UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-07820 |

| | |

| AMERICAN CENTURY CAPITAL PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 03-31 |

| | |

| Date of reporting period: | 03-31-2014 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

ANNUAL REPORT | MARCH 31, 2014 |

Equity Income Fund

|

| |

| President’s Letter | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| Additional Information | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

|

| |

| Dear Investor:

Thank you for reviewing this annual report for the 12 months ended March 31, 2014. It provides investment performance, market analysis, and portfolio information, presented with the expert perspective of our portfolio management team.

Annual reports remain important vehicles for conveying information about fund returns, including key factors that affected fund performance. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

|

| Jonathan Thomas |

Monetary Policy-Driven, Mostly “Risk-On” Results in the U.S. and Europe

Stimulative monetary policies and expectations of economic improvement helped drive financial market returns during the reporting period. We believe the combination of optimism about the economy, low costs of capital in the money markets, and central bank purchases of longer-maturity fixed income securities (quantitative easing, or QE) helped persuade investors to seek risk and yield, especially in the U.S. and Europe. Stock index returns were strong in these markets, particularly at the smaller capitalization end of the company size spectrum. The MSCI Europe and S&P 500 Indices advanced 24.50% and 21.86%, respectively, and their smaller capitalization counterparts performed even better. In the U.S., growth stocks generally outperformed value stocks.

Some of the same growth and optimism factors that drove stocks higher, plus hints that QE tapering would begin in the U.S., hampered U.S. government bond returns, which dipped into negative territory for the reporting period. On the other hand, U.S. corporate bonds, especially high-yield corporates, posted mostly positive returns because of their higher yields, declining spreads (yield differences between corporate and similar-maturity U.S. Treasury securities), and relatively low default rates. At the other end of the U.S. bond spectrum, Treasury inflation-protected securities (TIPS) underperformed, hurt by the combination of rising yields and low inflation.

Looking ahead, we see further signs of economic improvement for the U.S. in 2014, but headwinds persist. Interest rates could normalize further, and economic growth and U.S. employment levels remain subpar compared with past post-recession periods. In this environment, we continue to believe in a disciplined, diversified, long-term investment approach, using professionally managed stock and bond portfolios—as appropriate—for meeting financial goals. We appreciate your continued trust in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | | |

| Total Returns as of March 31, 2014 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date |

| Investor Class | TWEIX | 13.64% | 14.88% | 7.22% | 10.84% | 8/1/94 |

| Russell 3000 Value Index | – | 21.65% | 21.87% | 7.61% | 10.07%(1) | – |

| S&P 500 Index | – | 21.86% | 21.14% | 7.41% | 9.50%(1) | – |

| Institutional Class | ACIIX | 13.85% | 15.13% | 7.43% | 8.44% | 7/8/98 |

A Class(2) | TWEAX | | | | | 3/7/97 |

| No sales charge* | | 13.36% | 14.59% | 6.95% | 9.02% | |

| With sales charge* | | 6.80% | 13.24% | 6.32% | 8.64% | |

| B Class | AEKBX | | | | | 9/28/07 |

| No sales charge* | | 12.51% | 13.76% | – | 4.16% | |

| With sales charge* | | 8.51% | 13.64% | – | 4.16% | |

| C Class | AEYIX | 12.53% | 13.74% | 6.15% | 6.51% | 7/13/01 |

| R Class | AEURX | 13.12% | 14.30% | 6.67% | 7.45% | 8/29/03 |

| R6 Class | AEUDX | – | – | – | 7.41%(3) | 7/26/13 |

| |

| * | Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six years of purchase are subject to a CDSC that declines from 5.00% during the first year to 0.00% after the sixth year. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| |

| (1) | Since 7/31/94, the date nearest the Investor Class’s inception for which data are available. |

| |

| (2) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge. |

| |

| (3) | Total returns for periods less than one year are not annualized. |

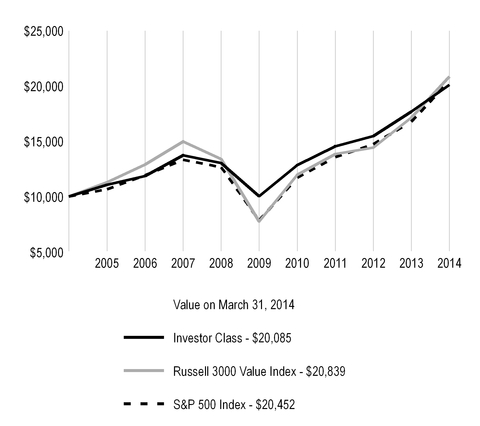

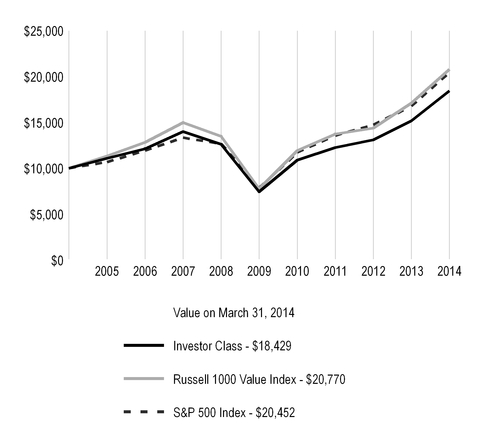

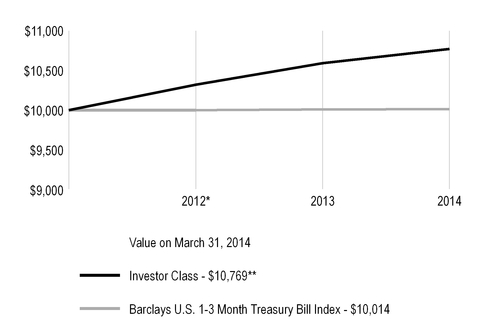

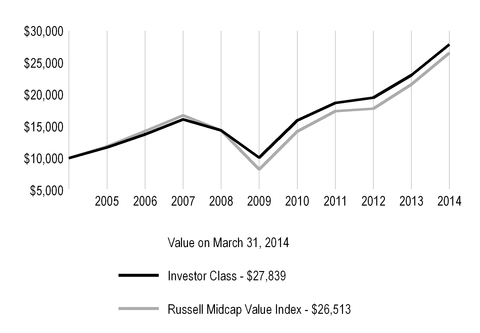

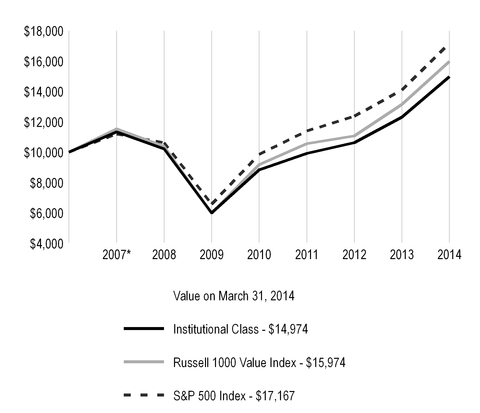

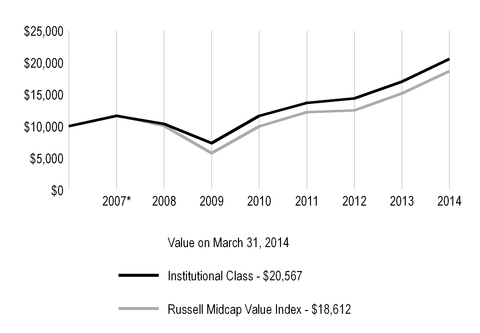

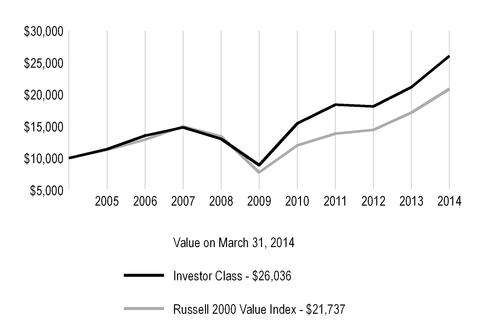

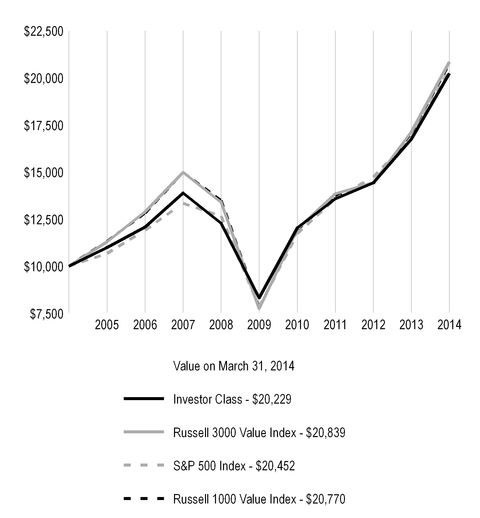

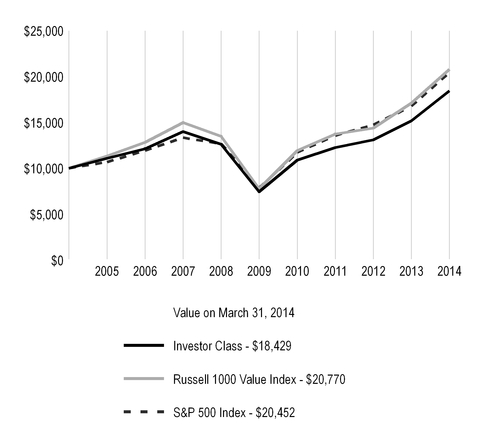

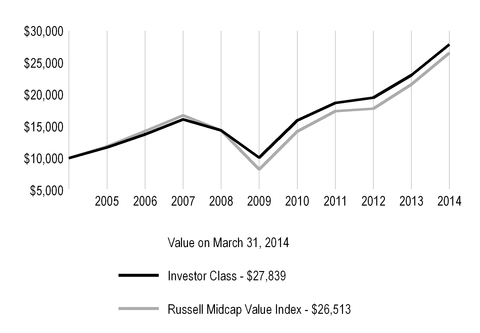

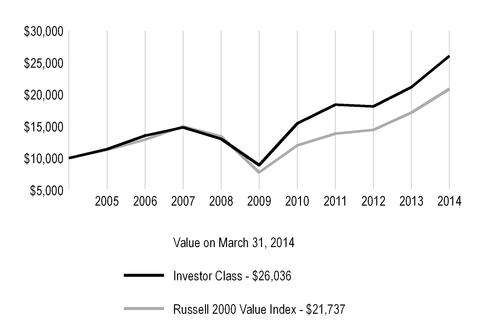

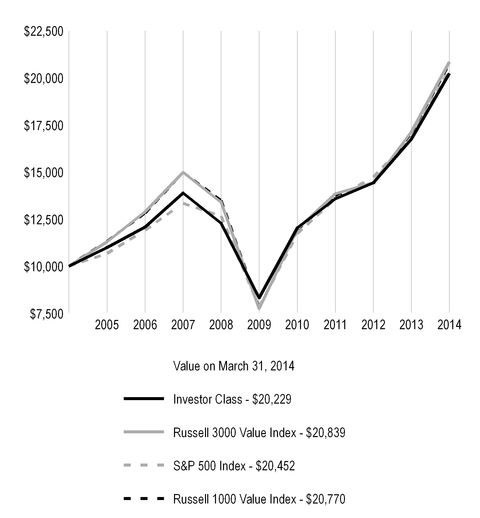

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

|

|

| Growth of $10,000 Over 10 Years |

$10,000 investment made March 31, 2004 |

|

| | | | | | |

| Total Annual Fund Operating Expenses | | |

| Investor Class | Institutional Class | A Class | B Class | C Class | R Class | R6 Class |

| 0.94% | 0.74% | 1.19% | 1.94% | 1.94% | 1.44% | 0.59% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

Portfolio Managers: Phil Davidson, Kevin Toney, and Michael Liss

Performance Summary

Equity Income returned 13.64%* for the 12 months ended March 31, 2014. By comparison, its benchmark, the Russell 3000 Value Index, returned 21.65%. The broader market, as measured by the S&P 500 Index, returned 21.86%. The portfolio’s return reflects operating expenses, while the indices’ returns do not.

The U.S. stock market generated strong gains during the one-year reporting period. When the period began, riskier asset classes led the market, as the Federal Reserve’s (Fed) bond-buying programs continued. Market leadership changed after the Fed suggested it might start tapering its asset purchases if economic conditions improved. Higher-quality stocks came into favor and as interest rates rose, higher-yielding stocks, such as real estate investment trusts (REITs) and utilities, declined. As the Fed sought to calm fears about eventual tapering, riskier stocks posted gains, but they reversed direction in mid-August on positive economic data, which suggested the Fed might announce tapering as soon as September. After the Fed surprised the markets by making no changes to its stimulus programs, lower-quality, riskier stocks rallied and continued to outperform through the end of 2013. In December, the U.S. economy showed new signs of strength and the Fed announced it would begin modestly scaling back its asset purchases in January 2014. As interest rates trended down in the last three months of the reporting period, yield-oriented securities, including utilities and REITs, rallied. For the reporting period overall, riskier, lower-yielding, and lower-quality stocks outperformed. Though value stocks recorded significant gains, they underperformed growth stocks. Large-cap value stocks underperformed mid-cap value stocks and small-cap value stocks.

Equity Income’s higher-quality, income-producing securities performed well in absolute terms, generating positive absolute results in nine of the 10 sectors in which it was invested. Many of the companies owned by the portfolio have strong balance sheets and competitive positions, which allowed them to continue paying dividends and, in some cases, increase their dividend payouts. Equity Income underperformed on a relative basis, primarily because of its conservative positioning in the financials, industrials, and consumer discretionary sectors. An underweight position relative to the benchmark and security selection in the energy sector, as well as specific investments in the information technology and financials sectors, added to relative performance.

Equity Income is carefully managed with the goal of providing solid long-term performance. Since its inception on August 1, 1994, Equity Income has produced an average annual return of 10.84%, topping the returns of the Russell 3000 Value Index and the S&P 500 Index for the same period (see performance information on pages 3 and 4).

Positioning in Convertible Securities Detracted From Relative Performance

Rising interest rates put pressure on the portfolio’s complement of convertible securities. In financials, the portfolio was constrained by its investment in a Wells Fargo convertible security, which underperformed. In the industrials sector, an investment in a Stanley Black & Decker convertible security detracted from returns after the company lowered guidance for organic revenue growth and 2014 earnings. The consumer discretionary sector was the source of an International Game Technology convertible security, which declined after the company provided disappointing guidance.

*All fund returns referenced in this commentary are for Investor Class shares.

Industrials and Utilities Sectors Provided Notable Detractors

In industrials, an overweight position in ADT detracted. The security monitoring company has experienced an increase in subscriber-acquisition costs and associated lower-than-expected account growth as a result of competitors' aggressive tactics, a situation we consider largely transitory. We also believe the company’s Pulse home automation and security offering will continue to have a positive influence on the business.

In the utilities sector, the portfolio was overweight Consolidated Edison, which declined on news of a gas pipeline explosion in New York City. Concern about regulatory oversight also weighed on the stock.

Energy Sector Contributed Positively

An underweight in the energy sector added to relative returns. The portfolio also benefited from security selection, including investments in Total SA and Halliburton. Total performed well on projected lower capital spending and improving free-cash flow. Halliburton announced it would repurchase $3.3 billion of its stock through a Dutch auction, which aided the oil-field services company’s shares.

Information Technology Sector Supplied Top Contributors

Holdings in the information technology sector enhanced relative returns. The portfolio owned Molex, a manufacturer of electronic and fiber-optic interconnection products and systems. Its share price rose on news that Koch Industries would acquire it for a significant premium. The portfolio also benefited from an overweight position in Applied Materials, which reported solid results and provided better-than-expected guidance, driven by strength in core semiconductor capital equipment orders.

Financials Sector Provided Notable Contributors

Although the portfolio’s conservative positioning in financials limited its performance, the sector was also the source of a number of notable contributors. An overweight position in PNC Financial Services Group added to results after the diversified financial services company reported positive fourth-quarter earnings. Its share price also rose on expectations of higher short-term interest rates. The portfolio also benefited from an overweight position in Marsh & McLennan. The insurance company reported strong results on revenue growth in its risk and insurance business, strict expense control that led to operating margin improvement, and market share gains. Marsh also expanded its share buyback program and raised its quarterly dividend.

Outlook

We will continue to follow our disciplined, bottom-up investment process, selecting companies one at a time for the portfolio. As of March 31, 2014, the team saw attractive opportunities in consumer staples, health care, industrials, and utilities, as reflected by the portfolio’s overweight positions in these sectors. Conversely, smaller relative weightings were given to consumer discretionary, information technology, energy, financials, and materials stocks, relying on fundamental analysis to identify strong, financially sound businesses whose securities provide attractive yields.

|

| |

| MARCH 31, 2014 |

| Top Ten Holdings | % of net assets |

| Johnson & Johnson | 4.9% |

| Wells Fargo & Co. (Convertible) | 4.6% |

| Exxon Mobil Corp. | 4.2% |

| Bank of America Corp. (Convertible) | 3.2% |

| PNC Financial Services Group, Inc. (The) | 2.9% |

| Northern Trust Corp. | 2.5% |

| Occidental Petroleum Corp. | 2.5% |

| PepsiCo, Inc. | 2.4% |

| Procter & Gamble Co. (The) | 2.4% |

| Stanley Black & Decker, Inc. (Convertible) | 2.3% |

| | |

| Top Five Industries | % of net assets |

| Commercial Banks | 15.1% |

| Oil, Gas and Consumable Fuels | 12.2% |

| Pharmaceuticals | 9.4% |

| Semiconductors and Semiconductor Equipment | 6.0% |

| Insurance | 4.0% |

| | |

| Types of Investments in Portfolio | % of net assets |

| Common Stocks | 71.9% |

| Convertible Preferred Stocks | 11.8% |

| Convertible Bonds | 9.6% |

| Preferred Stocks | 3.7% |

| Total Equity Exposure | 97.0% |

| Temporary Cash Investments | 2.7% |

| Other Assets and Liabilities | 0.3% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2013 to March 31, 2014.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | | | | | |

| | | Beginning

Account Value

10/1/13 | | Ending

Account Value

3/31/14 | | Expenses Paid

During Period(1)

10/1/13 - 3/31/14 | | Annualized

Expense Ratio(1) |

| Actual | | | | | | | | |

| Investor Class | | $1,000 | | $1,090.90 | | $4.80 | | 0.92% |

| Institutional Class | | $1,000 | | $1,093.10 | | $3.76 | | 0.72% |

| A Class | | $1,000 | | $1,089.60 | | $6.10 | | 1.17% |

| B Class | | $1,000 | | $1,085.50 | | $9.98 | | 1.92% |

| C Class | | $1,000 | | $1,085.60 | | $9.98 | | 1.92% |

| R Class | | $1,000 | | $1,088.50 | | $7.39 | | 1.42% |

| R6 Class | | $1,000 | | $1,092.70 | | $2.97 | | 0.57% |

| Hypothetical | | | | | | | | |

| Investor Class | | $1,000 | | $1,020.34 | | $4.63 | | 0.92% |

| Institutional Class | | $1,000 | | $1,021.34 | | $3.63 | | 0.72% |

| A Class | | $1,000 | | $1,019.10 | | $5.89 | | 1.17% |

| B Class | | $1,000 | | $1,015.36 | | $9.65 | | 1.92% |

| C Class | | $1,000 | | $1,015.36 | | $9.65 | | 1.92% |

| R Class | | $1,000 | | $1,017.85 | | $7.14 | | 1.42% |

| R6 Class | | $1,000 | | $1,022.09 | | $2.87 | | 0.57% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

MARCH 31, 2014

|

| | | | |

| | Shares/Principal Amount | Value |

| COMMON STOCKS — 71.9% |

| AEROSPACE AND DEFENSE — 0.9% |

| BAE Systems plc | 4,990,900 | $ | 34,463,841 |

|

| Rockwell Collins, Inc. | 686,756 | 54,713,850 |

|

| | | 89,177,691 |

|

| AIR FREIGHT AND LOGISTICS — 2.0% |

| United Parcel Service, Inc., Class B | 2,089,395 | 203,465,285 |

|

| AUTOMOBILES — 0.2% |

| Honda Motor Co., Ltd. | 616,800 | 21,716,332 |

|

| BEVERAGES — 2.4% |

| PepsiCo, Inc. | 2,998,265 | 250,355,128 |

|

| CAPITAL MARKETS — 2.9% |

| Goldman Sachs Group, Inc. (The) | 212,781 | 34,864,167 |

|

| Northern Trust Corp. | 3,963,583 | 259,852,501 |

|

| | | 294,716,668 |

|

| CHEMICALS — 1.3% |

| Air Products & Chemicals, Inc. | 448,200 | 53,353,728 |

|

| Potash Corp. of Saskatchewan, Inc. | 2,344,000 | 84,899,680 |

|

| | | 138,253,408 |

|

| COMMERCIAL BANKS — 6.7% |

| Comerica, Inc. | 769,662 | 39,868,492 |

|

| Commerce Bancshares, Inc. | 2,398,427 | 111,334,981 |

|

| JPMorgan Chase & Co. | 1,599,767 | 97,121,854 |

|

| KeyCorp | 7,399,000 | 105,361,760 |

|

| PNC Financial Services Group, Inc. (The) | 3,388,559 | 294,804,633 |

|

| SunTrust Banks, Inc. | 999,777 | 39,781,127 |

|

| | | 688,272,847 |

|

| COMMERCIAL SERVICES AND SUPPLIES — 3.2% |

| ADT Corp. (The) | 2,625,341 | 78,628,963 |

|

|

| | | | | | |

| | Shares/Principal Amount | Value |

| Republic Services, Inc. | 3,373,541 |

| $ | 115,240,160 |

|

| Tyco International Ltd. | 1,899,282 |

| 80,529,557 |

|

| Waste Management, Inc. | 1,299,238 |

| 54,658,943 |

|

| | | 329,057,623 |

|

| COMMUNICATIONS EQUIPMENT — 0.4% |

| Cisco Systems, Inc. | 1,799,700 |

| 40,331,277 |

|

| DIVERSIFIED TELECOMMUNICATION SERVICES — 1.9% |

| AT&T, Inc. | 2,999,346 |

| 105,187,064 |

|

| CenturyLink, Inc. | 2,857,855 |

| 93,851,958 |

|

| | | 199,039,022 |

|

| ELECTRIC UTILITIES — 0.2% |

| Westar Energy, Inc. | 698,000 |

| 24,541,680 |

|

| ELECTRICAL EQUIPMENT — 0.5% |

| ABB Ltd. | 2,140,278 |

| 55,198,618 |

|

| FOOD AND STAPLES RETAILING — 2.7% |

| Sysco Corp. | 4,056,148 |

| 146,548,627 |

|

| Wal-Mart Stores, Inc. | 1,698,878 |

| 129,845,246 |

|

| | | 276,393,873 |

|

| FOOD PRODUCTS — 2.9% |

| Campbell Soup Co. | 2,099,348 |

| 94,218,738 |

|

| General Mills, Inc. | 2,498,200 |

| 129,456,724 |

|

| Hillshire Brands Co. | 1,999,700 |

| 74,508,822 |

|

| | | 298,184,284 |

|

| GAS UTILITIES — 3.5% |

| AGL Resources, Inc. | 977,338 |

| 47,850,469 |

|

ONE Gas, Inc.(1)(2) | 2,396,071 |

| 86,090,831 |

|

| Piedmont Natural Gas Co., Inc. | 2,997,359 |

| 106,076,535 |

|

WGL Holdings, Inc.(1) | 2,998,417 |

| 120,116,585 |

|

| | | 360,134,420 |

|

|

| | | | | | |

| | Shares/Principal Amount | Value |

| HEALTH CARE EQUIPMENT AND SUPPLIES — 1.7% |

| Becton Dickinson and Co. | 1,481,200 |

| $ | 173,418,896 |

|

| HEALTH CARE PROVIDERS AND SERVICES — 1.6% |

| Quest Diagnostics, Inc. | 2,756,300 |

| 159,644,896 |

|

| HOUSEHOLD PRODUCTS — 2.4% |

| Procter & Gamble Co. (The) | 3,089,790 |

| 249,037,074 |

|

| INDUSTRIAL CONGLOMERATES — 2.1% |

| 3M Co. | 597,600 |

| 81,070,416 |

|

| General Electric Co. | 5,092,200 |

| 131,837,058 |

|

| | | 212,907,474 |

|

| INSURANCE — 3.6% |

| Allstate Corp. (The) | 999,052 |

| 56,526,362 |

|

| Chubb Corp. (The) | 1,298,835 |

| 115,985,966 |

|

| Marsh & McLennan Cos., Inc. | 3,999,880 |

| 197,194,084 |

|

| | | 369,706,412 |

|

| METALS AND MINING — 0.5% |

| Goldcorp, Inc. New York Shares | 995,500 |

| 24,369,840 |

|

| Nucor Corp. | 464,900 |

| 23,496,046 |

|

| | | 47,865,886 |

|

| MULTI-UTILITIES — 2.9% |

| Consolidated Edison, Inc. | 2,577,678 |

| 138,292,425 |

|

| PG&E Corp. | 2,817,110 |

| 121,699,152 |

|

| Wisconsin Energy Corp. | 799,500 |

| 37,216,725 |

|

| | | 297,208,302 |

|

| OIL, GAS AND CONSUMABLE FUELS — 12.2% |

| Chevron Corp. | 1,723,392 |

| 204,928,543 |

|

| El Paso Pipeline Partners LP | 1,728,342 |

| 52,524,313 |

|

| Exxon Mobil Corp. | 4,447,482 |

| 434,430,042 |

|

| Occidental Petroleum Corp. | 2,698,300 |

| 257,121,007 |

|

| Spectra Energy Partners LP | 2,224,869 |

| 108,907,337 |

|

| Total SA | 2,989,525 |

| 196,041,448 |

|

| | | 1,253,952,690 |

|

| PHARMACEUTICALS — 9.4% |

| Eli Lilly & Co. | 1,571,688 |

| 92,509,556 |

|

|

| | | | | | |

| | Shares/Principal Amount | Value |

| Johnson & Johnson | 5,088,880 |

| $ | 499,880,682 |

|

| Merck & Co., Inc. | 3,179,731 |

| 180,513,329 |

|

| Pfizer, Inc. | 4,992,179 |

| 160,348,790 |

|

| Teva Pharmaceutical Industries Ltd. ADR | 539,200 |

| 28,491,328 |

|

| | | 961,743,685 |

|

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.2% |

| Annaly Capital Management, Inc. | 1,998,500 |

| 21,923,545 |

|

| SEMICONDUCTORS AND SEMICONDUCTOR EQUIPMENT — 2.6% |

| Applied Materials, Inc. | 9,449,302 |

| 192,954,747 |

|

| Intel Corp. | 2,999,300 |

| 77,411,933 |

|

| | | 270,366,680 |

|

| THRIFTS AND MORTGAGE FINANCE — 1.0% |

Capitol Federal Financial, Inc.(1) | 7,999,069 |

| 100,388,316 |

|

TOTAL COMMON STOCKS (Cost $5,636,810,386) | 7,387,002,012 |

|

| CONVERTIBLE PREFERRED STOCKS — 11.8% |

| COMMERCIAL BANKS — 7.8% |

| Bank of America Corp., 7.25% | 289,977 |

| 331,794,583 |

|

| Wells Fargo & Co., 7.50% | 404,949 |

| 475,005,177 |

|

| | | 806,799,760 |

|

| ELECTRIC UTILITIES — 0.5% |

| NextEra Energy, Inc., 5.80%, 9/1/16 | 980,126 |

| 52,946,407 |

|

| INSURANCE — 0.4% |

| MetLife, Inc., 5.00%, 10/8/14 | 1,299,161 |

| 40,014,159 |

|

| MACHINERY — 2.3% |

| Stanley Black & Decker, Inc., 4.75%, 11/17/15 | 1,843,885 |

| 235,058,460 |

|

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.8% |

| Health Care REIT, Inc., 6.50% | 1,399,893 |

| 77,736,058 |

|

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $1,111,657,488) | 1,212,554,844 |

|

|

| | | | | | |

| | Shares/Principal Amount | Value |

| CONVERTIBLE BONDS — 9.6% |

| AEROSPACE AND DEFENSE — 0.9% |

| L-3 Communications Holdings, Inc., 3.00%, 8/1/35 | $ | 69,973,000 |

| $ | 93,501,421 |

|

| CAPITAL MARKETS — 0.8% |

| Janus Capital Group, Inc., 3.25%, 7/15/14 | 25,448,000 |

| 25,543,430 |

|

| Janus Capital Group, Inc., 0.75%, 7/15/18 | 41,539,000 |

| 49,976,609 |

|

| | | 75,520,039 |

|

| FOOD AND STAPLES RETAILING — 0.4% |

Credit Suisse AG, (convertible into Wal-Mart Stores, Inc.), 4.10%, 6/5/14(4) | 580,000 |

| 44,286,480 |

|

| HEALTH CARE PROVIDERS AND SERVICES — 1.7% |

| LifePoint Hospitals, Inc., 3.50%, 5/15/14 | 167,586,000 |

| 178,269,608 |

|

| HOTELS, RESTAURANTS AND LEISURE — 2.0% |

| International Game Technology, 3.25%, 5/1/14 | 199,567,000 |

| 200,065,918 |

|

| MULTILINE RETAIL — 0.4% |

Bank of America Corp., (convertible into Target Corp.), 3.07%, 5/29/14(3)(4) | 693,000 |

| 41,791,365 |

|

| SEMICONDUCTORS AND SEMICONDUCTOR EQUIPMENT — 3.4% |

| Intel Corp., 2.95%, 12/15/35 | 195,489,000 |

| 230,554,839 |

|

| Microchip Technology, Inc., 2.125%, 12/15/37 | 63,974,000 |

| 118,991,640 |

|

| | | 349,546,479 |

|

TOTAL CONVERTIBLE BONDS(Cost $901,763,685) | 982,981,310 |

|

| PREFERRED STOCKS — 3.7% |

| COMMERCIAL BANKS — 0.6% |

| U.S. Bancorp, 6.00% | 2,315,421 |

| 63,558,306 |

|

|

| | | | |

| | Shares/Principal Amount | Value |

| DIVERSIFIED FINANCIAL SERVICES — 3.1% |

| Citigroup, Inc., 5.95% | 179,858,000 | $ | 176,036,017 |

|

| General Electric Capital Corp., 6.25% | 129,900,000 | 139,587,163 |

|

| | | 315,623,180 |

|

TOTAL PREFERRED STOCKS (Cost $376,781,454) | 379,181,486 |

|

| TEMPORARY CASH INVESTMENTS — 2.7% |

| Repurchase Agreement, Bank of America Merrill Lynch, (collateralized by various U.S. Treasury obligations, 0.75% - 1.375%, 10/31/17 - 6/30/18, valued at $54,644,416), in a joint trading account at 0.03%, dated 3/31/14, due 4/1/14 (Delivery value $53,539,779) | 53,539,734 |

|

| Repurchase Agreement, Goldman Sachs & Co., (collateralized by various U.S. Treasury obligations, 4.25%, 8/15/15, valued at $48,061,739), in a joint trading account at 0.03%, dated 3/31/14, due 4/1/14 (Delivery value $47,115,004) | 47,114,965 |

|

| SSgA U.S. Government Money Market Fund | 181,521,360 | 181,521,360 |

|

TOTAL TEMPORARY CASH INVESTMENTS (Cost $282,176,059) | 282,176,059 |

|

TOTAL INVESTMENT SECURITIES — 99.7% (Cost $8,309,189,072) | 10,243,895,711 |

|

| OTHER ASSETS AND LIABILITIES — 0.3% | 33,162,992 |

|

| TOTAL NET ASSETS — 100.0% | $ | 10,277,058,703 |

|

|

| | | | | | | | | | |

| FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS |

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) |

| USD | 44,274,623 |

| CHF | 39,073,241 |

| Credit Suisse AG | 4/30/14 | $ | 66,823 |

|

| USD | 1,564,790 |

| CHF | 1,386,575 |

| Credit Suisse AG | 4/30/14 | (3,992 | ) |

| USD | 162,897,715 |

| EUR | 118,118,856 |

| UBS AG | 4/30/14 | 181,246 |

|

| USD | 4,098,036 |

| EUR | 2,982,928 |

| UBS AG | 4/30/14 | (11,143 | ) |

| USD | 22,528,012 |

| GBP | 13,617,358 |

| Credit Suisse AG | 4/30/14 | (169,338 | ) |

| USD | 1,577,689 |

| GBP | 948,167 |

| Credit Suisse AG | 4/30/14 | (2,712 | ) |

| USD | 2,836,107 |

| GBP | 1,700,816 |

| Credit Suisse AG | 4/30/14 | 1,195 |

|

| USD | 17,926,908 |

| JPY | 1,832,882,880 |

| Credit Suisse AG | 4/30/14 | 166,273 |

|

| | | | | | | $ | 228,352 |

|

|

| | |

| Notes to Schedule of Investments |

| ADR | - | American Depositary Receipt |

| CHF | - | Swiss Franc |

| EUR | - | Euro |

| GBP | - | British Pound |

| JPY | - | Japanese Yen |

| USD | - | United States Dollar |

| (1) | Affiliated Company: the fund’s holding represents ownership of 5% or more of the voting securities of the company; therefore, the company is affiliated as defined in the Investment Company Act of 1940. |

| (2) | Non-income producing. |

| (3) | Restricted security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be sold without restriction to qualified institutional investors and have been deemed liquid under policies approved by the Board of Directors. The aggregate value of these securities at the period end was $41,791,365, which represented 0.4% of total net assets. |

| (4) | Equity-linked debt security. The aggregated value of these securities at the period end was $86,077,845, which represented 0.8% of total net assets. |

See Notes to Financial Statements.

|

|

| Statement of Assets and Liabilities |

|

| | | |

| MARCH 31, 2014 | |

| Assets | |

| Investment securities - unaffiliated, at value (cost of $8,048,491,543) | $ | 9,937,299,979 |

|

| Investment securities - affiliated, at value (cost of $260,697,529) | 306,595,732 |

|

| Total investment securities, at value (cost of $8,309,189,072) | 10,243,895,711 |

|

| Foreign currency holdings, at value (cost of $6,014,600) | 5,896,847 |

|

| Receivable for investments sold | 54,964,019 |

|

| Receivable for capital shares sold | 6,022,932 |

|

| Unrealized appreciation on forward foreign currency exchange contracts | 415,537 |

|

| Dividends and interest receivable | 32,598,582 |

|

| | 10,343,793,628 |

|

| | |

| Liabilities | |

| Payable for investments purchased | 40,045,714 |

|

| Payable for capital shares redeemed | 17,639,492 |

|

| Unrealized depreciation on forward foreign currency exchange contracts | 187,185 |

|

| Accrued management fees | 7,770,877 |

|

| Distribution and service fees payable | 1,091,657 |

|

| | 66,734,925 |

|

| | |

| Net Assets | $ | 10,277,058,703 |

|

| | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $ | 8,196,157,135 |

|

| Undistributed net investment income | 30,478,380 |

|

| Undistributed net realized gain | 115,592,388 |

|

| Net unrealized appreciation | 1,934,830,800 |

|

| | $ | 10,277,058,703 |

|

|

| | | | | |

| | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Investor Class, $0.01 Par Value |

| $5,406,361,675 |

| 611,358,843 | $8.84 |

| Institutional Class, $0.01 Par Value |

| $1,422,724,960 |

| 160,801,780 | $8.85 |

| A Class, $0.01 Par Value |

| $2,722,730,936 |

| 307,894,310 | $8.84* |

| B Class, $0.01 Par Value |

| $7,151,019 |

| 807,691 | $8.85 |

| C Class, $0.01 Par Value |

| $521,688,421 |

| 58,993,058 | $8.84 |

| R Class, $0.01 Par Value |

| $169,851,506 |

| 19,254,703 | $8.82 |

| R6 Class, $0.01 Par Value |

| $26,550,186 |

| 2,999,395 | $8.85 |

*Maximum offering price $9.38 (net asset value divided by 0.9425).

See Notes to Financial Statements.

|

| | | |

| YEAR ENDED MARCH 31, 2014 | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (including $13,295,137 from affiliates and net of foreign taxes withheld of $1,514,917) | $ | 302,393,240 |

|

| Interest | 37,306,569 |

|

| | 339,699,809 |

|

| | |

| Expenses: | |

| Management fees | 93,797,918 |

|

| Distribution and service fees: | |

| A Class | 6,863,759 |

|

| B Class | 72,704 |

|

| C Class | 5,004,121 |

|

| R Class | 887,152 |

|

| Directors' fees and expenses | 255,142 |

|

| Other expenses | 204 |

|

| | 106,881,000 |

|

| | |

| Net investment income (loss) | 232,818,809 |

|

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions (including $5,302,399 from affiliates) | 712,243,100 |

|

| Foreign currency transactions | (12,622,958 | ) |

| | 699,620,142 |

|

| | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | 392,563,773 |

|

| Translation of assets and liabilities in foreign currencies | (1,476,818 | ) |

| | 391,086,955 |

|

| | |

| Net realized and unrealized gain (loss) | 1,090,707,097 |

|

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 1,323,525,906 |

|

See Notes to Financial Statements.

|

|

| Statement of Changes in Net Assets |

|

| | | | | | |

| YEARS ENDED MARCH 31, 2014 AND MARCH 31, 2013 |

| Increase (Decrease) in Net Assets | March 31, 2014 | March 31, 2013 |

| Operations | | |

| Net investment income (loss) | $ | 232,818,809 |

| $ | 248,585,110 |

|

| Net realized gain (loss) | 699,620,142 |

| 611,716,511 |

|

| Change in net unrealized appreciation (depreciation) | 391,086,955 |

| 460,422,440 |

|

| Net increase (decrease) in net assets resulting from operations | 1,323,525,906 |

| 1,320,724,061 |

|

| | | |

| Distributions to Shareholders | | |

| From net investment income: | | |

| Investor Class | (124,129,537) |

| (141,411,242) |

|

| Institutional Class | (37,307,135) |

| (39,268,857) |

|

| A Class | (55,188,935) |

| (60,626,082) |

|

| B Class | (91,296) |

| (125,779) |

|

| C Class | (6,327,715) |

| (7,713,146) |

|

| R Class | (3,122,822) |

| (3,904,523) |

|

| R6 Class | (115,999) |

| — |

|

| From net realized gains: | | |

| Investor Class | (335,350,023) |

| (54,375,647) |

|

| Institutional Class | (92,742,391) |

| (14,101,988) |

|

| A Class | (171,064,581) |

| (25,558,607) |

|

| B Class | (440,329) |

| (75,975) |

|

| C Class | (31,338,388) |

| (4,635,644) |

|

| R Class | (10,633,123) |

| (1,808,569) |

|

| R6 Class | (94,089) |

| — |

|

| Decrease in net assets from distributions | (867,946,363) |

| (353,606,059) |

|

| | | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions | (497,411,893) |

| (495,740,206) |

|

| | | |

| Net increase (decrease) in net assets | (41,832,350) |

| 471,377,796 |

|

| | | |

| Net Assets | | |

| Beginning of period | 10,318,891,053 |

| 9,847,513,257 |

|

| End of period | $ | 10,277,058,703 |

| $ | 10,318,891,053 |

|

| | | |

| Undistributed net investment income | $ | 30,478,380 |

| $ | 7,820,981 |

|

See Notes to Financial Statements.

|

|

| Notes to Financial Statements |

MARCH 31, 2014

1. Organization

American Century Capital Portfolios, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Equity Income Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified as defined under the 1940 Act. The fund’s investment objective is to seek current income. Capital appreciation is a secondary objective.

The fund offers the Investor Class, the Institutional Class, the A Class, the B Class, the C Class, the R Class and the R6 Class. The A Class may incur an initial sales charge. The A Class, B Class and C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class and R6 Class shareholders do not require the same level of shareholder and administrative services from American Century Investment Management, Inc. (ACIM) (the investment advisor) as shareholders of other classes. In addition, financial intermediaries do not receive any service, distribution or administrative fees for the R6 Class. As a result, the Institutional Class and R6 Class are charged lower unified management fees. Sale of the R6 Class commenced on July 26, 2013.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. Equity securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Fixed income securities maturing in greater than 60 days at the time of purchase are valued at the evaluated mean as provided by independent pricing services or at the mean of the most recent bid and asked prices as provided by investment dealers. Fixed income securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium or at the evaluated mean as provided by an independent pricing service. Evaluated mean prices are commonly derived through utilization of market models, which may consider, among other factors: trade data, quotations from dealers and active market makers, relevant yield curve and spread data, related sector levels, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information.

Open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost, which approximates fair value. Forward foreign currency exchange contracts are valued at the mean of the appropriate forward exchange rate at the close of the NYSE as provided by an independent pricing service.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the

Board of Directors. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s net asset value per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. If significant fluctuations in foreign markets are identified, the fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Equity-Linked Debt and Linked-Equity Securities — The fund may invest in hybrid equity securities, which usually convert into common stock at a date predetermined by the issuer. These securities generally offer a higher dividend yield than that of the common stock to which the security is linked. These instruments are issued by a company other than the one to which the security is linked and carry the credit of the issuer, not that of the underlying common stock. The securities’ appreciation is limited based on a predetermined final cap price at the date of the conversion. Risks of investing in these securities include, but are not limited to, a set time to capture the yield advantage, limited appreciation potential, decline in value of the underlying stock, and failure of the issuer to pay dividends or to deliver common stock at maturity.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that ACIM has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination

by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account the fund’s assets as well as certain assets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that have very similar investment teams and investment strategies (strategy assets). The annual management fee schedule ranges from 0.80% to 1.00% for the Investor Class, A Class, B Class, C Class and R Class. The annual management fee schedule ranges from 0.60% to 0.80% for the Institutional Class and 0.45% to 0.65% for the R6 Class. The effective annual management fee for each class for the period ended March 31, 2014 was 0.93% for the Investor Class, A Class, B Class, C Class and R Class, 0.73% for the Institutional Class and 0.58% for the R6 Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, B Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the B Class and C Class will each pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended March 31, 2014 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor's management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. Fees and expenses incurred in conjunction with the directors during the year ended March 31, 2014 are detailed in the Statement of Operations. The fund’s officers do not receive compensation from the fund.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended March 31, 2014 were $5,761,126,443 and $6,918,311,832, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

|

| | | | | | | | |

| | Year ended March 31, 2014(1) | Year ended March 31, 2013 |

| | Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 3,000,000,000 | | 3,000,000,000 | |

| Sold | 82,204,397 | $ | 715,805,817 |

| 76,024,391 | $ | 597,947,028 |

|

| Issued in reinvestment of distributions | 49,378,415 | 421,725,022 |

| 22,338,077 | 174,877,435 |

|

| Redeemed | (169,995,596) | (1,478,399,801 | ) | (146,334,035) | (1,151,473,579) |

|

| | (38,412,784) | (340,868,962) |

| (47,971,567) | (378,649,116) |

|

| Institutional Class/Shares Authorized | 800,000,000 | | 800,000,000 | |

| Sold | 28,301,561 | 246,512,129 |

| 46,181,538 | 363,530,803 |

|

| Issued in reinvestment of distributions | 14,457,971 | 123,615,426 |

| 6,053,770 | 47,472,340 |

|

| Redeemed | (62,221,978) | (541,196,330) |

| (43,198,213) | (341,038,687) |

|

| | (19,462,446) | (171,068,775) |

| 9,037,095 | 69,964,456 |

|

| A Class/Shares Authorized | 1,000,000,000 | | 1,000,000,000 | |

| Sold | 62,955,986 | 549,347,268 |

| 46,885,114 | 369,627,808 |

|

| Issued in reinvestment of distributions | 25,765,702 | 219,970,225 |

| 10,511,256 | 82,265,889 |

|

| Redeemed | (91,493,432) | (794,721,903) |

| (73,599,329) | (577,844,321) |

|

| | (2,771,744) | (25,404,410) |

| (16,202,959) | (125,950,624) |

|

| B Class/Shares Authorized | 10,000,000 | | 10,000,000 | |

| Sold | 45,117 | 392,939 |

| 20,835 | 162,686 |

|

| Issued in reinvestment of distributions | 54,870 | 467,653 |

| 21,391 | 167,245 |

|

| Redeemed | (153,401) | (1,335,182) |

| (183,461) | (1,448,864) |

|

| | (53,414) | (474,590) |

| (141,235) | (1,118,933) |

|

| C Class/Shares Authorized | 250,000,000 | | 250,000,000 | |

| Sold | 9,618,153 | 83,806,631 |

| 2,928,355 | 23,068,339 |

|

| Issued in reinvestment of distributions | 3,555,455 | 30,263,365 |

| 1,199,209 | 9,371,585 |

|

| Redeemed | (9,406,833) | (81,707,044) |

| (9,937,584) | (78,010,192) |

|

| | 3,766,775 | 32,362,952 |

| (5,810,020) | (45,570,268) |

|

| R Class/Shares Authorized | 100,000,000 | | 100,000,000 | |

| Sold | 3,316,604 | 28,799,908 |

| 3,519,932 | 27,523,237 |

|

| Issued in reinvestment of distributions | 1,563,652 | 13,303,933 |

| 709,461 | 5,535,436 |

|

| Redeemed | (6,905,105) | (60,041,105) |

| (6,031,434) | (47,474,394) |

|

| | (2,024,849) | (17,937,264) |

| (1,802,041) | (14,415,721) |

|

| R6 Class/Shares Authorized | 50,000,000 | | N/A | |

| Sold | 3,038,963 | 26,326,976 |

| | |

| Issued in reinvestment of distributions | 24,425 | 210,088 |

| | |

| Redeemed | (63,993) | (557,908) |

| | |

| | 2,999,395 | 25,979,156 |

| | |

| Net increase (decrease) | (55,959,067) | $ | (497,411,893 | ) | (62,890,727) | $ | (495,740,206 | ) |

| | | | | |

| (1) July 26, 2013 (commencement of sale) through March 31, 2014 for the R6 Class. |

6. Affiliated Company Transactions

If a fund's holding represents ownership of 5% or more of the voting securities of a company, the company is affiliated as defined in the 1940 Act. A summary of transactions for each company which is or was an affiliate at or during the year ended March 31, 2014 follows:

|

| | | | | | | | | | | | | | | | | | |

| March 31, 2013 | | | | March 31, 2014 |

| Company | Share

Balance | Purchase

Cost | Sales Cost | Realized

Gain (Loss) | Dividend

Income | Share

Balance | Market

Value |

| Capitol Federal Financial, Inc. | 9,582,659 |

| $ | 14,555,263 |

| $ | 33,279,203 |

| $ | 1,012,986 |

| $ | 5,337,808 |

| 7,999,069 | $ | 100,388,316 |

|

ONE Gas, Inc.(1) | — |

| 80,244,176 |

| — |

| — |

| — |

| 2,396,071 | 86,090,831 |

|

Piedmont Natural Gas Co., Inc.(2) | 3,799,512 |

| 25,001,785 |

| 50,058,664 |

| 3,902,305 |

| 3,591,946 |

| 2,997,359 | (2) |

|

| WGL Holdings, Inc. | 2,580,517 |

| 20,268,526 |

| 3,859,655 |

| 387,108 |

| 4,365,383 |

| 2,998,417 | 120,116,585 |

|

| | | $ | 140,069,750 |

| $ | 87,197,522 |

| $ | 5,302,399 |

| $ | 13,295,137 |

| | $ | 306,595,732 |

|

| |

| (2) | Company was not an affiliate March 31, 2014. |

7. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

| |

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments. |

| |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars. |

| |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

|

| | | | | | | | |

| | Level 1 | Level 2 | Level 3 |

| Assets | | | |

| Investment Securities | | | |

| Common Stocks | $ | 7,079,581,773 |

| $ | 307,420,239 |

| — |

|

| Convertible Preferred Stocks | — |

| 1,212,554,844 |

| — |

|

| Convertible Bonds | — |

| 982,981,310 |

| — |

|

| Preferred Stocks | — |

| 379,181,486 |

| — |

|

| Temporary Cash Investments | 181,521,360 |

| 100,654,699 |

| — |

|

| | $ | 7,261,103,133 |

| $ | 2,982,792,578 |

| — |

|

| Other Financial Instruments | | | |

| Forward Foreign Currency Exchange Contracts | — |

| $ | 415,537 |

| — |

|

| | | | |

| Liabilities | | | |

| Other Financial Instruments | | | |

| Forward Foreign Currency Exchange Contracts | — |

| $ | (187,185 | ) | — |

|

8. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund's exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on foreign currency transactions and change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The foreign currency risk derivative instruments held at period end as disclosed on the Schedule of Investments are indicative of the fund's typical volume during the period.

The value of foreign currency risk derivative instruments as of March 31, 2014, is disclosed on the Statement of Assets and Liabilities as an asset of $415,537 in unrealized appreciation on forward foreign currency exchange contracts and a liability of $187,185 in unrealized depreciation on forward foreign currency exchange contracts. For the year ended March 31, 2014, the effect of foreign currency risk derivative instruments on the Statement of Operations was $(12,593,390) in net realized gain (loss) on foreign currency transactions and $(1,439,298) in change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies.

9. Federal Tax Information

The tax character of distributions paid during the years ended March 31, 2014 and March 31, 2013 were as follows:

|

| | | | | | |

| | 2014 | 2013 |

| Distributions Paid From | | |

| Ordinary income | $ | 349,262,012 |

| $ | 253,049,629 |

|

| Long-term capital gains | $ | 518,684,351 |

| $ | 100,556,430 |

|

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of March 31, 2014, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

|

| | | |

| Federal tax cost of investments | $ | 8,414,071,144 |

|

| Gross tax appreciation of investments | $ | 1,884,207,961 |

|

| Gross tax depreciation of investments | (54,383,394 | ) |

| Net tax appreciation (depreciation) of investments | $ | 1,829,824,567 |

|

| Net tax appreciation (depreciation) on derivatives and translation of assets and liabilities in foreign currencies | $ | (106,202 | ) |

| Net tax appreciation (depreciation) | $ | 1,829,718,365 |

|

| Undistributed ordinary income | $ | 88,955,318 |

|

| Accumulated long-term gains | $ | 162,227,885 |

|

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

|

| | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | | | | |

| Per-Share Data | | | | | | | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| | Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses | Net

Investment

Income

(Loss) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| Investor Class | | | | | | | | | | | | | |

| 2014 | $8.47 | 0.20 | 0.92 | 1.12 | (0.20) | (0.55) | (0.75) | $8.84 | 13.64% | 0.93% | 2.31% | 57% |

| $5,406,362 |

|

| 2013 | $7.69 | 0.21 | 0.86 | 1.07 | (0.21) | (0.08) | (0.29) | $8.47 | 14.33% | 0.93% | 2.63% | 83% |

| $5,504,359 |

|

| 2012 | $7.43 | 0.20 | 0.25 | 0.45 | (0.19) | – | (0.19) | $7.69 | 6.24% | 0.95% | 2.69% | 115% |

| $5,363,783 |

|

| 2011 | $6.76 | 0.21 | 0.67 | 0.88 | (0.21) | – | (0.21) | $7.43 | 13.23% | 0.96% | 3.09% | 146% |

| $5,123,937 |

|

| 2010 | $5.42 | 0.18 | 1.33 | 1.51 | (0.17) | – | (0.17) | $6.76 | 28.04% | 0.97% | 2.93% | 105% |

| $3,829,492 |

|

| Institutional Class | | | | | | | | | | | | |

| 2014 | $8.47 | 0.22 | 0.92 | 1.14 | (0.21) | (0.55) | (0.76) | $8.85 | 13.85% | 0.73% | 2.51% | 57% |

| $1,422,725 |

|

| 2013 | $7.69 | 0.22 | 0.87 | 1.09 | (0.23) | (0.08) | (0.31) | $8.47 | 14.69% | 0.73% | 2.83% | 83% |

| $1,527,723 |

|

| 2012 | $7.44 | 0.21 | 0.24 | 0.45 | (0.20) | – | (0.20) | $7.69 | 6.31% | 0.75% | 2.89% | 115% |

| $1,316,758 |

|

| 2011 | $6.77 | 0.23 | 0.66 | 0.89 | (0.22) | – | (0.22) | $7.44 | 13.60% | 0.76% | 3.29% | 146% |

| $894,544 |

|

| 2010 | $5.42 | 0.19 | 1.34 | 1.53 | (0.18) | – | (0.18) | $6.77 | 28.30% | 0.77% | 3.13% | 105% |

| $792,024 |

|

| A Class | | | | | | | | | | | | | |

| 2014 | $8.47 | 0.18 | 0.91 | 1.09 | (0.17) | (0.55) | (0.72) | $8.84 | 13.36% | 1.18% | 2.06% | 57% |

| $2,722,731 |

|

| 2013 | $7.69 | 0.19 | 0.86 | 1.05 | (0.19) | (0.08) | (0.27) | $8.47 | 14.05% | 1.18% | 2.38% | 83% |

| $2,631,737 |

|

| 2012 | $7.43 | 0.18 | 0.25 | 0.43 | (0.17) | – | (0.17) | $7.69 | 5.98% | 1.20% | 2.44% | 115% |

| $2,512,840 |

|

| 2011 | $6.76 | 0.20 | 0.66 | 0.86 | (0.19) | – | (0.19) | $7.43 | 12.95% | 1.21% | 2.84% | 146% |

| $2,188,714 |

|

| 2010 | $5.42 | 0.17 | 1.32 | 1.49 | (0.15) | – | (0.15) | $6.76 | 27.71% | 1.22% | 2.68% | 105% |

| $1,385,436 |

|

|

| | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | | | | |

| Per-Share Data | | | | | | | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| | Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses | Net

Investment

Income

(Loss) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| B Class | | | | | | | | | | | | | |

| 2014 | $8.48 | 0.11 | 0.92 | 1.03 | (0.11) | (0.55) | (0.66) | $8.85 | 12.51% | 1.93% | 1.31% | 57% |

| $7,151 |

|

| 2013 | $7.70 | 0.13 | 0.86 | 0.99 | (0.13) | (0.08) | (0.21) | $8.48 | 13.20% | 1.93% | 1.63% | 83% |

| $7,304 |

|

| 2012 | $7.44 | 0.12 | 0.26 | 0.38 | (0.12) | – | (0.12) | $7.70 | 5.18% | 1.95% | 1.69% | 115% |

| $7,716 |

|

| 2011 | $6.77 | 0.15 | 0.66 | 0.81 | (0.14) | – | (0.14) | $7.44 | 12.08% | 1.96% | 2.09% | 146% |

| $8,102 |

|

| 2010 | $5.42 | 0.12 | 1.33 | 1.45 | (0.10) | – | (0.10) | $6.77 | 26.92% | 1.97% | 1.93% | 105% |

| $7,383 |

|

| C Class | | | | | | | | | | | | | |

| 2014 | $8.47 | 0.12 | 0.91 | 1.03 | (0.11) | (0.55) | (0.66) | $8.84 | 12.53% | 1.93% | 1.31% | 57% |

| $521,688 |

|

| 2013 | $7.69 | 0.13 | 0.86 | 0.99 | (0.13) | (0.08) | (0.21) | $8.47 | 13.21% | 1.93% | 1.63% | 83% |

| $467,913 |

|

| 2012 | $7.44 | 0.12 | 0.25 | 0.37 | (0.12) | – | (0.12) | $7.69 | 5.05% | 1.95% | 1.69% | 115% |

| $469,355 |

|

| 2011 | $6.77 | 0.15 | 0.66 | 0.81 | (0.14) | – | (0.14) | $7.44 | 12.25% | 1.96% | 2.09% | 146% |

| $384,918 |

|

| 2010 | $5.42 | 0.12 | 1.33 | 1.45 | (0.10) | – | (0.10) | $6.77 | 26.74% | 1.97% | 1.93% | 105% |

| $193,776 |

|

| R Class | | | | | | | | | | | | | |

| 2014 | $8.45 | 0.16 | 0.91 | 1.07 | (0.15) | (0.55) | (0.70) | $8.82 | 13.12% | 1.43% | 1.81% | 57% |

| $169,852 |

|

| 2013 | $7.67 | 0.17 | 0.86 | 1.03 | (0.17) | (0.08) | (0.25) | $8.45 | 13.81% | 1.43% | 2.13% | 83% |

| $179,855 |

|

| 2012 | $7.42 | 0.16 | 0.24 | 0.40 | (0.15) | – | (0.15) | $7.67 | 5.59% | 1.45% | 2.19% | 115% |

| $177,061 |

|

| 2011 | $6.75 | 0.18 | 0.66 | 0.84 | (0.17) | – | (0.17) | $7.42 | 12.68% | 1.46% | 2.59% | 146% |

| $141,693 |

|

| 2010 | $5.41 | 0.15 | 1.32 | 1.47 | (0.13) | – | (0.13) | $6.75 | 27.44% | 1.47% | 2.43% | 105% |

| $92,239 |

|

| R6 Class | | | | | | | | | | | | | |

2014(3) | $8.94 | 0.17 | 0.46 | 0.63 | (0.17) | (0.55) | (0.72) | $8.85 | 7.41% | 0.58%(4) | 2.93%(4) | 57%(5) |

| $26,550 |

|

|

| | | | |

| Notes to Financial Highlights | | |

| |

| (1) | Computed using average shares outstanding throughout the period. |

| |

| (2) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized. |

| |

| (3) | July 26, 2013 (commencement of sale) through March 31, 2014. |

| |

| (5) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended March 31, 2014. |

See Notes to Financial Statements.

|

|

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of

American Century Capital Portfolios, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Equity Income Fund (the “Fund”), one of the funds constituting American Century Capital Portfolios, Inc., as of March 31, 2014, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of March 31, 2014, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Equity Income Fund of American Century Capital Portfolios, Inc. as of March 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

Kansas City, Missouri