UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

F O R M 2 0 - F/A

£ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES EXCHANGE ACT OF 1934

OR

T ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from __________ to ______________

Commission file number 0-22216

CANADIAN ZINC CORPORATION

(Exact name of Company as specified in its charter)

Not applicable

(Translation of Company’s name into English)

Province of British Columbia, Canada

(Jurisdiction of incorporation or organization)

650 West Georgia Street, Suite 1710, Vancouver, British Columbia, V6B 4N9

(Address of principal executive offices)

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| None | | |

Securities to be registered pursuant to Section 12(g) of the Act:

Common Shares without par value |

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

(Title of Class)

Indicate the number of outstanding shares of each of the Company’s classes of capital or common stock as of the close of the period covered by the Annual Report:

| 107,590,212 Common Shares as at December 31, 2006 |

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 12 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark which financial statement item the Company has elected to follow:

(APPLICABLE ONLY TO COMPANYS INVOLVED IN BANKRUPTCY PROCEEDING DURING THE PAST FIVE YEARS)

Indicate by check mark whether the Company has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes £ | No £ | Not Applicable T |

The information set forth in this Annual Report on Form 20-F is as at December 31, 2006 unless an earlier or later date is indicated.

Financial information is presented in accordance with accounting principles generally accepted in Canada. Significant measurement differences between accounting principles generally accepted in Canada and in the United States, as applicable to the Company, are set forth in Item 5 of this Annual Report and in Note 13 to the accompanying Financial Statements of the Company.

Statements in this Annual Report regarding expected completion dates of feasibility studies, anticipated commencement dates of mining or metal production operations, projected quantities of future metal production and anticipated production rates, operating efficiencies, costs and expenditures are forward-looking statements. Actual results could differ materially depending upon the availability of materials, equipment, required permits or approvals and financing, the occurrence of unusual weather or operating conditions, the accuracy of reserve estimates, lower than expected ore grades or the failure of equipment or processes to operate in accordance with specifications. See “Risk Factors” for other factors that may affect the Company’s future financial performance.

FORM 20-F ANNUAL REPORT

FISCAL YEAR ENDED DECEMBER 31, 2006

TABLE OF CONTENTS

EXPLANATORY NOTE TO FORM 20-F/A

This note is to certify that in the previously filed Form 20-F filed May 29, 2007, being Exhibit 19.2 and 19.3 were inadvertently filed incorrectly. The omission has been corrected in the filing of this Amended Form 20-F.

No amendments have been made to the content of the Form 20-F and that this corrected filing is solely intended to correct the above filing error.

PART I

This Form 20-F is being filed as an Annual Report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

This Form 20-F is being filed as an Annual Report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

A. Selected Financial Data

The following selected financial data of the Company for 2006, 2005 2004, 2003 and 2002, expressed in accordance with United States generally accepted accounting principles (U.S. GAAP) are derived from the financial statements of the Company, which have been prepared in accordance with Canadian generally accepted accounting principles (Canadian GAAP), the application of which, in the case of the Company, conforms in all material respects for the periods presented with U.S. GAAP, except as referred to in Note 13 to the financial statements.

The selected financial data should be read in conjunction with the financial statements and other financial information included elsewhere in this Annual Report.

Selected Financial Data

(CDN$ in 000, except per share data)

Information in Accordance with U.S. GAAP

| | Year | Year | Year | Year | Year |

| | Ended | Ended | Ended | Ended | Ended |

| | Dec 31/06 | Dec 31/05 | Dec 31/04 | Dec 31/03 | Dec 31/02 |

| Net income (loss) | (9,615) | (3,633) | (3,038) | (1,155) | (1,296) |

| Net income (loss) per Share | (0.10) | (0.05) | (0.05) | (0.03) | (0.04) |

| Wgt. Avg. No. Shares | 94,735 | 71,378 | 67,175 | 39,889 | 33,549 |

| Dividends Per Share | 0 | 0 | 0 | 0 | 0 |

| Working Capital | 29,142 | 16,040 | 12,758 | 13,186 | (5) |

| Prairie Creek Mine Prop. | 4,800 | 4,723 | 4,822 | 3,470 | 3,250 |

| Current Liability | 464 | 48 | 175 | 209 | 77 |

| Additional paid in capital | 66,492 | 46,096 | 39,375 | 36,523 | 22,011 |

| Shareholders' Equity | 30,353 | 19,572 | 16,485 | 16,671 | 3,383 |

| Total Assets | 34,862 | 20,923 | 17,888 | 16,998 | 3,460 |

The following selected financial data of the Company for 2006, 2005, 2004, 2003 and 2002, prepared in accordance with Canadian GAAP are derived from the financial statements of the Company, which have been prepared in accordance with Canadian GAAP.

Selected Financial Data

(CDN$ in 000, except per share data)

Information in Accordance with Canadian GAAP

| | Year | Year | Year | Year | Year |

| | Ended | Ended | Ended | Ended | Ended |

| | Dec 31/06 | Dec 31/05 | Dec 31/04 | Dec 31/03 | Dec 31/02 |

| Net income (loss) | (1,486) | (1,967) | (679) | (905) | (937) |

| Net income (loss) Per Share | (0.02) | (0.03) | (0.01) | (0.02) | (0.03) |

| Wgt. Avg. No. Shares | 94,735 | 71,378 | 67,175 | 39,889 | 33,548 |

| Working Capital | 29,142 | 16,040 | 12,758 | 13,130 | (6) |

| Prairie Creek Mine Prop. | 26,700 | 18,495 | 16,928 | 13,216 | 12,746 |

| Current Liability | 464 | 48 | 175 | 209 | 77 |

| Shareholders' Equity | 53,784 | 33,344 | 28,591 | 26,417 | 12,879 |

| Total Assets | 56,762 | 34,695 | 29,994 | 26,745 | 12,956 |

In this Annual Report on Form 20-F, unless otherwise specified, all monetary amounts are expressed in Canadian dollars. On December 31, 2006 the exchange rate, based on the noon buying rate published by The Bank of Canada, for the conversion of Canadian dollars into United States dollars (the “Noon Rate of Exchange”) was 1.17.

The following table sets out the high and low exchange rates for each of the last six months.

| | April | March | February | January | December | November |

| High for period | 1.16 | 1.18 | 1.18 | 1.18 | 1.38 | 1.14 |

| Low for period | 1.10 | 1.15 | 1.16 | 1.16 | 1.16 | 1.13 |

| | Year ended December 31 |

| | 2006 | 2005 | 2004 | 2003 | 2002 |

| Average for the period | 1.13 | 1.21 | 1.30 | 1.40 | 1.57 |

B. Capitalization and Indebtedness

This Form 20-F is being filed as an Annual Report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

C. Reasons For The Offer and Use of Proceeds

This Form 20-F is being filed as an Annual Report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

D. Risk Factors

The following is a brief discussion of those distinctive or special characteristics of the Company’s operations and industry which may have a material impact on, or constitute risk factors in respect of, the Company’s future financial performance. A more detailed discussion is described in Section 3 of the Company’s Annual Information Form dated March 30, 2007 filed as Exhibit 15.A hereto and incorporated herein by reference.

Political and Legislative

Canadian Zinc conducts its operations in the Mackenzie Valley in the Northwest Territories of Canada in an area which is claimed by the Deh Cho First Nations as their traditional territory. No land claim settlement agreement has been reached between Canada and the Deh Cho and title to the land is in dispute. The Company’s operations are potentially subject to a number of political and legislative risks and the Company is not able to determine the impact of these risks on its business. The Company’s operations and exploration activities are subject to extensive federal, provincial, territorial and local laws and regulations. Such laws and regulations are subject to change and can become more stringent and costly over time.

In 2000 there was a major change to the legislative and regulatory framework and regulations in the Mackenzie Valley. There can be no assurance that these laws and regulations will not change in the future in a manner that could have an adverse effect on the Company’s activities and financial condition.

Permitting and Environment

The Prairie Creek Project is located in an environmentally sensitive remote area in the Mackenzie Mountains, within the watershed of the South Nahanni River and in proximity to, but outside, the Nahanni National Park Reserve. The Company is required to obtain various permits to carry on its activities and is subject to various reclamation and environmental conditions. Canadian Zinc does not have all of the permits necessary to operate the Prairie Creek Mine and there can be no assurance that it will be able to obtain those permits or obtain them within a reasonable time. The Company has experienced long delays in obtaining permits to date.

The Company anticipates continuing difficulties with its permitting activities and faces ongoing opposition and legal challenges from certain interests.

Exploration and Development

Exploration for minerals and development of mining operations involve many risks, many of which are outside the Company’s control. In addition to the normal and usual risks of exploration and mining, the Prairie Creek Property is situated in a remote location and does not have the benefit of major infrastructure or easy access.

In accordance with United States Standards of Disclosure for Mineral Projects the Prairie Creek Project would be regarded as being in the exploration stage and under United States Generally Accepted Accounting Principles Canadian Zinc would be regarded as an exploration stage enterprise. The Prairie Creek Project does not have proven or probable mineral reserves as such terms are recognized by the United States Securities and Exchange Commission (see Item 4.D Principal Property - Prairie Creek Property - Northwest Territories - Resource Estimation).

The Resource Estimation uses the terms “measured”, “indicated” and “inferred” mineral resources. While such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize these terms. “Inferred mineral resources” have significant uncertainty as to their existence and as to their economic feasibility. There is significant risk that all or part of an inferred mineral resource may not exist or may not be economically mineable. It cannot be assumed that all or any part

of an inferred mineral resource would ever be upgraded to a higher category. It cannot be assumed that all or any part of measured or indicated resources will ever be converted into mineral reserves.

Under Canadian GAAP, the Company is considered to be a development stage enterprise as it is in the process of developing the Prairie Creek Project towards production. This development plan is based upon a Scoping Study prepared internally by the Company in 2001. A Scoping Study is not a Feasibility Study. The Scoping Study outlined the plan for the development of the Prairie Creek Project based on the historical development and existing infrastructure at the Prairie Creek Property and on the Resource Estimation. The Resource Estimation does not constitute mineable reserves. The historical development was carried out principally in 1980 to 1982 and the infrastructure, including the mill, was constructed in the same period, based on a feasibility study prepared by Kilborn Engineering (Pacific) Limited in 1980. The Kilborn feasibility study is outdated and cannot be relied upon. The existing infrastructure, including the mill, buildings, camp etc. is now twenty-five years old and, although it has been held under care and maintenance, it has lain idle for twenty-five years and was never operated. There is significant risk attaching to the proposed operation of aged equipment.

Metal Prices and Market Sentiment

The prices of metals fluctuate widely and are affected by many factors outside the Company's control. The relative prices of metals and future expectations for such prices have a significant impact on the market sentiment for investment in mining and mineral exploration companies. Metal price fluctuations may be either exacerbated or mitigated by international currency fluctuations which affect the metal price received in terms of the domestic currency in which they are produced. The Company relies on equity financings for its working capital requirements and to fund its exploration, development and permitting activities. The Company does not have sufficient funds to put the Prairie Creek Property into production from its own financial resources. There is no assurance that such financing will be available to the Company, or that it will be available on acceptable terms.

Enforcement of Foreign Judgments

Canadian Zinc is organized under the law of, and headquartered in, British Columbia, Canada, and none of its directors and officers are citizens or residents of the United States. In addition, all of its assets are located outside the United States. As a result, it may be difficult or impossible for an investor to (i) enforce in courts outside the United States judgments against the Company and its directors and officers obtained in United States courts based upon the civil liability provisions of United States federal securities law or (ii) bring in courts outside the United States an original action against the Company and/or its directors and officers to enforce liabilities based upon such United States securities laws.

A. History and Development of the Company

Canadian Zinc Corporation (“the Company” or “CZN”) was incorporated in British Columbia, Canada, on December 16, 1965 under the name "Pizza Patio Management Ltd". The Company changed its name to "San Andreas Resources Corporation" on August 29, 1991 and to "Canadian Zinc Corporation" on May 25, 1999.

The Company's head office, and the registered and records office, is located at Suite 1710, 650 West Georgia Street, Vancouver, British Columbia, Canada V6B 4N9.

The authorized capital of the Company is an unlimited number of common shares without par value of which 107,590,212 shares were issued and outstanding as at December 31, 2006.

The Company is a public company listed on the Toronto Stock Exchange (“TSX”) under the symbol "CZN” and traded in the United States (Other OTC) by the National Association of Securities Dealers Quotation System

under the symbol “CZICF”. In April 2007 the Company’s shares were admitted for quotation on the OTC Bulletin Board under the symbol “OTCBB-CZICF”

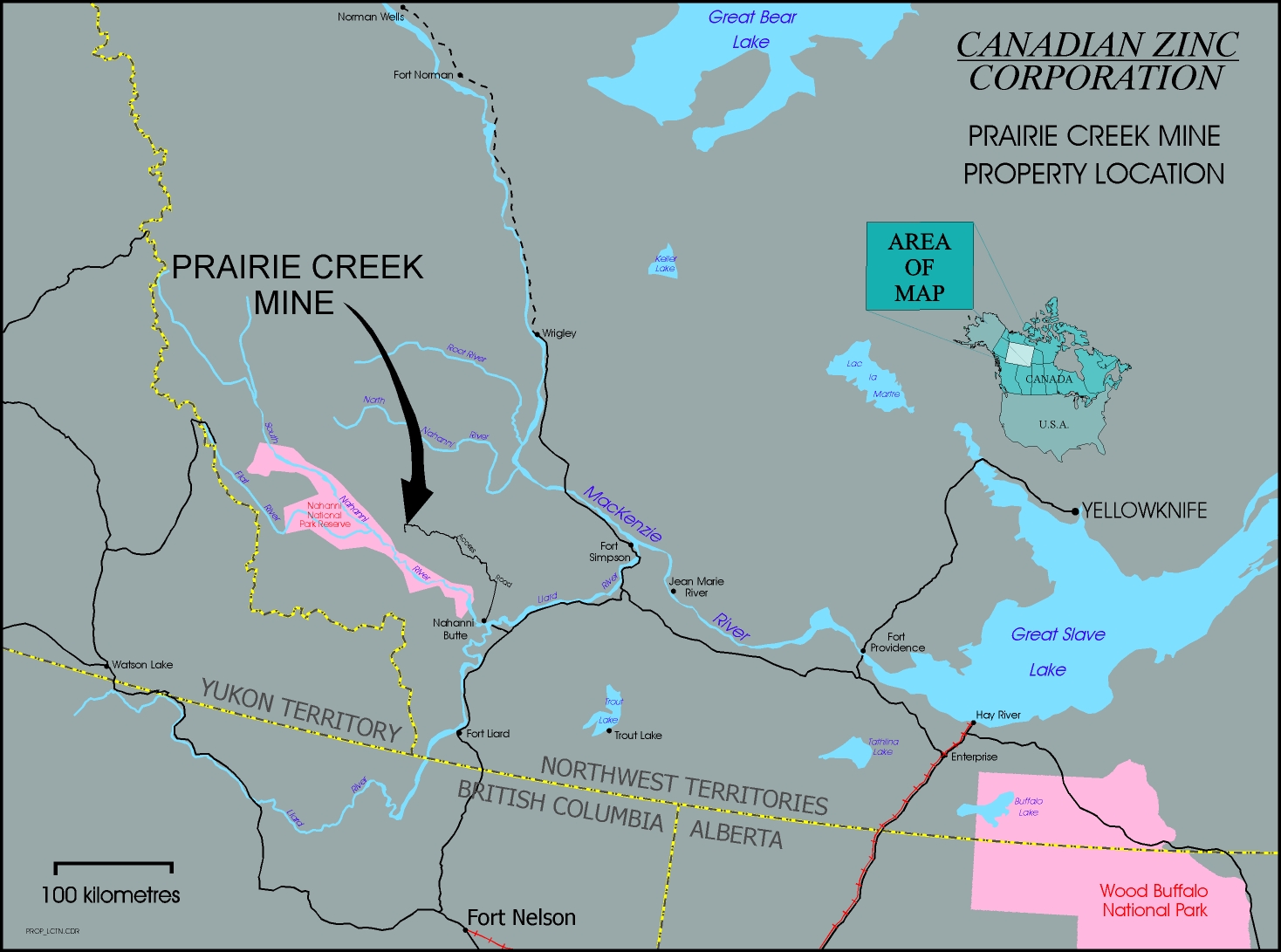

The Company is engaged in the business of exploration and, when warranted, development of natural resource properties. The Company is exploring the Prairie Creek Property and adjacent ground (a zinc/lead/silver property) located approximately 500 kilometers west of Yellowknife in the Northwest Territories, Canada.

For the purposes of the United States regulatory requirements and United States Generally Accepted Accounting Principles the Company is considered to be an exploration stage enterprise.

Pursuant to an August 23, 1991 Option Agreement, the Company entered into an option to acquire a 60% interest in the Prairie Creek Property from Nanisivik Mines Ltd. (an unaffiliated third party). Subsequently, pursuant to a March 29, 1993 Asset Purchase Agreement that superseded the Option Agreement, the Company acquired a 100% interest in the Prairie Creek Property, and a 60% interest in the plant and equipment, subject to a net smelter royalty of 2%, in favour of Titan Pacific Resources Ltd. (“Titan”) with a maximum payout of $8.2 million.

The purchase price for the mineral interests was $3,250,000 paid between 1993 and 1995 in full, in cash and shares. The purchase price was allocated $2,750,000 to the land and $500,000 to the plant and equipment.

In January 2004 the Company completed an agreement with Titan to purchase Titan's interest in the Prairie Creek Mine Property. Under the Agreement, the Company acquired the outstanding 40% interest in the physical plant and equipment at Prairie Creek, which it did not already own, and also repurchased the 2% net smelter royalty interest with a face value of $8.2 million. The consideration was the issue to Titan of 300,000 common shares and 250,000 share purchase warrants exercisable at $1.25 per share until June 22, 2005. The transaction simplified and consolidated the Company's 100% royalty free ownership interest of the Prairie Creek Property.

The Company relies on equity financings to fund its financial commitments. During 2003, the Company completed a number of financings to fund its on going programs, resulting in a total of $15.6 million being raised. During 2004 the Company raised $2,444,625 through the exercise of share purchase warrants and employee stock options. During 2005 the Company raised $5,406,368 through the private placement of shares and the exercise of share purchase warrants. During 2006 the Company raised $22,037,177 (net) through the private placement of shares and the exercise of share purchase warrants and employee stock options.

B. Business Overview

The Company’s principal focus is the exploration and development of the Prairie Creek mine, a large high-grade zinc/lead/silver property located in the Northwest Territories of Canada.

The original discovery of mineralization on the Prairie Creek Property was made in 1928 at the showing known as the "No. 5 Zone". In 1958, a limited mapping program was undertaken by Fort Reliance Minerals Ltd. The claims lapsed in 1965 and were restaked by the prospector and subsequently conveyed to Cadillac Explorations Ltd. ("Cadillac") in 1966. Cadillac also acquired a 182,590 acre prospecting permit. This permit expired in 1969 and 6,659 acres (210 claims) were selected by Cadillac and brought to lease.

During 1966 to 1969, trenching was carried out on a number of zones and underground exploration commenced. The property was optioned to Penarroya Canada Ltee. ("Penarroya") in 1970 and the underground development was extended. Surface drilling and preliminary metallurgical testing was also conducted. Penarroya discontinued their work in late 1970 and Cadillac resumed full operation of the project. Cadillac further developed the underground workings and resampled the crosscuts in 1979.

In 1980 an independent feasibility study was completed by Kilborn Engineering (Pacific) Limited which resulted in a decision to put the property into production. In December 1980, Procan Exploration Company Ltd. ("Procan") (a company associated with Nelson and Bunker Hunt of Texas) agreed to provide financing for construction, mine development and working capital necessary to attain production based on the Kilborn feasibility study. Between 1980 and 1982, extensive mine development took place. Cadillac acquired a 1000-ton per day concentrator and transported it to the minesite. The mill was erected and a camp constructed. Two adits were established and extensive underground development took place. During this time the site was serviced by winter road and over 500 loads of supplies were transported to site. Construction activities continued until May 1982 and were almost complete when they were suspended due to lack of financing. Subsequently Cadillac went into bankruptcy in May 1983 and site maintenance and operations were taken over by Procan.

In 1991, Nanisivik Mines Limited acquired the property through the bankruptcy proceedings. In August 1991, Nanisivik granted the Company an option to earn a 60% interest in the property and in March 1993, the Company acquired a 100% interest in the Prairie Creek Property, subject to a 2% net smelter return royalty in favour of Titan Pacific Resources Ltd. In January 2004 the Company acquired Titan’s 2% royalty and consolidated the Company’s 100% royalty free ownership interest in the Prairie Creek Property.

Between 1991 and 2000 the Company carried out various exploration programs on the Prairie Creek Property.

In January of 2001, the Company completed a Scoping Study designed to outline and guide the re-development of the existing mine and mill on the Prairie Creek Property. The preliminary study indicated the feasibility of a mining and milling operation on the site and identified a number of different development and production scenarios. The operation would utilize the existing mine and mill infrastructure put in place in 1982, but never operated. Indicated capital costs for the new operation were estimated in 2000 to be $40.5 million, including the construction of an all weather access road to the site. The Scoping Study has not been updated.

The Prairie Creek Project is located in an environmentally sensitive remote area in the Mackenzie Mountains, within the watershed of the South Nahanni River and in proximity to, but outside, the Nahanni National Park Reserve. The Company is required to obtain various permits to carry on its activities and is subject to various reclamation and environmental conditions. Canadian Zinc does not have all of the permits necessary to operate the Prairie Creek Mine and there can be no assurance that it will be able to obtain those permits or obtain them within a reasonable time. The Company has experienced long delays in obtaining permits to date. The Company anticipates continuing difficulties with its permitting activities and faces ongoing opposition and legal challenges from certain interests.

Throughout the years 2003 through 2006, the Company’s principal focus was its efforts to advance the Prairie Creek Project towards development, principally in the permitting process. In 2001 the Company applied for two surface exploration drilling permits, an underground exploration permit, a pilot plant metallurgical permit and a permit for use of part of the road from the Property. Following Environmental Assessment the two surface exploration land use permits were issued in 2001. The underground exploration and pilot plant permit applications were referred for Environmental Assessment which lasted throughout all of 2001, 2002 and into June of 2003.

The improvement in metal prices during 2003, including in particular, zinc, lead and silver, enhanced the attractiveness of the Prairie Creek Project. With the general improvement in metal prices, and the investment market for resource companies, during the second half of 2003 the Company completed a number of financings to fund the ongoing permitting, exploration and development of the Prairie Creek Property.

In September 2003, a Land Use Permit and Water Licence for underground exploration and development and for metallurgical testing in a pilot plant were issued to the Company by the Mackenzie Valley Land and Water Board. An appeal to the Federal Court seeking judicial review of the decision of the Water Board to issue the Water Licence was filed in October 2003 by the Deh Cho First Nations and heard by the Court in August 2005.

In December 2005 the Court issued its Judgment directing the Water Board to reissue the Licence containing modified language which had been agreed between the Company and the Minister of Indian and Northern Affairs Canada. The Licence was reissued by the Board in February 2006.

In 2003 the Company submitted a separate application for a Land Use Permit for use of the existing road from the Liard Highway to the mine site and claimed legal exemption from the Environmental Assessment process. The claim for exemption was denied by the Water Board and the Company filed an appeal to the Supreme Court of the Northwest Territories. That Appeal was heard by the Court in December 2004 and in May 2005 the Court issued its Judgment ruling that the proposed development is exempt under the Act from Environmental Assessment. The Land Use Permit was issued in April 2007 and is valid for a period of five years to April 10, 2012.

In the spring of 2004 the Company applied to the Mackenzie Valley Land and Water Board for an amendment to expand the area of the existing surface exploration Land Use Permit. The application was referred for Environmental Assessment and this assessment was conducted by the Mackenzie Valley Impact Review Board throughout 2005, culminating in a decision dated December 20, 2005 in which the Review Board recommended to the Minister of Indian Affairs and Northern Development that the development proceed to the regulatory phase of approvals. On February 3, 2006 the Minister accepted the recommendations of the Review Board and the application was referred back to the Water Board to finalize the terms and conditions of the permit. The Land Use Permit was issued by the Board in May 2006, is valid for a period of five years and permits the Company to conduct exploration, including drilling, anywhere on the Prairie Creek Property.

During 2005 the Company carried out an extensive program of site rehabilitation and maintenance including design of a new water treatment plant, upgrade of fuel facilities and the construction of a new water polishing pond.

During 2006 the Company undertook a major underground exploration and development program driving a new decline about 400 meters within the underground mine, from which a detailed underground drilling program was initiated. A surface exploration program was carried out on Zone 5 about five kilometers south of the minesite.

In 2007 the Company will continue with the development of the Prairie Creek Project, including surface and underground exploration and development. At the same time the ongoing permitting process will continue.

The Company continues to search for projects of merit and has examined a number of opportunities during the year, none of which have come to fruition at this time. The Company will scrutinize all new projects and carry out a thorough investigation of each property, before committing the Company’s capital and resources on any project.

C. Organizational Structure

The Company has no subsidiaries and, to the best of its knowledge, no shareholders holding more than 10% of its issued and outstanding shares.

D. Property, Plant and Equipment

The properties of the Company are in the exploration and development stage only. The Company has no producing properties and has not had any revenue from mining since incorporation. The existing infrastructure, including the mill, buildings, camp etc. is now twenty-five years old and, although it has been held under care and maintenance, it has lain idle for twenty-five years and was never operated.

Principal Property - Prairie Creek, Northwest Territories

The Prairie Creek Property consists of a 100% interest in the mining leases, surface leases and staked mineral claims described below.

The Prairie Creek Property is comprised of:

| · | Mining Leases Numbers 2854, 2931, 2932, 2933, 3313, 3314, 3315, and 3338; (8,749.4 acres, expiring from July 13, 2010 to August 5, 2020). |

| · | Surface Leases Numbers 95 F/10-5-5 and 95 F/10-7-4; (325.81 acres). The Surface Leases are held from the Department of Indian Affairs and Northern Development and expire March 31, 2012. |

| · | Mineral Claims: Four additional mineral claims, referred to as the Gate Claims, were staked in 1999 in the vicinity of the Prairie Creek Property. These claims consist of the Gate 1-4 Claims covering an area of 9,245.35 hectares. Sufficient assessment work has been filed on these claims to hold them in good standing until July 19, 2007. Six additional mineral claims Way 1-6 covering an area of 10,196.18 acres were staked in 2006 adjacent to existing mining leases or mineral claims to enlarge the size of the Prairie Creek property and are in good standing until November 11, 2008. |

All of the above leases and claims are in good standing at the date hereof.

The Prairie Creek Mine is located on land claimed by the Nahanni Butte Dene Band of the Deh Cho First Nations (“DCFN”) as their traditional territory. The DCFN are engaged in ongoing land settlement negotiations with the Government of Canada and the Government of the Northwest Territories in what is referred to as the Deh Cho Process. [Refer to Section D.10 on First Nations below].

In July 2003, as part of the Interim Measures Agreement between Canada and the DCFN as part of the Deh Cho Process, Canada made an interim withdrawal of certain lands for a period of five years. Part of the lands withdrawn under the interim withdrawal order include the area represented by the Company’s Mining Lease No. 2854, a portion of Mining Leases No. 2931, 3314 and 3313 and part of the area over which the road that connects the Property to the highway passes. In accordance with Sections 19 and 23 of the Interim Measures Agreement such withdrawal is subject to the continuing exercise of existing rights, titles, interests, entitlements, licences, permits, reservations, benefits and privileges and does not affect access to or across withdrawn land

2. Location, Access and Climate

The Prairie Creek Property is situated approximately 500 kilometers west of Yellowknife, the administrative centre of the Northwest Territories.

Year round access to the Property is provided by aircraft to a 3000-foot gravel airstrip immediately adjacent to the camp. The Prairie Creek Property was also accessible by road which extends from the Property to the Liard Highway, a distance of 170 kilometers and which was originally permitted for use in the winter months throughout its full length and for year round use for the first 40 kilometers out from the mine site. In April 2007 the Company received a five year permit to use the road in the winter months. The road needs to be re-established. The Liard Highway is the major north-south transportation route, which connects Fort Nelson, British Columbia to Fort Simpson, Northwest Territories.

The climate is sub-Arctic, being characterized by long cold winters with pleasant summers. Snowfall is moderate and only minor difficulty has been experienced in operating throughout the winter months.

| 3. | Property Geological Summary |

Three distinct styles of base metal mineralization have so far been discovered on the Property: Vein, Stratabound and Mississippi Valley-type (“MVT”). The Vein and Stratabound styles of mineralization occur within the Prairie Creek embayment feature in a Siluro-Ordovician sedimentary sequence. The majority of the current mineral resource reports to Vein mineralization and occurs in a crosscutting steeply east dipping fault with a northerly strike. The remainder of the current mineral resource occurs as Stratabound massive sulphides, which were discovered proximal to the Vein mineralization. The close proximity of the two styles of deposit may indicate a somewhat similar genetic origin. MVT zinc/lead mineralization is exposed in the northern portion of the property within a carbonate sequence that is marginal to the paleo-embayment feature.

The principal Vein structure at Prairie Creek cuts through Ordovician age dolostones and graphitic shales of the Whittaker and Road River Formations. The Prairie Creek vein deposit is estimated to contain a measured and indicated historical mineral resource of 2.3 million tonnes grading 12.5% zinc (Zn), 12.2% lead (Pb), 190 g/tonne silver (Ag) and 0.4% copper (Cu) with additional inferred resources of 8.1 million tonnes grading 12.9% Zn, 10.5% Pb, 171 g/t Ag, and 0.4% Cu.

The distinctly different style of mineralization, termed Stratabound, was encountered by the Company in 1992 during deeper drilling near the Vein. The Stratabound mineralization presently consists of a measured and indicated historical mineral resource of 1.3 million tonnes grading 10.6% Zn, 5.2% Pb and 56 g/tonne Ag. This style of deposit is found, so far, wholly within the Upper Whittaker Formation dolostones. Stratabound sphalerite-galena-pyrite sulphides occur predominately in a subunit of the Whittaker, termed the Mottled Horizon, located approximately 200 meters below the present mill level (870) underground workings.

The above historical resource estimate was calculated by MRDI in 1998 and was not prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects and does not comply with United States Standards for disclosure of mineral projects. [See section 6. “Resource Estimation” below].

Since 1991, the Company has completed over 47,000 meters of surface diamond drilling and an underground sampling program which has greatly expanded the inventory of known resources on the Property. In 2006 a new underground drilling program was initiated and approximately 1,800 meters of drilling had been completed by year end. This program is ongoing and will continue into mid 2007.

The Vein-type deposit remains open ended to the north and south of the current Zone 3 resource, which is defined over only 2.5 kilometers of the 16-kilometer prospective corridor. The discovery in 1992 of Stratabound type mineralization in the Main Zone opened up multiple exploration targets for the discovery of further Stratabound deposits. Potential for significant increases in Stratabound mineralization exist throughout the Property. Drilling so far has been somewhat restricted by topography limiting the areas of potential mineralization that can be drilled. A limited surface drilling program totaling 600 meters was conducted on Zone 8, located about five kilometers south of the mine site, in 2006.

With many Vein occurrences exposed throughout the length of the Property, the prospects for additional Vein and Stratabound material are excellent over the remaining 14 kilometers of structure on the Property. The Company believes that there remains excellent potential for discovering additional massive sulphides in the vicinity of the Prairie Creek Mine, which will further add to the already substantial mineral resource base.

The Prairie Creek Mine is located in the southern portion of the Mackenzie Mountains physiographic subdivision within the Northern Cordillera Geosyncline. The Southern Mackenzie Mountains are underlain by Lower Paleozoic carbonates of the Mackenzie shelf, and associated basinal limestones, dolostones and shales.

Structurally the prevalent orientation of faulting and folding is north-south. Faults and fold axial planes dip both east and west. A number of north trending thrust faults cut through the region. The east dipping Tundra Thrust Fault and, 30 kilometers to the west, the west dipping Arnica Thrust Fault define the present margins of the Prairie Creek paleobasin, which accumulated a thick Devonian sequence of sediments (including the Cadillac and Funeral Formations). The two principal styles of base metal sulphide mineralization occur within the Prairie Creek basinal feature in the Ordovician-Silurian Whittaker and Road River Formations.

The northern part of the Property is underlain by a marginal carbonate sequence of the Root River, Camsell and Sombre Formations. This sequence is bounded to the east by the east dipping Tundra Thrust, which forms the eastern boundary of the Prairie Creek basinal sequence.

In the southern part of the Property the mine is geologically situated on the eastern margin of the Prairie Creek Embayment. This ancient basinal feature is composed primarily of a conformable sequence including the Lower Ordovician Whittaker Formation dolostones, Silurian Road River Formation shales, and Cadillac Formation thinly bedded limy shales. Lower to Middle Devonian Arnica and Funeral Formation dolostones and limestone overlie this assemblage on the northern part of the property.

In the southern part of the property faulting and folding axes trend generally north-south, resulting in windows of older Road River shales cored by the Whittaker Formation dolostones being exposed along the core of the main Prairie Creek anticline. The Prairie Creek anticline is structurally bounded to the east by the Prairie Creek Fault and to the west by the Gate Fault.

Property Base Metal Mineralization

There are three main styles of base metal mineralization so far located on the Property: Vein sulphides, Stratabound sulphides (both of which occur in the southern part of the Property) and Mississippi Valley type sulphides (MVT) which are found in the marginal carbonates in the northern sector of the property. Exploration at Prairie Creek has revealed many base metal mineral showings along the entire 17-kilometer length of the Property. Historical exploration of the property has led to referencing some of these surface mineral showings by name and some by numbers.

In the southern part of the Property, where Vein occurrences are exposed at surface, the mineral showings were referred to as sequentially numbered Zones. Some of these mineral Zones are now known to also contain subsurface Stratabound mineralization. The subsurface area above the underground workings is referred to as Zone 3 (or the Main Zone). Originally Zones 1 and 2 occurred adjacent to Zone 3; however, as a result of continuing exploration, Zone 1 and 2 are now incorporated and considered part of Zone 3. Zone 3 contains the historical estimated mineral resource, which includes both Vein and Stratabound mineralization. Extending south from the minesite (or Zone 3) are a series of other Vein exposures referred to as Zones 4 through 12, extending over a distance of 10 kilometers. A further expression of Vein mineralization, known as the Rico Showing, is located 4 kilometers to the north of Zone 3.

In the northern section of the Property MVT type showings occur and are referred to, from north to south over a distance of 10 kilometers, as the Samantha, Joe, Horse, Zulu, Zebra and Road Showings.

Vein Sulphides

Quartz Vein Sulphide mineralization occurs in a north-south trending 16 kilometer long corridor in the southern portion of the Property (referred to as Zones 1 through 12). The bulk of the mineral resources outlined to date on the Property are established on only one of these Vein occurrences, namely Zone 3 (which includes Zone 1 and 2).

The Vein in Zone 3 strikes approximately north and dips steeply to the east (variable from -40°E to -90° and averages -65°E). Most of the surface mineralized zones at Prairie Creek occur within Road River Formation shales. These showings generally occur close to the axial plane of a tight north-south doubly plunging anticline. Mineralization comprises massive to disseminated galena, sphalerite, with lesser pyrite, and tennantite-tetrahedrite in a quartz-carbonate-dolomite matrix. Silver is present in equal amounts both in galena and tennantite-tetrahedrite. Vein widths are variable (from <0.1m to >5m) but overall averages indicate a horizontal thickness of approximately 2.7 meters. The most extensive known Vein occurrence is in Zone 3 where underground development has proven 940 meters of strike length and diamond drilling has indicated a continuance of the Vein for a further 1.2 kilometers. The Vein remains open to the north and is expected to continue at depth for a further 4 kilometers. Evidence of the Vein continuing is the vein mineralization occurrence at the Rico Showing on surface 4 kilometers north on strike of the vein in Zone 3. In Zone 3, the Vein appears to be a tensional fault feature co-planar to a tight North-South trending fold axis.

At the end of the 930 meter level workings, the main Vein dissipates into the mid Road River shales. Rock competency appears to be a controlling feature governing Vein formation. Consequently, in the upper shales of the Road River and Cadillac Formations the Vein is not well developed. Drilling at depth has indicated a continuance of the Vein, however little information is available below the 600 meter elevation mark.

Also of note, towards the end of the 930 meter level workings (crosscut 30) are a series of narrow (average 0.5 meter wide) massive sphalerite-tennantite Veins striking at approximately 40° to the main Vein trend. This mineralization is referred to as Vein Stockwork and carries a calculated mineral resource based on underground sampling and limited diamond drilling. [307,000 tonnes Measured & Indicated: 742,000 tonnes Inferred] [See section 6 “Resource Estimation” below]. It is postulated that the Stockwork system filled tensional openings formed by primary movement along the Vein fault structure.

Stratabound Sulphides

Stratabound mineralization was discovered in 1992 while drilling to extend Vein resources at depth. So far indications of Stratabound mineralization have been found by drilling along the trend of the Prairie Creek Vein System over a strike length of more than 3 kilometers. This type of deposit has so far been located by drill holes in Zones 3, 4, 5 and 6. Stratabound massive sulphides occur largely within a mottled dolostone unit of the Whittaker Formation close to both the Vein system and the axis of the Prairie Creek anticline. With additional drill hole information on the structural and stratigraphic setting of the deposit it was proposed that a model along the lines of some of the Irish carbonate hosted lead/zinc deposits (i.e., Lisheen, Galmoy and Silvermines) may be the most appropriate analogy for the Prairie Creek Stratabound deposit.

Stratabound sulphide mineralization has now been identified in three stratigraphic horizons of the Upper Whittaker Formation. Stratabound mineralization consists of sphalerite-pyrite-galena, totally replacing the host dolostone with little apparent alteration. Apparent thicknesses of the Stratabound zone of up to 28 meters have been drill intercepted. Stratabound mineralization is generally fine grained, banded to semi massive, consisting of massive fine grained sphalerite, coarse grained galena and disseminated to massive pyrite. This type of sulphide mineralization appears to be genetically related to the Vein mineralization, however it is different in its mineralogy and structural setting.

The main drill defined Stratabound deposit occurs 200 meters below the 870 meter level at the minesite. There are currently no underground workings that intercept Stratabound material.

Mississippi Valley Type Sulphides - MVT

MVT type sulphide mineralization has been located at the Zebra showing, which is the southern most showing in a belt that extends for 10 kilometers to the north of the Main Zone and includes the Zulu, Joe and Samantha showings. MVT mineralization is comprised of colliform rims of sphalerite, brassy pyrite-marcasite and minor galena with or without later dolomite infilling. Mineralization is hosted within the Road River Formation.

Mineralization occurs discontinuously at approximately the same stratigraphic horizon along this NNW trend. This sulphide appears to be classic Mississippi Valley Type mineralization occurring in open cavity type settings. This style of mineralization is similar to some of the deposits mined at Pine Point, Northwest Territories.

Since these showings occur in a more remote part of the Property and are somewhat lower grade they have not been the focus of any major exploration to date.

5. Gate Claims

During 1999 the Gate 1-4 Mineral Claims were staked covering an area of 9,245.35 acres to the west of the main property adjacent to the existing land holdings. A small exploration program on the newly staked mineral claims consisted of geological mapping, soil and rock sampling over areas that contain similar geology with that of the Prairie Creek Property. This exploration resulted in the discovery of a Vein in outcrop, with select samples grading similar with that of the main established Vein at the Prairie Creek Property. Also a large zinc soil anomaly was located over favourable geology.

6. Resource Estimation

In January 1998, a Resource Estimation was carried out by MRDI Canada, a wholly owned subsidiary of AMEC E&C Services Limited.

The 1998 Historical Resource Estimate was not prepared in accordance with National Instrument 43-101, but in accordance with the JORC Australasian Code. The Company is not treating the Historical Resource Estimate as a National Instrument 43-101-defined current resource or reserve verified by a Qualified Person and this Historical Resource Estimate should not be relied upon.

The 1998 Mineral Resource Estimation reflected the impact of step-out exploratory drilling, completed by the Company since acquiring the property, at depth and along strike of the previously known mineral reserve. The information used in the resource estimate by MRDI was derived from the Company’s diamond drill hole data, channel sampling from underground development and from a number of the more clearly defined drill logs from previous operators. MRDI staff visited the property site and agreed that the data and interpreted model represents the Prairie Creek Deposit.

The database for compilation incorporated 1,529 sample assays from the Vein (both underground channels and diamond drilling), 39 samples from the Stockwork (both underground channels and diamond drilling) and 282 sample assays (drilling only) from the Stratabound mineralization. The silver grades were cut to 600 g/tonne. Specific gravity laboratory measurements were provided for 231 Vein samples and 22 Stratabound samples. MRDI completed regression analysis to determine an appropriate function to calculate specific gravity for the remainder of the samples.

The mineral resource was classified into measured, indicated and inferred resources, based upon level of confidence according to the Australasian Code for Reporting Identified Mineral Resources and Ore Reserves, using drilling grid spacing and continuity of mineralization as determined through the geo-statistical review of the data.

The 1998 Historical Resource Estimate was prepared by MRDI under the supervision of Alan Taylor, a Qualified Person for the purposes of National Instrument 43-101.

As a Qualified Person Alan Taylor, Vice-President of Exploration representing Canadian Zinc Corporation, states that in his opinion the categories of measured, indicated and inferred mineral resources in The Australasian Code for Reporting of Mineral Resources and Ore Reserves published by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy and the Australian Institute of Geoscientists and the Minerals Council of Australia (JORC) used by MRDI are substantially equivalent to the categories of measured, indicated and inferred mineral resources defined in the Canadian Institute of Mining and Metallurgy Standards on Mineral Resources and Reserves - Definitions and Guidelines as incorporated in National Instrument 43-101.

The 1998 Historical Resource Estimate is considered to continue to be relevant to an assessment of the Prairie Creek Property, in part because no recent estimates have been made and, because of the extensive information utilized in making the Estimate, is, subject to the qualifications therein and herein, considered to be reliable. It is planned that an updated estimate of the resources will be made upon completion of the 2006/2007 underground drilling program.

It should be noted that the 1998 Mineral Resource Estimate is strictly an in-situ mineral resource estimation and further delineation drilling and underground drifting is required in order to raise the confidence level of the resources.

The assessment is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary assessment will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

A summary report of the MRDI Resources Estimation is contained as an appendix to the Scoping Study, which has been filed on SEDAR and is available under the title Technical Reports filed April 24, 2001.

The table below shows this “estimated resource,” contained in Zone 3 only, as calculated by MRDI in the course of their 1998 independent review. The “resource” grades include all intercepts in a specific area, and has had no blocks removed by a cut off grade.

Prairie Creek (Historical) Resource Estimate | Zone 3 Only. MRDI (January 1998) |

| | Type | Category | Tonnes | Zn% | Pb% | Ag g/t | Cu% |

| | Vein | Measured | 542,000 | 12.5% | 13.0% | 197.0 | 0.4% |

| | Vein | Indicated | 1,434,000 | 11.2% | 12.8% | 190.0 | 0.4% |

| | Subtotal | | 1,976,000 | 11.6% | 12.9% | 191.9 | 0.4% |

| | Vein | Inferred | 7,412,000 | 12.7% | 11.0% | 174.0 | 0.4% |

| | Stockwork | Measured | 79,000 | 31.1% | 15.0% | 294.0 | 0.7% |

| | Stockwork | Indicated | 228,000 | 14.5% | 5.6% | 134.0 | 0.4% |

| | Subtotal | | 307,000 | 18.8% | 8.0% | 175.2 | 0.5% |

| | Stockwork | Inferred | 742,000 | 14.6% | 5.0% | 145.0 | 0.4% |

| | | | | | | | |

| | Stratabound | Measured | 500,000 | 10.5% | 5.4% | 51.0 | 0.0% |

| | Stratabound | Indicated | 785,000 | 10.6% | 5.1% | 59.0 | 0.0% |

| | Subtotal | | 1,285,000 | 10.6% | 5.2% | 55.9 | 0.0% |

| | Stratabound | Inferred | 124,000 | 7.9% | 2.7% | 26.0 | 0.0% |

| | | |

| | Total Resource by Categories | |

| | Vein / Stock / Strata | Measured | 1,121,000 | 12.9% | 9.8% | 138.7 | 0.2% |

| | Vein / Stock / Strata | Indicated | 2,447,000 | 11.3% | 9.7% | 142.8 | 0.3% |

| | Subtotal Measured & Indicated | 3,568,000 | 11.8% | 9.7% | 141.5 | 0.3% |

| | | | | | | | |

| | Vein / Stock / Strata | Inferred | 8,278,000 | 12.8% | 10.3% | 169.2 | 0.4% |

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated or Inferred Resources:

The information presented herein uses the terms “measured”, “indicated” and “inferred” mineral resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize these terms. “Inferred mineral resources” have significant uncertainty as to their existence, and as to their economic feasibility. United States investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically mineable. It cannot be assumed that all or any part of an inferred mineral resource would ever be upgraded to a higher category. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves.

7. Scoping Study

In 2000/2001, the Company completed a preliminary Scoping Study designed to outline and guide the re-development of the existing mine and mill on the Prairie Creek Property.

The Study took six months to complete and included metallurgical testwork, mill re-design, alternative mining methods, inclusion of paste backfill in the mine design, capital and operating cost estimates, a review of smelter terms and conditions for the Prairie Creek concentrates and other operating parameters. In connection with the Scoping Study further metallurgical samples were collected and the mill equipment was reassessed. The road access corridor, tailings pond and the underground workings were re-examined for future production considerations and capital cost estimates. The Scoping Study was prepared in house using consultants and contractors at a cost of approximately $400,000. The Scoping Study has not been updated.

The Study was examined by Micon International Ltd. of Toronto, who confirmed that “all of the elements necessary for a scoping study have been incorporated” and that “the assumptions made within are considered reasonable for a study of this nature”.

The complete Scoping Study has been filed on SEDAR, and may be found under the Company’s profile on SEDAR at www.SEDAR.com [Technical Reports April 24, 2001] and is incorporated herein by reference.

The Scoping Study assumes that Prairie Creek would be mined at 1,500 tonnes per day as a mixture of Vein and Stratabound resources at “average” deposit grades. The Scoping Study demonstrates that a 1,500 tonne per day mining operation could be established at Prairie Creek producing in the order of 95 million pounds of saleable zinc annually over at least 18 years (based on the current estimated combined [measured, indicated and inferred] resource of 11.8 million tonnes grading 12.5% Zn, 10.1% Pb, 161 g/t Ag and 0.4% Cu). [See section 6 “Resource Estimation” above].

The Scoping Study identified a number of different development and production scenarios. The operation utilized the existing mine and mill infrastructure put in place in 1982. Indicated capital costs for the new operation were estimated in the Scoping Study to be $40.5 million, including the construction of an all weather access road to the site. These indicated capital costs were estimated in 2000, are preliminary in nature, and may not be attained. The indicated capital costs will be re-estimated in a proposed feasibility study.

Discussions with concentrate sales professionals and preliminary discussions with smelters indicate that the Prairie Creek concentrates will be readily saleable, subject to the payment of usual penalties for elevated impurity levels, including mercury, in the Vein zinc, lead and copper concentrates. Cash flows have been prepared taking into account these penalties. Subsequent work in 2002 has indicated that the zinc concentrate can be smelted using the Sherrit hydrometallurgical process, opening up the market for the concentrates to hydro as well as conventional pyro-metallurgical smelters. A number of upside scenarios exist for the operation, including reduction of penalty levels in the concentrate and further mechanization in the mine to reduce costs. These alternatives will be examined further during the follow-up feasibility study process and do not form part of the base case.

The base case financial model in the Scoping Study indicates that the operation at a capital cost of $40.5 million would have a pre-tax and financing IRR of 45.6% and an NPV (at 10% discounted cash flow) of $97.2 million over the first ten years of a minimum 18 year mine life. The Scoping Study used long term metal prices of US$0.90 per lb Cu, US$0.50 per lb Zn, US$0.25 per lb Pb and US$5.50 per ounce Ag and generally prevailing 2000 smelter treatment charges. The Canadian dollar was kept constant at US$0.66. The base case indicated a break-even cash cost of production of US 34.5 cents per pound of saleable zinc after by-product credits, but before financing and taxation. For every cent the Zn price is over the break-even production cost of US 34.5 cents per pound, pre-tax and financing cash flow increases by around US$0.64 million per annum.

All cost figures should be considered order of magnitude estimates and will require verification by more detailed study to convert the Scoping Study into a bankable feasibility study.

It should be noted that the economic assessment in the Scoping Study is preliminary and based, in part, on mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as reserves in accordance with National Instrument 43-101. Mineral resources that are not mineral reserves do not have demonstrated economic viability. In addition, the Scoping Study is preliminary in nature, despite the existing underground development and the on-site mill, and the assumptions made within the Scoping Study and its subsequent results may not be attained.

The Company is now examining the various alternatives outlined within the Scoping Study and is working towards converting this into a bankable feasibility study. As part of the full feasibility program, it is the Company’s intention to carry out additional delineation drilling. During 2004 the Company rehabilitated the underground workings in preparation for the planned decline and underground drilling program. This site development work continued in 2005 when a new water polishing pond was constructed to treat the water discharge from the 870 portal, the planned decline and also any water discharge from the pilot milling program. In 2006 a new 400 meter decline was driven to provide an underground drilling platform to access resource blocks below the current underground workings.

The development plan for the Prairie Creek Project is based upon the Scoping Study prepared internally by the Company in 2001. A Scoping Study is not a Feasibility Study. The Scoping Study outlined the plan for the development of the Prairie Creek Project based on the historical development and existing infrastructure at the Prairie Creek Property and on the Resource Estimation. The Resource Estimation does not constitute mineable reserves. The historical development was carried out principally in 1980 to 1982 and the infrastructure, including the mill, was constructed in the same period based on a feasibility study prepared by Kilborn Engineering (Pacific) Limited in 1980. The Kilborn feasibility study is outdated and cannot be relied upon. The existing infrastructure, including the mill, buildings, camp etc. is now twenty-five years old and although it has been held under care and maintenance it has lain idle for twenty-five years and was never operated. There is a significant risk attaching to the proposed operation of aged equipment.

During 2004, 2005 and 2006 metallurgical testing was carried out on the ore from the Prairie Creek Mine.

During 2004 representative bulk samples of vein mineralization were extracted from various locations within the existing underground workings at the Prairie Creek Mine. In addition, diamond drill core samples of Stratabound Mineralization were also collected from this deeper lying deposit which has not yet been accessed by underground development. One ore type is representative of the vein mineralization in the upper and lower level of existing developed underground workings. It is typically high in zinc, silver and lead in a mixture of sulphide and oxide minerals. The second ore type of Stratabound mineralization contains zinc, lead, silver and iron sulphide minerals.

The samples were shipped to SGS Lakefield Research Laboratories at Lakefield, Ontario where a total of 60 bench scale tests were undertaken over six months under the direction of the Company’s metallurgical consultant. The samples were first assayed for both sulphide and oxide mineralization and then combined into composite samples to ensure true representation of the Prairie Creek mineral deposit. Mineral samples from two separate zones of vein mineralization (Upper and Lower Zones), and including both sulphide and oxide mineralization, and from the stratabound zone, and additional composite samples from all three zones, were tested to develop and optimize the Prairie Creek mill flow sheet. The batch and locked cycle tests provided extensive analytical information and positive metallurgical results.

During 2006 a new metallurgical bulk sample was collected from multiple headings of the vein within the existing underground development and also shipped to Lakefield for further testing and optimization studies. These samples were composited and blended to create representative samples of the ore that will provide feed to a future operating mill. The metallurgical program has shown that heavy media separation, demonstrated in earlier tests, is repeatable and that higher grade concentrates can be produced by processing the upgraded material.

The work carried out by the Company on the Prairie Creek Property since 2001 described above has not materially changed the information in the Scoping Study Technical Report filed in April 2001.

8. Permitting at Prairie Creek

(a) Regulatory Framework

At the time of its construction in 1980 - 1982, the Prairie Creek Mine had been fully permitted for full scale mining and milling operations. Permitting had been undertaken under the regulatory regime of the day, which involved a comprehensive environmental assessment and public review before the Northwest Territories Water Board. A considerable number of technical and baseline studies describing the proposed development and the physical and biological environment were undertaken at that time.

Water Licence N3L3-0932 was issued by the Department of Indian Affairs and Northern Development on July 1, 1982 pursuant to the Northern Inland Waters Act and Regulations, authorizing use of up to 1,150 m3/day and 420,000 m3/year of water from the Prairie Creek Valley Aquifer and setting standards for discharge of process effluent to Prairie Creek. Land Use Permit N80F249 was issued July 2, 1980 for the road connecting Prairie Creek to the Liard Highway, the first 40 kilometers being permitted for year round use with the remaining 130 kilometers permitted for use in winter months only. The Land Use Permit was extended in 1981 and again in 1982 to June 1983. Surface Leases were issued for the minesite area and airstrip. The Water Licence and Land Use Permit subsequently expired.

In 1998, a totally new regulatory and resource management scheme was introduced in this part of Canada. During the negotiation of native land claim settlements in the Mackenzie Valley, first with the Dene/Metis in the late 1980’s and then with the Gwich’in and Sahtu Dene/Metis people, the Federal Government agreed to establish a new resources management system through the creation of boards with joint membership which reflects First Nations’ desire to participate more effectively in the regulation of land and water throughout the Mackenzie Valley.

The Mackenzie Valley Resource Management Act (“MVRMA”) or (the “Act”) was enacted in 1998 for a defined area called the “Mackenzie Valley”, which includes the area where the Prairie Creek Mine is situated. Prior to that, the applicable legislation was the Canadian Environmental Assessment Act, S.C. 1992 c.37. (“CEAA”) The CEAA no longer applies in the Mackenzie Valley, except under very specific situations.

The MVRMA is a piece of federal legislation that creates an integrated co-management structure for public and private lands and waters throughout the Mackenzie Valley in the Northwest Territories. The Act was proclaimed December 22, 1998; however, Part IV, which establishes the Mackenzie Valley Land and Water Board, was not proclaimed until March 31, 2000.

The overall legislative scheme of the MVRMA is designed to implement the Gwich’in and the Sahtu Land Claim Settlement Agreements (collectively the “Comprehensive Agreements”) by providing for an integrated system of land and water management in the Mackenzie Valley. Under the Comprehensive Agreements, Land Use Planning Boards and Land and Water Boards must be established for the settlement areas referred to in those Agreements. In addition, an Environmental Impact Review Board must be established for the Mackenzie Valley along with a Land and Water Board for an area extending beyond the settlement areas.

The Act established public boards to regulate the use of land and water, to prepare regional land use plans to guide development, and to carry out environmental assessment and reviews of proposed projects in the Mackenzie Valley. The Act also makes provisions for monitoring cumulative impacts on the environment, and for periodic, independent environmental audits.

As institutions of public government, the Boards regulate all uses of land and water while considering the economic, social and cultural well-being of residents and communities in the Mackenzie Valley. These Boards are charged with regulating all land and water uses, including deposits of waste, in the areas in the Mackenzie Valley under their jurisdiction.

The MVRMA ensures a greater role for Aboriginal people in land use planning, environmental assessment, and the regulation of land and water use. As stated in the MVRMA, "the purpose of the establishment of boards by this Act is to enable residents of the Mackenzie Valley to participate in the management of its resources for the benefit of the residents and of other Canadians." (Section 9.1. MVRMA). To reflect the desire of First Nations to be more actively involved in resource management decision-making, half the members of each Board will be nominated by First Nations, and half by the Federal and Territorial governments. Public boards are formed through nominations. Under the land claims agreements, First Nations are entitled to nominate one-half of the members of the board, reflecting the board’s jurisdiction over all lands including First Nation settlement lands. The Federal Government, Territorial Government and First Nations can each nominate at their own discretion.

The Act also anticipates amendments to accommodate new land settlements and self-governments as they are finalized. As land claims are settled, the Act provides for additional regional boards to be established in the Deh Cho, North Slave and South Slave regions. The Deh Cho area is not settled. Prior to additional regional Boards being established, First Nations in the Deh Cho region were asked to participate in the new system by recommending members to the Mackenzie Valley Environmental Impact Review Board and the Mackenzie Valley Land and Water Board.

Under the MVRMA, public boards are responsible for:

| · | preparing regional land use plans to guide the development and use of land, waters and other resources [Land Use Planning Board]; |

| · | regulating all uses of land and water [Mackenzie Valley Land and Water Board (MVLWB)]; and |

| · | carrying out the environmental assessment and review process [Mackenzie Valley Environmental Impact Review Board (MVEIRB)]. |

Consultation is the cornerstone of the MVRMA. Public Boards under the Act have established their own consultation guidelines.

Each Board has its own specific jurisdiction.

The Land Use Planning Board develops and implements a land use plan for the respective settlement areas in the Mackenzie Valley.

Land and water boards issue land use permits and water licences under the Mackenzie Valley Land Use Regulations and the Northwest Territories Waters Act and Regulations, within the Mackenzie Valley.

The MVEIRB is responsible for environmental impact review and assessment at a valley-wide level, including the Sahtu and Gwich’in settlement areas.

The public boards perform regulatory functions, such as permitting and licensing, and conducting environmental reviews, previously undertaken by the Department of Indian Affairs and Northern Development (DIAND) and the NWT Water Board. Inspection and enforcement continue to be the responsibility of DIAND.

After consultation with the Land and Water Board, the Minister of DIAND may give written policy direction to the Board with respect to the exercise of any of its functions. The Minister also approves the issuance of Type A water licences. Regarding a Type 'A' water licence, the Minister may attach terms and conditions such as provision for a security deposit, a requirement for water quality and quantity measurements, and a requirement for abandonment and restoration plans.

DIAND controls, manages and administers all Crown lands in the Mackenzie Valley under the authority of the Territorial Lands Act, and the Federal Real Property Act. Aside from managing Crown lands and waters, DIAND is still responsible for the administration, inspection and enforcement requirements associated with renewable, non-renewable and environmental legislation. This includes the Mackenzie Valley Resource Management Act, the Northwest Territories Waters Act, and the Federal Real Property Act.

DIAND inspectors are responsible for ensuring compliance with legislation, regulations and the terms and conditions that are part of permits and licences issued by the Land and Water Boards. These responsibilities are exercised by DIAND under the authority of the Territorial Lands Regulations, Territorial Quarry Regulations, Canada Mining Regulations and the Federal Property Regulations.

Under the Northwest Territories Waters Act, S.C. 1992, (C.29) (Waters Act) no person can use water or deposit waste in specific areas in the Northwest Territories without a licence to do so, S 8 and 9. Section 102 of the MVRMA provides that it is the MVLWB which has the jurisdiction with respect of all uses of water and deposits of waste in the area for which a licence is required under the Waters Act. The MVLWB may issue, amend, renew and cancel licences in accordance with the Waters Act and exercise any other power of the Northwest Territories Water Board under the Waters Act.

The stated objective of the MVLWB is to "regulate the use of land and waters and the deposit of waste so as to provide for the conservation, development and utilization of land and water resources in a manner that will provide optimum benefit to the residents of the settlement areas and of the Mackenzie Valley and to all Canadians." The MVLWB’s main function which is relevant to the Company, is to issue land use permits and water licences on land in unsettled land claim areas in the Mackenzie Valley, inclusive of the Deh Cho area.

(b) Permitting Process

All applications for a land use permit or a water licence in relation to a development in the Mackenzie Valley are made to the Water Board or one of its regional boards, as determined by the location of the development. In the case of Prairie Creek, being located within the Deh Cho First Nations territory, for which a land claim settlement agreement has not as yet been reached, applications are processed by the MVLWB.

There are three stages in the environmental impact assessment process in the Mackenzie Valley: preliminary screening, environmental assessment and environmental impact review. Not all developments will necessarily go through each of the three stages. All projects undergo a preliminary screening, after which it is decided whether a project must proceed to a full environmental assessment or go straight to the regulatory phase.

The environmental impact assessment process is triggered by an application to the MVLWB for a water licence. The application requires the inclusion of certain baseline and other technical information to allow them to be appropriately assessed and processed. Information provided with an application is used for undertaking a preliminary screening and for regulatory review of the application.

Preliminary screening is the first step in the environmental impact assessment process. Preliminary screening applications are done by the Land and Water Board. It is during the preliminary screening that the Board determines whether there is any public concern related to a proposed project or if it might have significant adverse environmental impacts.

During the preliminary screening, a systematic approach is taken to documenting the potential environmental effects of a proposed project. Next, the Board determines whether these effects need to be eliminated or minimized and, if so, how the project plan should be modified. In the end, the Board makes a recommendation on the need for further assessment.

The legislation requires that the MVLWB conduct a pre-screening of a proposal for development (s.124). Where the MVLWB determines that the development might have a significant adverse impact on the environment, or might be a cause of public concern, the MVLWB refers the proposal to the MVEIRB for an environmental assessment (s.125).

Environmental assessment is the second stage of the environmental impact assessment process. Projects may be referred to the MVEIRB by the Water Board (the preliminary screener), some other government department or agency, the First Nation qualified to make a referral, or on the Mackenzie Valley Environmental Impact Review Board’s own motion.

The MVEIRB is responsible for the environmental impact assessment process throughout the Mackenzie Valley. It is the main instrument for environmental assessment and review, replacing the CEAA in the Mackenzie Valley except under specific instances.

The MVEIRB:

| · | Conducts environmental assessments; |

| · | Conducts environmental impact reviews; |

| · | Maintains a public registry of all preliminary screenings conducted by Regulatory Authorities; and |

| · | Makes recommendations to the Minister of DIAND for rejection or approval of any proposal. |

Once a development proposal is referred to the Mackenzie Valley Environmental Impact Review Board for an environmental assessment, notices are placed in northern newspapers. The next step is for the developer to submit a “project description” to the Review Board. The project description describes what the developer plans to do and how it will be carried out. The MVEIRB develops a work plan and terms of reference in order to conduct the Environmental Assessment.

The public has an opportunity to comment on the project and identify issues which may require consideration. Public information submitted to the Review Board throughout this process, including the project description, and all technical and public submissions, are placed on a public registry.

The Review Board has guidelines for how they conduct environmental assessments. These guidelines provide information for submissions to the Review Board, including timelines and opportunities to present information at any public hearings that may be held. The environmental impact assessment process has several points where the local government and other stakeholders can contribute to and affect the regulatory process. There will also be occasions where the local government will be asked to comment on a proposed development.

The environmental assessment process looks at the same factors considered in the preliminary screening, as well as addressing potential cumulative effects, socio-cultural considerations and alternate means of carrying out the project that are technically and economically feasible and the potential environmental effects of such alternate means. If the Mackenzie Valley Environmental Impact Review Board determines there will be significant adverse environmental impact from a project, it has the choice of referring the development to an environmental impact public review before a panel. The Review Board may also recommend measures to prevent or mitigate these impacts.

The environmental impact review (EIR) stage is a detailed analysis and public review. This is normally reserved for development projects where the environmental impact may be significant and could include public hearings in affected communities. An environmental impact review is conducted by a panel consisting of members of the Mackenzie Valley Environmental Impact Review Board, as well as any expert members they may appoint. The panel is required to issue terms of reference and the applicant must submit an impact statement. There must be public notification of the submission of the impact statement, and public consultation or hearings in communities which may be affected by the development. The panel conducts an analysis of the information received.

Upon completing the assessment, the MVEIRB submits its Environmental Assessment Report (EAR) to the Federal Minister of Indian Affairs and Northern Development who is responsible for distributing the EAR to other Ministers with jurisdiction over the proposed development (s.128).

The Minister of DIAND, along with the other Responsible Ministers, is required to make a decision on the EAR. The Minister may adopt the recommendations of the Mackenzie Valley Environmental Impact Review Board, refer the report back to the Review Board for further consideration (s.130) or reject the Report and order further environmental impact review. Once the recommendations contained in the EAR are adopted by the Minister, and the other responsible Ministers, those recommendations are to be included by the MVLWB as conditions of any Water Licence or Land Use Permit that it issues for that proposed development (s.62).

When finally adopted by the Minister the application is sent to MVLWB for issuance of permits and licences by the MVLWB in the regulatory phase. The regulatory phase is the process of issuing regulatory authorizations once the development is approved through the environmental assessment process. The authorizations include terms and conditions which reflect the recommendations approved during the EA process, as well as other standard conditions for carrying out development.

Decisions of the Mackenzie Valley Land and Water Board are subject to review by the Supreme Court of the Northwest Territories.

(c) "Grandfather” Provisions