0000909037 sqm:MexicoPesosCurrencyMember ifrs-full:IntangibleAssetsOtherThanGoodwillMember sqm:NoncurrentAssetsMember 2021-12-31 0000909037 sqm:LeaseLiabilitiesAtNominalAmountMember sqm:SqmIndustrialSaMember sqm:ElTrovadorSaMember 2021-12-31 0000909037 currency:CLP sqm:CurrentLiabilitiesMember sqm:OtherCurrentNonfinancialLiabilitiesMember ifrs-full:LaterThanThreeMonthsAndNotLaterThanOneYearMember 2020-12-31 0000909037 sqm:LeaseLiabilitiesAtNominalAmountMember ifrs-full:LaterThanTwoYearsAndNotLaterThanThreeYearsMember sqm:SqmSalarSaMember sqm:SkmIndustrialLtdaMember 2020-12-31

P

RESENTATION OF INFORMATION

In this Annual Report on Form 20-F, except as otherwise provided or unless the context requires otherwise, all references to “

we

,” “

us

,” “

Company

” or “

SQM

” are to Sociedad Química y Minera de Chile S.A., an open stock corporation (

sociedad anónima abierta

) organized under the laws of the Republic of Chile, and its consolidated subsidiaries.

All references to “

US$

,” “

U.S. dollars,

” “

USD

” and “

dollars

” are to United States dollars, references to “

pesos,

” “

CLP

” and “

Ch$

” are to Chilean pesos, references to ThUS$ are to thousands of United States dollars, references to ThCh$ are to thousands of Chilean pesos and references to “

UF

” are to

Unidades de Fomento

. The UF is an inflation-indexed, peso-denominated unit that is linked to, and adjusted daily to reflect changes in, the previous month’s Chilean consumer price index. As of December 31, 2021, UF 1.00 was equivalent to US$36.69 and Ch$30,991.74 according to the Chilean Central Bank (

Banco Central de Chile

). As of March 1, 2022, UF 1.00 was equivalent to US$39.54 and Ch$31,552.64.

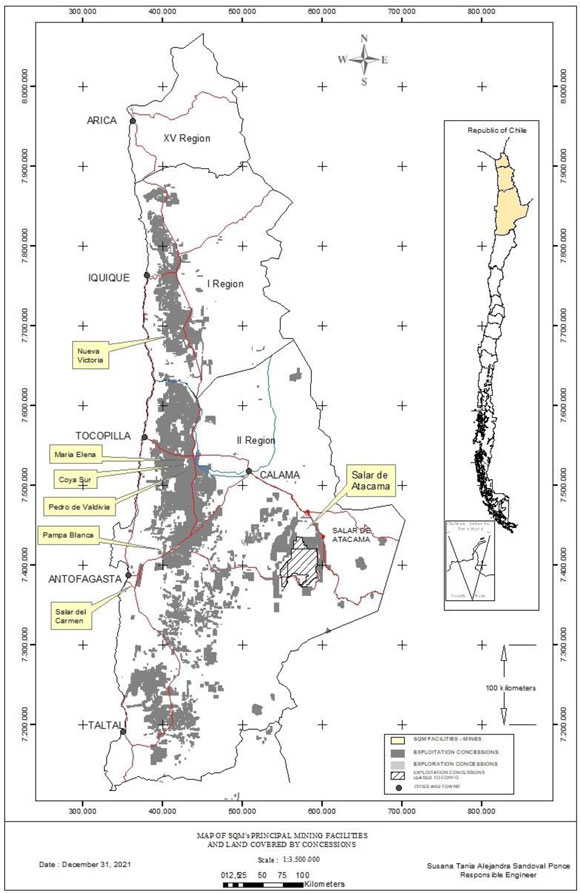

The Republic of Chile is governed by a democratic government, organized in fifteen regions plus the Metropolitan Region (surrounding and including Santiago, the capital of Chile). Our production operations are concentrated in northern Chile, specifically in the Tarapacá Region and in the Antofagasta Region.

We use the metric system of weights and measures in calculating our operating and other data. The United States equivalent units of the most common metric units used by us are as shown below:

1 kilometer equals approximately 0.6214 miles

1 meter equals approximately 3.2808 feet

1 centimeter equals approximately 0.3937 inches

1 hectare equals approximately 2.4710 acres

1 metric ton (“MT” or “metric ton”) equals 1,000 kilograms or approximately 2,205 pounds.

We are not aware of any independent, authoritative source of information regarding sizes, growth rates or market shares for most of our markets. Accordingly, the market size, market growth rate and market share estimates contained herein have been developed by us using internal and external sources and reflect our best current estimates. These estimates have not been confirmed by independent sources.

Percentages and certain amounts contained herein have been rounded for ease of presentation. Any discrepancies in any figure between totals and the sums of the amounts presented are due to rounding.

“

assay values

” Chemical result or mineral component amount contained by the sample.

“

average global metallurgical recoveries

” Percentage that measures the metallurgical treatment effectiveness based on the quantitative relationship between the initial product contained in the mine-extracted material and the final product produced in the plant.

“

average mining exploitation factor

” Index or ratio that measures the mineral exploitation effectiveness, based on the quantitative relationship between (in-situ mineral minus exploitation losses) / in-situ mineral.

“

CAGR

”

Compound annual growth rate, the year over year growth rate of an investment over a specified period of time.

“

cash and cash equivalents

”

The International Accounting Standards Board (IASB) defines cash and cash equivalents as short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

“

CCHEN

” The Chilean Nuclear Energy Commission (

Comisión Chilena de Energía Nuclear

).

“

Controller Group

” * A person or company or group of persons or companies that according to Chilean law, have executed a joint performance agreement, that have a direct or indirect share in a company’s ownership and have the power to influence the decisions of the company’s management.

“

Corfo

” Production Development Corporation (

Corporación de Fomento de la Producción

), formed in 1939, a Chilean national organization in charge of promoting Chile’s manufacturing productivity and commercial development.

“

CMF

” The Chilean Financial Market Commission. (

La Comisión para el Mercado Financiero).

“

cut-off grade

” The minimal assay value or chemical amount of some mineral component above which exploitation is economical.

“

dilution

” Loss of mineral grade because of contamination with barren material (or waste) incorporated in some exploited ore mineral.

“

exploitation losses

” Amounts of ore mineral that have not been extracted in accordance with exploitation designs.

“

fertigation

” The process by which plant nutrients are applied to the ground using an irrigation system.

“

geostatistical analysis

” Statistical tools applied to mining planning, geology and geochemical data that allow estimation of averages, grades and quantities of mineral resources and reserves.

“

heap leaching

” A process whereby minerals are leached from a heap, or pad, of ROM (run of mine) ore by leaching solutions percolating down through the heap and collected from a sloping, impermeable liner below the pad.

“

horizontal layering

” Rock mass (stratiform seam) with generally uniform thickness that conform to the sedimentary fields (mineralized and horizontal rock in these cases).

“

hypothetical resources

” Mineral resources that have limited geochemical reconnaissance, based mainly on geological data and sample assay values spaced between 500–1000 meters.

“

Indicated Mineral Resource

” ** That part of a mineral resource with a level of geological confidence between that of measured and inferred resources; quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit.

“

Inferred Mineral Resource

” ** That part of a mineral resource with the lowest level of geological confidence; quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability.

“

industrial crops

” Refers to crops that require processing after harvest in order to be ready for consumption or sale. Tobacco, tea and seed crops are examples of industrial crops.

“

Kriging Method”

A technique used to estimate ore reserves, in which the spatial distribution of continuous geophysical variables is estimated using control points where values are known.

“LIBOR”

London Inter Bank Offered Rate.

“

limited reconnaissance

” Low or limited level of geological knowledge.

“

Measured Mineral Resource

” ** That part of a mineral resource with the highest level of geological confidence; quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit.

“

metallurgical treatment

” A set of chemical and physical processes applied to the caliche ore and to the salar brines to extract their useful minerals (or metals).

“

Mineral Reserve

” ** An estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted.

“

Mineral Resource

” ** A concentration or occurrence of material of economic interest in or on the earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled.

“

ore depth

” Depth of the mineral that may be economically exploited.

“

ore type

” Main mineral having economic value contained in the caliche ore (sodium nitrate or iodine).

“

ore

” A mineral or rock from which a substance having economic value may be extracted.

“

Probable Mineral Reserve

” ** The economically mineable part of an indicated and, in some cases, a measured mineral resource.

“

Proven Mineral Reserve

” ** The economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource.

“

solar salts

”

A mixture of 60% sodium nitrate and 40% potassium nitrate used in the storage of thermo-energy.

“

vat leaching

” A process whereby minerals are extracted from crushed ore by placing the ore in large vats containing leaching solutions.

“

waste

” Rock or mineral which is not economical for metallurgical treatment.

“

Weighted average age

” The sum of the product of the age of each fixed asset at a given facility and its current gross book value as of December 31, 2021 divided by the total gross book value of the Company’s fixed assets at such facility as of December 31, 2021.

| | The definition of a Controller Group that has been provided is the one that applied to the Company. Chilean law provides for a broader definition of a “controller group”, as such term is defined in Title XV of Chilean Law No. 18,045. |

| | The definitions we use for resources and reserves are as defined in subpart 1300 of Regulation SK. |

C

AUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F contains statements that are or may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not based on historical facts and reflect our expectations for future events and results. Words such as “believe,” “expect,” “predict,” “anticipate,” “intend,” “estimate,” “should,” “may,” “likely,” “could” or similar expressions may identify forward-looking information. These statements appear throughout this Form 20-F and include statements regarding the intent, belief or current expectations of the Company and its management, including but not limited to any statements concerning:

| | trends affecting the prices and volumes of the products we sell and the effects on our results; |

| | level of reserves, quality of the ore and brines, and production levels and yields; |

| | our capital investment program and financing sources |

| | our Sustainable Development Plan; |

| | development of new products, anticipated cost synergies and product and service line growth; |

| | our business outlook, future economic performance, anticipated profitability, revenues, expenses, or other financial items; |

| | the future impact of competition; and |

Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements included in this Form 20-F, including, without limitation, the information under “Item 4. Information on the Company,” “Item Number 5. Operating and Financial Review and Prospects” and “Item 11. Quantitative and Qualitative Disclosures About Market Risk.” Factors that could cause actual results to differ materially include, but are not limited to:

| | volatility of global prices for our products; |

| | political, economic and demographic developments in certain emerging market countries, where we conduct a large portion of our business; |

| | the impact of the global novel coronavirus (COVID-19) pandemic, including any new strain and any associated economic downturn on our future operating and financial performance; |

| | changes in production capacities; |

| | the nature and extent of future competition in our principal markets; |

| | our ability to implement our capital expenditures program, including our ability to obtain financing when required; |

| | changes in raw material and energy prices; |

| | currency and interest rate fluctuations; |

| | risks relating to the estimation of our reserves; |

| | changes in quality standards or technology applications; |

| | adverse legal, regulatory or labor disputes or proceedings; |

| | changes in governmental regulations; |

| | a potential change of control of our company; and |

| | additional risk factors discussed below under Item 3. “Key Information—Risk Factors." |

Risks Relating to our Business

| | Our inability to extend or renew the mineral exploitation rights relating to the Salar de Atacama concession beyond their current expiration date in December 2030 could have a material adverse effect on our business, financial condition and results of operations. |

| | Volatility of world lithium, fertilizer and other chemical prices and high raw materials and energy prices that increase cost of sales, production costs and potentially result in energy unavailability, as well as changes in production capacities, including new production of iodine, potassium nitrate or lithium from current or new competitors in the markets in which we operate or variations of our inventory levels for economic or operational reasons could affect our prices, business, financial condition and results of operations. |

| | Our sales could be impacted by global shipping constraints. |

| | Our sales to emerging markets and expansion strategy expose us to risks related to economic conditions and trends in those countries as well as subject us to differing regulatory, tax and other regimes. |

| | We have a capital expenditure program that is subject to significant risks and uncertainties. |

| | Our reserve estimates are internally prepared and not subject to review by external geologists or an external auditing firm and could be subject to significant changes, which may have a material adverse effect on our business, financial condition and results of operations. |

| | Chemical and physical properties of our products could adversely affect their commercialization. |

| | Changes in technology or other developments could result in preferences for substitute products. |

| | We are exposed to labor strikes and labor liabilities that could impact our production levels and costs. |

| | We are and might be subject to new and upcoming labor laws and regulations in Chile and may be exposed to liabilities and potential costs for non-compliance. |

| | Lawsuits and arbitrations could adversely impact us. |

| | Environmental laws and regulations could expose us to higher costs, liabilities, claims and failure to meet current and future production targets and changes in regulations regarding, or any revocation or suspension of mining, port or other concessions or changes in water rights laws and other regulations could affect our business, financial condition and results of operations. |

| | A significant percentage of our shares are held by two principal shareholder groups who may have interests that are different from that of other shareholders and of each other. Any change in such principal shareholder groups may result in a change of control of the Company or of its Board of Directors or its management, which may have a material adverse effect on our business, financial condition and results of operations. |

| | Tianqi is a significant shareholder and a competitor of the Company, which could result in risks to free competition. |

| | Our information technology systems may be vulnerable to disruption which could place our systems at risk from data loss, operational failure, or compromise of confidential information. |

| | Recent international trade tensions could have a negative effect on our financial performance. |

| | Outbreaks of communicable infections or diseases, or other public health pandemics, such as the outbreak of the novel coronavirus (COVID-19) currently being experienced around the world, have impacted and may further impact the markets in which we, our customers and our suppliers operate or market and sell products and could have a material adverse effect on our operations business, financial condition and results of operations. |

| | If our stakeholders and other constituencies believe we fail to appropriately address sustainability and other environmental, social and governance (ESG) concerns it may adversely affect our business. |

| | Climate change can create physical risks and other risks that could adversely affect our business and operations and adverse weather conditions or significant changes in weather patterns could have a material adverse impact on our results of operations. |

Risks Relating to Financial Markets

| | Currency fluctuations and risks associated with the discontinuation, reform or replacement of benchmark indices may have a negative effect on our financial performance. |

| | We may be subject to risks associated with the discontinuation, reform or replacement of benchmark indices. |

| | As we are a company based in Chile, we are exposed to political risks and civil unrest in Chile. |

| | Changes to the Chilean Constitution could impact a wide range of rights, including mining rights, water rights and property rights generally . |

| | Changes in regulations regarding, or any revocation or suspension of mining, port or other concessions could affect our business, financial condition and results of operations . |

| | The Chilean government could separately levy additional taxes on mining companies operating in Chile or declare lithium mining to be in the national interest, which could enable the expropriation of our lithium assets. |

| | New legislation affecting mining licenses could materially adversely affect our mining licenses and mining concessions |

| | Legislation and growing case law regarding indigenous and tribal peoples might affect our development plans. |

| | Chile has different corporate disclosure and accounting standards than those you may be familiar with in the United States. |

| | Chile is located in a seismically active region. |

| | The price of our ADSs and the U.S. dollar value of any dividends will be affected by fluctuations in the U.S. dollar/Chilean peso exchange rate. |

| | Developments in other emerging markets could materially affect the value of our ADSs and our shares. |

| | The volatility and low liquidity of the Chilean securities markets could affect the ability of our shareholders to sell our ADSs. |

| | Our share or ADS price may react negatively to future acquisitions, capital increases and investments. |

| | ADS holders may be unable to enforce rights under U.S. securities laws. |

| | As preemptive rights may be unavailable for our ADS holders, they have the risk of their holdings being diluted if we issue new stock. |

| | If we were classified as a Passive Foreign Investment Company by the U.S. Internal Revenue Service, there could be adverse consequences for U.S. investors. |

| | Changes in Chilean tax regulations could have adverse tax consequences for U.S. investors. |

| | We are subject to risks related to the ongoing military conflict between Ukraine and Russia. |

| | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| | OFFER STATISTICS AND EXPECTED TIMETABLE |

| | Capitalization and Indebtedness |

| | Reasons for the Offer and Use of Proceeds |

Our operations are subject to certain risk factors that may affect SQM’s business, financial condition, cash flows, or results of operations. In addition to other information contained in this Annual Report on Form 20-F, you should carefully consider the risks described below. These risks are not the only ones we face. Additional risks not currently known to us or that are known but that we currently believe are not significant may also affect our business operations. Our business, financial condition, cash flows or results of operations could be materially affected by any of these risks.

Risks Relating to our Business

Our inability to extend or renew the mineral exploitation rights relating to the Salar de Atacama concession, upon which our business is substantially dependent, beyond their current expiration date in December 2030 could have a material adverse effect on our business, financial condition and results of operations.

Our subsidiary SQM Salar S.A. (“SQM Salar”), as leaseholder, holds exclusive and temporary rights to exploit mineral resources in the Salar de Atacama in northern Chile. These rights are owned by Corfo, a Chilean government entity, and leased to SQM Salar pursuant to (i) a 1993 lease agreement over mining exploitation concessions between SQM Salar and Corfo, as amended from time to time (the “Lease Agreement”), and (ii) the Salar de Atacama project agreement between Corfo and SQM Salar, as amended from time to time (the “Project Agreement”). The Lease Agreement provides for SQM Salar to (i) make quarterly lease payments to Corfo based on product sales from leased mining properties and annual contributions to research and development, to local communities, to the Antofagasta Regional Government and to the municipalities of San Pedro de Atacama, María Elena and Antofagasta, (ii) maintain Corfo’s rights over the mining exploitation concessions and (iii) make annual payments to the Chilean government for such concession rights. The Lease Agreement expires on December 31, 2030.

Our business is substantially dependent on the exploitation rights under the Lease Agreement and the Project Agreement, since all of our products originating from the Salar de Atacama are derived from our extraction operations under the Lease Agreement. For the year ended December 31, 2021, revenues related to products originating from the Salar de Atacama represented 47% of our consolidated revenues, consisting of revenues from our potassium business line and our lithium and derivatives business line for the period. As of December 31, 2021, only 9 years remain on the term of the Lease Agreement and we had extracted approximately 32% of the total permitted accumulated extraction and sales limit of lithium under the lithium extraction and sales limits.

Although we expect to begin the process of discussing the extension or renewal of the mineral exploitation rights in the Salar de Atacama under the Lease Agreement and Project Agreement with Corfo well in advance of the December 2030 expiration date, we cannot assure you that we will successfully reach an agreement with Corfo to extend or renew our mineral exploitation rights beyond 2030. Any negotiation with Corfo for an extension or renewal could involve renegotiation of any or all of the terms and conditions of the Lease Agreement and Project Agreement, including, among other things, the lithium and potassium extraction and sales limits, the lease payment rates and calculations, or other payments to Corfo.

In the event that we are not able to extend or renew the Lease Agreement beyond the current expiration date of the Lease Agreement in 2030, we would be unable to continue extraction of lithium and potassium under the Lease Agreement, which could have a material adverse effect on our business, financial condition and results of operations.

Volatility of world lithium, fertilizer and other chemical prices and changes in production capacities could affect our business, financial condition and results of operations.

The prices of our products are determined principally by world prices, which, in some cases, have been subject to substantial volatility in recent years. World lithium, fertilizer and other chemical prices constantly vary depending upon the relationship between supply and demand at any given time. Supply and demand dynamics for our products are tied to a certain extent to global economic cycles and have been impacted by circumstances related to such cycles. Furthermore, the supply of lithium, certain fertilizers, or other chemical products, including certain products that we provide, varies principally depending on the production of the major producers, (including us) and their respective business strategies.

We expect that prices for the products we manufacture will continue to be influenced, among other things, by worldwide supply and demand and the business strategies of major producers. Some of the major producers (including us) have increased or decreased production and have the ability to increase or decrease production.

As a result of the above, the prices of our products may be subject to substantial volatility. High volatility or a substantial decline in the prices or sales volumes of one or more of our products could have a material adverse effect on our business, financial condition and results of operations.

Our sales could be impacted by global shipping constraints

We sell our products in more than 110 countries in the world. Our products are shipped

in containers or break bulk format

from the port terminals in Antofagasta, Tocopilla, Mejillones and Iquique in Chile.

Current challenges in the global shipping industry have led to congestion in ports, a shortage in containers, and a lack of space on ships. Because of this situation, we face a risk of potential supply chain disruptions that may adversely affect our operations and ability to deliver our products to our customers.

Depending on the terms of shipments to customers, the risk of loss

related to these shipping issues

could fall on us.

Additionally, our revenues and collections may also be adversely affected by significant increases in the cost of transportation, as a result of increases in fuel or labor costs, higher demand for

logistics

services, or otherwise, and transportation delays that

could have a

negative impact

on our

sales agreements

and

customer relationships

.

Our sales to emerging markets and expansion strategy expose us to risks related to economic conditions and trends in those countries.

We sell our products in more than 110 countries around the world. In 2021, approximately 53% of our sales were made in emerging market countries: 11% in Latin America (excluding Chile); 8% in Africa and the Middle East (excluding Israel); 8% in Chile

;

and 26% in Asia and Oceania (excluding Australia, Japan, New Zealand, South Korea and Singapore). In Note 21.1 to our consolidated financial statements, we reported revenues from Chile

,

Latin America and the Caribbean and Asia and others of US$1.8 billion. We expect to expand our sales in these and other emerging markets in the future. In addition, we may carry out acquisitions or joint ventures in jurisdictions in which we currently do not operate, relating to any of our businesses or to new businesses in which we believe we may have sustainable competitive advantages. The results of our operations and our prospects in other countries in which we establish operations will depend, in part, on the general level of political stability, economic activity and policies in those countries as well as the duration of the COVID-19 or other pandemics. Future developments in the political systems or economies of these countries or the implementation of future governmental policies in those countries, including the imposition of withholding and other taxes, restrictions on the payment of dividends or repatriation of capital, the imposition of import duties or other restrictions, the imposition of new environmental regulations or price controls or changes in relevant laws or regulations, could have a material adverse effect on our business, financial condition and results of operations in those countries.

Our inventory levels may vary for economic or operational reasons.

In general, economic conditions or operational factors can affect our inventory levels. Higher inventories carry a financial risk due to increased need for cash to fund working capital and could imply an increased risk of loss of product. At the same time, lower levels of inventory can hinder the distribution network and process, thus impacting sales volumes. There can be no assurance that inventory levels will remain stable. These factors could have a material adverse effect on our business, financial condition and results of operations.

New production of iodine, potassium nitrate or lithium from current or new competitors in the markets in which we operate could adversely affect prices.

In recent years, new and existing competitors have increased the supply of iodine, potassium nitrate and lithium, which has affected prices for those products. Further production increases could negatively impact prices. There is limited information on the status of new iodine, potassium nitrate or lithium production capacity expansion projects being developed by current and potential competitors and, as such, we cannot make accurate projections regarding the capacities of possible new entrants into the market and the dates on which they could become operational. If these potential projects are completed in the short term, they could adversely affect market prices and our market share, which, in turn, could have a material adverse effect on our business, financial condition and results of operations.

We have a capital expenditure program that is subject to significant risks and uncertainties.

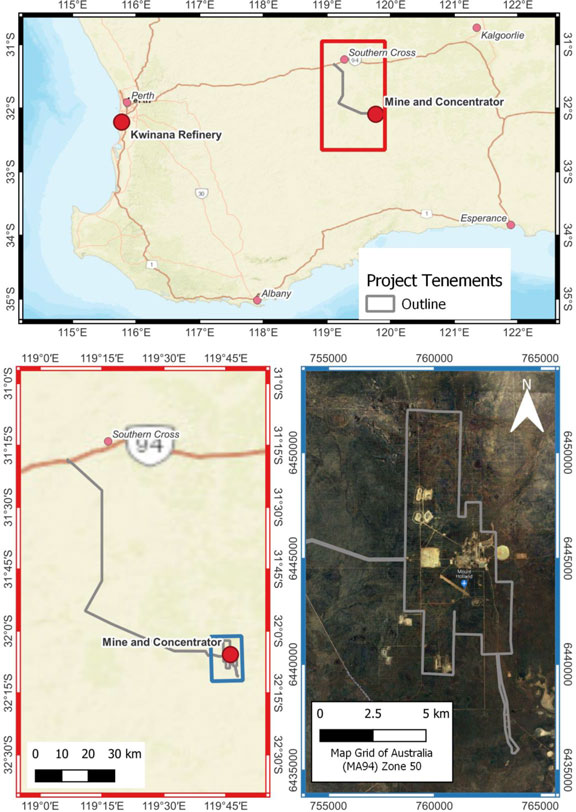

Our business is capital intensive. Specifically, the exploration and exploitation of reserves, mining and processing costs, the maintenance of machinery and equipment and compliance with applicable laws and regulations require substantial capital expenditures. We must continue to invest capital to maintain or to increase our exploitation levels and the amount of finished products we produce. For example, we have a US$2.25 billion investment plan for the years 2021-2024. The plan will allow us to expand our operations of lithium, iodine and nitrate by accessing natural resources both in the Salar de Atacama and caliche ore deposits in Chile as well as through the 50,0000 metric ton Mt. Holland lithium hydroxide project in Western Australia (a joint venture that we are developing with our partner Wesfarmers). The plan also aims to increase our mining capacity while protecting the environment, reduce operational costs and increase our annual production capacity of nitrates and iodine to meet expected growth in those markets.

Mining industry development projects typically require a number of years and significant expenditures before production can begin. Such projects could experience unexpected problems and delays during development, construction and start-up.

Our decision to develop a project typically is based on the results of feasibility studies, which estimate the anticipated economic returns of a project. The actual project profitability or economic feasibility may differ from such estimates as a result of any of the following factors, among others: changes in tonnage, grades and metallurgical characteristics of ore or other raw materials to be mined and processed; estimated future prices of the relevant products; changes in customer demand; higher construction and infrastructure costs; the quality of the data on which engineering assumptions were made; higher production costs; adverse geotechnical conditions; availability of adequate labor force; availability and cost of water and energy; availability and cost of transportation; fluctuations in inflation and currency exchange rates; availability and terms of financing; and potential delays relating to social and community issues.

In addition, we require environmental permits for our new projects. Obtaining permits in certain cases may cause significant delays in the execution and implementation of new projects and, consequently, may require us to reassess the related risks and economic incentives.

This may require modifying our operations to incorporate the use of seawater and updating our mining equipment and operational centers.

We cannot assure you that we will be able to maintain our production levels or generate sufficient cash flow or that we will have access to sufficient investments, loans or other financing alternatives, to continue our activities at or above present levels, or that we will be able to implement our projects or receive the necessary permits required for them in time. Any or all of these factors may have a material adverse effect on our business, financial condition and results of operations.

High raw materials and energy prices could increase our production costs and cost of sales, and energy may become unavailable at any price.

We rely on certain raw materials and various energy sources (diesel, electricity, liquefied natural gas, fuel oil and others) to manufacture our products. Purchases of energy and raw materials we do not produce constitute an important part of our cost of sales, approximately 15% in 2021. In addition, we may not be able to obtain energy at any price if supplies are curtailed or otherwise become unavailable. To the extent we are unable to pass on increases in the prices of energy and raw materials to our customers or we are unable to obtain energy, our business, financial condition and results of operations could be materially adversely affected.

Our reserve estimates are internally prepared and not subject to review by external geologists or an external auditing firm and could be subject to significant changes, which may have a material adverse effect on our business, financial condition and results of operations.

Our caliche ore mining reserve estimates and our Salar de Atacama brine mining reserve estimates are prepared by our own geologists and hydrogeologists and are not subject to authentication by external geologists or an external auditing firm. However, our reserve estimates in the Salar de Atacama were reviewed by qualified persons and this information is presented to Corfo.

Previously

, our reserve estimates in the Salar de Atacama were also reviewed by the Superior Council for Scientific Investigations (

Consejo Superior de Investigaciones Científicas

) or CSIC, and this information was presented to CCHEN.

Estimation methods involve numerous uncertainties as to the quantity and quality of the reserves, and reserve estimates could change upwards or downwards.

A downward change in our estimates and/or quality of our reserves could affect future volumes and costs of production and therefore have a material adverse effect on our business, financial condition and results of operations.

Chemical and physical properties of our products could adversely affect their commercialization.

Since our products are derived from natural resources, they contain inorganic impurities that may not meet certain customer or government standards. As a result, we may not be able to sell our products if we cannot meet such requirements. In addition, our cost of production may increase in order to meet such standards. Failure to meet such standards could materially adversely affect our business, financial condition and results of operations if we are unable to sell our products in one or more markets or to important customers in such markets.

Changes in technology or other developments could result in preferences for substitute products.

Our products, particularly iodine, lithium and their derivatives, are preferred raw materials for certain industrial applications, such as rechargeable batteries and liquid-crystal displays (LCDs). Changes in technology, the development of substitute products or other developments could adversely affect demand for these and other products which we produce. In addition, other alternatives to our products may become more economically attractive as global commodity prices shift. Any of these events could have a material adverse effect on our business, financial condition and results of operations.

We are exposed to labor strikes and labor liabilities that could impact our production levels and costs.

Over 93% of our employees are employed in Chile, of which approximately 66% were represented by 20 labor unions as of December 31, 2021. As of December 31, 2021, all collective bargaining agreements had been renegotiated. We are exposed to labor strikes and illegal work stoppages by both our own employees and our independent contractors’ employees that could impact our production levels in both our own plants and our independent contractors’ plants. If a strike or illegal work stoppage occurs and continues for a sustained period of time, we could be faced with increased costs and even disruption in our product flow that could have a material adverse effect on our business, financial condition and results of operations.

We are and might be subject to new and upcoming labor laws and regulations in Chile and may be exposed to liabilities and potential costs for non-compliance.

We are subject to recently enacted and might be subject to new local labor laws and regulations that govern, among other things, the relationship between us and our employees and will be subject to new labor bills currently under discussion in the Chilean Congress, mainly as a result of the impact of the global novel coronavirus (COVID-19) pandemic as well as to the economic and political volatility and civil unrest in Chile beginning in October and November 2019. There have been changes and proposed changes to various labor laws which include, but are not limited to, modifications related to teleworking, inclusion of workers with disabilities, minimum wage, unemployment insurance benefits, employee and employer relationships, pensions, profit sharing, regular work hours and other matters related to COVID-19.

Any changes to regulations to which we are subject could have a material adverse effect on our business, financial condition and results of operations.

Lawsuits and arbitrations could adversely impact us.

We are party to a range of lawsuits and arbitrations involving different matters as described in Note

20

to our Consolidated Financial Statements and “Item 8.A. Legal Proceedings.” Although we intend to defend our positions vigorously, our defense of these actions may not be successful

and responding to such lawsuits and arbitrations diverts our management’s attention from day-to-day operations. Adverse judgments or settlements in these lawsuits may have a material adverse effect on our business, financial condition and results of operations. In addition, our strategy of being a world leader includes entering into commercial and production alliances, joint ventures and acquisitions to improve our global competitive position. As these operations increase in complexity and are carried out in different jurisdictions, we may be subject to legal proceedings that, if settled against us, could have a material adverse effect on our business, financial condition and results of operations.

We have operations in multiple jurisdictions with differing regulatory, tax and other regimes.

We operate in multiple jurisdictions with complex regulatory environments that are subject to different interpretations by companies and respective governmental authorities. These jurisdictions may have different tax codes, environmental regulations, labor codes and legal framework, which adds complexity to our compliance with these regulations. Any failure to comply with such regulations could have a material adverse effect on our business, financial condition and results of operations.

Environmental laws and regulations could expose us to higher costs, liabilities, claims and failure to meet current and future production targets.

Our operations in Chile are subject to national and local regulations relating to environmental protection. In accordance with such regulations, we are required to conduct environmental impact studies or statements before we conduct any new projects or activities or significant modifications of existing projects that could impact the environment or the health of people in the surrounding areas. We are also required to obtain an environmental license for those projects and activities. The Chilean Environmental Assessment Service (

Servicio de Evaluación Ambiental

) evaluates environmental impact studies and statements submitted for its approval. The public, government agencies or local authorities may review and challenge projects that may adversely affect the environment, either before these projects are executed or once they are operating, if they fail to comply with applicable regulations. In order to ensure compliance with environmental regulations, Chilean authorities may impose fines up to approximately US$9 million per infraction, revoke environmental permits or temporarily or permanently close facilities, among other enforcement measures.

Chilean environmental regulations have become increasingly stringent in recent years, both with respect to the approval of new projects and in connection with the implementation and development of projects already approved, and we believe that this trend is likely to continue. Given public interest in environmental enforcement matters, these regulations or their application may also be subject to political considerations that are beyond our control.

We regularly monitor the impact of our operations on the environment and on the health of people in the surrounding areas and have, from time to time, made modifications to our facilities to minimize any adverse impact. Future developments in the creation or implementation of environmental requirements or their interpretation could result in substantially increased capital, operation or compliance costs or otherwise adversely affect our business, financial condition and results of operations.

The success of our current investments at the Salar de Atacama and Nueva Victoria is dependent on the behavior of the ecosystem variables being monitored over time. If the behavior of these variables in future years does not meet environmental requirements, our operation may be subject to important restrictions by the authorities on the maximum allowable amounts of brine and/or water extraction. For example, on December 13, 2017, the Environmental Court of Antofagasta ordered a temporary and partial closure of certain water extraction wells located in the Salar de Llamara. In October 2018, the Environmental Court of Antofagasta accepted our claim, and dismissed the restrictions without prejudice. It is possible that third parties could seek to reinstate these restrictions in the future. On December 26, 2019, the same Court ruled that the environmental compliance plan presented by SQM Salar S.A. with respect to the Salar de Atacama and approved by the Chilean Environmental Enforcement Authority (

Superintendencia del Medio Ambiente

) or SMA in January 2019, did not comply with certain completeness and efficiency requirements of the Chilean environmental legislation.

In September 2021, SQM Salar S.A. proposed to the SMA a new environmental compliance plan, which is currently subject to review. We believe that the new proposed environmental compliance plan, safeguards the protection of the environment and is evaluating all courses of action available under applicable law with respect to this ruling.

Our future development depends on our ability to sustain future production levels, which requires additional investments and the submission of the corresponding environmental impact studies or statements. If we fail to obtain approval or required environmental licenses, our ability to maintain production at specified levels will be seriously impaired, thus having a material adverse effect on our business, financial condition and results of operations.

In addition, our worldwide operations are subject to international and local environmental regulations. Since environmental laws and regulations in the different jurisdictions in which we operate may change, we cannot guarantee that future environmental laws, or changes to existing environmental laws, will not materially adversely impact our business, financial condition and results of operations.

A significant percentage of our shares are held by two principal shareholder groups who may have interests that are different from that of other shareholders and of each other. Any change in such principal shareholder groups may result in a change of control of the Company or of its Board of Directors or its management, which may have a material adverse effect on our business, financial condition and results of operations.

As of March 1, 2022, two principal shareholder groups held in the aggregate 48.33% of our total outstanding shares, including 94.19% of our Series A common shares, and have the power to elect six of our eight directors. The interests of the two principal shareholder groups may in some cases differ from those of other shareholders and of each other.

As of March 1, 2021, one principal shareholder group is Sociedad de Inversiones Pampa Calichera S.A. and its related companies, Inversiones Global Mining Chile Limitada and Potasios de Chile S.A. (together, the “Pampa Group”), which owned approximately 25.20% of the total outstanding shares of SQM, and another principal shareholder is Tianqi Lithium Corporation (“Tianqi”), which directly and indirectly owned approximately 23.13% of the total outstanding shares of SQM.

The divestiture by the Pampa Group or Tianqi, or potential changes in the circumstances that have led to the determination of the CMF that there is currently no controlling shareholder of the Company, or a combination thereof, may have a material adverse effect on our business, financial condition and results of operations.

Tianqi is a significant shareholder and a competitor of the Company, which could result in risks to free competition

Tianqi is a competitor in the lithium business, and as a result of the number of SQM shares that it owns, it has the right to choose up to three Board members. Under Chilean law, we are restricted in our ability to decline to provide information about us, which may include competitively sensitive information, to a director of our company. On August 27, 2018, Tianqi and the Chilean antitrust regulator, the Chilean National Economic Prosecutor’s Office (

Fiscalía Nacional Económica

), or FNE, entered into an extrajudicial agreement, under which certain restrictive measures were implemented in order to (i) maintain the competitive conditions of the lithium market, (ii) mitigate the risks described in the agreement and (iii) limit Tianqi’s access to certain information of the Company and its subsidiaries, which is defined as “sensitive information” under the agreement.

During the approval process of the extrajudicial agreement before the FNE, we expressed our concerns regarding the measures contained in the extrajudicial agreement since, in the Company’s opinion, the measures (i) could not effectively resolve the risks that Tianqi and the FNE have sought to mitigate, (ii) are not sufficient to avoid access to our “sensitive information” that, in the possession of a competitor, could harm us and the proper functioning of the market and (iii) could contradict the Chilean Corporations Act.

The presence of a shareholder which is at the same time a competitor of ours and the right of this competitor to choose Board members could generate risks to free competition and/or increase the risks of an investigation of free competition against us, whether in Chile or in other countries, all of which could have a material adverse effect on our business, financial condition and results of operations.

Our information technology systems may be vulnerable to disruption which could place our systems at risk from data loss, operational failure, or compromise of confidential information.

We rely on various computer and information technology systems, and on third party developers and contractors, in connection with our operations, including two networks that link our principal subsidiaries to our operating and administrative facilities in Chile and other parts of the world and ERP software systems, which are used mainly for accounting, monitoring of supplies and inventories, billing, quality control, research activities, and production process and maintenance control. In addition, we use cloud technologies, which allows us to support new business processes and respond quickly and at low cost to changing conditions in our business and of the markets. Our information technology systems are susceptible to disruption, damage or failure from a variety of sources, including errors by employees or contractors, computer viruses, cyber-attacks, misappropriation of data by outside parties, and various other threats. We have taken measures to identify and mitigate these risks with the object of reducing operational risk and improving security and operational efficiency, which also includes modernization of existing information technology infrastructure and communications systems. However, we cannot guarantee that due to the increasing sophistication of cyber-attacks our systems will not be compromised and because we do not maintain specialized cybersecurity insurance, our insurance coverage for protection against cybersecurity risk may not be sufficient. Cybersecurity breaches could result in losses of assets or production, operational delays, equipment failure, inaccurate recordkeeping, or disclosure of confidential information, any of which could result in business interruption, reputational damage, lost revenue, litigation, penalties or additional expenses and could have a material adverse effect on our business, financial condition and results of operations.

Recent international trade tensions could have a negative effect on our financial performance.

Economic conditions in China, an important market for the Company, are sensitive to global economic conditions. The global financial markets have experienced significant disruptions in the past, including the recent international trade disputes and tariff actions announced by the United States, China and certain other countries. The U.S. government has imposed significant tariffs on Chinese goods, and Chinese government has, in turn, imposed tariffs on certain goods manufactured in the United States. There is no assurance that the list of goods impacted by additional tariffs will not be expanded or the tariffs will not be increased materially. We are unable to predict how China or U.S. government policy, in particular, the outbreak of a trade war between China and the United States and additional tariffs on bilateral imports, may continue to impact global economic conditions. If the list of goods is further expanded or the tariff is further increased, global economic conditions of both countries could be impacted, and growth in demand for lithium or other commodities could decrease, which may have a material adverse effect on our business, financial condition and results of operations.

Outbreaks of communicable infections or diseases, or other public health pandemics, such as the outbreak of the novel coronavirus (COVID-19) currently being experienced around the world, have impacted and may further impact the markets in which we, our customers and our suppliers operate or market and sell products and could have a material adverse effect on our operations business, financial condition and results of operations.

Disease outbreaks and other public health conditions, such as the global outbreak of COVID-19 currently being experienced, in markets in which we, our customers and our suppliers operate, could have a significant negative impact on our revenues, profitability and business. The Chilean government has imposed several measures that may affect our operations, including mandatory quarantines for people who have been in contact with infected people, restrictions on the number of people that can be together, and lockdowns on specific communities that may suffer higher rates of infection or death, among others.

As a precaution, our management has voluntarily implemented several additional measures to help reduce the speed at which COVID-19 may spread in our company, including measures to mitigate the spread in the workplace, significant reductions in employee travel and a mandatory quarantine for people who have arrived from high-risk destinations, in consultation with governmental and international health organization guidelines, and will continue to implement measures consistent with the evolving COVID-19 situation. While these measures have been implemented to reduce the risk of the spread of the virus in our facilities, there can be no assurance that these measures will reduce or limit the impact of COVID-19 on our operations, business, financial condition or results of operations. Our operations could be stopped as a result of, among other reasons, regulatory restrictions or a significant outbreak of the virus among our staff, which could prevent employees from reporting to shifts.

While the global impacts of the COVID-19 pandemic are constantly changing, international financial markets have reflected the uncertainty associated with the slowdown of the global economy and the potential impact if businesses, workers, customers and others are prevented or restricted from conducting business activities due to quarantines, business closures or other restrictions imposed by businesses or governmental authorities in response to the COVID-19 outbreak.

If our stakeholders and other constituencies believe we fail to appropriately address sustainability and other environmental, social and governance (ESG) concerns it may adversely affect our business.

In October 2020, we announced our sustainable development plan, which includes voluntarily expanding our monitoring systems, promoting better and more profound conversations with neighboring communities and becoming carbon neutral and reducing water by 65% and brine extraction by 50% of our authorized limits. We also announced a goal of obtaining international certifications and participating in international sustainability indices which we consider essential for a sustainable future.

While we are dedicated to our efforts related to sustainability, if we fail to address appropriately all relevant stakeholders’ concerns in connection with ESG criteria, we may face opposition, which could negatively affect our reputation, delay operations, or lead to litigation threats or actions. If we do not maintain our reputation with key stakeholders and constituencies and effectively manage these sensitive issues, they could adversely affect our business, results of operations, and financial condition.

Climate change and a global transition to a low carbon economy can create physical risks and other risks that could adversely affect our business and operations and adverse weather conditions or significant changes in weather patterns could have a material adverse impact on our results of operations.

The impact of climate change and climate change-driven responses, such as a global transition to a low carbon economy on our operations and our customers’ operations

,

remains uncertain, but the regulatory, market-risks associated with climate change as well as the physical effects of climate change could have an adverse effect on us and our customers as experts believe that climate change may be associated with more extreme weather conditions These effects could include, but may not be limited to, changes in regional weather patterns, including drought and rainfall levels, water availability, sea levels, storm patterns and intensities and temperature levels, including increased volatility in seasonal temperatures via excessively hot or cold temperatures. These extreme weather conditions could vary by geographic location.

Climate-derived threats include, among others, changes in regional weather patterns, including changes in precipitation and evaporation parameters that, on the one hand, intensify drought phenomena, affecting the availability of water and, on the other hand, bring intense rains in short periods of time that generate other unwanted events that affect our operation and also our surrounding communities, such as road closures, infrastructure, landslides, among others. Additionally, rising sea levels and storm surges, increasing the days of port closures could impact the supply chain affecting our customers and suppliers. Other events such as storm patterns and intensities, increased wind speed, heat waves, cold waves, among other events considered as acute physical risks of climate change. Other effects are related to temperature levels, including increased volatility in seasonal temperatures through excessively high or low temperatures. These extreme weather conditions may vary by geography and location. Weather conditions have historically caused volatility in the agricultural industry (and indirectly in our results of operations) by causing crop failures or significantly reduced harvests, which can adversely affect application rates, demand for our plant nutrition products and our customers’ creditworthiness. Weather conditions can also lead to a reduction in farmable acres, flooding, drought or wildfires, which could also adversely impact growers’ crop yields and the uptake of plant nutrients, reducing the need for application of plant nutrition products for the next planting season which could result in lower demand for our plant nutrition products and negatively impact the prices of our products.

Any prolonged change in weather patterns in our markets, as a result of climate change or otherwise, could have a material adverse impact on the results of our operations.

Risks Relating to Financial Markets

Currency fluctuations may have a negative effect on our financial performance.

We transact a significant portion of our business in U.S. dollars, and the U.S. dollar is the currency of the primary economic environment in which we operate. In addition, the U.S. dollar is our functional currency for financial statement reporting purposes. A significant portion of our costs, however, is related to the Chilean peso. Therefore, an increase or decrease in the exchange rate between the Chilean peso and the U.S. dollar would affect our costs of production. The Chilean peso has been subject to large devaluations and revaluations in the past and may be subject to significant fluctuations in the future. As of December 31, 2021, the Chilean peso exchange rate was Ch$844.69 per U.S. dollar, while as of December 31, 2020 the Chilean peso exchange rate was Ch$710.95 per U.S. dollar. The Chilean peso therefore depreciated against the U.S. dollar by 18.8% in 2021. As of March 1, 2022, the Observed Exchange Rate was Ch$798.01 per U.S. dollar.

As an international company operating in several other countries, we also transact business and have assets and liabilities in other non-U.S. dollar currencies, such as, among others, the Euro, the South African rand, the Mexican peso, the Chinese yuan, the Thai baht and the Brazilian real.

As a result, fluctuations in the exchange rates of such foreign currencies to the U.S. dollar may have a material adverse effect on our business, financial condition and results of operations.

We may be subject to risks associated with the discontinuation, reform or replacement of benchmark indices.

Interest rate, foreign exchange rate and other types of indices which are deemed to be “benchmarks” are the subject of increased regulatory scrutiny and may be discontinued, reformed or replaced. For example, in 2017, the U.K. Financial Conduct Authority announced that it will no longer persuade or compel banks to submit rates for the calculation of the London interbank offered rate (“LIBOR”) benchmark after 2021. This reform will, and other future reforms may, cause benchmarks to be different than they have been in the past, or to disappear entirely, or have other consequences which cannot be fully anticipated which introduces a number of risks for our business. These risks include (i) legal risks arising from potential changes required to document new and existing transactions; (ii) financial risks arising from any changes in the valuation of financial instruments linked to benchmark rates; (iii) pricing risks arising from how changes to benchmark indices could impact pricing mechanisms on some instruments; (iv) operational risks arising from the potential requirement to adapt IT systems, trade reporting infrastructure and operational processes; and (v) conduct risks arising from the potential impact of communication with customers and engagement during the transition period. Various replacement benchmarks, and the timing of and mechanisms for implementation are being considered. The transition away from LIBOR to risk-free reference rates (RFRs) requires financial firms to make a variety of internal changes, for example updating front-and back-office systems, retraining staff and redesigning processes, as well as potentially modifying or renegotiating potentially thousands of LIBOR-linked contracts. All banks and other financial market participants must eliminate their dependence on LIBOR by this date if they are to avoid disruption when the publication of LIBOR ceases. Although as of December 31, 2021 we had approximately US$70 million short- and long-term debt that use a LIBOR benchmark, it is not currently possible to determine whether, or to what extent, any such changes would affect us. However, the discontinuation or reformation of existing benchmark rates or the implementation of alternative benchmark rates may have a material adverse effect on our business, financial condition and results of operations.

In addition to the financial benchmarks, there are also market benchmarks used for the pricing of our long-term supply contracts, which may also be subject to regulatory scrutiny, or which may be discontinued, reformed or replaced. For example, for some of our long-term supply contracts, prices reference to indices prepared by commodity reporting agencies such as the Shanghai Metals Market (SMM) and Fastmarkets.

As we are a company based in Chile, we are exposed to political risks and civil unrest in Chile.

Our business, financial condition and results of operations could be affected by changes in policies of the Chilean government, other political developments in or affecting Chile, legal changes in the standards or administrative practices of Chilean authorities or the interpretation of such standards and practices, over which we have no control. The Chilean government has modified, and has the ability to modify, monetary, fiscal, tax, social and other policies in order to influence the Chilean economy or social conditions. We have no control over government policies and cannot predict how those policies or government intervention will affect the Chilean economy or social conditions, or, directly and indirectly, our business, financial condition and results of operations. Changes in policies involving exploitation of natural resources, taxation and other matters related to our industry may adversely affect our business, financial condition and results of operations.

We are exposed to economic and political volatility and civil unrest in Chile. Changes in social, political, regulatory and economic conditions or in laws and policies governing foreign trade, manufacturing, development and investment in Chile, as well as crises and political uncertainties in Chile, could adversely affect economic growth in Chile. In October and November 2019, Chile experienced riots and widespread mass demonstrations in Santiago and other major cities in Chile, triggered by an increase in public transportation fares in the city of Santiago, which involved violence and significant property damage and caused commercial disruptions throughout the country. As a result, on October 18, 2019 the Chilean government declared a 15-day period state of emergency and imposed a nighttime curfew in the greater Santiago region and other cities. The state of emergency has since been lifted and the Chilean government has introduced several social reforms. Also in 2019, then President Sebastian Piñera announced a pay cut for members of the Chilean Congress and the highest-paid civil servants and replaced eight ministers of his government. On November 15, 2019, representatives of Chile’s leading political parties agreed to hold a referendum, allowing Chileans to vote on whether to replace the Chilean Constitution. In a November 2020 referendum, Chilean citizens strongly supported convening a constitutional convention to draft a new Chilean Constitution. Any new Constitution could significantly alter the Chilean political situation, affect the Chilean economy, its business outlook, change existing rights, including rights to exploit natural resources, and water and property rights, any of which could adversely affect our business, results of operations, and financial condition.

The constitutional convention has already drafted proposals that may have a material impact on our business and operations. Although the final text of the Constitution is still being discussed and the voting of the proposals is still at an initial stage, the convention has accepted some proposals which seek to annul all of the existing mining and water rights and establish a whole new regime regarding mining and exploitation of natural resources. Also, the convention has approved certain proposals seeking to protect indigenous people and to recover indigenous land and territories. Part of our operations are located in areas that may be deemed to be indigenous land according to current and future legislation. Once the full text of the new Chilean Constitution has been drafted, it will be submitted to a national referendum in which the Chilean citizens will decide to approve or reject this text by a simple majority vote. We cannot predict the outcome of such referendum. If the referendum rejects the text of the new Chilean Constitution, the existing Chilean Constitution would remain in effect.

We cannot give any assurance that these reforms and proposals or the constitutional reform process will resolve the social and economic concerns or that mass protests or civil unrest will not resume. The long-term effects of this social unrest are hard to predict but could include slower economic growth, which could adversely affect our business, results of operations, and financial condition.

In addition, in December 2021, Chile elected Gabriel Boric as the new president. President Boric took office on March 11, 2022 and his agenda is mainly focused on the elimination of private pension funds, social security programs, increases in the minimum wage and pensions, and increases in corporate taxes. President Boric is also a strong supporter of the constitutional reforms being considered by the constitutional convention drafting a new Chilean Constitution. While it is still very early in President Boric’s term and there is uncertainty regarding how President Boric’s reforms may affect the political and business climate in Chile in the future, it is possible that these reforms could lead to higher-than-expected inflation levels, unemployment, higher corporate taxes and financial constraints on small and medium-sized companies, any of which could have an adverse effect on our business, results of operations, and financial condition.

Future adverse developments in Chile, including political events, financial or other crises, changes to policies regarding foreign exchange controls, regulations, and taxation, may impair our ability to execute our business plan and could adversely affect our growth, results of operations, and financial condition. Inflation, devaluation, social instability, and other political, economic, or diplomatic developments could also reduce our profitability. Economic and market conditions in Chilean financial and capital markets may be affected by international events, which could unfavorably affect the value of our securities.

Changes to the Chilean Constitution could impact a wide range of rights, including mining rights, water rights and property rights generally, and could affect our business, financial condition and results of operations.

A new Chilean Constitution is in the process of being drafted by a constitutional convention, which was convened on July 4, 2021. The constitutional convention will have approximately one year to draft an entirely new Chilean Constitution. A wide range of rights could potentially be under consideration for reform under the new Chilean Constitution, including mining rights, water rights and property rights generally. If approved by the constitutional convention, the final draft of the new Chilean Constitution will be submitted for approval to a public referendum with mandatory participation and would require a simple majority vote for approval. If a new Constitution is not approved, the existing Chilean Constitution, which has been in place since 1980, would remain in effect. There can be no assurance that the constitutional convention will agree on a draft of a new Chilean Constitution or that the Chilean citizens will approve any draft Chilean Constitution approved by the constitutional convention. Any changes to rights under a new Chilean Constitution could change the political situation of Chile and affect the Chilean economy and the business outlook for the country generally and our business, results of operations, and financial condition.

Changes in regulations regarding, or any revocation or suspension of mining, port or other concessions could affect our business, financial condition and results of operations.

We conduct our mining operations, including brine extraction, under exploitation and exploration concessions granted in accordance with provisions of the Chilean Constitution and related laws and statutes. Our exploitation concessions essentially grant a perpetual right (with the exception of the rights granted to SQM Salar with respect to the Salar de Atacama concessions under the Lease Agreement described above, which expires in 2030) to conduct mining operations in the areas covered by the concessions, provided that we pay annual concession fees. Our exploration concessions permit us to explore for mineral resources on the land covered thereby for a specified period of time and to subsequently request a corresponding exploitation concession. Any changes to the Chilean Constitution with respect to the exploitation and exploration of natural resources and concessions granted as a result of the constitutional convention could materially adversely affect our existing exploitation and exploration concessions or our ability to obtain future concessions and could have a material adverse effect on our business, financial condition and results of operations.

We also operate port facilities at Tocopilla, Chile, for the shipment of products and the delivery of raw materials pursuant to maritime concessions, which have been granted under applicable Chilean laws and are normally renewable on application, provided that such facilities are used as authorized and annual concession fees are paid.

Any significant adverse changes to any of these concessions, any changes to regulations to which we are subject or adverse changes to our other concession rights, or a revocation or suspension of any of our concessions, could have a material adverse effect on our business, financial condition and results of operations.

Changes in water rights laws and other regulations could affect our business, financial condition and results of operations.

We hold water use rights that are key to our operations. These rights were obtained from the Chilean Water Authority (

Dirección General de Aguas

) for supply of water from rivers and wells near our production facilities, which we believe are sufficient to meet current operating requirements.

In January 2022, the Chilean Congress approved a bill that amends the

Chilean

Water Code

(

),

which is only waiting for its promulgation and subsequent publication in order to

become

an applicable Chilean law. This modification introduces several changes to the

Water Code.

A

significant

amendment is the change in the

time periods for

which the water rights were granted. According to this new legislation

,

water rights

: (1)

will have a temporary nature being granted for a maximum of 30 years (

the specific

period will depend on the characteristic of the riverbed and its water availability);

(2)

will be subject

, in whole

or

in part,

to expiration for its non-use;

(3)

will have to

give

human consumption and sanitation priority in the use of water; and

(4)

will be subject to a minimum ecological flow to ensure nature conservation and environmental protection,

as

determined by the Water Authority. It shall be noted that the water regulation and its distribution is one of the most important focuses of the

constitutional convention

, and therefore, new changes may come into effect.

The Chilean Congress is considering a draft bill that declares lithium mining to be in the national interest, which if passed in its current form, could enable the expropriation of our lithium assets.

The Chilean

Congress is currently processing a bill, bulletin 10,638-08, which “Declares the exploitation and commercialization of lithium and Sociedad Química y Minera de Chile S.A. to be of national interest.” The purpose of this bill is to enable the potential expropriation of our assets, or our lithium operations in general. The bill is subject to further discussion in the Chilean

Congress, which includes several possible changes to its current wording. We cannot guarantee that the bill will not eventually be approved by the Chilean

Congress,

that its final wording will not refer to us or our lithium operations. If the bill is approved as currently drafted, it could have a material adverse effect on our business, financial condition and results of operations.

The Chilean government could levy additional taxes on mining companies operating in Chile.

In Chile, there is a royalty tax that is applied to mining activities developed in the country.

The Chilean Congress is currently processing a bill, bulletin 12,093-08, which proposes to institute a royalty fee of 3% on the value of extracted minerals. The bill is subject to further discussion in the Chilean Congress, which includes several possible changes to its current wording. We cannot guarantee that the bill will not eventually be approved by the Chilean Congress. If the bill is approved as currently drafted, it could have a material adverse effect on our business, financial condition and results of operations.

New

legislation

affecting mining licenses

could materially adversely affect our mining licenses and mining concessions

.

Law No. 21,420

,

published in the Official Gazette on February 4, 2022, reduces or eliminates certain tax exemptions in order to finance a new social security

program

called “Universal Guaranteed Pension”. Among others changes, this law contemplates amendments to the Chilean Mining Code, such as

:

(i) the increase in the value of the mining licenses related to the mining concessions (

an

increase of at least 4 times the previous value); (ii) the modification of the term on which the

mining

exploration concessions are granted and the prohibition

on

the holder to

obtain

a new

mining

exploration concession in the same area once the previous

concession

has expired; and (iii) amendments to the mining concessions

award

process.

Ratification of the International Labor Organization’s Convention 169 concerning indigenous and tribal peoples might affect our development plans.