UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07890

AIM Tax-Exempt Funds (Invesco Tax-Exempt Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Glenn Brightman 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 2/29

Date of reporting period: 2/29/2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

| | |

| | |

| Annual Report to Shareholders | | February 29, 2024 |

Invesco AMT-Free Municipal Income Fund

Nasdaq:

A: OPTAX ∎ C: OMFCX ∎ Y: OMFYX ∎ R6: IORAX

Beginning in July 2024, amendments adopted by the Securities and Exchange Commission will substantially impact the design, content, and delivery of shareholder reports. These newly designed shareholder reports will highlight key fund information in a clear and concise format and must be mailed to each shareholder that has not elected to receive the reports electronically. Other information, including financial statements, will no longer be included in the shareholder report but will be available at invesco.com/reports, delivered upon request, and filed on a semi-annual basis on Form N-CSR.

If you would like to receive shareholder reports and other communications electronically instead of by mail, you may make that request by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at invesco.com/edelivery. If you do not make this request or enroll in e-delivery, you will receive future shareholder reports and other communications by mail.

Management’s Discussion of Fund Performance

| | | | |

| |

Performance summary | |

For the fiscal year ended February 29, 2024, Class A shares of Invesco AMT-Free Municipal Income Fund (the Fund), at net asset value (NAV), outperformed the S&P Municipal Bond 5+ Year Investment Grade Index. Your Fund’s long-term performance appears later in this report. | |

Fund vs. Indexes | |

Total returns, 2/28/23 to 2/29/24, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. | |

| |

Class A Shares | | | 6.22 | % |

Class C Shares | | | 5.44 | |

Class Y Shares | | | 6.48 | |

Class R6 Shares | | | 6.54 | |

S&P Municipal Bond 5+ Year Investment Grade Index▼ | | | 5.88 | |

U.S. Consumer Price Index∎ | | | 3.15 | |

| |

Source(s): ▼RIMES Technologies Corp.; ∎Bloomberg LP | | | | |

Market conditions and your Fund

During the fiscal year ended February 29, 2024, investment grade municipal bonds returned 5.42%, high yield municipal bonds returned 8.30% and taxable municipal bonds returned 4.78%.1

At the beginning of the fiscal year, investors were hopeful for the 2023 calendar year, despite ongoing concerns about inflation and interest rates; however, in March, the focus unexpectedly shifted as Silicon Valley Bank collapsed after a bank run, marking the second-largest bank failure in US history. Fears about the health of the global banking system ensued, and demand for perceived safe-haven asset classes increased, driving down Treasury and municipal yields. Although three other bank failures followed, fears of larger systemic instability faded in the following months.

Debt ceiling concerns dominated most of the second quarter of 2023. The US government could have defaulted on its debt obligations, causing economic fallout across the global economy, had congressional action not been taken in early June. After months of on-and-off negotiations between the White House and congressional leaders, just ahead of the payment deadline, the US Congress passed and President Biden signed into law the Fiscal Responsibility Act, an agreement that suspends the limit on the federal debt ceiling until 2025 in exchange for capping federal spending.

In its efforts to rein in inflation without harming employment or the overall economy, the Federal Reserve Board (the Fed) continued with its most aggressive monetary policy since the 1980s. The Fed raised the federal funds rate in March, May and July, bringing the target rate to 5.50%.2 However, investor sentiment shifted in early November, as the Fed held interest rates steady and publicly backed away from the rate hike it had signaled for December. Bond yields fell, igniting a rally across the fixed income market, including

municipal bonds. The rally continued through November and into December as inflation continued to ease, and US economic growth remained contained. In December, the Fed again left interest rates unchanged and adopted a transitory tone, suggesting to market participants that rate cuts might be coming in 2024.2

New municipal supply continued at a slow pace as issuers, with cash on their balance sheets, have been reluctant to issue at higher interest rates. However, 2024 began with the highest tax-exempt supply seen over a January-February period since 2007: $60 billion.1 This skewed the fiscal year’s new issuance total to $388 billion, up 15% from the previous year’s $338 billion.1 Year-to-date 2024 was also constructive in terms of inflows to municipal funds. Following two years of outsized inflows and outflows, the municipal market began its return to a more normalized trend as we finished the fiscal year.3

As a result of Puerto Rico’s restructuring of $22 billion of general obligation debt in March 2022, marking significant progress towards its long-winded bankruptcy process, the Commonwealth’s weight in the Bloomberg High Yield Municipal Bond Index increased from 13% in February 2019 to 17% in March 2022 as the newly restructured bonds reentered the index.1 During the fiscal year, the focus turned to the Puerto Rico Electric and Power Authority (PREPA). As of February 29, 2024, bankruptcy negotiations and U.S. District Court proceedings related to PREPA were ongoing.

Municipal bonds have a long history of low defaults as many are issued to fund essential services to Americans. This continues to be the case as evidenced by S&P rating changes – during calendar year 2023, S&P’s rating activity was positive, with 949 ratings upgraded versus 278 downgraded, translating to more than three upgrades for every downgrade.4 This positive dynamic, which we believe will continue, likely stems from benefits of the various federal stimulus measures,

including the American Rescue Plan Act, the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, as well as higher revenues collected by state and local governments.

We believe the valuable benefits of municipal bonds will prevail over current market volatility and economic uncertainty. We continue to rely on our experienced portfolio managers and credit analysts to weather the economic challenges while identifying marketplace opportunities to add long-term value for shareholders.

During the fiscal year, an overweight exposure to bonds A-rated† and below contributed to the Fund’s performance relative to its benchmark the S&P Municipal Bond 5+ Year Investment Grade Index. Additionally, an overweight exposure in higher coupon bonds (4.00% and higher) contributed to the Fund’s relative return. On a state level, bonds domiciled in Illinois also added to the Fund’s relative performance.

An underweight allocation to AAA and AA-rated† bonds contributed to the Fund’s performance relative to its benchmark the S&P Municipal Bond 5+ Year Investment Grade Index. An underweight exposure in local general obligation bonds also detracted from the Fund’s relative performance. On a state level, bonds domiciled in New York were a detractor from the Fund’s relative results.

During the fiscal year, leverage contributed to the Fund’s performance relative to its benchmark the S&P Municipal Bond 5+ Year Investment Grade Index. The Fund achieved a leveraged position through the use of inverse floating rate securities or tender option bonds. The Fund uses leverage because we believe that, over time, leveraging provides opportunities for additional income and total return for shareholders. However, the use of leverage also can expose shareholders to additional volatility. For more information about the Fund’s use of leverage, see the Notes to Financial Statements later in this report.

We wish to remind you that the Fund is subject to interest rate risk, meaning when interest rates rise, the value of fixed income securities tends to fall. The degree to which the value of fixed income securities may decline due to rising interest rates may vary depending on the speed and magnitude of the increase in interest rates, as well as individual security characteristics, such as price, maturity, duration and coupon and market forces, such as supply and demand for similar securities. We are monitoring interest rates, as well as the market, economic and geopolitical factors that may impact the direction, speed and magnitude of changes to interest rates across the maturity spectrum, including the potential impact of monetary policy changes by the Fed and certain foreign central banks. If interest rates rise or fall faster than expected, markets may experience increased volatility, which may affect the value and/or liquidity of certain of the Fund’s investments.

| | |

| 2 | | Invesco AMT-Free Municipal Income Fund |

Thank you for investing in Invesco AMT-Free Municipal Income Fund and for sharing our long-term investment horizon.

| 2 | Source: US Federal Reserve |

| 4 | Source: Standard & Poor’s |

† Standard & Poor’s, Fitch Ratings, Moody’s. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. “Non-Rated” indicates the debtor was not rated and should not be interpreted as indicating low quality. For more information on rating methodology, please visit spglobal.com, fitchratings.com and ratings.moodys.com.

Portfolio manager(s):

Josh Cooney

Elizabeth Mossow

Tim O’Reilly

Mark Paris

Julius Williams

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| 3 | | Invesco AMT-Free Municipal Income Fund |

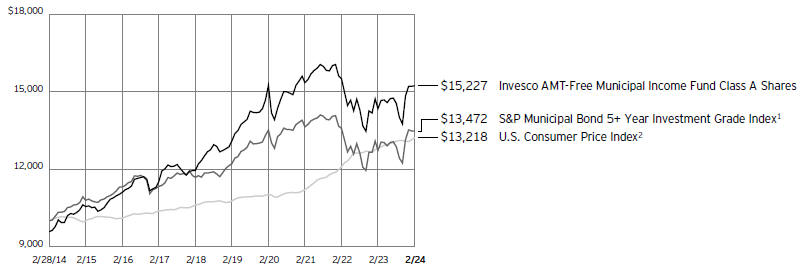

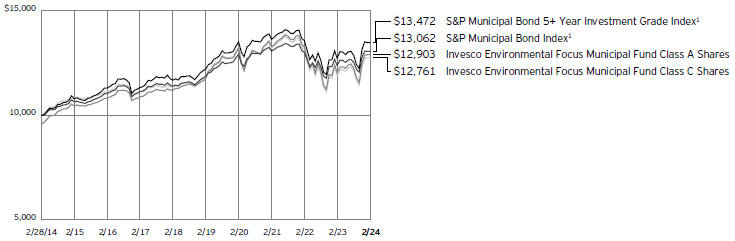

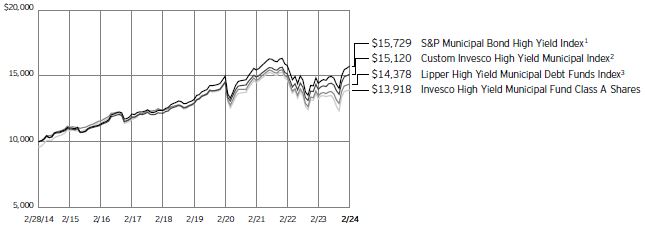

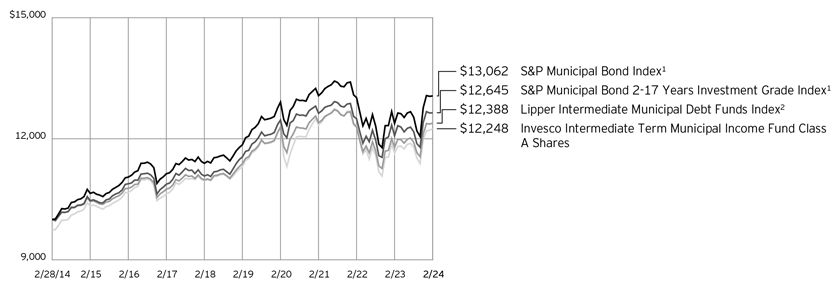

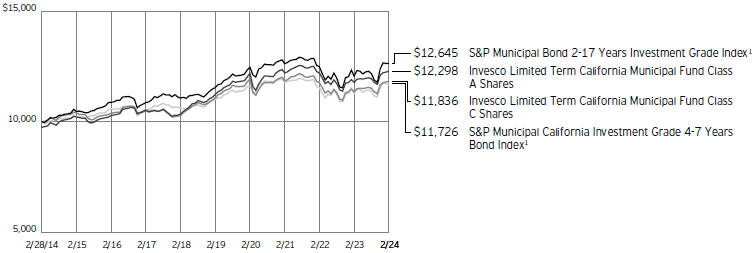

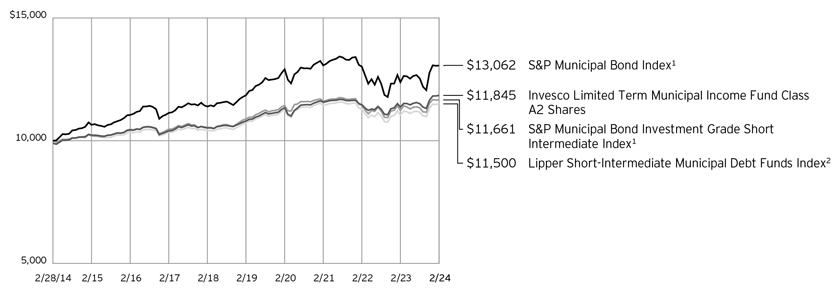

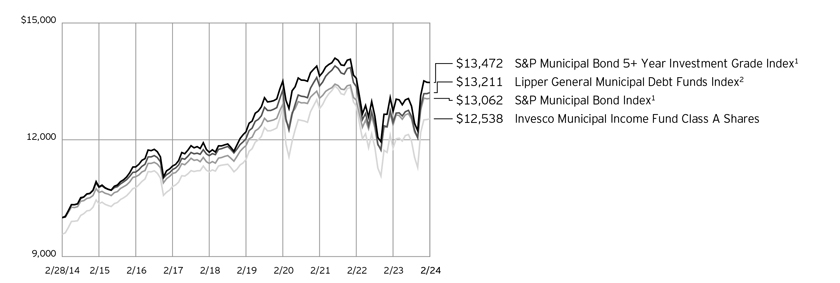

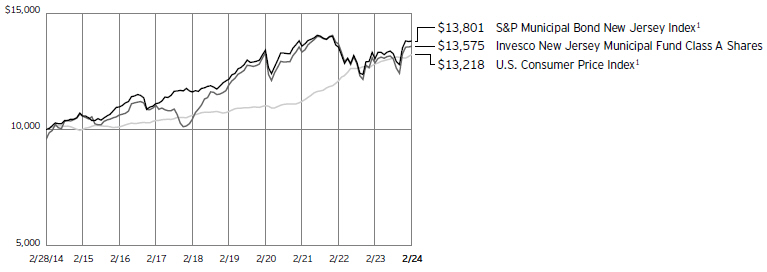

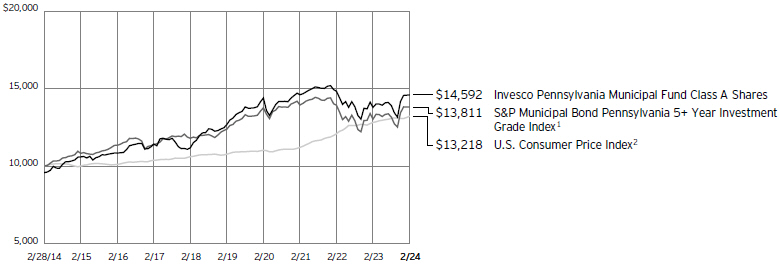

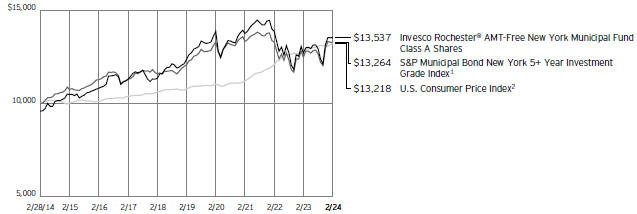

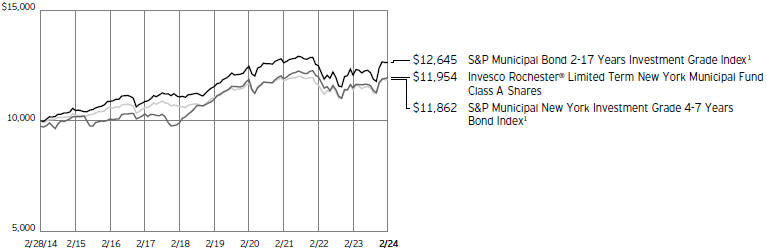

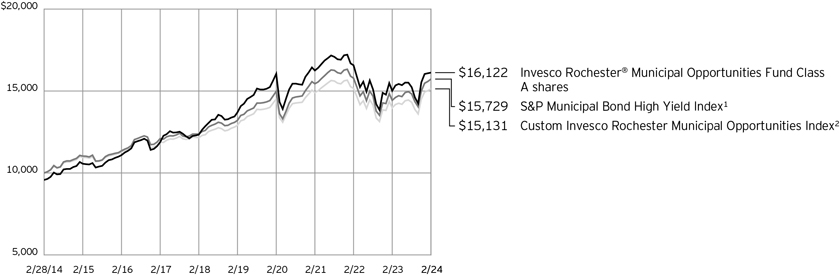

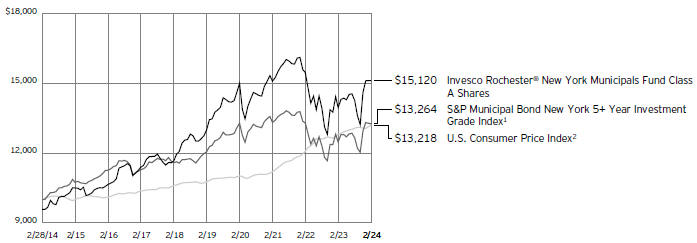

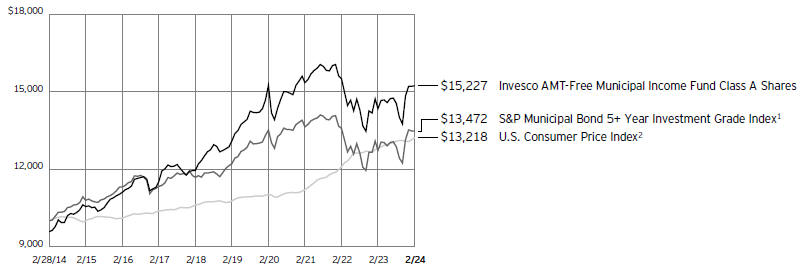

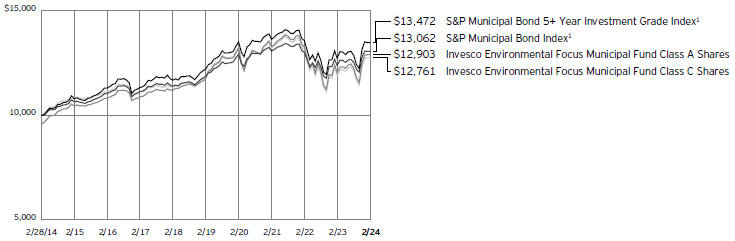

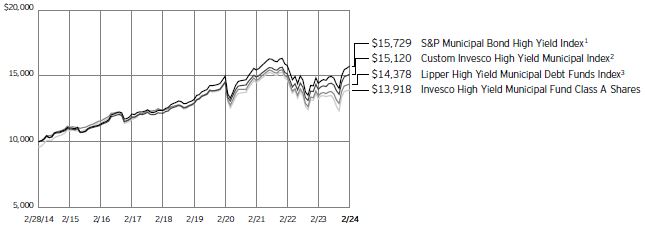

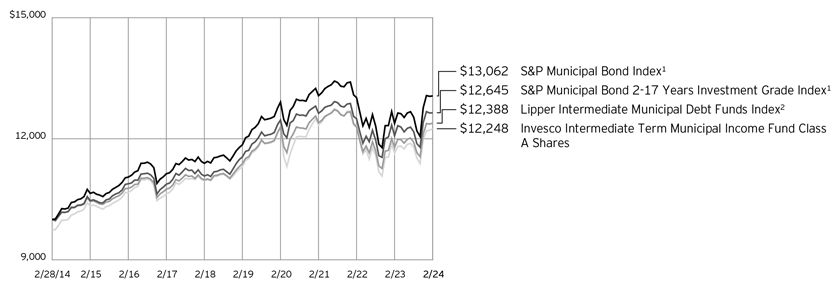

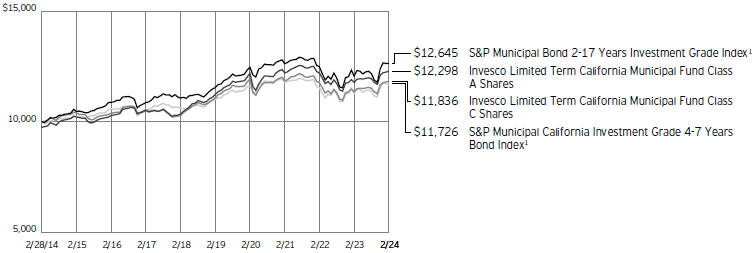

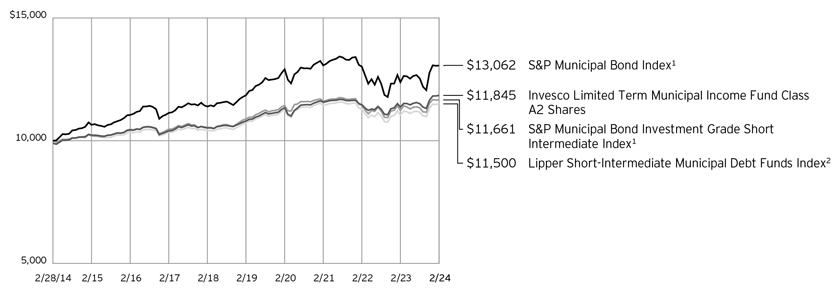

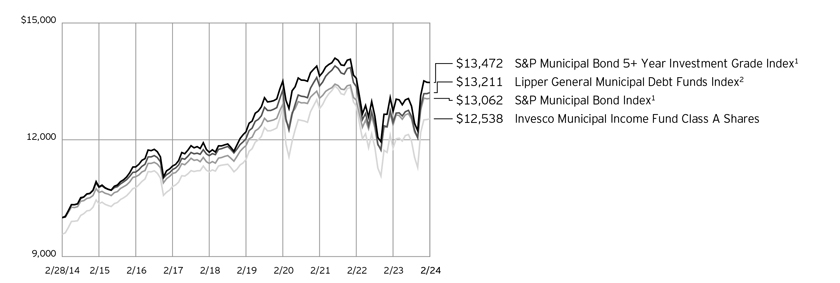

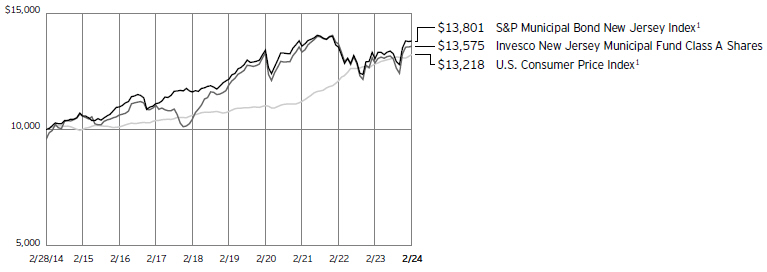

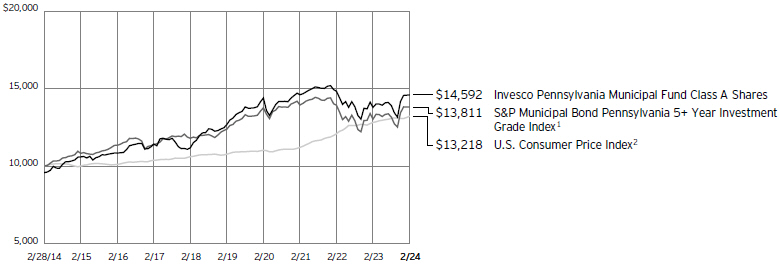

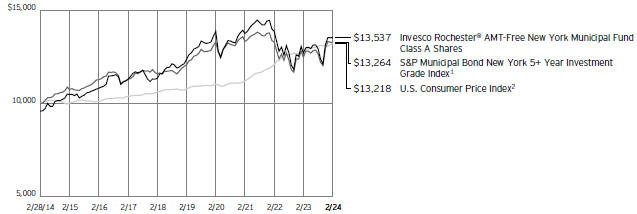

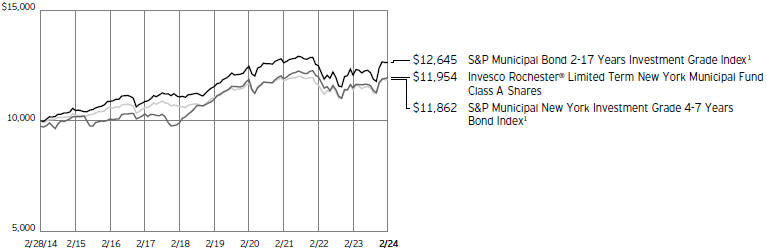

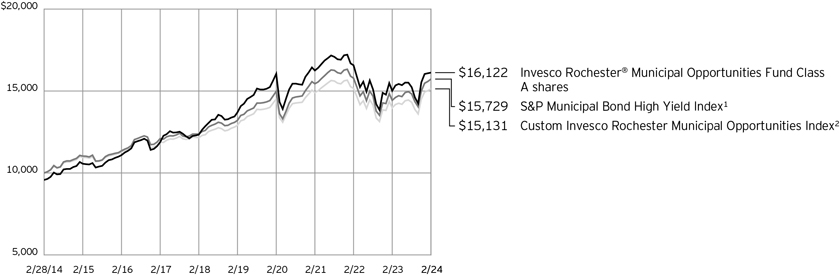

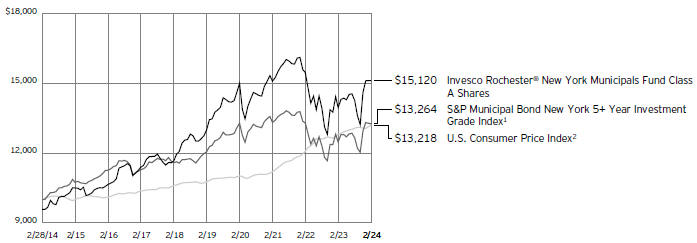

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 2/28/14

| 1 | Source: RIMES Technologies Corp. |

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management

fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects Fund expenses and management fees; performance of a market index does

not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

| | |

| 4 | | Invesco AMT-Free Municipal Income Fund |

| | | | |

| |

Average Annual Total Returns | |

As of 2/29/24, including maximum applicable sales charges | |

Class A Shares | | | | |

Inception (10/27/76) | | | 5.41 | % |

10 Years | | | 4.29 | |

5 Years | | | 2.19 | |

1 Year | | | 1.73 | |

| |

Class C Shares | | | | |

Inception (8/29/95) | | | 4.04 | % |

10 Years | | | 4.10 | |

5 Years | | | 2.30 | |

1 Year | | | 4.44 | |

| |

Class Y Shares | | | | |

Inception (11/29/10) | | | 6.04 | % |

10 Years | | | 5.00 | |

5 Years | | | 3.32 | |

1 Year | | | 6.48 | |

| |

Class R6 Shares | | | | |

10 Years | | | 4.90 | % |

5 Years | | | 3.39 | |

1 Year | | | 6.54 | |

Effective May 24, 2019, Class A, Class C and Class Y shares of the Oppenheimer Rochester AMT-Free Municipal Fund, (the predecessor fund), were reorganized into Class A, Class C and Class Y shares, respectively, of the Invesco Oppenheimer Rochester® AMT-Free Municipal Fund. The Fund was subsequently renamed the Invesco AMT-Free Municipal Income Fund (the Fund). Returns shown above, for periods ending on or prior to May 24, 2019, for Class A, Class C and Class Y shares are those for Class A, Class C and Class Y shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

Class R6 shares incepted on May 24, 2019. Performance shown on and prior to that date is that of the predecessor fund’s Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 4.25% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on

Class C shares is 1% for the first year after purchase. Class Y and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| | |

| 5 | | Invesco AMT-Free Municipal Income Fund |

Supplemental Information

Invesco AMT-Free Municipal Income Fund’s investment objective is to seek tax-free income.

| ∎ | Unless otherwise stated, information presented in this report is as of February 29, 2024, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data is provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | The S&P Municipal Bond 5+ Year Investment Grade Index seeks to measure the performance of investment-grade US municipal bonds with maturities equal to or greater than five years. |

| ∎ | The U.S. Consumer Price Index is a measure of change in consumer prices as determined by the US Bureau of Labor Statistics. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

| | |

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. | | |

| |

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE | | |

| | |

| 6 | | Invesco AMT-Free Municipal Income Fund |

Fund Information

Portfolio Composition

| | | | |

| By credit sector | | % of total investments | |

| |

Revenue Bonds | | | 79.29% | |

| |

General Obligation Bonds | | | 13.75 | |

| |

Other | | | 4.19 | |

| |

Pre-Refunded Bonds | | | 2.77 | |

| |

| Top Five Debt Holdings | | | | |

| | | % of total net assets | |

| |

1. Valdez (City of), AK, Series 1994, VRD Ref. RB | | | 1.63% | |

| |

2. Los Angeles Department of Water & Power Water System Revenue, Series 2022, RB | | | 1.16 | |

| |

3. Buckeye Tobacco Settlement Financing Authority, Series 2020 B-2, Ref. RB | | | 1.07 | |

| |

4. Washington (State of) Metropolitan Area Transit Authority, Series 2020 A, RB | | | 1.04 | |

| |

5. California (State of) County Tobacco Securitization Agency, Series 2006 B, RB | | | 0.94 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

Data presented here are as of February 29, 2024.

| | |

| 7 | | Invesco AMT-Free Municipal Income Fund |

Schedule of Investments

February 29, 2024

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value |

Municipal Obligations–101.75% | | | | | | | | | | | | | | |

Alabama–3.50% | | | | | | | | | | | | | | |

Birmingham (City of) & Jefferson (County of), AL Civic Center Authority; Series 2018 A, RB | | | 5.00% | | | | 07/01/2048 | | | $ | 2,500 | | | $ 2,563,819 |

Birmingham (City of), AL Private Educational Building Authority (Birmingham-Southern College); Series 1996, RB | | | 6.13% | | | | 12/01/2025 | | | | 195 | | | 143,449 |

Birmingham (City of), AL Water Works Board; Series 2016 B, Ref. RB(a)(b) | | | 5.00% | | | | 01/01/2027 | | | | 16,150 | | | 17,145,094 |

Black Belt Energy Gas District (The); Series 2022 C-1, RB(b) | | | 5.25% | | | | 06/01/2029 | | | | 10,000 | | | 10,542,532 |

Fort Deposit (Town of), AL Cooperative District; Series 2003, RB | | | 6.00% | | | | 02/01/2036 | | | | 155 | | | 153,686 |

Homewood (City of), AL Educational Building Authority (Samford University); Series 2017 A, Ref. RB | | | 5.00% | | | | 12/01/2047 | | | | 4,500 | | | 4,557,911 |

Jefferson (County of), AL; | | | | | | | | | | | | | | |

Series 2017, Ref. Revenue Wts. | | | 5.00% | | | | 09/15/2035 | | | | 4,500 | | | 4,752,403 |

Series 2024, Ref. RB | | | 5.25% | | | | 10/01/2049 | | | | 9,000 | | | 9,687,883 |

Series 2024, Ref. RB | | | 5.50% | | | | 10/01/2053 | | | | 5,000 | | | 5,468,704 |

Lower Alabama Gas District (The); Series 2016 A, RB | | | 5.00% | | | | 09/01/2046 | | | | 5,000 | | | 5,425,787 |

Mobile (City of), AL Improvement District (McGowin Park); Series 2016 A, RB | | | 5.25% | | | | 08/01/2030 | | | | 200 | | | 194,410 |

Southeast Alabama Gas Supply District (The) (No. 2); Series 2024 B, Ref. RB(b) | | | 5.00% | | | | 05/01/2032 | | | | 10,000 | | | 10,642,844 |

Southeast Energy Authority A Cooperative District (No. 2); Series 2021 B, RB(b) | | | 4.00% | | | | 12/01/2031 | | | | 7,895 | | | 7,936,698 |

Southeast Energy Authority A Cooperative District (No. 3); Series 2022 A-1, RB(b) | | | 5.50% | | | | 12/01/2029 | | | | 4,105 | | | 4,395,618 |

Southeast Energy Authority A Cooperative District (No. 4); Series 2022 B-1, RB(b) | | | 5.00% | | | | 08/01/2028 | | | | 2,000 | | | 2,079,609 |

| | | | | | | | | | | | | | | 85,690,447 |

| | | | |

Alaska–1.63% | | | | | | | | | | | | | | |

Alaska (State of) Industrial Development & Export Authority (Boys & Girls Home & Family Services, Inc.); Series 2007 C, RB(c) | | | 5.88% | | | | 12/01/2027 | | | | 600 | | | 660 |

Valdez (City of), AK; Series 1994, VRD Ref. RB(d) | | | 3.20% | | | | 05/01/2031 | | | | 40,000 | | | 40,000,112 |

| | | | | | | | | | | | | | | 40,000,772 |

| | | | |

Arizona–2.11% | | | | | | | | | | | | | | |

Arizona (State of) Industrial Development Authority (Academies of Math & Science); | | | | | | | | | | | | | | |

Series 2017 A, Ref. RB (CEP - Ohio School District) | | | 5.00% | | | | 07/01/2042 | | | | 675 | | | 688,793 |

Series 2017 A, Ref. RB (CEP - Ohio School District) | | | 5.00% | | | | 07/01/2047 | | | | 925 | | | 937,654 |

Series 2017 A, Ref. RB (CEP - Ohio School District) | | | 5.00% | | | | 07/01/2051 | | | | 1,000 | | | 1,010,618 |

Series 2018 A, Ref. RB (CEP - Ohio School District) | | | 5.00% | | | | 07/01/2038 | | | | 500 | | | 515,796 |

Series 2018 A, Ref. RB (CEP - Ohio School District) | | | 5.00% | | | | 07/01/2048 | | | | 1,800 | | | 1,825,843 |

Series 2018 A, Ref. RB (CEP - Ohio School District) | | | 5.00% | | | | 07/01/2052 | | | | 2,125 | | | 2,149,154 |

Arizona (State of) Industrial Development Authority (Provident Group - Eastern Michigan University Parking); | | | | | | | | | | | | | | |

Series 2018, RB(e) | | | 5.00% | | | | 05/01/2048 | | | | 1,100 | | | 605,000 |

Series 2018, RB(e) | | | 5.00% | | | | 05/01/2051 | | | | 1,000 | | | 550,000 |

Arizona (State of) Industrial Development Authority (Provident Group-NCCU Properties LLC); Series 2019 A, RB (INS - BAM)(f) | | | 5.00% | | | | 06/01/2058 | | | | 570 | | | 591,902 |

Arizona (State of) Industrial Development Authority (Social Bonds); Series 2020 A, RB | | | 4.00% | | | | 11/01/2050 | | | | 2,100 | | | 1,963,561 |

Chandler (City of), AZ Industrial Development Authority (Intel Corp.); Series 2005, RB(b) | | | 3.80% | | | | 06/15/2028 | | | | 5,000 | | | 5,089,310 |

Festival Ranch Community Facilities District (Assessment Districts Nos. 4 & 5); Series 2007, RB | | | 5.75% | | | | 07/01/2032 | | | | 270 | | | 265,727 |

Maricopa (County of), AZ Industrial Development Authority (GreatHearts Arizona); | | | | | | | | | | | | | | |

Series 2017 C, RB (CEP - Ohio School District) | | | 5.00% | | | | 07/01/2037 | | | | 80 | | | 82,705 |

Series 2017 C, RB (CEP - Ohio School District) | | | 5.00% | | | | 07/01/2048 | | | | 145 | | | 147,231 |

Maricopa (County of), AZ Industrial Development Authority (Legacy Traditional Schools); Series 2019, Ref. RB(g) | | | 5.00% | | | | 07/01/2049 | | | | 1,400 | | | 1,347,381 |

Merrill Ranch Community Facilities District No. 1 (Assessment Area One); Series 2006, RB | | | 5.30% | | | | 07/01/2030 | | | | 167 | | | 167,036 |

Phoenix (City of), AZ Industrial Development Authority (Espiritu Community Development Corp. Charter School); Series 2006 A, RB | | | 6.25% | | | | 07/01/2036 | | | | 390 | | | 375,071 |

Phoenix (City of), AZ Industrial Development Authority (Great Hearts Academies);

Series 2016 A, Ref. RB | | | 5.00% | | | | 07/01/2041 | | | | 1,200 | | | 1,199,069 |

Phoenix Civic Improvement Corp.; Series 2019, RB | | | 4.00% | | | | 07/01/2044 | | | | 6,855 | | | 6,782,419 |

Pima (County of), AZ Industrial Development Authority (Arizona Charter Schools); Series 2013 Q, Ref. RB | | | 5.38% | | | | 07/01/2031 | | | | 1,575 | | | 1,564,066 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 8 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

Arizona–(continued) | | | | | | | | | | | | | | |

Pima (County of), AZ Industrial Development Authority (Christian Care Tuscon, Inc.); | | | | | | | | | | | | | | |

Series 2017 A, Ref. RB(a)(b) | | | 5.00% | | | | 06/15/2025 | | | $ | 550 | | | $ 568,420 |

Series 2017 C, RB(a)(b) | | | 5.00% | | | | 06/15/2025 | | | | 1,010 | | | 1,043,826 |

Pima (County of), AZ Industrial Development Authority (Excalibur Charter School (The)); Series 2016, Ref. RB(g) | | | 5.50% | | | | 09/01/2046 | | | | 900 | | | 835,421 |

Pima (County of), AZ Industrial Development Authority (Paideia Academies (The)); | | | | | | | | | | | | | | |

Series 2019, RB | | | 5.13% | | | | 07/01/2039 | | | | 195 | | | 186,118 |

Series 2019, RB | | | 5.25% | | | | 07/01/2049 | | | | 240 | | | 220,487 |

Pima (County of), AZ Industrial Development Authority (Tuscon Country Day School); Series 2007, Ref. RB | | | 5.00% | | | | 06/01/2037 | | | | 725 | | | 642,321 |

Salt River Project Agricultural Improvement & Power District; Series 2023 B, RB | | | 5.25% | | | | 01/01/2053 | | | | 15,220 | | | 17,034,376 |

Salt Verde Financial Corp.; | | | | | | | | | | | | | | |

Series 2007, RB | | | 5.50% | | | | 12/01/2029 | | | | 100 | | | 107,431 |

Series 2007, RB | | | 5.00% | | | | 12/01/2032 | | | | 3,000 | | | 3,209,521 |

| | | | | | | | | | | | | | | 51,706,257 |

| | | | |

Arkansas–0.14% | | | | | | | | | | | | | | |

Arkansas (State of) Development Finance Authority (Baptist Memorial Health);

Series 2020, Ref. RB | | | 5.00% | | | | 09/01/2044 | | | | 2,000 | | | 2,002,538 |

Cave Springs Municipal Property Owners’ Improvement District No. 3; Series 2007, GO Bonds(h) | | | 6.25% | | | | 02/01/2038 | | | | 1,480 | | | 1,480,000 |

| | | | | | | | | | | | | | | 3,482,538 |

| | | | |

California–10.54% | | | | | | | | | | | | | | |

Bay Area Toll Authority (San Francisco Bay Area); Series 2019 S-8, Ref. RB(a)(b) | | | 5.00% | | | | 10/01/2029 | | | | 5,000 | | | 5,702,579 |

California (State of); | | | | | | | | | | | | | | |

Series 2016, Ref. GO Bonds | | | 5.00% | | | | 09/01/2037 | | | | 10,085 | | | 10,518,103 |

Series 2018, GO Bonds | | | 5.00% | | | | 10/01/2047 | | | | 13,500 | | | 13,912,490 |

Series 2020, GO Bonds | | | 4.00% | | | | 03/01/2050 | | | | 2,600 | | | 2,612,823 |

Series 2021, Ref. GO Bonds | | | 5.00% | | | | 10/01/2041 | | | | 1,500 | | | 1,682,192 |

Series 2022, GO Bonds | | | 4.00% | | | | 04/01/2049 | | | | 1,325 | | | 1,339,686 |

California (State of) Community Choice Financing Authority (Clean Energy);

Series 2024, RB(b) | | | 5.00% | | | | 04/01/2032 | | | | 10,000 | | | 10,740,063 |

California (State of) Community Choice Financing Authority (Green Bonds); | | | | | | | | | | | | | | |

Series 2023 C, RB(b) | | | 5.25% | | | | 10/01/2031 | | | | 3,250 | | | 3,440,030 |

Series 2023, RB(b) | | | 5.00% | | | | 08/01/2029 | | | | 5,000 | | | 5,246,671 |

California (State of) County Tobacco Securitization Agency; Series 2006 B, RB(i) | | | 0.00% | | | | 06/01/2050 | | | | 129,820 | | | 23,030,457 |

California (State of) County Tobacco Securitization Agency (Alameda County Tobacco Asset Securitization Corp.); Series 2002, RB | | | 5.88% | | | | 06/01/2035 | | | | 10 | | | 10,209 |

California (State of) County Tobacco Securitization Agency (Fresno County Tobacco Funding Corp.); | | | | | | | | | | | | | | |

Series 2006 A, RB(i) | | | 0.00% | | | | 06/01/2046 | | | | 7,000 | | | 1,688,121 |

Series 2006 B, RB(i) | | | 0.00% | | | | 06/01/2046 | | | | 6,000 | | | 1,400,616 |

California (State of) County Tobacco Securitization Agency (Stanislaus County Tobacco Funding Corp.); Series 2002 A, RB | | | 5.88% | | | | 06/01/2043 | | | | 2,450 | | | 2,450,960 |

California (State of) Health Facilities Financing Authority (Cedars-Sinai Health System); Series 2021, Ref. RB | | | 5.00% | | | | 08/15/2051 | | | | 10,000 | | | 10,907,955 |

California (State of) Health Facilities Financing Authority (Commonspirit Health); Series 2020 A, Ref. RB | | | 4.00% | | | | 04/01/2049 | | | | 1,500 | | | 1,442,239 |

California (State of) Health Facilities Financing Authority (Sutter Health); | | | | | | | | | | | | | | |

Series 2016 B, Ref. RB(a)(b) | | | 5.00% | | | | 11/15/2026 | | | | 4,080 | | | 4,322,519 |

Series 2016 B, Ref. RB | | | 5.00% | | | | 11/15/2046 | | | | 5,920 | | | 6,058,137 |

California (State of) Housing Finance Agency; | | | | | | | | | | | | | | |

Series 2019 A, RB | | | 4.25% | | | | 01/15/2035 | | | | 163 | | | 162,508 |

Series 2019 A-2, RB | | | 4.00% | | | | 03/20/2033 | | | | 6,999 | | | 7,013,849 |

California (State of) Housing Finance Agency (Social Certificates); Series 2023-1, RB | | | 4.38% | | | | 09/20/2036 | | | | 3,482 | | | 3,448,922 |

California (State of) Municipal Finance Authority (CHF-Davis I, LLC - West Village Student Housing); Series 2018, RB (INS - BAM)(f) | | | 5.00% | | | | 05/15/2043 | | | | 4,250 | | | 4,406,870 |

California (State of) Statewide Communities Development Authority (Community Facilities District No. 2007-01); Series 2015, Ref. RB | | | 5.00% | | | | 09/01/2030 | | | | 810 | | | 828,654 |

Cathedral (City of), CA Redevelopment Agency Successor Agency (Merged Redevelopment); | | | | | | | | | | | | | | |

Series 2014 A, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 08/01/2032 | | | | 1,450 | | | 1,459,228 |

Series 2014 A, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 08/01/2033 | | | | 885 | | | 890,367 |

Golden State Tobacco Securitization Corp.; Series 2017 A-1, Ref. RB(a)(b) | | | 5.00% | | | | 06/01/2027 | | | | 170 | | | 183,329 |

Grossmont-Cuyamaca Community College District (Election of 2012); Series 2018 B, GO Bonds | | | 4.00% | | | | 08/01/2047 | | | | 3,165 | | | 3,166,348 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 9 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

California–(continued) | | | | | | | | | | | | | | |

Inland Empire Tobacco Securitization Corp.; Series 2007 F, RB(g)(i) | | | 0.00% | | | | 06/01/2057 | | | $ | 345,750 | | | $ 22,503,104 |

Long Beach (City of), CA Bond Finance Authority; Series 2007 A, RB | | | 5.50% | | | | 11/15/2037 | | | | 2,000 | | | 2,294,064 |

Los Angeles (City of), CA Department of Water & Power; Series 2017 A, RB | | | 5.00% | | | | 07/01/2042 | | | | 5,000 | | | 5,233,927 |

Los Angeles Department of Water & Power Water System Revenue; Series 2022, RB(j) | | | 5.00% | | | | 07/01/2042 | | | | 25,000 | | | 28,404,275 |

Los Angeles Unified School District (Sustainability Bonds); Series 2022 QRR, GO Bonds | | | 5.25% | | | | 07/01/2047 | | | | 5,000 | | | 5,743,083 |

M-S-R Energy Authority; | | | | | | | | | | | | | | |

Series 2009 B, RB | | | 7.00% | | | | 11/01/2034 | | | | 10,000 | | | 12,692,583 |

Series 2009 B, RB | | | 6.50% | | | | 11/01/2039 | | | | 9,820 | | | 12,625,284 |

Oak Grove School District (Election of 2008); Series 2018 E, Ref. GO Bonds(k) | | | 5.00% | | | | 08/01/2042 | | | | 4,500 | | | 2,677,774 |

Oxnard (City of), CA Financing Authority; | | | | | | | | | | | | | | |

Series 2014, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 06/01/2032 | | | | 1,250 | | | 1,254,087 |

Series 2014, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 06/01/2033 | | | | 1,500 | | | 1,504,868 |

Series 2014, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 06/01/2034 | | | | 850 | | | 852,696 |

Poway Unified School District Public Financing Authority; | | | | | | | | | | | | | | |

Series 2015 B, Ref. RB (INS - BAM)(f) | | | 5.00% | | | | 09/01/2033 | | | | 1,725 | | | 1,785,432 |

Series 2015 B, Ref. RB (INS - BAM)(f) | | | 5.00% | | | | 09/01/2034 | | | | 3,075 | | | 3,179,393 |

San Diego (County of), CA Regional Airport Authority; | | | | | | | | | | | | | | |

Series 2019 A, Ref. RB | | | 5.00% | | | | 07/01/2044 | | | | 5,000 | | | 5,394,827 |

Series 2021 A, RB (INS - AGM)(f) | | | 5.00% | | | | 07/01/2051 | | | | 15,000 | | | 16,311,147 |

Santa Cruz (County of), CA Redevelopment Successor Agency; Series 2015 A, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 09/01/2035 | | | | 1,880 | | | 1,936,684 |

Transbay Joint Powers Authority (Green Bonds); | | | | | | | | | | | | | | |

Series 2020 A, RB | | | 5.00% | | | | 10/01/2045 | | | | 1,000 | | | 1,028,665 |

Series 2020 A, RB | | | 5.00% | | | | 10/01/2049 | | | | 1,000 | | | 1,020,492 |

Twin Rivers Unified School District; Series 2020, GO Bonds (INS - AGM)(f)(i) | | | 0.00% | | | | 08/01/2044 | | | | 8,990 | | | 3,485,921 |

| | | | | | | | | | | | | | | 257,994,231 |

| | | | |

Colorado–3.49% | | | | | | | | | | | | | | |

Aurora (City of), CO (Pipeline/Interceptor); Series 2023, RB | | | 4.00% | | | | 08/01/2053 | | | | 13,285 | | | 12,658,414 |

Berthoud-Heritage Metropolitan District No. 1; Series 2019, RB | | | 5.63% | | | | 12/01/2048 | | | | 2,000 | | | 2,002,430 |

BNC Metropolitan District No. 1; Series 2017 A, Ref. GO Bonds (INS - BAM)(f) | | | 5.00% | | | | 12/01/2037 | | | | 550 | | | 580,406 |

Colorado (State of) Educational & Cultural Facilities Authority (Stargate Charter School); Series 2018 A, Ref. RB | | | 5.00% | | | | 12/01/2038 | | | | 1,000 | | | 1,044,409 |

Colorado (State of) Health Facilities Authority (Adventhealth Obligated Group);

Series 2019 A, Ref. RB | | | 4.00% | | | | 11/15/2043 | | | | 2,000 | | | 1,963,756 |

Colorado (State of) Health Facilities Authority (Christian Living Neighborhoods); Series 2016, Ref. RB | | | 5.00% | | | | 01/01/2031 | | | | 1,400 | | | 1,409,119 |

Colorado (State of) Health Facilities Authority (CommonSpirit Health); Series 2022, RB | | | 5.25% | | | | 11/01/2052 | | | | 7,500 | | | 7,950,659 |

Denver (City & County of), CO; | | | | | | | | | | | | | | |

Series 2018 B, Ref. RB | | | 5.00% | | | | 12/01/2048 | | | | 12,500 | | | 13,175,256 |

Series 2022 B, RB | | | 5.25% | | | | 11/15/2053 | | | | 8,000 | | | 8,867,386 |

Series 2022 C, Ref. RB | | | 5.25% | | | | 11/15/2053 | | | | 6,120 | | | 6,783,550 |

E-470 Public Highway Authority; Series 1997 B, RB (INS - NATL)(f)(i) | | | 0.00% | | | | 09/01/2025 | | | | 125 | | | 119,032 |

Ebert Metropolitan District; Series 2018 A-2, GO Bonds (INS - BAM)(f) | | | 5.00% | | | | 12/01/2043 | | | | 1,605 | | | 1,697,988 |

Hunters Overlook Metropolitan District No. 5; | | | | | | | | | | | | | | |

Series 2019 A, GO Bonds | | | 5.00% | | | | 12/01/2039 | | | | 874 | | | 863,836 |

Series 2019 A, GO Bonds | | | 5.00% | | | | 12/01/2049 | | | | 1,360 | | | 1,288,364 |

Hunting Hill Metropolitan District; Series 2018, Ref. GO Bonds | | | 5.63% | | | | 12/01/2048 | | | | 2,071 | | | 2,076,776 |

Public Authority for Colorado Energy; | | | | | | | | | | | | | | |

Series 2008, RB | | | 6.25% | | | | 11/15/2028 | | | | 1,495 | | | 1,585,899 |

Series 2008, RB | | | 6.50% | | | | 11/15/2038 | | | | 1,920 | | | 2,374,466 |

Rampart Range Metropolitan District No. 1; Series 2017, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 12/01/2047 | | | | 6,165 | | | 6,387,288 |

Tender Option Bond Trust Receipts/Certificates; | | | | | | | | | | | | | | |

Series 2022, VRD RB(d)(g) | | | 3.50% | | | | 05/01/2038 | | | | 5,000 | | | 5,000,000 |

Series 2022, VRD RB(d)(g) | | | 3.50% | | | | 05/01/2046 | | | | 6,000 | | | 6,000,000 |

Vauxmont Metropolitan District; Series 2020, Ref. GO Bonds (INS - AGM)(f) | | | 5.00% | | | | 12/01/2050 | | | | 1,500 | | | 1,571,963 |

| | | | | | | | | | | | | | | 85,400,997 |

| | | | |

Connecticut–0.87% | | | | | | | | | | | | | | |

Connecticut (State of) Health & Educational Facilities Authority; Series 2020 G-1, Ref. RB(g) | | | 5.00% | | | | 07/01/2050 | | | | 1,100 | | | 997,419 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 10 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

Connecticut–(continued) | | | | | | | | | | | | | | |

Connecticut (State of) Health & Educational Facilities Authority (Fairfield University); Series 2017 R, Ref. RB | | | 4.00% | | | | 07/01/2047 | | | $ | 6,125 | | | $ 5,924,637 |

Connecticut (State of) Health & Educational Facilities Authority (Nuvance Health); Series 2019 A, Ref. RB | | | 4.00% | | | | 07/01/2049 | | | | 12,430 | | | 11,202,212 |

Georgetown (City of), CT Special Taxing District; Series 2006 A, GO Bonds(c)(h) | | | 5.13% | | | | 10/01/2036 | | | | 500 | | | 60,000 |

Hamden (Town of), CT; Series 2018 A, Ref. GO Bonds (INS - BAM)(f) | | | 5.00% | | | | 08/15/2030 | | | | 625 | | | 673,098 |

Mashantucket Western Pequot Tribe; Series 2013, RB(c) | | | 6.05% | | | | 07/01/2031 | | | | 11,260 | | | 2,505,364 |

| | | | | | | | | | | | | | | 21,362,730 |

| | | | |

District of Columbia–3.09% | | | | | | | | | | | | | | |

District of Columbia; | | | | | | | | | | | | | | |

Series 2020 A, RB | | | 4.00% | | | | 03/01/2045 | | | | 4,335 | | | 4,325,524 |

Series 2023 A, RB | | | 5.25% | | | | 05/01/2048 | | | | 5,245 | | | 5,908,449 |

District of Columbia Tobacco Settlement Financing Corp.; | | | | | | | | | | | | | | |

Series 2001, RB | | | 6.75% | | | | 05/15/2040 | | | | 4,260 | | | 4,393,296 |

Series 2006 B, RB(i) | | | 0.00% | | | | 06/15/2046 | | | | 72,125 | | | 15,504,488 |

Metropolitan Washington Airports Authority (Dulles Metrorail and Capital Improvement); | | | | | | | | | | | | | | |

Series 2019 A, Ref. RB | | | 5.00% | | | | 10/01/2044 | | | | 5,000 | | | 5,251,918 |

Series 2019 B, Ref. RB | | | 4.00% | | | | 10/01/2049 | | | | 10,000 | | | 9,405,818 |

Washington (State of) Metropolitan Area Transit Authority; Series 2020 A, RB | | | 4.00% | | | | 07/15/2045 | | | | 25,600 | | | 25,351,442 |

Washington Metropolitan Area Transit Authority (Green Bonds); Series 2023 A, RB | | | 5.25% | | | | 07/15/2053 | | | | 5,000 | | | 5,535,322 |

| | | | | | | | | | | | | | | 75,676,257 |

| | | | |

Florida–6.08% | | | | | | | | | | | | | | |

Alachua (County of), FL Health Facilities Authority (Shands Teaching Hospital & Clinics, Inc.); Series 2019, Ref. RB | | | 5.00% | | | | 12/01/2037 | | | | 2,580 | | | 2,727,723 |

Amelia Concourse Community Development District; Series 2007, RB | | | 5.75% | | | | 05/01/2038 | | | | 310 | | | 301,784 |

Arlington Ridge Community Development District; Series 2006 A, RB | | | 5.50% | | | | 05/01/2036 | | | | 125 | | | 125,063 |

Broward (County of), FL; Series 2022 A, RB | | | 4.00% | | | | 10/01/2047 | | | | 5,005 | | | 4,929,527 |

Broward (County of), FL (Convention Center Expansion); Series 2021, RB | | | 4.00% | | | | 09/01/2047 | | | | 17,250 | | | 16,719,585 |

Broward (County of), FL School Board; Series 2022, GO Bonds | | | 5.00% | | | | 07/01/2051 | | | | 10,000 | | | 10,903,906 |

Canaveral Port Authority; Series 2018 B, RB | | | 5.00% | | | | 06/01/2048 | | | | 5,000 | | | 5,145,149 |

Capital Trust Agency, Inc. (Advantage Academy of Hillsborough); | | | | | | | | | | | | | | |

Series 2019 A, RB | | | 5.00% | | | | 12/15/2049 | | | | 455 | | | 437,210 |

Series 2019 A, RB | | | 5.00% | | | | 12/15/2054 | | | | 320 | | | 303,398 |

Capital Trust Agency, Inc. (Florida Charter Educational Foundation, Inc.); | | | | | | | | | | | | | | |

Series 2018 A, RB(g) | | | 5.38% | | | | 06/15/2038 | | | | 255 | | | 251,604 |

Series 2018 A, RB(g) | | | 5.38% | | | | 06/15/2048 | | | | 480 | | | 450,591 |

Chapel Creek Community Development District; Series 2006 A, RB(c)(h) | | | 5.50% | | | | 05/01/2038 | | | | 1,175 | | | 787,250 |

Clearwater Cay Community Development District; Series 2006 A, RB (Acquired 02/16/2010; Cost $539,852)(c)(h)(l) | | | 5.50% | | | | 05/01/2037 | | | | 826 | | | 470,787 |

Creekside Community Development District; Series 2006, RB(c)(h) | | | 5.20% | | | | 05/01/2038 | | | | 2,280 | | | 1,071,600 |

Highland Meadows Community Development District; Series 2006 A, RB | | | 5.50% | | | | 05/01/2036 | | | | 80 | | | 80,045 |

Indigo Community Development District; Series 2005, RB(h) | | | 5.75% | | | | 05/01/2036 | | | | 218 | | | 156,935 |

Jacksonville (City of), FL Health Facilities Authority; Series 1997 B, RB(a) | | | 5.25% | | | | 08/15/2027 | | | | 15 | | | 15,162 |

JEA Water & Sewer System; Series 2024 A, Ref. RB | | | 5.50% | | | | 10/01/2054 | | | | 10,000 | | | 11,357,942 |

Lake (County of), FL (Imagine South Lake Charter School Program); Series 2019, RB(g) | | | 5.00% | | | | 01/15/2054 | | | | 190 | | | 172,015 |

Lake Helen (City of), FL (Ivy Hawn Charter School of the Arts); | | | | | | | | | | | | | | |

Series 2018 A, RB(g) | | | 5.50% | | | | 07/15/2048 | | | | 565 | | | 517,227 |

Series 2018 A, RB(g) | | | 5.75% | | | | 07/15/2053 | | | | 600 | | | 577,755 |

Lakeland (City of), FL (Lakeland Regional Health); Series 2015, RB | | | 5.00% | | | | 11/15/2040 | | | | 5,000 | | | 5,033,079 |

Lucaya Community Development District; Series 2005, RB | | | 5.38% | | | | 05/01/2035 | | | | 1,030 | | | 1,030,612 |

Magnolia Creek Community Development District; Series 2007 A, RB(c) | | | 5.90% | | | | 05/01/2039 | | | | 195 | | | 182,473 |

Magnolia West Community Development District; Series 2017, RB | | | 5.35% | | | | 05/01/2037 | | | | 70 | | | 70,437 |

Manatee (County of), FL; Series 2023, Ref. RB | | | 4.00% | | | | 10/01/2048 | | | | 5,000 | | | 4,950,000 |

Miami-Dade (County of), FL; | | | | | | | | | | | | | | |

Series 2009, RB (INS - BAM)(f)(i) | | | 0.00% | | | | 10/01/2042 | | | | 6,925 | | | 3,187,225 |

Series 2019 B, RB | | | 4.00% | | | | 10/01/2049 | | | | 17,745 | | | 17,352,168 |

Series 2021, RB | | | 4.00% | | | | 10/01/2051 | | | | 5,000 | | | 4,828,279 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 11 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

Florida–(continued) | | | | | | | | | | | | | | |

Miami-Dade (County of), FL Transit System; | | | | | | | | | | | | | | |

Series 2020 A, RB | | | 4.00% | | | | 07/01/2048 | | | $ | 12,185 | | | $ 11,864,843 |

Series 2020 A, RB | | | 4.00% | | | | 07/01/2050 | | | | 5,000 | | | 4,830,304 |

Miromar Lakes Community Development District; Series 2015, Ref. RB | | | 5.00% | | | | 05/01/2035 | | | | 1,195 | | | 1,200,269 |

Naturewalk Community Development District; Series 2007 A, RB(c)(h) | | | 5.50% | | | | 05/01/2038 | | | | 335 | | | 107,200 |

Orange (County of), FL Health Facilities Authority (Orlando Health Obligated Group); Series 2022, RB | | | 4.00% | | | | 10/01/2052 | | | | 10,000 | | | 9,596,768 |

Orlando (City of), FL Utilities Commission; Series 2018 A, RB | | | 5.00% | | | | 10/01/2038 | | | | 3,000 | | | 3,172,833 |

Osceola (County of), FL; Series 2020 A-1, Ref. RB | | | 5.00% | | | | 10/01/2049 | | | | 2,055 | | | 2,107,132 |

Palace Coral Gables Community Development District; | | | | | | | | | | | | | | |

Series 2011, RB | | | 5.00% | | | | 05/01/2032 | | | | 385 | | | 385,244 |

Series 2011, RB | | | 5.63% | | | | 05/01/2042 | | | | 1,000 | | | 1,000,649 |

Polk (County of), FL Industrial Development Authority (Carpenter’s Home Estates); Series 2019, Ref. IDR | | | 5.00% | | | | 01/01/2049 | | | | 750 | | | 689,040 |

Reunion East Community Development District; | | | | | | | | | | | | | | |

Series 2002 A-2, RB(c)(h) | | | 7.38% | | | | 05/01/2033 | | | | 860 | | | 9 |

Series 2005, RB(c)(h) | | | 5.80% | | | | 05/01/2036 | | | | 810 | | | 8 |

Ridgewood Trails Community Development District; Series 2007 A, RB | | | 5.65% | | | | 05/01/2038 | | | | 15 | | | 15,009 |

South Bay Community Development District; | | | | | | | | | | | | | | |

Series 2005 A, RB(c)(h) | | | 5.95% | | | | 05/01/2036 | | | | 1,645 | | | 16 |

Series 2005 A-1, Ref. RB | | | 5.95% | | | | 05/01/2036 | | | | 1,620 | | | 1,625,672 |

Series 2005 A-2, Ref. RB(c)(h) | | | 6.60% | | | | 05/01/2036 | | | | 1,095 | | | 547,500 |

Series 2005 B-2, Ref. RB(c)(h) | | | 6.60% | | | | 05/01/2025 | | | | 935 | | | 467,501 |

Tampa (City of), FL; | | | | | | | | | | | | | | |

Series 2020 A, RB(i) | | | 0.00% | | | | 09/01/2033 | | | | 210 | | | 146,359 |

Series 2020 A, RB(i) | | | 0.00% | | | | 09/01/2034 | | | | 880 | | | 589,023 |

Series 2020 A, RB(i) | | | 0.00% | | | | 09/01/2035 | | | | 750 | | | 479,846 |

Series 2020 A, RB(i) | | | 0.00% | | | | 09/01/2036 | | | | 850 | | | 516,248 |

Series 2020 A, RB(i) | | | 0.00% | | | | 09/01/2037 | | | | 825 | | | 473,806 |

Series 2020 A, RB(i) | | | 0.00% | | | | 09/01/2038 | | | | 1,050 | | | 568,301 |

Series 2020 A, RB(i) | | | 0.00% | | | | 09/01/2039 | | | | 1,000 | | | 510,874 |

Villages of Avignon Community Development District (The); Series 2007 A, RB(c)(h) | | | 5.40% | | | | 05/01/2037 | | | | 250 | | | 12,500 |

Vista Community Development District; Series 2006 A, RB | | | 5.38% | | | | 05/01/2037 | | | | 3,400 | | | 3,401,364 |

Waterford Estates Community Development District; Series 2006 A, RB | | | 5.50% | | | | 05/01/2037 | | | | 1,595 | | | 1,597,101 |

Waterstone Community Development District; | | | | | | | | | | | | | | |

Series 2007 A, RB(h)(k) | | | 6.88% | | | | 05/01/2037 | | | | 146 | | | 98,086 |

Series 2007 B, RB(h)(i) | | | 0.00% | | | | 11/01/2028 | | | | 748 | | | 523,410 |

West Villages Improvement District; | | | | | | | | | | | | | | |

Series 2005 A-1, RB | | | 5.75% | | | | 05/01/2036 | | | | 2,770 | | | 2,772,382 |

Series 2005 A-2, RB(c)(h) | | | 5.75% | | | | 05/01/2036 | | | | 2,925 | | | 1,696,500 |

Westridge Community Development District; Series 2005, RB | | | 5.80% | | | | 05/01/2037 | | | | 390 | | | 390,197 |

Westside Community Development District; Series 2019-2, RB | | | 5.65% | | | | 05/01/2037 | | | | 525 | | | 352,871 |

Wildwood (City of), FL Village Community Development Disctrict No. 15; | | | | | | | | | | | | | | |

Series 2023, RB(g) | | | 5.00% | | | | 05/01/2043 | | | | 1,500 | | | 1,534,315 |

Series 2023, RB(g) | | | 5.25% | | | | 05/01/2054 | | | | 1,000 | | | 1,027,838 |

Zephyr Ridge Community Development District; Series 2006 A, RB (Acquired 06/29/2009; Cost $973,791)(c)(h)(l) | | | 5.63% | | | | 05/01/2037 | | | | 979 | | | 489,330 |

| | | | | | | | | | | | | | | 148,926,879 |

| | | | |

Georgia–2.67% | | | | | | | | | | | | | | |

Atlanta (City of), GA Department of Aviation (Green Bonds); Series 2023 B-1, RB | | | 5.00% | | | | 07/01/2053 | | | | 6,750 | | | 7,361,221 |

Atlanta (City of), GA Urban Residential Finance Authority (Trestletree Village Apartments); Series 2013 A, RB | | | 5.00% | | | | 11/01/2048 | | | | 490 | | | 360,590 |

Brookhaven (City of), GA Urban Redevelopment Agency; Series 2023 A, RB | | | 4.00% | | | | 07/01/2053 | | | | 5,000 | | | 4,969,758 |

Columbia (City of), GA (Wellstar Health System, Inc.); Series 2023, RAC | | | 5.13% | | | | 04/01/2048 | | | | 5,500 | | | 5,959,189 |

Floyd (County of), GA Development Authority (The Spires at Berry College); | | | | | | | | | | | | | | |

Series 2018 A, RB | | | 5.75% | | | | 12/01/2033 | | | | 1,155 | | | 1,149,781 |

Series 2018 A, RB | | | 6.00% | | | | 12/01/2038 | | | | 2,260 | | | 2,242,308 |

Series 2018 A, RB | | | 6.25% | | | | 12/01/2048 | | | | 5,565 | | | 5,461,331 |

Series 2018 A, RB | | | 6.50% | | | | 12/01/2053 | | | | 3,205 | | | 3,205,042 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 12 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

Georgia–(continued) | | | | | | | | | | | | | | |

Fulton (County of), GA Development Authority (Piedmont Healthcare, Inc.); | | | | | | | | | | | | | | |

Series 2016 A, Ref. RB | | | 5.00% | | | | 07/01/2046 | | | $ | 3,000 | | | $ 3,051,365 |

Series 2019, RB | | | 4.00% | | | | 07/01/2049 | | | | 11,150 | | | 10,551,635 |

Main Street Natural Gas, Inc.; | | | | | | | | | | | | | | |

Series 2019 A, RB | | | 5.00% | | | | 05/15/2043 | | | | 1,040 | | | 1,066,888 |

Series 2023 B, RB(b) | | | 5.00% | | | | 03/01/2030 | | | | 5,000 | | | 5,306,395 |

Series 2023 C, RB(b) | | | 5.00% | | | | 09/01/2030 | | | | 5,000 | | | 5,323,515 |

Series 2024 A, RB(b) | | | 5.00% | | | | 09/01/2031 | | | | 5,435 | | | 5,816,223 |

Oconee (County of), GA Industrial Development Authority (Presbyterian Village Athens); | | | | | | | | | | | | | | |

Series 2018 A-1, RB | | | 6.13% | | | | 12/01/2038 | | | | 880 | | | 812,817 |

Series 2018 A-1, RB | | | 6.25% | | | | 12/01/2048 | | | | 1,230 | | | 1,082,926 |

Series 2018 A-1, RB | | | 6.38% | | | | 12/01/2053 | | | | 1,030 | | | 905,838 |

Series 2018 A-2, RB(b) | | | 5.50% | | | | 12/01/2028 | | | | 690 | | | 637,500 |

| | | | | | | | | | | | | | | 65,264,322 |

| | | | |

Guam–0.17% | | | | | | | | | | | | | | |

Guam (Territory of); Series 2015 D, Ref. RB | | | 5.00% | | | | 11/15/2039 | | | | 2,500 | | | 2,527,670 |

Guam (Territory of) Waterworks Authority; Series 2020 A, RB | | | 5.00% | | | | 01/01/2050 | | | | 1,500 | | | 1,547,724 |

| | | | | | | | | | | | | | | 4,075,394 |

| | | | |

Illinois–6.73% | | | | | | | | | | | | | | |

Chicago (City of), IL; Series 2012, RB (INS - BAM)(f) | | | 4.00% | | | | 01/01/2042 | | | | 1,200 | | | 1,200,084 |

Chicago (City of), IL (O’Hare International Airport); | | | | | | | | | | | | | | |

Series 2015 B, Ref. RB | | | 5.00% | | | | 01/01/2034 | | | | 2,500 | | | 2,534,730 |

Series 2017 D, RB | | | 5.00% | | | | 01/01/2052 | | | | 3,000 | | | 3,062,316 |

Series 2018 B, RB | | | 5.00% | | | | 01/01/2053 | | | | 10,000 | | | 10,467,773 |

Series 2020 A, Ref. RB | | | 4.00% | | | | 01/01/2036 | | | | 5,000 | | | 5,150,954 |

Chicago (City of), IL Board of Education; | | | | | | | | | | | | | | |

Series 1998 B-1, GO Bonds (INS - NATL)(f)(i) | | | 0.00% | | | | 12/01/2024 | | | | 915 | | | 889,402 |

Series 1999 A, GO Bonds (INS - NATL)(f)(i) | | | 0.00% | | | | 12/01/2024 | | | | 1,405 | | | 1,365,694 |

Series 2016, RB | | | 6.00% | | | | 04/01/2046 | | | | 4,300 | | | 4,509,540 |

Series 2018 A, Ref. GO Bonds (INS - AGM)(f) | | | 5.00% | | | | 12/01/2026 | | | | 775 | | | 801,337 |

Series 2018 A, Ref. GO Bonds (INS - AGM)(f) | | | 5.00% | | | | 12/01/2028 | | | | 2,250 | | | 2,391,479 |

Series 2018 A, Ref. GO Bonds (INS - AGM)(f) | | | 5.00% | | | | 12/01/2031 | | | | 1,000 | | | 1,061,186 |

Series 2018 A, Ref. GO Bonds (INS - AGM)(f) | | | 5.00% | | | | 12/01/2034 | | | | 1,205 | | | 1,276,145 |

Series 2022 A, GO Bonds | | | 5.00% | | | | 12/01/2047 | | | | 3,200 | | | 3,212,005 |

Chicago (City of), IL Transit Authority; | | | | | | | | | | | | | | |

Series 2020 A, Ref. RB | | | 5.00% | | | | 12/01/2045 | | | | 20 | | | 20,830 |

Series 2020 A, Ref. RB | | | 5.00% | | | | 12/01/2055 | | | | 2,140 | | | 2,214,827 |

Cook (County of), IL; Series 2021 A, Ref. RB | | | 4.00% | | | | 11/15/2041 | | | | 3,500 | | | 3,464,946 |

Cook County Community School District No. 147; Series 2004 A, Ref. GO Bonds (INS - BAM)(f) | | | 7.13% | | | | 06/01/2024 | | | | 385 | | | 386,672 |

Du Page (County of), IL Special Service Area No. 31 (Monarch Landing, Inc.);

Series 2006, RB | | | 5.63% | | | | 03/01/2036 | | | | 275 | | | 275,322 |

Gilberts (Village of), IL; Series 2014, Ref. RB(a)(b) | | | 5.00% | | | | 03/26/2024 | | | | 2,000 | | | 2,001,906 |

Gilberts (Village of), IL Special Service Area No. 24 (The Conservancy); Subseries 2014 A, RB | | | 5.38% | | | | 03/01/2034 | | | | 634 | | | 609,549 |

Harvey (City of), IL; | | | | | | | | | | | | | | |

Series 2008, RB | | | 6.88% | | | | 08/01/2028 | | | | 2,310 | | | 2,144,306 |

Series 2023 A, GO Bonds | | | 4.50% | | | | 01/01/2054 | | | | 3,585 | | | 2,850,043 |

Illinois (State of); | | | | | | | | | | | | | | |

Series 2014, GO Bonds | | | 5.00% | | | | 04/01/2025 | | | | 2,000 | | | 2,002,117 |

Series 2014, GO Bonds | | | 5.00% | | | | 02/01/2039 | | | | 1,525 | | | 1,525,574 |

Series 2017 C, GO Bonds | | | 5.00% | | | | 11/01/2029 | | | | 3,000 | | | 3,192,209 |

Series 2018 A, GO Bonds | | | 5.00% | | | | 05/01/2036 | | | | 2,610 | | | 2,751,705 |

Series 2018 A, Ref. GO Bonds | | | 5.00% | | | | 10/01/2029 | | | | 6,500 | | | 7,033,354 |

Series 2018 A, Ref. GO Bonds | | | 5.00% | | | | 10/01/2032 | | | | 3,000 | | | 3,236,230 |

Series 2018 A, Ref. GO Bonds | | | 5.00% | | | | 10/01/2033 | | | | 750 | | | 804,610 |

Series 2018 B, Ref. GO Bonds | | | 5.00% | | | | 10/01/2029 | | | | 5,000 | | | 5,410,273 |

Series 2020, GO Bonds | | | 5.50% | | | | 05/01/2039 | | | | 3,750 | | | 4,145,757 |

Illinois (State of) Finance Authority (Northshore University Health); Series 2020 B, VRD RB(d) | | | 3.00% | | | | 08/15/2049 | | | | 5,200 | | | 5,200,000 |

Illinois (State of) Finance Authority (University of Illinois Health Services); Series 2020, RB | | | 4.00% | | | | 10/01/2040 | | | | 3,950 | | | 3,739,131 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 13 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

Illinois–(continued) | | | | | | | | | | | | | | |

Illinois (State of) Regional Transportation Authority; | | | | | | | | | | | | | | |

Series 2018 B, RB | | | 4.00% | | | | 06/01/2043 | | | $ | 1,365 | | | $ 1,372,012 |

Series 2018 XF2618, Revenue Ctfs.(j) | | | 4.00% | | | | 06/01/2043 | | | | 18,000 | | | 18,092,466 |

Illinois (State of) Sports Facilities Authority; | | | | | | | | | | | | | | |

Series 2014, Ref. RB (INS - AGM)(f) | | | 5.25% | | | | 06/15/2032 | | | | 2,000 | | | 2,004,949 |

Series 2019, Ref. RB (INS - BAM)(f) | | | 5.00% | | | | 06/15/2028 | | | | 2,520 | | | 2,669,984 |

Series 2019, Ref. RB (INS - BAM)(f) | | | 5.00% | | | | 06/15/2029 | | | | 1,455 | | | 1,563,185 |

Series 2019, Ref. RB (INS - BAM)(f) | | | 5.00% | | | | 06/15/2030 | | | | 245 | | | 260,526 |

Illinois (State of) Toll Highway Authority; | | | | | | | | | | | | | | |

Series 2020 A, RB | | | 5.00% | | | | 01/01/2045 | | | | 21,090 | | | 22,763,217 |

Series 2021 A, RB | | | 4.00% | | | | 01/01/2046 | | | | 7,785 | | | 7,670,525 |

Jefferson County Township High School District No. 201; | | | | | | | | | | | | | | |

Series 2012 A, GO Bonds | | | 6.50% | | | | 12/30/2027 | | | | 895 | | | 1,004,918 |

Series 2012 A, GO Bonds | | | 6.50% | | | | 12/30/2028 | | | | 955 | | | 1,101,095 |

Series 2012 A, GO Bonds | | | 6.50% | | | | 12/30/2031 | | | | 1,160 | | | 1,423,444 |

Lincolnshire (Village of), IL (Sedgewick); Series 2004, RB | | | 6.25% | | | | 03/01/2034 | | | | 1,709 | | | 1,710,550 |

Northern Illinois Municipal Power Agency; Series 2016 A, Ref. RB | | | 4.00% | | | | 12/01/2041 | | | | 1,050 | | | 1,047,620 |

Plano (City of), IL Special Service Area No. 5 (Lakewood Springs Club); Series 2006, RB | | | 6.00% | | | | 03/01/2036 | | | | 337 | | | 321,887 |

Sales Tax Securitization Corp.; Series 2018 C, Ref. RB (INS - BAM)(f) | | | 5.25% | | | | 01/01/2048 | | | | 5,000 | | | 5,261,489 |

Southwestern Illinois Development Authority; Series 2006, RB(c) | | | 5.63% | | | | 11/01/2026 | | | | 890 | | | 667,500 |

Stephenson County School District No. 145 Freeport; | | | | | | | | | | | | | | |

Series 2018 A, GO Bonds(a)(b) | | | 5.00% | | | | 02/01/2028 | | | | 210 | | | 226,490 |

Series 2018 A, GO Bonds(a)(b) | | | 5.00% | | | | 02/01/2028 | | | | 135 | | | 145,601 |

Series 2018 A, GO Bonds(a)(b) | | | 5.00% | | | | 02/01/2028 | | | | 160 | | | 172,564 |

Series 2018 A, GO Bonds(a)(b) | | | 5.00% | | | | 02/01/2028 | | | | 40 | | | 43,372 |

Series 2018 A, GO Bonds(a)(b) | | | 5.00% | | | | 02/01/2028 | | | | 30 | | | 32,529 |

Series 2018 A, GO Bonds(a)(b) | | | 5.00% | | | | 02/01/2028 | | | | 25 | | | 27,108 |

Series 2018 A, GO Bonds (INS - AGM)(f) | | | 5.00% | | | | 02/01/2032 | | | | 905 | | | 978,055 |

Series 2018 A, GO Bonds (INS - AGM)(f) | | | 5.00% | | | | 02/01/2033 | | | | 660 | | | 711,014 |

Series 2018 A, GO Bonds (INS - AGM)(f) | | | 5.00% | | | | 02/01/2034 | | | | 590 | | | 634,477 |

Yorkville (United City of), IL (United City Special Services Area); Series 2013, Ref. RB | | | 5.00% | | | | 03/01/2033 | | | | 1,848 | | | 1,813,275 |

| | | | | | | | | | | | | | | 164,651,858 |

| | | | |

Indiana–0.51% | | | | | | | | | | | | | | |

Columbus (City of), IN (Vivera Senior Living); Series 2019, RB | | | 5.63% | | | | 05/01/2039 | | | | 3,555 | | | 2,985,317 |

Indiana (State of) Finance Authority (Good Samaritan Hospital); Series 2016 A, RB | | | 5.50% | | | | 04/01/2026 | | | | 1,620 | | | 1,656,645 |

Indiana (State of) Municipal Power Agency; Series 2016 A, Ref. RB | | | 5.00% | | | | 01/01/2037 | | | | 7,500 | | | 7,753,092 |

| | | | | | | | | | | | | | | 12,395,054 |

| | | | |

Iowa–0.93% | | | | | | | | | | | | | | |

Iowa (State of) Finance Authority; Series 2007, RB(c) | | | 5.90% | | | | 12/01/2028 | | | | 400 | | | 440 |

Iowa (State of) Finance Authority (Alcoa, Inc.); Series 2012, RB | | | 4.75% | | | | 08/01/2042 | | | | 5,000 | | | 4,957,392 |

Iowa (State of) Finance Authority (Iowa Fertilizer Co.); Series 2022, Ref. RB(b) | | | 5.00% | | | | 12/01/2042 | | | | 7,785 | | | 8,230,417 |

Iowa (State of) Finance Authority (Mercy Medical Center); Series 2012, RB | | | 5.00% | | | | 08/15/2028 | | | | 1,685 | | | 1,686,229 |

Iowa (State of) Finance Authority (Unitypoint Health); Series 2018 B, Ref. RB | | | 5.00% | | | | 02/15/2048 | | | | 1,300 | | | 1,342,863 |

Iowa (State of) Finance Authority (Wedum Walnut Ridge LLC); Series 2007 B, RB | | | 5.38% | | | | 06/01/2025 | | | | 75 | | | 74,279 |

PEFA, Inc.; Series 2019, RB(b) | | | 5.00% | | | | 09/01/2026 | | | | 5,190 | | | 5,300,945 |

Xenia (City of), IA Rural Water District; Series 2016, Ref. RB(a)(b) | | | 5.00% | | | | 12/01/2026 | | | | 1,000 | | | 1,055,371 |

| | | | | | | | | | | | | | | 22,647,936 |

| | | | |

Kentucky–2.29% | | | | | | | | | | | | | | |

Kentucky (Commonwealth of) Municipal Power Agency (Prairie State); | | | | | | | | | | | | | | |

Series 2016 A, Ref. RB (INS - NATL)(f) | | | 5.00% | | | | 09/01/2032 | | | | 5,480 | | | 5,661,790 |

Series 2016 A, Ref. RB (INS - NATL)(f) | | | 5.00% | | | | 09/01/2033 | | | | 11,525 | | | 11,868,495 |

Series 2016 A, Ref. RB (INS - NATL)(f) | | | 5.00% | | | | 09/01/2034 | | | | 5,000 | | | 5,126,269 |

Kentucky (Commonwealth of) Property & Building Commission (No. 115); | | | | | | | | | | | | | | |

Series 2017, RB | | | 5.00% | | | | 04/01/2037 | | | | 2,500 | | | 2,628,675 |

Series 2017, RB (INS - BAM)(f) | | | 5.00% | | | | 04/01/2038 | | | | 2,500 | | | 2,617,507 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 14 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

Kentucky–(continued) | | | | | | | | | | | | | | |

Kentucky (Commonwealth of) Property & Building Commission (No. 119); | | | | | | | | | | | | | | |

Series 2018, RB | | | 5.00% | | | | 05/01/2035 | | | $ | 1,500 | | | $ 1,610,387 |

Series 2018, RB | | | 5.00% | | | | 05/01/2036 | | | | 1,170 | | | 1,252,238 |

Series 2018, RB | | | 5.00% | | | | 05/01/2037 | | | | 4,605 | | | 4,914,307 |

Kentucky (Commonwealth of) Public Energy Authority; | | | | | | | | | | | | | | |

Series 2022 A-1, RB(b) | | | 4.00% | | | | 08/01/2030 | | | | 15,000 | | | 15,066,849 |

Series 2024 A, RB(b) | | | 5.00% | | | | 07/01/2030 | | | | 5,000 | | | 5,250,620 |

| | | | | | | | | | | | | | | 55,997,137 |

| | | | |

Louisiana–1.95% | | | | | | | | | | | | | | |

Denham Springs (City of) & Livingston (Parish of), LA Housing & Mortgage Finance Authority; Series 2007, RB (CEP - GNMA) | | | 5.00% | | | | 11/01/2040 | | | | 3 | | | 3,156 |

Louisiana (State of); Series 2023 A-1, Ref. VRD RB (LOC - Toronto-dominion Bank)(d)(m) | | | 2.95% | | | | 05/01/2043 | | | | 10,000 | | | 10,000,000 |

Louisiana (State of) Public Facilities Authority (19th Judicial District Court Building); Series 2015, Ref. RB(a)(b) | | | 5.00% | | | | 06/01/2025 | | | | 2,500 | | | 2,561,026 |

Louisiana (State of) Public Facilities Authority (Archdiocese of New Orleans); | | | | | | | | | | | | | | |

Series 2017, Ref. RB | | | 5.00% | | | | 07/01/2032 | | | | 395 | | | 316,000 |

Series 2017, Ref. RB | | | 5.00% | | | | 07/01/2033 | | | | 300 | | | 240,000 |

Series 2017, Ref. RB | | | 5.00% | | | | 07/01/2037 | | | | 345 | | | 276,000 |

Louisiana (State of) Public Facilities Authority (Ochsner Clinic Foundation);

Series 2017, Ref. RB | | | 5.00% | | | | 05/15/2046 | | | | 7,500 | | | 7,675,027 |

Louisiana Stadium & Exposition District; Series 2023 A, Ref. RB | | | 5.25% | | | | 07/01/2053 | | | | 15,000 | | | 16,468,993 |

Louisiana State University & Agricultural & Mechanical College Board of Supervisors; Series 2016 A, Ref. RB(a)(b) | | | 5.00% | | | | 07/01/2026 | | | | 4,035 | | | 4,218,451 |

New Orleans (City of), LA Aviation Board (Parking Facilities Corp. Consolidated Garage System); | | | | | | | | | | | | | | |

Series 2018 A, RB (INS - AGM)(f) | | | 5.00% | | | | 10/01/2043 | | | | 700 | | | 731,364 |

Series 2018 A, RB (INS - AGM)(f) | | | 5.00% | | | | 10/01/2048 | | | | 1,280 | | | 1,327,867 |

St. John the Baptist (Parish of), LA (Marathon Oil Corp.); | | | | | | | | | | | | | | |

Series 2017, Ref. RB(b) | | | 2.13% | | | | 07/01/2024 | | | | 2,000 | | | 1,983,147 |

Subseries 2017 A-3, Ref. RB(b) | | | 2.20% | | | | 07/01/2026 | | | | 2,000 | | | 1,904,131 |

| | | | | | | | | | | | | | | 47,705,162 |

| | | | |

Maryland–0.53% | | | | | | | | | | | | | | |

Anne Arundel (County of), MD; Series 2023, GO Bonds | | | 4.00% | | | | 10/01/2052 | | | | 5,000 | | | 4,940,933 |

Gaithersburg (City of), MD (Asbury Maryland Obligated Group); Series 2018 A, Ref. RB | | | 5.00% | | | | 01/01/2036 | | | | 1,500 | | | 1,514,443 |

Maryland (State of) Health & Higher Educational Facilities Authority; | | | | | | | | | | | | | | |

Series 2001, RB (INS - AMBAC)(f) | | | 5.00% | | | | 07/01/2034 | | | | 5 | | | 5,036 |

Series 2016, Ref. RB | | | 5.00% | | | | 06/01/2036 | | | | 400 | | | 406,839 |

Maryland Economic Development Corp. (University of Maryland College Park);

Series 2016, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 06/01/2035 | | | | 4,530 | | | 4,697,567 |

Prince George’s (County of), MD (Victoria Falls); Series 2005, RB | | | 5.25% | | | | 07/01/2035 | | | | 1,490 | | | 1,496,026 |

| | | | | | | | | | | | | | | 13,060,844 |

| | | | |

Massachusetts–1.45% | | | | | | | | | | | | | | |

Massachusetts (Commonwealth of); Series 2016-XF0530, Ctfs. Of Obligation(j) | | | 5.00% | | | | 12/01/2035 | | | | 20,000 | | | 21,073,520 |

Massachusetts (Commonwealth of) Development Finance Agency; | | | | | | | | | | | | | | |

Series 2016 I, Ref. RB | | | 5.00% | | | | 07/01/2036 | | | | 2,000 | | | 2,057,286 |

Series 2019 A, Ref. RB | | | 4.00% | | | | 07/01/2044 | | | | 3,000 | | | 2,645,352 |

Massachusetts (Commonwealth of) Transportation Fund (Rail Enhancement Program); Series 2021 A, RB(j) | | | 4.00% | | | | 06/01/2050 | | | | 10,000 | | | 9,734,792 |

| | | | | | | | | | | | | | | 35,510,950 |

| | | | |

Michigan–2.86% | | | | | | | | | | | | | | |

Detroit (City of), MI; Series 2003 B-R, RB (INS - AGM)(f) | | | 7.50% | | | | 07/01/2033 | | | | 60 | | | 60,175 |

Detroit (City of), MI Downtown Development Authority (Catalyst Development); | | | | | | | | | | | | | | |

Series 2018 A, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 07/01/2043 | | | | 150 | | | 150,141 |

Series 2018 A, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 07/01/2048 | | | | 1,350 | | | 1,328,501 |

Michigan (State of); | | | | | | | | | | | | | | |

Series 2020 B, RB | | | 4.00% | | | | 11/15/2045 | | | | 10,000 | | | 10,071,612 |

Series 2021, RB | | | 4.00% | | | | 11/15/2046 | | | | 6,000 | | | 6,001,563 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 15 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

Michigan–(continued) | | | | | | | | | | | | | | |

Michigan (State of) Finance Authority; | | | | | | | | | | | | | | |

Series 2005 A, RB | | | 6.00% | | | | 12/01/2035 | | | $ | 1,155 | | | $ 1,111,603 |

Series 2008 C, RB(i) | | | 0.00% | | | | 06/01/2058 | | | | 289,275 | | | 12,808,345 |

Series 2014, Ref. RB(a)(b)(g) | | | 6.75% | | | | 07/01/2024 | | | | 1,945 | | | 1,966,164 |

Series 2014, Ref. RB(g) | | | 6.75% | | | | 07/01/2044 | | | | 4,055 | | | 3,688,826 |

Michigan (State of) Finance Authority (Detroit Water & Sewerage Department); | | | | | | | | | | | | | | |

Series 2014 C-6, Ref. RB | | | 5.00% | | | | 07/01/2033 | | | | 1,000 | | | 1,004,082 |

Series 2014 D-4, Ref. RB | | | 5.00% | | | | 07/01/2032 | | | | 2,450 | | | 2,460,161 |

Series 2014 D-4, Ref. RB | | | 5.00% | | | | 07/01/2034 | | | | 1,000 | | | 1,004,050 |

Series 2014 D-6, Ref. RB (INS - NATL)(f) | | | 5.00% | | | | 07/01/2025 | | | | 1,000 | | | 1,005,010 |

Series 2014 D-6, Ref. RB (INS - NATL)(f) | | | 5.00% | | | | 07/01/2026 | | | | 895 | | | 898,334 |

Series 2014 D-6, Ref. RB (INS - NATL)(f) | | | 5.00% | | | | 07/01/2027 | | | | 930 | | | 933,192 |

Series 2015 C, RB | | | 5.00% | | | | 07/01/2034 | | | | 2,200 | | | 2,229,086 |

Michigan (State of) Finance Authority (Old Redforf Academy); Series 2010 A, RB | | | 5.90% | | | | 12/01/2030 | | | | 455 | | | 450,970 |

Michigan (State of) Finance Authority (Universal Learning Academy); Series 2018, Ref. RB | | | 5.75% | | | | 11/01/2040 | | | | 635 | | | 624,266 |

Michigan (State of) Strategic Fund (Wolverine Human Services); Series 2007, RB(c) | | | 5.85% | | | | 08/31/2027 | | | | 6,074 | | | 5,467,504 |

Plymouth Educational Center Charter School; | | | | | | | | | | | | | | |

Series 2005, Ref. RB(h) | | | 5.38% | | | | 11/01/2030 | | | | 400 | | | 244,000 |

Series 2005, Ref. RB(h) | | | 5.63% | | | | 11/01/2035 | | | | 1,325 | | | 808,250 |

Renaissance Public School Academy; Series 2012 A, RB | | | 6.00% | | | | 05/01/2037 | | | | 500 | | | 500,142 |

Walled Lake Consolidated School District; | | | | | | | | | | | | | | |

Series 2019, GO Bonds | | | 4.00% | | | | 05/01/2039 | | | | 600 | | | 612,582 |

Series 2019, GO Bonds | | | 4.00% | | | | 05/01/2040 | | | | 1,220 | | | 1,242,045 |

Series 2019, GO Bonds | | | 4.00% | | | | 05/01/2041 | | | | 2,485 | | | 2,528,143 |

Wayne (County of), MI Airport Authority (Detroit Metropolitan Wayne County Airport); Series 2021 A, RB | | | 5.00% | | | | 12/01/2046 | | | | 10,000 | | | 10,909,966 |

| | | | | | | | | | | | | | | 70,108,713 |

| | | | |

Minnesota–0.18% | | | | | | | | | | | | | | |

Bethel (City of), MN (Benedictine Health System - St. Peter Communities); Series 2018 A, Ref. RB | | | 5.50% | | | | 12/01/2048 | | | | 1,050 | | | 935,680 |

Duluth (City of), MN Economic Development Authority (Essentia Health Obligated Group); | | | | | | | | | | | | | | |

Series 2018 A, Ref. RB | | | 5.00% | | | | 02/15/2043 | | | | 2,300 | | | 2,355,002 |

Minnesota (State of) Higher Education Facilities Authority (Trustees of the Hamline University of Minnesota); Series 2017, Ref. RB | | | 5.00% | | | | 10/01/2047 | | | | 900 | | | 904,279 |

Mound (City of), MN Housing & Redevelopment Authority; Series 2006, Ref. RB | | | 5.00% | | | | 02/15/2027 | | | | 323 | | | 318,190 |

| | | | | | | | | | | | | | | 4,513,151 |

| | | | |

Mississippi–0.47% | | | | | | | | | | | | | | |

Mississippi (State of) Development Bank; Series 2016, RB (CEP - Colorado Higher Education Intercept Program) | | | 5.00% | | | | 12/01/2046 | | | | 10,000 | | | 10,246,875 |

Mississippi Business Finance Corp. (System Energy Resources, Inc.); Series 2021, RB | | | 2.38% | | | | 06/01/2044 | | | | 1,795 | | | 1,138,475 |

| | | | | | | | | | | | | | | 11,385,350 |

| | | | |

Missouri–0.92% | | | | | | | | | | | | | | |

Branson (City of), MO Industrial Development Authority (Branson Hills Redevelopment); | | | | | | | | | | | | | | |

Series 2005 A, RB(h) | | | 7.05% | | | | 05/01/2027 | | | | 60 | | | 52,577 |

Series 2007 A, RB(h) | | | 5.75% | | | | 05/01/2026 | | | | 630 | | | 564,957 |

Broadway-Fairview Transportation Development District; Series 2006 A, RB(h) | | | 5.88% | | | | 12/01/2031 | | | | 675 | | | 209,250 |

Chillicothe (City of), MO (South U.S. 65); Series 2006, RB | | | 5.63% | | | | 04/01/2027 | | | | 400 | | | 393,737 |

Columbia (City of), MO Housing Authority (Stuart Park/Paquin Tower Apartments); | | | | | | | | | | | | | | |

Series 2015, RB | | | 5.00% | | | | 12/15/2040 | | | | 580 | | | 542,405 |

Series 2015, RB | | | 5.13% | | | | 12/15/2050 | | | | 1,330 | | | 1,193,632 |

Grindstone Plaza Transportation Development District; Series 2006 A, RB | | | 5.50% | | | | 10/01/2031 | | | | 355 | | | 355,042 |

Hollister (City of), MO; Series 2019, RB(g) | | | 5.63% | | | | 10/01/2039 | | | | 3,700 | | | 3,442,700 |

Kansas City (City of), MO Industrial Development Authority (Ward Parkway Center Community Improvement District); Series 2016 A, Ref. RB(g) | | | 5.00% | | | | 04/01/2046 | | | | 295 | | | 268,069 |

Lee’s Summit (City of), MO Industrial Development Authority; Series 2007, RB(c)(h) | | | 5.75% | | | | 03/01/2029 | | | | 250 | | | 137,500 |

Maplewood (City of), MO (Maplewood South Redevelopment Area); Series 2005, Ref. RB | | | 5.75% | | | | 11/01/2026 | | | | 855 | | | 838,460 |

Missouri (State of) Health & Educational Facilities Authority (SSM Health);

Series 2018 A, RB | | | 5.00% | | | | 06/01/2048 | | | | 7,500 | | | 7,723,595 |

Northwoods Transportation Development District; Series 2006 A, RB | | | 5.85% | | | | 02/01/2031 | | | | 50 | | | 44,530 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 16 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

Missouri–(continued) | | | | | | | | | | | | | | |

St. Charles (County of), MO Industrial Development Authority (Suemandy/Mid-Rivers Community Improvement District); Series 2016, RB(g) | | | 5.00% | | | | 10/01/2046 | | | $ | 1,025 | | | $ 870,054 |

St. Louis (City of), MO (Abbey Condominiums); | | | | | | | | | | | | | | |

Series 2006 A, RB(e)(h) | | | 6.00% | | | | 08/04/2025 | | | | 481 | | | 28,860 |

Series 2007, RB(h) | | | 5.50% | | | | 05/29/2028 | | | | 661 | | | 198,305 |

St. Louis (City of), MO Land Clearance for Redevelopment Authority (Scottrade Center); Series 2018 A, RB | | | 5.00% | | | | 04/01/2048 | | | | 3,250 | | | 3,316,872 |

St. Louis (County of), MO; Series 2007 A, RB(h) | | | 5.50% | | | | 09/02/2028 | | | | 373 | | | 108,170 |

St. Louis (County of), MO (Ludwig Lofts); Series 2008, RB(e)(h) | | | 6.69% | | | | 04/21/2029 | | | | 1,080 | | | 183,600 |

St. Louis (County of), MO (Printers Lofts Tax Increment Financing);

Series 2006, RB(e)(h) | | | 6.00% | | | | 08/21/2026 | | | | 545 | | | 54,500 |

St. Louis (County of), MO (Washington Park Redevelopment); | | | | | | | | | | | | | | |

Series 2006, RB(e)(h) | | | 6.00% | | | | 08/21/2026 | | | | 846 | | | 101,520 |

Series 2006, RB(h) | | | 5.50% | | | | 03/09/2027 | | | | 1,879 | | | 357,010 |

Series 2007 A, RB(h) | | | 5.50% | | | | 01/20/2028 | | | | 712 | | | 270,560 |

Series 2007 B, RB(e)(h) | | | 5.50% | | | | 01/20/2028 | | | | 466 | | | 23,300 |

Series 2008 A, RB(h) | | | 6.60% | | | | 01/21/2028 | | | | 3,254 | | | 1,301,600 |

Stone Canyon Community Improvement District (Infrastructure Improvement);

Series 2007, RB (Acquired 09/23/2011; Cost $287,597)(c)(h)(l) | | | 5.75% | | | | 04/01/2027 | | | | 320 | | | 28,800 |

| | | | | | | | | | | | | | | 22,609,605 |

| | | | |

Montana–0.11% | | | | | | | | | | | | | | |

Hardin (City of), MT; Series 2006, RB(e)(h) | | | 6.25% | | | | 09/01/2031 | | | | 11,710 | | | 2,810,400 |

| | | | |

Nebraska–0.73% | | | | | | | | | | | | | | |

Central Plains Energy Project (No. 3); Series 2017 A, Ref. RB | | | 5.00% | | | | 09/01/2035 | | | | 6,150 | | | 6,662,349 |

Central Plains Energy Project (No. 5); Series 2022-1, RB(b) | | | 5.00% | | | | 10/01/2029 | | | | 5,000 | | | 5,249,914 |

Omaha (City of), NE Public Power District; Series 2021 A, RB (INS - AGM)(f) | | | 4.00% | | | | 02/01/2051 | | | | 6,000 | | | 5,876,140 |

| | | | | | | | | | | | | | | 17,788,403 |

| | | | |

Nevada–0.55% | | | | | | | | | | | | | | |

Clark (County of), NV (Special Improvement District No. 128); | | | | | | | | | | | | | | |

Series 2007 A, RB | | | 5.00% | | | | 02/01/2026 | | | | 130 | | | 130,469 |

Series 2007 A, RB | | | 5.05% | | | | 02/01/2031 | | | | 245 | | | 245,772 |

Clark (County of), NV (Stadium Improvement Bonds); Series 2018 A, GO Bonds | | | 5.00% | | | | 05/01/2048 | | | | 2,500 | | | 2,612,332 |

Clark County School District; Series 2018 B, GO Bonds (INS - BAM)(f) | | | 5.00% | | | | 06/15/2036 | | | | 5,280 | | | 5,727,273 |

Las Vegas Valley Water District; Series 2022 A, GO Bonds | | | 4.00% | | | | 06/01/2051 | | | | 5,000 | | | 4,834,720 |

| | | | | | | | | | | | | | | 13,550,566 |

| | | | |

New Hampshire–0.54% | | | | | | | | | | | | | | |

Manchester Housing & Redevelopment Authority, Inc.; Series 2000 B, RB (INS - BAM)(f)(i) | | | 0.00% | | | | 01/01/2029 | | | | 305 | | | 237,200 |

New Hampshire (State of) Business Finance Authority; Series 2020-1A, RB | | | 4.13% | | | | 01/20/2034 | | | | 7,227 | | | 7,049,022 |

New Hampshire (State of) Business Finance Authority (Social Bonds); Series 2022-2A, RB | | | 4.00% | | | | 10/20/2036 | | | | 4,994 | | | 4,774,694 |

New Hampshire (State of) Business Finance Authority (Vista (The)); | | | | | | | | | | | | | | |

Series 2019 A, RB(g) | | | 5.25% | | | | 07/01/2039 | | | | 410 | | | 381,369 |

Series 2019 A, RB(g) | | | 5.63% | | | | 07/01/2046 | | | | 230 | | | 211,247 |

Series 2019 A, RB(g) | | | 5.75% | | | | 07/01/2054 | | | | 570 | | | 519,913 |

| | | | | | | | | | | | | | | 13,173,445 |

| | | | |

New Jersey–7.21% | | | | | | | | | | | | | | |

Atlantic City (City of), NJ; | | | | | | | | | | | | | | |

Series 2017 A, Ref. GO Bonds (INS - BAM)(f) | | | 5.00% | | | | 03/01/2032 | | | | 250 | | | 262,473 |

Series 2017 A, Ref. GO Bonds (INS - BAM)(f) | | | 5.00% | | | | 03/01/2037 | | | | 500 | | | 517,157 |

Casino Reinvestment Development Authority, Inc.; | | | | | | | | | | | | | | |

Series 2014, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 11/01/2030 | | | | 2,000 | | | 2,024,520 |

Series 2014, Ref. RB (INS - AGM)(f) | | | 5.00% | | | | 11/01/2032 | | | | 2,000 | | | 2,022,021 |

Hudson County Improvement Authority (Hudson County Courthouse); Series 2020, RB | | | 4.00% | | | | 10/01/2046 | | | | 10,000 | | | 10,017,517 |

New Jersey (State of); Series 2020 A, GO Bonds | | | 4.00% | | | | 06/01/2032 | | | | 6,380 | | | 6,989,647 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 17 | | Invesco AMT-Free Municipal Income Fund |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value |

New Jersey–(continued) | | | | | | | | | | | | | | |

New Jersey (State of) Economic Development Authority; | | | | | | | | | | | | | | |

Series 2016 AAA, RB(a)(b) | | | 5.00% | | | | 12/15/2026 | | | $ | 3,000 | | | $ 3,180,763 |

Series 2017 DDD, RB | | | 5.00% | | | | 06/15/2028 | | | | 1,930 | | | 2,049,425 |