UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07820 | |||||

| AMERICAN CENTURY CAPITAL PORTFOLIOS, INC. | ||||||

| (Exact name of registrant as specified in charter) | ||||||

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||

| (Address of principal executive offices) | (Zip Code) | |||||

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||

| (Name and address of agent for service) | ||||||

| Registrant’s telephone number, including area code: | 816-531-5575 | |||||

| Date of fiscal year end: | 03-31 | |||||

| Date of reporting period: | 09-30-2010 | |||||

ITEM 1. REPORTS TO STOCKHOLDERS.

| Semiannual Report |

| September 30, 2010 |

American Century Investments®

Equity Income Fund

Table of Contents

| President’s Letter | 2 | |

| Independent Chairman’s Letter | 3 | |

| Market Perspective | 4 | |

| U.S. Stock Index Returns | 4 | |

| Equity Income | ||

| Performance | 5 | |

| Portfolio Commentary | 7 | |

| Top Ten Holdings | 9 | |

| Top Five Industries | 9 | |

| Types of Investments in Portfolio | 9 | |

| Shareholder Fee Example | 10 | |

| Financial Statements | ||

| Schedule of Investments | 12 | |

| Statement of Assets and Liabilities | 16 | |

| Statement of Operations | 17 | |

| Statement of Changes in Net Assets | 18 | |

| Notes to Financial Statements | 19 | |

| Financial Highlights | 25 | |

| Other Information | ||

| Proxy Voting Results | 31 | |

| Additional Information | 32 | |

| Index Definitions | 33 | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

President’s Letter

Jonathan Thomas

Jonathan ThomasDear Investor:

To learn more about the capital markets, your investment, and the portfolio management strategies American Century Investments provides, we encourage you to review this shareholder report for the financial reporting period ended September 30, 2010.

On the following pages, you will find investment performance and portfolio information, presented with the expert perspective and commentary of our portfolio management team. This report remains one of our most important vehicles for conveying the information you need about your investment performance, and about the market factors and strategies that affect fund returns. For additional information on the markets, we encourage you to visit the “Insights & News” tab at our Web site, americancentury.com, for updates and further expert commentary.

The top of our Web site’s home page also provides a link to “Our Story,” which, first and foremost, outlines our commitment—since 1958—to helping clients reach their financial goals. We believe strongly that we will only be successful when our clients are successful. That’s who we are.

Another important, unique facet of our story and who we are is “Profits with a Purpose,” which describes our bond with the Stowers Institute for Medical Research (SIMR). SIMR is a world-class biomedical organization—founded by our company founder James E. Stowers, Jr. and his wife Virginia—that is dedicated to researching the causes, treatment, and prevention of gene-based diseases, including cancer. Through American Century Investments’ private ownership structure, more than 40% of our profits support SIMR.

Mr. Stowers’ example of achieving financial success and using that platform to help humanity motivates our entire American Century Investments team. His story inspires us to help each of our clients achieve success. Thank you for sharing your financial journey with us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

Independent Chairman’s Letter

Don Pratt

Don PrattDear Fellow Shareholders,

As regulators and the markets continue to sort out the events of the credit crisis, a consistent theme has been that financial services firms should re-examine their risk management practices. Risk management has been a regular part of American Century Investments’ activities for many years. However, recently American Century and your mutual fund board have been spending additional time focusing on our risk oversight processes.

The board’s efforts are now organized around three categories of risk: investment risk, operational risk, and enterprise risk. This approach has facilitated a realignment of many risk oversight tasks that the board has historically conducted. Investment risk tasks include a review of portfolio risk, monitoring the use of derivatives, and performance assessment. Operational risk focuses on compliance, valuation, shareholder services, and trading activities. Enterprise risk addresses the financial condition of the advisor, human resource development, and reputational risks. Risk oversight tasks are addressed in every quarterly board meeting, and a review of the advisor’s entire risk management program is undertaken annually. We acknowledge and support the approach that American Century Investments takes to its risk management responsibilities. While the board has refocused its efforts in this important oversight area, we recognize that risk oversight is a journey and we expect to continue to improve our processes.

Our September quarterly board meeting was held in the New York offices of American Century Investments. This gave the directors an opportunity to meet with the portfolio management teams for each of the global and international funds overseen by the board. Each team uses sophisticated investment tools and daily risk analysis in managing client assets. We also were impressed with the “bench strength” that has been developed under the leadership of the Global and Non-U.S. Equity CIO Mark Kopinski. These face-to-face meetings provide an opportunity for the directors – working on behalf of shareholders – to validate the advisor’s efforts and the investment management approach being followed.

I thank you for your continued confidence in American Century during this turbulent time in the economy and investment markets. If you have thoughts or questions you would like to share with the board send them to me at dhpratt@fundboardchair.com.

Best regards,

Don Pratt

3

Market Perspective

By Phil Davidson, Chief Investment Officer, U.S. Value Equity

Mixed Results for U.S. Stocks

U.S. stocks were mixed but generally lower for the six months ended September 30, 2010, as market volatility increased notably. The key factor driving this volatility was increased uncertainty regarding the U.S. economic recovery, which appeared to wane following the robust growth rate it experienced in the last half of 2009.

Evidence of slowing economic activity during the six-month period included a slowdown in the manufacturing sector, further deterioration in the housing market, persistently high unemployment, and a decline in retail sales. In addition, sovereign debt problems in Europe also led to concerns about the impact of a potential fiscal crisis on global economic growth. The combination sent stocks into a tailspin in the second quarter of 2010.

The equity market rebounded in the third quarter, with the bulk of the rally occurring in September—the highest monthly return for stocks since April 2009. The Federal Reserve indicated that it would reinstate the quantitative easing measures used to stimulate economic growth in 2009, and the market rallied in the hope that these efforts would resuscitate the economic recovery. Despite a strong finish, the broad equity indices fell slightly for the six months, although mid- and small-cap issues posted modestly positive results (see the table below).

Value Stocks Lagged

Value stocks underperformed their growth-oriented counterparts across all market capitalizations during the six-month period. The primary reason was the lagging performance of the financial sector, which is the largest component in most value indices. Financial companies continued to struggle with high unemployment, continued weakness in the housing market, growing loan delinquencies and defaults, and uncertainty regarding the impact of recent financial reform legislation.

On the positive side, the recent trend of rising dividend payouts remained supportive for value stocks. The growth in dividends reflected both a significant recovery in corporate earnings (excluding financials) over the past year and increasingly healthy balance sheets. The question going forward is whether companies can sustain this level of profitability and financial strength in a slow-growth economic environment.

| U.S. Stock Index Returns | ||||

| For the six months ended September 30, 2010* | ||||

| Russell 1000 Index (Large-Cap) | –1.21% | Russell 2000 Index (Small-Cap) | 0.25% | |

| Russell 1000 Growth Index | –0.27% | Russell 2000 Growth Index | 2.43% | |

| Russell 1000 Value Index | –2.14% | Russell 2000 Value Index | –1.90% | |

| Russell Midcap Index | 2.12% | *Total returns for periods less than one year are not annualized. | ||

| Russell Midcap Growth Index | 2.95% | |||

| Russell Midcap Value Index | 1.40% | |||

4

Performance

Equity Income

| Total Returns as of September 30, 2010 | |||||||

| Average Annual Returns | |||||||

Ticker Symbol | 6 months(1) | 1 year | 5 years | 10 years | Since Inception | Inception Date | |

| Investor Class | TWEIX | 2.00% | 11.34% | 3.03% | 6.94% | 10.38% | 8/1/94 |

Russell 3000 Value Index | — | -2.11% | 9.15% | -0.39% | 2.96% | 8.45%(2) | — |

| S&P 500 Index | — | -1.42% | 10.16% | 0.64% | -0.43% | 7.80%(2) | — |

Lipper Equity Income Index | — | -0.96% | 9.83% | 0.58% | 2.27% | 6.84%(2) | — |

| Institutional Class | ACIIX | 2.25% | 11.55% | 3.26% | 7.15% | 7.12% | 7/8/98 |

A Class(3) No sales charge* With sales charge* | TWEAX | 1.87% -3.95% | 11.06% 4.71% | 2.77% 1.55% | 6.68% 6.05% | 8.09% 7.62% | 3/7/97 |

B Class No sales charge* With sales charge* | AEKBX | 1.49% -3.51% | 10.20% 6.20% | — — | — — | -4.11% -5.21% | 9/28/07 |

C Class No sales charge* With sales charge* | AEYIX | 1.65% 0.65% | 10.38% 10.38% | 2.03% 2.03% | — — | 4.57% 4.57% | 7/13/01 |

| R Class | AEURX | 1.75% | 10.80% | 2.52% | — | 5.10% | 8/29/03 |

| * | Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| (1) | Total returns for periods less than one year are not annualized. |

| (2) | Since 7/31/94, the date nearest the Investor Class’s inception for which data are available. |

| (3) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

5

Equity Income

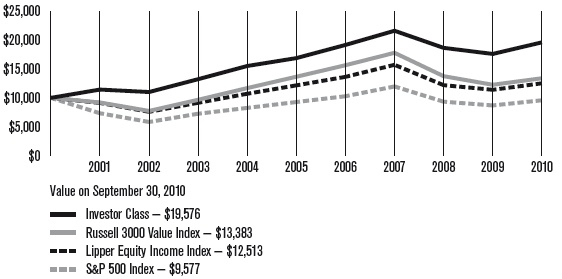

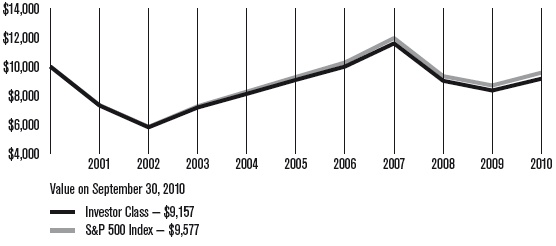

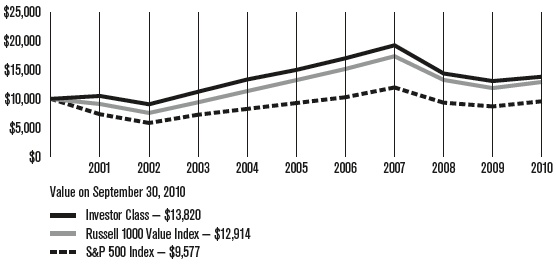

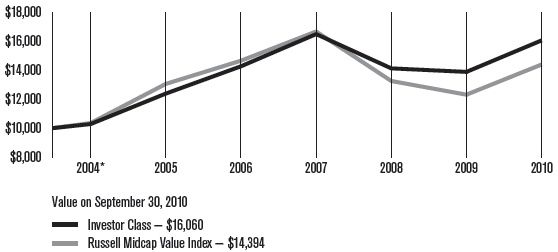

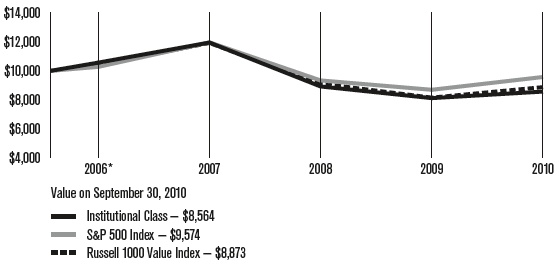

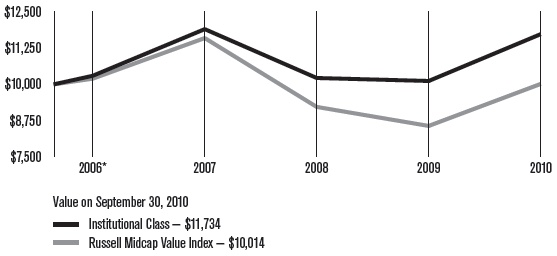

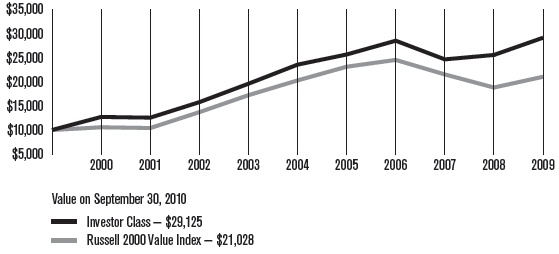

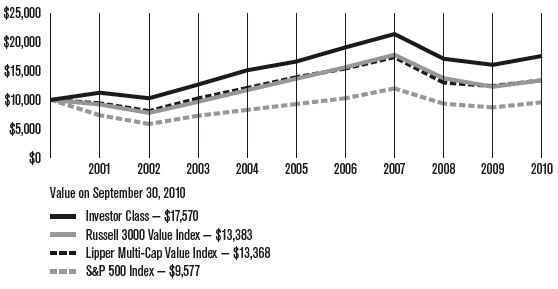

| Growth of $10,000 Over 10 Years |

| $10,000 investment made September 30, 2000 |

| Total Annual Fund Operating Expenses | |||||

| Investor Class | Institutional Class | A Class | B Class | C Class | R Class |

| 0.97% | 0.77% | 1.22% | 1.97% | 1.97% | 1.47% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

6

Portfolio Commentary

Equity Income

Portfolio Managers: Phil Davidson, Kevin Toney, and Michael Liss

Performance Summary

Equity Income returned 2.00%* for the six months ended September 30, 2010. By comparison, the Lipper Equity Income Index returned -0.96%, and the average return for Morningstar’s Large Cap Value category** (its performance, like Equity Income’s, reflects operating expenses) was -2.44%. The fund’s benchmark, the Russell 3000 Value Index, and the S&P 500 Index, representative of the broad market, fell -2.11% and -1.42%, respectively. The portfolio’s return reflects operating expenses, while the indices’ returns

do not.

Stocks suffered steep declines during the first three months of the reporting period as investors, unsettled by the debt crisis in Europe and softer-than-expected U.S. economic news, fled into defensive investments such as U.S. Treasuries and utilities. However, in spite of continued economic uncertainty, stock prices rose once the turmoil in Europe moderated. Counter-intuitively, both higher-risk and higher-yielding securities outperformed. Higher-risk stocks were in favor as fears of a double-dip recession eased, while investors continued to favor higher-yielding securities because of very low interest rates. In this environment, Equity Income’s higher-quality, income-producing securities performed well on a relative basis. Many of the companies owned by the portfolio have strong balance sheets and competitive positions, which allowed them to continue paying dividends and, in some cases, increase their dividend payouts.

Equity Income is carefully managed to provide solid long-term performance. Since its inception on August 1, 1994, Equity Income has produced an average annual return of 10.38%, topping the returns for the Lipper Equity Income Index, Morningstar’s Large Cap Value category average, the Russell 3000 Value Index, and the S&P 500 Index for the same period (see performance information on pages 5 – 6 and the footnotes below).

Financials Contributed

Equity Income benefited from an underweight position and strategic stock selection in financials, the weakest sector in the benchmark. In keeping with the management team’s cautious and conservative approach, the portfolio did not own Bank of America’s common stock, which underperformed. However, it did hold the bank’s less-risky convertible preferred stock, which appreciated in price as the company stabilized its balance sheet. The portfolio had no exposure to commercial bank Wells Fargo or diversified financial services company Citigroup. Both stocks declined in the benchmark.

| * | All fund returns referenced in this commentary are for Investor Class shares. Total returns for periods less than one year are not annualized. |

| ** | The average returns for Morningstar’s Large Cap Value category were 8.02%, -0.28% and 2.47% for the one-, five- and ten-year periods ended September 30, 2010, respectively, and 7.07% since the fund’s inception. © Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. |

7

Equity Income

Elsewhere in the sector, our investments were concentrated in the less-volatile names in the insurance industry. Equity Income was overweight shares of Ace Ltd. and Chubb Corp. Despite a difficult pricing and low interest rate environment, both companies posted attractive returns on capital and increased dividends.

Industrials Boosted Results

Security selection within industrials added to relative results. United Parcel Service (UPS) delivered strong earnings growth based on growth internationally, cost savings, and an improved competitive environment following DHL’s exit from the U.S. parcel market. General Electric (GE) contributed to relative performance despite a negative return for the period as the portfolio was substantially underweight this stock. Two overweight positions in multi-national companies Emerson Electric and Caterpillar along with positive returns for these stocks also contributed to the portfolio’s performance.

Information Technology Added Value

Select holdings within information technology enhanced performance. Equity Income owned a convertible security issued by Intel which contributed to relative returns. It was also underweight Intel’s common stock, which dropped sharply after the company lowered its third-quarter revenue forecast, citing weaker-than-expected consumer demand for personal computers. Other holdings that contributed to relative performance in this sector were two convertible bonds issued by DST Systems and Sybase. The latter company was acquired by SAP.

Energy Detracted

Although an overweight in the energy sector boosted relative results, Equity Income’s mix of large integrated oil and gas companies offset progress. One key detractor was Exxon Mobil Corp. which saw its share price decline in part due to investor disappointment over the price paid for its acquisition of XTO Energy earlier in 2010.

Outlook

We will continue to follow our disciplined, bottom-up investment process, selecting companies one at a time for the portfolio. As of September 30, 2010, we see attractive opportunities in energy and utilities, reflected by our overweight positions in these sectors. We continue to be selective in holdings of industrials, health care, financials, and consumer discretionary companies, relying on fundamental analysis to identify strong, financially sound businesses whose securities provide attractive yields.

8

Equity Income

| Top Ten Holdings | |

| % of net assets as of 9/30/10 | |

| Exxon Mobil Corp. | 5.0% |

| AT&T, Inc. | 4.0% |

| Bank of America Corp. (Convertible) | 3.9% |

| U.S. Bancorp. (Convertible) | 3.5% |

| Total SA | 3.0% |

| Johnson & Johnson | 2.9% |

| United Parcel Service, Inc., Class B | 2.7% |

| Annaly Capital Management, Inc. (Convertible) | 2.5% |

| Host Hotels & Resorts LP (Convertible) | 2.5% |

| Chevron Corp. | 2.4% |

| Top Five Industries | |

| % of net assets as of 9/30/10 | |

| Oil, Gas & Consumable Fuels | 12.9% |

| Pharmaceuticals | 7.7% |

| Real Estate Investment Trusts (REITs) | 7.1% |

| Specialty Retail | 5.1% |

| Insurance | 5.0% |

| Types of Investments in Portfolio | |

| % of net assets as of 9/30/10 | |

| Domestic Common Stocks | 66.4% |

| Foreign Common Stocks | 6.0% |

| Convertible Bonds | 20.8% |

| Convertible Preferred Stocks | 4.2% |

| Total Equity Exposure | 97.4% |

| Temporary Cash Investments | 2.3% |

| Other Assets and Liabilities | 0.3% |

9

Shareholder Fee Example (Unaudited)

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from April 1, 2010 to September 30, 2010.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) regis tered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

10

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Beginning Account Value 4/1/10 | Ending Account Value 9/30/10 | Expenses Paid During Period* 4/1/10 – 9/30/10 | Annualized Expense Ratio* | |

| Actual | ||||

| Investor Class | $1,000 | $1,020.00 | $4.91 | 0.97% |

| Institutional Class | $1,000 | $1,022.50 | $3.90 | 0.77% |

| A Class | $1,000 | $1,018.70 | $6.17 | 1.22% |

| B Class | $1,000 | $1,014.90 | $9.95 | 1.97% |

| C Class | $1,000 | $1,016.50 | $9.96 | 1.97% |

| R Class | $1,000 | $1,017.50 | $7.43 | 1.47% |

| Hypothetical | ||||

| Investor Class | $1,000 | $1,020.21 | $4.91 | 0.97% |

| Institutional Class | $1,000 | $1,021.21 | $3.90 | 0.77% |

| A Class | $1,000 | $1,018.95 | $6.17 | 1.22% |

| B Class | $1,000 | $1,015.19 | $9.95 | 1.97% |

| C Class | $1,000 | $1,015.19 | $9.95 | 1.97% |

| R Class | $1,000 | $1,017.70 | $7.44 | 1.47% |

| * | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

11

Schedule of Investments

Equity Income

SEPTEMBER 30, 2010 (UNAUDITED)

Shares/ Principal Amount | Value | |

| Common Stocks — 72.4% | ||

| AEROSPACE & DEFENSE — 1.2% | ||

| Honeywell International, Inc. | 538,600 | $ 23,666,084 |

| Raytheon Co. | 1,211,800 | 55,391,378 |

| 79,057,462 | ||

| AIR FREIGHT & LOGISTICS — 2.7% | ||

| United Parcel Service, Inc., Class B | 2,785,021 | 185,733,051 |

| CAPITAL MARKETS — 2.5% | ||

| AllianceBernstein Holding LP | 751,173 | 19,838,479 |

| Northern Trust Corp. | 2,238,800 | 107,999,712 |

| T. Rowe Price Group, Inc. | 867,600 | 43,436,394 |

| 171,274,585 | ||

| CHEMICALS — 1.4% | ||

| E.I. du Pont de Nemours & Co. | 2,162,900 | 96,508,598 |

| COMMERCIAL BANKS — 0.8% | ||

| Commerce Bancshares, Inc. | 1,464,549 | 55,052,397 |

| COMMERCIAL SERVICES & SUPPLIES — 1.7% | ||

| Pitney Bowes, Inc. | 1,280,000 | 27,366,400 |

| Republic Services, Inc. | 1,725,500 | 52,610,495 |

| Waste Management, Inc. | 1,106,145 | 39,533,622 |

| 119,510,517 | ||

| CONSTRUCTION MATERIALS — 0.7% | ||

| Martin Marietta Materials, Inc. | 651,095 | 50,114,782 |

| DISTRIBUTORS — 1.2% | ||

| Genuine Parts Co. | 1,831,900 | 81,684,421 |

| DIVERSIFIED — 1.9% | ||

| Standard & Poor’s 500 Depositary Receipt, Series 1 | 1,125,800 | 128,476,296 |

| DIVERSIFIED TELECOMMUNICATION SERVICES — 4.9% | ||

| AT&T, Inc. | 9,598,800 | 274,525,680 |

| Qwest Communications International, Inc. | 9,646,900 | 60,486,063 |

| 335,011,743 | ||

| ELECTRIC UTILITIES — 1.0% | ||

| Northeast Utilities | 1,266,800 | 37,459,276 |

| Portland General Electric Co. | 1,490,133 | 30,219,897 |

| 67,679,173 | ||

| ELECTRICAL EQUIPMENT — 1.6% | ||

| Emerson Electric Co. | 1,577,800 | 83,086,948 |

| Rockwell Automation, Inc. | 372,900 | 23,019,117 |

| 106,106,065 | ||

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 0.5% | ||

| Molex, Inc., Class A | 1,809,100 | 31,623,068 |

| FOOD & STAPLES RETAILING — 2.2% | ||

| Walgreen Co. | 1,101,100 | 36,886,850 |

| Wal-Mart Stores, Inc. | 2,119,116 | 113,415,088 |

| 150,301,938 | ||

| FOOD PRODUCTS — 2.5% | ||

| H.J. Heinz Co. | 2,558,700 | 121,205,619 |

| Unilever NV CVA | 1,715,600 | 51,278,008 |

| 172,483,627 | ||

| GAS UTILITIES — 3.4% | ||

| AGL Resources, Inc. | 1,821,500 | 69,872,740 |

| Nicor, Inc. | 1,215,000 | 55,671,300 |

| Piedmont Natural Gas Co., Inc. | 296,000 | 8,584,000 |

WGL Holdings, Inc.(1) | 2,521,688 | 95,269,373 |

| 229,397,413 | ||

| HOTELS, RESTAURANTS & LEISURE — 0.1% | ||

| McDonald’s Corp. | 90,100 | 6,713,351 |

| HOUSEHOLD PRODUCTS — 3.7% | ||

| Clorox Co. | 888,000 | 59,282,880 |

| Kimberly-Clark Corp. | 1,459,500 | 94,940,475 |

| Procter & Gamble Co. (The) | 1,642,830 | 98,520,515 |

| 252,743,870 | ||

| INSURANCE — 4.9% | ||

| ACE Ltd. | 1,009,500 | 58,803,375 |

| Allstate Corp. (The) | 1,930,400 | 60,904,120 |

| Chubb Corp. (The) | 774,600 | 44,144,454 |

| Marsh & McLennan Cos., Inc. | 4,906,489 | 118,344,515 |

| MetLife, Inc. | 760,606 | 29,245,301 |

| Transatlantic Holdings, Inc. | 492,804 | 25,044,299 |

| 336,486,064 | ||

| IT SERVICES — 2.5% | ||

| Accenture plc, Class A | 2,153,200 | 91,489,468 |

| Automatic Data Processing, Inc. | 1,357,200 | 57,043,116 |

| Paychex, Inc. | 739,200 | 20,320,608 |

| 168,853,192 | ||

| MACHINERY — 0.3% | ||

| Caterpillar, Inc. | 35,200 | 2,769,536 |

| Harsco Corp. | 734,900 | 18,063,842 |

| 20,833,378 | ||

12

Equity Income

Shares/ Principal Amount | Value |

| MEDIA — 0.6% | ||

| Omnicom Group, Inc. | 1,040,200 | $ 41,067,096 |

| METALS & MINING — 0.2% | ||

| Nucor Corp. | 380,487 | 14,534,604 |

| MULTI-UTILITIES — 3.5% | ||

| Consolidated Edison, Inc. | 3,330,368 | 160,590,345 |

| PG&E Corp. | 1,503,100 | 68,270,802 |

| Wisconsin Energy Corp. | 177,300 | 10,247,940 |

| 239,109,087 | ||

| OIL, GAS & CONSUMABLE FUELS — 11.6% | ||

| Chevron Corp. | 2,028,700 | 164,426,135 |

| El Paso Pipeline Partners LP | 1,604,732 | 51,463,755 |

| Exxon Mobil Corp. | 5,575,029 | 344,481,042 |

| Spectra Energy Partners LP | 758,354 | 26,239,048 |

| Total SA | 3,989,400 | 205,604,366 |

| 792,214,346 | ||

| PHARMACEUTICALS — 7.7% | ||

| Abbott Laboratories | 321,000 | 16,769,040 |

| Bristol-Myers Squibb Co. | 2,412,540 | 65,403,959 |

| Eli Lilly & Co. | 1,197,900 | 43,759,287 |

| Johnson & Johnson | 3,250,135 | 201,378,365 |

| Merck & Co., Inc. | 3,527,200 | 129,836,232 |

| Pfizer, Inc. | 3,989,024 | 68,491,542 |

| 525,638,425 | ||

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.6% | ||

| Weyerhaeuser Co. | 2,689,324 | 42,383,746 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 1.3% | ||

| Applied Materials, Inc. | 5,369,446 | 62,715,129 |

| Intel Corp. | 886,900 | 17,055,087 |

| Microchip Technology, Inc. | 326,100 | 10,255,845 |

| 90,026,061 | ||

| SPECIALTY RETAIL — 3.2% | ||

| Home Depot, Inc. (The) | 3,058,000 | 96,877,440 |

| Lowe’s Cos., Inc. | 5,425,100 | 120,925,479 |

| 217,802,919 | ||

| THRIFTS & MORTGAGE FINANCE — 2.0% | ||

| Capitol Federal Financial, Inc. | 537,000 | 13,263,900 |

| Hudson City Bancorp., Inc. | 3,273,800 | 40,136,788 |

| People’s United Financial, Inc. | 6,522,300 | 85,376,907 |

| 138,777,595 | ||

TOTAL COMMON STOCKS (Cost $4,404,842,466) | 4,947,198,870 | |

| Convertible Bonds — 20.8% | ||

| CAPITAL MARKETS — 0.8% | ||

BNP Paribas, (convertible into Charles Schwab Corp. (The)), 7.45%, 2/15/11(2)(3) | $ 1,321,400 | 19,001,732 |

Goldman Sachs Group, Inc. (The), (convertible into Charles Schwab Corp. (The)), 9.45%, 11/22/10(2)(3) | 862,000 | 12,194,516 |

| Janus Capital Group, Inc., 3.25%, 7/15/14 | 20,000,000 | 22,900,000 |

| 54,096,248 | ||

| COMMERCIAL BANKS — 4.1% | ||

BNP Paribas, (convertible into SunTrust Banks, Inc.), 15.65%, 3/3/11(2)(3) | 750,000 | 18,161,250 |

Goldman Sachs Group, Inc. (The), (convertible into SunTrust Banks, Inc.), 16.15%, 1/26/11(2)(3) | 645,000 | 16,160,197 |

| U.S. Bancorp., VRN, 0.00%, 12/11/10 | 242,292,000 | 241,843,760 |

| 276,165,207 | ||

COMMUNICATIONS EQUIPMENT(4) | ||

Ciena Corp., 4.00%, 3/15/15(3) | 2,000,000 | 2,157,500 |

| COMPUTERS & PERIPHERALS — 0.4% | ||

Cadence Design Systems, Inc., 2.625%, 6/1/15(3) | 10,000,000 | 11,887,500 |

Morgan Stanley, (convertible into Hewlett-Packard Co.), 5.85%, 2/14/11(2)(3) | 380,500 | 16,363,402 |

| 28,250,902 | ||

| DIVERSIFIED FINANCIAL SERVICES — 0.7% | ||

BNP Paribas, (convertible into JPMorgan Chase & Co.), 9.45%, 3/3/11(2)(3) | 360,000 | 13,413,600 |

Deutsche Bank AG, (convertible into JPMorgan Chase & Co.), 9.35%, 2/23/11(2)(3) | 900,000 | 34,559,100 |

| 47,972,700 | ||

| ENERGY EQUIPMENT & SERVICES — 0.2% | ||

Bank of America N.A., (convertible into Baker Hughes, Inc.), 11.60%, 2/9/11(2)(3) | 385,000 | 16,493,766 |

13

Equity Income

Shares/ Principal Amount | Value |

| FOOD & STAPLES RETAILING — 0.2% | ||

Credit Suisse Securities USA LLC, (convertible into Walgreen Co.), 6.10%, 12/23/10(2)(3) | $ 520,000 | $ 15,826,200 |

| HEALTH CARE EQUIPMENT & SUPPLIES — 0.2% | ||

| Beckman Coulter, Inc., 2.50%, 12/15/36 | 11,500,000 | 11,744,375 |

| HEALTH CARE PROVIDERS & SERVICES — 2.0% | ||

| LifePoint Hospitals, Inc., 3.50%, 5/15/14 | 9,200,000 | 9,200,000 |

| LifePoint Hospitals, Inc., 3.25%, 8/15/25 | 44,300,000 | 43,469,375 |

| Lincare Holdings, Inc., 2.75%, 11/1/37 | 76,062,000 | 81,766,650 |

| 134,436,025 | ||

| HOUSEHOLD DURABLES — 0.2% | ||

Deutsche Bank AG, (convertible into Toll Brothers, Inc.), 14.21%, 12/15/10(2)(3) | 765,000 | 14,806,957 |

| LIFE SCIENCES TOOLS & SERVICES — 1.0% | ||

| Life Technologies Corp., 3.25%, 6/15/25 | 58,414,000 | 65,350,663 |

| METALS & MINING — 0.3% | ||

| Newmont Mining Corp., 3.00%, 2/15/12 | 15,000,000 | 21,431,250 |

| OIL, GAS & CONSUMABLE FUELS — 1.1% | ||

| Peabody Energy Corp., 4.75%, 12/15/41 | 68,000,000 | 76,160,000 |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 6.5% | ||

| Annaly Capital Management, Inc., 4.00%, 2/15/15 | 153,000,000 | 169,447,500 |

Host Hotels & Resorts LP, 3.25%, 4/15/24(3) | 160,889,000 | 168,933,450 |

| Rayonier TRS Holdings, Inc., 3.75%, 10/15/12 | 55,028,000 | 60,462,015 |

Rayonier TRS Holdings, Inc., 4.50%, 8/15/15(3) | 38,670,000 | 46,355,663 |

| 445,198,628 | ||

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 1.2% | ||

| Linear Technology Corp., 3.125%, 5/1/27 | 34,000,000 | 34,212,500 |

| Microchip Technology, Inc., 2.125%, 12/15/37 | 19,500,000 | 21,986,250 |

| Verigy Ltd., 5.25%, 7/15/14 | 26,739,000 | 27,641,441 |

| 83,840,191 | ||

| SPECIALTY RETAIL — 1.9% | ||

| Best Buy Co., Inc., 2.25%, 1/15/22 | 81,659,000 | 89,926,974 |

Credit Suisse Securities USA LLC, (convertible into Lowe’s Cos., Inc.), 8.85%, 11/22/10(2)(3) | 1,000,000 | 22,385,000 |

Morgan Stanley, (convertible into Gap, Inc. (The)), 10.15%, 1/14/11(2)(3) | 732,400 | 14,164,616 |

| 126,476,590 | ||

TOTAL CONVERTIBLE BONDS (Cost $1,339,221,686) | 1,420,407,202 | |

| Convertible Preferred Stocks — 4.2% | ||

| DIVERSIFIED FINANCIAL SERVICES — 3.9% | ||

Bank of America Corp., 7.25%, 12/31/49(5) | 271,500 | 266,748,750 |

| INSURANCE — 0.1% | ||

| Hartford Financial Services Group, Inc., 7.25%, 4/1/13 | 255,000 | 6,048,600 |

| OIL, GAS & CONSUMABLE FUELS — 0.2% | ||

| Apache Corp., 6.00%, 8/1/13 | 287,183 | 16,656,614 |

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $224,535,731) | 289,453,964 | |

| Temporary Cash Investments — 2.3% | ||

| JPMorgan U.S. Treasury Plus Money Market Fund Agency Shares | 47,648 | 47,648 |

Repurchase Agreement, Credit Suisse First Boston, Inc., (collateralized by various U.S. Treasury obligations, 3.375%, 11/15/19, valued at $156,751,671), in a joint trading account at 0.18%, dated 9/30/10, due 10/1/10 (Delivery value $153,700,769) | 153,700,000 | |

TOTAL TEMPORARY CASH INVESTMENTS (Cost $153,747,648) | 153,747,648 | |

TOTAL INVESTMENT SECURITIES — 99.7% (Cost $6,122,347,531) | 6,810,807,684 | |

| OTHER ASSETS AND LIABILITIES — 0.3% | 22,480,723 | |

| TOTAL NET ASSETS — 100.0% | $6,833,288,407 | |

14

Equity Income

| Forward Foreign Currency Exchange Contracts | ||||

| Contracts to Sell | Counterparty | Settlement Date | Value | Unrealized Gain (Loss) |

179,063,366 EUR for USD | UBS AG | 10/29/10 | $244,063,368 | $(2,669,835) |

(Value on Settlement Date $241,393,533)

Notes to Schedule of Investments

| CVA = Certificaten Van Aandelen |

| EUR = Euro |

| USD = United States Dollar |

| VRN = Variable Rate Note. Interest reset date is indicated. Rate shown is effective at the period end. |

| (1) | Affiliated Company: the fund’s holding represents ownership of 5% or more of the voting securities of the company; therefore, the company is affiliated as defined in the Investment Company Act of 1940. |

| (2) | Equity-linked debt security. The aggregated value of these securities at the period end was $213,530,336, which represented 3.1% of total net assets. |

| (3) | Security was purchased under Rule 144A of the Securities Act of 1933 or is a private placement and, unless registered under the Act or exempted from registration, may only be sold to qualified institutional investors. The aggregate value of these securities at the period end was $442,864,449, which represented 6.5% of total net assets. |

| (4) | Industry is less than 0.05% of total net assets. |

| (5) | Perpetual security. These securities do not have a predetermined maturity date. The coupon rates are fixed for a period of time and may be structured to adjust thereafter. Interest reset or next call date is indicated, as applicable. |

| See Notes to Financial Statements. |

15

Statement of Assets and Liabilities

| SEPTEMBER 30, 2010 (UNAUDITED) | |

| Assets | |

| Investment securities — unaffiliated, at value (cost of $6,052,727,383) | $6,715,538,311 |

| Investment securities — affiliated, at value (cost of $69,620,148) | 95,269,373 |

| Total investment securities, at value (cost of $6,122,347,531) | 6,810,807,684 |

| Receivable for investments sold | 60,876,934 |

| Receivable for capital shares sold | 14,767,589 |

| Dividends and interest receivable | 23,311,975 |

| 6,909,764,182 | |

| Liabilities | |

| Payable for investments purchased | 52,769,056 |

| Payable for capital shares redeemed | 15,369,997 |

| Payable for forward foreign currency exchange contracts | 2,669,835 |

| Accrued management fees | 5,110,051 |

| Service fees (and distribution fees — A Class and R Class) payable | 408,312 |

| Distribution fees payable | 148,524 |

| 76,475,775 | |

| Net Assets | $6,833,288,407 |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $ 7,207,812,439 |

| Undistributed net investment income | 7,452,811 |

| Accumulated net realized loss on investment and foreign currency transactions | (1,067,764,263) |

| Net unrealized appreciation on investments and translation of assets and liabilities in foreign currencies | 685,787,420 |

| $ 6,833,288,407 | |

| Net assets | Shares outstanding | Net asset value per share | ||||||||||

| Investor Class, $0.01 Par Value | $4,071,033,652 | 600,191,309 | $6.78 | |||||||||

| Institutional Class, $0.01 Par Value | $820,465,287 | 120,911,249 | $6.79 | |||||||||

| A Class, $0.01 Par Value | $1,589,972,178 | 234,403,123 | $6.78 | * | ||||||||

| B Class, $0.01 Par Value | $7,117,173 | 1,047,887 | $6.79 | |||||||||

| C Class, $0.01 Par Value | $240,845,290 | 35,495,355 | $6.79 | |||||||||

| R Class, $0.01 Par Value | $103,854,827 | 15,341,485 | $6.77 | |||||||||

*Maximum offering price $7.19 (net asset value divided by 0.9425)

See Notes to Financial Statements.

16

Statement of Operations

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2010 (UNAUDITED) | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (including $1,896,324 from affiliates and net of foreign taxes withheld of $930,538) | $ 119,911,031 |

| Interest | 18,624,269 |

| 138,535,300 | |

| Expenses: | |

| Management fees | 29,727,567 |

| Distribution fees: | |

| B Class | 26,563 |

| C Class | 804,837 |

| Service fees: | |

| B Class | 8,855 |

| C Class | 268,279 |

| Distribution and service fees: | |

| A Class | 1,796,180 |

| R Class | 238,249 |

| Directors’ fees and expenses | 127,310 |

| Other expenses | 294,558 |

| 33,292,398 | |

| Net investment income (loss) | 105,242,902 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions (including $382,364 from affiliates) | 144,335,419 |

| Foreign currency transactions | (4,680,359) |

| 139,655,060 | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | (105,198,130) |

| Translation of assets and liabilities in foreign currencies | (1,852,317) |

| (107,050,447) | |

| Net realized and unrealized gain (loss) | 32,604,613 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ 137,847,515 |

See Notes to Financial Statements.

17

Statement of Changes in Net Assets

| SIX MONTHS ENDED SEPTEMBER 30, 2010 (UNAUDITED) AND YEAR ENDED MARCH 31, 2010 | ||

| Increase (Decrease) in Net Assets | September 30, 2010 | March 31, 2010 |

| Operations | ||

| Net investment income (loss) | $ 105,242,902 | $ 155,068,579 |

| Net realized gain (loss) | 139,655,060 | 229,428,715 |

| Change in net unrealized appreciation (depreciation) | (107,050,447) | 917,431,499 |

| Net increase (decrease) in net assets resulting from operations | 137,847,515 | 1,301,928,793 |

| Distributions to Shareholders | ||

| From net investment income: | ||

| Investor Class | (66,428,745) | (91,538,788) |

| Institutional Class | (14,074,318) | (18,672,015) |

| A Class | (23,354,459) | (27,339,571) |

| B Class | (84,554) | (92,764) |

| C Class | (2,682,272) | (2,474,684) |

| R Class | (1,420,693) | (1,479,300) |

| Decrease in net assets from distributions | (108,045,041) | (141,597,122) |

| Capital Share Transactions | ||

| Net increase (decrease) in net assets from capital share transactions | 503,135,386 | 794,999,912 |

| Net increase (decrease) in net assets | 532,937,860 | 1,955,331,583 |

| Net Assets | ||

| Beginning of period | 6,300,350,547 | 4,345,018,964 |

| End of period | $6,833,288,407 | $6,300,350,547 |

| Undistributed net investment income | $7,452,811 | $10,254,950 |

See Notes to Financial Statements.

18

Notes to Financial Statements

SEPTEMBER 30, 2010 (UNAUDITED)

1. Organization and Summary of Significant Accounting Policies

Organization — American Century Capital Portfolios, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act) as an open-end management investment company and is organized as a Maryland corporation. Equity Income Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified under the 1940 Act. The fund’s investment objective is to seek current income. Capital appreciation is a secondary objective. The fund pursues its objectives by investing in securities of companies with a favorable income-paying history that have prospects for income payments to continue or increase. The following is a summary of the fund’s significant accounting policies.

Multiple Class — The fund is authorized to issue the Investor Class, the Institutional Class, the A Class, the B Class, the C Class and the R Class. The A Class may incur an initial sales charge. The A Class, B Class and C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expe nses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Security Valuations — Securities traded primarily on a principal securities exchange are valued at the last reported sales price, or at the mean of the latest bid and asked prices where no last sales price is available. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official close price. Investments in open-end management investment companies are valued at the reported net asset value. Debt securities maturing in greater than 60 days at the time of purchase are valued at current market value as provided by a commercial pricing service or at the mean of the most recent bid and asked prices. Debt securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium. Discount notes may be valued through a commercial pricing service or at amortized cost, which approximates fair value. Securities traded on foreign securities exchanges and over-the-counter markets are normally completed before the close of business on days that the New York Stock Exchange (the Exchange) is open and may also take place on days when the Exchange is not open. If an event occurs after the value of a security was established but before the net asset value per share was determined that was likely to materially change the net asset value, that security would be valued as determined in accordance with procedures adopted by the Board of Directors. If the fund determines that the market price of a portfolio security is not readily available, or that the valuation methods mentioned above do not reflect the security’s fair value, such security is valued as determined by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors, if such determination would materially impact a fund’s net asset value. Certain other circumstances may cause the fund to use alternative procedures to value a security such as: a security has been declared in default; trading in a security has been halted during the trading day; or there is a foreign market holiday and no trading will commence.

Security Transactions — For financial reporting purposes, security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

19

Equity-Linked Debt and Linked-Equity Securities — The fund may invest in hybrid equity securities, which usually convert into common stock at a date predetermined by the issuer. These securities generally offer a higher dividend yield than that of the common stock to which the security is linked. These instruments are issued by a company other than the one to which the security is linked and carry the credit of the issuer, not that of the underlying common stock. The securities’ appreciation is limited based on a predetermined final cap price at the date of the conversion. Risks of investing in these securities include, but are not limited to, a set time to capture the yield advantage, limited appreciation potential, decline in value of the underlying stock, and failure of the issuer to pay dividends or to deliver common stock at maturity.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and certain expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. For assets and liabilities, other than investments in securities, net realized and unrealized gains and losses from foreign currency translations arise from changes in currency exchange rates.

Net realized and unrealized foreign currency exchange gains or losses occurring during the holding period of investment securities are a component of net realized gain (loss) on investment transactions and net unrealized appreciation (depreciation) on investments, respectively. Certain countries may impose taxes on the contract amount of purchases and sales of foreign currency contracts in their currency. The fund records the foreign tax expense, if any, as a reduction to the net realized gain (loss) on foreign currency transactions.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2007. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Distributions to Shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income are declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

20

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

Use of Estimates — The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

2. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a Management Agreement (the Agreement) with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The Agreement provides that all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on the daily net assets of the specific class of shares of the fund and paid monthly in arrears. The rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account the fund’s assets as wel l as certain assets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that have very similar investment teams and investment strategies (strategy assets). The annual management fee schedule ranges from 0.80% to 1.00% for the Investor Class, A Class, B Class, C Class and R Class. The Institutional Class is 0.20% less at each point within the range. The effective annual management fee for each class for the six months ended September 30, 2010 was 0.96% for the Investor Class, A Class, B Class, C Class and R Class and 0.76% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, B Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay American Century Investment Services, Inc. (ACIS) an annual distribution and service fee of 0.25%. The plans provide that the B Class and C Class will each pay ACIS an annual distribution fee of 0.75% and service fee of 0.25%. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the six months ended September 30, 2010, are detailed in the Statement of Operations.

Related Parties — Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACIM, the distributor of the corporation, ACIS, and the corporation’s transfer agent, American Century Services, LLC.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a Mutual Funds Services Agreement with J.P. Morgan Investor Services Co. (JPMIS) and a securities lending agreement with JPMorgan Chase Bank (JPMCB). JPMCB is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor in ACC.

3. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the six months ended September 30, 2010, were $5,184,526,905 and $4,722,138,960, respectively.

21

4. Capital Share Transactions

Transactions in shares of the fund were as follows:

| Six months ended September 30, 2010 | Year ended March 31, 2010 | |||

| Shares | Amount | Shares | Amount | |

| Investor Class/Shares Authorized | 1,800,000,000 | 1,800,000,000 | ||

| Sold | 84,386,765 | $ 557,459,521 | 169,677,002 | $1,047,154,389 |

| Issued in reinvestment of distributions | 8,757,776 | 58,449,385 | 13,016,992 | 82,056,572 |

| Redeemed | (59,065,414) | (390,644,665) | (154,423,129) | (955,914,532) |

| 34,079,127 | 225,264,241 | 28,270,865 | 173,296,429 | |

| Institutional Class/Shares Authorized | 360,000,000 | 350,000,000 | ||

| Sold | 18,682,601 | 123,708,554 | 47,822,155 | 296,483,471 |

| Issued in reinvestment of distributions | 1,860,161 | 12,415,010 | 2,654,543 | 16,791,045 |

| Redeemed | (16,669,472) | (110,739,668) | (26,155,585) | (159,873,283) |

| 3,873,290 | 25,383,896 | 24,321,113 | 153,401,233 | |

| A Class/Shares Authorized | 650,000,000 | 600,000,000 | ||

| Sold | 54,778,387 | 361,911,189 | 107,205,616 | 663,509,713 |

| Issued in reinvestment of distributions | 3,339,014 | 22,294,604 | 4,162,263 | 26,333,580 |

| Redeemed | (28,513,368) | (188,284,034) | (53,208,153) | (333,546,851) |

| 29,604,033 | 195,921,759 | 58,159,726 | 356,296,442 | |

| B Class/Shares Authorized | 5,000,000 | 10,000,000 | ||

| Sold | 26,160 | 171,825 | 724,358 | 4,355,007 |

| Issued in reinvestment of distributions | 10,517 | 70,295 | 11,269 | 71,783 |

| Redeemed | (78,741) | (523,052) | (86,971) | (547,248) |

| (42,064) | (280,932) | 648,656 | 3,879,542 | |

| C Class/Shares Authorized | 105,000,000 | 100,000,000 | ||

| Sold | 9,467,681 | 62,874,701 | 14,315,632 | 88,023,700 |

| Issued in reinvestment of distributions | 322,953 | 2,156,759 | 325,677 | 2,055,686 |

| Redeemed | (2,930,126) | (19,332,582) | (3,896,987) | (24,563,635) |

| 6,860,508 | 45,698,878 | 10,744,322 | 65,515,751 | |

| R Class/Shares Authorized | 50,000,000 | 50,000,000 | ||

| Sold | 3,021,624 | 19,921,796 | 11,210,088 | 68,808,648 |

| Issued in reinvestment of distributions | 206,573 | 1,376,177 | 226,679 | 1,442,220 |

| Redeemed | (1,548,274) | (10,150,429) | (4,358,485) | (27,640,353) |

| 1,679,923 | 11,147,544 | 7,078,282 | 42,610,515 | |

| Net increase (decrease) | 76,054,817 | $ 503,135,386 | 129,222,964 | $ 794,999,912 |

5. Affiliated Company Transactions

If a fund’s holding represents ownership of 5% or more of the voting securities of a company, the company is affiliated as defined in the 1940 Act. A summary of transactions for each company which is or was an affiliate at or during the six months ended September 30, 2010 follows:

| March 31, 2010 | September 30, 2010 | ||||||

| Company | Share Balance | Purchase Cost | Sales Cost | Realized Gain (Loss) | Dividend Income | Share Balance | Market Value |

| WGL Holdings, Inc. | 2,505,688 | $3,370,741 | $2,578,796 | $382,364 | $1,896,324 | 2,521,688 | $95,269,373 |

22

6. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities; |

| • | Level 2 valuation inputs consist of significant direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or |

| • | Level 3 valuation inputs consist of significant unobservable inputs (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the valuation inputs used to determine the fair value of the fund’s securities and other financial instruments as of September 30, 2010. The Schedule of Investments provides additional details on the fund’s portfolio holdings.

| Level 1 | Level 2 | Level 3 | ||||||||||

| Investment Securities | ||||||||||||

| Domestic Common Stocks | $4,540,023,653 | — | — | |||||||||

| Foreign Common Stocks | 150,292,843 | $256,882,374 | — | |||||||||

| Convertible Bonds | — | 1,420,407,202 | — | |||||||||

| Convertible Preferred Stocks | — | 289,453,964 | — | |||||||||

| Temporary Cash Investments | 47,648 | 153,700,000 | — | |||||||||

| Total Value of Investment Securities | $4,690,364,144 | $2,120,443,540 | — | |||||||||

| Other Financial Instruments | ||||||||||||

Total Unrealized Gain (Loss) on Forward Foreign Currency Exchange Contracts | — | $(2,669,835 | ) | — | ||||||||

7. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund’s exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting u nrealized appreciation or depreciation are determined daily using prevailing exchange rates. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on foreign currency transactions and change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The risk of loss from non-performance by

23

the counterparty may be reduced by the use of master netting agreements. The foreign currency risk derivative instruments held at period end as disclosed on the Schedule of Investments are indicative of the fund’s typical volume during the period.

The value of foreign currency risk derivative instruments as of September 30, 2010, is disclosed on the Statement of Assets and Liabilities as a liability of $2,669,835 in payable for forward foreign currency exchange contracts. For the six months ended September 30, 2010, the effect of foreign currency risk derivative instruments on the Statement of Operations was $(4,702,326) in net realized gain (loss) on foreign currency transactions and $(1,841,759) in change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies.

8. Risk Factors

There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social, and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions.

9. Interfund Lending

The fund, along with certain other funds in the American Century Investments family of funds, may participate in an interfund lending program, pursuant to an Exemptive Order issued by the Securities and Exchange Commission (SEC). This program provides an alternative credit facility allowing the fund to borrow from or lend to other funds in the American Century Investments family of funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. The interfund loan rate earned/paid on interfund lending transactions is determined daily based on the average of certain current market rates. Interfund lending transactions normally extend only overnight, but can have a maximum duration of seven days. The program is subject to annual appr oval by the Board of Directors. During the six months ended September 30, 2010, the fund did not utilize the program.

10. Federal Tax Information

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of September 30, 2010, the components of investments for federal income tax purposes were as follows:

| Federal tax cost of investments | $6,370,394,140 | |||

| Gross tax appreciation of investments | $504,196,760 | |||

| Gross tax depreciation of investments | (63,783,216 | ) | ||

| Net tax appreciation (depreciation) of investments | $440,413,544 | |||

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

As of March 31, 2010, the fund had accumulated capital losses of $(997,492,082), which represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations. Capital loss carryovers of $(417,263,106) and $(580,228,976) expire in 2017 and 2018, respectively.

24

Financial Highlights

Equity Income

| Investor Class | ||||||||||||||||||||||||

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | ||||||||||||||||||||||||

2010(1) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||||||

| Per-Share Data | ||||||||||||||||||||||||

Net Asset Value, Beginning of Period | $6.76 | $5.42 | $7.30 | $8.65 | $8.11 | $8.05 | ||||||||||||||||||

Income From Investment Operations | ||||||||||||||||||||||||

Net Investment Income (Loss)(2) | 0.11 | 0.18 | 0.22 | 0.23 | 0.21 | 0.20 | ||||||||||||||||||

Net Realized and Unrealized Gain (Loss) | 0.02 | 1.33 | (1.87 | ) | (0.62 | ) | 1.05 | 0.36 | ||||||||||||||||

Total From Investment Operations | 0.13 | 1.51 | (1.65 | ) | (0.39 | ) | 1.26 | 0.56 | ||||||||||||||||

| Distributions | ||||||||||||||||||||||||

From Net Investment Income | (0.11 | ) | (0.17 | ) | (0.23 | ) | (0.23 | ) | (0.17 | ) | (0.18 | ) | ||||||||||||

From Net Realized Gains | — | — | — | (0.73 | ) | (0.55 | ) | (0.32 | ) | |||||||||||||||

| Total Distributions | (0.11 | ) | (0.17 | ) | (0.23 | ) | (0.96 | ) | (0.72 | ) | (0.50 | ) | ||||||||||||

Net Asset Value, End of Period | $6.78 | $6.76 | $5.42 | $7.30 | $8.65 | $8.11 | ||||||||||||||||||

Total Return(3) | 2.00 | % | 28.04 | % | (22.98 | )% | (5.17 | )% | 15.79 | % | 7.21 | % | ||||||||||||

| �� | ||||||||||||||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||||||

Ratio of Operating Expenses to Average Net Assets | 0.97 | %(4) | 0.97 | % | 0.98 | % | 0.97 | % | 0.97 | % | 0.98 | % | ||||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets | 3.37 | %(4) | 2.93 | % | 3.36 | % | 2.68 | % | 2.43 | % | 2.53 | % | ||||||||||||

| Portfolio Turnover Rate | 80 | % | 105 | % | 296 | % | 165 | % | 160 | % | 150 | % | ||||||||||||

| Net Assets, End of Period (in thousands) | $4,071,034 | $3,829,492 | $2,913,351 | $3,719,757 | $4,790,510 | $3,715,366 | ||||||||||||||||||

| (1) | Six months ended September 30, 2010 (unaudited). |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year are not annualized. Total returns are calculated based on the net asset value of the last business day. |

| (4) | Annualized. |

| See Notes to Financial Statements. |

25

Equity Income

| Institutional Class | ||||||||||||||||||||||||

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | ||||||||||||||||||||||||

2010(1) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||||||

| Per-Share Data | ||||||||||||||||||||||||

Net Asset Value, Beginning of Period | $6.77 | $5.42 | $7.31 | $8.65 | $8.11 | $8.06 | ||||||||||||||||||

Income From Investment Operations | ||||||||||||||||||||||||

Net Investment Income (Loss)(2) | 0.12 | 0.19 | 0.23 | 0.25 | 0.23 | 0.22 | ||||||||||||||||||

Net Realized and Unrealized Gain (Loss) | 0.02 | 1.34 | (1.88 | ) | (0.61 | ) | 1.05 | 0.35 | ||||||||||||||||

Total From Investment Operations | 0.14 | 1.53 | (1.65 | ) | (0.36 | ) | 1.28 | 0.57 | ||||||||||||||||

| Distributions | ||||||||||||||||||||||||

From Net Investment Income | (0.12 | ) | (0.18 | ) | (0.24 | ) | (0.25 | ) | (0.19 | ) | (0.20 | ) | ||||||||||||

From Net Realized Gains | — | — | — | (0.73 | ) | (0.55 | ) | (0.32 | ) | |||||||||||||||

| Total Distributions | (0.12 | ) | (0.18 | ) | (0.24 | ) | (0.98 | ) | (0.74 | ) | (0.52 | ) | ||||||||||||

Net Asset Value, End of Period | $6.79 | $6.77 | $5.42 | $7.31 | $8.65 | $8.11 | ||||||||||||||||||

Total Return(3) | 2.25 | % | 28.30 | % | (22.94 | )% | (4.85 | )% | 16.01 | % | 7.29 | % | ||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||||||

Ratio of Operating Expenses to Average Net Assets | 0.77 | %(4) | 0.77 | % | 0.78 | % | 0.77 | % | 0.77 | % | 0.78 | % | ||||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets | 3.57 | %(4) | 3.13 | % | 3.56 | % | 2.88 | % | 2.63 | % | 2.73 | % | ||||||||||||

| Portfolio Turnover Rate | 80 | % | 105 | % | 296 | % | 165 | % | 160 | % | 150 | % | ||||||||||||

| Net Assets, End of Period (in thousands) | $820,465 | $792,024 | $502,435 | $496,033 | $551,202 | $382,909 | ||||||||||||||||||

| (1) | Six months ended September 30, 2010 (unaudited). |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year are not annualized. Total returns are calculated based on the net asset value of the last business day. |

| (4) | Annualized. |

| See Notes to Financial Statements. |

26

Equity Income

A Class(1) | ||||||||||||||||||||||||

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | ||||||||||||||||||||||||

2010(2) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||||||

| Per-Share Data | ||||||||||||||||||||||||

Net Asset Value, Beginning of Period | $6.76 | $5.42 | $7.30 | $8.65 | $8.11 | $8.05 | ||||||||||||||||||

Income From Investment Operations | ||||||||||||||||||||||||

Net Investment Income (Loss)(3) | 0.10 | 0.17 | 0.20 | 0.20 | 0.19 | 0.18 | ||||||||||||||||||

Net Realized and Unrealized Gain (Loss) | 0.02 | 1.32 | (1.86 | ) | (0.61 | ) | 1.05 | 0.36 | ||||||||||||||||

Total From Investment Operations | 0.12 | 1.49 | (1.66 | ) | (0.41 | ) | 1.24 | 0.54 | ||||||||||||||||

| Distributions | ||||||||||||||||||||||||

From Net Investment Income | (0.10 | ) | (0.15 | ) | (0.22 | ) | (0.21 | ) | (0.15 | ) | (0.16 | ) | ||||||||||||

From Net Realized Gains | — | — | — | (0.73 | ) | (0.55 | ) | (0.32 | ) | |||||||||||||||

| Total Distributions | (0.10 | ) | (0.15 | ) | (0.22 | ) | (0.94 | ) | (0.70 | ) | (0.48 | ) | ||||||||||||

Net Asset Value, End of Period | $6.78 | $6.76 | $5.42 | $7.30 | $8.65 | $8.11 | ||||||||||||||||||

Total Return(4) | 1.87 | % | 27.71 | % | (23.18 | )% | (5.40 | )% | 15.51 | % | 6.94 | % | ||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||||||

Ratio of Operating Expenses to Average Net Assets | 1.22 | %(5) | 1.22 | % | 1.23 | % | 1.22 | % | 1.22 | % | 1.23 | % | ||||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets | 3.12 | %(5) | 2.68 | % | 3.11 | % | 2.43 | % | 2.18 | % | 2.28 | % | ||||||||||||

| Portfolio Turnover Rate | 80 | % | 105 | % | 296 | % | 165 | % | 160 | % | 150 | % | ||||||||||||

| Net Assets, End of Period (in thousands) | $1,589,972 | $1,385,436 | $794,323 | $933,600 | $1,280,888 | $902,749 | ||||||||||||||||||

| (1) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class. |

| (2) | Six months ended September 30, 2010 (unaudited). |

| (3) | Computed using average shares outstanding throughout the period. |

| (4) | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. Total returns are calculated based on the net asset value of the last business day. |

| (5 | )Annualized. |

| See Notes to Financial Statements. |

27

Equity Income

| B Class | ||||||||||||||||

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | ||||||||||||||||

2010(1) | 2010 | 2009 | 2008(2) | |||||||||||||

| Per-Share Data | ||||||||||||||||

| Net Asset Value, Beginning of Period | $6.77 | $5.42 | $7.30 | $8.99 | ||||||||||||

| Income From Investment Operations | ||||||||||||||||

Net Investment Income (Loss)(3) | 0.08 | 0.12 | 0.15 | 0.08 | ||||||||||||

| Net Realized and Unrealized Gain (Loss) | 0.02 | 1.33 | (1.86 | ) | (0.95 | ) | ||||||||||

| Total From Investment Operations | 0.10 | 1.45 | (1.71 | ) | (0.87 | ) | ||||||||||

| Distributions | ||||||||||||||||

| From Net Investment Income | (0.08 | ) | (0.10 | ) | (0.17 | ) | (0.09 | ) | ||||||||

| From Net Realized Gains | — | — | — | (0.73 | ) | |||||||||||

| Total Distributions | (0.08 | ) | (0.10 | ) | (0.17 | ) | (0.82 | ) | ||||||||

| Net Asset Value, End of Period | $6.79 | $6.77 | $5.42 | $7.30 | ||||||||||||

Total Return(4) | 1.49 | % | 26.92 | % | (23.75 | )% | (10.28 | )% | ||||||||

| Ratios/Supplemental Data | ||||||||||||||||

| Ratio of Operating Expenses to Average Net Assets | 1.97 | %(5) | 1.97 | % | 1.98 | % | 1.97 | %(5) | ||||||||

| Ratio of Net Investment Income (Loss) to Average Net Assets | 2.37 | %(5) | 1.93 | % | 2.36 | 2.11 | %(5) | |||||||||

| Portfolio Turnover Rate | 80 | % | 105 | % | 296 | % | 165 | %(6) | ||||||||

| Net Assets, End of Period (in thousands) | $7,117 | $7,383 | $2,392 | $235 | ||||||||||||

| (1) | Six months ended September 30, 2010 (unaudited). |

| (2) | September 28, 2007 (commencement of sale) through March 31, 2008. |

| (3) | Computed using average shares outstanding throughout the period. |

| (4) | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. Total returns are calculated based on the net asset value of the last business day. |

| (5) | Annualized. |

| (6) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended March 31, 2008. |

| See Notes to Financial Statements. |

28

Equity Income

| C Class | ||||||||||||||||||||||||

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | ||||||||||||||||||||||||

2010(1) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||||||

| Per-Share Data | ||||||||||||||||||||||||

Net Asset Value, Beginning of Period | $6.77 | $5.42 | $7.30 | $8.65 | $8.11 | $8.06 | ||||||||||||||||||

Income From Investment Operations | ||||||||||||||||||||||||

Net Investment Income (Loss)(2) | 0.08 | 0.12 | 0.15 | 0.14 | 0.12 | 0.13 | ||||||||||||||||||