Annual Shareholders Meeting The Inn at New Hyde Park May 16, 2012 Long Island’s Premier Community Bank ASTORIA FINANCIAL CORPORATION

2 Forward Looking Statement Forward Looking Statement Forward Looking Statement This presentation may contain a number of forward -looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Secur ities Exchange Act of 1934, as amended. These statements may be identified by the use of the words “anticipate,”“believe,”“could,”“estimate,”“expect,”“intend,”“may,” “outlook,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” and similar terms and phrases, including references to assumptions. Forward-looking statements are based on various assumptions and analyses made by us in light of our management ’s experience and perception of historical trends, current condit ions and expected future developments, as well as other factors we believe are appropriat e under the circumstances. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors (many of which are beyond our control) that could cause actual results to differ materially fr om future results expressed or implied by such forward - looking statements. These factors include, without limitation, the following: the timing and occurrence or non-occurrence of events may be subject to circumstances beyond our control; th ere may be increases in competitive pressure among financial institutions or from non -financial institutions; changes in the interest rate environment may reduce interest margins or affect the value of our investments; changes in depos it flows, loan demand or real estate values may adversely affect our business; changes in accounting principles,policies or guidelines may cause our financial condition to be perceived differently; general economic conditions, either nationally or locally in some or all areas in which we do business, or conditions in the real estate or securities markets or the banking industry may be less favorable than we currently anticipate; legislative or regulatory changes, includi ng the implementation of the Dodd -Frank Wall Street Reform and Consumer Protection Act of 2010 and any actions regar ding foreclosures, may adversely affect our business; transition of our regulatory supervisor from the Office of Thrift Supervision to the Office of the Comptroller of the Currency; effects of changes in existing U.S. government or government-sponsored mortgage programs; technological changes may be more difficult or expensive than weanticipate; success or consummation of new business initiatives may be more difficult or expensive than we anticipate; or litigation or other matters before regulatory agencies, whether currently existing or commencing in the future, may be d etermined adverse to us or may delay occurrence or non-occurrence of events longer than we anticipate. We have no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document.

3 Corporate Profile Corporate Profile Corporate Profile • $17.1 billion in assets • $13.4 billion in loans • $11.1 billion in deposits • 6.4% deposit market share in Long Island market (1) ─ Largest thrift depository • Insider & ESOP stock ownership: 17% (2) • Well capitalized All figures in this presentation are as of March 31, 2012, except as noted. (1) Deposit market share data as of June 30, 2011. (2) Excludes stock options. NYSE: AF

4 2011 Financial Highlights 2011 Financial Highlights 2011 Financial Highlights Operations • Low cost savings, money market and checking account deposits increased $910.7 million, or 19%, from December 31, 2010, to $5.7 billion, or 51%of total deposits. • Residential portfolio originations of $3.5 billion for 2011 • Multi-family/CRE originations of $204.0 million for 2011 Asset Quality • Total non-performing loans decreased $57.8 million, or 15%, from December 31, 2010 to $332.9 million • Total REO decreased $15.7 million, or 25%, from December 31, 2010, to $48.1 million

5 1Q12 Financial Highlights 1Q12 Financial Highlights 1Q12 Financial Highlights Operations •Low cost savings, money market and checking account deposits increased $176.1 million, or 12% annualized, from December 31, 2011 to $5.9 billion, or 53% of total deposits •Residential portfolio originations of $880.4 million for the first quarter 2012 •Multi-family/CRE loan originations for portfolio totaled $344.3 million, up 70% from 2011 fourth quarter •Multi-family/CRE loan pipeline increased 101% from December 31, 2011 to $798.6 million Asset Quality •Early stage loan delinquencies (30-89 days) declined $52.2 million, or 24%, from December 31, 2011 to $163.3 million •Total loan delinquencies (30 days or more past due) and real estate owned, net, declined $37.6 million, or 6%, from December 31, 2011, to $558.8million

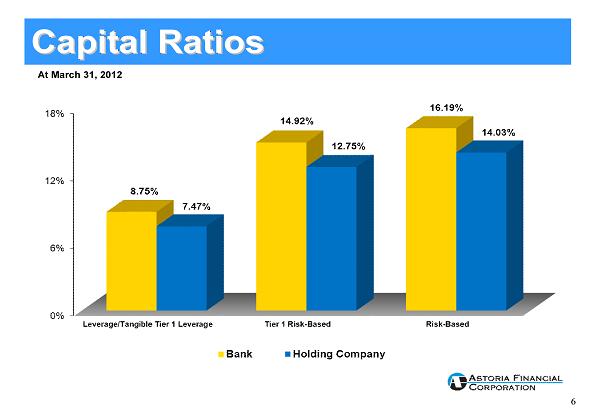

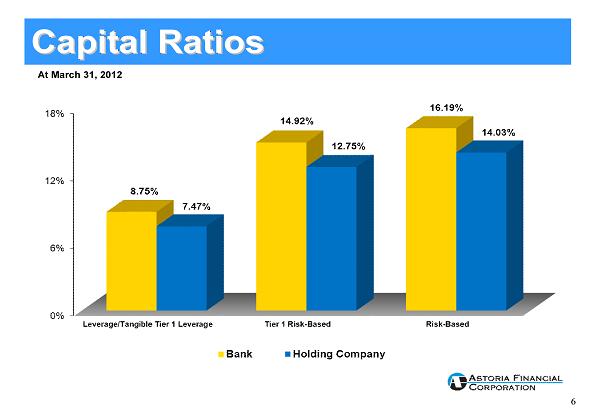

6 Capital Ratios Capital Ratios Capital Ratios At March 31, 2012

7 Core Competency Core Competency Core Competency •Mortgage Lending ─ Portfolio lender, not a mortgage banker xResidential lending expertise xMulti-family and CRE lending expertise ─ Solid asset quality •Retail Banking ─ Premier community bank on Long Island ─ Dominant deposit market share ─ #1 thrift depository in core market, #4 among all banks

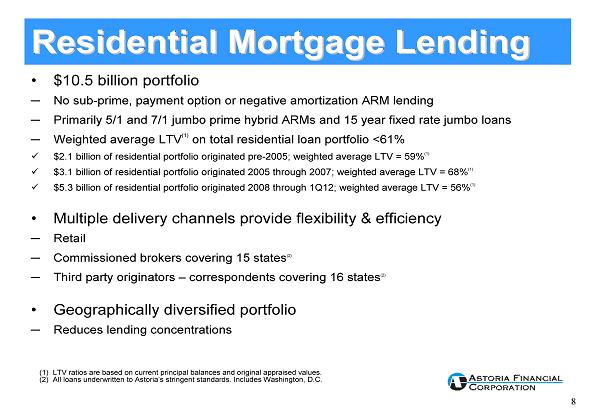

8 Residential Mortgage Lending Residential Mortgage Lending Residential Mortgage Lending • $10.5 billion portfolio ─ No sub-prime, payment option or negative amortization ARM lending ─ Primarily 5/1 and 7/1 jumbo prime hybrid ARMs and 15 year fixed rate jumbo loans ─ Weighted average LTV (1) on total residential loan portfolio <61% x $2.1 billion of residential portfolio originated pre-2005; weighted average LTV = 59% (1) x $3.1 billion of residential portfolio originated 2005 through 2007; weighted average LTV = 68% (1) x $5.3 billion of residential portfolio originated 2008 through 1Q12; weighted average LTV = 56% (1) • Multiple delivery channels provide flexibility & efficiency ─ Retail ─ Commissioned brokers covering 15 states (2) ─ Third party originators –correspondents covering 16 states (2) • Geographically diversified portfolio ─ Reduces lending concentrations (1) LTV ratios are based on current principal balances and original appraised values. (2) All loans underwritten to Astoria’s stringent standards. Includes Washington, D.C.

9 Multi-family/Commercial Real Estate Portfolio Multi Multi - - family/Commercial Real Estate Portfolio family/Commercial Real Estate Portfolio • $2.5 billion portfolio ─ Weighted average coupon at March 31, 2012: 5.56% (1) , weighted average LTV < 57% (2) ─ 1Q12 originations of $344.3 million, average loan amount = $3.4 million with a weighted average LTV at origination of 52% • Approximately 70% of multi-family portfolio originated prior to 2011 is subject to rent control or rent stabilization. Approximately 90% of multi- family closed and pipeline loans are subject to rent control or rent stabilization • Resumed originating loans in 3Q11 ─ Pipeline of $798.6 million at March 31, 2012 with average couponof 3.68%, and average loan size of $3.1 million ─ Focus: x Rent controlled, rent stabilized apartments in New York City x $3 -$5 million in size (1) Excludes non-performing loans. (2) Based on current principal balances and original appraised values.

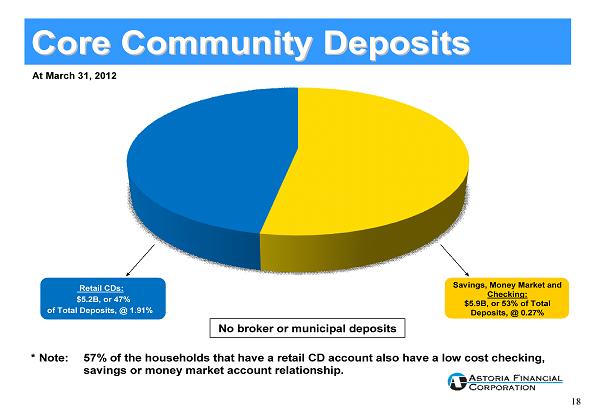

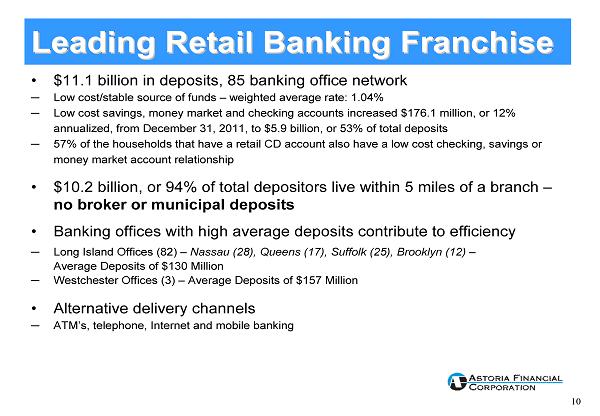

10 Leading Retail Banking Franchise Leading Retail Banking Franchise Leading Retail Banking Franchise • $11.1 billion in deposits, 85 banking office network ─ Low cost/stable source of funds –weighted average rate: 1.04% ─ Low cost savings, money market and checking accounts increased $176.1 million, or 12% annualized, from December 31, 2011, to $5.9 billion, or 53% of total deposits ─ 57% of the households that have a retail CD account also have a low cost checking, savings or money market account relationship • $10.2 billion, or 94% of total depositors live within 5 miles ofa branch – no broker or municipal deposits • Banking offices with high average deposits contribute to efficiency ─ Long Island Offices (82) –Nassau (28), Queens (17), Suffolk (25), Brooklyn (12) – Average Deposits of $130 Million ─ Westchester Offices (3) –Average Deposits of $157 Million • Alternative delivery channels ─ ATM’s, telephone, Internet and mobile banking

11 TOTAL 4 COUNTY POPULATION: 7,598,823 Exceeds population of 38 individual U.S. states Overall LI Deposit Share Ranking: #1-all thrifts, #4-all banks Sources: FDIC Summary of Deposits (as of June 30, 2011) SNL Financial LC Kings County (Brooklyn) Population: 2,521,808 Median household income: $38,578 Deposits: $1.3 billion Branches: 12 Market share: 4% Rank: #1 thrift, #7 all banks Queens County Population: 2,240,310 Median household income: $52,935 Deposits: $2.6 billion Branches: 17 Market share: 6% Rank: #1 thrift, #5 all banks Nassau County Population: 1,341,439 Median household income: $92,674 Deposits: $4.4 billion Branches: 28 Market share: 8% Rank: #1 thrift, #5 all banks Suffolk County Population: 1,495,266 Median household income: $82,593 Deposits: $2.5 billion Branches: 25 Market share: 7% Rank: #1 thrift, #5 all banks Well Positioned in Key Markets Long Island Powerhouse Long Island Powerhouse Long Island Powerhouse

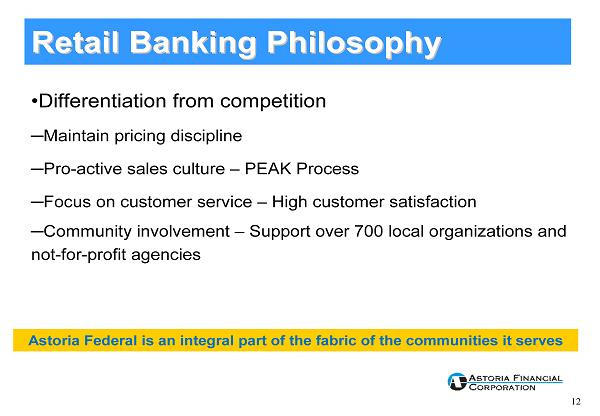

12 Retail Banking Philosophy Retail Banking Philosophy Retail Banking Philosophy •Differentiation from competition ─Maintain pricing discipline ─Pro-active sales culture –PEAK Process ─Focus on customer service –High customer satisfaction ─Community involvement –Support over 700 local organizations and not-for-profit agencies Astoria Federal is an integral part of the fabric of the communities it serves

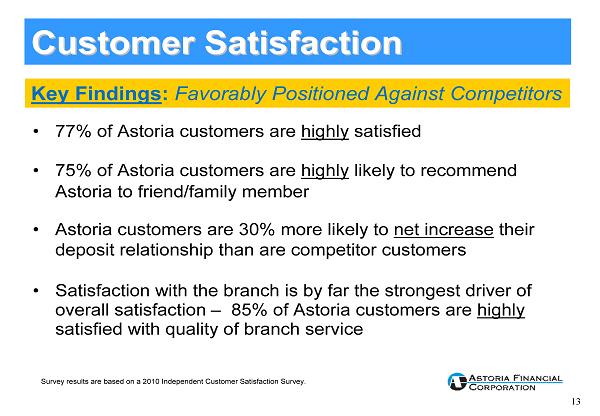

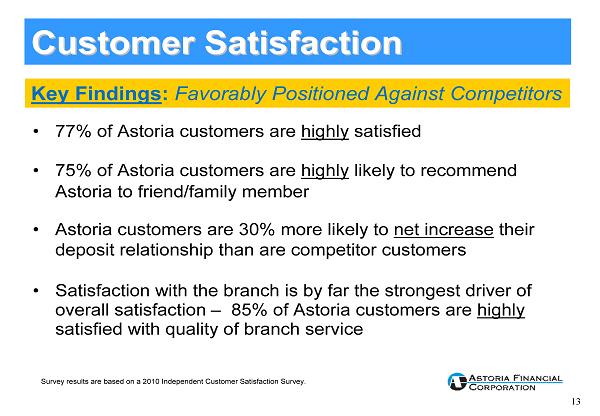

13 Customer Satisfaction Customer Satisfaction Key Findings: Favorably Positioned Against Competitors • 77% of Astoria customers are highlysatisfied • 75% of Astoria customers are highlylikely to recommend Astoria to friend/family member • Astoria customers are 30% more likely to net increasetheir deposit relationship than are competitor customers • Satisfaction with the branch is by far the strongest driver of overall satisfaction– 85% of Astoria customers are highly satisfied with quality of branch service Survey results are based on a 2010 Independent Customer Satisfaction Survey.

14 Key Initiatives • Education First ─ Supports lifelong learning, promotes savings and provides meaningful financial solutions to improve the way our customers live and the neighborhoods we serve • Neighborhood Outreach ─ Through funding and volunteer efforts, supports over 700 community-based organizations and not-for-profit agencies that enrich the communities within our market area ─ Reinforces community involvement by promoting neighborhood news and events in our local community branches • Results/Recognition ─ Seven consecutive “Outstanding”Community Reinvestment Act ratings by our primary banking regulator Astoria Federal is an integral part of the fabric of the communities it serves Community Involvement Community Involvement

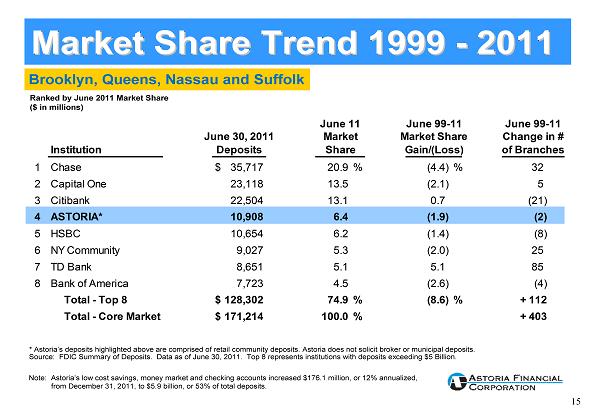

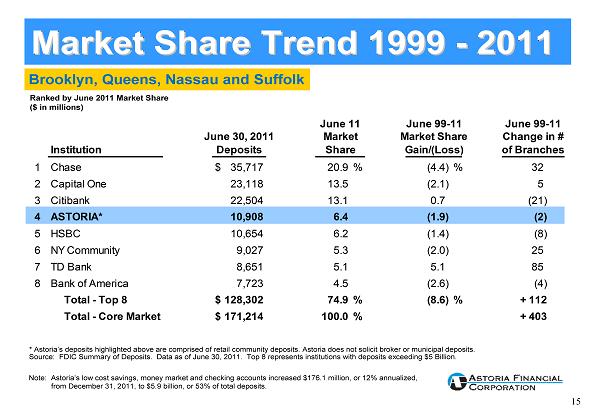

15 Brooklyn, Queens, Nassau and Suffolk June 11 June 99-11 June 99-11 June 30, 2011 Market Market Share Change in # Institution Deposits Share Gain/(Loss) of Branches 1 Chase $ 35,717 20.9% (4.4)% 32 2 Capital One 23,118 13.5 (2.1) 5 3 Citibank 22,504 13.1 0.7 (21) 4 ASTORIA* 10,908 6.4 (1.9) (2) 5 HSBC 10,654 6.2 (1.4) (8) 6 NY Community 9,027 5.3 (2.0) 25 7 TD Bank 8,651 5.1 5.1 85 8 Bank of America 7,723 4.5 (2.6) (4) Total - Top 8 $128,302 74.9% (8.6)% + 112 Total - Core Market $171,214 100.0% + 403 Ranked by June 2011 Market Share ($ in millions) * Astoria’s deposits highlighted above are comprised of retail community deposits. Astoria does not solicit broker or municipal deposits. Source: FDIC Summary of Deposits. Data as of June 30, 2011. Top 8 represents institutions with deposits exceeding $5 Billion. Note: Astoria’s low cost savings, money market and checking accounts increased$176.1 million, or 12% annualized, from December 31, 2011, to $5.9 billion, or 53% of total deposits. Market Share Trend 1999 -2011 Market Share Trend 1999 Market Share Trend 1999 - - 2011 2011

16 • Operating Efficiency • Margin •Growth Current Focus Current Focus Current Focus

17 Poised for Growth Poised for Growth Poised for Growth • Assets: ─ Multi-family/CRE loan originations totaled $344.3 million for 1Q12 ─ Multi-family/CRE loan pipeline increased 101% from December 31, 2011 to $798.6 million • Liabilities: ─ Low cost savings, money market and checking account deposits increased $176.1 million, or 12% annualized, from December 31, 2011 to $5.9 billion, or 53% of total deposits. Continue with personal and business checking marketing campaigns

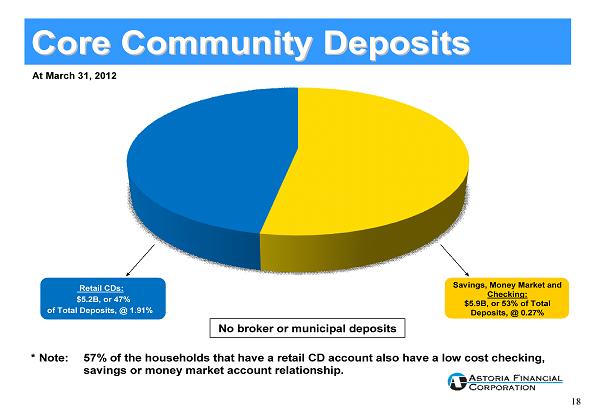

18 Savings, Money Market and Checking: $5.9B, or 53% of Total Deposits, @ 0.27% Retail CDs: $5.2B, or 47% of Total Deposits, @ 1.91% At March 31, 2012 No broker or municipal deposits Core Community Deposits Core Community Deposits * Note: 57% of the households that have a retail CD account also have a low cost checking, savings or money market account relationship.

19 Current Focus Current Focus Current Focus • Growth • Margin •Operating Efficiency

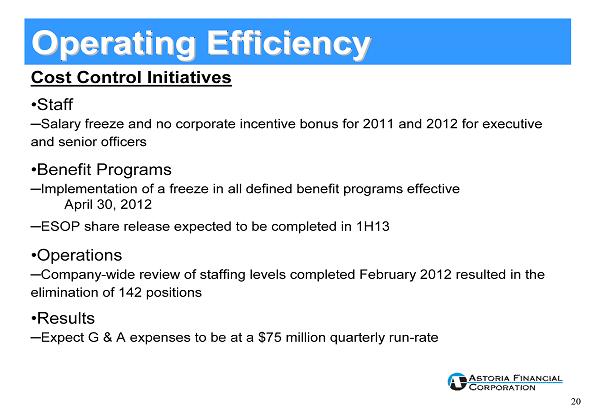

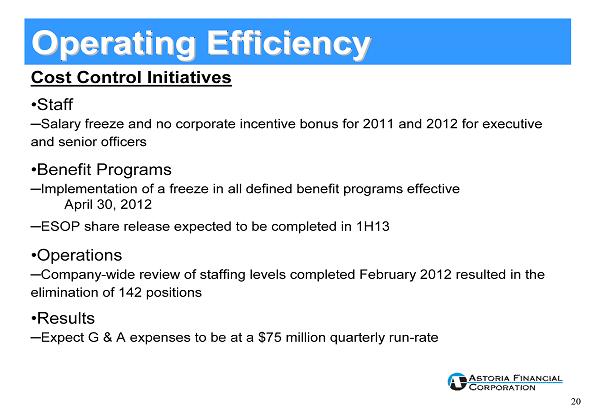

20 Operating Efficiency Operating Efficiency Operating Efficiency Cost Control Initiatives •Staff ─Salary freeze and no corporate incentive bonus for 2011 and 2012for executive and senior officers •Benefit Programs ─Implementation of a freeze in all defined benefit programs effective April 30, 2012 ─ESOP share release expected to be completed in 1H13 •Operations ─Company-wide review of staffing levels completed February 2012 resulted in the elimination of 142 positions •Results ─Expect G & A expenses to be at a $75 million quarterly run-rate

21 Current Focus Current Focus • Growth • Operating Efficiency •Margin

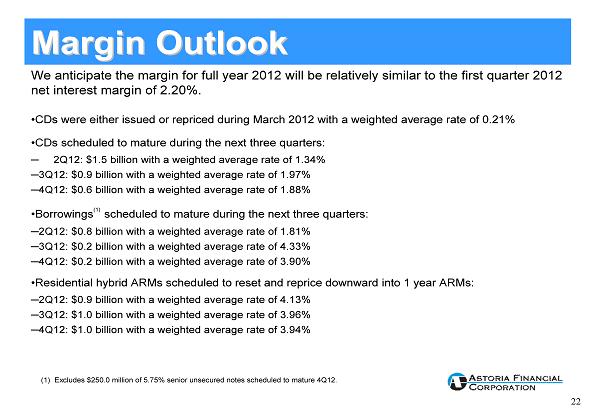

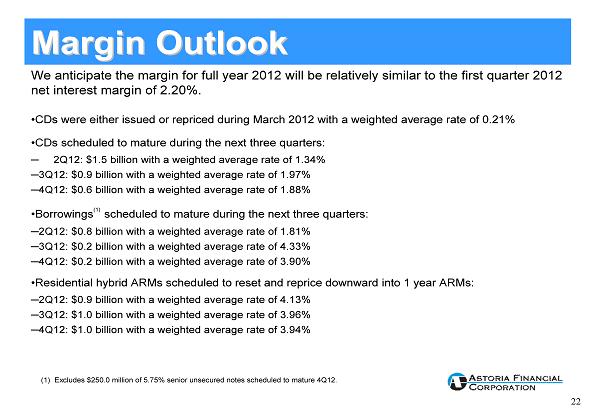

22 Margin Outlook Margin Outlook We anticipate the margin for full year 2012 will be relatively similar to the first quarter 2012 net interest margin of 2.20%. •CDs were either issued or repriced during March 2012 with a weighted average rate of 0.21% •CDs scheduled to mature during the next three quarters: ─ 2Q12: $1.5 billion with a weighted average rate of 1.34% ─3Q12: $0.9 billion with a weighted average rate of 1.97% ─4Q12: $0.6 billion with a weighted average rate of 1.88% •Borrowings (1) scheduled to mature during the next three quarters: ─2Q12: $0.8 billion with a weighted average rate of 1.81% ─3Q12: $0.2 billion with a weighted average rate of 4.33% ─4Q12: $0.2 billion with a weighted average rate of 3.90% •Residential hybrid ARMs scheduled to reset and reprice downward into 1 year ARMs: ─2Q12: $0.9 billion with a weighted average rate of 4.13% ─3Q12: $1.0 billion with a weighted average rate of 3.96% ─4Q12: $1.0 billion with a weighted average rate of 3.94% (1) Excludes $250.0 million of 5.75% senior unsecured notes scheduled to mature 4Q12.

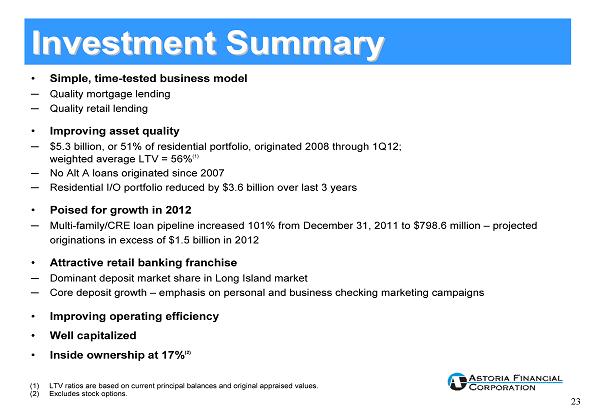

23 • Simple, time-tested business model ─ Quality mortgage lending ─ Quality retail lending • Improving asset quality ─ $5.3 billion, or 51% of residential portfolio, originated 2008 through 1Q12; weighted average LTV = 56% (1) ─ No Alt A loans originated since 2007 ─ Residential I/O portfolio reduced by $3.6 billion over last 3 years • Poised for growth in 2012 ─ Multi-family/CRE loan pipeline increased 101% from December 31, 2011 to $798.6 million –projected originations in excess of $1.5 billion in 2012 • Attractive retail banking franchise ─ Dominant deposit market share in Long Island market ─ Core deposit growth –emphasis on personal and business checking marketing campaigns • Improving operating efficiency • Well capitalized • Inside ownership at 17% (2) (1) LTV ratios are based on current principal balances and original appraised values. (2) Excludes stock options. Investment Summary Investment Summary

24 Contact Information Contact Information Web site: www.astoriafederal.com Email: ir@astoriafederal.com Telephone: (516) 327-7869 Address: Astoria Financial Corporation Attn: Investor Relations One Astoria Federal Plaza Lake Success, NY 11042