UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07896

GAMCO Global Series Funds, Inc.

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

Bruce N. Alpert

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

The GAMCO Vertumnus Fund

Annual Report — December 31, 2011

Mario J. Gabelli, CFA

To Our Shareholders,

The Sarbanes-Oxley Act requires a fund’s principal executive and financial officers to certify the entire contents of the semiannual and annual shareholder reports in a filing with the Securities and Exchange Commission (“SEC”) on Form N-CSR. This certification would cover the portfolio manager’s commentary and subjective opinions if they are attached to or a part of the financial statements. Many of these comments and opinions would be difficult or impossible to certify.

Because we do not want our portfolio managers to eliminate their opinions and/or restrict their commentary to historical facts, we have separated their commentary from the financial statements and investment portfolio and have sent it to you separately. Both the commentary and the financial statements, including the portfolio of investments, will be available on our website at www.gabelli.com.

Performance Discussion (Unaudited)

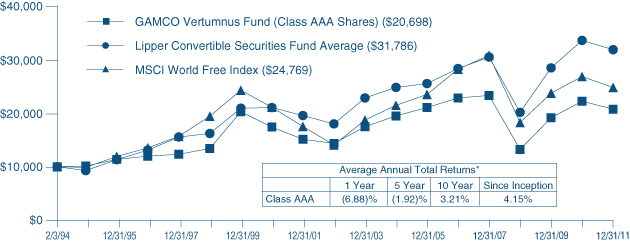

For the year ended December 31, 2011, the net asset value (“NAV”) per Class AAA Share of The GAMCO Vertumnus Fund declined 6.9% compared with decreases of 5.7% and 7.6% for the Bank of America Merrill Lynch Global 300 Convertible Index and the Morgan Stanley Capital International (“MSCI”) World Free Index, respectively. See page 2 for additional performance information.

Enclosed are the schedule of investments and financial statements as of December 31, 2011.

In the face of a number of macro shocks and increased global uncertainty, convertibles the world over underperformed in 2011. Convertible returns generally moved in tandem with their respective equity markets throughout the year. The combination of this year’s major events: the earthquake and nuclear disaster in Fukushima, the political brinksmanship over the debt ceiling in the U.S. which led to the country losing its AAA rating, and the ongoing European sovereign debt crisis, combined to make this an especially harsh period for the asset class. The combination of major negative events, headline driven volatility of markets, and credit spread widening all worked to drive convertibles lower.

After outperforming in 2010, the U.S. convertibles market declined in 2011, losing 5.2% on a total return basis, trailing the Dow Jones Industrials Average, S&P 500, Russell 1000, U.S. Treasuries, and both high grade and high yield corporate bonds.

Summarizing constituent performance for 2011 by quality, size, and type, using component data from Barclay’s Convertibles Index, reveals the following: on a ratings basis, investment grade converts outperformed speculative grade (high yield and non-rated) converts by a wide margin. This performance was likely attributable to the widening of credit spreads, especially during periods of extreme market volatility such as the third quarter. By market capitalization, convertible securities of mid cap companies had 2011 total returns of (2.4)%, suffering less than both large caps and small caps, which were down (7.2)% and (4.6)%, respectively. A comparison by convertible type style shows that cash-pay and preferreds fared better than both zero coupon and mandatories in 2011.

Selected holdings that contributed positively to performance in 2011 were Merck & Co. (2.0% of net assets as of December 31, 2011), the second largest healthcare company in the world; Pfizer Inc., (1.1%), the world’s largest pharmaceutical company; and Roche Holdings (2.3%) based in Switzerland, one the world’s leading healthcare companies. Some of our weaker performing stocks during the year were JPMorgan Chase & Co., a leading financial services firm, and Telekom Austria (0.4%), the largest communications company in Austria.

We appreciate your confidence and trust.

| | |

| | Sincerely yours, |

| |

| |  |

| |

February 22, 2012 | | Bruce N. Alpert President |

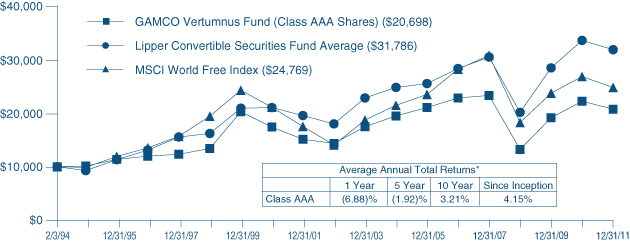

Comparative Results

| | | | | | | | | | | | | | | | |

Average Annual Returns through December 31, 2011 (a) (Unaudited) | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception

(2/3/94) | |

Class AAA (GAGCX) | | | (6.88 | )% | | | (1.92 | )% | | | 3.21 | % | | | 4.15 | % |

Bank Of America Merrill Lynch Global 300 Convertible Index | | | (5.67 | ) | | | 2.83 | | | | 5.97 | | | | 6.18 | (d) |

MSCI World Free Index | | | (7.63 | ) | | | (4.43 | ) | | | 1.66 | | | | 3.51 | (e) |

Lipper Convertible Securities Fund Average | | | (5.23 | ) | | | 2.56 | | | | 5.10 | | | | 6.89 | |

Class A (GAGAX) | | | (6.65 | ) | | | (1.86 | ) | | | 3.27 | | | | 4.17 | |

With sales charge (b) | | | (12.02 | ) | | | (3.01 | ) | | | 2.66 | | | | 3.83 | |

Class C (GACCX) | | | (7.55 | ) | | | (2.72 | ) | | | 2.46 | | | | 3.71 | |

With contingent deferred sales charge (c) | | | (8.47 | ) | | | (2.72 | ) | | | 2.46 | | | | 3.71 | |

Class I (GAGIX) | | | (6.37 | ) | | | (1.68 | ) | | | 3.34 | | | | 4.22 | |

In the current prospectus dated April 29, 2011, the gross expense ratios for Class AAA, A, C, and I Shares are 2.87%, 2.87%, 3.62%, and 2.62%, respectively, and the net expense ratios in the current prospectus for these share classes are 2.02%, 2.02%, 2.77%, and 1.77%, respectively. Class AAA and Class I Shares do not have a sales charge. See page 9 for the expense ratios for the year ended December 31, 2011. The maximum sales charge for Class A and C Shares is 5.75% and 1.00%, respectively.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of dividends and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after the date of purchase. Current performance may be lower or higher than the performance data presented. Returns would have been lower had the Adviser not reimbursed certain expenses of the Fund. Visit www.gabelli.com for performance information as of the most recent month end. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectus contains information about these and other matters and should be read carefully before investing. Investing in foreign securities involves risks not ordinarily associated with investments in domestic issues, including currency fluctuation, economic and political risks. The Class AAA Share NAVs are used to calculate performance for the periods prior to the issuance of Class A Shares, Class C Shares, and Class I Shares on May 2, 2001, November 26, 2001, and January 11, 2008, respectively. The actual performance of the Class C Shares would have been lower due to the additional expenses associated with this class of shares. The actual performance of the Class I Shares would have been higher due to lower expenses related to this class of shares. The Bank of America Merrill Lynch Global 300 Convertible Index is an unmanaged global convertible index composed of companies representative of the market structure of countries in North America, Europe, and the Asia/Pacific region. The MSCI World Free Index is an unmanaged free float adjusted market capitalization weighted index composed of companies representative of the market structure of developed market countries in North America, Europe, and the Asia/Pacific region. The Lipper Convertible Securities Fund Average reflects the performance of mutual funds classified in this particular category. Dividends are considered reinvested. You cannot invest directly in an index. | |

| | (b) | Performance results include the effect of the maximum 5.75% sales charge at the beginning of the period. | |

| | (c) | Assuming payment of the 1% maximum contingent deferred sales charge imposed on redemptions made within one year of purchase. | |

| | (d) | There is no data available for the Bank of America Merrill Lynch Global 300 Convertible Index prior to December 31, 1994. | |

| | (e) | MSCI World Free Index since inception performance is as of January 31, 1994. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE GAMCO VERTUMNUS FUND (CLASS AAA SHARES), LIPPER CONVERTIBLE SECURITIES FUND AVERAGE, AND MSCI WORLD FREE INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

2

The GAMCO Vertumnus Fund

Disclosure of Fund Expenses (Unaudited)

For the Six Month Period from July 1, 2011 through December 31, 2011

Expense Table

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All mutual funds have operating expenses. As a shareholder of a fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways:

Actual Fund Return: This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’s actual return during the past six months, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return: This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown.

In this case – because the hypothetical return used is not the Fund’s actual return – the results do not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which would be described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The “Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the year ended December 31, 2011.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

07/01/11 | | | Ending

Account

Value

12/31/11 | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

Period* | |

The GAMCO Vertumnus Fund | | | | | | | | | |

Actual Fund Return | | | | | | | | | |

| Class AAA | | | $1,000.00 | | | | $ 924.60 | | | | 2.02 | % | | | $ 9.80 | |

| Class A | | | $1,000.00 | | | | $ 924.70 | | | | 2.01 | % | | | $ 9.75 | |

| Class C | | | $1,000.00 | | | | $ 920.70 | | | | 2.76 | % | | | $ 13.36 | |

| Class I | | | $1,000.00 | | | | $ 926.20 | | | | 1.77 | % | | | $ 8.59 | |

Hypothetical 5% Return | | | | | | | | | | | | | |

| Class AAA | | | $1,000.00 | | | | $1,015.02 | | | | 2.02 | % | | | $ 10.26 | |

| Class A | | | $1,000.00 | | | | $1,015.07 | | | | 2.01 | % | | | $ 10.21 | |

| Class C | | | $1,000.00 | | | | $1,011.29 | | | | 2.76 | % | | | $ 13.99 | |

| Class I | | | $1,000.00 | | | | $1,016.28 | | | | 1.77 | % | | | $ 9.00 | |

* Expenses are equal to the Fund’s annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184 days), then divided by 365.

3

Summary of Portfolio Holdings (Unaudited)

The following table presents portfolio holdings as a percent of net assets as of December 31, 2011:

The GAMCO Vertumnus Fund

| | | | |

Telecommunications | | | 15.2% | |

Metals and Mining | | | 12.5% | |

Computer Hardware | | | 12.1% | |

Health Care | | | 12.1% | |

Energy and Utilities | | | 11.6% | |

Financial Services | | | 8.3% | |

Diversified Industrial | | | 6.5% | |

Commercial Services | | | 5.1% | |

Business Services | | | 3.6% | |

Aerospace | | | 2.2% | |

| | | | |

Consumer Products | | | 1.9% | |

Electronics | | | 1.8% | |

Computer Software and Services | | | 1.8% | |

Aviation | | | 1.4% | |

Entertainment | | | 1.3% | |

Food and Beverage | | | 1.0% | |

U.S. Government Obligations | | | 0.9% | |

Retail | | | 0.7% | |

Broadcasting | | | 0.0% | |

Other Assets and Liabilities (Net) | | | 0.0% | |

| | | | |

| | | 100.0% | |

| | | | |

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain this information at www.gabelli.com or by calling the Fund at 800-GABELLI (800-422-3554). The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

The Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30th, no later than August 31st of each year. A description of the Fund’s proxy voting policies, procedures, and how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

4

The GAMCO Vertumnus Fund

Schedule of Investments — December 31, 2011

| | | | | | | | | | | | |

Principal

Amount | | | | | Cost | | | Market

Value | |

| | | | | | | | | | | | |

| | |

| | | | CONVERTIBLE CORPORATE BONDS — 85.3% | | | | | |

| | | | Aviation — 1.4% | | | | | | | | |

| $ | 50,000 | | | Textron Inc., Ser. TXT, Cv., 4.500%, 05/01/13 | | $ | 50,000 | | | $ | 77,000 | |

| | | | | | | | | | | | |

| | | |

| | | | Broadcasting — 0.0% | | | | | | | | |

| | 400,000 | | | Citadel Broadcasting Corp., Sub. Deb. Cv., Escrow, 4.000%, 02/11/20† (a) | | | 0 | | | | 0 | |

| | | | | | | | | | | | |

| | | |

| | | | Business Services — 3.6% | | | | | | | | |

| | 200,000 | | | The Interpublic Group of Companies Inc., Cv.,

4.250%, 03/15/23 | | | 189,036 | | | | 203,250 | |

| | | | | | | | | | | | |

| | | |

| | | | Commercial Services — 5.1% | | | | | | | | |

| | 300,000 | | | The Providence Service Corp., Sub. Deb. Cv.,

6.500%, 05/15/14 | | | 281,186 | | | | 289,500 | |

| | | | | | | | | | | | |

| | | |

| | | | Computer Hardware — 12.1% | | | | | | | | |

| | 700,000 | | | SanDisk Corp., Cv.,

1.000%, 05/15/13 (b) | | | 598,801 | | | | 685,125 | |

| | | | | | | | | | | | |

| | |

| | | | Computer Software and Services — 1.8% | | | | | |

| | 100,000 | | | Mentor Graphics Corp., Sub. Deb. Cv., 4.000%, 04/01/31 (c) | | | 99,005 | | | | 101,625 | |

| | | | | | | | | | | | |

| | | |

| | | | Consumer Products — 1.9% | | | | | | | | |

| | 400,000 | | | Eastman Kodak Co., Cv., 7.000%, 04/01/17 | | | 318,464 | | | | 107,000 | |

| | | | | | | | | | | | |

| | | |

| | | | Diversified Industrial — 6.5% | | | | | | | | |

| | 200,000 | | | GenCorp Inc., Sub. Deb. Cv., 4.063%, 12/31/39 | | | 168,108 | | | | 181,250 | |

| | 200,000 | | | Griffon Corp., Sub. Deb. Cv., 4.000%, 01/15/17 (c) | | | 200,000 | | | | 190,000 | |

| | | | | | | | | | | | |

| | | | | | | 368,108 | | | | 371,250 | |

| | | | | | | | | | | | |

| | | |

| | | | Electronics — 0.9% | | | | | | | | |

| | 52,000 | | | Advanced Micro Devices Inc., Cv., 5.750%, 08/15/12 | | | 49,414 | | | | 52,780 | |

| | | | | | | | | | | | |

| | | |

| | | | Energy and Utilities — 10.4% | | | | | | | | |

| | 350,000 | | | Covanta Holding Corp., Cv., 3.250%, 06/01/14 | | | 350,000 | | | | 366,625 | |

| | 300,000 | | | JA Solar Holdings Co. Ltd., Cv., 4.500%, 05/15/13 | | | 294,471 | | | | 222,000 | |

| | | | | | | | | | | | |

| | | | | | | 644,471 | | | | 588,625 | |

| | | | | | | | | | | | |

| | | |

| | | | Entertainment — 1.3% | | | | | | | | |

| | 50,000 | | | Take-Two Interactive Software Inc., Cv., 4.375%, 06/01/14 | | | 50,000 | | | | 72,125 | |

| | | | | | | | | | | | |

| | | |

| | | | Financial Services — 7.8% | | | | | | | | |

| | 200,000 | | | CompuCredit Holdings Corp., Cv., 3.625%, 05/30/25 | | | 100,643 | | | | 197,000 | |

| | 250,000 | | | Janus Capital Group Inc., Cv., 3.250%, 07/15/14 | | | 250,000 | | | | 246,875 | |

| | | | | | | | | | | | |

| | | | | | | 350,643 | | | | 443,875 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Principal

Amount | | | | | Cost | | | Market

Value | |

| | | | | | | | | | | | |

| | | |

| | | | Health Care — 6.7% | | | | | | | | |

| $ | 400,000 | | | Chemed Corp., Cv., 1.875%, 05/15/14 | | $ | 374,880 | | | $ | 377,000 | |

| | | | | | | | | | | | |

| | | |

| | | | Metals and Mining — 12.5% | | | | | | | | |

| | 100,000 | | | Alcoa Inc., Cv.,

5.250%, 03/15/14 | | | 100,000 | | | | 151,750 | |

| | 200,000 | | | Kinross Gold Corp., Cv., 1.750%, 03/15/28 (c) | | | 202,111 | | | | 196,250 | |

| | 250,000 | | | Newmont Mining Corp., Ser. B, Cv., 1.625%, 07/15/17 (b) | | | 328,551 | | | | 361,875 | |

| | | | | | | | | | | | |

| | | | | | | 630,662 | | | | 709,875 | |

| | | | | | | | | | | | |

| | | |

| | | | Telecommunications — 13.3% | | | | | | | | |

| | 450,000 | | | NII Holdings Inc., Cv., 3.125%, 06/15/12 | | | 447,679 | | | | 455,063 | |

| | 20,000,000 | (d) | | Softbank Corp., Cv., 1.500%, 03/31/13 | | | 239,403 | | | | 300,284 | |

| | | | | | | | | | | | |

| | | | | | | 687,082 | | | | 755,347 | |

| | | | | | | | | | | | |

| | | | TOTAL CONVERTIBLE CORPORATE BONDS | | | 4,691,752 | | | | 4,834,377 | |

| | | | | | | | | | | | |

| | | |

| | | | CORPORATE BONDS — 1.9% | | | | | | | | |

| | | | Energy and Utilities — 1.2% | | | | | | | | |

| | 200,000 | | | Texas Competitive Electric Holdings Co. LLC, Ser. B, 10.250%, 11/01/15 | | | 130,168 | | | | 70,000 | |

| | | | | | | | | | | | |

| | | |

| | | | Retail — 0.7% | | | | | | | | |

| | 1,900,000 | | | The Great Atlantic & Pacific Tea Co. Inc., 5.125%, 06/15/12† | | | 33,250 | | | | 38,000 | |

| | | | | | | | | | | | |

| | | | TOTAL CORPORATE BONDS | | | 163,418 | | | | 108,000 | |

| | | | | | | | | | | | |

Shares | | | | | | | | | |

| | | |

| | | | COMMON STOCKS — 11.9% | | | | | | | | |

| | | | Aerospace — 2.2% | | | | | | | | |

| | 1,000 | | | Goodrich Corp. | | | 120,875 | | | | 123,700 | |

| | | | | | | | | | | | |

| | | |

| | | | Electronics — 0.9% | | | | | | | | |

| | 1,000 | | | Netlogic Microsystems Inc.† | | | 48,164 | | | | 49,570 | |

| | | | | | | | | | | | |

| | | |

| | | | Financial Services — 0.5% | | | | | | | | |

| | 500 | | | Royal Bank of Canada | | | 27,160 | | | | 25,480 | |

| | | | | | | | | | | | |

| | | |

| | | | Food and Beverage — 1.0% | | | | | | | | |

| | 1,000 | | | Nestlé SA | | | 54,883 | | | | 57,490 | |

| | | | | | | | | | | | |

| | | |

| | | | Health Care — 5.4% | | | | | | | | |

| | 3,000 | | | Merck & Co. Inc. | | | 102,332 | | | | 113,100 | |

| | 3,000 | | | Pfizer Inc. | | | 54,795 | | | | 64,920 | |

| | 3,000 | | | Roche Holding AG, ADR | | | 112,245 | | | | 127,650 | |

| | | | | | | | | | | | |

| | | | | | | 269,372 | | | | 305,670 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

5

The GAMCO Vertumnus Fund

Schedule of Investments (Continued) — December 31, 2011

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market

Value | |

| | | | | | | | | | | | |

| | | |

| | | | COMMON STOCKS (Continued) | | | | | | | | |

| | | | Telecommunications — 1.9% | | | | | | | | |

| | 1,000 | | | AT&T Inc. | | $ | 28,721 | | | $ | 30,240 | |

| | 2,000 | | | Telekom Austria AG | | | 25,486 | | | | 23,912 | |

| | 2,000 | | | Vodafone Group plc, ADR | | | 51,310 | | | | 56,060 | |

| | | | | | | | | | | | |

| | | | | | | 105,517 | | | | 110,212 | |

| | | | | | | | | | | | |

| | | | TOTAL COMMON STOCKS | | | 625,971 | | | | 672,122 | |

| | | | | | | | | | | | |

Principal

Amount | | | | | | | | | |

| | |

| | | | U.S. GOVERNMENT OBLIGATIONS — 0.9% | | | | | |

| | $50,000 | | | U.S. Treasury Bill, 0.035%††, 05/17/12 | | | 49,993 | | | | 49,994 | |

| | | | | | | | | | | | |

| | | | TOTAL INVESTMENTS — 100.0% | | $ | 5,531,134 | | | | 5,664,493 | |

| | | | | | | | | | | | |

| | | | Other Assets and Liabilities (Net) — 0.0% | | | | (1,266 | ) |

| | | | | | | | | | | | |

| | | | NET ASSETS — 100.0% | | | $ | 5,663,227 | |

| | | | | | | | | | | | |

| (a) | Security fair valued under procedures established by the Board of Directors. The procedures may include reviewing available financial information about the company and reviewing the valuation of comparable securities and other factors on a regular basis. At December 31, 2011, the fair valued security had no market value. |

| (b) | Securities, or a portion thereof, with a market value of $974,625 were pledged as collateral for securities sold on short sales during the year. |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2011, the market value of Rule 144A securities amounted to $487,875 or 8.61% of net assets. |

| (d) | Principal amount denoted in Japanese Yen. |

| † | Non-income producing security. |

| †† | Represents annualized yield at date of purchase. |

| ADR | American Depositary Receipt |

See accompanying notes to financial statements.

6

The GAMCO Vertumnus Fund

Statement of Assets and Liabilities

December 31, 2011

| | | | |

Assets: | | | | |

Investments, at value (cost $5,531,134) | | $ | 5,664,493 | |

Foreign currency, at value (cost $1) | | | 1 | |

Cash | | | 4,725 | |

Receivable for Fund shares sold | | | 1,632 | |

Receivable from Adviser | | | 10,934 | |

Dividends and interest receivable | | | 46,632 | |

Prepaid expense | | | 19,524 | |

| | | | |

Total Assets | | | 5,747,941 | |

| | | | |

Liabilities: | | | | |

Payable to broker | | | 620 | |

Payable for Fund shares redeemed | | | 29,727 | |

Payable for distribution fees | | | 1,236 | |

Payable for shareholder communications expenses | | | 23,285 | |

Payable for legal and audit fees | | | 19,278 | |

Other accrued expenses | | | 10,568 | |

| | | | |

Total Liabilities | | | 84,714 | |

| | | | |

Net Assets (applicable to 1,517,271

shares outstanding) | | $ | 5,663,227 | |

| | | | |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 7,316,647 | |

Accumulated net investment income | | | 2,657 | |

Accumulated net realized loss on investments, securities sold short, and foreign currency transactions | | | (1,789,398 | ) |

Net unrealized appreciation on investments | | | 133,359 | |

Net unrealized depreciation on foreign currency translations | | | (38 | ) |

| | | | |

Net Assets | | $ | 5,663,227 | |

| | | | |

Shares of Capital Stock, each at $0.001 par value: | |

Class AAA: | | | | |

Net Asset Value, offering, and redemption price per share ($5,269,216 ÷ 1,410,999 shares outstanding; 75,000,000 shares authorized) | | | $3.73 | |

| | | | |

Class A: | | | | |

Net Asset Value and redemption price per share ($297,085 ÷ 79,244 shares outstanding; 50,000,000 shares authorized) | | | $3.75 | |

| | | | |

Maximum offering price per share (NAV÷ 0.9425, based on maximum sales charge of 5.75% of the offering price) | | | $3.98 | |

| | | | |

Class C: | | | | |

Net Asset Value and offering price per share ($41,539 ÷ 12,254 shares outstanding; 25,000,000 shares authorized) | | | $3.39 | (a) |

| | | | |

Class I: | | | | |

Net Asset Value, offering, and redemption price per share ($55,387 ÷ 14,774 shares outstanding; 25,000,000 shares authorized) | | | $3.75 | |

| | | | |

| (a) | Redemption price varies based on the length of time held. |

Statement of Operations

For the Year Ended December 31, 2011

| | | | |

Investment Income: | | | | |

Dividends (net of foreign withholding taxes of $1,797) | | $ | 33,585 | |

Interest | | | 311,243 | |

| | | | |

Total Investment Income | | | 344,828 | |

| | | | |

Expenses: | | | | |

Investment advisory fees | | | 73,175 | |

Distribution fees – Class AAA | | | 16,091 | |

Distribution fees – Class A | | | 1,760 | |

Distribution fees – Class C | | | 1,204 | |

Shareholder communications expenses | | | 49,253 | |

Custodian fees | | | 35,341 | |

Registration expenses | | | 28,183 | |

Shareholder services fees | | | 17,282 | |

Legal and audit fees | | | 11,644 | |

Directors’ fees | | | 1,948 | |

Interest expense | | | 1,464 | |

Miscellaneous expenses | | | 10,738 | |

| | | | |

Total Expenses | | | 248,083 | |

| | | | |

Less: | | | | |

Expenses reimbursed by Adviser (See Note 3) | | | (99,508 | ) |

| | | | |

Total Reimbursements | | | (99,508 | ) |

| | | | |

Net Expenses | | | 148,575 | |

| | | | |

Net Investment Income | | | 196,253 | |

| | | | |

Net Realized and Unrealized Gain/(Loss) on Investments, Securities Sold Short, and Foreign Currency: | | | | |

Net realized gain on investments | | | 217,418 | |

Net realized gain on securities sold short | | | 46,859 | |

Net realized loss on foreign currency transactions | | | (54 | ) |

| | | | |

Net realized gain on investments, securities sold short, and foreign currency transactions | | | 264,223 | |

| | | | |

Net change in unrealized appreciation/depreciation: | | | | |

on investments | | | (876,172 | ) |

on foreign currency translations | | | (55 | ) |

| | | | |

Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | (876,227 | ) |

| | | | |

Net Realized and Unrealized Gain/(Loss) on Investments, Securities Sold Short, and Foreign Currency | | | (612,004 | ) |

| | | | |

Net Decrease in Net Assets Resulting from Operations | | $ | (415,751 | ) |

| | | | |

See accompanying notes to financial statements.

7

The GAMCO Vertumnus Fund

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended

December 31, 2011 | | | Year Ended

December 31, 2010 | |

Operations: | | | | | | | | |

Net investment income | | $ | 196,253 | | | $ | 187,336 | |

Net realized gain on investments, securities sold short, and foreign currency transactions | | | 264,223 | | | | 50,517 | |

Net change in appreciation/depreciation on investments and foreign currency translations | | | (876,227 | ) | | | 1,082,289 | |

| | | | | | | | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | (415,751 | ) | | | 1,320,142 | |

| | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

Net investment income | | | | | | | | |

Class AAA | | | (177,101 | ) | | | (199,211 | ) |

Class A | | | (15,427 | ) | | | (17,989 | ) |

Class B* | | | — | | | | (33 | ) |

Class C | | | (2,326 | ) | | | (3,686 | ) |

Class I | | | (1,859 | ) | | | (1,777 | ) |

| | | | | | | | |

Total Distributions to Shareholders | | | (196,713 | ) | | | (222,696 | ) |

| | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Class AAA | | | (2,196,773 | ) | | | (672,695 | ) |

Class A | | | (773,043 | ) | | | 589,714 | |

Class B* | | | (1,671 | ) | | | 33 | |

Class C | | | (113,913 | ) | | | (21,895 | ) |

Class I | | | (8,827 | ) | | | (5,991 | ) |

| | | | | | | | |

Net Decrease in Net Assets from Capital Share Transactions | | | (3,094,227 | ) | | | (110,834 | ) |

| | | | | | | | |

Redemption Fees | | | 12 | | | | — | |

| | | | | | | | |

Net Increase/(Decrease) in Net Assets | | | (3,706,679 | ) | | | 986,612 | |

Net Assets: | | | | | | | | |

Beginning of period | | | 9,369,906 | | | | 8,383,294 | |

| | | | | | | | |

End of period (including undistributed net investment income of $2,657 and $0, respectively) | | $ | 5,663,227 | | | $ | 9,369,906 | |

| | | | | | | | |

| * | Class B Shares were fully redeemed and closed on July 5, 2011. |

See accompanying notes to financial statements.

8

The GAMCO Vertumnus Fund

Financial Highlights

Selected data for a share of capital stock outstanding throughout each period:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Income (Loss)

from Investment Operations | | | Distributions | | | | | | Ratios to Average Net Assets/

Supplemental Data | |

Period Ended

December 31 | | Net Asset

Value,

Beginning

of Period | | | Net

Investment

Income

(Loss)(a) | | | Net

Realized

and

Unrealized

Gain (Loss)

on

Investments | | | Total from

Investment

Operations | | | Net

Investment

Income | | | Net

Realized

Gain on

Investments | | | Return

of

Capital | | | Total

Distributions | | | Redemption

Fees(a)(b) | | | Net Asset

Value,

End of

Period | | | Total

Return† | | | Net Assets

End of

Period (in

000’s) | | | Net

Investment

Income

(Loss) | | | Operating

Expenses

Before

Reimburse-

ment | | | Operating

Expenses

Net of

Reimburse-

ment (c) | | | Dividend

Expense on

Securities

Sold Short | | | Portfolio

Turnover

Rate | |

Class AAA | |

2011 | | $ | 4.13 | | | $ | 0.11 | | | $ | (0.39 | ) | | $ | (0.28 | ) | | $ | (0.12 | ) | | | — | | | | — | | | $ | (0.12 | ) | | $ | 0.00 | | | $ | 3.73 | | | | (6.9 | )% | | $ | 5,269 | | | | 2.72 | % | | | 3.38 | % | | | 2.02 | % | | | — | | | | 45 | % |

2010 | | | 3.64 | | | | 0.08 | | | | 0.51 | | | | 0.59 | | | | (0.10 | ) | | | — | | | | — | | | | (0.10 | ) | | | — | | | | 4.13 | | | | 16.3 | | | | 8,018 | | | | 2.11 | | | | 2.87 | | | | 2.02 | | | | 0.01 | % | | | 68 | |

2009 | | | 2.62 | | | | 0.12 | | | | 1.03 | | | | 1.15 | | | | (0.13 | ) | | | — | | | | — | | | | (0.13 | ) | | | 0.00 | | | | 3.64 | | | | 44.7 | | | | 7,681 | | | | 3.87 | | | | 3.37 | | | | 2.04 | | | | — | | | | 62 | |

2008 | | | 4.77 | | | | 0.08 | | | | (2.11 | ) | | | (2.03 | ) | | | (0.12 | ) | | | — | | | | — | | | | (0.12 | ) | | | 0.00 | | | | 2.62 | | | | (43.2 | ) | | | 4,000 | | | | 1.88 | | | | 3.38 | | | | 2.02 | | | | — | | | | 110 | |

2007 | | | 5.48 | | | | (0.04 | ) | | | 0.16 | | | | 0.12 | | | | (0.19 | ) | | $ | (0.51 | ) | | $ | (0.13 | ) | | | (0.83 | ) | | | 0.00 | | | | 4.77 | | | | 2.1 | | | | 9,294 | | | | (0.70 | ) | | | 2.46 | | | | 2.12 | | | | — | | | | 141 | |

Class A | |

2011 | | $ | 4.14 | | | $ | 0.10 | | | $ | (0.37 | ) | | $ | (0.27 | ) | | $ | (0.12 | ) | | | — | | | | — | | | $ | (0.12 | ) | | $ | 0.00 | | | $ | 3.75 | | | | (6.7 | )% | | $ | 297 | | | | 2.47 | % | | | 3.38 | % | | | 2.02 | % | | | — | | | | 45 | % |

2010 | | | 3.65 | | | | 0.08 | | | | 0.51 | | | | 0.59 | | | | (0.10 | ) | | | — | | | | — | | | | (0.10 | ) | | | — | | | | 4.14 | | | | 16.3 | | | | 1,115 | | | | 2.16 | | | | 2.87 | | | | 2.02 | | | | 0.01 | % | | | 68 | |

2009 | | | 2.63 | | | | 0.12 | | | | 1.03 | | | | 1.15 | | | | (0.13 | ) | | | — | | | | — | | | | (0.13 | ) | | | 0.00 | | | | 3.65 | | | | 44.5 | | | | 472 | | | | 3.71 | | | | 3.37 | | | | 2.04 | | | | — | | | | 62 | |

2008 | | | 4.78 | | | | 0.10 | | | | (2.13 | ) | | | (2.03 | ) | | | (0.12 | ) | | | — | | | | — | | | | (0.12 | ) | | | 0.00 | | | | 2.63 | | | | (43.1 | ) | | | 196 | | | | 2.78 | | | | 3.38 | | | | 2.02 | | | | — | | | | 110 | |

2007 | | | 5.49 | | | | (0.04 | ) | | | 0.16 | | | | 0.12 | | | | (0.19 | ) | | $ | (0.51 | ) | | $ | (0.13 | ) | | | (0.83 | ) | | | 0.00 | | | | 4.78 | | | | 2.1 | | | | 57 | | | | (0.69 | ) | | | 2.45 | | | | 2.12 | | | | — | | | | 141 | |

Class C | |

2011 | | $ | 3.76 | | | $ | 0.07 | | | $ | (0.35 | ) | | $ | (0.28 | ) | | $ | (0.09 | ) | | | — | | | | — | | | $ | (0.09 | ) | | $ | 0.00 | | | $ | 3.39 | | | | (7.6 | )% | | $ | 42 | | | | 1.82 | % | | | 4.13 | % | | | 2.77 | % | | | — | | | | 45 | % |

2010 | | | 3.33 | | | | 0.05 | | | | 0.45 | | | | 0.50 | | | | (0.07 | ) | | | — | | | | — | | | | (0.07 | ) | | | — | | | | 3.76 | | | | 15.1 | | | | 166 | | | | 1.33 | | | | 3.62 | | | | 2.77 | | | | 0.01 | % | | �� | 68 | |

2009 | | | 2.41 | | | | 0.09 | | | | 0.94 | | | | 1.03 | | | | (0.11 | ) | | | — | | | | — | | | | (0.11 | ) | | | 0.00 | | | | 3.33 | | | | 43.5 | | | | 162 | | | | 2.96 | | | | 4.12 | | | | 2.79 | | | | — | | | | 62 | |

2008 | | | 4.43 | | | | 0.04 | | | | (1.94 | ) | | | (1.90 | ) | | | (0.12 | ) | | | — | | | | — | | | | (0.12 | ) | | | 0.00 | | | | 2.41 | | | | (43.6 | ) | | | 86 | | | | 1.11 | | | | 4.13 | | | | 2.77 | | | | — | | | | 110 | |

2007 | | | 5.19 | | | | (0.09 | ) | | | 0.16 | | | | 0.07 | | | | (0.19 | ) | | $ | (0.51 | ) | | $ | (0.13 | ) | | | (0.83 | ) | | | 0.00 | | | | 4.43 | | | | 1.2 | | | | 82 | | | | (1.65 | ) | | | 3.19 | | | | 2.87 | | | | — | | | | 141 | |

Class I | |

2011 | | $ | 4.14 | | | $ | 0.12 | | | $ | (0.38 | ) | | $ | (0.26 | ) | | $ | (0.13 | ) | | | — | | | | — | | | $ | (0.13 | ) | | $ | 0.00 | | | $ | 3.75 | | | | (6.4 | )% | | $ | 55 | | | | 3.01 | % | | | 3.13 | % | | | 1.77 | % | | | — | | | | 45 | % |

2010 | | | 3.66 | | | | 0.09 | | | | 0.50 | | | | 0.59 | | | | (0.11 | ) | | | — | | | | — | | | | (0.11 | ) | | | — | | | | 4.14 | | | | 16.4 | | | | 69 | | | | 2.37 | | | | 2.62 | | | | 1.77 | | | | 0.01 | % | | | 68 | |

2009 | | | 2.63 | | | | 0.13 | | | | 1.04 | | | | 1.17 | | | | (0.14 | ) | | | — | | | | — | | | | (0.14 | ) | | | 0.00 | | | | 3.66 | | | | 45.2 | | | | 67 | | | | 3.97 | | | | 3.12 | | | | 1.79 | | | | — | | | | 62 | |

2008(d) | | | 4.62 | | | | 0.08 | | | | (1.95 | ) | | | (1.87 | ) | | | (0.12 | ) | | | — | | | | — | | | | (0.12 | ) | | | 0.00 | | | | 2.63 | | | | (41.2 | ) | | | 29 | | | | 2.14 | (e) | | | 3.13 | (e) | | | 1.77 | (e) | | | — | | | | 110 | |

| † | | Total return represents aggregate total return of a hypothetical $1,000 investment at the beginning of the period and sold at the end of the period including reinvestment of distributions and does not reflect the applicable sales charges. Total return for a period of less than one year is not annualized. |

| (a) | | Per share amounts have been calculated using the average shares outstanding method. |

| (b) | | Amount represents less than $0.005 per share. |

| (c) | | The Fund incurred interest expense during the years ended December 31, 2011, 2010, 2008, and 2007. If interest expense had not been incurred, the ratios of operating expenses to average net assets would have been 2.00%, 2.01%, 2.00%, and 2.00% (Class AAA and Class A), 2.75%, 2.76%, 2.75%, and 2.75% (Class C), 1.75%, 1.76%, and 1.75% (Class I), respectively. For the year ended December 31, 2009, the effect of the interest expense was minimal. The Fund also incurred tax expense during the year ended December 31, 2009. If tax expense had not been incurred, the ratios of operating expenses to average net assets would have been 2.00% (Class AAA and Class A), 2.75% (Class C), and 1.75% (Class I), respectively. |

| (d) | | From the commencement of offering Class I Shares on January 11, 2008 through December 31, 2008. |

See accompanying notes to financial statements.

9

The GAMCO Vertumnus Fund

Notes to Financial Statements

1. Organization. Effective February 7, 2011, the Fund changed its name to The GAMCO Vertumnus Fund from the GAMCO Global Convertible Securities Fund, with a corresponding change in the name of each of its Classes of Shares. Coincident with the Board’s approval of these name changes, the Board also adopted a change to one of the Fund’s non-fundamental investment policies in order to give the portfolio manager enhanced investment management flexibility. Consequently, the Fund is no longer required to invest at least 40% of its total net assets in non-U.S. securities or related investments thereof, but the Fund will continue to invest in securities of issuers, or related investments thereof, located in at least three countries.

The GAMCO Vertumnus Fund, a series of GAMCO Global Series Funds, Inc. (the “Corporation”), was incorporated on July 16, 1993 in Maryland. The Fund is a non-diversified open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and one of four separately managed portfolios (collectively, the “Portfolios”) of the Corporation. The Fund’s primary objective is to obtain a high level of total return through a combination of income and capital appreciation. The Fund commenced investment operations on February 3, 1994.

2. Significant Accounting Policies. The Fund’s financial statements are prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), which may require the use of management estimates and assumptions. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation. Portfolio securities listed or traded on a nationally recognized securities exchange or traded in the U.S. over-the-counter market for which market quotations are readily available are valued at the last quoted sale price or a market’s official closing price as of the close of business on the day the securities are being valued. If there were no sales that day, the security is valued at the average of the closing bid and asked prices or, if there were no asked prices quoted on that day, then the security is valued at the closing bid price on that day. If no bid or asked prices are quoted on such day, the security is valued at the most recently available price or, if the Board of Directors (the “Board”) so determines, by such other method as the Board shall determine in good faith to reflect its fair market value. Portfolio securities traded on more than one national securities exchange or market are valued according to the broadest and most representative market, as determined by Gabelli Funds, LLC (the “Adviser”).

Portfolio securities primarily traded on a foreign market are generally valued at the preceding closing values of such securities on the relevant market, but may be fair valued pursuant to procedures established by the Board if market conditions change significantly after the close of the foreign market, but prior to the close of business on the day the securities are being valued. Debt instruments with remaining maturities of sixty days or less that are not credit impaired are valued at amortized cost, unless the Board determines such amount does not reflect the securities’ fair value, in which case these securities will be fair valued as determined by the Board. Debt instruments having a maturity greater than sixty days for which market quotations are readily available are valued at the average of the latest bid and asked prices. If there were no asked prices quoted on such day, the security is valued using the closing bid price. U.S. government obligations with maturities greater than sixty days are normally valued using a model that incorporates market observable data such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued principally using dealer quotations.

10

The GAMCO Vertumnus Fund

Notes to Financial Statements (Continued)

Securities and assets for which market quotations are not readily available are fair valued as determined by the Board. Fair valuation methodologies and procedures may include, but are not limited to: analysis and review of available financial and non-financial information about the company; comparisons with the valuation and changes in valuation of similar securities, including a comparison of foreign securities with the equivalent U.S. dollar value ADR securities at the close of the U.S. exchange; and evaluation of any other information that could be indicative of the value of the security.

The inputs and valuation techniques used to measure fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

| | • | | Level 1 — quoted prices in active markets for identical securities; |

| | • | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

| | • | | Level 3 — significant unobservable inputs (including the Fund’s determinations as to the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in the aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of the Fund’s investments in securities by inputs used to value the Fund’s investments as of December 31, 2011 is as follows:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| | | Level 1

Quoted Prices | | | Level 2 Other Significant

Observable Inputs | | | Level 3 Significant

Unobservable Inputs | | | Total Market Value

at 12/31/11 | |

INVESTMENTS IN SECURITIES: | | | | | | | | | | | | | | | | |

ASSETS (Market Value): | | | | | | | | | | | | | | | | |

Convertible Corporate Bonds (a) | | | — | | | $ | 4,834,377 | | | $ | 0 | | | $ | 4,834,377 | |

Corporate Bonds (a) | | | — | | | | 108,000 | | | | — | | | | 108,000 | |

Common Stocks (a) | | $ | 672,122 | | | | — | | | | — | | | | 672,122 | |

U.S. Government Obligations | | | — | | | | 49,994 | | | | — | | | | 49,994 | |

TOTAL INVESTMENTS IN SECURITIES – ASSETS | | $ | 672,122 | | | $ | 4,992,371 | | | $ | 0 | | | $ | 5,664,493 | |

(a) Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings.

At December 31, 2010, the market value of Level 2 securities was $7,183,469, or 81.06% of total investments. The Providence Service Corp. convertible corporate bond was appropriately listed as a Level 1 security at that time. However, the security did not trade on December 30, 2011 and was valued at the most recently available price, resulting in a transfer of the bond to a Level 2 security. The beginning of period value of the securities that transferred from Level 1 to Level 2 during the year amounted to $300,000, or 5.30% of total investments.

The Fund’s policy is to recognize transfers among Levels as of the beginning of the reporting period.

In May 2011, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (“IFRS”).” ASU 2011-04 includes common requirements

11

The GAMCO Vertumnus Fund

Notes to Financial Statements (Continued)

for measurement of and disclosure about fair value between U.S. GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity, and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers into and out of Level 1 and Level 2 fair value measurements. The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU 2011-04 and its impact on the financial statements.

Derivative Financial Instruments.

The Fund may engage in various portfolio investment strategies by investing in a number of derivative financial instruments for the purposes of hedging against changes in the value of its portfolio securities and in the value of securities it intends to purchase or hedging against a specific transaction with respect to either the currency in which the transaction is denominated or another currency. Investing in certain derivative financial instruments, including participation in the options, futures, or swap markets, entails certain execution, liquidity, hedging, tax, and securities, interest, credit, or currency market risks. Losses may arise if the Adviser’s prediction of movements in the direction of the securities, foreign currency, and interest rate markets is inaccurate. Losses may also arise if the counterparty does not perform its duties under a contract, or that, in the event of default, the Fund may be delayed in or prevented from obtaining payments or other contractual remedies owed to it under derivative contracts. The creditworthiness of the counterparties is closely monitored in order to minimize these risks. Participation in derivative transactions involves investment risks, transaction costs, and potential losses to which the Fund would not be subject absent the use of these strategies. The consequences of these risks, transaction costs, and losses may have a negative impact on the Fund’s ability to pay distributions.

The Fund’s derivative contracts held at December 31, 2011, if any, are not accounted for as hedging instruments under GAAP and are disclosed in the Schedule of Investments together with the related counterparty.

Securities Sold Short. The Fund may enter into short sale transactions. Short selling involves selling securities that may or may not be owned and, at times, borrowing the same securities for delivery to the purchaser, with an obligation to replace such borrowed securities at a later date. The proceeds received from short sales are recorded as liabilities and the Fund records an unrealized gain or loss to the extent of the difference between the proceeds received and the value of an open short position on the day of determination. The Fund records a realized gain or loss when the short position is closed out. By entering into a short sale, the Fund bears the market risk of an unfavorable change in the price of the security sold short. Dividends on short sales are recorded as an expense by the Fund on the ex-dividend date and interest expense is recorded on the accrual basis. The broker retains collateral for the value of the open positions, which is adjusted periodically as the value of the position fluctuates. At December 31, 2011, there were no short sales outstanding.

12

The GAMCO Vertumnus Fund

Notes to Financial Statements (Continued)

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments, and other assets and liabilities are translated into U.S. dollars at current exchange rates. Purchases and sales of investment securities, income, and expenses are translated at the exchange rate prevailing on the respective dates of such transactions. Unrealized gains and losses that result from changes in foreign exchange rates and/or changes in market prices of securities have been included in unrealized appreciation/depreciation on investments and foreign currency translations. Net realized foreign currency gains and losses resulting from changes in exchange rates include foreign currency gains and losses between trade date and settlement date on investment securities transactions, foreign currency transactions, and the difference between the amounts of interest and dividends recorded on the books of the Fund and the amounts actually received. The portion of foreign currency gains and losses related to fluctuation in exchange rates between the initial purchase trade date and subsequent sale trade date is included in realized gain/(loss) on investments.

Foreign Securities. The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the inability to repatriate funds, less complete financial information about companies, and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

Foreign Taxes. The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

Restricted and Illiquid Securities. The Fund may invest up to 15% of its net assets in securities for which the markets are illiquid. Illiquid securities include securities the disposition of which is subject to substantial legal or contractual restrictions. The sale of illiquid securities often requires more time and results in higher brokerage charges or dealer discounts and other selling expenses than does the sale of securities eligible for trading on national securities exchanges or in the over-the-counter markets. Restricted securities may sell at a price lower than similar securities that are not subject to restrictions on resale. Securities freely saleable among qualified institutional investors under special rules adopted by the SEC may be treated as liquid if they satisfy liquidity standards established by the Board. The continued liquidity of such securities is not as well assured as that of publicly traded securities, and accordingly the Board will monitor their liquidity. The Fund held no illiquid securities at December 31, 2011. For the restricted securities the Fund held as of December 31, 2011, refer to the Schedule of Investments.

Securities Transactions and Investment Income. Securities transactions are accounted for on the trade date with realized gain or loss on investments determined by using the identified cost method. Interest income (including amortization of premium and accretion of discount) is recorded on the accrual basis. Premiums and discounts on debt securities are amortized using the effective yield to maturity method. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities that are recorded as soon after the ex-dividend date as the Fund becomes aware of such dividends.

13

The GAMCO Vertumnus Fund

Notes to Financial Statements (Continued)

Determination of Net Asset Value and Calculation of Expenses. Certain administrative expenses are common to, and allocated among, various affiliated funds. Such allocations are made on the basis of each fund’s average net assets or other criteria directly affecting the expenses as determined by the Adviser pursuant to procedures established by the Board.

In calculating the NAV per share of each class, investment income, realized and unrealized gains and losses, redemption fees, and expenses other than class specific expenses are allocated daily to each class of shares based upon the proportion of net assets of each class at the beginning of each day. Distribution expenses are borne solely by the class incurring the expense.

Custodian Fee Credits and Interest Expense. When cash balances are maintained in the custody account, the Fund receives credits which are used to offset custodian fees. The gross expenses paid under the custody arrangement are included in custodian fees in the Statement of Operations with the corresponding expense offset, if any, shown as “Custodian fee credits.” When cash balances are overdrawn, the Fund is charged an overdraft fee equal to 2.00% above the federal funds rate on outstanding balances. This amount, if any, would be included in the Statement of Operations.

Distributions to Shareholders. Distributions to shareholders are recorded on the ex-dividend date. Distributions to shareholders are based on income and capital gains as determined in accordance with federal income tax regulations, which may differ from income and capital gains as determined under GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities and foreign currency transactions held by the Fund and timing differences. Distributions from net investment income for federal income tax purposes include net realized gains on foreign currency transactions. These book/tax differences are either temporary or permanent in nature. To the extent these differences are permanent; adjustments are made to the appropriate capital accounts in the period when the differences arise. Permanent differences were primarily due to the tax treatment of currency gains and losses, adjustments on investments in hybrid securities, and conversion of premiums from securities sold. These reclassifications have no impact on the NAV of the Fund. For the year ended December 31, 2011, reclassifications were made to decrease accumulated distributions in excess of net investment income by $10,038 and increase accumulated net realized loss on investments, securities sold short, and foreign currency transactions by $10,038.

The tax character of distributions paid during the years ended December 31, 2011 and December 31, 2010 was as follows:

| | | | | | | | |

| | | Year Ended

December 31, 2011 | | | Year Ended

December 31, 2010 | |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 196,713 | | | $ | 222,696 | |

Provision for Income Taxes. The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

14

The GAMCO Vertumnus Fund

Notes to Financial Statements (Continued)

As of December 31, 2011, the components of accumulated earnings/losses on a tax basis were as follows:

| | | | |

Accumulated capital loss carryforwards | | $ | (1,789,374 | ) |

Undistributed ordinary income | | | 5,429 | |

Net unrealized appreciation on investments and foreign currency translations | | | 130,525 | |

| | | | |

Total | | $ | (1,653,420 | ) |

| | | | |

At December 31, 2011, the Fund had net capital loss carryforwards for federal income tax purposes which are available to reduce future required distributions of net capital gains to shareholders. Under the Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward for an unlimited period capital losses incurred in years beginning after December 22, 2010. In addition, these losses must be utilized prior to the losses incurred in pre-enactment taxable years. As a result of the rule, pre-enactment capital loss carryforwards may have an increased likelihood of expiring unused. Additionally, post enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

| | | | |

Capital Loss Carryforward Available through 2016 | | $ | 1,409,463 | |

Capital Loss Carryforward Available through 2017 | | | 379,911 | |

| | | | |

Total Capital Loss Carryforwards | | $ | 1,789,374 | |

| | | | |

During the year ended December 31, 2011, the Fund utilized capital loss carryforwards of $254,185.

At December 31, 2011, the temporary difference between book basis and tax basis net unrealized appreciation on investments was primarily due to deferral of losses from wash sales for tax purposes, adjustments on income from investments in defaulted securities, and taxable bond premiums added back for current and prior years.

The following summarizes the tax cost of investments and the related net unrealized appreciation at December 31, 2011:

| | | | | | | | | | | | | | | | |

| | | Cost | | | Gross

Unrealized

Appreciation | | | Gross

Unrealized

Depreciation | | | Net

Unrealized

Appreciation | |

Investments | | $ | 5,533,930 | | | $ | 500,002 | | | $ | (369,439 | ) | | $ | 130,563 | |

15

The GAMCO Vertumnus Fund

Notes to Financial Statements (Continued)

The Fund is required to evaluate tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Income tax and related interest and penalties would be recognized by the Fund as tax expense in the Statement of Operations if the tax positions were deemed not to meet the more-likely-than-not threshold. For the year ended December 31, 2011, the Fund did not incur any income tax, interest, or penalties. As of December 31, 2011, the Adviser has reviewed all open tax years and concluded that there was no impact to the Fund’s net assets or results of operations. Tax years ended December 31, 2008 through December 31, 2011 remains subject to examination by the Internal Revenue Service and state taxing authorities. On an ongoing basis, the Adviser will monitor the Fund’s tax positions to determine if adjustments to this conclusion are necessary.

3. Investment Advisory Agreement and Other Transactions. The Fund has entered into an investment advisory agreement (the “Advisory Agreement”) with the Adviser which provides that the Fund will pay the Adviser a fee, computed daily and paid monthly, at the annual rate of 1.00% of the value of its average daily net assets. In accordance with the Advisory Agreement, the Adviser provides a continuous investment program for the Fund’s portfolio, oversees the administration of all aspects of the Fund’s business and affairs, and pays the compensation of all Officers and Directors of the Fund who are affiliated persons of the Adviser.

The Adviser has contractually agreed to waive its investment advisory fee and/or to reimburse expenses of the Fund to the extent necessary to maintain the annualized total operating expenses of the Fund (excluding brokerage, acquired fund fees and expenses, interest, taxes, and extraordinary expenses) until at least May 1, 2013, at no more than 2.00%, 2.00%, 2.75%, and 1.75% of the value of the Fund’s average daily net assets for Class AAA, Class A, Class C, and Class I, respectively. For the year ended December 31, 2011, the Adviser reimbursed the Fund in the amount of $99,508. In addition, the Fund has agreed, during the two year period following any waiver or reimbursement by the Adviser, to repay such amount to the extent, after giving effect to the repayment, such adjusted annualized total operating expenses of the Fund would not exceed 2.00%, 2.00%, 2.75%, and 1.75% of the value of the Fund’s average daily net assets for Class AAA, Class A, Class C, and Class I, respectively. The agreements are renewable annually. At December 31, 2011, the cumulative amount which the Fund may repay the Adviser is $175,614.

| | | | |

For the year ended December 31, 2010, expiring December 31, 2012 | | $ | 76,106 | |

For the year ended December 31, 2011, expiring December 31, 2013 | | | 99,508 | |

| | | | |

| | $ | 175,614 | |

| | | | |

The Corporation pays each Director who is not considered to be an affiliated person an annual retainer of $6,000 plus $1,000 for each Board meeting attended and each Director is reimbursed by the Corporation for any out of pocket expenses incurred in attending meetings. All Board committee members receive $1,000 per meeting attended. The Chairman of the Audit Committee receives an annual fee of $3,000, and the Lead Director receives an annual fee of $2,000. A Director may receive a single meeting fee, allocated among the participating funds, for participation in certain meetings held on behalf of multiple funds. Directors who are directors or employees of the Adviser or an affiliated company receive no compensation or expense reimbursement from the Corporation.

16

The GAMCO Vertumnus Fund

Notes to Financial Statements (Continued)

4. Distribution Plan. The Fund’s Board has adopted a distribution plan (the “Plan”) for each class of shares, except for Class I Shares, pursuant to Rule 12b-1 under the 1940 Act. G.distributors, LLC serves as successor “Distributor” to Gabelli & Company, Inc. (“Gabelli & Co.”) effective August 1, 2011, both affiliates of the Fund. Under the Class AAA, Class A, and Class C Share Plans, payments are authorized to the Distributor at annual rates of 0.25%, 0.25%, and 1.00%, respectively, of the average daily net assets of those classes, the annual limitations under each Plan. Such payments are accrued daily and paid monthly.

5. Portfolio Securities. Purchases and sales of securities during the year ended December 31, 2011, other than short-term securities and U.S. Government obligations, aggregated $3,175,983 and $4,618,746, respectively.

6. Transactions with Affiliates. During the year ended December 31, 2011, the Fund paid brokerage commissions on security trades of $1,869 to Gabelli & Co. Additionally, the current and former Distributors informed the Fund that they retained a total of $1,027 from investors representing commissions (sales charges and underwriting fees) on sales and redemptions of Fund shares.

The cost of calculating the Fund’s NAV per share is a Fund expense pursuant to the Advisory Agreement. The Adviser did not seek a reimbursement during the year ended December 31, 2011.

7. Line of Credit. The Fund participates in an unsecured line of credit of up to $75,000,000 under which it may borrow up to 10% of its net assets from the custodian for temporary borrowing purposes. Borrowings under this arrangement bear interest at the higher of the sum of the LIBOR rate plus 125 basis points or the sum of the federal funds rate plus 125 basis points at the time of borrowing. This amount, if any, would be included in “interest expense” in the Statement of Operations. At December 31, 2011, there were no borrowings outstanding under the line of credit.

The average daily amount of borrowings outstanding under the line of credit during the year ended December 31, 2011 was $71,860 with a weighted average interest rate of 1.44%. The maximum amount borrowed at any time during the year ended December 31, 2011 was $908,000.

8. Capital Stock. The Fund offers four classes of shares – Class AAA Shares, Class A Shares, Class C Shares, and Class I Shares. Class AAA Shares are offered without a front-end sales charge only to investors who acquire them directly from the Distributor, through selected broker/dealers, or the transfer agent. Class I Shares are offered without a sales charge, solely to certain institutions, directly through the Distributor, or brokers that have entered into selling agreements specifically with respect to Class I Shares. Class A Shares are subject to a maximum front-end sales charge of 5.75%. Class B shares were fully redeemed on July 5, 2011. Class C Shares are subject to a 1.00% CDSC for one year after purchase.

The Fund imposes a redemption fee of 2.00% on all classes of shares that are redeemed or exchanged on or before the seventh day after the date of a purchase. The redemption fee is deducted from the proceeds otherwise payable to the redeeming shareholders and is retained by the Fund as an increase in paid-in capital. The redemption fees retained by the Fund during the year ended December 31, 2011 amounted to $12. There were no redemption fees retained by the Fund during the year ended December 31, 2010. The redemption fee does not apply to redemptions of shares where (i) the shares were purchased through automatic reinvestment of distributions, (ii) the redemption was initiated by the Fund, (iii) the shares were purchased through programs

17

The GAMCO Vertumnus Fund

Notes to Financial Statements (Continued)

that collect the redemption fee at the program level and remit them to the Fund, or (iv) the shares were purchased through programs that the Adviser determines to have appropriate anti-short-term trading policies in place or as to which the Adviser has received assurances that look-through redemption fee procedures or effective anti-short-term trading policies and procedures are in place.

Transactions in shares of capital stock were as follows:

| | | | | | | | | | | | | | | | |

| | | Year Ended

December 31, 2011 | | | Year Ended

December 31, 2010 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Class AAA | | | | | | | | | | | | | | | | |

Shares sold | | | 200,889 | | | $ | 820,736 | | | | 1,209,301 | | | $ | 4,645,361 | |

Shares issued upon reinvestment of distributions | | | 41,264 | | | | 160,875 | | | | 47,458 | | | | 187,767 | |

Shares redeemed | | | (774,668 | ) | | | (3,178,384 | ) | | | (1,421,079 | ) | | | (5,505,823 | ) |

| | | | | | | | | | | | | | | | |

Net decrease | | | (532,515 | ) | | $ | (2,196,773 | ) | | | (164,320 | ) | | $ | (672,695 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Class A | | | | | | | | | | | | | | | | |

Shares sold | | | 88,466 | | | $ | 364,309 | | | | 215,094 | | | $ | 883,882 | |

Shares issued upon reinvestment of distributions | | | 1,582 | | | | 6,268 | | | | 1,890 | | | | 7,577 | |

Shares redeemed | | | (280,211 | ) | | | (1,143,620 | ) | | | (76,753 | ) | | | (301,745 | ) |

| | | | | | | | | | | | | | | | |

Net increase/(decrease) | | | (190,163 | ) | | $ | (773,043 | ) | | | 140,231 | | | $ | 589,714 | |

| | | | | | | | | | | | | | | | |

| | | | |

Class B* | | | | | | | | | | | | | | | | |

Shares issued upon reinvestment of distributions | | | 5 | | | $ | 17 | | | | 9 | | | $ | 33 | |

Shares redeemed | | | (460 | ) | | | (1,688 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net increase/(decrease) | | | (455 | ) | | $ | (1,671 | ) | | | 9 | | | $ | 33 | |

| | | | | | | | | | | | | | | | |

| | | | |

Class C | | | | | | | | | | | | | | | | |

Shares sold | | | 38,267 | | | $ | 132,535 | | | | 27,328 | | | $ | 94,614 | |

Shares issued upon reinvestment of distributions | | | 631 | | | | 2,276 | | | | 759 | | | | 2,743 | |

Shares redeemed | | | (70,700 | ) | | | (248,724 | ) | | | (32,721 | ) | | | (119,252 | ) |

| | | | | | | | | | | | | | | | |

Net decrease | | | (31,802 | ) | | $ | (113,913 | ) | | | (4,634 | ) | | $ | (21,895 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Class I | | | | | | | | | | | | | | | | |

Shares sold | | | 946 | | | $ | 3,922 | | | | 1,957 | | | $ | 7,844 | |

Shares issued upon reinvestment of distributions | | | 469 | | | | 1,829 | | | | 440 | | | | 1,752 | |

Shares redeemed | | | (3,422 | ) | | | (14,578 | ) | | | (3,931 | ) | | | (15,587 | ) |

| | | | | | | | | | | | | | | | |

Net decrease | | | (2,007 | ) | | $ | (8,827 | ) | | | (1,534 | ) | | $ | (5,991 | ) |

| | | | | | | | | | | | | | | | |

* Class B Shares were fully redeemed on July 5, 2011. | | | | | | | | | | | | | | | | |

9. Indemnifications. The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts. Management has reviewed the Fund’s existing contracts and expects the risk of loss to be remote.

18

The GAMCO Vertumnus Fund

Notes to Financial Statements (Continued)

10. Other Matters. On April 24, 2008, the Adviser entered into a settlement with the SEC to resolve an inquiry regarding prior frequent trading in shares of the GAMCO Global Growth Fund (the “Global Growth Fund”) by one investor who was banned from the Global Growth Fund in August 2002. Under the terms of the settlement, the Adviser, without admitting or denying the SEC’s findings and allegations, paid $16 million (which included a $5 million civil monetary penalty). On the same day, the SEC filed a civil action in the U.S. District Court for the Southern District of New York against the Executive Vice President and Chief Operating Officer of the Adviser, alleging violations of certain federal securities laws arising from the same matter. The officer, who also is an officer of the Global Growth Fund and other funds in the Gabelli/GAMCO complex, including this Fund, denies the allegations and is continuing in his positions with the Adviser and the funds. The settlement by the Adviser did not have, and the resolution of the action against the officer is not expected to have, a material adverse impact on the Adviser or its ability to fulfill its obligations under the Advisory Agreement.

11. Subsequent Events. Management has evaluated the impact on the Fund of all subsequent events occurring through the date the financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

19

The GAMCO Vertumnus Fund

Report of Independent Registered Public Accounting Firm

To the shareholders and Board of Directors of

GAMCO Global Series Funds, Inc.

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The GAMCO Vertumnus Fund (the “Fund”), one of the series constituting GAMCO Global Series Funds, Inc., as of December 31, 2011, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2011, by correspondence with the Fund’s custodian and brokers, or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The GAMCO Vertumnus Fund, one of the series of GAMCO Global Series Funds, Inc., at December 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the periods indicated therein, in conformity with U.S. generally accepted accounting principles.

Philadelphia, Pennsylvania

February 27, 2012

20

The GAMCO Vertumnus Fund

Board Consideration and Re-Approval of Investment Advisory Agreement (Unaudited)

During the six months ended December 31, 2011, the Board of Directors of the Corporation approved the continuation of the investment advisory agreement with the Adviser for the Fund on the basis of the recommendation by the directors (the “Independent Board Members”) who are not “interested persons” of the Fund. The following paragraphs summarize the material information and factors considered by the Independent Board Members as well as their conclusions relative to such factors.