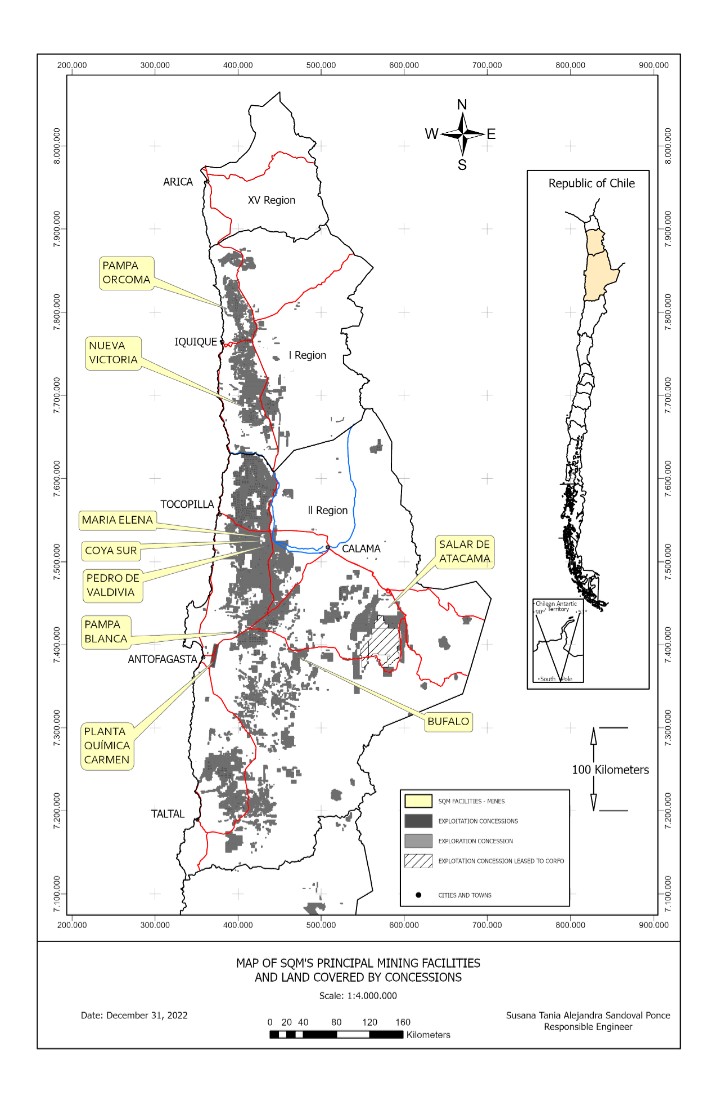

We operate port facilities at Tocopilla, Chile for the shipment of products and the delivery of raw materials in conformity with maritime concessions, which have been granted by the respective administrative authorities. These concessions are normally renewable on application, provided that such facilities are used as authorized and annual concession fees are paid.

In 2005, Law No. 20,026, known as the “Law to Establish a Specific Tax on Mining Activity” (Ley que Establece un Impuesto Específico a la Actividad Minera) or the “Royalty Law”, established a tax to be applied to mining activities developed in Chile. In 2010, modifications were made to the Royalty Law and taxes were increased.

On February 24, 2020, Law No.21,210 the “Law to Modernize the Tax Legislation” was published. As a result of these reforms, open stock corporations, such as SQM, are subject to the general corporate tax rules. The corporate tax rate that applies to us increased to 27% in 2018.

The Chilean government may again decide to levy additional taxes on mining companies or other corporations in Chile, and such taxes could have a material adverse impact on our business, financial conditions and results of operations.

We are also subject to the Chilean Labor Code and the Subcontracting Law, which are overseen by the Labor Authority (Dirección del Trabajo), the National Geology and Mining Service (Servicio Nacional de Geología y Minería) or “Sernageomin”, and the National Health Service. Recent changes to these laws and their application may have a material adverse effect on our business, financial condition and results of operations. See “Item 3.D. Risk Factors—Risks Relating to Our Business—We are exposed to labor strikes and labor liabilities that could impact our production levels and costs.”

In addition, we are subject to Law No. 20,393, which establishes criminal liability for legal entities, for crimes such as, (a) asset laundering, (b) financing terrorism, (c) bribery and (d) obliging employees to breach sanitary restrictions ordered by the local authorities. Potential sanctions for violations under this law could include (i) fines, (ii) loss of certain governmental benefits during a given period, (iii) a temporary or permanent bar against the corporation executing contracts with governmental entities, and (iv) dissolution of the corporation.

We are subject to the Securities Market Law and Law No. 18,046 on Corporations (Ley de Sociedades Anónimas) or the “Chilean Corporations Act”, which regulates corporate governance of public companies. Specifically, the Chilean Corporations Act regulates, among other things, independent director requirements, disclosure obligations to the general public and to the CMF, as well as regulations relating to the use of inside information, the independence of external auditors, and procedures for the analysis of transactions with related parties. See “Item 6.C. Board Practices” and “Item 7.B. Related Party Transactions.”

Law No. 21,455, which was published in the Official Gazette on June 21, 2022, establishes a legal framework for facing the challenges derived from climate change and complying with the Chilean State’s international commitments regarding such issue. Law No. 21,455, amends the Chilean Corporations Act to recquire open stock corporations registered in the Securities Register to periodically provide information to CMF in connection with the impact of their activities on the environment and climate change.

Law No. 21,521, which was published in the Official Gazette on January 4, 2023, seeks to promote competition and financial inclusion in financial services through innovation and technology. Law No. 21,521 regulates the following financial services: (i) crowdfunding platforms; (ii) alternative systems for the transaction of financial instruments or securities; (iii) credit advice; (iv) investment advice (v) custody of financial instruments; (vi) order routing, and (vii) intermediation of financial instruments. In addition, Law No. 21,521 amends the Chilean Corporations Act to increase by 2,000 (or the higher number determined by the CMF) the number of shareholders that a closed corporation must have to be required to register its shares in the Securities Registry and become an open stock corporation. Law No. 21,521 also amends the Securities Market Law to establish a simplified regime for debt securities, which will be detailed by the CMF.

There are currently no material legal or administrative proceedings pending against us except as discussed under “Item 8.A.7 Legal Proceedings”, in Note 20 to our consolidated financial statements and below under “Safety, Health and Environmental Regulations in Chile.”