UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006

Commission File No. 0-22158

NetManage, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 77-0252226 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer

Identification No.) |

| |

| 20883 Stevens Creek Boulevard, | | |

| Cupertino, California | | 95014 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

(408) 973-7171

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common stock, $0.01 par value, including related Preferred Shares Purchase Rights | | The NASDAQ Global Market Inc. |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (check one):

| | | | |

| Large accelerated filer¨ | | Accelerated filer¨ | | Non-accelerated filerx |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The approximate aggregate market value of the common stock, $0.01 par value per share, held by non-affiliates of the registrant on June 30, 2006, the last business day of the registrant’s most recently completed second fiscal quarter, was $31,276,001, based upon the closing price of the common stock reported on the NASDAQ Global Market on that date (1).

The number of shares of common stock outstanding as of April 23, 2007 was 9,545,225.

DOCUMENTS INCORPORATED BY REFERENCE

None

| (1) | Excludes 3,136,909 shares of common stock held by directors, officers, and stockholders whose beneficial ownership exceeds five percent of the shares outstanding at June 30, 2006. Exclusion of shares held by any person should not be construed to indicate that such persons possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant or that such person is otherwise an “affiliate” for any other purpose. |

Explanatory Note

This Form 10-K/A amends and replaces Items 10, 11, 12, 13 and 14 of the Annual Report on Form 10-K for the year ended December 31, 2006 originally filed by NetManage, Inc. (“NetManage”) on April 2, 2007 (the “Original Form 10-K”), amends to supplement Item 5 of the original Form 10-K, and includes exhibits under Item 15 that were not filed with the Original Form 10-K. In the Original Form 10-K, most of these items were incorporated by reference from NetManage’s proxy statement that was to be filed in connection with the 2007 annual meeting of NetManage’s stockholders. Because the date for the 2007 annual meeting of NetManage’s stockholders has not yet been determined and, accordingly, NetManage’s proxy statement has not been finalized, Items 10, 11, 12, 13 and 14 of Form 10-K are being filed via this Form 10-K/A Certain additional exhibits are being included under Item 15 to this Form 10-K/A, to provide such information and exhibits on a timely basis. This Form 10-K/A does not amend or update any other information set forth in the Original Form 10-K.

PART II

Item 5—Market for registrant’s common equity and related stockholder matters

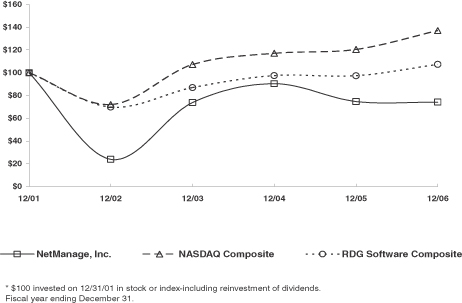

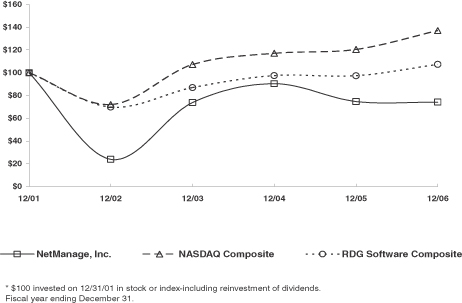

The following graph shows the total stockholder return of an investment of $100 in stock on December 31, 2001 or index including reinvestment of dividends. for; (i) the Company’s Common stock; (ii) the NASDAQ Composite (U.S.) Index; and (iii) the RDG Software Composite Index. All values assume reinvestment of the full amount of all dividends and are calculated as of December 31st of each year:

PART III

Item 10—Directors and executive officers of the registrant

Except in regard to the Vice President, Finance and Chief Financial Officer, the information required by this item for all other executive officers of NetManage, pursuant to instruction 3 of paragraph (b) of Item 401 of Regulation S-K, is set forth following Item 4 of Part I of this Form 10-K under Executive Officers of the Registrant.

| | |

Omer Regev Age 42 | | Omer Regev joined NetManage in April 2007 as Vice President, Finance and Chief Financial Officer. From August 2005 to April 2007, Mr. Regev served as Chief Financial Officer at Port Authority Technologies, a provider for Information Leak Prevention (ILP) solutions which was recently acquired by Websense. From March 2004 to August 2005, Mr. Regev worked as Chief Financial Officer at Kagoor Network, a provider of session border control (SBC) technology, which was acquired by Juniper Networks. From March 1998 to February 2004, Mr. Regev was the Chief Financial Officer at XACCT Technologies, a company that provided IP billing record creation and account provisioning and which was subsequently acquired by AMDOCS. Mr. Regev has also served in the Israeli Navy and holds an MBA and Bachelor in Economics from Tel-Aviv University. |

The information required by this item with respect to other executive officers of NetManage, pursuant to instruction 3 of paragraph (b) of Item 401 of Regulation S-K, is set forth following Item 4 of Part I of this Form 10-K under Executive Officers of the Registrant.

1

The NetManage Board of Directors is divided into three classes (Class I, Class II and Class III), with one class of directors elected at each annual meeting of stockholders for a three-year term.

Class I Director Nominees Whose Terms Expire In 2007

| | |

John Bosch Age 72 | | John Bosch has served as a director of NetManage since December 1991. Currently, Mr. Bosch is a consultant. From November 1981 to December 1999, Mr. Bosch served as a general partner with Bay Partners, a venture capital firm. In 1976, he co-founded Cronus Precision Products, Inc., a digital timing company, and served as its President and Chief Executive Officer until 1981. In 1970, Mr. Bosch co-founded Anixter, Bosch and Russell, a consulting firm specializing in marketing and sales consulting for high technology companies and in technical venture analysis for the venture capital community. He is a graduate of the University of Southern California where he received a B.S. degree in mechanical engineering and an M.B.A. in International Trade. |

| |

Dr. Shelley Harrison Age 64 | | Dr. Shelley A. Harrison has served as a director of NetManage since July 1996. Dr. Harrison has served as Chairman of the Board of Directors of Spacehab, Inc. since 1993, a company that develops, owns and operates habitable modules and logistics supply services for the manned U.S. Space Shuttle missions, and from April 1996 to March 2003 was also the Chief Executive Officer. Dr. Harrison co-founded and served as the first Chief Executive Officer and Chairman of Symbol Technologies, Inc. from February 1973 to October 1982. Dr. Harrison is also a founder of the high-tech venture capital firms Harrison Enterprises, Inc., and PolyVentures I and II L.P., and Dr. Harrison currently serves as the Chairman of the Board of Directors of Harrison Enterprises, Inc., and member of the Board of SafeNet, Inc. Dr. Harrison received his B.S. in Electrical Engineering from New York University and received an M.S. and Ph.D. in Electrophysics from Polytechnic University. Dr. Harrison served as a consultant to the Company from May 2003 to May 2005 as described underItem 13—Certain Relationships and Related Transactions. |

Class II Directors Whose Terms Expire In 2008

| | |

Uzia Galil Age 82 | | Uzia Galil has been a director of NetManage since its inception in 1990. Mr. Galil currently serves as President and Chief Executive Officer of Uzia Initiatives and Management Ltd., a company specializing in the promotion and nurturing of new businesses associated with mobile communication, innovative consumer electronics and medical informatics which he founded in November 1999. From 1962 until October 1999, Mr. Galil served as President, Chief Executive Officer, and has also served as Chairman of the Board of Directors of Elron Electronic Industries Ltd., or Elron, an Israeli high technology holding company. From January 1981 until November 1999, Mr. Galil also served as Chairman of the Board of Directors of Elbit Ltd., an electronic communication affiliate of Elron, and as a member of the Boards of Directors of Elbit Systems Ltd., a defense electronics affiliate of Elron, and all other private companies held in the Elron portfolio. Mr. Galil currently serves as a member of the Board of Directors of Orbotech Ltd, which makes automated optical inspection and computer aided manufacturing systems for printed circuit boards, flat panel displays, integrated circuit packaging, and electronics assemblies; Partner Communications Co. Ltd., which operates the GSM network in Israel, using the Orange brand name; and is currently Chairman of the Board of Zoran Corporation, a provider of digital solutions-on-a-chip in the consumer electronics market. Mr. Galil holds an M.S. in Electrical Engineering from Purdue University and a B.S. from the Technion-Israel Institute of Technology in Haifa, Israel. From 1980 to 1990, Mr. Galil served as Chairman of the International Board of Governors of the Technion. Mr. Galil has also been awarded an honorary doctorate in technical sciences by the Technion in recognition of his contribution to the development of science-based industries in Israel, an honorary doctorate in philosophy by the Weizmann Institute |

2

| | |

| | of Science, an honorary doctorate in engineering by Polytechnic University, New York, and an honorary doctorate from the Ben-Gurion University of the Negev in Israel. In addition, Mr. Galil has been awarded the Solomon Bublick Prize Laureate from the Hebrew University of Jerusalem as well as the Outstanding Electrical and Computer Engineer Award by Purdue University. Mr. Galil is a recipient of the Israel Prize for his contribution to the development of Israel’s hi-tech industry. Mr. Galil is the former father-in-law of Zvi Alon, the Chairman of the Board of Directors, President, and Chief Executive Officer of NetManage. |

| |

Darrell Miller Age 60 | | Darrell Miller has served as a director of NetManage since 1993 and served as Executive Vice President, Corporate Strategic Marketing for NetManage from December 1994 to February 1996, at which time he retired. From 1987 to 1992, Mr. Miller was employed by Novell, Inc., a computer network company, in numerous positions including Executive Vice President responsible for strategic and marketing operations and Executive Vice President responsible for product development. From 1984 to 1987, Mr. Miller served as the Director of Marketing for Ungermann-Bass, a manufacturer of networking equipment. Mr. Miller also serves on the Board of Directors of Xpoint Technologies, Inc., a developer of fault tolerant software. Mr. Miller is a graduate of the University of Denver where he received a B.S. in business administration. |

Class III Directors Whose Terms Expire In 2009

| | |

Zvi Alon Age 55 | | Zvi Alon is the founder of NetManage, Inc. and has served as our Chairman of the Board, President and Chief Executive Officer since its formation in 1990. From 1986 to 1989, Mr. Alon was the President of Halley Systems, a manufacturer of networking equipment including bridges and routers. He also has served as Manager, Standard Product Line at Sytek, Inc., a networking company, and Manager of the Strategic Business Group for Architecture, Graphics and Data Communications at Intel Corporation, a semiconductor manufacturer. Mr. Alon received a B.S. degree in electrical engineering from the Technion-Israel Institute of Technology in Haifa, Israel. |

| |

Abraham Ostrovsky Age 64 | | Abraham Ostrovsky has served as a director of NetManage since January 1998. Mr. Ostrovsky served as the Chairman of the Board of Accelio Corporation (formerly Jetform) from June 1994 to April 2002, a provider of electronic forms and enterprise workflow products, and served as its Chief Executive Officer from 1992 to 1995. Mr. Ostrovsky also served as Chairman of the Board and Chief Executive Officer of Compressent Corporation, which develops and licenses color facsimile and communications software, from March 1996 to December 1997. Mr. Ostrovsky currently serves as non-executive Chairman of CenterBeam, Inc., an information technology outsourcing servicer. Mr. Ostrovsky served as Chairman of the Board of Directors of Digital Now, Inc., a developer of digital imaging technology and Internet-based activity for the photo processing industry, from 2000 to 2003. |

| |

Dr. Harry J. Saal Age 64 | | Dr. Harry J. Saal has served as a director of NetManage since October 2006. From October 1973 to October 1978, Dr. Saal worked at International Business Machines Corporation (IBM) in Haifa, Israel, and in San Jose, California, which manufactures and sells computer services, hardware, and software and also provides financing services in support of its computer business. Dr. Saal was the founder and Chief Executive Officer during October 1986 of Network General Corporation, the first company wholly dedicated to the area of network diagnostics. Dr. Saal also founded and served as Chief Executive Officer of Smart Valley, Inc., a non-profit organization chartered to create a regional electronic community based on an advanced information infrastructure from 1993 to 1995. |

3

| | |

| | Dr. Saal is currently serving on the Board of the Northern California Chapter of the Arthritis Foundation and American Institute of Mathematics and Numenta, Inc., a company developing computer memory systems modeled after the human neocortex and which can be applied to solve problems in computer vision, artificial intelligence, robotics and machine learning. Mr. Saal currently serves as a member of the technical committee, charged with monitoring and enforcing the recently settled Microsoft Antitrust case. Previously, he served as President of Cultural Initiatives Silicon Valley; Chairman of the Board of the Community Foundation Silicon Valley; and Vice Chairman of the American Leadership Forum, Silicon Valley Chapter. Dr. Saal graduated magna cum laude from Columbia University in 1969, where he also received his Ph.D. in High Energy Physics. In 1997, Columbia University awarded Dr. Saal its highest honor, the John Jay Award. |

COMMITTEES OF THE NETMANAGE BOARD OF DIRECTORS

Board Committees and Meetings

During the fiscal year ended December 31, 2006, the Board of Directors (also referred to as the “Board”) held five meetings. Standing committees of the Board in 2006 included the Audit Committee, the Option Committee, and the Compensation Committee. During the fiscal year ended December 31, 2006, each member of the Board attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he served that was held during the period for which he was a director or committee.

Audit Committee

NetManage has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee assists the Board in fulfilling its responsibilities for generally overseeing NetManage’s financial reporting processes and the audit of NetManage’s financial statements. The Audit Committee meets with our independent registered public accounting firm at least quarterly to review the results of our quarterly financial reviews, our annual audit, and to discuss our financial statements. We certify that the Board adopted and approved an amended and restated charter for the Audit Committee on January 29, 2004, and that the Audit Committee has reviewed and reassessed the adequacy of the formal written charter on an annual basis. We filed a copy of our amended and restated charter for the Audit Committee with the Securities and Exchange Commission (the “SEC”) as an exhibit to our April 16, 2004 Proxy Statement. The charter gives the Audit Committee the authority and responsibility for the appointment, retention, compensation and oversight of our independent accountants, including pre-approval of all audit and non-audit services to be performed by our independent accountants. The Audit Committee charter has also been amended to give this committee broader authority to fulfill its obligations under the SEC and National Association of Securities Dealers (the “NASD”) requirements.

The Audit Committee is currently composed of three Non-Employee Directors: Messrs. Bosch, Miller, and Ostrovsky. The Audit Committee held four meetings during 2006. The Board has determined that all members of the Audit Committee are “independent” as that term is currently defined in Rule 4200(a)(15) of the listing standards of the NASD. The Board of Directors has also determined that Mr. Ostrovsky meets the SEC criteria of an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K. Mr. Ostrovsky’s extensive background and experience includes serving as the Chief Executive Officer of Accelio Corporation (formerly JetForm) where Mr. Ostrovsky actively supervised the company’s Chief Financial Officer and participated extensively in accounting, auditing, and internal control and risk management matters.

Option Committee

The functions of the Option Committee are to review and recommend awards of stock options for approval by the Board of Directors under our stock option plans to employees and consultants who are not subject to

4

Section 16 of the Exchange Act, and to recommend any changes or amendments to the Company’s stock option plans. The Option Committee currently consists of Messrs. Bosch and Miller, both of whom are independent, Non-Employee Directors. The Option Committee met twelve times during 2006.

Compensation Committee

The Compensation Committee reviews and approves specific compensation matters including the grant of options for the Chief Executive Officer, and all executive staff who report directly to the Chief Executive Officer as well as performing such other functions regarding compensation as the Board may delegate. The Board adopted and approved an amended and restated charter for the Compensation Committee on January 29, 2004. We filed a copy of our amended and restated charter for the Compensation Committee with the SEC as an exhibit to our April 16, 2004 Proxy Statement. The Compensation Committee is currently composed of three independent Non-Employee Directors: Messrs. Bosch, Galil, and Ostrovsky. Mr. Alon makes his recommendations to the Compensation Committee with respect to options and any repurchases under our stock option plans and the 1993 Employee Stock Purchase Plan, as amended, subject to Section 16 of the Exchange Act, for individuals other than the Chief Executive Officer. The Compensation Committee determines the terms of option grants (including the number of shares) for all such individuals. The Compensation Committee met once during 2006.

Nominations of Candidates for Director

The Company does not currently have a nominating committee. The full Board of Directors, in consultation with the Company’s Chief Executive Officer, recommends candidates for election to the Company’s Board of Directors and from time to time reviews the appropriate skills and characteristics required of individual Board members in the context of the current make-up of the Board, including such factors as business experience, diversity, and personal skills in technology, finance, marketing, international business, financial reporting, corporate governance, and other areas that are expected to contribute to an effective Board, and therefore, the Company believes it is unnecessary to have a nominating committee. The Board adopted and approved the Company’s Nominating Policy on April 2, 2004. We filed a copy of our Nominating Policy with the SEC as an exhibit to our April 16, 2004 Proxy Statement. The Nominating Policy provides guidelines to the Board of Directors of NetManage with the identification, evaluation and recommendation of nominees for the Company’s Board for each annual meeting and is designed to assist with the evaluation of the composition of the Company’s Board and its committees. The Board of Directors shall identify potential nominees by asking current directors and executive officers to notify the Board of Directors if they become aware of persons, meeting the criteria described above, who might serve on the Company’s Board. The Board of Directors also, from time to time, may engage firms that specialize in identifying director candidates.

The Board of Directors also considers candidates recommended by stockholders for election as directors. Such recommendations should be sent to the Board in care of the Corporate Secretary at the Company’s headquarters, and should include information as to the candidate’s name, biographical data and qualifications per the Nominating Policy. The Independent Directors believe that the minimum qualifications for serving as a director of the Company are that a nominee demonstrate, by a significant accomplishment in his or her field, an ability to make a meaningful contribution to the Company’s board’s oversight of the business and affairs of the Company and have an impeccable record and reputation for honest and ethical conduct in both his or her professional and personnel activities. In addition, the independent directors shall examine a candidate’s specific experiences and skills, time and availability in light of other commitments, potential conflicts of interest and independence from management and the Company.

On December 7, 2006, Riley Investment Partners, L.P. (formerly known as SACC Partners LP), an affiliate of Riley Investment Management LLC and a stockholder of NetManage as described in Item 12, sent a notice to NetManage notifying NetManage of (i) its intent to nominate for election at the 2007 annual meeting of NetManage stockholders two directors to the NetManage Board in lieu of any persons who may be nominated by

5

the NetManage Board, and (ii) its intent to bring before the 2007 annual meeting of NetManage stockholders eight other proposals, including a proposal to amend the Bylaws to institute term limits on directors. In addition, on December 7, 2006, Riley Investment Management LLC issued a press release announcing the delivery of this notice to NetManage and announcing that an affiliate planned to launch a partial tender to offer to purchase shares of NetManage common stock. The press release stated that, because of the substantial effort and expense it will take to elect Riley’s nominees to the NetManage board of directors, Riley will consider whether to withdraw the board nominations and proposals if it is unable to acquire at least an additional 7.1% of NetManage’s shares or the tender offer is otherwise unsuccessful. On January 18, 2007, Riley Investment Partners, L.P. announced that it had terminated its tender offer without purchasing any shares. It is unclear if affiliates of Riley still intend to take the actions contemplated by the December 7, 2006 notice, and accordingly, the NetManage board of directors has not made any determinations on these matters.

NetManage maintains on its website, www.netmanage.com, copies of the charters of each of the committees of the NetManage Board of Directors, as well as copies of its Corporate Governance Guidelines and Code of Ethics policy. Copies of these documents are also available in print upon request of NetManage’s Corporate Secretary. The Code of Ethics is a code of ethics which applies to all of our directors, officers and employees, including the chief executive officer, and chief financial officer.

Item 11—Executive and director compensation

Compensation Discussion and Analysis

In this compensation discussion and analysis, we explain our general compensation philosophy for the NetManage executive staff, including those named in the2006 Summary Compensation Table,and provide an overview and analysis of the different material elements of compensation that we provide our executive officers, as well as for our Non-Employee Directors.

Material Elements of Compensation

Executive Compensation Objectives and Major Policies

Our primary goal is to align compensation with our business objectives and performance. Our aim is to attract, retain and reward executive officers and other key employees who contribute to our long-term success and to motivate those individuals to enhance long-term stockholder value. To establish this relationship between executive compensation and the creation of stockholder value, the Compensation Committee has adopted a total compensation package comprised of base salary, bonus and stock option awards. Key elements of this compensation package are:

| | • | | We pay competitively with leading software and high technology companies with which we compete for employees and other service providers; |

| | • | | We maintain annual incentive opportunities sufficient to provide motivation to achieve specific operating goals and to generate rewards that bring total compensation to competitive levels, and |

| | • | | We provide significant equity-based incentives for executives and other key employees to ensure that these individuals are motivated over the long term to respond to our business challenges and opportunities as owners and not just as employees. |

Company Performance and Chief Executive Officer Compensation

The 2006 salary and potential bonus of Mr. Alon, our Chief Executive Officer were established by the Compensation Committee in light of Mr. Alon’s responsibilities as President and Chief Executive Officer, on the basis of the salary received by him in 2004 and 2005 and our overall 2006 performance. Mr. Alon’s annual salary for 2006 was $475,000, and his target bonus was $285,000. The Committee determined that Mr. Alon’s salary

6

and bonus are necessary to maintain Mr. Alon’s compensation at a competitive level in the industry. The Committee then reviewed Mr. Alon’s performance during fiscal year 2006, taking into account the Company’s overall financial performance, Mr. Alon’s specific business achievements over the last year and progress that had been made with respect to certain Company initiatives. The Compensation Committee determined that our goals were not attained in the fiscal year 2006, and, accordingly, did not award any cash bonuses to Mr. Alon in 2006.

Executive Officer Salaries

With respect to the executive officers hired in 2006, salary, potential bonus and stock option grants were determined on the basis of negotiations between us and each officer with due regard to the officer’s experience, prevailing market conditions and internal equity. Similarly, we negotiated with the former executive officers at the time of such officer’s hiring and reached a level of compensation that we believed was reasonably required to obtain the services of such officer.

NetManage reviews and administers compensation changes for all employees, including our continuing Named Executive Officers, on an annual basis. Each January, after performance results for the prior year are finalized and the business planning performance targets for the current year are complete, base salary changes and long-term incentive grants are reviewed and where applicable are approved by the appropriate authorized individuals. For the 2006 compensation administration cycle, management reviewed and summarized published reports by Radford Survey and presented management’s analysis of the Radford Survey’s to the Committee at their January 2006 meeting.

Specific Elements of Executive Compensation

Specifically, management examined the pattern of compensation practices among similar companies and adjusted benchmark data for the general industry and broad industry groups to reflect the pay level they expected the peer companies to pay if they were NetManage’s revenue size. The Committee and management also discussed the relative compensation and organizational roles and responsibilities of the Named Executive Officers.

We paid or provided the following elements of compensation to the Named Executive Officers with respect to 2006:

Base salaries

To remain competitive for critical talent, we linked our base salaries to approximately the 50th percentile of the relevant benchmark in the industry. For 2006, each named executive officer’s base pay was at or slightly above the 50th percentile of the applicable market.

Short-term incentives

We provided each of the Named Executive Officers with the opportunity to earn an annual cash bonus for 2006 performance. These awards are generally intended to qualify as performance based under Section 162(m) of the Internal Revenue Code. Historically, a substantial portion of the cash compensation paid to our executive officers, including the Chief Executive Officer, has been in the form of discretionary cash bonuses payable on a quarterly basis. The Compensation Committee believes that the bonus compensation of the Chief Executive Officer and our other executive officers should be expressly linked to our performance. Consistent with this philosophy, the bonus compensation is contingent primarily upon achieving a sufficient level of corporate profitability and the Company’s overall financial performance. Bonus payments are based on a target bonus pool established at the beginning of the year for each officer.

7

In reviewing 2006 bonuses, the Compensation Committee determined that the Company’s goals for 2006 were not achieved and therefore determined not to pay cash bonuses to any of the executive officers for 2006.

Long-Term Incentives

To date, long-term incentives have consisted solely of grants of options to purchase our common stock. Generally, the Compensation Committee makes stock option grants annually to certain of our executive officers. Each grant is designed to align the interests of the executive officer with those of the stockholders and provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business. Each grant allows the officer to acquire shares of our common stock at a fixed price per share (being the closing price of the shares on the NASDAQ Global Market on the grant date) over a specified period of time (up to ten years). Each option generally becomes exercisable in a series of installments over a four-year period, contingent upon the officer’s continued employment with us. Accordingly, the option will provide a return to the executive officer only if he remains employed by us during the vesting period, and then only if the fair market value of the underlying shares appreciates over the option term.

The size of the option grant to each executive officer is set by the Compensation Committee at a level that is intended to create a meaningful opportunity for stock ownership based upon the individual’s current position with us, the individual’s personal performance in recent periods, and his or her potential for future responsibility and promotion over the option term. The Compensation Committee also takes into account the number of unvested options held by the executive officer in order to maintain an appropriate level of equity incentive for that individual, the relevant weight given to each of these factors varies from individual to individual. The Compensation Committee has established certain guidelines with respect to the option grants made to the executive officers, but has the flexibility to make adjustments to those guidelines at its discretion.

Our primary long-term incentive program presently consists of the 1992 Plan and the 1999 Plan. Options granted under the 1992 Plan generally vest over four years beginning on the first of the month following the date of hire of the optionee. These options are subject to a 25% cliff-vesting period that matures on the one-year anniversary of the grant date after which they are subject to monthly vesting to encourage key employees to continue in our employ. Through option grants, executives receive significant equity incentives to build long-term stockholder value. The exercise price of options granted under the 1992 Plan is generally 100% of the fair market value (being the closing price of the shares on the NASDAQ Global Market) of our common stock on the date of grant. The 1999 Plan provides for the grant of non-qualified stock options for employees of the Company (or a subsidiary corporation). Options granted under the 1999 Plan generally vest over four years beginning on the date of grant of the option. These options are subject to a 25% cliff-vesting period that matures on the one-year anniversary of the grant date after which they are subject to monthly vesting.

Deferred compensation

NetManage sponsors a qualified 401(k) savings plan that covers most employees, including the Named Executive Officers, and other executive officers, however, NetManage does not match any deferred contributions of any of it employees, including its Named Executive Officers and other executive officers.

Non-Qualified Deferred Compensation

NetManage does not provide any non-qualified deferred compensation plans for any employees, including the Named Executive Officers.

Pension Benefits

NetManage does not provide Pension benefits to its employees, including its Named Executive Officers.

8

Certain Tax Considerations

Section 162(m) of the Internal Revenue Code of 1986, as amended, precludes a public corporation from taking a tax deduction for individual compensation in excess of $1 million for its chief executive officer or any of its four other highest-paid officers. This limitation applies to all compensation paid to the covered executive officers, which is not considered to be performance-based. The Compensation Committee considers the implications of this deduction limitation as one of many factors when setting compensation policy and making individual compensation determinations. The 1992 Plan contains provisions that permit certain grants to be made that would qualify for the performance-based exception. However, not all grants issued under the 1992 Plan qualify for this exception. The Compensation Committee does not expect that the Company would be denied a deduction under Section 162(m) for compensation paid during 2006; however, it is possible that in 2007 or some future year, a portion of the compensation deemed paid to a Company executive based on the exercise of one or more options will not be deductible under Code Section 162(m).

2006 Summary Compensation Table

The following table sets forth all compensation awarded, earned or paid for services rendered in all capacities to us and our subsidiaries during 2006 to our Chief Executive Officer and certain other executive officers (collectively, the “Named Executive Officers”). This information includes the dollar values of base salaries, bonus awards, the number of stock options granted, and certain other compensation, whether paid or deferred.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | |

| | | Year (b) | | Salary ($) (c) | | | Bonus ($) (d) | | Stock

Awards ($) (e) | | Option

Awards

($) (1) (f) | | Non-Equity

Incentive Plan

Compensation ($) (g) | | Change in

Pension Value and

Nonqualified

Deferred

Compensation

Earnings ($) (h) | | All Other

Compensation

($) (i) | | | Total ($) (j) |

Zvi Alon | | 2006 | | 475,000 | | | — | | — | | 176,296 | | — | | — | | 4,636 | (2) | | 655,932 |

Chairman of the Board, President and Chief Executive Officer | | | | | | | | | | | | | | | | | | | | |

Michael R. Peckham (3) | | 2006 | | 177,845 | | | — | | — | | 33,793 | | — | | — | | 26,610 | (4) | | 238,248 |

Former Senior Vice President Finance, and Chief Financial Officer | | | | | | | | | | | | | | | | | | | | |

George Bennett | | 2006 | | 311,344 | (5) | | — | | — | | 10,744 | | — | | — | | 38,715 | (6) | | 360,803 |

Vice President North America Sales | | | | | | | | | | | | | | | | | | | | |

Cheli Aflalo-Karpel | | 2006 | | 178,800 | | | — | | — | | 26,388 | | — | | — | | 71,413 | (7) | | 276,601 |

Vice President of Operations Europe and Israel | | | | | | | | | | | | | | | | | | | | |

Ido Hardonag | | 2006 | | 194,000 | | | — | | — | | 41,257 | | — | | — | | 64,502 | (8) | | 299,759 |

Senior Vice President of Worldwide Engineering | | | | | | | | | | | | | | | | | | | | |

Notes to 2006 Summary Compensation Table:

| (1) | This column reflects the stock awards expense taken in 2006 in accordance with FAS 123R assuming no forfeitures. |

| (2) | Represents Group Life and other social benefits |

9

| (3) | Mr. Peckham left the Company in August 2006. Salary for 2006 includes a payout for unused paid time off. |

| (4) | Includes i) $1,445 for Group Life and other social benefits and ii) $25,165 gain from the exercise and sale of vested stock options. |

| (5) | Includes base salary and sales commissions. |

| (6) | Includes money reimbursed for relocation costs. |

| (7) | Includes i) $19,336 for Company sponsored travel or car allowance; ii) $47,665 for Group Life and other social benefits; and iii) $4,412 gain from the exercise and sale of vested stock options granted pursuant to the 1992 or 1999 Stock Option Plans. |

| (8) | Includes i) $14,942 for Company sponsored travel or car allowance; and ii) $49,560 for Group Life and other social benefits. |

Grants of Plan-Based Awards

The following table shows the number of options to purchase common stock that was granted by NetManage during 2006 to each person named in the 2006 Summary Compensation Table. NetManage did not grant any stock appreciation rights to the Named Executive Officers for fiscal year 2006. As described inCompensation Discussion and Analysis NetManage did not pay any cash bonuses to any executive officers for fiscal year 2006.

| | | | | | | | | | | | | | | | | | | | | | |

| | | 2006 Grants of Plan-Based Awards |

| | | | | Estimated Future Payouts Under

Non-Equity Incentive Plan Awards (1) | | Estimated Future Payouts

Under

Equity Incentive Plan Awards | | All Other

Stock

Awards:

Number

of Shares

of Stock

or

Units (#) | | All Other

Option

Awards:

Number of

Securities

Underlying

Options (#) | | Exercise

or Base

Price of

Option

Awards

($/share) | | Grant

Date

Fair

Value

of

Stock

and

Option

Awards

($) |

Name (a) | | Grant

Date (b) | | Threshold ($) (c) | | Target ($) (d) | | Maximum ($) (e) | | Threshold ($) (f) | | Target ($) (g) | | Maximum ($) (h) | | (i) | | (j) | | (k) | | (l) |

Zvi Alon | | 1/26/06 | | — | | — | | — | | — | | — | | — | | — | | 37,500 | | 5.98 | | 5.98 |

Michael Peckham | | 1/26/06 | | — | | — | | — | | — | | — | | — | | — | | 12,000 | | 5.98 | | 5.98 |

George Bennett (1) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

Cheli Aflalo-Karpel | | 1/26/06 | | — | | — | | — | | — | | — | | — | | — | | 9,750 | | 5.98 | | 5.98 |

Ido Hardonag | | 1/26/06 | | — | | — | | — | | — | | — | | — | | — | | 12,000 | | 5.98 | | 5.98 |

Notes to Grants of Plan Based Awards:

(1) | Mr, Bennett joined the Company in November 2005. |

10

Outstanding Equity Awards at Fiscal Year-End

The market values in the table below are based on the closing market price of NetManage common stock at December 31, 2006 of $5.29 per share.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Outstanding Equity Awards at December 31, 2006 |

| | | Option Awards | | Stock Awards |

Name (a) | | Number of

Securities

Underlying

Unexercised

Options: #

Exercisable

(b) | | | Number of

Securities

Underlying

Unexercised

Options: #

Unexercisable

(c) | | | Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#)

(d) | | Option

Exercise

Price ($) (e) | | Option

Expiration

Date (f) | | Number

of Shares

or Units

of Stock

that Have

Not

Vested (#) (g) | | Market

Value of

Shares or

Units of

Stock

that Have

Not

Vested ($) (h) | | Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units or

Other

Rights

that Have

Not

Vested (#) (i) | | Equity

Incentive

Plan

Awards:

Market

Value of

Payout

Value of

Unearned

Shares,

Units or

Other

Rights

that Have

Not

Vested ($) (j) |

Zvi Alon | | — | | | 37,500 | (1) | | — | | $ | 5.98 | | 1/25/2016 | | — | | — | | — | | — |

| | 16,210 | (2) | | — | | | — | | $ | 4.78 | | 12/15/2013 | | — | | — | | — | | — |

| | 30,218 | (2) | | — | | | — | | $ | 4.78 | | 12/15/2013 | | — | | — | | — | | — |

| | 661 | (2) | | — | | | — | | $ | 4.78 | | 12/15/2013 | | — | | — | | — | | — |

| | 47,143 | (2) | | — | | | — | | $ | 4.78 | | 12/15/2013 | | — | | — | | — | | — |

| | 47,143 | (2) | | — | | | — | | $ | 4.78 | | 12/15/2013 | | — | | — | | — | | — |

| | 42,196 | (2) | | — | | | — | | $ | 4.78 | | 12/15/2013 | | — | | — | | — | | — |

| | 47,143 | (2) | | — | | | — | | $ | 4.78 | | 12/15/2013 | | — | | — | | — | | — |

| | 42,187 | (2) | | 14,063 | (2) | | — | | $ | 4.78 | | 12/15/2013 | | — | | — | | — | | — |

| | 62,176 | (3) | | 52,610 | (3) | | — | | $ | 5.27 | | 9/30/2014 | | — | | — | | — | | — |

| | 17,968 | (3) | | 19,532 | (3) | | | | $ | 6.56 | | 1/26/2015 | | — | | — | | — | | — |

Michael Peckham (4) | | — | | | — | | | — | | | — | | — | | — | | — | | — | | — |

George Bennett | | 7,500 | (3) | | 22,500 | (3) | | — | | $ | 5.30 | | 11/29/2015 | | — | | — | | — | | — |

Cheli Aflalo-Karpel | | — | | | 9,750 | (1) | | — | | $ | 5.98 | | 1/25/2016 | | — | | — | | — | | — |

| | 583 | (1) | | 334 | (1) | | — | | $ | 1.54 | | 3/30/2013 | | — | | — | | — | | — |

| | 3,868 | (3) | | 2,019 | (3) | | — | | $ | 4.78 | | 12/15/2013 | | — | | — | | — | | — |

| | 1,125 | (3) | | 675 | (3) | | — | | $ | 6.76 | | 5/27/2014 | | — | | — | | — | | — |

| | 2,670 | (3) | | 2,456 | (3) | | — | | $ | 5.30 | | 10/28/2014 | | — | | — | | — | | — |

| | 4,698 | (3) | | 5,552 | (3) | | — | | $ | 7.12 | | 2/10/2015 | | — | | — | | — | | — |

Ido Hardonag | | — | | | 12,000 | (1) | | — | | $ | 5.98 | | 1/26/2016 | | — | | — | | — | | — |

| | 30,000 | (3) | | — | | | — | | $ | 1.05 | | 10/31/2012 | | — | | — | | — | | — |

| | 10,456 | (3) | | 3,485 | (3) | | — | | $ | 4.78 | | 12/16/2013 | | — | | — | | — | | — |

| | 9,520 | (3) | | 8,056 | (3) | | — | | $ | 5.27 | | 10/1/2014 | | — | | — | | — | | — |

| | 5,750 | (3) | | 6,250 | (3) | | — | | $ | 6.56 | | 1/26/2015 | | — | | — | | — | | — |

Notes to Outstanding Equity Awards Table:

| (1) | Represents shares granted pursuant to NetManage’s 1999 Stock Option Plan with an exercise price equal to the fair market value of NetManage common stock on the date of grant. The option grant vests and becomes exercisable in installments over a period of four years from the date of grant. Twenty five percent (25%) of the shares shall vest on the first anniversary of the date of grant and one forty-eighth (1/48) of the shares shall vest each month thereafter. |

| (2) | Represents replacement options granted on December 16, 2003 with an exercise price equal to the fair market value of NetManage’s common stock on the date of grant ($4.78), pursuant to a voluntary stock option exchange program announced on May 16, 2003. |

11

| (3) | Represents shares granted pursuant to NetManage’s 1992 Stock Option Plan with an exercise price equal to the fair market value of NetManage common stock on the date of grant. The option grant vests and becomes exercisable in installments over a period of four years from the date of grant. Twenty five percent (25%) of the shares shall vest on the first anniversary of the date of grant and one forty-eighth (1/48) of the shares shall vest each month thereafter. |

| (4) | Mr. Peckham left the Company in August 2006. |

Option Exercises and Stock Vested

The following table provides information regarding amounts realized by each Named Executive Officer due to the vesting or exercise of equity compensation during the year.

| | | | | | | | |

| | | Option Exercises and Stock Vested in 2006 |

| | | Option Awards | | Stock Awards |

Name (a) | | Number of

Shares

Acquired

on

Exercise(#) (b) (1) | | Value

Realized

on

Exercise($)

(c) | | Number

of Shares

Acquired

on

Vesting(#)

(d) | | Value

Realized

on

Vesting($)

(e) |

Zvi Alon | | — | | — | | — | | — |

Michael Peckham (2) | | 56,864 | | 25,165 | | — | | — |

George Bennett | | — | | — | | — | | — |

Cheli Aflalo-Karpel | | 1,250 | | 4,450 | | — | | — |

Ido Hardonag | | — | | — | | — | | — |

Notes to Option Exercises and Stock Vested in 2006 Table (all values are based on the closing price per share of NetManage common stock on the vest date):

| (1) | Represents exercise of options granted pursuant to the 1992 or the 1999 stock option plans. |

| (2) | Mr. Peckham left the Company in August 2006. |

Employment Contracts, Termination of Employment and Change of Control Arrangements

We currently have no employment contracts or change of control agreements with any of our Named Executive Officers.

Currently, in the event a change in control of the Company occurs, each outstanding option issued pursuant to: (i) the 1992 Plan; (ii) the 1999 Plan, or (iii) Directors’ Plan will automatically accelerate in full, subject to the limitations as stated below. All options granted under the 1992 Plan prior to its April 25, 2003 restatement will accelerate in full upon a change in control. In the event of a change in control, each outstanding option under the 1992 Plan as amended and restated will automatically accelerate in full, unless; (i) the option is assumed by the successor corporation or otherwise continued in effect, or (ii) the option is replaced with a cash incentive program which preserves the spread existing on the unvested option shares (the excess of the fair market value of those shares over the option exercise price payable for such shares) and provides for subsequent payout in accordance with the same vesting schedule in effect for those option shares. In addition, all unvested shares outstanding under the 1992 Plan will immediately vest, except to the extent that our repurchase rights with respect to those shares are to be assigned to the successor corporation or otherwise continued in effect. The Board or Option Committee will have complete discretion to grant one or more options which will become exercisable for all the option shares in the event the optionee’s service with us or the successor entity is terminated (actually or constructively) within a designated period following a change in control transaction in which those options are assumed or otherwise continued in effect.

12

The Board or Option Committee will have the discretion to structure one or more option grants under the 1992 Plan so that those options will vest immediately upon a change in control, whether or not the options are to be assumed or otherwise continued in effect.

All options granted under the 1999 Plan as amended and restated, will automatically accelerate in full and will be exercisable for a period of at least 10 days prior to the closing in the event of: (i) a merger or consolidation in which the Company is not the surviving corporation; (ii) a reverse merger in which the Company is the surviving corporation but the shares of the Company’s common stock outstanding immediately preceding the merger are converted by virtue of the merger into other property, whether in the form of securities, cash or otherwise, or (iii) any other capital reorganization in which more than fifty percent (50%) of the shares of the Company entitled to vote are exchanged. Such options shall be terminated if not exercised prior to the closing of such transaction; provided, however, that in no event shall any such accelerated vesting or termination of the options occur in connection with a transaction effected solely for the purpose of changing the situs of the Company’s incorporation (e.g. from Delaware to California).

All options granted under the 1993 Directors Plan, as amended and restated, will automatically accelerate in full in the event of: (i) a merger or consolidation in which the Company is not the surviving corporation; (ii) a reverse merger in which the Company is the surviving corporation but the shares of the Company’s common stock outstanding immediately preceding the merger are converted by virtue of the merger into other property, whether in the form of securities, cash or otherwise, or (iii) any other capital reorganization in which more than fifty percent (50%) of the shares of the Company entitled to vote are exchanged at the time during which such option may be exercised shall be accelerated and the options terminated if not exercised prior to such event. In the event of a dissolution or liquidation of the Company, any outstanding options shall terminate if not exercised prior to such event.

Director Compensation

Employee directors do not receive any separate compensation for their Board activities although service on the Board may be considered when establishing their compensation as employees. Non-employee Directors receive the compensation described below.

Non-employee Directors currently receive a fixed sum of $20,000 in cash compensation per year, payable in quarterly installments, for service on the Board of Directors. In addition, the Chairman of the Audit Committee is paid $4,000 per year in cash compensation, and the Chairman of the Compensation Committee is paid $2,000 in cash compensation per year. The designated Audit Committee financial expert receives an additional $4,000 in cash compensation per year. Non-employee Directors may also be reimbursed for certain expenses in connection with attendance at Board and committee meetings.

Non-employee Directors are eligible to receive options under the 1993 Non-employee Directors’ Stock Option Plan, as amended and restated, (the “Directors’ Plan”) and under our 1999 Stock Option Plan, as amended and restated. A total of 200,000 shares of common stock have been reserved for issuance under the Directors’ Plan. Under the Directors’ Plan, each person that is elected for the first time as a director and who is not otherwise employed by us or our affiliates (a “Non-employee Director”) is granted an option to purchase 16,000 shares of common stock upon the date of his or her election to the Board. At each annual meeting of stockholders, each person who is then a Non-employee Director and has been a Non-employee Director for at least three months is granted an option to purchase an additional 4,000 shares of common stock.

13

The following table provides information on compensation for Non-Employee Directors who served during fiscal year 2006.

| | | | | | | | | | | | | | |

| | | Director Compensation |

Name (a) | | Fees

Earned or

Paid in

Cash ($)

(b) | | Stock

Awards ($)

(c) | | Option

Awards ($)

(d) (7) | | Non Equity

Incentive Plan

Compensation ($)

(e) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($)

(f) | | All Other

Compensation ($)

(g) | | Total ($) (h) |

John Bosch (1)(2)(3)(4) | | 26,000 | | — | | 7,694 | | — | | — | | — | | 33,694 |

Uzia Galil (3) | | 20,000 | | — | | 7,694 | | — | | — | | — | | 27,694 |

Dr. Shelley Harrison | | 20,000 | | — | | 5,508 | | — | | — | | — | | 25,508 |

Darrell Miller (1)(2) | | 20,000 | | — | | 7,694 | | — | | — | | — | | 27,694 |

Abraham Ostrovsky (2)(3)(5) | | 24,000 | | — | | 7,694 | | — | | — | | — | | 31,694 |

Dr. Harry J. Saal (6) | | 5,000 | | — | | 2,220 | | — | | — | | — | | 7,220 |

Notes to Director Compensation Table:

| (1) | Member of the Option Committee. |

| (2) | Member of the Audit Committee. |

| (3) | Member of the Compensation Committee. |

| (4) | Mr. Bosch is the Chair for the Audit Committee and the Compensation Committee |

| (5) | Mr. Ostrovsky is the designated financial expert of the Audit Committee |

| (6) | Dr. Saal was appointed to the Board in October 2006. |

| (7) | This column reflects the stock option awards expense taken in 2006 in accordance with FAS 123R assuming no forfeitures. |

REPORT OF COMPENSATION COMMITTEE

The Compensation Committee of the Board of Directors has reviewed and discussed theCompensation Discussion and Analysis with management. Based on such review and discussions, the Compensation Committee recommended to the Board of Directors that theCompensation Discussion and Analysis be included in the proxy statement for the 2007 annual meeting of stockholders.

John Bosch

Abraham Ostrovsky

Uzia Galil

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires the Company’s executive officers and directors and persons who own more than 10% of the Common stock of the Company to file reports of ownership and changes in ownership of common stock of the Company with the Securities and Exchange Commission (the “SEC”). Based solely on a review of copies of such reports and written representations from the reporting persons, the Company believes that during the year ended December 31, 2006, its executive officers, directors and greater than 10% stockholders filed on a timely basis all reports due under Section 16(a) of the Exchange Act.

14

Item 12—Security ownership of certain beneficial owners and management and related stockholder matters

The following table sets forth certain information regarding the ownership of our common stock as of April 23, 2006 by: (i) each of our Non-employee Directors, including each Nominee; (ii) each of the Named Executive Officers, listed in the Summary Compensation Table set forth elsewhere in Item 11 above; (iii) all of our Named Executive Officers and directors as a group, and (iv) all those persons known to us to be the beneficial owners of more than 5% of the outstanding common stock. Except as otherwise indicated below, the information as to each person has been furnished by such person, and each person has sole voting power and sole investment power with respect to all shares beneficially owned by such person, except as otherwise indicated and subject to community property laws where applicable. Except as otherwise set forth below, the address of each named individual is our address as set forth herein.

| | | | | |

| | | Beneficial Ownership | |

Beneficial Owner | | Number of

Shares | | Percent

Total (%)

(1) | |

Executive Officers & Directors | | | | | |

Zvi Alon (2) | | 1,784,211 | | 18.69 | % |

John Bosch (3) | | 19,610 | | * | |

Uzia Galil (4) | | 93,220 | | * | |

Shelley Harrison (5) | | 113,921 | | 1.19 | % |

Darrell Miller (6) | | 16,282 | | * | |

Abraham Ostrovsky (7) | | 23,307 | | * | |

Harry Saal (8) | | — | | * | |

Michael Peckham (9) | | — | | * | |

George Bennett (10) | | 11,250 | | * | |

Ido Hardonag (11) | | 66,663 | | * | |

Cheli Aflalo-Karpel (12) | | 19,683 | | * | |

All Named Executive Officers and directors as a group (13 persons) (14) | | 2,210,323 | | 23.16 | % |

| | |

Stock Ownership of Other 5% Beneficial Owners | | | | | |

Spectrum Galaxy Fund Ltd. (13) | | 805,421 | | 8.4 | % |

Zeff Capital Partners, I, L.P. | | | | | |

Zeff Holding Company, LLC | | | | | |

Mr. Daniel Zeff c/o 50 California Street, Suite 1500 San Francisco, CA 94111 | | | | | |

| | |

Emancipation Capital Master, Ltd. (15) Charles Frumberg c/o 1120 Avenue of the Americas, Suite 1504, New York, NY 10036 | | 683,315 | | 7.24 | % |

| | |

Riley Investment Management LLC (13) Riley Investment Partners Riley Investment Partners Master Fund, L.P. Bryant Riley c/o 11100 Santa Monica Blvd Suite 810 Los Angeles, CA 90025 | | 668,752 | | 7.04 | % |

| (1) | Based on 9,545,225 shares of common stock outstanding as of April 23, 2007. |

| (2) | Includes (i) 42,352 shares owned by Mr. Alon; (ii) 5,428 shares held by the Alon Family Foundation, with respect to which Mr. Alon has voting and investment control; (iii) 696,801 shares held by the Alon Family |

15

| | Trust, with respect to which Mr. Alon has voting and investment control; (iv) 648,799 shares held by the Elyad, LLC, representing approximately 6.00% of the outstanding Common Shares, with respect to which Mr. Alon has voting rights, and (v) 390,831 shares issuable upon exercise of options that are exercisable within 60 days of April 23, 2007. |

| (3) | Includes 143 shares held by Mr. Bosch’s spouse. Mr. Bosch disclaims beneficial ownership of these shares. Also includes 19,467 shares issuable upon exercise of options that are exercisable within 60 days of April 23, 2007. |

| (4) | Includes 71,429 shares owned by Uzia and Ella Galil. Also includes 21,791 shares issuable upon exercise of options that are exercisable within 60 days of April 23, 2007. |

| (5) | Includes 113,921 shares issuable upon exercise of options that are exercisable within 60 days of April 23, 2007. |

| (6) | Includes 16,282 shares issuable upon exercise of options that are exercisable within 60 days of April 23, 2007. |

| (7) | Includes 18,164 shares issuable upon exercise of options that are exercisable within 60 days of April 23, 2007. |

| (8) | Dr. Saal was appointed to the Board of Directors in October, 2006. |

| (9) | Mr. Peckham left the Company in August 2006. |

| (10) | Includes 11,250 shares issuable upon exercise of options that are exercisable within 60 days of April 23, 2007. |

| (11) | Includes 64,915 shares issuable upon exercise of options that are exercisable within 60 days of April 23, 2007. |

| (12) | Includes 19,683 shares issuable upon exercise of options that are exercisable within 60 days of April 23, 2007. |

| (13) | Based upon the Form Schedule 13G filed with the Securities and Exchange Commission on April 16, 2007. As calculated in accordance with Rule 13d-3 of the Exchange Act, Zeff beneficially owns 805,421 shares of the NetManage’s common stock, representing 8.4% of the common stock. Zeff does not directly own any shares of common stock. Zeff’s beneficial ownership is comprised of 391,954 shares of common stock held by Capital and 413,467 shares of common stock held by Spectrum. Zeff beneficially owns the shares of common stock held by Capital in his capacity as the sole manager and member of Holding, which in turn serves as the general partner Capital. Zeff beneficially owns the shares of common stock held by Spectrum in his capacity as investment manager to Zeff Capital Offshore Fund, a class of shares of Spectrum. |

| (14) | Based on the Form Schedule 13D filed with the Securities and Exchange Commission on September 22, 2006. Emancipation Capital Master, Ltd., a Cayman Islands exempted company (“Emancipation Capital”); and (ii) Mr. Charles Frumberg (“Mr. Frumberg”) who serves as the managing member of Emancipation Management LLC, (“Emancipation Management”) which acts as the investment manager of Emancipation Capital. Emancipation Management acts as the investment manager of Emancipation Capital. The managing member of Emancipation Management is Charles Frumberg. Emancipation Capital is a Beneficial owner, with shared power to vote or direct the vote and to dispose or direct the disposition, of 683,315 shares, or an aggregate of 7.24% of outstanding shares. Mr. Frumberg is a Beneficial owner, with shared power to vote or direct the vote and to dispose or direct the disposition, of 683,315 shares and, or an aggregate of 7.24% of outstanding shares. |

| (15) | Based upon the Form Schedule 13D/A filed with the Securities and Exchange Commission on April 3, 2007. Because Riley Investment Management LLC has sole investment and voting power over 668,752 shares of common stock owned by Riley Investment Partners, L.P. and Riley Investment Partners Master Fund, L.P., Riley Investment Management LLC may be deemed to have beneficial ownership of these shares. Riley Investment Management LLC has shared voting and dispositive power over 47,939 shares of common stock owned of by an investment advisory client of Riley Investment Management LLC. However, Riley Investment Management LLC disclaims beneficial ownership of these shares. |

16

Equity Compensation Plan Information

The following table reflects our equity compensation plan information as of December 31, 2006:

| | | | | | | |

Plan Category | | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

(a) | | Weighted-average

exercise price of

outstanding options,

warrants and rights (b) | | Number of securities

remaining available for

issuance under equity

compensation plans

(excluding securities

reflected in column (a))(1) (c) |

Equity compensation plans adopted by the security holders: | | | | | | | |

1992 Plan (2) | | 1,087,627 | | $ | 5.33 | | 1,647,507 |

Directors’ Plan | | 104,460 | | $ | 6.51 | | 95,540 |

1993 Employee Stock Purchase Plan (3) | | N/A | | | N/A | | 692,082 |

1999 Plan | | 402,857 | | $ | 4.36 | | 290,043 |

| | | | | | | |

Aggregate total of all equity compensation plans approved by security holders | | 1,594,944 | | $ | 5.16 | | 2,033,090 |

| (1) | Excludes shares of common stock issuable upon the exercise of the outstanding options, warrants and rights listed in column (a). |

| (2) | On June 5, 2002, the stockholders approved an automatic share increase provision to the 1992 Plan pursuant to which the share reserve under the plan shall automatically increase on the first trading day of January in each calendar year. Beginning with the 2003 calendar year through the calendar year 2007, the share reserve under the plan shall increase by an amount equal to three percent (3%) of the total number of shares of the Company’s common stock outstanding on the last trading day of December in the immediately preceding calendar year. |

| (3) | On June 5, 2002, the stockholders approved an automatic share increase provision to the 1993 Employee Stock Purchase Plan pursuant to which the share reserve under the plan shall automatically increase on the first trading day of January in each calendar year. Beginning with the 2003 calendar year through the calendar year 2007, the share reserve under the plan shall increase by an amount equal to one percent (1%) of the total number of shares of the Company’s common stock outstanding on the last trading day of December in the immediately preceding calendar year. The Employee Stock Purchase Plan was suspended by the Board in November 2006. |

Item 13—Certain relationships and related transactions

We have entered into indemnification agreements with certain officers and directors which provide, among other things, that we will indemnify such officer or director, under the circumstances and to the extent provided for therein, for expenses, damages, judgments, fines and settlements he or she may be required to pay in actions or proceedings to which he or she is or may be made a party by reason of his or her position as a director, officer or other agent of ours, and otherwise to the full extent permitted under Delaware law and our Bylaws.

On May 28, 2003, the Company entered into an independent contractor services agreement with Dr. Shelley Harrison, a director of the Company, pursuant to which Dr. Harrison received compensation in consideration for consultancy and advisory services that he provided the Company over a two-year period. In connection with his entering into the agreement, Dr. Harrison resigned from the Company’s Audit Committee effective May 28, 2003. The terms of the agreement required the Company to pay Dr. Harrison a fixed fee of $138,000 per year, and a one time grant to Dr. Harrison of an option to purchase 150,000 total shares, inclusive of 3,200 shares Dr. Harrison was eligible to receive under the 1993 Directors Plan for 2003 and 2004 and 146,800 shares from the 1999 Plan, at an exercise price of $1.92 per share (which represents the quoted market price of the stock at the date of grant). The option vested on a monthly basis over the two-year term of the agreement. The option expires five years from the date of issuance. The fair value of the 146,800 options from the 1999 Plan was determined using the Black-Scholes option pricing model with the following assumptions: stock price $2.95–$9.65; no dividends; risk free interest rate

17

of 2.00%–3.72%; volatility of 38%–99%; and a contractual life of five years. The fair value of the option is subject to change over the vesting period of the option based on changes in the underlying assumptions (variable award accounting). The contract with Dr. Harrison expired on May 28, 2005.

Item 14—Principal accountant fees and services

The following information describes the fees billed by Deloitte & Touche LLP to the Company for the fiscal years ended December 31, 2005 and 2006:

Fees Billed by Deloitte & Touche LLP during 2005 and 2006

The following fees were billed by Deloitte and Touche LLP, the Company’s independent registered public accounting firm, for services rendered in 2005 and 2006:

| | | | | | |

Fee Category | | 2005 | | 2006 |

Audit Fees | | $ | 450,350 | | $ | 583,100 |

Audit Related Fees | | | 7,365 | | | 4,000 |

Tax Fees | | | 7,314 | | | 15,567 |

All Other Fees | | | — | | | 8,000 |

| | | | | | |

Total Deloitte & Touche Fees | | $ | 465,029 | | $ | 610,667 |

| | | | | | |

Audit Fees: The amounts above represent amounts billed by Deloitte and Touche LLP for the audit of our annual financial statements, reviews of SEC Forms 10-Q and Form 10-K and statutory audit requirements at certain non-U.S. locations. The aggregate fees billed to the Company by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte & Touche”) represent fees for professional services rendered for the audit of the Company’s annual consolidated financial statements for the fiscal years ended December 31, 2005 and 2006 and for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for 2005 and 2006 and consents and assistance with review of documents filed with the SEC.

Audit Related Fees: The amounts above represent reports in each of 2005 and 2006 that Deloitte & Touche provided in a non-U.S. location associated with employee tax benefits.

Tax Fees: The amounts above represent fees billed to us by Deloitte & Touche for 2005 and 2006 are for tax compliance, tax planning, and tax refund activity in U.S. and non-U.S. locations.

All Other Fees: The amounts above represent the aggregate fees billed by Deloitte & Touche for services rendered to the Company, other than the services described above under “Audit Fees”, “Audit Related Fees”, and “Tax Fees”, for 2006, included software fees, and support, installation and training fees.

We did not engage Deloitte & Touche to provide services to us regarding financial information systems during 2005 or 2006.

Audit Committee’s Pre-Approval Policies and Procedures

The Audit Committee pre-approved all of the services provided by the independent registered public accountants during the fiscal years 2005 and 2006. Following are the material elements of the Audit Committee’s pre-approval policies and procedures:

Audit Services and Fees: Annually, the Audit Committee will review and approve 100% of the audit services and estimated audit fees for the following year. The projections are updated quarterly and the Audit Committee will consider and, if appropriate, pre-approve any amounts exceeding the original estimates.

18

Non-Audit Services and Fees: Annually, and otherwise as necessary, the Audit Committee will review and pre-approve 100% of the non-audit services and estimated audit fees for such services. For recurring services, such as tax compliance and statutory filings the Audit Committee will review and approve the services and estimated total fees for such matters by category and location of service. The projections are updated quarterly and the Audit Committee will consider and, if appropriate, pre-approve any amounts exceeding the original estimates. For non-recurring services such as special tax projects, due diligence or other consulting, the Audit Committee will review and pre-approve the services and the estimated fees by individual project. The projections are updated quarterly and the Audit Committee will pre-approve any amounts exceeding the original estimates.

Should an engagement need pre-approval before the next Committee meeting, authority to grant such approval is delegated to the Audit Committee Chairman (or if he were unavailable, another Audit Committee member). Such approval would be reviewed with the entire Audit Committee at the next meeting.

The Audit Committee has considered whether the provision of the services described under All Other Fees above is compatible with maintaining Deloitte & Touche’s independence and has determined that such services have not adversely affected Deloitte & Touche’s independence.

19

PART IV

Item 15—Exhibits and financial statement schedules

(a) The following documents are filed as a part of this Report:

| | |

Exhibit

Number | | |

| 31.1 | | Certification of Chairman, President and Chief Executive Officer of NetManage, Inc. pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

| 31.2 | | Certification of Vice President, Finance and Chief Financial Officer of NetManage, Inc. pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

| 32.1 | | Certification of Chairman, President and Chief Executive Officer of NetManage, Inc. pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| |

| 32.2 | | Certification of Vice President, Finance and Chief Financial Officer of NetManage, Inc. pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

20

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | NETMANAGE, INC. (REGISTRANT) |

| | |

| Date: April 30, 2007 | | By | | /s/ Zvi Alon |

| | | | Chairman, President and Chief Executive Officer |

21

EXHIBIT INDEX

| | |

Exhibit

Number | | |

| 31.1 | | Certification of Chairman, President and Chief Executive Officer of NetManage, Inc. pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

| 31.2 | | Certification of Vice President, Finance and Chief Financial Officer of NetManage, Inc. pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

| 32.1 | | Certification of Chairman, President and Chief Executive Officer of NetManage, Inc. pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| |

| 32.2 | | Certification of Vice President, Finance and Chief Financial Officer of NetManage, Inc. pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |