UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07852

USAA Mutual Funds Trust

(Exact name of registrant as specified in charter)

| 15935 La Cantera Pkwy, San Antonio, Texas | | 78256 |

| (Address of principal executive offices) | | (Zip code) |

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-235-8396

Date of fiscal year end: March 31

Date of reporting period: September 30, 2021

Item 1. Reports to Stockholders.

September 30, 2021

Semi Annual Report

USAA Global Equity Income Fund

Victory Capital means Victory Capital Management Inc., the investment adviser of the USAA Mutual Funds. USAA Mutual Funds are distributed by Victory Capital Services, Inc., member FINRA, an affiliate of Victory Capital. Victory Capital and its affiliates are not affiliated with United Services Automobile Association or its affiliates. USAA and the USAA logos are registered trademarks and the USAA Mutual Funds and USAA Investments logos are trademarks of United Services Automobile Association and are being used by Victory Capital and its affiliates under license.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Capital site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

TABLE OF CONTENTS

Investment Objective & Portfolio Holdings | | | 2 | | |

Schedule of Portfolio Investments | | | 3 | | |

Financial Statements | |

Statement of Assets and Liabilities | | | 11 | | |

Statement of Operations | | | 12 | | |

Statements of Changes in Net Assets | | | 13 | | |

Financial Highlights | | | 14 | | |

Notes to Financial Statements | | | 16 | | |

Supplemental Information | | | 25 | | |

Proxy Voting and Portfolio Holdings Information | | | 25 | | |

Expense Examples | | | 25 | | |

Privacy Policy (inside back cover) | | | |

This report is for the information of the shareholders and others who have received a copy of the currently effective prospectus of the Fund, managed by Victory Capital Management Inc. It may be used as sales literature only when preceded or accompanied by a current prospectus, which provides further details about the Fund.

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call (800) 235-8396, and form W-4P (OMB No. 1545-0074 withholding certificate for pension or annuity payments) will be electronically sent.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

1

USAA Mutual Funds Trust

USAA Global Equity Income Fund | | September 30, 2021 | |

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks total return with an emphasis on current income.

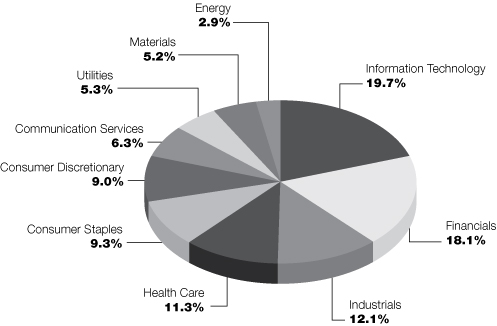

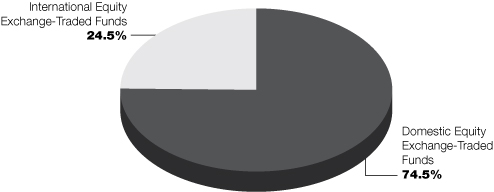

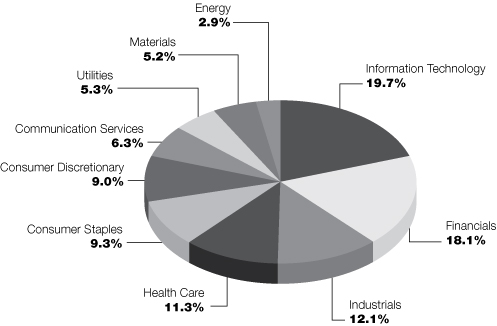

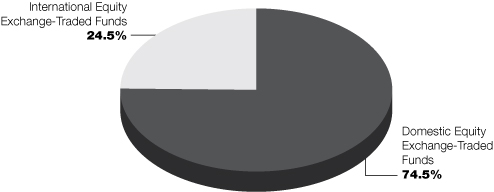

Sector Allocation*

September 30, 2021

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

2

USAA Mutual Funds Trust

USAA Global Equity Income Fund | | Schedule of Portfolio Investments

September 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (99.2%) | |

Australia (0.8%): | |

Energy (0.1%): | |

Washington H Soul Pattinson & Co. Ltd. (a) | | | 3,210 | | | $ | 89 | | |

Financials (0.4%): | |

ASX Ltd. | | | 4,306 | | | | 249 | | |

Materials (0.3%): | |

Evolution Mining Ltd. | | | 70,468 | | | | 178 | | |

| | | | 516 | | |

Austria (0.1%): | |

Energy (0.1%): | |

OMV AG | | | 1,357 | | | | 82 | | |

Belgium (0.4%): | |

Communication Services (0.3%): | |

Telenet Group Holding NV | | | 4,803 | | | | 183 | | |

Consumer Staples (0.1%): | |

Etablissements Franz Colruyt NV | | | 1,235 | | | | 63 | | |

| | | | 246 | | |

Canada (5.5%): | |

Consumer Discretionary (0.6%): | |

Dollarama, Inc. | | | 3,899 | | | | 169 | | |

Magna International, Inc. | | | 2,945 | | | | 222 | | |

| | | | 391 | | |

Consumer Staples (0.1%): | |

Metro, Inc. | | | 1,399 | | | | 68 | | |

Energy (0.8%): | |

Canadian Natural Resources Ltd. | | | 10,141 | | | | 371 | | |

Parkland Corp. | | | 4,259 | | | | 119 | | |

| | | | 490 | | |

Financials (3.3%): | |

Bank of Montreal | | | 5,065 | | | | 506 | | |

Manulife Financial Corp. | | | 13,254 | | | | 255 | | |

Power Corp. of Canada | | | 9,948 | | | | 328 | | |

Sun Life Financial, Inc. | | | 6,426 | | | | 331 | | |

The Bank of Nova Scotia | | | 4,500 | | | | 277 | | |

The Toronto-Dominion Bank | | | 5,611 | | | | 371 | | |

| | | | 2,068 | | |

Industrials (0.2%): | |

Thomson Reuters Corp. | | | 855 | | | | 95 | | |

See notes to financial statements.

3

USAA Mutual Funds Trust

USAA Global Equity Income Fund | | Schedule of Portfolio Investments — continued

September 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Information Technology (0.5%): | |

Constellation Software, Inc. | | | 178 | | | $ | 292 | | |

| | | | 3,404 | | |

Denmark (1.1%): | |

Health Care (0.9%): | |

Coloplast A/S Class B | | | 1,254 | | | | 196 | | |

Novo Nordisk A/S Class B | | | 3,439 | | | | 331 | | |

| | | | 527 | | |

Industrials (0.2%): | |

AP Moller — Maersk A/S Class B | | | 55 | | | | 149 | | |

| | | | 676 | | |

Finland (0.7%): | |

Communication Services (0.1%): | |

Elisa Oyj | | | 1,132 | | | | 70 | | |

Utilities (0.6%): | |

Fortum Oyj | | | 11,424 | | | | 347 | | |

| | | | 417 | | |

France (0.5%): | |

Consumer Staples (0.5%): | |

L'Oreal SA | | | 780 | | | | 323 | | |

Germany (1.5%): | |

Consumer Discretionary (0.2%): | |

Volkswagen AG Preference Shares | | | 398 | | | | 89 | | |

Financials (1.1%): | |

Allianz SE Registered Shares | | | 2,734 | | | | 613 | | |

Deutsche Boerse AG | | | 366 | | | | 59 | | |

| | | | 672 | | |

Industrials (0.1%): | |

Deutsche Post AG Registered Shares | | | 1,063 | | | | 67 | | |

Information Technology (0.1%): | |

SAP SE | | | 603 | | | | 81 | | |

| | | | 909 | | |

Hong Kong (0.9%): | |

Consumer Discretionary (0.1%): | |

Xinyi Glass Holdings Ltd. | | | 26,000 | | | | 77 | | |

Financials (0.3%): | |

Hong Kong Exchanges and Clearing Ltd. | | | 2,600 | | | | 160 | | |

Industrials (0.2%): | |

Jardine Matheson Holdings Ltd. | | | 2,000 | | | | 106 | | |

Utilities (0.3%): | |

Power Assets Holdings Ltd. | | | 37,000 | | | | 217 | | |

| | | | 560 | | |

See notes to financial statements.

4

USAA Mutual Funds Trust

USAA Global Equity Income Fund | | Schedule of Portfolio Investments — continued

September 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Ireland (1.9%): | |

Health Care (0.1%): | |

STERIS PLC | | | 353 | | | $ | 72 | | |

Industrials (0.6%): | |

Eaton Corp. PLC | | | 1,889 | | | | 282 | | |

Trane Technologies PLC | | | 728 | | | | 126 | | |

| | | | 408 | | |

Information Technology (1.2%): | |

Seagate Technology Holdings PLC | | | 8,852 | | | | 730 | | |

| | | | 1,210 | | |

Italy (0.5%): | |

Utilities (0.5%): | |

Enel SpA | | | 25,013 | | | | 192 | | |

Terna — Rete Elettrica Nazionale | | | 19,120 | | | | 136 | | |

| | | | 328 | | |

Japan (7.7%): | |

Communication Services (2.2%): | |

Kakaku.com, Inc. | | | 2,700 | | | | 87 | | |

KDDI Corp. | | | 14,700 | | | | 484 | | |

Nintendo Co. Ltd. | | | 800 | | | | 382 | | |

Nippon Telegraph & Telephone Corp. | | | 16,400 | | | | 455 | | |

| | | | 1,408 | | |

Consumer Discretionary (1.6%): | |

Bridgestone Corp. | | | 5,100 | | | | 241 | | |

Iida Group Holdings Co. Ltd. | | | 7,500 | | | | 193 | | |

Sony Group Corp. | | | 1,500 | | | | 167 | | |

Toyota Motor Corp. | | | 21,500 | | | | 383 | | |

| | | | 984 | | |

Consumer Staples (0.5%): | |

Seven & i Holdings Co. Ltd. | | | 6,400 | | | | 291 | | |

Energy (0.5%): | |

ENEOS Holdings, Inc. | | | 80,400 | | | | 327 | | |

Financials (1.0%): | |

ORIX Corp. | | | 9,100 | | | | 170 | | |

Resona Holdings, Inc. | | | 29,800 | | | | 119 | | |

Sumitomo Mitsui Financial Group, Inc. | | | 10,000 | | | | 352 | | |

| | | | 641 | | |

Health Care (0.3%): | |

Hoya Corp. | | | 1,100 | | | | 172 | | |

Industrials (0.7%): | |

ITOCHU Corp. | | | 10,600 | | | | 309 | | |

Mitsubishi Corp. | | | 4,100 | | | | 129 | | |

| | | | 438 | | |

See notes to financial statements.

5

USAA Mutual Funds Trust

USAA Global Equity Income Fund | | Schedule of Portfolio Investments — continued

September 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Information Technology (0.7%): | |

Fujitsu Ltd. | | | 1,100 | | | $ | 199 | | |

Nomura Research Institute Ltd. | | | 3,100 | | | | 114 | | |

Seiko Epson Corp. | | | 5,100 | | | | 103 | | |

| | | | 416 | | |

Materials (0.2%): | |

Asahi Kasei Corp. | | | 13,300 | | | | 142 | | |

| | | | 4,819 | | |

Netherlands (2.8%): | |

Communication Services (0.3%): | |

Koninklijke KPN NV | | | 56,389 | | | | 177 | | |

Consumer Staples (0.8%): | |

Koninklijke Ahold Delhaize NV | | | 14,985 | | | | 499 | | |

Industrials (0.5%): | |

Wolters Kluwer NV | | | 3,057 | | | | 324 | | |

Information Technology (0.8%): | |

| ASML Holding NV | | | 625 | | | | 467 | | |

Materials (0.4%): | |

LyondellBasell Industries NV Class A | | | 2,763 | | | | 259 | | |

| | | | 1,726 | | |

Singapore (0.7%): | |

Financials (0.7%): | |

DBS Group Holdings Ltd. | | | 3,400 | | | | 76 | | |

Oversea-Chinese Banking Corp. Ltd. | | | 7,000 | | | | 59 | | |

Singapore Exchange Ltd. | | | 26,400 | | | | 193 | | |

United Overseas Bank Ltd. | | | 6,400 | | | | 121 | | |

| | | | 449 | | |

Spain (1.3%): | |

Energy (0.3%): | |

Enagas SA | | | 6,585 | | | | 146 | | |

Utilities (1.0%): | |

Endesa SA | | | 9,299 | | | | 188 | | |

Iberdrola SA | | | 9,493 | | | | 95 | | |

Red Electrica Corp. SA | | | 17,395 | | | | 349 | | |

| | | | 632 | | |

| | | | 778 | | |

Sweden (0.3%): | |

Consumer Discretionary (0.3%): | |

Husqvarna AB Class B | | | 16,012 | | | | 191 | | |

Switzerland (6.0%): | |

Consumer Discretionary (0.5%): | |

Garmin Ltd. | | | 1,881 | | | | 292 | | |

Consumer Staples (0.8%): | |

Nestle SA Registered Shares | | | 4,121 | | | | 497 | | |

See notes to financial statements.

6

USAA Mutual Funds Trust

USAA Global Equity Income Fund | | Schedule of Portfolio Investments — continued

September 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Financials (0.8%): | |

Partners Group Holding AG | | | 96 | | | $ | 150 | | |

Zurich Insurance Group AG | | | 843 | | | | 345 | | |

| | | | 495 | | |

Health Care (1.8%): | |

Novartis AG Registered Shares | | | 8,016 | | | | 657 | | |

Roche Holding AG | | | 1,375 | | | | 502 | | |

| | | | 1,159 | | |

Industrials (1.4%): | |

ABB Ltd. Registered Shares | | | 6,186 | | | | 207 | | |

Geberit AG Registered Shares | | | 660 | | | | 485 | | |

SGS SA Registered Shares | | | 58 | | | | 169 | | |

| | | | 861 | | |

Materials (0.7%): | |

EMS-Chemie Holding AG | | | 77 | | | | 73 | | |

Givaudan SA Registered Shares | | | 50 | | | | 228 | | |

Holcim Ltd. | | | 2,542 | | | | 122 | | |

| | | | 423 | | |

| | | | 3,727 | | |

United Kingdom (2.8%): | |

Consumer Staples (1.0%): | |

British American Tobacco PLC | | | 18,338 | | | | 641 | | |

Financials (0.5%): | |

Admiral Group PLC | | | 4,108 | | | | 172 | | |

Aon PLC Class A | | | 448 | | | | 128 | | |

| | | | 300 | | |

Industrials (0.6%): | |

Ferguson PLC | | | 626 | | | | 87 | | |

Intertek Group PLC | | | 1,012 | | | | 68 | | |

RELX PLC | | | 8,774 | | | | 252 | | |

| | | | 407 | | |

Information Technology (0.2%): | |

The Sage Group PLC | | | 13,234 | | | | 126 | | |

Materials (0.5%): | |

Rio Tinto PLC | | | 4,333 | | | | 284 | | |

| | | | 1,758 | | |

United States (63.7%): | |

Communication Services (3.4%): | |

Activision Blizzard, Inc. | | | 866 | | | | 67 | | |

Comcast Corp. Class A | | | 4,505 | | | | 252 | | |

Omnicom Group, Inc. | | | 10,072 | | | | 730 | | |

The Interpublic Group of Cos., Inc. | | | 5,500 | | | | 202 | | |

Verizon Communications, Inc. | | | 15,776 | | | | 852 | | |

| | | | 2,103 | | |

See notes to financial statements.

7

USAA Mutual Funds Trust

USAA Global Equity Income Fund | | Schedule of Portfolio Investments — continued

September 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Consumer Discretionary (5.7%): | |

Best Buy Co., Inc. | | | 5,806 | | | $ | 614 | | |

D.R. Horton, Inc. | | | 1,235 | | | | 104 | | |

Genuine Parts Co. | | | 3,457 | | | | 419 | | |

Lowe's Cos., Inc. | | | 1,693 | | | | 343 | | |

McDonald's Corp. | | | 930 | | | | 224 | | |

Starbucks Corp. | | | 1,909 | | | | 211 | | |

Target Corp. | | | 3,227 | | | | 738 | | |

The Home Depot, Inc. | | | 2,478 | | | | 813 | | |

Tractor Supply Co. | | | 428 | | | | 87 | | |

| | | | 3,553 | | |

Consumer Staples (5.5%): | |

Bunge Ltd. | | | 1,054 | | | | 86 | | |

Campbell Soup Co. | | | 3,100 | | | | 130 | | |

Colgate-Palmolive Co. | | | 3,883 | | | | 293 | | |

General Mills, Inc. | | | 5,218 | | | | 312 | | |

Kimberly-Clark Corp. | | | 745 | | | | 99 | | |

Philip Morris International, Inc. | | | 7,934 | | | | 752 | | |

The Clorox Co. | | | 2,101 | | | | 348 | | |

The Hershey Co. | | | 1,176 | | | | 199 | | |

The Kroger Co. | | | 9,494 | | | | 384 | | |

The Procter & Gamble Co. | | | 2,262 | | | | 316 | | |

Tyson Foods, Inc. Class A | | | 3,679 | | | | 290 | | |

Walgreens Boots Alliance, Inc. | | | 3,693 | | | | 174 | | |

Walmart, Inc. | | | 459 | | | | 64 | | |

| | | 3,447 | | |

Energy (1.1%): | |

Cabot Oil & Gas Corp. | | | 5,215 | | | | 114 | | |

ConocoPhillips | | | 3,135 | | | | 212 | | |

EOG Resources, Inc. | | | 4,204 | | | | 337 | | |

| | | | 663 | | |

Financials (10.0%): | |

Aflac, Inc. | | | 3,700 | | | | 193 | | |

Ameriprise Financial, Inc. | | | 1,893 | | | | 500 | | |

Citizens Financial Group, Inc. | | | 3,500 | | | | 164 | | |

Comerica, Inc. | | | 1,389 | | | | 112 | | |

Erie Indemnity Co. Class A | | | 884 | | | | 158 | | |

Fifth Third Bancorp | | | 5,000 | | | | 212 | | |

Huntington Bancshares, Inc. | | | 17,386 | | | | 269 | | |

KeyCorp | | | 26,225 | | | | 567 | | |

M&T Bank Corp. | | | 2,577 | | | | 385 | | |

MetLife, Inc. | | | 6,854 | | | | 423 | | |

Morgan Stanley | | | 1,774 | | | | 172 | | |

MSCI, Inc. | | | 554 | | | | 337 | | |

Regions Financial Corp. | | | 9,856 | | | | 210 | | |

S&P Global, Inc. | | | 868 | | | | 369 | | |

T. Rowe Price Group, Inc. | | | 4,032 | | | | 793 | | |

The Allstate Corp. | | | 3,932 | | | | 500 | | |

The Goldman Sachs Group, Inc. | | | 703 | | | | 266 | | |

The PNC Financial Services Group, Inc. | | | 1,394 | | | | 273 | | |

The Progressive Corp. | | | 2,287 | | | | 207 | | |

The Travelers Cos., Inc. | | | 1,000 | | | | 152 | | |

| | | | 6,262 | | |

See notes to financial statements.

8

USAA Mutual Funds Trust

USAA Global Equity Income Fund | | Schedule of Portfolio Investments — continued

September 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Health Care (8.2%): | |

Abbott Laboratories | | | 2,500 | | | $ | 295 | | |

AmerisourceBergen Corp. | | | 550 | | | | 66 | | |

Amgen, Inc. | | | 3,112 | | | | 662 | | |

Anthem, Inc. | | | 784 | | | | 292 | | |

Bristol-Myers Squibb Co. | | | 3,256 | | | | 193 | | |

Cardinal Health, Inc. | | | 2,964 | | | | 147 | | |

CVS Health Corp. | | | 791 | | | | 67 | | |

Danaher Corp. | | | 534 | | | | 163 | | |

Eli Lilly & Co. | | | 2,095 | | | | 484 | | |

Johnson & Johnson | | | 4,762 | | | | 769 | | |

Medtronic PLC | | | 1,251 | | | | 157 | | |

Pfizer, Inc. | | | 12,305 | | | | 529 | | |

Quest Diagnostics, Inc. | | | 945 | | | | 137 | | |

Stryker Corp. | | | 460 | | | | 121 | | |

Thermo Fisher Scientific, Inc. | | | 258 | | | | 147 | | |

UnitedHealth Group, Inc. | | | 2,293 | | | | 896 | | |

| | | | 5,125 | | |

Industrials (7.6%): | |

3M Co. | | | 3,247 | | | | 570 | | |

C.H. Robinson Worldwide, Inc. | | | 858 | | | | 75 | | |

Cummins, Inc. | | | 1,955 | | | | 439 | | |

Fastenal Co. | | | 5,169 | | | | 267 | | |

FedEx Corp. | | | 326 | | | | 72 | | |

Honeywell International, Inc. | | | 956 | | | | 203 | | |

Illinois Tool Works, Inc. | | | 1,208 | | | | 250 | | |

Lockheed Martin Corp. | | | 1,372 | | | | 473 | | |

Norfolk Southern Corp. | | | 419 | | | | 100 | | |

Northrop Grumman Corp. | | | 334 | | | | 120 | | |

PACCAR, Inc. | | | 3,754 | | | | 296 | | |

Parker-Hannifin Corp. | | | 215 | | | | 60 | | |

Republic Services, Inc. | | | 668 | | | | 80 | | |

Robert Half International, Inc. | | | 4,014 | | | | 403 | | |

Rockwell Automation, Inc. | | | 1,409 | | | | 414 | | |

Snap-on, Inc. | | | 700 | | | | 146 | | |

Union Pacific Corp. | | | 824 | | | | 162 | | |

United Parcel Service, Inc. Class B | | | 1,961 | | | | 357 | | |

W.W. Grainger, Inc. | | | 384 | | | | 151 | | |

Waste Management, Inc. | | | 482 | | | | 72 | | |

| | | | 4,710 | | |

Information Technology (16.2%): | |

Apple, Inc. | | | 14,897 | | | | 2,108 | | |

Applied Materials, Inc. | | | 2,366 | | | | 304 | | |

Broadcom, Inc. | | | 804 | | | | 390 | | |

Cisco Systems, Inc. | | | 11,744 | | | | 639 | | |

HP, Inc. | | | 6,763 | | | | 185 | | |

Intel Corp. | | | 7,444 | | | | 397 | | |

Intuit, Inc. | | | 430 | | | | 232 | | |

Juniper Networks, Inc. | | | 4,700 | | | | 129 | | |

See notes to financial statements.

9

USAA Mutual Funds Trust

USAA Global Equity Income Fund | | Schedule of Portfolio Investments — continued

September 30, 2021 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Shares | | Value | |

Lam Research Corp. | | | 147 | | | $ | 84 | | |

Mastercard, Inc. Class A | | | 412 | | | | 143 | | |

Microsoft Corp. | | | 8,222 | | | | 2,318 | | |

NetApp, Inc. | | | 9,071 | | | | 814 | | |

NVIDIA Corp. | | | 1,388 | | | | 287 | | |

Oracle Corp. | | | 5,220 | | | | 455 | | |

Paychex, Inc. | | | 2,331 | | | | 262 | | |

QUALCOMM, Inc. | | | 1,633 | | | | 211 | | |

Texas Instruments, Inc. | | | 5,160 | | | | 992 | | |

Visa, Inc. Class A | | | 758 | | | | 169 | | |

| | | | 10,119 | | |

Materials (3.1%): | |

Air Products & Chemicals, Inc. | | | 307 | | | | 79 | | |

Celanese Corp. | | | 1,096 | | | | 165 | | |

International Paper Co. | | | 6,618 | | | | 370 | | |

Nucor Corp. | | | 2,812 | | | | 277 | | |

Packaging Corp. of America | | | 3,352 | | | | 461 | | |

PPG Industries, Inc. | | | 1,600 | | | | 229 | | |

RPM International, Inc. | | | 1,083 | | | | 84 | | |

Steel Dynamics, Inc. | | | 1,455 | | | | 85 | | |

The Sherwin-Williams Co. | | | 747 | | | | 209 | | |

| | | | 1,959 | | |

Utilities (2.9%): | |

American Electric Power Co., Inc. | | | 1,400 | | | | 114 | | |

Duke Energy Corp. | | | 4,073 | | | | 397 | | |

Exelon Corp. | | | 4,236 | | | | 205 | | |

NRG Energy, Inc. | | | 8,439 | | | | 345 | | |

OGE Energy Corp. | | | 6,617 | | | | 218 | | |

UGI Corp. | | | 12,979 | | | | 553 | | |

| | | | 1,832 | | |

| | | | 39,773 | | |

Total Common Stocks (Cost $47,052) | | | 61,892 | | |

Collateral for Securities Loaned^ (0.2%) | |

United States (0.2%): | |

HSBC U.S. Government Money Market Fund I Shares, 0.03% (b) | | | 93,467 | | | | 93 | | |

Total Collateral for Securities Loaned (Cost $93) | | | 93 | | |

Total Investments (Cost $47,145) — 99.4% | | | 61,985 | | |

Other assets in excess of liabilities — 0.6% | | | 405 | | |

NET ASSETS — 100.00% | | $ | 62,390 | | |

^ Purchased with cash collateral from securities on loan.

(a) All or a portion of this security is on loan.

(b) Rate disclosed is the daily yield on September 30, 2021.

PLC — Public Limited Company

See notes to financial statements.

10

USAA Mutual Funds Trust | | Statement of Assets and Liabilities

September 30, 2021 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited)

| | | USAA Global Equity

Income Fund | |

Assets: | |

Investments, at value (Cost $47,145) | | $ | 61,985 | (a) | |

Foreign currency, at value (Cost $9) | | | 9 | | |

Cash | | | 298 | | |

Receivables: | |

Interest and dividends | | | 148 | | |

Capital shares issued | | | 1 | | |

Reclaims | | | 126 | | |

From Adviser | | | 18 | | |

Prepaid expenses | | | 13 | | |

Total Assets | | | 62,598 | | |

Liabilities: | |

Payables: | |

Collateral received on loaned securities | | | 93 | | |

Capital shares redeemed | | | 18 | | |

Accrued expenses and other payables: | |

Investment advisory fees | | | 28 | | |

Administration fees | | | 8 | | |

Custodian fees | | | 4 | | |

Transfer agent fees | | | 12 | | |

Compliance fees | | | — | (b) | |

Trustees' fees | | | 1 | | |

Other accrued expenses | | | 44 | | |

Total Liabilities | | | 208 | | |

Net Assets: | |

Capital | | | 42,626 | | |

Total accumulated earnings/(loss) | | | 19,764 | | |

Net Assets | | $ | 62,390 | | |

Net Assets | |

Fund Shares | | $ | 62,368 | | |

Institutional Shares | | | 22 | | |

Total | | $ | 62,390 | | |

Shares (unlimited number of shares authorized with no par value): | |

Fund Shares | | | 4,987 | | |

Institutional Shares | | | 2 | | |

Total | | | 4,989 | | |

Net asset value, offering and redemption price per share: (c) | |

Fund Shares | | $ | 12.51 | | |

Institutional Shares | | $ | 12.21 | | |

(a) Includes $88 of securities on loan.

(b) Rounds to less than $1 thousand.

(c) Per share amount may not recalculate due to rounding of net assets and/or shares outstanding.

See notes to financial statements.

11

USAA Mutual Funds Trust | | Statement of Operations

For the Six Months Ended September 30, 2021 | |

(Amounts in Thousands) (Unaudited)

| | | USAA Global Equity

Income Fund | |

Investment Income: | |

Dividends | | $ | 944 | | |

Securities lending (net of fees) | | | 1 | | |

Foreign tax withholding | | | (48 | ) | |

Total Income | | | 897 | | |

Expenses: | |

Investment advisory fees | | | 181 | | |

Administration fees — Fund Shares | | | 49 | | |

Administration fees — Institutional Shares | | | — | (a) | |

Sub-Administration fees | | | 11 | | |

Custodian fees | | | 12 | | |

Transfer agent fees — Fund Shares | | | 44 | | |

Transfer agent fees — Institutional Shares | | | — | (a) | |

Trustees' fees | | | 24 | | |

Compliance fees | | | — | (a) | |

Legal and audit fees | | | 28 | | |

State registration and filing fees | | | 14 | | |

Interfund lending fees | | | — | (a) | |

Interest fees | | | — | (a) | |

Other expenses | | | 25 | | |

Total Expenses | | | 388 | | |

Expenses waived/reimbursed by Adviser | | | (40 | ) | |

Net Expenses | | | 348 | | |

Net Investment Income (Loss) | | | 549 | | |

Realized/Unrealized Gains (Losses) from Investments: | |

Net realized gains (losses) from investment securities and foreign currency

translations | | | 5,529 | | |

Net change in unrealized appreciation/depreciation on investment securities and

foreign currency transactions | | | (2,384 | ) | |

Net realized/unrealized gains (losses) on investments | | | 3,145 | | |

Change in net assets resulting from operations | | $ | 3,694 | | |

(a) Rounds to less than $1 thousand.

See notes to financial statements.

12

USAA Mutual Funds Trust | | Statements of Changes in Net Assets | |

(Amounts in Thousands)

| | | USAA Global Equity Income Fund | |

| | | Six Months

Ended

September 30,

2021

(unaudited) | | Year

Ended

March 31,

2021 | |

From Investments: | |

Operations: | |

Net investment income (loss) | | $ | 549 | | | $ | 1,215 | | |

Net realized gains (losses) from investments | | | 5,529 | | | | (359 | ) | |

Net change in unrealized appreciation/depreciation on

investments | | | (2,384 | ) | | | 25,890 | | |

Change in net assets resulting from operations | | | 3,694 | | | | 26,746 | | |

Distributions to Shareholders: | |

Fund Shares | | | (669 | ) | | | (1,102 | ) | |

Institutional Shares | | | — | | | | (89 | ) | |

Change in net assets resulting from distributions to shareholders | | | (669 | ) | | | (1,191 | ) | |

Change in net assets resulting from capital transactions | | | (16,347 | ) | | | (14,549 | ) | |

Change in net assets | | | (13,322 | ) | | | 11,006 | | |

Net Assets: | |

Beginning of period | | | 75,712 | | | | 64,706 | | |

End of period | | $ | 62,390 | | | $ | 75,712 | | |

Capital Transactions: | |

Fund Shares | |

Proceeds from shares issued | | $ | 2,433 | | | $ | 5,174 | | |

Distributions reinvested | | | 667 | | | | 921 | | |

Cost of shares redeemed | | | (13,206 | ) | | | (20,644 | ) | |

Total Fund Shares | | $ | (10,106 | ) | | $ | (14,549 | ) | |

Institutional Shares | |

Proceeds from shares issued | | $ | 22 | | | $ | — | | |

Cost of shares redeemed | | | (6,263 | ) | | | — | | |

Total Institutional Shares | | $ | (6,241 | ) | | $ | — | | |

Change in net assets resulting from capital transactions | | $ | (16,347 | ) | | $ | (14,549 | ) | |

Share Transactions: | |

Fund Shares | |

Issued | | | 191 | | | | 499 | | |

Reinvested | | | 53 | | | | 90 | | |

Redeemed | | | (1,049 | ) | | | (1,981 | ) | |

Total Fund Shares | | | (805 | ) | | | (1,392 | ) | |

Institutional Shares | |

Issued | | | 2 | | | | — | | |

Redeemed | | | (500 | ) | | | — | | |

Total Institutional Shares | | | (498 | ) | | | — | | |

Change in Shares | | | (1,303 | ) | | | (1,392 | ) | |

See notes to financial statements.

13

USAA Mutual Funds Trust | | Financial Highlights | |

For a Share Outstanding Throughout Each Period

| | | | | Investment Activities | | Distributions to

Shareholders From | |

| | | Net Asset

Value,

Beginning of

Period | | Net

Investment

Income

(Loss) | | Net Realized

and Unrealized

Gains (Losses)

on Investments | | Total from

Investment

Activities | | Net

Investment

Income | | Net Realized

Gains from

Investments | |

USAA Global Equity Income Fund | | | |

Fund Shares | | | |

Six Months Ended

September 30, 2021

(unaudited) | | $ | 12.03 | | | | 0.11 | (d) | | | 0.50 | | | | 0.61 | | | | (0.13 | ) | | | — | | |

Year Ended March 31:

2021 | | $ | 8.42 | | | | 0.17 | (d) | | | 3.61 | | | | 3.78 | | | | (0.17 | ) | | | — | | |

| 2020 | | $ | 10.51 | | | | 0.24 | (d) | | | (1.57 | ) | | | (1.33 | ) | | | (0.22 | ) | | | (0.54 | ) | |

| 2019 | | $ | 10.88 | | | | 0.27 | | | | 0.06 | | | | 0.33 | | | | (0.27 | ) | | | (0.43 | ) | |

| 2018 | | $ | 10.42 | | | | 0.23 | | | | 0.54 | | | | 0.77 | | | | (0.23 | ) | | | (0.08 | ) | |

| 2017 | | $ | 9.39 | | | | 0.21 | | | | 1.03 | | | | 1.24 | | | | (0.21 | ) | | | — | | |

Institutional Shares | | | |

Six Months Ended

September 30, 2021

(unaudited) | | $ | 12.04 | | | | 0.08 | (d) | | | 0.09 | | | | 0.17 | | | | — | | | | — | | |

Year Ended March 31:

2021 | | $ | 8.43 | | | | 0.18 | (d) | | | 3.61 | | | | 3.79 | | | | (0.18 | ) | | | — | | |

| 2020 | | $ | 10.52 | | | | 0.25 | (d) | | | (1.56 | ) | | | (1.31 | ) | | | (0.24 | ) | | | (0.54 | ) | |

| 2019 | | $ | 10.89 | | | | 0.27 | | | | 0.07 | | | | 0.34 | | | | (0.28 | ) | | | (0.43 | ) | |

| 2018 | | $ | 10.43 | | | | 0.23 | | | | 0.54 | | | | 0.77 | | | | (0.23 | ) | | | (0.08 | ) | |

| 2017 | | $ | 9.39 | | | | 0.23 | | | | 1.02 | | | | 1.25 | | | | (0.21 | ) | | | — | | |

* Assumes reinvestment of all net investment income and realized capital gain distributions, if any, during the period. Includes adjustments in accordance with U.S. Generally Accepted Accounting Principles and could differ from the Lipper reported return.

** For the period beginning July 1, 2019, the amount of any waivers or reimbursements and the amount of any recoupment are calculated without regard to the impact of any performance adjustment to the Fund's management fee.

^ The net expense ratio may not correlate to the applicable expense limits in place during the period since the current contractual expense limitation is applied for a period beginning July 1, 2019, and in effect through June 30, 2023, instead of coinciding with the Fund's fiscal year end. Details of the current contractual expense limitation in effect can be found in Note 4 of the accompanying Notes to Financial Statements.

(a) Not annualized for periods less than one year.

(b) Annualized for periods less than one year.

(c) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

(d) Per share net investment income (loss) has been calculated using the average daily shares method.

(e) Reflects a return to normal trading levels after a prior year transition or asset allocation shift.

(f) Reflects increased trading activity due to current year transition or asset allocation shift.

(g) Prior to August 1, 2018, USAA Asset Management Company ("AMCO") (previous investment Adviser) voluntarily agreed to limit the annual expenses of the Fund Shares to 1.20% of the Fund Shares' average daily net assets.

(h) Prior to August 1, 2018, AMCO voluntarily agreed to limit the annual expenses of the Institutional Shares to 1.10% of the Institutional Shares' average daily net assets.

See notes to financial statements.

14

USAA Mutual Funds Trust | | Financial Highlights — continued | |

For a Share Outstanding Throughout Each Period

| | | | | Ratios to Average Net Assets | | Supplemental Data | |

| | | Total

Distributions | | Net Asset

Value,

End of

Period | | Total

Return*(a) | | Net

Expenses**^(b) | | Net

Investment

Income

(Loss)(b) | | Gross

Expenses(b) | | Net Assets,

End of

Period

(000's) | | Portfolio

Turnover(a)(c) | |

USAA Global Equity Income Fund | |

Fund Shares | |

Six Months Ended

September 30, 2021

(unaudited) | | | (0.13 | ) | | $ | 12.51 | | | | 5.09 | % | | | 1.04 | % | | | 1.65 | % | | | 1.15 | % | | $ | 62,368 | | | | 10 | % | |

Year Ended March 31:

2021 | | | (0.17 | ) | | $ | 12.03 | | | | 45.23 | % | | | 1.03 | % | | | 1.65 | % | | | 1.18 | % | | $ | 69,690 | | | | 46 | %(e) | |

| 2020 | | | (0.76 | ) | | $ | 8.42 | | | | (14.02 | )% | | | 1.00 | % | | | 2.30 | % | | | 1.14 | % | | $ | 60,491 | | | | 109 | %(f) | |

| 2019 | | | (0.70 | ) | | $ | 10.51 | | | | 3.43 | % | | | 1.03 | %(g) | | | 2.56 | % | | | 1.10 | % | | $ | 75,086 | | | | 15 | % | |

| 2018 | | | (0.31 | ) | | $ | 10.88 | | | | 7.41 | % | | | 1.05 | % | | | 2.17 | % | | | 1.05 | % | | $ | 96,101 | | | | 22 | % | |

| 2017 | | | (0.21 | ) | | $ | 10.42 | | | | 13.33 | % | | | 1.20 | % | | | 2.28 | % | | | 1.26 | % | | $ | 85,830 | | | | 22 | % | |

Institutional Shares | |

Six Months Ended

September 30, 2021

(unaudited) | | | — | | | $ | 12.21 | | | | 1.41 | % | | | 1.05 | % | | | 1.34 | % | | | 2.47 | % | | $ | 22 | | | | 10 | % | |

Year Ended March 31:

2021 | | | (0.18 | ) | | $ | 12.04 | | | | 45.32 | % | | | 0.93 | % | | | 1.74 | % | | | 1.25 | % | | $ | 6,022 | | | | 46 | %(e) | |

| 2020 | | | (0.78 | ) | | $ | 8.43 | | | | (13.90 | )% | | | 0.90 | % | | | 2.40 | % | | | 1.51 | % | | $ | 4,215 | | | | 109 | %(f) | |

| 2019 | | | (0.71 | ) | | $ | 10.52 | | | | 3.47 | % | | | 0.97 | %(h) | | | 2.58 | % | | | 1.22 | % | | $ | 5,261 | | | | 15 | % | |

| 2018 | | | (0.31 | ) | | $ | 10.89 | | | | 7.35 | % | | | 1.10 | % | | | 2.14 | % | | | 1.29 | % | | $ | 5,447 | | | | 22 | % | |

| 2017 | | | (0.21 | ) | | $ | 10.43 | | | | 13.49 | % | | | 1.10 | % | | | 2.40 | % | | | 1.55 | % | | $ | 5,214 | | | | 22 | % | |

See notes to financial statements.

15

USAA Mutual Funds Trust | | Notes to Financial Statements

September 30, 2021 | |

(Unaudited)

1. Organization:

USAA Mutual Funds Trust (the "Trust") is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end investment company. The Trust is comprised of 46 funds and is authorized to issue an unlimited number of shares, which are units of beneficial interest with no par value.

The accompanying financial statements are those of the USAA Global Equity Income Fund (the "Fund"). The Fund offers two classes of shares: Fund Shares and Institutional Shares. The Fund is classified as diversified under the 1940 Act.

Each class of shares of the Fund has substantially identical rights and privileges, except with respect to fees paid under distribution plans, expenses allocable exclusively to each class of shares, voting rights on matters solely affecting a single class of shares, and the exchange privilege of each class of shares.

Under the Trust's organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies:

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements. The policies are in conformity with Generally Accepted Accounting Principles in the United States of America ("GAAP"). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund follows the specialized accounting and reporting requirements under GAAP that are applicable to investment companies under Accounting Standards Codification Topic 946.

Investment Valuation:

The Fund records investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Fund's investments are summarized in the three broad levels listed below:

• Level 1 — quoted prices in active markets for identical securities

• Level 2 — other significant observable inputs (including quoted prices for similar securities or interest rates applicable to those securities, etc.)

• Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The inputs or methodologies used for valuation techniques are not necessarily an indication of the risks associated with entering into those investments.

Victory Capital Management Inc. ("VCM" or the "Adviser") has established the Pricing and Liquidity Committee (the "Committee"), and subject to the Trust's Board of Trustees' (the "Board") oversight, the Committee administers and oversees the Fund's valuation policies and procedures, which are approved by the Board.

16

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2021 | |

(Unaudited)

Portfolio securities listed or traded on securities exchanges, including exchange-traded funds ("ETFs"), American Depositary Receipts ("ADRs"), and Rights, are valued at the closing price on the exchange or system where the security is principally traded, if available, or at the Nasdaq Official Closing Price. If there have been no sales for that day on the exchange or system, then a security is valued at the last available bid quotation on the exchange or system where the security is principally traded. In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Investments in open-end investment companies are valued at their net asset value ("NAV"). These valuations are typically categorized as Level 1 in the fair value hierarchy.

In the event that price quotations or valuations are not readily available, investments are valued at fair value in accordance with procedures established by and under the general supervision and responsibility of the Board. These valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy, based on the observability of inputs used to determine the fair value. The effect of fair value pricing is that securities may not be priced on the basis of quotations from the primary market in which they are traded, and the actual price realized from the sale of a security may differ materially from the fair value price. Valuing these securities at fair value is intended to cause the Fund's NAV to be more reliable than it otherwise would be.

In accordance with procedures adopted by the Board, fair value pricing may be used if events materially affecting the value of foreign securities occur between the time the exchange on which they are traded closes and the time the Fund's NAV is calculated. The Fund uses a systematic valuation model, provided daily by an independent third party to fair value its international equity securities. The valuations are considered as Level 2 in the fair value hierarchy.

A summary of the valuations as of September 30, 2021, based upon the three levels defined above, is included in the table below while the breakdown, by category, of investments is disclosed on the Schedule of Portfolio Investments (amounts in thousands):

| | | Level 1 | | Level 2 | | Level 3 | | Total | |

Common Stocks | | $ | 45,067 | | | $ | 16,825 | | | $ | — | | | $ | 61,892 | | |

Collateral for Securities Loaned | | | 93 | | | | — | | | | — | | | | 93 | | |

Total | | $ | 45,160 | | | $ | 16,825 | | | $ | — | | | $ | 61,985 | | |

For the six months ended September 30, 2021, there were no transfers in or out of Level 3 in the fair value hierarchy.

Real Estate Investment Trusts ("REITs"):

The Fund may invest in REITs, which report information on the source of their distributions annually. REITs are pooled investment vehicles that invest primarily in income producing real estate or real estate related loans or interests (such as mortgages). Certain distributions received from REITs during the year are recorded as realized gains or return of capital as estimated by the Fund or when such information becomes known.

Investment Companies:

Open-End Funds:

The Fund may invest in portfolios of open-end investment companies. These investment companies value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value by the methods established by the board of directors of the underlying funds.

Foreign Exchange Currency Contracts:

The Fund may enter into foreign exchange currency contracts to convert U.S. dollars to and from various foreign currencies. A foreign exchange currency contract is an obligation by the Fund to

17

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2021 | |

(Unaudited)

purchase or sell a specific currency at a future date at a price (in U.S. dollars) set at the time of the contract. The Fund does not engage in "cross-currency" foreign exchange contracts (i.e., contracts to purchase or sell one foreign currency in exchange for another foreign currency). The Fund's foreign exchange currency contracts might be considered spot contracts (typically a contract of one week or less) or forward contracts (typically a contract term over one week). A spot contract is entered into for purposes of hedging against foreign currency fluctuations relating to a specific portfolio transaction, such as the delay between a security transaction trade date and settlement date. Forward contracts are entered into for purposes of hedging portfolio holdings or concentrations of such holdings. Each foreign exchange currency contract is adjusted daily by the prevailing spot or forward rate of the underlying currency, and any appreciation or depreciation is recorded for financial statement purposes as unrealized until the contract settlement date, at which time the Fund records realized gains or losses equal to the difference between the value of a contract at the time it was opened and the value at the time it was closed. The Fund could be exposed to risk if a counterparty is unable to meet the terms of a foreign exchange currency contract or if the value of the foreign currency changes unfavorably. In addition, the use of foreign exchange currency contracts does not eliminate fluctuations in the underlying prices of the securities. As of September 30, 2021, the Fund had no open forward foreign exchange currency contracts.

Investment Transactions and Related Income:

Changes in holdings of investments are accounted for no later than one business day following the trade date. For financial reporting purposes, however, investment transactions are accounted for on trade date or the last business day of the reporting period. Interest income is determined on the basis of coupon interest accrued using the effective interest method which adjusts, where applicable, the amortization of premiums or accretion of discounts. Dividend income is recorded on the ex-dividend date. Gains or losses realized on sales of securities are recorded on the identified cost basis.

Withholding taxes on interest, dividends and gains as a result of certain investments in ADRs by the Fund have been provided for in accordance with each investment's applicable country's tax rules and rates.

Securities Lending:

The Fund, through a securities lending agreement with Citibank, N.A. ("Citibank"), may lend its securities to qualified financial institutions, such as certain broker-dealers, to earn additional income, net of income retained by Citibank. Borrowers are required to secure their loans for collateral in the amount of at least 102% of the value of U.S. securities loaned or at least 105% of the value of non-U.S. securities loaned, marked-to-market daily. Any collateral shortfalls associated with increases in the valuation of the securities loaned are cured the next business day once the shortfall exceeds $100 thousand. Collateral may be cash, U.S. government securities, or other securities as permitted by Securities and Exchange Commission ("SEC") guidelines. Cash collateral may be invested in high-quality, short-term investments, primarily open-end investment companies. Collateral requirements are determined daily based on the value of the Fund's securities on loan as of the end of the prior business day. During the time portfolio securities are on loan, the borrower will pay the Fund any dividends or interest paid on such securities plus any fee negotiated between the parties to the lending agreement. The Fund also earns a return from the collateral. The Fund pays Citibank various fees in connection with the investment of cash collateral and fees based on the investment income received from securities lending activities. Securities lending income (net of these fees) is disclosed on the Statement of Operations. Loans are terminable upon demand and the borrower must return the loaned securities within the lesser of one standard settlement period or five business days. Risks relating to securities-lending transactions include that the borrower may not provide additional collateral when required or return the securities when due, and that the value of the short-term investments will be less than the amount of cash collateral required to be returned to the borrower. The Fund's agreement with Citibank does not include master netting provisions. Non-cash collateral received by the Fund may not be sold or re-pledged, except to satisfy borrower default. Cash collateral is listed on the Fund's Schedule of Portfolio Investments and Financial Statements while non-cash collateral is not included.

18

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2021 | |

(Unaudited)

The following table (amounts in thousands) is a summary of the Fund's securities lending transactions as of September 30, 2021.

Value of

Securities on Loan | | Non-Cash Collateral | | Cash Collateral | |

| $ | 88 | | | $ | — | | | $ | 93 | | |

Foreign Currency Translations:

The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities of the Fund denominated in a foreign currency are translated into U.S. dollars at current exchange rates. Purchases and sales of securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates on the date of the transactions. The Fund does not isolate the portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuations arising from changes in market prices of securities held. Such fluctuations are disclosed as Net change in unrealized appreciation/depreciation on investment securities and foreign currency translations on the Statement of Operations. Any realized gains or losses from these fluctuations, including foreign currency arising from in-kind redemptions, are disclosed as Net realized gains (losses) from investment securities and foreign currency translations on the Statement of Operations.

Foreign Taxes:

The Fund may be subject to foreign taxes related to foreign income received (a portion of which may be reclaimable), capital gains on the sale of securities, and certain foreign currency transactions. All foreign taxes are recorded in accordance with the applicable regulations and rates that exist in the foreign jurisdictions in which the Fund invests.

Federal Income Taxes:

It is the Fund's policy to continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized gains sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes is required in the financial statements. The Fund has a tax year end of March 31.

Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last four tax years, which includes the current fiscal tax year end). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Allocations:

Expenses directly attributable to the Fund are charged to the Fund, while expenses that are attributable to more than one fund in the Trust, or jointly with an affiliated trust, are allocated among the respective funds in the Trust and/or an affiliated trust based upon net assets or another appropriate basis.

Income, expenses (other than class-specific expenses such as transfer agent fees, state registration fees, and printing fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets on the date income is earned or expenses and realized and unrealized gains and losses are incurred.

19

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2021 | |

(Unaudited)

3. Purchases and Sales:

Cost of purchases and proceeds from sales/maturities of securities (excluding securities maturing less than one year from acquisition) for the six months ended September 30, 2021, were as follows for the Fund (amounts in thousands):

Excluding

U.S. Government Securities | |

| Purchases | | Sales | |

| $ | 6,648 | | | $ | 23,228 | | |

4. Fees and Transactions with Affiliates and Related Parties:

Investment Advisory Fees:

Investment advisory services are provided to the Fund by the Adviser, which is a New York corporation registered as an investment adviser with the SEC. The Adviser is an indirect wholly owned subsidiary of Victory Capital Holdings, Inc., a publicly traded Delaware corporation, and a wholly owned direct subsidiary of Victory Capital Operating, LLC.

Under the terms of the Investment Advisory Agreement, the Adviser is entitled to receive a base fee and a performance adjustment. The Fund's base fee is accrued daily and paid monthly at an annualized rate of 0.50% of the Fund's average daily net assets. Amounts incurred and paid to VCM for the six months ended September 30, 2021, are reflected on the Statement of Operations as Investment Advisory fees.

On November 6, 2018, United Services Automobile Association ("USAA"), the parent company of USAA Asset Management Company ("AMCO"), the prior investment adviser to the Fund announced that AMCO would be acquired by Victory Capital Holdings Inc. (the "Transaction"). A special shareholder meeting was held on April 18, 2019, at which shareholders of the Fund approved a new investment advisory agreement between the Trust, on behalf of the Fund, and VCM. The Transaction closed on July 1, 2019, and effective July 1, 2019, VCM replaced AMCO as the investment adviser to the Fund and no performance adjustments were made for the period beginning July 1, 2019, through June 30, 2020. Only performance beginning as of July 1, 2019, and thereafter is utilized in calculating future performance adjustments.

The performance adjustment for each share class is accrued daily and calculated monthly by comparing each class' performance to that of the Lipper Global Equity Income Funds Index. The Lipper Global Equity Income Funds Index tracks the total return performance of the largest funds within the Lipper Global Equity Income Funds category.

The performance period for each share class consists of the current month plus the previous 35 months (or the number of months beginning July 1, 2019, if fewer). The following table is utilized to determine the extent of the performance adjustment:

Over/Under Performance Relative to Index

(in basis points)(a) | | Annual Adjustment Rate

(in basis points) | |

| | +/- 100 to 400 | | | | +/- 4 | | |

| | +/- 401 to 700 | | | | +/- 5 | | |

| | +/- 701 and greater | | | | +/- 6 | | |

(a) Based on the difference between the average annual performance of the relevant share class of the Fund and its relevant Lipper index, rounded to the nearest basis point.

Each class' annual performance adjustment rate is multiplied by the average daily net assets of each respective class over the entire performance period, which is then multiplied by a fraction, the numerator of which is the number of days in the month and the denominator of which is 365 (366 in

20

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2021 | |

(Unaudited)

leap years). The resulting amount is then added to (in the case of overperformance), or subtracted from (in the case of underperformance) the base fee.

Under the performance fee arrangement, each class pays a positive performance fee adjustment for a performance period whenever the class outperforms the Lipper Global Equity Income Funds Index over that period, even if the class has overall negative returns during the performance period.

For the period April 1, 2021, to September 30, 2021, performance adjustments were $14 and $1 for Fund Shares and Institutional Shares, in thousands, respectively. Performance adjustments were 0.04% and 0.15% for Fund Shares and Institutional Shares, respectively. The performance adjustment rate included in the investment advisory fee may differ from the maximum over/under Annual Adjustment Rate due to differences in average net assets for the reporting period and rolling 36 month performance periods.

The Trust relies on an exemptive order granted to VCM and its affiliated funds by the SEC in March 2019 permitting the use of a "manager-of-managers" structure for certain funds. Under a manager-of-managers structure, the investment adviser may select (with approval of the Board and without shareholder approval) one or more subadvisers to manage the day-to-day investment of a fund's assets. For the six months ended September 30, 2021, the Fund had no subadvisers.

Administration and Servicing Fees:

VCM serves as the Fund's administrator and fund accountant. Under the Fund Administration, Servicing and Accounting Agreement, VCM is paid an administration and servicing fee that is accrued daily and paid monthly at an annualized rate of 0.15% and 0.10%, which is based on the Fund's average daily net assets of the Fund Shares and Institutional Shares, respectively. Amounts incurred for the six months ended September 30, 2021, are reflected on the Statement of Operations as Administration fees.

Citi Fund Services Ohio, Inc. ("Citi"), an affiliate of Citibank, acts as sub-administrator and sub-fund accountant to the Fund pursuant to a Sub-Administration and Sub-Fund Accounting Services Agreement between VCM and Citi. VCM pays Citi a fee for providing these services. The Fund reimburses VCM and Citi for out-of-pocket expenses incurred in providing these services and certain other expenses specifically allocated to the Fund. Amounts incurred for the six months ended September 30, 2021, are reflected on the Statement of Operations as Sub-Administration fees.

The Fund (as part of the Trust) has entered into an agreement to provide compliance services with the Adviser, pursuant to which the Adviser furnishes its compliance personnel, including the services of the Chief Compliance Officer ("CCO"), and other resources reasonably necessary to provide the Trust with compliance oversight services related to the design, administration, and oversight of a compliance program for the Trust in accordance with Rule 38a-1 under the 1940 Act. The CCO is an employee of the Adviser, which pays the compensation of the CCO and support staff. Funds in the Trust, Victory Variable Insurance Funds, Victory Portfolios, and Victory Portfolios II (collectively, the "Victory Funds Complex") in the aggregate, compensate the Adviser for these services. Amounts incurred for the six months ended September 30, 2021, are reflected on the Statement of Operations as Compliance fees.

Transfer Agency Fees:

Victory Capital Transfer Agency, Inc. ("VCTA"), an affiliate of the Adviser, provides transfer agency services to the Fund. VCTA provides transfer agent services to the Fund Shares based on an annual charge of $23 per shareholder account plus out-of-pocket expenses. VCTA pays a portion of these fees to certain intermediaries for the administration and servicing of accounts that are held with such intermediaries. Transfer agent's fees for the Institutional Shares are paid monthly based on a fee accrued daily at an annualized rate of 0.10% of average daily net assets, plus out-of-pocket expenses. Amounts incurred and paid to VCTA for the six months ended September 30, 2021, are reflected on the Statement of Operations as Transfer Agent fees.

FIS Investor Services LLC serves as sub-transfer agent and dividend disbursing agent for the Fund pursuant to a Sub-Transfer Agent Agreement between VCTA and FIS Investor Services LLC. VCTA provides FIS Investor Services LLC a fee for providing these services.

21

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2021 | |

(Unaudited)

Distributor/Underwriting Services:

Victory Capital Services, Inc. (the "Distributor"), an affiliate of the Adviser, serves as Distributor for the continuous offering of the shares of the Fund pursuant to a Distribution Agreement between the Distributor and the Trust, and receives no fee or other compensation for these services.

Other Fees:

Citibank serves as the Fund's custodian. The Fund pays Citibank a fee for providing these services. Amounts incurred for the six months ended September 30, 2021, are reflected on the Statement of Operations as Custodian fees.

K&L Gates LLP provides legal services to the Trust.

The Adviser has entered into an expense limitation agreement with the Fund until at least June 30, 2023. Under the terms of the agreement, the Adviser has agreed to waive fees or reimburse certain expenses to the extent that ordinary operating expenses incurred by certain classes of the Fund in any fiscal year exceed the expense limit for such classes of the Fund. Such excess amounts will be the liability of the Adviser. Acquired fund fees and expenses, interest, taxes, brokerage commissions, other expenditures, which are capitalized in accordance with GAAP, and other extraordinary expenses not incurred in the ordinary course of the Fund's business are excluded from the expense limits. As of September 30, 2021, the expense limits (excluding voluntary waivers) were 1.00% and 0.90% for Fund Shares and Institutional Shares, respectively.

Under the terms of the expense limitation agreement, amended May 1, 2021, the Fund has agreed to repay fees and expenses that were waived or reimbursed by the Adviser for a period of up to three years (thirty-six (36) months) after the waiver or reimbursement took place, subject to the lesser of any operating expense limits in effect at the time of: (a) the original waiver or expense reimbursement; or (b) the recoupment, after giving effect to the recoupment amount. Prior to May 1, 2021, the Fund was permitted to recoup fees waived and expenses reimbursed for up to three years after the fiscal year in which the waiver or reimbursement took place, subject to the limitations above. This change did not have any effect on the amounts previously reported for recoupment.

As of September 30, 2021, the following amounts are available to be repaid to the Adviser (amounts in thousands). The Fund has not recorded any amounts available to be repaid as a liability due to an assessment that such repayment is not probable at September 30, 2021.

Expires

2023 | | Expires

2024 | | Expires

2025 | | Total | |

$ | 93 | | | $ | 117 | | | $ | 40 | | | $ | 250 | | |

The Adviser may voluntarily waive or reimburse additional fees to assist the Fund in maintaining competitive expense ratios. Voluntary waivers and reimbursements applicable to the Fund are not available to be recouped at a future time. There were no voluntary waivers or reimbursements for the six months ended September 30, 2021.

Certain officers and/or interested trustees of the Fund are also officers and/or employees of the Adviser, administrator, fund accountant, sub-administrator, sub-fund accountant, custodian, and Distributor.

5. Risks:

The Fund may be subject to other risks in addition to these identified risks.

Market Risk — Overall stock market risks may affect the value of the Fund. Domestic and international factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises, and related geopolitical events, as well as environmental disasters such as earthquakes, fires, and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods.

22

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2021 | |

(Unaudited)

Equity Risk — The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions. A company's earnings or dividends may not increase as expected due to poor management decisions, competitive pressures, breakthroughs in technology, reliance on suppliers, labor problems or shortages, corporate restructurings, fraudulent disclosures, natural disasters, military confrontations, war, terrorism, public health crises, or other events, conditions, and factors. Price changes may be temporary or last for extended periods.

Foreign Securities Risk — Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market.

6. Borrowing and Interfund Lending:

Line of Credit:

The Victory Funds Complex participates in a short-term demand note "Line of Credit" agreement with Citibank. The Line of Credit agreement with Citibank was renewed on June 29, 2021, with a termination date of June 27, 2022. Under the agreement with Citibank, the Victory Funds Complex may borrow up to $600 million, of which $300 million is committed and $300 million is uncommitted. $40 million of the Line of Credit is reserved for use by the Victory Floating Rate Fund, another series of the Victory Funds Complex, with Victory Floating Rate Fund paying the related commitment fees for that amount. The purpose of the Line of Credit is to meet temporary or emergency cash needs. For the six months ended September 30, 2021, Citibank received an annual commitment fee of 0.15% on $300 million for providing the Line of Credit. Each Fund in the Victory Funds Complex pays a pro-rata portion of the commitment fees plus any interest (one month LIBOR plus one percent) on amounts borrowed. Prior to June 29, 2021, the Victory Funds Complex paid an annual commitment fee of 0.15% and an upfront fee of 0.10%. Each Fund in the Victory Funds Complex paid a pro-rata portion of the upfront fee. Interest charged to each Fund during the period, if applicable, is reflected on the Statement of Operations under Line of credit fees.

The Fund had no borrowings under the Line of Credit agreement during the six months ended September 30, 2021.

Interfund Lending:

The Trust and Adviser rely on an exemptive order granted by the SEC in March 2017 (the "Order"), permitting the establishment and operation of an Interfund Lending Facility (the "Facility"). The Facility allows the Fund to directly lend and borrow money to or from any other fund in the Victory Funds Complex that is permitted to participate in the Facility, relying upon the Order at rates beneficial to both the borrowing and lending funds. Advances under the Facility are allowed for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities, and are subject to each Fund's borrowing restrictions. The interfund loan rate is determined, as specified in the Order, by averaging the current repurchase agreement rate and the current bank loan rate. As a Borrower, interest charged to the Fund, if any, during the period is reflected on the Statement of Operations under Interfund lending fees. As a Lender, interest earned by the Fund, if any, during the period is presented on the Statement of Operations under Interfund lending.

23

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2021 | |

(Unaudited)

The average borrowing or lending for the days outstanding and average interest rate for the Fund that utilized the Facility during the six months ended September 30, 2021, were as follows (amounts in thousands):

Borrower or

Lender | | Amount

Outstanding at

September 30, 2021 | | Average

Borrowing* | | Days

Borrowing

Outstanding | | Average

Interest

Rate* | | Maximum

Borrowing

During the

Period | |

| Borrower | | $ | — | | | $ | 3,888 | | | | 1 | | | | 0.57 | % | | $ | 3,888 | | |

* For the six months ended September 30, 2021, based on the number of days borrowings were outstanding.

7. Federal Income Tax Information:

The Fund intends to distribute any net investment income quarterly. Distributable net realized gains, if any, are declared and paid at least annually.

The amounts of dividends from net investment income and distributions from net realized gains (collectively distributions to shareholders) are determined in accordance with federal income tax regulations, which may differ from GAAP. To the extent these "book/tax" differences are permanent in nature (e.g., net operating loss and distribution reclassification), such amounts are reclassified within the components of net assets based on their federal tax-basis treatment; temporary differences (e.g., wash sales) do not require reclassification. To the extent dividends and distributions exceed net investment income and net realized gains for tax purposes, they are reported as distributions of capital. Net investment losses incurred by the Fund may be reclassified as an offset to capital on the accompanying Statement of Assets and Liabilities.

The tax character of current year distributions paid and the tax basis of the current components of accumulated earnings (deficit) will be determined at the end of the current tax year ending March 31, 2022.

As of the tax year ended March 31, 2021, the Fund had net capital loss carryforwards as shown in the table below (amounts in thousands). It is unlikely that the Board will authorize a distribution of capital gains realized in the future until the capital loss carryforwards have been used.

Short-Term

Amount | | Long-Term

Amount | | Total | |

| $ | 697 | | | $ | — | | | $ | 697 | | |

24

USAA Mutual Funds Trust | | Supplemental Information

September 30, 2021 | |

(Unaudited)

Proxy Voting and Portfolio Holdings Information

Proxy Voting:

Information regarding the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling (800) 235-8396. The information is also included in the Fund's Statement of Additional Information, which is available on the SEC's website at www.sec.gov.

Information relating to how the Fund voted proxies relating to portfolio securities held during the most recent 12 months ended June 30 is available on the SEC's website at www.sec.gov.

Availability of Schedules of Portfolio Investments:

The Trust files a complete list of Schedules of Portfolio Investments with the SEC for the first and third quarter of each fiscal year on Form N-PORT. Form N-PORT is available on the SEC's website at www.sec.gov.

Expense Examples

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2021, through September 30, 2021.

The Actual Expense figures in the table below provide information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled "Actual Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

The Hypothetical Expense figures in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. If these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value

4/1/21 | | Actual

Ending

Account

Value

9/30/21 | | Hypothetical

Ending

Account

Value

9/30/21 | | Actual

Expenses Paid

During Period

4/1/21-

9/30/21* | | Hypothetical

Expenses Paid

During Period

4/1/21-

9/30/21* | | Annualized

Expense Ratio

During Period

4/1/21-

9/30/21 | |

Fund Shares | | $ | 1,000.00 | | | $ | 1,050.90 | | | $ | 1,019.85 | | | $ | 5.35 | | | $ | 5.27 | | | | 1.04 | % | |

Institutional Shares | | | 1,000.00 | | | | 1,014.10 | | | | 1,019.80 | | | | 5.30 | | | | 5.32 | | | | 1.05 | % | |

* Expenses are equal to the average account value multiplied by the Fund's annualized expense ratio multiplied by 183/365 (the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year).

25

Privacy Policy

Protecting the Privacy of Information

The Trust respects your right to privacy. We also know that you expect us to conduct and process your business in an accurate and efficient manner. To do so, we must collect and maintain certain personal information about you. This is the information we collect from you on applications or other forms, and from the transactions you make with us or third parties. It may include your name, address, social security number, account transactions and balances, and information about investment goals and risk tolerance.

We do not disclose any information about you or about former customers to anyone except as permitted or required by law. Specifically, we may disclose the information we collect to companies that perform services on our behalf, such as the transfer agent that processes shareholder accounts and printers and mailers that assist us in the distribution of investor materials. We may also disclose this information to companies that perform marketing services on our behalf. This allows us to continue to offer you Victory investment products and services that meet your investing needs, and to effect transactions that you request or authorize. These companies will use this information only in connection with the services for which we hired them. They are not permitted to use or share this information for any other purpose.

To protect your personal information internally, we permit access only by authorized employees and maintain physical, electronic, and procedural safeguards to guard your personal information.*

* You may have received communications regarding information about privacy policies from other financial institutions which gave you the opportunity to "opt-out" of certain information sharing with companies which are not affiliated with that financial institution. The Trust does not share information with other companies for purposes of marketing solicitations for products other than the Trust. Therefore, the Trust does not provide opt-out options to their shareholders.

P.O. Box 182593

Columbus, Ohio 43218-2593

Visit our website at: | | Call | |

vcm.com | | (800) 235-8396 | |

September 30, 2021

Semi Annual Report

USAA California Bond Fund

Victory Capital means Victory Capital Management Inc., the investment adviser of the USAA Mutual Funds. USAA Mutual Funds are distributed by Victory Capital Services, Inc., member FINRA, an affiliate of Victory Capital. Victory Capital and its affiliates are not affiliated with United Services Automobile Association or its affiliates. USAA and the USAA logos are registered trademarks and the USAA Mutual Funds and USAA Investments logos are trademarks of United Services Automobile Association and are being used by Victory Capital and its affiliates under license.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Capital site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

TABLE OF CONTENTS

Investment Objective & Portfolio Holdings | | | 2 | | |

Schedule of Portfolio Investments | | | 3 | | |

Financial Statements | |

Statement of Assets and Liabilities | | | 11 | | |

Statement of Operations | | | 12 | | |

Statements of Changes in Net Assets | | | 13 | | |

Financial Highlights | | | 16 | | |

Notes to Financial Statements | | | 18 | | |

Supplemental Information | | | 27 | | |

Proxy Voting and Portfolio Holdings Information | | | 27 | | |

Expense Examples | | | 27 | | |

Privacy Policy (inside back cover) | | | |