | | — | | | 36,399 |

| | |

|

| |

|

|

Total Fees | | $ | 853,656 | | $ | 1,505,269 |

| | |

|

| |

|

|

| (1) | | Audit Fees. Consists of professional services rendered for the audit of the Company’s annual financial statements and the reviews of the financial statements included in the Company’s quarterly reports on Form 10-Q and services that are normally provided by accountants in connection with statutory and regulatory filings or engagements for those fiscal years. |

| (2) | | Audit-Related Fees. Consists of assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.” |

| (3) | | Tax Fees. Consists of professional services relating to tax compliance, tax advice and tax planning, including tax return preparation and technical tax advice. |

| (4) | | All Other Fees. Consists of consulting services for benefits and other accounting-related issues. |

The Audit Committee has established a policy for the pre-approval of all audit and permitted non-audit services of PricewaterhouseCoopers LLP. The policy sets forth the procedures and conditions for such pre-approval of services to be performed by the independent auditor. The policy utilizes a framework of general pre-approval for certain specified services and specific approval for all other services. The Audit Committee has also delegated authority to pre-approve services to be performed by PricewaterhouseCoopers LLP to the Chairman of the Audit Committee, provided that the Chairman of the Audit Committee then reports his pre-approval to the other members of the Audit Committee at the next Audit Committee meeting.

In 2003, there were no fees paid to PricewaterhouseCoopers under a de minimus exception to the rules that waives pre-approval for certain non-audit services.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors recommends that stockholders vote FOR the proposal to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent auditors for the fiscal year ending December 31, 2004.

10

PROPOSAL 3

ADOPTION OF 2004 EMPLOYEE STOCK PURCHASE PLAN

General

The stockholders are being asked to approve the adoption of our new 2004 Employee Stock Purchase Plan (the “Purchase Plan”), under which 250,000 shares of our Common Stock will be reserved for issuance. The Purchase Plan was approved by our Board of Directors on April 6, 2004, and will become effective upon stockholder approval of this proposal at the Annual Meeting.

The Purchase Plan is designed to allow our eligible employees and eligible employees of our participating subsidiaries (whether now existing or subsequently established) to purchase shares of Common Stock at six-month intervals through their accumulated periodic payroll deductions under the Purchase Plan. The Purchase Plan will serve as the successor to our Employee Stock Purchase Plan (the “Predecessor Plan”), which terminated on April 30, 2004. No further shares of our Common Stock will be issued under the Predecessor Plan.

The following is a summary of the principal features of the Purchase Plan. The summary, however, does not purport to be a complete description of all the provisions of the Purchase Plan. Any stockholder who wishes to obtain a copy of the actual plan document may do so upon written request to our Corporate Secretary at our principal executive offices at 1400 Marina Way South, Richmond, California 94804.

Administration

The Purchase Plan will be administered by the Compensation Committee. Such committee, as plan administrator, will have full authority to adopt administrative rules and procedures and to interpret the provisions of the Purchase Plan.

Securities Subject to the Purchase Plan

The number of shares of Common Stock reserved for issuance under the Purchase Plan will be limited to 250,000 shares. The shares issuable under the Purchase Plan may be made available from authorized but unissued shares of our Common Stock or from shares of Common Stock repurchased by us, including shares repurchased on the open market.

In the event that any change is made to our outstanding Common Stock (whether by reason of any recapitalization, stock dividend, stock split, exchange or combination of shares or other change in corporate structure effected without our receipt of consideration), appropriate adjustments will be made to (i) the maximum number and class of securities issuable under the Purchase Plan, (ii) the maximum number and class of securities purchasable per participant on any one purchase date, (iii) the maximum number and class of securities purchasable in total by all participants on any one purchase date and (iv) the number and class of securities and the price per share in effect under each outstanding purchase right. Such adjustments will be designed to preclude any dilution or enlargement of benefits under the Purchase Plan or the outstanding purchase rights thereunder.

Offering Periods and Purchase Rights

Shares of our Common Stock will be offered under the Purchase Plan through a series of offering periods, with a new offering period to begin on the first business day of May and November each year. The duration of each offering period will be set by the Compensation Committee prior to the start date, but no offering period may have a duration in excess of twenty-four months. Each offering period will itself be comprised of one or more six-month purchase intervals. These six-month purchase intervals will begin on the first business day in May and November each year and will end on the last business day of the following October and April respectively.

11

It is expected that the initial offering period will be comprised of a single purchase interval which will begin on July 1, 2004 and end on October 29, 2004, and that the immediately following offering period will be six months’ duration.

At the time the participant joins the offering period, he or she will be granted a purchase right to acquire shares of our Common Stock on the last day of each purchase interval within that offering period. All payroll deductions collected from the participant for each purchase interval will be automatically applied to the purchase of Common Stock at the end of that purchase interval, subject to certain limitations.

Eligibility and Participation

Any individual who is employed on a basis under which he or she is regularly expected to work for more than twenty hours per week for more than five months per calendar year in our employ or in the employ of any participating parent or subsidiary corporation (including any corporation which subsequently becomes such at any time during the term of the Purchase Plan) will be eligible to participate in the Purchase Plan. Each individual who is an eligible employee on the start date of any offering period may enter that offering period on such start date. However, an eligible employee may participate in only one offering period at a time.

As of April 12, 2004, approximately 471 employees, including 4 executive officers, were eligible to participate in the Purchase Plan.

Payroll Deductions and Stock Purchases

Each participant may authorize periodic payroll deductions in any multiple of one percent (1%) (up to a maximum of ten percent (10%)) of his or her base salary to be applied to the acquisition of Common Stock at six-month intervals. Accordingly, on each such purchase date (the last business day in April and October each year), the payroll deductions of each participant accumulated for the purchase interval ending on that purchase date will automatically be applied to the purchase of whole shares of Common Stock at the purchase price in effect for the participant for that purchase date.

Purchase Price

The purchase price of the Common Stock acquired on each semi-annual purchase date will be fixed by the Compensation Committee at the start of each offering period and will not be less than eighty-five percent (85%) of the lower of (i) the fair market value per share of our Common Stock on the participant’s entry date into the offering period or (ii) the fair market value on the purchase date. It is expected that the purchase price of the Common Stock to be in effect for the initial offering ending October 29, 2004 will be equal to ninety percent (90%) of the lower of (i) the fair market value per share of our Common Stock on the participant’s entry date into the offering period or (ii) the fair market value on the purchase date.

The fair market value per share of our Common Stock on any particular date under the Purchase Plan will be deemed to be equal to the closing selling price per share on such date on the Nasdaq National Market. On April 12, 2004, the fair market value of our Common Stock determined on such basis was $5.89 per share.

Special Limitations

The Purchase Plan imposes certain limitations upon a participant’s rights to acquire Common Stock, including the following limitations:

| | • | | Purchase rights granted to a participant may not permit such individual to purchase more than $25,000 worth of our Common Stock (valued at the time each purchase right is granted) for each calendar year those purchase rights are outstanding at any time. |

12

| | • | | Purchase rights may not be granted to any individual if such individual would, immediately after the grant, own or hold outstanding options or other rights to purchase, stock possessing five percent (5%) or more of the total combined voting power or value of all classes of our outstanding stock or the outstanding stock of any of our affiliates. |

| | • | | No participant may purchase more than 750 shares of Common Stock on any one purchase date. |

| | • | | The maximum number of shares of Common Stock purchasable in total by all participants on any one purchase date will be limited to 100,000 shares. |

The Compensation Committee will have the discretionary authority to increase or decrease the per participant and total participant purchase limitations as of the start date of any new offering period under the Purchase Plan, with the new limits to be in effect for that offering period and each subsequent offering period.

Termination of Purchase Rights

The participant may withdraw from the Purchase Plan at any time up to the last five business days of the purchase interval, and his or her accumulated payroll deductions for that interval will, at the participant’s election, either be applied to the purchase of shares on the next scheduled six-month purchase date or be refunded immediately.

The participant’s purchase right will immediately terminate upon his or her cessation of employment or loss of eligible employee status. Any payroll deductions which the participant may have made for the purchase interval in which such cessation of employment or loss of eligibility occurs will be refunded and will not be applied to the purchase of Common Stock.

Stockholder Rights

No participant will have any stockholder rights with respect to the shares covered by his or her purchase rights until the shares are actually purchased on the participant’s behalf and the participant has become a holder of record of the purchased shares. No adjustment will be made for dividends, distributions or other rights for which the record date is prior to the date of such purchase.

Assignability

No purchase rights will be assignable or transferable by the participant, and the purchase rights will be exercisable only by the participant.

Change in Control

Should we be acquired by merger, sale of substantially all of our assets or sale of securities possessing more than fifty percent (50%) of the total combined voting power of our outstanding securities, then all outstanding purchase rights will automatically be exercised immediately prior to the effective date of such acquisition. The purchase price will be not less than eighty-five percent (85%) of the lower of (i) the fair market value per share of Common Stock on the participant’s entry date into the offering period in which such acquisition occurs or (ii) the fair market value per share of Common Stock immediately prior to such acquisition. The actual percentage purchase price will be equal to the percentage purchase price previously set by the Compensation Committee for the offering period in which the participant is enrolled at the time of acquisition. The limitation on the maximum number of shares purchasable by each participant (but not the limitation on all participants in the aggregate) on any one purchase date will be applicable to any purchase date attributable to such an acquisition.

13

Share Pro-Ration

Should the total number of shares of Common Stock to be purchased pursuant to outstanding purchase rights on any particular date exceed the number of shares then available for issuance under the Purchase Plan, then the plan administrator will make a pro-rata allocation of the available shares on a uniform and nondiscriminatory basis, and the payroll deductions of each participant, to the extent in excess of the aggregate purchase price payable for the Common Stock pro-rated to such individual, will be refunded.

Amendment and Termination

The Purchase Plan will terminate upon the earliest to occur of (i) the last business day in October 2014, (ii) the date on which all shares available for issuance thereunder are sold pursuant to exercised purchase rights or (iii) the date on which all purchase rights are exercised in connection with a change in control or ownership.

Our Board of Directors may amend or suspend the Purchase Plan at the end of any six-month purchase interval. However, the Board may not, without stockholder approval, (i) increase the number of shares issuable under the Purchase Plan (except as permissible adjustments in the event of changes to our capitalization), (ii) alter the purchase price formula so as to reduce the purchase price or (iii) modify the requirements for eligibility to participate in the Purchase Plan. The Purchase Plan may be amended or terminated immediately upon action by our Board of Directors, should the financial accounting rules currently applicable to employee stock purchase plans such as the Purchase Plan be revised so as to require us to recognize compensation cost in connection with the shares offered for purchase under the Purchase Plan.

New Plan Benefits

No purchase rights will be granted and no shares will be issued under the Purchase Plan unless the Purchase Plan is approved by the stockholders at the Annual Meeting.

Federal Tax Consequences

The Purchase Plan is intended to be an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code. Under a plan that so qualifies, no taxable income will be recognized by a participant, and no deductions will be allowable to us, upon either the grant or the exercise of the purchase rights. Taxable income will not be recognized until there is a sale or other disposition of the shares acquired under the Purchase Plan or in the event the participant should die while still owning the purchased shares.

If the participant sells or otherwise disposes of the purchased shares within two years after his or her entry date into the offering period in which such shares were acquired or within one year after the purchase date on which those shares were actually acquired, then the participant will recognize ordinary income in the year of sale or disposition equal to the amount by which the fair market value of the shares on the purchase date exceeded the purchase price paid for those shares, and we will be entitled to an income tax deduction, for the taxable year in which such disposition occurs, equal in amount to such excess.

If the participant sells or disposes of the purchased shares more than two years after his or her entry date into the offering period in which the shares were acquired and more than one year after the purchase date of those shares, then the participant will recognize ordinary income in the year of sale or disposition equal to the lesser of (i) the amount by which the fair market value of the shares on the sale or disposition date exceeded the purchase price paid for those shares or (ii) the excess of the fair market value of the shares on the participant’s entry date into that offering period over the purchase price which would have been paid for those shares had they been purchased on such entry date; and any additional gain upon the disposition will be taxed as a long-term capital gain. We will not be entitled to an income tax deduction with respect to such disposition.

14

If the participant still owns the purchased shares at the time of death, the lesser of (i) the amount by which the fair market value of the shares on the date of death exceeds the purchase price or (ii) the excess of the fair market value of the shares on his or her entry date into the offering period in which those shares were acquired over the purchase price which would have been paid for those shares had they been purchased on such entry date.

Accounting Treatment

Under the accounting principles currently applicable to employee stock purchase plans qualified under Section 423 of the Internal Revenue Code, the issuance of Common Stock under the Purchase Plan will not result in a compensation expense chargeable against our reported earnings. However, we must disclose, in pro-forma statements to our financial statements, the impact the purchase rights granted under the Purchase Plan would have upon our reported earnings were the value of those purchase rights treated as compensation expense.

On March 31, 2004 the Financial Accounting Standards Board (“FASB”) issued an exposure draft of its Proposed Statement of Financial Accounting Standards for Share-Based Payments (the “Exposure Draft”), which, if approved by FASB without change, will substantially change the accounting treatment for the Purchase Plan beginning January 1, 2005. Pursuant to the Exposure Draft, the fair value of each purchase right which is granted or vests under the Purchase Plan on or after January 1, 2005 will be charged as a direct compensation expense to our reported earnings over the offering period to which that purchase right pertains. The fair value of each such purchase right will be determined as of its grant date.

Vote Required

The affirmative vote of a majority of our outstanding voting shares present or represented and entitled to vote at the Annual Meeting is required for approval of the Purchase Plan. Should such stockholder approval not be obtained, then the Purchase Plan will not be implemented.

RECOMMENDATION OF BOARD OF DIRECTORS

Our Board of Directors recommends that the stockholders vote FOR the approval of the implementation of the Purchase Plan. The Board believes that it is in our best interests to provide our employees with the opportunity to acquire an ownership interest in us through their participation in the Purchase Plan and thereby encourage them to remain in our employ and more closely align their interests with those of the stockholders.

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s Common Stock as of December 31, 2003 (except where otherwise indicated), by (i) all persons known by the Company to be beneficial owners of more than five percent (5%) of its outstanding Common Stock, (ii) each director and nominee of the Company, (iii) the Named Executive Officers (as defined in “Executive Compensation and Other Information”) and (iv) all executive officers and directors of the Company as a group. Unless otherwise indicated, the principal address of each of the persons below is 1400 Marina Way South, Richmond, California 94804.

| | | | | |

| | | Amount and Nature of

Beneficial Ownership(1)

| |

Name and Address of Beneficial Owner

| | Number of Shares

| | Percent of Class

| |

Brown Capital Management, Inc.(2) 1201 N. Calvert Street Baltimore, MD 21202 | | 2,709,112 | | 17.03 | % |

| | |

Merrill Lynch & Co., Inc.(3) World Financial Center, North Tower 250 Vesey Street New York, NY 10381 | | 1,978,275 | | 12.43 | % |

| | |

Peter R. Johnson(4)(5)(6) c/o PRJ Holdings, Inc. 600 Montgomery Street San Francisco, CA 94111 | | 1,818,160 | | 11.50 | % |

| | |

Fidelity Mutual Research Group(7) 82 Devonshire Street Boston, MA 02109 | | 1,030,814 | | 6.48 | % |

| | |

Brown Investment Advisory & Trust Company(8) 901 South Bond Street, Suite 400 Baltimore, MD 21231 | | 1,006,375 | | 6.30 | % |

| | |

Elizabeth A. Fetter(4) | | 174,171 | | 1.08 | % |

| | |

Garth Saloner(4)(6) | | 149,759 | | * | |

| | |

Charles K. Crovitz | | — | | * | |

| | |

John P. Dougall(4) | | 47,084 | | * | |

| | |

Patrick S. Jones(4) | | 10,062 | | * | |

| | |

Terry R. Peets | | — | | * | |

| | |

Jeremiah J. Sullivan | | 5,937 | | * | |

| | |

John C. Parsons, Jr.(4) | | 57,200 | | * | |

| | |

Ray Rike(4) | | 21,875 | | * | |

| | |

Fred Ruffin | | 1,500 | | * | |

| | |

James Rowley(4) | | 50,250 | | * | |

| | |

All current executive officers and directors as

a group (10 persons)(4)(9) | | 459,138 | | 2.88 | % |

| * | | Less than one percent (1%). |

16

| (1) | | Applicable percentages are based on 15,920,737 shares outstanding on December 31, 2003, adjusted as required by rules promulgated by the SEC. Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options, warrants and convertible notes currently exercisable or convertible, or exercisable or convertible within 60 days after December 31, 2003 are deemed outstanding for computing the percentage of the person holding such options but are not deemed outstanding for computing the percentage of any other person. Unless otherwise indicated in the footnotes to this table and subject to any applicable community property laws, the Company believes that each of the stockholders named in the table have sole voting and investment power with respect to the shares of Common Stock indicated as beneficially owned by them. |

| (2) | | Pursuant to a Schedule 13G filed with the SEC on February 11, 2004, Brown Capital Management reported total shares of 2,709,112 with sole voting power over 1,294,376 of such shares and sole dispositive power over all 2,709,112 shares, which represents 17.03% of class. |

| (3) | | Pursuant to an Amendment to Schedule 13G filed by Merrill Lynch & Co., Inc. (“ML&Co.”) on January 27, 2004, ML&Co. is a parent holding company filing on behalf of Merrill Lynch Investment Managers, an operating division of ML&Co., consisting of ML&Co.’s indirectly owned asset management subsidiaries. ML&Co.’s asset management subsidiaries holding shares of the Company’s Common Stock include FAM D/B/A Mercury Advisors; Fund Asset Management, L.P.; Merrill Lynch Investment Managers, L.P.; and Merrill Lynch Investment Managers, L.L.C. Of the total 1,978,275 shares beneficially held by ML&Co., 1,502,575 are held by Master Small Cap Value Trust, an affiliated entity that alone would hold over 5% of the Company’s Common Stock. ML&Co. has shared voting power and shared dispositive power over all of Master Small Cap Value Trust’s 1,502,575 shares. |

| (4) | | The amounts shown include the following shares issuable upon exercise of options to purchase shares of Common Stock that are currently exercisable or will become exercisable within 60 days after December 31, 2003: Mr. Johnson, 127,082; Mr. Dougall, 47,084; Dr. Saloner, 61,040; Mr. Jones, 9,062; Mr. Sullivan, 5,937; Ms. Fetter, 161,666; Mr. Parsons, 57,200; Mr. Rike, 21,875; and Mr. Rowley, 48,750. |

| (5) | | Pursuant to a Schedule 13D filed with the SEC by Peter R. Johnson on September 12, 2003, he reported total shares of 1,818,160 with sole voting power over 1,741,960 of such shares, 30,000 shares were held by the Peter R. and Victoria J. Johnson Foundation and 46,200 shares were held by the Peter R. Johnson and Victoria J. Johnson GST Trust, of which Mr. Johnson is a trustee. |

| (6) | | The amounts shown include the following shares issuable upon exercise of warrants to purchase shares of Common Stock, granted in connection with the Company’s 2001 acquisition of its subsidiary Tradeweave, Inc., that are currently exercisable or will become exercisable within 60 days after December 31, 2003: Mr. Johnson, 83,643; Dr. Saloner, 21,357. |

| (7) | | Pursuant to a Schedule 13G filed with the SEC on February 16, 2004, Fidelity Mutual Research Group reported total shares of 1,030,814 with sole voting power over 131,400 of such shares and sole dispositive power over 1,030,814 shares. |

| (8) | | Pursuant to a Schedule 13G filed with the SEC on February 12, 2004, Brown Investment Advisory & Trust Company reported that it had sole voting power over all 903,913 shares, sole dispositive power over 989,475 of such shares, shared dispositive power over 16,900 of such shares. |

| (9) | | The amount shown includes 376,771 shares issuable upon exercise of options and warrants to purchase shares of Common Stock that are currently exercisable or will become exercisable within 60 days after December 31, 2003. |

17

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities and Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who beneficially own more than 10% of the Company’s Common Stock, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than 10% stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely upon a review of copies of reports furnished to the Company and written representations that no other reports were required during the fiscal year ended December 31, 2003, all the Company’s officers, directors and greater than 10% stockholders complied with the applicable Section 16(a) filing requirements.

18

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash and Certain Other Compensation

The following table provides certain summary information concerning the compensation earned for services rendered in all capacities to the Company and its subsidiaries for the 2003, 2002 and 2001 fiscal years by the Company’s Chief Executive Officer and each of the Company’s other executive officers whose salary and bonus for the 2003 fiscal year was in excess of $100,000. In addition, Messrs. Parsons and Ruffin are included in the table because they each would have been among the four most highly compensated executive officers of the Company on the last day of the 2003 fiscal year had they not resigned earlier that year. All the individuals named in such table are referred to in this Proxy Statement as the “Named Executive Officers.”

| | | | | | | | | | | | | | | | | | | | | | |

| | | Year

| | Annual Compensation

| | Long Term

Compensation Awards

| |

Name and Principal Position

| | | Salary(1)

| | Bonus

| | Other Annual

Compensation

| | | Securities

Underlying

Options

| | Restricted

Stock

Awards

| | | All Other

Compensation

| |

| | | | | | | |

Elizabeth A. Fetter(2) President and Chief Executive Officer (since 10/10/01) | | 2003

2002

2001 | | $

$

$ | 450,000

350,000

78,220 | | $

$

$ | 248,265

336,000

75,000 | | | | | | 150,000

60,000

300,000 | | $

| 1,193,750

—

— | (3)

| | $

$

| 6,527

4,716

— | (4)

(5)

|

| | | | | | | |

James Rowley(6) Senior Vice President and Chief Technology Officer (since 5/13/02) | | 2003

2002

2001 | | $

$

| 285,417

159,135

— | | $

$

| 140,852

153,854

— | | | | | | 40,000

100,000

— | | $

| 333,750

—

— | (7)

| | $

$

| 6,231

5,638

— | (4)

(5)

|

| | | | | | | |

Ray Rike(8) Senior Vice President of Worldwide Sales (since 12/2/02) | | 2003

2002

2001 | | $

$

| 230,000

18,333

— | | $

$

| 178,010

18,333

— | | | | | | 25,000

75,000

— | | $

| 132,600

—

— | (9)

| | $

| 6,000

—

— | (4)

|

| | | | | | | |

Jack Parsons(10) Former Senior Vice President and Chief Financial Officer (from 1/30/02 through 11/14/03) | | 2003

2002

2001 | | $

$

| 228,125

231,090

— | | $

$

| 97,969

255,144

— | | | | | | 40,000

120,000

— | |

| —

—

— |

| | $

$

| 273,923

0

— | (11)

|

| | | | | | | |

Fred Ruffin(12) Former Senior Vice President of Human Resources (from 11/19/01 through 9/30/03) | | 2003

2002

2001 | | $

$

$ | 150,000

205,192

23,141 | | $

$

$ | 25,808

82,304

31,667 | | $ | 21,937 | (13) | | 24,000

75,000

20,000 | |

| —

—

— |

| | $

$

| 159,903

6,471

— | (14)

(5)

|

| (1) | | Salary includes amounts deferred under the Company’s 401(k) Plan and Non-Qualified Deferred Compensation Plan. |

| (2) | | Ms. Fetter joined the Company in October 2001; her annualized base salary for 2001 would have been $350,000. |

| (3) | | On March 18, 2003 Ms. Fetter was awarded share rights as to 25,000 shares pursuant to the Company’s 1993 Stock Option/Stock Issuance Plan. Each share right entitles Ms. Fetter to receive one share of Common Stock on January 1, 2006, provided she continues in the Company’s employ through such date. In the event of a change of control of the Company, all of the share rights will vest, and the shares subject to those rights will be immediately issued, subject to certain limitations regarding excess “parachute payments” under Internal Revenue Code Section 280G. On the March 18, 2003 award date, the fair market value of the Common Stock was $ 5.25 per share for a total grant value of $131,250. As of December 31, 2003, Ms. Fetter has not been issued any shares of Common Stock pursuant to her share right award. |

19

| | | On October 1, 2003, Ms. Fetter was awarded share rights as to an additional 125,000 shares pursuant to the Company’s 1993 Stock Option/Stock Issuance Plan. The 125,000 shares subject to this award will vest monthly over a three-year period ending October 1, 2006. Shares that vest under the 125,000 share award will actually be issued to Ms. Fetter on the last day of the calendar year in which they vest. In the event of a change of control of the Company, up to 41,667 share rights will vest, and the shares subject to those vested rights will be immediately issued, subject to certain limitations regarding excess “parachute payments” under Internal Revenue Code Section 280G. On the October 1, 2003 award date, the fair market value of the Common Stock was $ 8.50 per share, for a total grant value of $1,062,500. |

| | | As of December 31, 2003, Ms. Fetter had been issued 10,416 shares of Common Stock under this share right award. However, 3,723 of those 10,416 shares were withheld by the Company in satisfaction of the withholding tax liability Ms. Fetter incurred in connection with the issuance of those shares. |

| | | No dividends or dividend equivalent units are payable with respect to the shares of Common Stock subject to the share right awards. As of December 31, 2003, the market price of the remaining 139,584 shares of Common Stock subject to the share right awards made to Ms. Fetter was $1,133,422 (based on the closing selling price per share on that date). |

| (4) | | Consists of Company contributions made to the Company’s 401(k) and/or Non-Qualified Deferred Compensation Plans that match a portion of the salary deferral contributions made by such officer to such plan(s) ($6,000 for Ms. Fetter, $6,000 for Mr. Rowley and $6,000 for Mr. Rike) and life insurance premiums paid by the Company on such officer’s behalf ($527 for Ms. Fetter, $231 for Mr. Rowley and $0 for Mr. Rike). |

| (5) | | Consists of Company contributions made to the Company’s 401(k) and Non-Qualified Deferred Compensation Plans that match a portion of the salary deferral contributions made by such officer to such plans ($4,114 for Ms. Fetter, $6,000 for Mr. Ruffin and $5,250 for Mr. Rowley) and long-term disability insurance premiums paid by the Company on such officer’s behalf ($602 for Ms. Fetter, $471 for Mr. Ruffin, $388 for Mr. Rowley, $0 for Mr. Rike and $0 for Mr. Parsons). |

| (6) | | Mr. Rowley joined the Company in May 2002; his annualized base salary for 2002 would have been $250,000. |

| (7) | | On March 18, 2003 Mr. Rowley was awarded share rights as to 15,000 shares pursuant to the Company’s 1993 Stock Option/Stock Issuance Plan. Each share right entitles Mr. Rowley to receive one share of Common Stock on March 18, 2006, provided he continues in the Company’s employ through such date. In the event of a change of control of the Company, all of the share rights will vest, and the shares subject to those rights will be immediately issued, subject to certain limitations regarding excess “parachute payments” under Internal Revenue Code Section 280G. On the March 18, 2003 award date, the fair market value of the Company’s Common Stock was $ 5.25 per share for a total grant value of $78,750. As of December 31, 2003, Mr. Rowley had not been issued any shares of Common Stock pursuant to his share right award. |

| | | On October 1, 2003 Mr. Rowley was awarded share rights as to an additional 30,000 shares pursuant to the Company’s 1993 Stock Option/Stock Issuance Plan. Each share right entitles Mr. Rowley to receive one share of Common Stock on October 1, 2006, provided he continues in the Company’s employ through such date. In the event of a change of control of the Company, all of the share rights will vest, and the shares subject to those rights will be immediately issued, subject to certain limitations regarding excess “parachute payments” under Internal Revenue Code Section 280G. On the October 1, 2003 award date, the fair market value of the Common Stock was $ 8.50 per share for a total grant value of $255,000. |

| | | No dividends or dividend equivalent units are payable with respect to the shares of Common Stock subject to the share right awards. As of December 31, 2003 the market price of the 45,000 shares of Common Stock subject to the share rights awarded to Mr. Rowley (based on the closing selling price per share on that date) was $365,400. |

| (8) | | Mr. Rike joined the Company in December 2002; his annualized base salary for 2002 would have been $220,000. |

20

| (9) | | On December 3, 2003 Mr. Rike was awarded share rights as to 15,000 shares pursuant to the Company’s 1993 Stock Option/Stock Issuance Plan. Each share right entitles Mr. Rike to receive one share of Common Stock on December 2, 2006, provided he continues in the Company’s employ through such date. In the event of a change of control of the Company, all of the share rights will vest, and the shares subject to those rights will be immediately issued, subject to certain limitations regarding excess “parachute payments” under Internal Revenue Code Section 280G. On the December 3, 2003 award date, the fair market value of the Common Stock was $8.84 per share for a total grant value of $132,600. |

| | | No dividends or dividend equivalent units are payable with respect to the shares of Common Stock subject to the share right award. As of December 31, 2003, Mr. Rike had not been issued any shares of Common Stock pursuant to his share right award. As of December 31, 2003 the market price of the 15,000 shares of Common Stock subject to the share rights awarded to Mr. Rike (based on the closing selling price per share on that date) was $121,800. |

| (10) | | Mr. Parsons joined the Company in January 2002; his annualized base salary for 2002 would have been $250,000. Mr. Parsons left the Company in November 2003; his annualized base salary for 2003 would have been $265,000. |

| (11) | | Consists of $198,750 in severance pay, $35,670 in consulting fees, $32,656 paid upon the completion of a designated performance milestone following Mr. Parson’s termination of employment, and $6,847 in continued health care coverage costs reimbursable by the Company. |

| (12) | | Mr. Ruffin joined the Company in November 2001; his annualized base salary for 2001 would have been $190,000. Mr. Ruffin left the Company in September 2003; his annualized base salary for 2003 would have been $200,000. |

| (13) | | Consists of accrued but unused paid time off that was paid out upon his termination of employment. |

| (14) | | Consists of $150,000 in severance pay, $6,000 in Company contributions made to the Company’s 401(k) and Non-Qualified Deferred Compensation Plans that match a portion of the salary deferral contributions made by Mr. Ruffin to such plans and $3,903 in continued health care coverage costs reimbursable by the Company. |

21

Stock Options

The Company granted options to purchase 1,345,490 shares of Common Stock during the 2003 fiscal year, of which options to purchase a total of 279,000 shares had been granted to the Named Executive Officers. The following table sets forth information concerning the stock options granted during the 2003 fiscal year to the Named Executive Officers. No stock appreciation rights were granted to the Named Executive Officers during such year.

Option Grants In Last Fiscal Year

| | | | | | | | | | | | | | | | | |

| | | Number of

Securities

Underlying

Options

Granted(#)

| | | Individual Grants

| | Expiration

Date

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term(3)

|

| | | | Percent of Total

Options Granted

to Employees in | | | Exercise

or Base

Price per | | |

Name

| | | Fiscal Year(1)

| | | Share(2)

| | | 5%

| | 10%

|

Elizabeth A. Fetter | | 60,000 | (4) | | 4.46 | % | | $ | 6.00 | | 7/17/2013 | | $ | 226,402 | | $ | 573,747 |

Elizabeth A. Fetter | | 60,000 | (4) | | 4.46 | % | | $ | 4.90 | | 2/12/2013 | | $ | 184,895 | | $ | 468,560 |

Elizabeth A. Fetter | | 30,000 | (5) | | 2.23 | % | | $ | 4.90 | | 2/12/2013 | | $ | 92,448 | | $ | 234,280 |

John C. Parsons, Jr. | | 20,000 | (4) | | 1.49 | % | | $ | 6.00 | | 7/17/2013 | | $ | 75,467 | | $ | 191,249 |

John C. Parsons, Jr. | | 20,000 | (4) | | 1.49 | % | | $ | 4.90 | | 2/12/2013 | | $ | 61,632 | | $ | 156,187 |

Ray Rike | | 25,000 | (4) | | 1.86 | % | | $ | 6.00 | | 7/17/2013 | | $ | 94,334 | | $ | 239,061 |

James Rowley | | 20,000 | (4) | | 1.49 | % | | $ | 6.00 | | 7/17/2013 | | $ | 75,467 | | $ | 191,249 |

James Rowley | | 20,000 | (4) | | 1.49 | % | | $ | 4.90 | | 2/12/2013 | | $ | 61,632 | | $ | 156,187 |

Fred Ruffin | | 12,000 | (4) | | 0.89 | % | | $ | 6.00 | | 7/17/2013 | | $ | 45,280 | | $ | 114,749 |

Fred Ruffin | | 12,000 | (4) | | 0.89 | % | | $ | 4.90 | | 2/12/2013 | | $ | 36,979 | | $ | 93,712 |

| (1) | | Based on an aggregate of 1,345,490 options granted during 2003. |

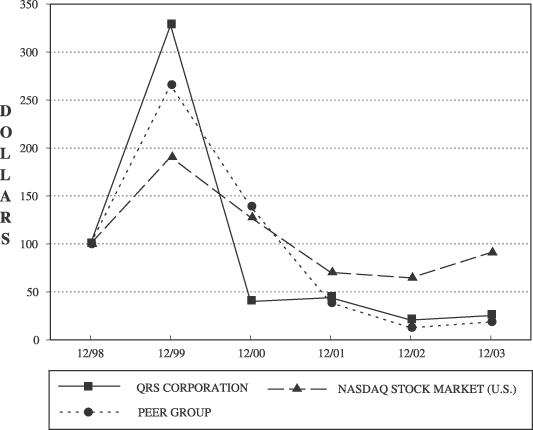

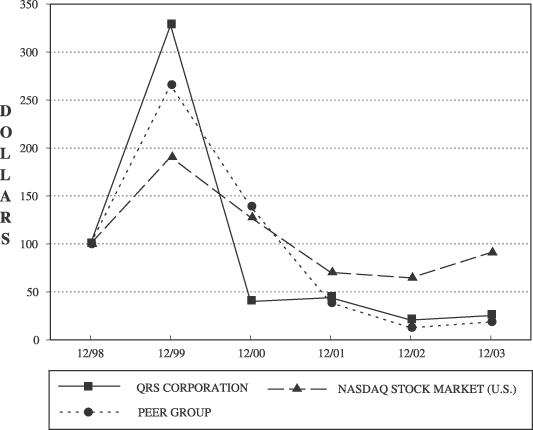

| (2) | | The exercise price per share is equal to the fair market value of the Common Stock on the date of grant. The exercise price may be paid in cash or in shares of Common Stock valued at the fair market value on the exercise date. Options may also be exercised, to the extent permissible under applicable law and Company policy, through a cashless exercise procedure pursuant to which the optionee provides irrevocable instructions to a brokerage firm to sell the purchased shares and to remit to the Company, out of the sale proceeds, an amount equal to the exercise price plus all applicable withholding taxes. |