Item 1. Reports to Stockholders

|

| |

| |

| Annual report |

| |

| Closed-end funds |

| |

| |

| Delaware Funds® by Macquarie Closed-End Municipal Bond Funds |

| |

| March 31, 2021 |

| |

| |

| |

| |

| |

Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Fund’s shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by logging into your Investor Center account at computershare.com/investor and going to “Communication Preferences” or by calling Computershare and speaking to a representative. You may elect to receive paper copies of all future shareholder reports free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at 866 437-0252. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Delaware Funds by Macquarie or your financial intermediary. |

| |

| |

Table of Contents

Table of contents

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. Macquarie Investment Management (MIM) is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisors: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A. For more information, including press releases, please visit delawarefunds.com/closed-end.

Unless otherwise noted, views expressed herein are current as of March 31, 2021, and subject to change for events occurring after such date.

The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Funds are governed by US laws and regulations.

All third-party marks cited are the property of their respective owners.

©2021 Macquarie Management Holdings, Inc.

Table of Contents

Portfolio management review

Delaware Funds® by Macquarie Closed-End Municipal Bond Funds

April 6, 2021 (Unaudited)

Delaware Investments® Colorado Municipal Income Fund, Inc.

| Performance preview (for the year ended March 31, 2021) | | | | |

| Delaware Investments Colorado Municipal Income Fund, Inc. @ market price | | 1-year return | | +10.82% |

| Delaware Investments Colorado Municipal Income Fund, Inc. @ NAV | | 1-year return | | +10.83% |

| Lipper Closed-end Other States Municipal Debt Funds Average @ market price | | 1-year return | | +17.04% |

| Lipper Closed-end Other States Municipal Debt Funds Average @ NAV | | 1-year return | | +8.08% |

Past performance does not guarantee future results.

Performance at market price will differ from performance at net asset value (NAV). Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s distribution rate.

For complete, annualized performance for Delaware Investments Colorado Municipal Income Fund, Inc., please see the table on page 4.

Delaware Investments Minnesota Municipal Income Fund II, Inc.

| Performance preview (for the year ended March 31, 2021) | | | | |

| Delaware Investments Minnesota Municipal Income Fund II, Inc. @ market price | | 1-year return | | +9.99% |

| Delaware Investments Minnesota Municipal Income Fund II, Inc. @ NAV | | 1-year return | | +7.54% |

| Lipper Closed-end Other States Municipal Debt Funds Average @ market price | | 1-year return | | +17.04% |

| Lipper Closed-end Other States Municipal Debt Funds Average @ NAV | | 1-year return | | +8.08% |

Past performance does not guarantee future results.

Performance at market price will differ from performance at net asset value (NAV). Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s distribution rate.

For complete, annualized performance for Delaware Investments Minnesota Municipal Income Fund II, Inc., please see the table on page 7.

Delaware Investments National Municipal Income Fund

| Performance preview (for the year ended March 31, 2021) | | | | |

| Delaware Investments National Municipal Income Fund @ market price | | 1-year return | | +12.11% |

| Delaware Investments National Municipal Income Fund @ NAV | | 1-year return | | +13.20% |

| Lipper Closed-end General and Insured Municipal Debt Funds Average (Leveraged) @ market price | | 1-year return | | +17.37% |

| Lipper Closed-end General and Insured Municipal Debt Funds Average (Leveraged) @ NAV | | 1-year return | | +12.19% |

Past performance does not guarantee future results.

Performance at market price will differ from performance at net asset value (NAV). Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s distribution rate.

For complete, annualized performance for Delaware Investments National Municipal Income Fund, please see the table on page 10.

Economic conditions

During the fiscal year ended March 31, 2021, the US economy saw striking highs and lows. When this period began, worries about COVID-19 were mounting. State and local governments across the country temporarily locked down, while economic activity withered. In the second quarter of 2020, the nation’s gross domestic product (GDP) – a measure of national economic output – fell by an annualized 31.4%. It was the country’s biggest quarterly drop on record.

States and municipalities gradually began reopening their economies in the second half of 2020. With aggressive action from the US Federal Reserve and federal government to try to ease the damage, the country’s economic situation improved.

In March 2020, prior to the start of the Funds’ fiscal year, the Fed cut its benchmark short-term interest rate by a total of 1.50 percentage points, bringing the federal funds rate to essentially zero, where it remained throughout the fiscal year. Meanwhile, two massive federal economic stimulus and relief packages for businesses and individuals bookended the period. The Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion economic bill, had become law in

1

Table of Contents

Portfolio management review

Delaware Funds® by Macquarie Closed-End Municipal Bond Funds

March 2020. Nearly a year later came the passage of the $1.9 trillion American Rescue Plan Act.

Against this backdrop, the country’s GDP quickly, but only partially, rebounded. US GDP grew by 33.4% in the third quarter of 2020. In the fourth quarter, GDP rose an estimated 4.3%, as the country tried to maintain its economic momentum amid the pandemic. Investors widely expected economic recovery to continue in 2021 given widespread COVID-19 vaccinations.

US employment trends were similarly volatile. Just a month before the fiscal year began, in February 2020, US unemployment was just 3.5%, matching a more than 50-year low. Then, as the pandemic took hold and businesses shut down, the jobless rate soared, with the impact especially pronounced in the hospitality and travel industries. At the start of the Funds’ fiscal year, US unemployment stood at 4.4%. Just one month later, the jobless rate reached 14.8%, the highest level seen since the Great Depression.

As economies reopened, however, unemployment again fell sharply, dropping to 6.9% by October and finishing the fiscal year at 6.0% – well below the April 2020 peak but still considerably higher than 12 months earlier.

Municipal bond market conditions

Overall, the municipal bond market, as measured by the Bloomberg Barclays Municipal Bond Index, returned 5.51% for the fiscal year ended March 31, 2021.

Three weeks before the start of this fiscal year, volatility in the municipal bond market had soared, as concern about the pandemic caused liquidity to dry up and required highly leveraged institutional investors to quickly sell bonds at low prices.

Starting in April 2020, however, and generally continuing throughout the fiscal year, municipal bond market conditions meaningfully improved. Cheap bond valuations along with robust monetary and fiscal support led investors to conclude that state and local bond issuers were in better-than-expected financial shape, which lifted municipal bond prices throughout most of the period.

During the fiscal year, bonds with longer maturities outperformed their shorter-dated counterparts, while lower-rated bonds outpaced more highly rated issues. In the high yield market segment, bonds with credit ratings below investment grade (below BBB) enjoyed strong results. Lower-rated hospital bonds were a notable exception to this trend; they produced a positive return, but investors appeared to maintain some residual skepticism about the sector amid the pandemic.

The following tables show the returns experienced by municipal bonds of varying maturity lengths and credit ratings for the Funds’ fiscal year ended March 31, 2021:

| Returns by maturity | | |

| 1 year | | 1.91% |

| 3 years | | 3.50% |

| 5 years | | 5.07% |

| 10 years | | 5.44% |

| 22+ years | | 7.02% |

| | | |

| Returns by credit rating | | |

| AAA | | 3.91% |

| AA | | 4.50% |

| A | | 6.69% |

| BBB | | 11.26% |

Source: Bloomberg.

A consistent management approach

For all three Funds discussed in this report, we continued to follow the same management strategy we use regardless of the market backdrop. We emphasize a bottom-up investment approach, meaning we rely on our team’s thorough credit research to choose bonds on an issuer-by-issuer basis. We regularly seek tax-exempt bonds that offer the Funds’ shareholders what we view as an attractive trade-off between return opportunity and risk.

Pursuing this approach, we tend to maintain relatively less exposure to highly rated, lower yielding bonds. Instead, we prefer to overweight bonds with lower-investment-grade or below-investment-grade credit ratings and solid underlying credit quality, in our opinion. We prefer to own lower-rated issues because we believe they provide the Funds with greater opportunity to add long-term value for shareholders.

Therefore, to the extent possible, we continued to favor bonds with lower-investment-grade credit ratings (A and BBB) while also maintaining part of each Fund’s portfolio in high yield tax-exempt bonds (rated below BBB). When investing in the high yield market, we thoroughly analyze securities’ credit risk and emphasize those bonds that we believe offer the Funds’ shareholders a favorable risk-reward trade-off.

During the fiscal year, and particularly early in the period, we focused on buying various lower-rated, longer-maturity bonds with depressed valuations following the municipal bond market’s sharp pandemic-related downturn. This included adding to existing holdings in Puerto Rico general obligation debt, which we found attractively valued, particularly given the commonwealth’s improving fiscal backdrop.

2

Table of Contents

We also purchased bonds of senior-living facilities offering unusually attractive yields compared with the securities’ credit risk, in our view, as well as longer-dated bonds with 10-year call dates, which allowed the Funds to capitalize on a steeper yield curve and supplied what we saw as an attractive total return opportunity.

Reflecting available supply, we found it easier to add what we viewed as attractively valued lower-rated bonds in Delaware Investments® National Municipal Income Fund and Delaware Investments Colorado Municipal Income Fund, Inc. More limited availability of these types of bonds in the Minnesota marketplace meant we were less active with new purchases in Delaware Investments Minnesota Municipal Income Fund II, Inc.

We funded these purchases primarily by selling bonds with shorter call dates or those maturing in the next few years, consistent with our opinion of those bonds’ more limited total-return prospects.

Our purchase activity was down in the second half of the fiscal year, as rallying municipal bond prices made compelling value opportunities somewhat harder to find. As vaccines were developed and lockdowns abated, and the municipal bond marketplace correspondingly improved, we were largely content to maintain the Funds’ existing positions.

Individual performance effects

Again, longer-duration bonds – those with more sensitivity to interest rates – generally outperformed shorter-duration bonds during the fiscal year, and lower-rated bonds outpaced higher-quality bonds. The Funds’ strongest and weakest performers generally reflected these performance trends.

In Delaware Investments National Municipal Income Fund, for example, the Fund’s leading performers were Puerto Rico general obligation (GO) bonds. (Bonds issued by US territories are generally fully tax-exempt for US residents.) These bonds, with a credit rating below investment grade and a 2035 maturity date, generated a 43% total return for the Fund, benefiting from Puerto Rico’s improved credit quality and the securities’ low valuation at the beginning of the fiscal year. Wisconsin Health and Educational Facilities Authority bonds for senior housing facilities of Covenant Living Communities (rated BBB- and maturing in 2053) also generated a strong total return for this Fund. The Fund further benefited from bonds for the expansion project of the McCormick Place convention center in Chicago (rated BBB and maturing in 2050) that rose off depressed levels from the Fund’s purchase price. These issues gained 28% and 26% for the Fund, respectively, for the fiscal year.

This Fund’s weakest individual performers were lower-quality bonds for retirement communities already facing financial challenges that the pandemic made worse. The Fund’s holdings in nonrated bonds for Tuscan Gardens of Venetian Bay in Venice, Fla., and a bond issue rated BBB+ for Texas senior-living facility owner Cardinal Bay struggled for the 12-month period, returning -21% and -15%, respectively.

In Delaware Investments Colorado Municipal Income Fund, Inc., the Puerto Rico GO bonds we cited earlier for Delaware Investments National Municipal Income Fund were the Fund’s leading performers. Exposure to two strong-performing senior housing bonds also contributed to performance. These positions benefited from improved underlying credit quality, which allowed the securities to recover off depressed valuations. Namely, investments in bonds of Colorado Health Facilities Authority for Frasier Meadows Manor (+26%) and Capella of Grand Junction (+25%) both added value.

Meanwhile, the Fund’s weakest-performing position involved bonds for the Grand River Hospital District (-2%). These bonds, rated AA and due to mature in 2037, did not decline to the same extent as others during the market downturn, so they did not appreciate as much during the recovery. Another underperforming holding that still generated a positive return for the Fund was a bond issue for the Vail County Medical Center project (+3%). Like many healthcare issues, these bonds, rated A+ and maturing in 2035, were slower to recover than bonds in other sectors, as the pandemic still added an element of uncertainty to hospital finances.

Meanwhile, Delaware Investments Minnesota Municipal Income Fund II, Inc. also benefited from a Puerto Rico GO bond issue, this one maturing in 2038 and generating a 36% total return for the Fund. Two charter school bonds with below-investment-grade credit ratings, Prairie Seeds Academy (+25%) and Academia Cesar Chavez (+23%), contributed to results as the issuers’ underlying credit quality improved. In contrast, the Fund saw slight declines from holdings in bonds for the YMCA Association of the Greater Twin Cities (-0.3%) and RiverView Healthcare Association, a medical provider in Crookston (-0.2%).

3

Table of Contents

Performance summaries

Delaware Investments® Colorado Municipal Income Fund, Inc.

March 31, 2021 (Unaudited)

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Please obtain the most recent performance data by calling 866 437-0252 or visiting our website at delawarefunds.com/closed-end.

| Fund performance | | | | | | | | |

| Average annual total returns through March 31, 2021 | | 1 year | | 5 year | | 10 year | | Lifetime |

| At market price | | +10.82% | | +3.20% | | +6.12% | | +5.06%* |

| At net asset value | | +10.83% | | +3.99% | | +6.17% | | +5.18%* |

| * | The inception date of the performance shown is May 5, 1998. The Fund commenced operations on July 29, 1993. |

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, regional, and other factors of that state than geographically diversified funds.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

The Fund’s use of leverage may expose common shareholders to additional volatility, and cause the Fund to incur certain costs. In the event that the Fund is unable to meet certain criteria (including, but not limited to, maintaining certain ratings with Fitch Ratings, funding dividend payments or funding redemptions), the Fund will pay additional fees with respect to the leverage.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

Closed-end fund shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation or any other government agency.

4

Table of Contents

Closed-end funds, unlike open-end funds, are not continuously offered. After being issued during a one-time-only public offering, shares of closed-end funds are sold in the open market through a securities exchange. Net asset value (NAV) is calculated by subtracting total liabilities by total assets, then dividing by the number of shares outstanding. At the time of sale, your shares may have a market price that is above or below NAV, and may be worth more or less than your original investment.

The Bloomberg Barclays Municipal Bond Index, mentioned on page 2, measures the total return performance of the long-term investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Returns reflect the reinvestment of all distributions. Dividends and distributions, if any, are assumed, for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment policy. Shares of the Fund were initially offered with a sales charge of 6%. Performance since inception does not include the sales charge or any other brokerage commission for purchases made since inception.

Past performance is not a guarantee of future results.

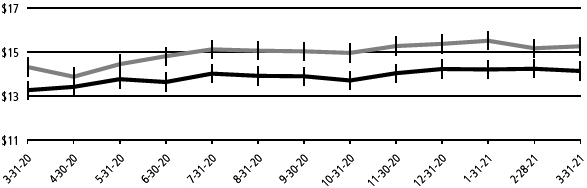

Market price versus net asset value (see notes on next page)

March 31, 2020 through March 31, 2021

| For period beginning March 31, 2020 through March 31, 2021 | | Starting value | | Ending value |

| Delaware Investments® Colorado Municipal Income Fund, Inc. @ NAV | | | $14.32 | | | | $15.26 | |

| Delaware Investments® Colorado Municipal Income Fund, Inc. @ market price | | | $13.27 | | | | $14.14 | |

Past performance is not a guarantee of future results.

5

Table of Contents

Performance summaries

Delaware Investments® Colorado Municipal Income Fund, Inc.

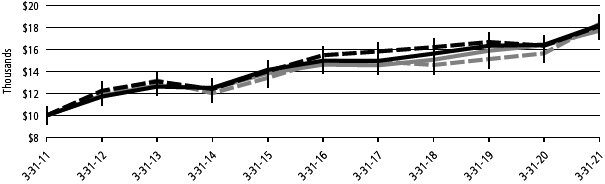

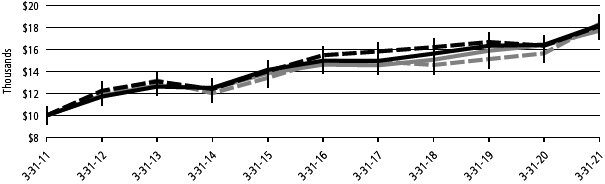

Performance of a $10,000 Investment

Average annual total returns from March 31, 2011 through March 31, 2021

| For period beginning March 31, 2011 through March 31, 2021 | | Starting value | | Ending value |

| Lipper Closed-end Other States Municipal Debt Funds Average @ market price | | | $10,000 | | | | $18,309 | |

| Delaware Investments® Colorado Municipal Income Fund, Inc. @ NAV | | | $10,000 | | | | $18,197 | |

| Delaware Investments® Colorado Municipal Income Fund, Inc. @ market price | | | $10,000 | | | | $18,107 | |

| Lipper Closed-end Other States Municipal Debt Funds Average @ NAV | | | $10,000 | | | | $17,699 | |

The “Performance of a $10,000 investment” graph assumes $10,000 invested in the Fund on March 31, 2011 and includes the reinvestment of all distributions at market value. The graph assumes $10,000 in the Lipper Closed-end Other States Municipal Debt Funds Average at market price and at NAV. Performance of the Fund and the Lipper class at market value is based on market performance during the period. Performance of the Fund and Lipper class at NAV is based on the fluctuations in NAV during the period. Delaware Investments Colorado Municipal Income Fund, Inc. was initially offered with a sales charge of 6%. For market price, performance shown in both graphs above does not include fees, the initial sales charge, or any brokerage commissions on purchases. For NAV, performance shown in both graphs above includes fees, but does not include the initial sales charge or any brokerage commissions for purchases. Investments in the Fund are not available at NAV.

The Lipper Closed-end Other States Municipal Debt Funds Average compares closed-end funds that invest in municipal debt issues with dollar-weighted average maturities of 5-10 years and are exempt from taxation on a specified city or state basis (source: Lipper).

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Market price is the price an investor would pay for shares of the Fund on the secondary market.

NAV is the total value of one fund share, generally equal to a fund’s net assets divided by the number of shares outstanding.

Past performance is not a guarantee of future results.

6

Table of Contents

Performance summaries

Delaware Investments® Minnesota Municipal Income Fund II, Inc.

March 31, 2021 (Unaudited)

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Please obtain the most recent performance data by calling 866 437-0252 or visiting our website at delawarefunds.com/closed-end.

Fund performance | | | | | | | | |

| Average annual total returns through March 31, 2021 | | 1 year | | 5 year | | 10 year | | Lifetime |

| At market price | | +9.99% | | +1.48% | | +4.86% | | +4.60%* |

| At net asset value | | +7.54% | | +3.52% | | +5.27% | | +4.94%* |

| * | The inception date of the performance shown is May 14, 1998. The Fund commenced operations on February 26, 1993. |

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, regional, and other factors of that state than geographically diversified funds.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

The Fund’s use of leverage may expose common shareholders to additional volatility, and cause the Fund to incur certain costs. In the event that the Fund is unable to meet certain criteria (including, but not limited to, maintaining certain ratings with Fitch Ratings, funding dividend payments or funding redemptions), the Fund will pay additional fees with respect to the leverage.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

Closed-end fund shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation or any other government agency.

7

Table of Contents

Performance summaries

Delaware Investments® Minnesota Municipal Income Fund II, Inc.

Closed-end funds, unlike open-end funds, are not continuously offered. After being issued during a one-time-only public offering, shares of closed-end funds are sold in the open market through a securities exchange. Net asset value (NAV) is calculated by subtracting total liabilities by total assets, then dividing by the number of shares outstanding. At the time of sale, your shares may have a market price that is above or below NAV, and may be worth more or less than your original investment.

The Bloomberg Barclays Municipal Bond Index, mentioned on page 2, measures the total return performance of the long-term investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Returns reflect the reinvestment of all distributions. Dividends and distributions, if any, are assumed, for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment policy. Shares of the Fund were initially offered with a sales charge of 7%. Performance since inception does not include the sales charge or any other brokerage commission for purchases made since inception.

Past performance is not a guarantee of future results.

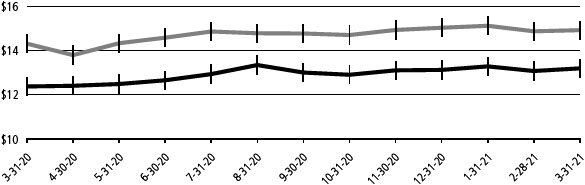

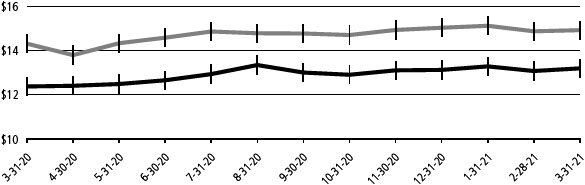

Market price versus net asset value (see notes on next page)

March 31, 2020 through March 31, 2021

| For period beginning March 31, 2020 through March 31, 2021 | | Starting value | | Ending value |

| Delaware Investments® Minnesota Municipal Income Fund II, Inc. @ NAV | | $14.31 | | $14.92 |

| Delaware Investments® Minnesota Municipal Income Fund II, Inc. @ market price | | $12.37 | | $13.19 |

Past performance is not a guarantee of future results.

8

Table of Contents

Performance of a $10,000 Investment

Average annual total returns from March 31, 2011 through March 31, 2021

| For period beginning March 31, 2011 through March 31, 2021 | | Starting value | | Ending value |

| Lipper Closed-end Other States Municipal Debt Funds Average @ market price | | $10,000 | | $18,309 |

| Lipper Closed-end Other States Municipal Debt Funds Average @ NAV | | $10,000 | | $17,699 |

| Delaware Investments® Minnesota Municipal Income Fund II, Inc. @ NAV | | $10,000 | | $16,719 |

| Delaware Investments® Minnesota Municipal Income Fund II, Inc. @ market price | | $10,000 | | $16,071 |

The “Performance of a $10,000 investment” graph assumes $10,000 invested in the Fund on March 31, 2011 and includes the reinvestment of all distributions at market value. The graph assumes $10,000 in the Lipper Closed-end Other States Municipal Debt Funds Average at market price and at NAV. Performance of the Fund and the Lipper class at market value is based on market performance during the period. Performance of the Fund and Lipper class at NAV is based on the fluctuations in NAV during the period. Delaware Investments Minnesota Municipal Income Fund II, Inc. was initially offered with a sales charge of 7%. For market price, performance shown in both graphs above does not include fees, the initial sales charge, or any brokerage commissions on purchases. For NAV, performance shown in both graphs above includes fees, but does not include the initial sales charge or any brokerage commissions for purchases. Investments in the Fund are not available at NAV.

The Lipper Closed-end Other States Municipal Debt Funds Average compares closed-end funds that invest in municipal debt issues with dollar-weighted average maturities of 5-10 years and are exempt from taxation on a specified city or state basis (source: Lipper).

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Market price is the price an investor would pay for shares of the Fund on the secondary market.

NAV is the total value of one fund share, generally equal to a fund’s net assets divided by the number of shares outstanding.

Past performance is not a guarantee of future results.

9

Table of Contents

Performance summaries

Delaware Investments® National Municipal Income Fund

March 31, 2021 (Unaudited)

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Please obtain the most recent performance data by calling 866 437-0252 or visiting our website at delawarefunds.com/closed-end.

| Fund performance | | | | | | | | |

| Average annual total returns through March 31, 2021 | | 1 year | | 5 year | | 10 year | | Lifetime |

| At market price | | +12.11% | | +3.81% | | +5.86% | | +4.86%* |

| At net asset value | | +13.20% | | +4.61% | | +6.81% | | +5.18%* |

| * | The inception date of the performance shown is May 14, 1998. The Fund commenced operations on February 26, 1993. |

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, regional, and other factors of that state than geographically diversified funds.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

The Fund’s use of leverage may expose common shareholders to additional volatility, and cause the Fund to incur certain costs. In the event that the Fund is unable to meet certain criteria (including, but not limited to, maintaining certain ratings with Fitch Ratings, funding dividend payments or funding redemptions), the Fund will pay additional fees with respect to the leverage.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

Closed-end fund shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation or any other government agency.

10

Table of Contents

Closed-end funds, unlike open-end funds, are not continuously offered. After being issued during a one-time-only public offering, shares of closed-end funds are sold in the open market through a securities exchange. Net asset value (NAV) is calculated by subtracting total liabilities by total assets, then dividing by the number of shares outstanding. At the time of sale, your shares may have a market price that is above or below NAV, and may be worth more or less than your original investment.

The Bloomberg Barclays Municipal Bond Index, mentioned on page 2, measures the total return performance of the long-term investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Returns reflect the reinvestment of all distributions. Dividends and distributions, if any, are assumed, for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment policy. Shares of the Fund were initially offered with a sales charge of 7%. Performance since inception does not include the sales charge or any other brokerage commission for purchases made since inception.

Past performance is not a guarantee of future results.

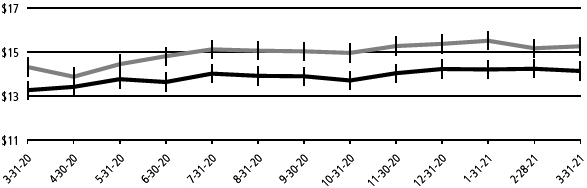

Market price versus net asset value (see notes on next page)

March 31, 2020 through March 31, 2021

| For period beginning March 31, 2020 through March 31, 2021 | | Starting value | | Ending value |

| Delaware Investments® National Municipal Income Fund @ NAV | | | $13.71 | | | | $14.84 | |

| Delaware Investments® National Municipal Income Fund @ market price | | | $12.24 | | | | $13.12 | |

Past performance is not a guarantee of future results.

11

Table of Contents

Performance summaries

Delaware Investments® National Municipal Income Fund

Performance of a $10,000 Investment

Average annual total returns from March 31, 2011 through March 31, 2021

| For period beginning March 31, 2011 through March 31, 2021 | | Starting value | | Ending value |

| Lipper Closed-end General and Insured Municipal Debt Funds Average (Leveraged) @ NAV | | | $10,000 | | | | $20,905 | |

| Lipper Closed-end General and Insured Municipal Debt Funds Average (Leveraged) @ market price | | | $10,000 | | | | $20,448 | |

| Delaware Investments® National Municipal Income Fund @ NAV | | | $10,000 | | | | $19,323 | |

| Delaware Investments® National Municipal Income Fund @ market price | | | $10,000 | | | | $17,671 | |

The “Performance of a $10,000 investment” graph assumes $10,000 invested in the Fund on March 31, 2011 and includes the reinvestment of all distributions at market value. The graph assumes $10,000 in the Lipper Closed-end General and Insured Municipal Debt Funds Average (Leveraged) at market price and at NAV. Performance of the Fund and the Lipper class at market value is based on market performance during the period. Performance of the Fund and Lipper class at NAV is based on the fluctuations in NAV during the period. Delaware Investments National Municipal Income Fund was initially offered with a sales charge of 7%. For market price, performance shown in both graphs above does not include fees, the initial sales charge, or any brokerage commissions on purchases. For NAV, performance shown in both graphs above includes fees, but does not include the initial sales charge or any brokerage commissions for purchases. Investments in the Fund are not available at NAV.

The Lipper Closed-end General and Insured Municipal Debt Funds Average (Leveraged) compares closed-end funds that either invest primarily in municipal debt issues rated in the top four credit ratings or invest primarily in municipal debt issues insured as to timely payment. These funds can be leveraged via use of debt, preferred equity, and/or reverse purchase agreements (source: Lipper).

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Market price is the price an investor would pay for shares of the Fund on the secondary market.

NAV is the total value of one fund share, generally equal to a fund’s net assets divided by the number of shares outstanding.

Past performance is not a guarantee of future results.

12

Table of Contents

Fund basics

As of March 31, 2021 (Unaudited)

Delaware Investments®

Colorado Municipal Income Fund, Inc. Fund objective The Fund seeks to provide current income exempt from both regular federal income tax and Colorado state income tax, consistent with the preservation of capital. Total Fund net assets $74 million Number of holdings 130 Fund start date July 29, 1993 NYSE American Symbol VCF CUSIP number 246101109 Delaware Investments®

Minnesota Municipal Income Fund II, Inc. Fund objective The Fund seeks to provide current income exempt from both regular federal income tax and Minnesota state personal income tax, consistent with the preservation of capital. Total Fund net assets $172 million Number of holdings 209 Fund start date February 26, 1993 NYSE American Symbol VMM CUSIP number 24610V103 | | Delaware Investments® National Municipal Income Fund Fund objective The Fund seeks to provide current income exempt from regular federal income tax, consistent with the preservation of capital. Total Fund net assets $67 million Number of holdings 171 Fund start date February 26, 1993 NYSE American Symbol VFL CUSIP number 24610T108 |

13

Table of Contents

Security type / sector / state / territory allocations

As of March 31, 2021 (Unaudited)

Sector designations may be different than the sector designations presented in other Fund materials.

Delaware Investments®

Colorado Municipal Income Fund, Inc.

| | Percentage |

| Security type / sector | | of net assets |

| Municipal Bonds* | | 139.21% | |

| Corporate Revenue Bonds | | 6.46% | |

| Education Revenue Bonds | | 19.69% | |

| Electric Revenue Bonds | | 5.81% | |

| Healthcare Revenue Bonds | | 33.67% | |

| Lease Revenue Bonds | | 2.20% | |

| Local General Obligation Bonds | | 18.05% | |

| Pre-Refunded/Escrowed to Maturity Bonds | | 14.96% | |

| Special Tax Revenue Bonds | | 18.80% | |

| State General Obligation Bonds | | 3.79% | |

| Transportation Revenue Bonds | | 9.41% | |

| Water & Sewer Revenue Bonds | | 6.37% | |

| Total Value of Securities | | 139.21% | |

| Liquidation Value of Preferred** | | (40.64% | ) |

| Receivables and Other Assets Net of | | | |

| Liabilities | | 1.43% | |

| Total Net Assets | | 100.00% | |

| * | As of the date of this report, Delaware Investments® Colorado Municipal Income Fund, Inc. held bonds issued by or on behalf of territories and the states of the US as follows: |

| | Percentage |

| State / territory | | of net assets |

| Colorado | | 121.70% |

| Guam | | 1.96% |

| Puerto Rico | | 15.55% |

| Total Value of Securities | | 139.21% |

| ** | More information regarding the Fund’s use of preferred shares as leverage is included in Note 6 in “Notes to financial statements.” The Fund utilizes preferred shares as leverage in an attempt to obtain a higher return for the Fund. There is no assurance that the Fund will achieve its a higher return or its investment objectives through the use of such leverage. |

Delaware Investments®

Minnesota Municipal Income Fund II, Inc.

| | Percentage |

| Security type / sector | | of net assets |

| Municipal Bonds* | | 141.79% | |

| Corporate Revenue Bonds | | 2.03% | |

| Education Revenue Bonds | | 23.10% | |

| Electric Revenue Bonds | | 13.83% | |

| Healthcare Revenue Bonds | | 38.69% | |

| Housing Revenue Bonds | | 2.05% | |

| Lease Revenue Bonds | | 8.75% | |

| Local General Obligation Bonds | | 14.78% | |

| Pre-Refunded/Escrowed to Maturity Bonds | | 16.65% | |

| Special Tax Revenue Bonds | | 3.28% | |

| State General Obligation Bonds | | 8.15% | |

| Transportation Revenue Bonds | | 7.35% | |

| Water & Sewer Revenue Bonds | | 3.13% | |

| Total Value of Securities | | 141.79% | |

| Liquidation Value of Preferred** | | (43.70% | ) |

| Receivables and Other Assets Net of | | | |

| Liabilities | | 1.91% | |

| Total Net Assets | | 100.00% | |

| * | As of the date of this report, Delaware Investments® Minnesota Municipal Income Fund II, Inc. held bonds issued by or on behalf of territories and the states of the US as follows: |

| | Percentage |

| State / territory | | of net assets |

| Guam | | 0.66% |

| Minnesota | | 136.66% |

| Puerto Rico | | 4.47% |

| Total Value of Securities | | 141.79% |

| ** | More information regarding the Fund’s use of preferred shares as leverage is included in Note 6 in “Notes to financial statements.” The Fund utilizes preferred shares as leverage in an attempt to obtain a higher return for the Fund. There is no assurance that the Fund will achieve its a higher return or its investment objectives through the use of such leverage. |

14

Table of Contents

Delaware Investments®

National Municipal Income Fund

| | Percentage |

| Security type / sector | | of net assets |

| Municipal Bonds* | | 142.96 | % |

| Corporate Revenue Bond | | 0.58 | % |

| Corporate Revenue Bonds | | 13.52 | % |

| Education Revenue Bonds | | 19.02 | % |

| Electric Revenue Bonds | | 5.04 | % |

| Healthcare Revenue Bonds | | 32.82 | % |

| Lease Revenue Bonds | | 9.46 | % |

| Local General Obligation Bonds | | 2.84 | % |

| Pre-Refunded/Escrowed to Maturity Bonds | | 6.97 | % |

| Special Tax Revenue Bonds | | 13.95 | % |

| State General Obligation Bonds | | 12.62 | % |

| Transportation Revenue Bonds | | 24.14 | % |

| Water & Sewer Revenue Bonds | | 2.00 | % |

| Total Value of Securities | | 142.96 | % |

| Liquidation Value of Preferred** | | (44.65 | %) |

| Receivables and Other Assets Net of | | | |

| Liabilities | | 1.69 | % |

| Total Net Assets | | 100.00 | % |

| * | As of the date of this report, Delaware Investments® National Municipal Income Fund held bonds issued by or on behalf of territories and the states of the US as follows: |

| | Percentage |

| State / territory | | of net assets |

| Alabama | | 0.78 | % |

| Arizona | | 9.24 | % |

| California | | 16.85 | % |

| Colorado | | 3.09 | % |

| District of Columbia | | 0.85 | % |

| Florida | | 7.15 | % |

| Georgia | | 1.92 | % |

| Guam | | 0.83 | % |

| Idaho | | 2.41 | % |

| Illinois | | 15.95 | % |

| Indiana | | 0.89 | % |

| Kansas | | 0.33 | % |

| Louisiana | | 3.25 | % |

| Maryland | | 1.21 | % |

| Massachusetts | | 0.85 | % |

| Michigan | | 1.71 | % |

| Missouri | | 2.58 | % |

| Montana | | 1.08 | % |

| Nebraska | | 0.46 | % |

| New Jersey | | 10.55 | % |

| New York | | 15.68 | % |

| North Carolina | | 1.11 | % |

| Ohio | | 2.99 | % |

| Oregon | | 0.83 | % |

| Pennsylvania | | 11.10 | % |

| Puerto Rico | | 14.88 | % |

| Texas | | 7.74 | % |

| Utah | | 1.11 | % |

| Virginia | | 0.40 | % |

| Washington | | 1.81 | % |

| Wisconsin | | 2.95 | % |

| Wyoming | | 0.38 | % |

| Total Value of Securities | | 142.96 | % |

| ** | More information regarding the Fund’s use of preferred shares as leverage is included in Note 6 in “Notes to financial statements.” The Fund utilizes preferred shares as leverage in an attempt to obtain a higher return for the Fund. There is no assurance that the Fund will achieve its a higher return or its investment objectives through the use of such leverage. |

15

Table of Contents

Schedules of investments

Delaware Investments® Colorado Municipal Income Fund, Inc.

March 31, 2021

| | | | | | Principal | | | |

| | | | | amount° | | Value (US $) |

| Municipal Bonds – 139.21% | | | | | |

| Corporate Revenue Bonds – 6.46% | | | | | |

| | Denver City & County | | | | | |

| | (United Airlines | | | | | |

| | | Project) | | | | | |

| | | 5.00% | | | | | |

| | | 10/1/32 (AMT) | | 215,000 | | $ | 228,855 |

| Public Authority for | | | | | |

| | Colorado Energy | | | | | |

| | Natural Gas Revenue | | | | | |

| | 6.50% 11/15/38 | | 2,250,000 | | | 3,457,890 |

| Public Authority for | | | | | |

| | Colorado Energy | | | | | |

| | Revenue | | | | | |

| | 6.25% 11/15/28 | | 865,000 | | | 1,082,824 |

| | | | | | | | 4,769,569 |

| Education Revenue Bonds – 19.69% | | | | | |

| Board of Trustees For | | | | | |

| | Colorado Mesa | | | | | |

| | University Enterprise | | | | | |

| | Revenue | | | | | |

| | Series B 5.00% | | | | | |

| | | 5/15/49 | | 750,000 | | | 927,427 |

| Colorado Educational & | | | | | |

| | Cultural Facilities | | | | | |

| | Authority Revenue | | | | | |

| | 144A 5.00% 7/1/36 # | | 500,000 | | | 540,745 |

| | 5.125% 11/1/49 | | 765,000 | | | 817,984 |

| | 144A 5.25% 7/1/46 # | | 500,000 | | | 538,450 |

| | (Alexander Dawson | | | | | |

| | | School-Nevada | | | | | |

| | | Project) | | | | | |

| | | 5.00% 5/15/29 | | 760,000 | | | 895,128 |

| | (Charter School - | | | | | |

| | | Atlas Preparatory | | | | | |

| | | School) | | | | | |

| | | 144A 5.25% | | | | | |

| | | 4/1/45 # | | 700,000 | | | 723,352 |

| | (Charter School - | | | | | |

| | | Community | | | | | |

| | | Leadership | | | | | |

| | | Academy) | | | | | |

| | | 7.45% 8/1/48 | | 500,000 | | | 553,200 |

| | (Charter School - Peak | | | | | |

| | | to Peak Charter) | | | | | |

| | | 5.00% 8/15/34 | | 1,000,000 | | | 1,112,790 |

| | (Global Village | | | | | |

| | | Academy - | | | | | |

| | | Northglenn Project) | | | | | |

| | | 144A 5.00% | | | | | |

| | | 12/1/50 # | | 475,000 | | | 502,944 |

| | (Improvement - | | | | | |

| | | Charter School - | | | | | |

| | | University Lab | | | | | |

| | | School Building) | | | | | |

| | | 5.00% 12/15/45 | | 500,000 | | | 541,490 |

| | (Johnson & Wales | | | | | |

| | | University) | | | | | |

| | | Series A 5.25% | | | | | |

| | | 4/1/37 | | 900,000 | | | 967,941 |

| | (Liberty Charter | | | | | |

| | | School) | | | | | |

| | | Series A 5.00% | | | | | |

| | | 1/15/44 | | 1,000,000 | | | 1,069,900 |

| | (Littleton Charter | | | | | |

| | | School Project) | | | | | |

| | | 4.375% | | | | | |

| | | 1/15/36 (AGC) | | 1,200,000 | | | 1,201,368 |

| | (Loveland Classical | | | | | |

| | | Schools) | | | | | |

| | | 144A 5.00% | | | | | |

| | | 7/1/36 # | | 625,000 | | | 684,200 |

| | (Science Technology | | | | | |

| | | Engineering and | | | | | |

| | | Math (Stem) | | | | | |

| | | School Project) | | | | | |

| | | 5.00% 11/1/54 | | 700,000 | | | 744,506 |

| | (Skyview Charter | | | | | |

| | | School) | | | | | |

| | | 144A 5.50% | | | | | |

| | | 7/1/49 # | | 750,000 | | | 802,388 |

| | (Vail Mountain School | | | | | |

| | | Project) | | | | | |

| | | 4.00% 5/1/46 | | 25,000 | | | 25,019 |

| | (Vega Collegiate | | | | | |

| | Academy Project) | | | | | |

| | Series A | | | | | |

| | 144A 5.00% 2/1/34 # | | 100,000 | | | 111,924 |

| | Series A | | | | | |

| | 144A 5.00% 2/1/51 # | | 900,000 | | | 978,408 |

| | (Windsor Charter | | | | | |

| | | Academy Project) | | | | | |

| | | 5.00% 9/1/46 | | 500,000 | | | 503,710 |

| Colorado School of | | | | | |

| | Mines | | | | | |

| | Series B 5.00% | | | | | |

| | | 12/1/42 | | 270,000 | | | 289,875 |

| | | | | | | | 14,532,749 |

16

Table of Contents

| | | | | | Principal | | | |

| | | | | amount° | | Value (US $) |

| Municipal Bonds (continued) | | | | | |

| Electric Revenue Bonds – 5.81% | | | | | |

| City of Fort Collins | | | | | |

| | Electric Utility | | | | | |

| | Enterprise Revenue | | | | | |

| | Series A 5.00% | | | | | |

| | | 12/1/42 | | 500,000 | | $ | 610,860 |

| City of Loveland | | | | | |

| | Colorado Electric & | | | | | |

| | Communications | | | | | |

| | Enterprise Revenue | | | | | |

| | Series A 5.00% | | | | | |

| | | 12/1/44 | | 1,060,000 | | | 1,287,730 |

| Puerto Rico Electric | | | | | |

| | Power Authority | | | | | |

| | Revenue | | | | | |

| | Series A 5.05% 7/1/42 ‡ | | 75,000 | | | 68,063 |

| | Series AAA 5.25% 7/1/25 ‡ | | 40,000 | | | 36,400 |

| | Series CCC 5.25% 7/1/27 ‡ | | 335,000 | | | 304,850 |

| | Series WW 5.00% 7/1/28 ‡ | | 325,000 | | | 294,937 |

| | Series WW 5.25% 7/1/33 ‡ | | 95,000 | | | 86,450 |

| | Series WW 5.50% 7/1/17 ‡ | | 210,000 | | | 188,213 |

| | Series WW 5.50% 7/1/19 ‡ | | 160,000 | | | 144,200 |

| | Series XX 4.75% 7/1/26 ‡ | | 45,000 | | | 40,669 |

| | Series XX 5.25% 7/1/40 ‡ | | 825,000 | | | 750,750 |

| | Series XX 5.75% 7/1/36 ‡ | | 155,000 | | | 141,825 |

| | Series ZZ 4.75% 7/1/27 ‡ | | 35,000 | | | 31,631 |

| | Series ZZ 5.00% 7/1/19 ‡ | | 280,000 | | | 250,950 |

| | Series ZZ 5.25% 7/1/24 ‡ | | 55,000 | | | 50,050 |

| | | | | | | | 4,287,578 |

| Healthcare Revenue Bonds – 33.67% | | | | | |

| Colorado Health | | | | | |

| | Facilities Authority | | | | | |

| | Revenue | | | | | |

| | (AdventHealth | | | | | |

| | | Obligated Group) | | | | | |

| | | Series A 4.00% | | | | | |

| | | 11/15/43 | | 1,000,000 | | | 1,157,690 |

| | (Adventist Health | | | | | |

| | | System/Sunbelt | | | | | |

| | | Obligated Group) | | | | | |

| | | Series A 5.00% | | | | | |

| | | 11/15/48 | | 1,000,000 | | | 1,206,920 |

| | (Bethesda Project) | | | | | |

| | | Series A1 5.00% | | | | | |

| | | 9/15/48 | | 750,000 | | | 823,665 |

| | (Boulder Community | | | | | |

| | Health Project) | | | | | |

| | 4.00% 10/1/38 | | 250,000 | | | 287,963 |

| | 4.00% 10/1/39 | | 250,000 | | | 287,168 |

| | (Boulder Community | | | | | |

| | Health Project) | | | | | |

| | 4.00% 10/1/40 | | 280,000 | | | 320,740 |

| | (Cappella of Grand | | | | | |

| | | Junction Project) | | | | | |

| | | 144A 5.00% | | | | | |

| | | 12/1/54 # | | 945,000 | | | 952,201 |

| | (Christian Living | | | | | |

| | | Community | | | | | |

| | | Project) | | | | | |

| | | 6.375% 1/1/41 | | 615,000 | | | 630,473 |

| | (CommonSpirit | | | | | |

| | Health) | | | | | |

| | Series A-1 4.00% 8/1/39 | | 550,000 | | | 624,173 |

| | Series A-2 4.00% 8/1/49 | | 1,500,000 | | | 1,657,515 |

| | Series A-2 5.00% 8/1/39 | | 1,500,000 | | | 1,846,455 |

| | Series A-2 5.00% 8/1/44 | | 1,500,000 | | | 1,820,100 |

| | (Covenant Living | | | | | |

| | | Communities and | | | | | |

| | | Services) | | | | | |

| | | Series A 4.00% | | | | | |

| | | 12/1/40 | | 750,000 | | | 837,038 |

| | (Covenant Retirement | | | | | |

| | | Communities Inc.) | | | | | |

| | | 5.00% 12/1/35 | | 1,000,000 | | | 1,108,730 |

| | (Frasier Meadows | | | | | |

| | | Retirement | | | | | |

| | | Community | | | | | |

| | | Project) | | | | | |

| | | Series B 5.00% | | | | | |

| | | 5/15/48 | | 340,000 | | | 356,575 |

| | (Healthcare Facilities - | | | | | |

| | | American Baptist) | | | | | |

| | | 8.00% 8/1/43 | | 500,000 | | | 532,875 |

| | (Mental Health Center | | | | | |

| | | of Denver Project) | | | | | |

| | | Series A 5.75% | | | | | |

| | | 2/1/44 | | 1,500,000 | | | 1,605,285 |

| | (National Jewish | | | | | |

| | | Health Project) | | | | | |

| | | 5.00% 1/1/27 | | 500,000 | | | 512,445 |

| | (Sanford Health) | | | | | |

| | | Series A 5.00% | | | | | |

| | | 11/1/44 | | 1,500,000 | | | 1,864,830 |

| | (SCL Health System) | | | | | |

| | Series A 4.00% 1/1/37 | | 575,000 | | | 676,028 |

| | Series A 4.00% 1/1/38 | | 1,950,000 | | | 2,285,575 |

| | Series A 4.00% 1/1/39 | | 465,000 | | | 543,418 |

17

Table of Contents

Schedules of investments

Delaware Investments® Colorado Municipal Income Fund, Inc.

| | | | | | Principal | | | |

| | | | | amount° | | Value (US $) |

| Municipal Bonds (continued) | | | | | |

| Healthcare Revenue Bonds (continued) | | | | | |

| Colorado Health | | | | | |

| | Facilities Authority | | | | | |

| | Revenue | | | | | |

| | (Sunny Vista Living | | | | | |

| | | Center) | | | | | |

| | | Series A | | | | | |

| | | 144A 6.25% | | | | | |

| | | 12/1/50 # | | 505,000 | | $ | 519,281 |

| | (Vail Valley Medical | | | | | |

| | | Center Project) | | | | | |

| | | 5.00% 1/15/35 | | 1,250,000 | | | 1,458,112 |

| | (Valley View Hospital | | | | | |

| | | Association | | | | | |

| | | Project) | | | | | |

| | | Series A 4.00% | | | | | |

| | | 5/15/34 | | 330,000 | | | 366,280 |

| Denver Health & | | | | | |

| | Hospital Authority | | | | | |

| | Health Care Revenue | | | | | |

| | Series A 4.00% | | | | | |

| | | 12/1/40 | | 500,000 | | | 567,530 |

| | | | | | | | 24,849,065 |

| Lease Revenue Bonds – 2.20% | | | | | |

| Denver Health & | | | | | |

| | Hospital Authority | | | | | |

| | (550 ACOMA, Inc.) | | | | | |

| | | 4.00% 12/1/38 | | 500,000 | | | 568,620 |

| State of Colorado | | | | | |

| | Department of | | | | | |

| | Transportation | | | | | |

| | Certificates of | | | | | |

| | Participation | | | | | |

| | 5.00% 6/15/34 | | 340,000 | | | 406,225 |

| | 5.00% 6/15/36 | | 545,000 | | | 648,725 |

| | | | | | | | 1,623,570 |

| Local General Obligation Bonds – 18.05% | | | | | |

| Adams & Weld Counties | | | | | |

| | School District No 27J | | | | | |

| | Brighton | | | | | |

| | 4.00% 12/1/30 | | 700,000 | | | 792,876 |

| Arapahoe County School | | | | | |

| | District No. 6 Littleton | | | | | |

| | Series A 5.50% | | | | | |

| | | 12/1/38 | | 650,000 | | | 849,232 |

| Beacon Point | | | | | |

| | Metropolitan District | | | | | |

| | 5.00% | | | | | |

| | | 12/1/30 (AGM) | | 600,000 | | | 714,000 |

| Boulder Valley School | | | | | |

| | District No RE- | | | | | |

| | 2 Boulder | | | | | |

| | Series A 4.00% | | | | | |

| | | 12/1/48 | | 500,000 | | | 577,810 |

| Denver City & County | | | | | |

| | Series B 5.00% | | | | | |

| | | 8/1/30 | | 2,000,000 | | | 2,696,320 |

| Grand River Hospital | | | | | |

| | District | | | | | |

| | 5.25% | | | | | |

| | | 12/1/37 (AGM) | | 675,000 | | | 782,467 |

| Jefferson County School | | | | | |

| | District No. R-1 | | | | | |

| | 5.25% 12/15/24 | | 750,000 | | | 883,447 |

| Sierra Ridge | | | | | |

| | Metropolitan District | | | | | |

| | No. 2 | | | | | |

| | Series A 5.50% | | | | | |

| | | 12/1/46 | | 500,000 | | | 520,605 |

| Verve Metropolitan | | | | | |

| | District No 1 | | | | | |

| | 5.00% 12/1/51 | | 1,000,000 | | | 1,064,340 |

| Weld County School | | | | | |

| | District No. RE-1 | | | | | |

| | 5.00% | | | | | |

| | | 12/15/30 (AGM) | | 500,000 | | | 611,380 |

| Weld County School | | | | | |

| | District No. RE- | | | | | |

| | 2 Eaton | | | | | |

| | Series 2 5.00% | | | | | |

| | | 12/1/44 | | 1,250,000 | | | 1,579,150 |

| Weld County School | | | | | |

| | District No. RE-3J | | | | | |

| | 5.00% | | | | | |

| | | 12/15/34 (BAM) | | 1,000,000 | | | 1,211,030 |

| Weld County School | | | | | |

| | District No. RE-8 | | | | | |

| | 5.00% 12/1/31 | | 510,000 | | | 626,479 |

| | 5.00% 12/1/32 | | 340,000 | | | 417,231 |

| | | | | | | | 13,326,367 |

18

Table of Contents

| | | | | Principal | | | |

| | | | amount° | | Value (US $) |

| Municipal Bonds (continued) | | | | | |

| Pre-Refunded/Escrowed to Maturity Bonds – 14.96% | | | | | |

| Colorado Health | | | | | |

| | Facilities Authority | | | | | |

| | Revenue | | | | | |

| | (Covenant Retirement | | | | | |

| | Communities Inc.) | | | | | |

| | Series A 5.75% | | | | | |

| | 12/1/36-23 § | | 1,000,000 | | $ | 1,146,050 |

| | (Evangelical Lutheran | | | | | |

| | Good Samaritan | | | | | |

| | Society) | | | | | |

| | 5.00% 6/1/28-23 § | | 1,250,000 | | | 1,378,700 |

| | 5.50% 6/1/33-23 § | | 2,000,000 | | | 2,227,400 |

| | 5.625% 6/1/43-23 § | | 1,000,000 | | | 1,116,390 |

| Colorado School of | | | | | |

| | Mines | | | | | |

| | Series B 5.00% | | | | | |

| | 12/1/42-22 § | | 1,115,000 | | | 1,203,208 |

| Denver City & County | | | | | |

| | Airport System | | | | | |

| | Revenue | | | | | |

| | Series B 5.00% | | | | | |

| | 11/15/37-22 § | | 1,700,000 | | | 1,832,328 |

| Eaton Area Park & | | | | | |

| | Recreation District | | | | | |

| | 5.25% 12/1/34-22 § | | 190,000 | | | 205,650 |

| | 5.50% 12/1/38-22 § | | 245,000 | | | 266,193 |

| Pueblo County | | | | | |

| | Certificates of | | | | | |

| | Participation | | | | | |

| | (County Judicial | | | | | |

| | Complex Project) | | | | | |

| | 5.00% | | | | | |

| | 9/15/42-22 (AGM) § | | 1,250,000 | | | 1,337,437 |

| Tallyn’s Reach | | | | | |

| | Metropolitan District | | | | | |

| | No. 3 | | | | | |

| | (Limited Tax | | | | | |

| | Convertible) | | | | | |

| | 5.125% | | | | | |

| | 11/1/38-23 § | | 295,000 | | | 330,279 |

| | | | | | | 11,043,635 |

| Special Tax Revenue Bonds – 18.80% | | | | | |

| Central Platte Valley | | | | | |

| | Metropolitan District | | | | | |

| | 5.00% 12/1/43 | | 375,000 | | | 396,210 |

| Commerce City | | | | | |

| | 5.00% | | | | | |

| | 8/1/44 (AGM) | | 1,000,000 | | | 1,123,760 |

| Fountain Urban Renewal | | | | | |

| | Authority Tax | | | | | |

| | Increment Revenue | | | | | |

| | (Academy Highlands | | | | | |

| | Project) | | | | | |

| | Series A 5.50% | | | | | |

| | 11/1/44 | | 655,000 | | | 693,134 |

| Guam Government | | | | | |

| | Business Privilege Tax | | | | | |

| | Revenue | | | | | |

| | Series A 5.125% 1/1/42 | | 435,000 | | | 448,576 |

| | Series A 5.25% 1/1/36 | | 565,000 | | | 583,142 |

| Lincoln Park | | | | | |

| | Metropolitan District | | | | | |

| | 5.00% | | | | | |

| | 12/1/46 (AGM) | | 500,000 | | | 594,690 |

| Prairie Center | | | | | |

| | Metropolitan District | | | | | |

| | No. 3 | | | | | |

| | Series A 144A 5.00% | | | | | |

| | 12/15/41 # | | 500,000 | | | 537,215 |

| Puerto Rico Sales Tax | | | | | |

| | Financing Revenue | | | | | |

| | (Restructured) | | | | | |

| | Series A-1 4.55% 7/1/40 | | 1,000,000 | | | 1,086,300 |

| | Series A-1 4.75% 7/1/53 | | 2,560,000 | | | 2,786,304 |

| | Series A-1 5.00% 7/1/58 | | 1,110,000 | | | 1,225,085 |

| | Series A-2 4.784% 7/1/58 | | 1,100,000 | | | 1,193,060 |

| Regional Transportation | | | | | |

| | District Sales Tax | | | | | |

| | Revenue | | | | | |

| | (FasTracks Project) | | | | | |

| | Series A 5.00% 11/1/30 | | 330,000 | | | 400,284 |

| | Series A 5.00% 11/1/31 | | 755,000 | | | 914,433 |

| Solaris Metropolitan | | | | | |

| | District No. 3 | | | | | |

| | (Limited Tax | | | | | |

| | Convertible) | | | | | |

| | Series A 5.00% | | | | | |

| | 12/1/46 | | 500,000 | | | 523,460 |

| Southlands Metropolitan | | | | | |

| | District No. 1 | | | | | |

| | Series A1 5.00% 12/1/37 | | 200,000 | | | 226,428 |

| | Series A1 5.00% 12/1/47 | | 300,000 | | | 334,218 |

19

Table of Contents

Schedules of investments

Delaware Investments® Colorado Municipal Income Fund, Inc.

| | | | | Principal | | | |

| | | | amount° | | Value (US $) |

| Municipal Bonds (continued) | | | | | |

| Special Tax Revenue Bonds (continued) | | | | | |

| Thornton Development | | | | | |

| | Authority | | | | | |

| | (East 144th Avenue & | | | | | |

| | I-25 Project) | | | | | |

| | Series B 5.00% 12/1/35 | | 265,000 | | $ | 304,106 |

| | Series B 5.00% 12/1/36 | | 440,000 | | | 504,077 |

| | | | | | | 13,874,482 |

| State General Obligation Bonds – 3.79% | | | | | |

| Commonwealth of | | | | | |

| | Puerto Rico | | | | | |

| | (General Obligation | | | | | |

| | Bonds) | | | | | |

| | Series A 5.00% 7/1/41 ‡ | | 305,000 | | | 247,050 |

| | Series A 5.375% 7/1/33 ‡ | | 305,000 | | | 266,494 |

| | Series A 5.50% 7/1/39 ‡ | | 1,350,000 | | | 1,134,000 |

| | Series A 8.00% 7/1/35 ‡ | | 535,000 | | | 421,312 |

| | Series B 5.75% 7/1/38 ‡ | | 440,000 | | | 380,600 |

| | Series C 6.00% 7/1/39 ‡ | | 400,000 | | | 348,000 |

| | | | | | | 2,797,456 |

| Transportation Revenue Bonds – 9.41% | | | | | |

| Colorado High | | | | | |

| | Performance | | | | | |

| | Transportation | | | | | |

| | Enterprise Revenue | | | | | |

| | (C-470 Express Lanes) | | | | | |

| | 5.00% 12/31/56 | | 1,000,000 | | | 1,126,670 |

| | (Senior U.S. 36 & | | | | | |

| | I-25 Managed | | | | | |

| | Lanes) | | | | | |

| | 5.75% | | | | | |

| | 1/1/44 (AMT) | | 1,110,000 | | | 1,197,024 |

| Denver City & County | | | | | |

| | Airport System | | | | | |

| | Revenue | | | | | |

| | Series A 5.00% 12/1/29 (AMT) | | 270,000 | | | 339,625 |

| | Series A 5.00% 11/15/30 (AMT) | | 750,000 | | | 916,327 |

| | Series A 5.00% 12/1/48 (AMT) | | 1,000,000 | | | 1,190,180 |

| E-470 Public Highway | | | | | |

| | Authority | | | | | |

| | Series A 5.00% | | | | | |

| | 9/1/34 | | 310,000 | | | 402,501 |

| Regional Transportation | | | | | |

| | District | | | | | |

| | (Denver Transit | | | | | |

| | Partners Eagle | | | | | |

| | P3 Project) | | | | | |

| | Series A 4.00% | | | | | |

| | 7/15/35 | | 1,500,000 | | | 1,774,470 |

| | | | | | | 6,946,797 |

| Water & Sewer Revenue Bonds – 6.37% | | | | | |

| Arapahoe County Water | | | | | |

| | & Wastewater | | | | | |

| | Authority Revenue | | | | | |

| | Series A 4.00% | | | | | |

| | 12/1/39 | | 1,250,000 | | | 1,493,112 |

| Central Weld County | | | | | |

| | Water District | | | | | |

| | 4.00% | | | | | |

| | 12/1/40 (AGM) | | 500,000 | | | 586,340 |

| Dominion Water & | | | | | |

| | Sanitation District, | | | | | |

| | Colorado | | | | | |

| | 6.00% 12/1/46 | | 245,000 | | | 256,145 |

| Guam Government | | | | | |

| | Waterworks Authority | | | | | |

| | Revenue | | | | | |

| | 5.00% 7/1/40 | | 360,000 | | | 415,145 |

| Metro Wastewater | | | | | |

| | Reclamation District | | | | | |

| | Series A 5.00% | | | | | |

| | 4/1/33 | | 500,000 | | | 657,095 |

| Morgan County Quality | | | | | |

| | Water District | | | | | |

| | 4.00% 12/1/45 (AGM) | | 750,000 | | | 869,955 |

| | 4.00% 12/1/50 (AGM) | | 365,000 | | | 421,670 |

| | | | | | | 4,699,462 |

| Total Municipal Bonds | | | | | |

| (cost $95,976,205) | | | | | 102,750,730 |

| Total Value of Securities–139.21% | | | | | |

| (cost $95,976,205) | | | | $ | 102,750,730 |

| ° | Principal amount shown is stated in USD unless noted that the security is denominated in another currency. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At March 31, 2021, the aggregate value of Rule 144A securities was $6,891,108, which represents 9.34% of the Fund’s net assets. See Note 7 in “Notes to financial statements.” |

20

Table of Contents

| ‡ | Non-income producing security. Security is currently in default. |

| § | Pre-refunded bonds. Municipal bonds that are generally backed or secured by US Treasury bonds. For pre-refunded bonds, the stated maturity is followed by the year in which the bond will be pre-refunded. See Note 7 in “Notes to financial statements.” |

| Summary of abbreviations: |

| AGC – Insured by Assured Guaranty Corporation |

| AGM – Insured by Assured Guaranty Municipal Corporation |

| AMT – Subject to Alternative Minimum Tax |

| BAM – Insured by Build America Mutual Assurance |

| USD – US Dollar |

See accompanying notes, which are an integral part of the financial statements.

21

Table of Contents

Schedules of investments

Delaware Investments® Minnesota Municipal Income Fund II, Inc.

March 31, 2021

| | | | | Principal | | | |

| | | | amount° | | Value (US $) |

| Municipal Bonds – 141.79% | | | | | |

| Corporate Revenue Bonds – 2.03% | | | | | |

| Minneapolis Community | | | | | |

| | Planning & Economic | | | | | |

| | Development | | | | | |

| | Department | | | | | |

| | (Limited Tax | | | | | |

| | Supported | | | | | |

| | Common Bond | | | | | |

| | Fund) | | | | | |

| | Series A 6.25% | | | | | |

| | 12/1/30 | | 1,000,000 | | $ | 1,009,190 |

| St. Paul Port Authority | | | | | |

| | Solid Waste Disposal | | | | | |

| | Revenue | | | | | |

| | (Gerdau St. Paul Steel | | | | | |

| | Mill Project) | | | | | |

| | Series 7 | | | | | |

| | 144A 4.50% | | | | | |

| | 10/1/37 (AMT) # | | 2,415,000 | | | 2,470,521 |

| | | | | | | 3,479,711 |

Education Revenue Bonds – 23.10% | | | | | |

| Bethel Charter School | | | | | |

| | Lease Revenue | | | | | |

| | (Spectrum High | | | | | |

| | School Project) | | | | | |

| | Series A 4.375% | | | | | |

| | 7/1/52 | | 1,100,000 | | | 1,167,320 |

| Brooklyn Park Charter | | | | | |

| | School Lease Revenue | | | | | |

| | (Prairie Seeds | | | | | |

| | Academy Project) | | | | | |

| | Series A 5.00% 3/1/34 | | 990,000 | | | 1,029,055 |

| | Series A 5.00% 3/1/39 | | 170,000 | | | 175,338 |

| Cologne Charter School | | | | | |

| | Lease Revenue | | | | | |

| | (Cologne Academy | | | | | |

| | Project) | | | | | |

| | Series A 5.00% 7/1/29 | | 270,000 | | | 291,740 |

| | Series A 5.00% 7/1/45 | | 445,000 | | | 469,435 |

| Deephaven Charter | | | | | |

| | School | | | | | |

| | (Eagle Ridge Academy | | | | | |

| | Project) | | | | | |

| | Series A 5.25% 7/1/37 | | 590,000 | | | 652,092 |

| | Series A 5.25% 7/1/40 | | 500,000 | | | 550,090 |

| Duluth Housing & | | | | | |

| | Redevelopment | | | | | |

| | Authority | | | | | |

| | (Duluth Public Schools | | | | | |

| | Academy Project) | | | | | |

| | Series A 5.00% | | | | | |

| | 11/1/48 | | 1,200,000 | | | 1,304,412 |

| Forest Lake Minnesota | | | | | |

| | Charter School | | | | | |

| | Revenue | | | | | |

| | (Lake International | | | | | |

| | Language Academy) | | | | | |

| | Series A 5.375% 8/1/50 | | 915,000 | | | 1,035,130 |

| | Series A 5.75% 8/1/44 | | 705,000 | | | 745,460 |

| Hugo Charter School | | | | | |

| | Lease Revenue | | | | | |

| | (Noble Academy | | | | | |

| | Project) | | | | | |

| | Series A 5.00% 7/1/34 | | 255,000 | | | 269,726 |

| | Series A 5.00% 7/1/44 | | 775,000 | | | 809,774 |

| Minneapolis Charter | | | | | |

| | School Lease Revenue | | | | | |

| | (Hiawatha Academies | | | | | |

| | Project) | | | | | |

| | Series A 5.00% 7/1/36 | | 750,000 | | | 797,055 |

| | Series A 5.00% 7/1/47 | | 900,000 | | | 949,635 |

| Minneapolis Student | | | | | |

| | Housing Revenue | | | | | |

| | (Riverton Community | | | | | |

| | Housing Project) | | | | | |

| | 5.25% 8/1/39 | | 205,000 | | | 215,754 |

| | 5.50% 8/1/49 | | 990,000 | | | 1,041,342 |

| Minnesota Higher | | | | | |

| | Education Facilities | | | | | |

| | Authority Revenue | | | | | |

| | (Bethel University) | | | | | |

| | 5.00% 5/1/47 | | 1,250,000 | | | 1,339,912 |

| | (Carleton College) | | | | | |