UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-07874

JPMorgan Insurance Trust

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800)480-4111

Date of fiscal year end: December 31

Date of reporting period: January 1, 2019 through December 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1).

Annual Report

JPMorgan Insurance Trust

December 31, 2019

JPMorgan Insurance Trust Core Bond Portfolio

| | | | |

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

| | |  | |

CONTENTS

Investments in the Portfolio are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Portfolio’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Portfolio or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Portfolio.

This Portfolio is intended to be a funding vehicle for variable annuity contracts and variable life insurance policies (collectively “Policies”) offered by the separate accounts of various insurance companies. Portfolio shares may also be offered to qualified pension and retirement plans and accounts permitting accumulation of assets on a tax-deferred basis (“Eligible Plans”). Individuals may not purchase shares directly from the Portfolio.

Prospective investors should refer to the Portfolio’s prospectuses for a discussion of the Portfolio’s investment objective, strategies and risks. Call J.P. Morgan Funds Service Center at1-800-480-4111 for a prospectus containing more complete information about the Portfolio, including management fees and other expenses. Please read it carefully before investing.

LETTER TO SHAREHOLDERS

February 10, 2020 (Unaudited)

Dear Shareholders,

We’ve entered 2020 with strong momentum at J.P. Morgan Asset Management, propelled by a strong 2019 for financial markets that included a 31.5% total return in the S&P 500 Index.

| | |

| | “Our goal remains being the most trusted asset manager in the world by using our unique breadth of capabilities to provide our clients and shareholders with the insights and solutions they need to achieve their long-term goals.” — Andrea L. Lisher |

In the first half of 2019, equity markets largely experienced steady gains, bolstered by the U.S. Federal Reserve’s decision to hold off increases in interest rates as well as investor optimism over U.S.-China trade negotiations and continued growth in corporate earnings. In the second half of the year, global equity prices were also supported by an initial U.S.-China trade agreement and by accommodative policies of leading global central banks, including a reduction in interest rates and a resumption of monthly asset purchases by the European Central Bank. These tailwinds overshadowed investor concerns about Brexit and weak economic data.

While 2019 was largely a rewarding year for investors, 2020 may bring increased market volatility amid geo-political tensions, the U.S. elections and the late-economic-cycle backdrop. On the other hand, leading central banks have clearly signaled they will remain supportive of continued economic expansion, which should also support financial markets. We believe investors who maintain a well-diversified portfolio and a long-term outlook will be best positioned in the year ahead.

Our goal remains to be the most trusted asset manager in the world by using our unique breadth of capabilities to provide our clients and shareholders with the insights and solutions they need to achieve their long-term goals.

On behalf of J.P. Morgan Asset Management, thank you for entrusting us to manage your assets. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

Andrea L. Lisher

Head of Americas, Client

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| DECEMBER 31, 2019 | | JPMORGAN INSURANCE TRUST | | | | | 1 | |

JPMorgan Insurance Trust Core Bond Portfolio

PORTFOLIO COMMENTARY

TWELVE MONTHS ENDED DECEMBER 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Portfolio (Class 1 Shares)* | | | 8.18% | |

| Bloomberg Barclays U.S. Aggregate Index | | | 8.72% | |

| |

| Net Assets as of 12/31/2019 | | $ | 380,459,813 | |

| Duration as of 12/31/2019 | | | 5.8 years | |

INVESTMENT OBJECTIVE**

The JPMorgan Insurance Trust Core Bond Portfolio (the “Portfolio”) seeks to maximize total return by investing primarily in a diversified portfolio of intermediate-and long-term debt securities.

HOW DID THE MARKET PERFORM?

Overall, both U.S. bond markets and equity markets provided positive returns for the reporting period amid falling interest rates, healthy corporate earnings and slow but continued growth in the U.S. economy. In the U.S. and elsewhere, equity markets generally outperformed bond markets. Within the U.S. fixed-income sector, high yield bonds (also known as “junk bonds”) outperformed both corporate debt and U.S. Treasury bonds.

WHAT WERE THE MAIN DRIVERS OF THE PORTFOLIO’S PERFORMANCE?

The Portfolio’s Class 1 shares underperformed the Bloomberg Barclays U.S. Aggregate Index (the “Benchmark”) for the twelve months ended December 31, 2019.

Relative to the Benchmark, the Portfolio’s underweight allocation to corporate credit, which was among the best performing fixed-income sectors, detracted from performance. Amid falling interest rates during the reporting period, the Portfolio’s overweight allocations to short duration asset-backed securities and U.S. agency bonds also detracted from relative performance. Generally, bonds with shorter duration will experience a smaller increase in price as interest rates fall versus bonds with longer duration.

The Portfolio’s security selection in corporate credit, mortgage-backed securities and asset-backed securities made a positive contribution to relative performance. The Portfolio’s underweight allocation to U.S. Treasury bonds also contributed to performance. The Portfolio’s longer overall duration relative to the Benchmark was a positive contributor to performance as interest rates fell during the period.

The Portfolio’s overweight position in the 5-to-10 year portion of the yield curve and underweight position in short-term maturities also contributed to performance relative to the

Benchmark. The yield curve shows the relationship between yields and maturity dates for a set of similar bonds at a given point in time.

HOW WAS THE PORTFOLIO POSITIONED?

The Portfolio’s primary strategy was to focus on security selection and relative value, which seeks to identify undervalued bonds among individual securities and across market sectors. The portfolio managers used bottom-up fundamental research to construct what they believed to be a portfolio of undervalued fixed income securities.

Relative to the Benchmark, the Portfolio was underweight in U.S. Treasury securities and investment grade credit and overweight in securitized debt sectors, including asset-backed, commercial-backed and mortgage-backed securities, which include both agency and non-agency debt. The Portfolio was overweight in the intermediate part of the yield curve, underweight in the long end of the yield curve, and held a longer duration posture during the period.

| | | | |

PORTFOLIO COMPOSITION*** | |

| U.S. Treasury Obligations | | | 24.9 | % |

| Corporate Bonds | | | 22.9 | |

| Mortgage-Backed Securities | | | 18.3 | |

| Asset-Backed Securities | | | 11.8 | |

| Collateralized Mortgage Obligations | | | 9.2 | |

| Commercial Mortgage-Backed Securities | | | 4.7 | |

| U.S. Government Agency Securities | | | 3.4 | |

| Others (each less than 1.0%) | | | 0.3 | |

| Short-Term Investments | | | 4.5 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Portfolio’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2019. The Portfolio’s composition is subject to change. |

| | | | | | |

| | | |

| 2 | | | | JPMORGAN INSURANCE TRUST | | DECEMBER 31, 2019 |

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OF DECEMBER 31, 2019 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS 1 SHARES | | May 1, 1997 | | | 8.18 | % | | | 2.97 | % | | | 3.99 | % |

CLASS 2 SHARES | | August 16, 2006 | | | 7.87 | | | | 2.69 | | | | 3.73 | |

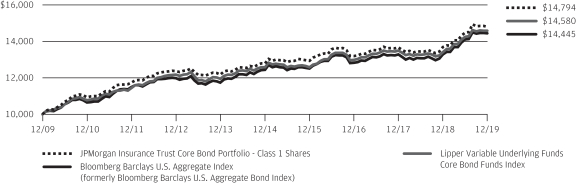

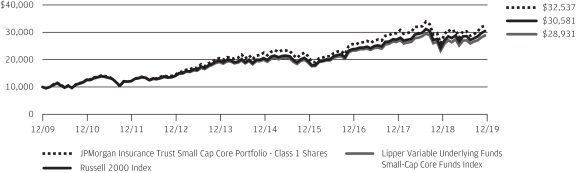

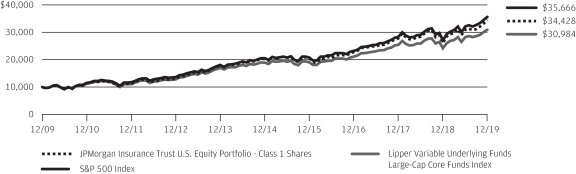

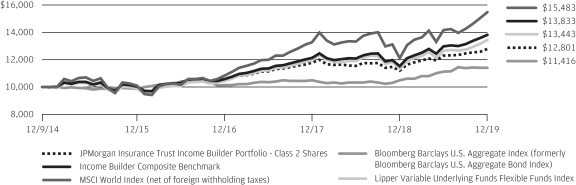

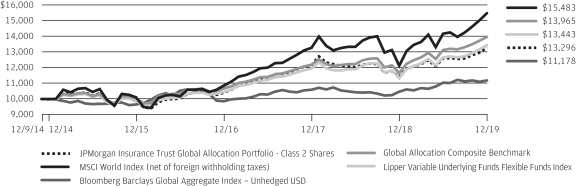

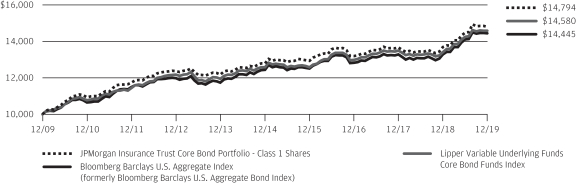

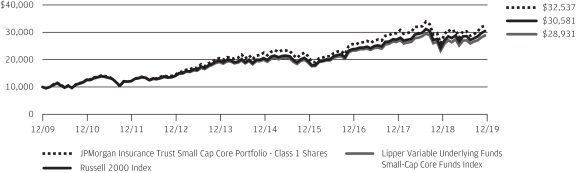

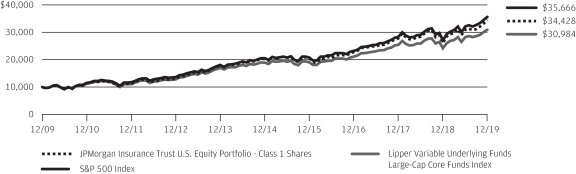

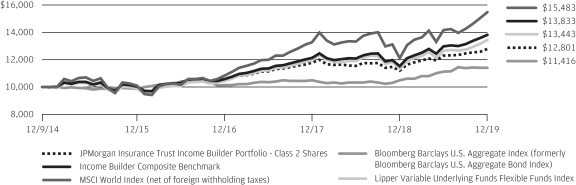

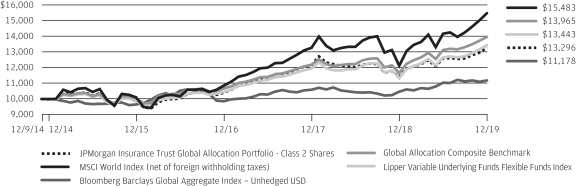

TEN YEAR PERFORMANCE(12/31/09 TO 12/31/19)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-datemonth-end performance information please call1-800-480-4111.

The graph illustrates comparative performance for $10,000 invested in Class 1 Shares of the JPMorgan Insurance Trust Core Bond Portfolio, the Bloomberg Barclays U.S. Aggregate Index and the Lipper Variable Underlying Funds Core Bond Funds Index from December 31, 2009 to December 31, 2019. The performance of the Portfolio assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays U.S. Aggregate Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Variable Underlying Funds Core Bond Funds Index includes expenses associated with a mutual fund, such as

investment management fees. These expenses are not identical to the expenses incurred by the Portfolio. The Bloomberg Barclays U.S. Aggregate Index is an unmanaged index that represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. The Lipper Variable Underlying Funds Core Bond Funds Index is an index based on the total returns of certain mutual funds within the Portfolio’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Portfolio performance does not reflect any charges imposed by the Policies or Eligible Plans. If these charges were included, the returns would be lower than shown. Portfolio performance may reflect the waiver of the Portfolio’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| DECEMBER 31, 2019 | | JPMORGAN INSURANCE TRUST | | | | | 3 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2019

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

U.S. Treasury Obligations — 24.8% | |

| | |

U.S. Treasury Bonds | | | | | | | | |

| | |

8.00%, 11/15/2021 | | | 338,000 | | | | 377,405 | |

| | |

5.38%, 2/15/2031 | | | 4,500 | | | | 6,035 | |

| | |

4.50%, 2/15/2036 | | | 276,000 | | | | 365,589 | |

| | |

5.00%, 5/15/2037 | | | 250,000 | | | | 353,489 | |

| | |

4.38%, 2/15/2038 | | | 1,214,000 | | | | 1,613,008 | |

| | |

4.25%, 5/15/2039 | | | 105,000 | | | | 138,023 | |

| | |

4.38%, 11/15/2039 | | | 1,415,000 | | | | 1,891,523 | |

| | |

3.88%, 8/15/2040 | | | 100,000 | | | | 125,890 | |

| | |

3.13%, 2/15/2043 | | | 500,000 | | | | 566,362 | |

| | |

2.88%, 5/15/2043 | | | 2,420,000 | | | | 2,633,204 | |

| | |

3.63%, 8/15/2043 | | | 2,715,000 | | | | 3,325,504 | |

| | |

3.75%, 11/15/2043 | | | 1,952,000 | | | | 2,438,132 | |

| | |

3.63%, 2/15/2044 | | | 2,345,000 | | | | 2,878,294 | |

| | |

2.50%, 2/15/2045 | | | 6,000,000 | | | | 6,114,293 | |

| | |

2.88%, 8/15/2045 | | | 500,000 | | | | 545,906 | |

| | |

3.00%, 11/15/2045 | | | 1,000,000 | | | | 1,117,358 | |

| | |

2.25%, 8/15/2046 | | | 3,063,400 | | | | 2,973,312 | |

| | |

3.00%, 2/15/2048 | | | 90,000 | | | | 101,058 | |

| | |

3.13%, 5/15/2048 | | | 176,200 | | | | 202,651 | |

| | |

2.88%, 5/15/2049 | | | 160,000 | | | | 176,158 | |

| | |

2.25%, 8/15/2049 | | | 1,370,000 | | | | 1,327,402 | |

| | |

U.S. Treasury Inflation Indexed Bonds | | | | | | | | |

| | |

3.63%, 4/15/2028 | | | 300,000 | | | | 610,541 | |

| | |

2.50%, 1/15/2029 | | | 100,000 | | | | 144,439 | |

| | |

U.S. Treasury Notes | | | | | | | | |

| | |

1.38%, 4/30/2020 | | | 125,000 | | | | 124,883 | |

| | |

3.50%, 5/15/2020 | | | 450,000 | | | | 453,006 | |

| | |

1.50%, 7/15/2020 | | | 200,000 | | | | 199,874 | |

| | |

2.63%, 11/15/2020 | | | 200,000 | | | | 201,668 | |

| | |

2.38%, 12/31/2020 | | | 100,000 | | | | 100,698 | |

| | |

3.63%, 2/15/2021 | | | 650,000 | | | | 664,146 | |

| | |

2.25%, 4/30/2021 | | | 115,000 | | | | 115,955 | |

| | |

2.63%, 5/15/2021 | | | 154,500 | | | | 156,600 | |

| | |

3.13%, 5/15/2021 | | | 600,000 | | | | 612,162 | |

| | |

2.00%, 5/31/2021 | | | 300,000 | | | | 301,602 | |

| | |

2.13%, 8/15/2021 | | | 500,000 | | | | 504,078 | |

| | |

1.25%, 10/31/2021 | | | 3,500,000 | | | | 3,477,965 | |

| | |

2.00%, 10/31/2021 | | | 100,000 | | | | 100,720 | |

| | |

1.88%, 11/30/2021 | | | 950,000 | | | | 955,255 | |

| | |

1.75%, 2/28/2022 | | | 3,300,000 | | | | 3,311,198 | |

| | |

1.63%, 8/31/2022 | | | 1,000,000 | | | | 1,000,326 | |

| | |

1.75%, 9/30/2022 | | | 150,000 | | | | 150,526 | |

| | |

1.50%, 2/28/2023 | | | 525,000 | | | | 522,842 | |

| | |

1.75%, 5/15/2023 | | | 3,079,000 | | | | 3,088,812 | |

| | |

2.75%, 5/31/2023 | | | 46,000 | | | | 47,665 | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

| | |

2.50%, 8/15/2023 | | | 600,000 | | | | 617,536 | |

| | |

1.38%, 8/31/2023 | | | 700,000 | | | | 693,017 | |

| | |

1.63%, 10/31/2023 | | | 2,000,000 | | | | 1,996,612 | |

| | |

2.13%, 2/29/2024 | | | 94,000 | | | | 95,663 | |

| | |

2.50%, 5/15/2024 | | | 30,000 | | | | 31,015 | |

| | |

2.00%, 6/30/2024 | | | 10,000 | | | | 10,130 | |

| | |

2.25%, 11/15/2024 | | | 112,000 | | | | 114,826 | |

| | |

2.00%, 2/15/2025 | | | 1,000,000 | | | | 1,013,443 | |

| | |

2.88%, 4/30/2025 | | | 146,000 | | | | 154,454 | |

| | |

2.13%, 5/15/2025 | | | 500,000 | | | | 509,792 | |

| | |

2.88%, 5/31/2025 | | | 318,000 | | | | 336,510 | |

| | |

2.00%, 8/15/2025 | | | 728,600 | | | | 737,810 | |

| | |

2.25%, 11/15/2025 | | | 610,000 | | | | 625,938 | |

| | |

1.63%, 2/15/2026 | | | 59,400 | | | | 58,811 | |

| | |

1.50%, 8/15/2026 | | | 28,000 | | | | 27,426 | |

| | |

2.00%, 11/15/2026 | | | 84,000 | | | | 84,873 | |

| | |

2.25%, 2/15/2027 | | | 108,000 | | | | 110,900 | |

| | |

2.75%, 2/15/2028 | | | 65,000 | | | | 69,209 | |

| | |

2.88%, 5/15/2028 | | | 940,800 | | | | 1,011,974 | |

| | |

1.63%, 8/15/2029 | | | 115,000 | | | | 111,943 | |

| | |

U.S. Treasury STRIPS Bonds | | | | | | | | |

| | |

2.49%, 5/15/2020 (a) | | | 3,693,000 | | | | 3,670,390 | |

| | |

1.77%, 8/15/2020 (a) | | | 2,120,000 | | | | 2,098,545 | |

| | |

2.36%, 2/15/2021 (a) | | | 910,000 | | | | 893,596 | |

| | |

2.04%, 5/15/2021 (a) | | | 1,590,000 | | | | 1,555,515 | |

| | |

2.16%, 8/15/2021 (a) | | | 1,800,000 | | | | 1,753,943 | |

| | |

3.20%, 11/15/2021 (a) | | | 675,000 | | | | 654,736 | |

| | |

2.76%, 2/15/2022 (a) | | | 970,000 | | | | 936,407 | |

| | |

2.72%, 5/15/2022 (a) | | | 760,000 | | | | 730,483 | |

| | |

3.14%, 8/15/2022 (a) | | | 75,000 | | | | 71,820 | |

| | |

2.84%, 11/15/2022 (a) | | | 500,000 | | | | 476,929 | |

| | |

2.99%, 2/15/2023 (a) | | | 2,690,000 | | | | 2,554,958 | |

| | |

2.66%, 5/15/2023 (a) | | | 2,420,000 | | | | 2,284,351 | |

| | |

2.22%, 8/15/2023 (a) | | | 1,890,000 | | | | 1,776,778 | |

| | |

2.68%, 11/15/2023 (a) | | | 173,000 | | | | 161,668 | |

| | |

1.68%, 2/15/2024 (a) | | | 327,000 | | | | 304,052 | |

| | |

3.31%, 11/15/2024 (a) | | | 110,000 | | | | 100,830 | |

| | |

3.75%, 2/15/2025 (a) | | | 50,000 | | | | 45,583 | |

| | |

5.10%, 5/15/2026 (a) | | | 100,000 | | | | 88,575 | |

| | |

3.52%, 8/15/2026 (a) | | | 23,000 | | | | 20,282 | |

| | |

3.65%, 11/15/2026 (a) | | | 250,000 | | | | 219,124 | |

| | |

4.17%, 2/15/2027 (a) | | | 300,000 | | | | 261,341 | |

| | |

3.68%, 5/15/2027 (a) | | | 725,000 | | | | 627,041 | |

| | |

3.31%, 8/15/2027 (a) | | | 250,000 | | | | 215,342 | |

| | |

4.04%, 11/15/2027 (a) | | | 710,000 | | | | 607,824 | |

| | |

3.08%, 2/15/2028 (a) | | | 27,000 | | | | 22,927 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 4 | | | | JPMORGAN INSURANCE TRUST | | DECEMBER 31, 2019 |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

U.S. Treasury Obligations — continued | |

| | |

2.96%, 5/15/2028 (a) | | | 140,000 | | | | 118,170 | |

| | |

7.39%, 8/15/2028 (a) | | | 50,000 | | | | 42,013 | |

| | |

4.13%, 2/15/2029 (a) | | | 658,000 | | | | 545,987 | |

| | |

3.95%, 11/15/2029 (a) | | | 200,000 | | | | 162,893 | |

| | |

4.82%, 5/15/2030 (a) | | | 300,000 | | | | 241,667 | |

| | |

3.98%, 8/15/2030 (a) | | | 300,000 | | | | 239,712 | |

| | |

3.62%, 11/15/2030 (a) | | | 500,000 | | | | 396,753 | |

| | |

4.55%, 2/15/2031 (a) | | | 350,000 | | | | 276,423 | |

| | |

3.96%, 5/15/2031 (a) | | | 275,000 | | | | 215,435 | |

| | |

3.32%, 11/15/2031 (a) | | | 760,000 | | | | 587,094 | |

| | |

3.79%, 2/15/2032 (a) | | | 350,000 | | | | 268,453 | |

| | |

3.63%, 5/15/2032 (a) | | | 2,250,000 | | | | 1,714,887 | |

| | |

3.15%, 8/15/2032 (a) | | | 3,300,000 | | | | 2,496,936 | |

| | |

4.28%, 11/15/2032 (a) | | | 800,000 | | | | 601,319 | |

| | |

3.81%, 2/15/2033 (a) | | | 400,000 | | | | 298,612 | |

| | |

3.95%, 5/15/2033 (a) | | | 1,175,000 | | | | 871,435 | |

| | |

6.37%, 8/15/2033 (a) | | | 100,000 | | | | 73,600 | |

| | |

4.41%, 11/15/2033 (a) | | | 1,025,000 | | | | 749,063 | |

| | |

3.92%, 2/15/2034 (a) | | | 775,000 | | | | 562,147 | |

| | |

2.84%, 5/15/2034 (a) | | | 2,200,000 | | | | 1,585,878 | |

| | |

3.36%, 11/15/2034 (a) | | | 50,000 | | | | 35,508 | |

| | |

3.30%, 2/15/2035 (a) | | | 65,000 | | | | 45,850 | |

| | |

3.61%, 5/15/2035 (a) | | | 250,000 | | | | 175,162 | |

| | |

2.36%, 11/15/2041 (a) | | | 100,000 | | | | 58,179 | |

| | |

U.S. Treasury STRIPS Notes 1.71%, 2/15/2020 (a) | | | 5,235,000 | | | | 5,224,755 | |

| | | | | | | | |

| | |

Total U.S. Treasury Obligations

(Cost $89,150,080) | | | | | | | 94,248,410 | |

| | | | | | | | |

Corporate Bonds — 22.8% | |

|

Aerospace & Defense — 0.4% | |

| | |

Airbus Finance BV (France) 2.70%, 4/17/2023 (b) | | | 32,000 | | | | 32,517 | |

| | |

Airbus SE (France) 3.15%, 4/10/2027 (b) | | | 164,000 | | | | 170,218 | |

| | |

BAE Systems Holdings, Inc. (United Kingdom) 3.80%, 10/7/2024 (b) | | | 45,000 | | | | 47,541 | |

| | |

BAE Systems plc (United Kingdom) 5.80%, 10/11/2041 (b) | | | 51,000 | | | | 65,769 | |

| | |

Boeing Co. (The) 3.95%, 8/1/2059 | | | 140,000 | | | | 148,971 | |

| | |

L3Harris Technologies, Inc. 3.83%, 4/27/2025 | | | 60,000 | | | | 63,974 | |

| | |

Lockheed Martin Corp. 4.50%, 5/15/2036 | | | 70,000 | | | | 82,843 | |

| | |

Northrop Grumman Corp. | | | | | | | | |

| | |

3.20%, 2/1/2027 | | | 76,000 | | | | 79,007 | |

| | |

3.25%, 1/15/2028 | | | 50,000 | | | | 52,118 | |

| | |

Precision Castparts Corp. 3.25%, 6/15/2025 | | | 30,000 | | | | 31,646 | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

|

Aerospace & Defense — continued | |

| | |

Rockwell Collins, Inc. 3.20%, 3/15/2024 | | | 28,000 | | | | 29,120 | |

| | |

United Technologies Corp. | | | | | | | | |

| | |

3.95%, 8/16/2025 | | | 50,000 | | | | 54,501 | |

| | |

6.13%, 7/15/2038 | | | 250,000 | | | | 346,623 | |

| | |

4.45%, 11/16/2038 | | | 230,000 | | | | 271,668 | |

| | |

4.50%, 6/1/2042 | | | 80,000 | | | | 95,646 | |

| | |

4.15%, 5/15/2045 | | | 25,000 | | | | 28,580 | |

| | |

3.75%, 11/1/2046 | | | 80,000 | | | | 86,872 | |

| | | | | | | | |

| | |

| | | | | | | 1,687,614 | |

| | | | | | | | |

|

Airlines — 0.0% (c) | |

| | |

Continental Airlines Pass-Through TrustSeries 2012-2, Class A, 4.00%, 10/29/2024 | | | 17,485 | | | | 18,440 | |

| | | | | | | | |

|

Automobiles — 0.0% (c) | |

| | |

BMW US Capital LLC (Germany) 2.25%, 9/15/2023 (b) | | | 45,000 | | | | 45,072 | |

| | | | | | | | |

|

Banks — 5.0% | |

| | |

ABN AMRO Bank NV (Netherlands) 4.75%, 7/28/2025 (b) | | | 200,000 | | | | 217,764 | |

| | |

AIB Group plc (Ireland) (ICE LIBOR USD 3 Month + 1.87%), 4.26%, 4/10/2025 (b) (d) | | | 250,000 | | | | 264,618 | |

| | |

ANZ New Zealand Int’l Ltd. (New Zealand) | | | | | | | | |

| | |

3.45%, 1/21/2028 (b) | | | 200,000 | | | | 210,770 | |

| | |

ASB Bank Ltd. (New Zealand) 3.13%, 5/23/2024 (b) | | | 230,000 | | | | 237,392 | |

| | |

Bank of America Corp. | | | | | | | | |

| | |

(ICE LIBOR USD 3 Month + 0.63%), | | | | | | | | |

| | |

3.50%, 5/17/2022 (d) | | | 250,000 | | | | 254,967 | |

| | |

3.30%, 1/11/2023 | | | 150,000 | | | | 155,043 | |

| | |

(ICE LIBOR USD 3 Month + 1.16%), 3.12%, 1/20/2023 (d) | | | 100,000 | | | | 101,969 | |

| | |

(ICE LIBOR USD 3 Month + 0.79%), 3.00%, 12/20/2023 (d) | | | 26,000 | | | | 26,626 | |

| | |

4.00%, 1/22/2025 | | | 114,000 | | | | 121,540 | |

| | |

Series L, 3.95%, 4/21/2025 | | | 92,000 | | | | 98,102 | |

| | |

(ICE LIBOR USD 3 Month + 0.81%), 3.37%, 1/23/2026 (d) | | | 100,000 | | | | 104,548 | |

| | |

4.45%, 3/3/2026 | | | 69,000 | | | | 75,722 | |

| | |

3.25%, 10/21/2027 | | | 514,000 | | | | 535,242 | |

| | |

(ICE LIBOR USD 3 Month + 1.51%), 3.71%, 4/24/2028 (d) | | | 260,000 | | | | 277,705 | |

| | |

(ICE LIBOR USD 3 Month + 1.04%), 3.42%, 12/20/2028 (d) | | | 408,000 | | | | 427,866 | |

| | |

(ICE LIBOR USD 3 Month + 1.07%), 3.97%, 3/5/2029 (d) | | | 280,000 | | | | 304,757 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2019 | | JPMORGAN INSURANCE TRUST | | | | | 5 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2019 (continued)

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Corporate Bonds — continued | | | | | |

| | |

Banks — continued | | | | | | | | |

| | |

(ICE LIBOR USD 3 Month + 1.32%), 4.08%, 4/23/2040 (d) | | | 125,000 | | | | 141,423 | |

| | |

(ICE LIBOR USD 3 Month + 1.52%), 4.33%, 3/15/2050 (d) | | | 125,000 | | | | 149,635 | |

| | |

Bank of Montreal (Canada) (USD Swap Semi 5 Year + 1.43%), 3.80%, 12/15/2032 (d) | | | 47,000 | | | | 49,019 | |

| | |

Bank of Nova Scotia (The) (Canada) 4.50%, 12/16/2025 | | | 25,000 | | | | 27,435 | |

| | |

Banque Federative du Credit Mutuel SA (France) 2.38%, 11/21/2024 (b) | | | 254,000 | | | | 253,725 | |

| | |

Barclays plc (United Kingdom) 3.65%, 3/16/2025 | | | 200,000 | | | | 208,175 | |

| | |

BNP Paribas SA (France) 3.50%, 3/1/2023 (b) | | | 200,000 | | | | 206,846 | |

| | |

BNZ International Funding Ltd. (New Zealand) 2.90%, 2/21/2022 (b) | | | 250,000 | | | | 254,210 | |

| | |

Citigroup, Inc. | | | | | | | | |

| | |

2.40%, 2/18/2020 | | | 50,000 | | | | 50,020 | |

| | |

2.90%, 12/8/2021 | | | 100,000 | | | | 101,620 | |

| | |

2.75%, 4/25/2022 | | | 200,000 | | | | 203,054 | |

| | |

(ICE LIBOR USD 3 Month + 0.72%), 3.14%, 1/24/2023 (d) | | | 74,000 | | | | 75,506 | |

| | |

(ICE LIBOR USD 3 Month + 0.90%), 3.35%, 4/24/2025 (d) | | | 90,000 | | | | 93,601 | |

| | |

4.40%, 6/10/2025 | | | 78,000 | | | | 84,710 | |

| | |

3.40%, 5/1/2026 | | | 75,000 | | | | 78,710 | |

| | |

4.45%, 9/29/2027 | | | 210,000 | | | | 231,099 | |

| | |

(ICE LIBOR USD 3 Month + 1.39%), 3.67%, 7/24/2028 (d) | | | 250,000 | | | | 266,212 | |

| | |

(ICE LIBOR USD 3 Month + 1.34%), 3.98%, 3/20/2030 (d) | | | 220,000 | | | | 240,497 | |

| | |

(ICE LIBOR USD 3 Month + 1.17%), 3.88%, 1/24/2039 (d) | | | 50,000 | | | | 54,859 | |

| | |

8.13%, 7/15/2039 | | | 56,000 | | | | 93,595 | |

| | |

4.75%, 5/18/2046 | | | 50,000 | | | | 59,913 | |

| | |

4.65%, 7/23/2048 | | | 120,000 | | | | 149,617 | |

| | |

Citizens Financial Group, Inc. | | | | | | | | |

| | |

2.38%, 7/28/2021 | | | 24,000 | | | | 24,112 | |

| | |

2.85%, 7/27/2026 | | | 200,000 | | | | 203,539 | |

| | |

Comerica, Inc. 4.00%, 2/1/2029 | | | 150,000 | | | | 163,666 | |

| | |

Commonwealth Bank of Australia (Australia) | | | | | | | | |

| | |

2.00%, 9/6/2021 (b) | | | 200,000 | | | | 200,387 | |

| | |

3.45%, 3/16/2023 (b) | | | 80,000 | | | | 83,332 | |

| | |

2.85%, 5/18/2026 (b) | | | 80,000 | | | | 81,569 | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

| | |

Banks — continued | | | | | | | | |

| | |

Cooperatieve Rabobank UA (Netherlands) 3.75%, 7/21/2026 | | �� | 450,000 | | | | 468,357 | |

| | |

Credit Agricole SA (France) 3.75%, 4/24/2023 (b) | | | 250,000 | | | | 261,357 | |

| | |

Credit Suisse Group Funding Guernsey Ltd. (Switzerland) | | | | | | | | |

| | |

3.80%, 6/9/2023 | | | 350,000 | | | | 366,197 | |

| | |

3.75%, 3/26/2025 | | | 250,000 | | | | 264,378 | |

| | |

Danske Bank A/S (Denmark) 2.00%, 9/8/2021 (b) | | | 200,000 | | | | 199,112 | |

| | |

Fifth Third Bancorp | | | | | | | | |

| | |

3.65%, 1/25/2024 | | | 90,000 | | | | 94,833 | |

| | |

3.95%, 3/14/2028 | | | 70,000 | | | | 76,892 | |

| | |

HSBC Holdings plc (United Kingdom) | | | | | | | | |

| | |

2.65%, 1/5/2022 | | | 400,000 | | | | 404,254 | |

| | |

(ICE LIBOR USD 3 Month + 0.99%), 3.95%, 5/18/2024 (d) | | | 229,000 | | | | 240,796 | |

| | |

4.38%, 11/23/2026 | | | 200,000 | | | | 216,477 | |

| | |

HSBC USA, Inc. 2.35%, 3/5/2020 | | | 135,000 | | | | 135,069 | |

| | |

Huntington Bancshares, Inc. | | | | | | | | |

| | |

3.15%, 3/14/2021 | | | 73,000 | | | | 73,893 | |

| | |

2.30%, 1/14/2022 | | | 88,000 | | | | 88,448 | |

| | |

ING Groep NV (Netherlands) | | | | | | | | |

| | |

4.10%, 10/2/2023 | | | 200,000 | | | | 212,626 | |

| | |

3.95%, 3/29/2027 | | | 200,000 | | | | 215,119 | |

| | |

KeyCorp | | | | | | | | |

| | |

2.90%, 9/15/2020 | | | 56,000 | | | | 56,372 | |

| | |

4.15%, 10/29/2025 | | | 65,000 | | | | 71,178 | |

| | |

Lloyds Banking Group plc (United Kingdom) 4.58%, 12/10/2025 | | | 200,000 | | | | 216,383 | |

| | |

Mitsubishi UFJ Financial Group, Inc. (Japan) | | | | | | | | |

| | |

3.00%, 2/22/2022 | | | 38,000 | | | | 38,712 | |

| | |

2.67%, 7/25/2022 | | | 80,000 | | | | 81,142 | |

| | |

3.76%, 7/26/2023 | | | 200,000 | | | | 210,550 | |

| | |

3.41%, 3/7/2024 | | | 170,000 | | | | 177,167 | |

| | |

3.75%, 7/18/2039 | | | 265,000 | | | | 289,757 | |

| | |

Mizuho Financial Group, Inc. (Japan) (ICE LIBOR USD 3 Month + 1.31%), 2.87%, 9/13/2030 (d) | | | 220,000 | | | | 219,490 | |

| | |

National Australia Bank Ltd. (Australia) | | | | | | | | |

| | |

3.38%, 1/14/2026 | | | 300,000 | | | | 315,291 | |

| | |

(US Treasury Yield Curve Rate T Note Constant Maturity 5 Year + 1.88%), 3.93%, 8/2/2034 (b) (d) | | | 440,000 | | | | 456,684 | |

| | |

NatWest Markets plc (United Kingdom) 3.63%, 9/29/2022 (b) | | | 315,000 | | | | 326,170 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 6 | | | | JPMORGAN INSURANCE TRUST | | DECEMBER 31, 2019 |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Corporate Bonds — continued | | | | | |

| | |

Banks — continued | | | | | | | | |

| | |

Nordea Bank Abp (Finland) 4.88%, 1/27/2020 (b) | | | 100,000 | | | | 100,203 | |

| | |

PNC Financial Services Group, Inc. (The) | | | | | | | | |

| | |

5.13%, 2/8/2020 | | | 150,000 | | | | 150,422 | |

| | |

Regions Financial Corp. | | | | | | | | |

| | |

2.75%, 8/14/2022 | | | 27,000 | | | | 27,475 | |

| | |

3.80%, 8/14/2023 | | | 27,000 | | | | 28,564 | |

| | |

Royal Bank of Canada (Canada) | | | | | | | | |

| | |

2.75%, 2/1/2022 | | | 66,000 | | | | 67,167 | |

| | |

3.70%, 10/5/2023 | | | 300,000 | | | | 316,937 | |

| | |

4.65%, 1/27/2026 | | | 30,000 | | | | 33,248 | |

| | |

Royal Bank of Scotland Group plc (United Kingdom) | | | | | | | | |

| | |

(US Treasury Yield Curve Rate T Note Constant Maturity 5 Year + 2.10%), 3.75%, 11/1/2029 (d) | | | 200,000 | | | | 204,079 | |

| | |

(ICE LIBOR USD 3 Month + 1.87%), 4.44%, 5/8/2030 (d) | | | 200,000 | | | | 220,697 | |

| | |

Societe Generale SA (France) 3.88%, 3/28/2024 (b) | | | 380,000 | | | | 399,343 | |

| | |

Standard Chartered plc (United Kingdom) | | | | | | | | |

| | |

(ICE LIBOR USD 3 Month + 1.15%), 4.25%, 1/20/2023 (b) (d) | | | 220,000 | | | | 227,658 | |

| | |

(ICE LIBOR USD 3 Month + 1.91%), 4.30%, 5/21/2030 (b) (d) | | | 200,000 | | | | 217,563 | |

| | |

Sumitomo Mitsui Financial Group, Inc. (Japan) | | | | | | | | |

| | |

2.44%, 10/19/2021 | | | 45,000 | | | | 45,398 | |

| | |

2.85%, 1/11/2022 | | | 130,000 | | | | 131,983 | |

| | |

2.78%, 10/18/2022 | | | 82,000 | | | | 83,480 | |

| | |

3.10%, 1/17/2023 | | | 55,000 | | | | 56,380 | |

| | |

3.94%, 10/16/2023 | | | 300,000 | | | | 318,058 | |

| | |

3.01%, 10/19/2026 | | | 25,000 | | | | 25,591 | |

| | |

3.04%, 7/16/2029 | | | 345,000 | | | | 351,547 | |

| | |

Toronto-Dominion Bank (The) (Canada) 3.25%, 3/11/2024 | | | 140,000 | | | | 146,477 | |

| | |

Truist Bank (ICE LIBOR USD 3 Month + 0.30%), 2.59%, 1/29/2021 (d) | | | 30,000 | | | | 30,060 | |

| | |

Truist Financial Corp. 2.70%, 1/27/2022 | | | 91,000 | | | | 92,215 | |

| | |

US Bancorp | | | | | | | | |

| | |

3.38%, 2/5/2024 | | | 120,000 | | | | 125,893 | |

| | |

7.50%, 6/1/2026 | | | 100,000 | | | | 126,427 | |

| | |

Wells Fargo & Co. | | | | | | | | |

| | |

3.07%, 1/24/2023 | | | 245,000 | | | | 250,032 | |

| | |

3.75%, 1/24/2024 | | | 105,000 | | | | 110,902 | |

| | |

3.30%, 9/9/2024 | | | 80,000 | | | | 83,869 | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

| | |

Banks — continued | | | | | | | | |

| | |

(ICE LIBOR USD 3 Month + 0.83%), 2.41%, 10/30/2025 (d) | | | 300,000 | | | | 300,000 | |

| | |

3.00%, 4/22/2026 | | | 284,000 | | | | 291,733 | |

| | |

4.10%, 6/3/2026 | | | 24,000 | | | | 25,860 | |

| | |

(ICE LIBOR USD 3 Month + 1.17%), 3.20%, 6/17/2027 (d) | | | 470,000 | | | | 487,176 | |

| | |

5.38%, 11/2/2043 | | | 200,000 | | | | 256,137 | |

| | |

4.40%, 6/14/2046 | | | 47,000 | | | | 53,799 | |

| | |

4.75%, 12/7/2046 | | | 53,000 | | | | 63,457 | |

| | |

Westpac Banking Corp. (Australia) | | | | | | | | |

| | |

2.85%, 5/13/2026 | | | 100,000 | | | | 102,344 | |

| | |

(USD ICE Swap Rate 5 Year + 2.24%), 4.32%, 11/23/2031 (d) | | | 140,000 | | | | 148,095 | |

| | |

4.42%, 7/24/2039 | | | 100,000 | | | | 109,732 | |

| | | | | | | | |

| | |

| | | | | | | 18,831,422 | |

| | | | | | | | |

|

Beverages — 0.5% | |

| | |

Anheuser-Busch Cos. LLC (Belgium) | | | | | | | | |

| | |

4.70%, 2/1/2036 | | | 571,000 | | | | 658,564 | |

| | |

4.90%, 2/1/2046 | | | 260,000 | | | | 307,486 | |

| | |

Anheuser-Busch InBev Finance, Inc. (Belgium) 4.70%, 2/1/2036 | | | 120,000 | | | | 138,402 | |

| | |

Anheuser-Busch InBev Worldwide, Inc. (Belgium) | | | | | | | | |

| | |

4.38%, 4/15/2038 | | | 150,000 | | | | 168,107 | |

| | |

4.44%, 10/6/2048 | | | 130,000 | | | | 145,675 | |

| | |

4.75%, 4/15/2058 | | | 95,000 | | | | 110,716 | |

| | |

Constellation Brands, Inc. | | | | | | | | |

| | |

4.40%, 11/15/2025 | | | 50,000 | | | | 54,581 | |

| | |

5.25%, 11/15/2048 | | | 25,000 | | | | 30,319 | |

| | |

Keurig Dr Pepper, Inc. | | | | | | | | |

| | |

3.13%, 12/15/2023 | | | 100,000 | | | | 102,748 | |

| | |

4.42%, 5/25/2025 | | | 30,000 | | | | 32,733 | |

| | |

3.43%, 6/15/2027 | | | 20,000 | | | | 20,817 | |

| | |

4.99%, 5/25/2038 | | | 43,000 | | | | 50,660 | |

| | |

4.42%, 12/15/2046 | | | 64,000 | | | | 68,780 | |

| | |

5.09%, 5/25/2048 | | | 60,000 | | | | 72,071 | |

| | | | | | | | |

| | |

| | | | | | | 1,961,659 | |

| | | | | | | | |

|

Biotechnology — 0.4% | |

| | |

AbbVie, Inc. | | | | | | | | |

| | |

3.20%, 11/21/2029 (b) | | | 516,000 | | | | 524,604 | |

| | |

4.50%, 5/14/2035 | | | 100,000 | | | | 113,168 | |

| | |

4.05%, 11/21/2039 (b) | | | 510,000 | | | | 538,973 | |

| | |

4.40%, 11/6/2042 | | | 105,000 | | | | 113,312 | |

| | |

Baxalta, Inc. | | | | | | | | |

| | |

3.60%, 6/23/2022 | | | 7,000 | | | | 7,183 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2019 | | JPMORGAN INSURANCE TRUST | | | | | 7 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2019 (continued)

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Corporate Bonds — continued | | | | | |

|

Biotechnology — continued | |

| | |

5.25%, 6/23/2045 | | | 3,000 | | | | 3,865 | |

| | |

Gilead Sciences, Inc. 4.00%, 9/1/2036 | | | 29,000 | | | | 32,036 | |

| | | | | | | | |

| | |

| | | | | | | 1,333,141 | |

| | | | | | | | |

|

Building Products — 0.0% (c) | |

| | |

Masco Corp. 6.50%, 8/15/2032 | | | 80,000 | | | | 98,244 | |

| | | | | | | | |

|

Capital Markets — 2.1% | |

| | |

Bank of New York Mellon Corp. (The) | | | | | | | | |

| | |

(ICE LIBOR USD 3 Month + 0.63%), 2.66%, 5/16/2023 (d) | | | 138,000 | | | | 140,064 | |

| | |

3.25%, 9/11/2024 | | | 100,000 | | | | 105,002 | |

| | |

Blackstone Holdings Finance Co. LLC 4.45%, 7/15/2045 (b) | | | 21,000 | | | | 23,612 | |

| | |

Brookfield Finance, Inc. (Canada) | | | | | | | | |

| | |

3.90%, 1/25/2028 | | | 55,000 | | | | 59,123 | |

| | |

4.85%, 3/29/2029 | | | 120,000 | | | | 137,232 | |

| | |

4.70%, 9/20/2047 | | | 44,000 | | | | 50,456 | |

| | |

Charles Schwab Corp. (The) 3.20%, 3/2/2027 | | | 100,000 | | | | 104,559 | |

| | |

CME Group, Inc. 3.00%, 3/15/2025 | | | 97,000 | | | | 100,686 | |

| | |

Credit Suisse Group AG (Switzerland) (SOFR + 1.56%), 2.59%, 9/11/2025 (b) (d) | | | 250,000 | | | | 250,700 | |

| | |

Daiwa Securities Group, Inc. (Japan) 3.13%, 4/19/2022 (b) | | | 49,000 | | | | 49,929 | |

| | |

Deutsche Bank AG (Germany) | | | | | | | | |

| | |

4.25%, 10/14/2021 | | | 100,000 | | | | 102,820 | |

| | |

3.30%, 11/16/2022 | | | 100,000 | | | | 100,981 | |

| | |

Goldman Sachs Group, Inc. (The) | | | | | | | | |

| | |

5.38%, 3/15/2020 | | | 206,000 | | | | 207,429 | |

| | |

2.35%, 11/15/2021 | | | 264,000 | | | | 264,987 | |

| | |

(ICE LIBOR USD 3 Month + 0.82%), 2.88%, 10/31/2022 (d) | | | 100,000 | | | | 101,396 | |

| | |

(ICE LIBOR USD 3 Month + 1.05%), 2.91%, 6/5/2023 (d) | | | 598,000 | | | | 607,651 | |

| | |

(ICE LIBOR USD 3 Month + 0.99%), 2.90%, 7/24/2023 (d) | | | 213,000 | | | | 216,764 | |

| | |

3.50%, 1/23/2025 | | | 100,000 | | | | 104,843 | |

| | |

(ICE LIBOR USD 3 Month + 1.20%), 3.27%, 9/29/2025 (d) | | | 137,000 | | | | 141,708 | |

| | |

4.25%, 10/21/2025 | | | 105,000 | | | | 113,925 | |

| | |

3.50%, 11/16/2026 | | | 142,000 | | | | 149,241 | |

| | |

3.85%, 1/26/2027 | | | 45,000 | | | | 47,858 | |

| | |

(ICE LIBOR USD 3 Month + 1.51%), 3.69%, 6/5/2028 (d) | | | 209,000 | | | | 221,862 | |

| | |

(ICE LIBOR USD 3 Month + 1.30%), 4.22%, 5/1/2029 (d) | | | 130,000 | | | | 143,155 | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

|

Capital Markets — continued | |

| | |

6.75%, 10/1/2037 | | | 80,000 | | | | 110,890 | |

| | |

(ICE LIBOR USD 3 Month + 1.43%), 4.41%, 4/23/2039 (d) | | | 215,000 | | | | 244,413 | |

| | |

4.80%, 7/8/2044 | | | 115,000 | | | | 139,042 | |

| | |

Intercontinental Exchange, Inc. 4.00%, 10/15/2023 | | | 59,000 | | | | 63,065 | |

| | |

Invesco Finance plc | | | | | | | | |

| | |

4.00%, 1/30/2024 | | | 29,000 | | | | 30,804 | |

| | |

3.75%, 1/15/2026 | | | 36,000 | | | | 38,344 | |

| | |

Jefferies Group LLC 6.45%, 6/8/2027 | | | 81,000 | | | | 94,920 | |

| | |

Macquarie Bank Ltd. (Australia) 4.00%, 7/29/2025 (b) | | | 100,000 | | | | 106,966 | |

| | |

Macquarie Group Ltd. (Australia) 6.00%, 1/14/2020 (b) | | | 220,000 | | | | 220,265 | |

| | |

(ICE LIBOR USD 3 Month + 1.37%), 3.76%, 11/28/2028 (b) (d) | | | 145,000 | | | | 151,522 | |

| | |

(ICE LIBOR USD 3 Month + 1.75%), 5.03%, 1/15/2030 (b) (d) | | | 220,000 | | | | 250,552 | |

| | |

Morgan Stanley | | | | | | | | |

| | |

5.50%, 7/28/2021 | | | 35,000 | | | | 36,869 | |

| | |

2.63%, 11/17/2021 | | | 170,000 | | | | 171,987 | |

| | |

2.75%, 5/19/2022 | | | 100,000 | | | | 101,799 | |

| | |

3.75%, 2/25/2023 | | | 142,000 | | | | 148,668 | |

| | |

4.10%, 5/22/2023 | | | 100,000 | | | | 105,566 | |

| | |

(ICE LIBOR USD 3 Month + 0.85%), 3.74%, 4/24/2024 (d) | | | 225,000 | | | | 235,038 | |

| | |

3.70%, 10/23/2024 | | | 69,000 | | | | 73,257 | |

| | |

4.00%, 7/23/2025 | | | 276,000 | | | | 298,431 | |

| | |

5.00%, 11/24/2025 | | | 70,000 | | | | 78,786 | |

| | |

3.88%, 1/27/2026 | | | 341,000 | | | | 365,955 | |

| | |

4.35%, 9/8/2026 | | | 20,000 | | | | 21,857 | |

| | |

3.63%, 1/20/2027 | | | 159,000 | | | | 169,118 | |

| | |

(ICE LIBOR USD 3 Month + 1.34%), 3.59%, 7/22/2028 (d) | | | 222,000 | | | | 235,777 | |

| | |

(ICE LIBOR USD 3 Month + 1.14%), 3.77%, 1/24/2029 (d) | | | 96,000 | | | | 103,211 | |

| | |

4.30%, 1/27/2045 | | | 85,000 | | | | 99,684 | |

| | |

Nomura Holdings, Inc. (Japan) 6.70%, 3/4/2020 | | | 65,000 | | | | 65,503 | |

| | |

Northern Trust Corp. (ICE LIBOR USD 3 Month + 1.13%), 3.38%, 5/8/2032 (d) | | | 29,000 | | | | 29,774 | |

| | |

Nuveen LLC 4.00%, 11/1/2028 (b) | | | 160,000 | | | | 177,954 | |

| | |

S&P Global, Inc. 3.25%, 12/1/2049 | | | 150,000 | | | | 152,966 | |

| | |

State Street Corp. 3.10%, 5/15/2023 | | | 24,000 | | | | 24,750 | |

| | |

TD Ameritrade Holding Corp. 2.95%, 4/1/2022 | | | 17,000 | | | | 17,372 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 8 | | | | JPMORGAN INSURANCE TRUST | | DECEMBER 31, 2019 |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Corporate Bonds — continued | | | | | |

|

Capital Markets — continued | |

| | |

UBS Group AG (Switzerland) 4.13%, 9/24/2025 (b) | | | 200,000 | | | | 217,378 | |

| | | | | | | | |

| | |

| | | | | | | 7,928,466 | |

| | | | | | | | |

|

Chemicals — 0.4% | |

| | |

Albemarle Corp. 5.45%, 12/1/2044 | | | 50,000 | | | | 57,187 | |

| | |

Celanese US Holdings LLC 3.50%, 5/8/2024 | | | 151,000 | | | | 156,025 | |

| | |

DuPont de Nemours, Inc. | | | | | | | | |

| | |

4.49%, 11/15/2025 | | | 100,000 | | | | 110,023 | |

| | |

5.32%, 11/15/2038 | | | 50,000 | | | | 59,546 | |

| | |

Eastman Chemical Co. 4.50%, 12/1/2028 | | | 220,000 | | | | 243,353 | |

| | |

Ecolab, Inc. 3.25%, 1/14/2023 | | | 90,000 | | | | 92,824 | |

| | |

International Flavors & Fragrances, Inc. | | | | | | | | |

| | |

4.45%, 9/26/2028 | | | 45,000 | | | | 49,154 | |

| | |

5.00%, 9/26/2048 | | | 52,000 | | | | 58,864 | |

| | |

Mosaic Co. (The) | | | | | | | | |

| | |

5.45%, 11/15/2033 | | | 36,000 | | | | 40,796 | |

| | |

4.88%, 11/15/2041 | | | 8,000 | | | | 8,365 | |

| | |

5.63%, 11/15/2043 | | | 80,000 | | | | 93,835 | |

| | |

Nutrien Ltd. (Canada) | | | | | | | | |

| | |

4.00%, 12/15/2026 | | | 70,000 | | | | 74,469 | |

| | |

4.20%, 4/1/2029 | | | 25,000 | | | | 27,534 | |

| | |

4.13%, 3/15/2035 | | | 90,000 | | | | 93,974 | |

| | |

5.00%, 4/1/2049 | | | 40,000 | | | | 47,559 | |

| | |

Sherwin-Williams Co. (The) 3.13%, 6/1/2024 | | | 29,000 | | | | 29,956 | |

| | |

Union Carbide Corp. | | | | | | | | |

| | |

7.50%, 6/1/2025 | | | 100,000 | | | | 121,469 | |

| | |

7.75%, 10/1/2096 | | | 80,000 | | | | 114,335 | |

| | | | | | | | |

| | |

| | | | | | | 1,479,268 | |

| | | | | | | | |

|

Commercial Services & Supplies — 0.0% (c) | |

| | |

Brambles USA, Inc. (Australia) 4.13%, 10/23/2025 (b) | | | 70,000 | | | | 74,094 | |

| | |

Republic Services, Inc. 2.90%, 7/1/2026 | | | 21,000 | | | | 21,491 | |

| | |

Waste Management, Inc. 3.45%, 6/15/2029 | | | 70,000 | | | | 74,861 | |

| | | | | | | | |

| | |

| | | | | | | 170,446 | |

| | | | | | | | |

|

Construction Materials — 0.0% (c) | |

| | |

Martin Marietta Materials, Inc. | | | | | | | | |

| | |

3.45%, 6/1/2027 | | | 52,000 | | | | 53,170 | |

| | |

3.50%, 12/15/2027 | | | 100,000 | | | | 103,714 | |

| | | | | | | | |

| | |

| | | | | | | 156,884 | |

| | | | | | | | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

|

Consumer Finance — 0.5% | |

| | |

AerCap Ireland Capital DAC (Ireland) 4.45%, 4/3/2026 | | | 150,000 | | | | 160,867 | |

| | |

American Express Co. 4.20%, 11/6/2025 | | | 150,000 | | | | 165,212 | |

| | |

American Express Credit Corp. 2.25%, 5/5/2021 | | | 73,000 | | | | 73,336 | |

| | |

American Honda Finance Corp. 2.30%, 9/9/2026 | | | 17,000 | | | | 16,960 | |

| | |

Avolon Holdings Funding Ltd. (Ireland) 4.38%, 5/1/2026 (b) | | | 150,000 | | | | 158,445 | |

| | |

Capital One Financial Corp. | | | | | | | | |

| | |

3.75%, 4/24/2024 | | | 130,000 | | | | 136,806 | |

| | |

4.20%, 10/29/2025 | | | 40,000 | | | | 43,135 | |

| | |

3.75%, 7/28/2026 | | | 196,000 | | | | 206,295 | |

| | |

General Motors Financial Co., Inc. | | | | | | | | |

| | |

3.45%, 4/10/2022 | | | 50,000 | | | | 51,124 | |

| | |

3.70%, 5/9/2023 | | | 68,000 | | | | 70,079 | |

| | |

3.95%, 4/13/2024 | | | 120,000 | | | | 125,377 | |

| | |

3.50%, 11/7/2024 | | | 80,000 | | | | 82,380 | |

| | |

4.00%, 1/15/2025 | | | 80,000 | | | | 84,041 | |

| | |

4.35%, 4/9/2025 | | | 80,000 | | | | 85,671 | |

| | |

4.30%, 7/13/2025 | | | 35,000 | | | | 37,385 | |

| | |

John Deere Capital Corp. | | | | | | | | |

| | |

3.35%, 6/12/2024 | | | 82,000 | | | | 86,450 | |

| | |

2.25%, 9/14/2026 | | | 125,000 | | | | 124,929 | |

| | |

Park Aerospace Holdings Ltd. (Ireland) 5.25%, 8/15/2022 (b) | | | 100,000 | | | | 106,540 | |

| | |

Synchrony Financial 3.70%, 8/4/2026 | | | 70,000 | | | | 72,260 | |

| | | | | | | | |

| | |

| | | | | | | 1,887,292 | |

| | | | | | | | |

|

Containers & Packaging — 0.1% | |

| | |

International Paper Co. 3.00%, 2/15/2027 | | | 57,000 | | | | 58,715 | |

| | |

Packaging Corp. of America 4.05%, 12/15/2049 | | | 155,000 | | | | 160,615 | |

| | |

WRKCo, Inc. | | | | | | | | |

| | |

3.00%, 9/15/2024 | | | 80,000 | | | | 81,570 | |

| | |

3.90%, 6/1/2028 | | | 35,000 | | | | 37,121 | |

| | | | | | | | |

| | |

| | | | | | | 338,021 | |

| | | | | | | | |

|

Diversified Consumer Services — 0.0% (c) | |

| | |

President & Fellows of Harvard College 3.30%, 7/15/2056 | | | 86,000 | | | | 88,632 | |

| | | | | | | | |

|

Diversified Financial Services — 0.5% | |

| | |

AIG Global Funding 1.90%, 10/6/2021 (b) | | | 100,000 | | | | 100,046 | |

| | |

CK Hutchison International Ltd. (United Kingdom) 1.88%, 10/3/2021 (b) | | | 200,000 | | | | 198,812 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2019 | | JPMORGAN INSURANCE TRUST | | | | | 9 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2019 (continued)

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Corporate Bonds — continued | | | | | |

|

Diversified Financial Services — continued | |

| | |

GE Capital International Funding Co. Unlimited Co. | | | | | | | | |

| | |

2.34%, 11/15/2020 | | | 251,000 | | | | 251,189 | |

| | |

4.42%, 11/15/2035 | | | 600,000 | | | | 638,866 | |

| | |

GTP Acquisition Partners I LLC | | | | | | | | |

| | |

2.35%, 6/15/2020 (b) | | | 58,000 | | | | 58,009 | |

| | |

3.48%, 6/16/2025 (b) | | | 67,000 | | | | 68,733 | |

| | |

Mitsubishi UFJ Lease & Finance Co. Ltd. (Japan) 2.65%, 9/19/2022 (b) | | | 200,000 | | | | 201,339 | |

| | |

National Rural Utilities Cooperative Finance Corp. 2.95%, 2/7/2024 | | | 44,000 | | | | 45,338 | |

| | |

ORIX Corp. (Japan) | | | | | | | | |

| | |

2.90%, 7/18/2022 | | | 40,000 | | | | 40,759 | |

| | |

3.25%, 12/4/2024 | | | 100,000 | | | | 104,181 | |

| | |

3.70%, 7/18/2027 | | | 100,000 | | | | 106,061 | |

| | |

Shell International Finance BV (Netherlands) 2.13%, 5/11/2020 | | | 70,000 | | | | 70,041 | |

| | | | | | | | |

| | |

| | | | | | | 1,883,374 | |

| | | | | | | | |

|

Diversified Telecommunication Services — 0.7% | |

| | |

AT&T, Inc. | | | | | | | | |

| | |

3.55%, 6/1/2024 | | | 155,000 | | | | 162,874 | |

| | |

3.95%, 1/15/2025 | | | 66,000 | | | | 70,739 | |

| | |

3.60%, 7/15/2025 | | | 45,000 | | | | 47,590 | |

| | |

4.13%, 2/17/2026 | | | 117,000 | | | | 126,702 | |

| | |

4.30%, 2/15/2030 | | | 178,000 | | | | 197,753 | |

| | |

4.90%, 8/15/2037 | | | 230,000 | | | | 264,232 | |

| | |

6.00%, 8/15/2040 | | | 125,000 | | | | 159,721 | |

| | |

5.35%, 9/1/2040 | | | 114,000 | | | | 137,252 | |

| | |

4.50%, 3/9/2048 | | | 88,000 | | | | 97,089 | |

| | |

Deutsche Telekom International Finance BV (Germany) 4.88%, 3/6/2042 (b) | | | 150,000 | | | | 176,614 | |

| | |

Telefonica Emisiones SA (Spain) | | | | | | | | |

| | |

5.13%, 4/27/2020 | | | 25,000 | | | | 25,237 | |

| | |

5.46%, 2/16/2021 | | | 19,000 | | | | 19,716 | |

| | |

Verizon Communications, Inc. | | | | | | | | |

| | |

2.63%, 8/15/2026 | | | 12,000 | | | | 12,174 | |

| | |

3.88%, 2/8/2029 | | | 75,000 | | | | 82,706 | |

| | |

4.02%, 12/3/2029 | | | 50,000 | | | | 55,850 | |

| | |

4.50%, 8/10/2033 | | | 125,000 | | | | 145,856 | |

| | |

4.40%, 11/1/2034 | | | 209,000 | | | | 241,814 | |

| | |

4.27%, 1/15/2036 | | | 85,000 | | | | 95,974 | |

| | |

5.25%, 3/16/2037 | | | 69,000 | | | | 86,464 | |

| | |

4.86%, 8/21/2046 | | | 134,000 | | | | 165,843 | |

| | |

4.67%, 3/15/2055 | | | 340,000 | | | | 419,371 | |

| | | | | | | | |

| | |

| | | | | | | 2,791,571 | |

| | | | | | | | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

|

Electric Utilities — 1.5% | |

| | |

AEP Transmission Co. LLC 3.15%, 9/15/2049 | | | 35,000 | | | | 33,745 | |

| | |

Alabama Power Co. 6.13%, 5/15/2038 | | | 62,000 | | | | 84,410 | |

| | |

Avangrid, Inc. 3.15%, 12/1/2024 | | | 72,000 | | | | 74,268 | |

| | |

Baltimore Gas & Electric Co. 3.50%, 8/15/2046 | | | 47,000 | | | | 47,726 | |

| | |

CenterPoint Energy Houston Electric LLC 3.95%, 3/1/2048 | | | 51,000 | | | | 57,107 | |

| | |

China Southern Power Grid International Finance BVI Co. Ltd. (China) 3.50%, 5/8/2027 (b) | | | 200,000 | | | | 209,312 | |

| | |

Cleveland Electric Illuminating Co. (The) | | | | | | | | |

| | |

3.50%, 4/1/2028 (b) | | | 95,000 | | | | 98,825 | |

| | |

4.55%, 11/15/2030 (b) | | | 65,000 | | | | 72,911 | |

| | |

Commonwealth Edison Co. 3.65%, 6/15/2046 | | | 30,000 | | | | 31,763 | |

| | |

Connecticut Light & Power Co. (The) 4.00%, 4/1/2048 | | | 41,000 | | | | 46,933 | |

| | |

Duke Energy Corp. | | | | | | | | |

| | |

2.65%, 9/1/2026 | | | 100,000 | | | | 100,382 | |

| | |

3.40%, 6/15/2029 | | | 61,000 | | | | 63,674 | |

| | |

Duke Energy Indiana LLC | | | | | | | | |

| | |

6.35%, 8/15/2038 | | | 43,000 | | | | 60,956 | |

| | |

6.45%, 4/1/2039 | | | 19,000 | | | | 27,272 | |

| | |

3.75%, 5/15/2046 | | | 60,000 | | | | 64,266 | |

| | |

Duke Energy Ohio, Inc. 3.70%, 6/15/2046 | | | 46,000 | | | | 48,690 | |

| | |

Duke Energy Progress LLC 3.70%, 10/15/2046 | | | 54,000 | | | | 57,630 | |

| | |

Duquesne Light Holdings, Inc. 3.62%, 8/1/2027 (b) | | | 160,000 | | | | 161,750 | |

| | |

Edison International | | | | | | | | |

| | |

3.55%, 11/15/2024 | | | 284,000 | | | | 290,658 | |

| | |

4.13%, 3/15/2028 | | | 100,000 | | | | 102,488 | |

| | |

Emera US Finance LP (Canada) 4.75%, 6/15/2046 | | | 130,000 | | | | 150,076 | |

| | |

Enel Finance International NV (Italy) 3.63%, 5/25/2027 (b) | | | 220,000 | | | | 227,690 | |

| | |

Entergy Arkansas LLC 3.50%, 4/1/2026 | | | 22,000 | | | | 23,187 | |

| | |

Entergy Corp. 2.95%, 9/1/2026 | | | 21,000 | | | | 21,317 | |

| | |

Entergy Louisiana LLC | | | | | | | | |

| | |

2.40%, 10/1/2026 | | | 59,000 | | | | 58,175 | |

| | |

3.05%, 6/1/2031 | | | 38,000 | | | | 39,253 | |

| | |

4.00%, 3/15/2033 | | | 40,000 | | | | 45,183 | |

| | |

Entergy Mississippi LLC | | | | | | | | |

| | |

2.85%, 6/1/2028 | | | 33,000 | | | | 33,715 | |

| | |

3.85%, 6/1/2049 | | | 135,000 | | | | 146,952 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 10 | | | | JPMORGAN INSURANCE TRUST | | DECEMBER 31, 2019 |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Corporate Bonds — continued | | | | | |

|

Electric Utilities — continued | |

| | |

Evergy Metro, Inc. | | | | | | | | |

| | |

3.15%, 3/15/2023 | | | 24,000 | | | | 24,724 | |

| | |

5.30%, 10/1/2041 | | | 50,000 | | | | 63,087 | |

| | |

4.20%, 3/15/2048 | | | 50,000 | | | | 57,166 | |

| | |

Evergy, Inc. 2.90%, 9/15/2029 | | | 170,000 | | | | 168,948 | |

| | |

FirstEnergy Corp. Series C, 4.85%, 7/15/2047 | | | 26,000 | | | | 30,837 | |

| | |

Florida Power & Light Co. | | | | | | | | |

| | |

5.40%, 9/1/2035 | | | 50,000 | | | | 62,949 | |

| | |

5.95%, 2/1/2038 | | | 30,000 | | | | 41,850 | |

| | |

Fortis, Inc. (Canada) 3.06%, 10/4/2026 | | | 124,000 | | | | 126,524 | |

| | |

Hydro-Quebec (Canada) Series IO, 8.05%, 7/7/2024 | | | 100,000 | | | | 125,743 | |

| | |

ITC Holdings Corp. 2.70%, 11/15/2022 | | | 100,000 | | | | 101,196 | |

| | |

Jersey Central Power & Light Co. | | | | | | | | |

| | |

4.30%, 1/15/2026 (b) | | | 40,000 | | | | 43,515 | |

| | |

6.15%, 6/1/2037 | | | 30,000 | | | | 38,722 | |

| | |

Massachusetts Electric Co. 4.00%, 8/15/2046 (b) | | | 56,000 | | | | 59,516 | |

| | |

MidAmerican Energy Co. | | | | | | | | |

| | |

3.50%, 10/15/2024 | | | 59,000 | | | | 62,506 | |

| | |

3.10%, 5/1/2027 | | | 93,000 | | | | 96,876 | |

| | |

Mid-Atlantic Interstate Transmission LLC 4.10%, 5/15/2028 (b) | | | 40,000 | | | | 43,725 | |

| | |

Nevada Power Co. Series CC, 3.70%, 5/1/2029 | | | 100,000 | | | | 108,184 | |

| | |

New England Power Co. (United Kingdom) 3.80%, 12/5/2047 (b) | | | 45,000 | | | | 47,120 | |

| | |

NextEra Energy Capital Holdings, Inc. 3.55%, 5/1/2027 | | | 27,000 | | | | 28,655 | |

| | |

Niagara Mohawk Power Corp. 3.51%, 10/1/2024 (b) | | | 19,000 | | | | 19,971 | |

| | |

Northern States Power Co. | | | | | | | | |

| | |

6.25%, 6/1/2036 | | | 65,000 | | | | 89,818 | |

| | |

2.90%, 3/1/2050 | | | 125,000 | | | | 119,066 | |

| | |

Oncor Electric Delivery Co. LLC 5.75%, 3/15/2029 | | | 25,000 | | | | 30,830 | |

| | |

Pennsylvania Electric Co. 3.25%, 3/15/2028 (b) | | | 19,000 | | | | 19,454 | |

| | |

Potomac Electric Power Co. 6.50%, 11/15/2037 | | | 75,000 | | | | 106,212 | |

| | |

PPL Capital Funding, Inc. | | | | | | | | |

| | |

3.40%, 6/1/2023 | | | 30,000 | | | | 30,955 | |

| | |

4.00%, 9/15/2047 | | | 20,000 | | | | 20,418 | |

| | |

Progress Energy, Inc. 4.40%, 1/15/2021 | | | 35,000 | | | | 35,678 | |

| | |

Public Service Co. of Colorado 3.20%, 11/15/2020 | | | 18,000 | | | | 18,091 | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

|

Electric Utilities — continued | |

| | |

Public Service Co. of Oklahoma Series G, 6.63%, 11/15/2037 | | | 175,000 | | | | 241,323 | |

| | |

Public Service Electric & Gas Co. | | | | | | | | |

| | |

3.00%, 5/15/2025 | | | 83,000 | | | | 86,147 | |

| | |

5.38%, 11/1/2039 | | | 28,000 | | | | 36,404 | |

| | |

Southern California Edison Co. | | | | | | | | |

| | |

Series C, 3.50%, 10/1/2023 | | | 53,000 | | | | 55,212 | |

| | |

Series B, 3.65%, 3/1/2028 | | | 80,000 | | | | 85,691 | |

| | |

Series 05-B, 5.55%, 1/15/2036 | | | 80,000 | | | | 95,750 | |

| | |

4.05%, 3/15/2042 | | | 100,000 | | | | 103,327 | |

| | |

Tampa Electric Co. 4.45%, 6/15/2049 | | | 100,000 | | | | 118,193 | |

| | |

Toledo Edison Co. (The) 6.15%, 5/15/2037 | | | 50,000 | | | | 68,511 | |

| | |

Union Electric Co. 2.95%, 6/15/2027 | | | 36,000 | | | | 37,061 | |

| | |

Virginia Electric & Power Co. | | | | | | | | |

| | |

Series A, 3.80%, 4/1/2028 | | | 180,000 | | | | 195,632 | |

| | |

6.35%, 11/30/2037 | | | 70,000 | | | | 96,951 | |

| | |

3.30%, 12/1/2049 | | | 50,000 | | | | 50,308 | |

| | |

Xcel Energy, Inc. 6.50%, 7/1/2036 | | | 7,000 | | | | 9,504 | |

| | | | | | | | |

| | |

| | | | | | | 5,582,664 | |

| | | | | | | | |

|

Electronic Equipment, Instruments & Components — 0.1% | |

| | |

Arrow Electronics, Inc. | | | | | | | | |

| | |

4.50%, 3/1/2023 | | | 8,000 | | | | 8,439 | |

| | |

3.25%, 9/8/2024 | | | 44,000 | | | | 45,206 | |

| | |

3.88%, 1/12/2028 | | | 22,000 | | | | 22,517 | |

| | |

Corning, Inc. 3.90%, 11/15/2049 | | | 174,000 | | | | 176,190 | |

| | | | | | | | |

| | |

| | | | | | | 252,352 | |

| | | | | | | | |

|

Energy Equipment & Services — 0.1% | |

| | |

Baker Hughes a GE Co. LLC | | | | | | | | |

| | |

3.14%, 11/7/2029 | | | 180,000 | | | | 184,712 | |

| | |

5.13%, 9/15/2040 | | | 40,000 | | | | 47,012 | |

| | |

Halliburton Co. | | | | | | | | |

| | |

3.80%, 11/15/2025 | | | 55,000 | | | | 58,660 | |

| | |

4.85%, 11/15/2035 | | | 30,000 | | | | 33,873 | |

| | |

6.70%, 9/15/2038 | | | 60,000 | | | | 79,308 | |

| | |

Schlumberger Holdings Corp. | | | | | | | | |

| | |

3.75%, 5/1/2024 (b) | | | 55,000 | | | | 57,916 | |

| | |

3.90%, 5/17/2028 (b) | | | 62,000 | | | | 65,971 | |

| | | | | | | | |

| | |

| | | | | | | 527,452 | |

| | | | | | | | |

|

Entertainment — 0.1% | |

| | |

NBCUniversal Media LLC 5.95%, 4/1/2041 | | | 75,000 | | | | 102,986 | |

| | |

Walt Disney Co. (The) 7.30%, 4/30/2028 | | | 150,000 | | | | 200,549 | |

| | | | | | | | |

| | |

| | | | | | | 303,535 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2019 | | JPMORGAN INSURANCE TRUST | | | | | 11 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2019 (continued)

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Corporate Bonds — continued | | | | | |

|

Equity Real Estate Investment Trusts (REITs) — 1.1% | |

| | |

Alexandria Real Estate Equities, Inc. | | | | | | | | |

| | |

3.80%, 4/15/2026 | | | 23,000 | | | | 24,566 | |

| | |

4.00%, 2/1/2050 | | | 125,000 | | | | 136,524 | |

| | |

American Campus Communities Operating Partnership LP 3.63%, 11/15/2027 | | | 100,000 | | | | 105,361 | |

| | |

American Tower Corp. | | | | | | | | |

| | |

5.90%, 11/1/2021 | | | 30,000 | | | | 32,037 | |

| | |

3.50%, 1/31/2023 | | | 87,000 | | | | 90,144 | |

| | |

5.00%, 2/15/2024 | | | 71,000 | | | | 78,150 | |

| | |

3.38%, 10/15/2026 | | | 44,000 | | | | 45,702 | |

| | |

3.70%, 10/15/2049 | | | 230,000 | | | | 228,459 | |

| | |

American Tower Trust #1 3.07%, 3/15/2023 (b) | | | 80,000 | | | | 81,007 | |

| | |

Boston Properties LP | | | | | | | | |

| | |

3.13%, 9/1/2023 | | | 30,000 | | | | 30,941 | |

| | |

3.20%, 1/15/2025 | | | 61,000 | | | | 63,266 | |

| | |

3.65%, 2/1/2026 | | | 67,000 | | | | 70,930 | |

| | |

Brixmor Operating Partnership LP | | | | | | | | |

| | |

3.65%, 6/15/2024 | | | 50,000 | | | | 52,259 | |

| | |

3.85%, 2/1/2025 | | | 50,000 | | | | 52,471 | |

| | |

Crown Castle International Corp. | | | | | | | | |

| | |

4.88%, 4/15/2022 | | | 30,000 | | | | 31,768 | |

| | |

5.25%, 1/15/2023 | | | 60,000 | | | | 65,149 | |

| | |

4.00%, 3/1/2027 | | | 24,000 | | | | 25,888 | |

| | |

Digital Realty Trust LP 3.70%, 8/15/2027 | | | 31,000 | | | | 32,813 | |

| | |

Duke Realty LP 3.25%, 6/30/2026 | | | 18,000 | | | | 18,631 | |

| | |

GAIF Bond Issuer Pty. Ltd. (Australia) 3.40%, 9/30/2026 (b) | | | 79,000 | | | | 80,108 | |

| | |

Goodman US Finance Three LLC (Australia) 3.70%, 3/15/2028 (b) | | | 43,000 | | | | 44,102 | |

| | |

Healthcare Trust of America Holdings LP 3.10%, 2/15/2030 | | | 310,000 | | | | 307,404 | |

| | |

Healthpeak Properties, Inc. | | | | | | | | |

| | |

3.88%, 8/15/2024 | | | 115,000 | | | | 122,248 | |

| | |

3.50%, 7/15/2029 | | | 132,000 | | | | 137,498 | |

| | |

3.00%, 1/15/2030 | | | 90,000 | | | | 90,220 | |

| | |

Liberty Property LP 3.25%, 10/1/2026 | | | 19,000 | | | | 19,829 | |

| | |

Life Storage LP 4.00%, 6/15/2029 | | | 150,000 | | | | 160,423 | |

| | |

National Retail Properties, Inc. | | | | | | | | |

| | |

3.60%, 12/15/2026 | | | 58,000 | | | | 60,863 | |

| | |

4.30%, 10/15/2028 | | | 150,000 | | | | 165,805 | |

| | |

Office Properties Income Trust | | | | | | | | |

| | |

3.60%, 2/1/2020 | | | 130,000 | | | | 130,000 | |

| | |

4.00%, 7/15/2022 | | | 78,000 | | | | 79,809 | |

| | |

Public Storage 3.39%, 5/1/2029 | | | 65,000 | | | | 68,966 | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

|

Equity Real Estate Investment Trusts (REITs) — continued | |

| | |

Realty Income Corp. | | | | | | | | |

| | |

3.88%, 7/15/2024 | | | 20,000 | | | | 21,323 | |

| | |

3.88%, 4/15/2025 | | | 60,000 | | | | 64,649 | |

| | |

4.65%, 3/15/2047 | | | 38,000 | | | | 45,934 | |

| | |

Regency Centers LP 2.95%, 9/15/2029 | | | 215,000 | | | | 214,557 | |

| | |

Scentre Group Trust 1 (Australia) 3.50%, 2/12/2025 (b) | | | 170,000 | | | | 176,299 | |

| | |

Senior Housing Properties Trust 4.75%, 2/15/2028 | | | 80,000 | | | | 80,671 | |

| | |

Simon Property Group LP 2.45%, 9/13/2029 | | | 227,000 | | | | 223,125 | |

| | |

SITE Centers Corp. 3.63%, 2/1/2025 | | | 61,000 | | | | 62,867 | |

| | |

UDR, Inc. | | | | | | | | |

| | |

2.95%, 9/1/2026 | | | 28,000 | | | | 28,480 | |

| | |

3.20%, 1/15/2030 | | | 150,000 | | | | 153,202 | |

| | |

3.00%, 8/15/2031 | | | 25,000 | | | | 25,006 | |

| | |

Ventas Realty LP | | | | | | | | |

| | |

4.13%, 1/15/2026 | | | 34,000 | | | | 36,389 | |

| | |

3.85%, 4/1/2027 | | | 49,000 | | | | 51,695 | |

| | |

Vornado Realty LP 3.50%, 1/15/2025 | | | 60,000 | | | | 62,369 | |

| | |

Welltower, Inc. | | | | | | | | |

| | |

2.70%, 2/15/2027 | | | 63,000 | | | | 63,195 | |

| | |

3.10%, 1/15/2030 | | | 85,000 | | | | 85,952 | |

| | | | | | | | |

| | |

| | | | | | | 4,129,054 | |

| | | | | | | | |

|

Food & Staples Retailing — 0.1% | |

| | |

Costco Wholesale Corp. 2.75%, 5/18/2024 | | | 21,000 | | | | 21,727 | |

| | |

CVS Pass-Through Trust | | | | | | | | |

| | |

7.51%, 1/10/2032 (b) | | | 72,142 | | | | 89,132 | |

| | |

Series 2013, 4.70%, 1/10/2036 (b) | | | 164,602 | | | | 174,936 | |

| | |

Kroger Co. (The) 5.40%, 7/15/2040 | | | 18,000 | | | | 20,900 | |

| | | | | | | | |

| | |

| | | | | | | 306,695 | |

| | | | | | | | |

|

Food Products — 0.3% | |

| | |

Campbell Soup Co. 4.80%, 3/15/2048 | | | 50,000 | | | | 57,741 | |

| | |

Cargill, Inc. 3.25%, 3/1/2023 (b) | | | 25,000 | | | | 25,814 | |

| | |

Conagra Brands, Inc. | | | | | | | | |

| | |

4.60%, 11/1/2025 | | | 45,000 | | | | 49,665 | |

| | |

5.30%, 11/1/2038 | | | 35,000 | | | | 41,471 | |

| | |

General Mills, Inc. | | | | | | | | |

| | |

4.00%, 4/17/2025 | | | 60,000 | | | | 64,839 | |

| | |

4.15%, 2/15/2043 | | | 100,000 | | | | 107,204 | |

| | |

Kellogg Co. 3.40%, 11/15/2027 | | | 38,000 | | | | 39,666 | |

| | |

Kraft Heinz Foods Co. 5.00%, 7/15/2035 | | | 155,000 | | | | 171,865 | |

| | |

McCormick & Co., Inc. 3.15%, 8/15/2024 | | | 54,000 | | | | 56,029 | |

| | |

Mead Johnson Nutrition Co. (United Kingdom) 4.13%, 11/15/2025 | | | 27,000 | | | | 29,484 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | JPMORGAN INSURANCE TRUST | | DECEMBER 31, 2019 |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Corporate Bonds — continued | | | | | |

|

Food Products — continued | |

| | |

Smithfield Foods, Inc. 5.20%, 4/1/2029 (b) | | | 160,000 | | | | 177,228 | |

| | |

Tyson Foods, Inc. | | | | | | | | |

| | |

3.95%, 8/15/2024 | | | 49,000 | | | | 52,501 | |

| | |

4.88%, 8/15/2034 | | | 20,000 | | | | 23,731 | |

| | |

5.15%, 8/15/2044 | | | 80,000 | | | | 96,773 | |

| | | | | | | | |

| | |

| | | | | | | 994,011 | |

| | | | | | | | |

|

Gas Utilities — 0.2% | |

| | |

Atmos Energy Corp. | | | | | | | | |

| | |

4.13%, 10/15/2044 | | | 50,000 | | | | 56,175 | |

| | |

4.13%, 3/15/2049 | | | 155,000 | | | | 177,558 | |

| | |

Boston Gas Co. 4.49%, 2/15/2042 (b) | | | 22,000 | | | | 25,024 | |

| | |

Brooklyn Union Gas Co. (The) 4.27%, 3/15/2048 (b) | | | 80,000 | | | | 90,446 | |

| | |

CenterPoint Energy Resources Corp. 4.50%, 1/15/2021 | | | 25,000 | | | | 25,480 | |

| | |

Dominion Energy Gas Holdings LLC | | | | | | | | |

| | |

2.80%, 11/15/2020 | | | 49,000 | | | | 49,341 | |

| | |

Series C, 3.90%, 11/15/2049 | | | 137,000 | | | | 136,384 | |

| | |

Piedmont Natural Gas Co., Inc. 3.50%, 6/1/2029 | | | 200,000 | | | | 213,593 | |

| | |

Southern Natural Gas Co. LLC | | | | | | | | |

| | |

8.00%, 3/1/2032 | | | 53,000 | | | | 76,691 | |

| | |

4.80%, 3/15/2047 (b) | | | 26,000 | | | | 29,543 | |

| | |

Southwest Gas Corp. 3.80%, 9/29/2046 | | | 44,000 | | | | 44,440 | |

| | | | | | | | |

| | |

| | | | | | | 924,675 | |

| | | | | | | | |

|

Health Care Equipment & Supplies — 0.2% | |

| | |

Abbott Laboratories 4.90%, 11/30/2046 | | | 210,000 | | | | 275,529 | |

| | |

Boston Scientific Corp. | | | | | | | | |

| | |

3.75%, 3/1/2026 | | | 100,000 | | | | 107,086 | |

| | |

4.55%, 3/1/2039 | | | 100,000 | | | | 117,353 | |

| | |

DH Europe Finance II SARL 3.25%, 11/15/2039 | | | 184,000 | | | | 184,961 | |

| | |

Zimmer Biomet Holdings, Inc. 3.70%, 3/19/2023 | | | 27,000 | | | | 28,125 | |

| | | | | | | | |

| | |

| | | | | | | 713,054 | |

| | | | | | | | |

|

Health Care Providers & Services — 0.6% | |

| | |

Anthem, Inc. | | | | | | | | |

| | |

3.30%, 1/15/2023 | | | 18,000 | | | | 18,614 | |

| | |

3.35%, 12/1/2024 | | | 70,000 | | | | 73,003 | |

| | |

4.10%, 3/1/2028 | | | 55,000 | | | | 59,691 | |

| | |

4.65%, 1/15/2043 | | | 18,000 | | | | 20,254 | |

| | |

4.65%, 8/15/2044 | | | 65,000 | | | | 73,471 | |

| | |

Cigna Corp. 4.50%, 2/25/2026 (b) | | | 127,000 | | | | 139,225 | |

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

|

Health Care Providers & Services — continued | |

| | |

CVS Health Corp. | | | | | | | | |

| | |

4.30%, 3/25/2028 | | | 95,000 | | | | 103,667 | |

| | |

3.25%, 8/15/2029 | | | 155,000 | | | | 157,307 | |

| | |

4.78%, 3/25/2038 | | | 240,000 | | | | 272,030 | |

| | |

5.05%, 3/25/2048 | | | 143,000 | | | | 168,952 | |

| | |

HCA, Inc. | | | | | | | | |

| | |

5.25%, 6/15/2026 | | | 130,000 | | | | 145,509 | |

| | |

5.13%, 6/15/2039 | | | 125,000 | | | | 137,953 | |

| | |

Laboratory Corp. of America Holdings 2.95%, 12/1/2029 | | | 295,000 | | | | 295,365 | |

| | |

Magellan Health, Inc. 4.90%, 9/22/2024 (e) | | | 15,000 | | | | 15,375 | |

| | |

Memorial Health Services 3.45%, 11/1/2049 | | | 245,000 | | | | 240,161 | |

| | |

Mount Sinai Hospitals Group, Inc. | | | | | | | | |

| | |

Series 2017, 3.98%, 7/1/2048 | | | 83,000 | | | | 83,887 | |

| | |

Providence St Joseph Health Obligated Group Series H, 2.75%, 10/1/2026 | | | 36,000 | | | | 36,314 | |

| | |

Quest Diagnostics, Inc. 3.45%, 6/1/2026 | | | 17,000 | | | | 17,845 | |

| | |

UnitedHealth Group, Inc. | | | | | | | | |

| | |

4.63%, 7/15/2035 | | | 34,000 | | | | 41,213 | |

| | |

3.50%, 8/15/2039 | | | 160,000 | | | | 167,588 | |

| | | | | | | | |

| | |

| | | | | | | 2,267,424 | |

| | | | | | | | |

|

Hotels, Restaurants & Leisure — 0.0% (c) | |

| | |

McDonald’s Corp. 4.70%, 12/9/2035 | | | 60,000 | | | | 71,010 | |

| | | | | | | | |

|

Household Products — 0.0% (c) | |

| | |

Procter & Gamble — ESOP Series A, 9.36%, 1/1/2021 | | | 17,505 | | | | 17,996 | |

| | | | | | | | |

|

Independent Power and Renewable Electricity Producers — 0.1% | |

| | |

Exelon Generation Co. LLC | | | | | | | | |

| | |

3.40%, 3/15/2022 | | | 50,000 | | | | 51,300 | |

| | |

4.25%, 6/15/2022 | | | 38,000 | | | | 39,730 | |

| | |

6.25%, 10/1/2039 | | | 100,000 | | | | 120,407 | |

| | |

5.75%, 10/1/2041 | | | 29,000 | | | | 33,475 | |

| | |

NRG Energy, Inc. 4.45%, 6/15/2029 (b) | | | 110,000 | | | | 115,081 | |

| | |

PSEG Power LLC 4.15%, 9/15/2021 | | | 37,000 | | | | 38,125 | |

| | |

Southern Power Co. 5.15%, 9/15/2041 | | | 50,000 | | | | 56,524 | |

| | |

Tri-State Generation & Transmission Association, Inc. 4.25%, 6/1/2046 | | | 25,000 | | | | 26,786 | |

| | | | | | | | |

| | |

| | | | | | | 481,428 | |

| | | | | | | | |

|

Industrial Conglomerates — 0.1% | |

| | |

General Electric Co. | | | | | | | | |

| | |

5.50%, 1/8/2020 | | | 88,000 | | | | 88,032 | |

| | |

5.88%, 1/14/2038 | | | 100,000 | | | | 120,985 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2019 | | JPMORGAN INSURANCE TRUST | | | | | 13 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2019 (continued)

| | | | | | | | |

| INVESTMENTS | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Corporate Bonds — continued | | | | | |

|

Industrial Conglomerates — continued | |

| | |

Honeywell International, Inc. 2.50%, 11/1/2026 | | | 150,000 | | | | 152,450 | |

| | | | | | | | |

| | |

| | | | | | | 361,467 | |

| | | | | | | | |

|

Insurance — 1.2% | |

| | |

AIA Group Ltd. (Hong Kong) | | | | | | | | |

| | |

3.20%, 3/11/2025 (b) | | | 200,000 | | | | 205,625 | |

| | |

3.90%, 4/6/2028 (b) | | | 210,000 | | | | 224,083 | |

| | |

3.60%, 4/9/2029 (b) | | | 200,000 | | | | 210,170 | |

| | |

American Financial Group, Inc. 3.50%, 8/15/2026 | | | 100,000 | | | | 102,921 | |

| | |

American International Group, Inc. | | | | | | | | |

| | |

4.13%, 2/15/2024 | | | 59,000 | | | | 63,313 | |

| | |

3.75%, 7/10/2025 | | | 24,000 | | | | 25,663 | |

| | |

3.88%, 1/15/2035 | | | 180,000 | | | | 190,728 | |

| | |

Assurant, Inc. 4.20%, 9/27/2023 | | | 85,000 | | | | 88,680 | |

| | |

Athene Global Funding | | | | | | | | |

| | |

2.75%, 4/20/2020 (b) | | | 106,000 | | | | 106,221 | |

| | |

2.75%, 6/25/2024 (b) | | | 155,000 | | | | 156,441 | |

| | |

2.95%, 11/12/2026 (b) | | | 410,000 | | | | 409,069 | |

| | |